- HIPO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

POS AM Filing

Hippo (HIPO) POS AMProspectus update (post-effective amendment)

Filed: 19 Apr 22, 5:07pm

Delaware | 6770 | 32- 0662604 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

| Large accelerated filer | Accelerated filer | ☐ | ||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

| Page | ||||

| ii | ||||

| v | ||||

| 1 | ||||

| 8 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 71 | ||||

| 100 | ||||

| 106 | ||||

| 112 | ||||

| 114 | ||||

| 123 | ||||

| 128 | ||||

| 138 | ||||

| 139 | ||||

| 142 | ||||

| 142 | ||||

| 142 | ||||

| F-1 | ||||

| • | “Business Combination” are to the Domestication together with the Merger; |

| • | “Bylaws” are to our amended and restated bylaws; |

| • | “Cayman Islands Companies Law” are to the Cayman Islands Companies Act (As Revised); |

| • | “Certificate of Incorporation” are our amended and restated certificate of incorporation; |

| • | “Closing” are to the closing of the Business Combination; |

| • | “Continental” are to Continental Stock Transfer & Trust Company; |

| • | “DGCL” are to the General Corporation Law of the State of Delaware; |

| • | “Domestication” are to the domestication of RTPZ as a corporation incorporated in the State of Delaware; |

| • | “Effective Time” are to the effective time of the Merger; |

| • | “ESPP” are to the Hippo Holdings Inc. 2021 Employee Stock Purchase Plan; |

| • | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| • | “Exchange Ratio” are to the quotient obtained by dividing (i) the Aggregate Merger Consideration by (ii) the aggregate fully-diluted number of shares of Hippo Holdings common stock issued and outstanding immediately prior to the First Merger; |

| • | “GAAP” are to accounting principles generally accepted in the United States of America; |

| • | “Hippo” are to Hippo Holdings Inc. and its consolidated subsidiaries and businesses, including Spinnaker, after the Business Combination; |

| • | “Hippo Holdings common stock” are to shares of Hippo Holdings common stock, par value $0.0001 per share; |

| • | “Hippo Holdings Inc.” or “Hippo Holdings” are to RTPZ after the Domestication and its name change from Reinvent Technology Partners Z to Hippo Holdings Inc.; |

| • | “Hippo Holdings options” are to options to purchase shares of Hippo Holdings common stock; |

| • | “Hippo notes” are to the convertible promissory notes issued by Hippo and convertible into shares of Hippo Holdings common stock; |

| • | “Incentive Award Plan” are to the Hippo Holdings Inc. 2021 Incentive Award Plan; |

| • | “initial public offering” are to RTPZ’s initial public offering that was consummated on November 23, 2020; |

| • | “IPO registration statement” are to the Registration Statement on Form S-1 (333-249799) filed by RTPZ in connection with its initial public offering, which became effective on November 18, 2020; |

| • | “IRS” are to the U.S. Internal Revenue Service; |

| • | “JOBS Act” are to the Jumpstart Our Business Startups Act of 2012; |

| • | “Merger” are to the merger of Merger Sub with and into Old Hippo, with Old Hippo surviving the merger as a wholly owned subsidiary of Hippo Holdings; |

| • | “Merger Sub” means RTPZ Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of RTPZ prior to the Business Combination, which, as a result of the Merger, merged into Old Hippo; |

| • | “NYSE” are to the New York Stock Exchange; |

| • | “Old Hippo” are to Hippo Enterprises Inc. prior to the Business Combination, which became a wholly owned subsidiary of Hippo Holdings and later merged into Hippo Holdings as a result of the Business Combination; |

| • | “Old Hippo capital stock” are to shares of Old Hippo common stock and Old Hippo preferred stock. |

| • | “Old Hippo common stock” are to shares of Old Hippo common stock, par value $0.00001 per share; |

| • | “Old Hippo preferred stock” are to the Series A-1 preferred stock, SeriesA-2 preferred stock, Series B preferred stock, SeriesC-1 preferred stock, Series C preferred stock, Series D preferred stock and Series E preferred stock of Old Hippo; |

| • | “Old Hippo warrants” are to the warrants to purchase shares of Hippo capital stock outstanding prior to the Effective Time; |

| • | “Organizational Documents” are to the Certificate of Incorporation and the Bylaws; |

| • | “PIPE Investment” are to the purchase of shares of Hippo Holdings common stock pursuant to the Subscription Agreements; |

| • | “PIPE Investors” are to those certain investors participating in the PIPE Investment pursuant to the Subscription Agreements; |

| • | “private placement warrants” are to the RTPZ private placement warrants outstanding as of the date of this prospectus and the warrants of Hippo Holdings issued as a matter of law upon the conversion thereof at the time of the Domestication; |

| • | “public shares” are to the RTPZ Class A ordinary shares (including those that underlie the units of RTPZ) that were offered and sold by RTPZ in its initial public offering and registered pursuant to the IPO registration statement and the shares of Hippo Holdings common stock issued as a matter of law upon the conversion thereof on the effective date of the Domestication. |

| • | “public warrants” are to the redeemable warrants (including those that underlie the units of RTPZ) that were offered and sold by RTPZ in its initial public offering and registered pursuant to the IPO registration statement or the redeemable warrants of Hippo Holdings issued as a matter of law upon the conversion thereof at the time of the Domestication; |

| • | “redemption” are to each redemption of public shares for cash pursuant to the Organizational Documents; |

| • | “Registration Rights Agreement” are to the Registration Rights Agreement entered into by and among Hippo Holdings, the Sponsor and the other holders of RTPZ Class B ordinary shares, certain former stockholders of Hippo, and Reinvent Capital Fund LP, as amended and modified from time to time; |

| • | “RTPZ” are to Reinvent Technology Partners Z prior to its domestication as a corporation in the State of Delaware; |

| • | “RTPZ Class A ordinary shares” are to RTPZ’s Class A ordinary shares, par value $0.0001 per share; |

| • | “RTPZ Class B ordinary shares” are to RTPZ’s Class B ordinary shares, par value $0.0001 per share; |

| • | “RTPZ founder shares” are to the 5,750,000 RTPZ Class B ordinary shares purchased by the Sponsor in a private placement prior to the initial public offering for an aggregate purchase price of $25,000 (or approximately $0.004 per share), and the RTPZ Class A ordinary shares that will be issued upon the conversion thereof; |

| • | “Sarbanes-Oxley Act” are to the Sarbanes-Oxley Act of 2002; |

| • | “SEC” are to the United States Securities and Exchange Commission; |

| • | “Securities Act” are to the Securities Act of 1933, as amended; |

| • | “Selling Securityholder” are to the selling securityholders named in this prospectus; |

| • | “Spinnaker” are to Spinnaker Insurance Company; |

| • | “Sponsor” are to Reinvent Sponsor Z LLC, a Cayman Islands limited liability company; |

| • | “Sponsor Agreement” are to that certain Sponsor Agreement, dated March 3, 2021, by and between RTPZ and Hippo, as amended and modified from time to time; |

| • | “Sponsor Shares” are to the RTPZ founder shares that were beneficially owned by the Sponsor as of the Domestication. |

| • | “Subscription Agreement” are to that certain Sponsor Agreement, dated March 3, 2021, by and between RTPZ and Hippo, as amended and modified from time to time; |

| • | “Transaction” are to Old Hippo becoming a wholly owned subsidiary of Hippo Holdings as a result of Merger Sub, a direct wholly owned subsidiary of RTPZ, merging with and into Old Hippo, with Old Hippo surviving as a wholly owned subsidiary of Hippo Holdings; |

| • | “Trust Account” are to the trust account established at the consummation of RTPZ’s initial public offering at JPMorgan Chase Bank, N.A. and maintained by Continental, acting as trustee; |

| • | “Warrant Agreement” is to the Warrant Agreement, dated as of November 18, 2020, by and between RTPZ and Continental, as warrant agent, as amended; and |

| • | “warrants” are to the public warrants and the private placement warrants. |

| • | our future results of operations and financial condition and our ability to attain profitability; |

| • | our ability to grow our business and, if such growth occurs, to effectively manage such growth; |

| • | customer satisfaction and our ability to attract, retain, and expand our customer base; |

