1 Supplemental Investor Information February 2023

2 Important Information As previously announced, on March 21, 2022, as contemplated by that certain Agreement and Plan of Merger, dated September 13, 2021 (the “Merger Agreement”), by and among Motive Capital Corp, a Cayman Islands exempted company (“Motive”), FGI Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Motive (“Merger Sub”), and Forge Global, Inc., a Delaware corporation (“Forge Global”), Motive changed its jurisdiction of incorporation by deregistering as an exempted company in the Cayman Islands and continuing and domesticating as a corporation incorporated under the laws of the State of Delaware (the “Domestication”), changing its name to “Forge Global Holdings, Inc.” (the “Company”), and following the Domestication, as contemplated by the Merger Agreement, Merger Sub merged with and into Forge Global, with Forge Global surviving the merger as a wholly owned subsidiary of the Company (together with the Domestication, the “Business Combination”). On March 25, 2022, the Company filed a Current Report on Form 8-K (the “Form 8-K”) which, among other things, included the audited financial statements (and notes thereto) of Forge Global as of and for the fiscal years ended December 31, 2021 and 2020 (the “Forge Global 2021 Financial Statements”), Management’s Discussion and Analysis of Financial Condition and Results of Operations for Forge Global for the years ended December 31, 2021 and 2020 (the “Forge Global 2021 MD&A”), and Unaudited Pro Forma Condensed Combined Financial Information of Motive and Forge Global as of and for the year ended December 31, 2021 giving effect to the Business Combination and related transactions (the “Pro Forma Financial Information,” and together with the Forge Global 2021 Financial Statements, Forge Global 2021 MD&A, and Pro Forma Financial Information, the “2021 Financial Information”). On May 16, 2022, the Company issued a press release announcing its results for the quarter ended March 31, 2022, which included certain quarterly financial information and key business metrics (the “Q1 Earnings Release”). The Company also filed a Quarterly Report on Form 10-Q which, among other things, included the interim unaudited financial statements (and notes thereto) of the Company as of and for the quarter ended March 31, 2022 (the “Q1 Financial Statements”), and Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Company for the quarter ended March 31, 2022 (the “Q1 MD&A,” and together with the Q1 Earnings Release and Q1 Financial Statements, the “Q1 Financial Information”). On August 11, 2022, the Company issued a press release announcing its results for the quarter ended June 30, 2022, which included certain quarterly financial information and key business metrics (the “Q2 Earnings Release”). The Company also filed a Quarterly Report on Form 10-Q on August 12, 2022, which, among other things, included the interim unaudited financial statements (and notes thereto) of the Company as of and for the quarter ended June 30, 2022 (the “Q2 Financial Statements”), and Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Company for the quarter ended June 30, 2022 (the “Q2 MD&A,” and together with the Q2 Earnings Release and Q2 Financial Statements, the “Q2 Financial Information”). On November 9, 2022, the Company issued a press release announcing its results for the quarter ended September 30, 2022, which included certain quarterly financial information and key business metrics (the “Q3 Earnings Release”). The Company will also file a Quarterly Report on Form 10-Q on or around November 10, 2022, which, among other things, will include the interim unaudited financial statements (and notes thereto) of the Company as of and for the quarter ended September 30, 2022 (the “Q3 Financial Statements”), and Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Company for the quarter ended September 30, 2022 (the “Q3 MD&A,” and together with the Q3 Earnings Release and Q3 Financial Statements, the “Q3 Financial Information”). To further assist investors, the Company is furnishing the following additional quarterly financial information, key business metrics, and data (the “Supplemental Information”). The following Supplemental Information is unaudited, has not been reviewed by the Company’s independent registered public accounting firm, and is subject to change. The Supplemental Information is qualified by in its entirety, and should be read in conjunction with, 1) the 2021 Financial Information, 2) the Q1 2022 Financial Information, 3) the Q2 2022 Financial Information, and 4) the Q3 2022 Financial Information.

