UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 3, 2021

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number: 001-39956

Ortho Clinical Diagnostics Holdings plc

(Exact name of Registrant as specified in its Charter)

England and Wales | 98-1574150 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1001 Route 202 Raritan, New Jersey | 08869 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 908-218-8000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Ordinary shares, $0.00001 par value per ordinary share |

| OCDX |

| Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☐ NO ☒

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). YES ☐ NO ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

| ☐ |

| Accelerated filer |

| ☐ |

|

|

|

| |||

Non-accelerated filer |

| ☒ |

| Smaller reporting company |

| ☐ |

|

|

|

|

|

|

|

|

|

|

| Emerging growth company |

| ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

As of June 28, 2020, the last business day of the registrant’s most recently completed fiscal second quarter, the registrant’s ordinary shares were not publicly traded. The registrant’s ordinary shares, $0.00001 nominal value per share, began trading on The Nasdaq Global Select Market (“Nasdaq”) on January 28, 2021. As of March 3, 2021, the aggregate market value of the registrant’s ordinary shares held by non-affiliates was approximately $1,582,048,957, based on the closing sale price of the ordinary shares on that date on Nasdaq.

As of March 3, 2021, 234,742,792 of the registrant’s ordinary shares were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

No items are incorporated by reference into this Annual Report on Form 10-K.

|

| Page |

|

| |

Item 1. | 4 | |

Item 1A. | 24 | |

Item 1B. | 54 | |

Item 2. | 55 | |

Item 3. | 55 | |

Item 4. | 55 | |

|

|

|

|

| |

Item 5. | 56 | |

Item 6. | 56 | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 59 |

Item 7A. | 81 | |

Item 8. | 83 | |

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 83 |

Item 9A. | 83 | |

Item 9B. | 83 | |

|

|

|

|

| |

Item 10. | 84 | |

Item 11. | 90 | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 102 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 103 |

Item 14. | 105 | |

|

|

|

|

| |

Item 15. | 107 | |

Item 16 | 109 |

i

Unless otherwise indicated or the context otherwise requires, references in this Annual Report on Form 10-K to:

| • | the term “2025 Notes” refers to the $400.0 million in aggregate principal amount of 7.375% Senior Notes due 2025 issued by the Lux Co-Issuer and the U.S. Co-Issuer. We redeemed $160 million in aggregate principal amount of 2025 Notes in February 2021 in connection with our IPO. As of the date of this Annual Report on Form 10-K, $240 million in aggregate principal amount of 2025 Notes was outstanding; |

| • | the term “2025 Notes Indenture” refers to the indenture governing the 2025 Notes, as amended, supplemented or otherwise modified from time to time; |

| • | the term “2028 Notes” refers to the $675.0 million in aggregate principal amount of 7.250% Senior Notes due 2028 issued by the Lux Co-Issuer and the U.S. Co-Issuer. We redeemed $270 million in aggregate principal amount of 2028 Notes in February 2021 in connection with our IPO. As of the date of this Annual Report on Form 10-K, $405 million in aggregate principal amount of 2028 Notes was outstanding; |

| • | the term “2028 Notes Indenture” refers to the indenture governing the 2028 Notes, as amended, supplemented or otherwise modified from time to time; |

| • | the term “Acquisition” refers to the acquisition by Bermuda Holdco pursuant to a stock and asset purchase agreement, dated January 16, 2014 (the “Acquisition Agreement”), of (i) certain assets and liabilities and (ii) all of the equity interests and substantially all of the assets and liabilities of certain entities which, together with their subsidiaries, comprised the Ortho Clinical Diagnostics business from Johnson & Johnson; |

| • | the term “assay” refers to an investigative (analytic) procedure in laboratory medicine, pharmacology, environmental biology and molecular biology for qualitatively assessing or quantitatively measuring the presence or amount or the functional activity of a target entity (the analyte), which can be a drug or biochemical substance or a cell in an organism or organic sample; |

| • | the term “Bermuda Holdco” refers to Ortho-Clinical Diagnostics Bermuda Co. Ltd., a Bermuda exempted limited liability company. As part of the Reorganization Transactions, the existing ordinary shares of Bermuda Holdco were contributed to UK Holdco in exchange for ordinary shares of UK Holdco; |

| • | the term “consumables” refers to miscellaneous items such as calibrators, pipettes and controls, which are run on our instruments in conjunction with and in support of assays and reagents; |

| • | the term “Credit Agreement” refers to that certain credit agreement governing our Senior Secured Credit Facilities; |

| • | the term “emerging markets” refers to all countries where we operate other than Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Italy, Japan, Luxembourg, the Netherlands, New Zealand, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom, the United States and certain other developed countries; |

| • | the term “GAAP” refers to the generally accepted accounting principles in the United States of America; |

| • | the term “Holdings” refers to Ortho-Clinical Diagnostics Holdings Luxembourg S.à r.l., a société à responsabilité limitée organized under the laws of the Grand Duchy of Luxembourg, having its registered office at 89C, rue Pafebruch, L-8308 Capellen, Grand Duchy of Luxembourg and registered with the Luxembourg trade and companies register (Registre de Commerce et des Sociétés de Luxembourg) under number B185679 and an indirect, wholly owned subsidiary of UK Holdco; |

| • | the term “Joint Business” refers to a long-term collaboration agreement with Grifols Diagnostic Solutions, Inc. that encompasses certain Clinical Laboratories and Donor Screening products; |

| • | the term “laboratories,” when we refer to our customers, refers to testing sites that process and provide results for in vitro diagnostic tests within hospitals, independent reference labs, physician office labs or physician clinics; |

| • | the term “Lux Co-Issuer” refers to Ortho-Clinical Diagnostics S.A., a société anonyme organized under the laws of the Grand Duchy of Luxembourg, having its registered office at 89C, rue Pafebruch, L-8308 Capellen Luxembourg and registered with the Luxembourg trade and companies register (Registre de Commerce et des Sociétés de Luxembourg) under number B 185693 and an indirect, wholly owned subsidiary of UK Holdco; |

| • | the terms “Principal Shareholder” and “Carlyle” refer to The Carlyle Group Inc. and its affiliates; |

| • | the term “reagent” refers to a substance that is added during a test in order to bring about a reaction. The resulting reaction is used to confirm the presence of another substance. Our reagents are used to identify different properties of blood; |

| • | the term “Reorganization Transactions” refers to the transactions described under “—Reorganization transactions”; |

1

| • | the term “Senior Secured Credit Facilities” refers to (a) the senior secured term loan facility in an original amount of $2,175.0 million, as increased by the incremental term loan (the “Incremental Term Loan”) of $200 million (collectively, the “Dollar Term Loan Facility”), (b) the euro-denominated senior secured term loan facility in an amount equal to €337.4 million (the “Euro Term Loan Facility” and, together with the Dollar Term Loan Facility, the “Term Loan Facilities”), and (c) the multi-currency senior secured revolving facility with commitments of $500.0 million (the “Revolving Credit Facility”). We repaid $892.7 million in aggregate principal amount of borrowings under our Dollar Term Loan Facility in connection with our IPO. As of the date of this Annual Report on Form 10-K, approximately $1,292.8 million in aggregate principal amount of borrowings under our Dollar Term Loan Facility were outstanding; |

| • | the term “throughput” refers to the number of tests performed during a certain time period; |

| • | the term “UK Holdco” refers to Ortho Clinical Diagnostics Holdings plc, a public limited company incorporated under the laws of England and Wales. As part of the Reorganization Transactions, the existing ordinary shares of Bermuda Holdco were contributed to UK Holdco in exchange for ordinary shares of UK Holdco; |

| • | the term “U.S. Co-Issuer” refers to Ortho-Clinical Diagnostics, Inc., a corporation incorporated under the laws of the State of New York and an indirect, wholly owned subsidiary of UK Holdco; |

| • | the terms “we,” “us,” “our,” “its,” our “Company” and “Ortho” refer to UK Holdco and its consolidated subsidiaries after giving effect to the Reorganization Transactions; |

References to a year refer to our fiscal years ended on the Sunday nearest December 31 of the specified year and consist of 52 weeks (for example, the terms “2020” and “fiscal 2020” refer to our fiscal year ended January 3, 2021, the terms “2019” and “fiscal 2019” refer to our fiscal year ended December 29, 2019 and the terms “2018” and “fiscal 2018” refer to our fiscal year ended December 30, 2018).