| • | our ability to maintain and enhance our brand and reputation; |

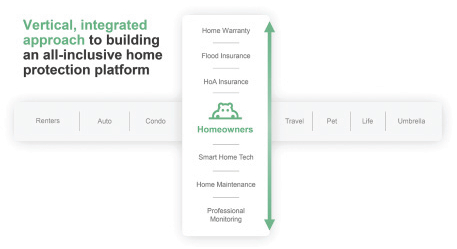

| • | our business strategy, including our diversified distribution strategy and our plans to expand into new markets and new products; |

| • | the effects of seasonal trends on our results of operations; |

| • | our expectations about our book of business, including our ability to cross-sell and to attain greater value from each customer; |

| • | our ability to compete effectively in our industry; |

| • | our ability to maintain reinsurance contracts and our near- and long-term strategies and expectations with respect to cession of insurance risk; |

| • | our ability to utilize our proprietary technology; |

| • | our ability to underwrite risks accurately and charge profitable rates; |

| • | our ability to leverage our data, technology and geographic diversity to help manage risk; |

| • | our ability to protect our intellectual property; |

| • | our ability to expand our product offerings or improve existing ones; |

| • | our ability to attract and retain personnel, including our officers and key employees; |

| • | potential harm caused by misappropriation of our data and compromises in cybersecurity; |

| • | potential harm caused by changes in internet search engines’ methodologies; |

| • | our expected use of cash on our balance sheet, our future capital needs and our ability to raise additional capital; |

| • | fluctuations in our results of operations and operating metrics; |

| • | our ability to receive, process, store, use and share data, and compliance with laws and regulations related to data privacy and data security; |

| • | our ability to stay in compliance with laws and regulation that currently apply, or become applicable, to our business both in the United States and internationally; |

| • | our inability to predict the lasting impacts of COVID-19 to our business in particular, and the global economy generally; |

| • | our public securities’ liquidity and trading; and |

| • | other factors detailed in the section titled “ Risk Factors |

• | Hippo Holdings makes policies fast and easy to buy. |

• | Hippo Holdings’ policies are designed for the modern homeowner. |

• | Hippo Holdings has designed a proactive, human approach to claims, enabled by technology. |

• | Hippo Holdings has pioneered what it believes is the most widely adopted Smart Home program in the U.S. industry. |

• | Hippo Holdings proactively helps its customers maintain and protect their homes. |

| • | We have a history of net losses and we may not achieve or maintain profitability in the future. |

| • | Our success and ability to grow our business depend on retaining and expanding our customer base. If we fail to add new customers or retain current customers, our business, revenue, operating results, and financial condition could be harmed. |

| • | The “Hippo” brand may not become as widely known as incumbents’ or other competitors’ brands or the brand may become tarnished. |

| • | Denial of claims or our failure to accurately and timely pay claims could materially and adversely affect our business, financial condition, results of operations, and our reputation. |

| • | Our limited operating history makes it difficult to evaluate our current business performance, implementation of our business model, and our future prospects. |

| • | We may not be able to manage our growth effectively. |

| • | Intense competition in the segments of the insurance industry in which we operate could negatively affect current financials and our ability to attain or increase profitability. |

| • | Reinsurance may be unavailable, including at current coverage, limits, or pricing, which may limit our ability to write new or renew existing business. Furthermore, reinsurance subjects our insurance company subsidiaries to counterparty credit and performance risk and may not be adequate to protect us against losses, each of which could have a material effect on our results of operations and financial condition. |

| • | Failure to maintain our risk-based capital at the required levels could adversely affect the ability of our insurance company subsidiaries to maintain regulatory authority to conduct our business. |

| • | Failure to maintain our financial strength ratings could adversely affect the ability of our insurance company subsidiaries to conduct our business as currently conducted. |

| • | If we are unable to underwrite risks accurately and charge competitive yet profitable rates to our customers, our business, results of operations, and financial condition will be adversely affected. |

| • | Our proprietary technology, which relies on third-party data, may not operate properly or as we expect it to. |

| • | Our technology platform may not operate properly or as we expect it to operate. |

| • | Our future success depends on our ability to continue to develop and implement our technology and to maintain the confidentiality of this technology. |

| • | New legislation or legal requirements may affect how we communicate with our customers, which could have a material adverse effect on our business model, financial condition, and results of operations. |

| • | We rely on external data and our digital platform to collect and evaluate information that we utilize in producing, pricing, and underwriting our insurance policies (in accordance with the rates, rules, and forms filed with our regulators, where required), managing claims and customer support, and improving business processes. Any legal or regulatory requirements that might restrict our ability to collect or utilize this data or our digital platform, or an outage by a data vendor, could thus materially and adversely affect our business, financial condition, results of operations, and prospects. |

| • | We depend on search engines, content based online advertising, and other online sources to attract consumers to our website, which may be affected by third-party interference beyond our control. In addition, our producer and partner distribution channels are significant sources of new customers and could be impacted by third-party interference or other factors. As we grow, our customer acquisition costs may increase. |

| • | We may require additional capital to grow our business, which may not be available on terms acceptable to us or at all. |

| • | Interruptions or delays in the services provided by our providers of third-party technology platforms or our internet service providers could impair the operability of our website and may cause our business to suffer. |

| • | Security incidents or real or perceived errors, failures, or bugs in our systems or website could impair our operations, result in loss of customers’ personal information, damage our reputation and brand, and harm our business and operating results. |

| • | Misconduct or fraudulent acts by employees, agents, claims vendors, or third parties may expose us to financial loss, disruption of business, regulatory assessments, and reputational harm. |

| • | Our success depends, in part, on our ability to establish and maintain relationships with quality and trustworthy service professionals. |

| • | We may be unable to prevent, monitor, or detect fraudulent activity, including policy acquisitions or payments of claims that are fraudulent in nature. |

| • | We are periodically subject to examinations by our primary state insurance regulators, which could result in adverse examination findings and necessitate remedial actions. |

| • | We are subject to laws and regulations concerning our collection, processing, storage, sharing, disclosure, and use of customer information and other sensitive data, and our actual or perceived (or alleged) failure to comply with data privacy and security laws and regulations could damage our reputation and brand and harm our business and operating results. |

| • | We employ third-party licensed data, software, technologies, and intellectual property for use in our business, and the inability to maintain or use these licenses, or errors or defects in the data, software, technologies, and intellectual property we license could result in increased costs or reduced service levels, which would adversely affect our business, financial condition, and results of operations. |

| • | Failure to protect or enforce our intellectual property rights could harm our business, results of operations, and financial condition. |

| • | Our services utilize third-party open source software components, which may pose particular risks to our proprietary software, technologies, products, and services in a manner that could negatively affect our business. |

| • | We may be unable to prevent or address the misappropriation of our data. |

| • | We rely on the experience and expertise of our founder, senior management team, highly-specialized insurance experts, key technical employees, and other highly skilled personnel. |

| • | If our customers were to claim that the policies they purchased failed to provide adequate or appropriate coverage, we could face claims that could harm our business, results of operations, and financial condition. |

| • | We may become subject to claims under Israeli law for remuneration or royalties for assigned invention rights by our Israel-based contractors or employees, which could result in litigation and adversely affect our business. |

| • | Our company culture has contributed to our success and if we cannot maintain this culture as we grow, our business could be harmed. |

| • | Our exposure to loss activity and regulation may be greater in states where we currently have more of our customers or where we are domiciled. |

| • | Our product development cycles are complex and subject to regulatory approval, and we may incur significant expenses before we generate revenues, if any, from new or expansion of or changes to existing products. |

| • | Our success depends upon the continued growth in the use of the internet for purchasing of insurance products. |

| • | New lines of business or new products and services may subject us to additional risks. |

| • | Litigation and legal proceedings filed by or against us and our subsidiaries, key vendors, joint ventures, or investments could have a material adverse effect on our business, results of operations, and financial condition. |

| • | Claims by others that we infringed their proprietary technology or other intellectual property rights could result in litigation which is expensive to support, and if resolved adversely, could harm our business. |

| • | If we are unable to make acquisitions and investments, or if we are unable to successfully integrate them into our business, our business, results of operations, and financial condition could be adversely affected. |

| • | We may not be able to utilize a portion of our net operating loss carryforwards (“NOLs”) to offset future taxable income, which could adversely affect our net income and cash flows. |