3 Use of Non-GAAP Financial Information In addition to its financial results determined in accordance with generally accepted accounting principles in the United States of America (“GAAP”), the Company presents Adjusted EBITDA, a non- GAAP financial measure. The Supplemental Information includes Adjusted EBITDA, a non-GAAP financial measure. The Company uses Adjusted EBITDA to evaluate its ongoing operations and for internal planning and forecasting purposes. The Company believes that Adjusted EBITDA, when taken together with the corresponding GAAP financial measure, provides meaningful supplemental information regarding its performance by excluding specific financial items that have less bearing on its core operating performance. The Company considers Adjusted EBITDA to be an important measure because it helps illustrate underlying trends in its business and its historical operating performance on a more consistent basis. However, non-GAAP financial information is presented for supplemental informational purposes only, has limitations as an analytical tool and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. In addition, other companies, including companies in the Company’s industry, may calculate similarly titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of Adjusted EBITDA as a tool for comparison. A reconciliation is provided in the Supplemental Information for Adjusted EBITDA to net income (loss), the most directly comparable financial measure stated in accordance with GAAP. Investors are encouraged to review Adjusted EBITDA and the reconciliation of Adjusted EBITDA to net income (loss), and not to rely on any single financial measure to evaluate the Company’s business. The Company defines Adjusted EBITDA as net loss, adjusted to exclude: (i) interest expense, net, (ii) provision for or benefit from income taxes, (iii) depreciation and amortization, (iv) share-based compensation expense, (v) change in fair value of warrant liabilities, (vi) acquisition-related transaction costs, and (vii) other significant gains, losses, and expenses (such as impairments, transaction bonus) the