The information in this preliminary proxy statement/prospectus is not complete and may be changed. The registrant may not sell the securities described in this preliminary proxy statement/ prospectus until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 8, 2021

PROXY STATEMENT FOR

EXTRAORDINARY GENERAL MEETING OF

REINVENT TECHNOLOGY PARTNERS Z

(A CAYMAN ISLANDS EXEMPTED COMPANY)

PROSPECTUS FOR

580,950,000 SHARES OF COMMON STOCK AND

4,600,000 REDEEMABLE WARRANTS

OF

REINVENT TECHNOLOGY PARTNERS Z

(AFTER ITS DOMESTICATION AS A CORPORATION INCORPORATED IN

THE STATE OF DELAWARE),

THE CONTINUING ENTITY FOLLOWING THE DOMESTICATION,

WHICH WILL BE RENAMED “HIPPO HOLDINGS INC.”

IN CONNECTION WITH THE BUSINESS COMBINATION DESCRIBED HEREIN

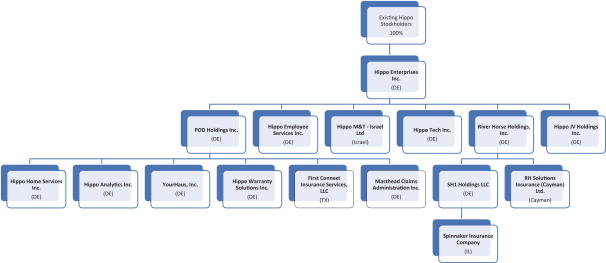

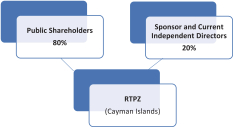

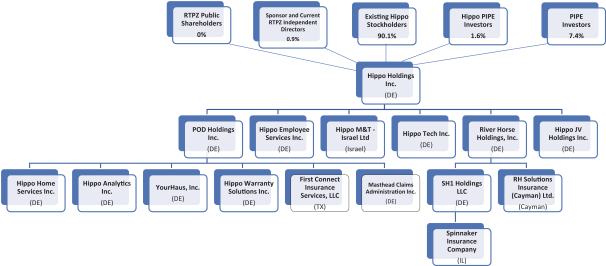

The board of directors of Reinvent Technology Partners Z, a Cayman Islands exempted company (“RTPZ” and, after the Domestication as described below, “Hippo Holdings”), has unanimously approved (1) the domestication of RTPZ as a Delaware corporation (the “Domestication”); (2) the merger of RTPZ Merger Sub Inc. (“Merger Sub”), a Delaware corporation and subsidiary of RTPZ, with and into Hippo Enterprises Inc. (“Hippo”), a Delaware corporation (the “First Merger”), with Hippo surviving the Merger as a wholly owned subsidiary of Hippo Holdings, and, immediately following the First Merger, the merger of Hippo (as the surviving corporation of the First Merger) with and into Hippo Holdings, with Hippo Holdings surviving (the “Second Merger” and, together with the First Merger, the “Mergers”), in each case pursuant to the terms of the Agreement and Plan of Merger, dated as of March 3, 2021, by and among RTPZ, Merger Sub and Hippo, attached to this proxy statement/prospectus as Annex A (the “Merger Agreement”), as more fully described elsewhere in this proxy statement/prospectus; and (3) the other transactions contemplated by the Merger Agreement and documents related thereto. In connection with the Business Combination, RTPZ will change its name to “Hippo Holdings Inc.”

As a result of and upon the effective time of the Domestication, among other things, (1) each then issued and outstanding share of RTPZ Class A ordinary shares, par value $0.0001 per share, of RTPZ (the “RTPZ Class A ordinary shares”), will convert automatically, on a one-for-one basis, into a share of common stock, par value $0.0001 per share, of Hippo Holdings (the “Hippo Holdings common stock”), (2) each of the then issued and outstanding Class B ordinary shares, par value $0.0001 per share, of RTPZ (the “RTPZ Class B ordinary shares”), will convert automatically, on a one-for-one basis, into a share of Hippo Holdings common stock (which shares are not being registered pursuant to this proxy statement/prospectus), (3) each then issued and outstanding warrant of RTPZ (the “RTPZ warrants”) will convert automatically into a warrant to acquire one share of Hippo Holdings common stock (the “Hippo Holdings warrants”) pursuant to the Warrant Agreement, dated as of November 18, 2020 (the “Warrant Agreement”), between RTPZ and Continental Stock Transfer & Trust Company (“Continental”), as warrant agent, and (4) each then issued and outstanding unit of RTPZ (the “RTPZ units”) will separate automatically into one share of Hippo Holdings common stock, on a one-for-one basis, and one-fifth of one Hippo Holdings warrant. Accordingly, this proxy statement/prospectus covers (1) 28,750,000 shares of Hippo Holdings common stock to be issued in the Domestication and (2) 4,600,000 Hippo Holdings warrants to be issued in the Domestication.

Immediately prior to the Effective Time, (i) each share of Hippo preferred stock will be converted into shares of Hippo common stock at the then-effective conversion rate as calculated pursuant to the terms of the Hippo Amended and Restated Certificate of Incorporation , (ii) the Hippo warrants will be exercised in full on a cash or cashless basis or terminated without exercise, as applicable, in accordance with their respective terms, and (iii) the Hippo notes will be automatically converted into shares of Hippo common stock in accordance with their respective terms. Subsequently, at the Effective Time, among other things, all outstanding shares of Hippo common stock as of immediately prior to the Effective Time, and, together with shares of Hippo common stock reserved in respect of Hippo options outstanding as of immediately prior to the Effective Time that will be converted into options based on Hippo Holdings common stock, will be cancelled in exchange for the right to receive, or the reservation of an aggregate of 552,200,000 shares of Hippo Holdings common stock (at a deemed value of $10.00 per share), which, in the case of Hippo options, will be shares underlying options based on Hippo Holding common stock, representing a pre-transaction equity value of Hippo of $5.522 billion (such total number of shares of Hippo Holdings common stock, the “Aggregate Merger Consideration”). The portion of the Aggregate Merger Consideration reflecting the conversion of the Hippo options is calculated