© ENERGY VAULT – ALL RIGHTS RESERVED Energy Vault The Preeminent Energy Storage Company Investor Presentation | September 2022 Exhibit 99.1

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 2 Disclaimer Forward-Looking Statements This presentation includes forward-looking statements that reflect the Company’s current views with respect to, among other things, the Company’s operations and financial performance. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies. These statements often include words such as “ anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “project,” “forecast,” “estimates,” “targets,” “projections,” “should,” “could,” “would,” “may,” “might,” “will” and other similar expressions. We base these forward-looking statements or projections on our current expectations, plans and assumptions, which we have made in light of our experience in our industry, as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances at the time. These forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us. These forward- looking statements are only predictions based upon our current expectations and projections about future events. These forward-looking statements involve significant risks and uncertainties that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward- looking statements, including changes in our strategy, expansion plans, customer opportunities, future operations, future financial position, estimated revenues and losses, projected costs, prospects and plans; the implementation, market acceptance and success of our business model and growth strategy; our ability to develop and maintain our brand and reputation; developments and projections relating to our business, our competitors, and industry; the impact of health epidemics, including the COVID-19 pandemic, on our business and the actions we may take in response thereto; our expectations regarding our ability to obtain and maintain intellectual property protection and not infringe on the rights of others; expectations regarding the time during which we will be an emerging growth company under the JOBS Act; our future capital requirements and sources and uses of cash; our ability to obtain funding for our operations and future growth; our business, expansion plans and opportunities and other important factors discussed under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2022 filed with the SEC on August 8, 2022, as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC’s website at www.sec.gov. New risks emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Any forward-looking statement made by us in this presentation speaks only as of the date of this presentation and is expressly qualified in its entirety by the cautionary statements included in this presentation. We undertake no obligation to publicly update or review any forward- looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable laws. You should not place undue reliance on our forward-looking statements. Non-GAAP Financial Metrics This presentation includes financial measures not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”), including Adjusted EBITDA, which is supplemental financial information that is not required by, or presented in accordance with, GAAP. Our management uses non- GAAP financial measures for business planning purposes and in measuring our performance relative to that of our competitors. Our management believes that presenting non-GAAP financial measures provides meaningful information to investors in understanding our operating results and may enhance investors’ ability to analyze financial and business trends. In addition, our management believes that non-GAAP financial measures allow investors to compare our results period to period more easily by excluding items that could have a disproportionately negative or positive impact on results in any particular period. However, this non-GAAP measures are not a substitute for, or superior to, GAAP measures and should not be considered as an alternative to net income (loss) as a measure of financial performance, or any other performance measure derived in accordance with GAAP. The presentation non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation, or as a substitute for our results as reported under GAAP. For example, because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company. Please refer to this presentation for additional information regarding non-GAAP measures, including reconciliations of the non-GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP. Market and Industry Data This presentation includes market and industry data and forecasts that we have derived from independent consultant reports, publicly available information, various industry publications, other published industry sources and our internal data and estimates. Independent consultant reports, industry publications and other published industry sources generally indicate that the information contained therein was obtained from sources believed to be reliable. The inclusion of market estimations, rankings and industry data in this presentation is based upon such reports, publications and other sources, our internal data and estimates and our understanding of industry conditions. Although we believe that such information is reliable, we have not had this information verified by any independent sources. You are cautioned not to give undue weight to such estimates. Trademarks Our registered or common law trademarks, tradenames and servicemarks appearing in this presentation are our property. Solely for convenience, our trademarks, tradenames and servicemarks referred to in this presentation may appear without the ®, TM and SM symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, tradenames and servicemarks. This presentation contains additional trademarks, tradenames and servicemarks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, tradenames and servicemarks to imply relationships with, or endorsement or sponsorship of us by, these other companies. No Solicitation of Sale This presentation does not constitute an offer to sell or a solicitation of an offer to buy securities, and shall not constitute an offer, solicitation or sale in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

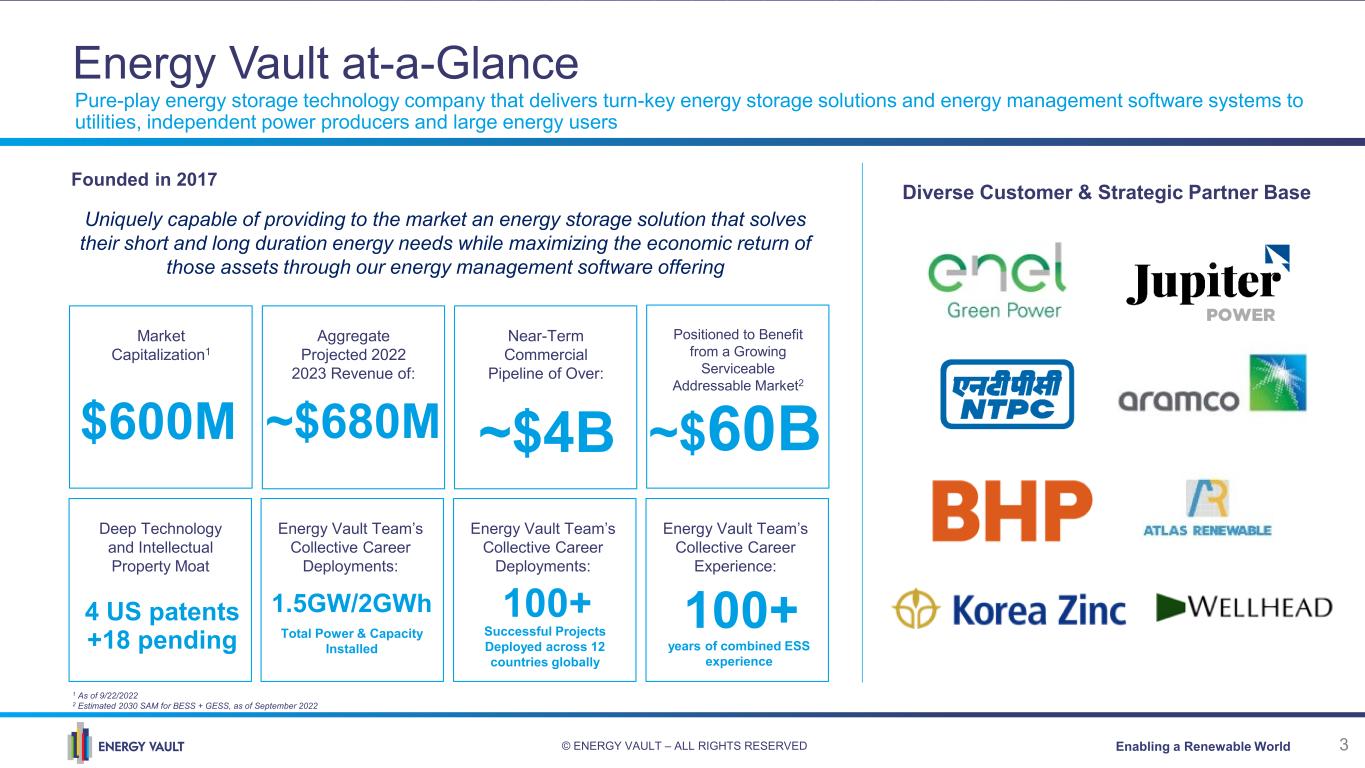

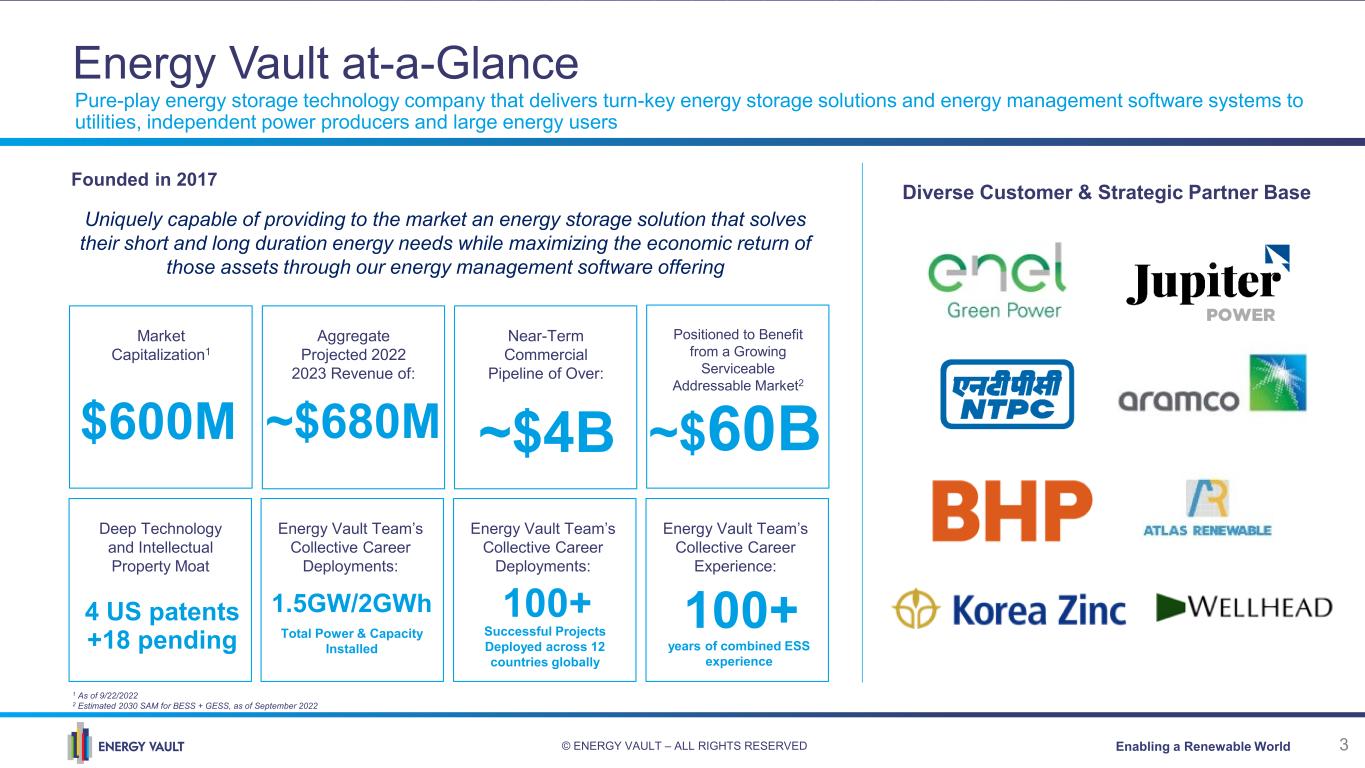

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 3 Energy Vault at-a-Glance 1 As of 9/22/2022 2 Estimated 2030 SAM for BESS + GESS, as of September 2022 Diverse Customer & Strategic Partner Base Pure-play energy storage technology company that delivers turn-key energy storage solutions and energy management software systems to utilities, independent power producers and large energy users Deep Technology and Intellectual Property Moat Positioned to Benefit from a Growing Serviceable Addressable Market2 Market Capitalization1 Aggregate Projected 2022 2023 Revenue of: Near-Term Commercial Pipeline of Over: Energy Vault Team’s Collective Career Deployments: Energy Vault Team’s Collective Career Deployments: Energy Vault Team’s Collective Career Experience: Founded in 2017 $600M ~$680M 4 US patents +18 pending ~$60B~$4B 1.5GW/2GWh Total Power & Capacity Installed 100+ Successful Projects Deployed across 12 countries globally 100+ years of combined ESS experience Uniquely capable of providing to the market an energy storage solution that solves their short and long duration energy needs while maximizing the economic return of those assets through our energy management software offering

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 4 Who We Are and What We Do Identify, develop and bring to market the most economical, flexible and sustainable energy storage solutionsMISSION • Energy Vault Solutions (EVS): Our Energy Management Software (EMS) for maximizing the applications and economic return of diverse energy storage assets including battery and gravity-based systems • EVx: Our proprietary gravity-based energy storage system is a technologically and economically viable system that is being commercially deployed today CORE COMPETENCIES We help utilities, independent power producers and large energy users to accelerate the transition to carbon free operations by offering the ideal energy storage solution for their needs VALUE PROPOSITION

