Non-compliance with environmental, social, and governance, or ESG, practices could harm our reputation, or otherwise adversely impact our business, while increased attention to ESG initiatives could increase our costs.

Expectations around a company's management of ESG matters continues to evolve rapidly, in many instances due to factors that are out of our control. To the extent ESG matters negatively impact our reputation, it may also impede our ability to compete as effectively to attract and retain employees or customers, which may adversely impact our operations.

The Israeli government is currently pursuing extensive changes to Israel’s judicial system. This has sparked extensive political debate. In response to the foregoing developments, many individuals, organizations and institutions, both within and outside of Israel, have voiced concerns that the proposed changes may negatively impact the business environment in Israel including due to reluctance of foreign investors to invest or transact business in Israel as well as to increased currency fluctuations, downgrades in credit rating, increased interest rates, increased volatility in security markets, and other changes in macroeconomic conditions. To the extent that any of these negative developments do occur, they may have an adverse effect on our business, our results of operations and our ability to raise additional funds, if deemed necessary by our management and board of directors.

| • | Israeli corporate law does not provide for shareholder action by written consent for public companies, thereby requiring all shareholder actions to be taken at a general meeting of shareholders; |

| • | our articles of association divide our directors into three classes, each of which is elected once every three years; |

| • | our articles of association generally require a vote of the holders of a majority of our outstanding ordinary shares entitled to vote present and voting on the matter at a general meeting of shareholders (referred to as simple majority), and solely the amendment of the provision relating to the removal of members of our board of directors, require a vote of the holders of 65% of our outstanding ordinary shares entitled to vote at a general meeting; |

| • | our articles of association provide that director vacancies may be filled by our board of directors. |

RISKS RELATED TO OWNERSHIP OF THE ADSs

If we are unable to maintain compliance with Nasdaq listing standards, our ADSs may be delisted from the Nasdaq Stock Market and you may face significant restrictions on the resale of your shares.

There can be no assurances that we will be able to maintain our Nasdaq listing in the future. On March 27, 2023, we received a notification from Nasdaq that the trading price of our ADSs did not meet the minimum bid price requirement of $1.00 per share for a period of 30 consecutive trading days. We were granted a 180-day compliance period, or September 18, 2023, to regain compliance by achieving a closing bid price of at least $1.00 per share for a minimum of 10 consecutive trading days. In the event we are unable to regain compliance with the Nasdaq Capital Market listing standards and our ADSs are delisted from the exchange, it would, among other things, likely lead to a number of negative implications, including an adverse effect on the price of our ADSs, reduced liquidity in our ADSs and greater difficulty in obtaining financing. In the event of a de-listing, we would take actions to restore our compliance with Nasdaq’s listing requirements, but we can provide no assurance that any such action taken by us would allow our ADSs to become listed again, stabilize the market price or improve the liquidity of our ADSs, prevent our ADSs from dropping below the Nasdaq minimum bid price requirement in the future, or prevent future non-compliance with Nasdaq’s listing requirements. If we cannot restore our compliance with Nasdaq’s listing requirements, we would pursue eligibility for trading of these securities on other markets or exchanges, such as the OTCQB or OTCQX, which are unorganized, inter-dealer, over-the-counter markets which provides significantly less liquidity than the Nasdaq Capital Market or other national securities exchanges.

The ADS price may be volatile, and you may lose all or part of your investment.

The market price of the ADSs could be highly volatile and may fluctuate substantially, including downward, as a result of many factors, including:

| • | changes in the prices of our raw materials or the products manufactured in factories using our technologies; |

| • | the trading volume of the ADSs; |

| • | general economic, market and political conditions, including negative effects on consumer confidence and spending levels that could indirectly affect our results of operations; |

| • | actual or anticipated fluctuations in our financial condition and operating results, including fluctuations in our quarterly and annual results; |

| • | announcements by us or our competitors of innovations, other significant business developments, changes in distributor relationships, acquisitions or expansion plans; |

| • | announcement by competitors or new market entrants of their entry into or exit from the alternative protein market; |

| • | overall conditions in our industry and the markets in which we intend to operate; |

| • | market conditions or trends in the packaged food sales industry that could indirectly affect our results of operations; |

| • | addition or loss of significant customers or other developments with respect to significant customers; |

| • | adverse developments concerning our manufacturers and suppliers; |

| • | changes in laws or regulations applicable to our products or business; |

| • | our ability to effectively manage our growth and market expectations with respect to our growth, including relative to our competitors; |

| • | changes in the estimation of the future size and growth rate of our markets; |

| • | announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments; |

| • | additions or departures of key personnel; |

| • | competition from existing products or new products that may emerge; |

| • | issuance of new or updated research or reports about us or our industry, or positive or negative recommendations or withdrawal of research coverage by securities analysts; |

| • | variance in our financial performance from the expectations of market analysts; |

| • | our failure to meet or exceed the estimates and projections of the investment community or that we may otherwise provide to the public; |

| • | fluctuations in the valuation of companies perceived by investors to be comparable to us; |

| • | disputes or other developments related to proprietary rights, including patents, and our ability to obtain intellectual property protection for our products; |

| • | litigation or regulatory matters; |

| • | announcement or expectation of additional financing efforts; |

| • | sales and short-selling of the ADSs; |

| • | our issuance of equity or debt; |

| • | changes in accounting practices; |

| • | ineffectiveness of our internal controls; |

| • | negative media or marketing campaigns undertaken by our competitors or lobbyists supporting the conventional meat industry; |

| • | the public’s response to publicity relating to the health aspects or nutritional value of products to be manufactured in factories using our technologies; and |

| • | other events or factors, many of which are beyond our control. |

In addition, the stock markets have experienced extreme price and volume fluctuations. Broad market and industry factors may materially harm the market price of the ADSs, regardless of our operating performance. These fluctuations often have been unrelated or disproportionate to the operating performance of those companies. These fluctuations, as well as general economic, political and market conditions such as recessions, interest rate changes, tariffs, international currency fluctuations, or the effects of disease outbreaks or pandemics (such as the COVID-19 pandemic), may negatively impact the market price of the ADSs. In the past, following periods of volatility in the market price of a company’s securities, securities class action litigation has often been instituted against that company. If we were involved in any similar litigation, we could incur substantial costs and our management’s attention and resources could be diverted.

We have never paid dividends on our share capital and we do not intend to pay dividends for the foreseeable future.

We have never declared or paid any dividends on our share capital and do not intend to pay any dividends in the foreseeable future. We anticipate that we will retain all of our future earnings for use in the development and growth of our business and for general corporate purposes. Accordingly, any gains from an investment in the ADSs will depend on price appreciation of the ADSs, which may never occur. In addition, Israeli law limits our ability to declare and pay dividends, and may subject our dividends to certain Israeli withholding taxes.

ADS holders may not receive the same distributions or dividends as those we make to the holders of our ordinary shares, and, in some limited circumstances, they may not receive dividends or other distributions on our ordinary shares and may not receive any value for them, if it is illegal or impractical to make them available.

The depositary for the ADSs has agreed to pay to ADS holders the cash dividends or other distributions it or the custodian receives on ordinary shares or other deposited securities underlying the ADSs, after deducting its fees and expenses. ADS holders will receive these distributions in proportion to the number of ordinary shares their ADSs represent. However, the depositary is not responsible if it decides that it is unlawful or impractical to make a distribution available to any holders of ADSs. For example, it would be unlawful to make a distribution to a holder of ADSs if it consists of securities that require registration under the Securities Act of 1933, as amended, or the Securities Act, but that are not properly registered or distributed under an applicable exemption from registration. In addition, conversion into U.S. dollars from foreign currency that was part of a dividend made in respect of deposited ordinary shares may require the approval or license of, or a filing with, any government or agency thereof, which may be unobtainable. In these cases, the depositary may determine not to distribute such property and hold it as “deposited securities” or may seek to affect a substitute dividend or distribution, including net cash proceeds from the sale of the dividends that the depositary deems an equitable and practicable substitute. We have no obligation to register under U.S. securities laws any ADSs, ordinary shares, rights or other securities received through such distributions. We also have no obligation to take any other action to permit the distribution of ADSs, ordinary shares, rights or anything else to holders of ADSs. In addition, the depositary may deduct from such dividends or distributions its fees and may withhold an amount on account of taxes or other governmental charges to the extent the depositary believes it is required to make such withholding. These restrictions may cause a material decline in the value of the ADSs.

ADS holders do not have the same rights as our shareholders.

