Investor Presentation May 27, 2021 Next Generation Targeted Therapy for Cancer Exhibit 99.3

Disclaimer ABOUT THIS PRESENTATION This presentation is for informational purpose sonly to assist interested parties in making their own evaluation with respect to a proposed business combination (the Business Combination) between Locust Walk Acquisition Corp. (LWAC) and eFFECTOR Therapeutics, Inc. (eFFECTOR or the Company) and related transactions, and for no other purpose. The information contained herein does not purport to be all inclusive and no representation or warranty, express or implied, is or will be given by LWAC, eFFECTOR, or any of their respective affiliates, directors, officers, employees or advisers or any other person as to the accuracy, completeness or reliability of the information contained in this presentation. The distribution of this presentation may be restricted by law and persons into whose possession this presentation comes should inform themselves about and observe any such restrictions. FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements regarding LWAC or the Company’s future results of operations and financial position, the amount of cash expected to be available to eFFECTOR after giving effect to any redemptions by LWAC stockholders, eFFECTOR’s business strategy, prospective products, product approvals, research and development costs, timing and likelihood of success, plans and objectives of management for future operations, future results of current and anticipated products and expected use of proceeds by LWAC, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may”, “believe”, “anticipate”, “could”,“ should”, “estimate”, “expect”, “intend”, “plan”, “project”, “will”, “forecast” and similar terms. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to, the risks relating to the Company set forth in the Appendix and the following risks relating to the Business Combination: the risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of LWAC’s securities; the failure to satisfy the conditions to closing the Business Combination, including the approval by the stockholders of LWAC and the receipt of certain governmental and regulatory approvals; the risk that some or all of LWAC’s stockholders may redeem their shares at the closing of the transaction; the effect of the announcement or pendency of the Business Combination on the Company’s business relationships and business generally; the outcome of any legal proceedings that may be instituted related to the Business Combination; and the ability to realize the anticipated benefits of the Business Combination. Moreover, the Company operates in a very competitive and rapidly changing environment. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond LWAC’s and the Company’s control, you should not rely on these forward-looking statements as predictions of future events. The foregoing list of factors is not exclusive, and readers should also refer to those risks that will be included under the header “Risk Factors” in the registration statement on Form S-4 to be filed by LWAC with the Securities and Exchange Commission (SEC) and those included under the header “Risk Factors” in LWAC’s Annual Report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 29, 2021. The events and circumstances reflected in these forward-looking statements may not be achieved or occur and actual results could differ materially from those Except as required by applicable law, neither LWAC nor the Company plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information ,future events, changed circumstances or otherwise. MARKET AND INDUSTRY DATA This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions, and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. CLINICAL INVESTIGATION/FDA This presentation concerns product candidates that are under clinical investigation and which have not yet been approved for marketing by the U.S. Food and Drug Administration (FDA). They are currently limited by Federal law to investigational use, and no representation is made as to their safety or effectiveness for the purposes for which they are being investigated. ADDITIONAL INFORMATION In connection with the proposed Business Combination, LWAC will file a registration statement on Form S-4 with the SEC, which will include a proxy statement/prospectus, that will be both the proxy statement to be distributed to holders of LWAC common stock in connection with its solicitation of proxies for the vote by LWAC stockholders with respect to the proposed Business Combination and other matters as may be described in the registration statement, as well as the prospectus relating to the offer and sale of the securities to be issued in the Business Combination. After the registration statement is declared effective, LWAC will mail a definitive proxy statement/prospectus and other relevant documents to its stockholders. This presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. LWAC’s stockholders, the Company, and other interested persons are advised to read, when available, the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about the Company, LWAC and the Business Combination. When available, the definitive proxy statement and other relevant materials for the proposed Business Combination will be sent to stockholders of LWAC as of a record date to be established for voting on the proposed Business Combination. Stockholders will also be able to obtain copies of the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: LWAC c/o eFFECTOR Therapeutics, Inc., 11120 Roselle Street, Suite A, San Diego, CA 92121. PARTICIPANTS IN THE SOLICITATION LWAC and its directors and executive officers may be deemed participants in the solicitation of proxies from LWAC’s stockholders with respect to the proposed Business Combination. A list of the names of those directors and executive officers and a description of their interests in LWAC is contained in LWAC’s final prospectus dated January 11, 2021 relating to its initial public offering, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov. Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the proposed Business Combination when available. The Company and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of LWAC in connection with the proposed Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination will be included in the proxy statement/prospectus for the proposed Business Combination when available. NO SOLICITATION OR OFFER This presentation and any oral statements made in connection with this presentation shall neither constitute an offer to sell nor the solicitation of an offer to buy any securities, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed Business Combination, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to any registration or qualification under the securities laws of any such jurisdictions. This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. TRADEMARKS This presentation contains trademarks, service marks, and trade names of the Company, LWAC and other companies, which are the property of their respective owners. 1

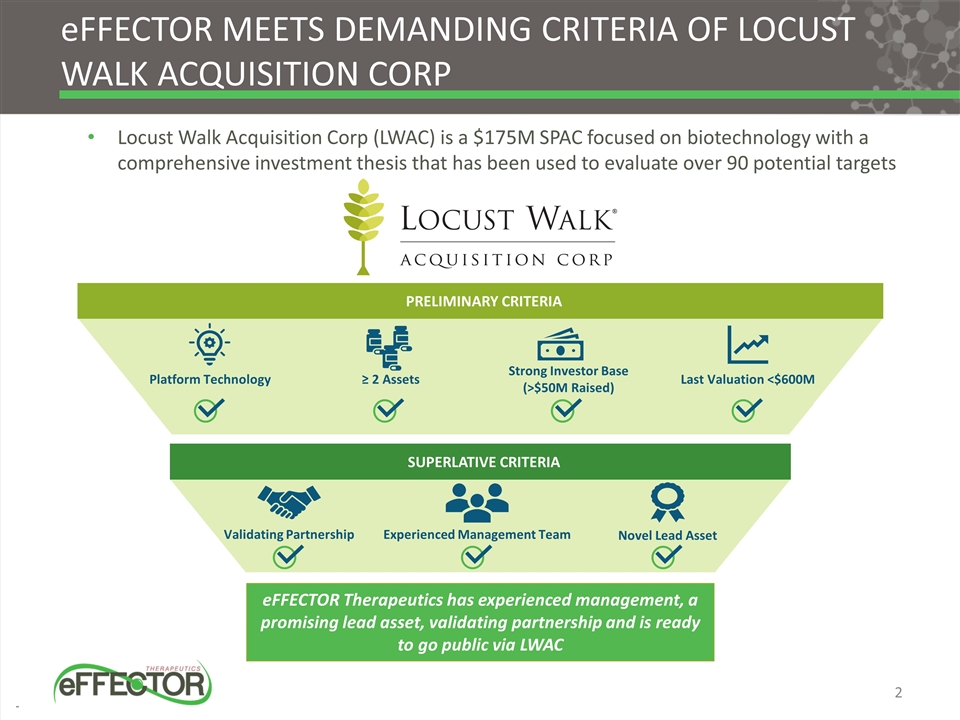

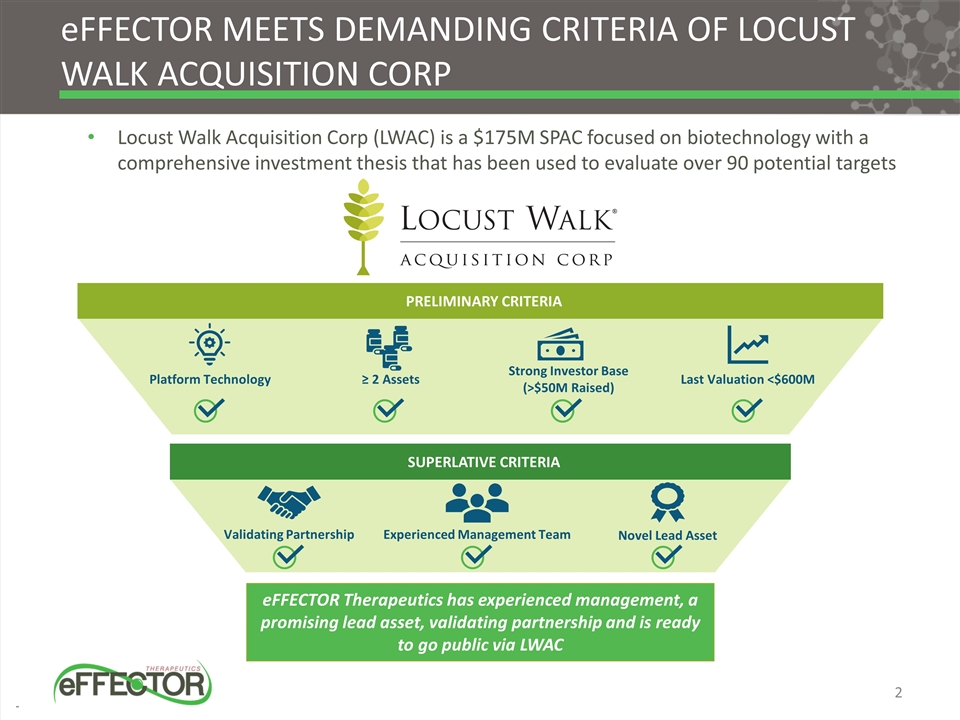

eFFECTOR MEETS DEMANDING CRITERIA OF LOCUST WALK ACQUISITION CORP Locust Walk Acquisition Corp (LWAC) is a $175M SPAC focused on biotechnology with a comprehensive investment thesis that has been used to evaluate over 90 potential targets SUPERLATIVE CRITERIA Validating Partnership Novel Lead Asset Experienced Management Team PRELIMINARY CRITERIA Platform Technology ≥ 2 Assets Last Valuation <$600M Strong Investor Base (>$50M Raised) eFFECTOR Therapeutics has experienced management, a promising lead asset, validating partnership and is ready to go public via LWAC

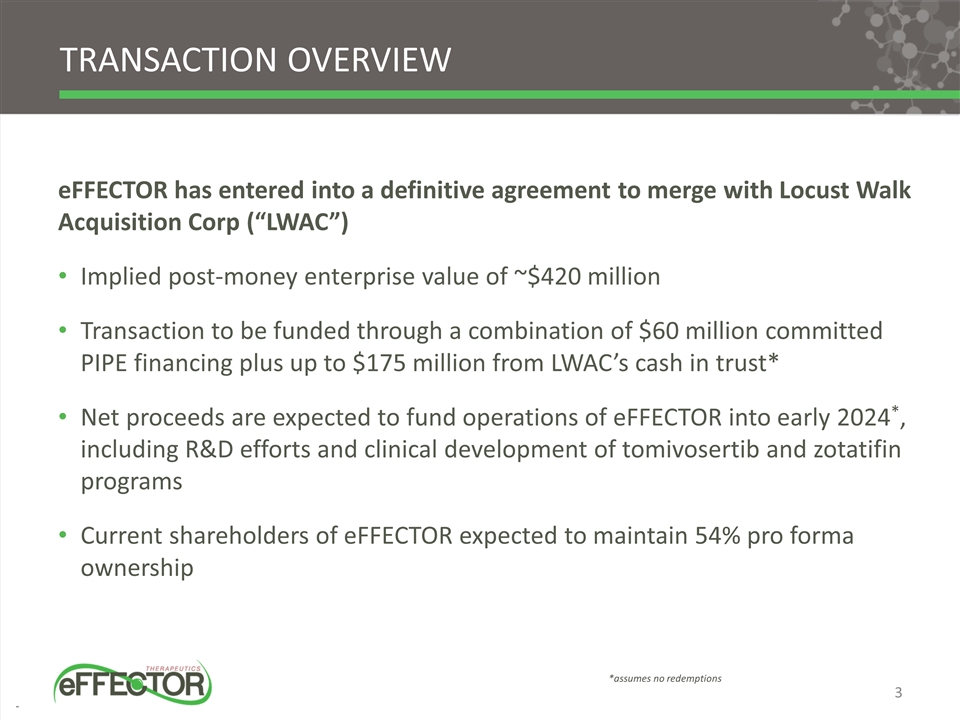

TRANSACTION OVERVIEW eFFECTOR has entered into a definitive agreement to merge with Locust Walk Acquisition Corp (“LWAC”) Implied post-money enterprise value of ~$420 million Transaction to be funded through a combination of $60 million committed PIPE financing plus up to $175 million from LWAC’s cash in trust* Net proceeds are expected to fund operations of eFFECTOR into early 2024*, including R&D efforts and clinical development of tomivosertib and zotatifin programs Current shareholders of eFFECTOR expected to maintain 54% pro forma ownership *assumes no redemptions 3

