© 2020 Playtika Ltd. All Rights Reserved. February 24th | 2022 FOURTH QUARTER AND FULL YEAR 2 0 2 1 Earnings Presentation

Presentation Title 2 LEGAL DISCLAIMER Forward-Looking Statements This presentation contains forward-looking statements. All statements contained in this presentation other than statements of historical facts, including statements regarding our business strategy, plans, market growth and our objectives for future operations, are forward-looking statements. The words “may,” “will,” “should,” “expect,” “would,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Forward-looking statements contained in this presentation include, but are not limited to, , future revenues, expenses, and capital requirements; the implementation of our business model and strategic plans and initiatives including increased focus on in-house game development; our ability to improve on our user metrics and our ability among others. We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate and financial trends that we believe may affect our business, financial condition, results of operations and prospects and these forward-looking statements are not guarantees of future performance or development. These forward-looking statements speak only as of the date of this presentation and are subject to a number of risks, uncertainties and assumptions, including business, regulatory, economic and competitive risks, uncertainties, contingencies and assumptions about us. Because forward-looking statements are inherently subject to risks and uncertainties, including our ability to compete in the market; our future relationship with third-party platforms, such as the iOS App Store and the Google Play Store; our ability to successfully launch new games and enhance our existing games that are commercially successful; continued growth in demand for in-app purchases in mobile games; our ability to acquire and integrate new games and content; the ability of our games to generate revenues;; capital expenditures and investments in our infrastructure; our use of working capital in general; retaining existing players, attracting new players and increasing the monetization of our player base; our ability to successfully manage our game economies; maintaining a technology infrastructure that can efficiently and reliably handle increased player usage, fast load times and the deployment of new features and products; attracting and retaining qualified employees and key personnel; maintaining, protecting and enhancing our intellectual property; protecting our players’ information and adequately addressing privacy concerns; our ability to expand into new markets and distribution platforms; and successfully acquiring and integrating companies and assets. Because some of these risks and uncertainties cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward- looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Additional factors that may cause future events and actual results, financial or otherwise, to differ, potentially materially, from those discussed in or implied by the forward-looking statements include the risks and uncertainties discussed in our filings with the Securities and Exchange Commission. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur, and reported results should not be considered as an indication of future performance. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Except as required by applicable law, we undertake no obligation to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. This presentation also contains estimates and other statistical data made by independent parties and by Playtika relating to market size and growth and other data about Playtika’s industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Non-GAAP Financial Measures This presentation contains certain non-GAAP financial measures of us, including Adjusted EBITDA and Adjusted EBITDA Margin. A "non-GAAP financial measure" is defined as a numerical measure of a company's financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the statements of income, balance sheets or statements of cash flow of the company. You should not consider these non-GAAP financial measures in isolation, or as a substitute for analysis of results as reported under GAAP. For information regarding the non-GAAP financial measures used by us, and for a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures, see the Appendix to this presentation. 2

