The information in this preliminary proxy statement/prospectus is not complete and may be changed. The registrant may not sell the securities described in this preliminary proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission is declared effective. This preliminary proxy statement/prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 15, 2021

PROXY STATEMENT FOR

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS OF

REINVENT TECHNOLOGY PARTNERS Y

(A CAYMAN ISLANDS EXEMPTED COMPANY)

PROSPECTUS FOR

634,966,482 SHARES OF COMMON STOCK AND

12,218,750 REDEEMABLE WARRANTS

OF

REINVENT TECHNOLOGY PARTNERS Y

(AFTER ITS DOMESTICATION AS A CORPORATION INCORPORATED IN

THE STATE OF DELAWARE),

THE CONTINUING ENTITY FOLLOWING THE DOMESTICATION,

WHICH WILL BE RENAMED “AURORA INNOVATION, INC.”

IN CONNECTION WITH THE MERGER DESCRIBED HEREIN

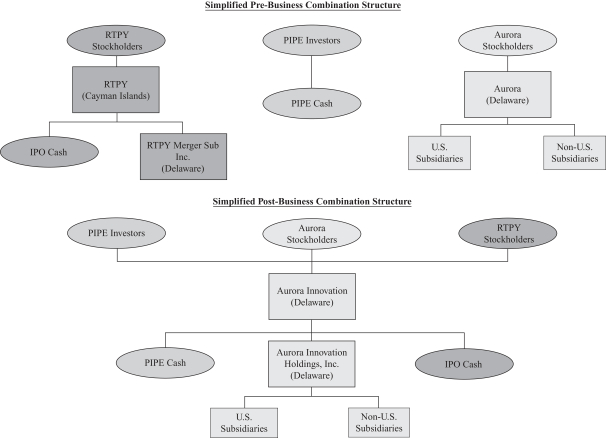

The transaction committee formed by the board of directors (the “Transaction Committee”) of Reinvent Technology Partners Y, a Cayman Islands exempted company (“RTPY” and, after the Domestication as described below, “Aurora Innovation”), has unanimously approved (1) the domestication of RTPY as a Delaware corporation (the “Domestication”); (2) the merger of RTPY Merger Sub Inc. (“Merger Sub”), a Delaware corporation and subsidiary of RTPY, with and into Aurora Innovation, Inc. (“Aurora”), a Delaware corporation (the “Merger” and, together with the Domestication, the “Business Combination”), with Aurora surviving the Merger as a wholly owned subsidiary of Aurora Innovation, pursuant to the terms of the Agreement and Plan of Merger, dated as of July 14, 2021, by and among RTPY, Merger Sub and Aurora, attached to this proxy statement/prospectus as Annex A (the “Merger Agreement”), as more fully described elsewhere in this proxy statement/prospectus; and (3) the other transactions contemplated by the Merger Agreement and documents related thereto. In connection with the Merger, RTPY will change its name to “Aurora Innovation, Inc.”

RTPY formed the Transaction Committee, consisting of all of the members of the board of directors of RTPY other than Reid Hoffman and Karen Francis, to evaluate and make any decision on behalf of the full board of directors of RTPY with respect to the Business Combination with Aurora Innovation. Ms. Francis, who is also a director of TuSimple Holdings Inc., is not a member of the Transaction Committee, was not permitted to attend any sessions of the Transaction Committee, and has recused herself from discussions of the board of directors of RTPY about the Business Combination and voting on matters related to the Business Combination. Reid Hoffman, a non-voting observer on the board of directors of RTPY and a member of Aurora’s board of directors, was not a member of the Transaction Committee, was not permitted to attend any sessions of the Transaction Committee, and has recused himself from discussions and decisions of the board of directors of RTPY about the Business Combination. Mr. Hoffman also recused himself from discussions of the Aurora board of directors or management about the Business Combination and voting on matters related to the Business Combination.

As a result of and upon the effective time of the Domestication, among other things, (1) each of the then issued and outstanding Class A ordinary shares, par value $0.0001 per share, of RTPY (the “RTPY Class A ordinary shares”), will convert automatically, on a one-for-one basis, into one share of Class A common stock, par value $0.0001 per share, of Aurora Innovation (the “Aurora Innovation Class A common stock”), (2) each of the then issued and outstanding Class B ordinary shares, par value $0.0001 per share, of RTPY (the “RTPY Class B ordinary shares”), will convert automatically, on a one-for-one basis, into one share of Aurora Innovation Class A common stock (which shares are not being registered pursuant to the registration statement of which this proxy statement/prospectus forms a part), (3) each then issued and outstanding warrant of RTPY (the “RTPY warrants”) will convert automatically into a warrant to acquire one share of Aurora Innovation Class A common stock (the “Aurora Innovation warrants”) pursuant to the Warrant Agreement, dated as of March 15, 2021 (the “Warrant Agreement”), between RTPY and Continental Stock Transfer & Trust Company (“Continental”), as warrant agent, and (4) each then issued and outstanding unit of RTPY (the “RTPY units”) will separate automatically into one share of Aurora Innovation Class A common stock, on a one-for-one basis, and one-eighth of one Aurora Innovation warrant. Accordingly, this proxy statement/prospectus covers (1) 97,750,000 shares of Aurora Innovation Class A common stock to be issued in the Domestication and (2) 12,218,750 Aurora Innovation warrants to be issued in the Domestication.

At the effective time of the Merger, among other things, all outstanding shares of Aurora capital stock (after giving effect to the Pre-Closing Restructuring, as more fully described elsewhere in this proxy statement/prospectus), together with shares of Aurora common stock reserved in respect of Aurora Awards (as defined below) outstanding as of immediately prior to the effective time of the Merger that will be converted into awards based on Aurora Innovation Class A common stock, will be cancelled in exchange for the right to receive, or the reservation of, an aggregate of 627,541,299 shares of Aurora Innovation Class A common stock (at a deemed value of $10.00 per share) and an aggregate of 485,108,408 shares of Aurora Innovation Class B common stock (at a deemed value of $10.00 per share), which, in the case of Aurora Awards, will be shares underlying awards based on Aurora Innovation Class A common stock, representing a pre-transaction equity value of Aurora of $11.0 billion. Specifically, after giving effect to the Pre-Closing Restructuring, (a) each share of Aurora common stock will be cancelled and converted into the right to receive a number of shares of Aurora Innovation Class A common stock equal to the quotient obtained by dividing (i) the number of shares Aurora Innovation common stock equal to the quotient obtained by dividing (x)$11.0 billion, representing the pre-transaction equity value of Aurora by (y) $10.00 (such quotient, the “Aggregate