J.P. Morgan �Healthcare �Conference January 11, 2022 (Nasdaq: OCDX) Exhibit 99.1

This presentation and the oral remarks may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among others, statements concerning (i) Ortho Clinical Diagnostics Holdings plc (the “Company’s”) unaudited preliminary financial information for the fiscal fourth quarter and the fiscal year ended January 2, 2022 and (ii) the benefits of the business combination transactions involving Quidel Corporation and the Company, including the combined company’s future financial and operating results, plans, objectives, expectations and intentions and other statements that are not historical facts. The preliminary financial information set forth in this presentation is subject to the completion of the Company’s audit process and subject to change. The estimated preliminary results included in this presentation should not be viewed as a substitute for the Company’s annual financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). There can be no assurance that the estimated preliminary results will be realized, and you are cautioned not to place undue reliance on the preliminary financial information, which reflects management’s current expectations and anticipated results of operations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, or industry results to differ materially from those expressed or implied by such forward-looking statements. Therefore, any statements contained herein that are not statements of historical fact may be forward-looking statements and should be evaluated as such. Without limiting the foregoing, the words as “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “project,” “forecast,” “estimates,” “targets,” “projections,” “should,” “could,” “would,” “may,” “might,” “will,” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. Factors that might materially affect such forward looking statements include: the ongoing global coronavirus (COVID-19) pandemic; risks related to the proposed acquisition of us by Quidel Corporation (“Quidel”), including (i) failure to complete the proposed transaction on the proposed terms or on the anticipated timeline, or at all, (ii) risks and uncertainties related to securing the necessary regulatory and shareholder approvals, the sanction of the High Court of Justice of England and Wales and satisfaction of other closing conditions to consummate the proposed transaction, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive transaction agreement relating to the proposed transaction, (iv) the challenges and costs of closing, integrating, restructuring and achieving anticipated synergies, (v) the ability to retain key employees, and (vi) economic, business, competitive, and/or regulatory factors affecting the businesses of Ortho Clinical Diagnostics and Quidel; increased competition; manufacturing problems or delays or failure to develop and market new or enhanced products or services; adverse developments in global market, economic and political conditions; our ability to obtain additional capital on commercially reasonable terms may be limited or non-existent; our inability to implement our strategies for improving growth or to realize the anticipated benefits of any acquisitions and divestitures, including as a result of difficulties integrating acquired businesses with, or disposing of divested businesses from, our current operations; a need to recognize impairment charges related to goodwill, identified intangible assets and fixed assets; inability to achieve some or all of the operational cost improvements and other benefits that we expect to realize; our ability to operate according to our business strategy should our collaboration partners fail to fulfill their obligations; risk that the insurance we maintain may not fully cover all potential exposures; product recalls or negative publicity may harm our reputation or market acceptance of our products; decreases in the number of surgical procedures performed and the resulting decrease in blood demand; fluctuations in our cash flows as a result of our reagent rental model; terrorist acts, conflicts, wars and natural disasters that may materially adversely affect our business, financial condition and results of operations; the outcome of legal proceedings instituted against us and/or others; risks associated with our non-U.S. operations, including currency translation risks, the impact of possible new tariffs and compliance with applicable trade embargoes; the effect of the United Kingdom’s withdrawal from the European Union; our inability to deliver products and services that meet customers’ needs and expectations; failure to maintain a high level of confidence in our products; significant changes in the healthcare industry and related industries that we serve, in an effort to reduce costs; reductions in government funding and reimbursement to our customers; price increases or interruptions in the supply of raw materials, components for our products and products and services provided to us by certain key suppliers and manufacturers; our ability to recruit and retain the experienced and skilled personnel we need to compete; work stoppages, union negotiations, labor disputes and other matters associated with our labor force; consolidation of our customer base and the formation of group purchasing organizations; unexpected payments to any pension plans applicable to our employees; our inability to obtain required clearances or approvals for our products; failure to comply with applicable regulations, which may result in significant costs or the suspension or withdrawal of previously obtained clearances or approvals; the inability of government agencies to hire, retain or deploy personnel or otherwise prevent new or modified products from being developed, cleared or approved or commercialized in a timely manner; disruptions resulting from President Biden’s invocation of the Defense Production Act; results of clinical studies, which may be delayed or fail to demonstrate the safety and effectiveness of our products; costs to comply with environmental and health and safety requirements, or costs related to liability for contamination or other potential environmental harm; healthcare fraud and abuse regulations that could result in liability, require us to change our business practices and restrict our operations in the future; failure to comply with the anti-corruption laws of the United States and various international jurisdictions; failure to comply with anti-terrorism laws and regulations and applicable trade embargoes; failure to comply with the requirements of federal, state and international laws pertaining to the privacy and security of health information; our inability to maintain our data management and information technology systems; data corruption, cyber-based attacks, security breaches and privacy violations; our inability to protect and enforce our intellectual property rights or defend against intellectual property infringement suits against us by third parties; risks related to changes in income tax laws and regulations; risks related to our substantial indebtedness; our ability to generate cash flow to service our substantial debt obligations; difficulties complying with Nasdaq rules regarding the composition of our Board of Directors and certain committees now that we are no longer a “controlled company”; risks related to the ownership of our ordinary shares; and other factors beyond our control. Unless legally required, we assume no obligation to update any such forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information. Information contained in this presentation concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on information from various sources, on assumptions that we have made that are based on such information and other similar sources and on our knowledge of, and expectations about, the markets for our service offerings. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Forward-Looking Statements

Forward-Looking Statements (continued) Additional Information and Where to Find it This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The proposed business combination transaction among Ortho Clinical Diagnostics Holdings plc (“Ortho Clinical Diagnostics”), Quidel Corporation (“Quidel”) and Coronado Topco, Inc. (“Topco”) will be submitted to the shareholders of Ortho Clinical Diagnostics and Quidel for their consideration. Ortho Clinical Diagnostics and Topco expect to file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a prospectus of Ortho Clinical Diagnostics and Topco and a proxy statement of Ortho Clinical Diagnostics. Ortho Clinical Diagnostics and Topco also plan to file other documents with the SEC regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS OF ORTHO CLINICAL DIAGNOSTICS ARE URGED TO READ THE PROXY STATEMENT, PROSPECTUS AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of the proxy statement, prospectus and other documents containing important information about Ortho Clinical Diagnostics, Quidel and Topco, once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Ortho Clinical Diagnostics, when and if available, can be obtained free of charge on Ortho Clinical Diagnostics’ website at https://www.orthoclinicaldiagnostics.com/en-us/home/ or by directing a written request to OrthoCareTechnicalSolutions@orthoclinicaldiagnostics.com. Ortho Clinical Diagnostics and certain of its respective directors, executive officers and certain members of management may be deemed to be participants in the solicitation of proxies from the shareholders of Ortho Clinical Diagnostics in connection with the proposed transaction. Information about the directors and executive officers of Ortho Clinical Diagnostics is set forth in its annual report on Form 10-K, which was filed with the SEC on March 19, 2021. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the prospectus and proxy statement and other relevant materials when and if filed with the SEC in connection with the proposed transaction.

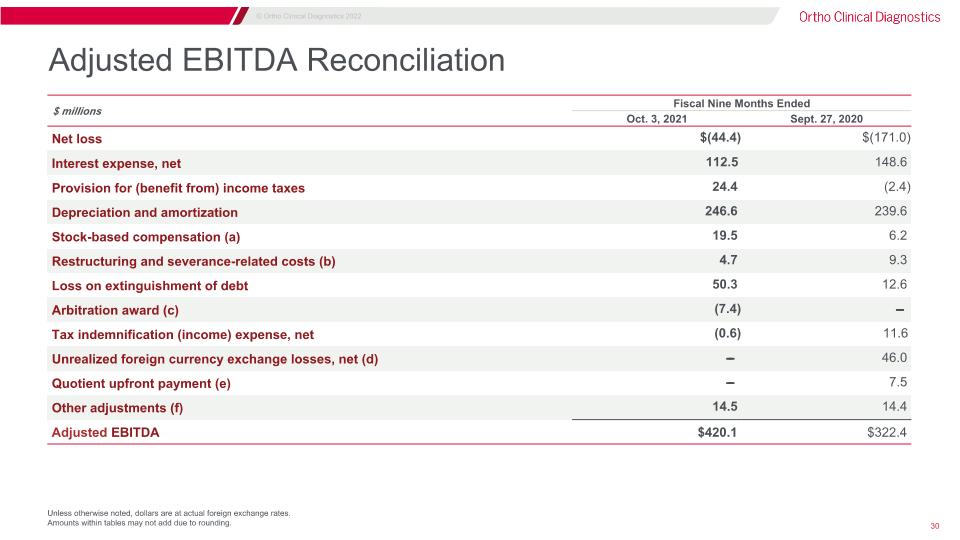

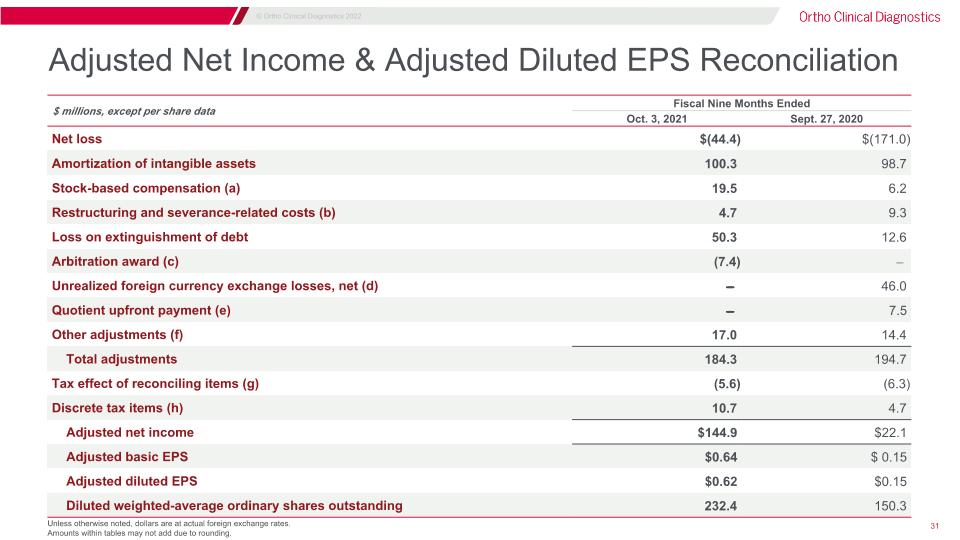

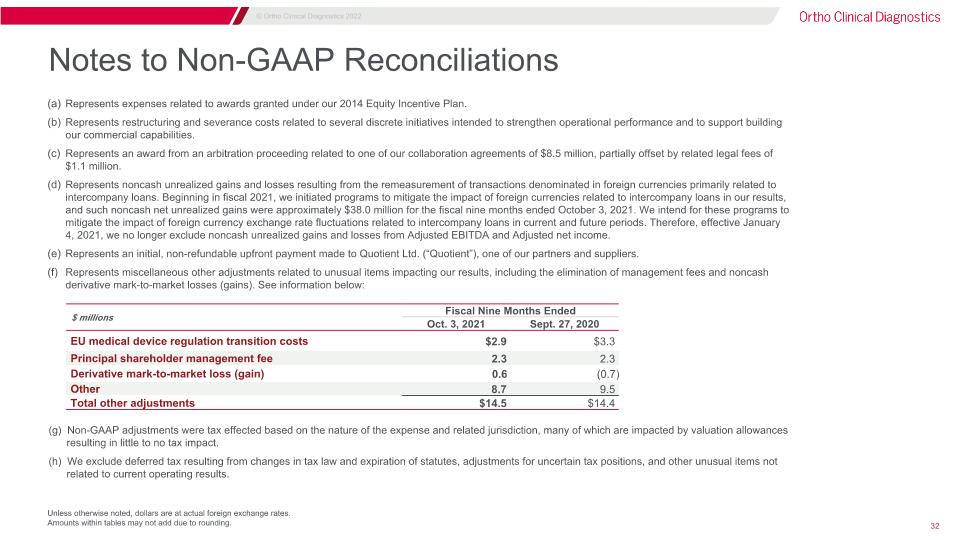

This presentation contains financial measures, such as core revenue excluding SARS-CoV-2 assay sales, constant currency growth rate, adjusted EBITDA, adjusted net income, adjusted diluted EPS and adjusted free cash flow, which are considered non-GAAP financial measures under applicable U.S. Securities and Exchange Commission rules and regulations. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. Adjusted EBITDA, adjusted net income, adjusted diluted EPS and adjusted free cash flow eliminate impacts of certain non-cash, unusual or other items that that we do not consider indicative of our ongoing operating performance. The Company’s definitions of these non-GAAP measures may differ from similarly titled measures used by others. The Company generally uses these non-GAAP financial measures to facilitate management’s financial and operational decision-making, including evaluation of the Company’s historical operating results, comparison to competitors’ operating results and determination of management incentive compensation. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends affecting the Company’s business. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. Reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the appendix to this presentation. For example, such reconciling items include the impact of unrealized foreign currency exchange gains or losses, gains or losses that are unusual or nonrecurring in nature as well as discrete taxable events. We cannot estimate or project these items and they may have a substantial and unpredictable impact on our results presented in accordance with GAAP. Non-GAAP Financial Measures

