Letter to Shareholders | Q3 2024 1 Q3 2024 LETTER TO SHAREHOLDERS

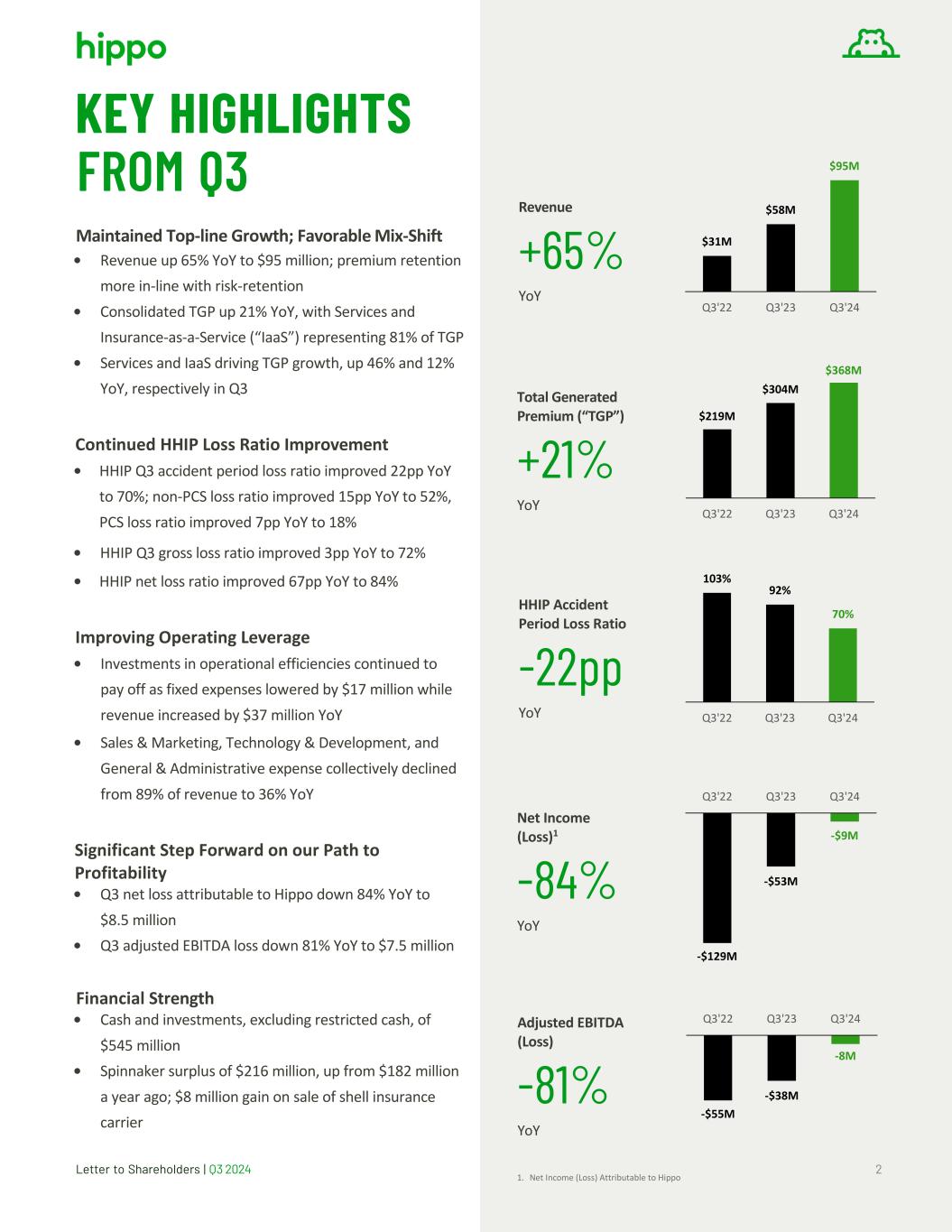

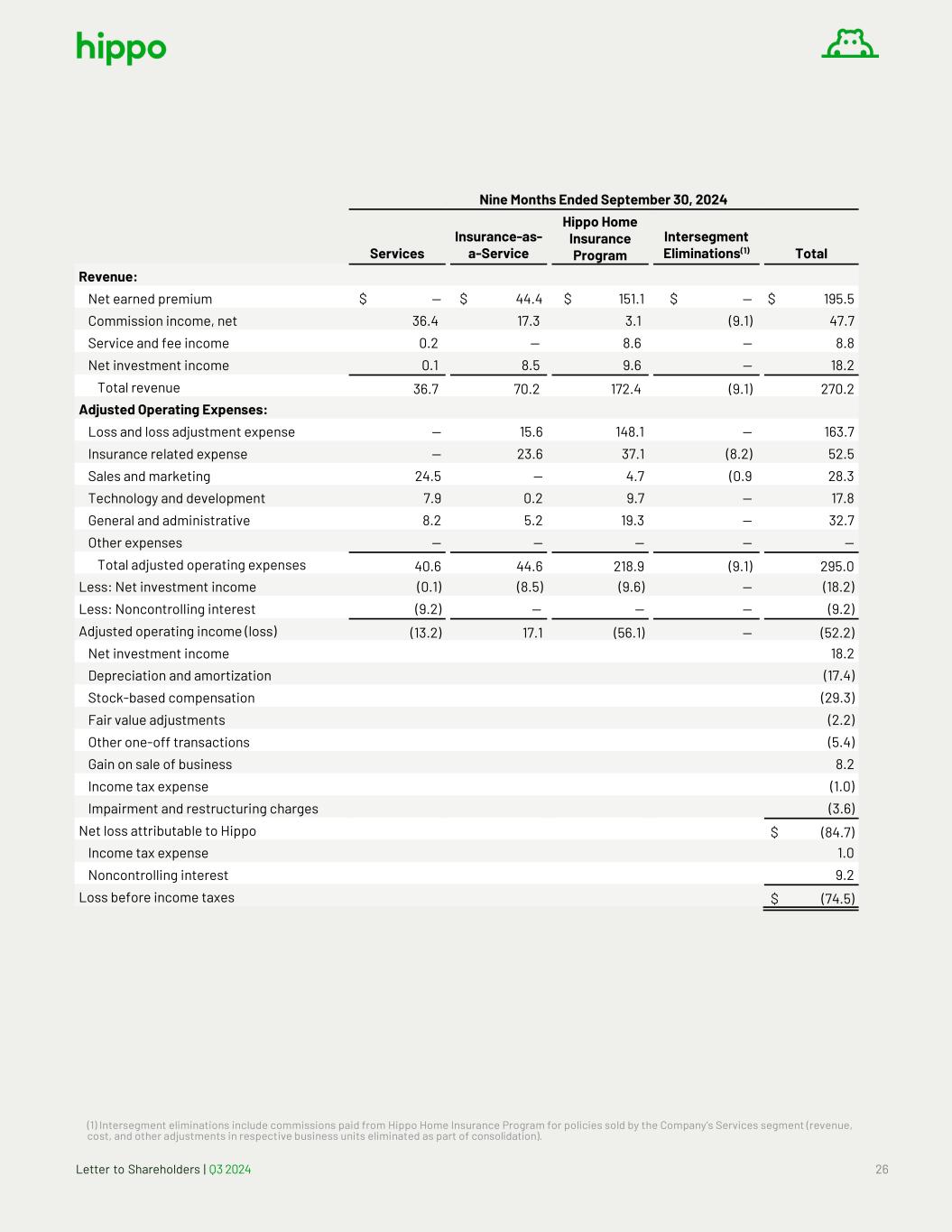

Letter to Shareholders | Q3 2024 2 1. Net Income (Loss) Attributable to Hippo KEY HIGHLIGHTS FROM Q3 Maintained Top-line Growth; Favorable Mix-Shift • Revenue up 65% YoY to $95 million; premium retention more in-line with risk-retention • Consolidated TGP up 21% YoY, with Services and Insurance-as-a-Service (“IaaS”) representing 81% of TGP • Services and IaaS driving TGP growth, up 46% and 12% YoY, respectively in Q3 Continued HHIP Loss Ratio Improvement • HHIP Q3 accident period loss ratio improved 22pp YoY to 70%; non-PCS loss ratio improved 15pp YoY to 52%, PCS loss ratio improved 7pp YoY to 18% • HHIP Q3 gross loss ratio improved 3pp YoY to 72% • HHIP net loss ratio improved 67pp YoY to 84% Improving Operating Leverage • Investments in operational efficiencies continued to pay off as fixed expenses lowered by $17 million while revenue increased by $37 million YoY • Sales & Marketing, Technology & Development, and General & Administrative expense collectively declined from 89% of revenue to 36% YoY Significant Step Forward on our Path to Profitability • Q3 net loss attributable to Hippo down 84% YoY to $8.5 million • Q3 adjusted EBITDA loss down 81% YoY to $7.5 million Financial Strength • Cash and investments, excluding restricted cash, of $545 million • Spinnaker surplus of $216 million, up from $182 million a year ago; $8 million gain on sale of shell insurance carrier HHIP Accident Period Loss Ratio -22pp YoY Adjusted EBITDA (Loss) -81% YoY Revenue +65% YoY $219M $304M $368M Q3'22 Q3'23 Q3'24 $31M $58M $95M Q3'22 Q3'23 Q3'24 Total Generated Premium (“TGP”) +21% YoY 103% 92% 70% Q3'22 Q3'23 Q3'24 Net Income (Loss)1 -84% YoY -$55M -$38M -8M Q3'22 Q3'23 Q3'24 -$129M -$53M -$9M Q3'22 Q3'23 Q3'24

Letter to Shareholders | Q3 2024 3 Q3’24: INVESTMENTS PAYING OFF Dear Shareholders, For the third quarter of 2024, we continued the positive momentum we’ve been building over the course of the year and made a significant step forward on our path to profitability. We also strengthened the foundation for growth in our New Homes channel. During the quarter, top-line premium and revenue continued to grow quickly while we posted a Hippo best- ever YoY improvement to our HHIP non-weather loss ratio. Our PCS loss results came in at expected levels despite an active Hurricane season. And we delivered another quarter of improved operating leverage as the investments we’ve made to streamline our operations continue to pay off. As we’ve discussed previously, we believe we have the best platform to help buyers of newly built homes secure cost-effective insurance quickly and easily. Beyond the benefits to consumers, Hippo’s New Homes program provides home builders access to a scalable, embedded insurance solution that streamlines the closing process for sales teams, lenders, and homebuyers by automating the evidence of insurance process. In Q3, we expanded home builder access to the program in California, Florida, and Texas, welcoming new builders Perry Homes and Van Daele to our roster of builder partners with more additions to come in Q4. By year's end, we expect to be in a position to provide access to insurance for almost 50,000 new homes annually in these states through both our Hippo program and our panel of carrier partners. After the close of the quarter, Hippo sold a majority stake in its independent agent platform, First Connect Insurance Services, to Centana Growth Partners for approximately $48 million, with the opportunity to earn additional proceeds of up to $12 million if First Connect achieves certain performance targets.

