SUPERPLAY LTD. AND ITS SUBSIDIARIES CONSOLIDATED FINANCIAL STATEMENTS AS OF DECEMBER 31, 2023 IN U.S. DOLLARS INDEX Page Report of Independent Auditors 2-3 Consolidated Balance Sheets 4-5 Consolidated Statements of Operations 6 Consolidated Statements of Convertible Preferred Shares and Shareholders' Deficit 7 Consolidated Statements of Cash Flows 8 Notes to Consolidated Financial Statements 9 - 26 - - - - - - - - - - - Exhibit 99.1

- 2 - REPORT OF INDEPENDENT AUDITORS To Board of Directors and Shareholders of SUPERPLAY LTD. Opinion We have audited the consolidated financial statements of SuperPlay LTD. and its subsidiaries (the Company), which comprise the consolidated balance sheets as of December 31, 2023 and 2022, and the related consolidated statements of operations, changes in convertible preferred shares and shareholders' deficit and cash flows for the years then ended, and the related notes (collectively referred to as the "financial statements"). In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2023 and 2022, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Substantial Doubt About the Company’s Ability to Continue as a Going Concern The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has suffered recurring losses from operations, has a net capital deficiency, and has stated that substantial doubt exists about the Company’s ability to continue as a going concern. Management's evaluation of the events and conditions and management’s plans regarding these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our opinion is not modified with respect to this matter. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. Kost Forer Gabbay & Kasierer 144 Menachem Begin Road, Building A Tel-Aviv 6492102, Israel Tel: +972-3-6232525 Fax: +972-3-5622555 ey.com

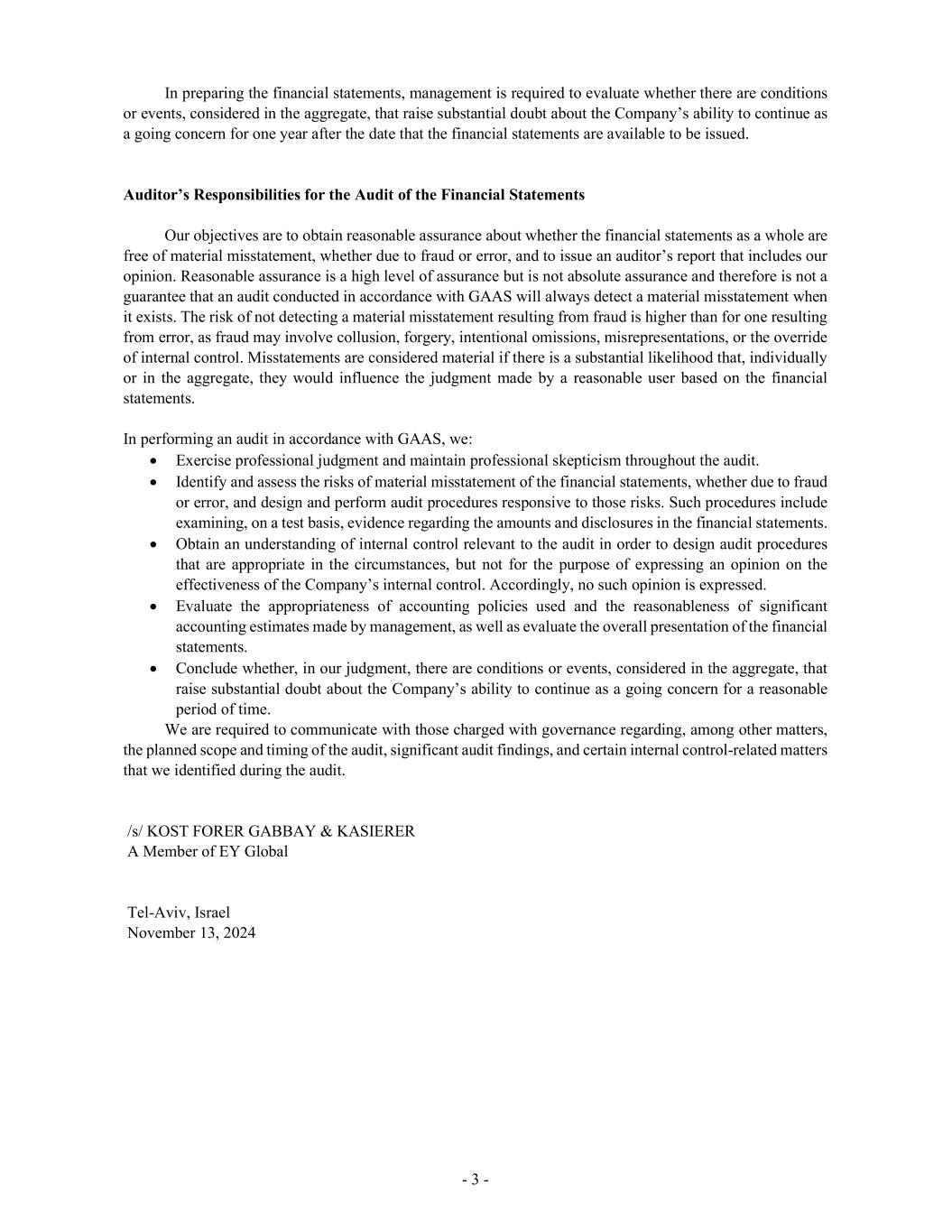

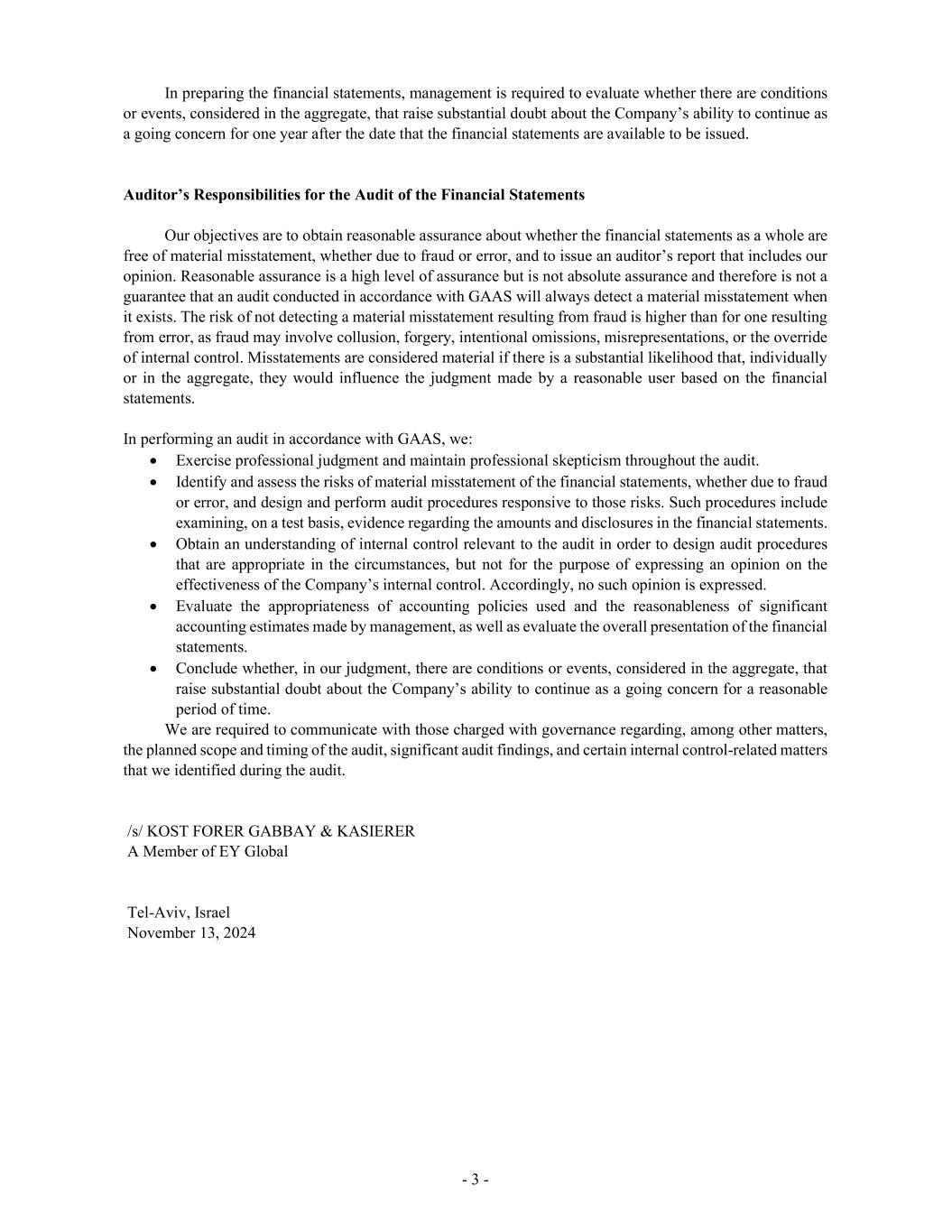

- 3 - In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued. Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. /s/ KOST FORER GABBAY & KASIERER A Member of EY Global Tel-Aviv, Israel November 31 , 2024