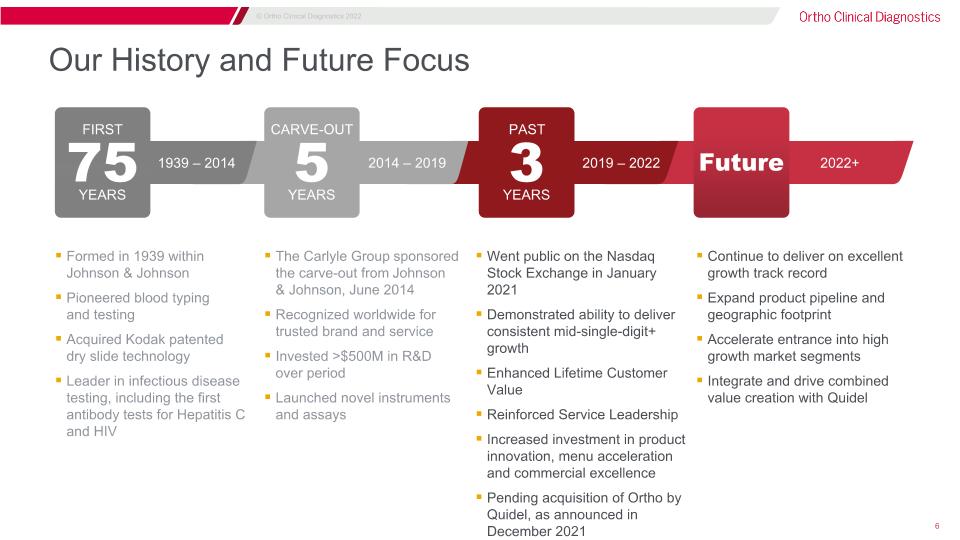

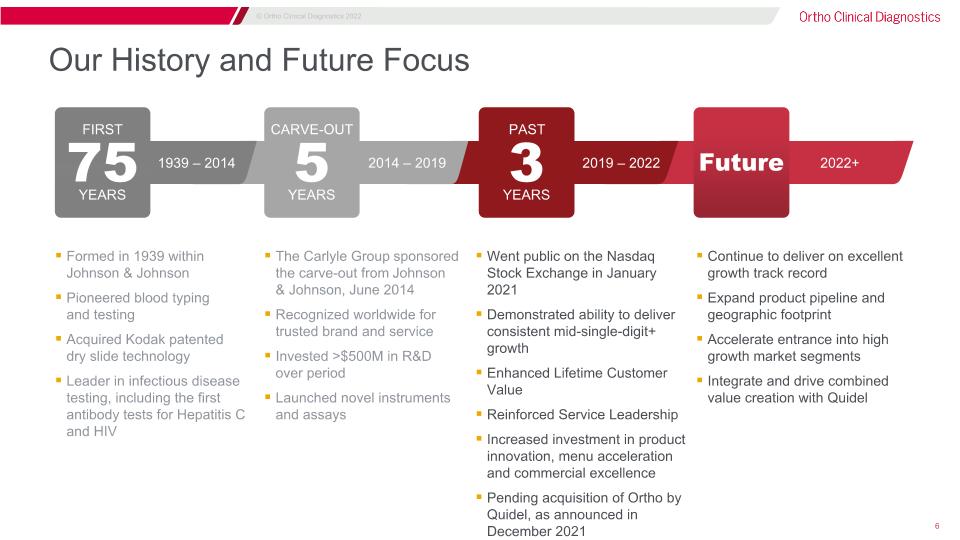

2019 – 2022 PAST 3 YEARS 2014 – 2019 CARVE-OUT 5 YEARS Our History and Future Focus Went public on the Nasdaq�Stock Exchange in January 2021 Demonstrated ability to deliver consistent mid-single-digit+ growth Enhanced Lifetime Customer Value Reinforced Service Leadership Increased investment in product innovation, menu acceleration and commercial excellence Pending acquisition of Ortho by Quidel, as announced in December 2021 The Carlyle Group sponsored�the carve-out from Johnson�& Johnson, June 2014 Recognized worldwide for�trusted brand and service Invested >$500M in R&D�over period Launched novel instruments�and assays Formed in 1939 within�Johnson & Johnson Pioneered blood typing�and testing Acquired Kodak patented�dry slide technology Leader in infectious disease �testing, including the first �antibody tests for Hepatitis C �and HIV Continue to deliver on excellent growth track record Expand product pipeline and geographic footprint Accelerate entrance into high growth market segments Integrate and drive combined value creation with Quidel 1939 – 2014 FIRST 75 YEARS 2022+ Future

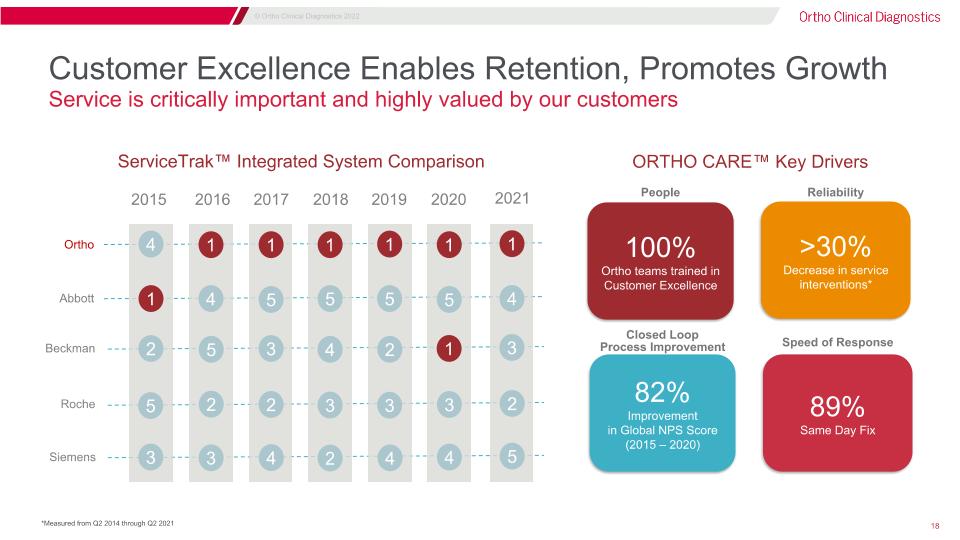

Three Strategic Priorities Drive Profitable Growth Strong momentum in base business, bolstered by innovative growth opportunities and operational efficiencies Launched new instrument platforms – OPTIX® Reader, VISION® Swift and VISION® Max Swift Launched new customer controls and 5 new or improved assays in 2021 Progress continues on “Dry-Dry” instrument platform in development that is expected to lead to significant portfolio simplification with disruptive throughput 4th consecutive quarter of double-digit core revenue growth through 3Q21 Continued commercial excellence program that was launched in 2019 focused on customer segmentation, commercial KPIs, and expanding customer facing resources (i.e. laboratory specialists) Ranked #1 in ServiceTrak™ Awards for sixth consecutive year; recent NPS was 22 percentage points higher than the next closest competitor Initiated global footprint expansion into India to bring efficiencies and scale, while fast-tracking product development and growth in emerging markets Gross profit margin expanded 280 bps to 50.8% for 3Q21-YTD Value capture savings of $18.4M 3Q21-YTD Reduced net leverage to 3.7x1, from 7.4x, and continue to target 2.5x-3.5x Product Innovation Global Commercial Excellence Operational Efficiency As of 3Q21; Net leverage is defined by net debt to trailing-twelve-month EBITDA

Financial �Results

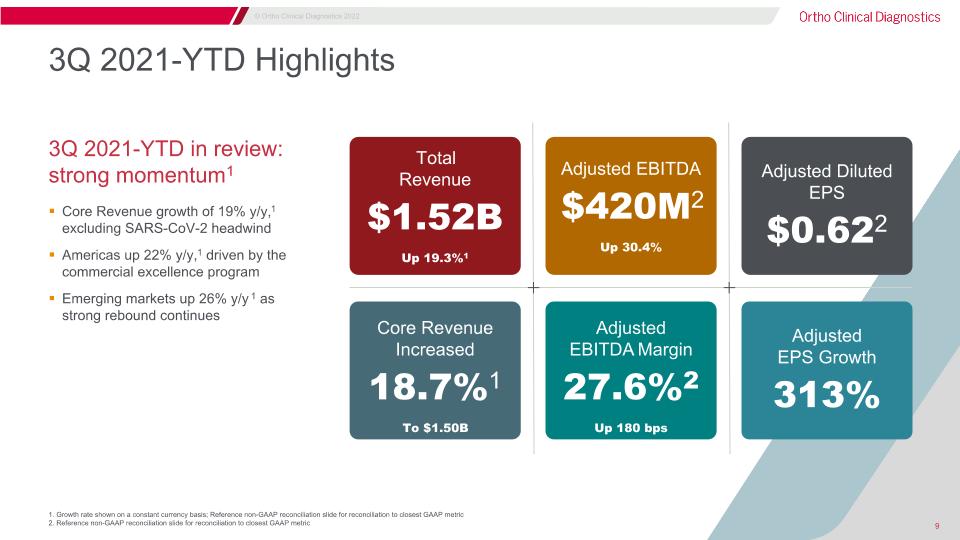

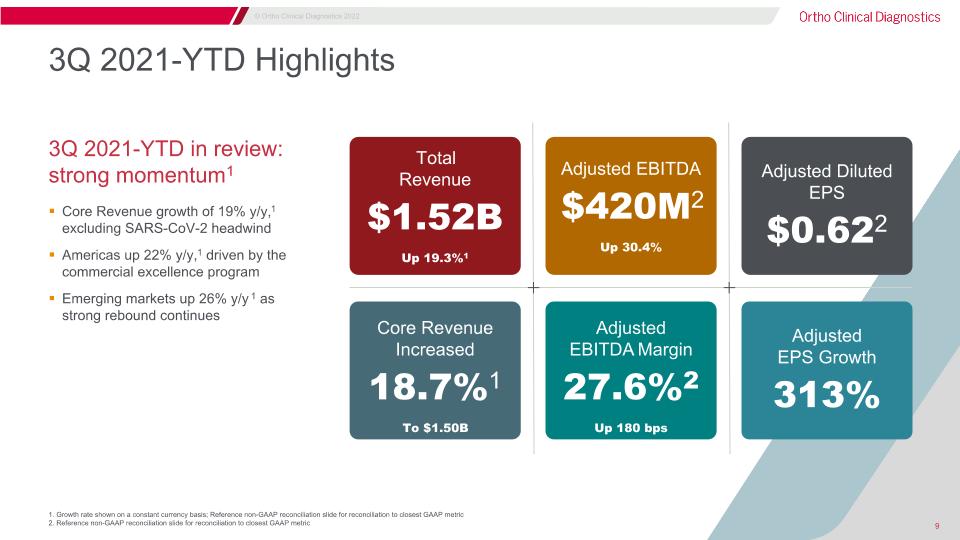

Core Revenue growth of 19% y/y,1 excluding SARS-CoV-2 headwind Americas up 22% y/y,1 driven by the commercial excellence program Emerging markets up 26% y/y 1 as strong rebound continues 3Q 2021-YTD in review:�strong momentum1 Adjusted �EPS Growth 313% Adjusted Diluted �EPS $0.622 Adjusted EBITDA $420M2 Up 30.4% Adjusted �EBITDA Margin 27.6%2 Up 180 bps 1. Growth rate shown on a constant currency basis; Reference non-GAAP reconciliation slide for reconciliation to closest GAAP metric 2. Reference non-GAAP reconciliation slide for reconciliation to closest GAAP metric 3Q 2021-YTD Highlights Core Revenue Increased 18.7%1 To $1.50B Total�Revenue $1.52B Up 19.3%1

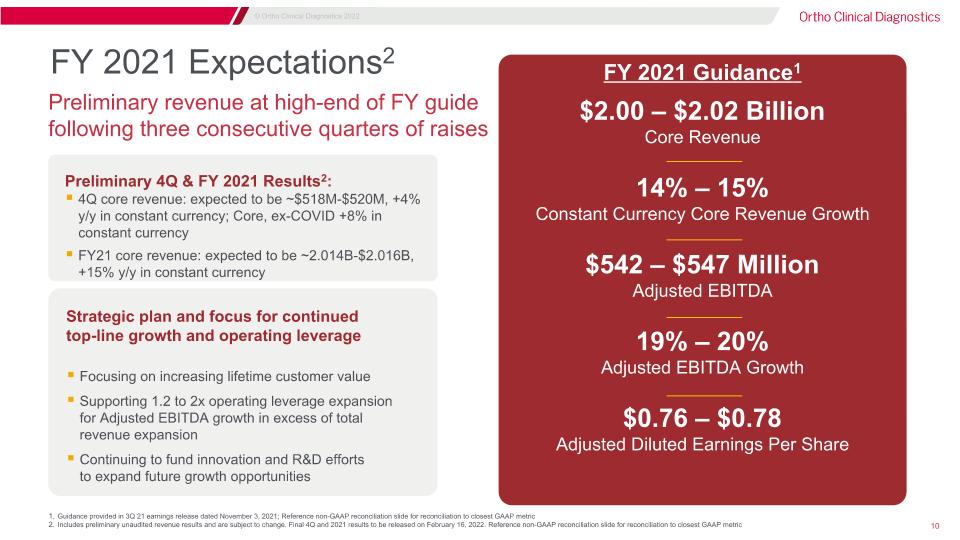

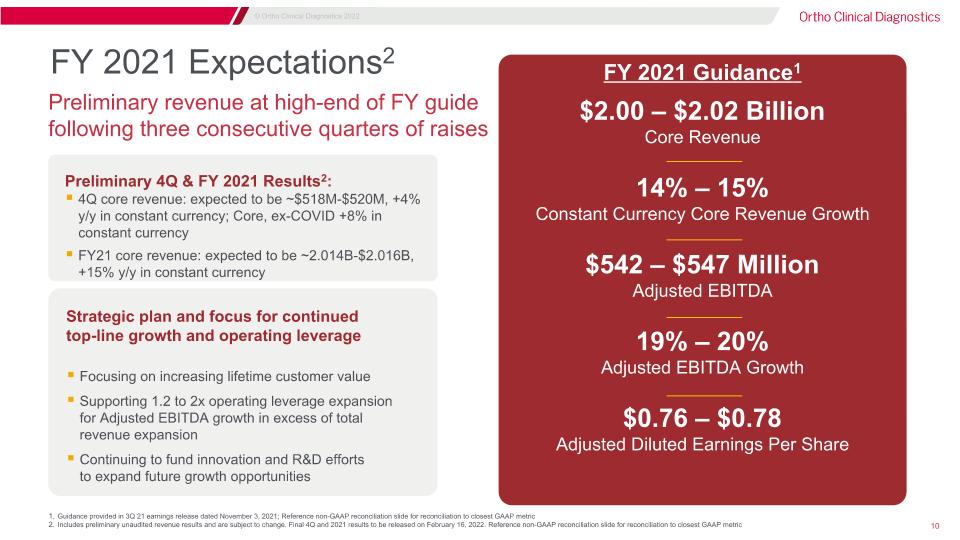

FY 2021 Expectations2 $2.00 – $2.02 Billion Core Revenue 14% – 15% Constant Currency Core Revenue Growth $542 – $547 Million Adjusted EBITDA 19% – 20% Adjusted EBITDA Growth $0.76 – $0.78 Adjusted Diluted Earnings Per Share Strategic plan and focus for continued�top-line growth and operating leverage Focusing on increasing lifetime customer value Supporting 1.2 to 2x operating leverage expansion�for Adjusted EBITDA growth in excess of total�revenue expansion Continuing to fund innovation and R&D efforts�to expand future growth opportunities Preliminary revenue at high-end of FY guide following three consecutive quarters of raises Preliminary 4Q & FY 2021 Results2: 4Q core revenue: expected to be ~$518M-$520M, +4% y/y in constant currency; Core, ex-COVID +8% in constant currency FY21 core revenue: expected to be ~2.014B-$2.016B, +15% y/y in constant currency Guidance provided in 3Q 21 earnings release dated November 3, 2021; Reference non-GAAP reconciliation slide for reconciliation to closest GAAP metric Includes preliminary unaudited revenue results and are subject to change. Final 4Q and 2021 results to be released on February 16, 2022. Reference non-GAAP reconciliation slide for reconciliation to closest GAAP metric FY 2021 Guidance1