| • | Our expansion strategy will subject us to additional costs and risks and our plans may not be successful. |

| • | We are subject to payment processing risk. |

| • | We are exposed to risk through our captive reinsurer, RH Solutions Insurance Ltd., which takes a share of the risk underwritten of affiliated and non-affiliated insurance carriers for business written through a managing general agent (“MGA”). |

| • | We are exposed to risk through our admitted and non-admitted insurance carriers, which underwrite insurance on behalf of our MGA and othernon-affiliated general agents and managing general agents. |

| • | The insurance business, including the market for homeowners’ insurance, is historically cyclical in nature, and we may experience periods with excess underwriting capacity and unfavorable premium rates, which could adversely affect our business. |

| • | Our actual incurred losses may be greater than our loss and loss adjustment expense reserves, which could have a material adverse effect on our financial condition and results of operations. |

| • | We are subject to extensive insurance industry regulations. |

| • | A regulatory environment that requires rate increases and product forms to be approved and that can dictate underwriting practices and mandate participation in loss sharing arrangements may adversely affect our results of operations and financial condition. |

| • | State insurance regulators impose additional reporting requirements regarding enterprise risk on insurance holding company systems, with which we must comply as an insurance holding company. |

| • | The increasing adoption by states of cybersecurity regulations could impose additional compliance burdens on us and expose us to additional liability. |

| • | The COVID-19 pandemic has caused disruption to our operations and may continue to negatively impact our business, key metrics, or results of operations in numerous ways that remain unpredictable. |

| • | Severe weather events and other catastrophes, including the effects of climate change, global pandemics, and terrorism, are inherently unpredictable and may have a material adverse effect on our financial results and financial condition. |

| • | We expect our results of operations to fluctuate on a quarterly and annual basis. In addition, our operating results and operating metrics are subject to seasonality and volatility, which could result in fluctuations in our quarterly revenues and operating results or in perceptions of our business prospects. |

| • | An overall decline in economic activity could have a material adverse effect on the financial condition and results of operations of our business. |

| • | Our results of operations and financial condition may be adversely affected due to limitations in the analytical models used to assess and predict our exposure to catastrophe losses. |

| • | Our insurance company subsidiaries are subject to minimum capital and surplus requirements, and failure to meet these requirements could subject us to regulatory action. |

| • | Our insurance company subsidiaries are subject to assessments and other surcharges from state guaranty funds and mandatory state insurance facilities, which may reduce our profitability. |

| • | Performance of our investment portfolio is subject to a variety of investment risks that may adversely affect our financial results. |

| • | Unexpected changes in the interpretation of our coverage or provisions, including loss limitations and exclusions in our policies, could have a material adverse effect on our financial condition and results of operations. |

| • | There may not be an active trading market for our common stock, which may make it difficult to sell shares of our common stock, and there can be no assurance that we will be able to comply with the continued listing standards of such exchange. |

| • | The market price of our common stock and warrants may be highly volatile, which could cause the value of your investment to decline. |

| • | If securities or industry analysts do not publish or cease publishing research or reports about us, our business, or our markets, or if they adversely change their recommendations or publish negative reports regarding our business or our stock, our stock price and trading volume could materially decline. |

| • | Some provisions of our Organizational Documents Certificate of Incorporation and Bylaws and Delaware law may have anti-takeover effects that could discourage an acquisition of us by others, even if an acquisition would be beneficial to our stockholders, and they may prevent attempts by our stockholders to replace or remove our current management. |

| • | Applicable insurance laws may make it difficult to effect a change of control. |

| • | Our Certificate of Incorporation designates the Court of Chancery of the State of Delaware as the exclusive forum for certain litigation that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us. |

| • | Claims for indemnification by our directors and officers may reduce our available funds to satisfy successful third-party claims against us and may reduce the amount of money available to us. |

| • | Taking advantage of the reduced disclosure requirements applicable to “emerging growth companies” may make our common stock less attractive to investors. |

| • | Failure to establish and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and stock price. |

| • | We depend on the ability of our subsidiaries to transfer funds to us to meet our obligations, and our insurance company subsidiaries’ ability to pay dividends to us is restricted by law. |

| • | We do not currently expect to pay any cash dividends. |

| • | The requirements of being a public company, including compliance with the reporting requirements of the Exchange Act, the requirements of the Sarbanes-Oxley Act and the Dodd-Frank Act, and the listing standards of NYSE, may strain our resources, increase our costs, and divert management’s attention, and we may be unable to comply with these requirements in a timely or cost-effective manner. In addition, key members of our management team have limited experience managing a public company. |

| • | Sales of a substantial number of shares of our common stock by our existing stockholders in the public market could cause our stock price to fall. |

| • | Warrants are exercisable for Hippo Holdings common stock, which increases the number of shares eligible for future resale in the public market and could result in dilution to our stockholders. |

| • | We may redeem the unexpired warrants prior to their exercise at a time that is disadvantageous to you, thereby making your warrants worthless. |

| • | Our warrants are accounted for as liabilities and the changes in value of our warrants could have a material effect on our financial results. |

| • | we fail to effectively use search engines, social media platforms, content-based online advertising, and other online sources for generating traffic to our website; |

| • | potential customers in a particular marketplace or more generally do not meet our underwriting guidelines; |

| • | our products are not competitive in terms of customer experience, pricing, or insurance coverage options; |

| • | our competitors mimic our digital platform or develop other innovative services, causing current and potential customers to purchase their insurance products instead of our products; |

| • | we lose customers to new market entrants and/or existing competitors; |

| • | we do not obtain regulatory approvals necessary for expansion into new markets or in relation to our products (such as line, form, underwriting, and rating approvals) or such approvals contain conditions that impose restrictions on our operations (such as limitations on growth); |

| • | our digital platform experiences disruptions; |

| • | we suffer reputational harm to our brand resulting from negative publicity, whether accurate or inaccurate; |

| • | we fail to expand geographically; |

| • | we fail to offer new and competitive products, to provide effective updates to our existing products or to keep pace with technological improvements in our industry; |

| • | we are unable to maintain traditional retail agent relationships; |

| • | customers have difficulty installing, updating or otherwise accessing our website on mobile devices or web browsers as a result of actions by us or third parties; |

| • | customers are unable or unwilling to adopt or embrace new technology; |

| • | technical or other problems frustrate the customer experience, particularly if those problems prevent us from generating quotes or paying claims in a fast and reliable manner; or |

| • | we are unable to address customer concerns regarding the content, data privacy, and security generally or for our digital platform specifically. |

| • | changes in the financial profile of one of our insurance companies; |

| • | changes in a rating agency’s determination of the amount of capital required to maintain a particular rating; or |

| • | increases in the perceived risk of our investment portfolio, a reduced confidence in management or our business strategy, or other considerations that may or may not be under our control. |

| • | collect and properly and accurately analyze a substantial volume of data from our customers; |

| • | develop, test, and apply appropriate actuarial projections and rating formulas; |

| • | review and evaluate competitive product offerings and pricing dynamics; |

| • | closely monitor and timely recognize changes in trends; and |

| • | project both frequency and severity of our customers’ losses with reasonable accuracy. |

| • | insufficient, inaccurate, or unreliable data; |

| • | incorrect or incomplete analysis of available data; |

| • | uncertainties generally inherent in estimates and assumptions; |

| • | our failure to establish or implement appropriate actuarial projections and rating formulas or other pricing methodologies; |

| • | incorrect or incomplete analysis of the competitive environment; |

| • | regulatory constraints on rate increases or coverage limitations; |

| • | our failure to accurately estimate investment yields and the duration of our liability for loss and loss adjustment expenses; and |

| • | unanticipated litigation, court decisions, legislative or regulatory actions, or changes to the existing regulatory landscape. |

| • | failure to identify, attract, reward and retain people in leadership positions in our organization who share and further our culture, values, and mission; |

| • | the increasing size and geographic diversity of our workforce and our ability to promote a uniform and consistent culture across all our offices and employees; |

| • | competitive pressures to move in directions that may divert us from our mission, vision, and values; |

| • | the continued challenges of a rapidly evolving industry; and |

| • | the increasing need to develop expertise in new areas of business that affect us. |

| • | intense competition for suitable acquisition targets, which could increase prices and adversely affect our ability to consummate deals on favorable or acceptable terms; |

