LETTER TO SHAREHOLDERS Q2 2022

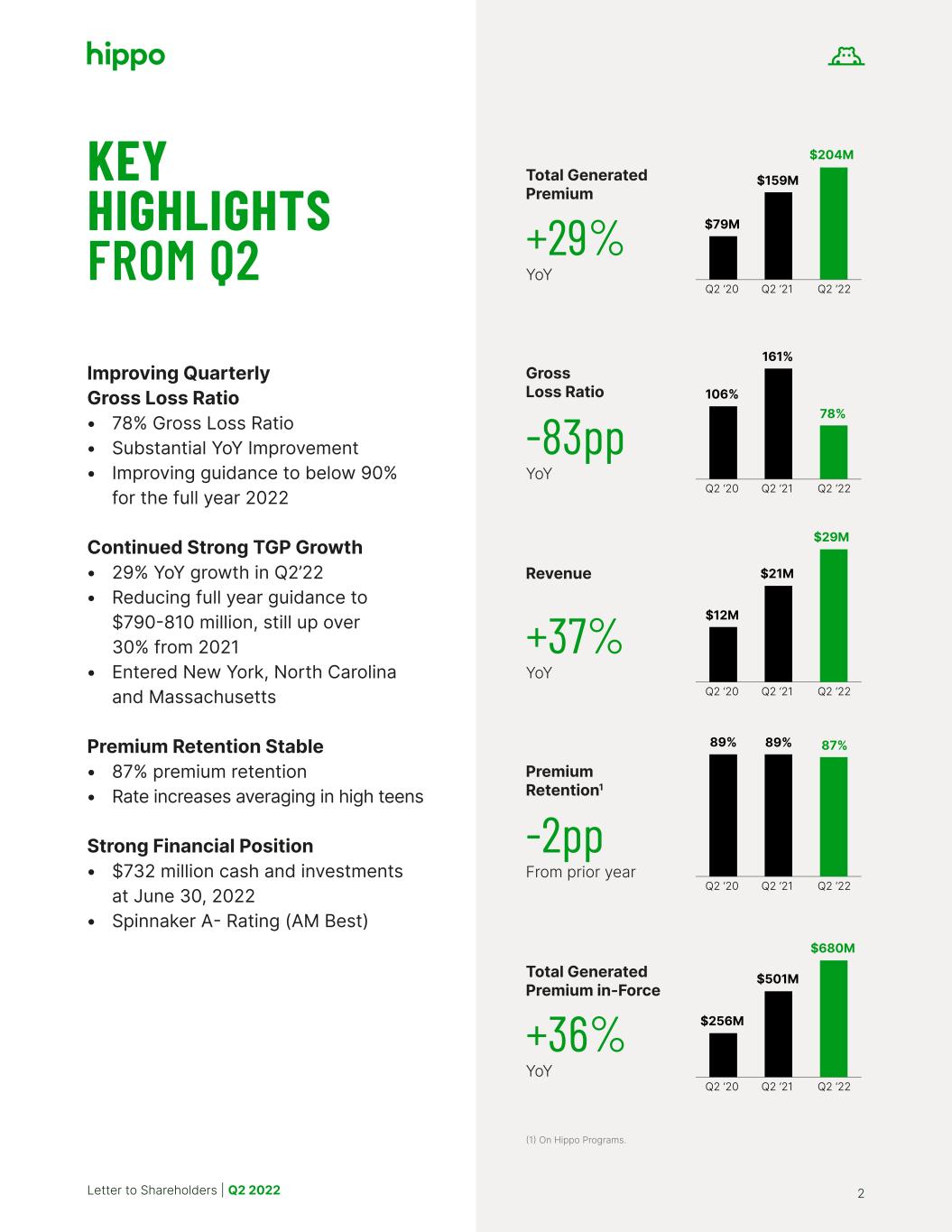

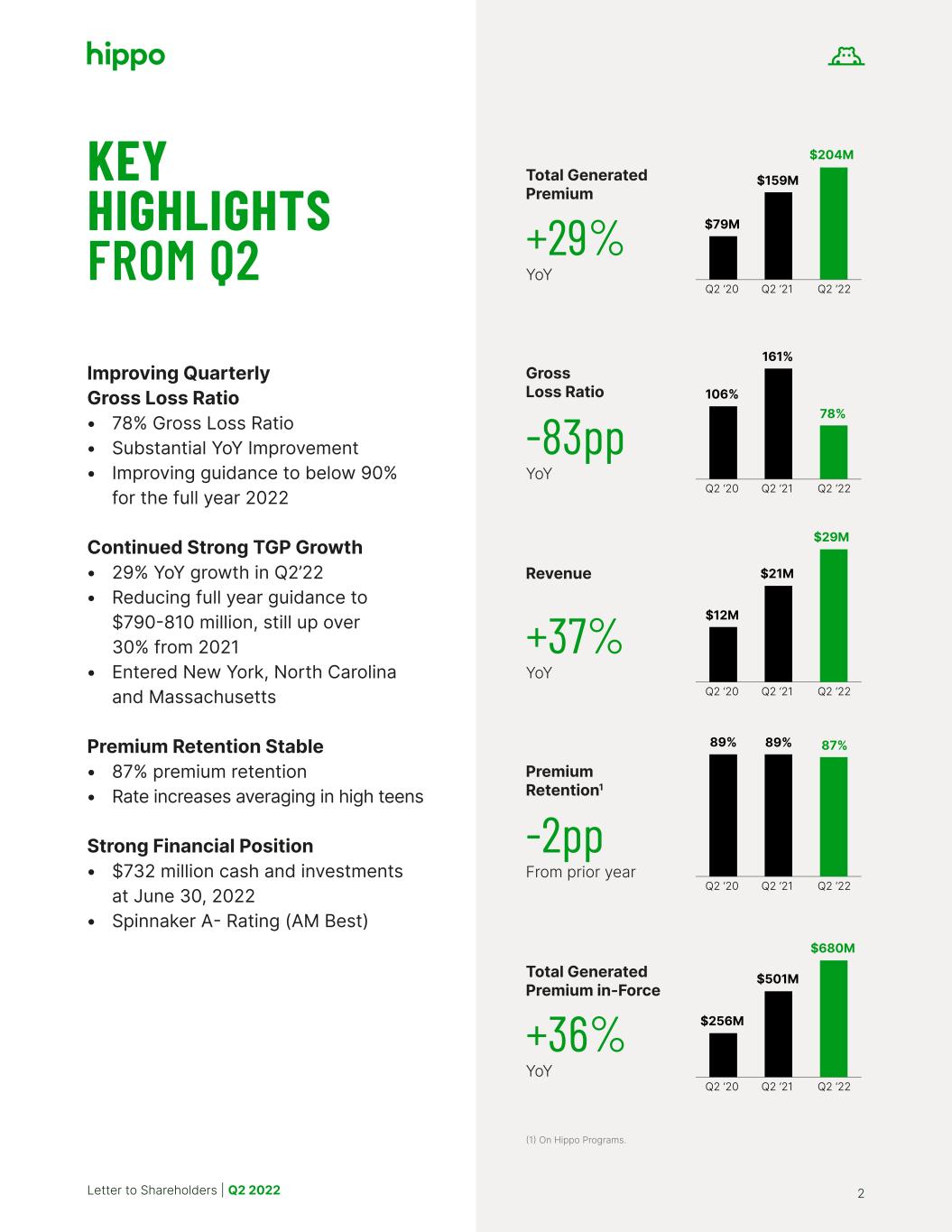

Letter to Shareholders | Q2 2022 2 KEY HIGHLIGHTS FROM Q2 Improving Quarterly Gross Loss Ratio • 78% Gross Loss Ratio • Substantial YoY Improvement • Improving guidance to below 90% for the full year 2022 Continued Strong TGP Growth • 29% YoY growth in Q2’22 • Reducing full year guidance to $790-810 million, still up over 30% from 2021 • Entered New York, North Carolina and Massachusetts Premium Retention Stable • 87% premium retention • Rate increases averaging in high teens Strong Financial Position • $732 million cash and investments at June 30, 2022 • Spinnaker A- Rating (AM Best) Total Generated Premium +29% YoY $204M Q2 ‘22Q2 ‘21Q2 ‘20 $159M $79M (1) On Hippo Programs. Gross Loss Ratio -83pp YoY 78% Q2 ‘22Q2 ‘21Q2 ‘20 161% 106% Revenue +37% YoY $29M Q2 ‘22Q2 ‘21Q2 ‘20 $21M $12M Premium Retention1 -2pp From prior year 87% Q2 ‘22Q2 ‘21Q2 ‘20 89%89% Total Generated Premium in-Force +36% YoY $680M Q2 ‘22Q2 ‘21Q2 ‘20 $501M $256M

Letter to Shareholders | Q2 2022 3 A NOTE FROM OUR FOUNDER Before we dig into the details of another solid quarter of delivering upon what we said we’d do, I wanted to take this opportunity to thank Hippo’s supporters, investors, and employees, for my time as the CEO of the company. When I founded Hippo in 2015, I had a vision of what we could do for homeowners and how we could run a great business and I think we’re well on our way to achieving that vision. As Executive Chairman and Hippo’s largest individual investor, I continue to be involved on an ongoing basis and dedicated to the continued success of Hippo. Rick and I have worked side-by-side for six years to build Hippo into what it is today. As we look out to the next phase of Hippo’s development, Rick’s operational background makes him ideal to lead in the CEO role. As an entrepreneur at heart, I will be focused on finding more strategic opportunities for Hippo, on our long-term growth and on advancing our mission of “protecting the joy of home ownership”. Nothing gives me more pride and confidence than Rick’s promotion to the CEO role and knowing that Hippo is in amazing hands. Thank you, Assaf Wand Founder & Executive Chairman

