Filed by Novus Capital Corporation II pursuant to

Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Novus Capital Corporation II

Commission File No.: 001-39982

The following is the English-language translation of an article that originally appeared in a French-language publication.

Batteries at 1.6 billion

“This merger will provide all the means to Energy Vault”

The boss of the Ticino start-up justifies his alliance with an American financial company - a renowned SPAC - in order to bring its gigantic power stations of “gravity” storage.

Pierre-Alexandre Sallier

Posted today at 11:33 am Computer generated

0 comments

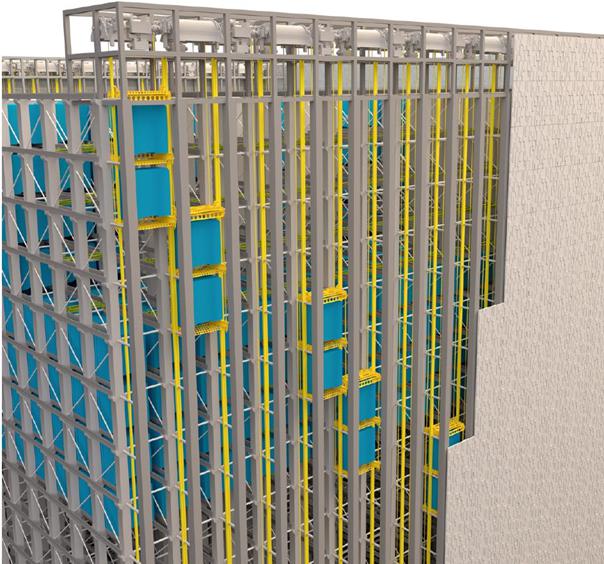

image of a temporary electricity storage plant - a “resiliency center” - that Energy Vault plans to install alongside solar panel farms. ENERGY VAULT INC.

Energy Vault first made a name for itself with a surprising concrete mobile, thirty stories high, north of Bellinzona. A first step towards pharaonic power storage plants by gravity - the first could come out of the ground next year, in Italy. The Ticino SME then distinguished itself as the Swiss start-up that attracted the most money - $ 100 million invested in 2019 by the SoftBank Vision Fund, a heavyweight in Silicon Valley. A new envelope of 100 million received this summer - in particular from the oil arm of the Saudi state, Aramco - promised him a destiny of "unicorn", these Californian SMEs force-fed hundreds of millions of dollars to impose their inventions.

Since Thursday, it 's is done. But in a ... exotic way. Founders Robert Piconi and Andrea Pedretti along with their powerful co-shareholders have announced their intention to bring Energy Vault - valued at $ 1.6 billion - into obscure Midwestern financial firm, Novus Capital Corp. II. Purpose of the maneuver? Use it as a springboard to join the New York Stock Exchange this winter. Launched by a millionaire of the internet bubble, accompanied by a former head of Qualcomm, this entity has indeed already been listed on Wall Street for a year.

Here is therefore one of the most prominent start-ups in Switzerland which falls under the fold of a “SPAC” - these sulphurous financial companies at the center of a recent speculative bubble. Could the whole project of giant concrete batteries be reduced to a stock market "blow"? Joined in California, Robert Piconi, denies it. And repeats that the objective is to build a storage giant, profitable at the beginning of 2024.

Robert Piconi, in his Californian offices, on August 16. After studying and then working for years in the United States in telecommunications, the latter returned four years ago to Ticino to launch Energy Vault.

Alex J. Berliner / ABImages

Less than a month after receiving $ 100 million you are creating a surprise by transferring Energy Vault to a team of financiers ready to take it to the New York Stock Exchange early next year. Why such a rush?

Robert Piconi: This agreement did not come out of nowhere. Since the start of the year, orders have poured in from all five continents for our concept of storage facilities. Beyond our partnership with Enel, we already have eight agreements to set up 1,200 megawatt hours (MWh) of storage - in Brazil, India or the United States - and are discussing plants totaling several thousand additional MWh (editor's note: the first tranche of the approved Italian power station is only 50 MWh). The interest of a stock market listing has emerged: it gives us access to all the necessary capital and allows us to focus fully on the construction of our power plants.

But why these Indiana financiers?

Because we've gotten to know them well over the past eight months. They participated in the fundraising round led by the organization Helena (editor's note: a consortium of personalities, wanting to solve “the planet's problems”) announced this summer.

This type of company called "SPAC" has been questioned for months. Many would only serve to enrich the financiers who set them up, to the detriment of the savers who trust them ...