| • | failure or material delay in closing a transaction, including as a result of regulatory review and approvals; |

| • | inadequacy of reserves for losses and loss expenses; |

| • | quality of their data and underwriting processes; |

| • | conditions imposed by regulatory agencies that make the realization of cost-savings through integration of operations more difficult; |

| • | difficulties in obtaining regulatory approvals on our ability to be an acquirer; |

| • | a need for additional capital that was not anticipated at the time of the acquisition; |

| • | transaction-related lawsuits or claims; |

| • | difficulties in integrating the technologies, operations, existing contracts, and personnel of an acquired company; |

| • | difficulties in retaining key employees or business partners of an acquired company; |

| • | diversion of financial and management resources from existing operations or alternative acquisition opportunities; |

| • | failure to realize the anticipated benefits or synergies of a transaction; |

| • | failure to identify the problems, liabilities, or other shortcomings or challenges of an acquired company or technology, including issues related to intellectual property, regulatory compliance practices, litigation, accounting practices, or employee or user issues; |

| • | risks that regulatory bodies may enact new laws or promulgate new regulations that are adverse to an acquired company or business; |

| • | theft of our trade secrets or confidential information that we share with potential acquisition candidates; |

| • | risk that an acquired company or investment in new offerings cannibalizes a portion of our existing business; |

| • | adverse market reaction to an acquisition; |

| • | significant attention from management and disruption to our business; and |

| • | potential dilution in value to our stockholders. |

| • | barriers to obtaining the required government approvals, licenses, or other authorizations, including seasoning or other limitations imposed by a state; |

| • | failures in identifying and entering into joint ventures with strategic partners or entering into joint ventures that do not produce the desired results; |

| • | challenges in, and the cost of, complying with various laws and regulatory standards, including with respect to the insurance business and insurance distribution, capital and outsourcing requirements, data privacy, tax and regulatory restrictions; |

| • | competition from incumbents that already own market share, better understand the market, may market and operate more effectively, and may enjoy greater affinity or awareness; and |

| • | differing demand dynamics, which may make our product offerings less successful. |

| • | the occurrence of severe weather conditions and other catastrophes; |

| • | our operating and financial performance, quarterly or annual earnings relative to similar companies; |

| • | publication of research reports or news stories about us, our competitors or our industry, or positive or negative recommendations, or withdrawal of research coverage by securities analysts; |

| • | the public’s reaction to our press releases, our other public announcements and our filings with the SEC; |

| • | announcements by us or our competitors of acquisitions, business plans or commercial relationships; |

| • | any major change in our board of directors or senior management, including the departure of our CEO; |

| • | sales of our common stock by us, our directors, executive officers, principal shareholders, our CEO and/or the PIPE Investors, or expectations of such sales given the release of shares from applicable lock-ups over time; |

| • | adverse market reaction to any indebtedness we may incur or securities we may issue in the future; |

| • | short sales, hedging and other derivative transactions in our common stock; |

| • | exposure to capital market risks related to changes in interest rates, realized investment losses, credit spreads, equity prices, foreign exchange rates and performance of insurance-linked investments; |

| • | our creditworthiness, financial condition, performance, and prospects; |

| • | changes in the fair values of our financial instruments (including certain warrants assumed in connection with the Business Combination); |

| • | our dividend policy and whether dividends on our common stock have been, and are likely to be, declared and paid from time to time; |

| • | perceptions of the investment opportunity associated with our common stock relative to other investment alternatives; |

| • | regulatory or legal developments; |

| • | changes in general market, economic, and political conditions; |

| • | conditions or trends in our industry, geographies, or customers; |

| • | changes in accounting standards, policies, guidance, interpretations or principles; |

| • | the impact of the COVID-19 pandemic on our management, employees, partners, customers, operating results, and the general market and economy; and |

| • | threatened or actual litigation or government investigations. |

| • | our board of directors is classified into three classes of directors with staggered three-year terms, and directors are only able to be removed from office for cause; |

| • | nothing in our Certificate of Incorporation precludes future issuances without stockholder approval of the authorized but unissued shares of our common stock; |

| • | advance notice procedures apply for stockholders to nominate candidates for election as directors or to bring matters before an annual meeting of stockholders; |

| • | our stockholders are only able to take action at a meeting of stockholders and not by written consent; |

| • | only our chairman of the board of directors, our chief executive officer, our president, or a majority of the board of directors are authorized to call a special meeting of stockholders; |

| • | no provision in our Certificate of Incorporation or Bylaws provides for cumulative voting, which limits the ability of minority stockholders to elect director candidates; |

| • | certain amendments to our Certificate of Incorporation requires the approval of two-thirds of the then outstanding voting power of our capital stock; |

| • | our Bylaws provide that the affirmative vote of two-thirds of the then-outstanding voting power of our capital stock, voting as a single class, is required for stockholders to amend or adopt any provision of our Bylaws; |

| • | our Certificate of Incorporation authorizes undesignated preferred stock, the terms of which may be established and shares of which may be issued, without the approval of the holders of our capital stock; and |

| • | certain litigation against us can only be brought in Delaware. |

| • | the business combination or transaction which resulted in the stockholder becoming an interested stockholder was approved by the board of directors prior to the time that the stockholder became an interested stockholder; |

| • | upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding shares owned by directors who are also officers of the corporation and shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| • | at or subsequent to the time the stockholder became an interested stockholder, the business combination was approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock which is not owned by the interested stockholder. |

| • | any breach of the director’s duty of loyalty to the corporation or its stockholders; |

| • | any act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| • | unlawful payments of dividends or unlawful stock repurchases or redemptions; or |

| • | any transaction from which the director derived an improper personal benefit. |

| • | be required to have only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure; |

| • | be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting; |

| • | be exempt from the “say on pay” and “say on golden parachute” advisory vote requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”); and |

| • | be exempt from certain disclosure requirements of the Dodd-Frank Act relating to compensation of its executive officers and be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Exchange Act. |

| • | We make Hippo policies fast and easy to buy |

| • | Our policies are designed for the modern homeowner |

| • | We have designed a proactive, human approach to claims, enabled by technology |

| • | We have pioneered what we believe is the most widely adopted Smart Home program in the industry |

| • | We proactively help our customers maintain and protect their homes |

| • | Significant initial capital requirements to support insurance risk, challenges finding cost-effective reinsurance without an underwriting track record, expensive off-the-shelf |

| • | Complicated and fragmented regulatory landscape with a unique set of rules from each state |

| • | Significant resource investment in tech and infrastructure to access, collect and validate insurance-related data, in addition to the development of multiple customized APIs |

| • | Difficulty accessing distribution networks, built upon a legacy, agent-based distribution, or resource-intensive process of creating and scaling new, alternative customer acquisition channels |

| • | We make insurance easy to buy: |

| • | We designed our policies for the modern homeowner: |

| • | We crafted a proactive, tech-enabled claims experience, focused on a live, white-glove approach: |

| • | Proactive, technology-enabled approach : We aspire to be there for our customers as soon as the need arises, if possible before they even reach out to us for support. We use live data to help identify major events like fires or storms. When we suspect that our customers’ homes may be impacted, our Claims Concierge team reaches out proactively to help ensure the safety of our customer, their families and their homes. We firmly believe in prioritizing the well-being of our customers and addressing damage to the home quickly, hopefully before things deteriorate or repair costs escalate. If we are effective, customers benefit from superior service in resolving claims, and we gain from better insurance outcomes by mitigating costs and increased customer loyalty. |

| • | Depending on the claim, our Claims Concierge team may use remote (virtual) inspection technology to expedite the claims handling process and, if possible, complete a claim remotely. When a specialist needs to visit the home, we leverage a network of vetted partners whom we work to quickly deploy, seeking to offer our customers full resolution as opposed to just an inspection. This network of trusted partners allows us to save on inspection costs when these partners also perform the work to resolve the issue, benefit from economies of scale in material purchases, and work to ensure quality repair work which reduces the probability of a repeat claim. This approach is designed to align everyone’s incentives and works to drive the best outcome and as fast a resolution as possible. |

| • | Human attention from live Claims Concierges : We believe that a customer calling about damage to their home, often a very complicated and stressful situation, needs to speak to a human who can |