Letter to Shareholders | Q3 2024 4 This transaction allows us to further increase focus on our core business while simultaneously freeing up First Connect to increase its level of investment to fulfill its potential as the premier independent agent distribution channel for carriers and MGAs. Hippo will continue as an enthusiastic customer, carrier partner, and minority shareholder in First Connect. The proceeds from the transaction further strengthen our cash position, and we have taken this as an opportunity to repurchase and retire some of our own shares. Over the past couple of years, we’ve been striking a balance between improving our efficiency and investing in our business to support future growth. The work our team has been doing is increasingly visible in our financial results and I’m optimistic about what is to come. Sincerely, Richard McCathron President & CEO

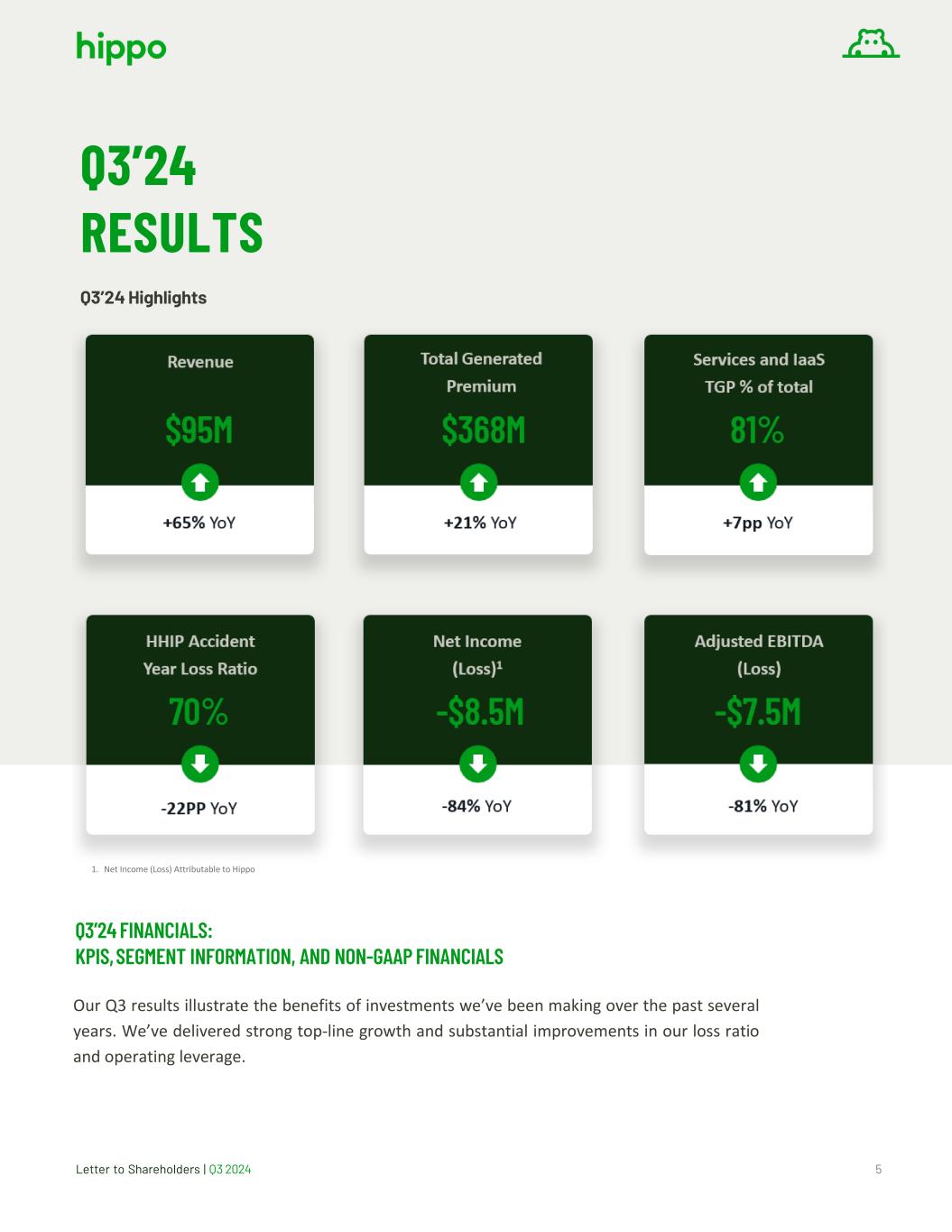

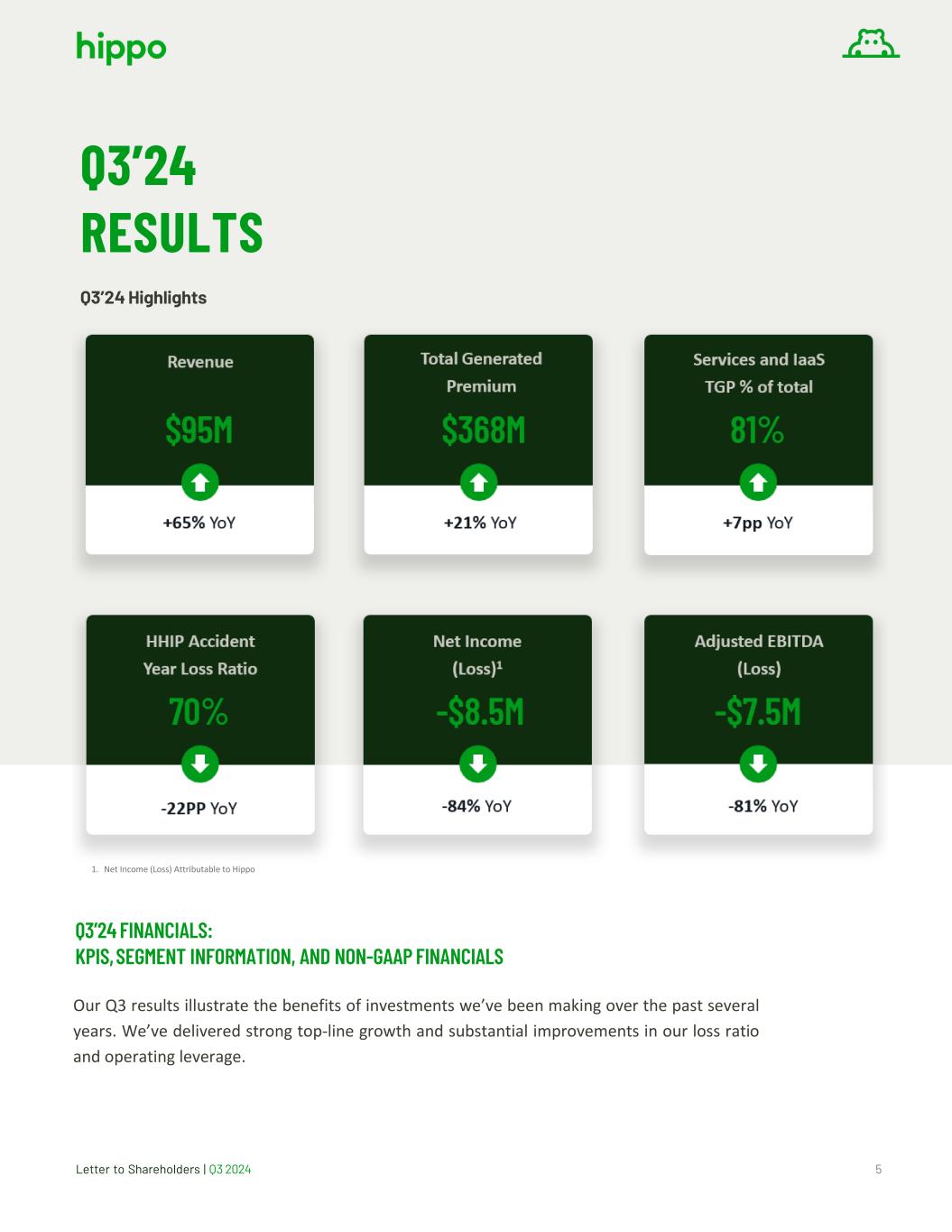

Letter to Shareholders | Q3 2024 5 1. Net Income (Loss) Attributable to Hippo Q3’24 RESULTS Q3’24 Highlights Q3’24 FINANCIALS: KPIS, SEGMENT INFORMATION, AND NON-GAAP FINANCIALS Our Q3 results illustrate the benefits of investments we’ve been making over the past several years. We’ve delivered strong top-line growth and substantial improvements in our loss ratio and operating leverage.

