Exhibit 10.21

OFFICE LEASE

BY AND BETWEEN

M WEST PROPCO XX, LLC,

a Delaware limited liability company

as Landlord

and

ENOVIX CORPORATION,

a Delaware corporation

as Tenant

For Premises located at

3501 W. Warren Avenue,

Fremont, California

MWest Lease Propco XX. LLC

[Enovix Corporation]

LEASE

This Lease is dated as of the date specified in Section A of the Summary of Basic Lease Terms and is made by and between the party identified as Landlord in Section B of the Summary and the party identified as Tenant in Section C of the Summary.

SUMMARY OF BASIC LEASE TERMS

| SECTION | |

| (LEASE REFERENCE) | TERMS |

| | |

| A. | Date: | December 4, 2013 |

| | | |

| B. | Landlord: | M West Propco XX, LLC |

| | | a Delaware limited liability company |

| | | |

| C. | Tenant: | Enovix Corporation, |

| | | a Delaware corporation |

| | | |

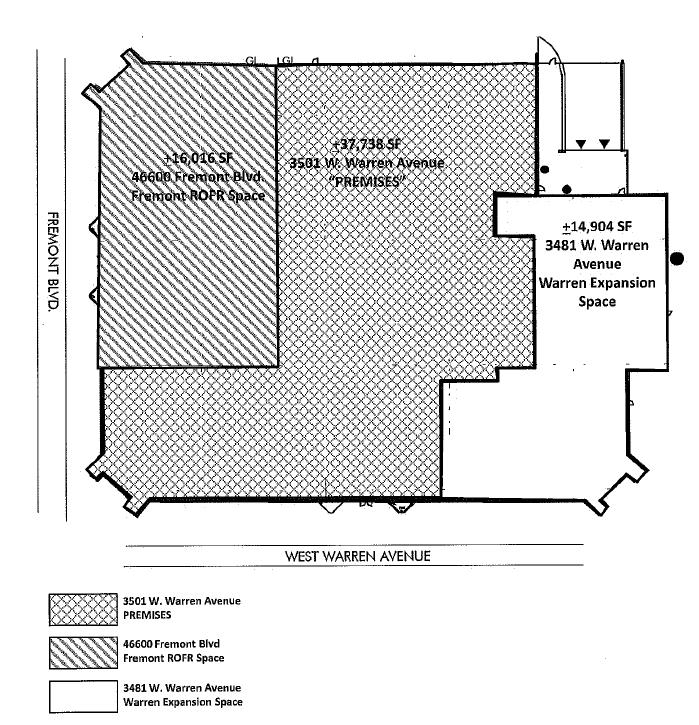

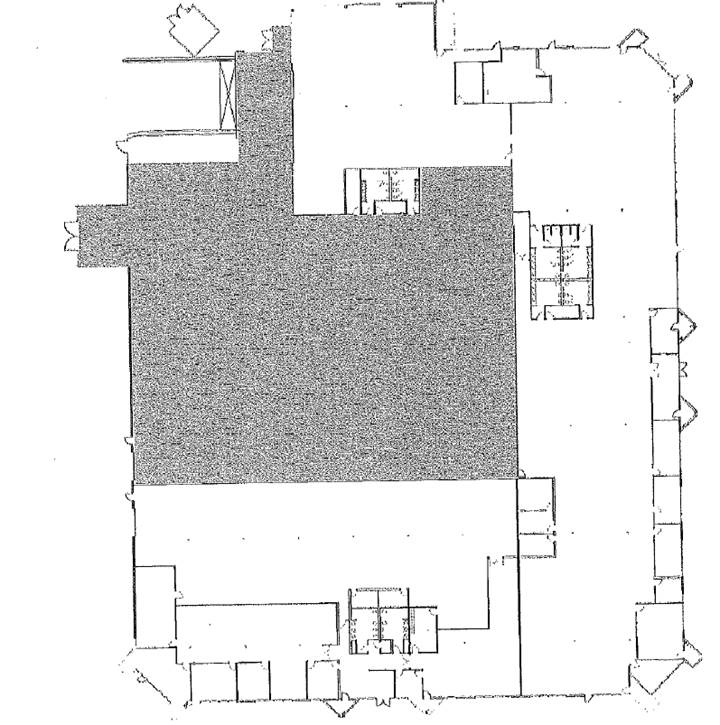

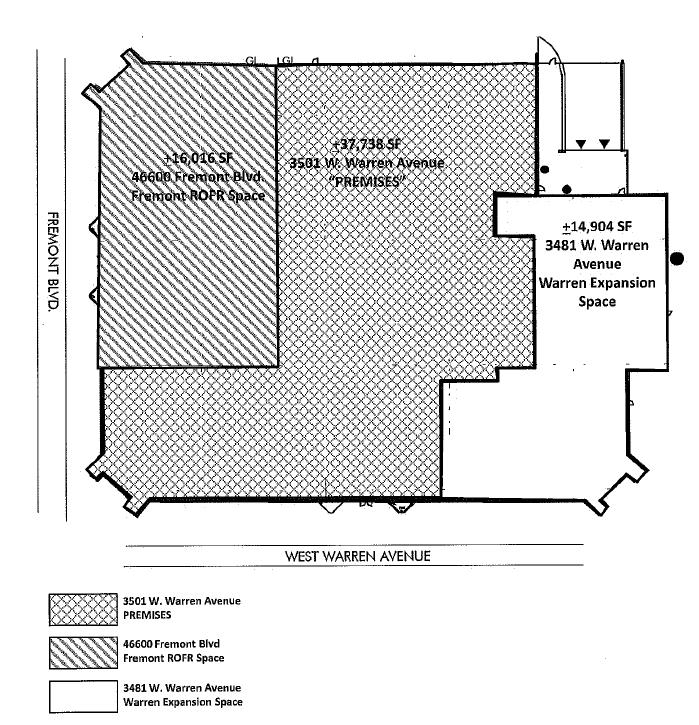

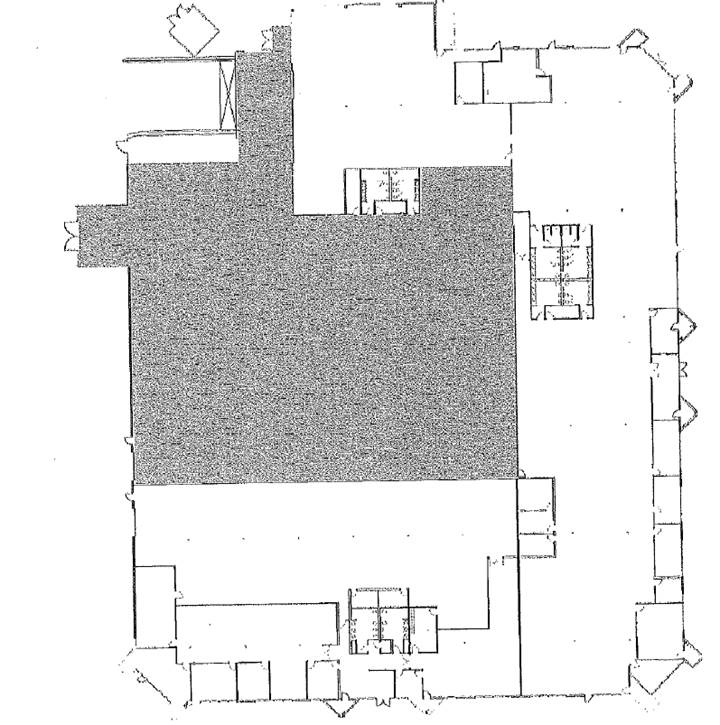

| D. | Premises: (§ 1.1) | That area consisting of approximately 37,738 rentable square feet of space in the Building and commonly known as 3501W. Warren Avenue, as further set forth on Exhibit A attached hereto.�� |

| | | |

| E. | Building: (§ 1.2) | That certain one (1) story office building consisting of approximately 68,658 rentable square feet and located at the intersection of W. Warren Avenue and Fremont Boulevard, Fremont, California. |

| | | |

| F. | Project: | That certain office project described further in Section 1.1.2 of this Lease. |

| | (§ 1.2) | |

| | | |

| G. | Tenant’s Share: (§ 3.2.2.5) | 54.9652% of the Building, based on the ratio that the rentable square footage of the Premises bears to the total rentable square footage in the Building. |

| | | |

| H. | Tenant’s Allocated Parking: (Art. 19) | 3.3 unreserved parking passes for every 1,000 rentable square feet of the Premises (i.e., one hundred twenty-four (124) unreserved parking passes, based on 37,738 rentable square feet in the Premises). |

| | | |

| I. | Lease Term: | Eighty-four (84) months (plus any partial month at the beginning of the Lease Term). |

| | (§ 2.1) | |

| | | |

| J. | Lease Commencement Date: (§ 2.1) | The earlier to occur of (i) the date upon which Tenant first commences to conduct business in the Premises, and (ii) January 1, 2014, |

| | | |

| K. | Lease Expiration Date: (§ 2.1) | The last day of the calendar month in which the seventh (7th) anniversary of the Lease Commencement Date occurs; provided, however, to the extent the Lease Commencement Date occurs on the first day of a calendar month, then the Lease Expiration Date shall be the day immediately preceding the seventh (7th) anniversary of the Lease Commencement Date. |