Letter to Shareholders | Q2 2022 4 Hippo is making steady progress towards our goals of profitability and delivering on our mission of protecting the joy of home ownership. In Q2, we delivered another quarter of strong Total Generated Premium (TGP) growth, revenue growth and, perhaps most importantly, significant loss ratio improvement. Our TGP was up 29% over the prior year quarter. We are growing throughout our geographies as we establish our presence and grow share in states launched over the past 18 months. During Q2, we announced our entry into the major states of New York, Massachusetts, and North Carolina. While these states will take some time to be meaningful contributors, our confidence is high in our ability to succeed in these new markets. Growth through our builder and partnership channels remains robust. We recently announced the creation of the AmeriSave Insurance Agency, powered by Hippo’s proprietary technology. We offer our partners a quality insurance experience for their customers creating a circular win- win-win cycle between our partners, their customers and Hippo. Our Q2 Gross Loss Ratio of 78% marks yet another leap of improvement from the prior year quarter. Our technology platform which leverages advanced analytics and data played a central role in this improvement. In addition, our increased geographic diversity, the early earning out of re-underwritten and re-rated policies, favorable reserve development, and relatively good weather all contributed to this improvement. We expect additional improvements as we continue to refine pricing and risk management, claims handling and cost efficiency. We are getting better at identifying our target customers and winning their business. As this attractive and appropriately priced business grows and as the other loss ratio improving efforts gain momentum, we expect our loss ratios to continue to converge with those of our large, national peers. Given our strong performance in the first half of 2022, we are pleased to be able to offer improved full year 2022 guidance for Gross Loss Ratio, bringing it down from our previous guidance of under 100% to under 90%, representing a potential 48 percentage point improvement from 138% in 2021. As we discussed in our Q1'22 letter, we’ve taken substantial re-underwriting and re-pricing ac- tions across our book of business as we sharpen our focus on achieving our loss ratio objectives. Q2’22: STEADY PROGRESS

Letter to Shareholders | Q2 2022 5 On average, these actions have resulted in double-digit rate increases, although some of our most attractive risks have seen rate reductions. We are pleased to report that our premium re- tention rate remains high at 87%, even though we are non-renewing policies that are not aligned with our customer segment goals. As we all return to busy lives in a post-pandemic world, helping our customers to manage and protect their biggest asset, their homes, is more important than ever. We recently launched our Hippo Home Care mobile experience which includes a Home Health Assessment, done either in-person or conducted through our mobile app, with a Hippo Home Care expert who can provide home care tips and create a personalized preventative maintenance plan for each Hippo customer. As we like to say, the best claims experience is to help our customers prevent losses from ever occurring. You may have begun seeing more of us online or on TV. We recently launched a targeted branding campaign, “Feel the House Power,” which focuses on our differentiated product and customer experience. A recent Hippo survey found that 87% of homeowners surveyed experience anxiety and dread about home maintenance and worry about what could go wrong next. Hippo empowers homeowners by giving them the confidence and control they need to stand up to whatever homeownership throws at them. We’re betting on our customers, not against them. Finally, we’re excited for our Investor Day on September 6th in New York City. Led by myself, Assaf and Stewart, several of our key leadership will present on topics including underwriting, technology and product development focusing on how Hippo differentiates itself. We will also welcome extensive Q&A. If you would like to join us in person, or if you would like to submit a question, please email us at investors@hippo.com. We’re looking forward to sharing our plans for furthering our mission of protecting the joy of home ownership as well as our financial outlook. Thank you, Richard McCathron President & CEO