Company believes are not indicative of its ongoing results. Forward-Looking Statements The Supplemental Information may contain “forward-looking statements, ”which generally are accompanied by words such as “believe,” “may,” ”could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “target,” “goal,” “expect,” “should,” “would,” “plan,” “predict,” “project,” “forecast,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict, indicate or relate to future events or trends or the Company’s future financial or operating performance, or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the Company’s beliefs regarding its financial position and operating performance, the benefits of the Business Combination, and future opportunities for the Company to expand its business. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, while considered reasonable by the Company and its management, are subject to risks and uncertainties that may cause actual results to differ materially from current expectations. You should carefully consider the risks and uncertainties described in the Company’s documents filed, or to be filed, with the SEC, including in its Quarterly Report on Form 10-Q that will be filed on or around November 10, 2022. There may be additional risks that the Company presently does not know of or that it currently believes are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans, or forecasts of future events and views as of the date of this Supplemental Information. The Company anticipates that subsequent events and developments will cause its assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this Supplemental Information. Accordingly, undue reliance should not be placed upon the forward-looking statements.

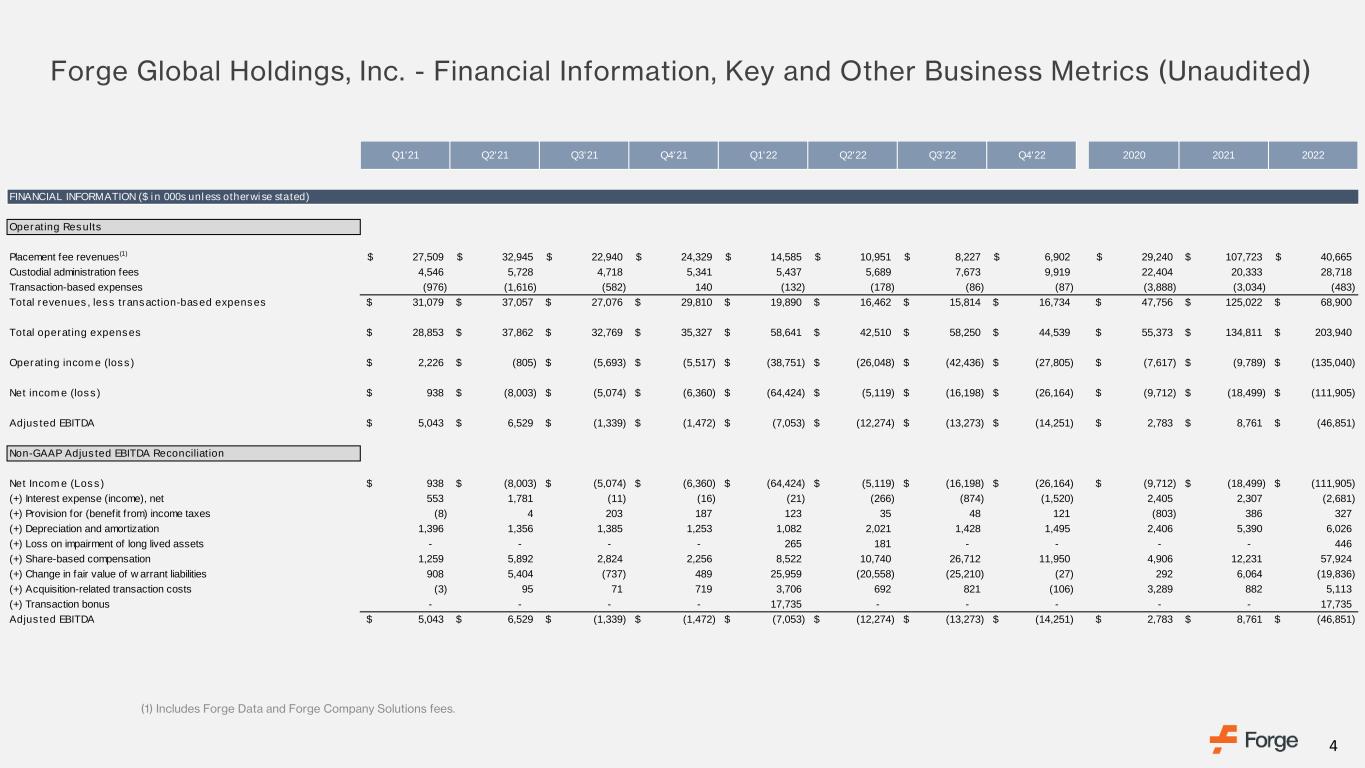

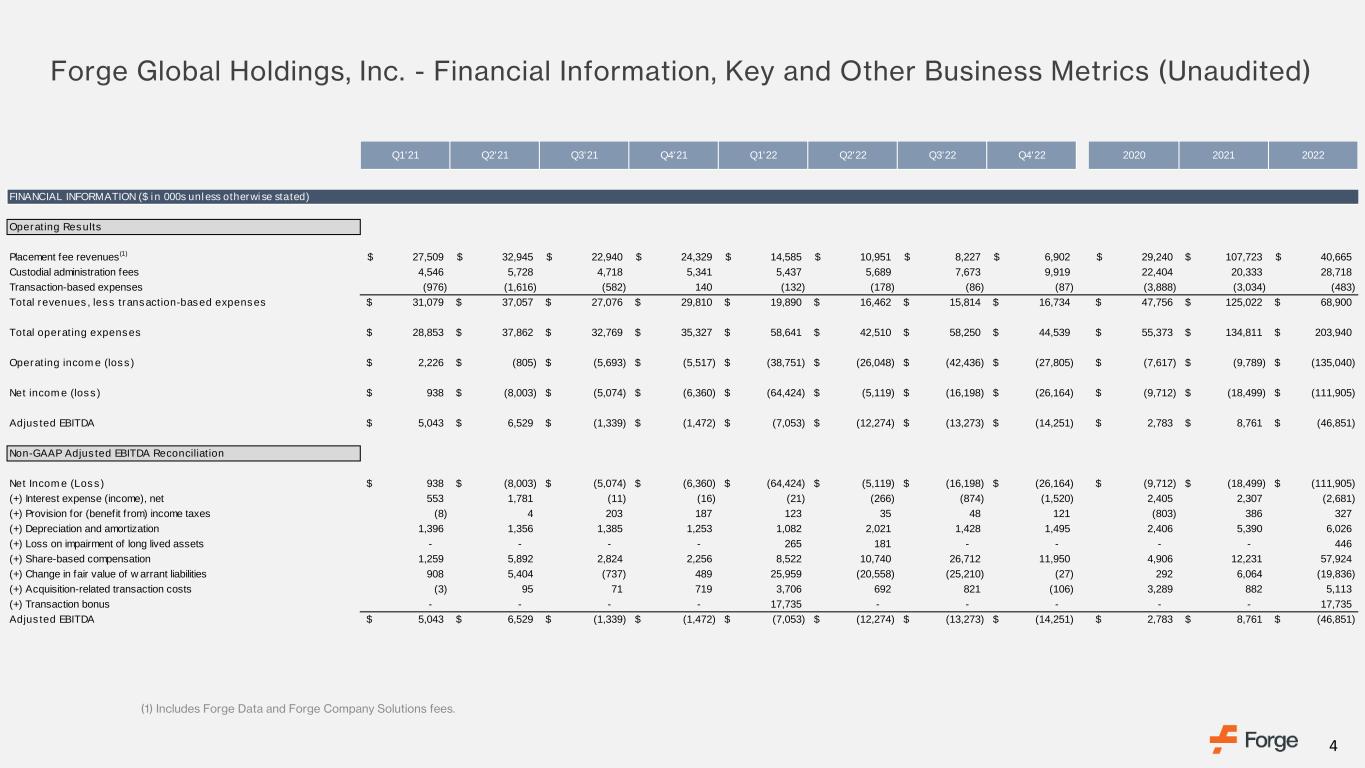