| L. | Base Monthly Rent: | |

| | (§ 3.1) | |

| | | | | | | | | Approximate Monthly | |

| Period During | | | | | | | | Base Rental Rate per | |

| Lease Term | | Annual Base Rent | | | Base Monthly Rent* | | | Rentable Square Foot | |

| Lease Months 1 – 12** | | $ | 375,870.48 | | | $ | 31,322.54 | | | $ | 0.83 | |

| Lease Months 13 – 24 | | $ | 389,025.95 | | | $ | 32,418.83 | | | $ | 0.86 | |

| Lease Months 25 – 36 | | $ | 402,641.85 | | | $ | 33,553.49 | | | $ | 0.89 | |

| Lease Months 37 – 48 | | $ | 416,734.32 | | | $ | 34,727.86 | | | $ | 0.92 | |

| Lease Months 49 – 60 | | $ | 431,320.02 | | | $ | 35,943.34 | | | $ | 0.95 | |

| Lease Months 61 – 72 | | $ | 446,416.22 | | | $ | 37,201.35 | | | $ | 0.99 | |

| Lease Months 73 – 84 | | $ | 462,040.79 | | | $ | 38,503.40 | | | $ | 1.02 | |

*The initial installment of Base Monthly Rent was calculated by multiplying the initial Approximate Monthly Base Rental Rate per Rentable Square Foot by the number of rentable square feet of space in the Premises, and the Annual Base Rent was calculated by multiplying the corresponding installment of Base Monthly Rent by twelve (12). In all subsequent Base Rent payment periods during the Lease Term, the calculation of Annual Base Rent (and subsequent installment of Base Monthly Rent) reflects an annual increase of three and one-half percent (3.5%).

**Subject to the terms set forth in Section 3.1 below, the monthly installment of Base Monthly Rent for the first nine (9) Lease Months shall be abated.

| M. | Prepaid Rent: | $31,332.54. |

| | (§ 3.3) | |

| | | |

| N. | Security Deposit: | $38,503.40, subject to the terms of Section 3.6 of the Lease. |

| | (§ 3.6) | |

| | | |

| O. | Permitted Use: (§ 4.1) | The Premises shall be used solely for (i) general office use, (ii) research and development, product testing and laboratory use, (iii) light manufacturing, (iv) storage, and (v) uses incidental to the foregoing (collectively, the “Permitted Uses”) in connection with Tenant’s production of small batteries, to the extent consistent with the Project, but for no other purpose, and in all cases subject to the terms and conditions set forth in Article 4 of the Lease and all applicable Laws. |

| P. | Landlord’s Address: | M West Propco XX, LLC |

| | | c/o MWest Properties |

| | | 3351 Olcott Street |

| | | Santa Clara, CA 95054 |

| | | Attn: Property Manager |

| | | |

| | With copies to: | DivcoWest Real Estate Services, Inc. |

| | | 575 Market Street, 35th floor |

| | | San Francisco, CA 94105 |

| | | Attn: Steve Novick |

| | | |

| | | and: |

| | | |

| | | DivcoWest Real Estate Services, Inc. |

| | | 575 Market Street, 35th Floor |

| | | San Francisco, CA 94105 |

| | | Attn: Jackie Moore, Esq. |

| | | |

| | | and: |

| | | |

| | | Allen Matkins Leck Gamble Mallory & Natsis LLP |

| | | 1901 Avenue of the Stars, Suite 1800 |

| | | Los Angeles, CA 90067 |

| | | Attn: Tony N. Natsis, Esq. |

| | | |

| Q. | Tenant’s Address: | Enovix Corporation |

| | | 3481 W. Warren Avenue |

| | | Fremont, California 94538 |

| | | |

| R. | Brokers: | Tenant’s Broker: |

| | (§ 21.30) | CBRE, Inc. |

| | | 225 W. Santa Clara St., 10th Floor |

| | | San Jose, CA 95113 |

| | | Attention: Tom Taylor, Chris Shepherd |

| | | |

| | | Landlord’s Broker: |

| | | CBRE, Inc. |

| | | 225 W. Santa Clara St., 10th Floor |

| | | San Jose, CA 95113 |

| | | Attention: Sherman Chan, Joe Kelly, Matt Wersel |

| | | |

| S. | Intentionally Omitted | |

| | | |

| T. | Tenant Improvement Allowance: | $320,000.00. |

| | (§ 2.1 of Exhibit B) | |

The foregoing Summary is hereby incorporated into and made a part of this Lease. Each reference in this Lease to any term of the Summary shall mean the respective information set forth above and shall be construed to incorporate all of the terms provided under the particular paragraph pertaining to such information. In the event of any conflict between the Summary and the Lease, the Summary shall control.

ARTICLE 1

PREMISES, BUILDING, PROJECT AND COMMON AREAS

1.1 Premises. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, the Premises set forth in Section D of the Summary for the Lease Term and upon the terms and conditions set forth in this Lease. Landlord reserves the right to use the exterior walls, floor, and roof in, beneath and above the Premises for the installation, repair, maintenance, use, and replacement of structural systems, utility lines and systems, ducts, wires, conduits and pipes leading through the Premises as Landlord deems necessary. In exercising its rights reserved herein, Landlord shall not unreasonably interfere with the operation of Tenant’s business operations from the Premises.

1.2 Building and Project. The Premises are a part of the building set forth in Section E of the Summary (the “Building”). The Building is part of the office project set forth in Section F of the Summary. The term “Project”, as used in this Lease, shall mean (i) the Building and the Common Areas (as defined in Section 1.3 below), (ii) the land (as improved with any landscaping, parking improvements and other improvements) upon which the Building and the Common Areas are located, and (iii) at Landlord’s reasonable discretion, any additional real property, areas, land, buildings or other improvements added thereto outside of the Project.

1.3 Common Areas. Tenant shall have the non-exclusive right to use in common with other tenants and occupants at the Project, and subject to any rules and regulations promulgated by Landlord from time to time pursuant to Section 4.5 of this Lease, those portions of the Project which are provided, from time to time, for use in common by Landlord, Tenant and any other tenants or occupants at the Project (such areas, together with such other portions of the Project designated by Landlord, in its discretion, are collectively referred to herein as the “Common Areas”). The manner in which the Common Areas are maintained and operated shall be at the reasonable discretion of Landlord and the use thereof shall be subject to any rules and regulations, as amended, promulgated by Landlord from time to time in Landlord’s reasonable discretion. Landlord reserves the right to temporarily close, make alterations or additions to, or change the location of elements of the Project and the Common Areas. Landlord reserves the right, without the same constituting an actual or constructive eviction and without entitling Tenant to any abatement of Rent, to: (i) close any part of the Common Areas to whatever extent required in Landlord’s opinion to prevent a dedication thereof or the accrual of any prescriptive rights therein; (ii) temporarily close the Common Areas to perform repairs or maintenance, or for any other reason deemed necessary by Landlord; (iii) change the shape, size, location and extent of the Common Areas; (iv) eliminate from or add to the Common Areas any land or improvement; (v) make changes to the Common Areas including, without limitation, changes in the location of driveways, entrances, passageways, doors and doorways, elevators, stairs, restrooms, exits, parking spaces, parking areas, sidewalks or the direction of the flow of traffic and the site of the Common Areas; and (vi) change the name or address of the Building or Project. In exercising its rights with regard to the Common Area set forth above, Landlord shall use commercially reasonable efforts to not materially interfere with Tenant’s use of, or access to, the Premises.

1.4 Rentable Square Feet of Premises. Landlord and Tenant hereby stipulate and agree that the rentable square footage of the Premises is as set forth in Section D of the Summary.

1.5 Expansion Space. Landlord hereby grants to the originally named Tenant herein (“Original Tenant”) and any “Permitted Assignee” (as that term is defined in Section 14.9 below) the option to lease approximately 14,904 rentable square feet of space in the Building, which space is commonly known as 3481 W. Warren Avenue (the “Warren Expansion Space”), upon the terms and conditions set forth in this Section 1.5 and this Lease.

1.5.1. Method of Exercise. The expansion option contained in this Section 1.5 shall be exercised only by Original Tenant and any Permitted Assignee (and not by any assignee, sublessee or other “Transferee,” as that term is defined in Section 14.1 of this Lease, of Tenant’s interest in this Lease). If Tenant elects to exercise its expansion option, then on or before the first (1st) anniversary of the Lease Commencement Date (for purposes of this Section 1.5, such period between the Lease Commencement Date and the first (1st) anniversary of such Lease Commencement Date shall be referred to as the “Expansion Period”), Tenant shall deliver written notice to Landlord stating that Tenant has elected to exercise its expansion option with respect to the Warren Expansion Space (“Tenant’s Expansion Notice”).

1.5.2. Delivery of the Warren Expansion Space. Landlord shall deliver the Warren Expansion Space to Tenant, and the term of Tenant’s lease of the Warren Expansion Space shall commence on the date that occurs five (5) business days after the parties execute the “Expansion Space Amendment” (as that term is defined in Section 1.5.7 below) and Landlord has received the “Expansion Space Security Deposit” (as that term is defined in Section 1.5.6 below) from Tenant (the “Warren Expansion Space Commencement Date”) and shall expire on the Lease Expiration Date, as the same shall be extended pursuant to Section 1.5.3 below.