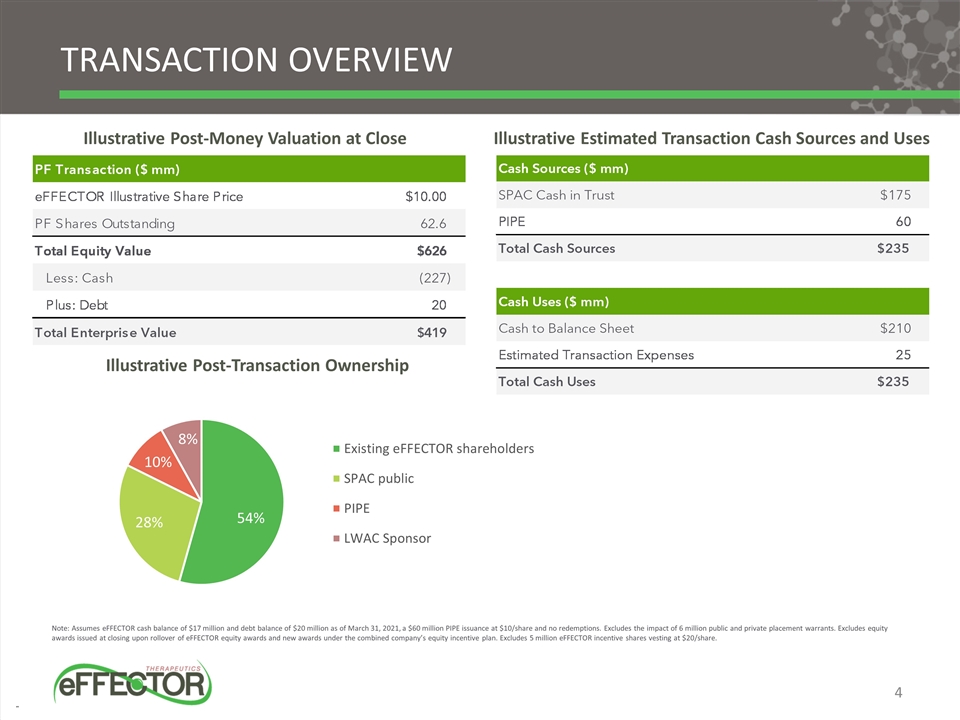

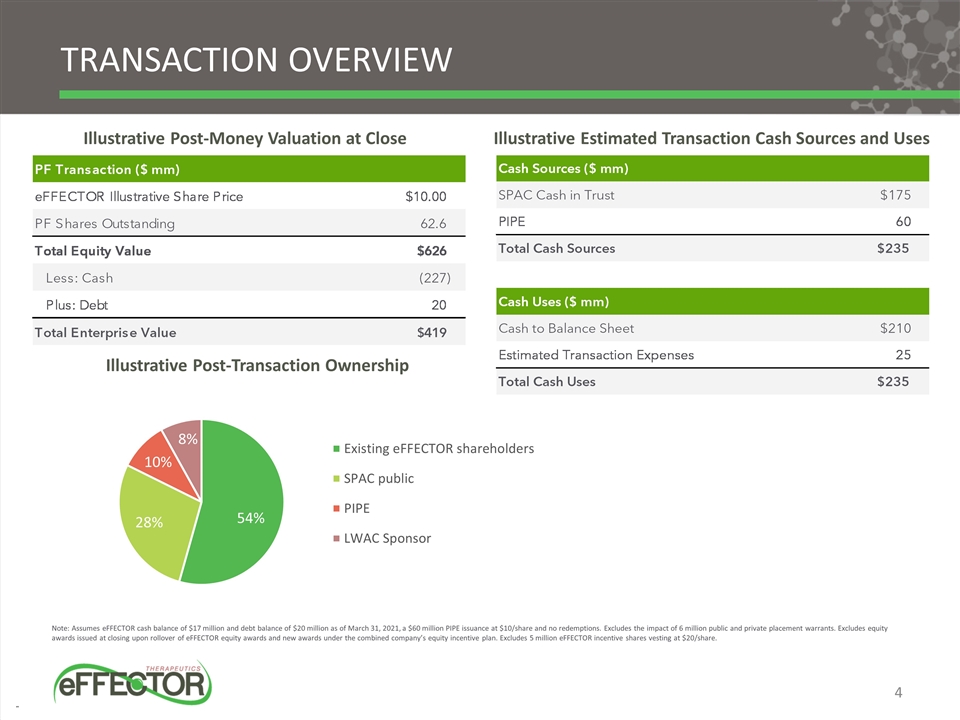

TRANSACTION OVERVIEW Illustrative Post-Money Valuation at Close Illustrative Estimated Transaction Cash Sources and Uses Illustrative Post-Transaction Ownership Note: Assumes eFFECTOR cash balance of $17 million and debt balance of $20 million as of March 31, 2021, a $60 million PIPE issuance at $10/share and no redemptions. Excludes the impact of 6 million public and private placement warrants. Excludes equity awards issued at closing upon rollover of eFFECTOR equity awards and new awards under the combined company’s equity incentive plan. Excludes 5 million eFFECTOR incentive shares vesting at $20/share.

Major UNMET NEED in ONCOLOGY: therapeutic strategies Designed to outsmart cancer Immuno-oncology and targeted therapies have improved outcomes, but only work for subsets of patients Most patients with metastatic cancer develop treatment resistance over time T cell exhaustion leads to disease progression in majority of patients on checkpoint inhibitors Targeted therapies can’t win when tumors overexpress multiple oncoproteins and resistance proteins Cancer is a complex, aggressive disease driven by multiple factors that enable it to evolve to evade existing therapies.

Imagine cancer medicines that are designed to: Be well tolerated and easier to take Shut down multiple drivers of cancer simultaneously Reactivate the immune system to eliminate tumors Make existing treatments work better and longer Delay need for toxic chemotherapy

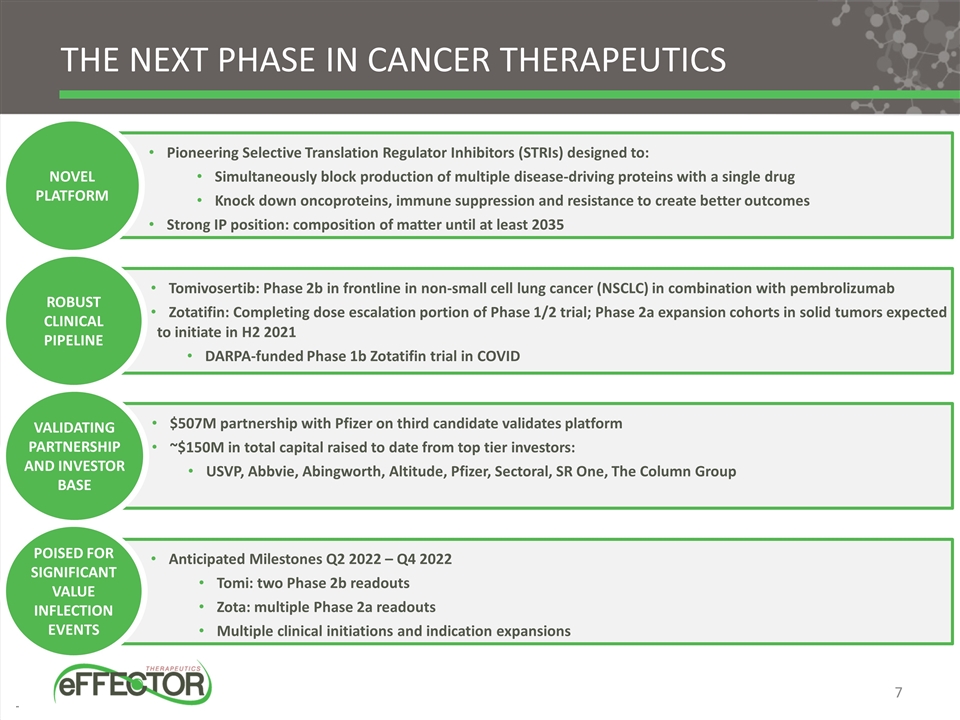

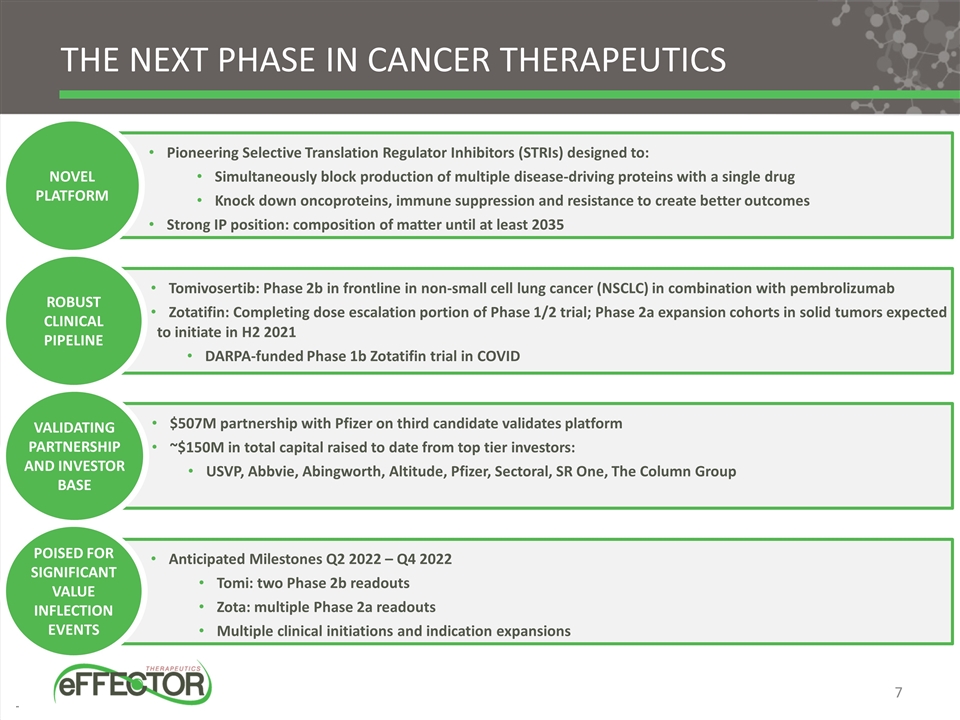

THE NEXT PHASE IN CANCER THERAPEUTICS Pioneering Selective Translation Regulator Inhibitors (STRIs) designed to: Simultaneously block production of multiple disease-driving proteins with a single drug Knock down oncoproteins, immune suppression and resistance to create better outcomes Strong IP position: composition of matter until at least 2035 NOVEL PLATFORM Tomivosertib: Phase 2b in frontline in non-small cell lung cancer (NSCLC) in combination with pembrolizumab Zotatifin: Completing dose escalation portion of Phase 1/2 trial; Phase 2a expansion cohorts in solid tumors expected to initiate in H2 2021 DARPA-funded Phase 1b Zotatifin trial in COVID ROBUST CLINICAL PIPELINE $507M partnership with Pfizer on third candidate validates platform ~$150M in total capital raised to date from top tier investors: USVP, Abbvie, Abingworth, Altitude, Pfizer, Sectoral, SR One, The Column Group VALIDATING PARTNERSHIP AND INVESTOR BASE Anticipated Milestones Q2 2022 – Q4 2022 Tomi: two Phase 2b readouts Zota: multiple Phase 2a readouts Multiple clinical initiations and indication expansions POISED FOR SIGNIFICANT VALUE INFLECTION EVENTS

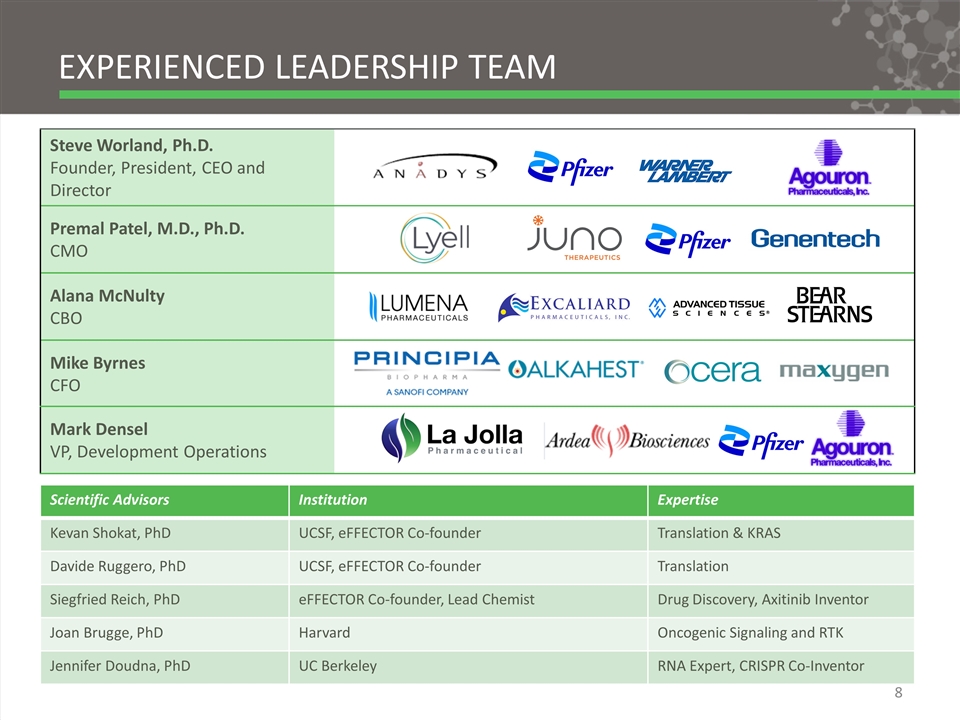

Steve Worland, Ph.D. Founder, President, CEO and Director Premal Patel, M.D., Ph.D. CMO Alana McNulty CBO Mike Byrnes CFO Experienced leadership team Scientific Advisors Institution Expertise Kevan Shokat, PhD UCSF, eFFECTOR Co-founder Translation & KRAS Davide Ruggero, PhD UCSF, eFFECTOR Co-founder Translation Siegfried Reich, PhD eFFECTOR Co-founder, Lead Chemist Drug Discovery, Axitinib Inventor Joan Brugge, PhD Harvard Oncogenic Signaling and RTK Jennifer Doudna, PhD UC Berkeley RNA Expert, CRISPR Co-Inventor Mark Densel VP, Development Operations