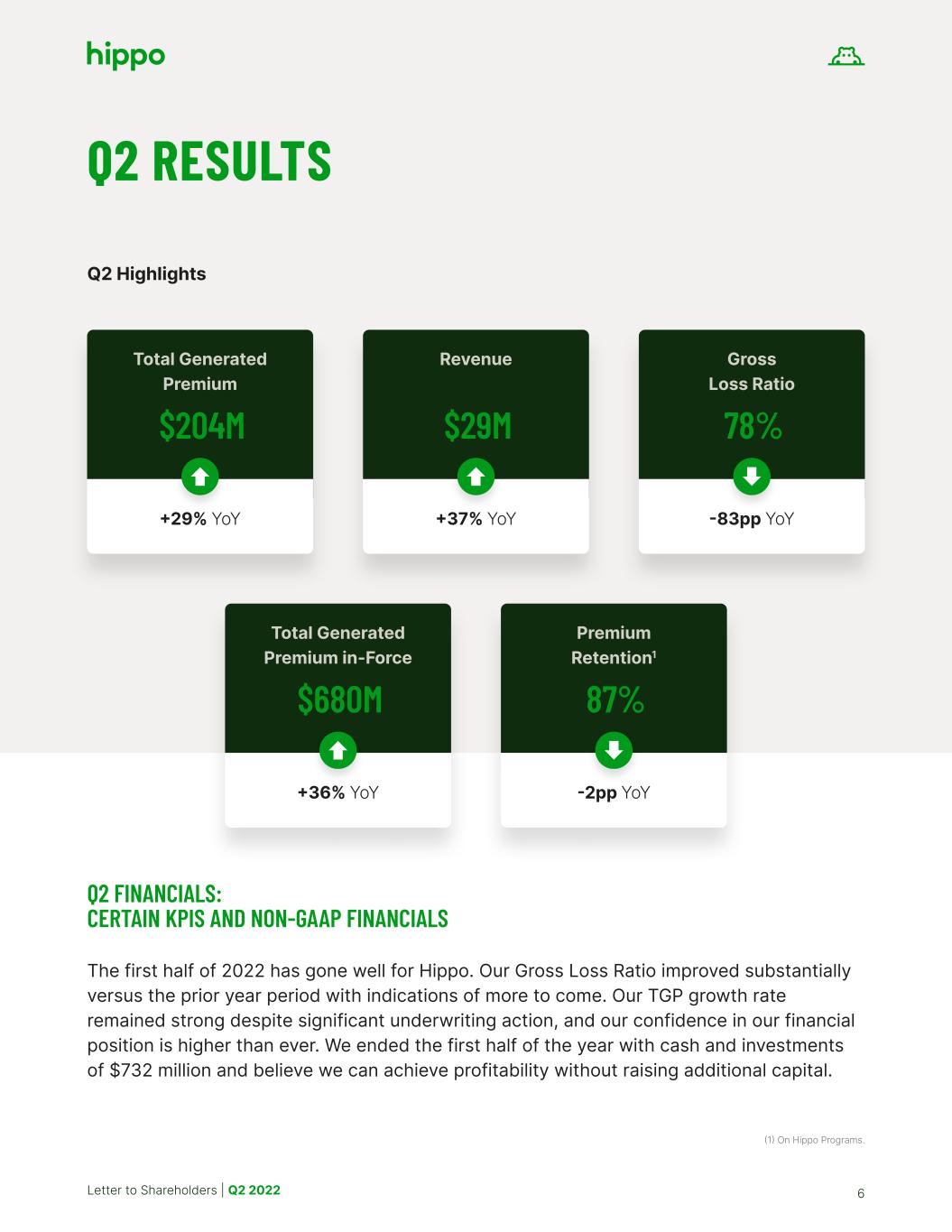

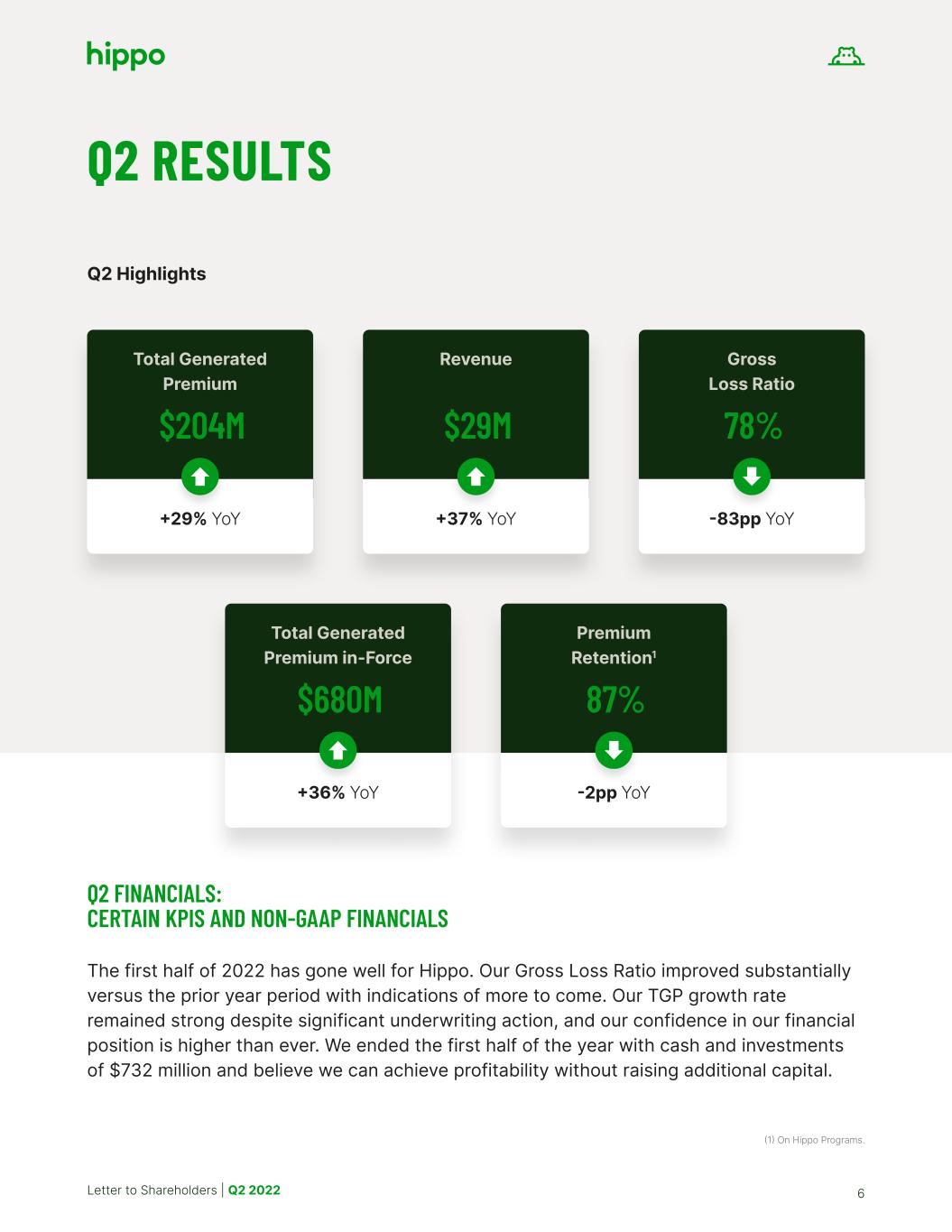

Letter to Shareholders | Q2 2022 6 Q2 RESULTS Q2 Highlights Q2 FINANCIALS: CERTAIN KPIS AND NON-GAAP FINANCIALS The first half of 2022 has gone well for Hippo. Our Gross Loss Ratio improved substantially versus the prior year period with indications of more to come. Our TGP growth rate remained strong despite significant underwriting action, and our confidence in our financial position is higher than ever. We ended the first half of the year with cash and investments of $732 million and believe we can achieve profitability without raising additional capital. Total Generated Premium $204M +29% YoY Revenue $29M +37% YoY Gross Loss Ratio 78% -83pp YoY Total Generated Premium in-Force $680M +36% YoY (1) On Hippo Programs. Premium Retention1 87% -2pp YoY

Letter to Shareholders | Q2 2022 7 Total Generated Premium Up 29% TGP was $204 million in Q2, up 29% from $159 million in the prior year quarter, while our Hippo Homeowners premium retention rate of 87% remains high. As we have worked to accelerate our timeline to profitability, we have become more selective in our underwriting. This has shifted the mix of customers toward our most attractive segments but on the margin, has slowed our TGP growth slightly. Moving forward, if potential policies are on the margin between a profitable and unprofitable expected loss ratio, we will continue to lean toward profitability when choosing whether to write the business on our Hippo program. As a result, we are slightly reducing our 2022 TGP guidance from $800-$820 million offered previously to $790-810 million. We plan to go into more detail about our future growth plans at our Investor Day in September. Geographic expansion has been a key driver of our growth as we develop a balanced portfolio of risk exposure. With the recent additions of New York, Massachusetts and North Carolina, we are now in 40 states. We estimate that our current geographic footprint covers approximately 94% of the US population but our share of the overall homeowners’ insurance market is still less than 1%, indicating ample room for share gains and long-term growth even while optimizing for a profitable underwriting result. Revenue up 37% Revenue in Q2 was $28.7 million, up 37% over the prior year quarter. As a reminder, revenue includes net premiums earned, growing and steady streams of ceding , MGA, and agency commissions paid to us by other carriers and reinsurers, as well as service and fee income. Also, we’re expanding our third- party program administrator business at Spinnaker and taking advantage of higher, low-risk yields on our cash balance to grow our investment income. The volume impact of our increased focus on nearer term profitability and the increased cost of certain kinds of reinsurance, which directly reduced our earned premium, have resulted in a short-term headwind on the earned premium portion of our revenue. As a result, we expect risk-bearing premium we will earn are likely to come in lower than our initial forecast in favor of lower dollar, but non-risk- bearing and higher margin, commission revenue. Therefore, we are lowering our guidance for 2022 revenue to $119-$121 million from $140-$142 million. Gross Loss Ratio of 78% Our Gross Loss Ratio in Q2 was 78%, an 83 percentage point improvement over Q2 last year. Q2 is typically when our customers face adverse weather