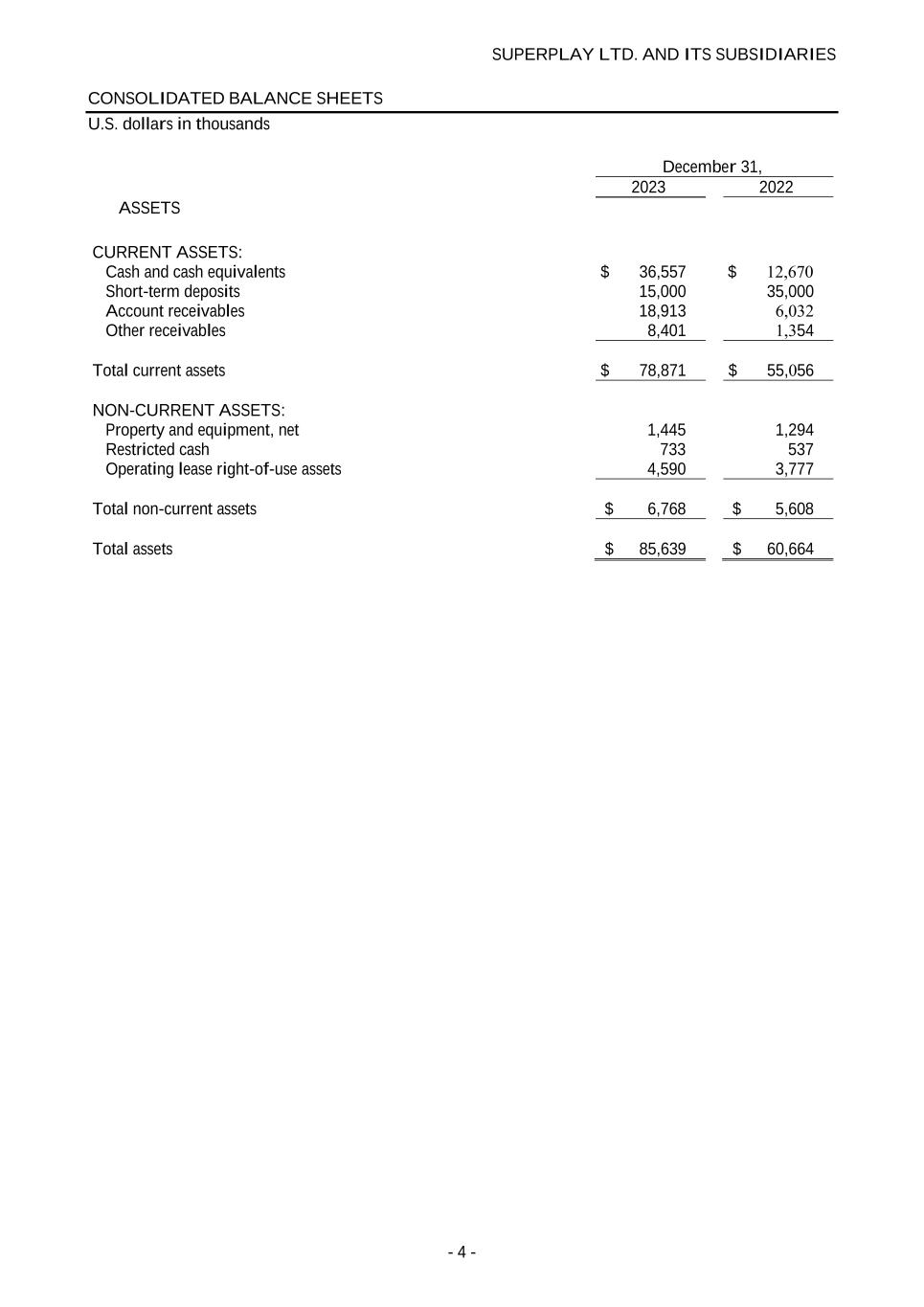

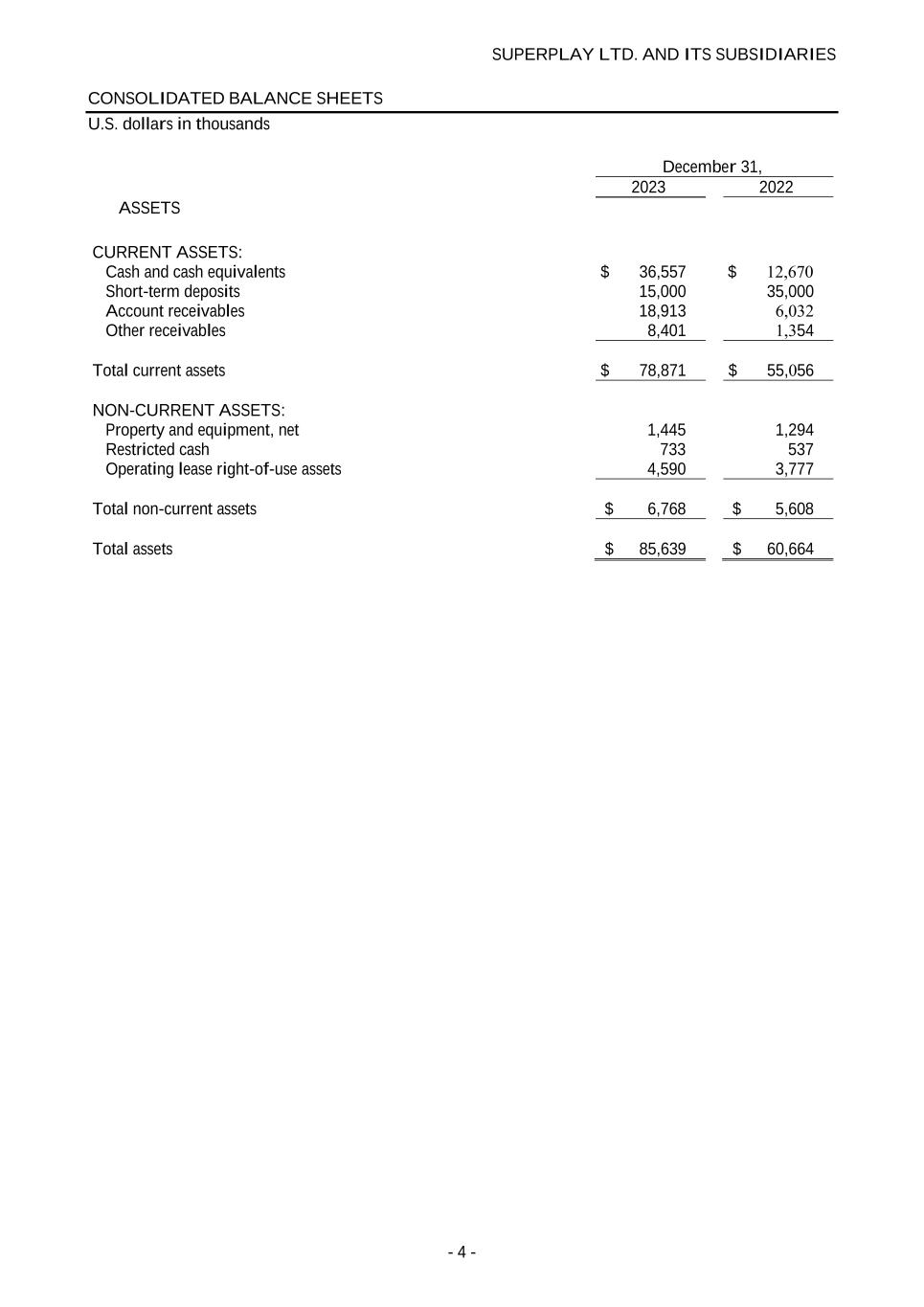

SUPERPLAY LTD. AND ITS SUBSIDIARIES - 4 - CONSOLIDATED BALANCE SHEETS U.S. dollars in thousands December 31, 2023 2022 ASSETS CURRENT ASSETS: Cash and cash equivalents $ 36,557 $ 12,670 Short-term deposits 15,000 35,000 Account receivables 18,913 6,032 Other receivables 8,401 1,354 Total current assets $ 78,871 $ 55,056 NON-CURRENT ASSETS: Property and equipment, net 1,445 1,294 Restricted cash 733 537 Operating lease right-of-use assets 4,590 3,777 Total non-current assets $ 6,768 $ 5,608 Total assets $ 85,639 $ 60,664

SUPERPLAY LTD. AND ITS SUBSIDIARIES - 5 - CONSOLIDATED BALANCE SHEETS U.S. dollars in thousands (except share and per share data) December 31, 2023 2022 LIABILITIES, CONVERTIBLE PREFERRED SHARES AND SHAREHOLDERS’ DEFICIT CURRENT LIABILITIES: Current maturities of loans* $ 35,387 $ 19,683 Short-term revolving credit line 18,000 18,000 Trade payables 3,774 2,353 Employees and payroll accruals 3,541 1,945 Accrued expenses and other current liabilities 18,864 5,434 Operating lease liability 1,024 704 Total current liabilities 80,590 48,119 NON-CURRENT LIABILITIES: Loans, net of current maturities* 35,056 15,382 Operating lease liability 2,985 2,530 Total non-current liabilities 38,041 17,912 Total liabilities $ 118,631 $ 66,031 Convertible preferred shares of NIS 0.01 par value: 2,384,607 shares authorized as of December 31, 2023 and 2022; 2,384,607 shares issued and outstanding as of December 2023 and 2022. 54,110 54,110 SHAREHOLDERS' DEFICIT: Ordinary shares of NIS 0.01 par value: 10,000,000 shares authorized as of December 31, 2023 and 2022; 1,066,936 and 1,063,906 shares issued and outstanding as of December 31, 2023 and 2022, respectively. 3 3 Additional paid in capital 5,627 2,819 Accumulated deficit (92,732) )62,299( Total shareholders' deficit )87,102( )59,477( Total liabilities, convertible preferred shares and shareholders' deficit $ 85,639 $ 664,06 The accompanying notes are an integral part of the consolidated financial statements. November 31 , 2024 Date of approval of the Amir Hanin Gilad Almog consolidated financial statements Chief Financial Officer CEO and Director * Amounts related to related parties.