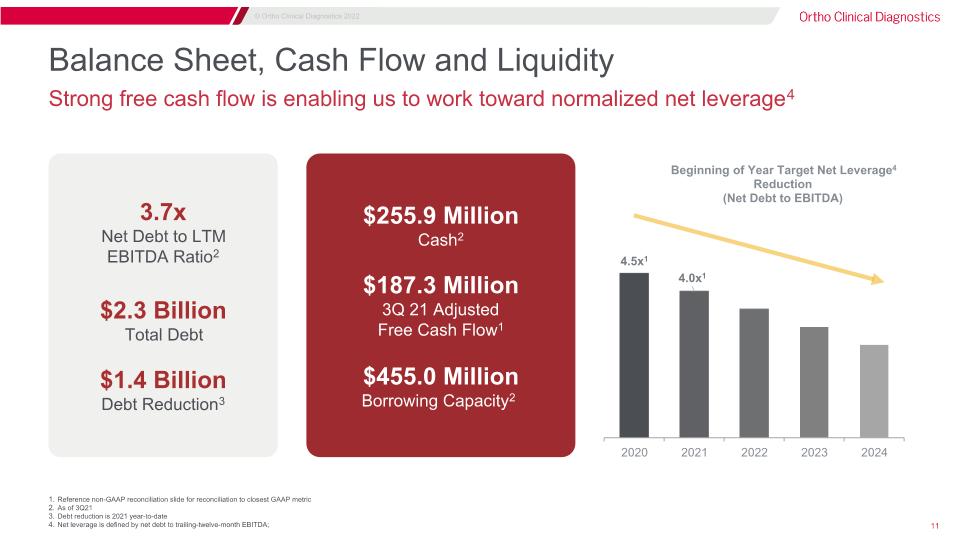

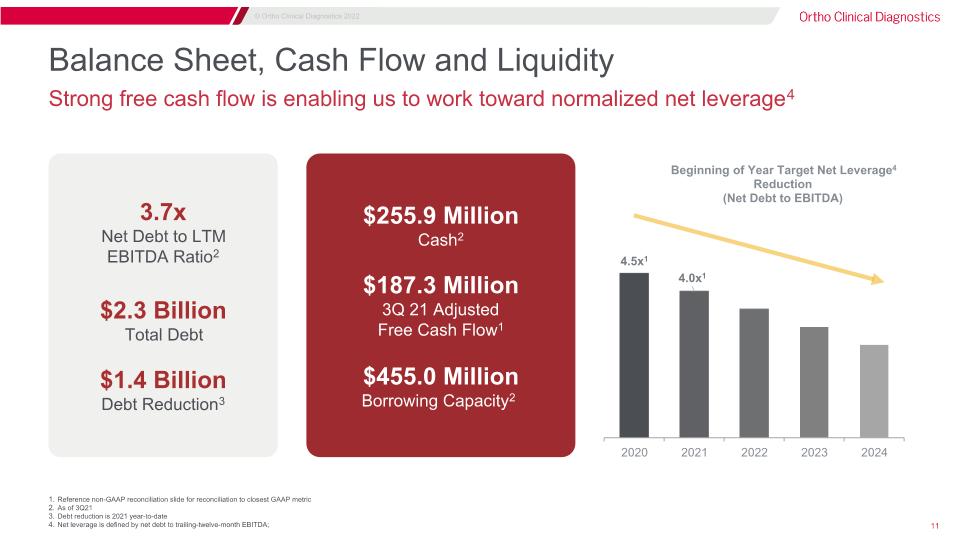

Balance Sheet, Cash Flow and Liquidity Strong free cash flow is enabling us to work toward normalized net leverage4 3.7x�Net Debt to LTM�EBITDA Ratio2 $2.3 Billion Total Debt $1.4 Billion Debt Reduction3 $255.9 Million Cash2 $187.3 Million 3Q 21 Adjusted�Free Cash Flow1 $455.0 Million Borrowing Capacity2 Reference non-GAAP reconciliation slide for reconciliation to closest GAAP metric As of 3Q21 Debt reduction is 2021 year-to-date Net leverage is defined by net debt to trailing-twelve-month EBITDA;

Business �Overview

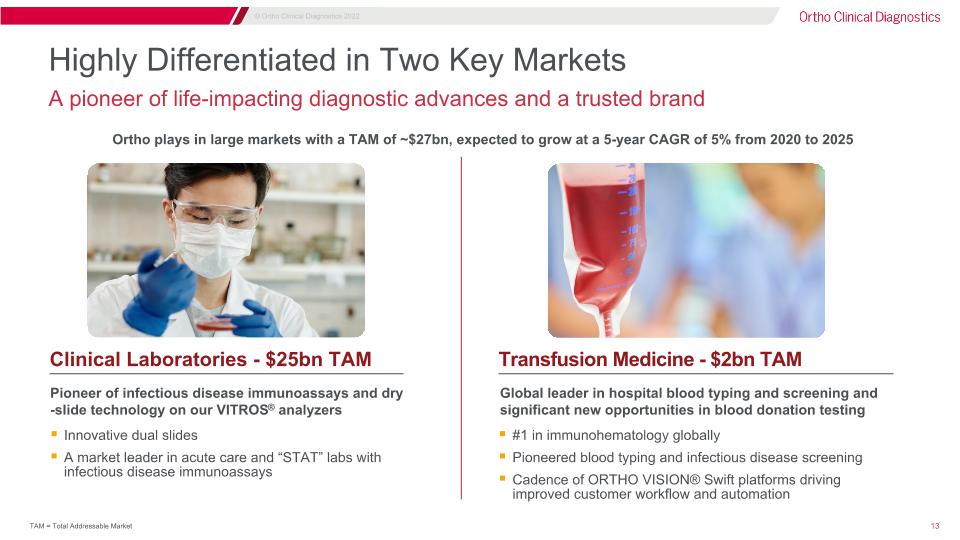

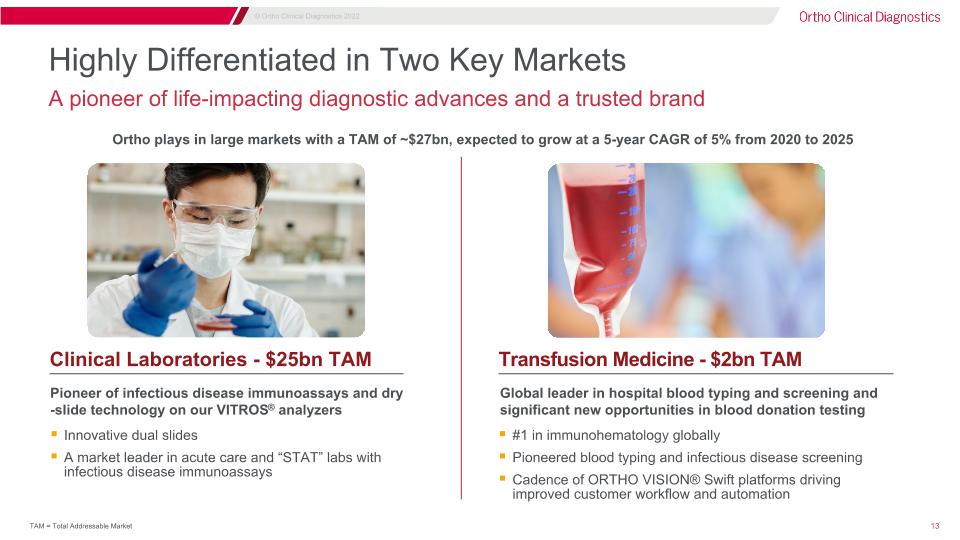

Highly Differentiated in Two Key Markets A pioneer of life-impacting diagnostic advances and a trusted brand Pioneer of infectious disease immunoassays and dry-slide technology on our VITROS® analyzers Innovative dual slides A market leader in acute care and “STAT” labs with infectious disease immunoassays Global leader in hospital blood typing and screening and significant new opportunities in blood donation testing #1 in immunohematology globally Pioneered blood typing and infectious disease screening Cadence of ORTHO VISION® Swift platforms driving improved customer workflow and automation Clinical Laboratories - $25bn TAM Transfusion Medicine - $2bn TAM Ortho plays in large markets with a TAM of ~$27bn, expected to grow at a 5-year CAGR of 5% from 2020 to 2025 TAM = Total Addressable Market

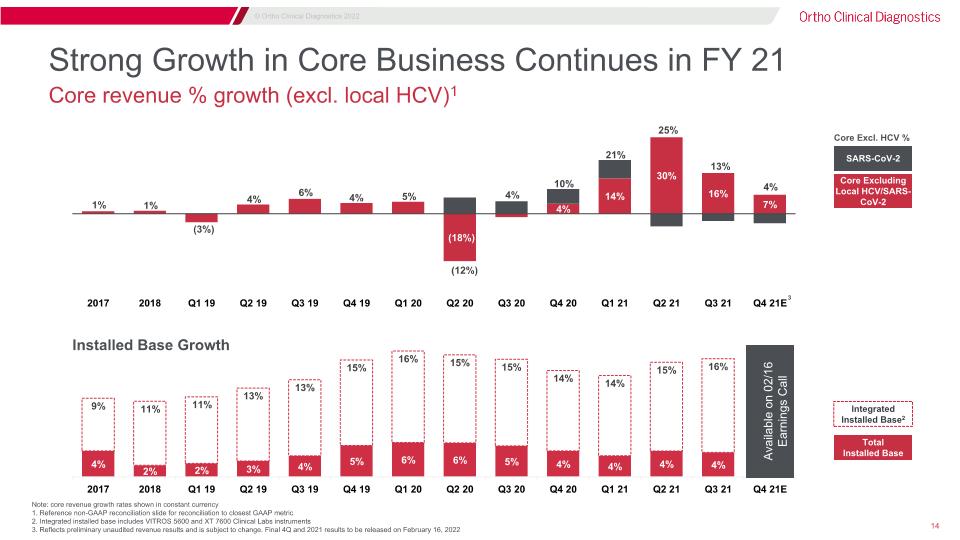

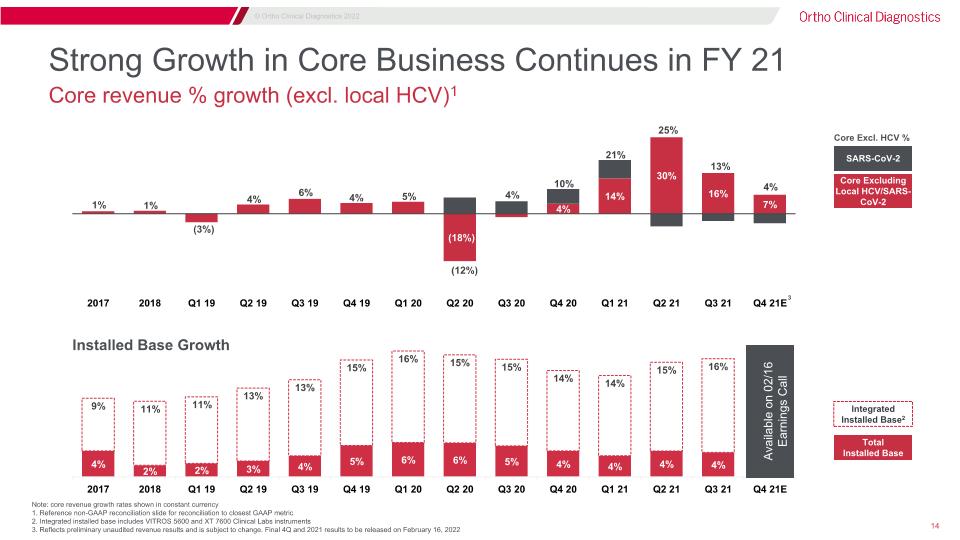

Strong Growth in Core Business Continues in FY 21 Core Excluding Local HCV/SARS-CoV-2 SARS-CoV-2 Core Excl. HCV % Total Installed Base Note: core revenue growth rates shown in constant currency 1. Reference non-GAAP reconciliation slide for reconciliation to closest GAAP metric 2. Integrated installed base includes VITROS 5600 and XT 7600 Clinical Labs instruments 3. Reflects preliminary unaudited revenue results and is subject to change. Final 4Q and 2021 results to be released on February 16, 2022 Integrated Installed Base2 Core revenue % growth (excl. local HCV)1 Installed Base Growth 3 Available on 02/16 Earnings Call