ADS holders do not have the same rights as our shareholders. For example, ADS holders may not attend shareholders’ meetings or directly exercise the voting rights attaching to the ordinary shares underlying their ADSs. ADS holders may vote only by instructing the depositary to vote on their behalf. If we request the depositary to solicit voting instructions from ADS holders (which we are not required to do), the depositary will notify ADS holders of a shareholders’ meeting and send or make voting materials available to them. Those materials will describe the matters to be voted on and explain how ADS holders may instruct the depositary how to vote. For instructions to be valid, they must reach the depositary by a date set by the depositary. The depositary will try, as far as practical, subject to the laws of Israel and the provisions of our articles of association or similar documents, to vote or to have its agents vote the deposited ordinary shares as instructed by ADS holders. If we do not request the depositary to solicit voting instructions from ADS holders, they can still send voting instructions, and, in that case, the depositary may try to vote as they instruct, but it is not required to do so. Except by instructing the depositary as described above, ADS holders won’t be able to exercise voting rights unless they surrender their ADSs and withdraw the ordinary shares. However, they may not know about the meeting enough in advance to withdraw the ordinary shares. We cannot assure ADS holders that they will receive the voting materials in time to ensure that they can instruct the depositary to vote their ordinary shares. In addition, the depositary and its agents are not responsible for failing to carry out voting instructions or for the manner of carrying out voting instructions. This means that ADS holders may not be able to exercise voting rights and there may be nothing they can do if their ordinary shares are not voted as they requested. In addition, ADS holders have no right to call a shareholders’ meeting.

ADS holders may be subject to limitations on transfer of their ADSs.

ADSs will be transferable on the books of the depositary. However, the depositary may close its transfer books at any time or from time to time when it deems expedient in connection with the performance of its duties. In addition, the depositary may refuse to deliver, transfer or register transfers of ADSs generally when our books or the books of the depositary are closed, or at any time if we or the depositary deem it advisable to do so because of any requirement of law or of any government or governmental body, under any provision of the deposit agreement, or for any other reason in accordance with the terms of the deposit agreement.

As a foreign private issuer whose ADSs are listed on Nasdaq, we follow certain home country corporate governance practices instead of certain Nasdaq requirements, we are not subject to U.S. proxy rules and are exempt from certain Exchange Act reporting requirements. If we were to lose our foreign private issuer status, our costs to modify our practices and maintain compliance under U.S. securities laws and Nasdaq rules would be significantly higher.

We are a foreign private issuer and are not subject to the same requirements that are imposed upon U.S. domestic issuers by the SEC. We are permitted to follow certain home country corporate governance practices instead of certain requirements of the rules of Nasdaq. As permitted under the Israeli Companies Law 1999, or Companies Law, pursuant to our articles of association, the quorum for an ordinary meeting of shareholders shall be the presence of at least two shareholders present in person, by proxy or by a voting instrument, who hold at least 25% of the voting power of our shares (and in an adjourned meeting, with some exceptions, a minimum of one shareholder) instead of 33 1⁄3% of our issued share capital as otherwise required under the Nasdaq corporate governance rules. We may also adopt and approve material changes to equity incentive plans in accordance with the Companies Law, which does not impose a requirement of shareholder approval for such actions. In addition, we follow Israeli corporate governance practice instead of the Nasdaq requirements to obtain shareholder approval for certain dilutive events (such as issuances that will result in a change of control, certain transactions other than a public offering involving issuances of a 20% or greater interest in us and certain acquisitions of the stock or assets of another company). Additionally, we follow Israeli corporate governance practices instead of Nasdaq requirements with regard to, among other things, the composition of our board of directors. For example, our board of directors currently comprises four directors, three of whom we have determined are independent, however during 2021, the majority of our board of directors was not deemed to be independent, in compliance with our home-country requirements. Accordingly, our shareholders may be afforded less protection that what is provided under the Nasdaq corporate governance rules to investors in U.S. domestic issuers. See “Item 16G. —Corporate Governance—Nasdaq Listing Rules and Home Country Practices.”

Additionally, we are exempt from the rules and regulations under the Exchange Act related to the furnishing and content of proxy statements, and our officers, directors, and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. Furthermore, although under regulations promulgated under the Companies Law, as an Israeli public company listed on Nasdaq, we are required to disclose the compensation of our five most highly compensated officers on an individual basis, this disclosure may not be as extensive as that required of U.S. domestic reporting companies. In addition, we are not required under the Exchange Act to file current reports and quarterly reports, including financial statements, with the SEC as frequently or as promptly as U.S. domestic reporting companies whose securities are registered under the Exchange Act. Moreover, we are not required to comply with Regulation FD, which restricts the selective disclosure of material information. These exemptions and leniencies reduce the frequency and scope of information and protections available to ADS holders in comparison to those applicable to U.S. domestic reporting companies.

If we cease to qualify as a foreign private issuer, we would be required to comply fully with the reporting requirements of the Exchange Act applicable to U.S. domestic issuers. We would lose our foreign private issuer status if a majority of our shares are owned by U.S. residents and a majority of our directors or executive officers are U.S. citizens or residents or we fail to meet additional requirements necessary to avoid loss of foreign private issuer status. If we are not a foreign private issuer, we will be required to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC, which are more detailed and extensive than the forms available to a foreign private issuer. We may also be required to modify certain of our policies to comply with accepted governance practices associated with U.S. domestic issuers and we would lose our ability to rely upon exemptions from certain corporate governance requirements on U.S. stock exchanges that are available to foreign private issuers. Such modifications and subsequent compliance would cause us to incur significant legal, accounting and other expenses that we would not incur as a foreign private issuer.

If we are a “passive foreign investment company” for U.S. federal income tax purposes, there may be adverse U.S. federal income tax consequences to U.S. investors

Based on our income and assets, we believe that we may be treated as a PFIC for the preceding taxable year. However, the determination of our PFIC status is made annually based on the factual tests described below. Consequently, while we may be a PFIC in future years, we cannot estimate with certainty at this stage whether or not we are likely to be treated as a PFIC in the current taxable year or any future taxable years. Generally, if, for any taxable year, at least 75 percent of our gross income is “passive income” or at least 50 percent of the average percentage of our assets during the taxable year (based on the average of the fair market values of the assets determined at the end of each quarterly period) are assets that produce or are held for the production of passive income, we will be characterized as a PFIC for U.S. federal income tax purposes. Passive income for this purpose generally includes, among other things, dividends, interest, rents, royalties, gains from commodities and securities transactions, and gains from assets that produce passive income. However, rents and royalties received from unrelated parties in connection with the active conduct of a trade or business should not be considered passive income for purposes of the PFIC test. For example, if we were to be characterized as a PFIC for U.S. federal income tax purposes in any taxable year during which a U.S. Holder (as defined in “Item 10.—Additional Information—Taxation — Material United States federal income tax considerations”) holds ordinary shares or ADSs, such U.S. Holder could be subject to additional taxes and interest charges upon certain distributions by us and any gain recognized on a sale, exchange or other disposition of our shares, whether or not we continue to be characterized as a PFIC. Certain adverse consequences of PFIC status can be mitigated if a U.S. Holder makes a “mark to market” election or an election to treat us as a qualified electing fund, or QEF. See “Item 10.—Additional Information—Taxation—Passive foreign investment company considerations.”

Whether we are a PFIC for any taxable year will depend on the composition of our income and the composition and value of our assets from time to time. Each U.S. Holder is strongly urged to consult its tax advisor regarding these issues and any available elections to mitigate such tax consequences.

If we are a controlled foreign corporation, there could be adverse U.S. federal income tax consequences to certain U.S. Holders.

Each “Ten Percent Shareholder” (as defined below) in a non-U.S. corporation that is classified as a “controlled foreign corporation,” or a CFC, for U.S. federal income tax purposes generally is required to include in income for U.S. federal tax purposes such Ten Percent Shareholder’s pro rata share of the CFC’s “Subpart F income,” “tested income,” “global intangible low-taxed income” and investment of earnings in U.S. property, even if the CFC has made no distributions to its shareholders. Subpart F income generally includes dividends, interest, rents, royalties, gains from the sale of securities and income from certain transactions with related parties. A non-U.S. corporation generally will be classified as a CFC for U.S. federal income tax purposes if Ten Percent Shareholders own, directly or indirectly, more than 50% of either the total combined voting power of all classes of stock of such corporation entitled to vote or of the total value of the stock of such corporation. A “Ten Percent Shareholder” is a United States person (as defined by the Internal Revenue Code of 1986, as amended, or the Code) who owns or is considered to own, directly, indirectly, or constructively, 10% or more of the value or total combined voting power of all classes of stock entitled to vote of such corporation.