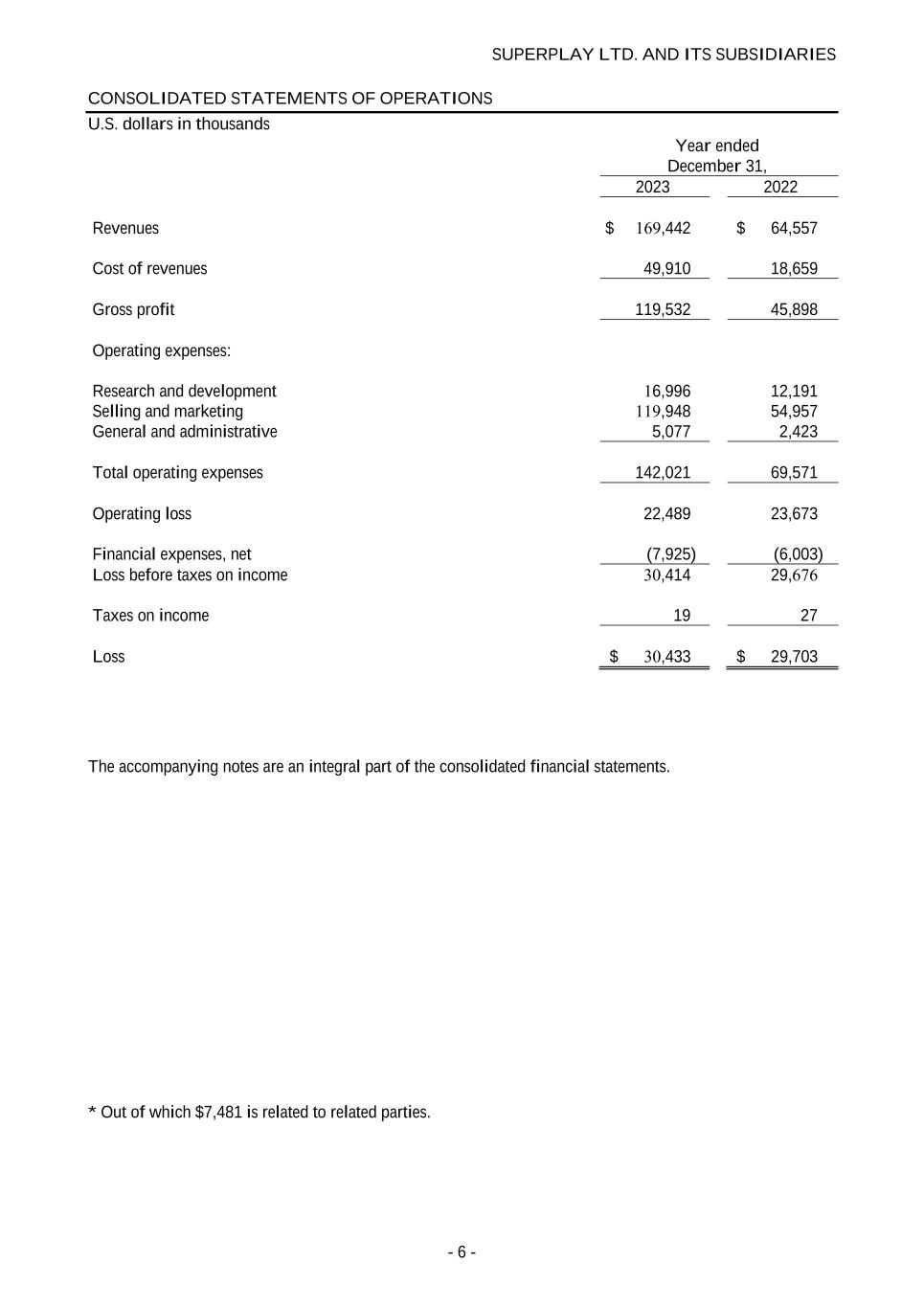

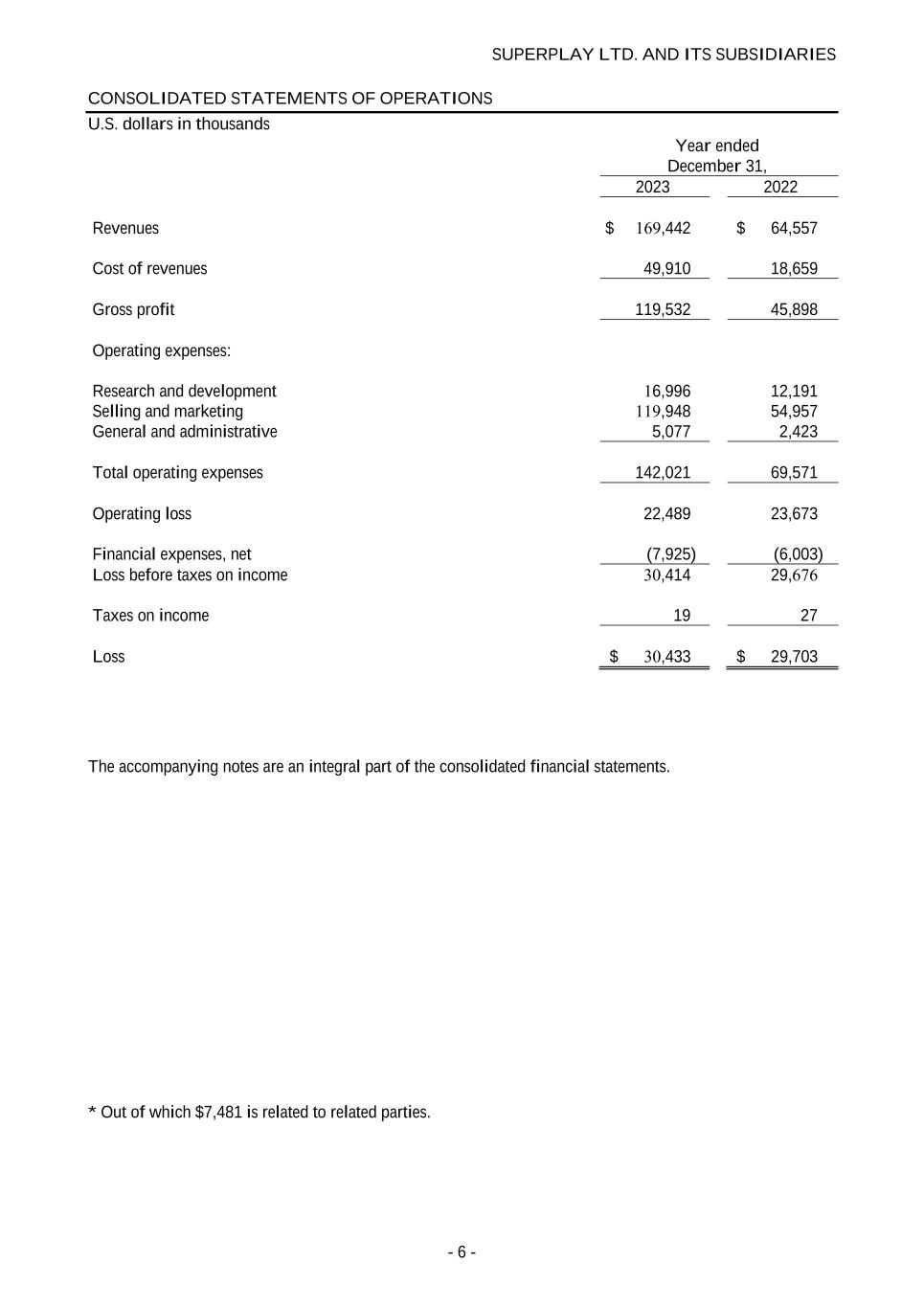

SUPERPLAY LTD. AND ITS SUBSIDIARIES - 6 - CONSOLIDATED STATEMENTS OF OPERATIONS U.S. dollars in thousands Year ended December 31, 2023 2022 Revenues $ 169,442 $ 64,557 Cost of revenues 49,910 18,659 Gross profit 119,532 45,898 Operating expenses: Research and development 16,996 12,191 Selling and marketing 119,948 54,957 General and administrative 5,077 2,423 Total operating expenses 142,021 69,571 Operating loss 22,489 23,673 Financial expenses, net (7,925) (6,003) Loss before taxes on income 30,414 29,676 Taxes on income 19 27 Loss $ 30,433 $ 29,703 The accompanying notes are an integral part of the consolidated financial statements. * Out of which $7,481 is related to related parties.

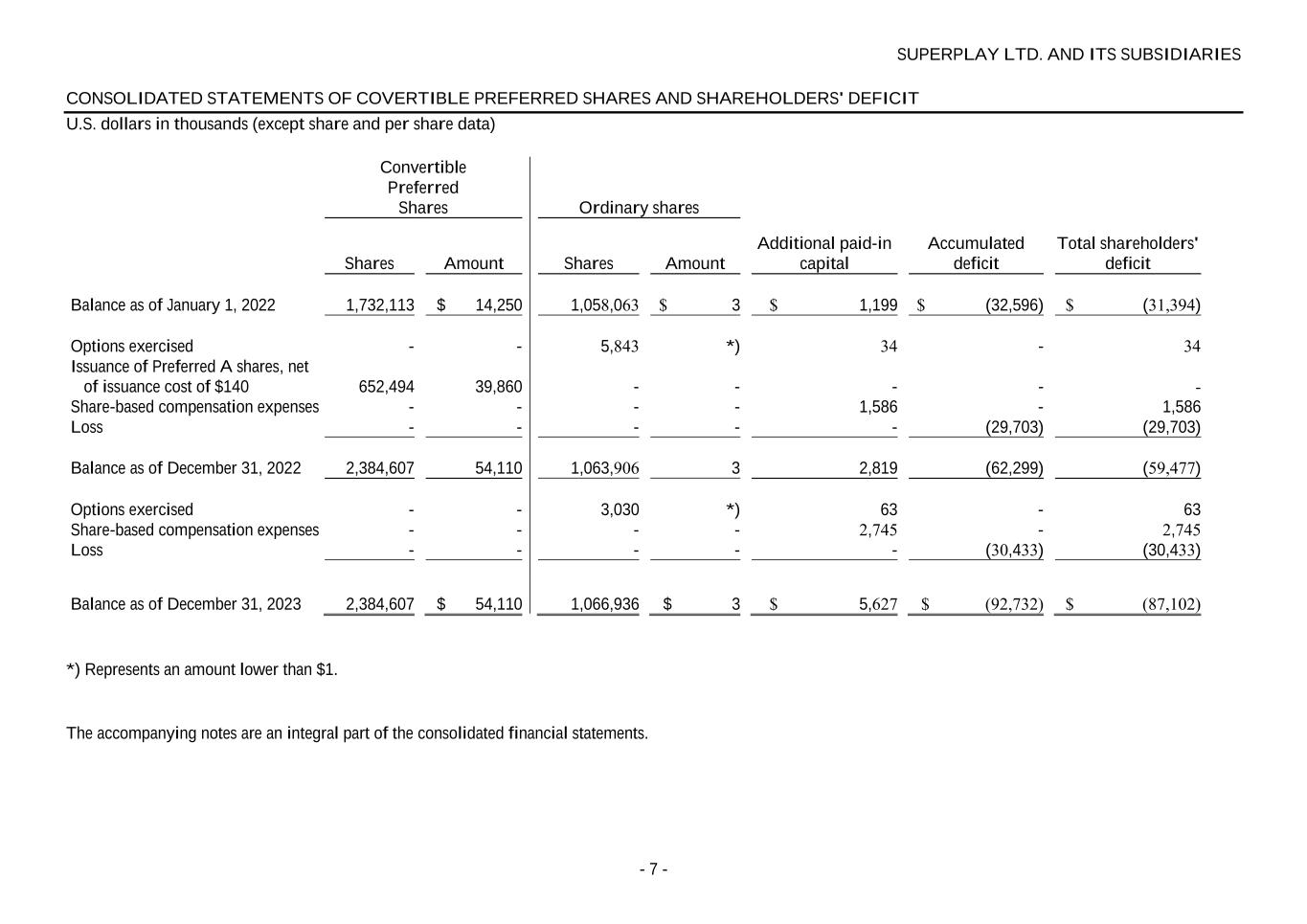

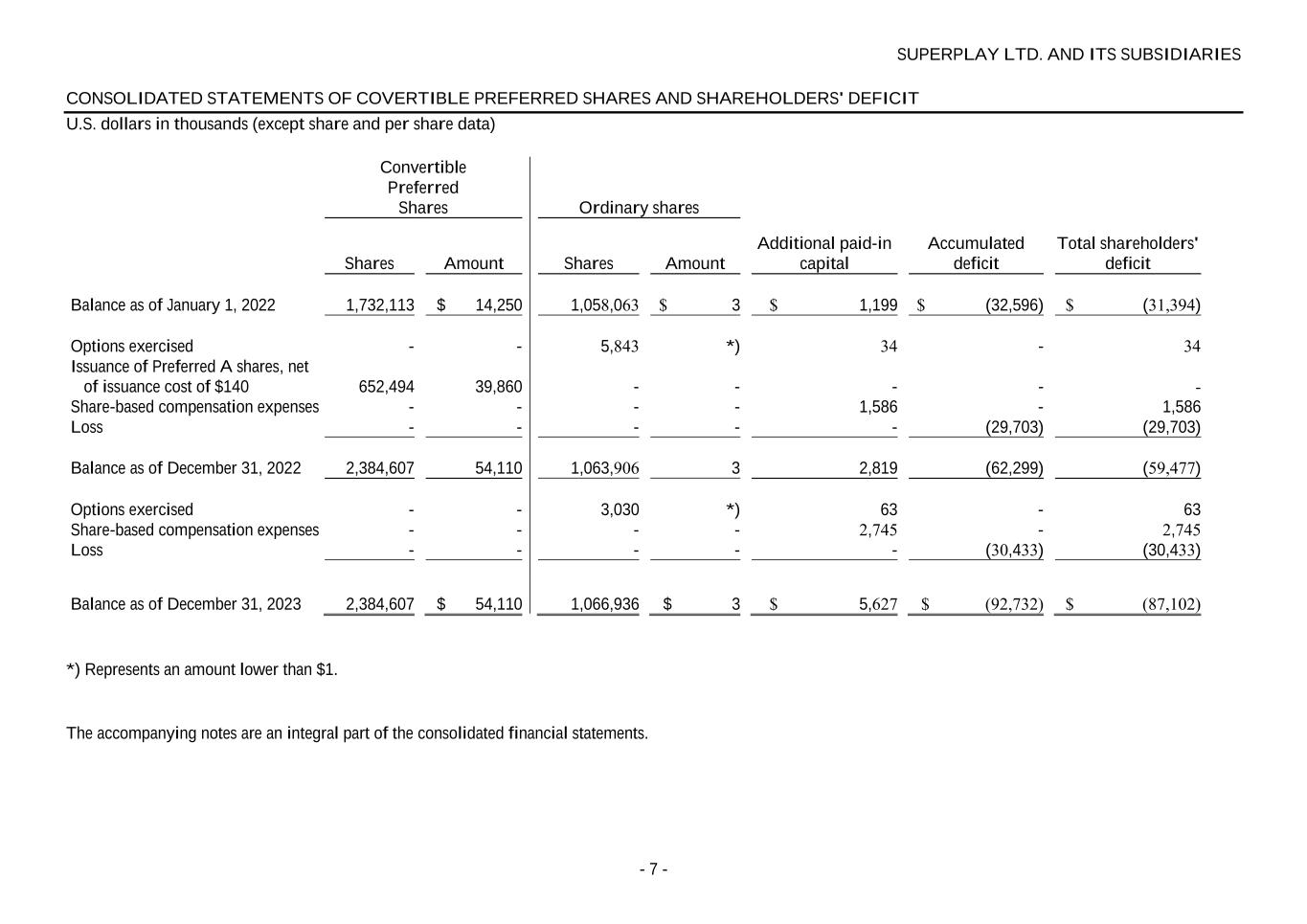

SUPERPLAY LTD. AND ITS SUBSIDIARIES - 7 - CONSOLIDATED STATEMENTS OF COVERTIBLE PREFERRED SHARES AND SHAREHOLDERS' DEFICIT U.S. dollars in thousands (except share and per share data) Convertible Preferred Shares Ordinary shares Shares Amount Shares Amount Additional paid-in capital Accumulated deficit Total shareholders' deficit Balance as of January 1, 2022 1,732,113 $ 14,250 1,058,063 $ 3 $ 1,199 $ (32,596) $ ( 39431, ) Options exercised - - 5,843 *) 34 - 34 Issuance of Preferred A shares, net of issuance cost of $140 652,494 39,860 - - - - - Share-based compensation expenses - - - - 1,586 - 1,586 Loss - - - - - (29,703) (29,703) Balance as of December 31, 2022 2,384,607 54,110 1,063,906 3 2,819 (62,299) (59,477) Options exercised - - 3,030 *) 63 - 63 Share-based compensation expenses - - - - 2,745 - 2,745 Loss - - - - - (30,433) (30,433) Balance as of December 31, 2023 2,384,607 $ 54,110 1,066,936 $ 3 $ 5,627 $ )92,732( $ )87,102( *) Represents an amount lower than $1. The accompanying notes are an integral part of the consolidated financial statements.

SUPER PLAY LTD. AND ITS SUBSIDIARIES - 8 - CONSOLIDATED STATEMENTS OF CASH FLOWS U.S. dollars in thousands Year ended December 31, 2023 2022 Cash flows from operating activities: Loss $ (30,433) $ (29,703) Adjustments to reconcile loss to net cash used in operating activities: Depreciation 390 362 Increase in account receivables )12,881( )2,741( Share-based compensation expenses 2,745 1,586 Change in accrued interest from loans 323 696 Decrease (Increase) in other receivables )7,047( 139 Decrease in operating lease right-of-use asset 640 365 Decrease in operating lease liability (678) (908) Increase in trade payables 1,421 402 Increase in employees and payroll accruals 1,596 1,596 Increase in accrued expenses and other current liabilities 13,430 1,024 Net cash used in operating activities (30,494) (27,182) Cash flows from investing activities: Proceed (Investment) from short-term deposits, net 20,000 (33,885) Purchase of property and equipment (541) (1,098) Investment in restricted cash (196) (55) Net cash provided (used) in investing activities 19,263 (35,038) Cash flows from financing activities: Issuance of Preferred A shares, net of issuance cost of $140 - 39,860 Proceeds from loans 94,263 39,820 Repayment of loans (59,208) )29,505( Proceeds from short-term revolving credit line - 8,000 Proceeds from exercise of options 63 34 Net cash provided by financing activities 35,118 58,209 Increase (decrease) in cash and cash equivalents 23,887 (4,011) Cash and cash equivalents at the beginning of the year 12,670 16,681 Cash and cash equivalents at the end of the year 36,557 12,670 Supplemental disclosure of cash flow information: Cash paid during the year for interest 7,158 3,531 Non-cash investing and financing activities: Right-of-use asset recognized with corresponding lease liability 1,453 4,412 The accompanying notes are an integral part of the consolidated financial statements.