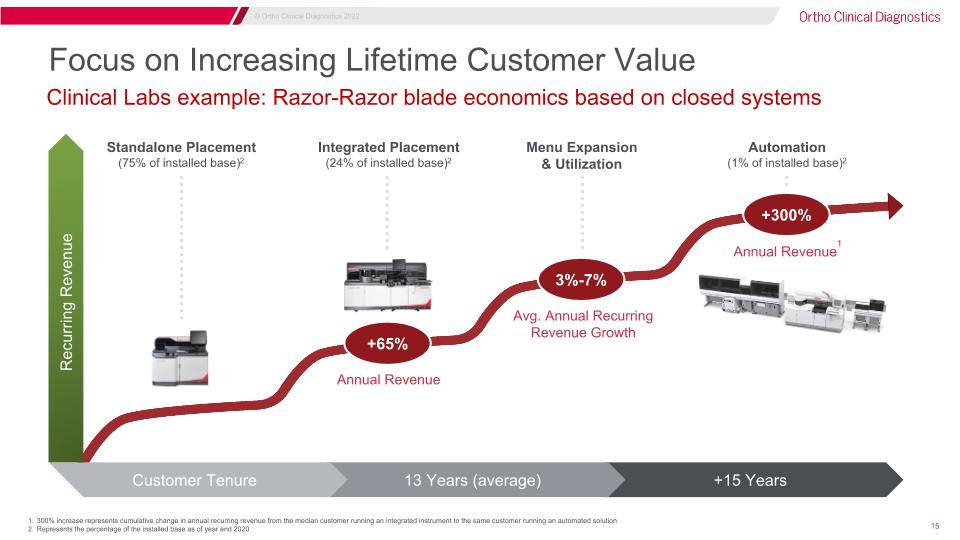

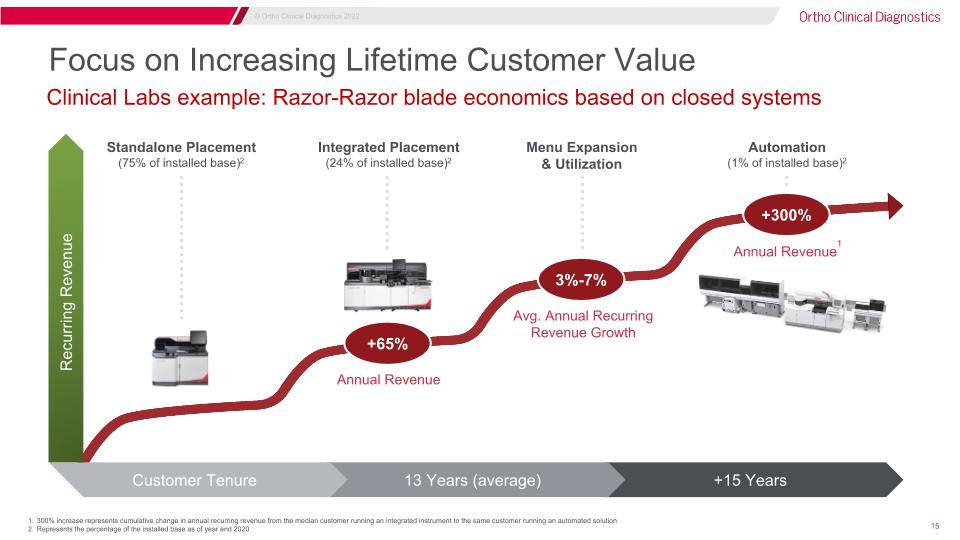

Focus on Increasing Lifetime Customer Value 300% increase represents cumulative change in annual recurring revenue from the median customer running an integrated instrument to the same customer running an automated solution Represents the percentage of the installed base as of year end 2020 Clinical Labs example: Razor-Razor blade economics based on closed systems Standalone Placement�(75% of installed base)2 Integrated Placement�(24% of installed base)2 Annual Revenue1 Avg. Annual Recurring Revenue Growth Automation�(1% of installed base)2 Menu Expansion & Utilization Annual Revenue +65% 3%-7% +300% +15 Years 13 Years (average) Customer Tenure Recurring Revenue

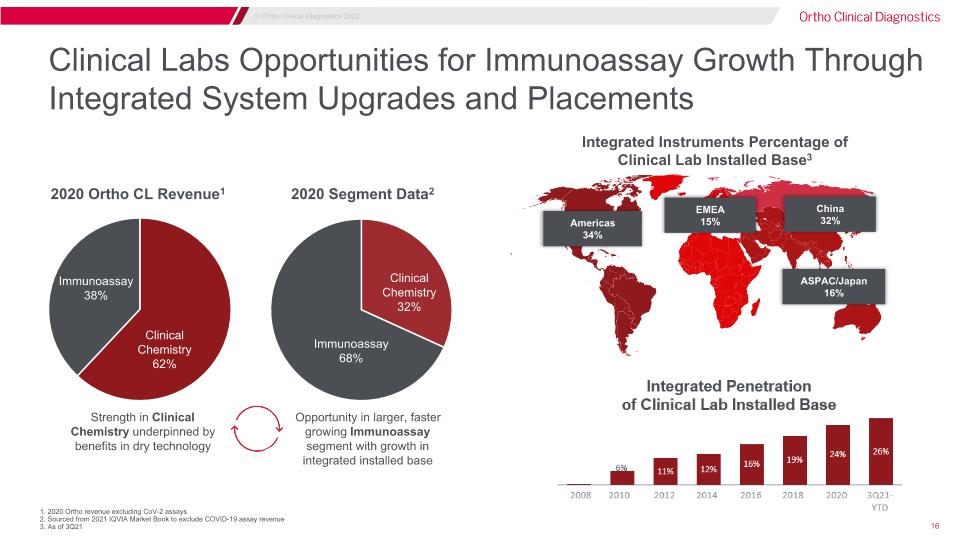

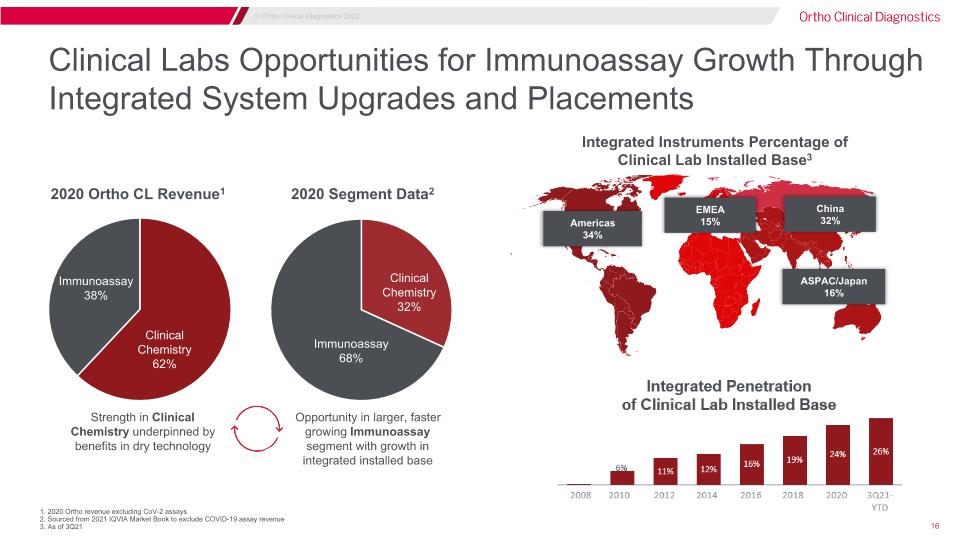

Clinical Labs Opportunities for Immunoassay Growth Through Integrated System Upgrades and Placements Integrated Instruments Percentage of Clinical Lab Installed Base3 Americas �34% EMEA 15% ASPAC/Japan 16% China 32% 2020 Ortho CL Revenue1 2020 Segment Data2 Strength in Clinical Chemistry underpinned by benefits in dry technology Opportunity in larger, faster growing Immunoassay segment with growth in integrated installed base Immunoassay 38% Clinical�Chemistry�62% Clinical Chemistry�32% Immunoassay 68% 1. 2020 Ortho revenue excluding CoV-2 assays 2. Sourced from 2021 IQVIA Market Book to exclude COVID-19 assay revenue 3. As of 3Q21

Market Specific & Globally Connected Commercial Edge Insight Driven Focused & Disciplined Digitally Enabled Phase 01 Phase 02 Phase 03 ASPAC, Japan, LATAM, Distribution Markets China, Western Europe North America Commercial Evolution Increase sales efficiency through strategy optimization Introduce and align new customer engagement channels (non sales) Identify additional growth opportunities Commercial 360 Enhance customer value by digitally aligning and integrating customer touchpoints Optimize customer engagement channels to accelerate revenue Expand market reach Commercial Excellence Program Has Improved Execution Define sweet spot through market and customer segmentation Establish growth equation Focused commercial KPI’s that drive strategy effectiveness Expanding customer facing resources (i.e. laboratory specialists)

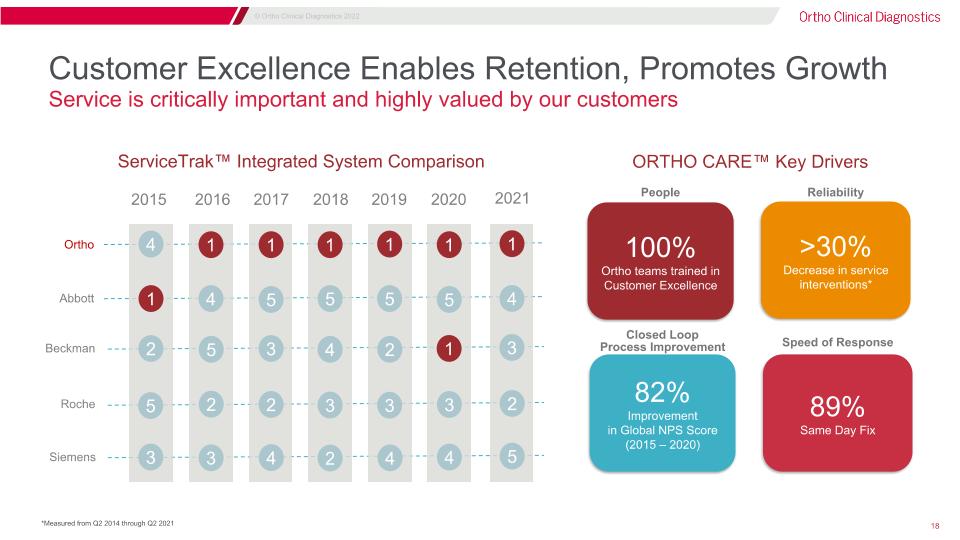

Customer Excellence Enables Retention, Promotes Growth Service is critically important and highly valued by our customers >30% Decrease in service interventions* 100% Ortho teams trained in Customer Excellence Closed Loop �Process Improvement 82% Improvement in Global NPS Score �(2015 – 2020) 89% Same Day Fix Speed of Response People Reliability ORTHO CARE™ Key Drivers ServiceTrak™ Integrated System Comparison 4 3 1 2 5 1 3 4 5 2 1 4 5 3 2 1 2 5 4 3 1 4 5 2 3 1 4 5 1 3 Ortho Abbott Beckman Roche Siemens 2015 2016 2017 2018 2019 2020 2021 1 5 4 3 2 *Measured from Q2 2014 through Q2 2021

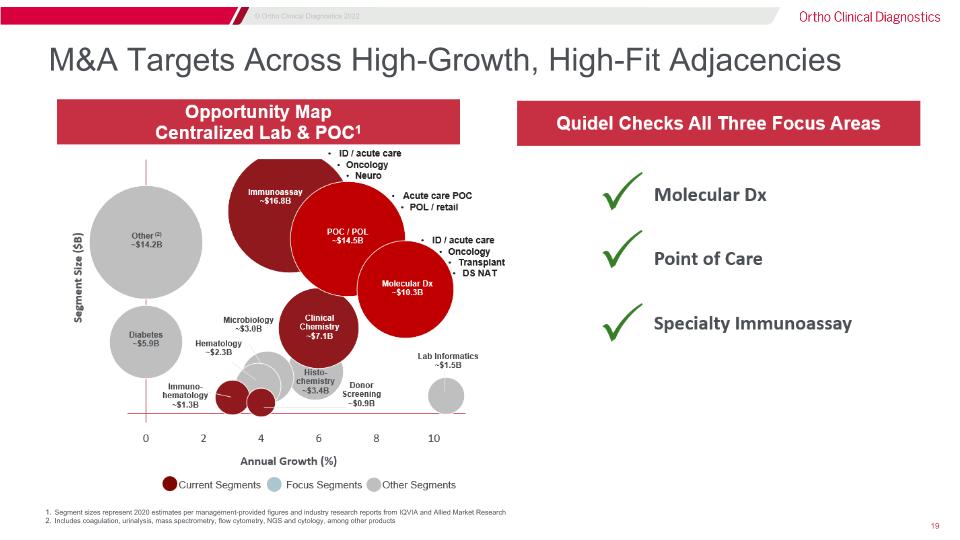

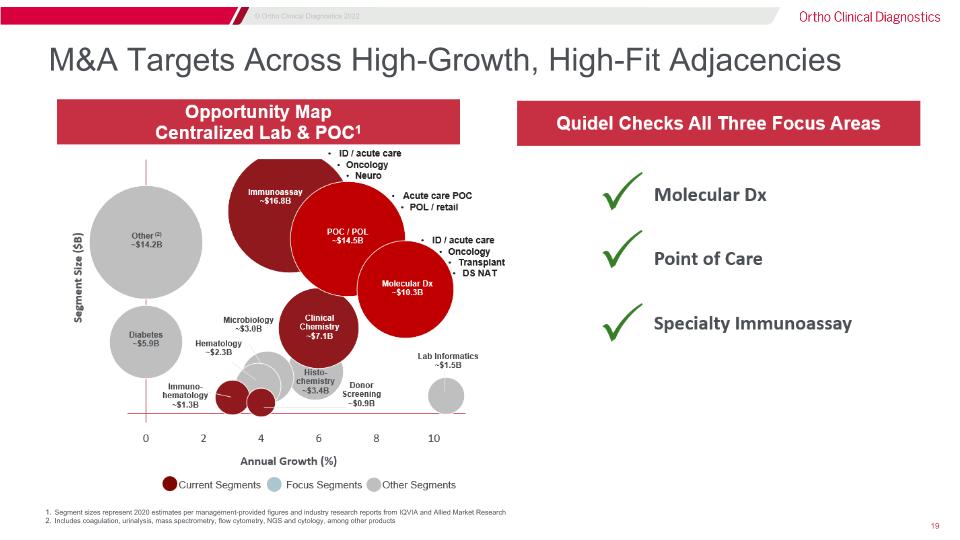

M&A Targets Across High-Growth, High-Fit Adjacencies Segment sizes represent 2020 estimates per management-provided figures and industry research reports from IQVIA and Allied Market Research Includes coagulation, urinalysis, mass spectrometry, flow cytometry, NGS and cytology, among other products