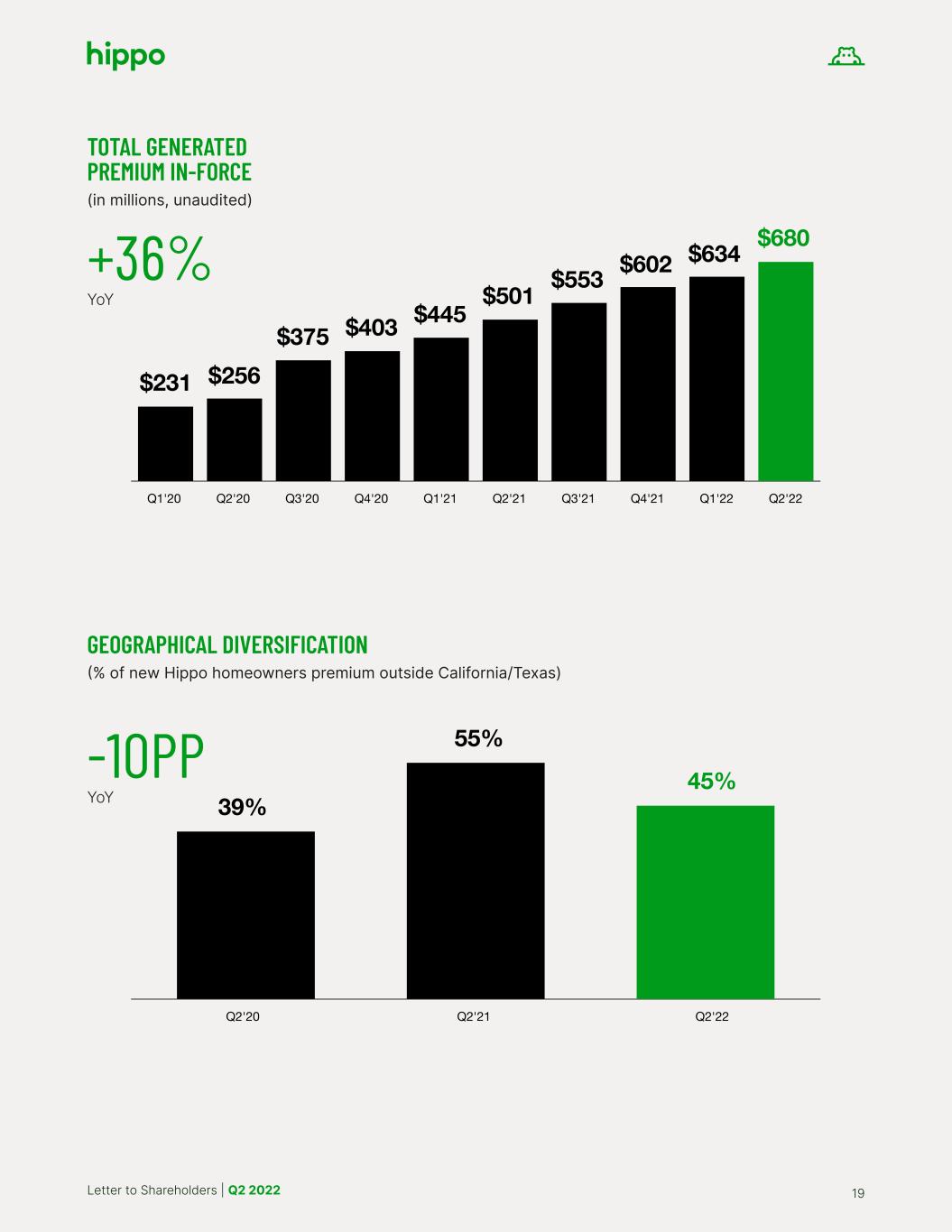

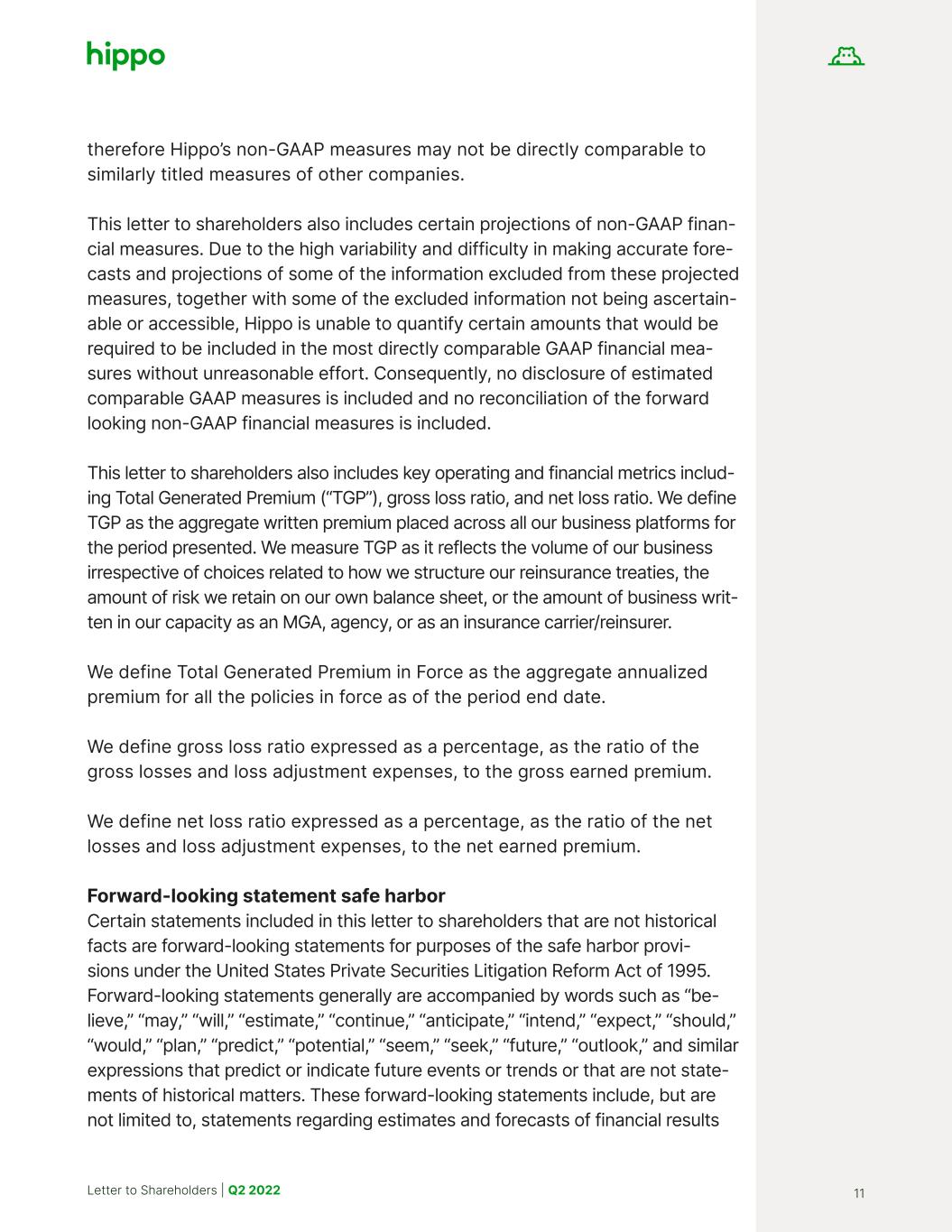

Letter to Shareholders | Q2 2022 8 events, particularly hail, but our increasingly balanced risk exposures have helped to blunt the overall impact on our results. Given the progress we are making in this area, we are comfortable offering improved guidance for full year Gross Loss Ratio and now believe we will be under 90% for the year, down from our previous guidance of 100%. Breaking down the loss ratio, losses from PCS catastrophic events represented 22 points of our Q2 loss ratio, net of 12% of favorable prior period development on PCS catastroph- ic losses, driven largely by hail and storms in the Central Plains States and northern Texas. We would highlight that a year ago, we were overweight in this geography and would have likely been impacted to a greater degree by the same weather. The quarter also included 10% of favorable loss reserve development on attritional losses from prior periods. Another key driver of our loss ratio improve- ment is our continued improvements to our rate adequacy and accuracy through the filing and implementation of segmented rate changes. An additional 5 states and 11 product rate changes went live in the quar- ter, bringing our year-to-date changes to 15 states and 34 products. On a premium basis, over 80% of the book has seen a rate change filed, approved and pushed live in 2022. The speed and nimbleness with which we have been able to effect these changes and sub- stantially improve our loss ratio is one exam- ple of the power of our technology platform. We are often asked by investors about the challenge of inflation. We would highlight According to a recent Hippo survey*… 70% 46% *Poll conducted 4/29-5/1/22 among 1,915 US adults, by Ipsos on behalf of Hippo 31% 94% of homeowners responding to the survey find homeownership to be an important part of the American dream; with nearly three-quarters (74%) agreeing it is a key to happiness Nearly half of younger homeowners (Gen Z and Millennial) (46%) responding to the survey are driven by their desire to become a homeowner and the vast majority (66%) agree homeownership is an important part of the American dream Although eager to stay on top of home maintenance, one in three homeowners (31%) responding to the survey put off repairs or upgrades, mainly due to limited knowledge and time. Nearly all of homeowners (94%) responding to the survey say they would rather take action on smaller repairs now to save big on costs later—especially first-time homeowners

Letter to Shareholders | Q2 2022 9 that the very core of one of our value propositions to our customers-the prevention of losses-helps avoid these inflation and supply chain problems. In addition, our pricing matches price to real risk which implicitly consid- ers inflation factors. Finally, we re-run our underwriting and rebuilding cost models automatically at each renewal, including the impact of inflation on estimated rebuilding cost, which allows our premiums to be resilient to these factors without additional rate filings. We look forward to sharing more about our underwriting and technological strengths at our Investor Day. Sales and Marketing Sales and Marketing expenses decreased to $19.4 million in Q2 from $22.2 million in the prior year quarter. As we focused on the execution of rate adjustments in the first half of 2022, we were conservative with our marketing spend. In the second half of the year, and now that many of the planned rate actions are live, we expect to lean into customer acquisition. We recently launched a new brand campaign to better inform our targeted customers about our unique value proposition. Technology and Development Technology and Development expenses increased to $16.5 million from $7.5 million in the prior year quarter, in part reflecting additional stock-based compensation. General and Administrative Expenses General and Administrative expenses increased to $18.2 million from $8.8 million in the prior year quarter reflecting additional stock-based compensation of $3.8 million and the higher costs related to being a public company following our business combination transaction in Q3 of 2021. Balance Sheet and Cash Position Our cash and investments at the end of the quarter were $732 million. While our investment strategy remains very conservative with high liquidity, we now hold $454 million in investments including US T-bills and high rated corporate bonds to capture the benefit of increasing short-term yields. We expect invest- ment income to contribute more towards our bottom line in future years. Net Loss and Adjusted EBITDA Net Loss attributable to Hippo was $73.5 million or $0.13 per share in Q2'22 com- pared to a Net Loss of $84.5 million in the prior year quarter. Adjusted EBITDA was a loss of $55.8 million versus a loss of $42.3 million in the prior year quarter.

Letter to Shareholders | Q2 2022 10 2022 Guidance We are updating our 2022 full year guidance as follows: • TGP of $790-810 million, reduced from $800-820 million, but still up over 30% versus 2021 • Gross Loss Ratio of below 90%, improved from 100% • Revenues of $119-121 million, down from $140-142 million Investor Day Please join us September 6 at 9am in New York City for our first Investor Day. We will have several in-depth presentations and discussions with our key busi- ness leaders including an extensive Q&A session with our Executive Chairman Assaf Wand and CEO and President Rick McCathron as well as a discussion of our financial outlook with our CFO, Stewart Ellis. If you would like to join, or would like to submit a question, please contact us through investors@hippo.com. Non-GAAP financial measures This letter to shareholders includes the non-GAAP financial measure (includ- ing on a forward-looking basis) Adjusted EBITDA. Hippo defines Adjusted EBITDA, a Non-GAAP financial measure, as net loss attributable to Hippo excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, net investment income, other non-cash fair mar- ket value adjustments, and contingent consideration for one of our acquisi- tion and other transactions that we consider to be unique in nature. Hippo ex- cludes these items from Adjusted EBITDA because it does not consider them to be directly attributable to its underlying operating performance. These non-GAAP measures are an addition, and not a substitute for or superior to measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of non-GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation. Hippo believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Hippo. Hippo’s management uses forward looking non-GAAP measures to evaluate Hippo’s projected financial and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents. For example other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and

Letter to Shareholders | Q2 2022 11 therefore Hippo’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. This letter to shareholders also includes certain projections of non-GAAP finan- cial measures. Due to the high variability and difficulty in making accurate fore- casts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertain- able or accessible, Hippo is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial mea- sures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward looking non-GAAP financial measures is included. This letter to shareholders also includes key operating and financial metrics includ- ing Total Generated Premium (“TGP”), gross loss ratio, and net loss ratio. We define TGP as the aggregate written premium placed across all our business platforms for the period presented. We measure TGP as it reflects the volume of our business irrespective of choices related to how we structure our reinsurance treaties, the amount of risk we retain on our own balance sheet, or the amount of business writ- ten in our capacity as an MGA, agency, or as an insurance carrier/reinsurer. We define Total Generated Premium in Force as the aggregate annualized premium for all the policies in force as of the period end date. We define gross loss ratio expressed as a percentage, as the ratio of the gross losses and loss adjustment expenses, to the gross earned premium. We define net loss ratio expressed as a percentage, as the ratio of the net losses and loss adjustment expenses, to the net earned premium. Forward-looking statement safe harbor Certain statements included in this letter to shareholders that are not historical facts are forward-looking statements for purposes of the safe harbor provi- sions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “be- lieve,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not state- ments of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial results

Letter to Shareholders | Q2 2022 12 and other operating and performance metrics, our business strategy, the quality of our products and services, and the potential growth of our business. These statements are based on the current expectations of Hippo’s management and are not predictions of actual performance. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions, and many actual events and circumstances are beyond the control of Hippo. These for- ward-looking statements are subject to a number of risks and uncertainties, including our ability to achieve or maintain profitability in the future; our ability to retain and expand our customer base and grow our business, including our builder network; our ability to manage growth effectively; risks relating to Hip- po’s brand and brand reputation; denial of claims or our failure to accurately and timely pay claims; the effects of intense competition in the segments of the insurance industry in which we operate; the availability and adequacy of rein- surance, including at current coverage, limits or pricing; our ability to underwrite risks accurately and charge competitive yet profitable rates to our customers, and the sufficiency of the analytical models we use to assess and predict expo- sure to catastrophe losses; risks related to our proprietary technology and our digital platform; outages or interruptions or delays in services provided by our third party providers, including our data vendor; risks related to our intellectual property; the seasonal and cyclical nature of our business; the effects of severe weather events and other natural or man-made catastrophes, including the ef- fects of climate change, global pandemics, and terrorism; continued disruptions from the COVID-19 pandemic; any overall decline in economic activity; and the effects of existing or new legal or regulatory requirements on our business, in- cluding with respect to maintenance of risk-based capital and financial strength ratings, data privacy and cybersecurity, and the insurance industry generally. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking state- ments. There may be additional risks that Hippo does not presently know, or that Hippo currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Hippo’s expectations, plans, or forecasts of future events and views as of the date of this letter to shareholders. Hip- po anticipates that subsequent events and developments will cause Hippo’s assessments to change. However, while Hippo may elect to update these for- ward-looking statements at some point in the future, Hippo specifically dis- claims any obligation to do so. These forward-looking statements should not be relied upon as representing Hippo’s assessments of any date subsequent to the date of this letter to shareholders. Accordingly, undue reliance should not be placed upon the forward-looking statements.