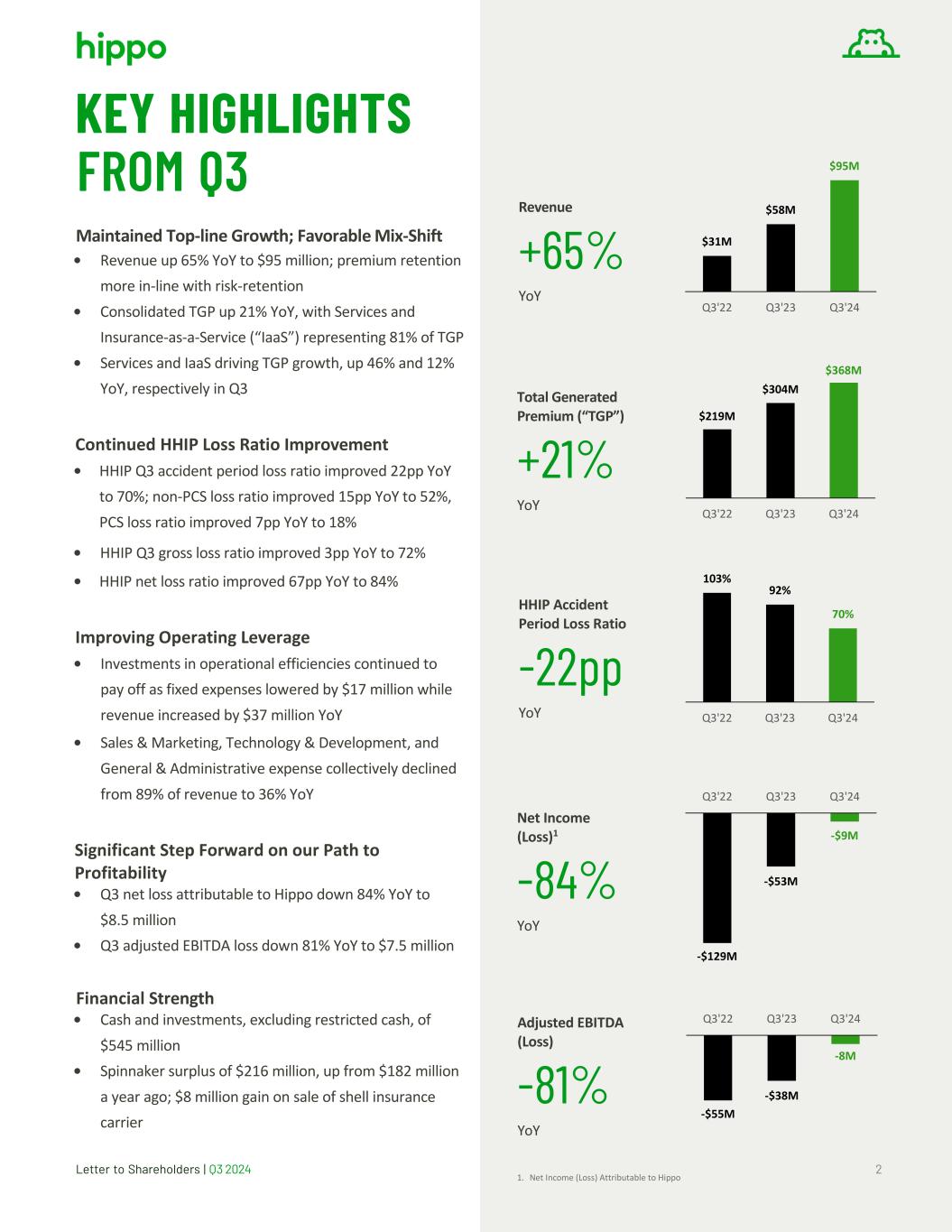

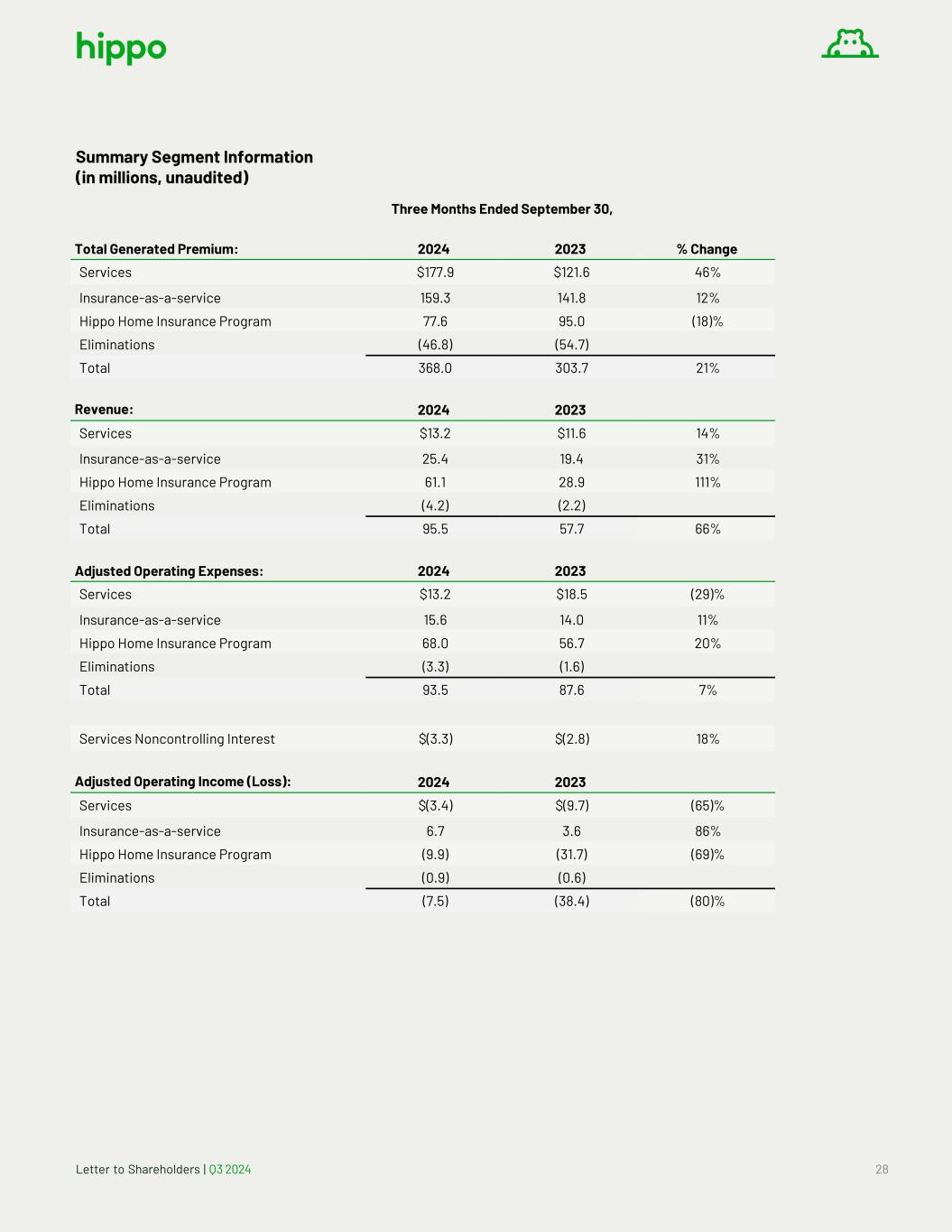

Letter to Shareholders | Q3 2024 6 Total Generated Premium (“TGP”) In Q3, TGP grew 21% YoY to $368 million. TGP in our Hippo Home Insurance Program segment declined 18% as a result of managing our exposure to high-CAT geographies but this was more than offset by TGP growth in our Insurance-as-a-Service segment of 12% and 46% TGP growth in our Services segment. Our TGP mix continued to shift towards the areas of our business that are less exposed to underwriting risk and weather volatility. The collective premium from the Services and IaaS segments was 81% of our total TGP this quarter, up from 74% a year ago.

Letter to Shareholders | Q3 2024 7 Revenue Revenue growth in Q3 again outpaced TGP growth, increasing 65% year over year to $95 million, up from $58 million in Q3 2023. Much like last quarter, the higher premium retention at HHIP and the volume increases in the IaaS and Services segments were the primary drivers of the growth. As we have discussed previously, our increasing confidence in both the magnitude and the predictability of our loss ratio has enabled us to retain a greater share of the premium we write on our own balance sheet. As a result of this higher premium retention, Net Earned Premium as a percentage of Gross Earned Premium in our HHIP business rose to 75% in Q3, up from 23% a year ago Like in previous quarters, IaaS revenue growth was driven mostly by the premium growth from existing programs, augmented by slightly higher risk-retention with some of the programs. In our Services segment, revenue grew more slowly than TGP due to the continued mix-shift from our Agency, where we earn commissions on a gross basis, to our First Connect platform, where we take a percentage of the gross commissions paid by carriers to our agency customers and recognize revenue on a net basis. We will not see this effect in future quarters because following the sale of First Connect on October 29th, our Agency will be the only driver of the Service’s segments financials.

Letter to Shareholders | Q3 2024 8 Loss and Loss Adjustment Expense Loss results in Q3 improved substantially year over year despite an active Hurricane season. HHIP PCS accident period loss ratio came in at 18%, an improvement of 20pp QoQ and an improvement of 7pp vs. Q3 last year. Despite the significant improvement in our PCS results, the real star of the show this quarter was the improvement in our HHIP non-PCS accident period loss ratio, which improved an unprecedented 15pp YoY to 52%. This improvement was driven by aggressive rate and underwriting actions across the portfolio as well as a favorable mix shift toward new homes, which generally experience lower non-weather losses than older homes. We achieved this improvement despite the shift at a portfolio level away from higher-CAT geographies, which all things equal, would tend to raise the non-PCS loss ratio. The combination of year over year improvements in both weather and non-weather loss ratios drove a substantial improvement in our total HHIP accident period loss ratio, which improved by 22 percentage points to 70%, from 92% in Q3 of last year. This portfolio-level improvement, combined with the improvements to our reinsurance structure drove an even larger improvement in our HHIP net loss ratio, which came in at 84% during the quarter, an improvement of 67pp versus Q3 of last year. Excluding the benefits of reserve releases in Q3’23, this improvement would have been 126pp.

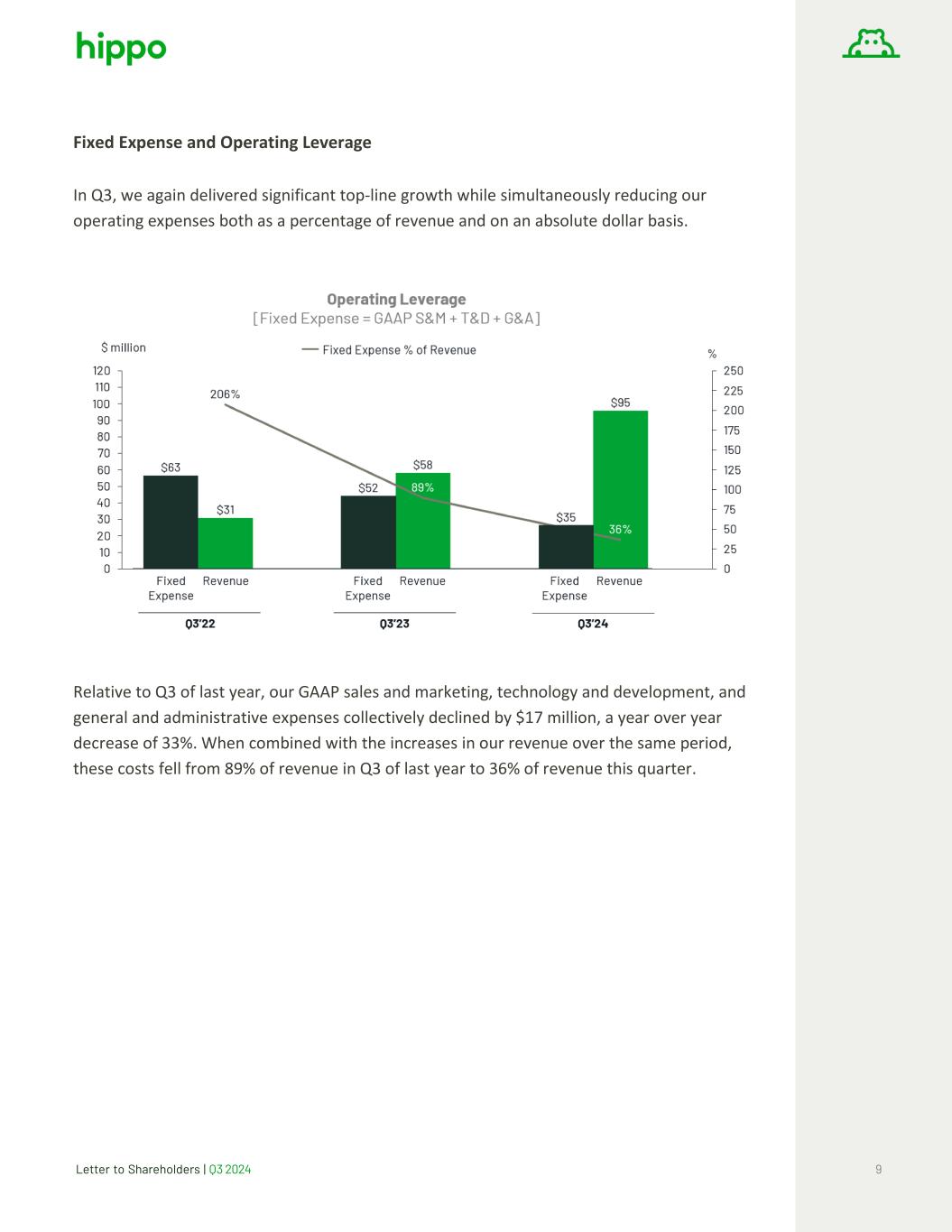

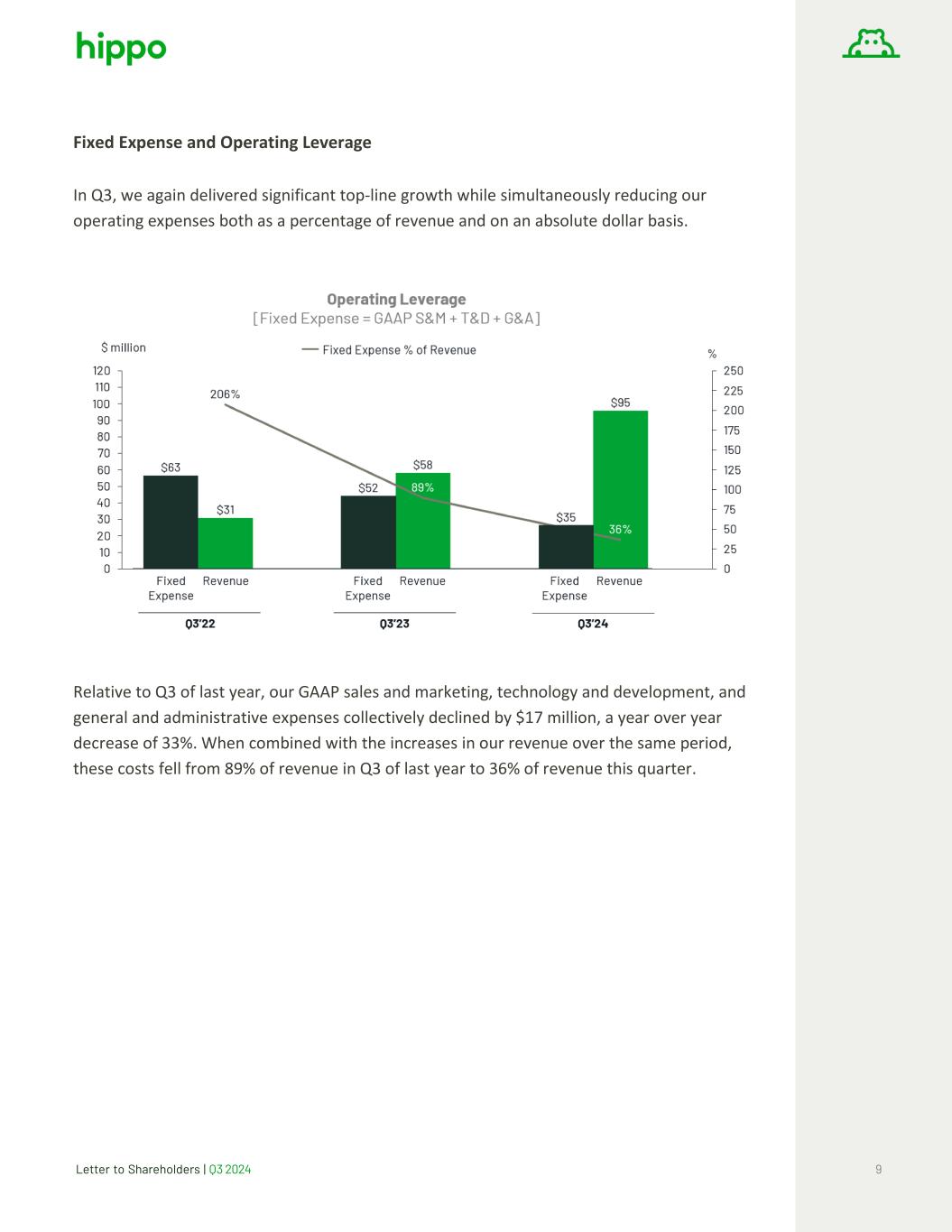

Letter to Shareholders | Q3 2024 9 Fixed Expense and Operating Leverage In Q3, we again delivered significant top-line growth while simultaneously reducing our operating expenses both as a percentage of revenue and on an absolute dollar basis. Relative to Q3 of last year, our GAAP sales and marketing, technology and development, and general and administrative expenses collectively declined by $17 million, a year over year decrease of 33%. When combined with the increases in our revenue over the same period, these costs fell from 89% of revenue in Q3 of last year to 36% of revenue this quarter.