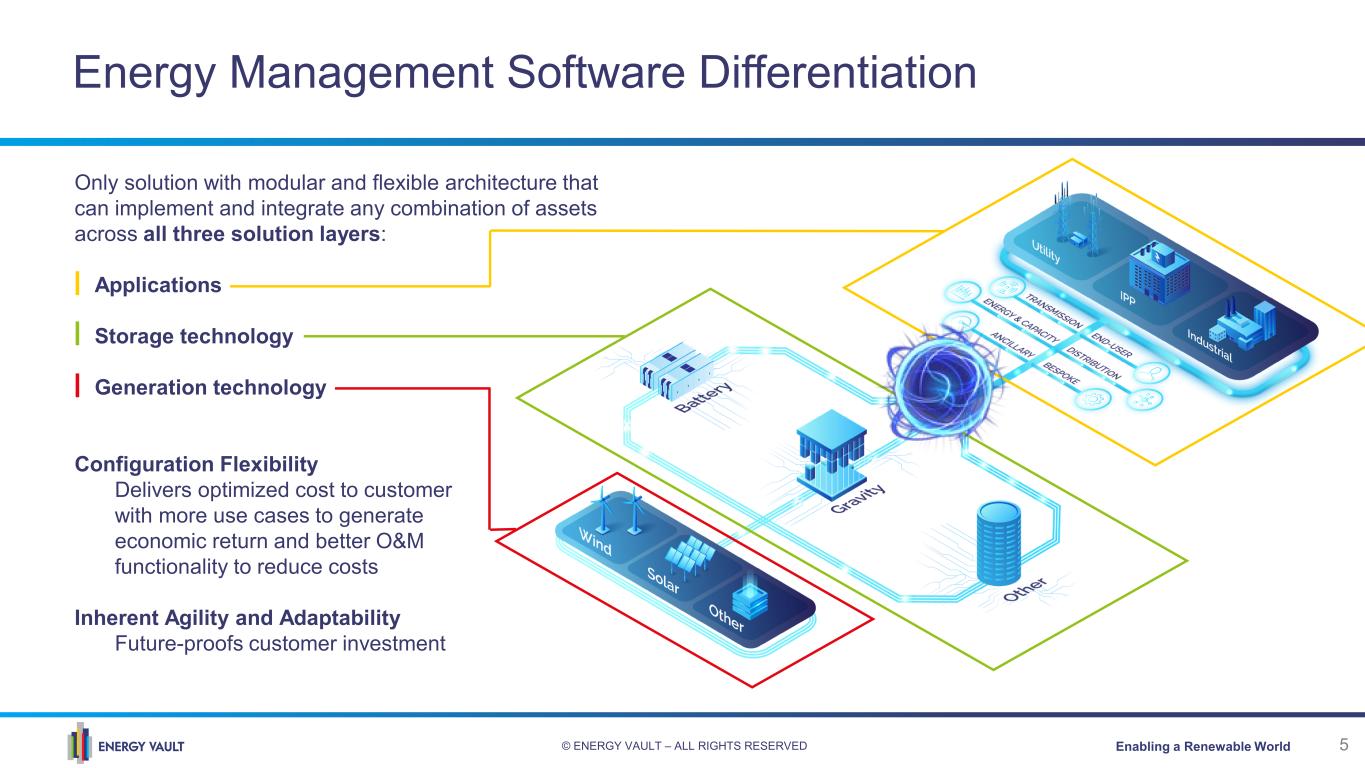

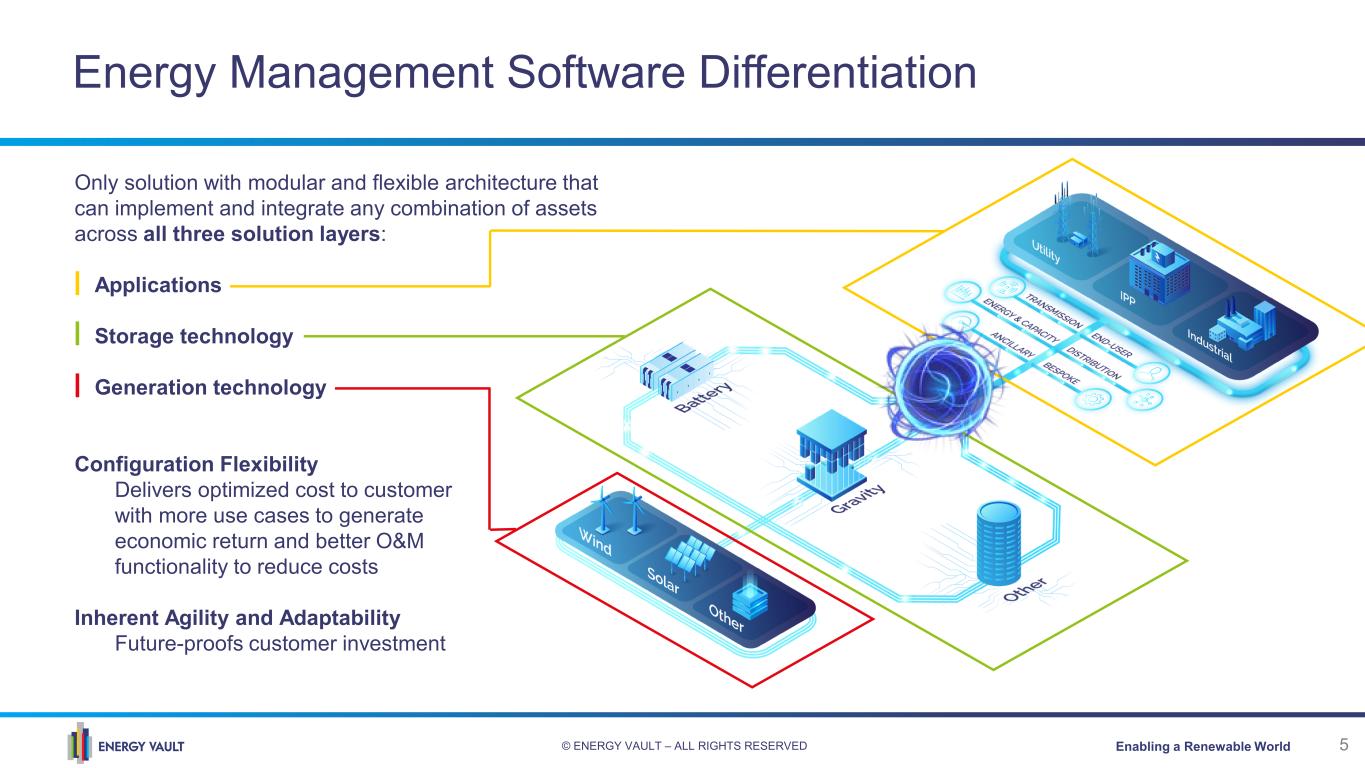

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 5 Energy Management Software Differentiation Only solution with modular and flexible architecture that can implement and integrate any combination of assets across all three solution layers: Applications Storage technology Generation technology Configuration Flexibility Delivers optimized cost to customer with more use cases to generate economic return and better O&M functionality to reduce costs Inherent Agility and Adaptability Future-proofs customer investment

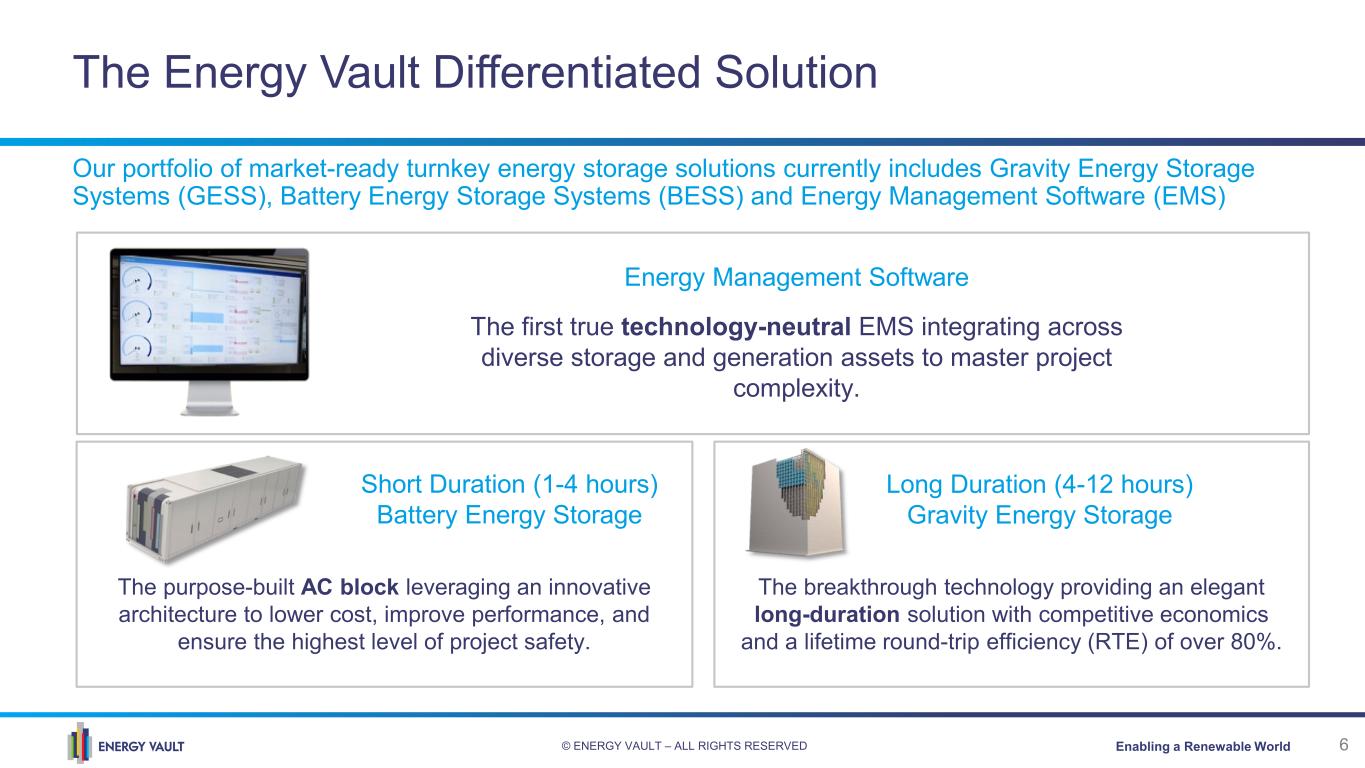

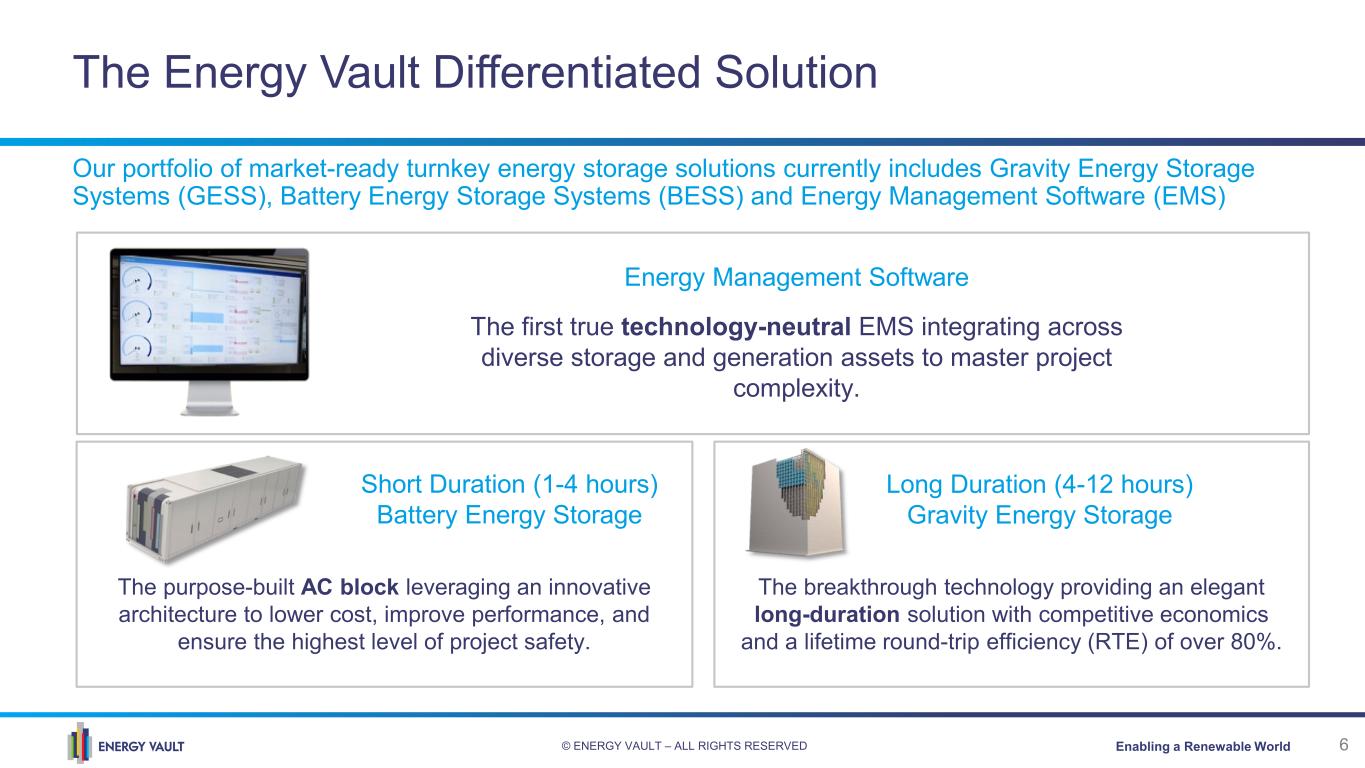

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 6 The breakthrough technology providing an elegant long-duration solution with competitive economics and a lifetime round-trip efficiency (RTE) of over 80%. The purpose-built AC block leveraging an innovative architecture to lower cost, improve performance, and ensure the highest level of project safety. The Energy Vault Differentiated Solution Our portfolio of market-ready turnkey energy storage solutions currently includes Gravity Energy Storage Systems (GESS), Battery Energy Storage Systems (BESS) and Energy Management Software (EMS) Energy Management Software The first true technology-neutral EMS integrating across diverse storage and generation assets to master project complexity. Long Duration (4-12 hours) Gravity Energy Storage Short Duration (1-4 hours) Battery Energy Storage

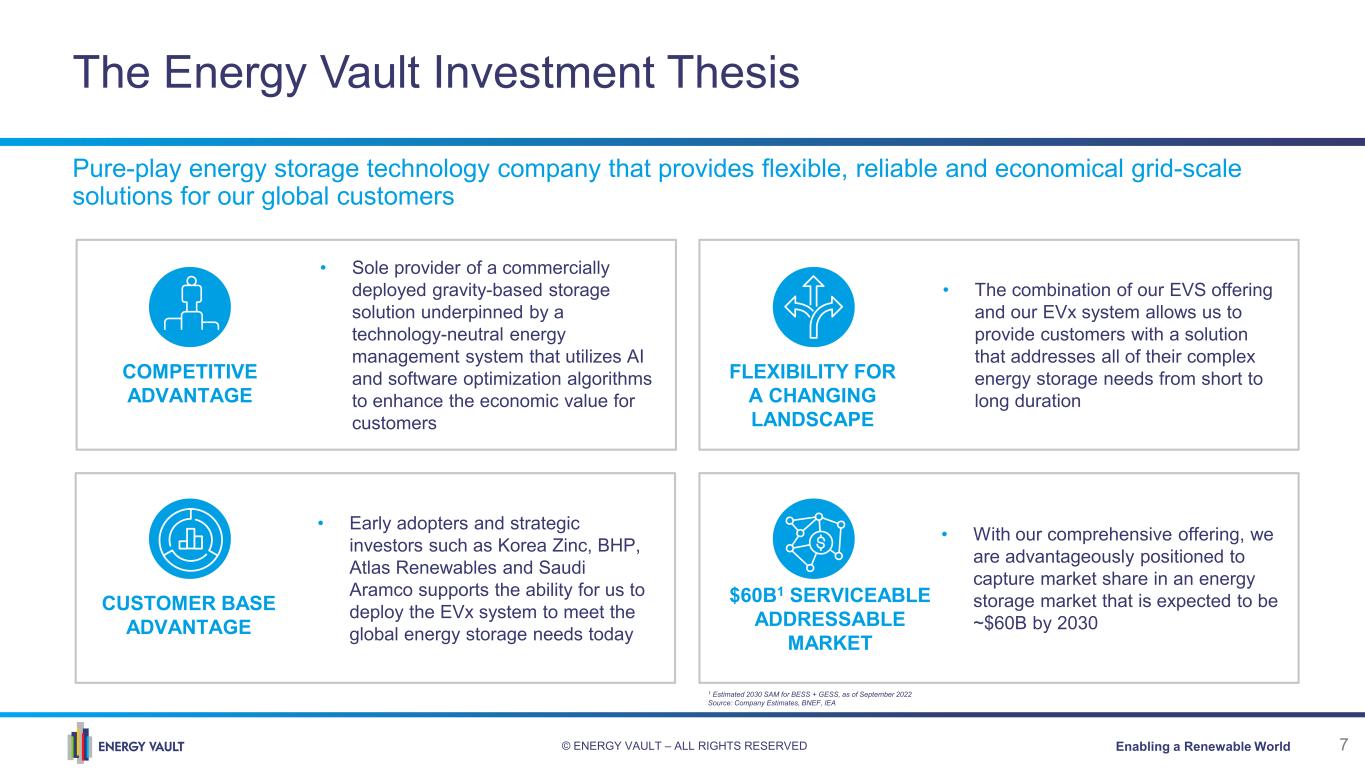

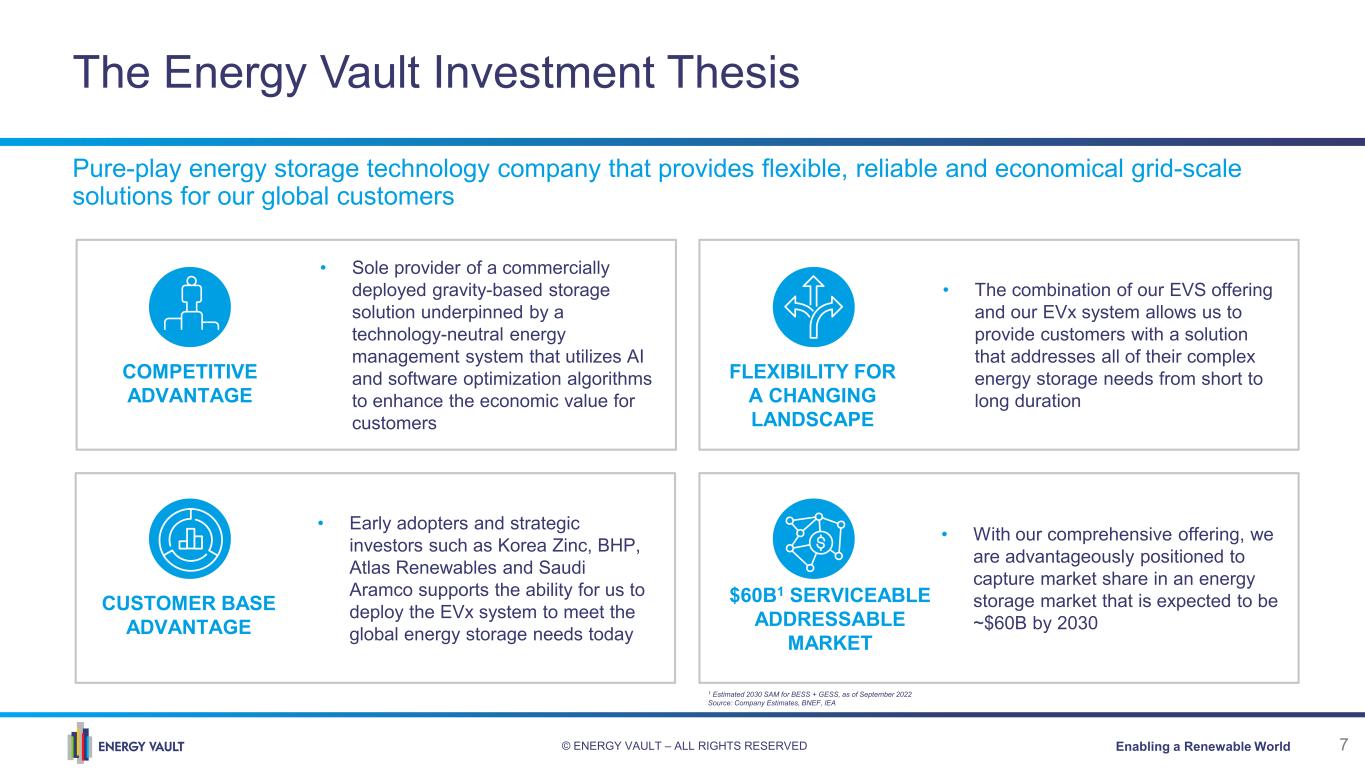

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 7 The Energy Vault Investment Thesis Pure-play energy storage technology company that provides flexible, reliable and economical grid-scale solutions for our global customers • Early adopters and strategic investors such as Korea Zinc, BHP, Atlas Renewables and Saudi Aramco supports the ability for us to deploy the EVx system to meet the global energy storage needs today • With our comprehensive offering, we are advantageously positioned to capture market share in an energy storage market that is expected to be ~$60B by 2030 CUSTOMER BASE ADVANTAGE $60B1 SERVICEABLE ADDRESSABLE MARKET • Sole provider of a commercially deployed gravity-based storage solution underpinned by a technology-neutral energy management system that utilizes AI and software optimization algorithms to enhance the economic value for customers • The combination of our EVS offering and our EVx system allows us to provide customers with a solution that addresses all of their complex energy storage needs from short to long duration COMPETITIVE ADVANTAGE FLEXIBILITY FOR A CHANGING LANDSCAPE 1 Estimated 2030 SAM for BESS + GESS, as of September 2022 Source: Company Estimates, BNEF, IEA