The determination of CFC status is complex and includes complex attribution rules. A non-corporate Ten Percent Shareholder with respect to a CFC generally will not be allowed certain tax deductions or foreign tax credits generally available to a corporate Ten Percent Shareholder. Failure to comply with CFC reporting obligations may subject a Ten Percent Shareholder to significant monetary penalties. We cannot provide any assurances that we will furnish to any Ten Percent Shareholder information that may be necessary to comply with the reporting and tax paying obligations applicable under the CFC rules of the Code. U.S. Holders should consult their own tax advisors with respect to the potential adverse U.S. tax consequences of becoming a Ten Percent Shareholder in a CFC.

| | ITEM 4. | INFORMATION ON THE COMPANY |

A. History and Development of the Company

We were incorporated in May 2018 in Israel as DocoMed Ltd., and originally provided digital health services. In July 2019, we changed our name to MeaTech Ltd. and later Steakholder Innovation Ltd., or Steakholder Innovation, and commenced our cultured meat technology development operations. In January 2020, Steakholder Innovation completed a merger with Ophectra Real Estate and Investment Ltd., or Ophectra, a company incorporated in Israel whose shares were traded on the TASE, whereupon the name of Ophectra was changed to Meat-Tech 3D Ltd., then MeaTech 3D Ltd. and finally Steakholder Foods Ltd., or Steakholder Foods.

According to the terms of the merger, Steakholder Foods acquired all outstanding shares of Steakholder Innovation from the shareholders of Steakholder Innovation, in return for the issuance of ordinary shares to the shareholders of Steakholder Innovation, as well as non-tradable merger warrants to receive ordinary shares upon the achievement of pre-defined milestones, which were achieved in 2020 and 2021. Steakholder Innovation become Steakholder Foods’ wholly-owned subsidiary.

In connection with the merger, the Tel Aviv District Court for Economic Affairs approved an arrangement whereby all of Ophectra’s assets and liabilities, whether certain or contingent, at the time of the merger were irrevocably assigned to a settlement fund, or Settlement Fund, for the purpose of settling Ophectra’s pre-merger liabilities (except for Ophectra’s ownership of 14.74% of the outstanding shares of Therapin Ltd., as described below). This includes all future liabilities arising from Ophectra’s activities prior to the merger (including tax liabilities, if any), and any commitments made by Ophectra prior to the merger. We also provided the Settlement Fund approximately NIS 1.3 million (approximately $0.4 million), which we included in our public listing expenses, for the purpose of settling any of Ophectra’s debts, and bear no additional liabilities to the Settlement Fund. Anyone who believed they had a claim to Ophectra’s assets were invited to lodge their claims to the trustees. Due to the fact that two years have passed since the merger, and the fact that the Settlement Fund no longer contains any assets, its trustees are expected to instigate proceedings to wind up the Settlement Fund.

Although Steakholder Foods was the legal acquirer of Steakholder Innovation’s shares as described above, the merger was not considered a business acquisition as defined in IFRS 3. As a result, it was determined that Steakholder Innovation is the acquirer of the business for accounting purposes and the transaction was treated as a reverse acquisition that does not constitute a business combination.

Therefore, the consolidated financial statements and financial data included herein for all periods through and including December 31, 2019 were adjusted retroactively to reflect the financial statements of Steakholder Innovation, other than the information concerning earnings per share, which is presented according to the equity information of Steakholder Foods (then called Ophectra Real Estate and Investments Ltd.), and our consolidated financial statements and financial data included herein from January 1, 2020 onward relate to Steakholder Foods.

We temporarily maintained ownership of 14.74% of the outstanding shares of Therapin Ltd., or Therapin, a company incorporated in Israel, while considering a possible collaboration, however, in May 2020, we returned these holdings to Therapin, and agreed to convert our investment of NIS 7.25 million in Therapin into an interest-free loan, to be repaid by the latter at a rate of NIS 0.48 million per annum for ten years (NIS 4.8 million in total) or in full upon an exit event, plus NIS 2.45 million to be paid upon an exit event, including a public offering, or repayment of 14.74% of any distributable surplus or dividend distributed by Therapin, up to the amount of the outstanding balance, as detailed in our separation agreement with Therapin. As part of the agreement, Therapin gave us an option to convert the cash payment to equity of Therapin.

B. Business Overview

Overview

We are an international deep-tech food company, headquartered in Rehovot, Israel, that initiated activities in 2019 and are listed on the Nasdaq Capital Market under the ticker “STKH”. We believe that cultivated meat technologies hold significant potential to improve meat production, develop a sustainable livestock system, simplify the meat supply chain, and offer consumers a range of new product offerings.

We are on a mission to make meat sustainable, delicious, and clean. We aim to provide an alternative to industrialized animal farming that reduces carbon footprint, minimizes water and land usage, and prevents the slaughtering of animals. By adopting a modular factory design, we expect to be able to offer a sustainable solution for producing a variety of beef, chicken, pork and seafood products, both as raw materials and whole cuts.

We are developing cultivated meat technologies, including three-dimensional printing technology, together with biotechnology processes and customizable manufacturing processes in order to manufacture cultivated meat that does not require animal slaughter. We are developing a novel, proprietary three-dimensional bioprinter to deposit layers of customized bio-ink in a three-dimensional geometry to form structured cultivated meat. We believe that the cultivated meat production processes we are developing, which are designed to offer our eventual customers an alternative to industrial slaughter, have the potential to improve the quality of the environment, shorten global food supply chains, and reduce the likelihood of health hazards such as zoonotic diseases transferred from animals to humans (including viruses, such as virulent avian influenza and COVID-19, and drug-resistant bacterial pathogens, such as some strains of salmonella).

In August 2020, we announced the completion of Project Carpaccio, whereby we printed a thin slice of meat consisting of muscle and fat tissue developed from stem cells, having developed the entire growth process of the tissue components, followed by three-dimensional printing using our dedicated, in-house printer.

In December 2021, we announced that we had successfully three-dimensionally printed a 3.67 oz cultivated steak, primarily composed of cultivated fat and muscle tissues. While cultivated meat companies have made some progress developing unstructured, or even undifferentiated, alternative meat products, such as minced meat and sausage, to the best of our knowledge, the industry has struggled in developing high-margin, high-value structured and cultivated meat products such as steak. Unlike minced meat, a cultivated meat steak product has to grow in fibers and contain connective tissues and fat. To be adopted by diners, we believe that cultivated steaks will need to be meticulously engineered to look and smell like conventional meat, both before and after cooking, and to taste and feel like meat to the diner. We believe that we are the first company to be developing both a proprietary bioprinter and the related processes for growing cultivated meat to focus on what we believe is a high value sector of the alternative protein market.

In May 2022, we joined the UN Global Compact initiative, committing to ten universally accepted principles in the areas of human rights, labor, environment, and anti-corruption and to act in support of the issues embodied in the UN’s Sustainable Development Goals.

We are led by our Chief Executive Officer, Arik Kaufman, who has founded various Nasdaq- and Tel Aviv Stock Exchange, or TASE, -traded foodtech companies, and currently serves as director of Wilk Technologies Ltd. He is also a founding partner of BlueOcean Sustainability Fund, LLC, or BlueSoundWaves, led by Ashton Kutcher, Guy Oseary and Effie Epstein, which has partnered with Steakholder to assist in attempting to accelerate the Company’s growth. Mr. Kaufman holds extensive personal experience in the fields of food-tech and bio-tech law, and has led and managed numerous complex commercial negotiations, as part of local and international fundraising, M&A transactions and licensing agreements. We have carefully selected personnel for the rest of our executive management team who possess substantial industry experience and share our core values.

Cultivated Meat Industry and Market Opportunity

Protein is a necessary staple for healthy nutrition. The growth in recent years of both the human population and global wealth is driving a decades-long trend of accelerating demand for meat. The demand for protein products has consistently risen in recent decades and is expected to continue to do so. The rising growth of demand for farm animals for the food industry has created significant environmental, health, financial and ethical challenges.

According to Statista, the value of the global meat sector was estimated at $838 billion in 2020, and was forecast to increase to $1.157 billion by 2025. According to market research firm Fortune Business Insights, the global meat substitute market was estimated at $5.4 billion in 2021 and is expected to grow to $10.8 billion by 2028. McKinsey & Company estimates between $20 and $25 billion in sales by 2030, and with regard to the longer term, Barclays predicted in November 2021 that by 2040, 20% of the demand for meat globally will be provided by cultivated meat – a $450 billion market opportunity. Jefferies likewise forecasts a $240-470 billion meat market, with 9%-18% of global meat demand provided by cultivated meat by 2040.

The meat industry is showing strong interest in the alternative protein space, both in plant-based and cell-based proteins. There are several drivers underlying the strong engagement with alternative proteins. We believe consumers are looking for less harmful protein sources, with approaches such as flexitarianism already an established middle path between vegetarian diets and those heavy in animal proteins, such as the paleo diet. Many meat processors have experienced the worst of the COVID-19 pandemic outbreaks and are seeking to minimize human involvement in the manufacturing process. To that end, retailers such as Costco and Walmart are increasingly opening their own meat processing facilities on which they can rely exclusively without the involvement of third party manufacturers.