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 9 - NOTE 1. ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Description of business and organization Super Play Ltd. (the "Company") was incorporated and commenced its operations on January 13, 2019. The Company is an interactive entertainment company that develops and operates social game services. The Company holds the following wholly owned (100%) subsidiaries: Simple Play Ltd, Screenshake Ltd, SuperPlay Games LLC. Superskill Games, Inc. The subsidiaries were designated to be engaged in operation activities. On January 31, 2024, the board approved the dissolution of Superskill Games, Inc. On February 1, 2024, Superskill Games, Inc, a wholly owned subsidiary of Superplay, has submitted to the Secretary of State of Delaware a certificate of dissolution and as such the subsidiary was dissolved. As of December 31, 2023, the Company's cash position (cash, cash equivalents and bank deposits) totaled $51,557 and has a negative cash flow from operating activities in the amount of $30,494 during the year then ended. The Company’s current operating plan includes various assumptions concerning the level and timing of cash receipts from sales and cash outlays for operating expenses and capital expenditures. The Company is planning to finance its operations from its existing and future working capital resources and to continue to evaluate additional sources of capital and financing. However, there is no assurance that additional capital and or financing will be available to the Company, and even if available, whether it will be on terms acceptable to the Company or in amounts required. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements do not include any adjustments to the carrying amounts and classifications of assets and liabilities that would result if the Company were unable to continue as a going concern. Basis of presentation and consolidation The accompanying consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”) and include SuperPlay and all subsidiaries in which the Company has a controlling financial interest. Control generally equates to ownership percentage, whereby affiliates that are more than 50% owned are consolidated. In the opinion of management, all adjustments considered necessary for a fair presentation have been recorded within the accompanying financial statements, consisting of normal, recurring adjustments, and all intercompany balances and transactions have been eliminated in the consolidation. Use of estimates The preparation of the consolidated financial statements in conformity with U.S. GAAP requires management to make estimates, judgments and assumptions. The Company's management believes that the estimates, judgments and assumptions used are reasonable based upon information available at the time they are made. These estimates, judgments and assumptions can affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at the dates of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

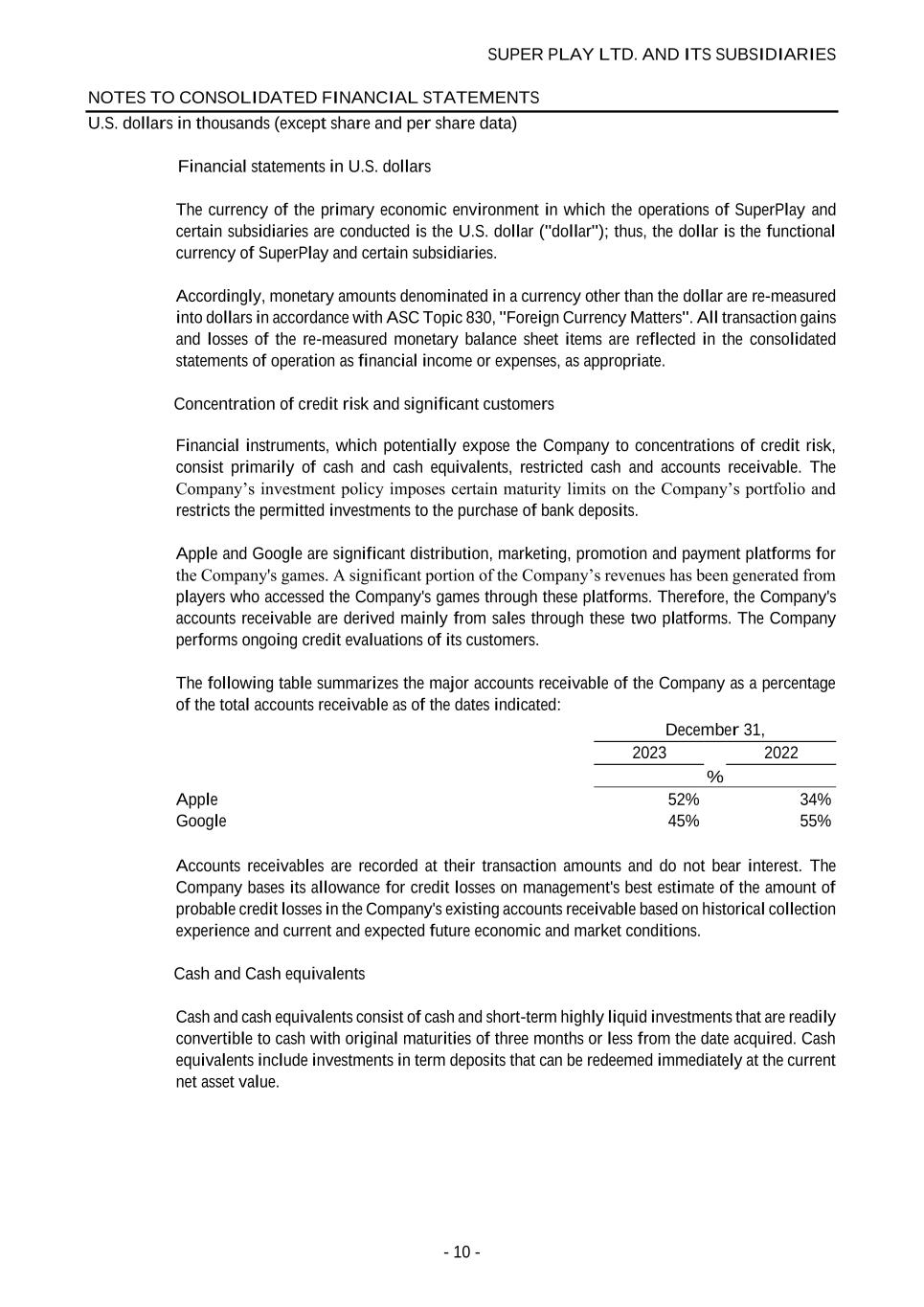

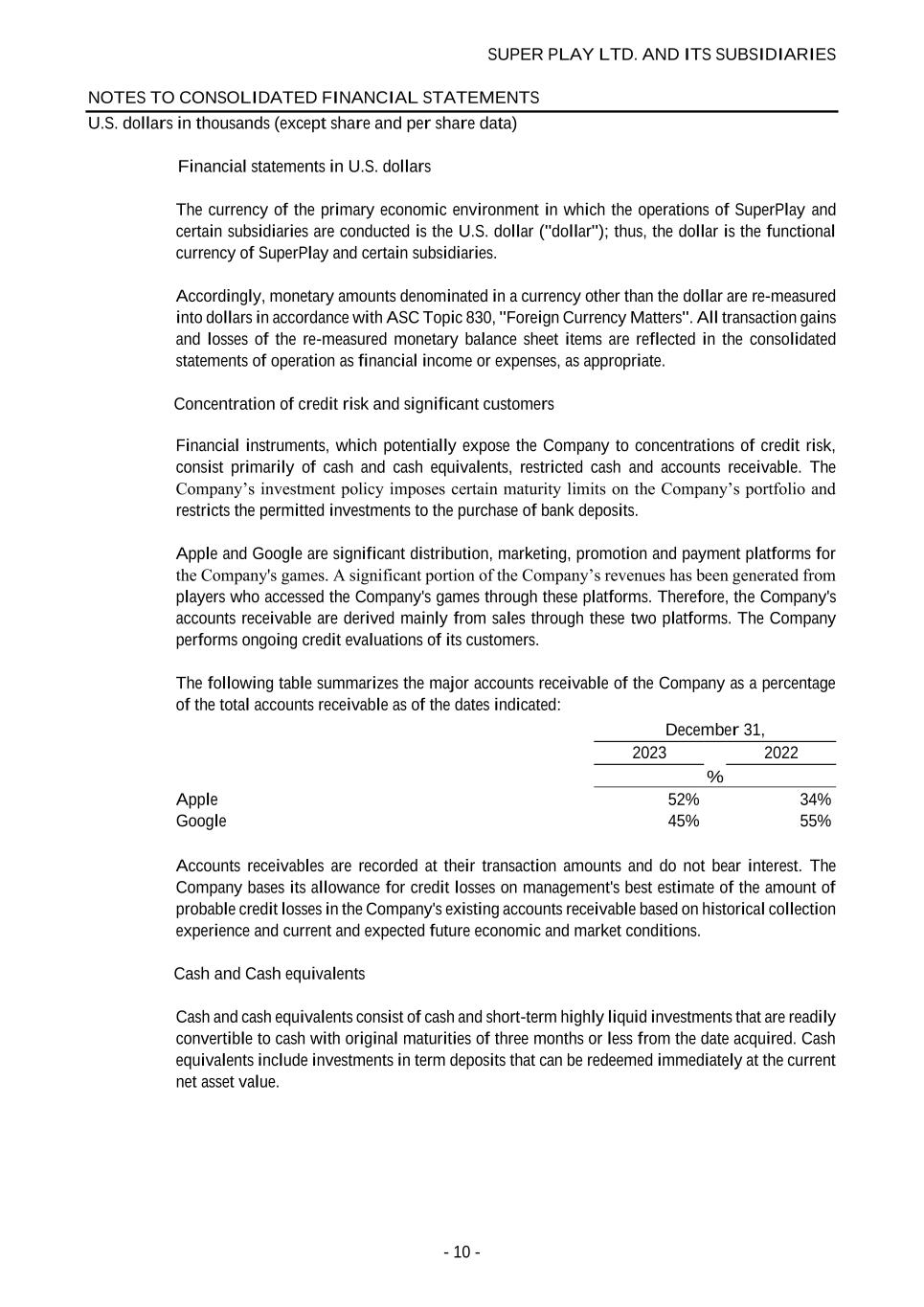

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 10 - Financial statements in U.S. dollars The currency of the primary economic environment in which the operations of SuperPlay and certain subsidiaries are conducted is the U.S. dollar ("dollar"); thus, the dollar is the functional currency of SuperPlay and certain subsidiaries. Accordingly, monetary amounts denominated in a currency other than the dollar are re-measured into dollars in accordance with ASC Topic 830, "Foreign Currency Matters". All transaction gains and losses of the re-measured monetary balance sheet items are reflected in the consolidated statements of operation as financial income or expenses, as appropriate. Concentration of credit risk and significant customers Financial instruments, which potentially expose the Company to concentrations of credit risk, consist primarily of cash and cash equivalents, restricted cash and accounts receivable. The Company’s investment policy imposes certain maturity limits on the Company’s portfolio and restricts the permitted investments to the purchase of bank deposits. Apple and Google are significant distribution, marketing, promotion and payment platforms for the Company's games. A significant portion of the Company’s revenues has been generated from players who accessed the Company's games through these platforms. Therefore, the Company's accounts receivable are derived mainly from sales through these two platforms. The Company performs ongoing credit evaluations of its customers. The following table summarizes the major accounts receivable of the Company as a percentage of the total accounts receivable as of the dates indicated: December 31, 2023 2022 % Apple 52% 34% Google 45% 55% Accounts receivables are recorded at their transaction amounts and do not bear interest. The Company bases its allowance for credit losses on management's best estimate of the amount of probable credit losses in the Company's existing accounts receivable based on historical collection experience and current and expected future economic and market conditions. Cash and Cash equivalents Cash and cash equivalents consist of cash and short-term highly liquid investments that are readily convertible to cash with original maturities of three months or less from the date acquired. Cash equivalents include investments in term deposits that can be redeemed immediately at the current net asset value.