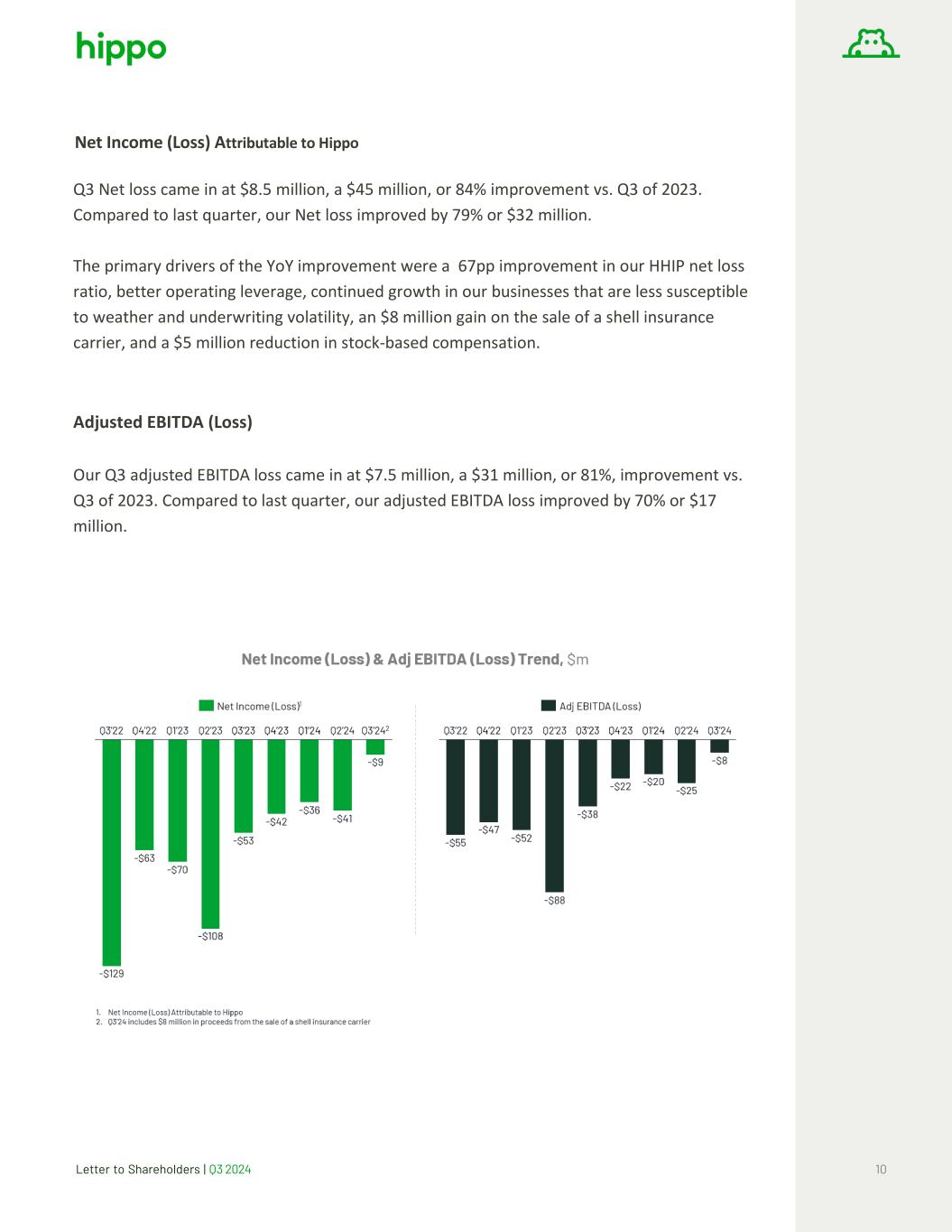

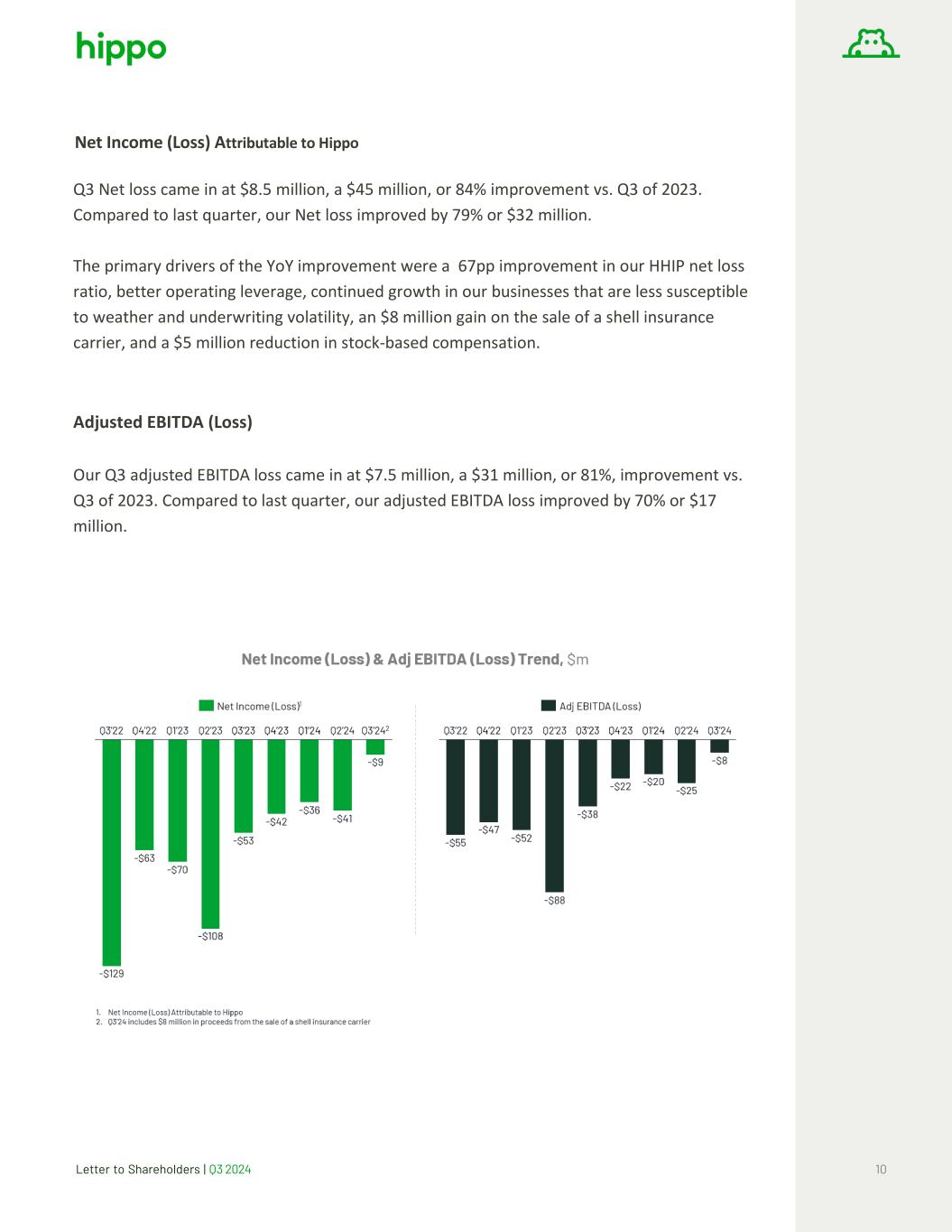

Letter to Shareholders | Q3 2024 10 Net Income (Loss) Attributable to Hippo Q3 Net loss came in at $8.5 million, a $45 million, or 84% improvement vs. Q3 of 2023. Compared to last quarter, our Net loss improved by 79% or $32 million. The primary drivers of the YoY improvement were a 67pp improvement in our HHIP net loss ratio, better operating leverage, continued growth in our businesses that are less susceptible to weather and underwriting volatility, an $8 million gain on the sale of a shell insurance carrier, and a $5 million reduction in stock-based compensation. Adjusted EBITDA (Loss) Our Q3 adjusted EBITDA loss came in at $7.5 million, a $31 million, or 81%, improvement vs. Q3 of 2023. Compared to last quarter, our adjusted EBITDA loss improved by 70% or $17 million.

Letter to Shareholders | Q3 2024 11 Cash and Investments Q3 ending cash and investments increased QoQ by $54 million, to $545 million. This increase was driven primarily by higher collections from reinsurers (reducing the amounts outstanding that are owed to Hippo) and the $8 million of proceeds from the sale of a shell insurance carrier, partially offset by the losses from operations. Subsequent Events After the end of Q3, on October 29th, 2024, we entered into an agreement with Centana Growth Partners to sell a majority of our shares in our independent agent platform, First Connect. As part of the agreement, Centana invested additional capital in First Connect to support its future growth and Hippo realized cash proceeds of approximately $48 million, with an opportunity to earn up to an additional $12 million over the next few years if First Connect achieves certain performance targets. Hippo retained a 19.2% stake in First connect. This transaction allows us to further increase focus on our core business while simultaneously freeing up First Connect to use the incremental investment from Centana to increase its level of investment in its future growth. The proceeds from this transaction have further strengthened our cash position. After the First Connect transaction closed, Hippo used $15.6 million of the proceeds to repurchase and retire 957,242, or 3.8%, of our total shares outstanding. This reduction in shares outstanding is reflected in the shares outstanding we reported today on the cover page of our Form 10-Q. Guidance The removal of First Connect from Hippo’s financials from the beginning of November will lower our expected Q4 TGP by approximately $50 to $60 million and expected revenue by approximately $1.5 to $1.8 million, but will have only a negligible impact on our expected net loss and adjusted EBITDA. Even with these effects and the expected impact of Hurricane Milton, we’d like to reiterate our previous Q4 guidance for revenue of $95 to $99 million and adjusted EBITDA of positive $5 to $6 million.

Letter to Shareholders | Q3 2024 12 Non-GAAP financial measures This letter to shareholders includes the non-GAAP financial measure (including on a forward- looking basis) Adjusted EBITDA. Hippo defines Adjusted EBITDA, a non-GAAP financial measure, as net loss attributable to Hippo excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, net investment income, restructuring charges, impairment expense, gains and losses on sales of business, other non-cash fair market value adjustments, and contingent consideration for one of our acquisitions and other transactions that we consider to be unique in nature. Hippo excludes these items from Adjusted EBITDA because it does not consider them to be directly attributable to its underlying operating performance. This non-GAAP measure is an addition, and not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of non-GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation. Hippo believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Hippo. Hippo’s management uses forward looking non- GAAP measures to evaluate Hippo’s projected financial and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents. For example other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Hippo’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. This letter to shareholders also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Hippo is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward looking non-GAAP financial measures is included.

Letter to Shareholders | Q3 2024 13 This letter to shareholders also includes key operating and financial metrics including Total Generated Premium (“TGP”), Gross Loss Ratio and Net Loss Ratio. We define TGP as the aggregate written premium placed across all our business platforms for the period presented. We measure TGP as it reflects the volume of our business irrespective of choices related to how we structure our reinsurance treaties, the amount of risk we retain on our own balance sheet or the amount of business written in our capacity as an MGA, agency or as an insurance carrier/reinsurer. • We define Total Generated Premium in force as the aggregate annualized premium for all the policies in force as of the period end date. • We define Gross Loss Ratio expressed as a percentage, which is the ratio of the gross losses and loss adjustment expenses to the gross earned premium. • We define Net Loss Ratio expressed as a percentage, which is the ratio of the net losses and loss adjustment expenses to the net earned premium. • We define Accident Period Loss Ratio as a percentage, which is the ratio of loss and loss adjustment expenses incurred and attributed to an accident period to the gross earned premium.