Limitations of Conventional Meat Production

In addition to questions about whether conventional meat production can adequately provide for the growing global population, conventional meat production raises serious environmental issues. According to the United Nations, 8% of the world’s freshwater is used for raising livestock for meat and leather. At least 18% of the greenhouse gases entering the atmosphere are from the livestock industry. 26% of the planet’s ice-free land is used for livestock grazing and 33% of croplands are used for animal feed. With regard to treatment of animals in conventional meat production, more than 70 billion animals are slaughtered annually with steady increases to be expected in line with increased demand for meat.

Another common consumer concern with industrial-scale animal rearing is the reliance on the intensive use of antibiotics. Antibiotics are used in livestock, especially pigs and poultry, to manage animal health, and to treat or prophylactically prevent diseases such as avian flu and swine flu. Their effects on human health have not been fully resolved, with concerns including the potential growth of antibiotic-resistant diseases in meat for human consumption.

Existing Alternative Proteins and their Limitations

Negative consumer sentiment towards the perceived ethical, health and environmental effects of the global meat industry help explain the strong focus that has developed on creating methods of protein production that are more sustainable, nutritious and conscious of animal welfare. Recent years have seen a combination of increasing consumer awareness and advanced technological development that has led to substantially increased demand for proteins that do not involve animal slaughter besides traditional plant-based proteins, such as soy, peas and chickpeas. Some of the alternative proteins being developed for human consumption for this purpose include:

Mycoproteins: Some of the most commercially successful novel alternative protein products are currently mycoproteins, which are derived from fungi. They are high in protein and fiber, low in saturated fat, and contain no cholesterol. However, they have been associated with allergic and gastrointestinal reactions. They are fermented to become a dough, which can develop a texture similar to that of meat.

Jackfruit: Jackfruit is a tropical fruit native to India, which has a similar taste to fruits such as apples and mangoes. While it contains substantially greater protein than these fruits, its protein content is lower than that of meat. Therefore, while its texture is somewhat similar to that of shredded meat, it is not generally viewed as an alternative to meat for consumers used to animal proteins, due to the difference in taste from traditional meat products, and its lower protein content.

Insects: Insects are an environmentally-friendly source of protein that requires significantly less land and water, and emits significantly less greenhouse gases than large mammals raised for slaughter. In addition, they can be fed food unsuitable for livestock that would otherwise be wasted. While crickets are the most common source of edible insects, research is currently taking place on new insect species of value for food production, as well as methods to produce them economically at scale. Insects can be consumed in their natural state; however many cultures consider insect consumption to be taboo and many people are disgusted by the idea. As a result, research is taking place into developing insect-based products in different forms not easily discernable as insect-based, including flour.

The Cultivated Meat Solution

We believe that cultivated meat grown through cellular agriculture, which aims to produce cultivated animal proteins without the need for large-scale slaughter, has the potential to satisfy consumer desire for meat while also avoiding the negative impacts of conventional meat production. Cellular agriculture is an efficient, closely-controlled indoor agricultural process that utilizes advanced technologies with conceptual similarities to hydroponics, which are used for growing meat cells rather than fruit. Cultivated meat is grown in cell culture rather than inside animals and applies tissue engineering practices for fat and muscle production for the purpose of human consumption. Instead of animal slaughter, stem cells are isolated from animal tissue, such as from an umbilical cord (following birth), an adipose or a muscle tissue, and then cultivated in vitro to form protein biomass, muscle fibers and fat cells. While also known as “cultured meat”, “clean meat”, “in vitro meat” or “lab-grown meat”, the term “cultivated meat” has gained the most traction as of late and is the term believed to best appeal to consumers.

Cultivated meat production is an advanced technology that operates as part of the wider field of cellular agriculture, which entails growing animal cells in bioreactors and is an emerging solution to the growing demand for alternative proteins. We are aware of a few dozen companies and institutions actively working to develop technologies and other products to meet this demand, some of whom are focused on producing red and white meats, while others are focused on fish and crustaceans. Some of these companies are working on culturing various types of cells, such as chicken, pork, kangaroo and foie gras. We believe this push of scaling-up cellular agriculture has the potential to offer a solution to the scale and environmental challenges confronting conventional meat production. Other alternative protein companies are already selling plant-based meat substitutes, but to our knowledge, these companies are not focused on the production of real meat products produced with animal cells.

We are engaged with experimentation to develop optimal and cost-effective cell culture media composition. In so doing, we are also exploring a range of types of and sources for growth factors suited to cell culture. These sources are expected to be sustainable and ethical, providing a route to enabling efficient and cost-effective processes. While many challenges remain, surveys are consistently showing consumer openness toward, and enthusiasm for, cultivated meat. According to “Consumer Acceptance of Cultured Meat: An Updated Review (2018–2020)” published by researchers at the University of Bath, “the evidence suggests that, while most people see more societal benefits than personal benefits of eating cultivated meat, there is a large potential market for cultivated meat products in many countries around the world. Cultivated meat is generally seen as more acceptable than other food technologies, and more appealing than other alternative proteins like insects. Although it is not as broadly appealing as plant-based proteins, evidence suggests it may be more uniquely positioned to appeal to meat-lovers who are resistant to other alternative proteins, and it is more appealing to certain demographic groups”.

We believe that cultivated meat could have several potential advantages over conventionally-harvested meat:

| • | Environmental: At least 18% of the greenhouse gases entering the atmosphere today are from the livestock industry. Research shows that the expected environmental footprint of cultivated meat includes approximately 78% to 96% fewer greenhouse gas emissions, 63%-95% less land use, 51% to 78% less water use, and 7% to 45% less energy use than conventionally-produced beef, lamb, pork and poultry. This suggests that the environmental consequences of switching from large-scale, factory farming to lab-grown cultivated meat could have a long-term positive impact on the environment. |

| • | Mitigating and reducing of health risks: Another potential benefit of cultivated meat is that its growth environment is designed to be less susceptible to biological risk and disease, through standardized, tailored production methods consistent with controlled manufacturing practices that are designed to contribute to improved nutrition, health and wellbeing. Therefore, cultivated meat reduces the risk of new diseases and future pandemics. Plant-based and cultivated meats are expected to be insusceptible to animal diseases and should therefore not contribute to pandemic risk because they do not require the use of live animals. Moreover, cultivated meat does not require antibiotics during its production and therefore will not contribute to antibiotic resistance. |

| • | Cost: While the precise economic value of harvested cells has yet to be determined, the potential to harvest large numbers of cells from a small number of live donor animals gives rise to the possibility of considerably higher returns than traditional agriculture, with production cycles potentially measured in months rather than years. By comparison, raising a cow for slaughter generally takes an average of 18 months, over which period 15,400 liters of water and 7 kilograms of feed will be consumed for every kilogram of beef produced. While the original cultivated burger is thought to have cost around $330 thousand, consulting firm CE Delft estimates that economies of scale combined with technological improvements will bring the cost of cultivated meat down to less than $8 per kilogram by 2035. |

| • | Animal Suffering: More and more people are grappling with the ethical question of whether humanity should continue to slaughter animals for food. There is a growing trend of opposition to the way animals are raised for slaughter, often in small, confined spaces with unnatural feeding patterns. In many cases, such animals suffer terribly throughout their lives. This consideration is likely a factor in many consumers choosing to incorporate more flexitarian, vegetarian and vegan approaches to their diets in recent years. |

| • | Alternate Use of Natural Resources: Eight percent of the world’s freshwater supply and one third of croplands are currently used to provide for livestock. The development of cultivated meat is expected to free up many of these natural resources, especially in developing economies where they are most needed. |

| • | Food Waste: The conventional meat industry’s largest waste management problem relates to the disposal of partially-used carcasses, which are usually buried, incinerated, rendered or composted, with attendant problems such as land, water or air pollution. Cultivated meat offers a potential solution for this problem, with only the desired cuts of meat being produced for consumption and only minimal waste product generated with no leftover carcass. |

Our Strategy

Our vision is to be a global leader in the production of meat through advanced biotechnology and engineering solutions for a more sustainable world, enabling the production of the food of the future. We are committed to making the right choice of meat for end consumers simple by developing high-quality meat that is slaughter-free, delicious, nutritious, and safer than farm-raised meat, We accomplish this by adopting a factory design intended to offer a sustainable solution for producing a variety of beef, chicken, sea-food and pork products, whether as raw materials or final consumer products.

Our technologies and processes have the potential to be sustainable. We are developing a meat production process that is designed to provide sustainability in an industry that, due to inefficiencies inherent in conventional meat farming, is not otherwise expected to be able to meet the growing demand for protein caused by rising population numbers and global affluence. These include the large amounts of land and water use that are needed for raising livestock, which causes precious natural resources to be squandered and the release of methane and other greenhouse gases by livestock.