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 11 - Short-term deposit Short-term bank deposits with original maturities of more than three months and less than one year at the date acquired are included in short-term bank deposits. Property and equipment, net The Company states property and equipment at cost. The Company computes depreciation using the straight-line method over the estimated useful lives of the respective assets or, in the case of leasehold improvements, the lease term of the respective assets, whichever is shorter. The Company examines fully depreciated assets annually and writes off those no longer in use. The depreciation periods for the Company's property and equipment are as follows: Useful life Computers 3 years Office furniture and equipment 10 to 14 years Electronic equipment 7 years Leasehold improvements Shorter of the estimated useful life or remaining term of lease Impairment of long-lived assets The Company’s long-lived assets to be held or used, including right-of-use (“ROU”) assets are tested for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable, in accordance with ASC 360, Accounting for the Impairment or Disposal of Long-Lived Assets. Impairment indicators include any significant changes in the manner of the Company’s use of the assets and significant negative industry or economic trends. When impairment indicators exist, the Company evaluate recoverability of an asset group by a comparison of the aggregate undiscounted projection future cash flows to the carrying amounts of the asset group. If such evaluation indicates that the carrying amount of the asset group is not recoverable, an impairment loss is calculated based on the excess of the carrying amount of the assets group over its fair value. Fair value is generally measured based on a discounted cash flow analysis. No impairment indicators have been identified during the years ended December 31, 2023 and 2022.

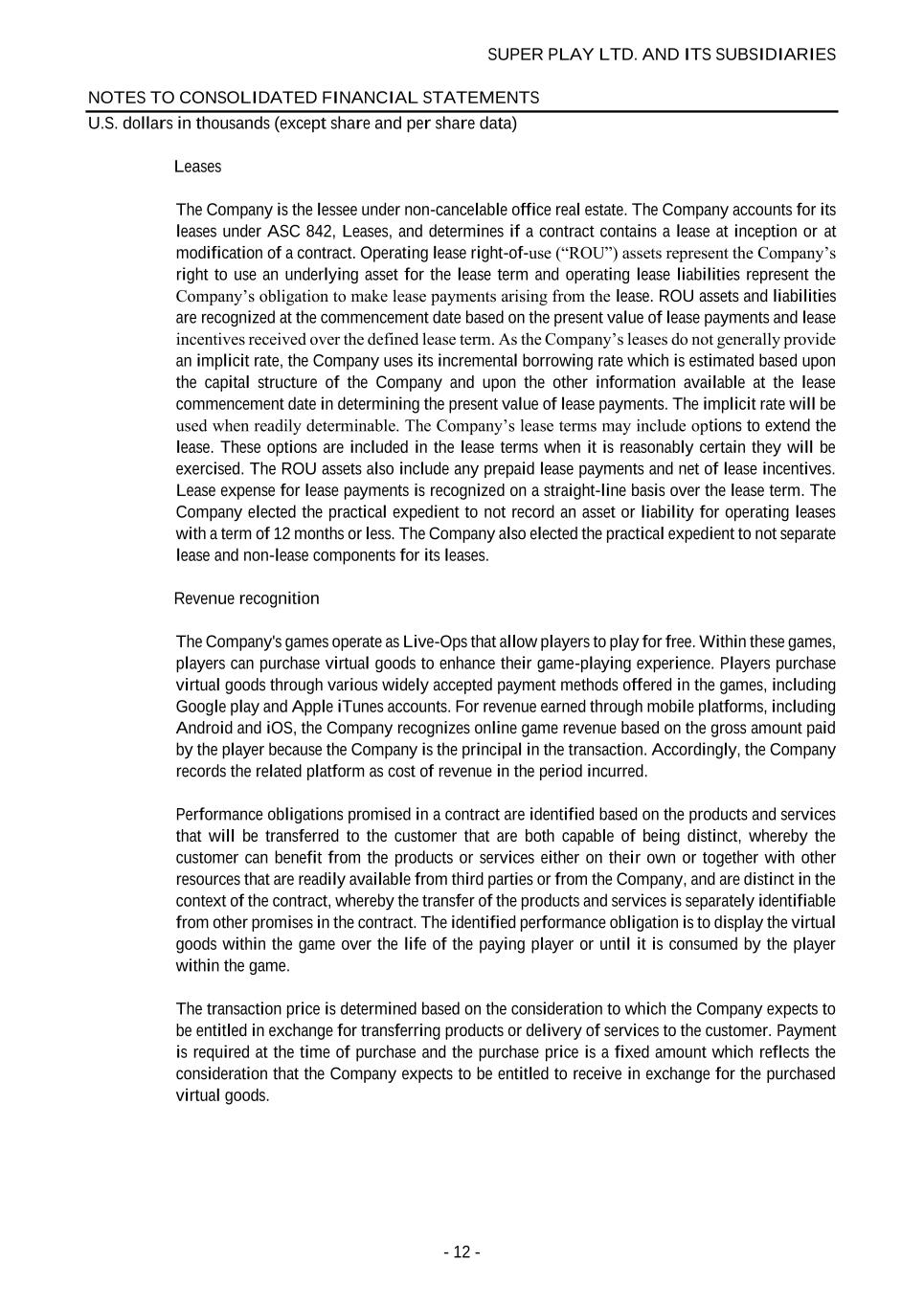

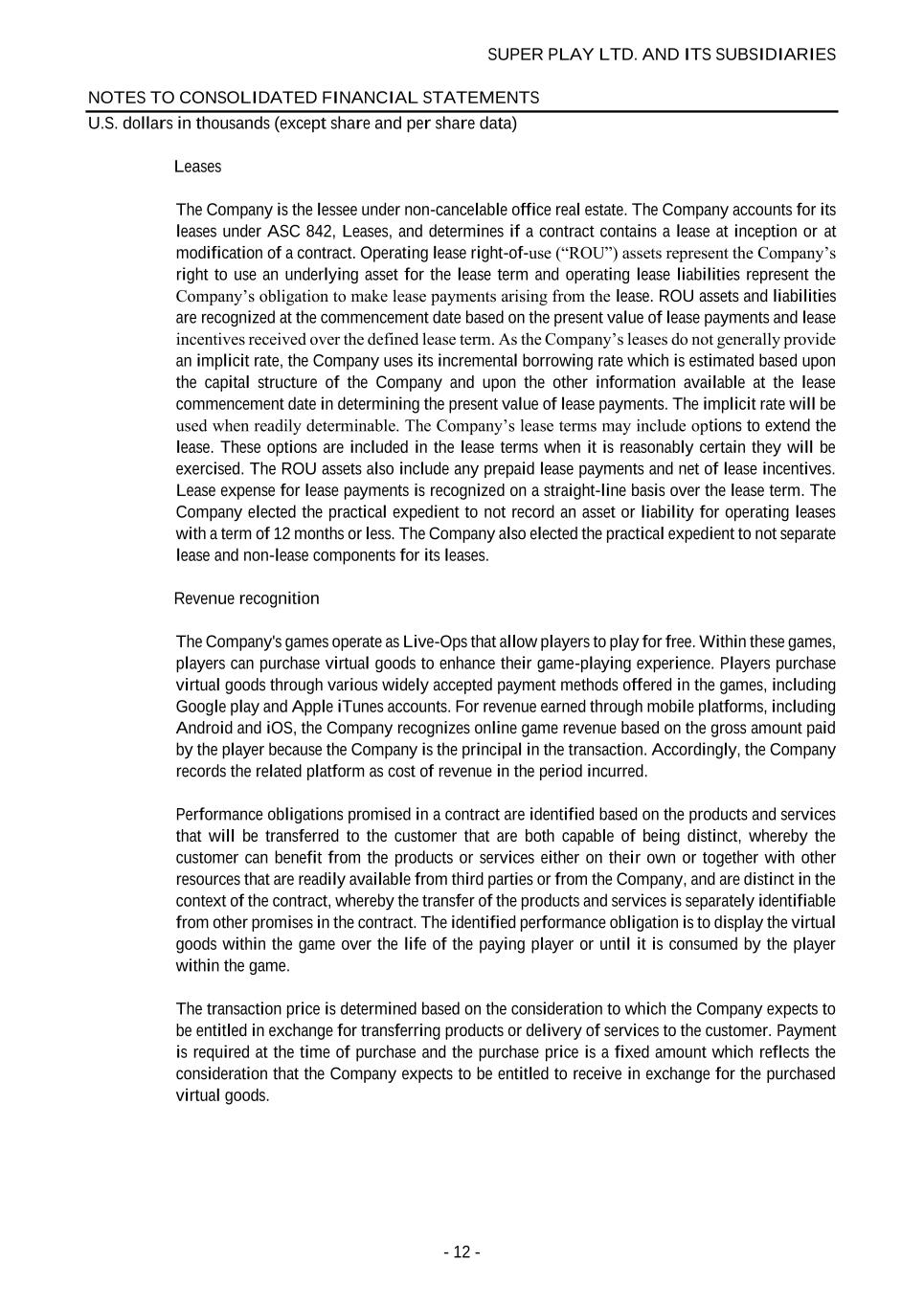

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 12 - Leases The Company is the lessee under non-cancelable office real estate. The Company accounts for its leases under ASC 842, Leases, and determines if a contract contains a lease at inception or at modification of a contract. Operating lease right-of-use (“ROU”) assets represent the Company’s right to use an underlying asset for the lease term and operating lease liabilities represent the Company’s obligation to make lease payments arising from the lease. ROU assets and liabilities are recognized at the commencement date based on the present value of lease payments and lease incentives received over the defined lease term. As the Company’s leases do not generally provide an implicit rate, the Company uses its incremental borrowing rate which is estimated based upon the capital structure of the Company and upon the other information available at the lease commencement date in determining the present value of lease payments. The implicit rate will be used when readily determinable. The Company’s lease terms may include options to extend the lease. These options are included in the lease terms when it is reasonably certain they will be exercised. The ROU assets also include any prepaid lease payments and net of lease incentives. Lease expense for lease payments is recognized on a straight-line basis over the lease term. The Company elected the practical expedient to not record an asset or liability for operating leases with a term of 12 months or less. The Company also elected the practical expedient to not separate lease and non-lease components for its leases. Revenue recognition The Company's games operate as Live-Ops that allow players to play for free. Within these games, players can purchase virtual goods to enhance their game-playing experience. Players purchase virtual goods through various widely accepted payment methods offered in the games, including Google play and Apple iTunes accounts. For revenue earned through mobile platforms, including Android and iOS, the Company recognizes online game revenue based on the gross amount paid by the player because the Company is the principal in the transaction. Accordingly, the Company records the related platform as cost of revenue in the period incurred. Performance obligations promised in a contract are identified based on the products and services that will be transferred to the customer that are both capable of being distinct, whereby the customer can benefit from the products or services either on their own or together with other resources that are readily available from third parties or from the Company, and are distinct in the context of the contract, whereby the transfer of the products and services is separately identifiable from other promises in the contract. The identified performance obligation is to display the virtual goods within the game over the life of the paying player or until it is consumed by the player within the game. The transaction price is determined based on the consideration to which the Company expects to be entitled in exchange for transferring products or delivery of services to the customer. Payment is required at the time of purchase and the purchase price is a fixed amount which reflects the consideration that the Company expects to be entitled to receive in exchange for the purchased virtual goods.