Acquisition �by Quidel

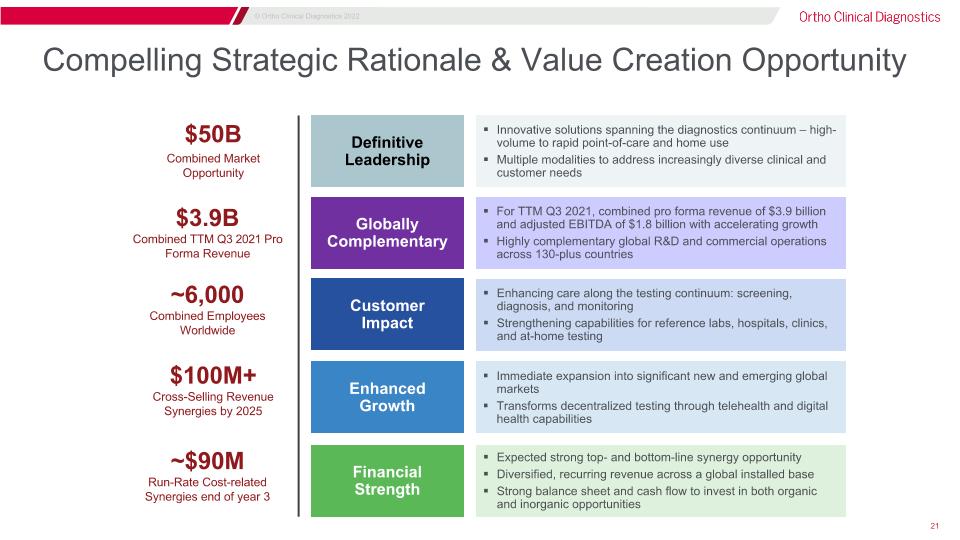

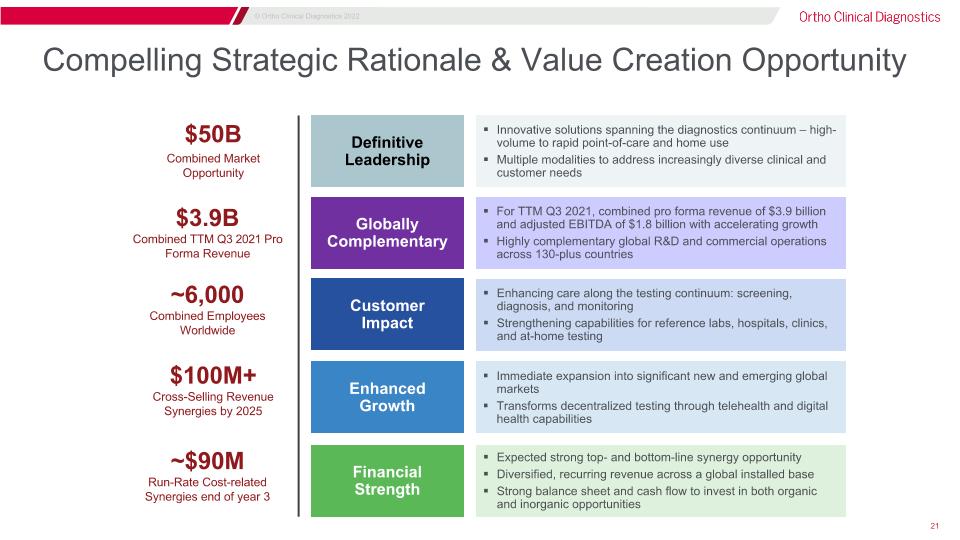

Compelling Strategic Rationale & Value Creation Opportunity $3.9B Combined TTM Q3 2021 Pro Forma Revenue ~6,000�Combined Employees Worldwide $50B Combined Market Opportunity $100M+�Cross-Selling Revenue Synergies by 2025 ~$90M�Run-Rate Cost-related Synergies end of year 3 Definitive Leadership Globally Complementary Customer Impact Enhanced Growth Financial Strength Innovative solutions spanning the diagnostics continuum – high-volume to rapid point-of-care and home use Multiple modalities to address increasingly diverse clinical and customer needs For TTM Q3 2021, combined pro forma revenue of $3.9 billion and adjusted EBITDA of $1.8 billion with accelerating growth Highly complementary global R&D and commercial operations across 130-plus countries Enhancing care along the testing continuum: screening, diagnosis, and monitoring Strengthening capabilities for reference labs, hospitals, clinics, and at-home testing Immediate expansion into significant new and emerging global markets Transforms decentralized testing through telehealth and digital health capabilities Expected strong top- and bottom-line synergy opportunity Diversified, recurring revenue across a global installed base Strong balance sheet and cash flow to invest in both organic and inorganic opportunities

Together, We Expect to Be a Stronger Dx Company R&D, Clinical/Regulatory, and Commercial capabilities expected to drive growth across segments Global infrastructure (NA, LATAM, EMEA, Japan, China, ASPAC) Diversified, stable and growing revenue 2,300 direct global teammates focused on commercial sales and service Longstanding and deep customer relationships (average of 13 years for clin labs) 14 instrument systems covering 24 therapeutic areas with 240 assays Dry slide technology offering improved ease of use (fewer parts and fewer tubes) Sizeable growth opportunities in fast growing segments Brand strength in POC testing and emerging Brand in OTC segments Robust R&D pipeline of 50 active projects including two new near-patient / POC platforms Exceptional balance sheet with ~$1Bn in cash (FY2021) and no debt Sofia 2 Project “Leapfrog” Sofia Q Next-Gen IA system (POC) Savanna Lyra (PCR reagents) POC IA Home Testing & Telemedicine POC MDx Two Complementary Organizations

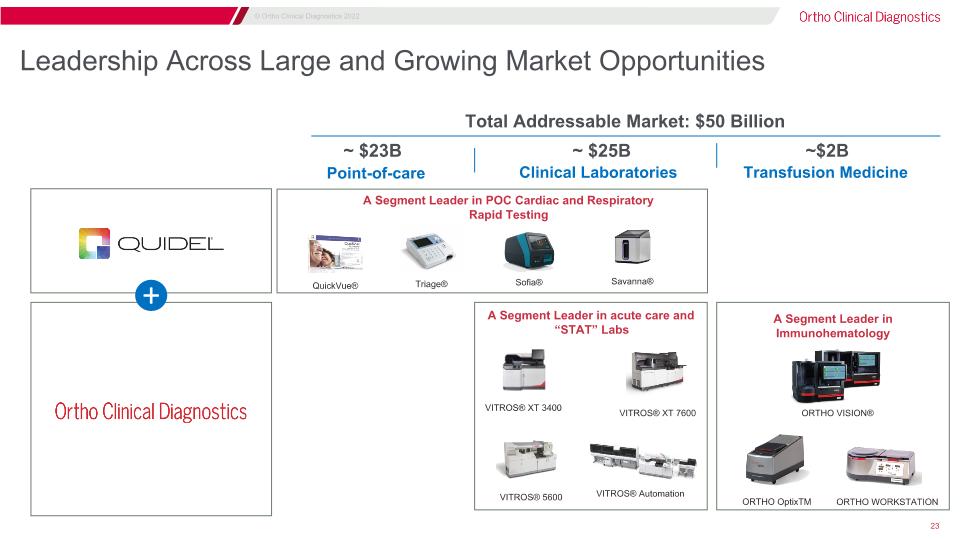

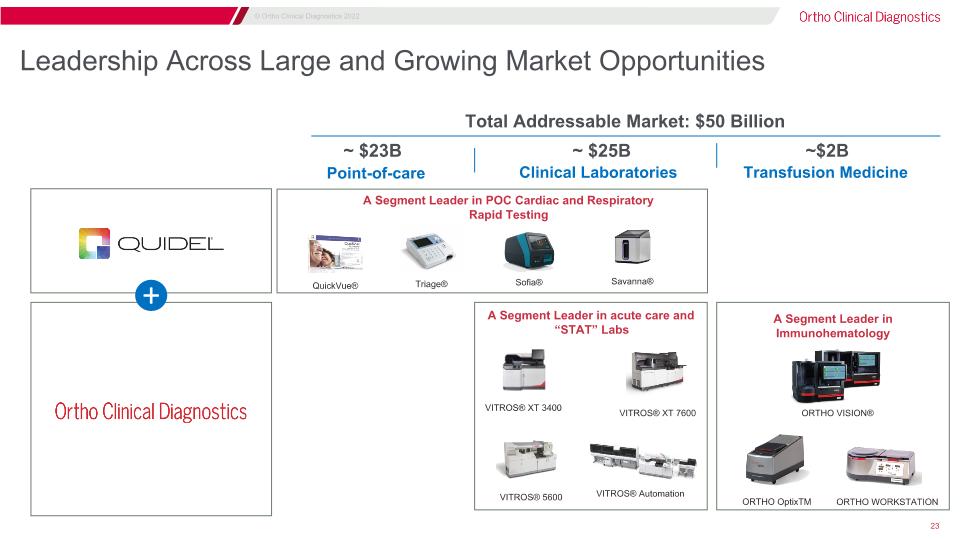

Leadership Across Large and Growing Market Opportunities Point-of-care Clinical Laboratories Transfusion Medicine Savanna® QuickVue® Sofia® Triage® ~ $23B ~ $25B ~$2B VITROS® XT 7600 VITROS® Automation VITROS® 5600 VITROS® XT 3400 ORTHO VISION® ORTHO WORKSTATION ORTHO OptixTM + Total Addressable Market: $50 Billion A Segment Leader in acute care and “STAT” Labs A Segment Leader in Immunohematology A Segment Leader in POC Cardiac and Respiratory Rapid Testing

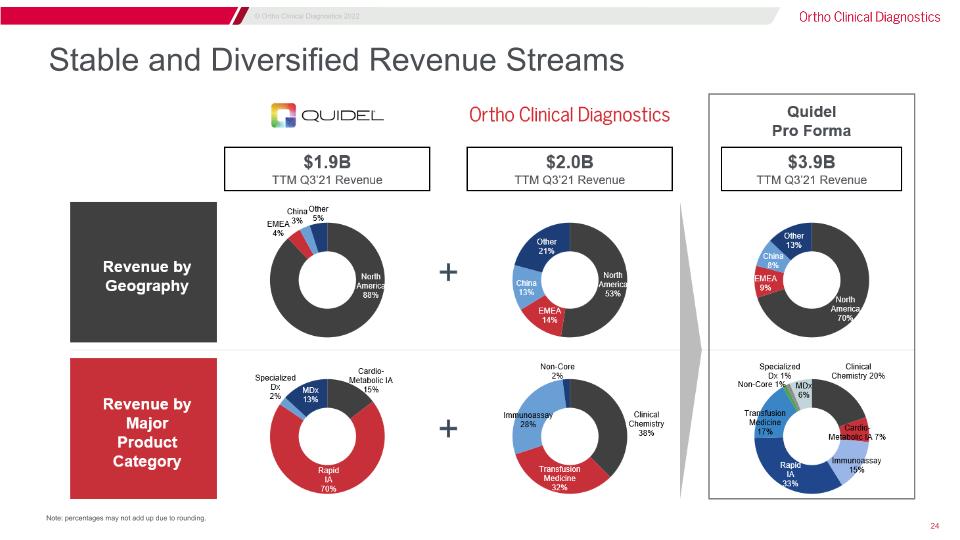

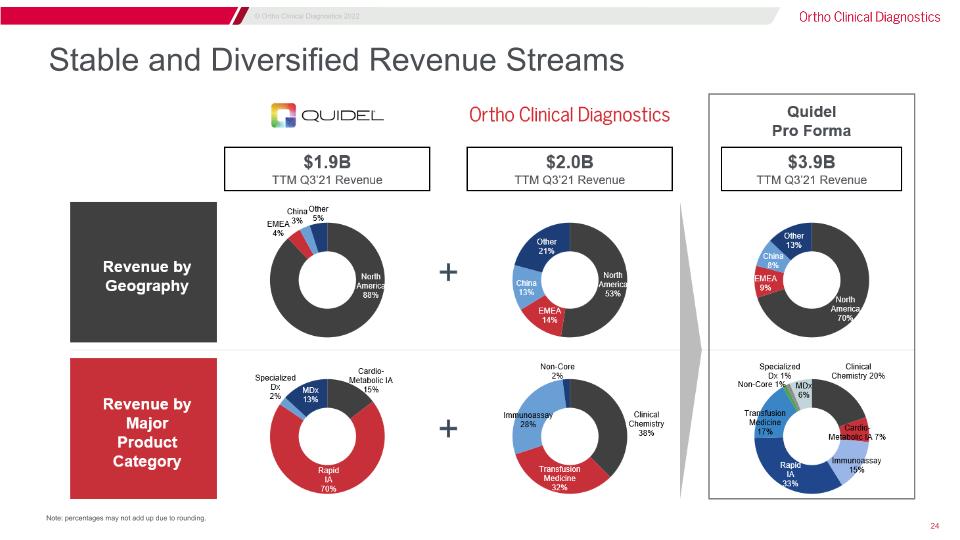

Stable and Diversified Revenue Streams Note: percentages may not add up due to rounding.