We are designing our cellular agriculture and bioprinting processes to be modular so that customers can initiate their cultivated meat activities at scales suitable for their specific needs and to grow their activities as their needs evolve. Whether a customer wishes to manufacture a hybrid product that includes cultivated and plant-based ingredients, cultivated fat as a raw material, or even 3D-printed steak, each facility can be adapted to scale-out product capabilities and production volumes.

We are developing a fully automated, clean and proprietary process for cultivated meat manufacturing in a controlled, sterile environment, which is expected to significantly increase food safety. Our production facilities will not house a single animal and will contain robust integrated monitoring systems and minimal human interaction, which will greatly reduce the risk of pathogen contamination of the type claimed to have caused the COVID-19 pandemic and numerous other human health crises.

We have carefully selected personnel for our management team who possess substantial industry experience, from diverse fields including the food industry, business development bioprinting, tissue engineering, industrial stem cell growth, software engineering, electronic and mechanical engineering and print materials development. We believe that this blend of talent and experience in managers who share our core values gives us the requisite insights and capabilities to execute our plan to develop technologies designed to meet demand in a scalable, profitable and sustainable way.

To achieve our mission, we intend to:

| • | Commercialize our technologies for use in consumer and business markets. We intend to commercialize our three-dimensional bio-printing capabilities, while also customizing bio-inks to enable the production of products based on a wide range of species in accordance with the needs of our partners and customers. We also intend to provide ingredients to business customers for use in consumer products in order to help meet the growing demand for sustainable, slaughter-free cultivated meat products. For example, manufacturers of meat alternatives, such as vegetarian sausages, may choose to include our cultivated fat biomass in their products in order to deliver the signature meaty flavors, aromas and textures of the meat that is otherwise provided by the conventional meat of species such as chicken, beef and pork. We believe that this combination has the potential to unlock a new level of meat experience. |

| • | Perfect the development of our cultivated meat manufacturing technology and processes. We intend to continue developing and refining our processes, procedures and equipment until we are in a position to commercialize our technologies, whether by manufacturing final products for consumers (B2B2C models) or ingredients for industrial use, as well as in outlicensing (B2B models). We are continuing to tackle the technological challenges involved in scaling up both our biological and printing processes to industrial-scale levels. |

In addition, we intend to license our production technology as well as provide associated products, such as cell lines, printheads, bioreactors and incubators, and services, such as technology implementation, training, and engineering support, whether directly or through contractors, to companies in fields including food processing, food retail and cultivated meat. We intend to charge our customers a production license fee, based upon the amount of meat printed. We expect that each production facility will periodically require us to provide them with our proprietary materials, such as fresh sets of starter cells, for a fee. In addition, other materials used in the production process, such as cell-culture media and additives in our bio-inks may be sourced from third parties. Whether these materials are customized for the specifics of our production processes, “white-labelled” generic materials or proprietary materials that we have developed, we may charge a fee for restocking such materials; however, we have not yet reached the stage where it would be possible to estimate to what extent this would contribute to any future revenue stream. Finally, we intend to provide paid product implementation and guidance services to our customers looking to establish cultivated meat manufacturing facilities. We expect that each facility licensing our technologies will need to deal with novel challenges and, as a result, will require the assistance of our expert knowledge in order to set up and implement our licensed technologies.

In December 2022, we announced that we will focus on commercialization of our 3D bio-printer in 2023 to accelerate our go-to-market strategy through business collaborations and partnerships. To facilitate an accelerated go-to-market plan, we will focus resources on dedicating business personnel to create and develop partnerships during 2023.

| • | Develop additional alternative proteins to meet growing industry demand. There are substantial technological challenges inherent in expanding our offering beyond our current cultivated beef technologies to additional alternative proteins and cell lines. However, we believe that our experience, know-how and intellectual property portfolio form an excellent basis from which to surmount such challenges. In January 2023, we announced a collaboration with Singaporean cultivated seafood developer, Umami Meats, to develop 3D-printed structured eel and grouper products pursuant to a grant from the Singapore-Israel R&D Foundation. The initiative is being funded by a grant from the Singapore-Israel Industrial R&D Foundation (SIIRD), a cooperation between Enterprise Singapore (ESG) and the Israel Innovation Authority (IIA). The collaboration aims to develop a scalable process for producing structured cultivated fish products and will involve the use of our newly-developed technology for mimicking the flaky texture of cooked fish which was the subject of a recent patent application. |

By the end of the first quarter of 2023, we intend to complete the project’s first prototype, a structured hybrid grouper product printed using our proprietary three-dimensional bio-printing technology and bio-inks, customized for cells provided by Umami Meats.

| • | Acquire synergistic and complementary technologies and assets. We intend to optimize our processes and diversify our product range to expand the cultivated meat technologies upon which marketable products can be based. We intend to accomplish this through a combination of internal development, acquisitions and collaborations, with a view to complementing our own processes and diversifying our product range along the cultivated meat production value chain in order to introduce cultivated products to the global market as quickly as possible. See also “- Additional Technologies” below. |

The Commercialization Roadmap

The following table sets forth a road map for the expected commercialization of substitutes for conventionally-farmed meat, which include:

| • | Fully-plant-based meat-like offerings that are already commercially available but lack the organoleptic properties of meat, primarily flavor, aroma, texture and color; |

| • | Hybrid meat products of the type that we are developing, which combines real cultivated fat with plant-based protein to offer meatier products with enhanced organoleptic properties; |

| • | Unstructured meat products, such as hamburgers and minced meat; |

| • | Thee-dimensional, printed, hybrid, structured products such as hybrid steaks, chicken breast and fish fillets (“ready to cook”); and |

| • | Fully-cultivated structured meat products, such as 3D-printed steaks. |

We are focusing on developing complex structured products, starting with ready-to-cook structured hybrid products, followed by fully cultivated and structured, maturated whole cuts of meat.

In September 2022, we announced the development of Omakase Beef Morsels, a richly-marbled, structured meat product developed using our proprietary 3D-printing process. Inspired by the marbling standard of Wagyu beef, we believe that Omakase Beef Morsels are an innovative culinary achievement elegantly designed as a meat lover’s delicacy for premium dining experiences.

The product is made up of multiple layers of muscle and fat tissue, which have been differentiated from bovine stem cells, and showcases the control, flexibility and consistency inherent in our bioprinting technology. Each layer is printed separately using two different bio-inks – one for muscle and one for fat. The layers can be printed in a variety of muscle/fat sequences to obtain differing results of juiciness and marbling of the cut.

We expect to reach industrial-speed printing capabilities in the second half of 2023 and generate initial revenues from our hybrid product technologies commencing in 2024, followed by whole cuts of meat commencing in 2025.

Omakase Beef Morsels (Photo credit: Shlomo Arbiv)

Meat Ingredients for Hybrid and Unstructured Cultivated Products

We continue to develop novel, proprietary, stem-cell-based technologies to produce fat, muscle and connective tissue biomass from multiple species, such as beef and fish, without harming any animals. We are leveraging this technology, including through novel hybrid food products, to expedite market entry while we develop an industrial process for cultivating and producing real meat, including through the use of three-dimensional bioprinting technology. The first expected application of the technology is in hybrid food products, which combines plant-based protein with cultivated animal biomass and is designed to provide meat analogues with qualities of “meatiness”, such as taste and texture, closer to that of conventional meat products than are currently available in the market today. To this end, we have conducted a number of taste tests where we demonstrated the potential that our cultivated fat biomass has to enhance the taste of plant-based protein products. We believe that a product comprised of as little as 10-25% of our cultivated fat biomass combined with plant-based protein has the potential to enhance meatiness. Our cultivated fat biomass is designed to be free of antibiotics and can be tailored to provide personalized nutritional profiles.

Our fat biomass production technology relies on the use of cells derived from proprietary cell lines. These cells grow naturally in suspension and in high densities. They also proliferate continuously, are relatively large and tend to easily accumulate lipid. This quality of the cells makes them an excellent candidate for producing cultivated fat, so we have used them to build a robust cell line that is free of genetic modifications, which we are now attempting to upscale towards industrial production volumes. Our most advanced cell line is being built with GMO pluripotent stem cells that can differentiate into muscle cells and fat cells and form connective tissue, which need fewer high-cost media components, such as growth factors, for their development. As a result, these cells may have higher growth potential with lower costs than alternative technologies. We have likewise developed the process for isolating, growing and differentiating bovine stem cells into muscle fibers, fat biomass and connective tissue.