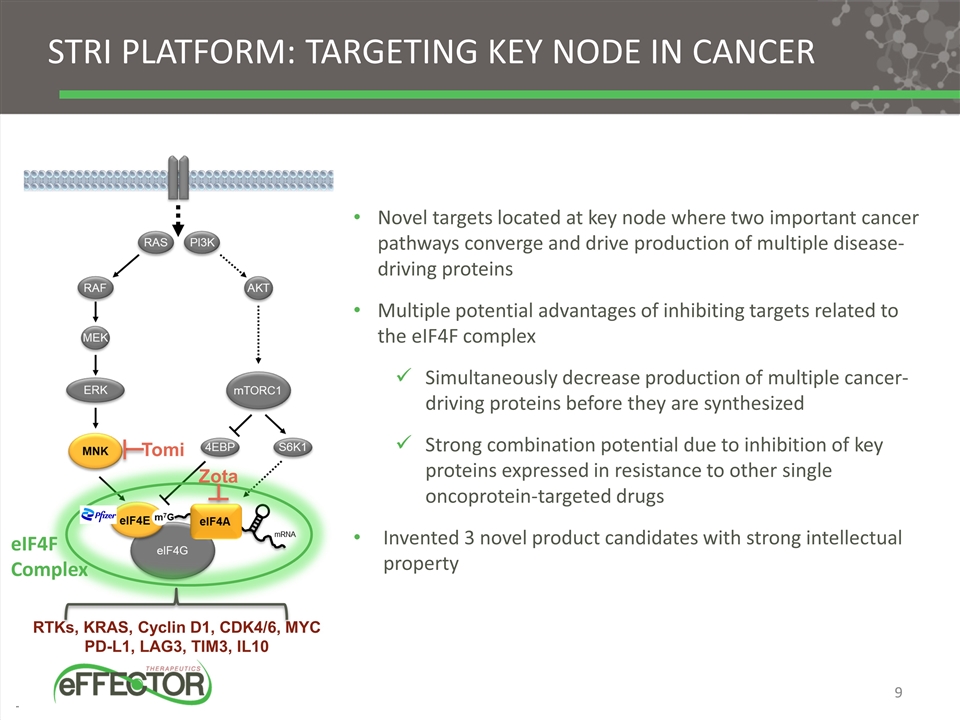

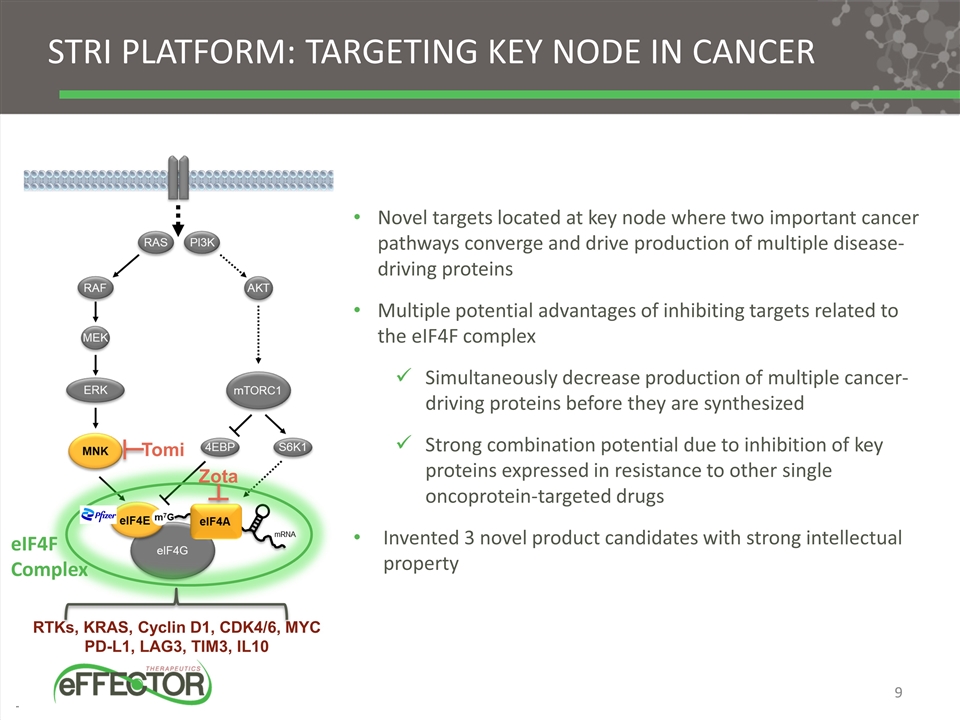

STRI Platform: Targeting key node in cancer Novel targets located at key node where two important cancer pathways converge and drive production of multiple disease-driving proteins Multiple potential advantages of inhibiting targets related to the eIF4F complex Simultaneously decrease production of multiple cancer-driving proteins before they are synthesized Strong combination potential due to inhibition of key proteins expressed in resistance to other single oncoprotein-targeted drugs Invented 3 novel product candidates with strong intellectual property RTKs, KRAS, Cyclin D1, CDK4/6, MYC PD-L1, LAG3, TIM3, IL10 eIF4F Complex Tomi Zota

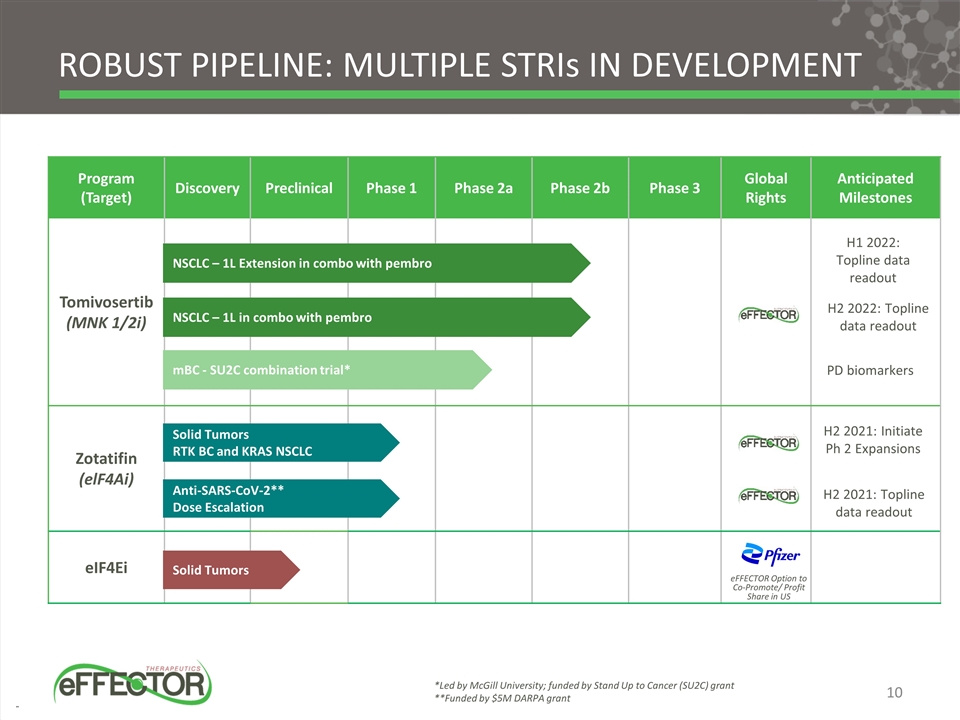

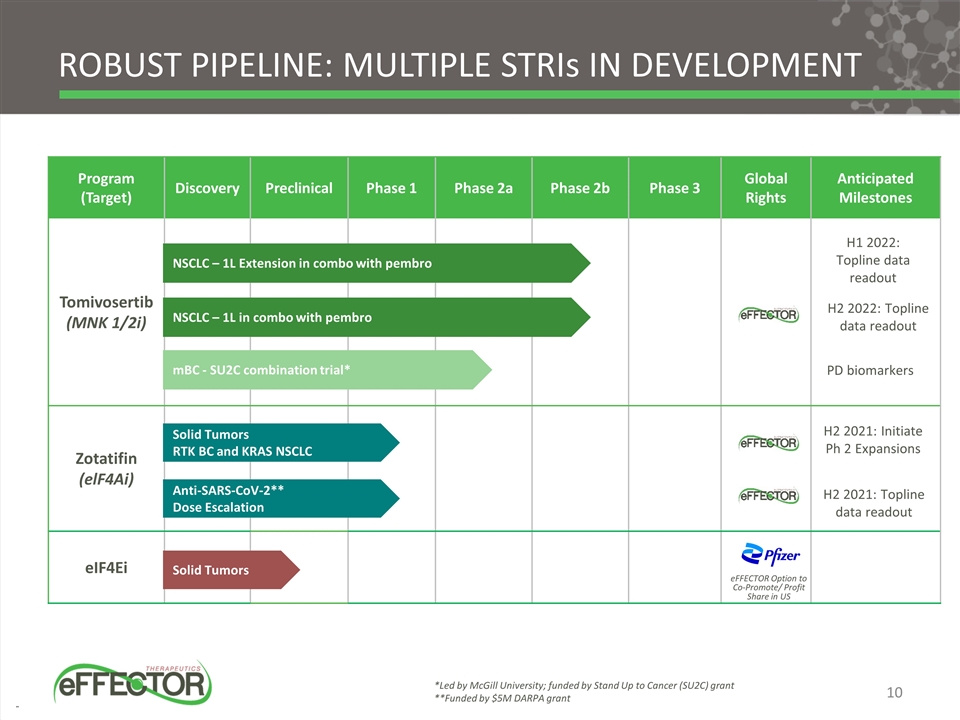

ROBUST Pipeline: Multiple STRIs in development Program (Target) Discovery Preclinical Phase 1 Phase 2a Phase 2b Phase 3 Global Rights Anticipated Milestones Tomivosertib (MNK 1/2i) Zotatifin (elF4Ai) eIF4Ei NSCLC – 1L Extension in combo with pembro Solid Tumors RTK BC and KRAS NSCLC Solid Tumors mBC - SU2C combination trial* *Led by McGill University; funded by Stand Up to Cancer (SU2C) grant **Funded by $5M DARPA grant eFFECTOR Option to Co-Promote/ Profit Share in US Anti-SARS-CoV-2** Dose Escalation NSCLC – 1L in combo with pembro H1 2022: Topline data readout H2 2022: Topline data readout H2 2021: Topline data readout H2 2021: Initiate Ph 2 Expansions PD biomarkers

Tomivosertib Designed to stimulate activation, prevent exhaustion and prolong memory of T cells MNK 1/2 Inhibitor

Checkpoint inhibitors (CPIs) have advanced oncology treatment but: Most patients don’t respond The majority of responders develop resistance and must progress to more toxic chemotherapeutics agents In combination with CPIs, tomi may help overcome resistance to prolong the utility of checkpoint inhibition, potentially delaying toxic chemo Encouraging Phase 2a clinical efficacy signal Data suggests potential to address common resistance mechanisms to CPIs Identified biomarker-driven patient selection strategy to enrich Phase 2b study with patients most likely to respond Tomivosertib (toMI): potential to Delay and reverse resistance to CPI therapy

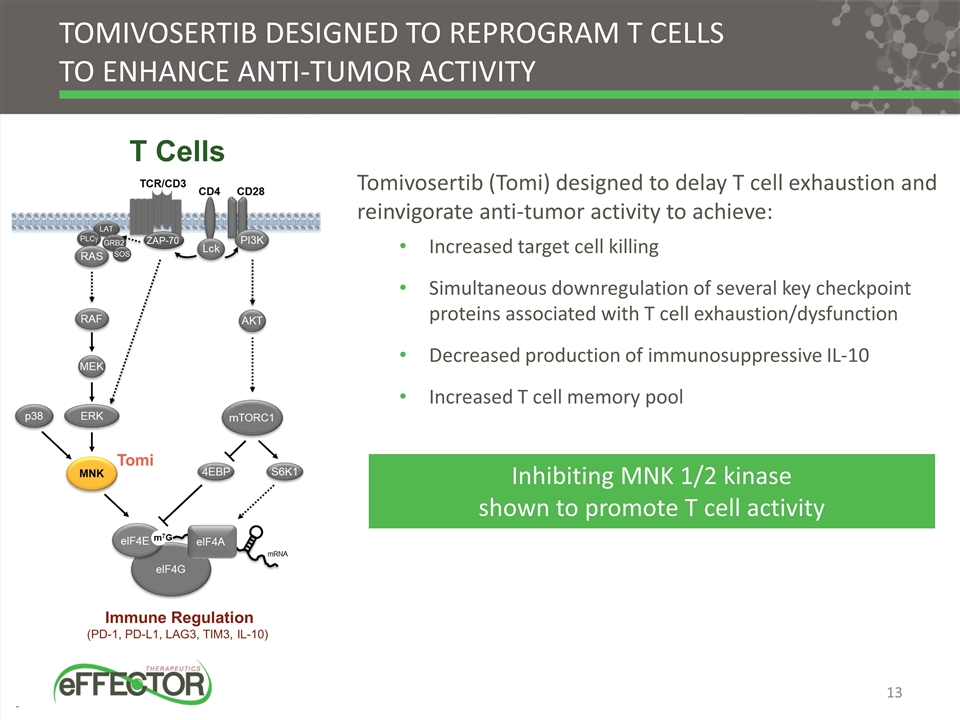

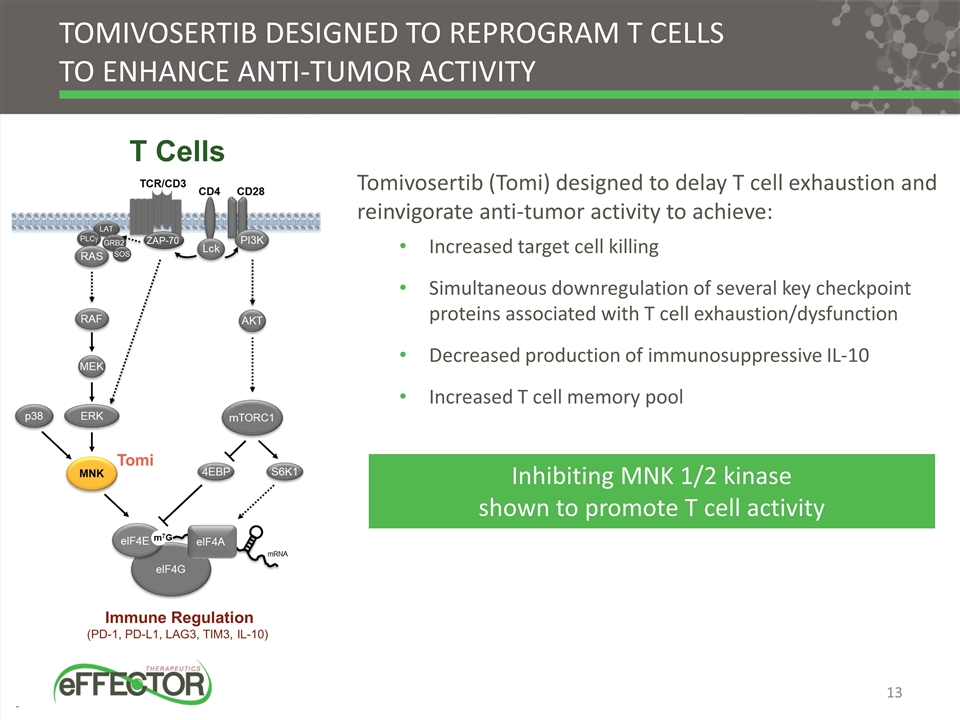

T Cells Tomivosertib (Tomi) designed to delay T cell exhaustion and reinvigorate anti-tumor activity to achieve: Increased target cell killing Simultaneous downregulation of several key checkpoint proteins associated with T cell exhaustion/dysfunction Decreased production of immunosuppressive IL-10 Increased T cell memory pool Immune Regulation (PD-1, PD-L1, LAG3, TIM3, IL-10) Tomivosertib Designed to Reprogram T Cells to Enhance Anti-tumor activity Tomi Inhibiting MNK 1/2 kinase shown to promote T cell activity