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 8 Experienced Management Team & Board of Directors Management Team Robert Piconi Co-Founder & Director Prior Executive leadership roles in Fortune 100 public companies across various industries BBA University of Notre Dame; MBA Northwestern University’s Kellogg School of Management Founder & CTO roles across multiple solar resource & renewable energy tech companies Andrea Pedretti Co-Founder & CTO BS/MSc Civil Engineering (ETH) Zürich, Switzerland Extensive operational financial leadership experience, including capital markets and M&A expertise David Hitchcock Interim Chief Financial Officer BS, Accounting & MBA Wake Forest University; Certified Public Accountant Leadership in world-class benchmarks in business operations and global supply chains strategies Chris Wiese Chief Operations Officer University of Wisconsin-Milwaukee; BS & MA Stephens Institute of Technology Executive Leadership roles in human resource management and talent acquisition Gonca Icoren Chief People Officer Cranfield University MSc International Human Resource Management. Orta Doğu Teknik Universities Executive leadership roles leading brand strategy, marketing and sales enablement Laurence Alexander Chief Marketing Officer Higher National Diploma Business Studies, London, UK Senior Legal Executive with broad global experience in energy, industrial gas, construction, & chemicals industries Josh McMorrow Chief Legal Officer Trinity University, B.S. International Business, cum laude and University of Texas School of Law, J.D. with Honors Product innovator and industry expert in climate change mitigation strategies Marco Terruzzin Chief Commercial & Product Officer MSc Mech. Engineering PhD, Energy Economics MBA U.VA, Darden School Energy storage veteran with deep experience and expertise in grid-scale technology integration John G. Jung President EVS™ B.A. Western University MBA, Strategy and Finance Ivey Business School Energy storage veteran with deep experience and expertise in grid-scale technology integration Akshay Ladwa Chief Technology Officer EVS™ MSc Mechanical Engineering, Michigan Board of Directors Rober Piconi Co-Founder & Director Bill Gross Co-Founder & Director Zia Huque Director Henry Elkus Director Larry Paulson Director Mary Beth Mandanas Non-Exec Director Thomas Ertel Non-Exec Director Corporate development leadership across a broad range of high growth segments. Kevin Keough SVP, Corporate Development B.S. Georgia Institute of Technology

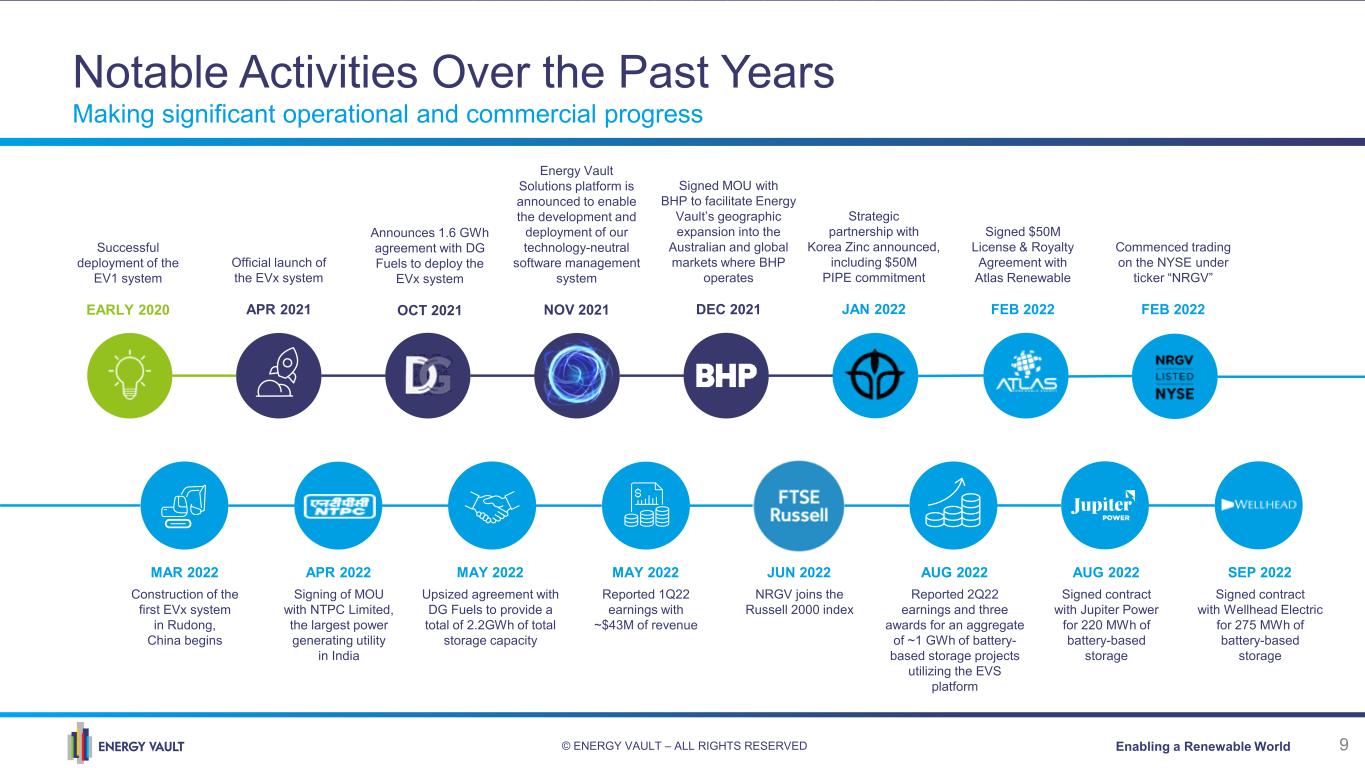

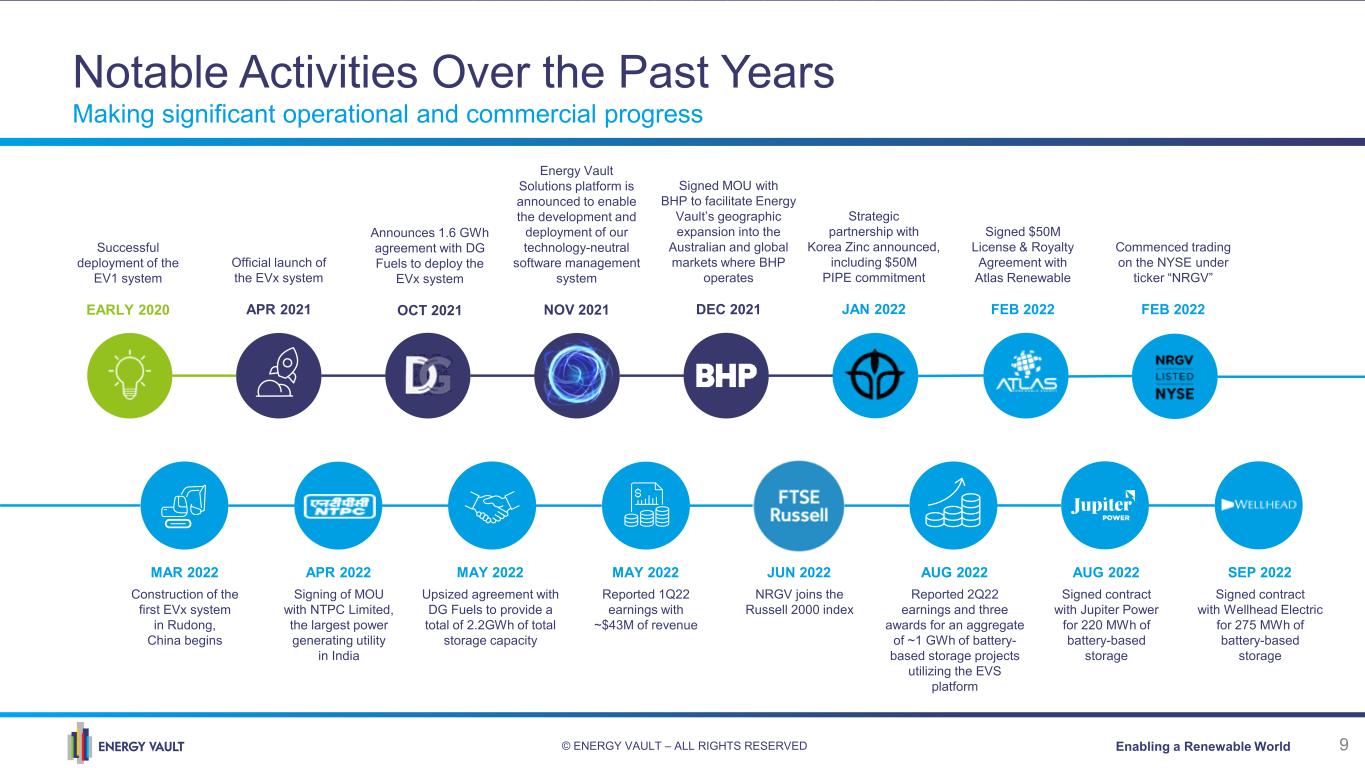

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 9 Notable Activities Over the Past Years Making significant operational and commercial progress Successful deployment of the EV1 system EARLY 2020 Official launch of the EVx system APR 2021 Announces 1.6 GWh agreement with DG Fuels to deploy the EVx system OCT 2021 Energy Vault Solutions platform is announced to enable the development and deployment of our technology-neutral software management system NOV 2021 Signed MOU with BHP to facilitate Energy Vault’s geographic expansion into the Australian and global markets where BHP operates DEC 2021 Strategic partnership with Korea Zinc announced, including $50M PIPE commitment JAN 2022 Signed $50M License & Royalty Agreement with Atlas Renewable FEB 2022 Commenced trading on the NYSE under ticker “NRGV” FEB 2022 MAR 2022 Construction of the first EVx system in Rudong, China begins APR 2022 Signing of MOU with NTPC Limited, the largest power generating utility in India MAY 2022 Upsized agreement with DG Fuels to provide a total of 2.2GWh of total storage capacity MAY 2022 Reported 1Q22 earnings with ~$43M of revenue JUN 2022 NRGV joins the Russell 2000 index AUG 2022 Reported 2Q22 earnings and three awards for an aggregate of ~1 GWh of battery- based storage projects utilizing the EVS platform AUG 2022 Signed contract with Jupiter Power for 220 MWh of battery-based storage SEP 2022 Signed contract with Wellhead Electric for 275 MWh of battery-based storage

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 10 EVx, Gravity Based Energy Storage System