13Letter to Shareholders | Q2 2022 APPENDIX

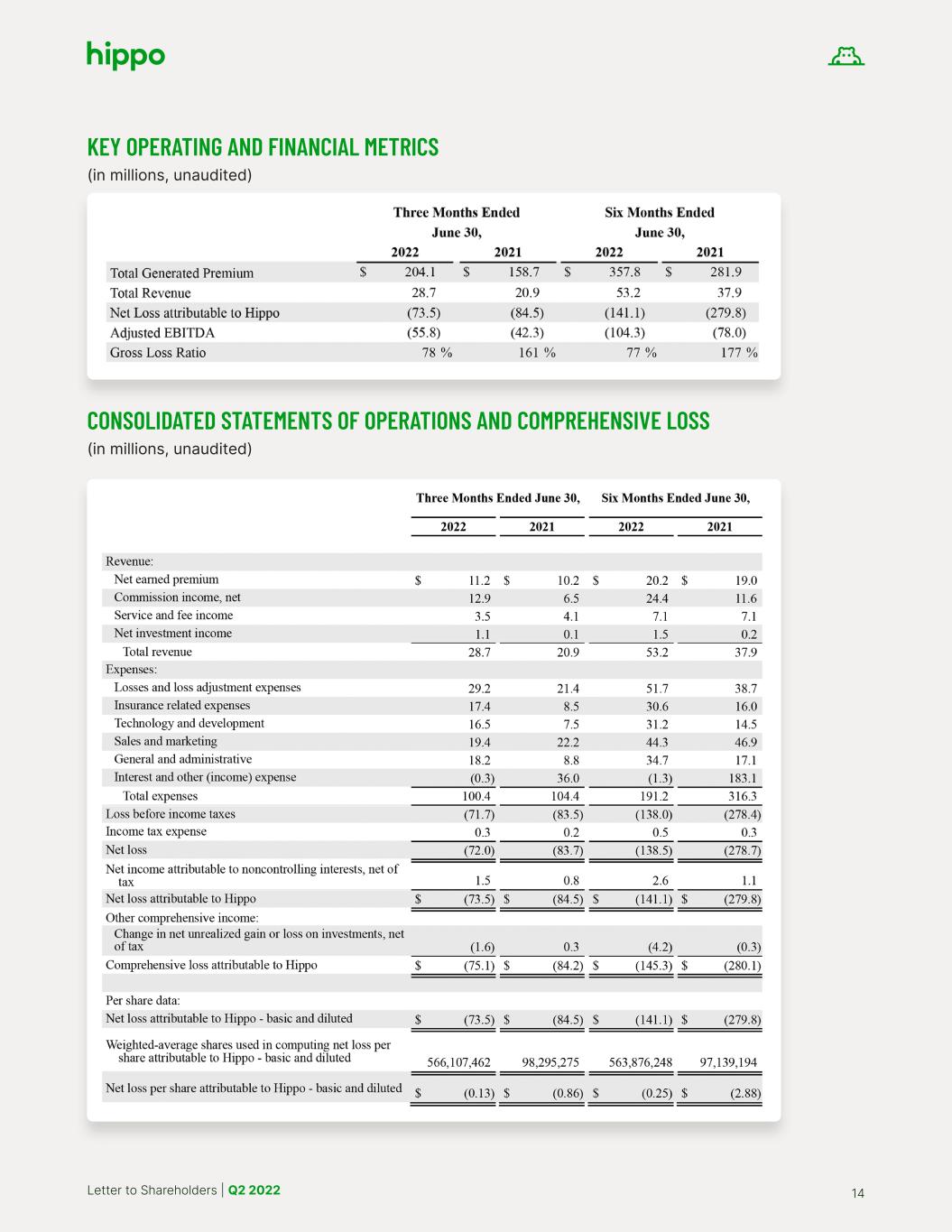

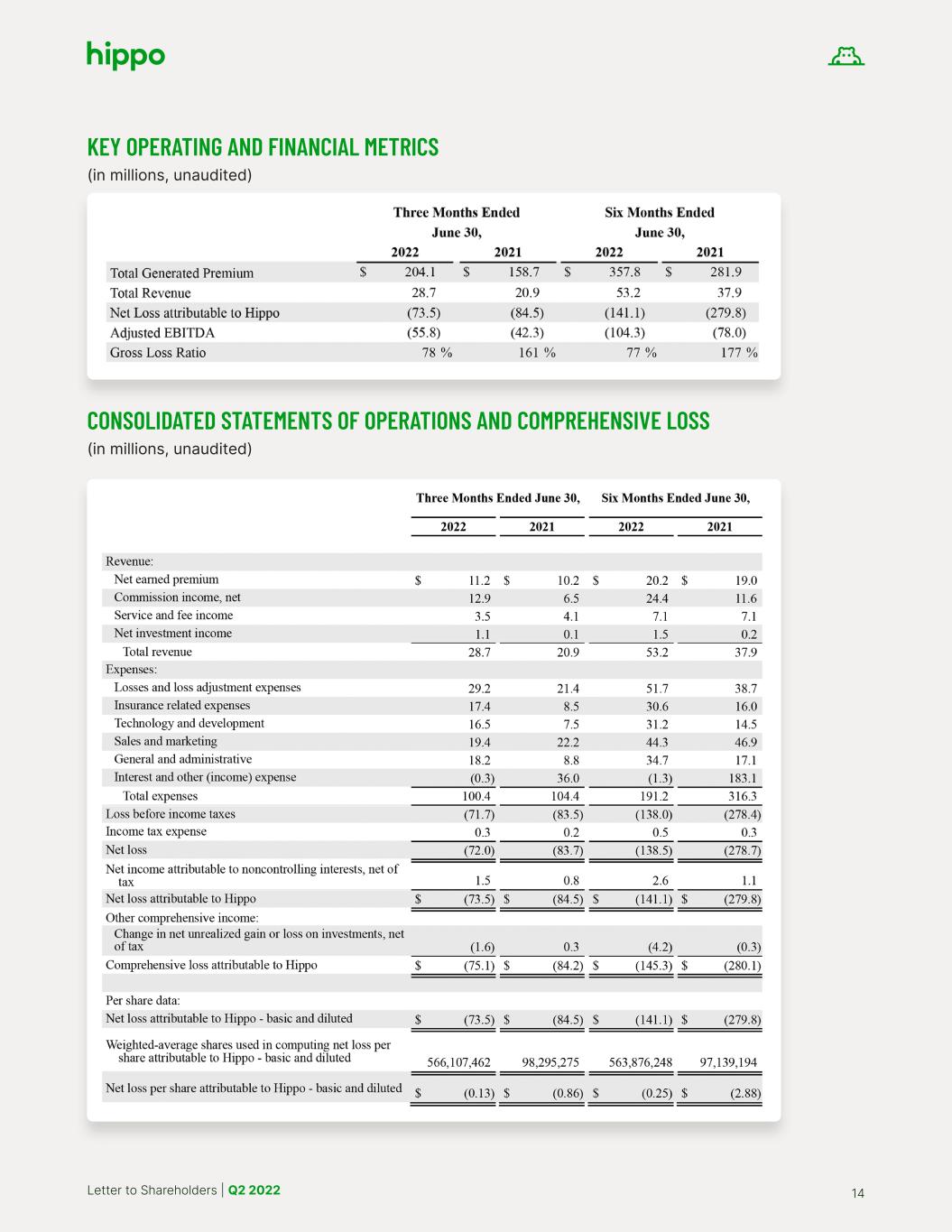

Letter to Shareholders | Q2 2022 14 KEY OPERATING AND FINANCIAL METRICS (in millions, unaudited) CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (in millions, unaudited)