References to our customers mean those customers we directly sell our products and services to, such as hospitals, clinics and our distributors. References to our end-customers mean customers who use our products, which include hospitals and clinics.

Reorganization Transactions

UK Holdco is a public limited company incorporated under the laws of England and Wales for purposes of becoming the new holding company of Bermuda Holdco and its subsidiaries and upon incorporation, it had an initial share capital of one ordinary share and 50,000 preferred redeemable shares (“Incorporation Shares”). Prior to the consummation of the Reorganization Transactions, UK Holdco had no subsidiaries or operations. On January 25, 2021, Carlyle and all other shareholders of Bermuda Holdco contributed all of their outstanding equity interests in Bermuda Holdco to UK Holdco in exchange for ordinary shares of UK Holdco on a 1-for-1 basis (the “Reorganization Transactions”). Following the Reorganization Transactions, the Incorporation Shares held by Carlyle were deferred, with no economic or voting rights attributable to such shares.

Following the completion of our initial public offering (“IPO”), we expect that Bermuda Holdco will be dissolved and UK Holdco will directly own all outstanding equity interests of Holdings and will indirectly own all outstanding equity interests of Holdings’ subsidiaries. Prior to the Reorganization Transactions, UK Holdco had no operations and no material assets or liabilities. As a result of the Reorganization Transactions, UK Holdco superseded Bermuda Holdco as the ultimate parent of Ortho and succeeded to the business and operations of Bermuda Holdco.

Trademarks and service marks

We own or have rights to trademarks, service marks or trade names that we use in connection with the operation of our business. In addition, our names, logos and website names and addresses are our service marks or trademarks. Other trademarks, service marks and trade names appearing in this Annual Report on Form 10-K are the property of their respective owners. The trademarks we own or have the right to use include, among others, ORTHO®, ORTHO CLINICAL DIAGNOSTICS®, ORTHO VISION™, BIOVUE® and VITROS®. Solely for convenience, in some cases, the trademarks, service marks and trade names referred to in this Annual Report on Form 10-K are listed without the applicable ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names.

Market, industry and other data

Throughout this Annual Report on Form 10-K, we refer to our market position or market share in various markets or regions. These references represent our best estimates of our market share at the time of this Annual Report on Form 10-K and are based on management’s knowledge of the industry and the market data and other statistical information obtained from independent industry publications, reports by market research firms or other published independent sources. We confirm that such information has been accurately reproduced and that, so far as we are aware, and are able to ascertain from information published by publicly available sources

2

and other publications, no facts have been omitted which would render the reproduced information inaccurate or misleading. Industry publications, reports and other published data generally state that the information contained therein has been obtained from sources believed to be reliable. Certain other market and industry data included in this Annual Report on Form 10-K, including the size of certain markets, are based on estimates of our management. These estimates have been derived from our management’s knowledge and experience in the markets in which we operate, as well as information obtained from surveys, reports by market research firms, our customers, distributors, suppliers, trade and business organizations and other contacts in the markets in which we operate. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K and elsewhere in this Annual Report on Form 10-K. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

Unless specifically noted otherwise, information presented in this Annual Report on Form 10-K with respect to our position relative to other industry participants is based on information or sources for the year ended December 31, 2019. Market size and market growth information presented in this Annual Report on Form 10-K reflects estimates of market sizes and growth in such markets for the year ended December 31, 2020 and for the years ended December 31, 2020 through 2024, respectively. In each such case, management believes such information presented represents the most recent data available to the Company.

Certain monetary amounts, percentages and other figures included in this Annual Report on Form 10-K have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables and charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Forward-looking statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such forward-looking statements reflect, among other things, our current expectations and anticipated results of operations, all of which are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements, market trends, or industry results to differ materially from those expressed or implied by such forward-looking statements. Therefore, any statements contained herein that are not statements of historical fact may be forward-looking statements and should be evaluated as such. Without limiting the foregoing, the words as “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “project,” “forecast,” “estimates,” “targets,” “projections,” “should,” “could,” “would,” “may,” “might,” “will,” and the negative thereof and similar words and expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors” in Part I, Item 1A of this report. Unless legally required, we assume no obligation to update any such forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information.

When we use the terms “Ortho,” the “Company,” “we,” “us” or “our” in this Annual Report on Form 10-K, we mean Ortho Clinical Diagnostics Holdings plc and its subsidiaries on a consolidated basis, unless the context indicates otherwise.

3

Our company

We are a pure-play in vitro diagnostics (“IVD”) business driven by our credo, “Because Every Test is A Life.” This guiding principle reflects the crucial role diagnostics play in global health and guides our priorities as an organization. As a leader in IVD, we impact approximately 800,000 patients every day. We are dedicated to improving outcomes for these patients and saving lives through providing innovative and reliable diagnostic testing solutions to the clinical laboratory and transfusion medicine communities. Our global infrastructure and commercial reach allow us to serve these markets with significant scale. We have an intense focus on the customer. We support our customers with high quality diagnostic instrumentation, a broad test portfolio and market leading service. Our products deliver consistently fast, accurate and reliable results that allow clinicians to make better-informed treatment decisions. Our business model generates significant recurring revenues and strong cash flow streams from ongoing sales of high margin consumables. In 2020, these consumables contributed more than 91% of our total revenue and approximately 93% of our core revenue. We maintain close connectivity with our customers through our global presence, with more than 4,500 employees, including approximately 2,200 commercial sales, service and marketing teammates. This global organization allows us to support our customers across more than 130 countries and territories.