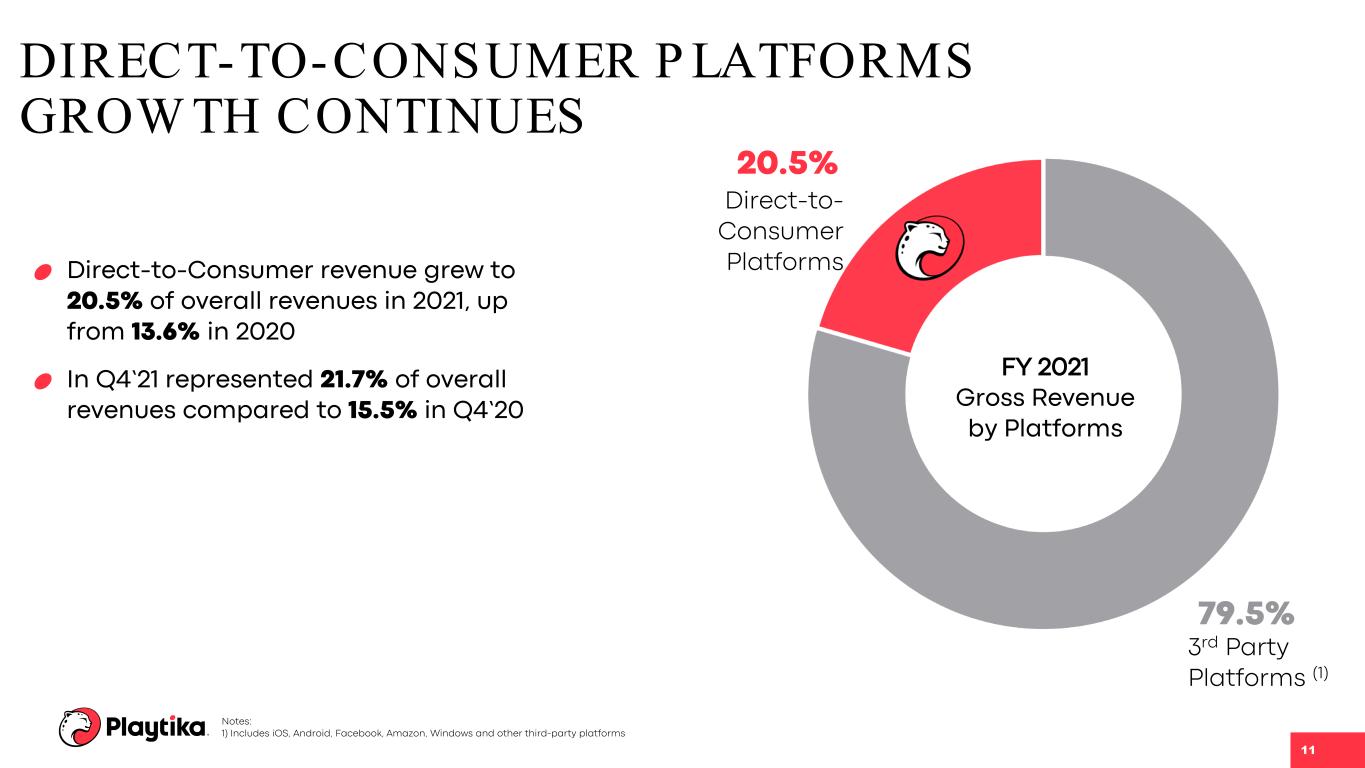

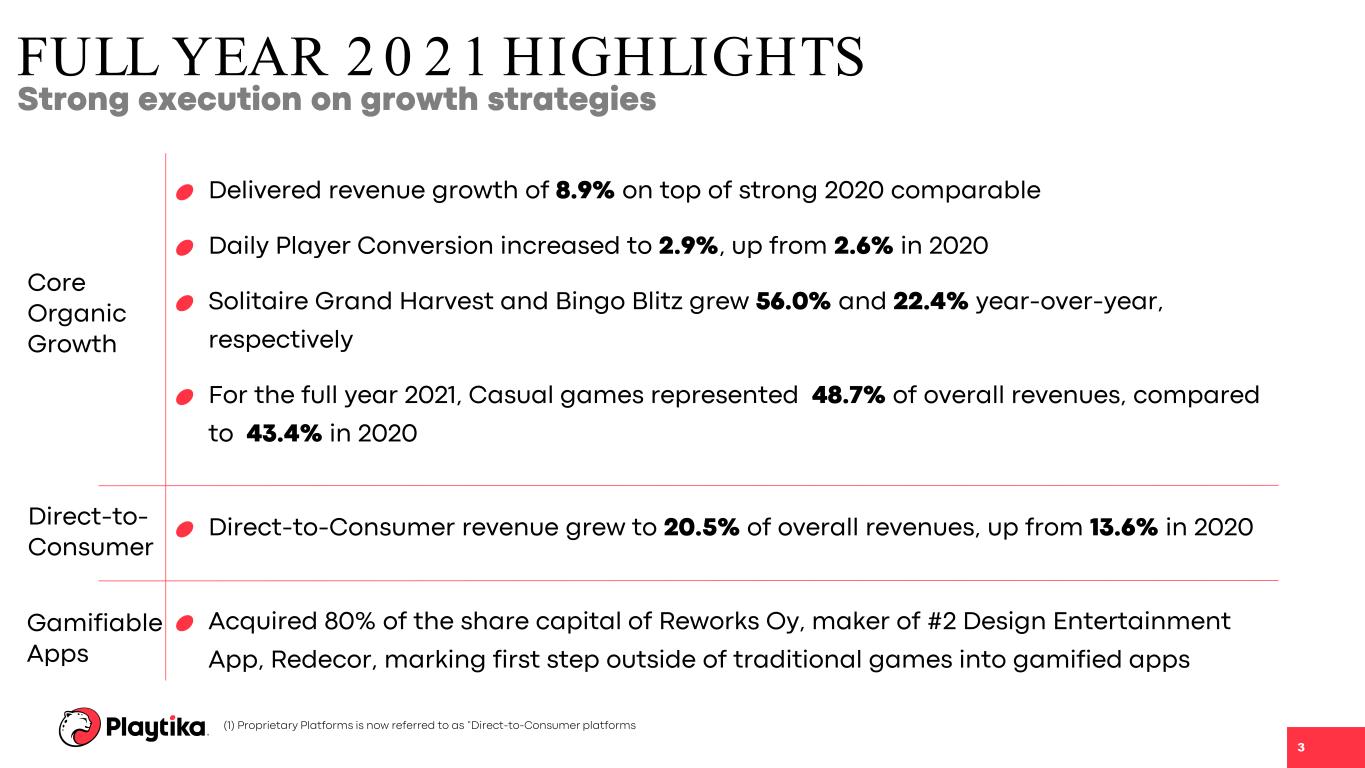

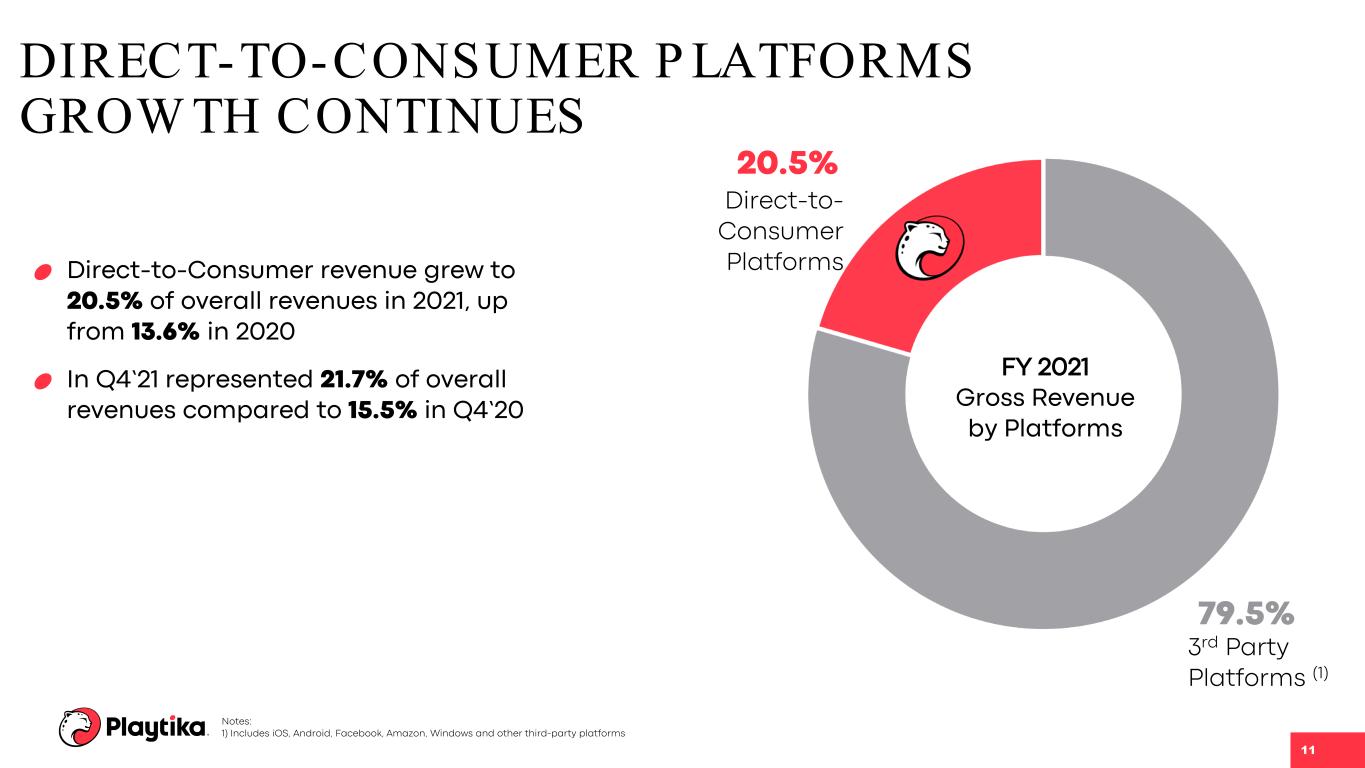

Presentation Title 3 FULL YEAR 2 0 2 1 HIGHLIGHTS Delivered revenue growth of 8.9% on top of strong 2020 comparable Daily Player Conversion increased to 2.9%, up from 2.6% in 2020 Solitaire Grand Harvest and Bingo Blitz grew 56.0% and 22.4% year-over-year, respectively For the full year 2021, Casual games represented 48.7% of overall revenues, compared to 43.4% in 2020 Direct-to-Consumer revenue grew to 20.5% of overall revenues, up from 13.6% in 2020 Acquired 80% of the share capital of Reworks Oy, maker of #2 Design Entertainment App, Redecor, marking first step outside of traditional games into gamified apps (1) Proprietary Platforms is now referred to as “Direct-to-Consumer platforms Strong execution on growth strategies Core Organic Growth Direct-to- Consumer Gamifiable Apps 3