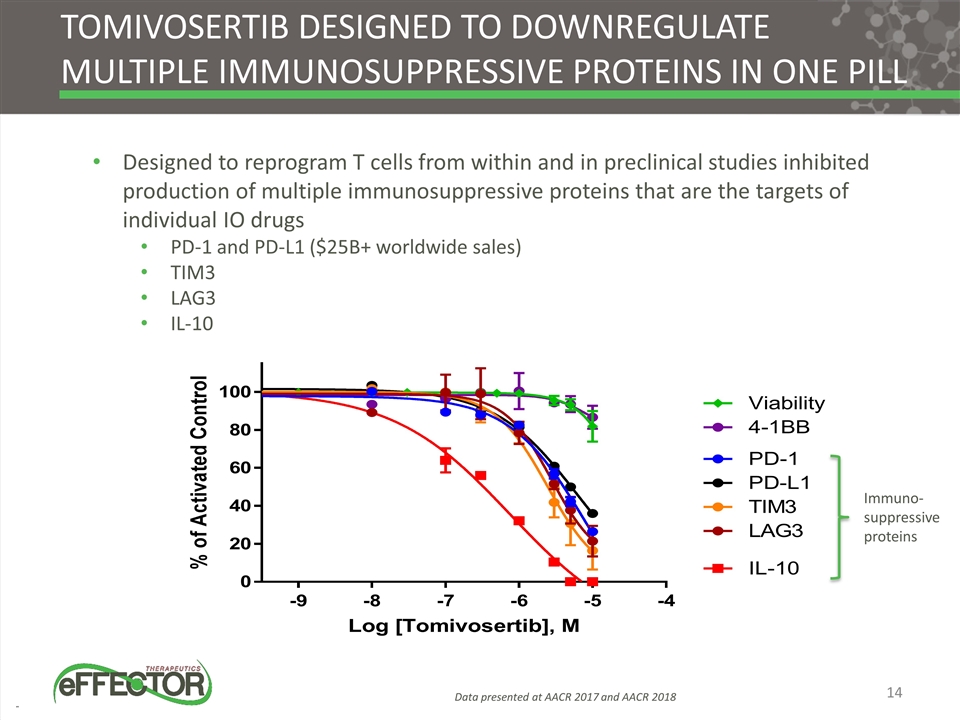

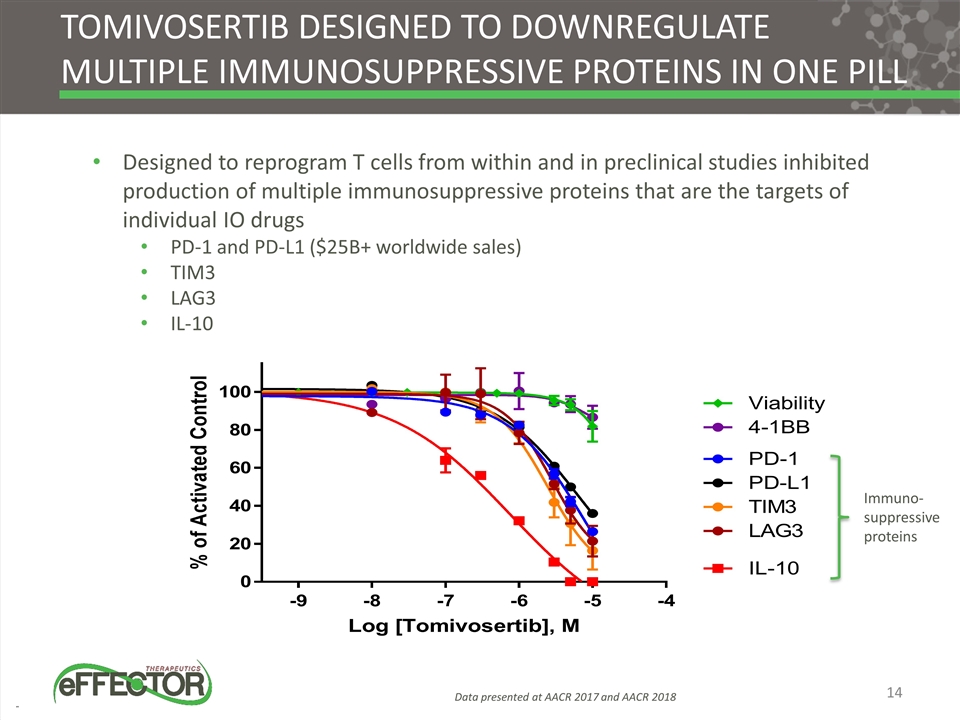

TOMIVOSERTIB Designed to downregulate multiple immunosuppressive proteins in one pill Designed to reprogram T cells from within and in preclinical studies inhibited production of multiple immunosuppressive proteins that are the targets of individual IO drugs PD-1 and PD-L1 ($25B+ worldwide sales) TIM3 LAG3 IL-10 Immuno-suppressive proteins Data presented at AACR 2017 and AACR 2018

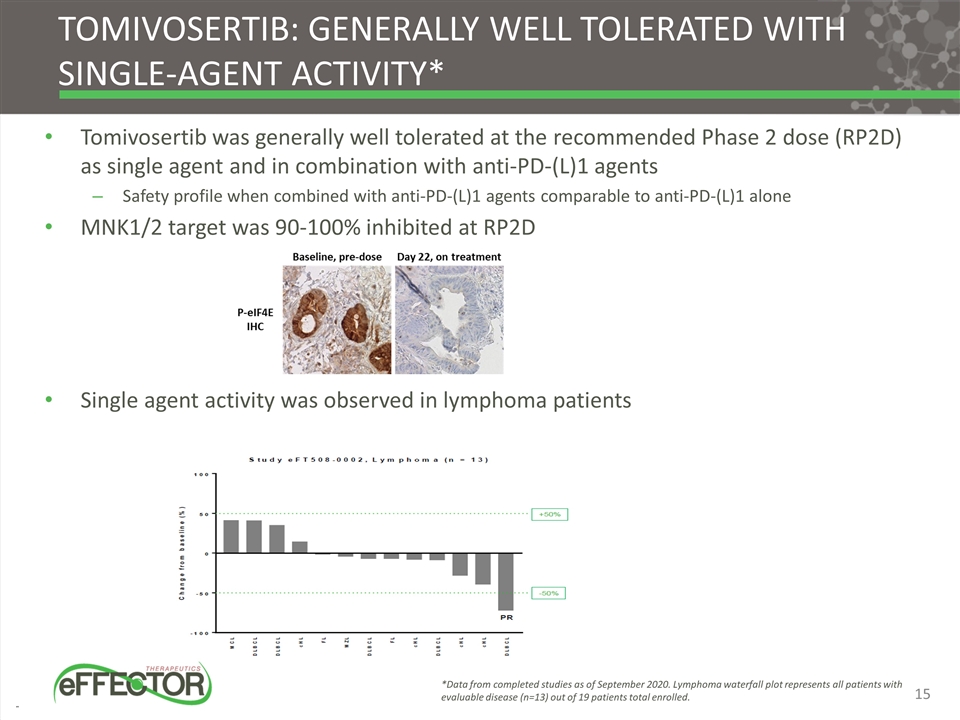

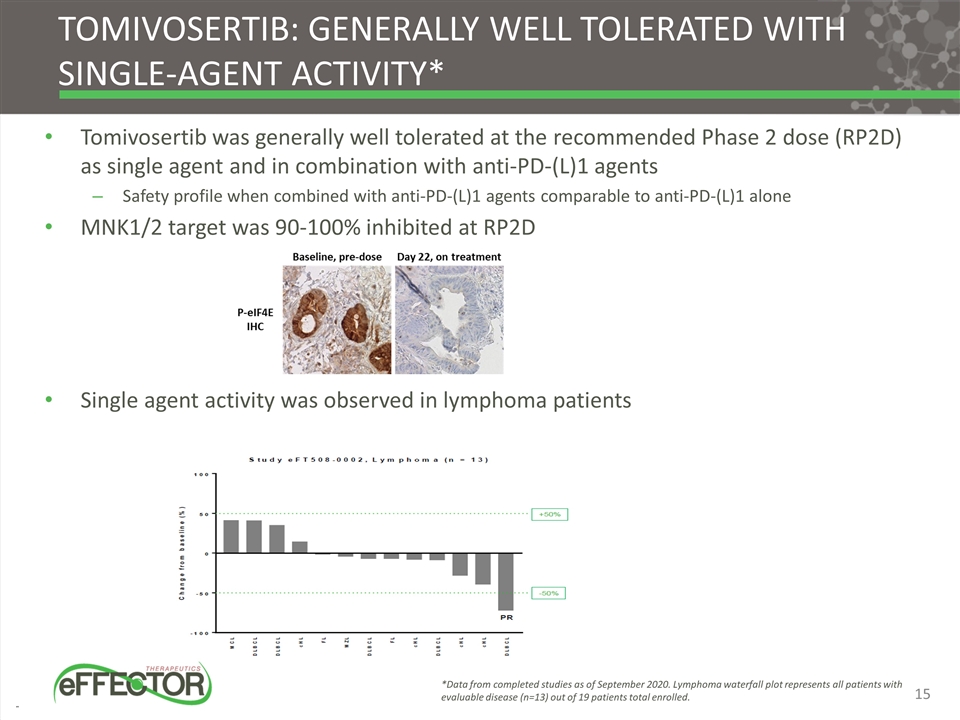

Tomivosertib: Generally Well Tolerated with Single-Agent Activity* Tomivosertib was generally well tolerated at the recommended Phase 2 dose (RP2D) as single agent and in combination with anti-PD-(L)1 agents Safety profile when combined with anti-PD-(L)1 agents comparable to anti-PD-(L)1 alone MNK1/2 target was 90-100% inhibited at RP2D Single agent activity was observed in lymphoma patients *Data from completed studies as of September 2020. Lymphoma waterfall plot represents all patients with evaluable disease (n=13) out of 19 patients total enrolled.

Phase 2a: Prolonged PFS when combined with anti-PD-(L)1 agents 39 patient Phase 2a study showed encouraging activity in multiple tumor types* Tomivosertib added on to patients not responding to anti-PD-(L)1 therapy with no change or break in anti-PD-(L)1 regimen Subset including all 17 NSCLC patients had clinical benefit Each had increasing metastatic disease on anti-PD-(L)1 therapy prior to adding tomivosertib (16 of 17 had RECIST progression) Inflection in tumor growth and durable tumor control observed in many patients after adding tomivosertib 2 confirmed partial responses (PR) and third patient with 28% reduction in tumor size 1 PR went on to confirmed complete response (CR) on extension Tomivosertib substantially improved PFS (up to 18 months), particularly in PD-L1+ patients Additional activity seen in other immunologically responsive tumors *Data through study completion in September 2020; initial data presented at ASCO 2020; PR and CR as determined by RECIST criteria

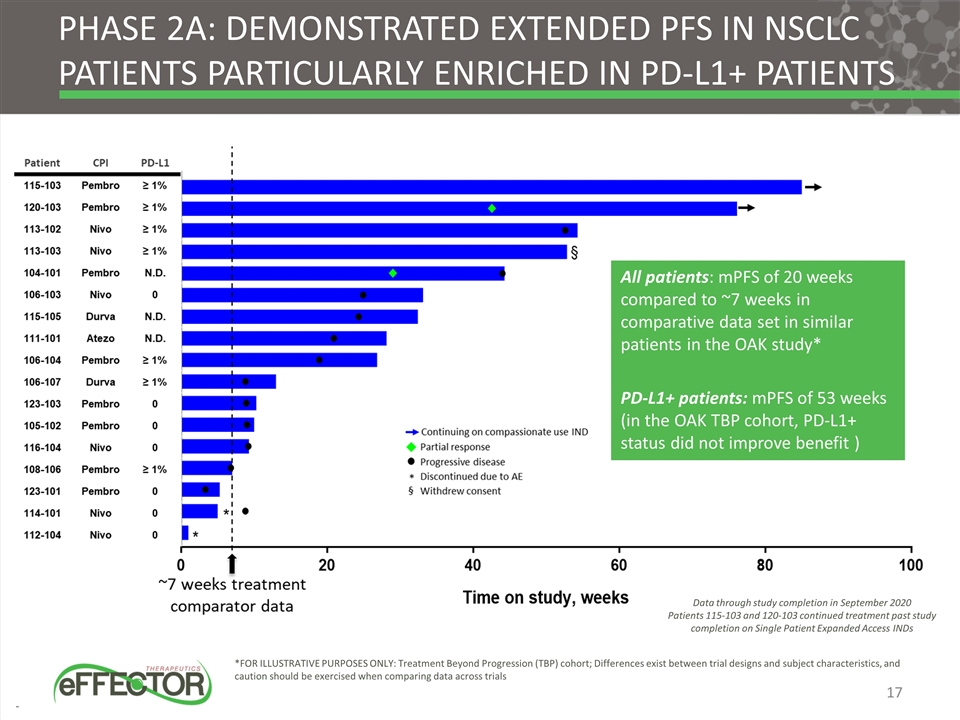

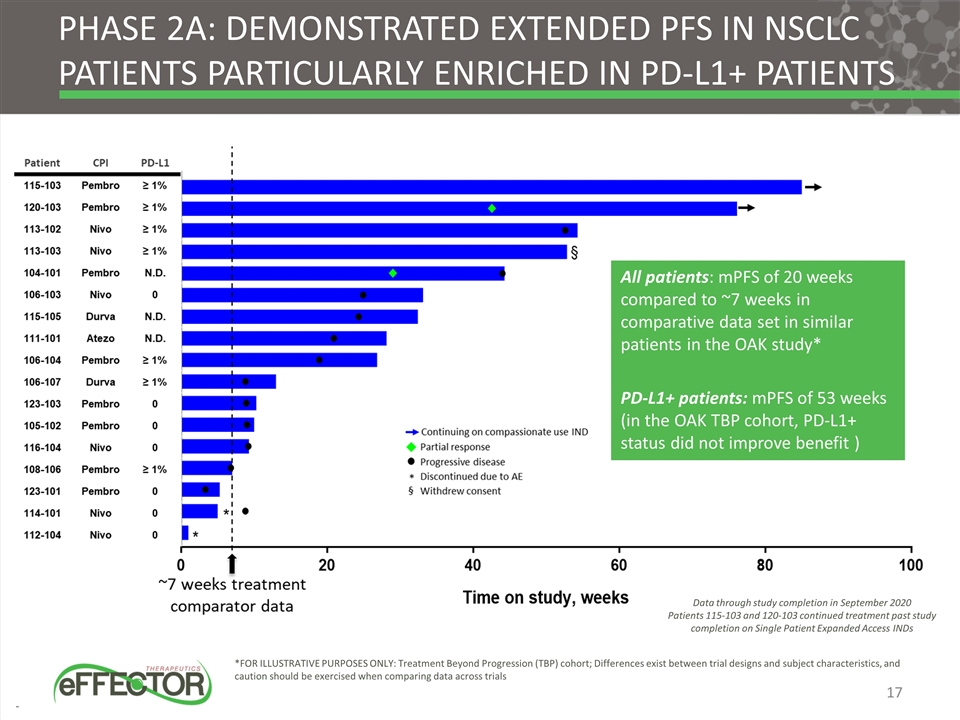

Phase 2A: Demonstrated extended PFS in NSCLC patients particularly enriched in PD-L1+ patients All patients: mPFS of 20 weeks compared to ~7 weeks in comparative data set in similar patients in the OAK study* PD-L1+ patients: mPFS of 53 weeks (in the OAK TBP cohort, PD-L1+ status did not improve benefit ) *FOR ILLUSTRATIVE PURPOSES ONLY: Treatment Beyond Progression (TBP) cohort; Differences exist between trial designs and subject characteristics, and caution should be exercised when comparing data across trials Data through study completion in September 2020 Patients 115-103 and 120-103 continued treatment past study completion on Single Patient Expanded Access INDs