The euphoria around these arrangements has led to excesses, but there are SPACs and SPACs ... Here, the Novus team takes a real risk in Energy Vault and commits large funds to it. For our part, we never went around the most offering PSPCs. We turned to financiers who were already in the capital - the arrangement was thought out in the interest of all shareholders. It has nothing to do with the structure of a classic SPAC.

Built not far from Bellinzona, the first demo model has been connected to the grid since the summer of 2020. Energy Vault

What guarantees that their objective is not to raise the mayonnaise, before getting rid of their titles to the public?

The assembly ensures that the financiers at the origin of the SPAC, the founders of Energy Vault - as well as our shareholders from the public - have the same interest: the success of our project. Example? The former face, like the others, a "lockup" of twelve months, during which they will not be able to sell their securities.

What are the means that are brought to you?

Novus' SPAC had obtained 288 million from the public when it was listed on the stock exchange a year ago. Its founders, along with other financial institutions like Softbank, bring in 100 million more. Depending on the size of the initial investor withdrawals from PSPC, Energy Vault will therefore get between $ 100 million and $ 388 million more.

Does this "deal" sign your departure for the United States?

No, we keep our operational center and the engineering office in Ticino. Because the heart of our activity and our suppliers still remains in Europe.

Computer-generated image of the interior of a “gravitational” electricity storage plant, punctuated by the ballet of blocks of material (blue) falling and rising according to electricity needs.

Forward-Looking Statements

This communication includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity, expectations and timing related to the rollout of the business of Energy Vault, Inc. (“Energy Vault” or the “Company”) and timing of deployments, customer growth and other business milestones, potential benefits of the proposed business combination and PIPE investment (the “Proposed Transactions”), and expectations related to the timing of the Proposed Transactions.

These statements are based on various assumptions, whether or not identified in this communication, and on the current expectations of Energy Vault’s management and the management of Novus Capital Corporation II (“Novus”) and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Energy Vault and Novus.

These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political, and legal conditions; the inability of the parties to successfully or timely consummate the Proposed Transactions, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Transactions or that the approval of the stockholders of Novus or Energy Vault is not obtained; failure to realize the anticipated benefits of the Proposed Transactions; risks relating to the uncertainty of the projected financial information with respect to Energy Vault; risks related to the rollout of Energy Vault’s business and the timing of expected business milestones; demand for renewable energy; ability to commercialize and sell its solution; ability to negotiate definitive contractual arrangements with potential customers; the impact of competitive technologies; ability to obtain sufficient supply of materials; the impact of Covid-19; global economic conditions; ability to meet installation schedules; the effects of competition on Energy Vault’s future business; the amount of redemption requests made by Novus’ public shareholders; and those factors discussed in Novus’ Annual Report on Form 10-K for the fiscal year ended December 31, 2020 under the heading “Risk Factors,” and other documents of Novus filed, or to be filed, with the SEC. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither Novus nor the Company presently know or that Novus and the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Novus’s and the Company’s expectations, plans or forecasts of future events and views as of the date of this communication. Novus and the Company anticipate that subsequent events and developments will cause their assessments to change. However, while Novus and the Company may elect to update these forward-looking statements at some point in the future, Novus and the Company specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing Novus’s or the Company’s assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Important Information and Where to Find It

This communication is being made in respect of the proposed merger transaction involving Novus and Energy Vault. Novus intends to file a registration statement on Form S-4 with the SEC, which will include a proxy statement/prospectus of Novus, and certain related documents, to be used at the meeting of stockholders to approve the proposed business combination and related matters. Investors and security holders of Novus are urged to read the proxy statement/prospectus, and any amendments thereto and other relevant documents that will be filed with the SEC, carefully and in their entirety when they become available because they will contain important information about Energy Vault, Novus and the business combination. The definitive proxy statement will be mailed to stockholders of Novus as of a record date to be established for voting on the proposed business combination. Investors and security holders will also be able to obtain copies of the registration statement and other documents containing important information about each of the companies once such documents are filed with the SEC, without charge, at the SEC’s web site at www.sec.gov. The information contained on, or that may be accessed through, the websites referenced in this communication is not incorporated by reference into, and is not a part of, this communication.

Participants in the Solicitation

Novus and its directors and executive officers may be considered participants in the solicitation of proxies with respect to the Proposed Transactions. Energy Vault and its executive officers and directors may also be deemed participants in such solicitation. Information about the directors and executive officers of Novus is set forth in its annual Report on Form 10-K for the fiscal year ended December 31, 2020. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the Proxy Statement and other relevant materials to be filed with the SEC regarding the Proposed Transactions when they become available. Novus stockholders and other interested persons should read the Proxy Statement carefully when it becomes available before making any voting decisions. When available, these documents can be obtained free of charge from the sources indicated above.