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 13 - Revenue is recognized at the time the related performance obligation is satisfied by transferring the promised product or delivery of service to the customer. The satisfaction of the performance obligation depends on the nature of the virtual goods purchased. The Company's revenues derive primarily from sales of consumable virtual goods. Consumable virtual goods represent items that can be consumed by a specific player action and do not provide the player any continuing benefit following consumption. The Company recognizes revenue from sales of consumable virtual items as the goods are consumed, which is usually within a few days from the purchase. The Company also derives revenues from the sale of advertisements within its games due to its contractual relationships with mobile ad networks. The Company has identified the display of advertisements within its games as a single performance obligation. Revenue from advertisements is recognized at a point-in-time when the advertisements are displayed in the game to the player, as the customer receive the benefits provided from these services. The Company is not the primary obligor in these arrangements, it does not set the pricing, nor does it establish or maintain the relationship with the advertiser. Accordingly, proceeds from advertisements are recorded to revenue net of amounts retained by the mobile ad networks. Research and development costs Research and development costs are charged to the consolidated statement of operations as incurred. The Company studio teams follow an agile development process, whereas the preliminary project stage remains ongoing until just prior to worldwide launch at which time final feature selection occurs. As such, the development costs are expensed as incurred to research and development in the consolidated statements of operations. The Company did not capitalize any software development costs during the years ended December 31, 2023, and 2022. Fair value measurement Fair value is defined as the exchange price that would be received from the sale of an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. The Company measures financial assets and liabilities at fair value at each reporting period using a fair value hierarchy which requires the Company to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s classification within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Three levels of inputs may be used to measure fair value: Level 1 – Quoted prices in active markets for identical assets or liabilities. Level 2 – Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 – Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 14 - The carrying amount of cash and cash equivalents, bank deposits, restricted cash, trade receivables, other current assets, trade payables, employees and payroll accruals, accrued expenses and other current liabilities approximate their fair value due to the short-term maturities of these instruments. Stock-based compensation The Company has a stock-based compensation program which provides for equity awards including time-based stock options. Stock-based compensation expense is measured at the grant date, based on the estimated fair value of the award, and is recognized as expense on a straight- line basis over the requisite service period. The Company records forfeitures as a reduction of stock-based compensation expense as those forfeitures occur. The Company used the Black-Scholes option pricing model to estimate the fair value and compensation cost associated with stock options. As it does not have a long history of market prices for its common stock because the stock is not publicly traded, the Company used observable data for a group of peer companies that grant options with substantially similar terms to assist in developing its volatility assumptions. If factors change and the Company employs different assumptions, stock-based compensation cost on future awards may differ significantly from what the Company has recorded in the past. Higher volatility and longer expected terms result in an increase to stock-based compensation determined at the date of grant. Future stock-based compensation cost and unrecognized stock- based compensation will increase to the extent that the Company grants additional equity awards to employees or assumes unvested equity awards in connection with acquisitions. If there are any modifications or cancellations of the underlying unvested equity awards, the Company may be required to accelerate any remaining unearned stock-based compensation cost or incur incremental cost. For share-based awards with only service-based vesting conditions, the compensation expense is recognized on a straight-line basis over the requisite service period. The Company’s stock-based compensation expense is recorded in the financial statement line item relevant to each of the award recipients. See Note 7, Convertible Preferred shares, shareholders’ Deficit and Equity incentive Plan, for additional disclosure. Advertising expense Costs for marketing and advertising of the Company’s games are primarily expensed as incurred and are included in the sales and marketing expenses in the Company’s consolidated statements of operations. Such costs primarily consist of player acquisition costs. Advertising expense was $114,455 and $51,537 in the years ended December 31, 2023 and 2022, respectively.

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 15 - Income taxes The Company accounts for income taxes using the asset and liability method whereby deferred tax asset and liability account balances are determined based on differences between financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that are expected to be in effect when the differences will reverse. The Company provides a valuation allowance, if necessary, to reduce deferred tax assets to the amount that is more likely than not to be realized. Deferred tax assets and deferred tax liabilities are presented under long- term assets and long-term liabilities, respectively. The need to establish valuation allowances for deferred tax assets is assessed periodically based on the more likely than not realization threshold. This assessment considers, among other matters, the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of statutory carryforward periods, the Company’s experience with operating loss and tax credit carryforwards expiring unused and tax planning alternatives. The Company implements a two-step approach to recognize and measure uncertain tax positions. The first step is to evaluate the tax position taken or expected to be taken in a tax return by determining if the weight of available evidence indicates that it is more likely than not that, on an evaluation of the technical merits, the tax position will be sustained on audit, including resolution of any related appeals or litigation processes. The second step is to measure the tax benefit as the largest amount that is more than 50% (cumulative basis) likely to be realized upon ultimate settlement. The Company classifies interest and penalties on income taxes (which includes uncertain tax positions) as taxes on income. Employee related benefits Severance pay The liability for the Company’s employees in Israel in respect of severance pay is calculated in accordance with Section 14 of the Severance Pay Law 5723-1963 ("Section 14"). Section 14 states that Company's contributions for severance pay shall be in lieu of severance compensation. Upon deposit of the related obligation for the employee under Section 14, no additional obligations shall be conducted between the parties regarding the matter of severance pay and no additional payments are required to be made by the Company to the employee. Expense resulting from contributions in accordance with Section 14 for the years ended December 31, 2023 and 2022 was $741 and $449, respectively. Recently Issued Accounting Pronouncements In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740), Improvements to Income Tax Disclosures, which requires disaggregated information about the effective tax rate reconciliation as well as information on income taxes paid. The guidance will be effective for the Company for annual periods beginning January 1, 2026, with early adoption permitted. The Company is currently evaluating the impact on its financial statement disclosures.

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 16 - NOTE 2. OTHER RECEIVABLES December 31, 2023 2022 Prepaid expenses $ 8,149 $ 874 Deposits 118 189 Governmental institutions 69 178 Interest receivables 26 89 Deferred charges 39 24 $ 8,401 $ 1,354 NOTE 3. PROPERTY AND EQUIPMENT, NET December 31, 2023 2022 Cost: Computers $ 731 $ 474 Office furniture and Equipment 275 263 Electronic equipment 16 7 Leasehold Improvements 1,267 1,004 $ 2,289 $ 1,748 Accumulated depreciation: Computers 362 205 Office furniture and Equipment 41 23 Electronic equipment 4 2 Leasehold Improvements 437 224 844 454 Depreciated cost $ 1,445 $ 1,294 Depreciation expenses for the years ended December 31, 2023, and 2022 amounted to $390 and $362, respectively. All the Company's property and equipment located in Israel.

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 17 - NOTE 4. LOANS AND SHORT-TERM REVOLVING CREDIT LINE December 31, 2023 December 31, 2022 Maturity Interest rate(s) Book Value Face value Book value Loans 2025 17% 70,443 70,443 35,065 Short-term revolving credit line 2024 SOFR + 7.5%. 18,000 18,000 18,000 Total 88,443 88,443 53,065 Less: Current maturities of loans 2024 17% 35,387 35,387 19,683 Loans, net of current maturities 35,056 35,056 15,382 a. On November 30, 2021, the Company entered into a revolving credit line agreement with Bank Mizrahi for a credit line of up to $20,000 that can be withdrawn over a period of two years. The borrowing base is available for a draw at any time throughout the agreement and is subject to several covenants. The revolving credit line bears an annual interest of SOFR + 7.5%. The interest will be paid on a weekly basis. On December 19, 2023, the Company signed an amendment to extend the agreement for a period of six months. As of December 31, 2023, the Company withdrew an amount of $18,000. On June 13, 2024, the Company signed an additional amendment to extend the agreement for another period of three months. On August 27, 2024, the Company has signed an additional amendment with Bank Mizrahi, see note 12a. b. On April 6, 2021, the Company entered into a certain Receivables Purchase Agreement with Nirvana Funding (the “RPA” and the “Purchaser”, respectively), a related party which is an affiliate of General Catalyst Group, one of the Company's shareholders. The original term of the agreement is until January 2022. According to the RPA, the Purchaser shall provide financing to the Company when the amounts will be derived from the Company’s actual marketing expenses. The RPA further provides that such amounts shall be repaid to the Purchaser from future receivables on account of revenues generated by the Company from new users acquired thereby as a result of the marketing activity financed by the Purchaser (i.e., the repayment schedule of the amounts extended by the Purchaser are conditioned upon the revenues generated from such new users). In addition, based on the RPA, an additional interest amount (if any) shall be paid to the Purchaser (the “Interest”), determined pursuant to the ratio between the amount extended by the Purchaser to the total marketing cost of such monthly campaign (each month has a separate marketing budget and repayment schedule), with the effective Interest depends on and varies according to the rate of revenues received from such new users. On February 10, 2022, the Company extended the RPA until December 2022. On January 23, 2023, the Company further extended the RPA for an additional year, until December 2023.

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 18 - On June 7, 2023, the Company signed an amendment to the RPA according to which both parties agreed that the Purchasers’ repayment schedule shall be annually capped, starting on January 1, 2023, of any given calendar year. On December 21, 2023, the Company signed an amendment to the RPA adopting new marketing budget for the year 2024 and also allowing the Company to apply for a lower amount than as contemplated under such amendment. The total funds provided by the debtor to the Company in 2023 amounted to $94,263. The Company recorded the proceeds as a liability related to the sale of future revenue that will be amortized using the effective interest method over the estimated life of the related expected royalties. The liability and the related interest expense are based on the Company's current estimates of future royalties. The Company periodically assesses the expected royalty payments and to the extent the future estimates or timing of such payments are materially different than previous estimates, the Company will adjust the debt's carrying amount. The adjustments to the carrying amount are recognized as interest expense in the period in which it occurs. As of December 31, 2023, all outstanding funds which have not been repaid by the Company including accrued interest amounted to $70,443 and are presented as other loans on the balance sheet, of which, the Company has a present obligation only with respect to an amount of $35,387 which is presented as current maturities of other loans on the balance sheet. The remaining amount of $35,056 is conditioned and to be repaid only upon generation of future revenues derived from the funded cohorts. The Interest amount with respect to the outstanding balance recorded as interest expenses during the twelve months ended December 31, 2023, amounted to $7,481. On May 6, 2024, the Company signed an additional amendment to the RPA. On September 12, 2024, the Company has signed a payoff letter with the Purchaser, see note 12d. NOTE 5. LEASES On July 15, 2021, the Company entered into a non-canceled lease agreement for the Company's offices in Israel for a period of four years with a renewal option for an additional three-year period. As it is reasonably certain the Company will exercise the renewal option, the renewal option is included in the calculation of operating lease ROU assets and operating liability. All of the Company's lease are located in Israel. The components of operating lease costs were as follows: December 31, 2023 2022 Operating lease cost $ 951 $ 824 Variable lease cost 57 19 $ 1,008 $ 843

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 19 - The following is a summary of weighted average remaining lease terms and discount rates for all of the Company's operating leases: December 31, 2023 Weighted average remaining lease term (years) 4.54 Weighted average discount rates 9.3% The future minimum lease payments included in the measurement of the Company's operating lease liabilities as of December 31, 2023, were as follows : December 31, 2023 2024 1,060 2025 1,086 2026 and thereafter 2,671 Total operating lease payments 4,817 Less imputed interest ( 808 Present value of future lease payments 4,009 NOTE 6. ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES December 31, 2023 2022 Accrued expenses $ 18,625 $ 5,278 Deferred revenue 128 80 Government institutions 19 - Other current liabilities 92 76 $ 18,864 $ 5,434

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 20 - NOTE 7. CONVERTIBLE PREFERRED SHARES, SHAREHOLDERS’ DEFICIT AND EQUITY INCENTIVE PLAN As of December 31, 2023, convertible preferred share consists of: Authorized, issued and out standing Carrying value Preferred Seed-1 1,035,335 10,000 Preferred Seed-2 696,778 4,250 Preferred A 652,494 39,860 2,384,607 54,110 Composition of share capital: (1) Ordinary shares confer upon their holders’ voting rights, the right to participate in shareholders meetings (each share confers one vote), the right to participate in any distribution of dividends and the right to take part in the division of the surplus assets in a case of the winding up the Company, subject to the terms of the AOA. (2) Preferred Seed shares are entitled to the same rights conferred by the ordinary shares in addition to the following rights as well as customary anti-dilution rights: In the event of Liquidation, Deemed Liquidation (e.g., change in control) or a Distribution, as defined in the Company's Articles of Association (the "AOA"), the holders of Series Seed shall be entitled to receive, on a pro rata and Pari passu basis among them, prior and in preference to any distribution in respect of the ordinary shares, but after the preference rights of the Preferred A Shares as specified below, an amount for each Series Seed Share held by them equal to the greater of (i) the sum of the applicable original issue price of such share, or (ii) the amount such holder would actually receive if such preferred share had been converted into ordinary shares immediately prior to such distribution event; in each case, plus any dividends declared but unpaid on such share, and less any amounts previously paid in respect of such share, in accordance with the company's AOA. (3) Preferred A shares are entitled to the same rights conferred by the ordinary shares, in addition to the following rights as well as customary anti-dilution rights: In the event of Liquidation, Deemed Liquidation (e.g., change in control) or a Distribution, as defined in the Company's AOA, the holders of Preferred A shares shall be entitled to receive, on a pro rata and Pari passu basis among them, prior and in preference to any distribution in respect of the Series Seed Shares and ordinary shares, an amount for each Preferred A Share held by them equal to the greater of (i) the sum of the applicable original issue price of such share, or (ii) the amount such holder would actually receive if such preferred share had been converted into ordinary shares immediately prior to such distribution event; in each case, plus any dividends declared but unpaid on such share, and less any amounts previously paid in respect of such share in accordance with the company's AOA.