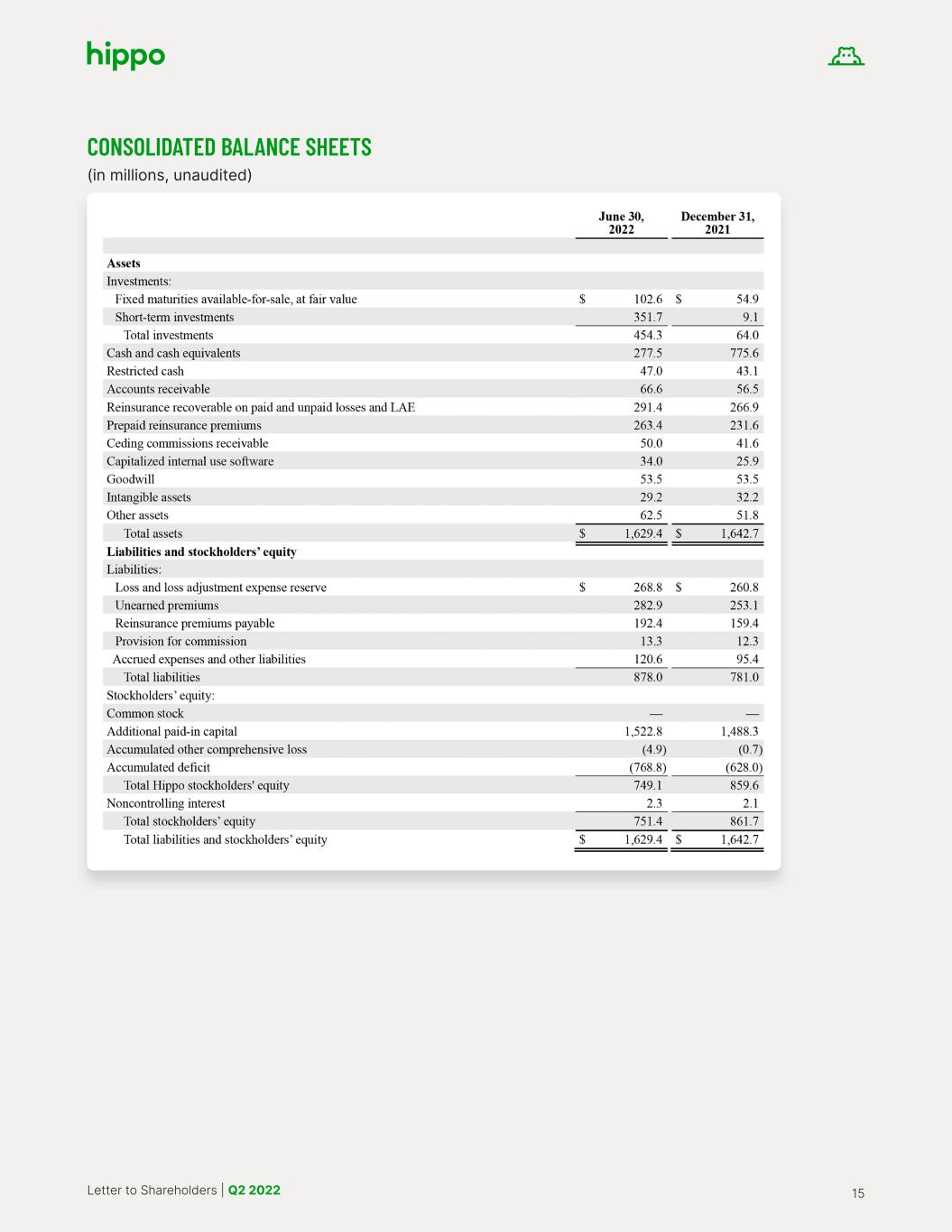

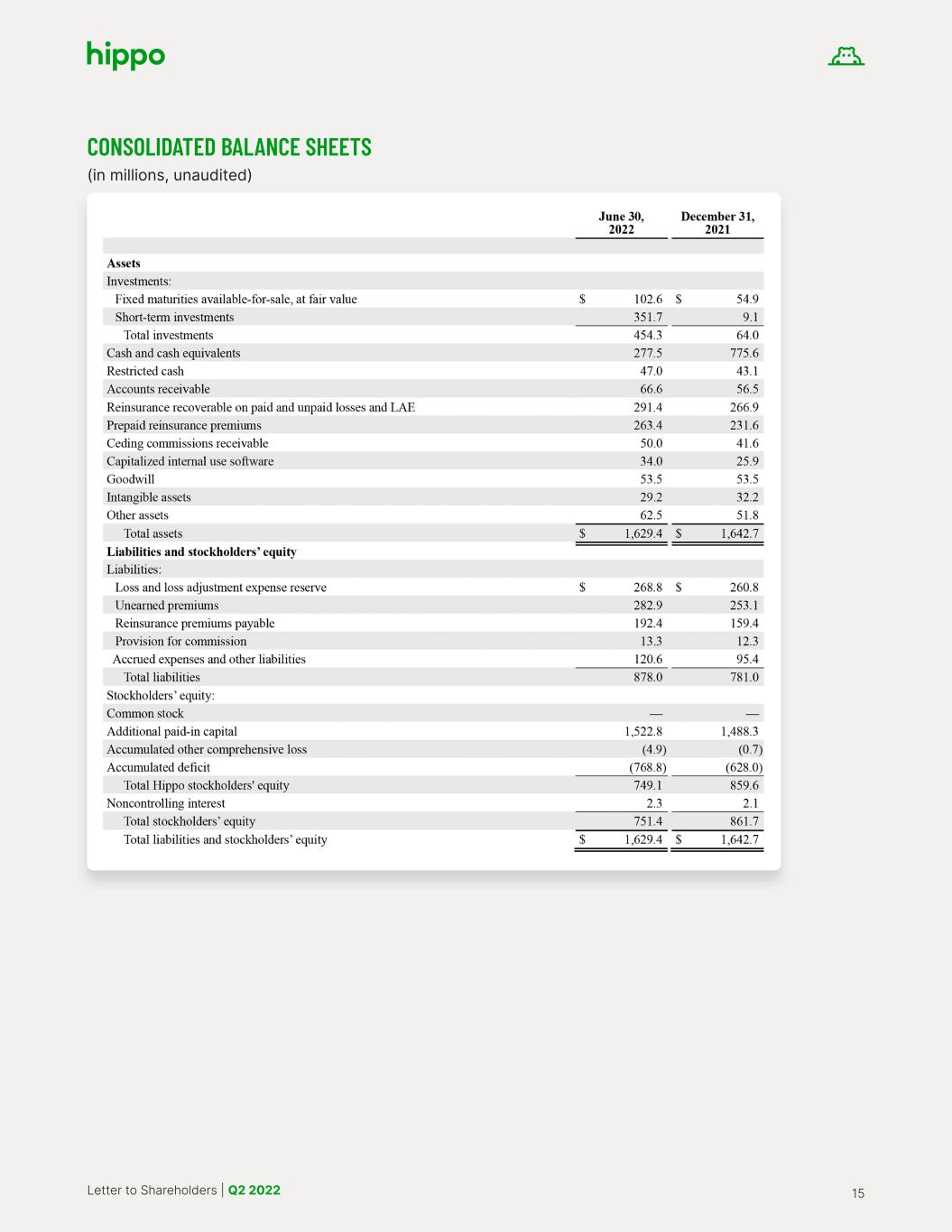

Letter to Shareholders | Q2 2022 15 CONSOLIDATED BALANCE SHEETS (in millions, unaudited)

Letter to Shareholders | Q2 2022 16 CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions, unaudited)