Some of the steps which we are taking in order to keep the growth media cost low include:

| • | Replacing expensive, animal-derived components in cell growth media with chemical replacements, including through in-house production, with a view to completing animal-free growth media and bio-ink by the first half of 2023; |

| • | Cell line optimizations, such as through high-throughput analyses of evolved isolates; |

| • | Bioprocess optimization and media recycling; |

| • | Upscaled growth factor production, such as through hollow fiber bioreactors; and |

| • | Long-term market optimization as a result of expected increased demand. |

Structured Fully-Cultivated Meat

In addition to meat ingredients for use in hybrid meats and unstructured, cultivated meat, we are developing the technology and processes to produce cultivated meat steak at an industrial scale. We are working to achieve this by creating an end-to-end technology that combines cellular agriculture with bioprinting to produce complex meat structures. We are developing cellular agriculture technology, such as cell lines, and approaches to working with growth media to support the growth of cells such as fat and muscle cells in a scalable process, and have demonstrated an ability to differentiate stem cells into fat and muscle cells. We expect the media to be composed of food-grade ingredients, with growth factors similar to those produced naturally in the bodies of cattle, albeit free of fetal bovine serum, traditionally a significant component of cellular growth media that is harvested from animals. We are engaged with experimentation to develop optimal and cost-effective antibiotic-free cell culture media, and are exploring a range of types of, and sources for, growth factors suited to cell culture. These sources are expected to be sustainable and ethical, providing a route to enabling effective and cost-effective processes. The processes we are developing are designed to allow cells of interest, following humane tissue extraction from the umbilical cord or biopsy, to be isolated, replicated, grown and maintained in vitro under controlled, laboratory conditions.

In February 2023, we announced that we had analyzed our muscle cells and found that they offer the same amino acid profile as that of the native tissue. The amino acid profile has two important roles in our cultivated beef products – taste and nutritional value. Our biology team tested 17 amino acids and compared them to native tissue, with the results showing that the team was able to create the same amino acid profile in the lab as in animals, This demonstrates that cultivated meat has the same biochemical composition as conventional meat, and we believe that it has the potential to provide similar nutritional value.

Amino acids are the building blocks of proteins, playing a crucial role in human nutrition. Meat is a rich source of amino acids, particularly those that are considered "essential" because the human body cannot produce them on its own. These essential amino acids include leucine, isoleucine, valine, lysine, methionine, phenylalanine, threonine, tryptophan, and histidine. These amino acids are important for a variety of bodily functions, including muscle growth and repair, immune function, and hormone production. The specific amino acid profile of meat, as well as its taste, varies depending on the animal species and how it is raised, as well as the cut of meat.

We are also developing proprietary bioprinting and tissue engineering technologies to enable the design and bioprinting of three-dimensional tissues. Our goal is for the meat produced using these technologies to have an authentic texture, flavor, appearance and aroma without being limited to the precise combinations of existing meat tissue, so that fat content of the meat, for example, can be adjusted to amounts other than those occurring naturally in animals in order to meet varied consumer preferences for fattier or leaner cuts of meat. We believe that the novel processes that we are developing have the potential to eventually be competitive with conventional manufacturing technologies for premium products as large-scale production of meat tissues will create new lines of meat without any unnecessary animal use.

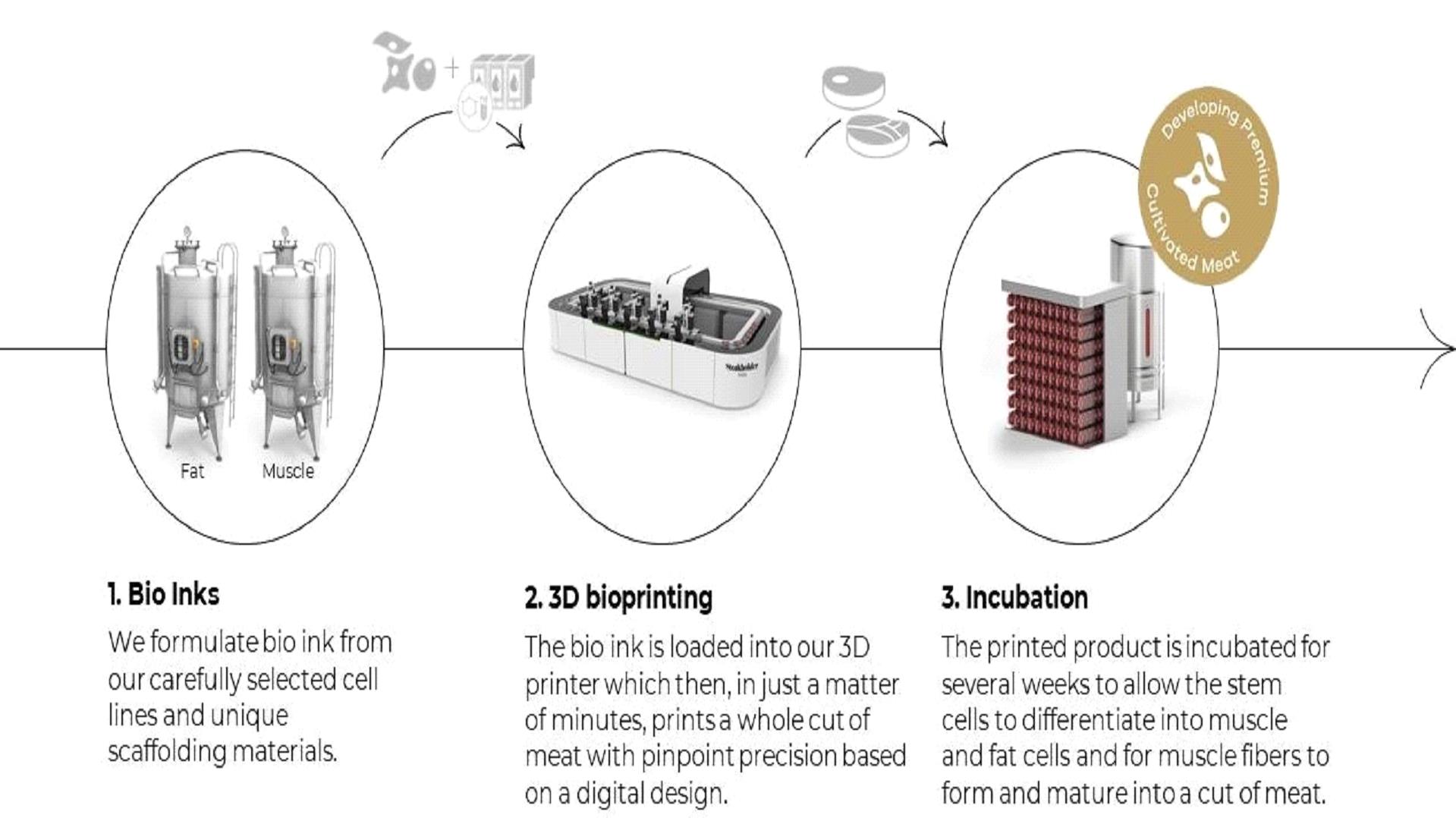

In the course of developing our technologies, we intend to develop a large-scale technology demonstration model. We have set forth below an illustration of the process that we are developing that we believe will, upon completion, allow us and our customers to develop and manufacture cultivated steaks at industrial scale.

We are working on slaughter-free meat development processes, including cell proliferation and differentiation and experiments with stem cell growth media to grow high-density stem cells based solely on compounds produced in laboratory processes.

In these experiments, we have developed stem cells able to differentiate into fat or muscle cells which allows for the maturation of fat tissue and muscle fibers following an isolation process of specific stem cells from sources, such as bovine umbilical cords or muscle tissue. These cells are nourished with nutritional compounds that we develop as a growth medium to direct their differentiation into fat tissue or muscle tissue as needed.

In February 2022, we announced the successful development of a novel technology process in which muscle cells are fused into significant muscle fibers that better resemble those in whole cuts of meat. Bovine stem cells were isolated, proliferated in the lab and differentiated into matured muscle cells with improved muscle fiber density, thickness and length.

Cell source for cultivated meat products

The process of industrial scale meat printing necessitates the isolation and development of cells able to produce both animal muscle and fat tissues. Our proprietary cell lines are isolated from various sources that harbor these properties. For example, adult stem cells can be isolated from various adult tissues and give rise to more cells of the same type, such as either fat or muscle tissues, while stem cells isolated from the umbilical cord immediately following birth can give rise to multiple types of cells, including both fat and muscle cells. Each of these cells has advantages and disadvantages and their adaptation to our robust meat production process is currently being evaluated.

Bioreactors

We are using software-controlled bioreactors to foster cell proliferation. The initial growth phase leverages exponential growth of stem cells to achieve sufficient cell volumes for food production. These stem cells initiate differentiation processes into multiple cell types, such as muscle and fat.

We are in the process of developing cell-culturing processes and protocols for use in bioreactor systems. Such bioreactor systems will enable monitoring and control of growth parameters, as well as testing and development of efficient and economical cell-growth processes in industrial breeding containers. Separate from the bioreactor development process, we have commenced development of a cell-suspension growth process. This growth process is different from cell growth on laboratory plates. We expect that the newly-developed processes may allow cell growth on a scale needed for industrial-scale meat development. We have already developed a cell-suspension growth process using chicken and beef cells in the course of developing both structured and unstructured products.