We have been pioneering life-impacting advances in diagnostics for over 80 years, from our earliest work in blood typing, to our innovation in infectious diseases and our latest developments in laboratory solutions. In 2014, we were acquired by The Carlyle Group from Johnson & Johnson and became an independent organization, solely focused on delivering high quality IVD products and service to our diagnostic customer base. At the time of the separation, our business had global scale, a reputation for high quality products, a strong quality management system and a research and development team with extensive scientific expertise. Over the past six years, we have significantly invested in our business with the objective of creating a highly efficient, innovative and lean organization capable of scaling to meet our customers’ needs. These investments included the following focus areas:

• | Infrastructure: We invested over $500 million in IT, finance, supply chain and other support functions to build out our infrastructure and capabilities as a standalone business and drive long-term, profitable growth. |

• | Research and Development: We increased our focus on innovation by investing approximately $550 million in research and development to enhance our existing capabilities and develop new instruments and assays to supplement our portfolio. |

• | Commercial: We redesigned our go-to-market strategy across all key regions, expanded our sales force, implemented new customer information systems and launched ORTHOCARE to enhance our service capabilities. |

• | Operations: We consolidated and streamlined our manufacturing capabilities and other global functions to improve profitability and cash flow, achieving more than $200 million in savings since our acquisition by Carlyle. |

• | Leadership: To capitalize on these investments, we recruited a highly qualified management team of experienced diagnostic and healthcare leaders focused on our customers and accelerated growth. |

With these investments, we have reinvigorated our portfolio, transformed our commercial model and emerged as a focused leader in the IVD market, which we believe positions our business for future growth.

IVD testing is a critical tool in evaluating health in many different settings around the world. IVD is a core component of routine health care check-ups for those who are presenting with symptoms or require procedures, and it influences up to 70% of critical healthcare clinical decision-making. Consequently, our IVD solutions have a profound impact on the assessment of health and the delivery of care. IVD is also critical in monitoring the transmission and spread of infectious disease outbreaks, where Ortho’s longstanding excellence in infectious disease testing is particularly relevant. Our solutions are central to the operations of hospitals, clinics, blood banks and donor centers around the world, where they are used to help diagnose certain conditions, such as cancer or heart attacks, and infectious diseases, such as hepatitis, HIV, and most recently, COVID-19, where we have launched two antibody tests and an antigen test, and we are actively expanding our menu of tests to address the global pandemic.

We operate in an approximately $26 billion addressable market, which is expected to grow at a CAGR of approximately 5% from 2020 to 2024. We compete in the two largest IVD markets, Immunoassay and Clinical Chemistry, which together comprise our Clinical Laboratories business and represent approximately $24 billion of our current addressable market. We expect our Clinical Laboratories business will be favorably impacted by an aging population, an increased need for testing of chronic conditions, the expansion of access to healthcare services, the emergence of new disease states and other macro trends. We are also the global leader in Transfusion Medicine, which includes hospital-based Immunohematology and Donor Screening for blood and plasma at hospitals and other donation centers. Transfusion Medicine represents approximately $2 billion of our current addressable market. We expect our

4

Transfusion Medicine business will be favorably impacted by increases in the number and type of surgical procedures, an aging population and other macro trends. There is significant overlap in our customer base given we currently sell to about 70% of the hospitals in the United States, and we are often able to leverage our leadership within Transfusion Medicine to cross-sell our Clinical Laboratories solutions. Because we focus primarily on acute or critical care diagnostics that are core to therapeutic decisions in hospitals, our markets are relatively resilient across business cycles. We offer our products and services globally, with distinct offerings targeted to the needs of customers in developed and emerging markets.

Today, we operate two lines of business, Clinical Laboratories and Transfusion Medicine, which together generate our core revenue:

• | Clinical Laboratories: Comprised of Clinical Chemistry, which is the measurement of target chemicals in bodily fluids for the evaluation of health and the clinical management of patients, and Immunoassay, which is the measurement of proteins as they act as antigens in the spread of disease, antibodies in the immune response spurred by disease, or markers of proper organ function and health. |

• | Transfusion Medicine: Comprised of Donor Screening, where blood and plasma is screened at donation for blood type and target diseases, and Immunohematology, where blood is typed and screened at the hospital blood bank before being transfused into the patient. |

Our broad offerings allow us to support our customer base and maximize the opportunity to provide each of our customers with a comprehensive array of products and services over time. We refer to this mutually beneficial approach as focusing on Lifetime Customer Value (“LCV”). Our focus on LCV underpins everything we do, from the design and execution of our commercial and service model, to our instrument and assay innovation, to the composition of our global footprint. Our approach has informed our choice to focus on medium- to high-volume laboratories, which in turn has helped us become a leader in our Focus Markets and transformed our financial profile. We intend to continue to invest in and evolve our LCV framework to best support our customers and maximize our financial results.

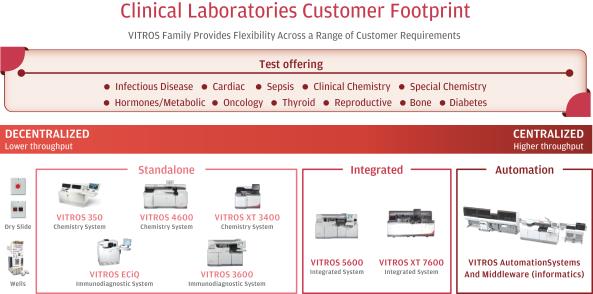

As an example, we may begin a Clinical Laboratories customer relationship by providing a standalone instrument (often a clinical chemistry analyzer) and a set of assays that are relevant to that customer’s specific testing needs. In 2020, approximately 73% of our Clinical Laboratories installed base was comprised of standalone instruments. As the customer and its testing needs grow, we look to migrate the customer, where appropriate, to an integrated analyzer that performs both clinical chemistry and immunoassay testing. This migration helps us increase our customers’ testing capabilities as well as the revenue we generate from customers. Building on our differentiation in dry chemistry, we grew our integrated instrument installed base at a CAGR of approximately 12% from 2015 to 2020, and in 2020, approximately 24% of our Clinical Laboratories installed base was comprised of integrated instruments. For our larger customers, we ultimately may expand their testing throughput by installing automation tracks that connect multiple analyzers along the automation track, while providing the full suite of our ever-expanding assay menu. In 2020, approximately 1% of our Clinical Laboratories installed base was comprised of automated systems. As we have significantly expanded our test menu offering, our integrated analyzers are now more often where our Clinical Laboratories relationship starts. In Transfusion Medicine, the life cycle is similar, as customers graduate from manual testing processes to semi-automated capabilities to fully-automated blood and plasma screening instrumentation as their testing volumes and technical competencies grow over time. In 2020, our installed base of Immunohematology instruments grew approximately 4%. We focus on building long-term customer relationships and continuing to enhance both our offering and the customer’s ability to care for their patients—ultimately deepening our commercial relationship and driving our financial model.

We believe that the strong clinical performance of our assays, our instruments’ ease-of-use and reliability, our best-in-class customer service and low total cost of ownership contribute to our high revenue retention rate of approximately 98% in 2020. We have longstanding relationships with our customers, with an average Clinical Laboratories customer relationship of almost 13 years and an average Transfusion Medicine customer relationship of almost 15 years. Our customer relationships are particularly strong in the medium- to high-volume laboratories (our “Focus Markets”), which compares to the broader market that includes low- and ultra high-volume laboratories. Our Focus Markets comprise approximately 70% of the total Clinical Laboratories market, and we believe that our Focus Markets will grow at a CAGR of approximately 5% from 2020 to 2024. In addition, our dry slide technology has an environmentally friendly profile as it does not require water system plumbing, it reduces hazardous waste and it requires less space for liquid storage. All of these attributes resonate particularly well with customers who are pursuing environmental goals or customers who operate in regions with scarce water supply.