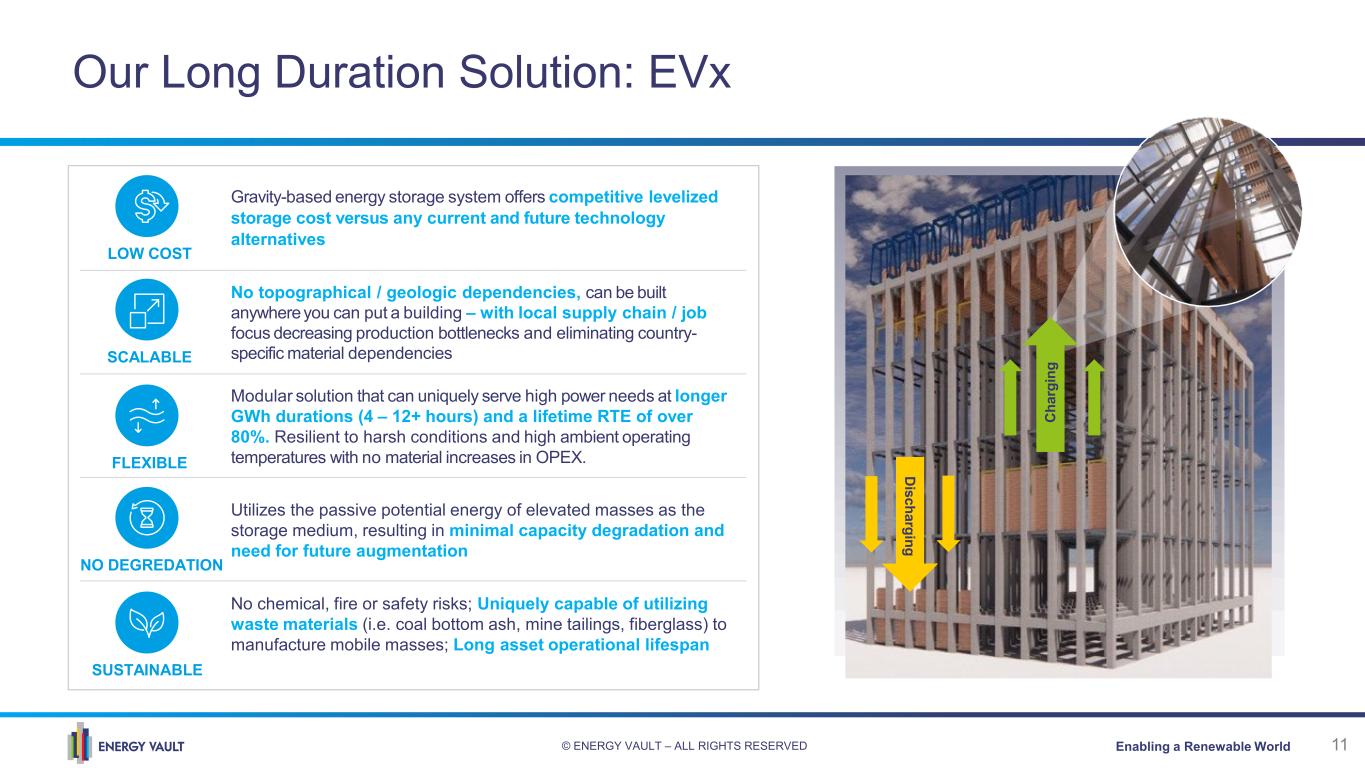

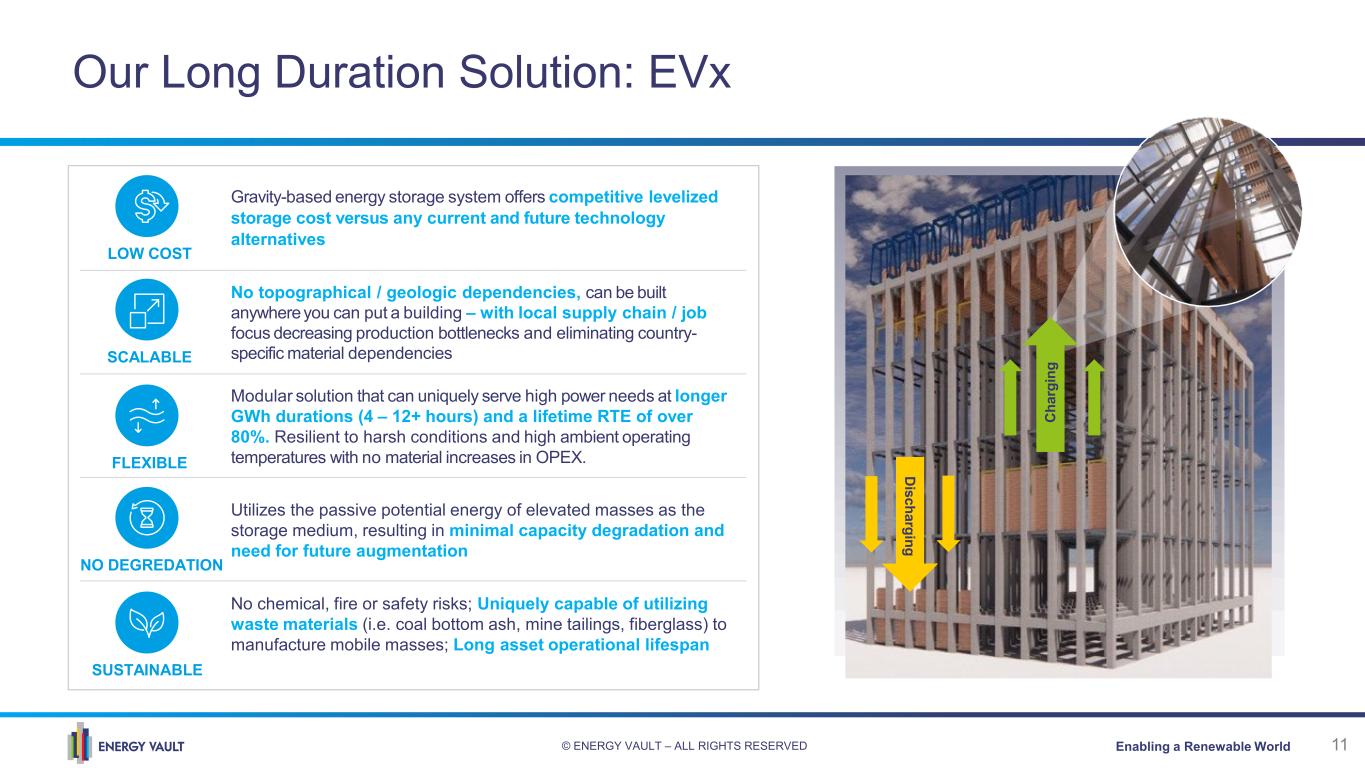

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 11 Our Long Duration Solution: EVx Gravity-based energy storage system offers competitive levelized storage cost versus any current and future technology alternatives No topographical / geologic dependencies, can be built anywhereyou can put a building – with local supply chain / job focus decreasing production bottlenecks and eliminating country- specific material dependencies Modular solution that can uniquely serve high power needs at longer GWh durations (4 – 12+ hours) and a lifetime RTE of over 80%. Resilient to harsh conditions and high ambient operating temperatures with no material increases in OPEX. Utilizes the passive potential energy of elevated masses as the storage medium, resulting in minimal capacity degradation and need for future augmentation No chemical, fire or safety risks; Uniquely capable of utilizing waste materials (i.e. coal bottom ash, mine tailings, fiberglass) to manufacture mobile masses; Long asset operational lifespan low carbon footprint LOW COST NO DEGREDATION SCALABLE FLEXIBLE SUSTAINABLE Discharging Ch ar gi ng

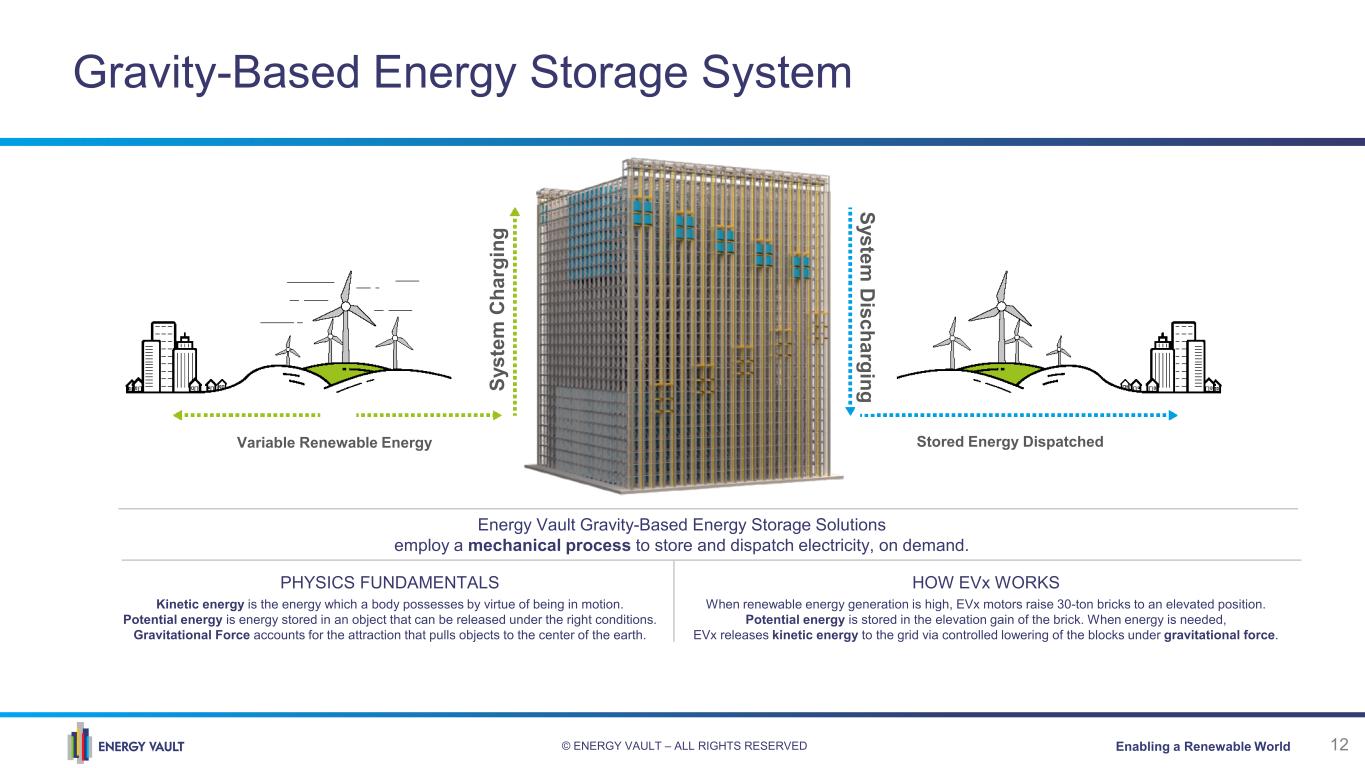

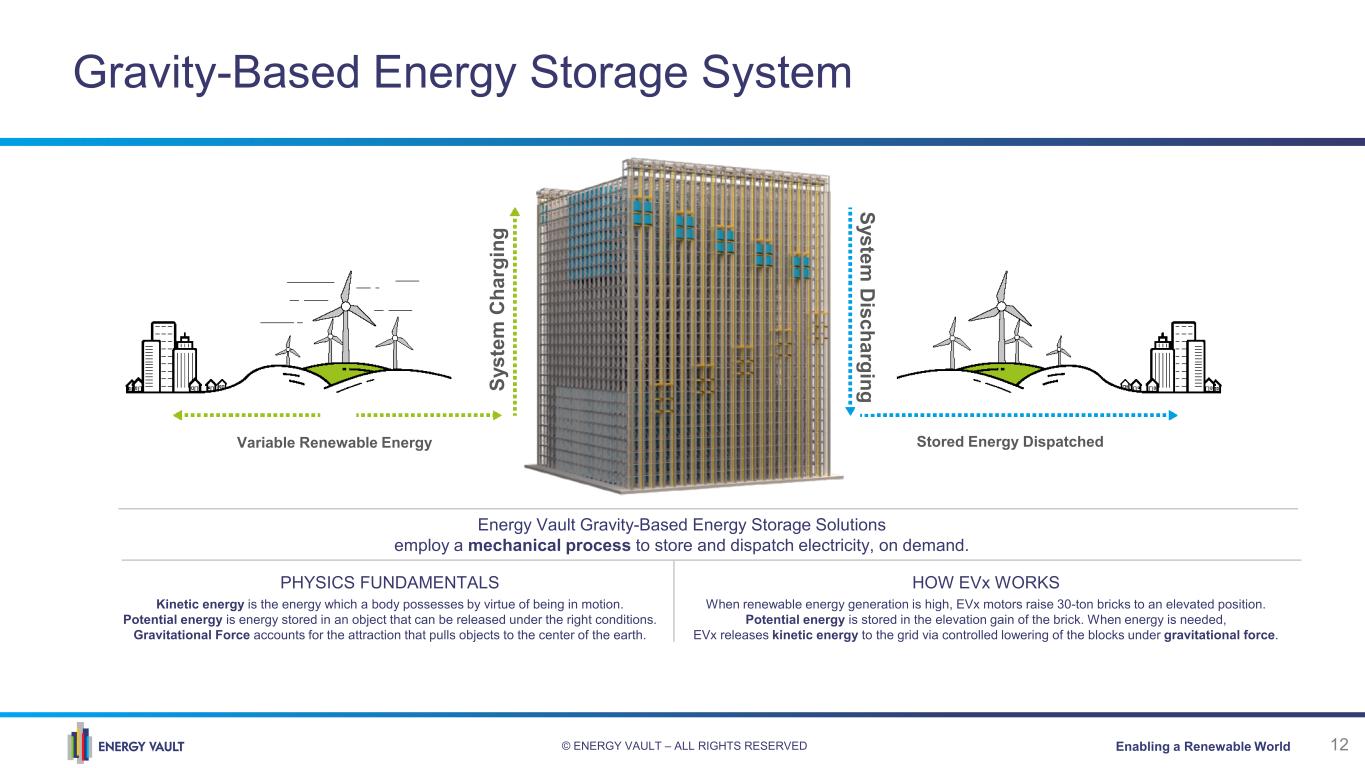

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 12 Variable Renewable Energy Sy st em C ha rg in g System D ischarging Stored Energy Dispatched PHYSICS FUNDAMENTALS Kinetic energy is the energy which a body possesses by virtue of being in motion. Potential energy is energy stored in an object that can be released under the right conditions. Gravitational Force accounts for the attraction that pulls objects to the center of the earth. HOW EVx WORKS When renewable energy generation is high, EVx motors raise 30-ton bricks to an elevated position. Potential energy is stored in the elevation gain of the brick. When energy is needed, EVx releases kinetic energy to the grid via controlled lowering of the blocks under gravitational force. Energy Vault Gravity-Based Energy Storage Solutions employ a mechanical process to store and dispatch electricity, on demand. Gravity-Based Energy Storage System

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 13 The EVx System 1 2 3 4The FOUNDATION is built by the EPC (engineering, procurement, construction) to local building code standards; depth and area specifications vary based on the size of the unit and the geology of the site. The FIXED FRAME structure is built by the EPC and is made with high- performance pre-cast concrete and steel reinforcement. The MOBILE MASSES are 30 ton composite bricks constructed onsite from locally sourced soil, waste, and composite materials. The LIFTING SYSTEM comprised of • Trolleys • Elevators • Power Supply • Motors / Generators • Control Box • Active Front End / Variable Frequency Drive 1 2 3 4 Fully Charged Structure height of 147m Footprint of the system scales linearly, for example with a 20 MW / 80 MWh system having a footprint of approx. 80m x 86m while a 20 MW / 160 MWh system would have a footprint of approx. 80m x 166m Energy Density ~= 120m2/MWh Can fully discharge, or recharge within 3 seconds Asset life 35-40 years or higher Fully Discharged