1.5.3. Lease Expiration Date. As of the Warren Expansion Space Commencement Date, the Lease Expiration Date shall be extended to the last day of the calendar month in which the tenth (10th) anniversary of the Lease Commencement Date occurs (provided, however, to the extent the Lease Commencement Date occurs on the first day of a calendar month, then the new Lease Expiration Date shall be the day immediately preceding the tenth (10th) anniversary of the Lease Commencement Date).

1.5.4. Base Monthly Rent.

1.5.4.1 Initial Premises. Effective as of the next installment of Base Monthly Rent due and payable by Tenant after the Warren Expansion Space Commencement Date, the Monthly Base Rental Rate per rentable square foot of the initial Premises shall increase by Zero and 30/100 Dollars ($0.30) per rentable square foot until the next anniversary of the Lease Commencement Date, and thereafter, on each anniversary of the Lease Commencement Date, the Monthly Base Rental Rate for the initial Premises shall increase by three and one-half percent (3.5%), which product shall be further increased by Zero and 30/100 Dollars ($0.30) per rentable square foot, and then that sum shall be multiplied by the total rentable square footage for the initial Premises.

1.5.4.2 Warren Expansion Space. The Monthly Base Rental Rate per rentable square foot payable by Tenant for the Warren Expansion Space shall be equal to the Monthly Base Rental Rate per rentable square foot then due and payable by Tenant for the initial Premises pursuant to the terms and conditions of this Lease (including, without limitation, Section 1.5.4.1 above).

1.5.5. Construction of Expansion Space. Tenant shall take the Warren Expansion Space in its then existing, “AS-IS” condition as of the Warren Expansion Space Commencement Date. Upon the Warren Expansion Space Commencement Date, Section T of the Summary of this Lease shall be amended to delete the figure “$320,000.00” and replace with the figure “$2,070,000.00,” which amount may be applied to costs relating to the design and construction of Tenant’s improvements that are permanently affixed to the initial Premises and/or the Warren Expansion Space. The construction of improvements in the Warren Expansion Space shall comply with the terms of Exhibit B attached to this Lease.

1.5.6. Security Deposit.

1.5.6.1 In General. As part of the “Expansion Space Amendment” (as that term is defined in Section 1.5.7 below), the Security Deposit shall be increased to an amount equal to nine (9) months of Base Monthly Rent for the entire Premises (i.e., the initial Premises and the Warren Expansion Space) for the last month of the Lease Term (as the same may be extended pursuant to Section 1.5.3 above). Concurrently with Tenant’s execution of the Expansion Space Amendment, Tenant shall deliver to Landlord an amount equal to the difference between (i) such amount, and (ii) the amount of the Security Deposit then held by Landlord (such amount, the “Expansion Space Security Deposit”) as security for the faithful performance by Tenant of the terms, covenants and conditions of the Lease. Notwithstanding anything to the contrary set forth in this Lease, the parties hereby agree that the “Initial Security Deposit” and any “Additional Security Deposit” (as those terms are defined in Section 3.6 below) and the Expansion Space Security Deposit shall collectively be treated as a single “Security Deposit” for all purposes under the Lease.

1.5.6.2 Reduction of Security Deposit. As of the Warren Expansion Space Commencement Date, subject to the terms of this Section 1.5.6.2, the amount of the Security Deposit shall be reduced by twenty-five percent (25%) during the Lease Term on the third (3rd) anniversary of the Lease Commencement Date, and each anniversary thereafter, through and including the seventh (7th) anniversary of the Lease Commencement Date (each of the third (3rd), fourth (4th), fifth (5th), sixth (6th) and seventh (7th) anniversaries of the Lease Commencement Date, a “Reduction Date”). Notwithstanding the foregoing or any provision to the contrary in this Lease, the Security Deposit shall not reduce on any Reduction Date to the extent that Tenant fails to tender to Landlord evidence reasonably satisfactory to Landlord that Tenant satisfies the “Reduction Conditions” (as that term is defined below). For purposes of this Section 1.5.6.2, the “Reduction Conditions” shall mean (a) Tenant has timely paid all monthly installments of “Rent” (as that term is defined in Section 3.2 below) under this Lease, (b) no monetary or material non-monetary default exists under this Lease, and (c) Tenant’s tangible net worth, as evidenced by financial statements delivered to Landlord and certified by an independent certified public accountant in accordance with generally accepted accounting principles that are consistently applied (“Net Worth”), is at least equal to Tenant’s Net Worth as of the date of this Lease.

1.5.7. Amendment to Lease. If Tenant timely exercises Tenant’s right to lease the Warren Expansion Space as set forth herein, then, within fifteen (15) days thereafter, Landlord and Tenant shall execute an amendment (the “Expansion Space Amendment”) adding the Warren Expansion Space to this Lease upon the same terms and conditions as the initial Premises, except as otherwise set forth in this Section 1.5. For purposes of calculating Tenant’s obligations under Article 3 of this Lease, Tenant’s Share shall be increased by an amount equal to the rentable square footage of the Warren Expansion Space leased by Tenant pursuant to this Section 1.5 divided by the total rentable square footage of the Building. Except to the extent inconsistent with the provisions of this Section 1.5, all provisions of the Lease which vary based upon the rentable square footage of the Premises shall be adjusted to reflect the addition of the Warren Expansion Space to the Premises. The Expansion Space Amendment, if applicable, shall be executed by Landlord and Tenant within fifteen (15) days following Tenant’s exercise of its expansion option for the Warren Expansion Space; provided, however, an otherwise valid exercise of Tenant’s expansion option shall be of full force and effect irrespective of whether the Expansion Space Amendment is timely signed by Landlord and Tenant.

1.5.8. Termination of Expansion Option. The rights contained in this Section 1.5 shall be personal to Original Tenant, and may only be exercised by Original Tenant and its Permitted Assignees (and not by any assignee, sublessee, or other Transferee of Tenant’s interest in this Lease) if the Lease then remains in full force and effect and if Original Tenant or its Permitted Assignee occupies the entire Premises. Tenant shall not have the right to lease the Warren Expansion Space as provided in this Section 1.5 if, as of the date of the attempted exercise of the expansion option by Tenant, or as of the scheduled Warren Expansion Space Commencement Date, Tenant is in monetary or material non-monetary default under this Lease . If Tenant fails to exercise the expansion option set forth in this Section 1.5 prior to the expiration of the Expansion Period, then Tenant’s expansion option shall automatically terminate and be of no further force or effect.

1.6 Right of First Refusal with respect to 46600 Fremont Boulevard. If, and only if, Tenant timely exercises its expansion option described in Section 1.5 of this Lease with respect to the Warren Expansion Space, and subject to the terms and conditions of this Section 1.6 below, Landlord hereby grants to the Original Tenant and its Permitted Assignees a one-time right of first refusal with respect to approximately 16,016 rentable square feet of space in the Building, which space is commonly known as 46600 Fremont Boulevard (the “Fremont ROFR Space”).

1.6.1. Procedure for Offer. Landlord shall notify Tenant (the “Fremont ROFR Notice”) during the twelve (12) month period following the date of Tenant’s Expansion Notice (the “ROFR Period”) when and if Landlord has agreed to the fundamental economic terms for lease of the Fremont ROFR Space to a third party. Pursuant to such Fremont ROFR Notice, Landlord shall offer to lease to Tenant the Fremont ROFR Space. The Fremont ROFR Notice shall describe the Fremont ROFR Space, and the lease term, rent and other fundamental economic terms and conditions upon which Landlord proposes to lease such Fremont ROFR Space to a third party.

1.6.2. Procedure for Acceptance. If Tenant wishes to exercise Tenant’s right of first refusal with respect to the Fremont ROFR Space described in the Fremont ROFR Notice, then within five (5) business days of delivery of the Fremont ROFR Notice to Tenant, Tenant shall deliver notice to Landlord of Tenant’s exercise of its right of first refusal with respect to all of the Fremont ROFR Space described in the Fremont ROFR Notice, at the rent, for the term, and upon the other fundamental economic terms and conditions contained in such Fremont ROFR Notice. If Tenant does not so notify Landlord within such five (5) business day period of Tenant’s exercise of its first refusal right, then Landlord shall be free to negotiate and enter into a lease for the Fremont ROFR Space with anyone whom it desires on any terms Landlord desires.

1.6.3. Amendment to Lease. If Tenant timely exercises Tenant’s right of first refusal to lease the Fremont ROFR Space as set forth herein, Landlord and Tenant shall, within fifteen (15) days thereafter, execute an amendment (the “ROFR Space Amendment”) adding the Fremont ROFR Space to this Lease upon the express terms and conditions set forth in the Fremont ROFR Notice, but otherwise upon the terms and conditions set forth in this Lease and this Section 1.6. The ROFR Space Amendment, if applicable, shall be executed by Landlord and Tenant within fifteen (15) days following Tenant’s exercise of its right to lease the Fremont ROFR Space; provided, however, an otherwise valid exercise of Tenant’s right of first refusal shall be of full force and effect irrespective of whether the ROFR Space Amendment is timely signed by Landlord and Tenant.