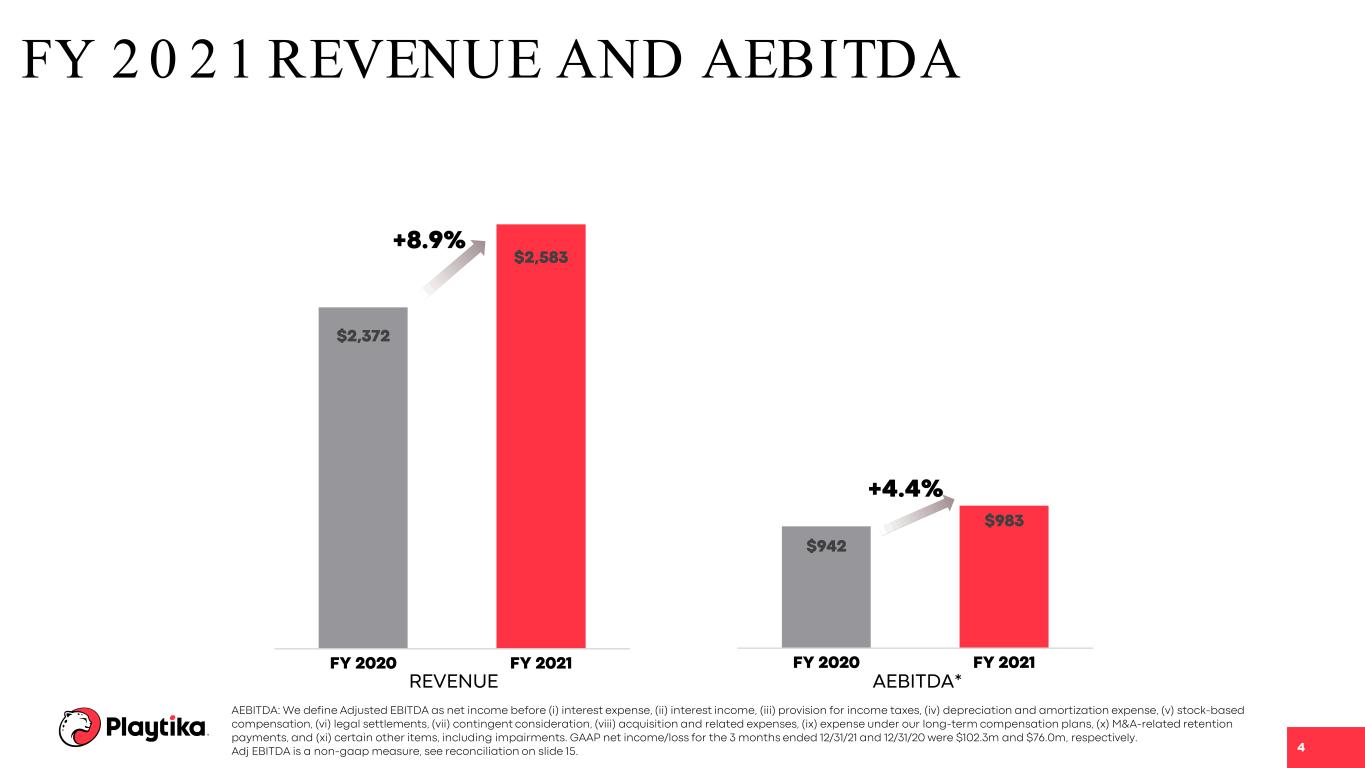

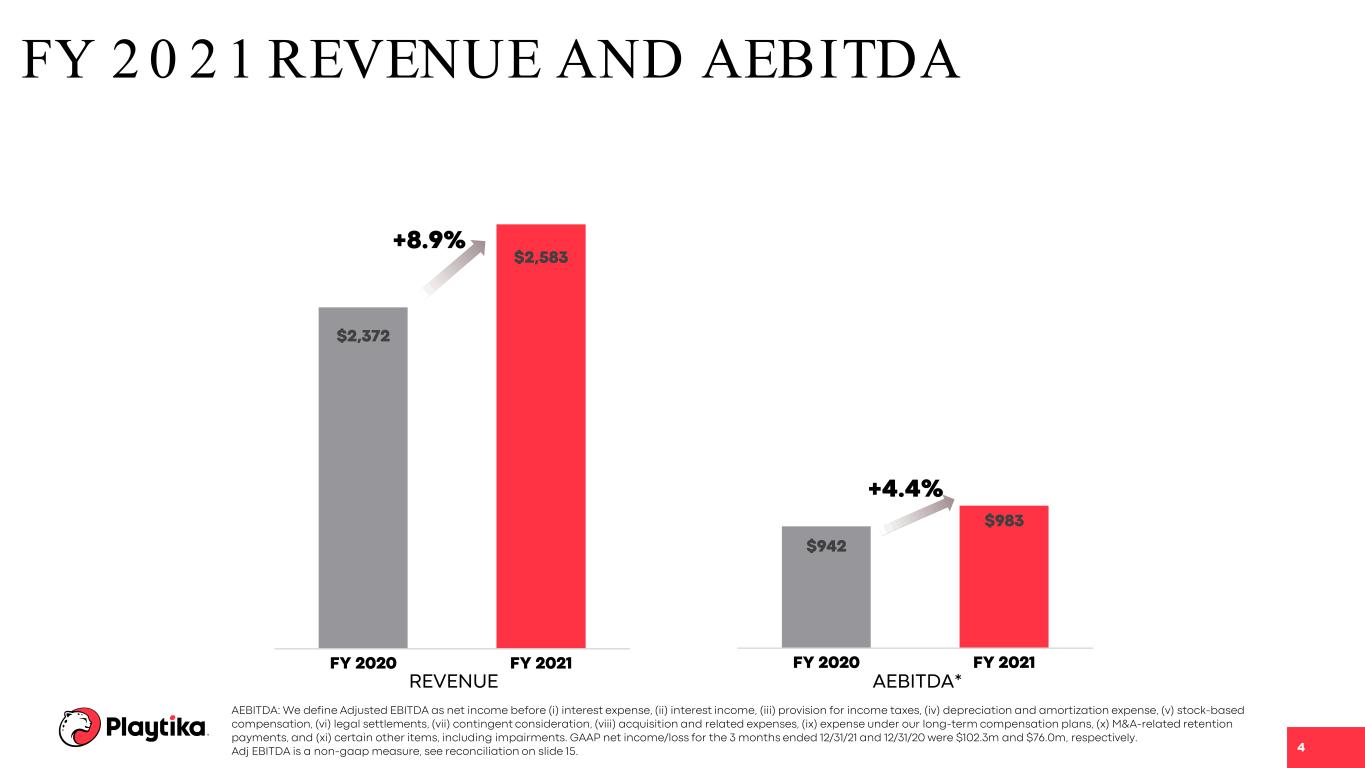

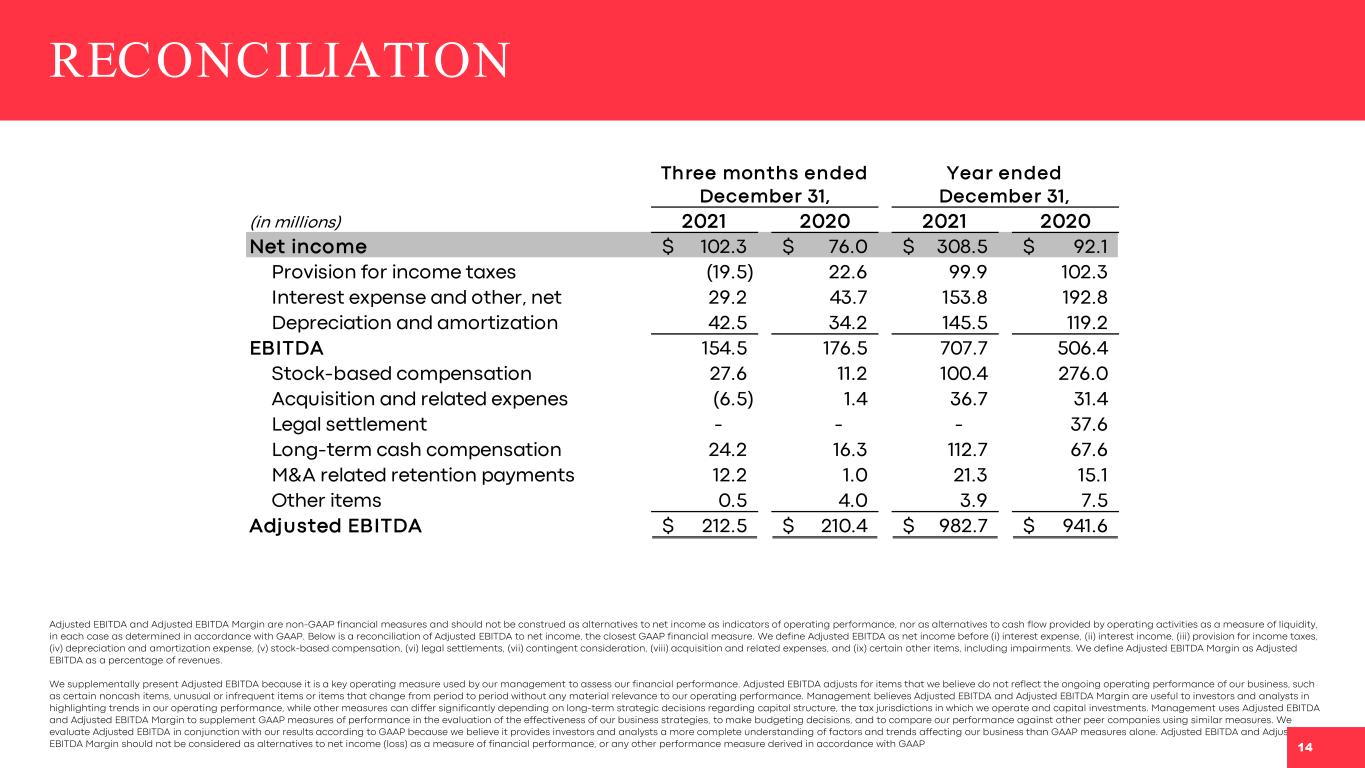

AEBITDA: We define Adjusted EBITDA as net income before (i) interest expense, (ii) interest income, (iii) provision for income taxes, (iv) depreciation and amortization expense, (v) stock-based compensation, (vi) legal settlements, (vii) contingent consideration, (viii) acquisition and related expenses, (ix) expense under our long-term compensation plans, (x) M&A-related retention payments, and (xi) certain other items, including impairments. GAAP net income/loss for the 3 months ended 12/31/21 and 12/31/20 were $102.3m and $76.0m, respectively. Adj EBITDA is a non-gaap measure, see reconciliation on slide 15. FY 2 0 2 1 REVENUE AND AEBITDA $942 $983 FY 2020 FY 2021 $2,372 $2,583 FY 2020 FY 2021 +8.9% +4.4% REVENUE AEBITDA* 4