Our revenue is driven by a “razor-razor blade” business model. Through this model, we generally sell or place instruments under long-term contracts, which support the ongoing sale of our assays, reagents and consumables. Our instruments are closed systems, requiring customers to purchase the assays, reagents and consumables from us. These sales generate a high proportion of recurring revenues. As of January 3, 2021, we had an installed base of approximately 20,000 instruments, which increased approximately 4%

5

since December 29, 2019. We also generate non-core revenue, including through our contract manufacturing business and certain business collaborations, which accounted for approximately 3% of our net revenue during the fiscal year ended January 3, 2021. During the fiscal year ended January 3, 2021, we recorded net revenue of $1,766.2 million, net loss of $211.9 million and Adjusted EBITDA of $456.0 million. As of January 3, 2021, we had total indebtedness of $3,718.5 million, and for the fiscal year ended January 3, 2021, our interest expense was $198.2 million. We note that our net revenue for the fiscal year ended January 3, 2021 was approximately 2.0% lower as compared to the prior year period, primarily due to decreased shipments to customers as a result of the global COVID-19 pandemic.

Our competitive strengths

We believe we are well positioned to drive sustained and profitable growth through our relentless focus on LCV. This customer-centric approach informs the execution of our commercial and service model and underpins our go-to-market strategy. Our customer focus allows us to retain and grow our customers by providing a superior customer experience driven by unparalleled quality of service, continuous innovation and access to a diverse product portfolio. We are able to leverage our global footprint to gain differentiated and leading positions across our Focus Markets. This intense focus on our customers has resulted in an attractive business model with high recurring revenues that allows us to continue to invest to reinforce our competitive strengths, which include:

Intense customer focus enabled by our broad portfolio and market leading positions

Our broad portfolio of Clinical Laboratories and Transfusion Medicine instruments covering the full spectrum of manual to fully automated systems allows us to effectively target our Focus Markets. In addition to our instrument portfolio, we offer a diverse menu of assays for the most commonly tested items, including infectious diseases, sepsis, cardiovascular conditions and both blood and plasma typing and screening. Our ability to respond to the full spectrum of our customers’ needs allows us to focus on and enhance LCV. We supplement our instrument and assay offerings with our leading service, commercial, and operational excellence, which we believe improves our customer retention, sales growth and profitability.

We are a leader in our Focus Markets with leading positions in Clinical Laboratories and Transfusion Medicine. The market opportunities for our Clinical Laboratories and Transfusion Medicine businesses are largely connected and, in both Clinical Laboratories and Transfusion Medicine, we can adapt and grow with our customers as they move from lower throughput to more automated solutions. In addition, we have developed a strategy for new product introductions in order to enhance LCV. For example, in our Transfusion Medicine business, we introduced semi-automated capabilities to increase our participation in certain emerging markets, such as China, Asia Pacific and Latin America, and continue the shift of certain customers from manual to semi-automated testing.

In Donor Screening, we are a leading player and we recently won a 5-year contract with a 5-year extension option with Creative Testing Solutions, the largest U.S. blood donation testing organization, which provides testing for a majority of the U.S. blood supply and is jointly owned by three of the leading U.S. blood service providers: the American Red Cross, OneBlood and Vitalant. Pursuant to this contract, we are Creative Testing Solutions’ sole supplier of serology Donor Screening testing in the United States. We expect this contract will start contributing revenues in the first quarter of 2021 and provides for collaborative research and development on our next generation Donor Screening instrument. With renewed commitment to the Donor Screening market and joint innovation with this new customer, we believe this relationship has the potential to support further growth in other international Donor Screening markets over time.

Our business model and customer-centric approach results in strong customer loyalty and a compelling financial profile with greater than 90% recurring revenue during 2020. The combination of our revenue growth and leading margin profile allows us to reinvest in innovation and commercial opportunities. In addition, we believe our broad portfolio and diversified end markets provide a resilient growth profile. For instance, our strength in acute care and infectious disease testing is durable as it requires on-demand testing. Most of these tests are conducted in in-patient laboratories and demand tends to be insulated from economic downturns. In addition, we believe the on-site laboratory contributes meaningfully to many of our hospital customers’ earnings and that our core market is relatively insulated from outsourcing to reference laboratories. We believe this combination of product and end market diversification allowed us to generally outperform the market on a core revenue growth basis during the recent COVID-19 pandemic and we believe this resiliency will continue into the future.

Superior customer experience and brand loyalty resulting in high customer retention and win rates

We deliver industry-leading test performance in a way that is easy for laboratory directors and technical staff to manage their operations on a daily basis, which leads to excellent customer appeal and loyalty. In 2015, we launched ORTHOCARE with the goal of providing best-in-class service and support program for hospitals, hospital networks, blood banks and laboratories. Our ORTHOCARE service program is a critical element of the superior customer experience that we deliver to our customers. Since forming ORTHOCARE, we were the highest recommended manufacturer for the last five consecutive years (2016 through 2020) in a survey of clinical laboratory professionals in U.S. hospitals conducted by ServiceTrak. In the same survey in 2020, we were ranked #1 in seven out of eight categories relating to our manufacturing, system and service performance.

6

In our Focus Markets, the simplicity and reliability of our instruments and tests often reduces the need for staff hands-on time, producing a lower total cost of ownership for our customers. We believe that after instrument cost, the quality of service is the largest driver of customer choice when selecting a Clinical Laboratories vendor. Our superior service and customer performance contribute to our revenue retention rate of approximately 98% in 2020 and our average Clinical Laboratories and Transfusion Medicine customer relationships of almost 13 years and 15 years, respectively.

In Clinical Laboratories, beyond the simplicity of dry chemistry slides, we offer instrument e-connectivity, customizable automation tracks, a suite of upgraded quality control reagents and market-leading calibration stability, producing higher efficiency and lower total cost of ownership. In Transfusion Medicine, our ORTHO VISION platform has expanded our leadership position because it automated and simplified the test workflow for time-strained blood bank staff, increasing throughput and efficiency.

Highly compelling solutions supported by our leading and innovative research and development capabilities

We have a rich history of innovation spanning over eight decades and now have a portfolio of 17 instruments and over 240 assays across Clinical Laboratories and Transfusion Medicine. Our unique dry slide technology for clinical chemistry delivers accurate results, stability and reliability in challenging laboratory environments, an environmentally friendly profile and superior ease-of-use. Our recently launched XT Slides provide the ability to perform two tests on one slide, resulting in 40% greater VITROS throughput with 96% first-pass yield. Combined with our robust instrument design and development capabilities, we engineer laboratory testing solutions for our customers that offer industry leading cost effectiveness for medium- and high-throughput testing applications, particularly where space is constrained. We have partnered with Quotient to commercialize, when approved, the next generation product in IH that enables a high level of multiplexing and addresses the ultra-high throughput market. In the last five years, we have engineered and delivered six new instrument platforms to market and expanded our assay offering by over 75 new or improved assays, which has increased our product vitality, market share and revenue growth.

Extensive and balanced global commercial footprint with reinvigorated focus on growth

We sell our products and services in more than 130 countries worldwide and have a direct presence in 35 countries. We support these commercial operations with approximately 2,200 commercial sales, service and regional marketing teammates and a network of more than 300 distributors globally. We also have an extensive global network of manufacturing and distribution centers that allows us to be closer and more responsive to our customers while managing and optimizing our cost structure. Our global footprint allows us to effectively launch our new product innovations, including instrument platform developments and new assays, across the globe. Our geographic balance also provides revenue diversification, which helps us to hedge against currency fluctuations and potential regional economic downturns.