1.6.4. Termination of First Refusal Right. The rights contained in this Section 1.6 shall be personal to Original Tenant, and may only be exercised by Original Tenant and its Permitted Assignees (and not by any assignee, sublessee, or other Transferee of Tenant’s interest in this Lease) if the Lease then remains in full force and effect and if Original Tenant occupies the entire Premises (i.e., the initial Premises and the Warren Expansion Space). Tenant shall not have the right to lease the Fremont ROFR Space as provided in this Section 1.6 if, as of the date of the attempted exercise of the right of first refusal by Tenant, or as of the scheduled date of delivery of the Fremont ROFR Space, Tenant is in monetary or material non-monetary default under this Lease. If Tenant does not exercise the right of first refusal set forth in this Section 1.6 prior to the expiration of the ROFR Period (whether or not Landlord has delivered a Fremont ROFR Notice), then Tenant’s right of first refusal shall automatically terminate and be of no further force or effect.

ARTICLE 2

LEASE TERM; DELIVERY OF PREMISES

2.1 Lease Term. The terms and conditions of this Lease shall be effective as of the date of this Lease. The term of this Lease (the “Lease Term”) shall commence on the “Lease Commencement Date”, as that term is set forth in Section J of the Summary, and shall terminate on the “Lease Expiration Date”, as that term is set forth in Section K of the Summary, unless this Lease is sooner terminated as provided in this Lease. For purposes of this Lease, the term “Lease Year” shall mean each consecutive twelve (12)-month period during the Lease Term; provided, however, that the first Lease Year shall commence on the Lease Commencement Date and end on the last day of the month in which the first anniversary of the Lease Commencement Date occurs (or, if the Lease Commencement Date is the first day of a calendar month, then the first Lease Year shall commence on the Lease Commencement Date and end on the day immediately preceding the first anniversary of the Lease Commencement Date), and the second and each succeeding Lease Year shall commence on the first day of the next calendar month; and further provided that the last Lease Year shall end on the Lease Expiration Date. For purposes of this Lease, the term “Lease Month” shall mean each succeeding calendar month during the Lease Term; provided that the first Lease Month shall commence on the Lease Commencement Date and shall end on the last day of the calendar month in which the Lease Commencement Date occurs and that the last Lease Month shall expire on the Lease Expiration Date. If Landlord is unable to deliver possession of the Premises to Tenant on any specific date for any reason whatsoever, then this Lease shall not be void or voidable, and Landlord shall not be liable to Tenant for any loss or damage resulting therefrom.

2.2 Delivery of Premises. Tenant acknowledges that it has had an opportunity to conduct, and has conducted, such inspections of the Premises as it deems necessary to evaluate its condition. Except as otherwise specifically provided herein, Tenant shall accept possession of the Premises in its then existing “AS-IS” condition. At the time following Landlord’s delivery of possession of the Premises to Tenant, Landlord may deliver to Tenant a notice in the form attached to this Lease as Exhibit C as a confirmation only of the information set forth therein, which Tenant shall execute and return to Landlord within ten (10) business days of receipt thereof; provided, however, if such notice is not factually correct, then Tenant shall make such changes as are necessary to make such notice factually correct and shall thereafter return such notice to Landlord within said ten (10) business day period. Tenant’s failure to timely execute and return such notice to Landlord shall be deemed Tenant’s acknowledgement of the truth of the information set forth in such notice.

2.3 Delivery Condition. Notwithstanding anything set forth in Section 2.2 above to the contrary. Landlord shall cause the “Building Systems,” as that term is defined below, which serve the Premises to be in good working condition and repair upon the delivery of the Premises to Tenant. In addition, promptly after the full execution and delivery of this Lease, Landlord shall provide to Tenant a copy of Landlord’s most recent heating, ventilation and air conditioning system report. The foregoing shall not be deemed to require Landlord to replace any of the Building Systems, as opposed to repair any Building Systems except to the extent necessary. If, during the first ninety (90) days of the Lease Term, there is a failure of any Building System(s) for any reason other than as a result of actions taken by Tenant or Tenant’s agents, Landlord shall not be liable to Tenant for any damages, but as Tenant’s sole remedy. Landlord, at no cost to Tenant (and which shall not be included in “Operating Expenses,” as that term is defined in Section 3.2.2.2 below), shall perform such work or take such other action as may be necessary to place the same in good working condition and repair. As used herein the term “Building Systems” shall mean the plumbing, sewer, drainage, electrical, fire protection, life safety systems and equipment, existing heating, ventilation and air conditioning systems, the compressed dry air system, and all other mechanical and electrical systems and equipment which are located in the internal core of the Building and which serve the Building generally.

2.4 Option Term.

2.4.1. Option Right. Landlord hereby grants to the Original Tenant and its Permitted Assignees one (1) option to extend the Lease Term for a period of five (5) years (the “Option Term”), which option shall be irrevocably exercised only by written notice delivered by Tenant to Landlord not earlier than twelve (12) months and not later than nine (9) months prior to the Lease Expiration Date (as the same may be extended pursuant to Section 1.5.3 above), provided that the following conditions (the “Option Conditions”) are satisfied: (i) as of the date of delivery of such notice, Tenant is not in default under this Lease; (ii) as of the end of the Lease Term, Tenant is not in default under this Lease; (iii) Tenant has not previously been in default under this Lease (beyond any applicable notice and cure period) more than once; and (iv) the Lease then remains in full force and effect and Original Tenant occupies the entire Premises at the time the option to extend is exercised and as of the commencement of the Option Term. Landlord may, at Landlord’s option, exercised in Landlord’s sole and absolute discretion, waive any of the Option Conditions in which case the option, if otherwise properly exercised by Tenant, shall remain in full force and effect. Upon the proper exercise of such option to extend, and provided that Tenant satisfies all of the Option Conditions (except those, if any, which are waived by Landlord), the Lease Term, as it applies to the Premises, shall be extended for a period of five (5) years. The rights contained in this Section 2.4 shall be personal to Original Tenant and may be exercised by Original Tenant and its Permitted Assignees only (and not by any assignee, sublessee or other Transferee of Tenant’s interest in this Lease).

2.4.2. Option Rent. The annual Rent payable by Tenant during the Option Term (the “Option Rent”) shall be equal to the “Fair Market Rent Rate,” as that term is defined below, for the Premises as of the commencement date of the Option Term. The “Fair Market Rent Rate,” as used in this Lease, shall be determined by calculating the net rent, which net rent shall then be adjusted on an effective basis, which net effective rent shall then be present valued and reduced by all upfront concessions and, thereafter, shall be future valued into an average annual constant rental rate figure (collectively, the “Constant Rate Equivalent Approach”). The Fair Market Rent Rate shall take into consideration any “base year” or “expense stop” applicable thereto), including all escalations, at which tenants (pursuant to leases consummated within the twelve (12) month period preceding the first day of the Option Term), are leasing non-sublease, non-encumbered, non-equity space comparable in size, location and quality to the Premises and consisting of at least thirty-five thousand (35,000) rentable square feet or greater transactions, for a term of five (5) years, in an arm’s length transaction, which comparable space is located in “Comparable Buildings,” as that term is defined in this Section 2.4.2, below (transactions satisfying the foregoing criteria shall be known as the “Comparable Transactions”), taking into consideration the following concessions (the “Concessions”): (a) rental abatement concessions, if any, being granted such tenants in connection with such comparable space; (b) tenant improvements or allowances provided or to be provided for such comparable space, and taking into account the value, if any, of the existing improvements in the subject space, such value to be based upon the age, condition, design, quality of finishes and layout of the improvements provided that for purposes of determining the Fair Market Rent Rate, the value of the then existing improvements in the Premises shall not exceed an amount equal to Sixty and 00/100 Dollars ($60.00) per rentable square foot of the Premises; and (c) other reasonable monetary concessions being granted such tenants in connection with such comparable space; provided, however, that in calculating the Fair Market Rent Rate, no consideration shall be given to (i) the fact that Landlord is or is not required to pay a real estate brokerage commission in connection with Tenant’s exercise of its right to extend the Lease Term, or the fact that landlords are or are not paying real estate brokerage commissions in connection with such comparable space, and (ii) any period of rental abatement, if any, granted to tenants in Comparable Transactions in connection with the design, permitting and construction of tenant improvements in such comparable spaces. The Fair Market Rent Rate shall additionally include a determination as to whether, and if so to what extent, Tenant must provide Landlord with financial security, such as a letter of credit or guaranty, for Tenant’s Rent obligations in connection with Tenant’s lease of the Premises during the Option Term. Such determination shall be made by reviewing the extent of financial security then generally being imposed in Comparable Transactions from tenants of comparable financial condition and credit history to the then existing financial condition and credit history of Tenant (with appropriate adjustments to account for differences in the then-existing financial condition of Tenant and such other tenants). The Concessions (A) shall be reflected in the effective rental rate (which effective rental rate shall take into consideration the total dollar value of such Concessions as amortized on a straight-line basis over the applicable term of the Comparable Transaction (in which case such Concessions evidenced in the effective rental rate shall not be granted to Tenant)) payable by Tenant, or (B) at Landlord’s election, all such Concessions shall be granted to Tenant in kind. For purposes of this Lease, the term “Comparable Buildings” shall mean the Building and those certain other comparable institutionally-owned buildings of similar size, age, location, quality of appearance and services to the Building, and located in the Fremont, California area.