Our Bio-Inks

Structured, three-dimensional printed products require the use of edible bio-inks, which are printable biological materials produced from the biomass produced in our bioreactors, as well as scaffolding materials. Bioinks produced differ in their differentiation potential into muscle, fat and connective tissue. In this step, our bio-inks are printed in thin layers in the desired combination, which provides creative control over the steak design, in a process that maintains the ongoing viability of the bio-ink cells. Since the printed layers are composed of viable cells, they are then able to coalesce and mature in an incubator with the help of bonding agents that serve as a scaffold that forms three-dimensional tissues. We are in the process of optimizing the characteristics of our proprietary bio-inks, including composition, motility, viscosity, temperature, structural stability, density and jettability, or the ability to be dispersed by a printer, as well as the factors helping the cells to connect in three-dimensional tissues.

We also have the capability to customize bio-inks for businesses that we work with, offering the opportunity to 3D print with their cell lines. This is currently being proven in the collaboration with Umami Meat as we are customizing the bio-ink to the Umami Meats Grouper cells.

Proprietary Bioprinting

Bioprinting is a process of fashioning a specific type or types of native or manipulated cells configured to form the edible tissue analog by depositing scaffolding material mixed with cells and other bio-inks. This is done through the use of an inkjet-style printer with drop-on-demand capabilities where inks are printed precisely into a three-dimensional design.

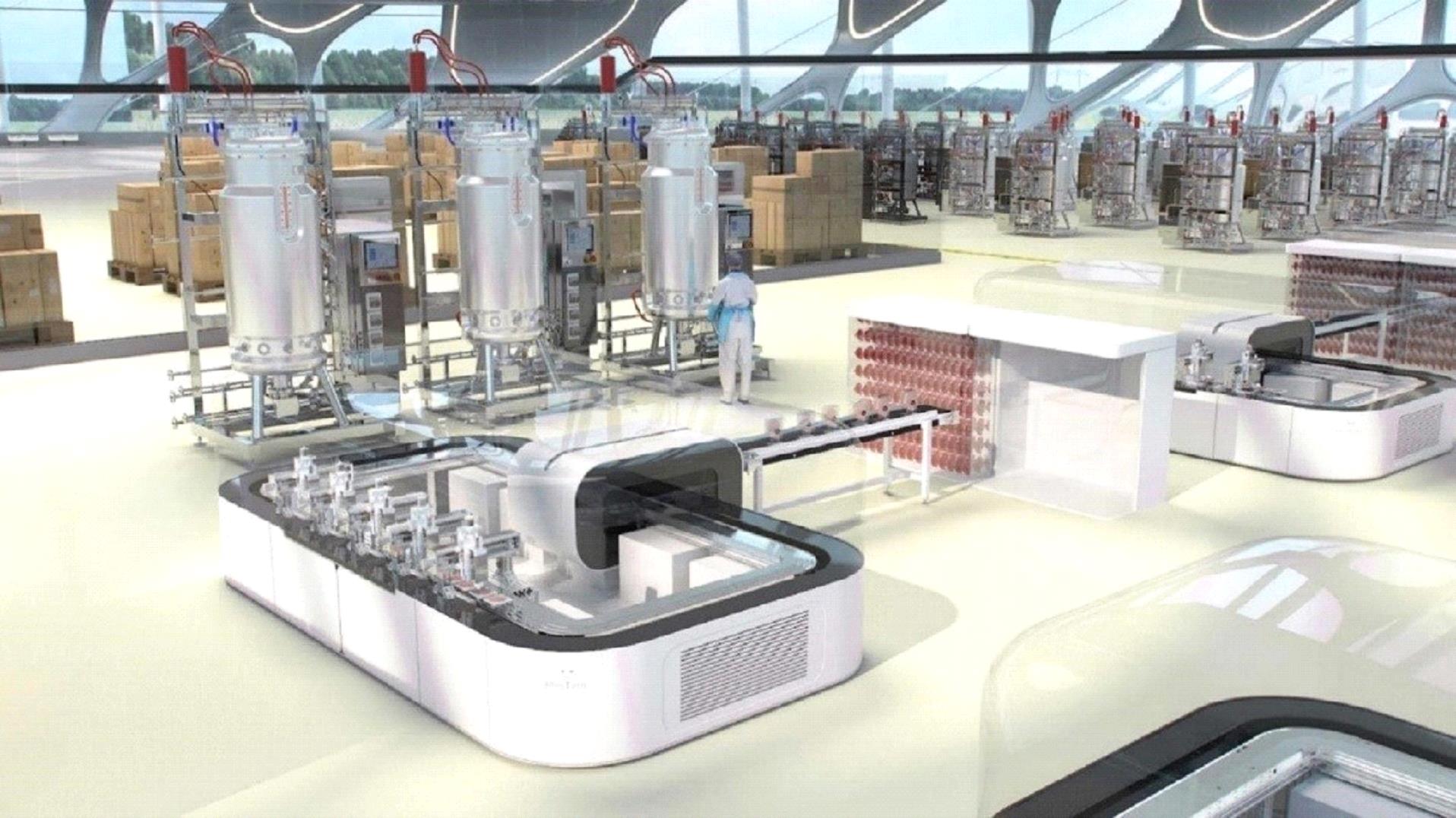

The image below depicts a potential laboratory model that we could use for the development and production of cultivated meat steaks.

After the completion of the bioprinting process, the tissue is transferred into a special incubator, where, in addition to providing nutrients and other chemical and biological agents, the system may physically manipulate the tissue. This “training” process increases the muscle cells differentiation, a process in which a cell changes its function and phenotype, and produces a stronger, more fibrous tissue.

To date, we have printed several cell types, which coalesced into fat and muscle tissue grown in our laboratory. In December 2021, we announced that we had successfully three-dimensionally printed a 3.67 ounce cultivated steak that was primarily composed of cultivated fat and muscle tissues without using soy or pea protein. The cells used to make the steak were produced with an advanced proprietary process that started by isolating bovine stem cells from tissue samples and multiplying them. Upon reaching sufficient cellular mass, stem cells were formulated into bio-inks compatible with our proprietary 3D bioprinter. The bio-inks were printed from a digital design file of a steak structure. The printed product was placed in an incubator to mature, allowing the stem cells to differentiate into fat and muscle cells and develop into fat and muscle tissue to form our steak.

In May 2022, we announced the development of a novel, multi-nozzle 3D bioprinting system for industrial scale production of complex cultivated meat products without impacting cell viability. We plan to offer the technology to third parties via our wholly-owned private subsidiary, Steakholder Innovation Ltd. as a potential additional revenue stream and to accelerate commercialization. We aim to conclude our first strategic engagement to this end in the second half of 2023.

In addition, in December 2022, we announced the development of a temperature-controlled print bed for our industrial-scale printer, which is a step forward on our path toward mass production of cultivated meat using 3D printing technology. Temperature control is a critical requirement when printing a cultivated product containing live cells. Maintaining optimal temperature poses a challenge in the architecture of our industrial printers, so the development of temperature-controlled print beds is a major milestone on the path to production at scale, whereby contactless electromagnetic power is delivered to the print bed which is connected to a wireless communication module that monitors and controls its temperature.

Cultivated Steak Scaffolding

Growing three-dimensional meat presents a unique challenge. Typically, animal cells must remain within 200 microns of a nutrient supply in order to survive. This is little more than the width of a human hair and is known as the diffusion limit. It is the reason that cells grow along the surface of a petri dish rather than forming vertical piles.

In the next step of the process that we are developing, we intend to build a scaffold to support the growth of three-dimensional meat. A “scaffold”, or “biocompatible scaffolding”, refers to an engineered platform having a predetermined three-dimensional structure that mimics the environment of the natural extracellular material, or ECM. The ECM is a three-dimensional network of large molecules that provide structural and biochemical support to surrounding cells. Collagen is the most abundant component in the ECM that supports the development and growth of complex tissues, and specifically, also muscle tissues. Engineering of bovine muscle tissues in vitro while avoiding the use of animal derived collagen requires the development of plant based scaffolds that would imitate the properties of the ECM. Plants are an obvious candidate for scaffolding as they are sustainable, cost worthy and could be processed to have similar properties of collagen fibers. We are developing technology to allow for the formation of a composite scaffold.