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 21 - In liquidation event (e.g., change in control) the liquidation preference provisions of the Preferred Seed shares and Preferred A shares are considered contingent redemption provisions that are not solely within the Company’s control. Accordingly, the Preferred Seed shares and Preferred A shares have been presented outside of permanent equity in the temporary equity (mezzanine) section of the consolidated financial statements. As of December 31, 2023 and 2022, the Company did not adjust the carrying values of the Preferred Seed shares and Preferred A shares to the deemed liquidation values of such shares since a liquidation event was not probable. Subsequent adjustments to increase the carrying values to the ultimate liquidation values will be made only when it becomes probable that such a deemed liquidation event will occur. Equity transactions On December 12, 2022, the Company signed a Share Purchase Agreement (the "SPA") with new and existing investors, upon which, the Company issued 652,494 Preferred A shares of NIS 0.01 par value each, for an aggregate amount of $39,860, net of issuance expenses in the amount of $140, reflecting a price of $61.09 per share. Overview of Stock Incentive Plan In 2019, the Company adopted the 2019 Equity Incentive Plan for granting stock options to purchase shares of the Company to subcontractors, employees, officers and directors as an incentive to attract and retain qualified personnel. As of December 31, 2023, a total of 683,643 shares of the Company’s common stock had been allocated to awards granted under the Plan and 21,356 shares remained available for future grants. Stock options A summary of the stock option activity in the year ended on December 31, 2023, is as follows: Number of options Weighted- average exercise price Weighted average remaining contractual term Outstanding as of December 31, 2022 273,178 $ 7.64 7.71 Granted 428,367 $ 20.94 8.58 Exercised (3,030) $ 20.63 - Forfeited (14,872) $ 24.36 - Outstanding as of December 31, 2023 683,643 $ 15.55 7.84 Options available for future grants 21,356

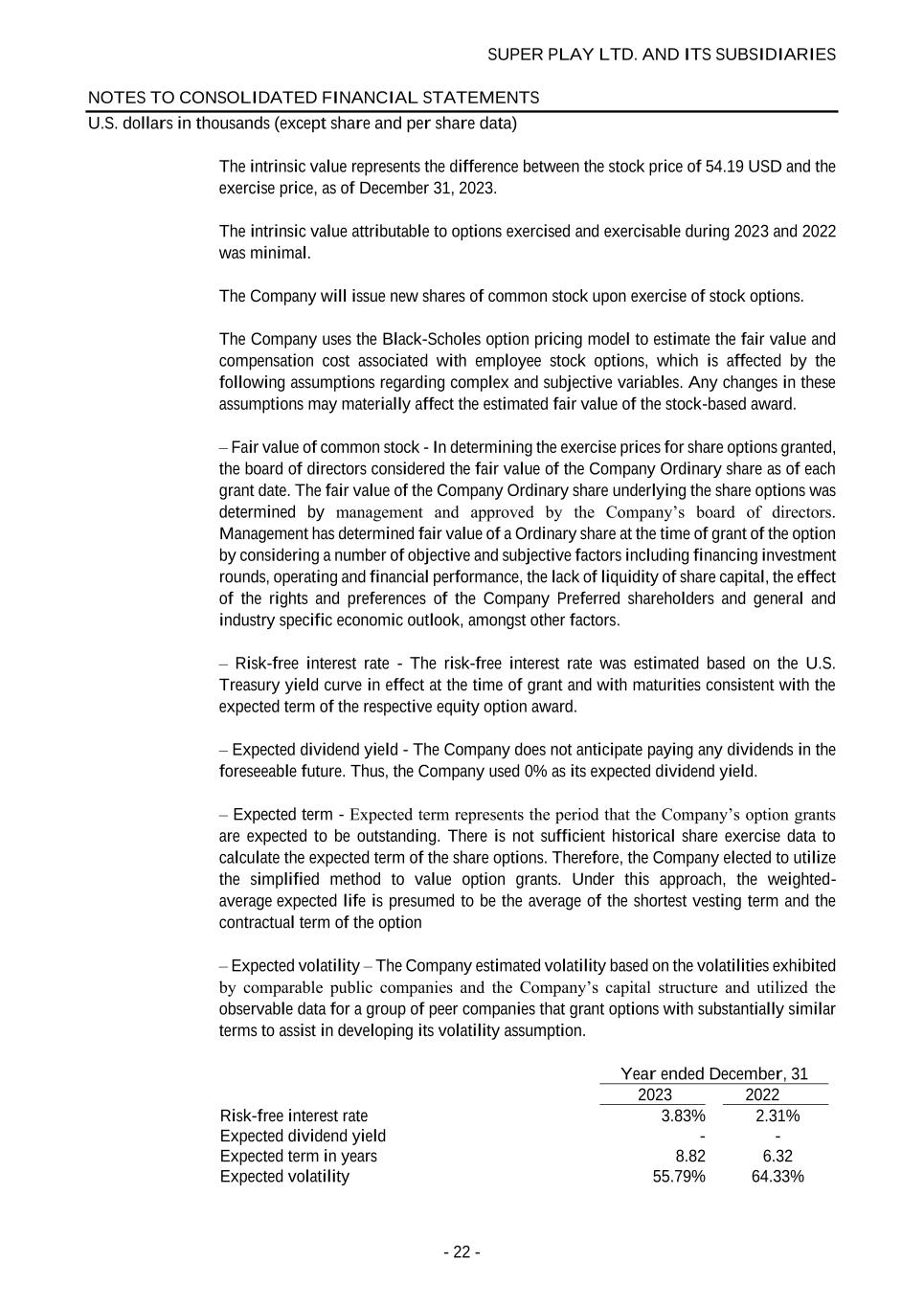

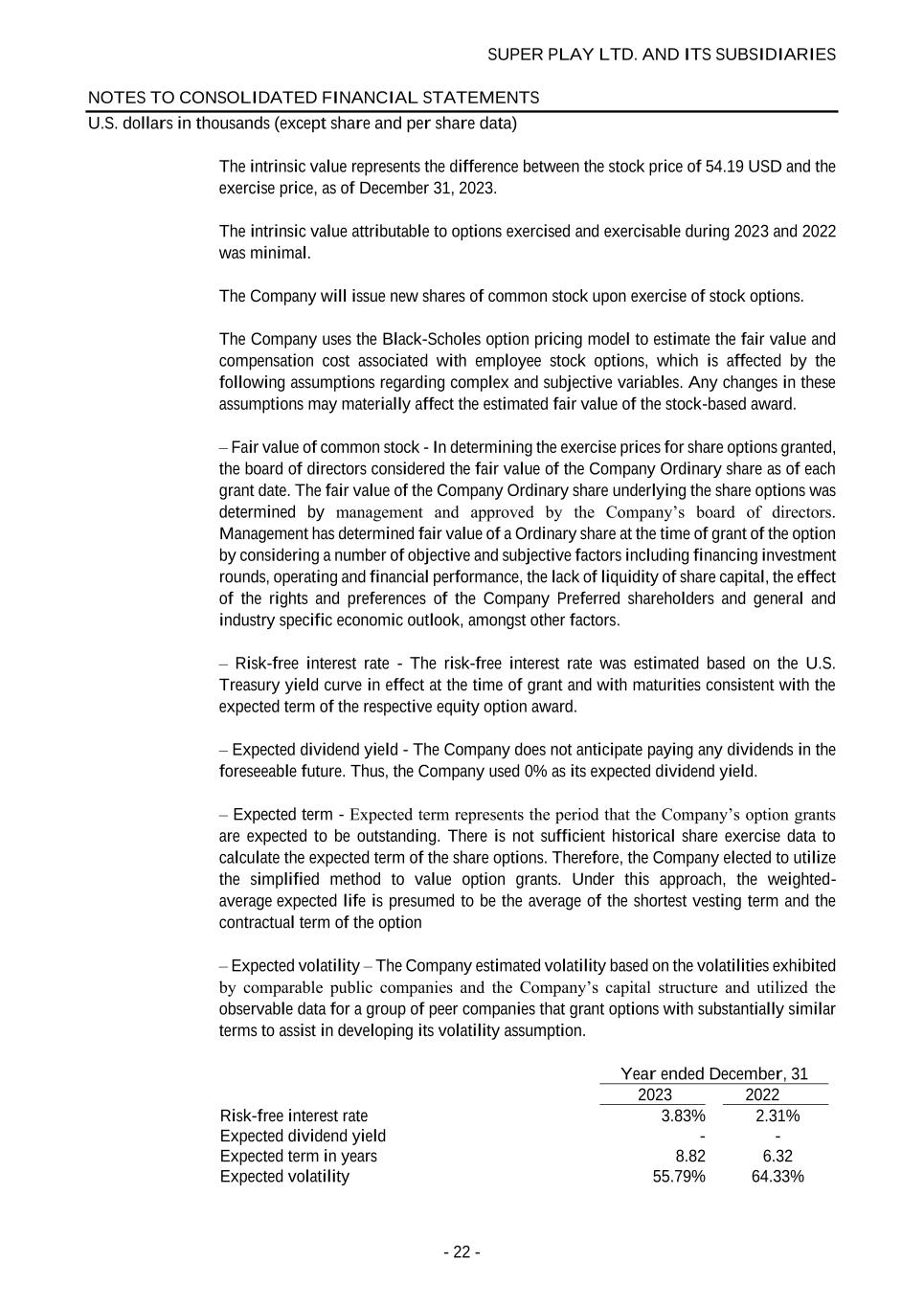

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 22 - The intrinsic value represents the difference between the stock price of 54.19 USD and the exercise price, as of December 31, 2023. The intrinsic value attributable to options exercised and exercisable during 2023 and 2022 was minimal. The Company will issue new shares of common stock upon exercise of stock options. The Company uses the Black-Scholes option pricing model to estimate the fair value and compensation cost associated with employee stock options, which is affected by the following assumptions regarding complex and subjective variables. Any changes in these assumptions may materially affect the estimated fair value of the stock-based award. – Fair value of common stock - In determining the exercise prices for share options granted, the board of directors considered the fair value of the Company Ordinary share as of each grant date. The fair value of the Company Ordinary share underlying the share options was determined by management and approved by the Company’s board of directors. Management has determined fair value of a Ordinary share at the time of grant of the option by considering a number of objective and subjective factors including financing investment rounds, operating and financial performance, the lack of liquidity of share capital, the effect of the rights and preferences of the Company Preferred shareholders and general and industry specific economic outlook, amongst other factors. – Risk-free interest rate - The risk-free interest rate was estimated based on the U.S. Treasury yield curve in effect at the time of grant and with maturities consistent with the expected term of the respective equity option award. – Expected dividend yield - The Company does not anticipate paying any dividends in the foreseeable future. Thus, the Company used 0% as its expected dividend yield. – Expected term - Expected term represents the period that the Company’s option grants are expected to be outstanding. There is not sufficient historical share exercise data to calculate the expected term of the share options. Therefore, the Company elected to utilize the simplified method to value option grants. Under this approach, the weighted- average expected life is presumed to be the average of the shortest vesting term and the contractual term of the option – Expected volatility – The Company estimated volatility based on the volatilities exhibited by comparable public companies and the Company’s capital structure and utilized the observable data for a group of peer companies that grant options with substantially similar terms to assist in developing its volatility assumption. Year ended December, 31 2023 2022 Risk-free interest rate 3.83% 2.31% Expected dividend yield - - Expected term in years 8.82 6.32 Expected volatility 55.79% 64.33%

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 23 - For options, 25% of the options generally vest on the first anniversary of the grant date, and the remaining 75% of the options vest in equal quarterly installments during the three years following the first anniversary of the grant date. The stock options have a contractual term of ten years. Stock-based compensation The following table summarizes stock-based compensation costs, as reported on the Company’s consolidated statements of comprehensive income: Year ended December, 31 2023 2022 Cost of revenues - 3 Research and development expenses 773 804 Salse and marketing expenses 152 114 General and administrative expenses 1,820 665 2,745 1,586 As of December 31, 2023 and 2022, unrecognized compensation costs related to shares options was 10,399 and 13,144, respectively, which was expected to be recognized over a weighted average period of 4.5 years and 5.5 years, respectively. NOTE 8. TAXES ON INCOME Tax laws applicable to the Company: The corporate tax rate in Israel in 2023 and 2022 is 23%. Deferred tax assets and liabilities Deferred taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts recorded for tax purposes. Significant components of the Company's deferred tax assets and liabilities are as follows: December, 31 2023 2022 Deferred tax assets Net operating loss carry-forwards 15,838 11,532 Accrued employee costs 538 274 Research and development expenses 3,517 2,152 Operating lease liabilities 1,022 1,243 Valuation allowance (19,763) (13,821) Net deferred tax assets 1,152 1,380 Deferred tax liability Operating lease right-of-use assets (1,152) (1,380) Deferred tax lability (1,152) (1,380 Net deferred tax assets (liabilities) - -