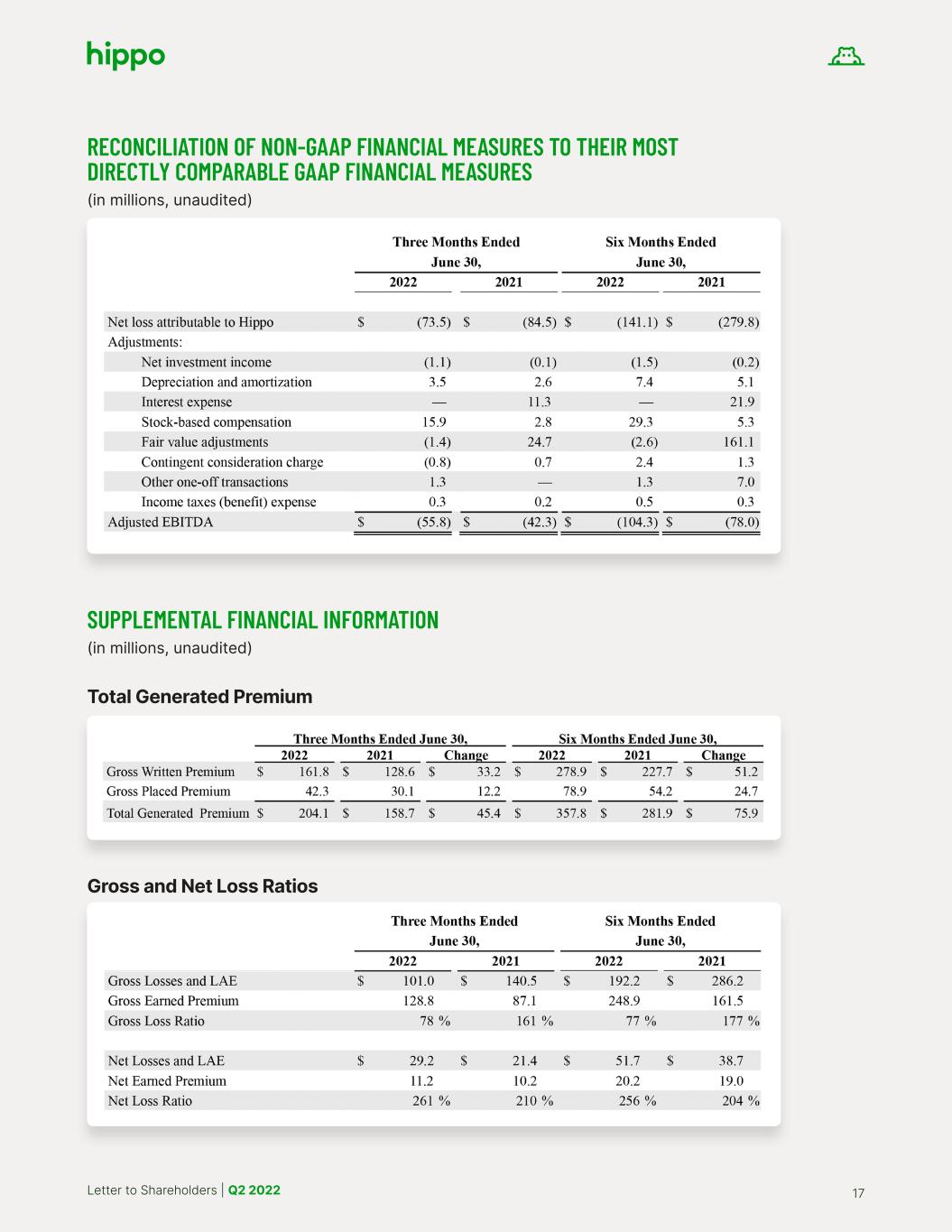

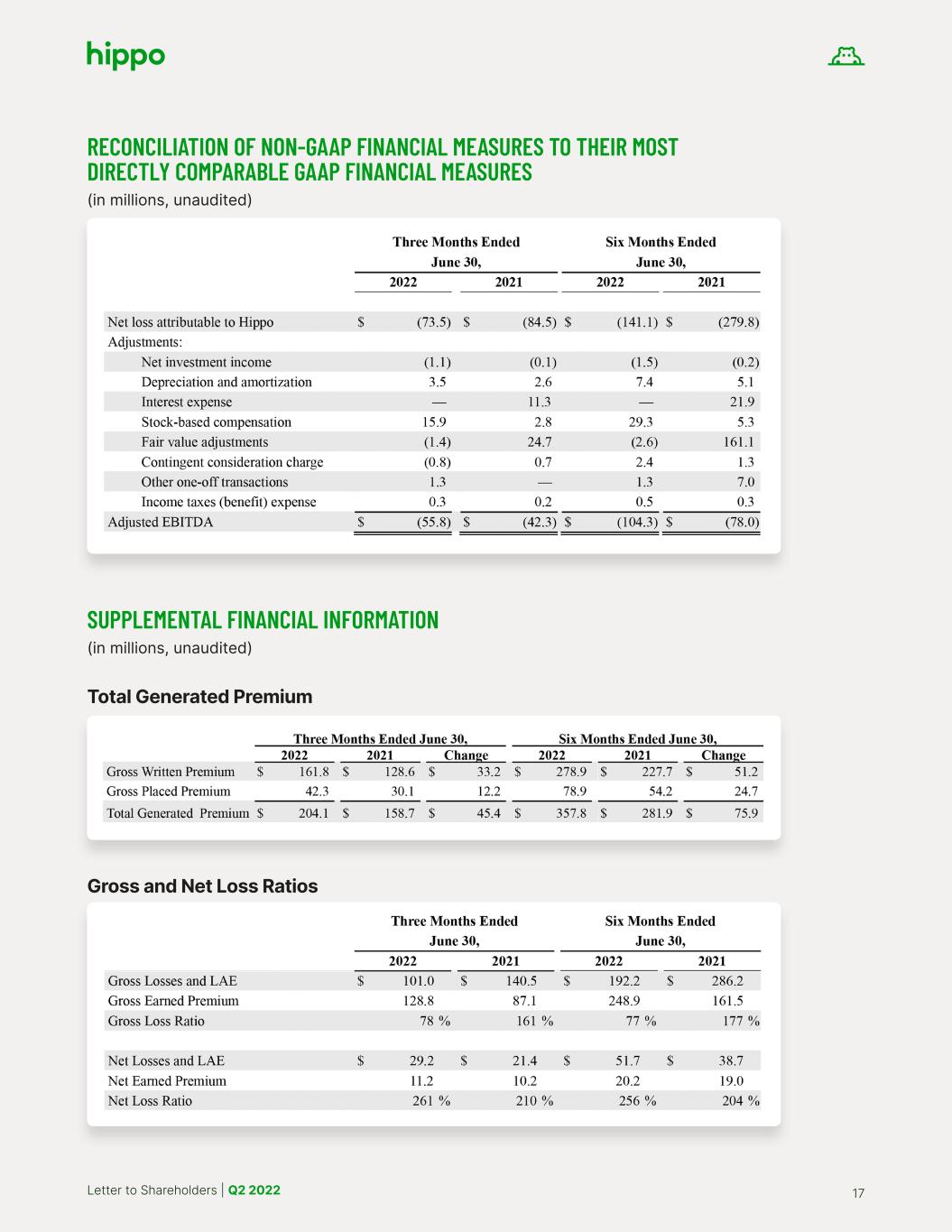

Letter to Shareholders | Q2 2022 17 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO THEIR MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES (in millions, unaudited) SUPPLEMENTAL FINANCIAL INFORMATION (in millions, unaudited) Total Generated Premium Gross and Net Loss Ratios

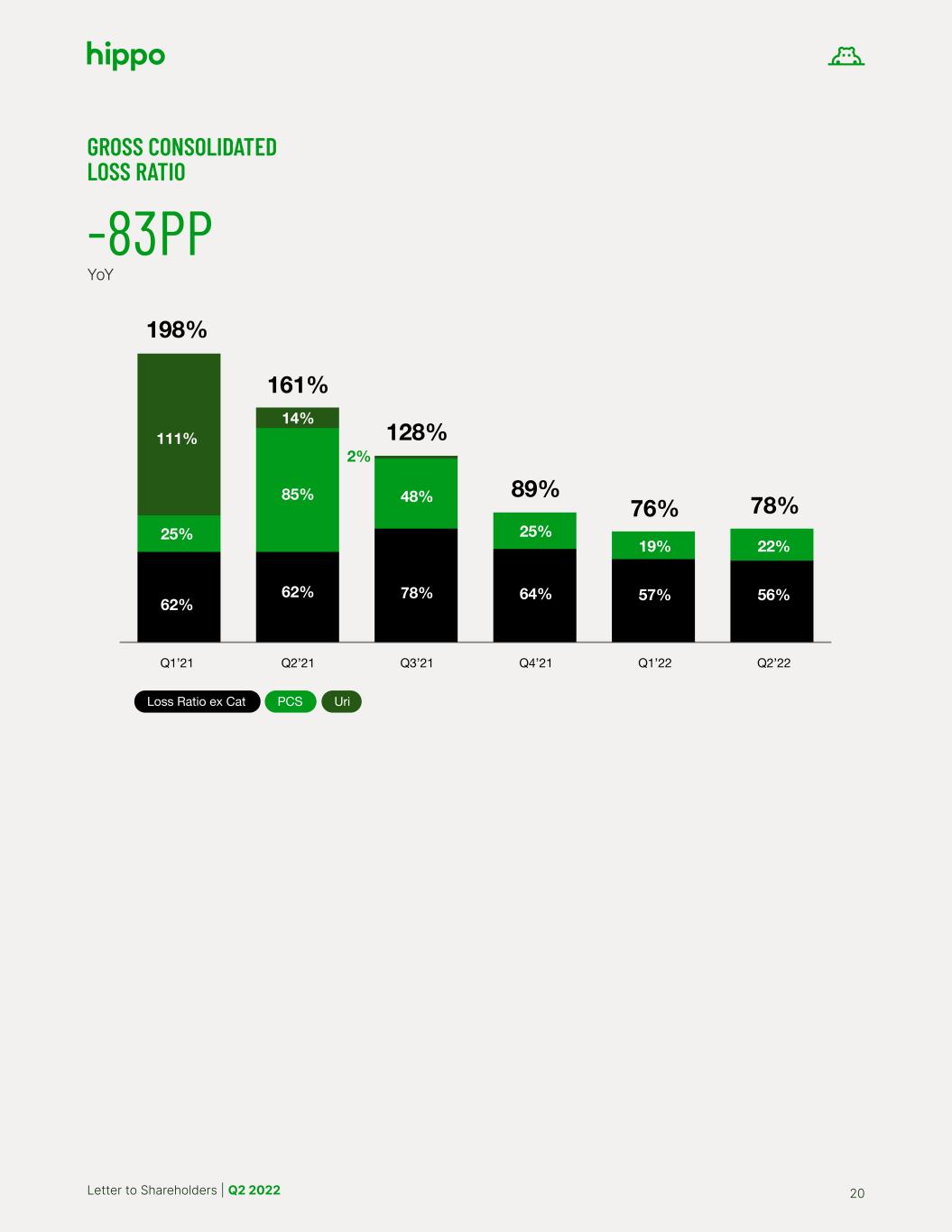

Letter to Shareholders | Q2 2022 18 Gross Loss Ratio Breakdown Insurance Related Expenses Breakdown (1) Refers to Losses from named Property Claims Services events. Direct acquisition costs were $16.3 million and $30.5 million for the three and six months ended June 30, 2022, of which $9.1 million and $18.7 million were offset by ceding commission income. Direct acquisition costs were $6.6 million and $10.9 million for the three and six months ended June 30, 2021, of which $5.3 million and $7.9 million was offset by ceding commission income.