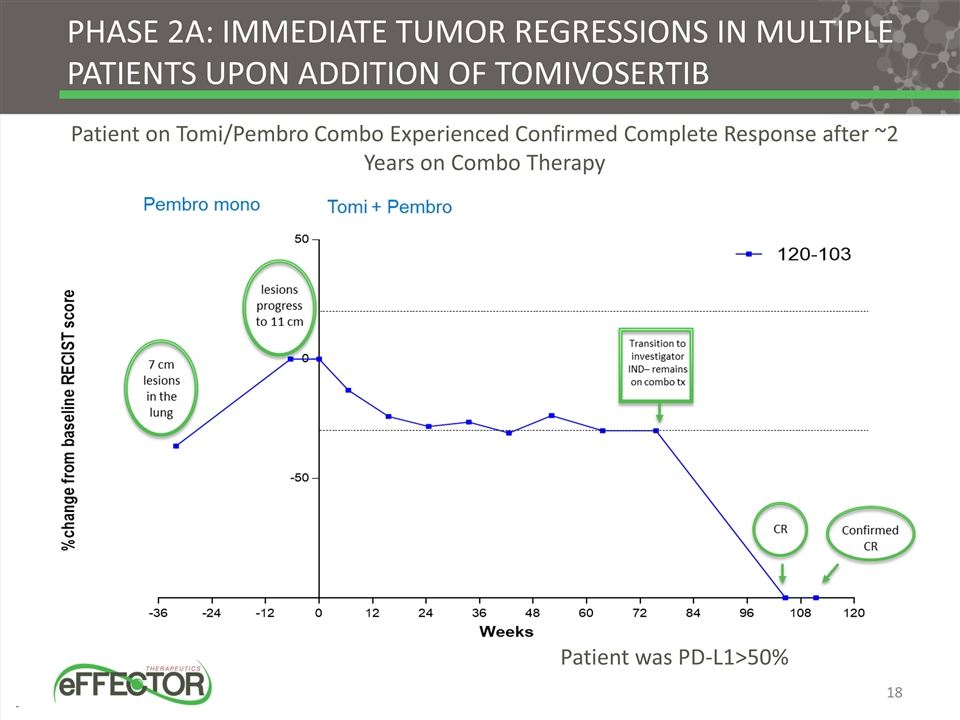

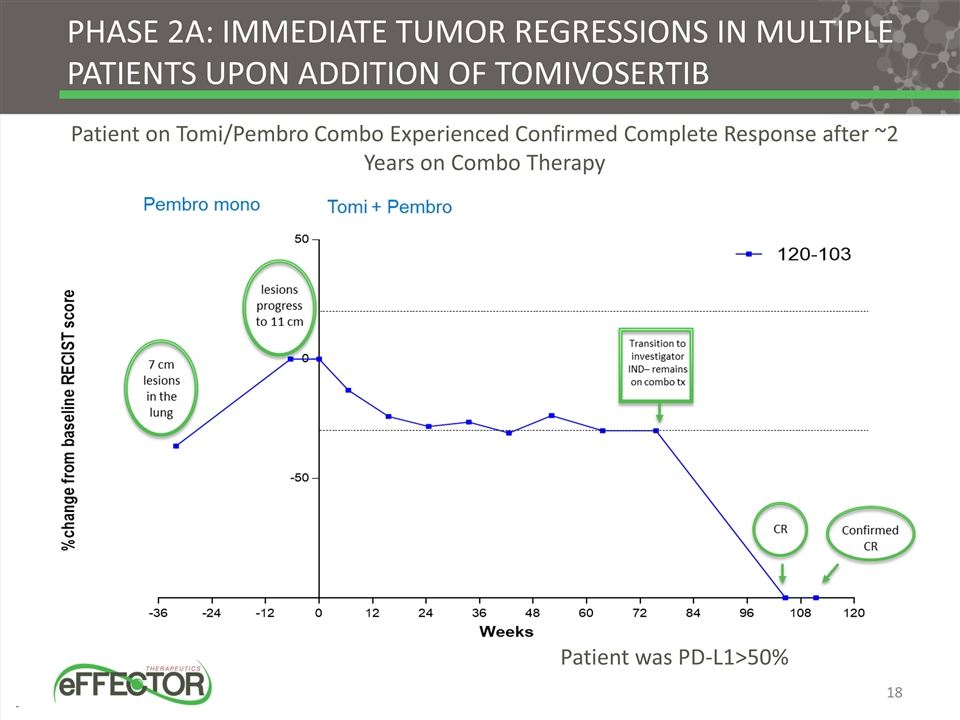

Phase 2A: immediate tumor regressions in multiple patients upon addition of tomivosertib Patient was PD-L1>50% Patient on Tomi/Pembro Combo Experienced Confirmed Complete Response after ~2 Years on Combo Therapy

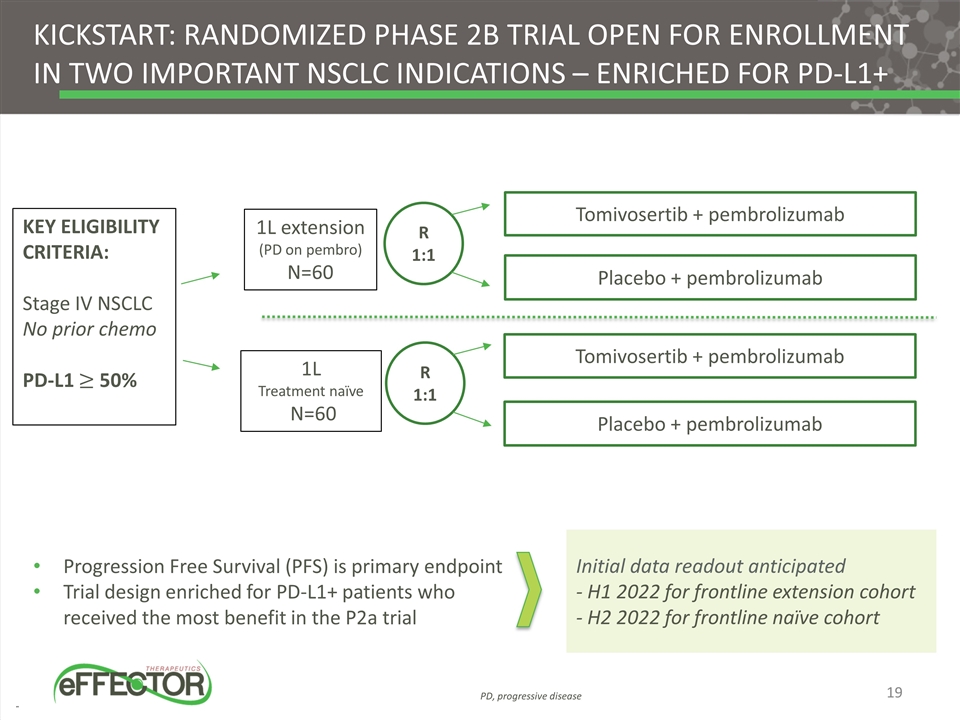

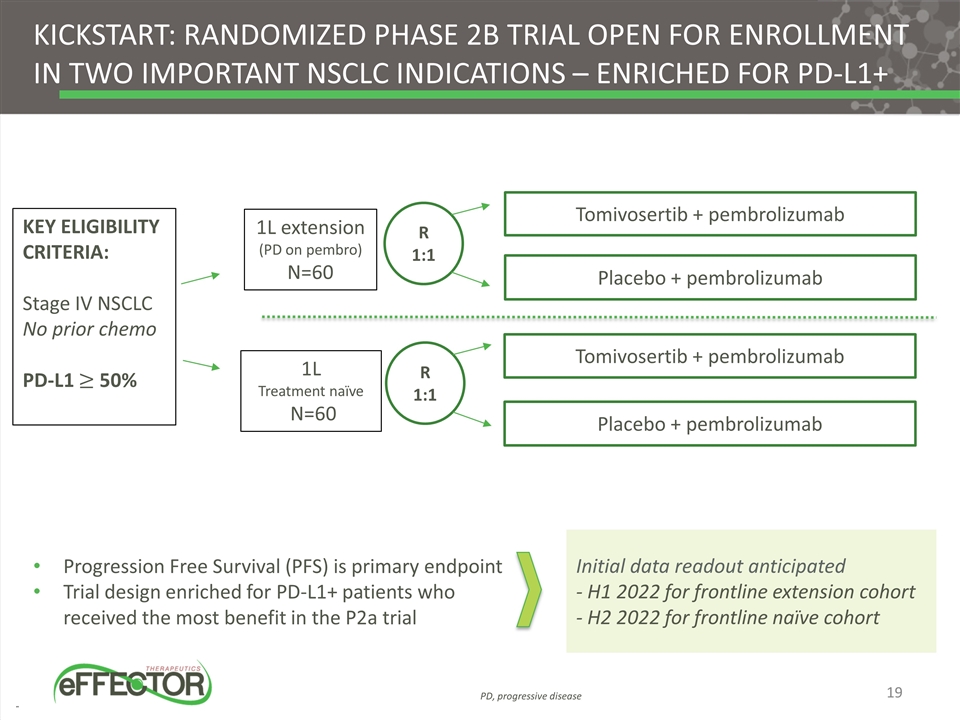

KEY ELIGIBILITY CRITERIA: Stage IV NSCLC No prior chemo PD-L1 50% Tomivosertib + pembrolizumab Placebo + pembrolizumab Progression Free Survival (PFS) is primary endpoint Trial design enriched for PD-L1+ patients who received the most benefit in the P2a trial Kickstart: randomized phase 2b trial open for enrollment in two important Nsclc indications – enriched for PD-L1+ 1L extension (PD on pembro) N=60 1L Treatment naïve N=60 R 1:1 Tomivosertib + pembrolizumab Placebo + pembrolizumab R 1:1 Initial data readout anticipated - H1 2022 for frontline extension cohort - H2 2022 for frontline naïve cohort PD, progressive disease