Letter to Shareholders | Q3 2024 14 Forward-looking statements safe harbor Certain statements included in this letter to shareholders that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial results and other operating and performance metrics, our business strategy, our cost reduction efforts, the quality of our products and services, and the potential growth of our business, including our ability and timing to achieve profitability. These statements are based on the current expectations of Hippo’s management and are not predictions of actual performance. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions, and many actual events and circumstances are beyond the control of Hippo. These forward-looking statements are subject to a number of risks and uncertainties, including our ability to achieve or maintain profitability in the future; our ability to retain and expand our customer base and grow our business, including our builder network; our ability to manage growth effectively; risks relating to Hippo’s brand and brand reputation; denial of claims or our failure to accurately and timely pay claims; the effects of intense competition in the segments of the insurance industry in which we operate; the availability and adequacy of reinsurance, including at current coverage, limits or pricing; our ability to underwrite risks accurately and charge competitive yet profitable rates to our customers, and the sufficiency of the analytical models we use to assess and predict exposure to catastrophe losses; risks related to our proprietary technology and our digital platform; outages or interruptions or delays in services provided by our third party providers, including our data vendor; risks related to our intellectual property; the seasonal and cyclical nature of our business; the effects of severe weather events and other natural or man-made catastrophes, including the effects of climate change, global pandemics, and terrorism; continued disruptions from the COVID-19 pandemic; any overall decline in economic activity; the effects of existing or new legal or regulatory requirements on our business, including with respect to maintenance of risk-based capital and financial strength ratings, data privacy and cybersecurity, and the insurance industry generally; and other risks set forth in the sections entitled “Risk Factors” in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

Letter to Shareholders | Q3 2024 15 If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward- looking statements. There may be additional risks that Hippo does not presently know, or that Hippo currently believes are immaterial, that could also cause actual results to differ from those contained in the forward- looking statements. In addition, forward-looking statements reflect Hippo’s expectations, plans, or forecasts of future events and views as of the date of this letter to shareholders. Hippo anticipates that subsequent events and developments will cause Hippo’s assessments to change. However, while Hippo may elect to update these forward-looking statements at some point in the future, Hippo specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Hippo’s assessments of any date subsequent to the date of this letter to shareholders. Accordingly, undue reliance should not be placed upon the forward- looking statements.

Letter to Shareholders | Q3 2024 16 APPENDIX

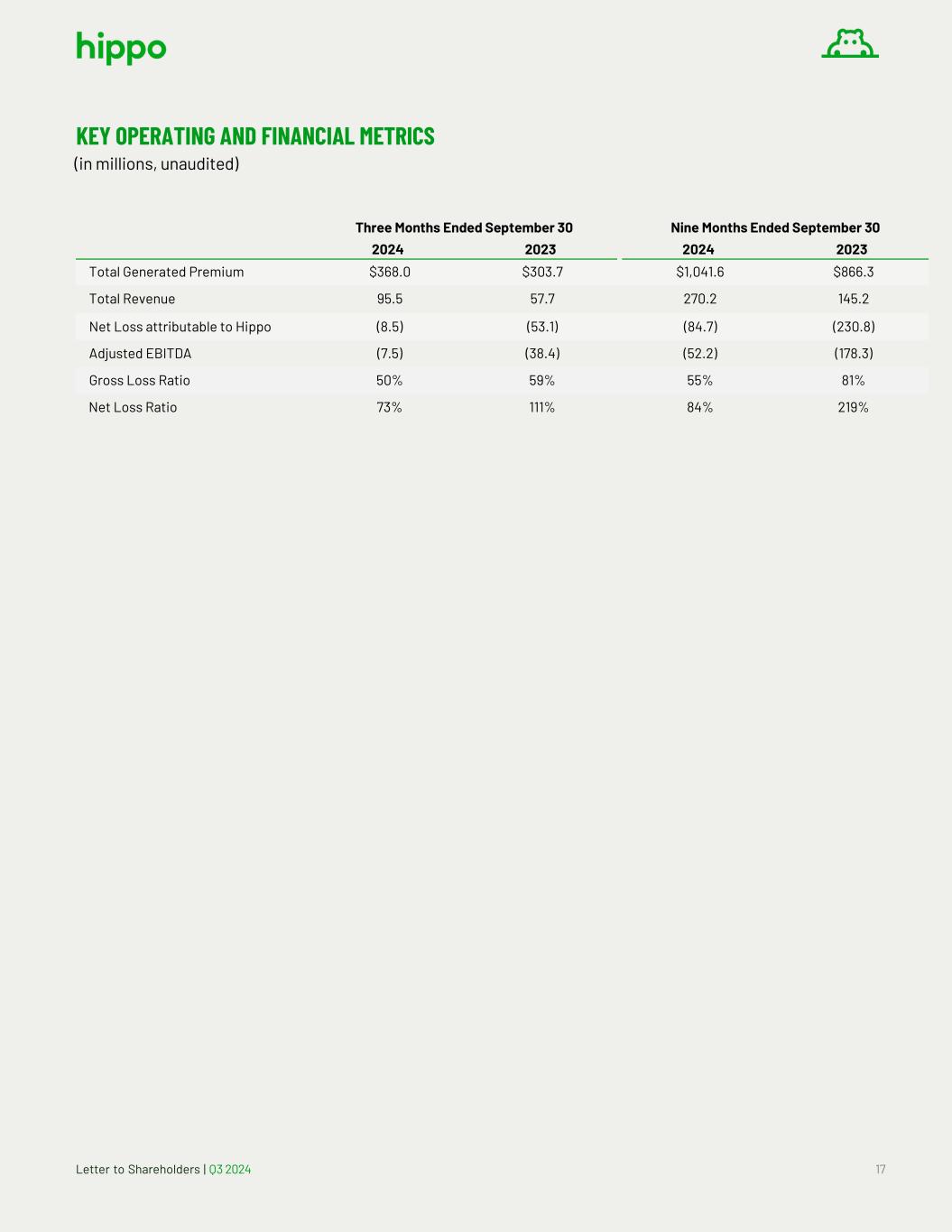

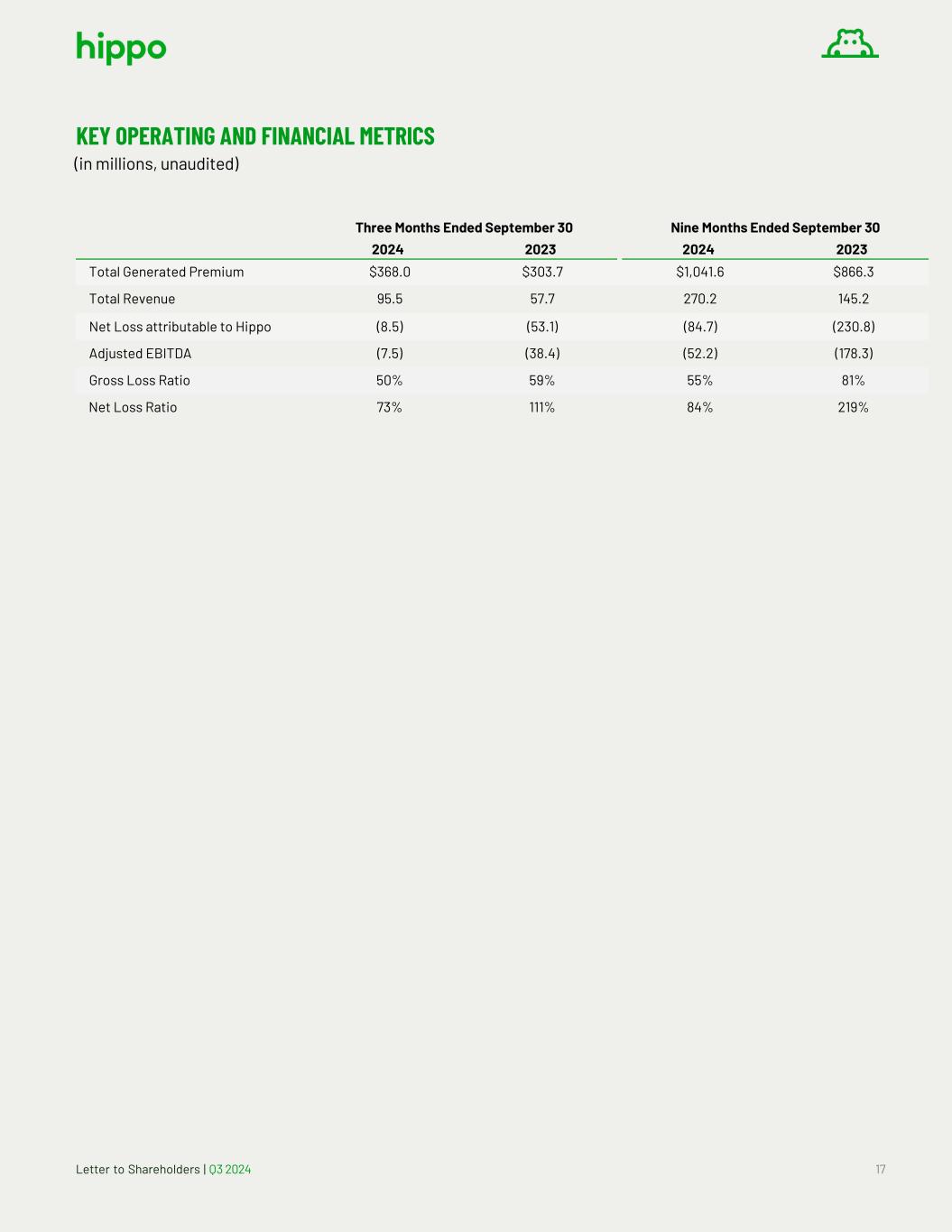

Letter to Shareholders | Q3 2024 17 KEY OPERATING AND FINANCIAL METRICS (in millions, unaudited) Three Months Ended September 30 Nine Months Ended September 30 2024 2023 2024 2023 Total Generated Premium $368.0 $303.7 $1,041.6 $866.3 Total Revenue 95.5 57.7 270.2 145.2 Net Loss attributable to Hippo (8.5) (53.1) (84.7) (230.8) Adjusted EBITDA (7.5) (38.4) (52.2) (178.3) Gross Loss Ratio 50% 59% 55% 81% Net Loss Ratio 73% 111% 84% 219%

Letter to Shareholders | Q3 2024 18 CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (in millions, except share and per share data, unaudited) Three Months Ended September 30 Nine Months Ended September 30 2024 2023 2024 2023 Revenue: Net earned premium $70.6 $32.9 $195.5 $69.0 Commission income, net 15.7 14.2 47.7 47.8 Service and fee income 3.0 4.9 8.8 11.9 Net investment income 6.2 5.7 18.2 16.5 Total revenue 95.5 57.7 270.2 145.2 Expenses: Losses and loss adjustment expenses 51.6 36.5 164.6 150.9 Insurance related expenses 22.6 20.3 67.9 54.8 Technology and development 7.0 11.9 23.1 36.6 Sales and marketing 12.5 18.9 40.3 63.9 General and administrative 15.3 20.7 53.5 62.0 Impairment and restructuring charges — — 3.6 — Gain on sale of business (8.2) — (8.2) — Other (income) expense, net (0.1) — (0.1) 0.5 Total expenses 100.7 108.3 344.7 368.7 Loss before income taxes (5.2) (50.6) (74.5) (223.5) Income tax expense (benefit) — (0.3) 1.0 0.2 Net loss (5.2) (50.3) (75.5) (223.7) Net income attributable to noncontrolling interests, net of tax 3.3 2.8 9.2 7.1 Net loss attributable to Hippo $(8.5) $(53.1) $(84.7) $(230.8) Other comprehensive income (loss): Change in net unrealized gain or loss on investments, net of tax 4.1 (0.7) 3.4 (0.1) Comprehensive loss attributable to Hippo $(4.4) $(53.8) $(81.3) $(230.9) Per share data: Net loss attributable to Hippo - basic and diluted $(8.5) $(53.1) $(84.7) $(230.8) Weighted-average shares used in computing net loss per share attributable to Hippo - basic and diluted 25,068,472 23,729,570 24,644,272 23,440,550 Net loss per share attributable to Hippo - basic and diluted $(0.34) $(2.24) $(3.44) $(9.85)

