of GRC’s former Nevada properties, including the Isabella Pearl Mine. On December 31, 2020 GRC completed the spin-off of its wholly-owned subsidiary, Fortitude Gold Corporation and its subsidiaries (“FGC”), into a separate, public company (the “Spin-Off”). The Spin-Off was effected by the distribution of all of the outstanding shares of FGC common stock to GRC’s shareholders (the “Distribution”). GRC’s shareholders of record as of the close of business on December 28, 2020 (the “Record Date”) received one share of FGC common stock for every 3.5 shares of GRC’s common stock held as of the Record Date. In this report, “Company,” “our,” “us” and “we” refer to Fortitude Gold Corporation together with its subsidiaries, unless the context otherwise require.

FGC is a mining company which pursues gold and silver projects that are expected to have both low operating costs and high returns on capital. We are presently focused on mineral production from our Isabella Pearl Mine in Nevada. The ore mined at Isabella Pearl is processed on site at our processing facilities and sold to a refiner as doré, which contains precious metals of gold and silver. We also continue exploration and evaluation work on our portfolio of other precious metal properties in Nevada and continue to evaluate other properties for possible acquisition.

Effective December 31, 2020, in connection with the Spin-Off, the Company entered into a Management Services Agreement (“MSA” or “Agreement”) with GRC that governed the relationship of the parties following the Spin-Off. The MSA provided that the Company received services from GRC and its subsidiaries to assist in the transition of the Company as a separate company including, managerial and technical supervision, advisory and consultation with respect to mining operations, exploration, environmental, safety and sustainability matters. The Company also received certain administrative services related to information technology, accounting and financial advisory services, legal and compliance support and investor relation and shareholder communication services. The agreed upon charges for services rendered were based on market rates that align with the rates that an unaffiliated service provider would charge for similar services. The MSA’s initial term was to expire on December 31, 2021, would automatically renew annually and may be cancelled upon 30 days written notice by one party to the other during the term. On April 21, 2021, GRC provided the Company 30 days written notice to cancel the MSA effective May 21, 2021.