2.4.3. Determination of Option Rent. In the event Tenant timely and appropriately exercises its option to extend the Lease Term pursuant to Section 2.4.1, above, Landlord shall deliver written notice (the “Landlord Response Notice”) to Tenant on or before the date which is thirty (30) days after Landlord’s receipt of the Exercise Notice of Landlord’s good faith determination of the Option Rent. Within ten (10) days following its receipt of the Landlord Response Notice, Tenant shall notify Landlord in writing whether it accepts or objects to the Option Rent set forth in Landlord’s Response Notice. In the event that Tenant in good faith objects to Landlord’s determination of the Option Rent, then Landlord and Tenant shall meet and attempt to agree upon the Option Rent using their best good-faith efforts. If Landlord and Tenant fail to reach agreement on or before the date that is ninety (90) days prior to the expiration of the initial Lease Term (the “Outside Agreement Date”), then the Option Rent shall be determined by arbitration pursuant to the terms of this Section 2.4.3. Each party shall make a separate determination of the Option Rent, within five (5) days following the Outside Agreement Date, and such determinations shall be submitted to arbitration in accordance with Section 2.4.3.1 through Section 2.4.3.4, below. The determination of the arbitrators shall be made by taking into consideration all Comparable Transactions as calculated under the Constant Rate Equivalent Approach.

2.4.3.1 Landlord and Tenant shall each appoint one arbitrator who shall by profession be a MAI appraiser, real estate broker, or real estate lawyer who shall have been active over the five (5) year period ending on the date of such appointment in the appraising and/or leasing of institutionally-owned properties in the vicinity of the Building. The determination of the arbitrators shall be limited solely to the issue area of whether Landlord’s or Tenant’s submitted Option Rent is the closest to the actual Option Rent as determined by the arbitrators, taking into account the requirements of Section 2.4.2 of this Lease. Each such arbitrator shall be appointed within fifteen (15) days after the Outside Agreement Date. Landlord and Tenant may consult with their selected arbitrators prior to appointment and may select an arbitrator who is favorable to their respective positions (including an arbitrator who has previously represented Landlord and/or Tenant, as applicable). The arbitrators so selected by Landlord and Tenant shall be deemed “Advocate Arbitrators.”

2.4.3.2 The two Advocate Arbitrators so appointed shall be specifically required pursuant to an engagement letter within ten (10) days of the appointment of the last appointed Advocate Arbitrator to agree upon and appoint a third arbitrator (“Neutral Arbitrator”) who shall be qualified under the same criteria set forth hereinabove for qualification of the two Advocate Arbitrators except that (i) neither the Landlord or Tenant or either parties’ Advocate Arbitrator may, directly, or indirectly, consult with the Neutral Arbitrator prior or subsequent to his or her appearance, and (ii) the Neutral Arbitrator cannot be someone who has represented Landlord and/or Tenant during the five (5) year period prior to such appointment. The Neutral Arbitrator shall be retained via an engagement letter jointly prepared by Landlord’s counsel and Tenant’s counsel.

2.4.3.3 Within ten (10) days following the appointment of the Arbitrator, Landlord and Tenant shall enter into an arbitration agreement (the “Arbitration Agreement”) which shall set forth the following:

2.4.3.3.1 Each of Landlord’s and Tenant’s best and final and binding determination of the Option Rent exchanged by the parties pursuant to Section 2.4.3, above;

2.4.3.3.2 An agreement to be signed by the Neutral Arbitrator, the form of which agreement shall be attached as an exhibit to the Arbitration Agreement, whereby the Neutral Arbitrator shall agree to undertake the arbitration and render a decision in accordance with the terms of this Lease, as modified by the Arbitration Agreement, and shall require the Neutral Arbitrator to demonstrate to the reasonable satisfaction of the parties that the Neutral Arbitrator has no conflicts of interest with either Landlord or Tenant;

2.4.3.3.3 Instructions to be followed by the Neutral Arbitrator when conducting such arbitration;

2.4.3.3.4 That Landlord and Tenant shall each have the right to submit to the Neutral Arbitrator (with a copy to the other party), on or before the date that occurs fifteen (15) days following the appointment of the Neutral Arbitrator, an advocate statement (and any other information such party deems relevant) prepared by or on behalf of Landlord or Tenant, as the case may be, in support of Landlord’s or Tenant’s respective determination of Option Rent (the “Briefs”);

2.4.3.3.5 That within five (5) business days following the exchange of Briefs, Landlord and Tenant shall each have the right to provide the Neutral Arbitrator (with a copy to the other party) with a written rebuttal to the other party’s Brief (the “First Rebuttals”); provided, however, such First Rebuttals shall be limited to the facts and arguments raised in the other party’s Brief and shall identify clearly which argument or fact of the other party’s Brief is intended to be rebutted;

2.4.3.3.6 That within five (5) business days following the parties’ receipt of each other’s First Rebuttal, Landlord and Tenant, as applicable, shall each have the right to provide the Neutral Arbitrator (with a copy to the other party) with a written rebuttal to the other party’s First Rebuttal (the “Second Rebuttals”); provided, however, such Second Rebuttals shall be limited to the facts and arguments raised in the other party’s First Rebuttal and shall identify clearly which argument or fact of the other party’s First Rebuttal is intended to be rebutted;

2.4.3.3.7 The date, time and location of the arbitration, which shall be mutually and reasonably agreed upon by Landlord and Tenant, taking into consideration the schedules of the Neutral Arbitrator, the Advocate Arbitrators, Landlord and Tenant, and each party’s applicable consultants, which date shall in any event be within forty-five (45) days following the appointment of the Neutral Arbitrator;

2.4.3.3.8 That no discovery shall take place in connection with the arbitration, other than to verify the factual information that is presented by Landlord or Tenant;

2.4.3.3.9 That the Neutral Arbitrator shall not be allowed to undertake an independent investigation or consider any factual information other than presented by Landlord or Tenant, except that the Neutral Arbitrator shall be permitted to visit the Project and the buildings containing the Comparable Transactions;

2.4.3.3.10 The specific persons that shall be allowed to attend the arbitration;

2.4.3.3.11 Tenant shall have the right to present oral arguments to the Neutral Arbitrator at the arbitration for a period of time not to exceed three (3) hours (“Tenant’s Initial Statement”);

2.4.3.3.12 Following Tenant’s Initial Statement, Landlord shall have the right to present oral arguments to the Neutral Arbitrator at the arbitration for a period of time not to exceed three (3) hours (“Landlord’s Initial Statement”);

2.4.3.3.13 Following Landlord’s Initial Statement, Tenant shall have up to two (2) additional hours to present additional arguments and/or to rebut the arguments of Landlord (“Tenant’s Rebuttal Statement”);

2.4.3.3.14 Following Tenant’s Rebuttal Statement, Landlord shall have up to two (2) additional hours to present additional arguments and/or to rebut the arguments of Tenant;

2.4.3.3.15 That, not later than ten (10) days after the date of the arbitration, the Neutral Arbitrator shall render a decision (the “Ruling”) indicating whether Landlord’s or Tenant’s submitted Option Rent is closer to the Option Rent;

2.4.3.3.16 That following notification of the Ruling, Landlord’s or Tenant’s submitted Option Rent determination, whichever is selected by the Neutral Arbitrator as being closer to the Option Rent shall become the then applicable Option Rent; and

2.4.3.3.17 That the decision of the Neutral Arbitrator shall be binding on Landlord and Tenant.

2.4.3.3.18 If a date by which an event described in Section 2.4.3.3, above, is to occur falls on a weekend or a holiday, the date shall be deemed to be the next business day

2.4.3.4 In the event that the Option Rent shall not have been determined pursuant to the terms hereof prior to the commencement of the Option Term, Tenant shall be required to pay the Option Rent, initially provided by Landlord to Tenant, and upon the final determination of the Option Rent, the payments made by Tenant shall be reconciled with the actual amounts due, and the appropriate party shall make any corresponding payment to the other party.