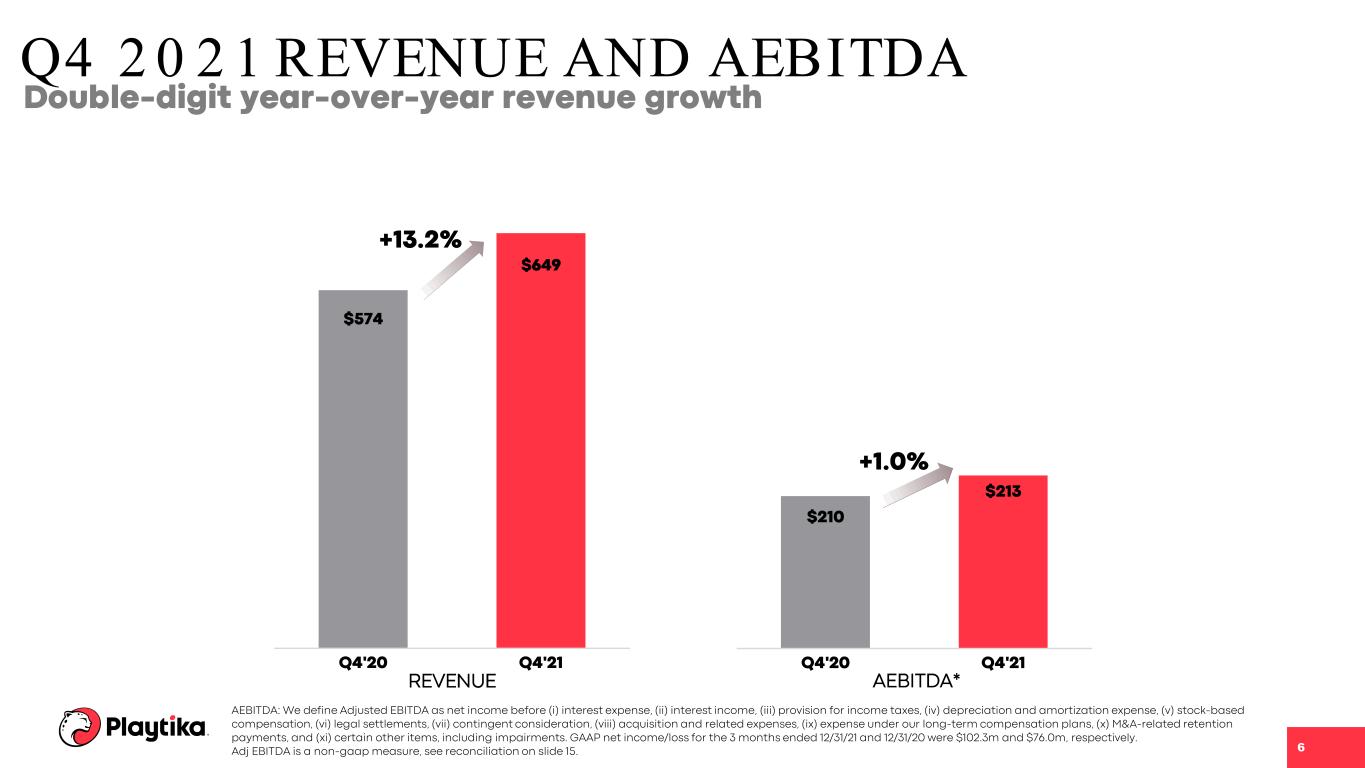

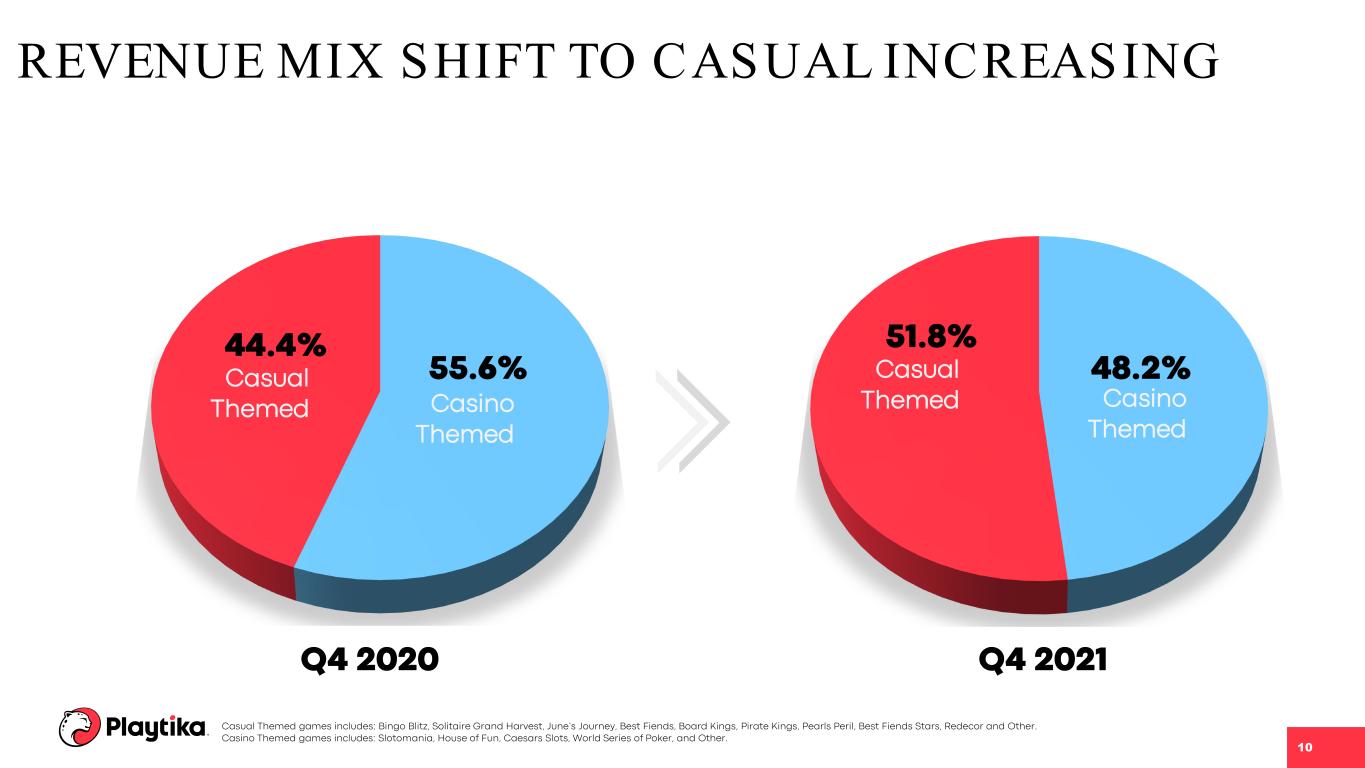

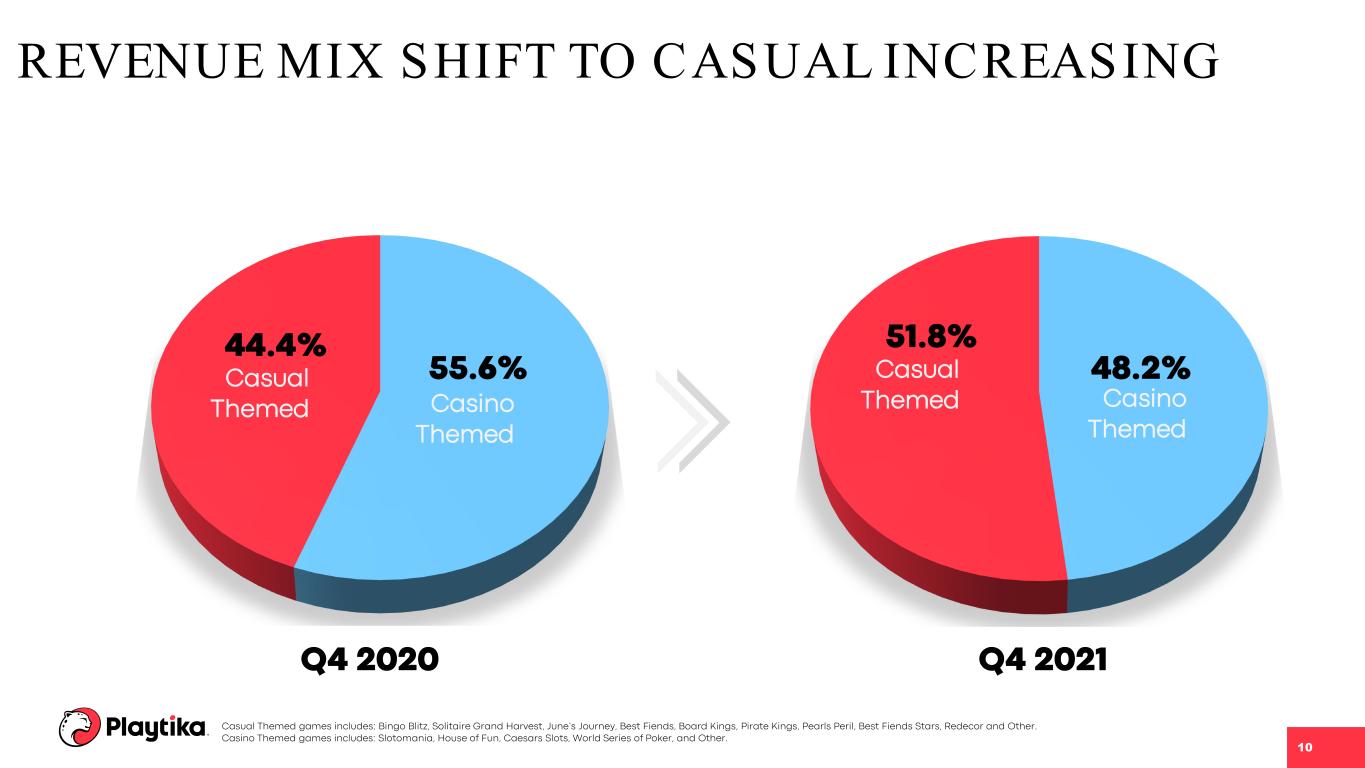

Presentation Title 5 FOURTH QUARTER HIGHLIGHTS Delivered strong Y/Y revenue growth of 13.2% Daily Player Conversion increased to 3.0%, up from 2.6% in Q4’20 Solitaire Grand Harvest and Bingo Blitz grew 60.1% and 17.7% year-over-year, respectively Caesars Casino marked its 10 year anniversary with 7.1% growth year-over-year Continued growth in casual games, now representing 51.8% of overall revenues, compared to 44.4% in Q4’20 Direct-to-Consumer1 platforms revenue grew to 21.7% of overall revenues, up from 15.5% in Q4’20 Casual portfolio revenue grew 31.5% year-over-year (1) Proprietary Platforms is now referred to as “Direct-to-Consumer’ platforms 5