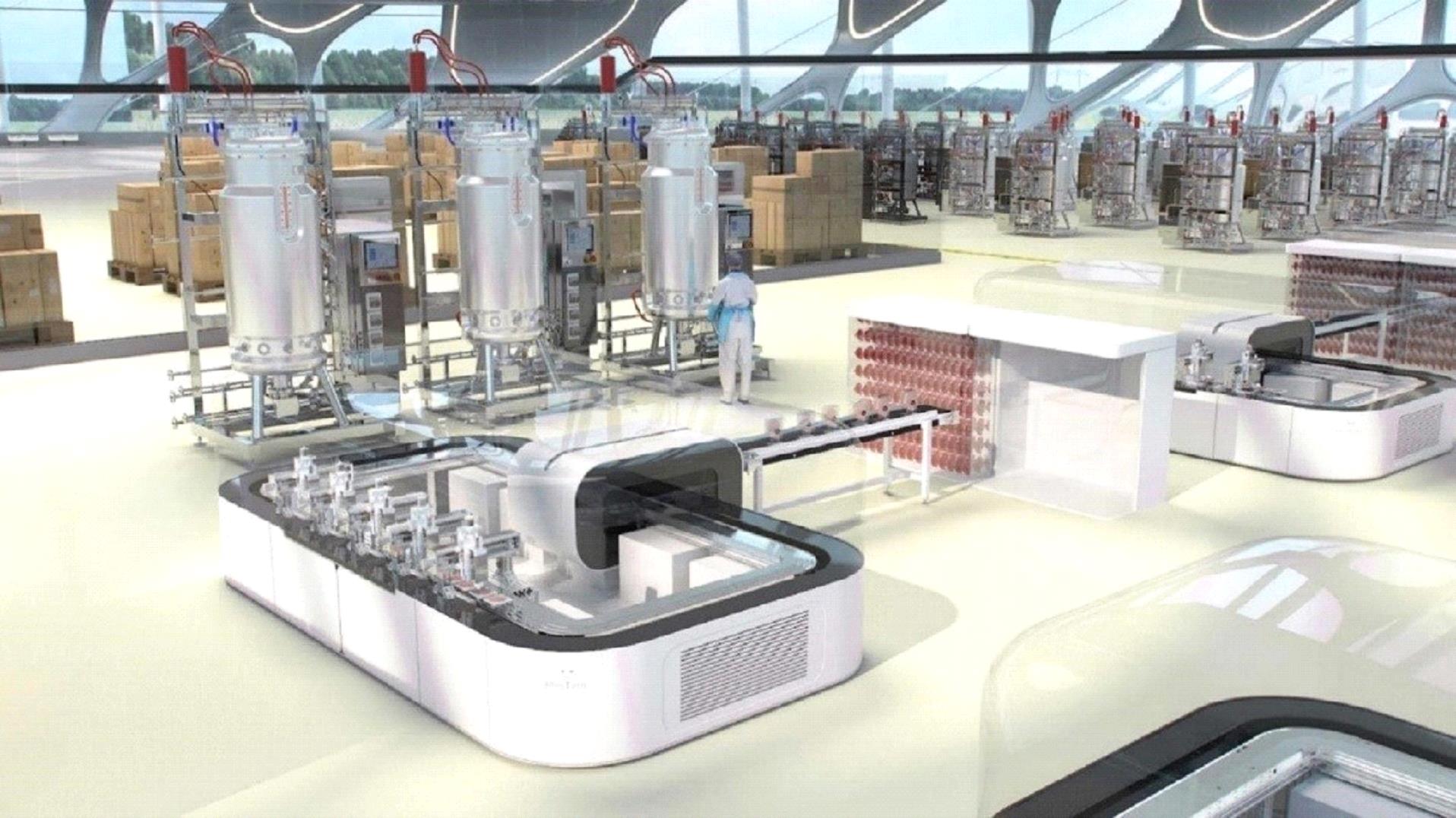

Modularity

We are focused on developing a process that will allow our food technology customers to operate a high-throughput manufacturing process for high-quality, healthy meat. Our cellular agriculture and bioprinting processes are being designed to be modular, meaning that they can work using different factory sizes. We believe we could license our technology to customers with industrial plants close to urban areas seeking to provide “just in time”, logistically-efficient, local and premium cellular agriculture. In addition, we believe a licensee of our technology could build a plant in a locality that does not have the resources needed for industrial animal husbandry, which would allow places like the United Arab Emirates, Hong Kong or Singapore to potentially become more agriculturally independent by increasing food security. As costs continue to decrease, we believe licensees of our technology could also build production facilities in localities where there is high agricultural seasonality or desertification risk.

Illustration of a contemplated cultivated meat manufacturing plant.

Clean Energy

We are developing processes intended to achieve high-volume manufacturing capabilities in line with the needs of today’s value-added food processors and other meat and food industry players. To this end, we are working on processes to scale up production, beginning with different cell types, including induced pluripotent stem cells and embryonic stem cells. We expect high-volume stem cell production to feed into differentiation bioreactors that are dedicated to producing fat and muscle cells. These cells are the key input for our downstream productization stages.

The processes we are developing are advanced biotechnological processes that are intended to produce cultivated meat in a clean environment with minimal environmental impact. We envision that factories utilizing our technologies will exist in greater harmony with their environment than typical current factories by supporting sustainability, utilizing renewable energy sources and recycling or treating their own waste.

Additional Technologies

We may incorporate novel bioreactor technologies that benefit cellular agriculture and the development of low-cost cell culture media not based on fetal bovine serum.

We also plan to add cell line types to expand the development of cultivated meat to other types of animals, as well as achieving market penetration in the shortest timeframe possible, which would allow us to realize the great potential in the market. We are developing cultivated meat, both unstructured hybrid products and structured, three-dimensional printed products, with an initial emphasis on bovine cells. Beyond hybrid products, cultivated fat is expected to be a component in other fat-based products, whether edible or otherwise, and an integrated component in our printing technology. We are working to create synergy and added value to the cultivated meat market, while also sustaining animal welfare and meeting the growing global demand for meat.

International Expansion

United States

In March 2022, we announced that we intended to open a U.S. office. We expect the new space will include activities in research and development, investor relations and business development. In September 2022, we commenced development of a bovine cell line in the United States, by isolating cells sourced from cattle raised on a farm approved by the United States Department of Agriculture, or USDA. We plan to make a regulatory submission in the United States for approval of our cultivated meat in the second half of 2023.

Europe

Peace of Meat Acquisition

In February 2021, we finalized our acquisition of Peace of Meat, a Belgian producer of cultivated avian products, for up to $19.9 million in cash and equity, depending on milestone achievements. Peace of Meat was established in Belgium in 2019 and developed cultured avian fat directly from animal cells without the need to grow or kill animals.

In April 2021, we commenced food technology development activities through our European subsidiary, MeaTech Europe BV, with an initial focus on hybrid foods using Peace of Meat’s cultivated fat. Hybrid foods are products composed of both plant and cultivated meat ingredients that have the potential to offer a meatier experience than purely plant-based meat alternatives. We currently expect food technology development activities to continue at our Israeli headquarters.

On March 7, 2023, we announced a restructuring plan for Peace of Meat, to which end Peace of Meat began implementing a series of changes designed to streamline its operations. On April 4, 2023, we announced that Peace of Meat would close, in the context of optimizing our funds and investment strategy, alongside enabling a greater focus on recently-announced core goals such as accelerating the commercialization of our 3D printing technology.

As part of our purchase of the shares of Peace of Meat at the end of 2020, Peace of Meat’s management had been granted full contractual autonomy throughout 2021 and 2022, and was provided with the funding required to develop its technologies in accordance with the terms of the purchase. Following the conclusion of the autonomous period and following our previously announced plans to restructure Peace of Meat, we further evaluated the expected return on our investment, and decided not to provide additional funds to Peace of Meat, in order to focus our efforts in the advancement of its core technology 3D printing of cultured products, and potential collaborations. As a result, Peace of Meat has ceased operations and is expected to be liquidated. As part of this process, we expect Peace of Meat’s assets to be realized, following which we shall consider how and when to continue development of cultivated avian products. The closure of Peace of Meat is expected to reduce our expenses by about $4.5 million annually, relative to 2022.

Asia

In November 2022, we received a registered trademark for our name in Japan, which we view as an important next step in our plans to penetrate the Japanese market and other markets in Asia. This follows on our collaboration with Umami Meats for the joint development of 3D-printed cultivated structured seafood. In addition, we plan to make a regulatory submission for approval of our cultivated meat in Singapore in the first half of 2023.

On April 3, 2023, we announced our participation in a strategic investment round in Wilk Technologies Ltd. (TASE: WILK), alongside leading players in the food industry, such as Danone and the Central Bottling Co. Ltd. (owner of Tara, Coca Cola Israel and more). The transaction was approved by our audit committee (due to related party considerations) and board of directors. As part of the investment, we purchased ordinary shares of Wilk in the amount of $450,000 at a 15% discount below their 45-day average closing price, giving us a 2.5% stake in Wilk. In parallel with this investment, we aim to identify synergies with Wilk, including various types of strategic cooperation with the company surrounding our proprietary biology and printing technologies.

Sales and Distribution

We are working to develop and establish sales and distribution capabilities. In the event that we complete the development of our technologies and secure adequate funding, we intend to consider commercialization collaborations where appropriate.