be relied upon for help. Our Claims Concierge team eliminates the often-inefficient use of bots or automation, as well as other burdensome processes. Our claims professionals are experienced in both claims handling and customer service. Once a claim is submitted, a Claims Concierge is assigned to the claim and focuses first on ensuring customer safety and alleviating stress. We seek to have the same Claims Concierge remain the key point of contact for the customer throughout the life of the claim. |

| • | We employ continuous risk reevaluation and underwriting: |

| • | We deploy what we believe is the most widely adopted Smart Home program in the U.S. home insurance space: |

| • | We help customers maintain their homes: in-home services. Moreover, Hippo Home Care has been building a proactive home maintenance offering: homeowners can consult with home professionals about specific home care and maintenance questions, or opt for broader virtual checkups focused on key systems around the home. |

| • | Direct to consumer: |

| • | Insurance partners (agents / producers): |

efficiency and accuracy that our online, direct-to-consumer |

| • | Non-insurance partners: |

| • | Home builders - we developed an insurance policy for new home construction, as well as a technology product that integrates with builders’ sales systems. These integrations allow us to offer the builder’s customers a simple, personalized insurance product precisely when their customers are in the market for a policy. These policies are heavily tailored to the customer’s property and can be easily purchased online or through our partner agency. Through these partnerships, we are able to access positively selected properties with a fundamentally better risk profile than those associated with older homes. The result is a potentially smoother home purchase experience and higher customer satisfaction for our builder partners. |

| • | Smart home providers - we have been developing proprietary integrations with the leading providers of smart home and security systems to offer their customers better home insurance coverage with meaningful premium discounts. Moreover, these benefits are also available to our partners’ customers if they purchase insurance from Hippo. |

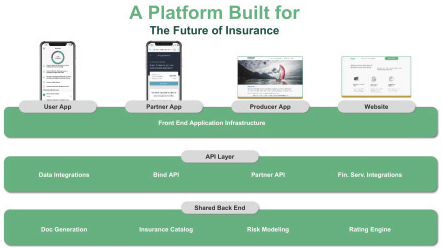

| • | Offering a fast and accurate online purchase flow that meets modern consumers’ expectations |

| • | Integrating smart home activation status into our policy management system |

| • | Quickly deploying rate changes in any state or region upon regulatory approval |

| • | Creating sophisticated feedback loops between internal teams to ensure cross-pollination (for example, fast underwriting improvements based on claims insights) |

| • | Developing proprietary, channel-specific technology to integrate Hippo’s offerings into partners’ platforms and streamlining their go-to-market |

| • | The majority of eligible customers opt into the program |

| • | The vast majority of the customers opting into the program activate their kits |

| • | Customers who keep their kits active receive meaningful premium discounts |

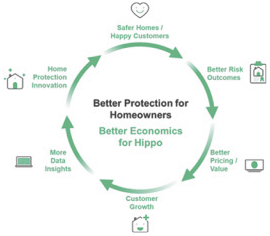

| • | Rapid growth across diverse channels |

| • | Risk prevention and proactive home protection |

| • | Better experiences throughout the customer journey |

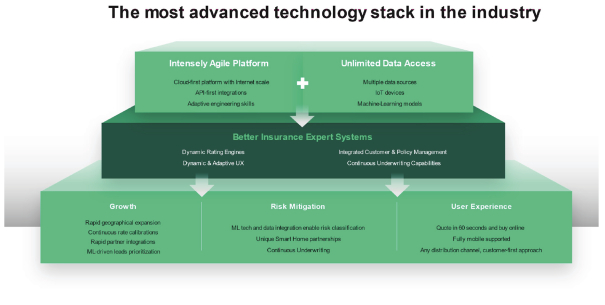

| • | Our agile development teams are able to design, deliver and iterate to build product features our customers and partners desire. We have built a flexible and adaptable software architecture and engineering teams to effectively innovate and implement new ideas. This is combined with an agile, iterative approach to experimentation and analytics, working to make sure that we continuously improve our knowledge of what customers want. |

| • | Our underlying software architecture and platform are designed to support future expansion and growth. We are creating data models, algorithms, learning engines, knowledge graphs and cloud platforms that are all intended to support a future set of goals - more ambitious partnerships, wider distribution channels, and larger numbers of customers. By anticipating future growth with a blueprint of technology capabilities and technical platforms, we are proactively preparing for the next step-change in our company’s growth trajectory. |

| • | We are keeping the pace of innovation high by investing in research and development of underlying technologies and capabilities that seek to change how the market operates in protecting homeowners. We launch tests with partners, look at new and proprietary data sources, offer additional virtual and in-home services, expand the boundaries of expectations on preventative measures, and try out new techniques for customer support and service. All of these are part of our innovation culture and supported by the technology infrastructure to build, experiment, measure, iterate. |

| • | We write and place home insurance and other insurance products from our agencies that have so far been largely unaffected by COVID-19. |

| • | Our systems are entirely cloud-based and accessible to our teams from any browser anywhere in the world. Customers’ phone calls are routed to our team’s laptops and answered and logged from wherever they happen to be. Internal communication has been via email, Slack, and Zoom since our founding. Our teams are able to access systems, support customers and collaborate with each other from anywhere, much as they did before the pandemic. |

| • | Our customers’ experience has also been largely unaffected by COVID-19 related disruptions. |

| • | We have initiated virtual inspections for our underwriting requirements and claims processing to keep our employees, agents, policy holders and potential policy holders safe. We are closely monitoring the impact of the COVID-19 pandemic and related economic effects on all aspects of our business, including how it will impact our production, loss ratios, recoverability of premium, our operations, and the fair value of our investment portfolio. |

| • | Our growth strategy is centered around accelerating our existing position in markets that we already serve by increasing our direct-to-consumer |

| • | In addition to efforts in states where we are currently selling insurance, we also expect to drive growth by expanding into new markets across the United States and by continuing to develop new strategic partnerships with key players involved in the real estate transaction ecosystem. |

| • | Finally, we plan to deepen our relationships with our customers by offering value-added services, both directly and through partners, that are not specifically insurance products, such as home maintenance, home monitoring, and home appliance warranties. |

| 1. | MGA |

| 2. | Agency |

| 3. | Insurance as a Service |

| 4. | Risk Retention |

| • | our excess ceding commission recorded as revenue will be lower |

| • | our sales and marketing expense will be lower |

| • | our bottom-line results will be unchanged |

| • | Premium for the risk retained by us is recognized on a pro-rata basis over the policy period. |

| • | Ceding commission on premium ceded to third-party reinsurers is deferred as a liability and recognized on a pro-rata basis over the term of the policy, net of acquisition costs. To the extent ceding commission received exceeds direct acquisition costs, the excess is presented as revenue in the commission income, net line on our statements of operations and comprehensive loss. The consolidated company (Hippo and Spinnaker) began to earn ceding commission on premium ceded to third-party reinsurers in September 2020 and the ceding commission is recognized net of acquisition costs, on apro-rata basis over the term of the policy. |