We believe that opportunities in emerging markets represent a strong area of growth and profitability for our business. We are using targeted commercial activities to expand in these attractive end markets. In addition, we are developing lower cost instruments and market-specific assays to compete directly with low cost local players in certain regions.

Disciplined approach to streamline operations and optimize our cost structure

We have taken a rigorous approach to continuously improve our operational and administrative resources and cost structure. We have an efficient network of manufacturing, distribution and support centers to support worldwide product availability, with assay manufacturing in the United States and Wales, partner instrument manufacturing in Switzerland and Mexico, product distribution centers in multiple locations across the globe, shared service centers in the United States and Prague and certain operations in India. This not only brings us closer to our customers, but consolidates manufacturing and several other support functions to lower-cost geographies. We have seen margin expansion over the last two years and hope to continue capitalizing on operational efficiencies going forward.

Deeply committed leadership team with broad experience in healthcare and diagnostics

Our dedicated and highly respected Global Leadership Team (“GLT”) is comprised of 16 members with significant experience in the IVD and healthcare industries. For instance, our Chairman and Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Chief Innovation Officer, General Counsel, and Executive Vice President of Strategy and Commercial Excellence each have more than 25 years of experience in their respective fields of expertise and together have more than 125 years of experience with IVD or commercial healthcare companies. These individuals are supported by their GLT colleagues with extensive industry knowledge and long-term experience leading at Ortho or other multinational companies in the IVD industry. Under their leadership we have transformed our mindset from standing up the business to executing on our growth strategies by increasing our customer focus and our emphasis on innovation and operational efficiency. We believe that the industry knowledge and dedication of our GLT members, combined with their long-term experience profitably growing multinational companies, are instrumental for the successful execution of our growth strategy going forward.

Our growth strategy

Our heritage and strength lie in our long-term customer relationships and trusted brand, which create a steady base of recurring revenue and a foundation for future growth. By focusing on LCV, we identify ways in which we can utilize product innovation and

7

impactful customer service and solutions to deepen these partnerships and add value over time. We plan to grow our business by broadening our existing relationships, winning new customers and targeting high-growth end markets and adjacencies. We are focused on sustainable long-term growth through commercial excellence that maximizes LCV, strengthens existing relationships through superior service and delivers innovative products for our customers and their patients. The key elements of our strategy to accelerate and sustain revenue growth and operating leverage include:

Focusing relentlessly on maximizing LCV, which is designed to produce and maintain a growing and recurring, high margin, durable financial profile and contributes to growth

Over our more than 80 years supporting the IVD testing needs of our customers, we have developed deep and enduring relationships with our customers. We seek to expand our relationship with both new and existing customers by offering them higher throughput integrated instrumentation, automation, and an expanding assay menu that grows with them as their needs evolve. On average globally, when one of our Clinical Laboratories customers upgrades from a standalone instrument to an integrated instrument, we typically see an increase in annual consumable revenues of approximately 65%. After this initial increase in utilization, we typically see that customer’s recurring revenues increase by approximately 3% to 7% on an annual basis. In our experience, by the time a customer is running sufficient volumes of tests to consider automation, annual reagent purchases have roughly doubled, and upgrading to an automated instrument increases this average by an additional 27%. This combined effect leads to an average increase of approximately 300% in annual revenues as a customer upgrades from an initial integrated placement to automation installation. In Transfusion Medicine, the pattern is even more striking. When a customer moves from manual testing to a semi-automated solution, the customer typically experiences an approximately 70% increase in workflow efficiency, and we see an average 600% increase in revenues. When they graduate to our fully automated ORTHO VISION instruments, these customers typically experience a 90% improvement in workflow efficiency and we see an additional increase of approximately 90% on average in recurring revenue.

LCV is both a critical measure of our customer relationships and a way to target increased value-add over time. Our focus on LCV contributes to our revenue retention rate of approximately 98% and our average Clinical Laboratories and Transfusion Medicine customer relationships of almost 13 years and 15 years, respectively. A significant number of our customers have long-term contracts with us and, combined with our greater than 90% recurring revenue profile, we believe our financial profile enables us to continue to invest and drive future growth.

Providing an unparalleled customer experience to retain and attract our existing and new customers

We continue to invest in both technology and business model innovation to expand our service advantages. For instance, improvements in instrument and assay reliability have reduced our service intervention rate by more than 30 percent since mid-2014. In addition to our core product innovations that continuously improve instrument reliability and ease-of-use—for instance, e-connectivity, improved controls, e-calibration and laboratory informatics—we are implementing exciting technology applications to support our award-winning service team. From smart mobile applications that enable service alerts and remote monitoring to merged reality on mobile devices, including smart glasses that support field engineers and customers in service calls, we continue to improve the efficiency and effectiveness of our service offerings. Over time, we will also seek to increase our ability to monetize our service differentiation beyond simply enhancing customer retention and contract wins.

Leveraging our global footprint to deliver innovative solutions to meet our customers’ needs in both developed and emerging markets

Our global commercial organization is comprised of approximately 2,200 commercial sales, service and regional marketing teammates. We recently invested in expanding and improving our commercial capabilities in our two most critical markets—North America and China—adding sales and regional marketing personnel, strengthening our distributor networks, increasing sales analytics and targeting support though our customer relationship management system. We focused our commercial teams more squarely on our Focus Markets, which increased our win rate and allowed our team to allocate resources and focus on relationship management, menu utilization and new assay adoption, helping drive our recent revenue growth in these markets. Since the execution of our U.S. commercial excellence program, we have enjoyed eight consecutive quarters of North America core recurring revenue growth and, up until the COVID-19 pandemic, we experienced similar results following implementation of our China program.

We are also focused on high growth emerging markets including China, Asia Pacific, the Middle East, Africa, Eastern Europe and Latin America. We are targeting increased investment in market-appropriate products and local capabilities in order to gain market share in these emerging markets and enhance our overall growth profile. For instance, we are planning the development of lower cost instruments and assays that are suitable for these emerging markets. In some countries, the government is playing a significant role in expanding population access to healthcare and diagnostic testing, particularly in more rural populations. The Chinese government, for instance, has dramatically increased the portion of the population with access to healthcare services and is actively pushing diagnostic volumes to tiers of smaller hospitals at the regional and provincial level, hospitals that fit well into our Focus Markets.

8

Creating meaningful product innovation through menu expansion, development of novel instruments and enhancement of automation and informatics

Since our separation from Johnson & Johnson, we have focused significant investment on improving and expanding our test menu, with the introduction of over 75 new or improved tests in the last five years, which we believe has contributed meaningfully to our accelerating growth. We continue to focus on developing significant new assays that are critical to our Focus Market customers while continuing to build our strength and differentiation in acute and critical care assays. In particular, recent launches in cardiac (hs troponin), HIV (HIV combo), sepsis (PCT) and COVID-19 are generating new growth.

We will continue to invest in the next generation of instruments for Clinical Laboratories and Transfusion Medicine. Given the longer cycle of innovation, it is important that we remain focused on the next platforms to drive customer acquisition and retention. In addition, our team is looking into novel technologies that we can leverage across Clinical Laboratories and Transfusion Medicine. We are also evaluating using our dry technology to increase multiplexing beyond dual slides and extending into dry immunoassay by leveraging patented microfluidics approaches. A completely dry integrated platform would likely reduce our instrument footprint, increase test throughput and reduce user complexity with excellent test reliability and performance.