ARTICLE 3

RENT

3.1 Base Rent; Base Rent Abatement. Commencing on the Lease Commencement Date, and continuing throughout the Lease Term, Tenant shall pay to Landlord the Base Monthly Rent set forth in Section L of the Summary (the “Base Monthly Rent”), in accordance with the terms of Section 3.3, below. Provided that Tenant is not then in default of the Lease, then during the first nine (9) Lease Months (the “Base Rent Abatement Period”), Tenant shall not be obligated to pay any Base Rent otherwise attributable to the Premises during such Base Rent Abatement Period (the “Base Rent Abatement”). Notwithstanding the foregoing, or anything to the contrary set forth in this Lease, Tenant shall be required to pay Tenant’s share of “Project Expenses” (as defined in Section 3.2.2.3) attributable to the Premises and all other Additional Rent due pursuant to the terms of this Lease during the Rent Abatement Period. Landlord and Tenant acknowledge and agree that the aggregate amount of the Rent Abatement equals Two Hundred Eighty-One Thousand Nine Hundred Two and 86/100 Dollars ($281,902.86); provided, however, if Tenant exercises its expansion right pursuant to Section 1.5 above during the Base Rent Abatement Period, and the Base Monthly Rent is therefore increased pursuant to Section 1.5.4.1, the aggregate amount of the Base Rent Abatement shall be adjusted accordingly. Tenant acknowledges and agrees that the foregoing Rent Abatement has been granted to Tenant as additional consideration for entering into this Lease, and for agreeing to pay the rental and perform the terms and conditions otherwise required under this Lease. If at any time during the Lease Term Tenant is in default under this Lease, and Tenant shall fail to cure such default within any applicable notice and cure periods provided in this Lease, or if this Lease is terminated for any reason other than Landlord’s breach of this Lease, then the dollar amount of the unapplied portion of the Rent Abatement as of the date of such default or termination, as the case may be, shall be converted to a credit to be applied to the Base Rent applicable at the end of the Lease Term and Tenant shall immediately be obligated to begin paying Base Rent for the Premises in full. Notwithstanding the foregoing or anything to the contrary set forth in this Lease, at any time during the Rent Abatement Period, Landlord shall have the right (but not the obligation), in its sole and absolute discretion, to pay Tenant the total amount of the then unamortized portion of the Rent Abatement amount, in which event (i) Tenant’s obligation to pay Base Monthly Rent shall automatically be reinstated for the remainder of the Rent Abatement Period covered by Landlord’s lump sum payment, at the then-applicable amounts and otherwise in accordance with the terms of this Lease, and (ii) Tenant shall not be entitled to any additional rent abatement under this Lease.

3.2 Additional Rent.

3.2.1. General Terms; Triple Net Lease. In addition to paying the Base Monthly Rent specified in Section 3.1, above, Tenant shall pay Tenant’s Share of Operating Expenses and Real Property Taxes, as those terms are defined in Section 3.2.2.2 and Section 3.2.2.4, below. Such payments by Tenant, together with any and all other amounts payable by Tenant to Landlord pursuant to the terms of this Lease, are hereinafter collectively referred to as the “Additional Rent”, and the Base Monthly Rent and the Additional Rent are herein collectively referred to as “Rent”. All amounts due under this Section 3.2 as Additional Rent shall be payable for the same periods and in the same manner as the Base Monthly Rent (provided, however, notwithstanding anything set forth in this Lease to the contrary, Tenant acknowledges and agrees that Additional Rent shall be payable by Tenant during the Base Rent Abatement Period). Without limitation on other obligations of Tenant which survive the expiration of the Lease Term, the obligations of Tenant to pay the Additional Rent provided for in this Section 3.2 shall survive the expiration of the Lease Term. Landlord and Tenant acknowledge that, except as otherwise provided to the contrary in this Lease, it is their intent and agreement that this Lease be a “TRIPLE NET” lease and that as such, the provisions contained in this Lease are intended to pass on to Tenant or reimburse Landlord for the costs and expenses reasonably associated with this Lease, the Building and the Project, and Tenant’s operation therefrom. To the extent such costs and expenses payable by Tenant cannot be charged directly to, and paid by, Tenant, such costs and expenses shall be paid by Landlord but reimbursed by Tenant as Additional Rent.

3.2.2. Definitions.

3.2.2.1 “Expense Year” shall mean each calendar year in which any portion of the Lease Term falls, through and including the calendar year in which the Lease Term expires, provided that Landlord, upon notice to Tenant, may change the Expense Year from time to time to any other twelve (12) consecutive month period, and, in the event of any such change, Tenant’s Share of Project Expenses shall be equitably adjusted for any Expense Year involved in such change.

3.2.2.2 “Operating Expenses” shall mean all expenses, costs and amounts of every kind and nature which Landlord pays or accrues during any Expense Year because of or in connection with the ownership, management, maintenance, security, repair, replacement, restoration or operation of the Project, or any portion thereof. Without limiting the generality of the foregoing, Operating Expenses shall specifically include any and all of the following: (i) the cost of supplying all utilities, the cost of operating, maintaining, repairing, and managing the utility, mechanical, sanitary, storm drainage and communication systems, and the cost of supplies, tools, equipment and maintenance and service contracts in connection therewith; (ii) the cost of licenses, certificates, permits and inspections, and the cost of contesting any governmental enactments which may affect Operating Expenses, and the costs incurred in connection with any transportation system management program or similar program; (iii) the cost of all insurance carried by Landlord in connection with the Project as reasonably determined by Landlord (including, without limitation, commercial general liability insurance, physical damage insurance covering damage or other loss caused by fire, earthquake, flood and other water damage, explosion, vandalism and malicious mischief, theft or other casualty, rental interruption insurance, and such insurance as may be required by any lessor under any present or future ground or underlying lease of the Building or Project or any holder of a mortgage, trust deed or other encumbrance now or hereafter in force against the Building or Project or any portion thereof); (iv) the cost of landscaping, directional signage, decorative lighting, and relamping, and the cost of maintaining fountains, sculptures, bridges and all supplies, tools, equipment and materials used in the operation, repair and maintenance of the Project, or any portion thereof; (v) the cost of parking area repair and maintenance, including, without limitation, resurfacing, repainting, restriping and cleaning; (vi) fees, charges and other costs, including management fees (or amounts in lieu thereof), consulting fees (including, without limitation, any consulting fees incurred in connection with the procurement of insurance), legal fees and accounting fees, of all contractors, engineers, consultants and all other persons engaged by Landlord or otherwise incurred by or charged by Landlord in connection with the management, operation, administration, maintenance and repair of the Building and the Project; (vii) payments under any equipment rental agreements or management agreements (including the cost of any actual or charged management fee and the actual or charged rental of any management office space); (viii) wages, salaries and other compensation and benefits, including taxes levied thereon, of all persons engaged in the operation, maintenance and security of the Project; (ix) costs under any instrument pertaining to the sharing of costs by the Project; (x) operation, repair, maintenance and replacement of all systems and equipment and components thereof of the Project; (xi) the cost of janitorial, alarm, security and other services, replacement of wall and floor coverings, ceiling tiles and fixtures in the Common Areas, maintenance and replacement of curbs and walkways, repair to roofs and re-roofing; (xii) amortization (including interest on the unamortized cost at an annual interest rate reasonably determined by Landlord) of the cost of acquiring or the rental expense of personal property used in the maintenance, operation and repair of the Project, or any portion thereof; (xiii) the cost of capital improvements or other costs incurred in connection with the Project (A) which are intended to effect economies in the operation, cleaning or maintenance of the Project, or any portion thereof, (B) that are required to comply with present conservation programs or that are first enacted or applied after the date of this Lease, (C) which are replacements or modifications of nonstructural items located in the Common Areas required to keep the Common Areas in good order or condition, (D) that are required under any governmental law or regulation, or (E) which are repairs, replacements or modifications to the “Building Systems” (as defined in Section 5.1, below); provided, however, that any capital expenditure shall be amortized (including interest on the unamortized cost) over its useful life as Landlord shall reasonably determine in accordance with sound real estate management and accounting principles; (xiv) costs, fees, charges or assessments imposed by, or resulting from any mandate imposed on Landlord by, any federal, state or local government for fire and police protection, trash removal, community services, or other services which do not constitute Real Estate Taxes, as that term is defined in Section 3.2.2.4, below; (xv) advertising, marketing and promotional expenditures incurred in connection with the Project, including, without limitation, costs of signs in, on or about the Project identifying or promoting the Project; (xvi) payments under any easement, license, operating agreement, declaration, restrictive covenant, or instrument pertaining to the sharing of costs by the Project or related to the use or operation of the Project; (xvii) all costs of applying and reporting for the Project or any part thereof to seek or maintain certification under the U.S. EPA’s Energy Star® rating system, the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) rating system or a similar system or standard; and (xviii) the cost to repair damage caused by fire or other peril not covered by the insurance specified in Section 9.2, below, up to a maximum amount in any Expense Year equal to two percent (2%) of the replacement cost of the damaged improvements. Notwithstanding the foregoing, for purposes of this Lease, Operating Expenses shall not, however, include:

(a) costs, including costs, including legal fees, space planners’ fees, advertising and promotional expenses, and brokerage fees incurred in connection with the original construction or development, or original or future leasing of the Project, and costs, including permit, license and inspection costs, incurred with respect to the installation of tenant improvements made for new tenants initially occupying space in the Project after the Lease Commencement Date or incurred in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants or other occupants of the Project (excluding, however, such costs relating to any common areas of the Project or parking facilities);

(b) except as set forth in items (xii), (xiii), and (xiv) above, depreciation, interest and principal payments on mortgages and other debt costs, if any, penalties and interest, costs of capital repairs and alterations, and costs of capital improvements and equipment and depreciation on the Building or Project or any Common Areas;

(c) costs for which the Landlord is reimbursed by any tenant or occupant of the Project or by insurance by its carrier or any tenant’s carrier or by anyone else, and electric power costs for which any tenant directly contracts with the local public service company;