| • | New business submissions; |

| • | Binding of new business submissions into policies; |

| • | Bound policies going effective; |

| • | Renewals of existing policies; and |

| • | Average size and premium rate of bound policies. |

Year Ended December 31, | ||||||||

2021 | 2020 | |||||||

($ in millions) | ||||||||

Total Generated Premium | $ | 606.1 | $ | 333.6 | ||||

Total Revenue | 91.2 | 51.6 | ||||||

Net Loss attributable to Hippo | (371.4 | ) | (141.5 | ) | ||||

Adjusted EBITDA | (172.4 | ) | (90.4 | ) | ||||

Gross Loss Ratio | 138 | % | 109 | % | ||||

Net Loss Ratio | 217 | % | 148 | % | ||||

2021 | 2020 | Change | ||||||||||

Gross Written Premium | $ | 477.3 | $ | 116.1 | $ | 361.2 | ||||||

Gross Placed Premium | 128.8 | 217.5 | (88.7 | ) | ||||||||

Total Generated Premium | $ | 606.1 | $ | 333.6 | $ | 272.5 | ||||||

Year Ended December 31, | ||||||||

2021 | 2020 | |||||||

Net loss attributable to Hippo | $ | (371.4 | ) | $ | (141.5 | ) | ||

Adjustments: | ||||||||

Net investment income | (0.3 | ) | (1.1 | ) | ||||

Depreciation and amortization | 11.0 | 6.7 | ||||||

Interest expense | 26.1 | 3.5 | ||||||

Stock-based compensation | 24.3 | 17.2 | ||||||

Fair value adjustments | 172.6 | 22.4 | ||||||

Gain on extinguishment of debt | (47.0 | ) | — | |||||

Contingent consideration charge | 3.5 | 3.4 | ||||||

Other one-off transactions | 8.1 | 0.8 | ||||||

Income taxes (benefit) expense | 0.7 | (1.8 | ) | |||||

Adjusted EBITDA | $ | (172.4 | ) | $ | (90.4 | ) | ||

Year Ended December 31, | ||||||||

2021 | 2020 | |||||||

Gross Losses and LAE | $ | 515.4 | $ | 106.9 | ||||

Gross Earned Premium | 374.5 | 98.0 | ||||||

Gross Loss Ratio | 138 | % | 109 | % | ||||

Year Ended December 31, | ||||||||

2021 | 2020 | |||||||

PCS component of gross loss ratio | 71 | % | 48 | % | ||||

Large loss component of the gross loss ratio (1) | 13 | % | 11 | % | ||||

Non-PCS, non-large loss component of gross loss ratio | 54 | % | 50 | % | ||||

Gross loss ratio | 138 | % | 109 | % | ||||

| (1) | Defined as the excess portion of non-weather losses in excess of $0.1 million loss per claim |

Year Ended December 31, | ||||||||

2021 | 2020 | |||||||

Net Losses and LAE | $ | 84.4 | $ | 25.3 | ||||

Net Earned Premium | 38.9 | 17.1 | ||||||

Net Loss Ratio | 217 | % | 148 | % | ||||

Year Ended December 31, | ||||||||||||||||

2021 | 2020 | Change | % Change | |||||||||||||

Revenue: | ||||||||||||||||

Net earned premium | $ | 38.9 | $ | 17.1 | $ | 21.8 | 127 | % | ||||||||

Commission income, net | 37.5 | 27.1 | 10.4 | 38 | % | |||||||||||

Service and fee income | 14.5 | 6.3 | 8.2 | 130 | % | |||||||||||

Net investment income | 0.3 | 1.1 | (0.8 | ) | (73 | )% | ||||||||||

Total revenue | 91.2 | 51.6 | 39.6 | 77 | % | |||||||||||

Expenses: | ||||||||||||||||

Losses and loss adjustment expenses | 84.4 | 25.3 | 59.1 | 234 | % | |||||||||||

Insurance related expenses | 41.7 | 19.3 | 22.4 | 116 | % | |||||||||||

Technology and development | 36.2 | 18.0 | 18.2 | 101 | % | |||||||||||

Sales and marketing | 95.0 | 69.4 | 25.6 | 37 | % | |||||||||||

General and administrative | 49.2 | 36.8 | 12.4 | 34 | % | |||||||||||

Interest and other (income) expense | 198.9 | 26.0 | 172.9 | 665 | % | |||||||||||

Gain on extinguishment of debt | (47.0 | ) | — | (47.0 | ) | N/A | ||||||||||

Total expenses | 458.4 | 194.8 | 263.6 | 135 | % | |||||||||||

Loss before income taxes | (367.2 | ) | (143.2 | ) | (224.0 | ) | 156 | % | ||||||||

Income taxes (benefit) expense | 0.7 | (1.8 | ) | 2.5 | (139 | )% | ||||||||||

Net loss | (367.9 | ) | (141.4 | ) | (226.5 | ) | 160 | % | ||||||||

Net income attributable to noncontrolling interests, net of tax | 3.5 | 0.1 | 3.4 | 3400 | % | |||||||||||

Net loss attributable to Hippo | $ | (371.4 | ) | $ | (141.5 | ) | $ | (229.9 | ) | 162 | % | |||||

Other comprehensive income: | ||||||||||||||||

Change in net unrealized gain on available-for-sale | (0.8 | ) | — | (0.8 | ) | N/A | ||||||||||

Comprehensive loss attributable to Hippo | $ | (372.2 | ) | $ | (141.5 | ) | $ | (230.7 | ) | 163 | % | |||||

Year Ended December 31, | ||||||||||||

2021 | 2020 | Change | ||||||||||

Gross written premium | $ | 477.3 | $ | 116.1 | $ | 361.2 | ||||||

Ceded written premium | (434.8 | ) | (78.4 | ) | (356.4 | ) | ||||||

Net written premium | 42.5 | 37.7 | 4.8 | |||||||||

Change in unearned premium | (3.6 | ) | (20.6 | ) | 17.0 | |||||||

Net earned premium | $ | 38.9 | $ | 17.1 | $ | 21.8 | ||||||

Year Ended December 31, | ||||||||

2021 | 2020 | |||||||

Amortization of deferred direct acquisition costs, net | $ | 13.9 | $ | 3.7 | ||||

Underwriting costs | 8.1 | 4.0 | ||||||

Employee-related costs (1) | 7.2 | 3.0 | ||||||

Amortization of capitalized internal use software | 4.9 | 2.6 | ||||||

Other (2) | 7.6 | 6.0 | ||||||

Total | $ | 41.7 | $ | 19.3 | ||||

| (1) | included in Employee-related costs are $4.2 million and $0.8 million related to our underwriting department, respectively. |

| (2) | included in Other are $5.3 million and $1.4 million related to overhead allocations, consultants, product filings, agent appointment fees, and other operating expenses, respectively. |

Year Ended December 31, | ||||||||||||

2021 | 2020 | Change | ||||||||||

Net cash provided by (used in): | ||||||||||||

Operating activities | $ | (124.5 | ) | $ | (65.4 | ) | $ | (59.1 | ) | |||

Investing activities | $ | (30.0 | ) | $ | (2.3 | ) | $ | (27.7 | ) | |||

Financing activities | $ | 480.8 | $ | 518.1 | $ | (37.3 | ) | |||||

December 31, 2021 | December 31, 2020 | |||||||||||||||

Gross | Net | Gross | Net | |||||||||||||

Loss and loss adjustment reserves | ||||||||||||||||

IBNR | $ | 195.0 | $ | 23.4 | $ | 72.1 | $ | 8.1 | ||||||||

Case reserves | 65.8 | 20.6 | 32.9 | 4.9 | ||||||||||||

Total reserves | $ | 260.8 | $ | 44.0 | $ | 105.1 | $ | 13.0 | ||||||||

10% increase in ultimate loss and loss adjustment expenses | 10% decrease in ultimate loss and loss adjustment expenses | |||||||

Impact on: | ||||||||

Loss and loss adjustment expense reserves, net | $ | 10.4 | $ | (11.5 | ) | |||

| • | paid and unpaid amounts recoverable; |

| • | any balances in dispute or subject to legal collection; |

| • | the financial wellbeing of a reinsurer (i.e. insolvent, liquidated, in receivership or otherwise subject to formal or informal regulatory restriction); |

| • | the likelihood of collection of the reinsurance recovery considering factors such as, amounts outstanding, length of collection periods, disputes, any collateral or letters of credit held and other relevant factors. |

| • | relevant precedent transactions involving our capital stock; |

| • | the liquidation preferences, rights, preferences, and privileges of our redeemable convertible preferred stock relative to the common stock; |

| • | our actual operating and financial performance; |

| • | current business conditions and projections; |

| • | our stage of development; |

| • | the likelihood and timing of achieving a liquidity event for the shares of common stock underlying the stock options, such as an initial public offering, given prevailing market conditions; |

| • | any adjustment necessary to recognize a lack of marketability of the common stock underlying the granted options; |

| • | recent secondary stock sales and tender offers; |

| • | the market performance of comparable publicly traded companies; and |

| • | U.S. and global capital market conditions. |

Name | Age | Position(s) | ||

Executive Officers | ||||

Assaf Wand | 47 | Chief Executive Officer, Co-Founder and Director | ||

Richard McCathron | 50 | President and Director | ||

Stewart Ellis | 46 | Chief Financial Officer | ||

Ran Harpaz | 48 | Chief Technology Officer | ||

Simon Fleming-Wood | 53 | Chief Marketing Officer | ||

Non-Employee Directors | ||||

Amy Errett (3) | 64 | Director | ||

Eric Feder (2) | 52 | Director | ||

Lori Dickerson Fouché (3) | 52 | Director | ||

Hugh R. Frater (1) | 66 | Director | ||

Noah Knauf (1)(2) | 42 | Director | ||

Sam Landman (2)(3) | 42 | Director | ||

Sandra Wijnberg (1)(3) | 65 | Director |

| (1) | Member of the audit, risk and compliance committee (the “Audit Committee”). |