We continue to build on advantages in ease-of-use and test workflow in the laboratory, with a primary focus on the needs of our target customer. We are co-developing improved automation track components and a new quality control menu with one of our partners. ORTHO CONNECT continues to evolve and develop across CL and TM as next generation middleware that enables the customer to track and control data and key performance metrics across their laboratories. Beyond this new platform, we plan to explore and seek to develop new digital solutions, such as laboratory informatics dashboards, to improve customer performance and workflow.

To support menu expansion and development of novel instruments, we are pursuing “Follow the Sun” research and development and manufacturing capabilities and partnerships in targeted locations across the globe that we believe will increase our local market access, tailor products for local market needs, reduce the time and cost required for product launches and accelerate our cadence of assay and instrument launches over time. As an example, we have built up research and development capabilities at our Pencoed, Wales site, which has a lower cost basis and ensures proximity to manufacturing for sustaining engineering of products.

Continuing to identify operating efficiencies to allow for reinvestment in growth and improve margins

Our leadership team has taken a disciplined, continuous improvement approach to streamlining our operational resources and cost structure. Executing on our value capture program over the last several years, our team has identified areas to improve margins and cash flows through consolidation of manufacturing to lower-cost geographies, annual Six Sigma projects in areas such as procurement, and information technology improvements. We opened a shared service center in Prague and have shifted several support functions abroad to manage costs. We continue to reinvest a significant portion of these savings in commercial and research and development projects to spur further growth. We expect to leverage our fixed cost base and the expansion of our diversified product portfolio to drive incremental margin improvement.

Pursuing business development opportunities, partnerships and strategic acquisitions to enter adjacencies or expand our current business units

We have a successful track record of partnering with a range of companies to accelerate research and development, add incremental competencies and/or co-develop products. We believe that our partnerships with Thermo Fisher, IDEXX and Quotient will help expand our capabilities in laboratory automation, veterinary and ultra-high throughput Immunohematology applications, respectively. In addition to these types of opportunities, we plan to explore adjacencies in both Clinical Laboratories and Transfusion Medicine that will leverage our global footprint, hospital and donor center call points and/or technology advantages.

Our management team is focused on mergers and acquisitions, partnerships and business development opportunities that we believe will ultimately enhance LCV and drive incremental top-line growth and profitability. We intend to pursue strategic opportunities that will accelerate our expansion or entry into attractive end-markets and geographies. We plan to maintain a disciplined approach to mergers and acquisitions and are constantly evaluating a wide range of opportunities that are natural adjacencies with the hospital and other call points in our Focus Markets.

Our industry

IVD involves testing of human tissue or fluid samples outside of the body to screen and detect diseases, infections and medical conditions. IVD testing is a core component of routine health care check-ups for those who are presenting with symptoms or require procedures. It influences up to 70% of critical healthcare clinical decision-making and can occur in a range of clinical settings from large reference laboratories and hospitals, to physician offices and retail clinics.

9

The global IVD market represents approximately $76 billion in global revenue in 2020. IVD is divided among multiple testing disciplines, including Immunoassay, Clinical Chemistry, Molecular Diagnostics, Anatomical Pathology, Microbiology, Hematology and Coagulation, among others. We compete in the two largest testing disciplines (excluding the impact of COVID-19), Immunoassay and Clinical Chemistry, which together comprise Clinical Laboratories, and represent approximately $24 billion of our current addressable market in 2020. We are also the global leader in Transfusion Medicine, which includes hospital-based Immunohematology and Donor Screening for blood and plasma at hospitals and other donation centers, and represents approximately $2 billion of our current addressable market. Today, we sell diagnostic instruments and reagents in a global market worth approximately $26 billion that is projected to grow at a CAGR of approximately 5% from 2020 to 2024.

Of the approximately $26 billion market where we currently play, approximately 62% resides in the more developed regions of North America, Europe, the Middle East and Africa and Japan, which are projected to grow at a CAGR of approximately 1% to 2% from 2020 to 2024. Approximately 38% is concentrated in the faster-growing regions of China, Asia Pacific and Latin America, which are projected to grow at a CAGR of approximately 8% to 11%. With approximately 31% of our core revenue coming from emerging markets, we have a strong position in these growing markets, which we expect will represent approximately 46% of our served market by 2024. We are focusing increased investment in market-appropriate products and local capabilities in order to gain market share in emerging markets and enhance our overall growth.

We believe there are six key trends affecting our end markets that will drive increasing demand for our products and solutions and offer new opportunities for business expansion:

• | Aging population and increased need for testing of chronic conditions. Populations continue to age, particularly in the developed economies, which is driving increased prevalence of both chronic conditions and the acute diseases of later life, such as cancer, cardiac disease, and neurodegenerative disorders. This demographic trend is leading to an increase in surgical volumes and supports growing demand for diagnostic testing and pre-surgical screening on both an acute and routine health screening basis, and accounts for a significant portion of ongoing test menu expansion. |

• | Expansion of healthcare, particularly in emerging markets. Continuing economic growth in emerging markets is increasing the size of the middle class and available disposable income, expanding resources available for healthcare. With most health decisions informed by diagnostic testing, economic development is driving instrument purchases and higher test volumes. In some countries, the government is also playing a significant role in expanding population access to healthcare and diagnostic testing, particularly in more rural populations. The Chinese government, for instance, has dramatically increased the portion of the population with access to healthcare and is actively pushing diagnostic volumes to tiers of smaller hospitals at the regional and provincial level. |

10

standalone specialty instruments. To enhance productivity, these platforms are also often connected by software and automation tracks to enable more seamless routing and testing of patient samples. |

• | Digital solutions and informatics. Diagnostic tests generate information that aids in clinical practice or the study of health and disease. This data, combined with the advancement of internet applications and software, offer new ways to create value for hospital and laboratory customers. Tying test data into laboratory information and electronic medical record systems is only the starting point. Digital solutions can also help laboratories manage test utilization, efficiency and inventory, aid in clinical decision support and pool test data for research purposes. |

• | New diagnostic technologies and continued decentralization. Diagnostics continue to advance with new technologies changing and improving test accuracy and operational performance. New modalities have emerged with the advent of molecular and genetic diagnostics, the expansion of proteomics supporting improved and broader immunoassay testing, and technologies like miniaturization, sensors, and microfluidics enabling point-of-care testing. Diagnostic testing at emergency room and intensive care unit bedsides in the hospital, physician offices, urgent care centers, pharmacy minute clinics and at the patient’s home is increasing. These technologies are creating new opportunities within IVD and growth for the broader IVD market overall. As the COVID-19 pandemic has underscored, point-of-care tests typically have lower test accuracy than those performed on central lab instruments, are often more expensive on a per test basis and can struggle with throughput for mass screening. |

• | Emergence and identification of new diseases and treatments to include plasma based therapies. The COVID-19 pandemic is the most salient example of the continuing emergence of new infectious diseases on a global scale which highlights the importance of accurate and efficient diagnostic testing. We have witnessed the emergence of HIV, Ebola, Zika, SARS and MERS, and it is estimated that one new infectious disease is emerging every year. New diagnostic tests and test volumes are driven both by the emergence of new diseases and by the discovery of new or improved markers for disease. Beyond infectious diseases, significant assay innovation is occurring in a range of therapy areas, including oncology, neurology and cardiovascular disease. |

Our products, pipeline and services

Throughout eight decades of innovation, we have been a leader in the diagnostics field and brought multiple innovations to market such as testing for RH phenotyping, HCV, Chagas’ Disease, and most recently COVID-19. In the last five years, we have engineered and delivered six new instrument platforms to market and expanded our assay offering with over 75 new or improved assays, which has increased our product vitality and revenue growth.

