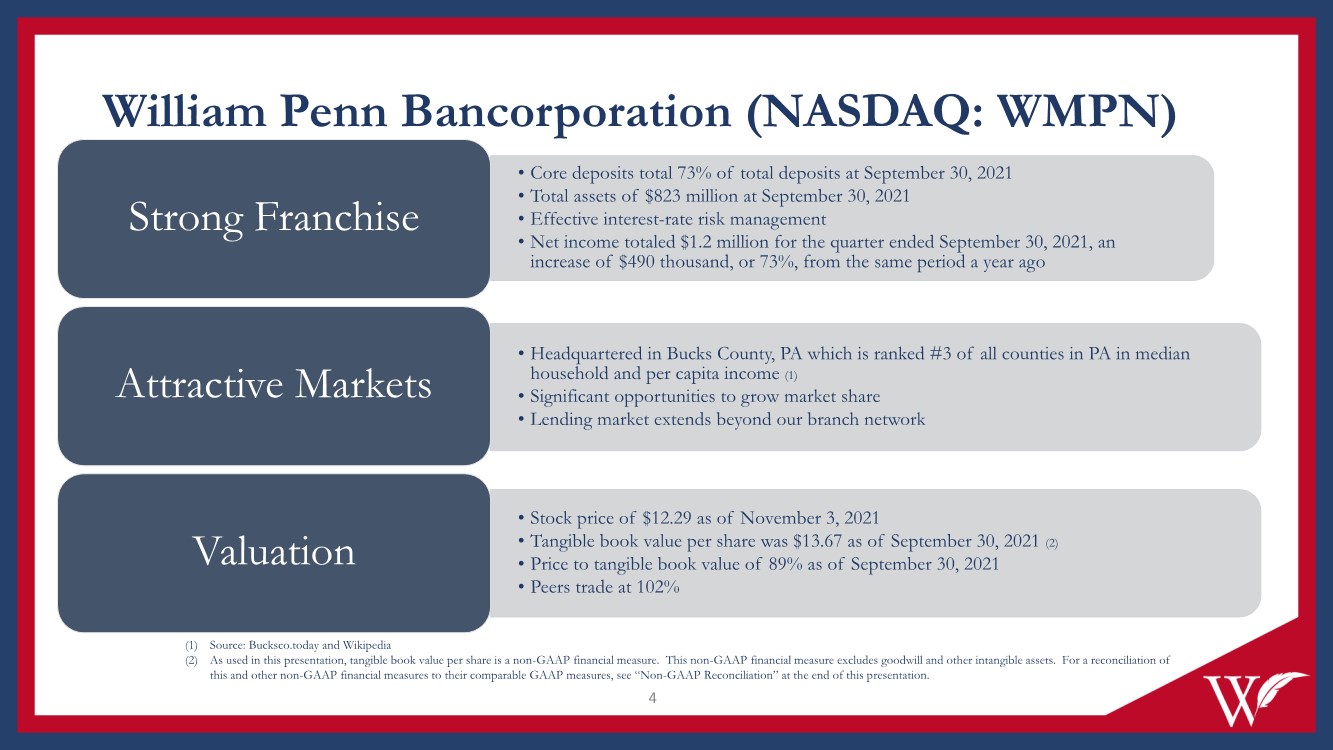

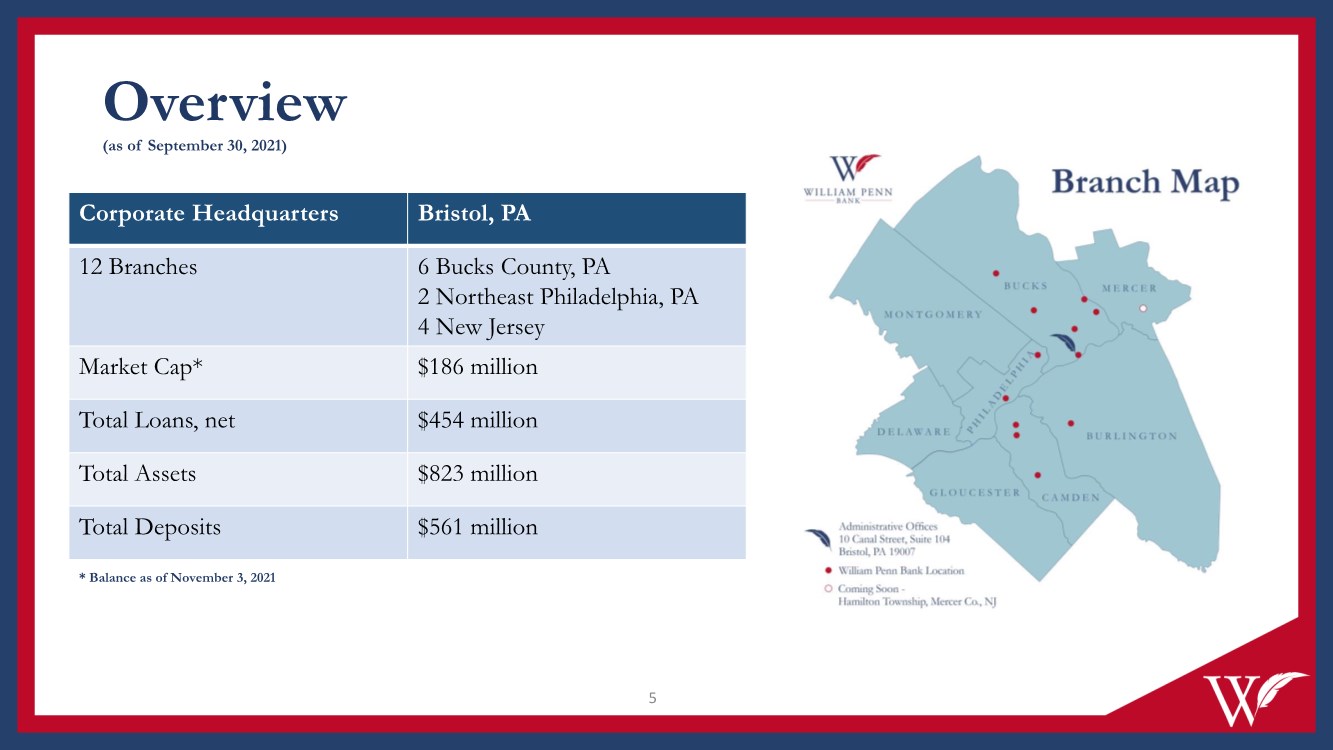

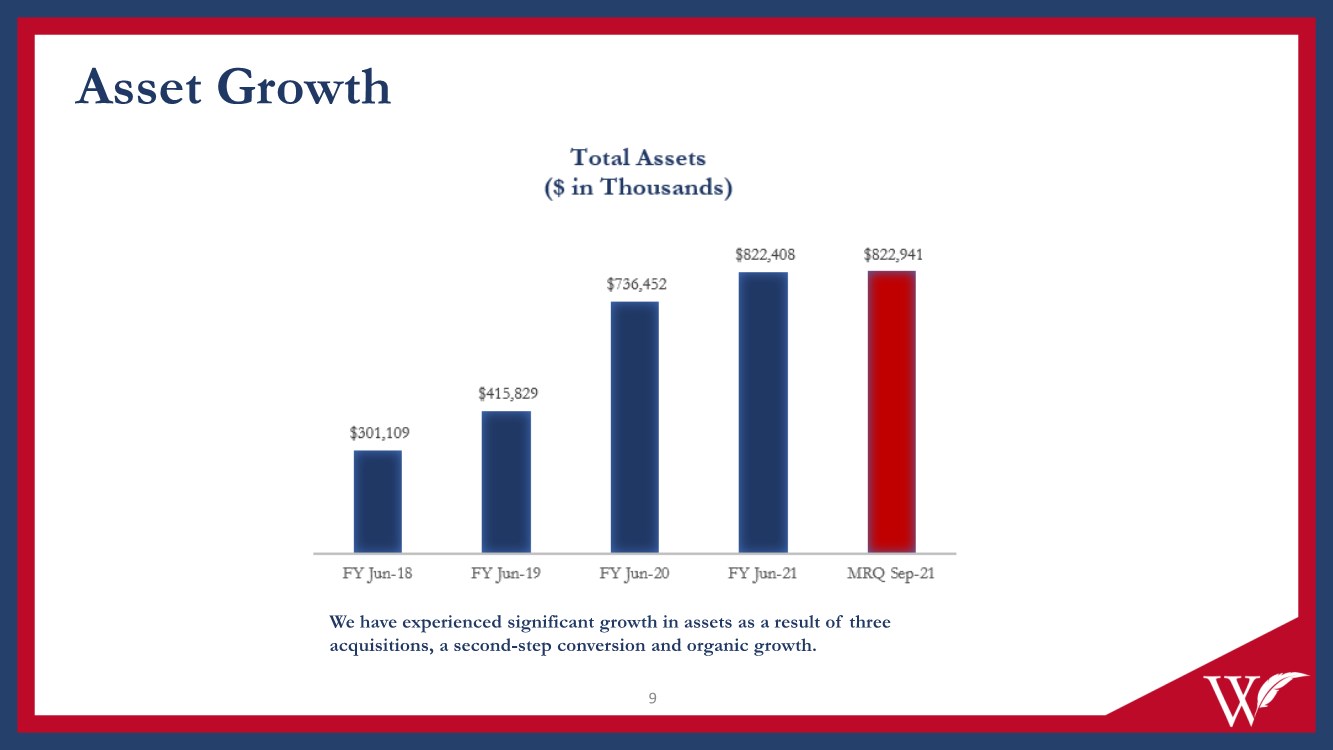

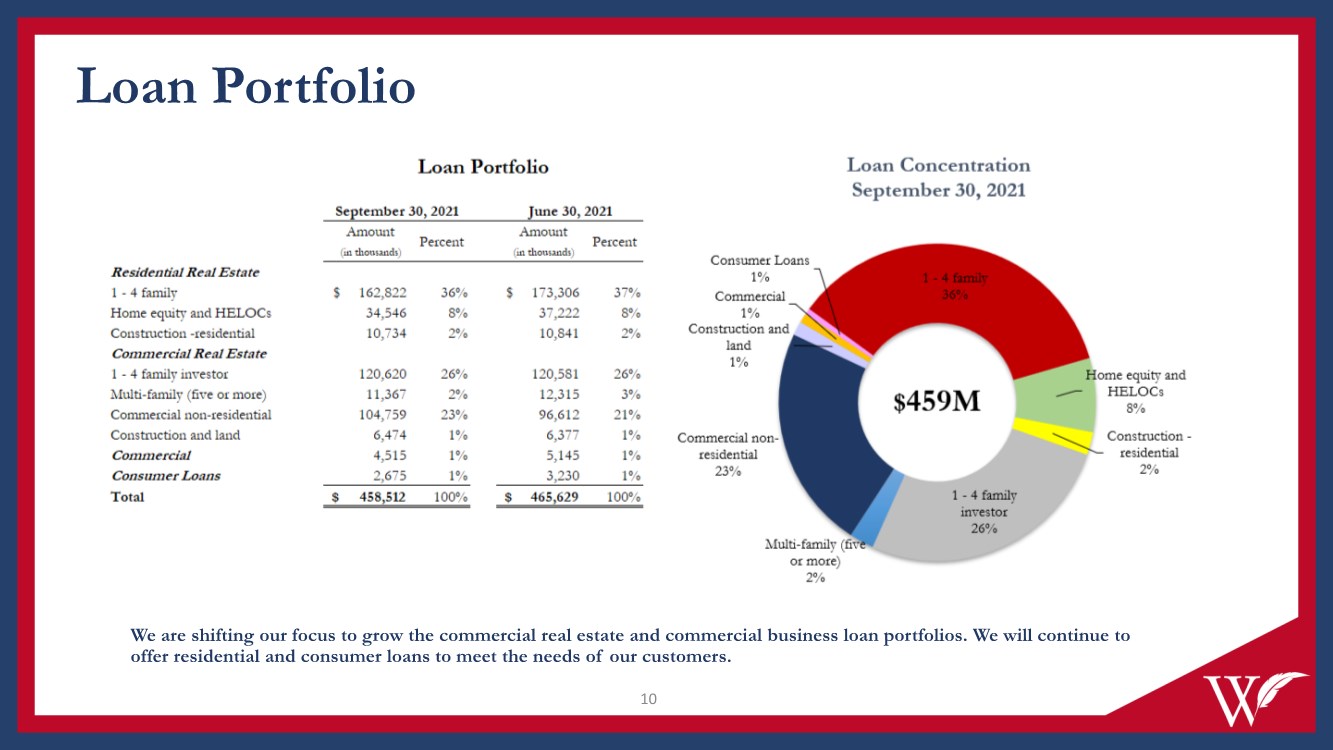

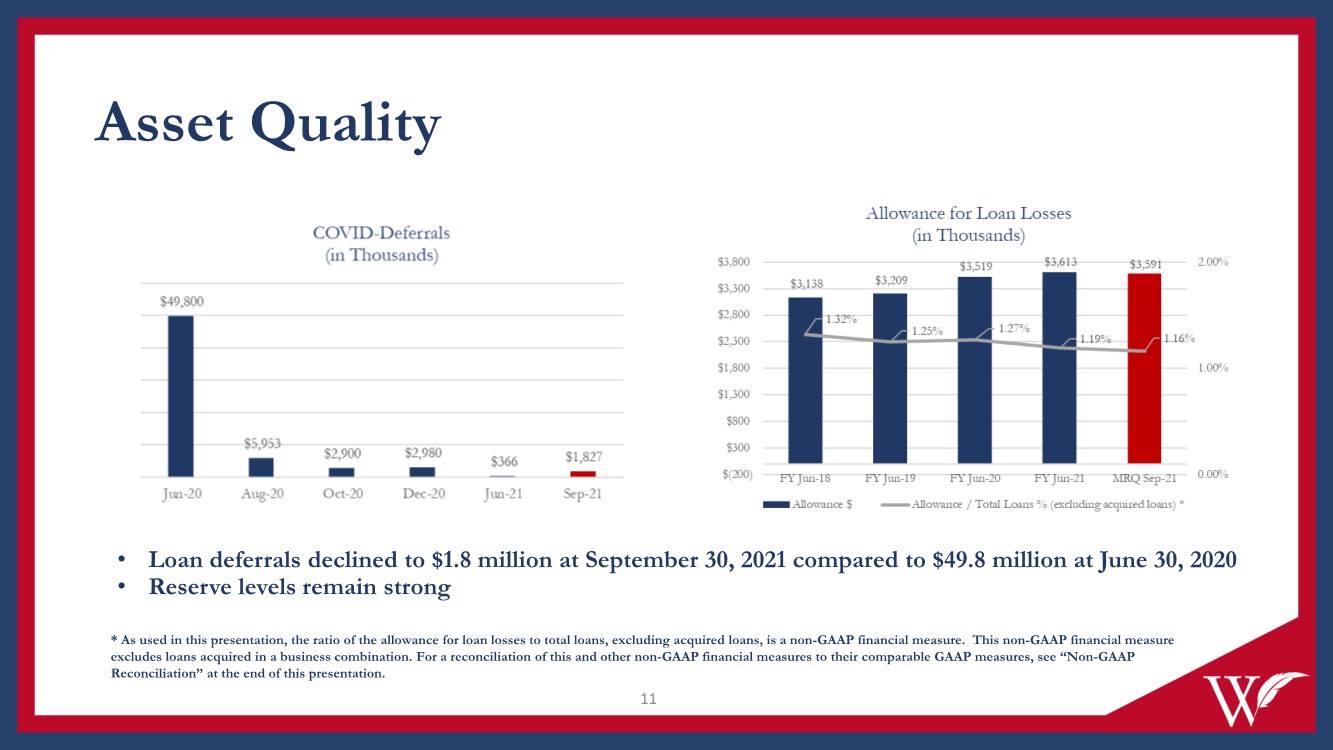

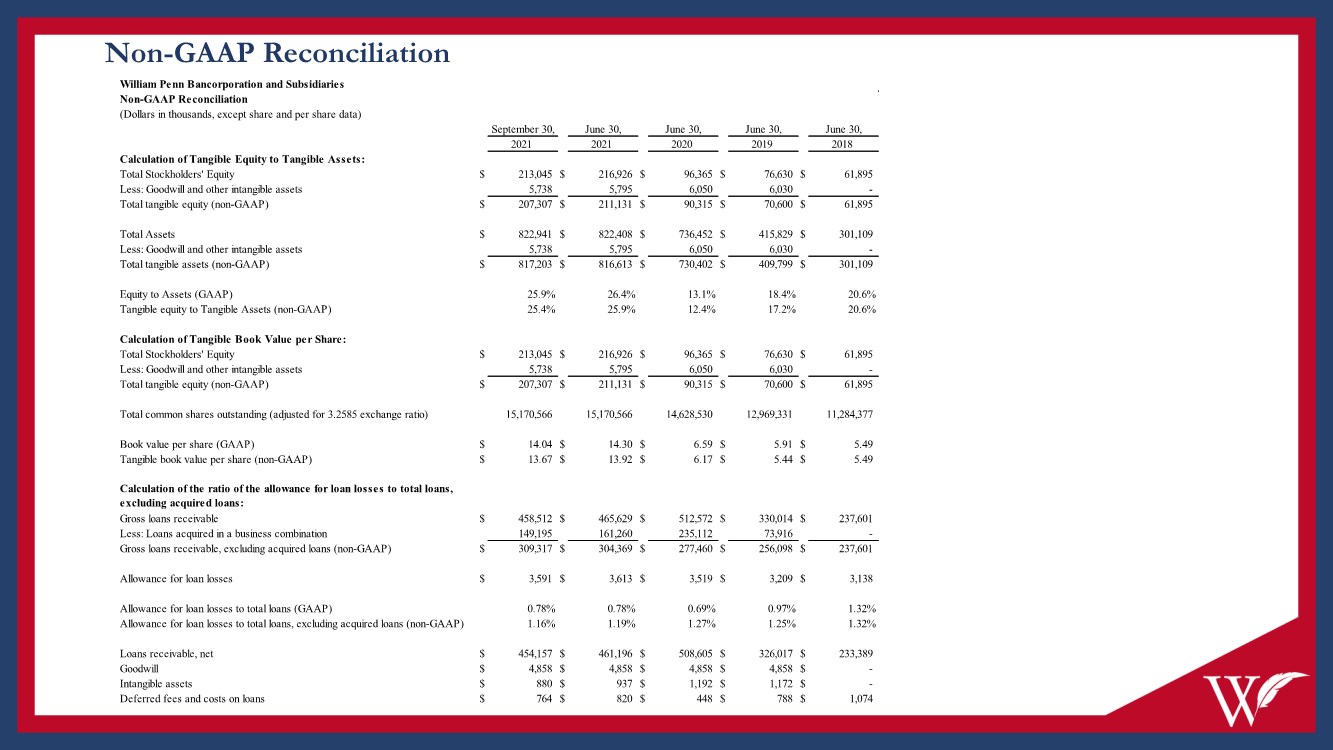

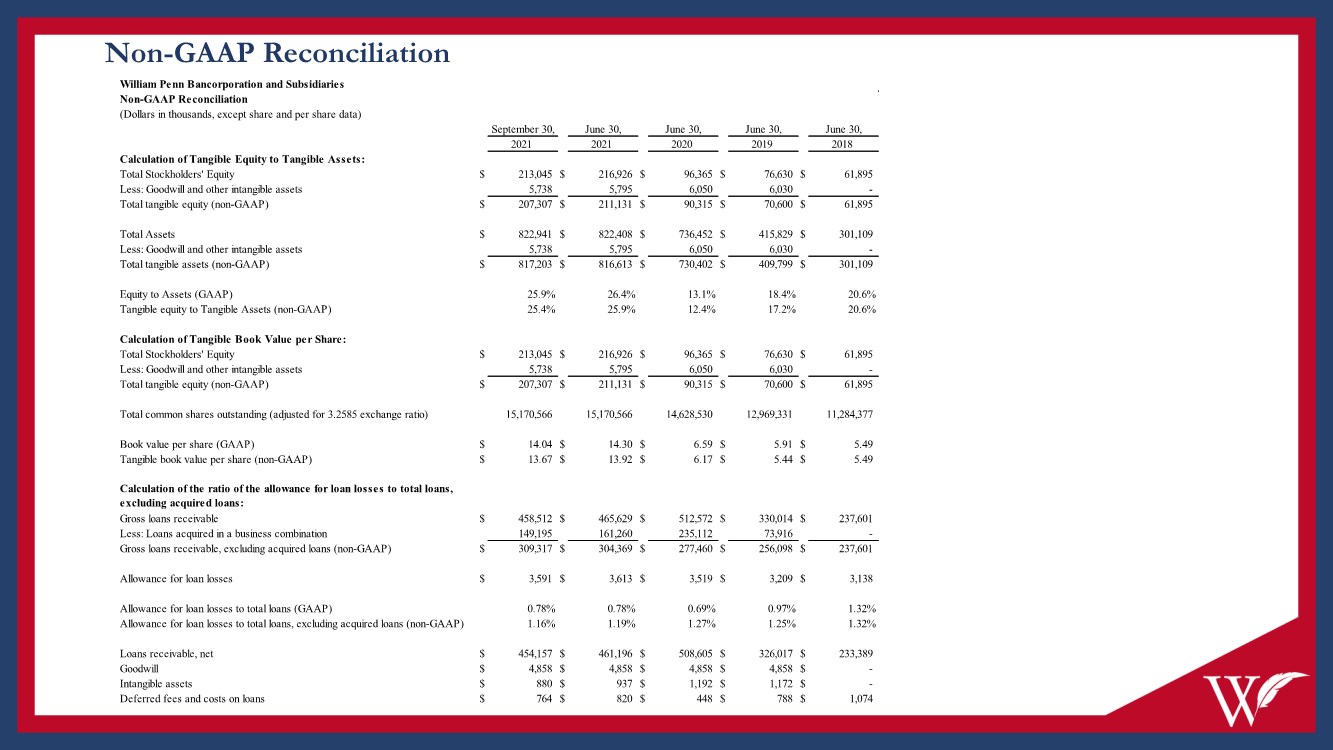

| Non-GAAP Reconciliation William Penn Bancorporation and Subsidiaries Non-GAAP Reconciliation (Dollars in thousands, except