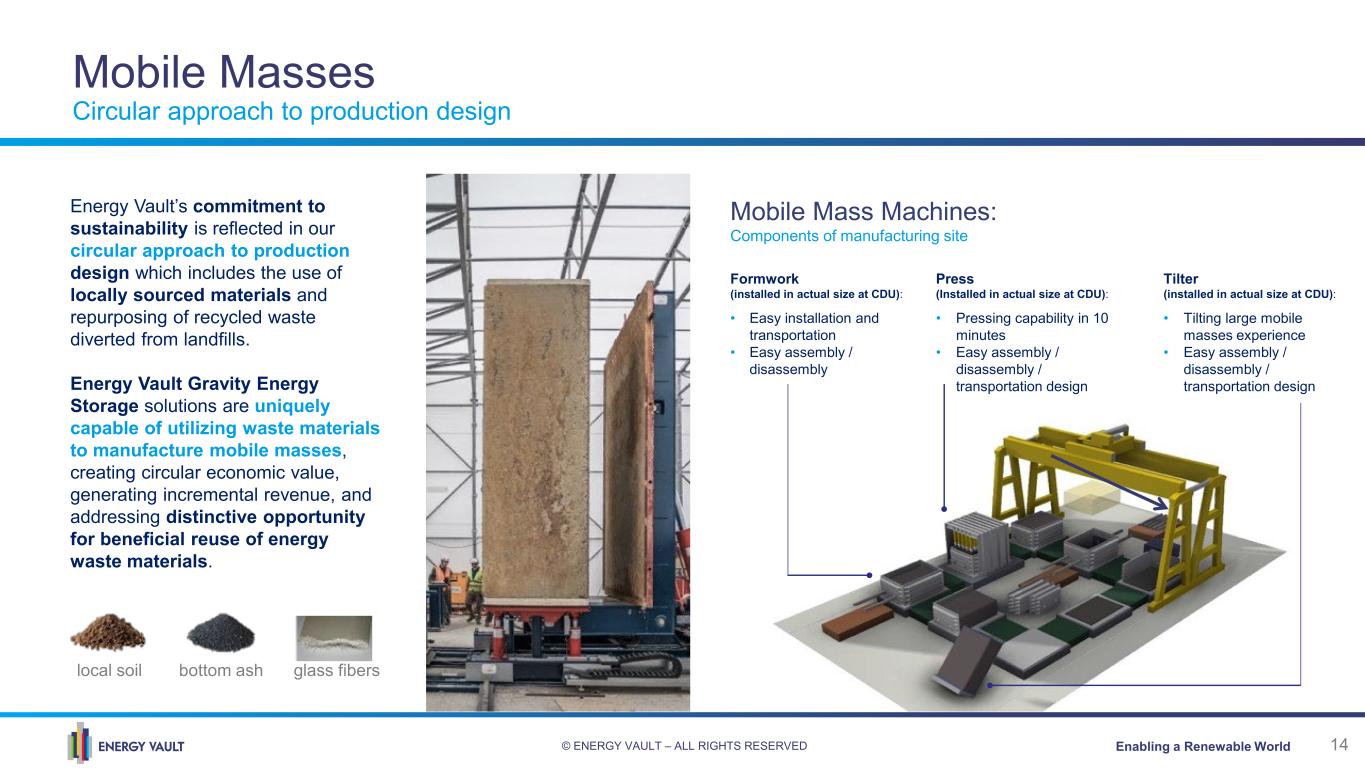

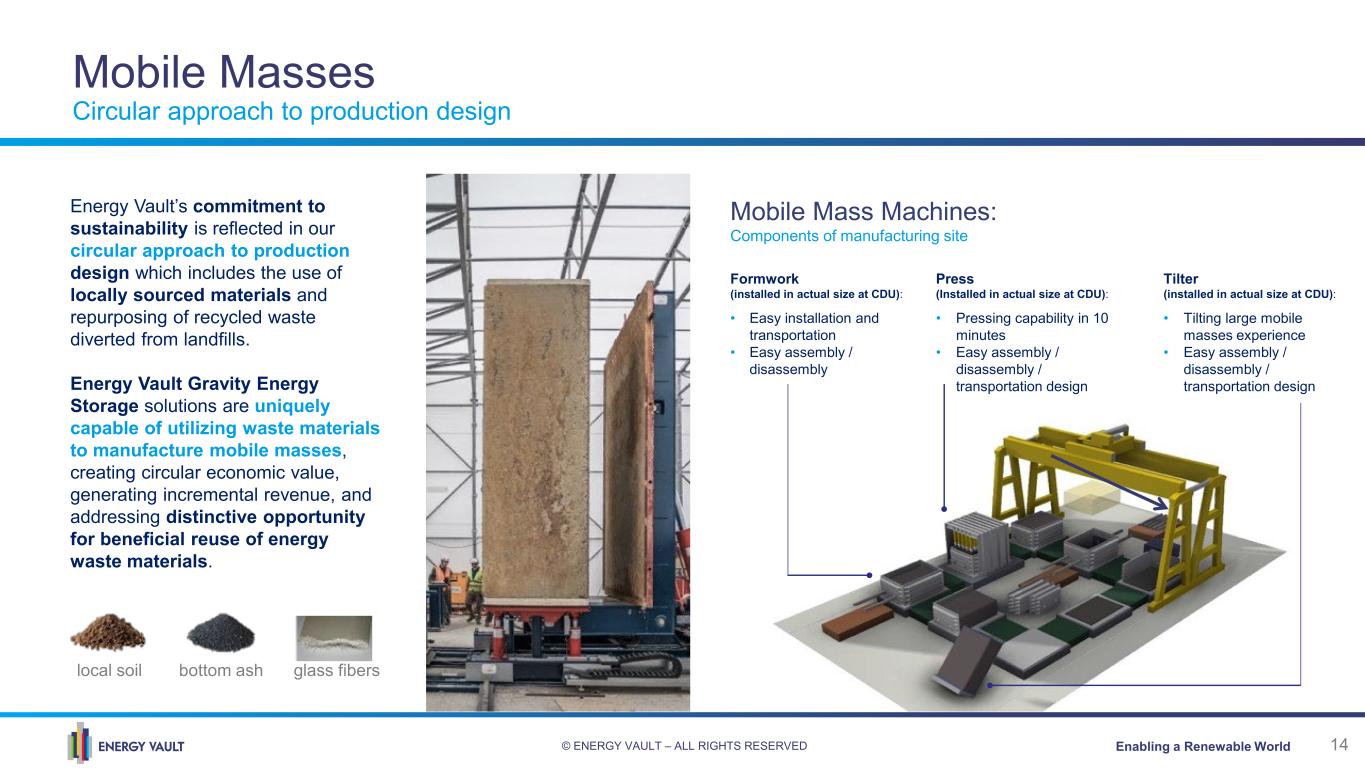

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 14 Mobile Masses Circular approach to production design Energy Vault’s commitment to sustainability is reflected in our circular approach to production design which includes the use of locally sourced materials and repurposing of recycled waste diverted from landfills. Energy Vault Gravity Energy Storage solutions are uniquely capable of utilizing waste materials to manufacture mobile masses, creating circular economic value, generating incremental revenue, and addressing distinctive opportunity for beneficial reuse of energy waste materials. local soil bottom ash glass fibers Mobile Mass Machines: Components of manufacturing site Press (Installed in actual size at CDU): • Pressing capability in 10 minutes • Easy assembly / disassembly / transportation design Formwork (installed in actual size at CDU): • Easy installation and transportation • Easy assembly / disassembly Tilter (installed in actual size at CDU): • Tilting large mobile masses experience • Easy assembly / disassembly / transportation design

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 15 Continuous Improvement for CapEx and LCOS Key Levers For Cost Reduction: • Optimization of construction materials • Normalization of raw cost including steel • Economies of scale for manufacturing power electronics • Construction automation reduces labor cost • Rudong, China project enables learning and real-time implementation of cost reduction initiatives Ongoing R&D Efforts to optimize design and cost: • Fixed frame and topology optimized structural system (Caltech and Johns Hopkins) • Confined soil columns (Caltech) • CO2 mineralization in bricks (University of Houston) Upside to economics through: “Inflation Reduction Act” standalone storage ITC, carbon credits and payment for remediation of waste, soil and recycled wind turbines R&D and innovation continues to drive down cost and optimize the design and operations of the system

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 16 Energy Vault Solutions (EVS)

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 17 Our Integration Solution: The Energy Management Software TECHNOLOGY-NEUTRAL CONTROL Integrates across multiple asset classes including storage, generation and transmission via modular software architecture, providing a variety of asset-specific and market-specific performance modes. MULTI-ASSET PLANT SIMULATION Offers tailored techno-economic performance optimization on a project and site-specific basis, employing AI techniques to solve across multi-variable market and geographic constraints. FLEET-WIDE ORCHESTRATION & OPTIMIZATION Coordinated asset operation and collective market dispatching within and across regulated markets. AUTOMATED MARKET BIDDER Utilizes economic bidding suite capable of optimization across multiple degrees of freedom as well as automated and smart dispatching functionalities. LIFECYCLE MANAGEMENT Incorporates consideration of long-term asset health via monitoring and issue resolution platform, allowing for integrated warranty and performance guarantee management, and providing the highest project uptime availability. EMS Core Control Suite

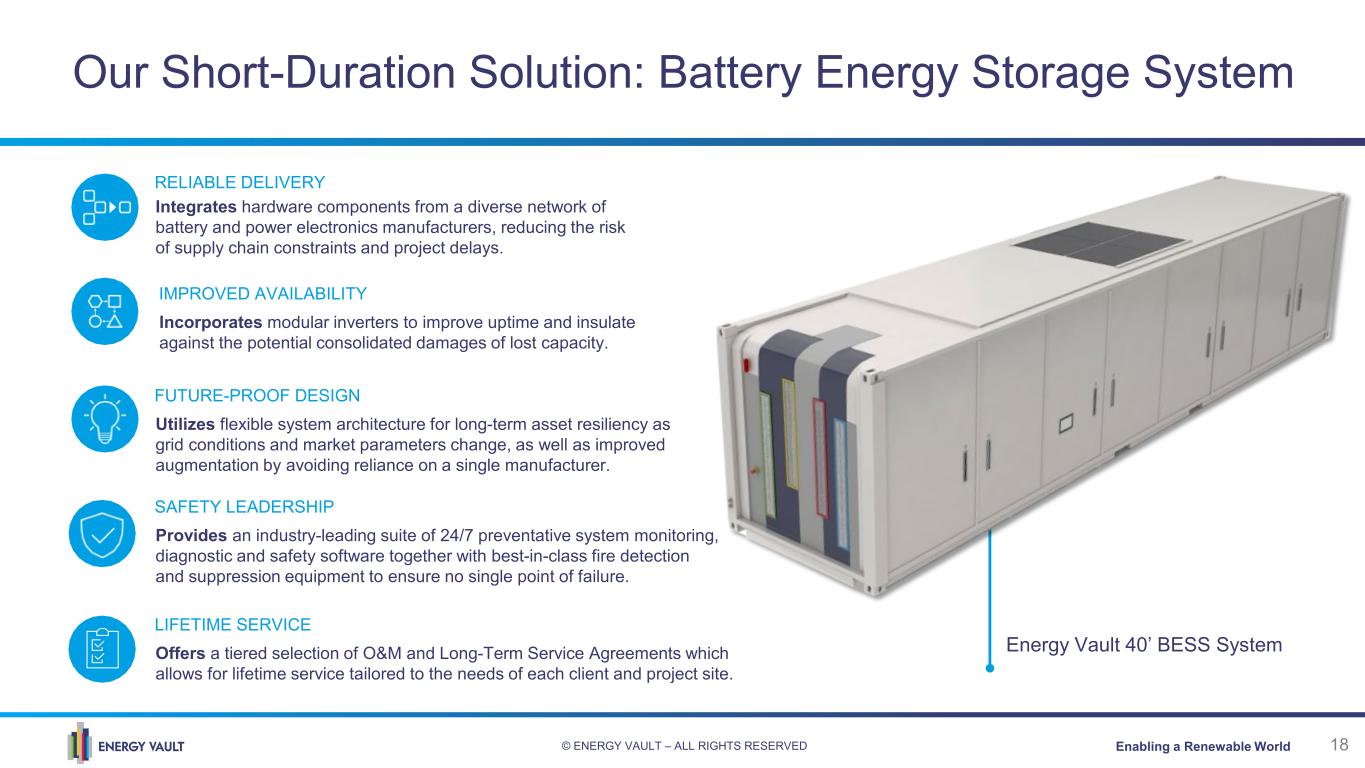

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 18 Energy Vault 40’ BESS System Our Short-Duration Solution: Battery Energy Storage System RELIABLE DELIVERY Integrates hardware components from a diverse network of battery and power electronics manufacturers, reducing the risk of supply chain constraints and project delays. IMPROVED AVAILABILITY Incorporates modular inverters to improve uptime and insulate against the potential consolidated damages of lost capacity.. FUTURE-PROOF DESIGN Utilizes flexible system architecture for long-term asset resiliency as grid conditions and market parameters change, as well as improved augmentation by avoiding reliance on a single manufacturer. SAFETY LEADERSHIP Provides an industry-leading suite of 24/7 preventative system monitoring, diagnostic and safety software together with best-in-class fire detection and suppression equipment to ensure no single point of failure. LIFETIME SERVICE Offers a tiered selection of O&M and Long-Term Service Agreements which allows for lifetime service tailored to the needs of each client and project site.

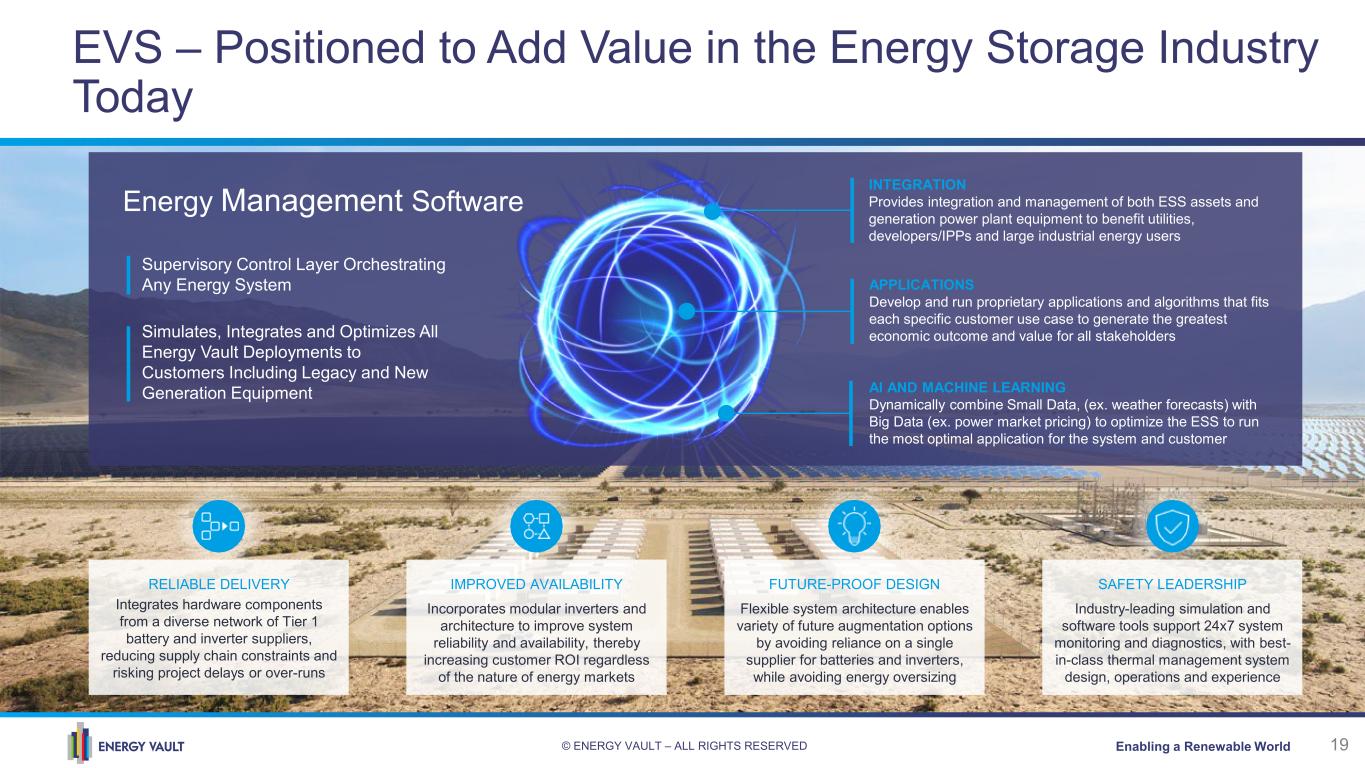

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 19 EVS – Positioned to Add Value in the Energy Storage Industry Today RELIABLE DELIVERY Integrates hardware components from a diverse network of Tier 1 battery and inverter suppliers, reducing supply chain constraints and risking project delays or over-runs IMPROVED AVAILABILITY Incorporates modular inverters and architecture to improve system reliability and availability, thereby increasing customer ROI regardless of the nature of energy markets FUTURE-PROOF DESIGN Flexible system architecture enables variety of future augmentation options by avoiding reliance on a single supplier for batteries and inverters, while avoiding energy oversizing SAFETY LEADERSHIP Industry-leading simulation and software tools support 24x7 system monitoring and diagnostics, with best- in-class thermal management system design, operations and experience Supervisory Control Layer Orchestrating Any Energy System Simulates, Integrates and Optimizes All Energy Vault Deployments to Customers Including Legacy and New Generation Equipment INTEGRATION Provides integration and management of both ESS assets and generation power plant equipment to benefit utilities, developers/IPPs and large industrial energy users APPLICATIONS Develop and run proprietary applications and algorithms that fits each specific customer use case to generate the greatest economic outcome and value for all stakeholders Energy Management Software AI AND MACHINE LEARNING Dynamically combine Small Data, (ex. weather forecasts) with Big Data (ex. power market pricing) to optimize the ESS to run the most optimal application for the system and customer

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 20 Industry Overview

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 21 Beneficiary of Inflation Reduction Act Accelerates adoption of Energy Vault’s innovative energy storage technologies • The Inflation Reduction Act (“IRA”) includes $369B of new spending specifically aimed at the clean energy industry • Investment Tax Credits (“ITC”) are now extended to standalone storage projects • Improved economics will reduce the cost to implement storage within the domestic market driving adoption of innovative long-duration energy storage systems, accelerating the demand trajectory and customer adoption of EVx and EVS systems • IRA will add significant upside to Energy Vault’s estimated $60B TAM in 2030, particularly in the segments of long-duration and complex energy storage applications • Wood Mackenzie, forecasted that a 30% storage ITC would increase U.S. storage deployments by +20-25% over the next five years • Our current financial and business plan does not include benefits of the ITC