Letter to Shareholders | Q3 2024 19 CONSOLIDATED BALANCE SHEETS (in millions, unaudited) September 30, 2024 December 31, 2023 Assets Investments: Fixed maturities available-for-sale $201.8 $161.7 Short-term investments 152.5 187.1 Total investments 354.3 348.8 Cash and cash equivalents 191.2 142.1 Restricted cash 39.7 53.0 Accounts receivable 157.8 145.2 Reinsurance recoverable on paid and unpaid losses and LAE 279.8 281.3 Prepaid reinsurance premiums 292.3 335.6 Ceding commissions receivable 89.0 73.8 Capitalized internal use software 50.2 48.4 Intangible assets 23.8 27.3 Other assets 67.3 69.2 Total assets $1,545.4 $1,524.7 Liabilities and stockholders’ equity Liabilities: Loss and loss adjustment expense reserve 351.1 322.5 Unearned premiums 473.8 419.2 Reinsurance premiums payable 261.2 260.1 Provision for commission 31.1 24.7 Accrued expenses and other liabilities 98.1 113.5 Total liabilities 1,215.3 1,140.0 Stockholders’ equity: Common stock — — Additional paid-in capital 1,645.1 1,615.2 Accumulated other comprehensive loss 0.5 (2.9) Accumulated deficit (1,319.2) (1,234.4) Total Hippo stockholders’ equity 326.4 377.9 Noncontrolling interest 3.7 6.8 Total stockholders’ equity 330.1 384.7 Total liabilities and stockholders’ equity $1,545.4 $1,524.7

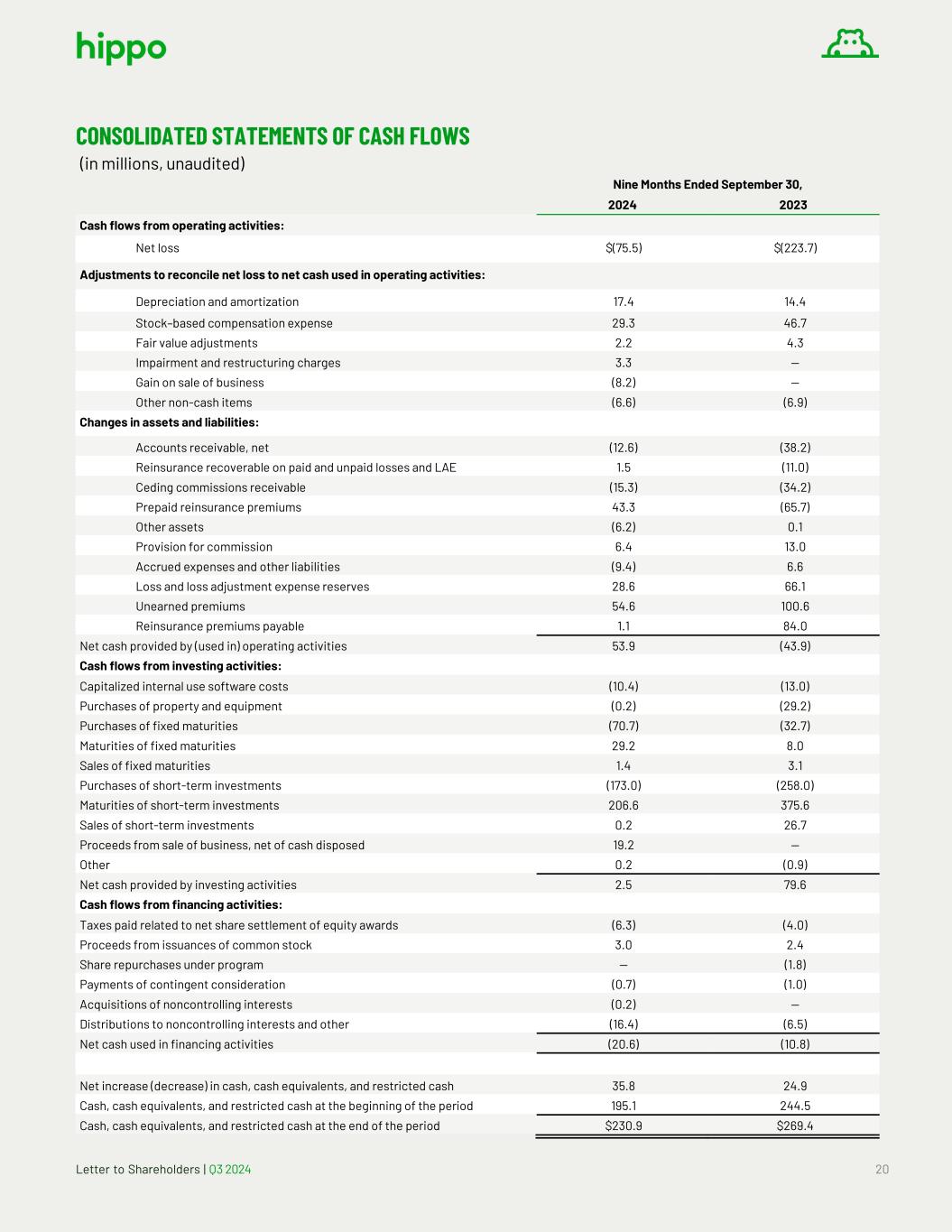

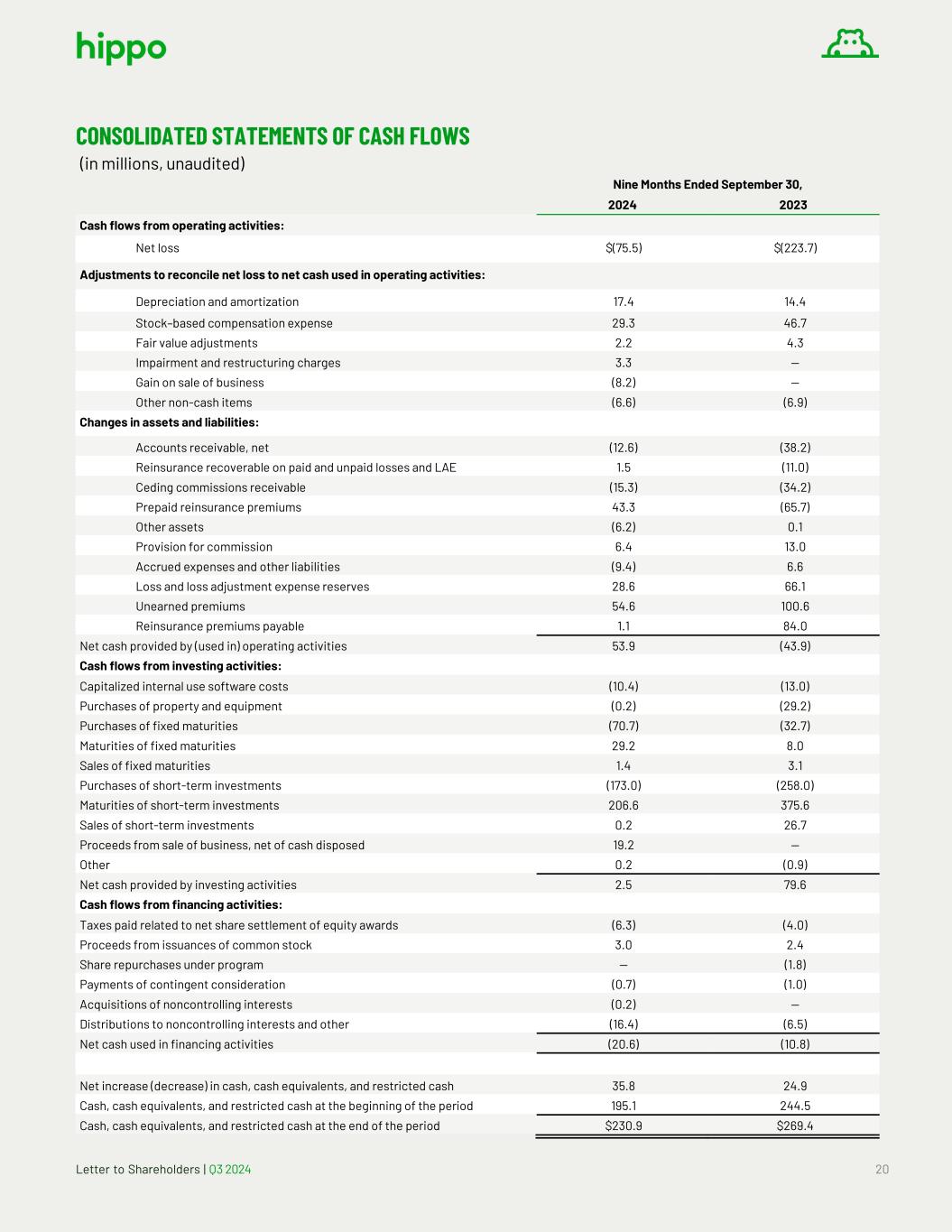

Letter to Shareholders | Q3 2024 20 CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions, unaudited) Nine Months Ended September 30, 2024 2023 Cash flows from operating activities: Net loss $(75.5) $(223.7) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 17.4 14.4 Stock–based compensation expense 29.3 46.7 Fair value adjustments 2.2 4.3 Impairment and restructuring charges 3.3 — Gain on sale of business (8.2) — Other non-cash items (6.6) (6.9) Changes in assets and liabilities: Accounts receivable, net (12.6) (38.2) Reinsurance recoverable on paid and unpaid losses and LAE 1.5 (11.0) Ceding commissions receivable (15.3) (34.2) Prepaid reinsurance premiums 43.3 (65.7) Other assets (6.2) 0.1 Provision for commission 6.4 13.0 Accrued expenses and other liabilities (9.4) 6.6 Loss and loss adjustment expense reserves 28.6 66.1 Unearned premiums 54.6 100.6 Reinsurance premiums payable 1.1 84.0 Net cash provided by (used in) operating activities 53.9 (43.9) Cash flows from investing activities: Capitalized internal use software costs (10.4) (13.0) Purchases of property and equipment (0.2) (29.2) Purchases of fixed maturities (70.7) (32.7) Maturities of fixed maturities 29.2 8.0 Sales of fixed maturities 1.4 3.1 Purchases of short-term investments (173.0) (258.0) Maturities of short-term investments 206.6 375.6 Sales of short-term investments 0.2 26.7 Proceeds from sale of business, net of cash disposed 19.2 — Other 0.2 (0.9) Net cash provided by investing activities 2.5 79.6 Cash flows from financing activities: Taxes paid related to net share settlement of equity awards (6.3) (4.0) Proceeds from issuances of common stock 3.0 2.4 Share repurchases under program — (1.8) Payments of contingent consideration (0.7) (1.0) Acquisitions of noncontrolling interests (0.2) — Distributions to noncontrolling interests and other (16.4) (6.5) Net cash used in financing activities (20.6) (10.8) Net increase (decrease) in cash, cash equivalents, and restricted cash 35.8 24.9 Cash, cash equivalents, and restricted cash at the beginning of the period 195.1 244.5 Cash, cash equivalents, and restricted cash at the end of the period $230.9 $269.4

Letter to Shareholders | Q3 2024 21 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO THEIR MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES (in millions, unaudited) Three Months Ended September 30 Nine Months Ended September 30 2024 2023 2024 2023 Net loss attributable to Hippo $(8.5) $(53.1) $(84.7) $(230.8) Adjustments: Net investment income (6.2) (5.7) (18.2) (16.5) Depreciation and amortization 5.9 4.9 17.4 14.4 Stock-based compensation 9.0 14.0 29.3 46.8 Fair value adjustments 0.3 0.6 2.2 4.3 Other one-off transactions 0.2 1.2 5.4 3.3 Income tax (benefit) expense — (0.3) 1.0 0.2 Impairment and restructuring charges — — 3.6 — Gain on sale of business (8.2) — (8.2) — Adjusted EBITDA $(7.5) $(38.4) $(52.2) $(178.3) SUPPLEMENTAL FINANCIAL INFORMATION (in millions, unaudited) Total Generated Premium Three Months Ended September 30 Nine Months Ended September 30 2024 2023 Change 2024 2023 Change Gross Written Premium $234.4 $229.5 $4.9 $686.8 $663.6 $23.2 Gross Placed Premium 133.6 74.2 59.4 354.8 202.7 152.1 Total Generated Premium $368.0 $303.7 $64.3 $1,041.6 $866.3 $175.3