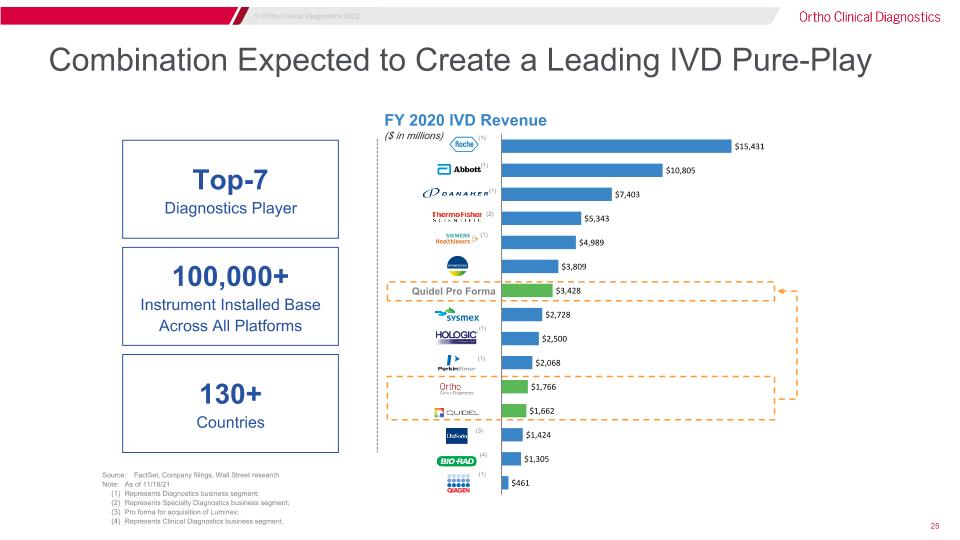

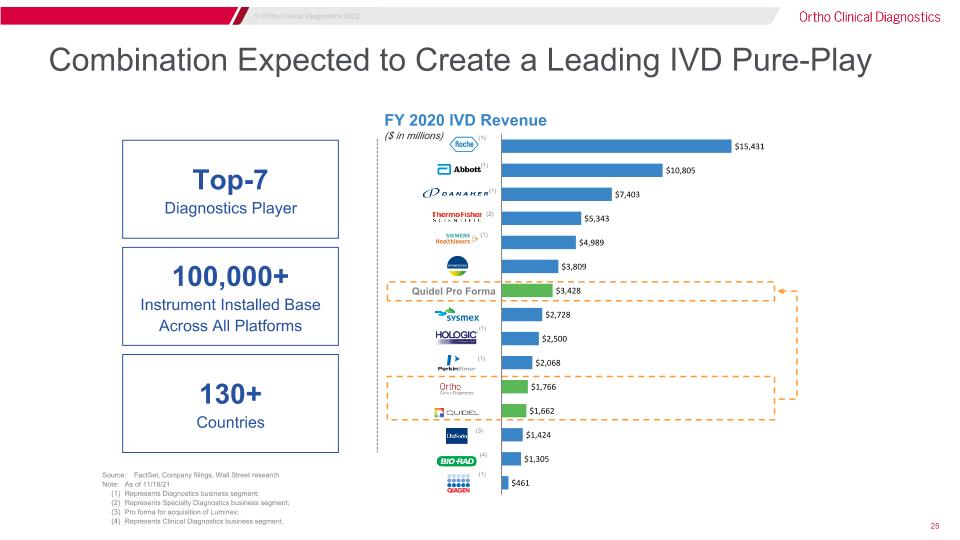

Combination Expected to Create a Leading IVD Pure-Play (4) (2) (3) (1) (1) (1) (1) (1) (1) Quidel Pro Forma 100,000+ Instrument Installed Base Across All Platforms Top-7 Diagnostics Player Source: FactSet, Company filings, Wall Street research Note: As of 11/18/21 Represents Diagnostics business segment; Represents Specialty Diagnostics business segment; Pro forma for acquisition of Luminex; Represents Clinical Diagnostics business segment. 130+ Countries FY 2020 IVD Revenue ($ in millions) (1)

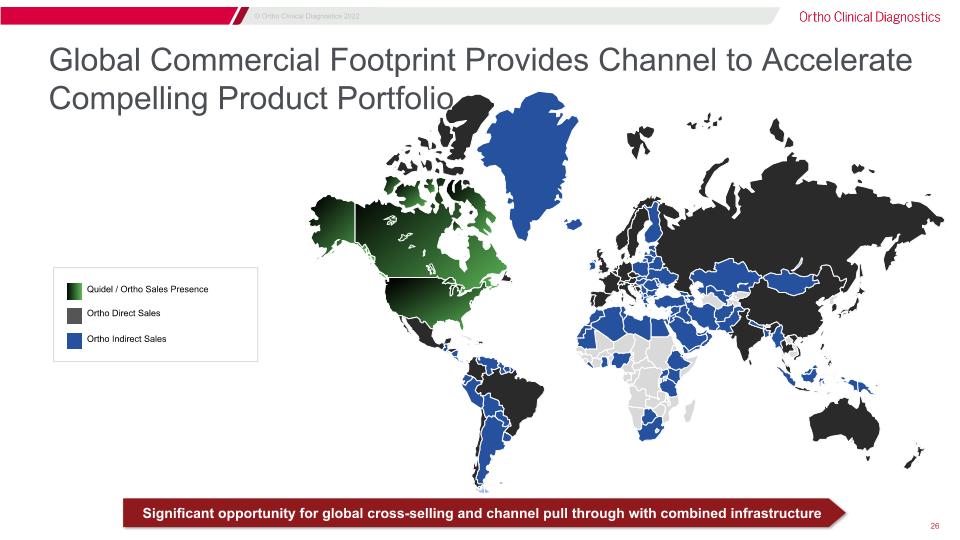

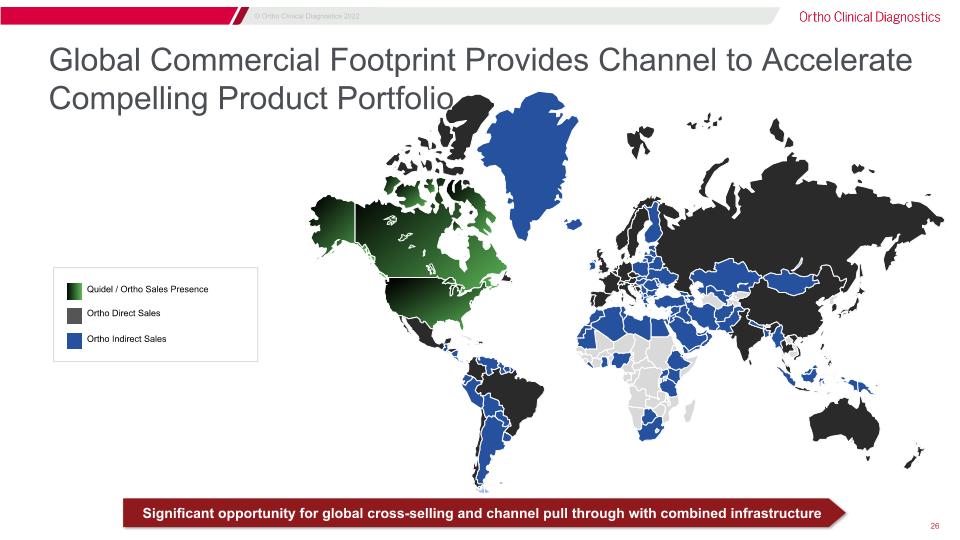

Global Commercial Footprint Provides Channel to Accelerate Compelling Product Portfolio Ortho Direct Sales Ortho Indirect Sales Quidel / Ortho Sales Presence Significant opportunity for global cross-selling and channel pull through with combined infrastructure

Dedicated Integration Team Focused on Clear Milestones Process allows the rest of the organization to continue running and growing the businesses Executive Steering Committee Integration Management Team Close the Deal & Prepare for Integration Next 120 Days Integrate the Organization 18 – 24 months Capture Synergies 36 months Revenue Synergies: Approx. 80% of the $100 million in revenue synergies come from Molecular products, cross-selling into same call-points and leveraging the geographical footprint and expertise outside U.S. to launch new products like Savanna. Cost Synergies: achievable $90 million identified, totaling approx. 5% of estimated total operating costs. Opportunity to refinance and pay off Ortho senior notes early represents another $30 million in annual savings. Ortho’s prior-year NOLs of $1.2 billion create a potential cash tax benefit.

APPENDIX

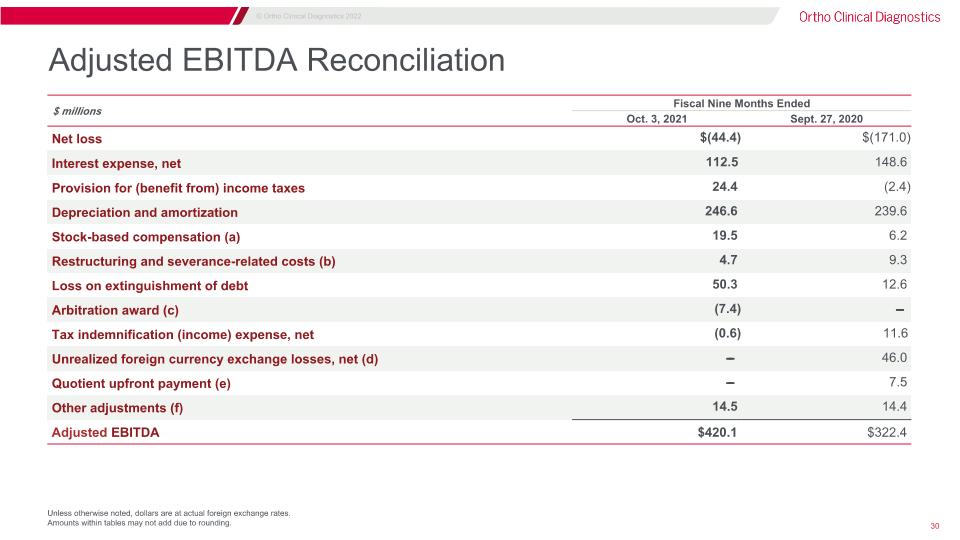

Adjusted EBITDA Reconciliation Unless otherwise noted, dollars are at actual foreign exchange rates. Amounts within tables may not add due to rounding. $ millions Fiscal Nine Months Ended Three Months Ended Oct. 3, 2021 Sept. 27, 2020 Net loss $(44.4) $(171.0) Interest expense, net 112.5 148.6 Provision for (benefit from) income taxes 24.4 (2.4) Depreciation and amortization 246.6 239.6 Stock-based compensation (a) 19.5 6.2 Restructuring and severance-related costs (b) 4.7 9.3 Loss on extinguishment of debt 50.3 12.6 Arbitration award (c) (7.4) ̵̶̶ Tax indemnification (income) expense, net (0.6) 11.6 Unrealized foreign currency exchange losses, net (d) ̵̶̶ 46.0 Quotient upfront payment (e) ̵̶̶ 7.5 Other adjustments (f) 14.5 14.4 Adjusted EBITDA $420.1 $322.4

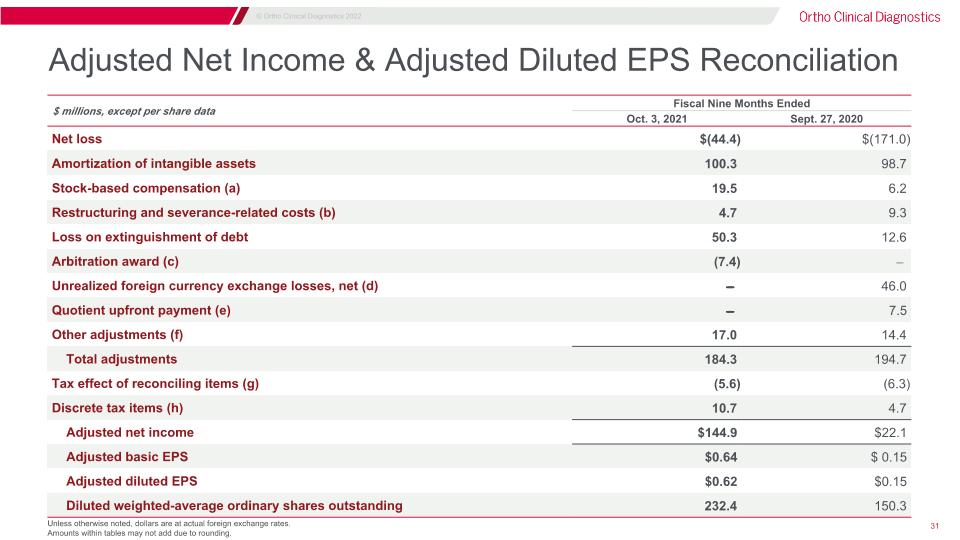

Adjusted Net Income & Adjusted Diluted EPS Reconciliation Unless otherwise noted, dollars are at actual foreign exchange rates. Amounts within tables may not add due to rounding. $ millions, except per share data Fiscal Nine Months Ended Three Months Ended Oct. 3, 2021 Sept. 27, 2020 Net loss $(44.4) $(171.0) Amortization of intangible assets 100.3 98.7 Stock-based compensation (a) 19.5 6.2 Restructuring and severance-related costs (b) 4.7 9.3 Loss on extinguishment of debt 50.3 12.6 Arbitration award (c) (7.4) ̵̶̶ Unrealized foreign currency exchange losses, net (d) ̵̶̶ 46.0 Quotient upfront payment (e) ̵̶̶ 7.5 Other adjustments (f) 17.0 14.4 Total adjustments 184.3 194.7 Tax effect of reconciling items (g) (5.6) (6.3) Discrete tax items (h) 10.7 4.7 Adjusted net income $144.9 $22.1 Adjusted basic EPS $0.64 $ 0.15 Adjusted diluted EPS $0.62 $0.15 Diluted weighted-average ordinary shares outstanding 232.4 150.3