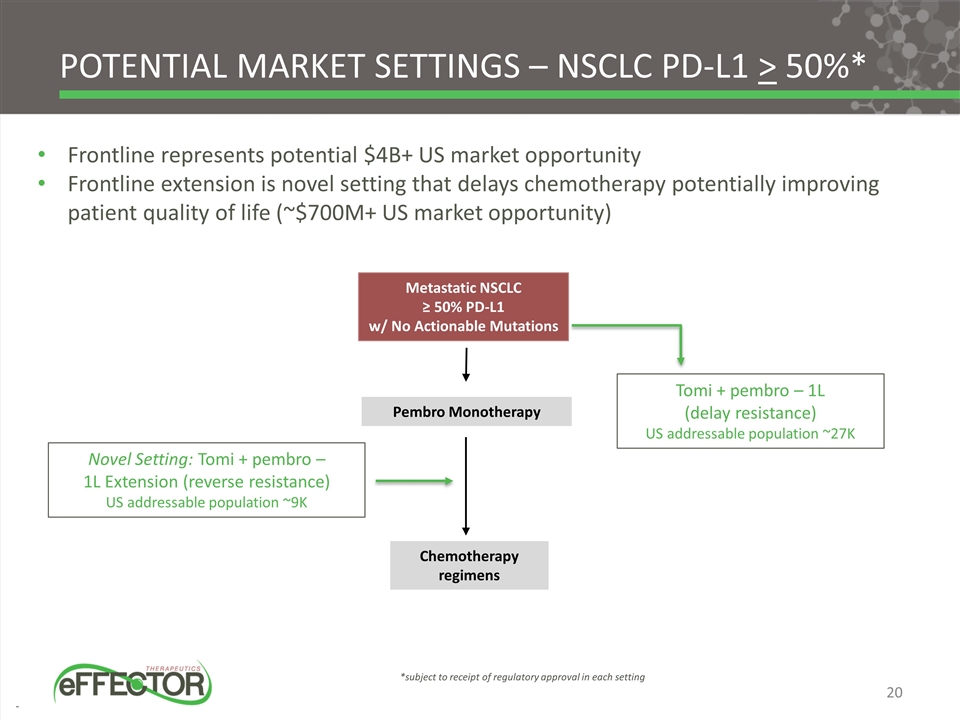

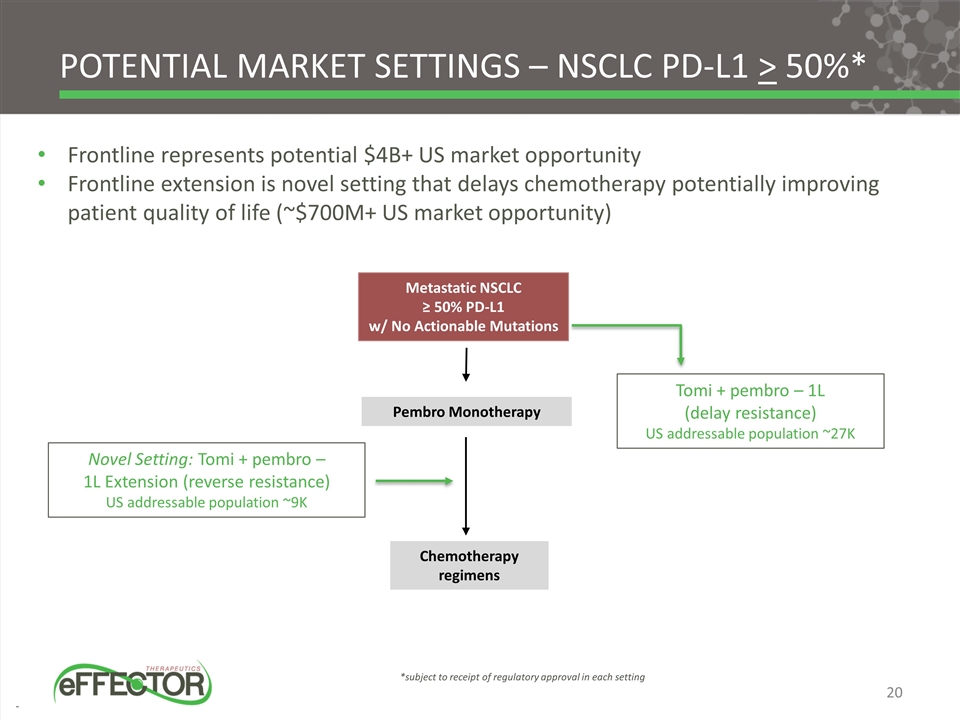

Pembro Monotherapy Metastatic NSCLC ≥ 50% PD-L1 w/ No Actionable Mutations Chemotherapy regimens Novel Setting: Tomi + pembro – 1L Extension (reverse resistance) US addressable population ~9K Tomi + pembro – 1L (delay resistance) US addressable population ~27K Potential Market Settings – NSCLC PD-L1 > 50%* *subject to receipt of regulatory approval in each setting Frontline represents potential $4B+ US market opportunity Frontline extension is novel setting that delays chemotherapy potentially improving patient quality of life (~$700M+ US market opportunity)

Zotatifin eIF4A Helicase Inhibitor Oncology: Designed to downregulate key oncoproteins and cell cycle proteins

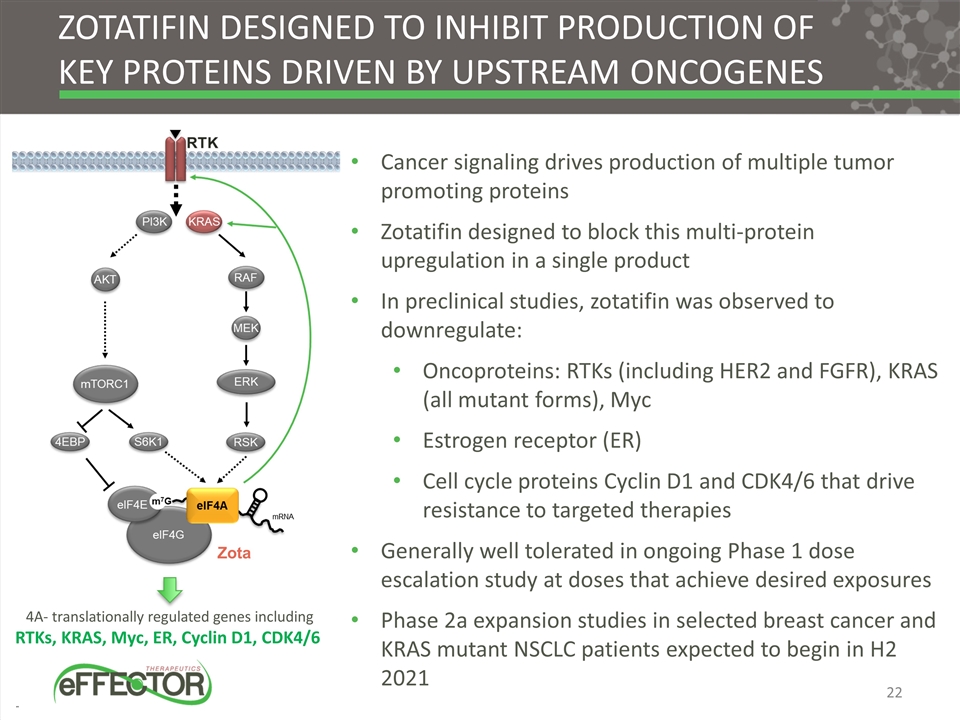

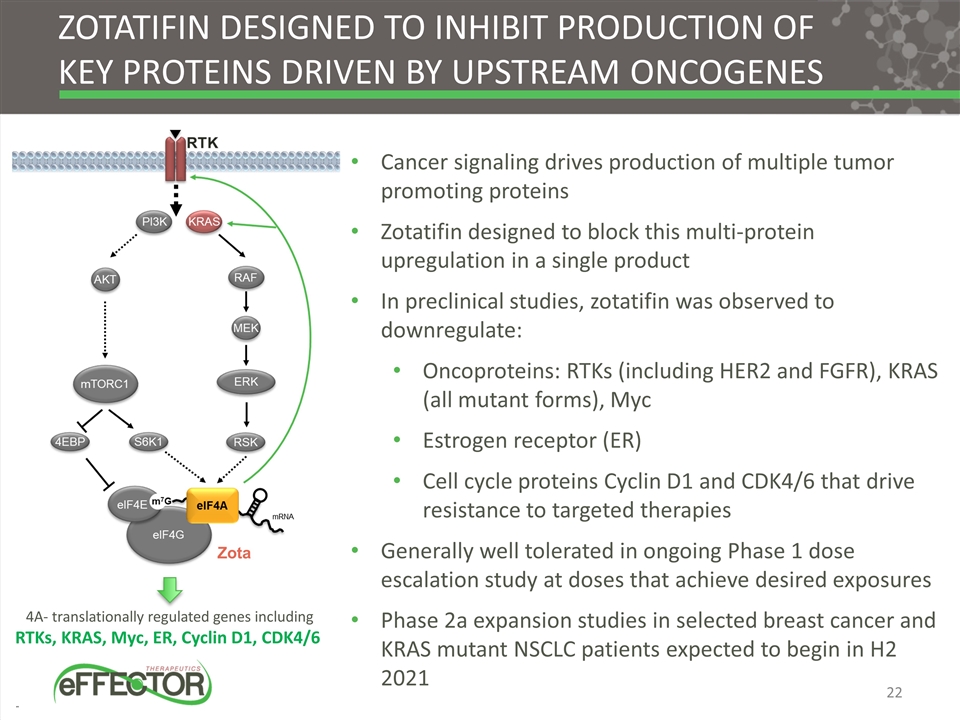

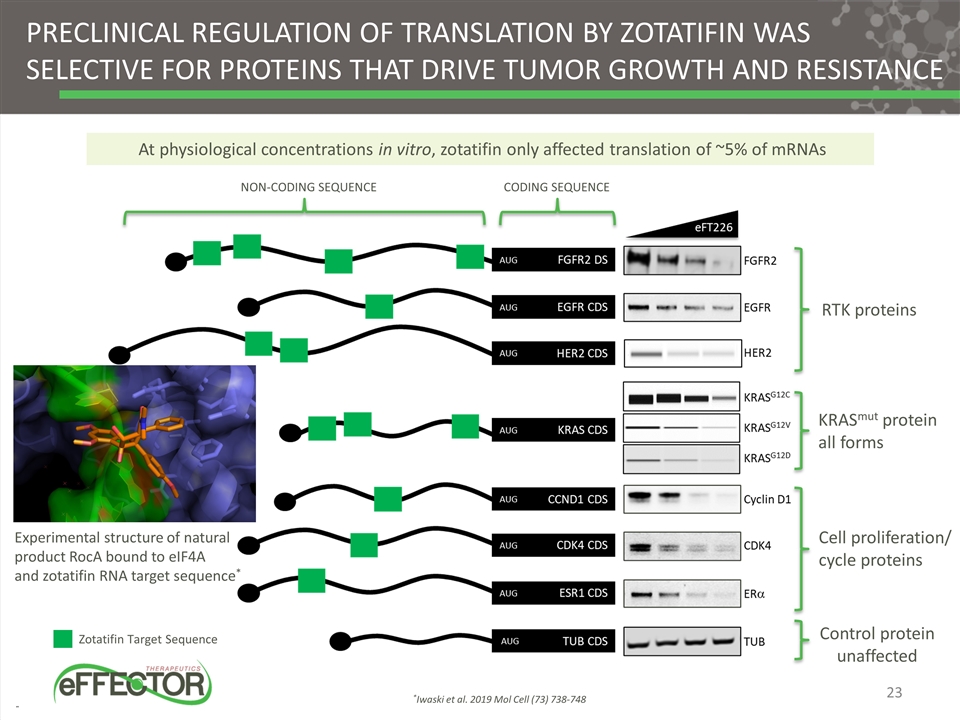

4A- translationally regulated genes including RTKs, KRAS, Myc, ER, Cyclin D1, CDK4/6 Zotatifin DESIGNED TO inhibit production of key proteins driven by upstream oncogenes Zota Cancer signaling drives production of multiple tumor promoting proteins Zotatifin designed to block this multi-protein upregulation in a single product In preclinical studies, zotatifin was observed to downregulate: Oncoproteins: RTKs (including HER2 and FGFR), KRAS (all mutant forms), Myc Estrogen receptor (ER) Cell cycle proteins Cyclin D1 and CDK4/6 that drive resistance to targeted therapies Generally well tolerated in ongoing Phase 1 dose escalation study at doses that achieve desired exposures Phase 2a expansion studies in selected breast cancer and KRAS mutant NSCLC patients expected to begin in H2 2021

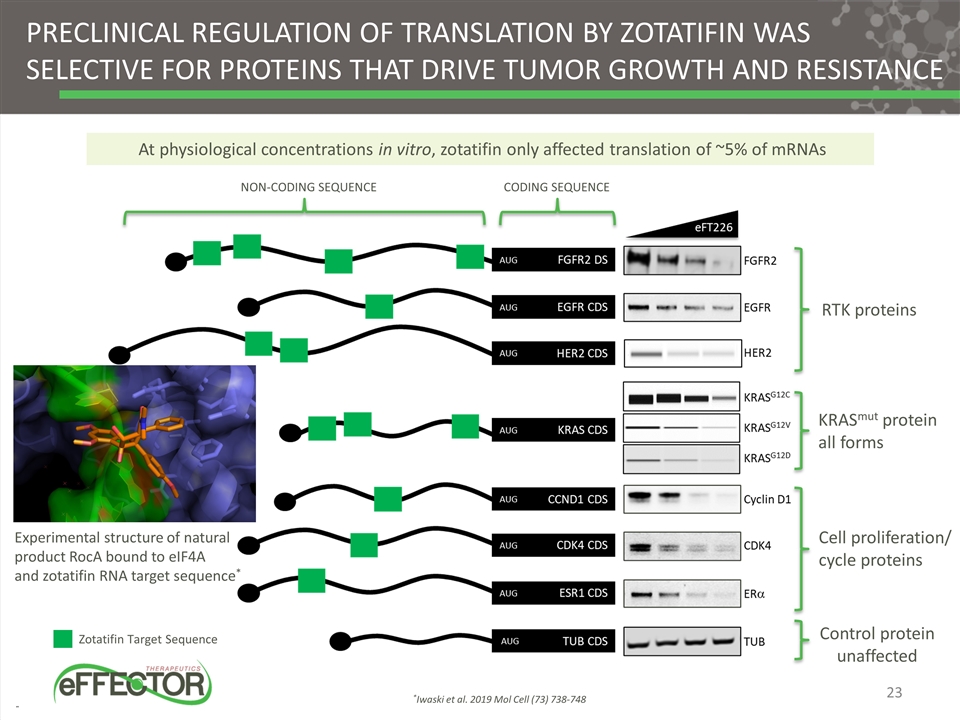

Preclinical regulation of translation by zotatifin was selective for proteins that drive tumor growth and resistance Zotatifin Target Sequence KRASmut protein all forms Cell proliferation/ cycle proteins RTK proteins Control protein unaffected Non-coding sequence coding sequence Experimental structure of natural product RocA bound to eIF4A and zotatifin RNA target sequence* *Iwaski et al. 2019 Mol Cell (73) 738-748 At physiological concentrations in vitro, zotatifin only affected translation of ~5% of mRNAs