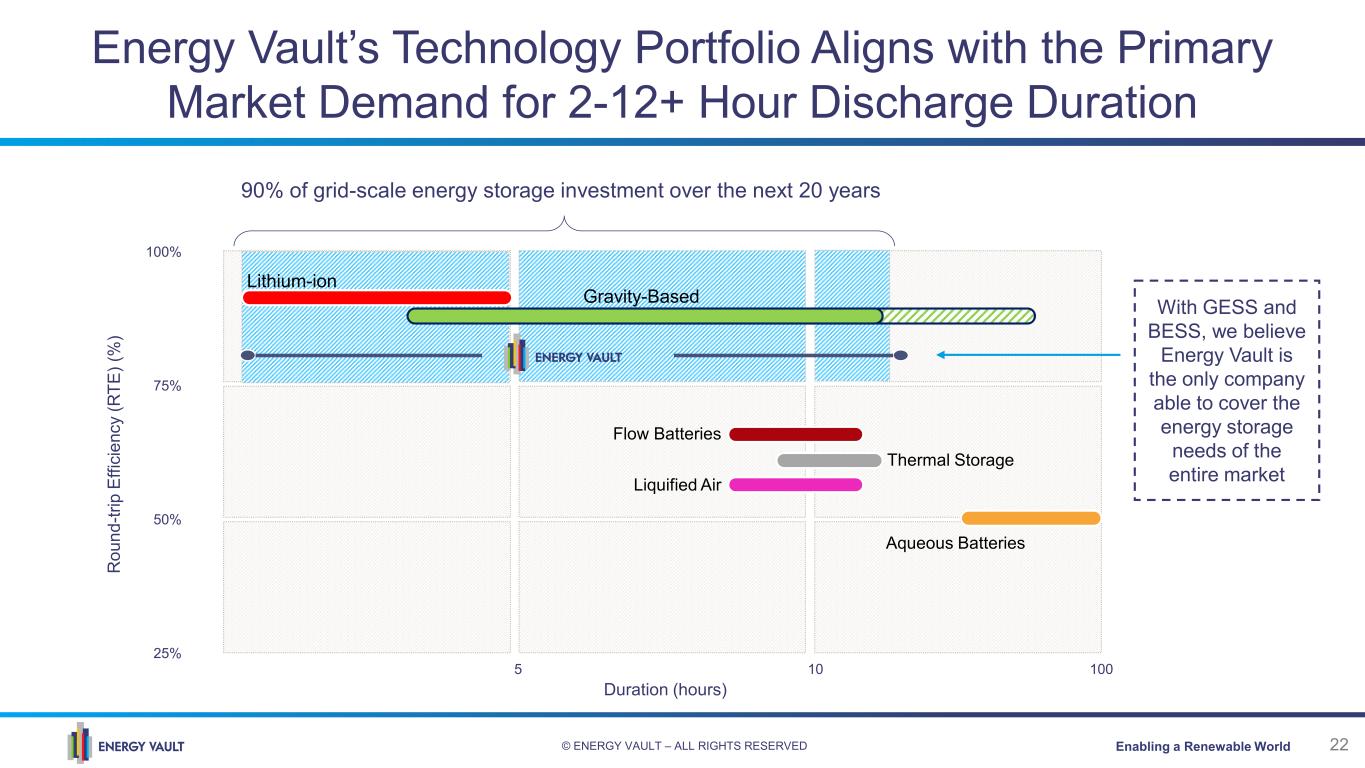

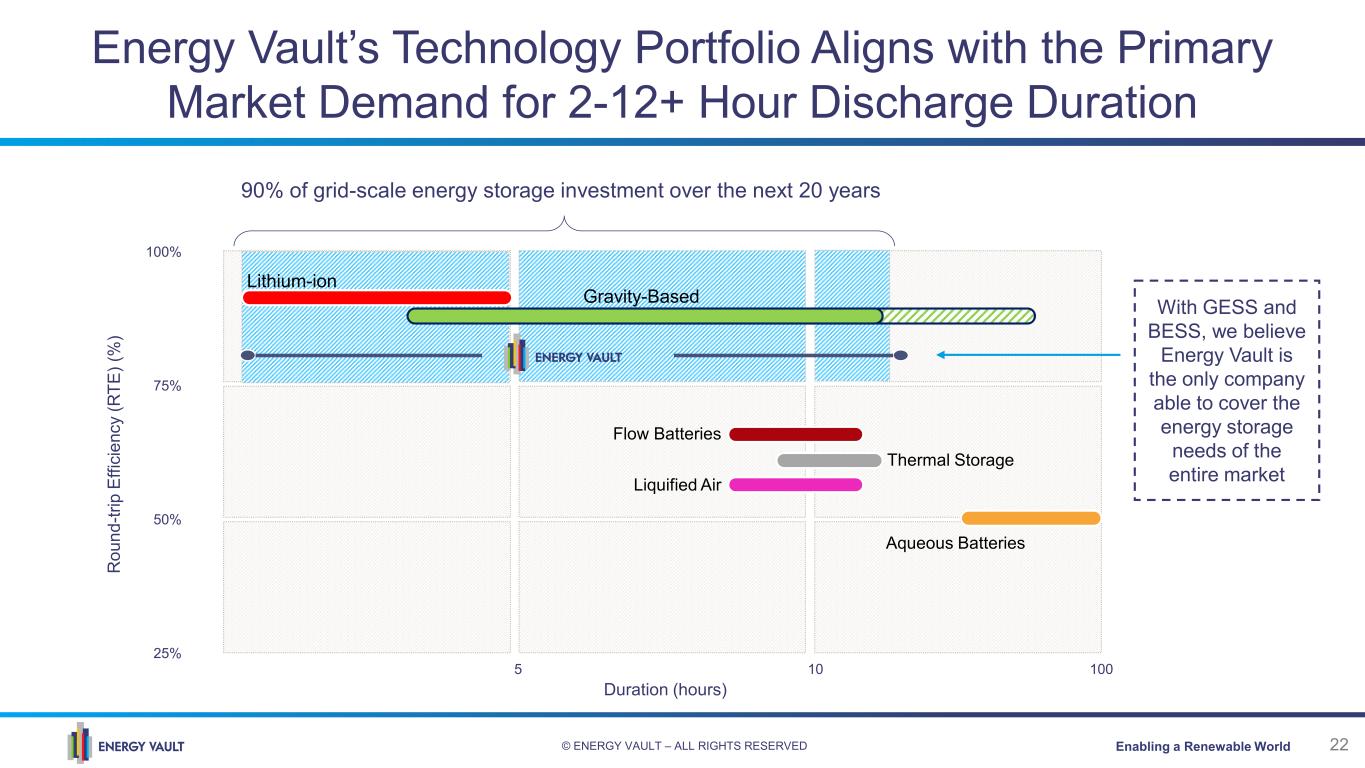

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 22 Energy Vault’s Technology Portfolio Aligns with the Primary Market Demand for 2-12+ Hour Discharge Duration 5 25% Duration (hours) R ou nd -tr ip E ffi ci en cy (R TE ) ( % ) 50% 75% 10 100 100% Lithium-ion Flow Batteries Thermal Storage Liquified Air Aqueous Batteries 90% of grid-scale energy storage investment over the next 20 years With GESS and BESS, we believe Energy Vault is the only company able to cover the energy storage needs of the entire market Gravity-Based

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 23 Commercial and Financial Progress

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 24 Near-Term Commercial Activities Abundant opportunities to gain profitable market share in BESS and GESS Submitted Proposals • 12.8 GWh • Potential Bookings ~$4B Short-Listed • 2.0 GWh • Potential Bookings ~$650M Awarded • 3.7 GWh • Potential Bookings ~$1.2B Booked Orders • 495 MWh • Bookings: $257M • Firm offer submitted • Approx. 50% BESS / GESS mix • Short-listed following competitive bid • Contract Negotiations • LOI / Firm Commitments • Contract Awarded • Signed contracts to be deployed & executed licensing agreements • Recently announced booked orders – 220 MWh with Jupiter Power and 275 MWh with Wellhead Electric • Awards include 2.2 GWh with DG Fuels, 440 MWh with a large western public utility, 36 MWh with Enel and others • Given customer contingencies, associated bookings and revenue related with DG Fuels are not included in our financial guidance • Does not include upside from royalty opportunities in China

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 25 Financial Guidance Reiterating confidence in achieving our targeted financial plan • Aggregate 2022-2023 Revenue: ~$680M • 2022 Revenue: $75-100M • 2023 Revenue: ~$600M Revenue Forecast • Signed contracts and strength of near-term sales funnel • GESS growth opportunities in China and Australia • Rapidly expanding energy storage market for all solutions Visibility into revenue forecast driven by: 2022 Expected Adj. EBITDA: (-$10M) to $3M Energy Vault has provided a reconciliation of Adjusted EBITDA to net income (loss), the most directly comparable GAAP measure, for the historical period on slides 34 and 35 hereto.

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 26 Recent Updates & Quarterly Financials

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 27 Recent Key Takeaways and Updates Executing on our engineering and software development plans to support upcoming customer deployments in line with our plans for the Gravity and EV Solutions portfolio Focus on R&D, innovation and continuous improvement enables annual double-digit cost reduction for EVx Construction continues to progress with Atlas Renewable and China Tianying for a 25 MW, 100 MWh gravity-based EVx system in China with expected completion in 1H23 Announced site planning with Ark Energy for a multi- GWh gravity-based and battery-based energy storage solutions Announced contract signing with Jupiter Power and Wellhead Electric for 220 MWh and 275 MWh respectively, for EVS Software and battery deployment in California and Texas ~$300M of cash on the balance sheet (roughly flat q/q) highlights disciplined capital investment and our capex-lite model as we continue to successfully expand the business Awarded a 440 MWh battery energy storage system with a large western public utility CNTY’s recent agreement with State Power Investment Group Zhejiang states that within three years, they are expected to implement no less than 1 GWh of gravity energy storage, utilizing our EVx platform

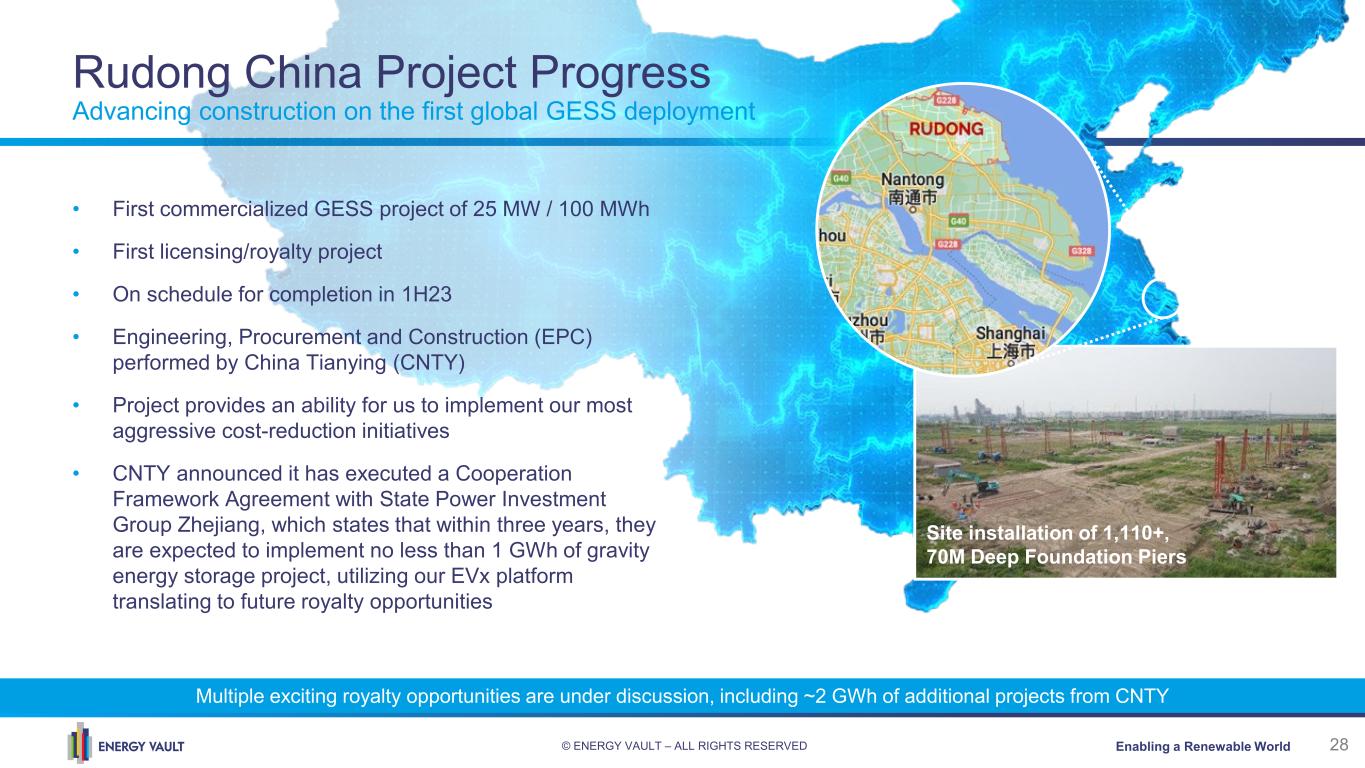

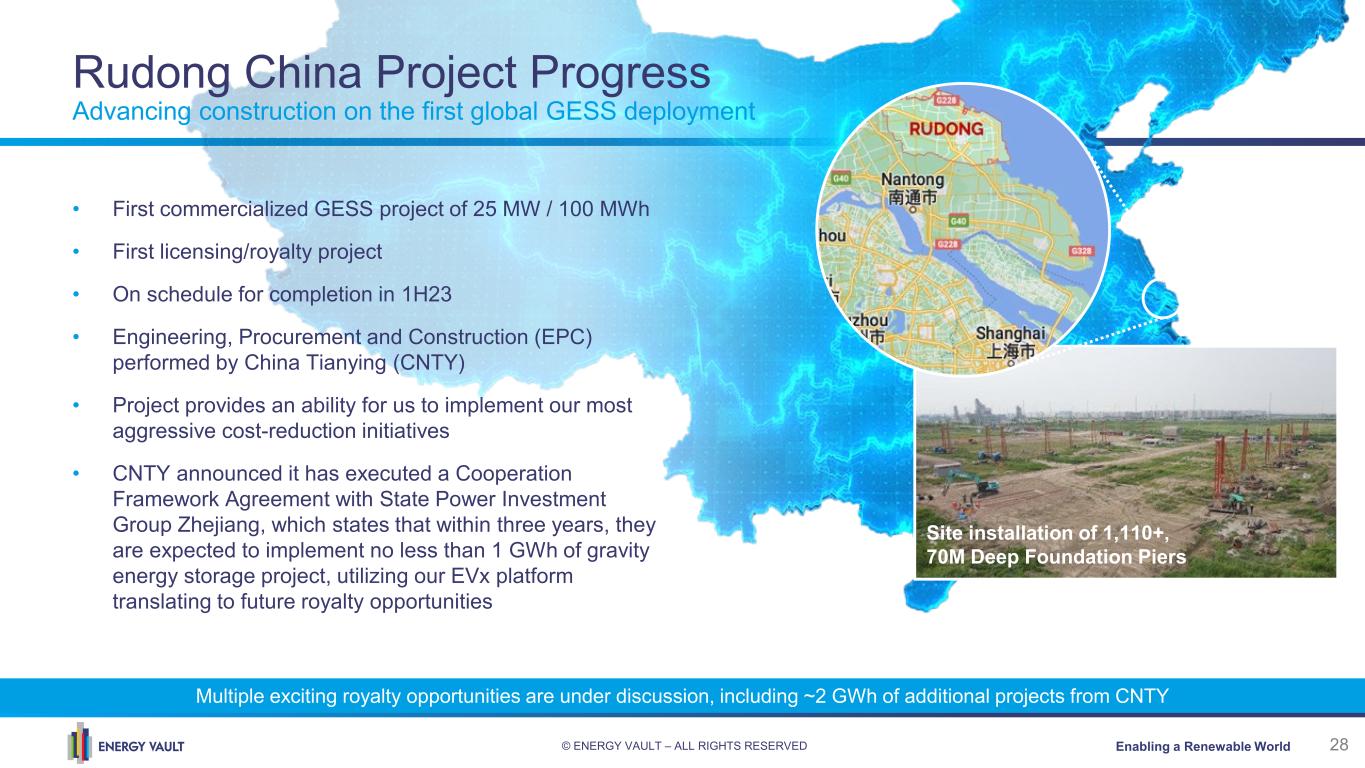

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 28 Rudong China Project Progress Advancing construction on the first global GESS deployment Multiple exciting royalty opportunities are under discussion, including ~2 GWh of additional projects from CNTY • First commercialized GESS project of 25 MW / 100 MWh • First licensing/royalty project • On schedule for completion in 1H23 • Engineering, Procurement and Construction (EPC) performed by China Tianying (CNTY) • Project provides an ability for us to implement our most aggressive cost-reduction initiatives • CNTY announced it has executed a Cooperation Framework Agreement with State Power Investment Group Zhejiang, which states that within three years, they are expected to implement no less than 1 GWh of gravity energy storage project, utilizing our EVx platform translating to future royalty opportunities Site installation of 1,110+, 70M Deep Foundation Piers