(d) any bad debt loss, rent loss, or reserves for bad debts or rent loss, or fines or penalties due to violation of law unless directly related to Tenant’s use of the Building or the Project;

(e) costs associated with the operation of the business of the partnership or entity which constitutes the Landlord, as the same are distinguished from the costs of operation of the Project (which shall specifically include, but not be limited to, accounting costs associated with the operation of the Project). Costs associated with the operation of the business of the partnership or entity which constitutes the Landlord include costs of partnership accounting and legal matters, costs of defending any lawsuits with any mortgagee (except as the actions of the Tenant may be in issue), costs of selling, syndicating, financing, mortgaging or hypothecating any of the Landlord’s interest in the Project, and costs incurred in connection with any disputes or negotiations between Landlord and its employees, between Landlord and Project management, or between Landlord and other tenants or occupants;

(f) the wages and benefits of any employee who does not devote substantially all of his or her employed time to the Project unless such wages and benefits are prorated to reflect time spent on operating and managing the Project vis-a-vis time spent on matters unrelated to operating and managing the Project; provided, that in no event shall Operating Expenses for purposes of this Lease include wages and/or benefits attributable to personnel above the level of Project manager;

(g) amounts paid as ground rental for the Project by the Landlord;

(h) except for a Project management fee to the extent allowed pursuant to item (vi), above, overhead and profit increment paid to the Landlord or to subsidiaries or affiliates of the Landlord for services in the Project to the extent the same exceeds the costs of such services rendered by qualified, first-class unaffiliated third parties on a competitive basis;

(i) any compensation paid to clerks, attendants or other persons in commercial concessions operated by the Landlord, provided that any compensation paid to any concierge at the Project shall be includable as an Operating Expense;

(j) all items and services for which Tenant or any other tenant in the Project reimburses Landlord or which Landlord provides selectively to one or more tenants (other than Tenant) without reimbursement;

(k) any costs expressly excluded from Operating Expenses elsewhere in this Lease;

(l) rent for any office space occupied by Project management personnel to the extent the size or rental rate of such office space exceeds the size or fair market rental value of office space occupied by management personnel of the comparable buildings in the vicinity of the Building, with adjustment where appropriate for the size of the applicable project;

(m) costs arising from the gross negligence or willful misconduct of Landlord or its agents, employees, vendors, contractors, or providers of materials or services;

(n) costs incurred to comply with laws relating to the removal of hazardous material (as defined under applicable law) which was in existence in the Building or on the Project prior to the Lease Commencement Date, and was of such a nature that a federal, State or municipal governmental authority, if it had then had knowledge of the presence of such hazardous material, in the state, and under the conditions that it then existed in the Building or on the Project, would have then required the removal of such hazardous material or other remedial or containment action with respect thereto; and costs incurred to remove, remedy, contain, or treat hazardous material, which hazardous material is brought into the Building or onto the Project after the date hereof by Landlord or any other tenant of the Project and is of such a nature, at that time, that a federal, State or municipal governmental authority, if it had then had knowledge of the presence of such hazardous material, in the state, and under the conditions, that it then exists in the Building or on the Project, would have then required the removal of such hazardous material or other remedial or containment action with respect thereto;

(o) costs incurred to correct any defects in the original construction or in the renovation of the Base Building or Common Areas;

(p) repairs or replacements covered by warranties or guaranties, to the extent of the proceeds actually received by Landlord, provided that Landlord has diligently attempted to obtain such proceeds;

(q) costs arising from Landlord’s charitable or political contributions;

(r) costs of installing the initial landscaping (if any) and any sculpture, paintings and objects of art for the Building and Common Area; and

(s) advertising and promotional expenses of Landlord.

If Landlord does not carry earthquake insurance for the Building during the Base Year but subsequently obtains earthquake insurance for the Building during the Lease Term, then from and after the date upon which Landlord obtains such earthquake insurance and continuing throughout the period during which Landlord maintains such insurance, Operating Expenses for the Base Year shall be deemed to be increased by the amount of the premium Landlord would have incurred had Landlord maintained such insurance for the same period of time during the Base Year as such insurance is maintained by Landlord during such subsequent Expense Year. If Landlord is not furnishing any particular work or service (the cost of which, if performed by Landlord, would be included in Operating Expenses) to a tenant who has undertaken to perform such work or service in lieu of the performance thereof by Landlord, Operating Expenses shall be deemed to be increased by an amount equal to the additional Operating Expenses which would reasonably have been incurred during such period by Landlord if it had at its own expense furnished such work or service to such tenant. If the Project is not at least one hundred percent (100%) occupied during all or a portion of any Expense Year, Landlord may elect to make an appropriate adjustment to the components of Operating Expenses for such year to determine the amount of Operating Expenses that would have been incurred had the Project been one hundred percent (100%) occupied; and the amount so determined shall be deemed to have been the amount of Operating Expenses for such year.

3.2.2.3 “Project Expenses” shall mean Operating Expenses and Real Property Taxes.

3.2.2.4 “Real Property Taxes” shall mean all federal, state, county, or local governmental or municipal taxes, fees, charges or other impositions of every kind and nature, whether general, special, ordinary or extraordinary (including, without limitation, real estate taxes, general and special assessments, transit taxes, business taxes, leasehold taxes or taxes based upon the receipt of rent, including gross receipts or sales taxes applicable to the receipt of rent, unless required to be paid by Tenant, personal property taxes imposed upon the fixtures, machinery, equipment, apparatus, systems and equipment, appurtenances, furniture and other personal property used in connection with the Project, or any portion thereof), which shall be paid or accrued during any Expense Year (without regard to any different fiscal year used by such governmental or municipal authority) because of or in connection with the ownership, leasing and operation of the Project, or any portion thereof Real Property Taxes shall include, without limitation: (i) any tax on the rent, right to rent or other income from the Project, or any portion thereof, or as against the business of leasing the Project, or any portion thereof; (ii) any assessment, tax, fee, levy or charge in addition to, or in substitution, partially or totally, of any assessment, tax, fee, levy or charge previously included within the definition of real property tax, it being acknowledged by Tenant and Landlord that Proposition 13 was adopted by the voters of the State of California in the June 1978 election (“Proposition 13”) and that assessments, taxes, fees, levies and charges may be imposed by governmental agencies for such services as fire protection, street, sidewalk and road maintenance, refuse removal and for other governmental services formerly provided without charge to property owners or occupants, and, in further recognition of the decrease in the level and quality of governmental services and amenities as a result of Proposition 13, Real Property Taxes shall also include any governmental or private assessments or the Project’s contribution towards a governmental or private cost-sharing agreement for the purpose of augmenting or improving the quality of services and amenities normally provided by governmental agencies; (iii) any increase in taxes resulting from a reassessment resulting from a change in ownership of the Project, new construction, or any other cause; (iv) any assessment, tax, fee, levy, or charge allocable to or measured by the area of the Premises, the tenant improvements in the Premises, or the Rent payable hereunder, including, without limitation, any business or gross income tax or excise tax with respect to the receipt of such rent, or upon or with respect to the possession, leasing, operating, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises, or any portion thereof; (v) any assessment, tax, fee, levy or charge, upon this transaction or any document to which Tenant is a party, creating or transferring an interest or an estate in the Premises; and (vi) all of the real estate taxes and assessments imposed upon or with respect to the Building and all of the real estate taxes and assessments imposed on the land and improvements comprising the Project, Any costs and expenses (including, without limitation, reasonable attorneys’ and consultants’ fees) incurred in attempting to protest, reduce or minimize Real Property Taxes shall be included in Real Property Taxes in the Expense Year such expenses are incurred. Tax refunds shall be credited against Real Property Taxes and refunded to Tenant regardless of when received, based on the Expense Year to which the refund is applicable, provided that in no event shall the amount to be refunded to Tenant for any such Expense Year exceed the total amount paid by Tenant as Additional Rent under this Section 3.2 for such Expense Year. If Real Property Taxes for any period during the Lease Term or any extension thereof are increased after payment thereof for any reason, including, without limitation, error or reassessment by applicable governmental or municipal authorities, Tenant shall pay Landlord upon demand Tenant’s Share of any such increased Real Property Taxes pursuant to the terms of this Lease. Notwithstanding anything to the contrary set forth in this Lease, only Landlord may institute proceedings to reduce Real Property Taxes and the filing of any such proceeding by Tenant without Landlord’s consent shall constitute an event of default by Tenant under this Lease. Notwithstanding the foregoing, Landlord shall not be obligated to file any application or institute any proceeding seeking a reduction in Real Property Taxes. Notwithstanding anything to the contrary contained in this Section 3.2.2.4, there shall be excluded from Real Property Taxes (i) all excess profits taxes, franchise taxes, gift taxes, capital stock taxes, inheritance and succession taxes, estate taxes, federal and state income taxes, and other taxes to the extent applicable to Landlord’s general or net income (as opposed to rents, receipts or income attributable to operations at the Project), (ii) any items included as Operating Expenses, (iii) any items paid by Tenant under Section 3.2.5 (taxes for which Tenant is directly responsible) of this Lease, and (iv) any tax penalties incurred as a result of Landlord’s failure to make payment and/or file any tax or informational returns when due. The parcel on which the Building is located may be a separate tax parcel that may also contain other buildings. In the event that the Building and such other buildings and improvements are included in the same tax bill, Landlord shall have the right to equitably allocate the Real Property Taxes between the Building and such other buildings and improvements, in Landlord’s reasonable discretion, consistent with sound real estate management and accounting principles.