| (2) | Member of the compensation committee (the “Compensation Committee”). |

| (3) | Member of the nominating and corporate governance committee (the “Nominating and Corporate Governance Committee”). |

| • | the Class I directors are Eric Feder, Noah Knauf and Sam Landman, and their terms will expire at our 2022 annual meeting of stockholders; |

| • | the Class II directors are Richard McCathron, Lori Dickerson Fouché and Hugh R. Frater, and their terms will expire at our 2023 annual meeting of stockholders; and |

| • | the Class III directors are Assaf Wand, Sandra Wijnberg and Amy Errett, and their terms will expire at the 2024 annual meeting of stockholders. |

| • | appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm; |

| • | discussing with Hippo’s independent registered public accounting firm their independence from management; |

| • | reviewing with Hippo’s independent registered public accounting firm the scope and results of their audit; |

| • | pre-approving all audit and permissiblenon-audit services to be performed by Hippo’s independent registered public accounting firm; |

| • | setting clear hiring policies for employees or former employees of Hippo’s independent registered public accounting firm; |

| • | overseeing the financial reporting process and discussing with management Hippo’s independent registered public accounting firm the interim and annual financial statements that Hippo files with the SEC; |

| • | overseeing Hippo’s risk assessment and risk management, including with respect to the underwriting and pricing of insurable risks, the settlement of claims, the appropriate levels of retained risk and other insurance-related matters; |

| • | establishing procedures for the receipt, retention, and treatment of complaints received by Hippo regarding accounting, internal accounting controls, or auditing matters; |

| • | reporting regularly to the Hippo board of directors regarding the activities of the Audit Committee; |

| • | reviewing and monitoring Hippo’s earnings releases, accounting principles, accounting policies, financial and accounting controls, and compliance with legal and regulatory requirements; and |

| • | periodically reviewing and reassessing the audit committee charter. |

| • | reviewing and approving corporate goals and objectives relevant to the compensation of Hippo’s Chief Executive Officer, evaluating the performance of Hippo’s Chief Executive Officer in light of these goals and objectives and setting or making recommendations to Hippo’s board of directors regarding the compensation of Hippo’s Chief Executive Officer; |

| • | reviewing and setting or making recommendations to Hippo’s board of directors regarding the compensation of Hippo’s other executive officers; |

| • | making recommendations to Hippo’s board of directors regarding the compensation of Hippo’s directors; |

| • | reviewing and approving or making recommendations to Hippo’s board of directors regarding Hippo’s incentive compensation and equity-based plans and arrangements; and |

| • | appointing and overseeing any compensation consultants. |

| • | identifying individuals qualified to become members of Hippo’s Board of Directors, consistent with criteria approved by Hippo’s Board of Directors; |

| • | recommending to Hippo’s Board of Directors the nominees for election to Hippo’s Board of Directors at annual meetings of Hippo’s stockholders; |

| • | overseeing the annual self-evaluation of Hippo’s Board of Directors and management; |

| • | reviewing Board committee structure and recommending directors to serve as committee members; and |

| • | developing and recommending to Hippo’s Board of Directors a set of corporate governance guidelines. |

| • | Assaf Wand, Co-Founder and Chief Executive Officer; |

| • | Richard McCathron, President; and |

| • | Stewart Ellis, Chief Financial Officer. |

Name and Principal Position | Year | Salary ($) (1) | Option Awards ($) (2) | Stock Awards ($) (2) | All Other Compensation ($) (3) | Total ($) | ||||||||||||||||||

Assaf Wand, Co-Founder and Chief Executive Officer | 2021 | 368,216 | — | — | 1,204,053 | 1,572,269 | ||||||||||||||||||

| 2020 | 258,333 | — | — | — | 258,333 | |||||||||||||||||||

Richard McCathron, President | 2021 | 383,333 | 1,106,327 | 1,388,781 | — | 2,878,441 | ||||||||||||||||||

| 2020 | 300,000 | 1,369,064 | — | 31,222 | 1,700,286 | |||||||||||||||||||

Stewart Ellis, Chief Financial Officer | 2021 | 391,667 | 1,105,481 | 1,388,781 | 1,170,703 | 4,056,632 | ||||||||||||||||||

| 2020 | 350,000 | 1,158,035 | — | — | 1,508,035 | |||||||||||||||||||

| (1) | From September to December 2021, compensation amounts received in non-U.S. currency have been converted into U.S. dollars using an exchange rate of 3.19 New Israeli Shekel (“NIS”) per dollar (which was the average exchange rate for 2021). |

| (2) | Amounts reported represent the aggregate grant-date fair value of the stock options awarded to the NEOs, calculated in accordance with ASC Topic 718. Assumptions used in the calculation of these amounts are included in Note 17 to our financial statements included elsewhere in this prospectus. The NEOs will only realize compensation to the extent the trading price of our common stock is greater than the exercise price of such stock options. |

| (3) | Amounts reported in 2021 represent the aggregate dollar value of the forgiveness of Messrs. Wand’s and Ellis’ loan extended pursuant to that certain Partial Recourse Promissory Note and Stock Pledge Agreement by and between us and Mr. Wand and the applicable NEO all interest accrued thereon has been forgiven upon the consummation of the Business Combination. Amounts reported in 2020 represent travel and lodging expenses in connection with Mr. McCathron’s travel from his home office in Austin, Texas to Hippo’s offices in the Bay Area, California. |

| Option Awards | Stock Awards | |||||||||||||||||||||||||

Name | Vesting Commencement Date | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units That Have Not Vested ($) (1) | |||||||||||||||||||

Assaf Wand | 10/15/2019 (2) | 4,586,013 | 4,586,020 | 0.81 | 10/14/2029 | — | — | |||||||||||||||||||

| 1/23/2019 (3) | — | — | — | — | 928,719 | 2,628,275 | ||||||||||||||||||||

Richard McCathron | 11/15/2021 (4) | — | — | — | — | 345,468 | 977,674 | |||||||||||||||||||

| 9/15/2021 (5) | 39,617 | 594,258 | 5.87 | 9/10/2031 | — | — | ||||||||||||||||||||

| 12/1/2020 (6) | — | — | — | — | 782,353 | 2,214,059 | ||||||||||||||||||||

| 8/27/2020 (7) | 231,811 | 463,622 | 1.06 | 9/28/2030 | — | — | ||||||||||||||||||||

| 5/13/2019 (7) | 74,792 | 307,874 | 0.34 | 5/15/2029 | — | — | ||||||||||||||||||||

| 1/23/2018 (8) | 130,992 | 32,601 | 0.16 | 1/23/2028 | — | — | ||||||||||||||||||||