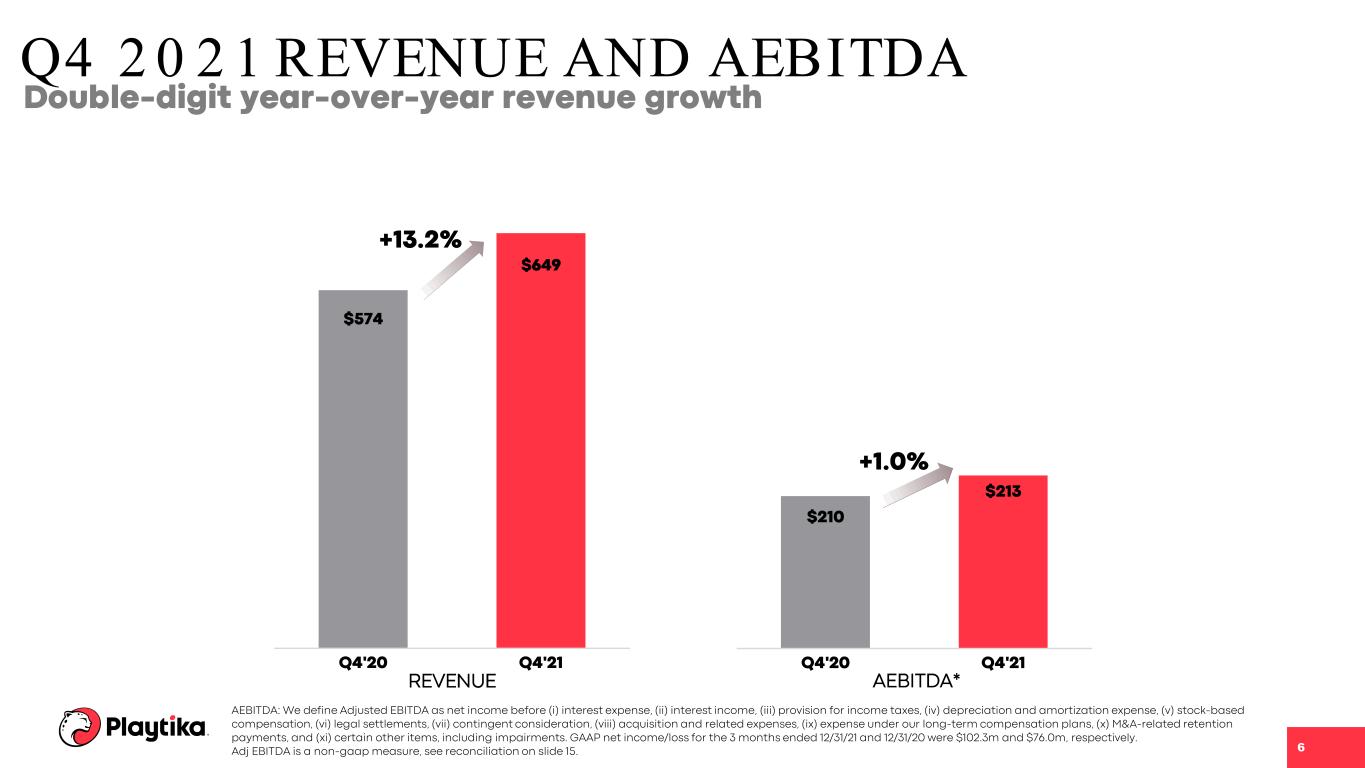

$210 $213 Q4'20 Q4'21 $574 $649 Q4'20 Q4'21 +13.2% +1.0% REVENUE AEBITDA* AEBITDA: We define Adjusted EBITDA as net income before (i) interest expense, (ii) interest income, (iii) provision for income taxes, (iv) depreciation and amortization expense, (v) stock-based compensation, (vi) legal settlements, (vii) contingent consideration, (viii) acquisition and related expenses, (ix) expense under our long-term compensation plans, (x) M&A-related retention payments, and (xi) certain other items, including impairments. GAAP net income/loss for the 3 months ended 12/31/21 and 12/31/20 were $102.3m and $76.0m, respectively. Adj EBITDA is a non-gaap measure, see reconciliation on slide 15. Double-digit year-over-year revenue growth Q4 2 0 2 1 REVENUE AND AEBITDA 6

0.59 0.68 +14.9% ARPDAU* ($) 2.6% 3.0% +42 bps Daily Payer Conversion* (%) 272 311 +14.3% Average Daily Paying Users* (Thousands) LIVEOP S CONTINUE TO DRIVE P LAYER METRICS Q4 2021Q4 2020 Average Daily Paying Users: the number of individuals who purchased, with real world currency, virtual currency or items in any of our games on a particular day. Daily Payer Conversion: (i) the total number of DPUs, (ii) divided by the number of DAUs on a particular day. Average Daily Payer Conversion for a particular period is the average of the Daily Payer Conversion rates for each day during that period. ARPDAU: Average Revenue per Daily Active User (i) the total revenue in a given period, (ii) divided by the number of days in that period, (iii) divided by the average DAUs during the period. 7