Clinical Laboratories

We have been a pioneer of important technological advances in clinical diagnostics, including our unique dry slide technology which offers customers superior test performance with clear ease-of-use advantages and lower total cost of ownership. Dry slide technology combines the spreading, masking, scavenger and reagent layers into one postage-stamp-sized slide that provides clinicians with high-quality results quickly, efficiently and economically. Our slides are very stable. The current approximate 6-month span between calibrations for slides is industry-leading and we expect this to be significantly improved through ongoing research and development. We carry a comprehensive clinical chemistry test menu, and dry slides have long shelf life with lower laboratory shelf space required. Our new XT7600 and XT3400 instruments extend these advantages with digital accuracy and XT multi-test slides, and we have a pipeline opportunity to increase plex further over time. Our dry slide chemistry is well positioned for rising environmental concerns given its eco-friendly profile with no water usage and significantly reduced clinical waste and biohazard.

Our flagship Clinical Laboratories platform is the VITROS family of instruments, which includes a series of clinical chemistry, immunoassay and integrated (combined chemistry and immunoassay) systems and automation and middleware solutions. The VITROS instruments run a wide range of assays, from infectious diseases, sepsis, cardiovascular conditions and anemia, to bone disease, diabetes, drugs of abuse / toxicology, oncology and renal disease. We have six VITROS instrument analyzers that provide standardized performance, and are still sufficiently flexible to meet the needs of our customers across the spectrum of laboratory sizes and volumes. Our VITROS instruments are placed in centralized, higher-throughput testing sites (hospitals and laboratories) and decentralized, lower-throughput sites (physician offices, clinics and specialty settings).

11

We launched the next generation of VITROS instruments—the XT 7600 integrated system and XT 3400 clinical chemistry analyzer—in 2018 and 2019, respectively. Both instruments deploy a new, highly accurate, digital reflectometer that measures test results and takes advantage of new XT chemistry slides, combining two tests that are frequently used together, and improving the economics for us and our customers. Additionally, we believe that digital sensing will enable improved test accuracy through better image processing over time. We believe the XT instruments offer several important advancements over prior generations:

• | 40% greater test throughput when using our XT-slides |

• | 96% first-pass yield on test results |

• | Designed to offer high reliability with a 98% up-time guarantee for U.S. customers |

Our Clinical Laboratories assay menu is quite broad, covering 24 different therapeutic areas and approximately 90% of a typical laboratory’s testing needs. We are particularly known for the strength of our dry clinical chemistry tests, as well as infectious disease and acute care immunoassays, including our high-performing cardiac markers for heart attack and congestive heart failure. In Greater China, for example, we believe we are the clinical chemistry market leader in separate “STAT” testing laboratories that seek rapid, high-performing assays to drive rapid clinical decisions.

Key products—Clinical Laboratories

|

|

|

Category | Description | Examples |

|

|

|

Standalone CC instrument(s) | High efficiency scalable analyzers that run our broad menu of general and special chemistry tests, including our differentiated dry chemistry Microslides, with no external water supply required | •VITROS 350 Chemistry System •VITROS XT3400 Chemistry System •VITROS 4600 Chemistry System |

|

|

|

Standalone IA instrument(s) | Random access, scalable throughput analyzers that run our broad immunoassay menu with no external water supply required | •VITROS ECiQ Immunodiagnostic System •VITROS 3600 Immunodiagnostic System |

|

|

|

Integrated instruments (CC+IA) | Random access, high throughput analyzers that run our expansive chemistry and immunoassay test menu within the same unit with no external water supply required | •VITROS 5600 Integrated System •VITROS XT7600 Integrated System |

|

|

|

Dry chemistry slides & XT multi-slides | Differentiated “dry” Microslide technology avoids the potential variability caused by water impurities and the frequent calibration common in wet chemistry products. XT slides deliver higher efficiency with two tests per slide | •VITROS XT MicroSlide Clinical Chemistry Technology |

|

|

|

12

|

|

|

Category | Description | Examples |

Critical care assays that help deliver accurate, reliable results in acute care situations | •VITROS Immunodiagnostic Products High-sensitivity Troponin •VITROS Immunodiagnostic Products NT-proBNP II •VITROS Immunodiagnostic Products B•R•A•H•M•S PCT (Procalcitonin) | |

|

|

|

Infectious Diseases—Assays for patient management and blood donor screening | High performing assays to identify presence of antigen and antibodies across a wide spectrum of infectious diseases | •VITROS HIV Combo Immunodiagnostic Assay •VITROS Anti-HCV Immunodiagnostic Assay •VITROS Anti-SARS IgG Immunodiagnostic Assay (1) •VITROS Anti-SARS-CoV2 Total Immunodiagnostic Assay (2) •VITROS SARS Antigen Immunodiagnostic Assay (3) |

|

|

|

Other Key Assays | Microtip assays offer a wide range of special chemistry testing using wet reagents but with no external water supply needed. | •VITROS HbA1c MicroTip Assay |

| ||

(1) | Marketed pursuant to FDA Emergency Use Authorization originally granted on April 24, 2020. Ortho’s VITROS Anti-SARS-CoV-2 IgG antibody test has an estimated 100% specificity (95% confidence interval = 99.1-100%). Under the FDA’s Emergency Use Authorization for the use of COVID-19 convalescent plasma, before a plasma donation can be released to hospitals and patients, the donation must be tested in order to confirm the level or amounts of antibodies in such donation. Ortho’s VITROS Anti-SARS-CoV-2 IgG antibody test is currently specified by the FDA as acceptable for use in this manufacturing step to determine whether a donation qualifies as a high or low titer unit of COVID-19 convalescent plasma. |

(2) | Marketed pursuant to FDA Emergency Use Authorization originally granted on April 14, 2020. |

(3) | Marketed throughout the European Union under CE Mark authority, designed to detect active SARS-CoV-2 (COVID-19) infection in symptomatic and asymptomatic individuals. Marketed in the United States pursuant to FDA Emergency Use Authorization originally granted on January 11, 2021 (product claims and indications for use vary between the European Union and U.S. markets). |

Transfusion Medicine

Immunohematology

In Immunohematology, we are the global market leader based on the strength of our instruments and assays. Our flagship IH analyzers are the ORTHO VISION and ORTHO VISION Max systems that automate blood typing and serology disease screening for blood banks. ORTHO VISION was originally launched in 2015, followed by the ORTHO VISION Max and soon, the new ORTHO VISION Swift, which is designed to be faster, quieter and even more cyber-secure than previous generations of our products. ORTHO VISION has been extremely successful in driving workflow simplification and automation for the customer. In addition, we sell the semi-automated Ortho Workstation for blood bank customers that have lower volumes or need for test automation.

13

In the near-term, pending FDA clearance, we plan to launch the new ORTHO OPTIX reader targeted at blood banks who desire greater precision reading their manual test results. OPTIX is designed to provide improved software and integration with laboratory information systems, improved workflow and 99.9% concordance with ORTHO VISION test results. OPTIX will provide an entry point for customers that want to move from manual to semi-automated testing.