Letter to Shareholders | Q3 2024 22 Gross and Net Loss Ratios Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Gross Losses and LAE $106.3 $124.5 $350.7 $450.9 Gross Earned Premium 213.4 210.7 632.1 563.0 Gross Loss Ratio 50% 59% 55% 81% Net Losses and LAE $51.6 $36.5 $164.6 $150.9 Net Earned Premium 70.6 32.9 195.5 69.0 Net Loss Ratio 73% 111% 84% 219% Gross Loss Ratio Breakdown Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 PCS Losses 11% 6% 10% 28% Non-PCS Losses 39% 53% 45% 53% Gross Loss Ratio 50% 59% 55% 81% Insurance Related Expenses Breakdown Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Amortization of deferred direct acquisition costs, net $11.7 $7.3 $35.8 $20.2 Employee-related costs 3.2 3.0 8.9 9.4 Underwriting costs 1.5 2.5 4.4 6.5 Amortization of capitalized internal use software 4.3 3.4 12.3 9.4 Other 1.9 4.1 6.5 9.3 Total $22.6 $20.3 $67.9 $54.8

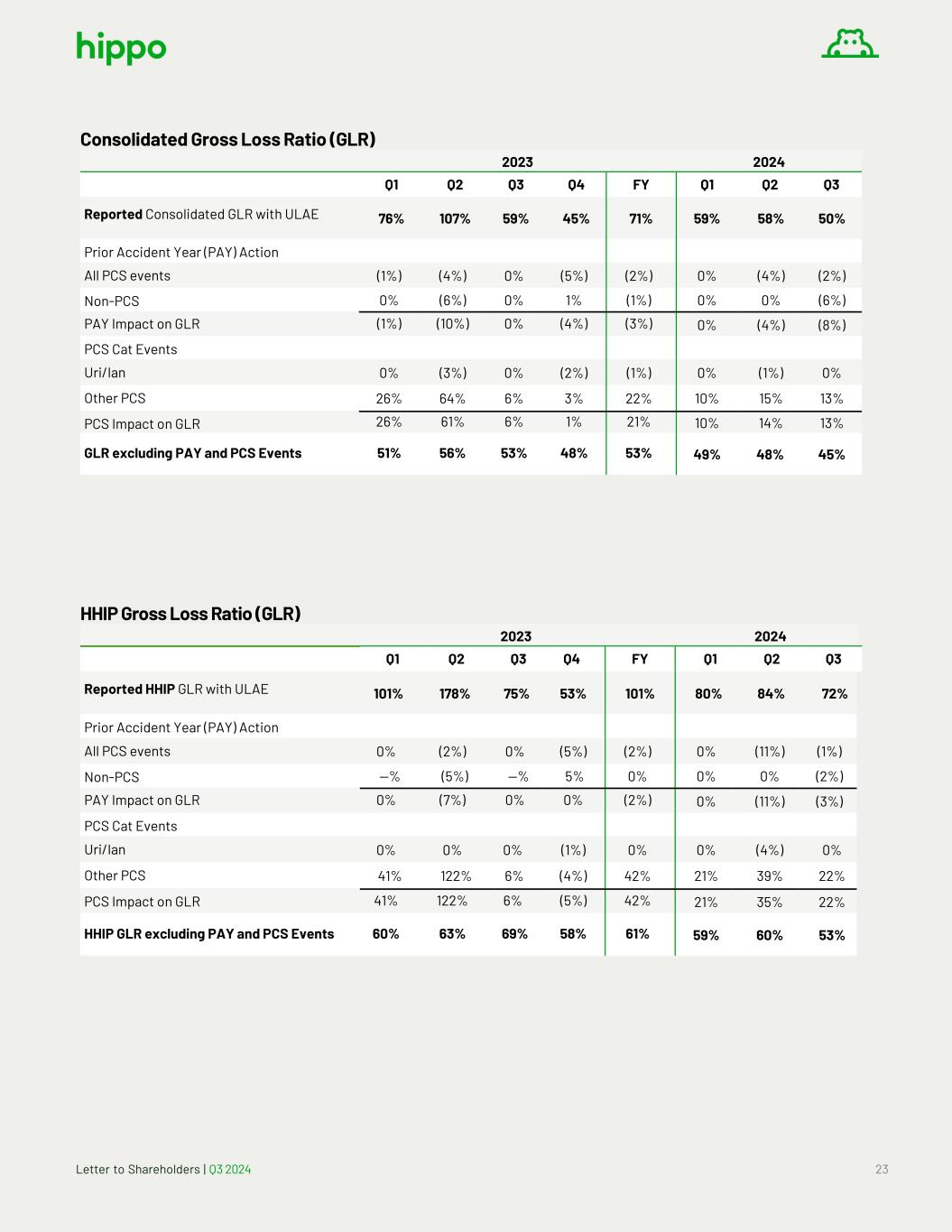

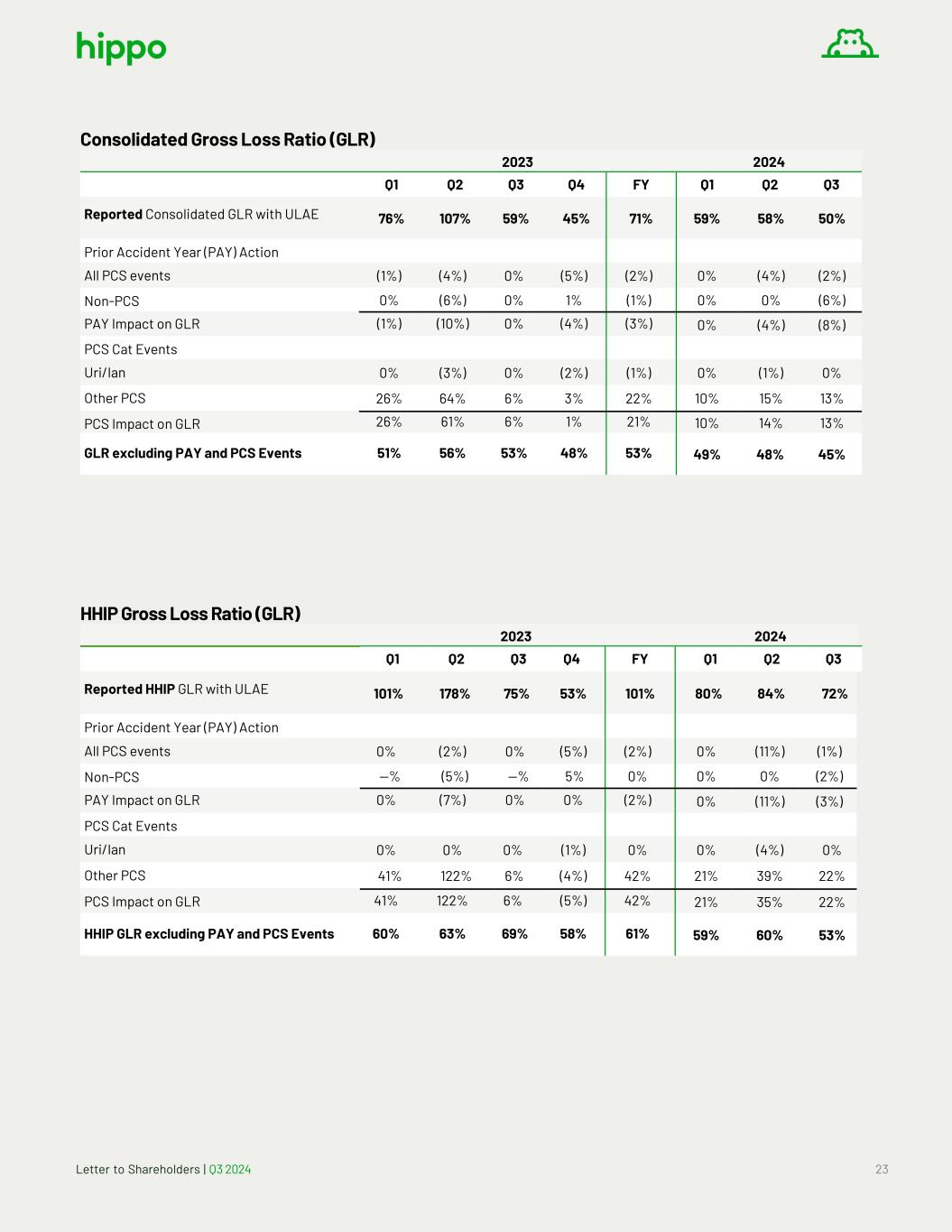

Letter to Shareholders | Q3 2024 23 Consolidated Gross Loss Ratio (GLR) 2023 2024 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Reported Consolidated GLR with ULAE 76% 107% 59% 45% 71% 59% 58% 50% Prior Accident Year (PAY) Action All PCS events (1%) (4%) 0% (5%) (2%) 0% (4%) (2%) Non-PCS 0% (6%) 0% 1% (1%) 0% 0% (6%) PAY Impact on GLR (1%) (10%) 0% (4%) (3%) 0% (4%) (8%) PCS Cat Events Uri/Ian 0% (3%) 0% (2%) (1%) 0% (1%) 0% Other PCS 26% 64% 6% 3% 22% 10% 15% 13% PCS Impact on GLR 26% 61% 6% 1% 21% 10% 14% 13% GLR excluding PAY and PCS Events 51% 56% 53% 48% 53% 49% 48% 45% HHIP Gross Loss Ratio (GLR) 2023 2024 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Reported HHIP GLR with ULAE 101% 178% 75% 53% 101% 80% 84% 72% Prior Accident Year (PAY) Action All PCS events 0% (2%) 0% (5%) (2%) 0% (11%) (1%) Non-PCS —% (5%) —% 5% 0% 0% 0% (2%) PAY Impact on GLR 0% (7%) 0% 0% (2%) 0% (11%) (3%) PCS Cat Events Uri/Ian 0% 0% 0% (1%) 0% 0% (4%) 0% Other PCS 41% 122% 6% (4%) 42% 21% 39% 22% PCS Impact on GLR 41% 122% 6% (5%) 42% 21% 35% 22% HHIP GLR excluding PAY and PCS Events 60% 63% 69% 58% 61% 59% 60% 53%

Letter to Shareholders | Q3 2024 24 SEGMENTS (in millions, unaudited) Three Months Ended September 30, 2024 Services Insurance-as- a-Service Hippo Home Insurance Program Intersegment Eliminations(1) Total Revenue: Net earned premium $ — $ 16.4 $ 54.2 $ — $ 70.6 Commission income, net 13.0 5.9 1.0 (4.2) 15.7 Service and fee income 0.1 — 2.9 — 3.0 Net investment income 0.1 3.1 3.0 — 6.2 Total revenue 13.2 25.4 61.1 (4.2) 95.5 Adjusted Operating Expenses: Loss and loss adjustment expense — 5.9 45.3 — 51.2 Insurance related expense — 7.9 12.2 (3.0) 17.1 Sales and marketing 8.0 — 1.5 (0.3) 9.2 Technology and development 2.5 0.1 2.8 — 5.4 General and administrative 2.7 1.7 6.2 — 10.6 Other expenses — — — — — Total adjusted operating expenses 13.2 15.6 68.0 (3.3) 93.5 Less: Net investment income (0.1) (3.1) (3.0) — (6.2) Less: Noncontrolling interest (3.3) — — — (3.3) Adjusted operating income (loss) (3.4) 6.7 (9.9) (0.9) (7.5) Net investment income 6.2 Depreciation and amortization (5.9) Stock-based compensation (9.0) Fair value adjustments (0.3) Other one-off transactions (0.2) Gain on sale of business 8.2 Income tax expense — Net loss attributable to Hippo $ (8.5) Income tax expense — Noncontrolling interest 3.3 Loss before income taxes $ (5.2) (1) Intersegment eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation).

Letter to Shareholders | Q3 2024 25 Three Months Ended September 30, 2023 Services Insurance-as- a-Service Hippo Home Insurance Program Intersegment Eliminations(1) Total Revenue: Net earned premium $ — $ 12.2 $ 20.7 $ — $ 32.9 Commission income, net 11.5 5.4 (0.5) (2.2) 14.2 Service and fee income 0.1 — 4.8 — 4.9 Net investment income — 1.8 3.9 — 5.7 Total revenue 11.6 19.4 28.9 (2.2) 57.7 Adjusted Operating Expenses: Loss and loss adjustment expense — 5.2 31.0 — 36.2 Insurance related expense — 7.1 9.4 (0.7) 15.8 Sales and marketing 10.6 — 4.3 (0.9) 14.0 Technology and development 4.5 0.2 4.3 — 9.0 General and administrative 3.3 1.5 7.7 — 12.5 Other expenses 0.1 — — — 0.1 Total adjusted operating expenses 18.5 14.0 56.7 (1.6) 87.6 Less: Net investment income — (1.8) (3.9) — (5.7) Less: Noncontrolling interest (2.8) — — — (2.8) Adjusted operating income (loss) (9.7) 3.6 (31.7) (0.6) (38.4) Net investment income 5.7 Depreciation and amortization (4.9) Stock-based compensation (14.0) Fair value adjustments (0.6) Other one-off transactions (1.2) Income tax benefit 0.3 Net loss attributable to Hippo $ (53.1) Income tax expense (0.3) Noncontrolling interest 2.8 Loss before income taxes $ (50.6) (1) Intersegment eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation).