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 24 - In assessing the realizability of deferred tax assets, management considers whether it is more likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. Based upon the level of historical taxable loss and projections for future taxable losses over the period in which the deferred tax assets are deductible, management believes it is more likely than not that the Company will not realize the benefits of these deductible differences as of December 31, 2023 and 2022 and accordingly, a full valuation allowance has been maintained and no deferred tax assets were shown in the accompanying balance sheet. Net operating loss carry-forwards As of December 31, 2023, the Company has Israeli carryforward tax losses amounting to approximately $69,000 The carryforward losses have no expiration date. The Company does not yet have any final tax assessments. NOTE 9. REVENUE FROM CONTRACTS WITH CUSTOMERS The following table provides information about disaggregated revenue by geographic location of the Company's players and type of platform: Year ended December, 31 2023 2022 Israel 725 308 USA 88,592 41,345 EMEA 67,313 17,295 APAC 6,651 2,809 Other 6,161 2,800 Total 169,442 64,557 Contract balances Payments from players for virtual items are collected by platform providers and remitted to the Company (net of the platform or clearing fees) generally within 45 days after the player transaction. The Company’s right to receive the payments collected by the platform providers is recorded as an account receivable as the right to receive payment is unconditional. Deferred revenues, which represent a contract liability, represent mostly unrecognized fees billed for virtual items which have not yet been consumed at the balance sheet date. Platform fees paid to platform providers and associated with deferred revenues represent a contract asset. Year ended December, 31 2023 2022 Account receivables 18,913 6,032 Contract assets (1) 39 24 Contract liability (2) 128 80

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 25 - (1) Contract assets are included within other receivables as “deferred charges” in the Company’s consolidated balance sheets. (2) Contract liabilities are included within accrued expenses and other current liabilities as “deferred revenues” in the Company’s consolidated balance sheets. During the year ended December 31, 2023, the Company recognized all of its contract liabilities balance as of December 31, 2022. NOTE 10. INTEREST EXPENSE AND OTHER, NET Year ended December 31, 2023 2022 Interest expense 9,306 5,369 Interest income (1,964) (98) Foreign currency translation differences, net 476 674 Other 107 58 7,925 6,003 NOTE 11. RELATED PARTIES a. Balances: December 31, 2023 2022 Loans (1) $ 70,443 $ 35,065 Employees and payroll accruals – Shareholders and CEO $ 53 $ 37 b. Transactions: Year ended December 31, 2023 2022 Loans interest expenses (1) $ 7,481 $ 4,593 Payroll and related expenses – Shareholders and CEO $ 568 $ 421 (1) See note 4b, with respect to Loans with a related parties.

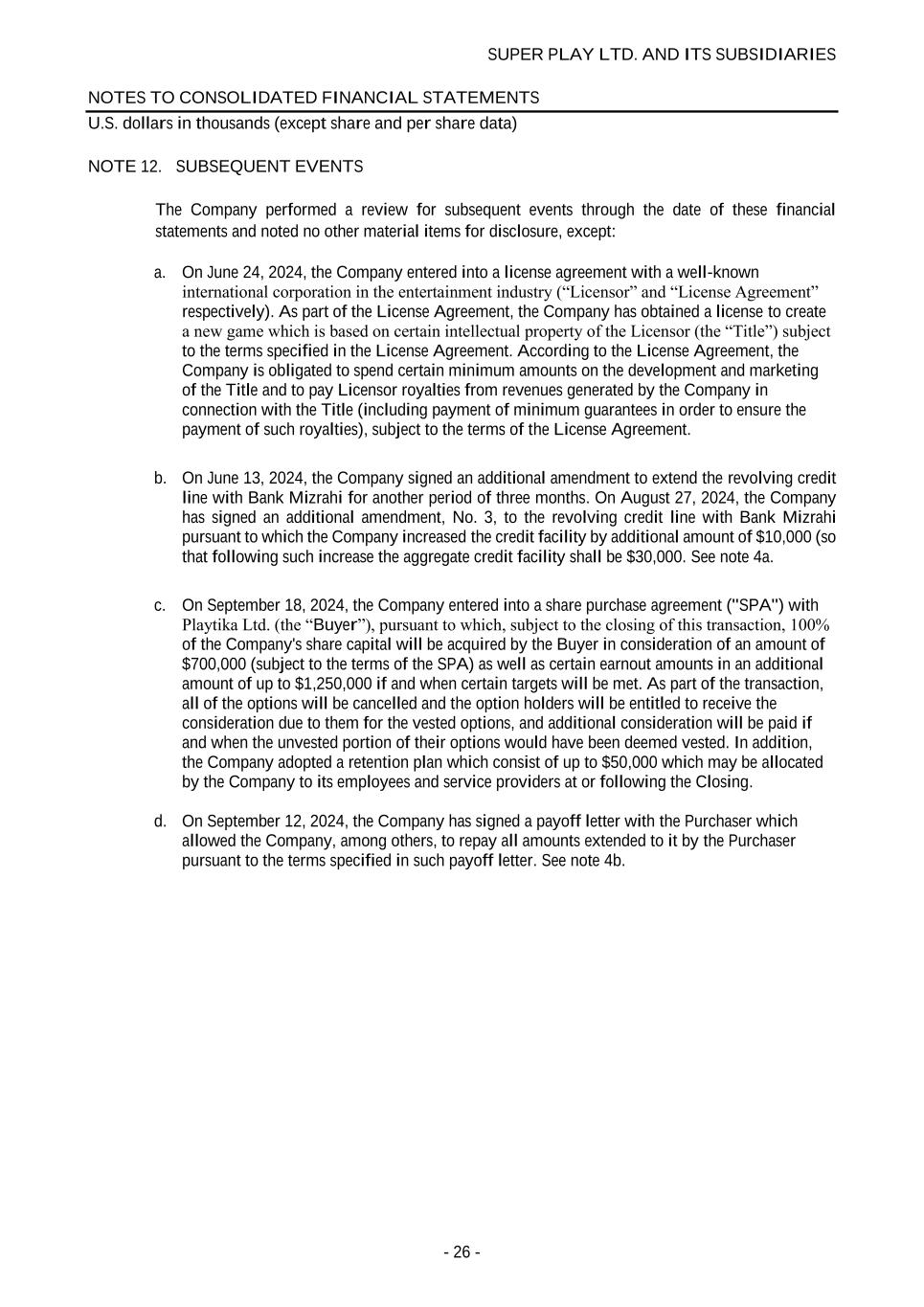

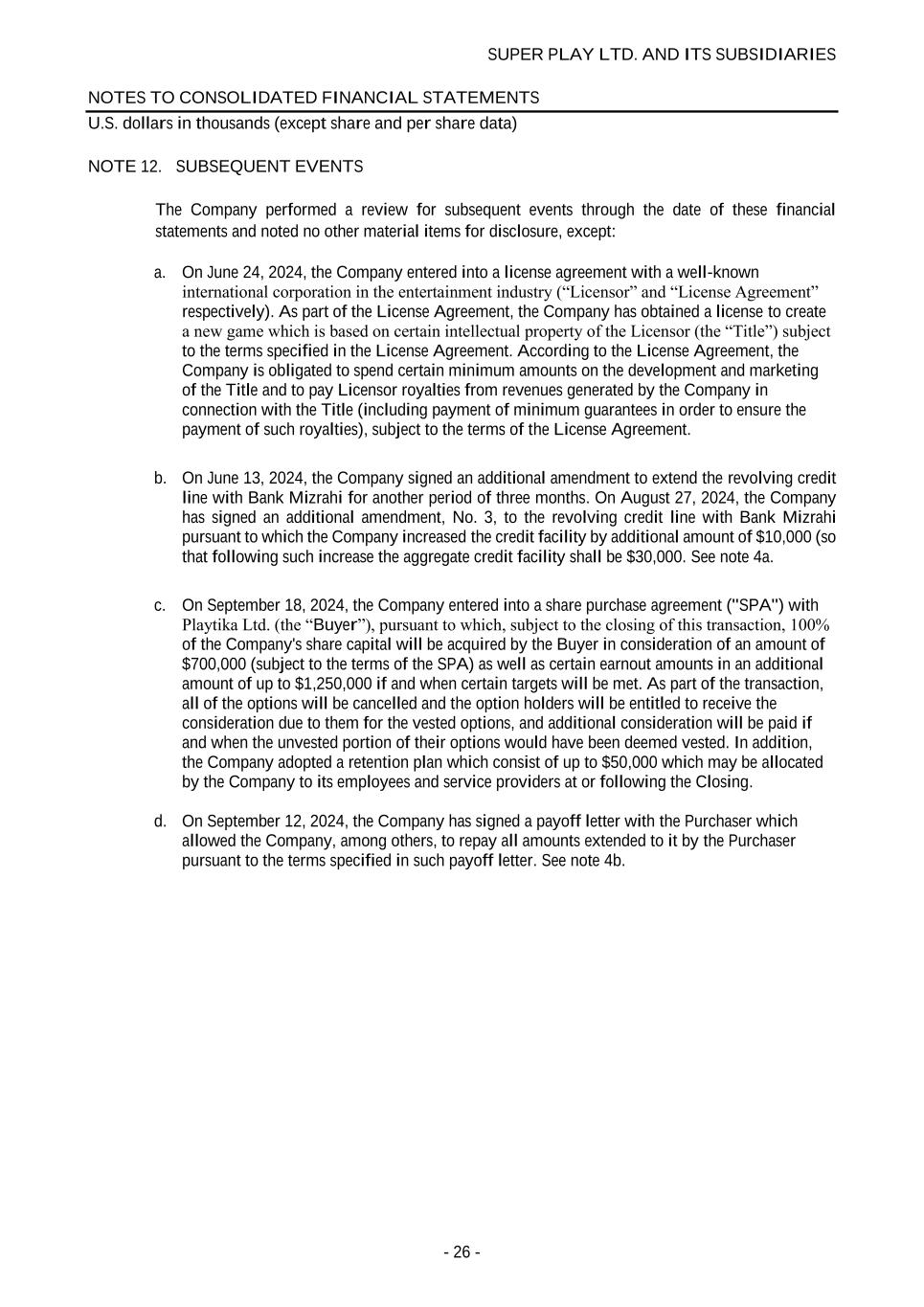

SUPER PLAY LTD. AND ITS SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS U.S. dollars in thousands (except share and per share data) - 26 - NOTE 12. SUBSEQUENT EVENTS The Company performed a review for subsequent events through the date of these financial statements and noted no other material items for disclosure, except: a. On June 24, 2024, the Company entered into a license agreement with a well-known international corporation in the entertainment industry (“Licensor” and “License Agreement” respectively). As part of the License Agreement, the Company has obtained a license to create a new game which is based on certain intellectual property of the Licensor (the “Title”) subject to the terms specified in the License Agreement. According to the License Agreement, the Company is obligated to spend certain minimum amounts on the development and marketing of the Title and to pay Licensor royalties from revenues generated by the Company in connection with the Title (including payment of minimum guarantees in order to ensure the payment of such royalties), subject to the terms of the License Agreement. b. On June 13, 2024, the Company signed an additional amendment to extend the revolving credit line with Bank Mizrahi for another period of three months. On August 27, 2024, the Company has signed an additional amendment, No. 3, to the revolving credit line with Bank Mizrahi pursuant to which the Company increased the credit facility by additional amount of $10,000 (so that following such increase the aggregate credit facility shall be $30,000. See note 4a. c. On September 18, 2024, the Company entered into a share purchase agreement ("SPA") with Playtika Ltd. (the “Buyer”), pursuant to which, subject to the closing of this transaction, 100% of the Company's share capital will be acquired by the Buyer in consideration of an amount of $700,000 (subject to the terms of the SPA) as well as certain earnout amounts in an additional amount of up to $1,250,000 if and when certain targets will be met. As part of the transaction, all of the options will be cancelled and the option holders will be entitled to receive the consideration due to them for the vested options, and additional consideration will be paid if and when the unvested portion of their options would have been deemed vested. In addition, the Company adopted a retention plan which consist of up to $50,000 which may be allocated by the Company to its employees and service providers at or following the Closing. d. On September 12, 2024, the Company has signed a payoff letter with the Purchaser which allowed the Company, among others, to repay all amounts extended to it by the Purchaser pursuant to the terms specified in such payoff letter. See note 4b.