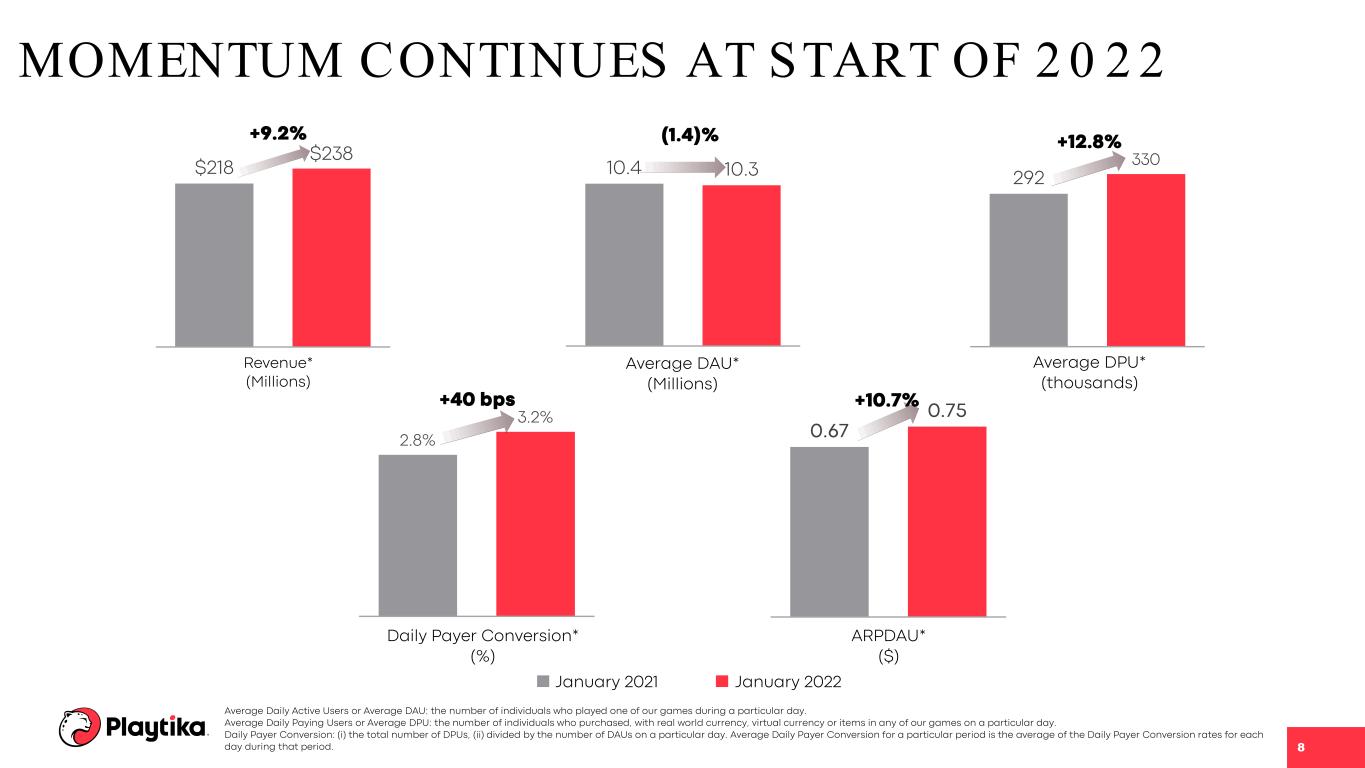

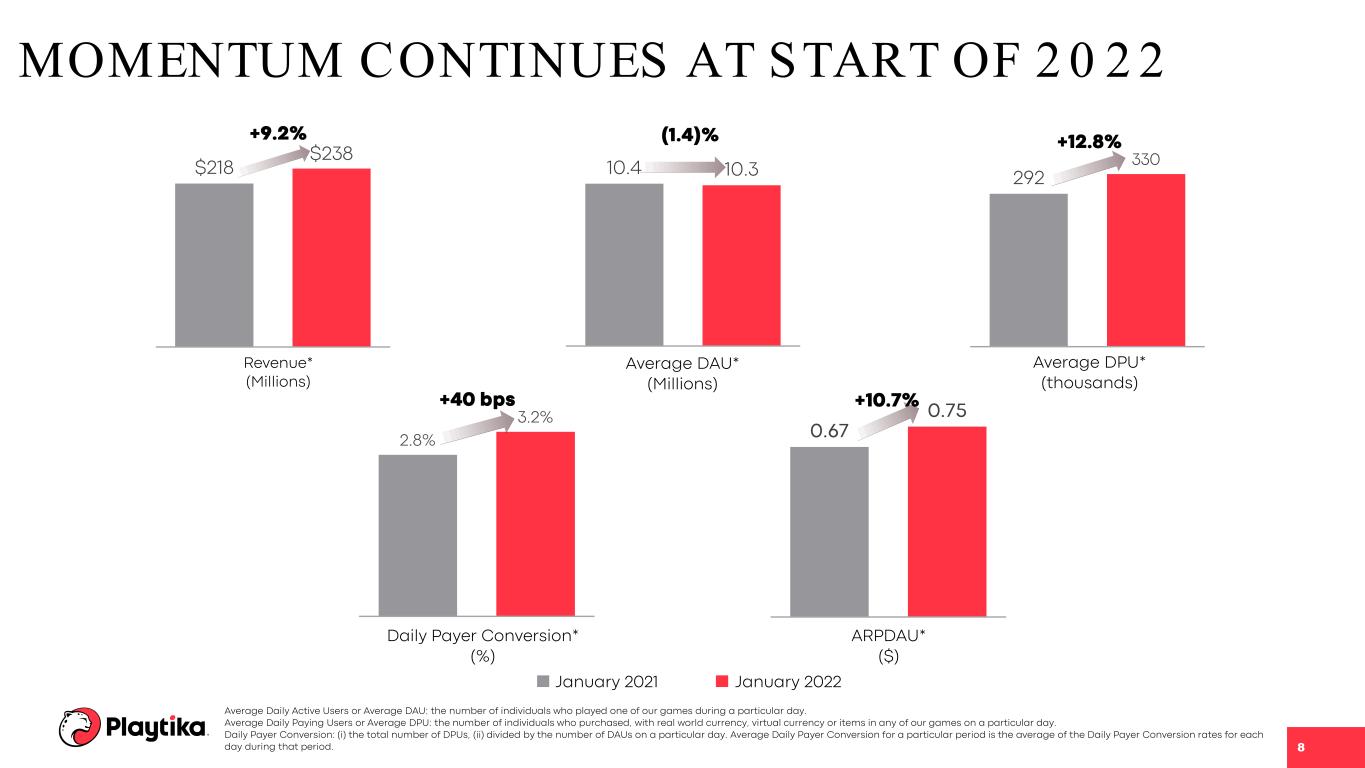

© 2020 Playtika Ltd. All Rights Reserved. 10.4 10.3 292 330 2.8% 3.2% 0.67 0.75 $218 $238 Average DPU* (thousands) Average DAU* (Millions) Revenue* (Millions) MOMENTUM CONTINUES AT START OF 2 0 2 2 January 2022January 2021 Average Daily Active Users or Average DAU: the number of individuals who played one of our games during a particular day. Average Daily Paying Users or Average DPU: the number of individuals who purchased, with real world currency, virtual currency or items in any of our games on a particular day. Daily Payer Conversion: (i) the total number of DPUs, (ii) divided by the number of DAUs on a particular day. Average Daily Payer Conversion for a particular period is the average of the Daily Payer Conversion rates for each day during that period. 8 +9.2% (1.4)% +12.8% Daily Payer Conversion* (%) ARPDAU* ($) +40 bps +10.7%

Q4 ‘2 1 CASE STUDIES: CASUAL GAINING TRACTION Q4’21 Revenue +17.7% Y/Y Introduced new lobby with rejuvenated look and feel Offline campaigns leading to new installs and revenue 2nd Largest Game by Revenue in Portfolio Q4’21 Revenue +60.1% Y/Y Optimized for scale with transition to Unity platform Success of MyFarm feature and continued localization in Germany Q4’21 Revenue +36.0% Y/Y Collectible album continues to drive growth 9