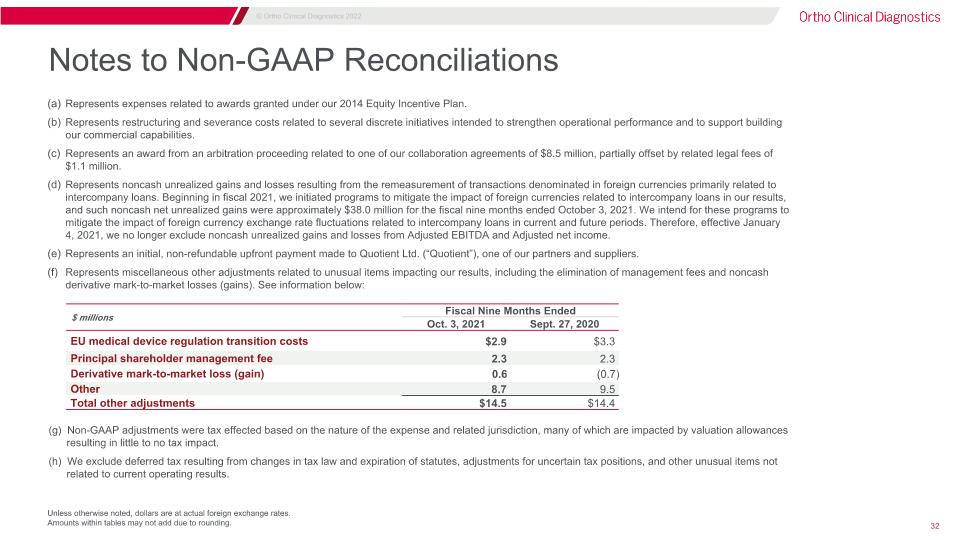

Notes to Non-GAAP Reconciliations Unless otherwise noted, dollars are at actual foreign exchange rates. Amounts within tables may not add due to rounding. $ millions Fiscal Nine Months Ended Three Months Ended Oct. 3, 2021 Sept. 27, 2020 EU medical device regulation transition costs $2.9 $3.3 Principal shareholder management fee 2.3 2.3 Derivative mark-to-market loss (gain) 0.6 (0.7) Other 8.7 9.5 Total other adjustments $14.5 $14.4 Represents expenses related to awards granted under our 2014 Equity Incentive Plan. Represents restructuring and severance costs related to several discrete initiatives intended to strengthen operational performance and to support building our commercial capabilities. Represents an award from an arbitration proceeding related to one of our collaboration agreements of $8.5 million, partially offset by related legal fees of $1.1 million. Represents noncash unrealized gains and losses resulting from the remeasurement of transactions denominated in foreign currencies primarily related to intercompany loans. Beginning in fiscal 2021, we initiated programs to mitigate the impact of foreign currencies related to intercompany loans in our results, and such noncash net unrealized gains were approximately $38.0 million for the fiscal nine months ended October 3, 2021. We intend for these programs to mitigate the impact of foreign currency exchange rate fluctuations related to intercompany loans in current and future periods. Therefore, effective January 4, 2021, we no longer exclude noncash unrealized gains and losses from Adjusted EBITDA and Adjusted net income. Represents an initial, non-refundable upfront payment made to Quotient Ltd. (“Quotient”), one of our partners and suppliers. Represents miscellaneous other adjustments related to unusual items impacting our results, including the elimination of management fees and noncash derivative mark-to-market losses (gains). See information below: (g) Non-GAAP adjustments were tax effected based on the nature of the expense and related jurisdiction, many of which are impacted by valuation allowances resulting in little to no tax impact. (h) We exclude deferred tax resulting from changes in tax law and expiration of statutes, adjustments for uncertain tax positions, and other unusual items not related to current operating results.

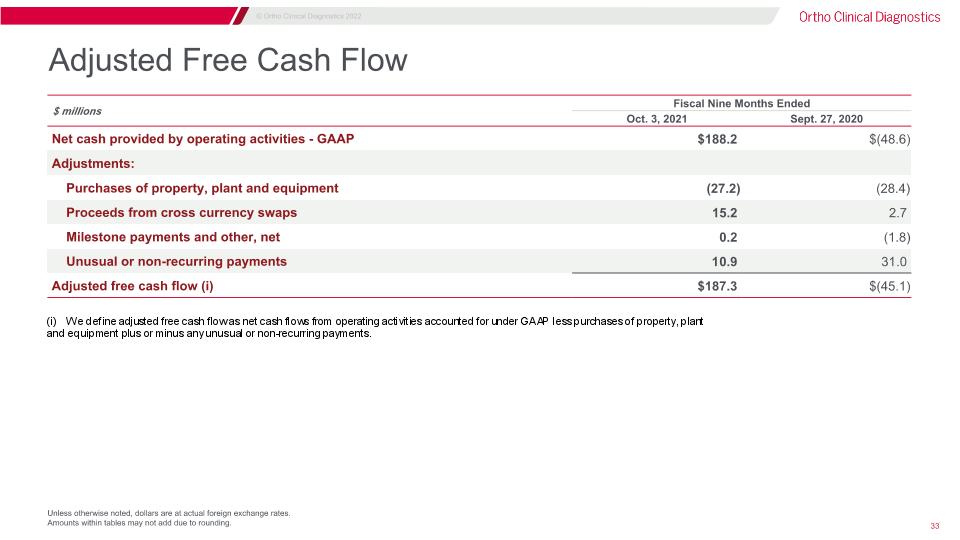

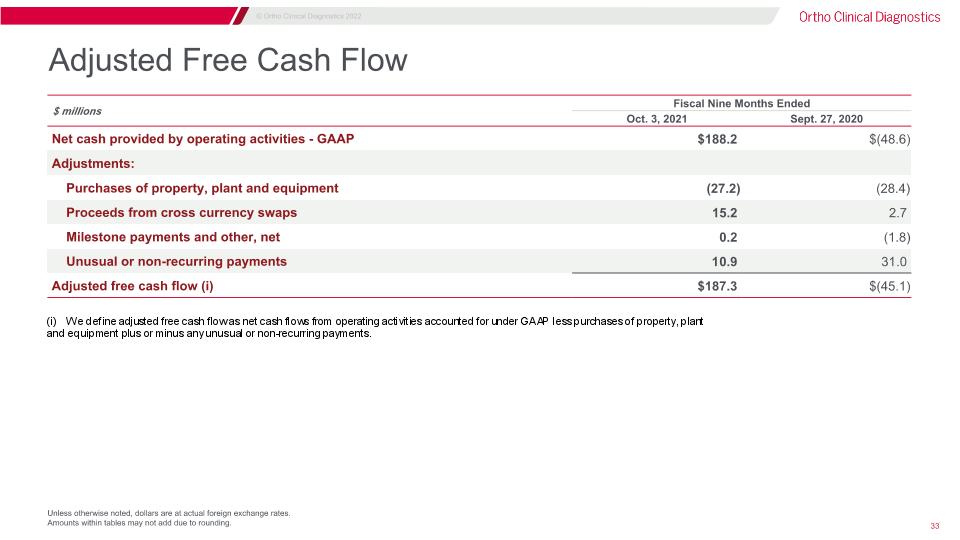

Adjusted Free Cash Flow Unless otherwise noted, dollars are at actual foreign exchange rates. Amounts within tables may not add due to rounding. $ millions Fiscal Nine Months Ended Three Months Ended Oct. 3, 2021 Sept. 27, 2020 Net cash provided by operating activities - GAAP $188.2 $(48.6) Adjustments: Purchases of property, plant and equipment (27.2) (28.4) Proceeds from cross currency swaps 15.2 2.7 Milestone payments and other, net 0.2 (1.8) Unusual or non-recurring payments 10.9 31.0 Adjusted free cash flow (i) $187.3 $(45.1)

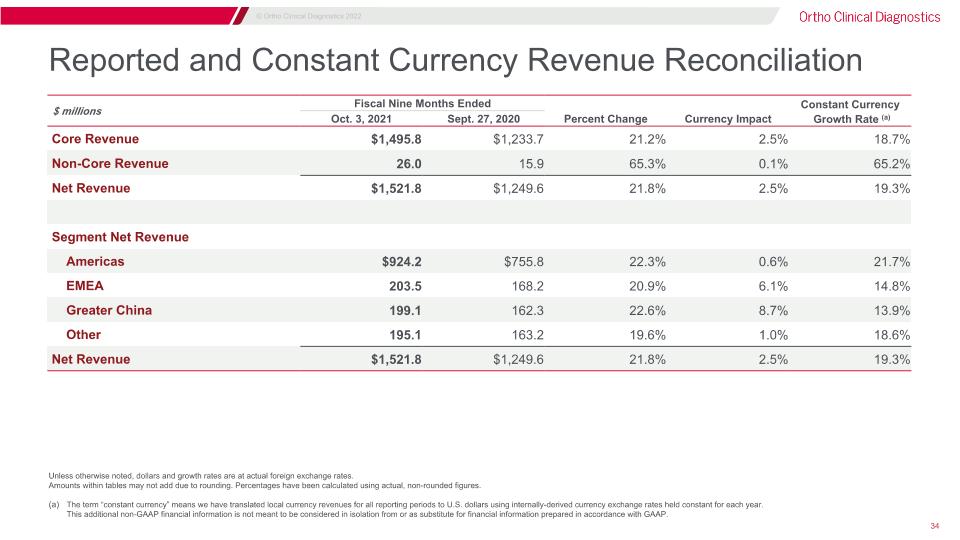

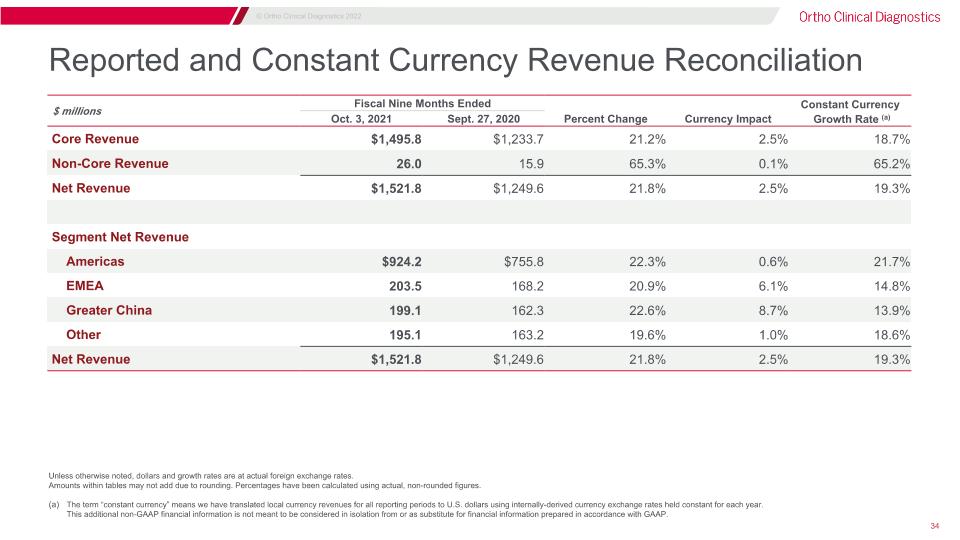

Reported and Constant Currency Revenue Reconciliation Unless otherwise noted, dollars and growth rates are at actual foreign exchange rates. Amounts within tables may not add due to rounding. Percentages have been calculated using actual, non-rounded figures. The term “constant currency” means we have translated local currency revenues for all reporting periods to U.S. dollars using internally-derived currency exchange rates held constant for each year.�This additional non-GAAP financial information is not meant to be considered in isolation from or as substitute for financial information prepared in accordance with GAAP. $ millions Fiscal Nine Months Ended Three Months Ended Constant Currency Oct. 3, 2021 Sept. 27, 2020 Percent Change Currency Impact Growth Rate (a) Core Revenue $1,495.8 $1,233.7 21.2% 2.5% 18.7% Non-Core Revenue 26.0 15.9 65.3% 0.1% 65.2% Net Revenue $1,521.8 $1,249.6 21.8% 2.5% 19.3% Segment Net Revenue Americas $924.2 $755.8 22.3% 0.6% 21.7% EMEA 203.5 168.2 20.9% 6.1% 14.8% Greater China 199.1 162.3 22.6% 8.7% 13.9% Other 195.1 163.2 19.6% 1.0% 18.6% Net Revenue $1,521.8 $1,249.6 21.8% 2.5% 19.3%