4 (1) Includes Forge Data and Forge Company Solutions fees. Forge Global Holdings, Inc. - Financial Information, Key and Other Business Metrics (Unaudited) Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 2020 2021 2022 FINANCIAL INFORMATION ($ in 000s unless otherwise stated) Operating Results Placement fee revenues(1) 27,509$ 32,945$ 22,940$ 24,329$ 14,585$ 10,951$ 8,227$ 6,902$ 29,240$ 107,723$ 40,665$ Custodial administration fees 4,546 5,728 4,718 5,341 5,437 5,689 7,673 9,919 22,404 20,333 28,718 Transaction-based expenses (976) (1,616) (582) 140 (132) (178) (86) (87) (3,888) (3,034) (483) Total revenues, less transaction-based expenses 31,079$ 37,057$ 27,076$ 29,810$ 19,890$ 16,462$ 15,814$ 16,734$ 47,756$ 125,022$ 68,900$ Total operating expenses 28,853$ 37,862$ 32,769$ 35,327$ 58,641$ 42,510$ 58,250$ 44,539$ 55,373$ 134,811$ 203,940$ Operating income (loss) 2,226$ (805)$ (5,693)$ (5,517)$ (38,751)$ (26,048)$ (42,436)$ (27,805)$ (7,617)$ (9,789)$ (135,040)$ Net income (loss) 938$ (8,003)$ (5,074)$ (6,360)$ (64,424)$ (5,119)$ (16,198)$ (26,164)$ (9,712)$ (18,499)$ (111,905)$ Adjusted EBITDA 5,043$ 6,529$ (1,339)$ (1,472)$ (7,053)$ (12,274)$ (13,273)$ (14,251)$ 2,783$ 8,761$ (46,851)$ Non-GAAP Adjusted EBITDA Reconciliation Net Income (Loss) 938$ (8,003)$ (5,074)$ (6,360)$ (64,424)$ (5,119)$ (16,198)$ (26,164)$ (9,712)$ (18,499)$ (111,905)$ (+) Interest expense (income), net 553 1,781 (11) (16) (21) (266) (874) (1,520) 2,405 2,307 (2,681) (+) Provision for (benefit from) income taxes (8) 4 203 187 123 35 48 121 (803) 386 327 (+) Depreciation and amortization 1,396 1,356 1,385 1,253 1,082 2,021 1,428 1,495 2,406 5,390 6,026 (+) Loss on impairment of long lived assets - - - - 265 181 - - - - 446 (+) Share-based compensation 1,259 5,892 2,824 2,256 8,522 10,740 26,712 11,950 4,906 12,231 57,924 (+) Change in fair value of w arrant liabilities 908 5,404 (737) 489 25,959 (20,558) (25,210) (27) 292 6,064 (19,836) (+) Acquisition-related transaction costs (3) 95 71 719 3,706 692 821 (106) 3,289 882 5,113 (+) Transaction bonus - - - - 17,735 - - - - - 17,735 Adjusted EBITDA 5,043$ 6,529$ (1,339)$ (1,472)$ (7,053)$ (12,274)$ (13,273)$ (14,251)$ 2,783$ 8,761$ (46,851)$