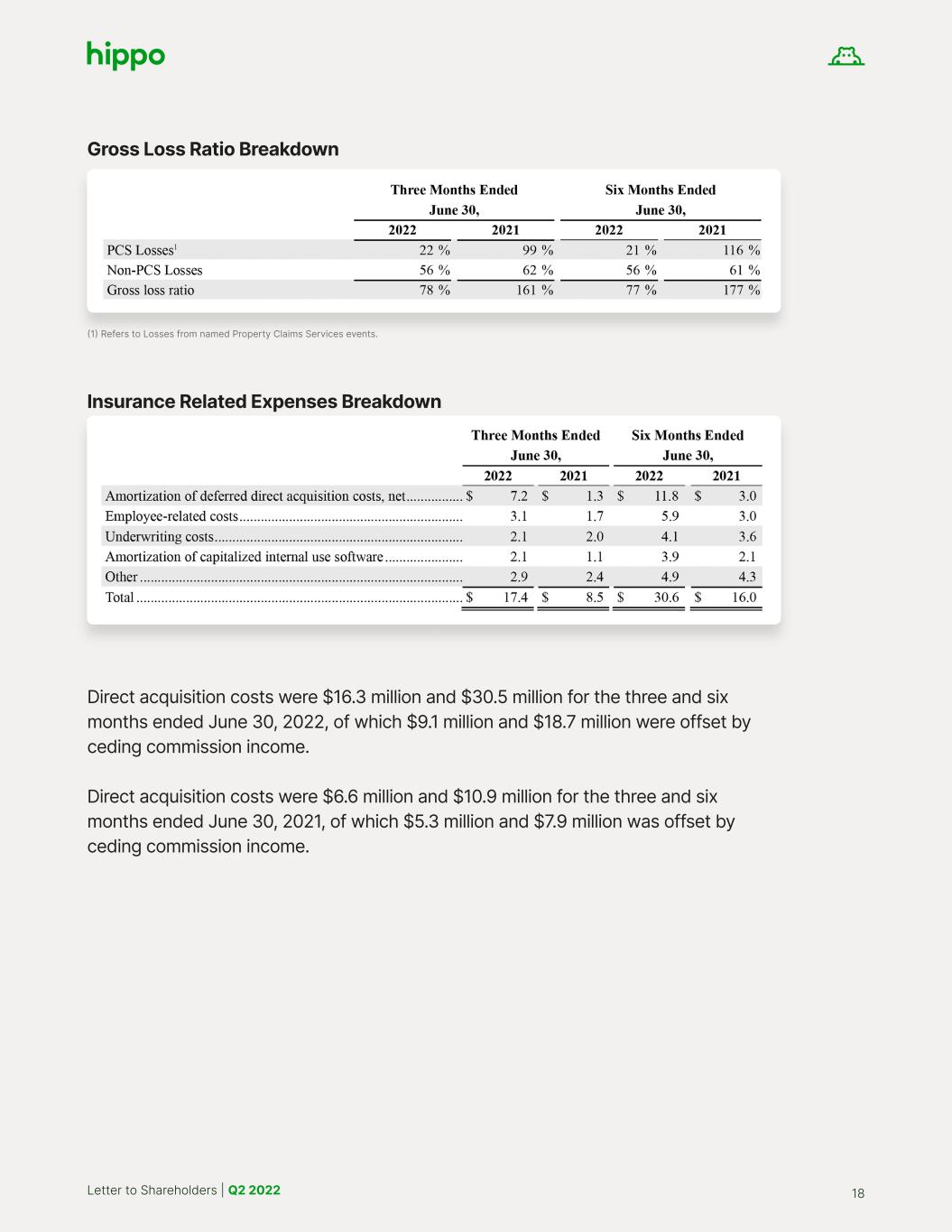

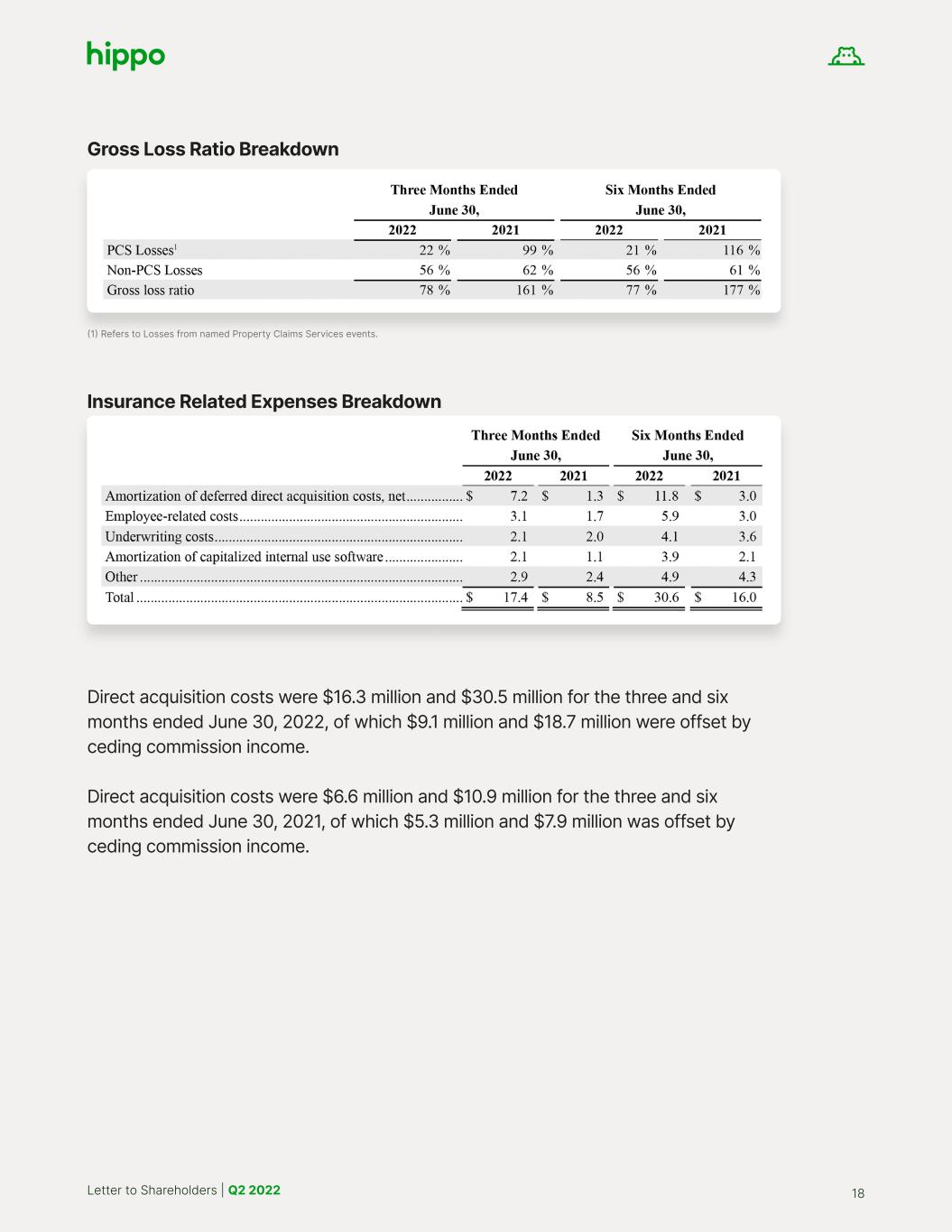

Letter to Shareholders | Q2 2022 19 TOTAL GENERATED PREMIUM IN-FORCE (in millions, unaudited) $403 $445 $501 $553 $602 $634 $680 Q2'20 Q3'20 Q4'20Q1'20 Q2'21 Q3'21 Q4'21 Q2'22Q1'22Q1'21 $375 $256$231 55% 45% Q2'20 Q2'22Q2'21 39% GEOGRAPHICAL DIVERSIFICATION (% of new Hippo homeowners premium outside California/Texas) +36% YoY -10PP YoY

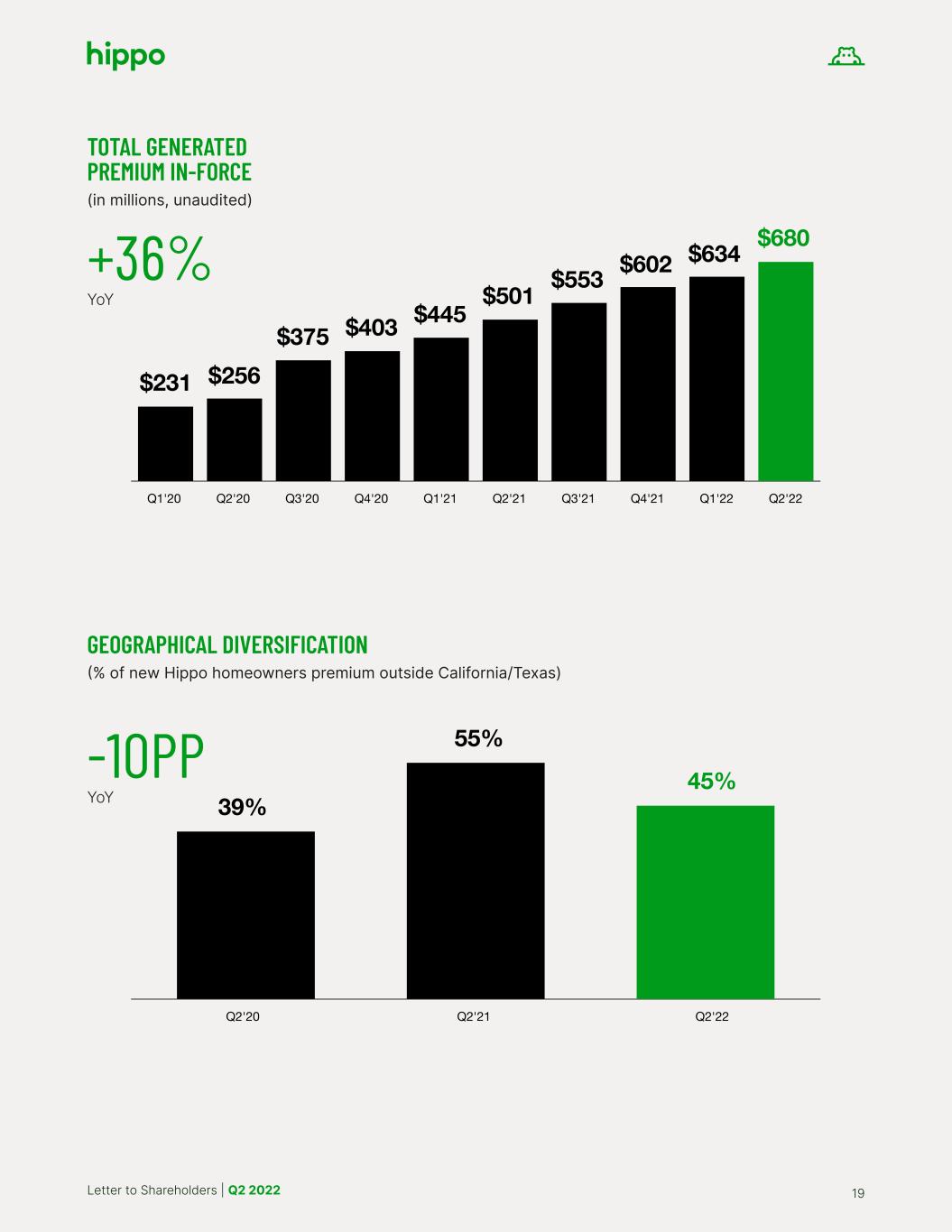

Letter to Shareholders | Q2 2022 20 GROSS CONSOLIDATED LOSS RATIO Q1’21 Q2’21 Q4’21 Q1’22 Q2’22Q3’21 62% 62% 78% 64% 56% 22% 57% 19% 25%25% 85% 48% 2% 111% 14% 128% 161% 198% 76% 78% 89% Loss Ratio ex Cat PCS Uri -83PP YoY