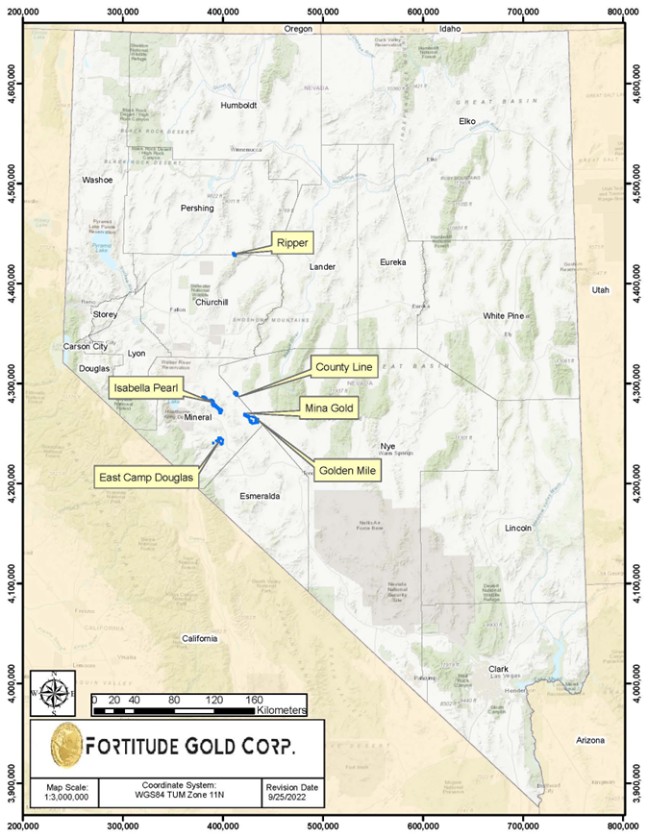

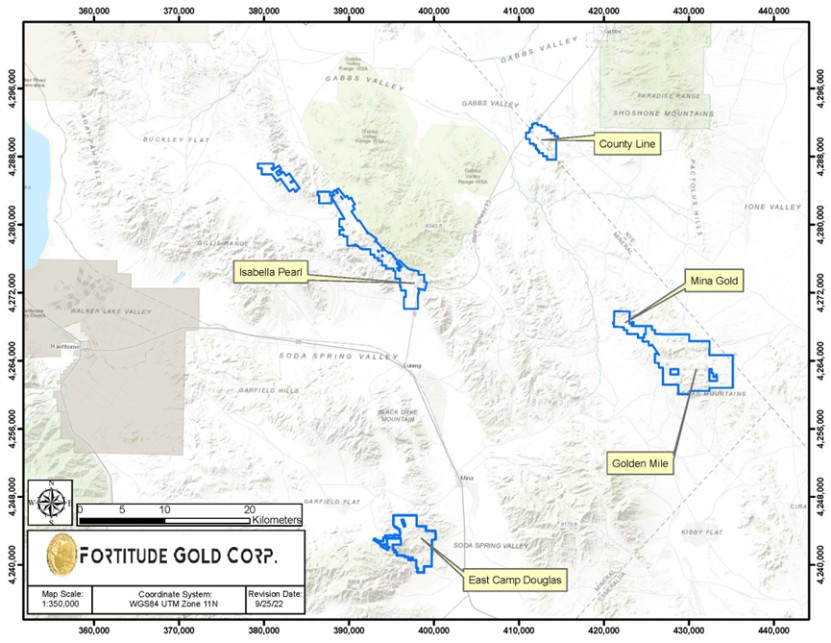

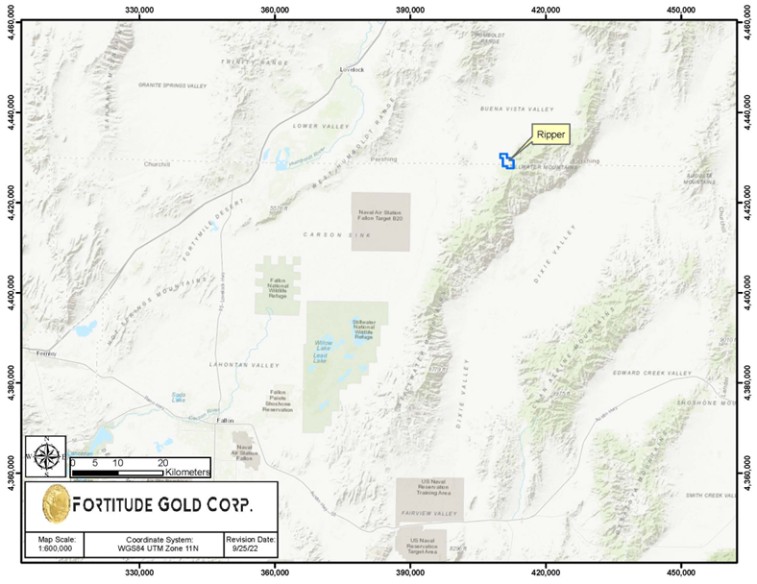

We own 100% of six properties in Nevada, totaling 1,724 unpatented mining claims covering approximately 32,178 acres, subject to the paramount title of the United States of America, under the administration of the Bureau of Land Management (“BLM”). Under the Mining Law of 1872, which governs the location of unpatented mining claims on federal lands, the owner (locator) has the right to explore, develop, and mine minerals on unpatented mining claims without payments of production royalties to the U.S. government, subject to the surface management regulations of the BLM. Currently, annual claim maintenance fees are the only federal payments related to unpatented mining claims. Annual maintenance fees of $305,865 were paid during 2021.

In addition to the unpatented claims, we also own 26, and lease one, patented mining claims covering approximately 165 acres and an additional 201 acres of fee lands in Mineral County, Nevada. Patented claims and fee lands unlike unpatented claims, pass title to the holder. The patented claims and fee lands are subject to payment of annual property taxes made to the county where they are located. Annual property taxes on our patented claims and fee lands have been paid through June 30, 2022.