LOCUST WALK ACQUISITION CORP.

NOTES TO CONDENSED FINANCIAL STATEMENTS

JUNE 30, 2021

(Unaudited)

NOTE 1. DESCRIPTION OF ORGANIZATION AND BUSINESS OPERATIONS

Locust Walk Acquisition Corp. (the “Company”) is a blank check company incorporated in Delaware on October 2, 2020. The Company was formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business transaction with one or more operating businesses or assets (a “Business Combination”).

The Company is not limited to a particular industry or sector for purposes of consummating a Business Combination. The Company is an early stage and emerging growth company and, as such, the Company is subject to all of the risks associated with early stage and emerging growth companies.

As of June 30, 2021, the Company had not yet commenced operations. All activity through June 30, 2021 relates to the Company’s formation, its initial public offering (the “IPO”), which is described below and, subsequent to the IPO, identifying a target company for a Business Combination. The Company will not generate any operating revenues until after the completion of its initial Business Combination, at the earliest. The Company will generate non-operating income in the form of interest income from the proceeds of the IPO.

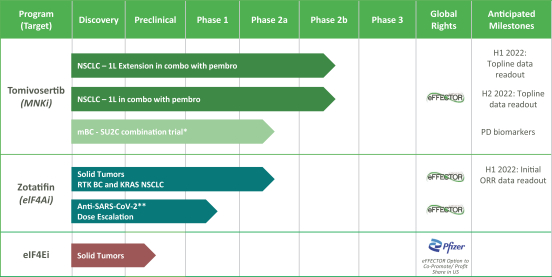

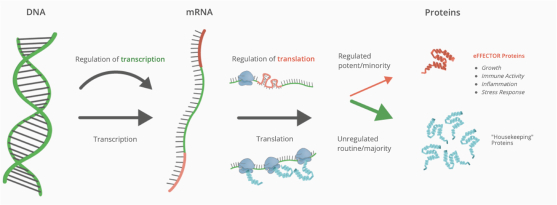

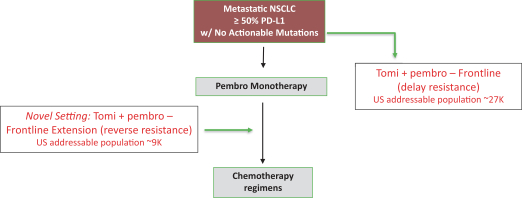

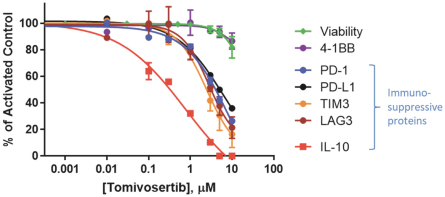

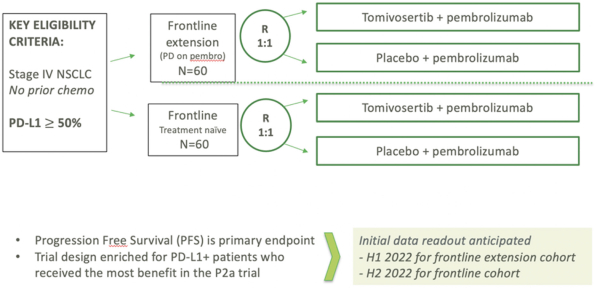

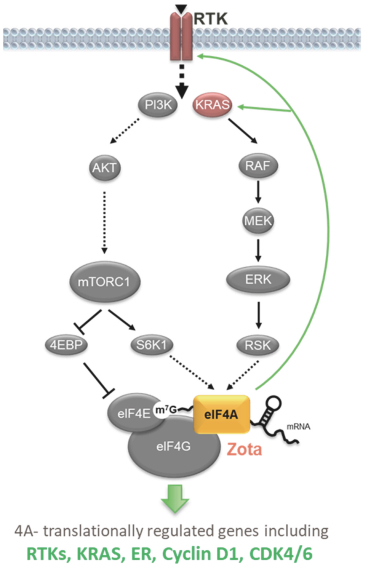

On May 26, 2021, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”), by and among the Company, Locust Walk Merger Sub, Inc., a Delaware corporation and a wholly owned Subsidiary of the Company (“Merger Sub”), and eFFECTOR Therapeutics, Inc., a Delaware corporation (“eFFECTOR”). For more information, see the “Merger” described below.

The registration statement for the Company’s IPO was declared effective on January 12, 2021. On January 12, 2021, the Company consummated the IPO of 17,500,000 units (the “Units” and, with respect to the Class A common stock included in the Units sold, the “Public Shares”), which includes the partial exercise by the underwriter of its over-allotment option in the amount of 2,200,000 Units, at $10.00 per Unit, generating gross proceeds of $175,000,000 (Note 3).

Simultaneously with the closing of the IPO, the Company consummated the sale of 545,000 units (the “Placement Units”) at a price of $10.00 per Placement Unit in a private placement to Locust Walk Sponsor, LLC (the “Sponsor”), that closed simultaneously with the IPO, generating gross proceeds of $5,450,000 (Note 4).

Transaction costs amounted to $10,097,226, consisting of $3,060,000 in cash underwriting fees, $6,565,000 of deferred underwriting fees and $472,226 of other offering costs.

Following the closing of the IPO, $175,000,000 was placed in a trust account (the “Trust Account”) and invested in U.S. government securities, within the meaning set forth in Section 2(a)(16) of the Investment Company Act of 1940, as amended (the “Investment Company Act”), with a maturity of 185 days or less, or in any open-ended investment company that holds itself out as a money market fund selected by the Company meeting the conditions of Rule 2a-7 of the Investment Company Act, as determined by the Company, until the earlier of: (i) the consummation of a Business Combination; (ii) the redemption of any Public Shares in connection with a stockholder vote to amend the Company’s Amended and Restated Certificate of Incorporation to modify the substance or timing of the Company’s obligation to redeem 100% of its Public Shares if it does not complete an initial Business Combination within 24 months from the consummation of the IPO (the “Combination Period”); or (iii) the distribution of the Trust Account, as described below, except that interest earned on the Trust Account can be released to pay the Company’s tax obligations, if the Company is unable to complete an initial Business Combination within the Combination Period or upon any earlier liquidation of the Company.

F-70