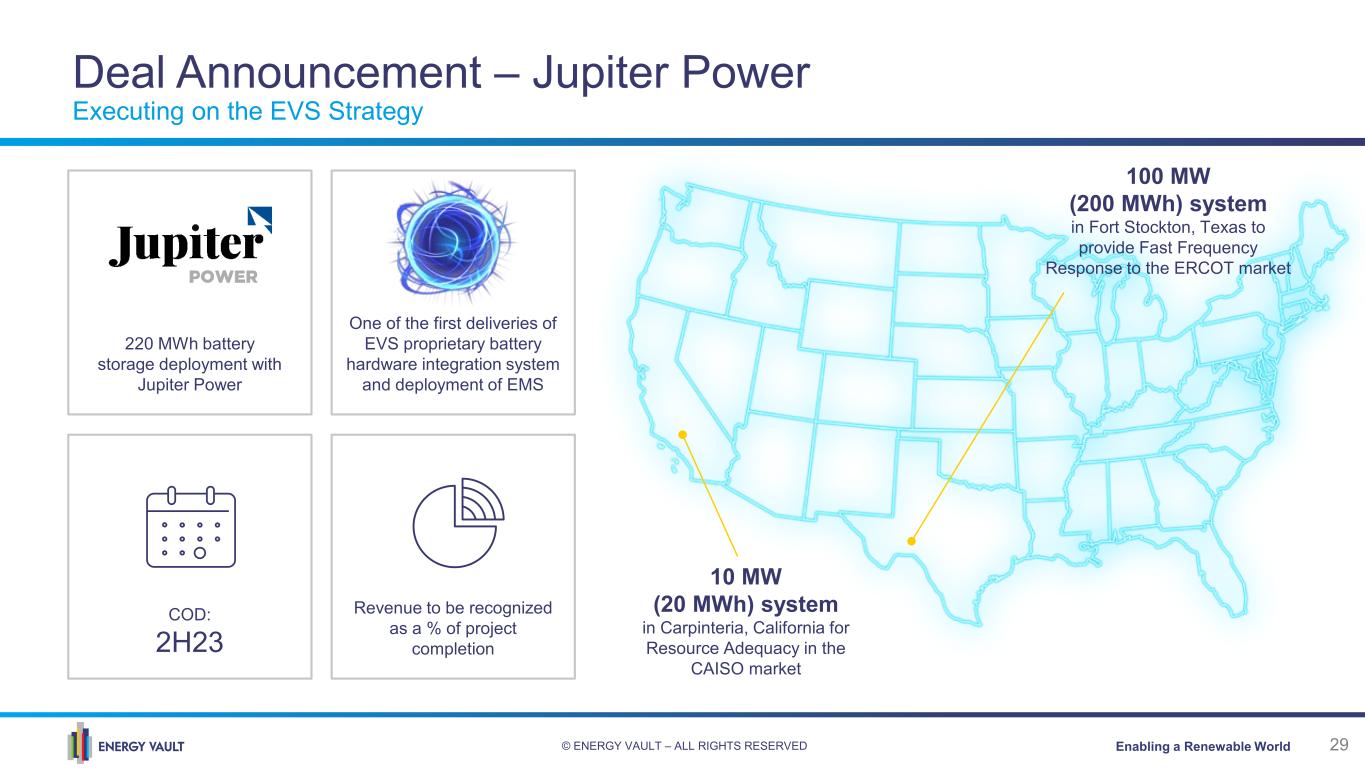

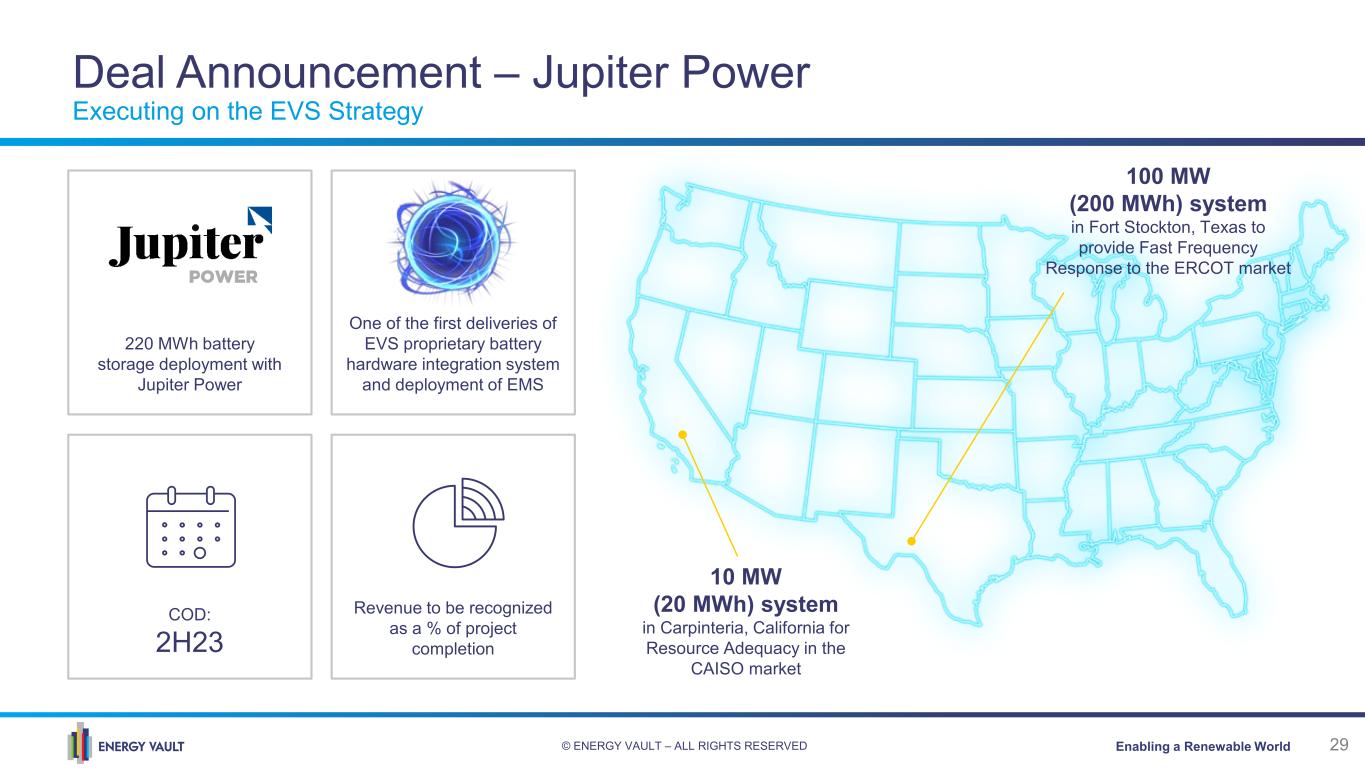

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 29 220 MWh battery storage deployment with Jupiter Power Deal Announcement – Jupiter Power Executing on the EVS Strategy COD: 2H23 One of the first deliveries of EVS proprietary battery hardware integration system and deployment of EMS Revenue to be recognized as a % of project completion 10 MW (20 MWh) system in Carpinteria, California for Resource Adequacy in the CAISO market 100 MW (200 MWh) system in Fort Stockton, Texas to provide Fast Frequency Response to the ERCOT market

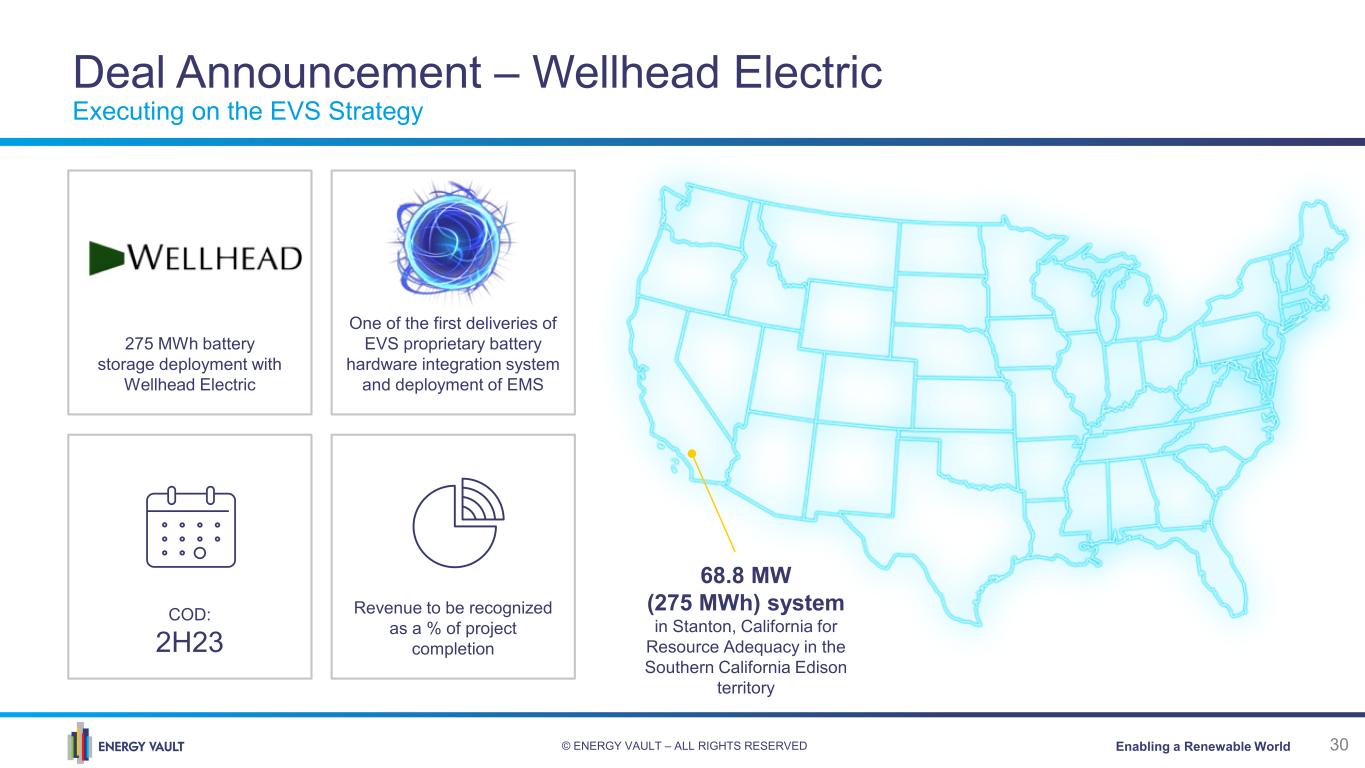

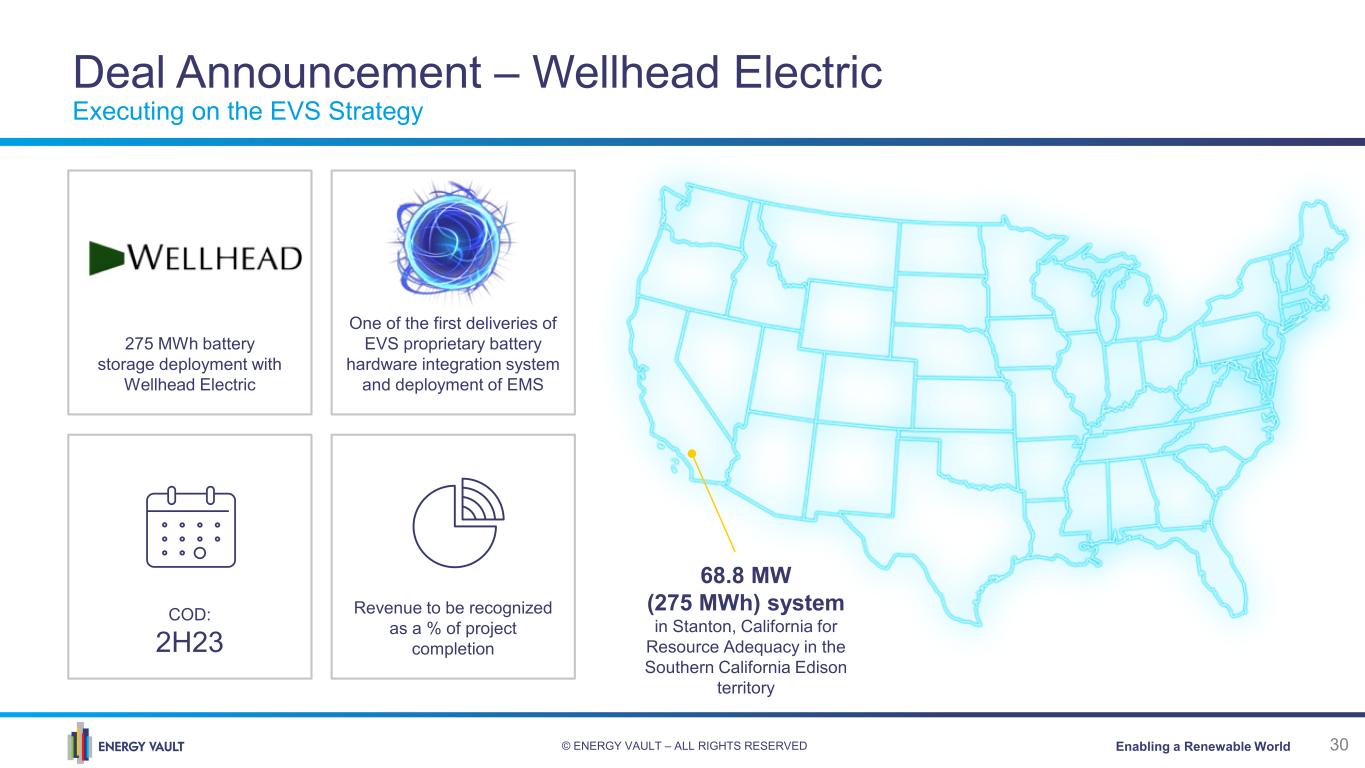

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 30 275 MWh battery storage deployment with Wellhead Electric Deal Announcement – Wellhead Electric Executing on the EVS Strategy COD: 2H23 One of the first deliveries of EVS proprietary battery hardware integration system and deployment of EMS Revenue to be recognized as a % of project completion 68.8 MW (275 MWh) system in Stanton, California for Resource Adequacy in the Southern California Edison territory