Stewart Ellis | 11/9/2021 (4) | — | — | — | — | 345,468 | 977,674 | |||||||||||||||||||

| 9/15/2021 (5) | 39,617 | 594,258 | 5.87 | 9/10/2031 | — | — | ||||||||||||||||||||

| 12/1/2020 (9) | — | — | — | — | 782,353 | 2,214,059 | ||||||||||||||||||||

| 2/25/2019 (10) | — | — | — | — | 1,041,918 | 2,948,628 | ||||||||||||||||||||

| (1) | Represents the fair market value per share of our common stock of $2.83 on December 31, 2021, multiplied by the number of shares that had not vested as of that date. |

| (2) | 1/4th of the shares subject to the option vest on the first anniversary of the vesting commencement date, and 1/16th of the shares subject to the option vest on each quarterly anniversary thereafter, subject to continued service with us through the applicable vesting date. If the NEO’s employment with us is terminated without cause or the NEO’s employment is constructively terminated in connection with a change of control, 50% of the shares subject to the option will vest and become exercisable on the date of termination. |

| (3) | Mr. Wand purchased 3,429,118 shares upon early exercise of his option prior to vesting. The unvested shares are subject to repurchase by us at the original exercise price of $0.34 per share upon a termination of Mr. Wand’s service. The shares vest as to 1/48th of the shares on each monthly anniversary of the vesting commencement date, subject to continued service with us through the applicable vesting date. Notwithstanding the foregoing, 100% of the unvested shares will vest upon a change in control. |

| (4) | The RSUs shall vest in 1/16th of the total number of RSUs for each of the first four quarters following the Vesting Commencement Date, and thereafter shall vest in respect of 3/16ths of the remaining four quarters, subject to continued service with us through the applicable vesting date. |

| (5) | 1/16th of the shares on each of the first four quarterly anniversary following the vesting commencement date, and 3/16ths of the shares on each of the remaining four quarterly anniversaries thereafter, subject to continued service with us through the applicable vesting date. |

| (6) | Mr. McCathron purchased 1,043,149 shares upon early exercise of an option prior to vesting. The unvested shares are subject to repurchase by us at the original exercise price of $1.06 per share upon a termination of Mr. McCathron’s service. The shares vest as to 1/48th of the shares vest on each monthly anniversary of the vesting commencement date, subject to continued service with us through the applicable vesting date. |

| (7) | 1/48th of the shares subject to the option vest on each monthly anniversary of the vesting commencement date, subject to continued service with us through the applicable vesting date. |

| (8) | 1/16th of the shares subject to the option vest on each quarterly anniversary of the vesting commencement date, subject to continued service with us through the applicable vesting date. |

| (9) | Mr. Ellis purchased 1,043,149 shares upon early exercise of his option prior to vesting. The unvested shares are subject to repurchase by us at the original exercise price of $1.06 per share upon a termination of Mr. Ellis’s service. The shares vest as to 1/48th of the shares on each monthly anniversary of the vesting commencement date, subject to continued service with us through the applicable vesting date. Notwithstanding the foregoing, 100% of the unvested shares will vest upon a change in control. |

| (10) | Mr. Ellis purchased 3,334,136 shares upon early exercise of his option prior to vesting. The unvested shares are subject to repurchase by us at the original exercise price of $0.34 per share upon a termination of Mr. Ellis’s service. 1/4th of the shares will vest on the on first anniversary of the vesting commencement date, and the remaining 3/4th vest quarterly over three years subject to continued service with us through the applicable vesting date. Notwithstanding the foregoing, 100% of the unvested shares will vest upon a change in control. |

| • | Each non-employee director will receive an annual cash retainer in the amount of $35,000 per year. The lead independent director of the board will receive an additional annual cash compensation in the amount of $22,500 per year for such lead independent director’s service on the board. |

| • | The chairperson of the audit committee will receive additional annual cash compensation in the amount of $20,000 per year for such chairperson’s service on the audit committee. Each non-chairperson member of the audit committee will receive additional annual cash compensation in the amount of $10,000 per year for such member’s service on the audit committee. |

| • | The chairperson of the compensation committee will receive additional annual cash compensation in the amount of $12,000 per year for such chairperson’s service on the compensation committee. Each non-chairperson member of the compensation committee will receive additional annual cash compensation in the amount of $6,000 per year for such member’s service on the compensation committee. |

| • | The chairperson of the nominating and corporate governance committee will receive additional annual cash compensation in the amount of $8,000 per year for such chairperson’s service on the nominating and corporate governance committee. Each non-chairperson member of the nominating and corporate governance committee will receive additional annual cash compensation in the amount of $4,000 per year for such member’s service on the nominating and corporate governance committee. |

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) | Total ($) | |||||||||

Amy Errett | 16,250 | 132,600 | 148,850 | |||||||||

Eric Feder | 17,083 | 132,600 | 149,683 | |||||||||

Lori Dickerson Fouché | 19,583 | 132,600 | 152,183 | |||||||||

Hugh R. Frater | 18,750 | 132,600 | 151,350 | |||||||||

Noah Knauf | 23,750 | 132,600 | 156,350 | |||||||||

Sam Landman | 18,750 | 132,600 | 151,350 | |||||||||

Sandra Wijnberg | 33,958 | 132,600 | 166,558 | |||||||||

| (1) | Amounts reported represent the aggregate grant-date fair value of the restricted stock units awarded to the non-employee directors, calculated in accordance with ASC Topic 718. Assumptions used in the calculation of these amounts are included in Note 17 to our financial statements included elsewhere in this prospectus. |

Name | Stock Awards Outstanding at Year End (#) | Option Awards Outstanding at Year End (#) | ||||||

Amy Errett | 30,000 | |||||||

Eric Feder | 30,000 | |||||||

Lori Dickerson Fouché | 30,000 | |||||||

Hugh R. Frater | 30,000 | |||||||

Noah Knauf | 30,000 | |||||||

Sam Landman | 30,000 | |||||||

Sandra Wijnberg | 30,000 | 243,401 | ||||||

| • | each person who is known to be the beneficial owner of more than 5% of shares of Hippo Holdings common stock; |

| • | each of Hippo Holdings’ current named executive officers and directors; and |

| • | all current executive officers and directors of Hippo Holdings as a group. |

Number of Shares of Hippo Holdings Common Stock | +60 Days Vested | Number of Shares Beneficially Owned | % | |||||||||||||

Name and Address of Beneficial Owner (1) | ||||||||||||||||

Five Percent Holders : | ||||||||||||||||

Fifth Wall Ventures, L.P. and affiliates (2) | 51,812,546 | — | 51,812,546 | 9.14 | % | |||||||||||

LEN FW INVESTOR, LLC and affiliates (3) | 77,189,421 | — | 77,189,421 | 13.61 | % | |||||||||||

Mitsui Sumitomo Insurance Co., Ltd (4) | 39,555,425 | — | 39,555,425 | 6.97 | % | |||||||||||

Bond Capital Fund, LP and affiliate (5) | 30,003,193 | — | 30,003,193 | 5.29 | % | |||||||||||

Named Executive Officers and Directors | ||||||||||||||||

Assaf Wand (6) | 32,384,660 | 4,586,013 | 36,970,673 | 6.52 | % | |||||||||||

Richard McCathron (7) | 2,771,530 | 651,072 | 3,422,602 | * | ||||||||||||

Stewart Ellis (8) | 3,391,203 | 39,617 | 3,430,820 | * | ||||||||||||

Amy Errett | — | — | — | — | ||||||||||||

Eric Feder (9) | 125,000 | — | 125,000 | * | ||||||||||||

Lori Dickerson Fouché | — | — | — | — | ||||||||||||

Hugh R. Frater (10) | 1,076,362 | — | 1,076,362 | * | ||||||||||||

Noah Knauf (11) | 167,213 | — | 167,213 | * | ||||||||||||

Sam Landman | 11,813 | — | 11,813 | * | ||||||||||||

Sandra Wijnberg (12) | 117,000 | 101,416 | 218,416 | * | ||||||||||||

Ran Harpaz (13) | 2,104,125 | 66,582 | 2,170,707 | * | ||||||||||||

Simon Fleming-Wood | — | 544,684 | 544,684 | * | ||||||||||||

All executive officers and directors as a group | 42,148,906 | 5,989,384 | 48,138,290 | 8.49 | % | |||||||||||

| * | Less than one percent |

| (1) | Unless otherwise noted, the business address of each of those listed in the table above is c/o Hippo Holdings Inc., 150 Forest Avenue, Palo Alto, California 94301. |

| (2) | Based solely on a Schedule 13G filed with the SEC on August 12, 2021 and a Form 4 filed with the SEC on April 12, 2022. Consists of 51,812,546 shares of common stock, of which (i) 25,974,574 are shares of common stock directly held by Fifth Wall Ventures SPV IV, L.P., (ii) 229,302 are common stock directly held by Fifth Wall Ventures SPV XVII, L.P. and (iii) 25,608,670 are shares of common stock directly held by Fifth Wall Ventures, L.P. Fifth Wall Ventures GP, LLC is the general partner of Fifth Wall Ventures SPV XVII, L.P., Fifth Wall Ventures SPV IV, L.P. and Fifth Wall Ventures, L.P., each a Delaware limited partnership (the “Subsidiary Funds”). Fifth Wall Ventures Management, L.P. serves as the sole manager of |