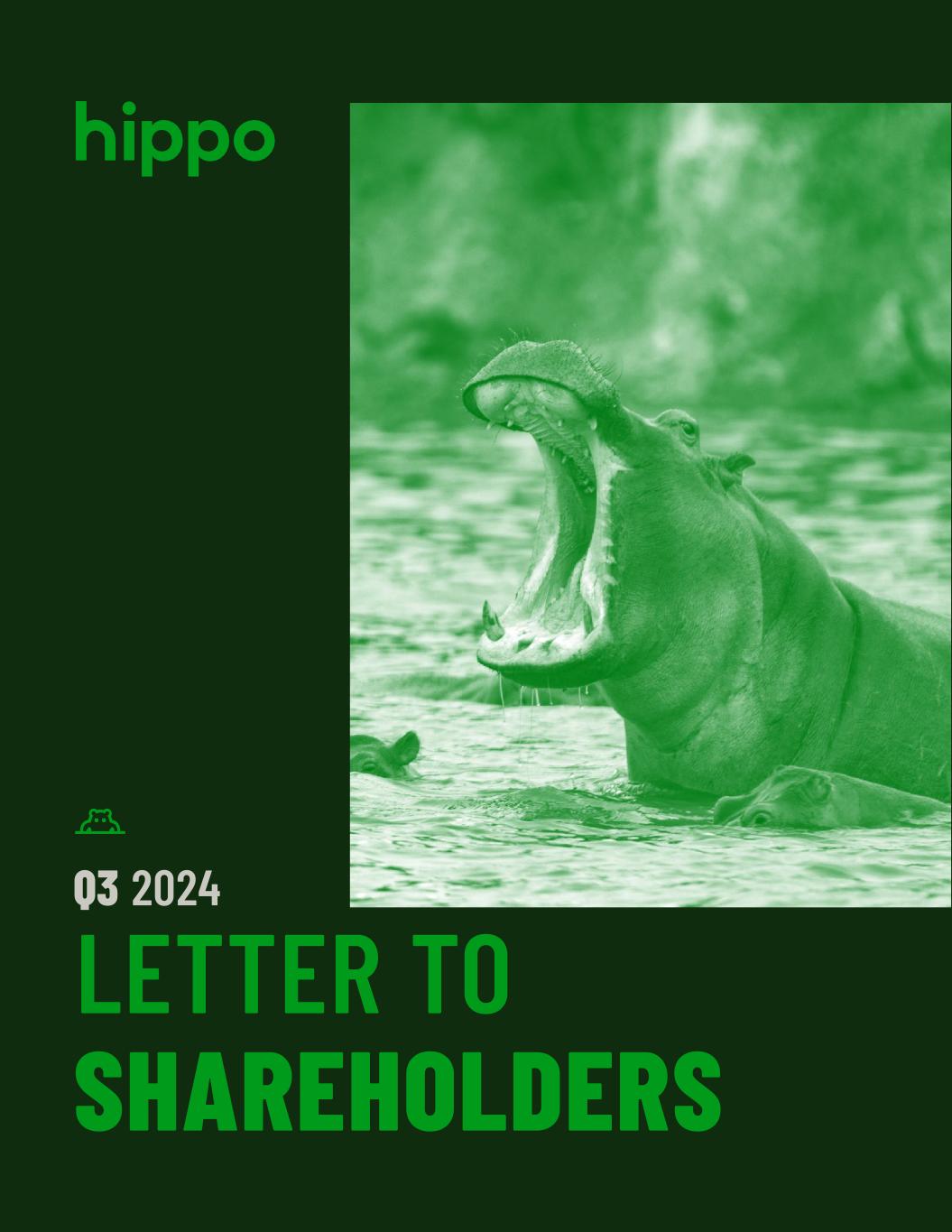

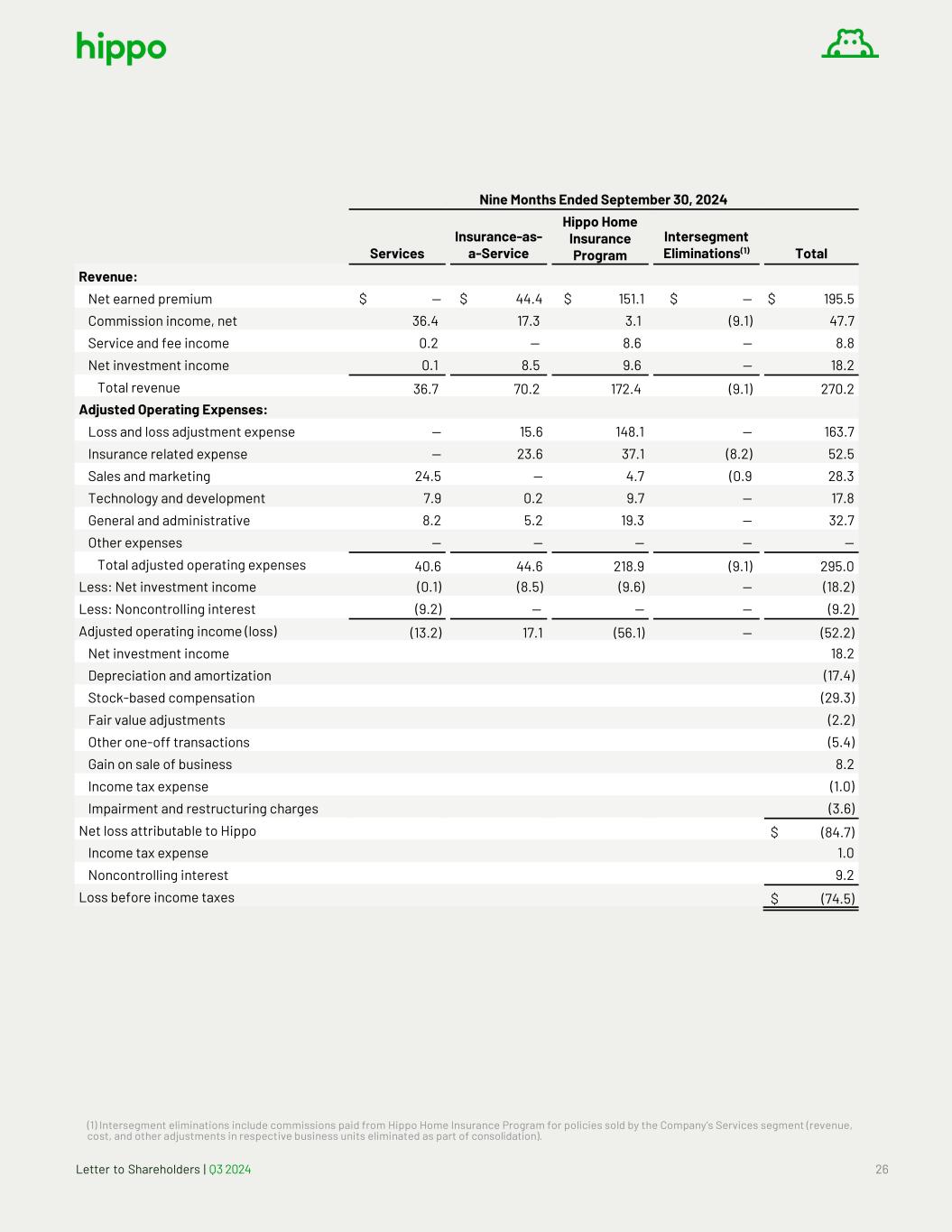

Letter to Shareholders | Q3 2024 26 Nine Months Ended September 30, 2024 Services Insurance-as- a-Service Hippo Home Insurance Program Intersegment Eliminations(1) Total Revenue: Net earned premium $ — $ 44.4 $ 151.1 $ — $ 195.5 Commission income, net 36.4 17.3 3.1 (9.1) 47.7 Service and fee income 0.2 — 8.6 — 8.8 Net investment income 0.1 8.5 9.6 — 18.2 Total revenue 36.7 70.2 172.4 (9.1) 270.2 Adjusted Operating Expenses: Loss and loss adjustment expense — 15.6 148.1 — 163.7 Insurance related expense — 23.6 37.1 (8.2) 52.5 Sales and marketing 24.5 — 4.7 (0.9 28.3 Technology and development 7.9 0.2 9.7 — 17.8 General and administrative 8.2 5.2 19.3 — 32.7 Other expenses — — — — — Total adjusted operating expenses 40.6 44.6 218.9 (9.1) 295.0 Less: Net investment income (0.1) (8.5) (9.6) — (18.2) Less: Noncontrolling interest (9.2) — — — (9.2) Adjusted operating income (loss) (13.2) 17.1 (56.1) — (52.2) Net investment income 18.2 Depreciation and amortization (17.4) Stock-based compensation (29.3) Fair value adjustments (2.2) Other one-off transactions (5.4) Gain on sale of business 8.2 Income tax expense (1.0) Impairment and restructuring charges (3.6) Net loss attributable to Hippo $ (84.7) Income tax expense 1.0 Noncontrolling interest 9.2 Loss before income taxes $ (74.5) (1) Intersegment eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation).

Letter to Shareholders | Q3 2024 27 Nine Months Ended September 30, 2023 Services Insurance-as- a-Service Hippo Home Insurance Program Intersegment Eliminations(1) Total Revenue: Net earned premium $ — $ 29.7 $ 39.3 $ — $ 69.0 Commission income, net 32.4 14.1 8.5 (7.2) 47.8 Service and fee income 0.4 — 11.5 — 11.9 Net investment income — 4.8 11.7 — 16.5 Total revenue 32.8 48.6 71.0 (7.2) 145.2 Adjusted Operating Expenses: Loss and loss adjustment expense — 11.7 138.2 — 149.9 Insurance related expense — 16.0 27.9 (2.3) 41.6 Sales and marketing 33.9 — 14.4 (3.3) 45.0 Technology and development 12.3 0.5 13.6 — 26.4 General and administrative 9.3 4.1 23.1 — 36.5 Other expenses 0.5 — — — 0.5 Total adjusted operating expenses 56.0 32.3 217.2 (5.6) 299.9 Less: Net investment income — (4.8) (11.7) — (16.5) Less: Noncontrolling interest (7.1) — — — (7.1) Adjusted operating income (loss) (30.3) 11.5 (157.9) (1.6) (178.3) Net investment income 16.5 Depreciation and amortization (14.4) Stock-based compensation (46.8) Fair value adjustments (4.3) Other one-off transactions (3.3) Income tax expense (0.2) Net loss attributable to Hippo $ (230.8) Income tax expense 0.2 Noncontrolling interest 7.1 Loss before income taxes $ (223.5) (1) Intersegment eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation).

Letter to Shareholders | Q3 2024 28 Summary Segment Information (in millions, unaudited) Three Months Ended September 30, Total Generated Premium: 2024 2023 % Change Services $177.9 $121.6 46% Insurance-as-a-service 159.3 141.8 12% Hippo Home Insurance Program 77.6 95.0 (18)% Eliminations (46.8) (54.7) Total 368.0 303.7 21% Revenue: 2024 2023 Services $13.2 $11.6 14% Insurance-as-a-service 25.4 19.4 31% Hippo Home Insurance Program 61.1 28.9 111% Eliminations (4.2) (2.2) Total 95.5 57.7 66% Adjusted Operating Expenses: 2024 2023 Services $13.2 $18.5 (29)% Insurance-as-a-service 15.6 14.0 11% Hippo Home Insurance Program 68.0 56.7 20% Eliminations (3.3) (1.6) Total 93.5 87.6 7% Services Noncontrolling Interest $(3.3) $(2.8) 18% Adjusted Operating Income (Loss): 2024 2023 Services $(3.4) $(9.7) (65)% Insurance-as-a-service 6.7 3.6 86% Hippo Home Insurance Program (9.9) (31.7) (69)% Eliminations (0.9) (0.6) Total (7.5) (38.4) (80)%

Letter to Shareholders | Q3 2024 29