3.2.2.5 “Tenant’s Share” shall mean the percentage set forth in Section G of the Summary.

3.2.3. Intentionally Omitted.

3.2.4. Calculation and Payment of Project Expenses.

3.2.4.1 Statement of Estimated Project Expenses. Landlord shall give Tenant a yearly expense estimate statement (the “Estimate Statement”) which shall set forth Landlord’s reasonable estimate (the “Estimate”) of the total amount of Project Expenses for the then-current Expense Year and the estimated Tenant’s Share of Project Expenses (the “Estimated Project Expenses”), The failure of Landlord to timely furnish the Estimate Statement for any Expense Year shall not preclude Landlord from enforcing its rights to collect any Estimated Project Expenses under this Section 3.2, nor shall Landlord be prohibited from revising any Estimate Statement theretofore delivered to the extent necessary. Thereafter, Tenant shall pay, with its next installment of Base Monthly Rent due, a fraction of the Estimated Project Expenses for the then-current Expense Year (reduced by any amounts paid pursuant to the last sentence of this Section 3.2.4.1). Such fraction shall have as its numerator the number of months which have elapsed in such current Expense Year, including the month of such payment, and twelve (12) as its denominator. Until a new Estimate Statement is furnished (which Landlord shall have the right to deliver to Tenant at any time), Tenant shall pay monthly, with the Base Monthly Rent installments, an amount equal to one-twelfth (1/12) of the total Estimated Project Expenses set forth in the previous Estimate Statement delivered by Landlord to Tenant.

3.2.4.2 Statement of Actual Building Direct Expenses. In addition, Landlord shall endeavor to give to Tenant within one hundred twenty (120) days following the end of each Expense Year, a statement (the “Statement”) which shall state the Project Expenses incurred or accrued for such preceding Expense Year, and which shall indicate the amount of Tenant’s Share of Project Expenses. Upon receipt of the Statement for each Expense Year commencing or ending during the Lease Term, Tenant shall pay, with its next installment of Base Monthly Rent due, or within thirty (30) days, whichever is earlier, the full amount of Tenant’s Share of Project Expenses for such Expense Year, less the amounts, if any, paid during such Expense Year as Estimated Project Expenses, and if Tenant paid more as Estimated Project Expenses than the actual Tenant’s Share of Project Expenses (an “Excess”), Tenant shall receive a credit in the amount of such Excess against Rent next due under this Lease. Even though the Lease Term has expired and Tenant has vacated the Premises, when the final determination is made of Tenant’s Share of Project Expenses for the Expense Year in which this Lease terminates, if Tenant’s Share of Project Expenses is greater than the amount of Estimated Project Expenses previously paid by Tenant to Landlord, Tenant shall, within thirty (30) days after receipt of the Statement, pay to Landlord such amount, and if Tenant paid more as Estimated Project Expenses than the actual Tenant’s Share of Project Expenses (again, an Excess), Landlord shall, within thirty (30) days, deliver a check payable to Tenant in the amount of such Excess. The provisions of this Section 3.2.4.2 shall survive the expiration or earlier termination of the Lease Term.

3.2.5. Taxes and Other Charges for Which Tenant is Directly Responsible.

3.2.5.1 Tenant shall be liable for and shall pay thirty (30) days before delinquency, any and all taxes levied against Tenant’s equipment, furniture, fixtures and any other personal property (“FF&E”) located in or about the Premises. If any such taxes on Tenant’s FF&E are levied against Landlord or Landlord’s property, or if the assessed value of Landlord’s property is increased by the inclusion therein of a value placed upon such FF&E, and if Landlord pays the taxes based upon such increased assessment, which Landlord shall have the right to do regardless of the validity thereof but only under proper protest if requested by Tenant, Tenant shall upon demand repay to Landlord the taxes so levied against Landlord or the proportion of such taxes resulting from such increase in the assessment, as the case may be.

3.2.5.2 If the tenant improvements in the Premises, whether installed and/or paid for by Landlord or Tenant and whether or not affixed to the real property so as to become a part thereof, are assessed for real property tax purposes at a valuation higher than the valuation at which tenant improvements conforming to Landlord’s “building standard” in other space in the Building are assessed, then the Real Property Taxes levied against Landlord or the property by reason of such excess assessed valuation shall be deemed to be taxes levied against personal property of Tenant and shall be governed by the provisions of Section 3.2.5.1, above.

3.2.5.3 Notwithstanding any contrary provision herein, Tenant shall pay prior to delinquency any (i) rent tax or sales tax, gross receipts tax, service tax, transfer tax or value added tax, business tax or any other applicable tax on the rent or services herein or otherwise respecting this Lease, (ii) taxes assessed upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises or any portion of the Project, including the parking facility for the Project; or (iii) taxes assessed upon this transaction or any document to which Tenant is a party creating or transferring an interest or an estate in the Premises.

3.2.5.4 Landlord’s Books and Records. Following Tenant’s receipt of the Statement, Tenant shall have the right, upon prior written notice to Landlord (“Audit Notice”), to commence and complete an audit of Landlord’s books and records concerning the Operating Expenses for the Landlord’s fiscal year that is the subject of such Statement (the “Records”), within ninety (90) days following the delivery of such Statement (the “Review Period”). Following delivery of an Audit Notice, and provided Tenant is not then in default under this Lease, Tenant shall have the right, at Tenant’s sole cost, during Landlord’s regular business hours and on reasonable prior notice to Landlord, to audit the Records at Landlord’s principal business office (or at any other location in northern California designated by Landlord). Such audit shall occur within thirty (30) days following the delivery of the Audit Notice. Tenant’s audit of the Records pursuant to this Section 3.2.5.4 shall be conducted only by a reputable independent nationally or regionally recognized certified public accounting firm, subject to Landlord’s reasonable approval, which accounting firm: (i) shall have previous experience in auditing financial operating records of landlords of office buildings; (ii) shall not already be providing accounting and/or lease administration services to Tenant and shall not have provided accounting and/or lease administration services to Tenant in the past three (3) years; (iii) shall not be retained by Tenant on a contingency fee basis (i.e., Tenant must be billed based on the actual time and materials that are incurred by the accounting firm in the performance of the audit), and a copy of the executed audit agreement between Tenant and auditor shall be provided to Landlord prior to the commencement of the audit; and (iv) at Landlord’s option, both Tenant and auditor shall be required to execute a commercially reasonable confidentially agreement prepared by Landlord. Any audit report prepared by Tenant’s auditors shall be delivered concurrently to Landlord and Tenant within the Review Period. If, after such audit of the Records, Tenant disputes the amount of Operating Expenses for the year under audit, Landlord and Tenant shall meet and attempt in good faith to resolve the dispute. If the parties are unable to resolve the dispute within sixty (60) days after completion of Tenant’s audit, then, at Tenant’s request, a certified public accounting firm selected by Landlord, and reasonably approved by Tenant, shall, at Tenant’s cost, conduct an audit of the relevant Operating Expenses (the “Neutral Audit”). Tenant shall pay all costs and expenses of the Neutral Audit unless the final determination in such Neutral Audit is that Landlord overstated Operating Expenses in the Statement for the year being audited by more than five percent (5%), in which case Landlord shall pay the actual and reasonable costs and expenses of the Neutral Audit, in an amount not to exceed Five Thousand and 00/100 Dollars ($5,000.00). In any event, Landlord will promptly reimburse Tenant or provide a credit for any overstatement of Operating Expenses, and Tenant shall promptly pay to Landlord any understatement of Operating Expenses. To the extent Landlord and Tenant fail to otherwise reach mutual agreement regarding Operating Expenses, the foregoing audit and Neutral Audit procedures shall be the sole methods to be used by Tenant to dispute the amount of any Operating Expenses payable by Tenant pursuant to the terms of this Lease.

3.3 Payment of Rent. Concurrently with the execution of this Lease by Tenant, Tenant shall pay to Landlord the amount set forth in Section M of the Summary as prepayment toward the first installment of Rent. All Rent required to be paid under this Lease in monthly installments shall be paid to Landlord in advance on the first day of each calendar month during the Lease Term. All Rent shall be paid in lawful money of the United States, without any abatement, deduction or offset whatsoever (except as specifically provided herein), and without any prior notice or demand therefor. Rent shall be paid to Landlord at the address set forth in Section P of the Summary, or, at Landlord’s option, to such other party or at such other place as Landlord may designate from time to time in writing, by notice to Tenant in accordance with the provisions of Section 21.5 of this Lease. If any Rent payment date (including the Lease Commencement Date) falls on a day of the month other than the first day of such month, or if any payment of Rent is for a period which is shorter than one month, the Rent for any fractional month shall accrue on a daily basis for the period from the date such payment is due to the end of such calendar month or to the end of the Lease Term at a rate per day which is equal to 1/365 of the applicable annual Rent. All other payments or adjustments required to be made under the terms of this Lease that require proration on a time basis shall be prorated on the same basis.