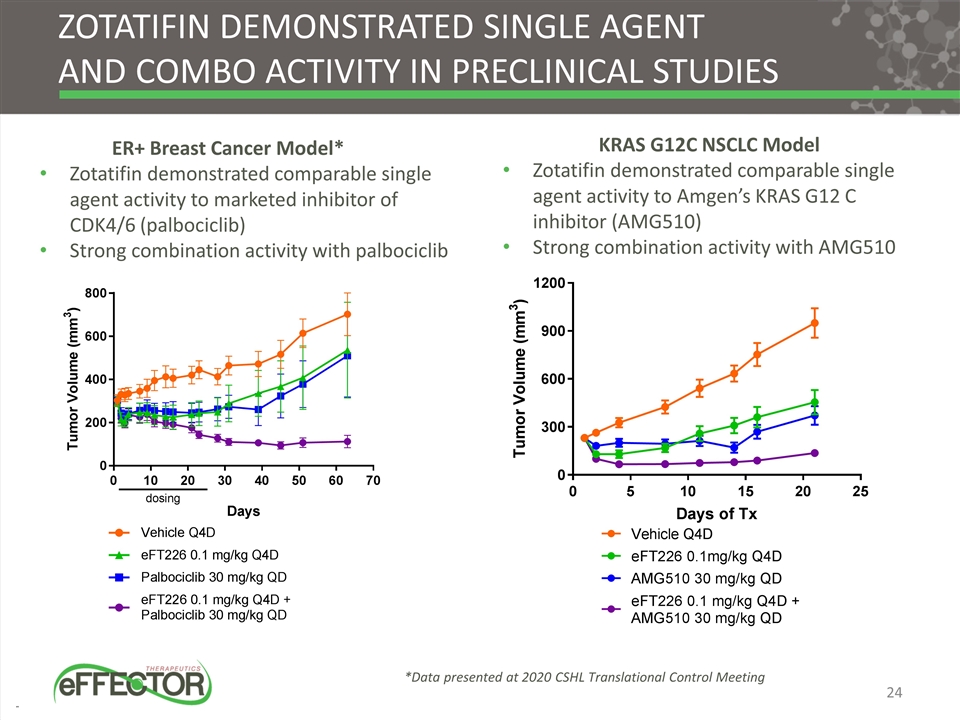

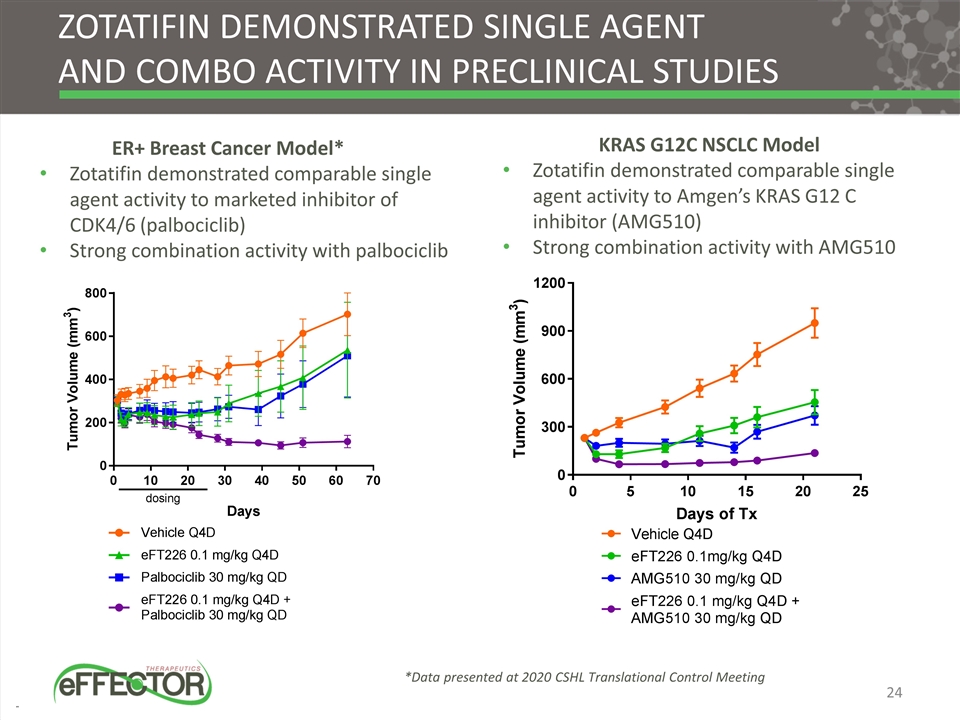

Zotatifin demonstrated single agent and combo activity in Preclinical studies ER+ Breast Cancer Model* Zotatifin demonstrated comparable single agent activity to marketed inhibitor of CDK4/6 (palbociclib) Strong combination activity with palbociclib KRAS G12C NSCLC Model Zotatifin demonstrated comparable single agent activity to Amgen’s KRAS G12 C inhibitor (AMG510) Strong combination activity with AMG510 *Data presented at 2020 CSHL Translational Control Meeting

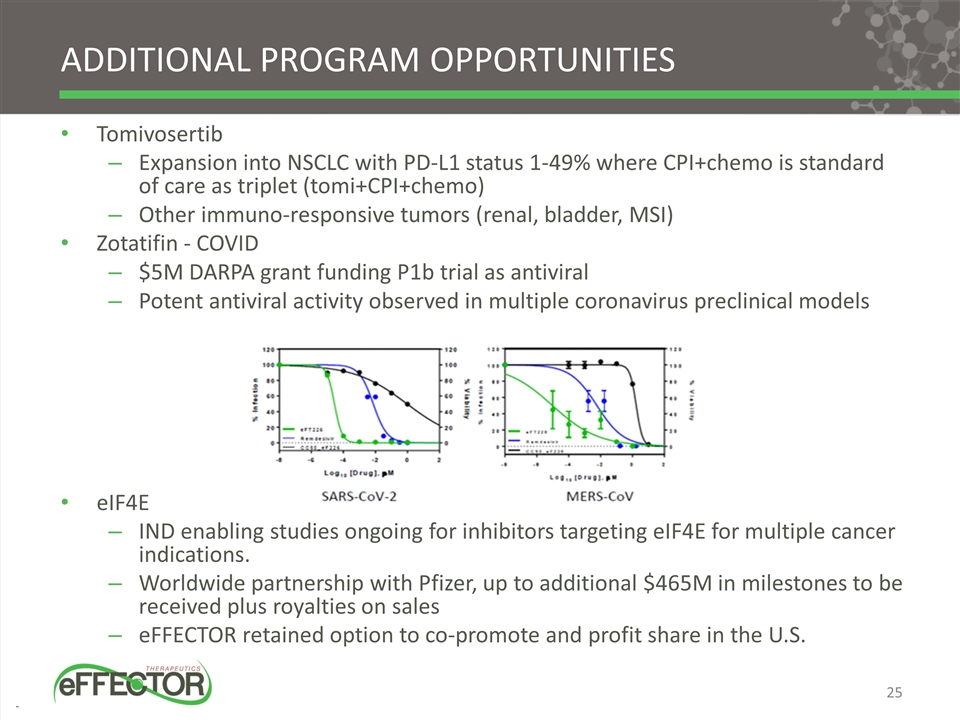

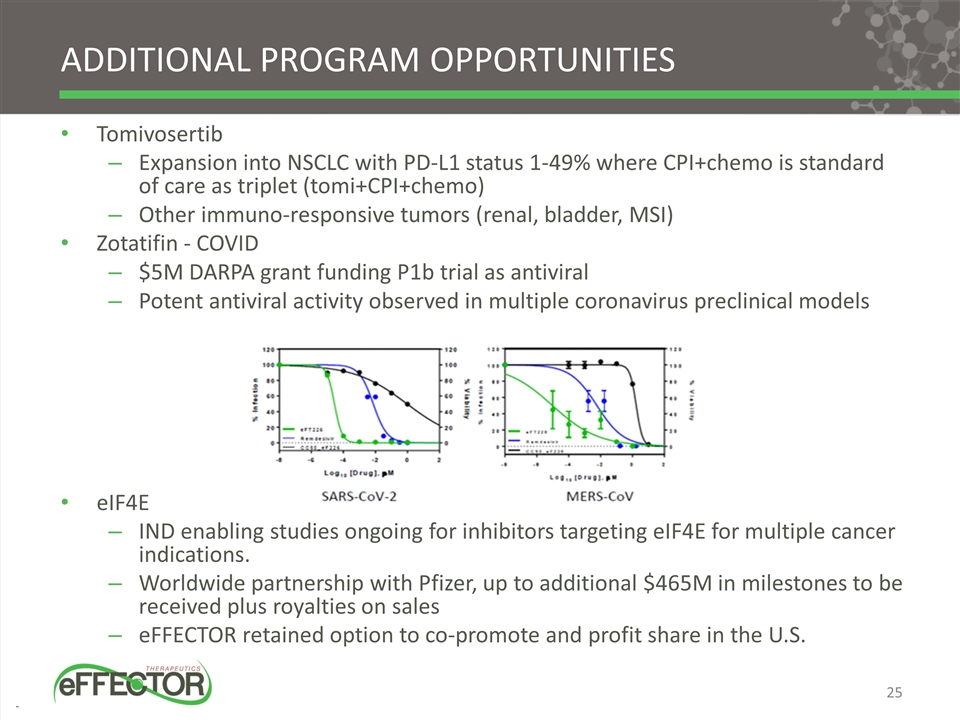

Additional program opportunities Tomivosertib Expansion into NSCLC with PD-L1 status 1-49% where CPI+chemo is standard of care as triplet (tomi+CPI+chemo) Other immuno-responsive tumors (renal, bladder, MSI) Zotatifin - COVID $5M DARPA grant funding P1b trial as antiviral Potent antiviral activity observed in multiple coronavirus preclinical models eIF4E IND enabling studies ongoing for inhibitors targeting eIF4E for multiple cancer indications. Worldwide partnership with Pfizer, up to additional $465M in milestones to be received plus royalties on sales eFFECTOR retained option to co-promote and profit share in the U.S.

Upcoming Milestones

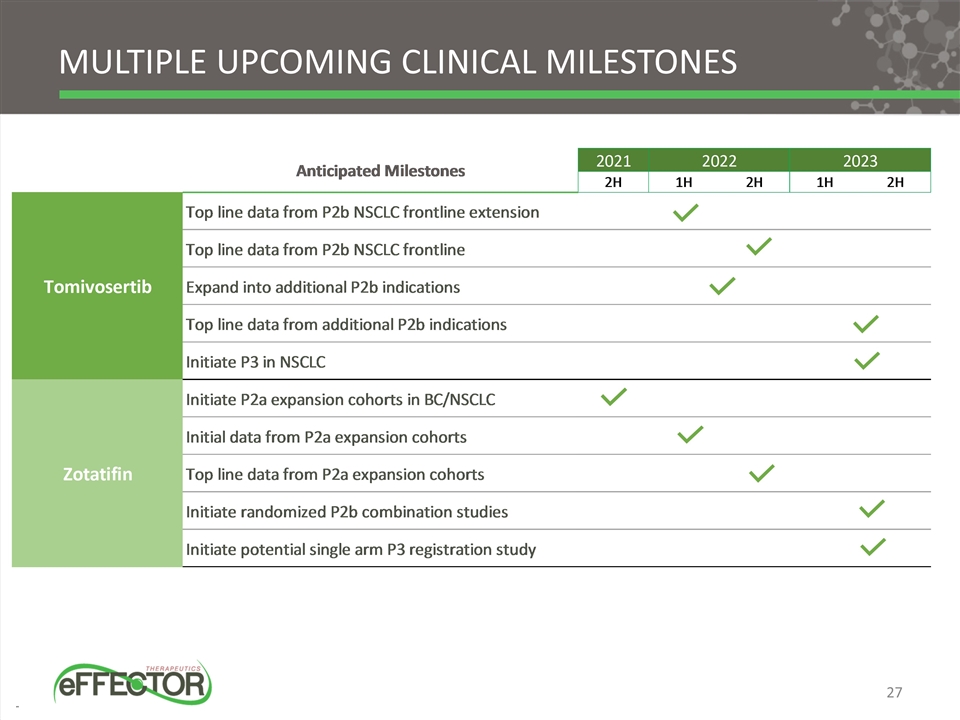

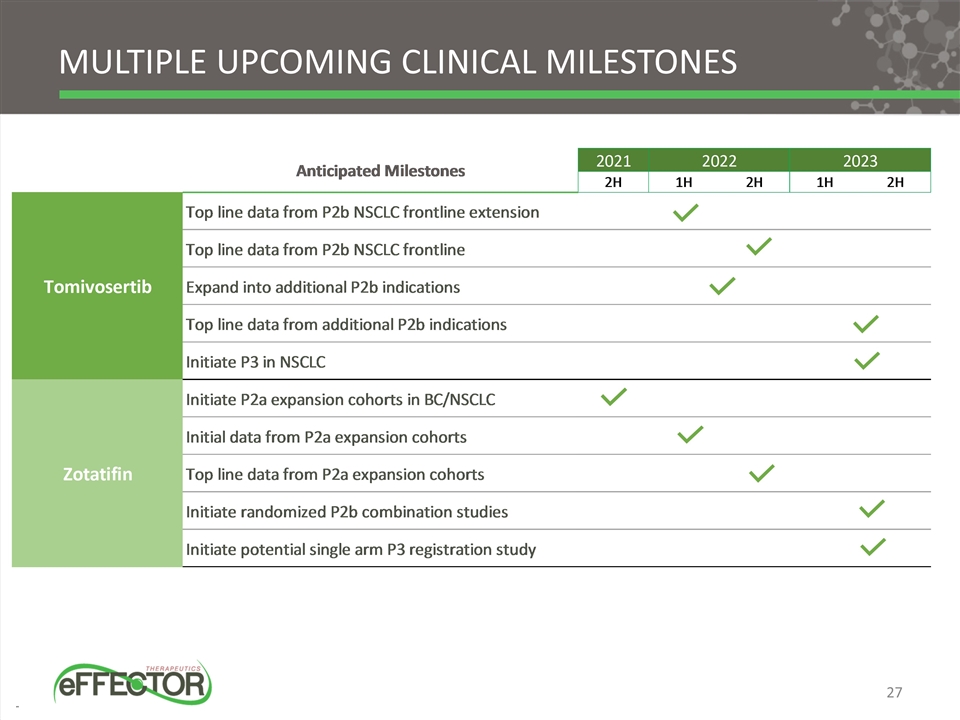

Multiple upcoming clinical milestones

Outlook Leverage strong scientific foundation as leaders in development of selective translation regulator inhibitors as a new class of therapies for cancer Trials underway for two product candidates Tomivosertib prolonged disease stabilization in Phase 2a study and biomarker-driven Phase 2b study in non-small cell lung cancer is open for enrollment Zotatifin demonstrated the ability to knock down multiple proteins acting within the tumor cell itself and is currently finishing a Phase 1 dose escalation portion of Phase 1/2 clinical trial

RISK FACTORS Risks Related to Our Limited Operating History, Financial Position and Capital Requirements We have a limited operating history, have incurred significant operating losses since our inception and expect to incur significant losses for the foreseeable future. We may never generate any revenue or become profitable or, if we achieve profitability, we may not be able to sustain it. We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our development programs, commercialization efforts or other operations. Raising additional capital may cause dilution to our stockholders, including purchasers of common stock in this offering, restrict our operations or require us to relinquish rights to our technologies or product candidates. Risks Related to the Discovery, Development and Regulatory Approval of Our Product Candidates We depend heavily on the success of Tomivosertib and Zotatifin, which are in either Phase 1 or Phase 2 clinical development. If we are unable to successfully develop and commercialize our product candidates or experience significant delays in doing so, our business will be materially harmed. Our approach to the discovery and development of product candidates based on our technology platform is unproven, and we do not know whether we will be able to develop any products of commercial value. Clinical and preclinical drug development involves a lengthy and expensive process with an uncertain outcome, and the results of preclinical studies and early clinical trials are not necessarily predictive of future results. Any of our product candidates may not have favorable results in later clinical trials, if any, or receive regulatory approval on a timely basis, if at all. Any difficulties or delays in the commencement or completion, or termination or suspension, of our clinical trials could result in increased costs to us, delay or limit our ability to generate revenue and adversely affect our commercial prospects. We may find it difficult to enroll patients in our clinical trials. If we encounter difficulties enrolling subjects in our clinical trials, our clinical development activities could be delayed or otherwise adversely affected. Use of our product candidates could be associated with side effects, adverse events or other properties or safety risks, which could delay or preclude approval, cause us to suspend or discontinue clinical trials, abandon a product candidate, limit the commercial profile of an approved label or result in other significant negative consequences that could severely harm our business, prospects, operating results and financial condition. We have never completed any later-stage clinical trials, and may be unable to do so for any of our product candidates. Our product candidates are subject to extensive regulation and compliance, which is costly and time consuming, and such regulation may cause unanticipated delays or prevent the receipt of the required approvals to commercialize our product candidates. We may expend our limited resources to pursue a particular product candidate and fail to capitalize on product candidates or indications that may be more profitable or for which there is a greater likelihood of success. We may seek Breakthrough Therapy designation or Fast Track designation by the FDA for one or more of our product candidates, but we may not receive such designation, and even if we do, such designation may not lead to a faster development or regulatory review or approval process and it does not increase the likelihood that our product candidates will receive marketing approval. We may conduct certain of our clinical trials for our product candidates outside of the United States. However, the FDA and other foreign equivalents may not accept data from such trials, in which case our development plans will be delayed, which could materially harm our business. Interim, topline and preliminary data from our clinical trials and preclinical studies that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data. Disruptions at the FDA and other government agencies caused by funding shortages or global health concerns could hinder their ability to hire, retain or deploy key leadership and other personnel, or otherwise prevent new or modified products from being developed, approved or commercialized in a timely manner or at all, which could negatively impact our business.