share and per share data) September 30, June 30, June 30, June 30, June 30, 2021 2021 2020 2019 2018 Calculation of Tangible Equity to Tangible Assets: Total Stockholders' Equity $ 213,045 $ 216,926 $ 96,365 $ 76,630 $ 61,895 Less: Goodwill and other intangible assets 5,738 5,795 6,050 6,030 - Total tangible equity (non-GAAP) $ 207,307 $ 211,131 $ 90,315 $ 70,600 $ 61,895 Total Assets $ 822,941 $ 822,408 $ 736,452 $ 415,829 $ 301,109 Less: Goodwill and other intangible assets 5,738 5,795 6,050 6,030 - Total tangible assets (non-GAAP) $ 817,203 $ 816,613 $ 730,402 $ 409,799 $ 301,109 Equity to Assets (GAAP) 25.9% 26.4% 13.1% 18.4% 20.6% Tangible equity to Tangible Assets (non-GAAP) 25.4% 25.9% 12.4% 17.2% 20.6% Calculation of Tangible Book Value per Share: Total Stockholders' Equity $ 213,045 $ 216,926 $ 96,365 $ 76,630 $ 61,895 Less: Goodwill and other intangible assets 5,738 5,795 6,050 6,030 - Total tangible equity (non-GAAP) $ 207,307 $ 211,131 $ 90,315 $ 70,600 $ 61,895 Total common shares outstanding (adjusted for 3.2585 exchange ratio) 15,170,566 15,170,566 14,628,530 12,969,331 11,284,377 Book value per share (GAAP) $ 14.04 $ 14.30 $ 6.59 $ 5.91 $ 5.49 Tangible book value per share (non-GAAP) $ 13.67 $ 13.92 $ 6.17 $ 5.44 $ 5.49 Calculation of the ratio of the allowance for loan losses to total loans, excluding acquired loans: Gross loans receivable $ 458,512 $ 465,629 $ 512,572 $ 330,014 $ 237,601 Less: Loans acquired in a business combination 149,195 161,260 235,112 73,916 - Gross loans receivable, excluding acquired loans (non-GAAP) $ 309,317 $ 304,369 $ 277,460 $ 256,098 $ 237,601 Allowance for loan losses $ 3,591 $ 3,613 $ 3,519 $ 3,209 $ 3,138 Allowance for loan losses to total loans (GAAP) 0.78% 0.78% 0.69% 0.97% 1.32% Allowance for loan losses to total loans, excluding acquired loans (non-GAAP) 1.16% 1.19% 1.27% 1.25% 1.32% Loans receivable, net $ 454,157 $ 461,196 $ 508,605 $ 326,017 $ 233,389 Goodwill $ 4,858 $ 4,858 $ 4,858 $ 4,858 $ - Intangible assets $ 880 $ 937 $ 1,192 $ 1,172 $ - Deferred fees and costs on loans $ 764 $ 820 $ 448 $ 788 $ 1,074 |