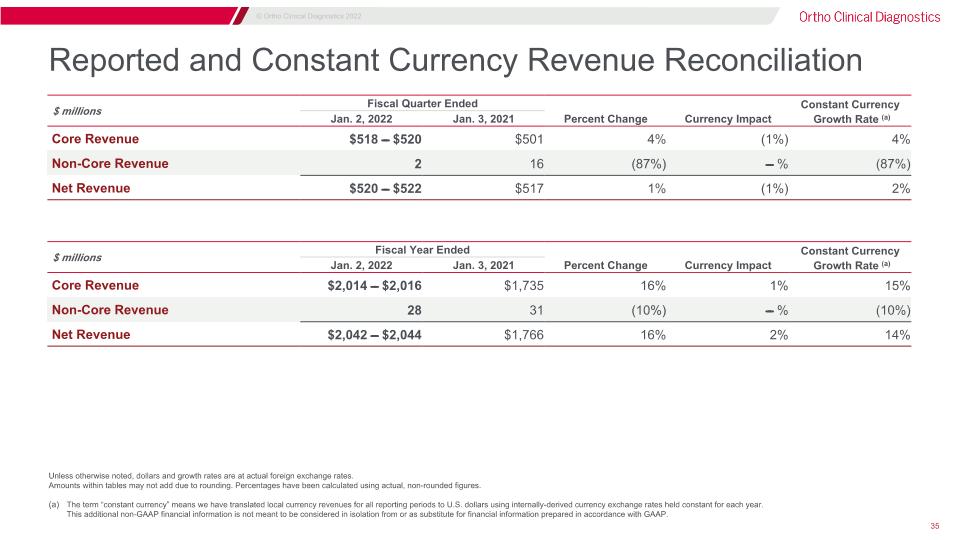

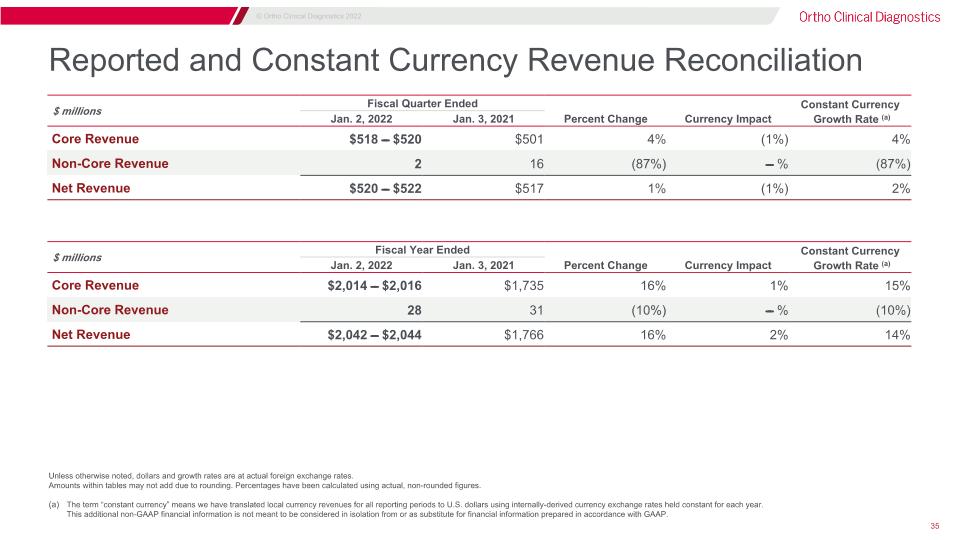

Reported and Constant Currency Revenue Reconciliation Unless otherwise noted, dollars and growth rates are at actual foreign exchange rates. Amounts within tables may not add due to rounding. Percentages have been calculated using actual, non-rounded figures. The term “constant currency” means we have translated local currency revenues for all reporting periods to U.S. dollars using internally-derived currency exchange rates held constant for each year.�This additional non-GAAP financial information is not meant to be considered in isolation from or as substitute for financial information prepared in accordance with GAAP. $ millions Fiscal Quarter Ended Three Months Ended Constant Currency Jan. 2, 2022 Jan. 3, 2021 Percent Change Currency Impact Growth Rate (a) Core Revenue $518 ̵̶̶ $520 $501 4% (1%) 4% Non-Core Revenue 2 16 (87%) ̵̶̶ % (87%) Net Revenue $520 ̵̶̶ $522 $517 1% (1%) 2% $ millions Fiscal Year Ended Three Months Ended Constant Currency Jan. 2, 2022 Jan. 3, 2021 Percent Change Currency Impact Growth Rate (a) Core Revenue $2,014 ̵̶̶ $2,016 $1,735 16% 1% 15% Non-Core Revenue 28 31 (10%) ̵̶̶ % (10%) Net Revenue $2,042 ̵̶̶ $2,044 $1,766 16% 2% 14%

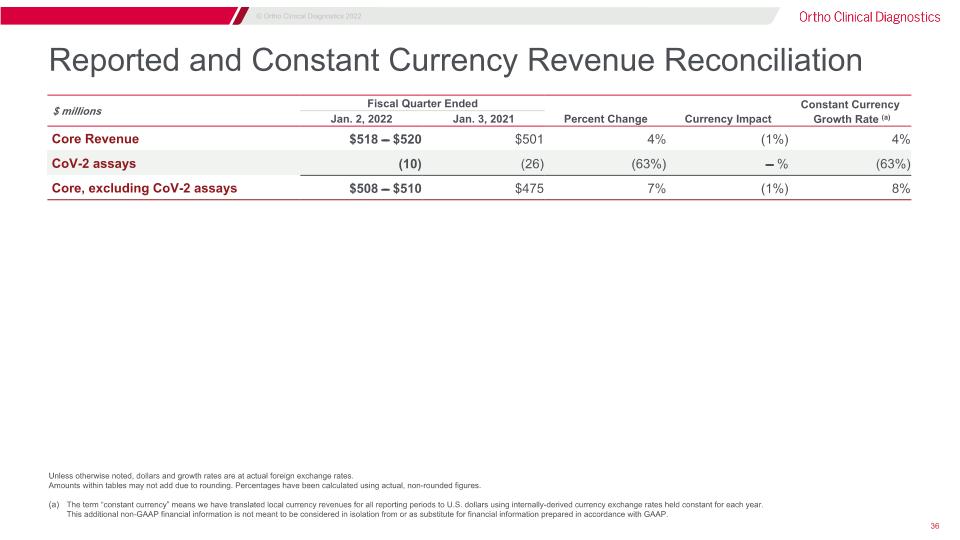

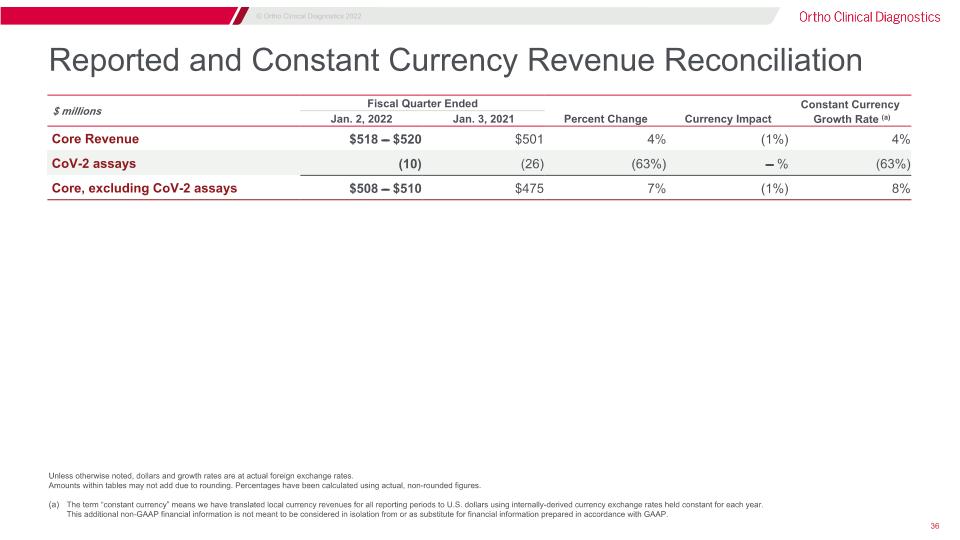

Reported and Constant Currency Revenue Reconciliation Unless otherwise noted, dollars and growth rates are at actual foreign exchange rates. Amounts within tables may not add due to rounding. Percentages have been calculated using actual, non-rounded figures. The term “constant currency” means we have translated local currency revenues for all reporting periods to U.S. dollars using internally-derived currency exchange rates held constant for each year.�This additional non-GAAP financial information is not meant to be considered in isolation from or as substitute for financial information prepared in accordance with GAAP. $ millions Fiscal Quarter Ended Three Months Ended Constant Currency Jan. 2, 2022 Jan. 3, 2021 Percent Change Currency Impact Growth Rate (a) Core Revenue $518 ̵̶̶ $520 $501 4% (1%) 4% CoV-2 assays (10) (26) (63%) ̵̶̶ % (63%) Core, excluding CoV-2 assays $508 ̵̶̶ $510 $475 7% (1%) 8%

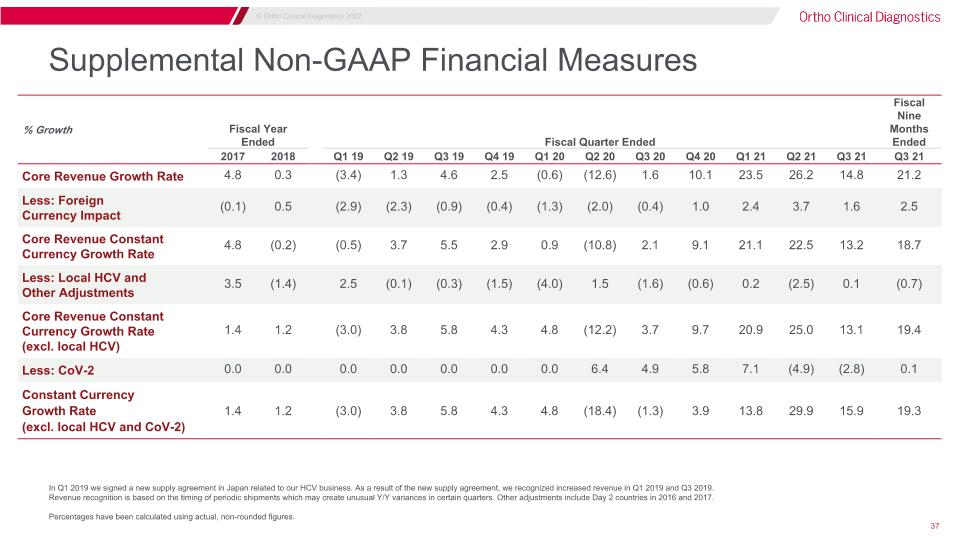

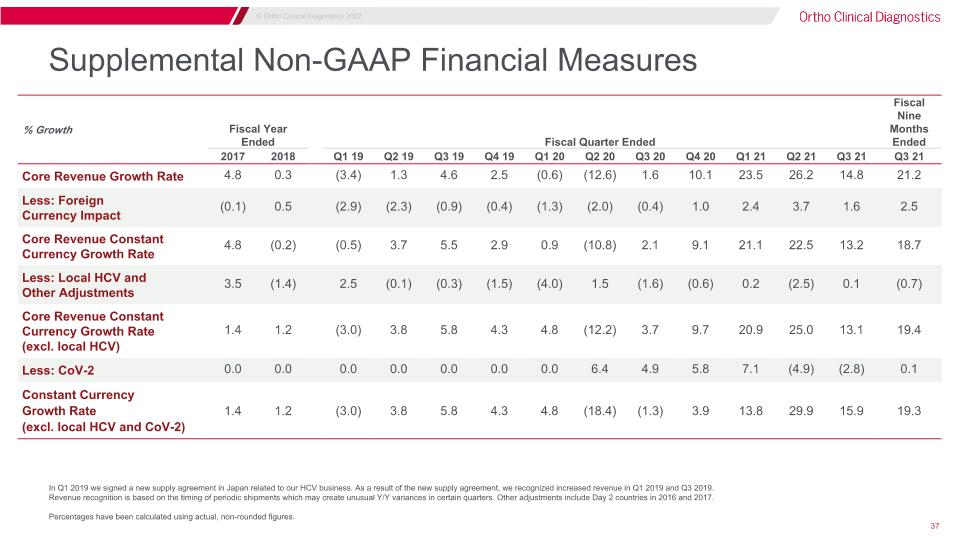

Supplemental Non-GAAP Financial Measures In Q1 2019 we signed a new supply agreement in Japan related to our HCV business. As a result of the new supply agreement, we recognized increased revenue in Q1 2019 and Q3 2019. �Revenue recognition is based on the timing of periodic shipments which may create unusual Y/Y variances in certain quarters. Other adjustments include Day 2 countries in 2016 and 2017. Percentages have been calculated using actual, non-rounded figures. % Growth Fiscal Year Ended Three Months Ended Fiscal Quarter Ended Fiscal Nine Months Ended 2017 2018 Q1 19 Q2 19 Q3 19 Q4 19 Q1 20 Q2 20 Q3 20 Q4 20 Q1 21 Q2 21 Q3 21 Q3 21 Core Revenue Growth Rate 4.8 0.3 (3.4) 1.3 4.6 2.5 (0.6) (12.6) 1.6 10.1 23.5 26.2 14.8 21.2 Less: Foreign �Currency Impact (0.1) 0.5 (2.9) (2.3) (0.9) (0.4) (1.3) (2.0) (0.4) 1.0 2.4 3.7 1.6 2.5 Core Revenue Constant Currency Growth Rate 4.8 (0.2) (0.5) 3.7 5.5 2.9 0.9 (10.8) 2.1 9.1 21.1 22.5 13.2 18.7 Less: Local HCV and �Other Adjustments 3.5 (1.4) 2.5 (0.1) (0.3) (1.5) (4.0) 1.5 (1.6) (0.6) 0.2 (2.5) 0.1 (0.7) Core Revenue Constant Currency Growth Rate�(excl. local HCV) 1.4 1.2 (3.0) 3.8 5.8 4.3 4.8 (12.2) 3.7 9.7 20.9 25.0 13.1 19.4 Less: CoV-2 0.0 0.0 0.0 0.0 0.0 0.0 0.0 6.4 4.9 5.8 7.1 (4.9) (2.8) 0.1 Constant Currency �Growth Rate �(excl. local HCV and CoV-2) 1.4 1.2 (3.0) 3.8 5.8 4.3 4.8 (18.4) (1.3) 3.9 13.8 29.9 15.9 19.3