REVENUE MIX SHIFT TO CASUAL INCREASING Casual Themed 44.4% Casino Themed 55.6% Q4 2020 Q4 2021 Casual Themed 51.8% Casino Themed 48.2% Casual Themed games includes: Bingo Blitz, Solitaire Grand Harvest, June’s Journey, Best Fiends, Board Kings, Pirate Kings, Pearls Peril, Best Fiends Stars, Redecor and Other. Casino Themed games includes: Slotomania, House of Fun, Caesars Slots, World Series of Poker, and Other. 10

DIRECT-TO-CONSUMER P LATFORMS GROW TH CONTINUES FY 2021 Gross Revenue by Platforms Notes: 1) Includes iOS, Android, Facebook, Amazon, Windows and other third-party platforms 3rd Party Platforms (1) Direct-to- Consumer Platforms 20.5% 79.5% 11 Direct-to-Consumer revenue grew to 20.5% of overall revenues in 2021, up from 13.6% in 2020 In Q4’21 represented 21.7% of overall revenues compared to 15.5% in Q4’20

REVENUE BY GEOGRAP HY USA. EMEA APAC. OTHER FY 2020 FY 2021 12 70% 70% 14% 15% 9% 8% 7% 7%

© 2020 Playtika Ltd. All Rights Reserved. AP P ENDIX 13

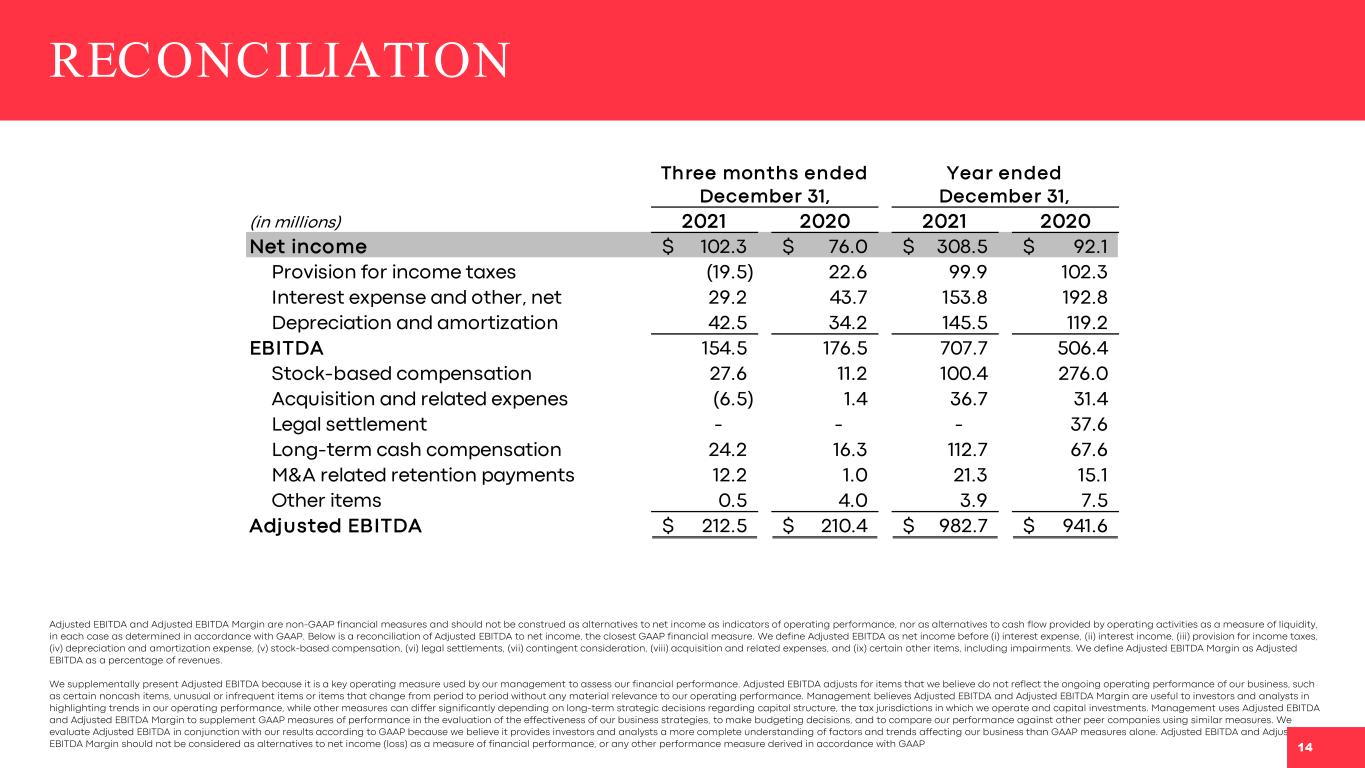

RECONCILIATION Adjusted EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures and should not be construed as alternatives to net income as indicators of operating performance, nor as alternatives to cash flow provided by operating activities as a measure of liquidity, in each case as determined in accordance with GAAP. Below is a reconciliation of Adjusted EBITDA to net income, the closest GAAP financial measure. We define Adjusted EBITDA as net income before (i) interest expense, (ii) interest income, (iii) provision for income taxes, (iv) depreciation and amortization expense, (v) stock-based compensation, (vi) legal settlements, (vii) contingent consideration, (viii) acquisition and related expenses, and (ix) certain other items, including impairments. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenues. We supplementally present Adjusted EBITDA because it is a key operating measure used by our management to assess our financial performance. Adjusted EBITDA adjusts for items that we believe do not reflect the ongoing operating performance of our business, such as certain noncash items, unusual or infrequent items or items that change from period to period without any material relevance to our operating performance. Management believes Adjusted EBITDA and Adjusted EBITDA Margin are useful to investors and analysts in highlighting trends in our operating performance, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate and capital investments. Management uses Adjusted EBITDA and Adjusted EBITDA Margin to supplement GAAP measures of performance in the evaluation of the effectiveness of our business strategies, to make budgeting decisions, and to compare our performance against other peer companies using similar measures. We evaluate Adjusted EBITDA in conjunction with our results according to GAAP because we believe it provides investors and analysts a more complete understanding of factors and trends affecting our business than GAAP measures alone. Adjusted EBITDA and Adjusted EBITDA Margin should not be considered as alternatives to net income (loss) as a measure of financial performance, or any other performance measure derived in accordance with GAAP 14 (in millions) 2021 2020 2021 2020 Net income 102.3$ 76.0$ 308.5$ 92.1$ Provision for income taxes (19.5) 22.6 99.9 102.3 Interest expense and other, net 29.2 43.7 153.8 192.8 Depreciation and amortization 42.5 34.2 145.5 119.2 EBITDA 154.5 176.5 707.7 506.4 Stock-based compensation 27.6 11.2 100.4 276.0 Acquisition and related expenes (6.5) 1.4 36.7 31.4 Legal settlement - - - 37.6 Long-term cash compensation 24.2 16.3 112.7 67.6 M&A related retention payments 12.2 1.0 21.3 15.1 Other items 0.5 4.0 3.9 7.5 Adjusted EBITDA 212.5$ 210.4$ 982.7$ 941.6$ Three months ended December 31, Year ended December 31,