RISK FACTORS (Cont’d) Risks Related to Our Reliance on Third Parties We rely on third parties to conduct our clinical trials and preclinical studies. If these third parties do not successfully carry out their contractual duties, comply with applicable regulatory requirements or meet expected deadlines, our development programs and our ability to seek or obtain regulatory approval for or commercialize our product candidates may be delayed. We rely on third parties for the manufacture of our product candidates for clinical and preclinical development. This reliance on third parties increases the risk that we will not have sufficient quantities of our product candidates or products or such quantities at an acceptable cost, which could delay, prevent or impair our development or commercialization efforts. Our reliance on third parties requires us to share our trade secrets, which increases the possibility that a competitor will discover them or that our trade secrets will be misappropriated or disclosed. We are dependent on our collaboration agreement with Pfizer for the discovery, development and commercialization of small-molecule inhibitors of eIF4E. Under certain circumstances, Pfizer may unilaterally terminate the agreement for convenience, which could materially and adversely affect our business. We may seek to enter into additional collaborations, licenses and other similar arrangements and may not be successful in doing so, and even if we are, we may relinquish valuable rights and may not realize the benefits of such relationships. Risks Related to Commercialization of Our Product Candidates Even if we receive regulatory approval for any product candidate, we will be subject to ongoing regulatory obligations and continued regulatory review, which may result in significant additional expense. Additionally, our product candidates, if approved, could be subject to labeling and other restrictions on marketing or withdrawal from the market, and we may be subject to penalties if we fail to comply with regulatory requirements or if we experience unanticipated problems with our product candidates, when and if any of them are approved. The commercial success of our product candidates will depend upon the degree of market acceptance of such product candidates by physicians, patients, healthcare payors and others in the medical community. The successful commercialization of our product candidates, if approved, will depend in part on the extent to which governmental authorities and health insurers establish coverage, adequate reimbursement levels and favorable pricing policies. Failure to obtain or maintain coverage and adequate reimbursement for our products could limit our ability to market those products and decrease our ability to generate revenue. We face significant competition from entities that have developed or may develop product candidates for cancer, including companies developing novel treatments and technology platforms. If our competitors develop technologies or product candidates more rapidly than we do or their technologies are more effective, our business and our ability to develop and successfully commercialize products may be adversely affected. The market opportunities for our product candidates may be limited to patients who are ineligible for or have failed prior treatments and may be small or different from our estimates. We currently have no marketing and sales organization and have no experience as a company in commercializing products, and we may have to invest significant resources to develop these capabilities. If we are unable to establish marketing and sales capabilities or enter into agreements with third parties to market and sell our products, we may not be able to generate product revenue. Our future growth may depend, in part, on our ability to operate in foreign markets, where we would be subject to additional regulatory burdens and other risks and uncertainties.

RISK FACTORS (Cont’d) Risks Related to Our Business Operations and Industry Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or any guidance we may provide. We are dependent on the services of our management and other clinical and scientific personnel, and if we are not able to retain these individuals or recruit additional management or clinical and scientific personnel, our business will suffer. We may encounter difficulties in managing our growth and expanding our operations successfully. We are subject to various federal, state and foreign healthcare and privacy laws and regulations, which could increase compliance costs, and our failure to comply with these laws and regulations could harm our results of operations and financial condition. Recently enacted legislation, future legislation and healthcare reform measures may increase the difficulty and cost for us to obtain marketing approval for and commercialize our product candidates and may affect the prices we may set. If product liability lawsuits are brought against us, we may incur substantial liabilities and may be required to limit commercialization of our products. Our insurance policies are expensive and only protect us from some business risks, which will leave us exposed to significant uninsured liabilities. We and any of our current and potential future collaborators will be required to report to regulatory authorities if any of our approved products cause or contribute to adverse medical events, and any failure to do so would result in sanctions that would materially harm our business Our internal computer systems, or those of any of our CROs, manufacturers, other contractors or consultants or current or potential future collaborators, may fail or suffer security breaches, which could result in a material disruption of our product development programs. Our business is subject to risks arising from COVID-19 and other epidemic diseases. Our business could be affected by litigation, government investigations and enforcement actions. Our employees and independent contractors, including principal investigators, CROs, consultants and vendors may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements. We may engage in strategic transactions that could impact our liquidity, increase our expenses and present significant distractions to our management. Our ability to use net operating loss carryforwards and other tax attributes may be limited in connection with this offering or other ownership changes. We prepare our consolidated financial statements in accordance with U.S. generally accepted accounting principles. These principles are subject to interpretation by the Securities and Exchange Commission and various bodies formed to create and interpret appropriate accounting principles and guidance. A change in these principles or guidance, or in their interpretations, may have a material effect on our reported results, as well as our processes and related controls, and may retroactively affect previously reported results.

RISK FACTORS (Cont’d) Risks Related to Our Intellectual Property If we are unable to obtain and maintain patent protection for our product candidates, or if the scope of the patent protection obtained is not sufficiently broad, our competitors could develop and commercialize products similar or identical to ours, and our ability to successfully commercialize our product candidates may be adversely affected. We may not be able to protect our intellectual property and proprietary rights throughout the world. Obtaining and maintaining our patent protection depends on compliance with various procedural, document submission, fee payment, and other requirements imposed by government patent agencies, and our patent protection could be reduced or eliminated for non-compliance with these requirements. Changes in U.S. patent law could diminish the value of patents in general, thereby impairing our ability to protect our products. Issued patents covering our product candidates could be found invalid or unenforceable if challenged in court or before administrative bodies in the United States or abroad. Patent terms may be inadequate to protect our competitive position on products and product candidates for an adequate amount of time. If we do not obtain patent term extension for our product candidates, our business may be materially harmed. We may be subject to claims challenging the inventorship of our patents and other intellectual property. If we are unable to protect the confidentiality of our trade secrets, our business and competitive position would be harmed. We may not identify relevant third-party patents or may incorrectly interpret the relevance, scope or expiration of a third-party patent, which might adversely affect our ability to develop and market our products and product candidates. We may be subject to claims that our employees, consultants or advisors have wrongfully used or disclosed alleged trade secrets of their current or former employers or claims asserting ownership of what we regard as our own intellectual property. Third-party claims of intellectual property infringement, misappropriation or other violations against us or our collaborators may prevent or delay the development and commercialization of our product candidates. We may become involved in lawsuits to protect or enforce our patents and other intellectual property rights, which could be expensive, time consuming and unsuccessful. If our trademarks and trade names are not adequately protected, then we may not be able to build name recognition in our markets of interest and our business may be adversely affected. Intellectual property rights do not necessarily address all potential threats. If we fail to comply with any of our obligations under our existing license agreement or any future license agreements, or disputes arise with respect to those agreements, it could have a negative impact on our business and our intellectual property rights. We may not be successful in obtaining or maintaining necessary rights to product components and processes for our development pipeline through acquisitions and in-licenses. We, our collaborator and our service providers may be subject to a variety of privacy and data security laws and contractual obligations, which could increase compliance costs and our failure to comply with them could subject us to potentially significant fines or penalties and otherwise harm our business.

RISK FACTORS (Cont’d) Risks Related to Becoming a Public Company We will incur significant increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives. We will be an emerging growth company and a smaller reporting company, and the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies may make our common stock less attractive to investors. If securities or industry analysts do not publish research or reports or publish unfavorable research or reports about our business, our stock price and trading volume could decline. If we fail to maintain proper and effective internal control over financial reporting, our ability to produce accurate and timely financial statements could be impaired, investors may lose confidence in our financial reporting and the trading price of our common stock may decline. Provisions in our proposed charter documents and under Delaware law could discourage a takeover that stockholders may consider favorable and may lead to entrenchment of management. Our proposed certificate of incorporation will provide that the Court of Chancery of the State of Delaware will be the exclusive forum for substantially all disputes between us and our stockholders and that the federal district courts shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers or employees. We could be subject to securities class action litigation. Risks Related to the Private Placement The conditions to closing the Private Placement may not be met and LWAC may be otherwise unable to raise additional financing to complete the Business Combination or to fund the operations and growth of the combined company following the Business Combination (the “Combined Company”). The issuance of shares of the Combined Company’s securities in connection with the Private Placement will dilute substantially the voting power of purchasers in the Private Placement. LWAC may issue shares of its Class A common stock upon the conversion of its Class B common stock at a ratio greater than one-to-one at the closing of the Business Combination as a result of the anti-dilution provisions contained in its amended and restated certificate of incorporation. Any such issuance would dilute the interest of the Combined Company’s stockholders, including purchasers in the Private Placement. In addition to acting as placement agents, (i) Credit Suisse Securities (USA) LLC is acting as equity capital markets and financial advisor to the Company and (ii) an entity affiliated with certain members of LWAC's management, Locust Walk Partners, LLC, has provided financial advisory services to LWAC in connection with the proposed transaction, which may give rise to potential conflicts of interests or the appearance thereof.

RISK FACTORS (Cont’d) Risks Related to the Business Combination Each of LWAC and eFFECTOR will incur significant transaction costs in connection with the Business Combination. The consummation of the Business Combination is subject to a number of conditions and if those conditions are not satisfied or waived, the Business Combination agreement may be terminated in accordance with its terms and the Business Combination may not be completed. The ability to successfully effect the Business Combination and the Combined Company’s ability to successfully operate the business thereafter will be largely dependent upon the efforts of certain key personnel of eFFECTOR. The loss of such key personnel could negatively impact the operations and financial results of the combined business. There is no assurance that a stockholder’s decision whether to redeem its shares for a pro rata portion of LWAC’s trust account will put the stockholder in a better future economic position. If the Business Combination’s benefits do not meet the expectations of investors or securities analysts, the market price of LWAC’s securities or, following the consummation of the Business Combination, the Combined Company’s securities, may decline. A market for the Combined Company’s securities may not develop, which would adversely affect the liquidity and price of such securities. There can be no assurance that the Combined Company’s securities will be approved for listing on the Nasdaq Global Market (“Nasdaq”) or that the Combined Company will be able to comply with the continued listing standards of Nasdaq. Directors of LWAC have potential conflicts of interest in recommending that LWAC’s stockholders vote in favor of the adoption of the Business Combination. LWAC may redeem unexpired warrants prior to their exercise at a time that is disadvantageous to the holders of LWAC warrants, thereby making such warrants worthless. Further, even if the Business Combination is completed, there can be no assurance that LWAC’s warrants will be in the money during their exercise period, and they may expire worthless. If LWAC seeks stockholder approval of the Business Combination, its sponsor, directors, officers, advisors and their affiliates may elect to purchase shares or warrants from public stockholders, which may influence a vote on the Business Combination and reduce the public “float” of LWAC’s Class A common stock or warrants. If LWAC seeks stockholder approval of the Business Combination, its sponsor, officers and directors have agreed to vote in favor of such Business Combination, regardless of how its public stockholders vote. The ability of LWAC’s public stockholders to exercise redemption rights with respect to a large number of its shares could increase the probability that the Business Combination would be unsuccessful. The LWAC public shareholders can redeem some or all of the $175 million held in trust, and significant redemptions could materially impact our cash position and runway. LWAC is not required to obtain an opinion from an independent investment banking firm or from an independent accounting firm, and consequently, its stockholders may have no assurance from an independent source that the price it is paying for the business is fair to LWAC from a financial point of view. Legal proceedings in connection with the Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Business Combination. The Business Combination or Combined Company may be materially adversely affected by the recent COVID-19 outbreak. Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect LWAC’s and the Combined Company’s business, including LWAC’s and the Combined Company’s ability to consummate the Business Combination, and results of operations.

RISK FACTORS (Cont’d) General Risk Factors We are subject to U.S. and certain foreign export and import controls, sanctions, embargoes, anti-corruption laws and anti-money laundering laws and regulations. Compliance with these legal standards could impair our ability to compete in domestic and international markets. We could face criminal liability and other serious consequences for violations, which could harm our business. We and any of our third-party manufacturers or suppliers may use potent chemical agents and hazardous materials, and any claims relating to improper handling, storage or disposal of these materials could be time consuming or costly. Business disruptions could seriously harm our future revenue and financial condition and increase our costs and expenses. Unstable market and economic conditions may have serious adverse consequences on our business, financial condition and stock price. Changes in U.S. tax law may materially adversely affect our financial condition, results of operations and cash flows.

Investor Presentation May 27, 2021 Next Generation Targeted Therapy for Cancer