We also have a partnership with Quotient for the Immunohematology application of the MosaiQTM analyzer, which is designed to employ a cutting-edge microarray technology to allow advanced multiplexing. MosaiQ multiplexing is expected to enable multiple tests to be run simultaneously on a single, low-volume patient sample and drive significantly higher test throughput, which would strengthen our position in the ultra-high throughput segment of the IH market. It also offers the potential for streamlined inventory management and concordant results across donor screening and pre-transfusion testing and matching.

Our Immunohematology instruments operate with two different modalities of test consumables. In the United States, our automated systems use patented ID-Micro Typing System (“IS-MTS”) gel cards and outside the United States, we sell BIOVUE cassettes that utilize column agglutination technology (“CAT”). Both approaches are designed to provide reliable test results and simplify test workflow. With the 2016 launch of ORTHO SERA reagents, we offer a comprehensive test Immunohematology menu that we believe covers more than 99% of most tested blood antigens and all the diseases regularly required for transfusion screening globally.

Donor Screening

Our Donor Screening business is focused on instruments and tests used for blood and plasma screening for infectious diseases for customers, which include some of the largest donor testing institutions, primarily in the United States. In Donor Screening, our core instrument offering is the ORTHO VERSEIA Integrated Processor (“VIP”)—an automated pipetting and processing system that brings together the ORTHO VERSEIA pipettor and ORTHO Summit Processor to enable end-to-end pipetting and processing. We are currently upgrading the VIP system in collaboration with a key U.S. customer and expect to launch the next generation in 2021. For Donor Screening, our serology test menu covers the full range of blood types and a comprehensive set of infectious disease screens, including important tests for tropical diseases like Chagas’ that are critical for care in emerging markets.

Key products—Transfusion Medicine

|

|

|

|

|

|

Category | Description | Examples |

|

|

|

Immunohematology Manual and Semi-automated | The only 2-in-1 blood testing system using reliable Column Agglutination Technology (CAT). The Reader delivers objective grading, results interpretation concordant with the ORTHO VISION Analyzer | •Manual Blood Bank Reagents •ORTHO Workstation •ORTHO OPTIX™ Reader |

|

|

|

Immunohematology Automated | A suite of automated instrument solutions connected with an optional middleware software that bridges the gap between instruments and hospital IT networks | •ORTHO VISION Analyzer •ORTHO VISION Max Analyzer •ORTHO CONNECT Middleware •ORTHO PROVUE •ORTHO AUTOVUE |

|

|

|

Immunohematology BIOVUE | Safe, cost-effective test format that can be used manually or with the fully automated analyzers, the ORTHO BIOVUE cassette is easy to use and ideal for both routine and specialized immunohematology testing. | •BIOVUE Cassettes |

|

|

|

Immunohematology ID-MTS Gel Cards | Safe, cost-effective test format that can be used manually or with the fully automated analyzers. The ID-MTS Gel card is easy to use and ideal for both routine and specialized immunohematology testing. | •ID-MTS Gel Cards |

|

|

|

Immunohematology Key Screening & Typing Assays | BIOVUE and ID-MTS product lines offer comprehensive testing solutions including: Type and screen, Donor confirmation, Antibody screening and identification, Rh phenotype, Rare antigen testing, DAT | •Anti-Fya, Anti-Fyb, Anti-Jka, Anti-Jkb, Anti-S, Anti-s, Anti-K, Anti-D (IAT), Anti-D (DVI), Anti-P1, Anti-Lea, Anti-Leb and Anti-N |

|

|

|

U.S. Donor Screening | Ultra-high throughput Donor Testing platform capable of 264 tests per hour. Designed to run a comprehensive panel of highly sensitive and specific assays for use in Donor Testing | •ORTHO VERSEIA Integrated Processor •ORTHO HBc ELISA •ORTHO T. cruzi ELISA •ORTHO HCV 3.0 ELISA |

| ||

14

Our services

In addition to the products we provide, ORTHOCARE Services are a critical element of how we deliver value to our customers. As of December 2020, we had approximately 900 service teammates globally. We employ highly trained service professionals including over 340 laboratory specialists with advanced qualifications. For example, more than 95% of our U.S. laboratory specialists have medical technician degrees.

Our highly valued suite of ORTHOCARE service offerings includes:

• | Guarantee 98% up-time to our U.S. customers—High instrument reliability and a proactive maintenance program. |

• | E-CONNECTIVITY Remote Monitoring Software—More than 80% of our installed base of VITROS 5600, XT 7600 and ORTHO VISION platforms are e-connected, enabling remote monitoring and improved analyzer availability. |

• | Laboratory Informatics—Solutions designed to deliver incremental value to the laboratory, including inventory planning, laboratory productivity metrics and technical documentation. |

• | ValuMetrix—A highly valued consulting service proven to increase laboratory workflow, productivity and laboratory service levels utilizing Lean principles and process excellence. This service offering provides actionable insights into demand for new products, services and workflow. |

• | Global Technical Solution Center—Seven technical solution centers delivering first line support in over 15 languages, meaning we can resolve service issues remotely without an on-site visit approximately two-thirds of the time. |

• | Smart Service Mobile App—First in class technology enabled on iPhone and Android devices that allows our service teams to receive up-to-date analyzer health checks, proactive alerts and performance monitoring to ensure the highest level of reliability is achieved. |

• | Training and Education—Flexible educational resources for the lifetime of the customer relationship, including virtual technical training, continuing education and professional development. |

• | Smart Start—Concierge implementation program led by certified project managers. Easier implementation using collaborative software to keep up to date with real- time progress reports, customized dashboards and status updates. |

• | Merged Reality—Enables product experts to provide remote ‘side by side’ assistance to field service engineers and customers through mobile devices, including smart glasses. This allows both parties to see the same thing at the same time and provide guided instruction leading to better and faster fix rates. |

We are globally recognized for service excellence and continue to invest in people and technology to increase value for our customers.

Sales, marketing and distribution

We use state-of-the-art manufacturing and distribution capabilities to produce and deliver diagnostic instruments and assays for hospitals, laboratories and blood and plasma centers worldwide. Our primary distribution center locations are centrally located in the United States and Europe and have extended hours and efficient transportation processes.

Our sales team is comprised of highly skilled and experienced professionals. In the United States, we use a generalized sales force for Immunohematology and Clinical Laboratories and a separate specialist sales force for Donor Screening. Across this global footprint, we operate a region-specific sales model. Our developed markets, specifically in North America and Western Europe, are served primarily through direct sales; however, we generally utilize third-party distributors in emerging markets, such as China, the Middle East, Africa and Eastern Europe as this model is more commercially effective.

Our global team strives to deliver a differentiated level of customer service and support by surrounding our customers with devoted and experienced professionals. Our network of field engineers is responsible for installing our instruments and providing customer support. In addition, our call center team and laboratory specialists are available to provide customer training and ongoing customer support.

Research and development

Our research and development focus is on designing and developing products while balancing our research and development team’s capacity, development timelines and overall cost. We have been a pioneer of important technological advances in diagnostics, including our unique dry slide technology and our automated and semi-automated blood banking systems. Our research and development team is comprised of a balanced mix of experienced professionals with years of experience in the diagnostics industry and recently

15