5 (2) Key business metrics and other business metrics as of and for the full year and quarterly periods of 2021 and 2022 are based on actual results of operations; key business metrics and other business metrics presented as of and for the year ended December 31, 2020 and for last-twelve-months (LTM) periods through the third quarter of 2021 are prepared on a pro-forma basis, which combines the metrics from Forge and SharesPost’s brokerage businesses as if the SharesPost acquisition had occurred at the beginning of the fiscal year 2020. (3) Represents end of period value. Includes both CaaS and Alt IRA accounts. (4) Number of distinct companies in whose shares at least one buy or sell IOI, or indication of interest, was created in this period. (5) Custodial cash represents amounts on deposit with financial institutions for the benefit of the Company's custodial accounts. Forge Global Holdings, Inc. - Financial Information, Key and Other Business Metrics (Unaudited) Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 2020 2021 2022 KEY BUSINESS METRICS ($ in 000s unless otherwise stated) (2) Trading Business Placement fee revenues, less transaction-based expenses - LTM 69,820$ 92,070$ 96,926$ 104,689$ 92,609$ 72,052$ 57,834$ 40,182$ 48,864$ 104,689$ 40,182$ Number of trades - LTM 4,445 5,169 4,979 4,890 3,972 3,232 2,636 2,184 3,448 4,890 2,184 Number of trades - Period 1,514 1,370 1,022 984 596 630 426 532 3,448 4,890 2,184 Transaction volume ($B) - LTM 2.4$ 3.0$ 3.0$ 3.2$ 2.8$ 2.3$ 1.8$ 1.2$ 1.9$ 3.2$ 1.2$ Transaction volume ($B) - Period 0.8$ 0.9$ 0.7$ 0.8$ 0.4$ 0.3$ 0.2$ 0.2$ 1.9$ 3.2$ 1.2$ Net Take Rate - LTM 2.1% 2.6% 3.1% 3.3% 3.3% 3.2% 3.2% 3.3% 2.6% 3.3% 3.3% Net Take Rate - Period 3.5% 3.4% 3.3% 2.9% 3.5% 3.2% 3.6% 2.8% 2.6% 3.3% 3.3% Custody Business Total Custodial Accounts (3) 1,787,208 1,880,564 1,985,235 2,124,677 2,228,101 1,739,838 1,811,774 1,871,146 1,574,211 2,124,677 1,871,146 Assets Under Custody ($B) (3) 13.8$ 14.6$ 14.5$ 14.3$ 14.9$ 15.3$ 15.0$ 14.9$ 13.3$ 14.3$ 14.9$ OTHER BUSINESS METRICS (2) Distinct private companies transacted in - LTM 169 195 202 217 222 196 191 191 Distinct private companies transacted in - Period 114 122 96 108 115 90 77 76 Total number of issuers w ith IOIs (4) 286 368 416 435 476 463 478 436 Custodial cash balance ($MM) (5) 616$ 620$ 620$ 687$ 689$ 680$ 685$ 635$