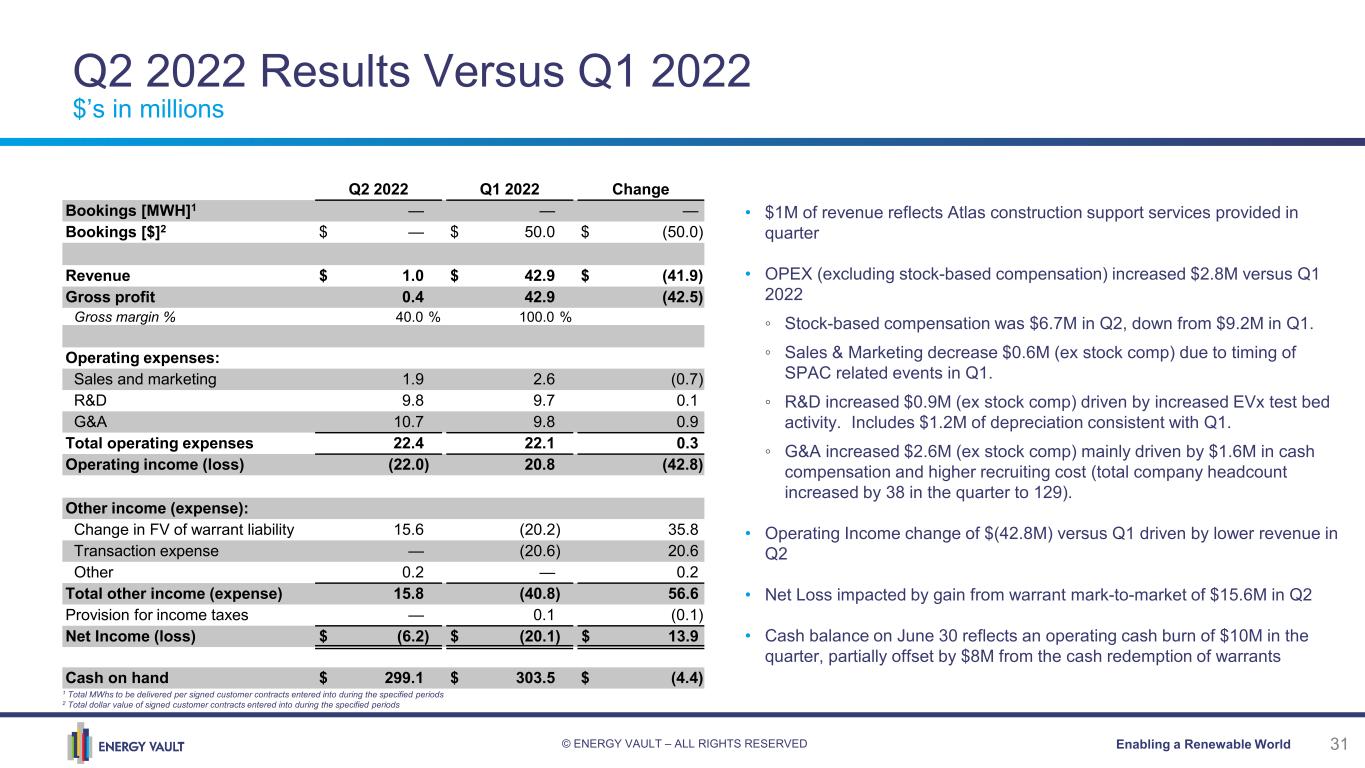

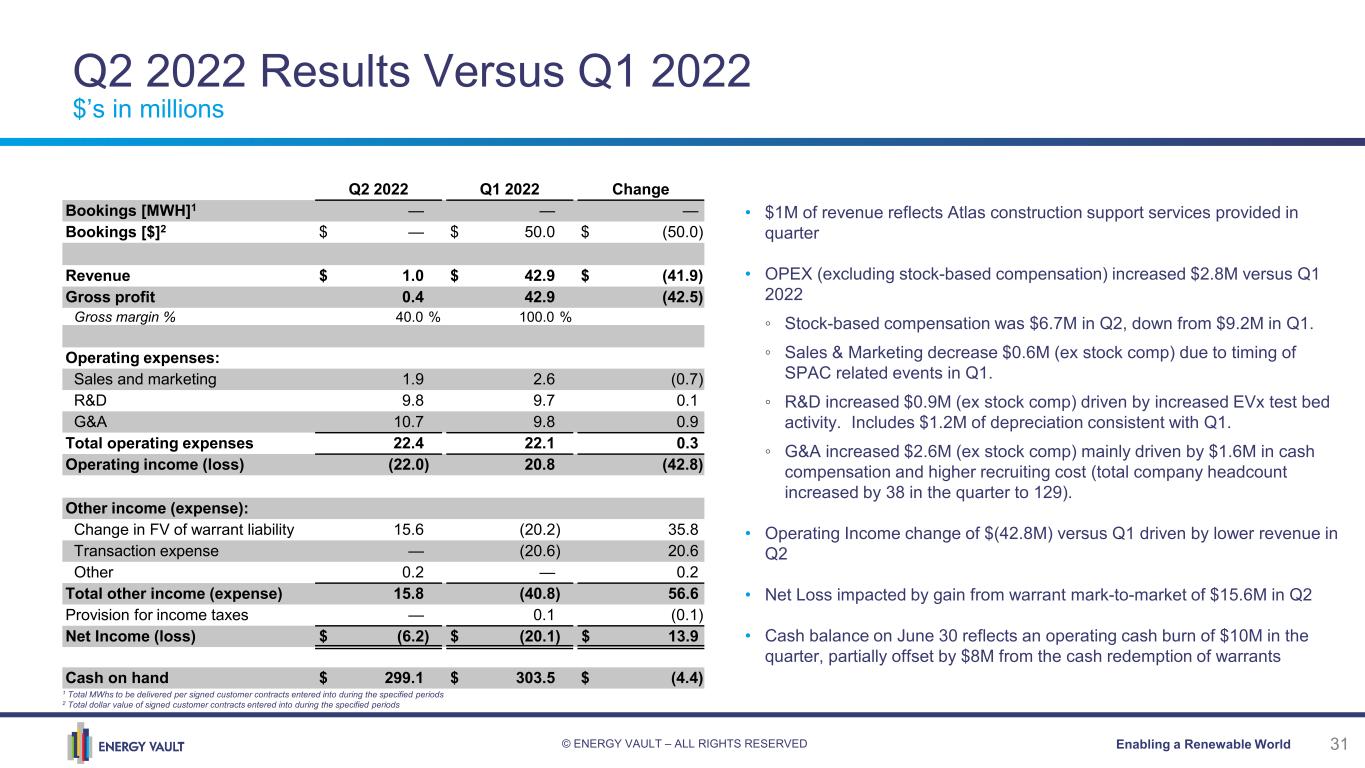

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 31 Q2 2022 Results Versus Q1 2022 $’s in millions • $1M of revenue reflects Atlas construction support services provided in quarter • OPEX (excluding stock-based compensation) increased $2.8M versus Q1 2022 ◦ Stock-based compensation was $6.7M in Q2, down from $9.2M in Q1. ◦ Sales & Marketing decrease $0.6M (ex stock comp) due to timing of SPAC related events in Q1. ◦ R&D increased $0.9M (ex stock comp) driven by increased EVx test bed activity. Includes $1.2M of depreciation consistent with Q1. ◦ G&A increased $2.6M (ex stock comp) mainly driven by $1.6M in cash compensation and higher recruiting cost (total company headcount increased by 38 in the quarter to 129). • Operating Income change of $(42.8M) versus Q1 driven by lower revenue in Q2 • Net Loss impacted by gain from warrant mark-to-market of $15.6M in Q2 • Cash balance on June 30 reflects an operating cash burn of $10M in the quarter, partially offset by $8M from the cash redemption of warrants Q2 2022 Q1 2022 Change Bookings [MWH]1 — — — Bookings [$]2 $ — $ 50.0 $ (50.0) Revenue $ 1.0 $ 42.9 $ (41.9) Gross profit 0.4 42.9 (42.5) Gross margin % 40.0 % 100.0 % Operating expenses: Sales and marketing 1.9 2.6 (0.7) R&D 9.8 9.7 0.1 G&A 10.7 9.8 0.9 Total operating expenses 22.4 22.1 0.3 Operating income (loss) (22.0) 20.8 (42.8) Other income (expense): Change in FV of warrant liability 15.6 (20.2) 35.8 Transaction expense — (20.6) 20.6 Other 0.2 — 0.2 Total other income (expense) 15.8 (40.8) 56.6 Provision for income taxes — 0.1 (0.1) Net Income (loss) $ (6.2) $ (20.1) $ 13.9 Cash on hand $ 299.1 $ 303.5 $ (4.4) 1 Total MWhs to be delivered per signed customer contracts entered into during the specified periods 2 Total dollar value of signed customer contracts entered into during the specified periods

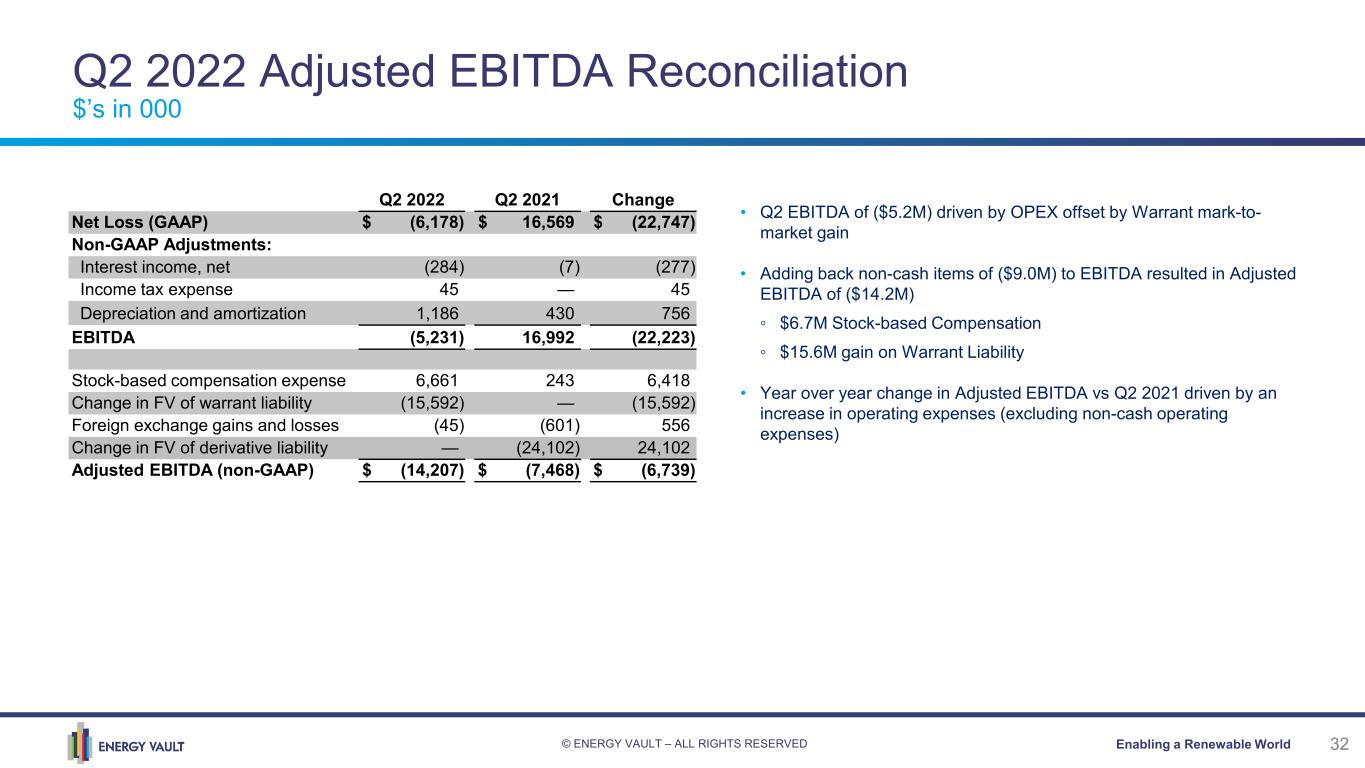

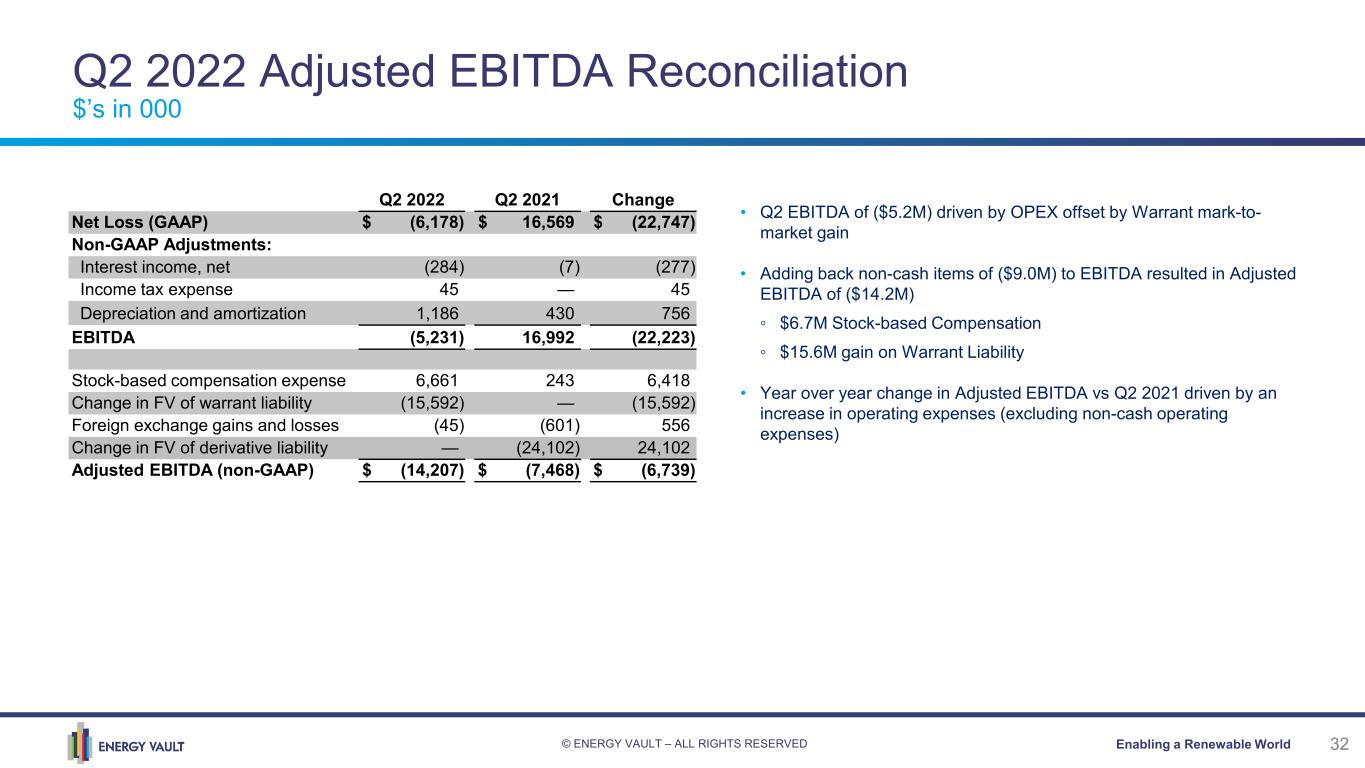

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 32 Q2 2022 Adjusted EBITDA Reconciliation $’s in 000 • Q2 EBITDA of ($5.2M) driven by OPEX offset by Warrant mark-to- market gain • Adding back non-cash items of ($9.0M) to EBITDA resulted in Adjusted EBITDA of ($14.2M) ◦ $6.7M Stock-based Compensation ◦ $15.6M gain on Warrant Liability • Year over year change in Adjusted EBITDA vs Q2 2021 driven by an increase in operating expenses (excluding non-cash operating expenses) Q2 2022 Q2 2021 Change Net Loss (GAAP) $ (6,178) $ 16,569 $ (22,747) Non-GAAP Adjustments: Interest income, net (284) (7) (277) Income tax expense 45 — 45 Depreciation and amortization 1,186 430 756 EBITDA (5,231) 16,992 (22,223) Stock-based compensation expense 6,661 243 6,418 Change in FV of warrant liability (15,592) — (15,592) Foreign exchange gains and losses (45) (601) 556 Change in FV of derivative liability — (24,102) 24,102 Adjusted EBITDA (non-GAAP) $ (14,207) $ (7,468) $ (6,739)

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 33 Q2 YTD Adjusted EBITDA Reconciliation $’s in 000 • YTD EBITDA of ($24.0M) driven by the change in fair value of our warranty liability, transaction costs from our IPO, and stock-based compensation mainly driven by the acceleration of stock awards because of the IPO event and Q2 IPO grants • Adding back non-cash and nonrecurring expenses of $41M to EBITDA results in Adjusted EBITDA of $17M on a YTD basis ◦ Stock Comp $15.9M ◦ Warrant Liability $4.6M ◦ Transaction Costs $20.6M YTD 2022 YTD 2021 Change Net Loss (GAAP) $ (26,257) $ (12,426) $ (13,831) Non-GAAP Adjustments: Interest income, net (331) (15) (316) Income tax expense 173 — 173 Depreciation and amortization 2,404 447 1,957 EBITDA (24,011) (11,994) (12,017) Stock-based compensation expense 15,863 250 15,613 Change in FV of warrant liability 4,645 — 4,645 Transaction costs 20,586 — 20,586 Foreign exchange gains and losses (56) 1,339 (1,395) Adjusted EBITDA (non-GAAP) $ 17,027 $ (10,405) $ 27,432

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 34 Appendix

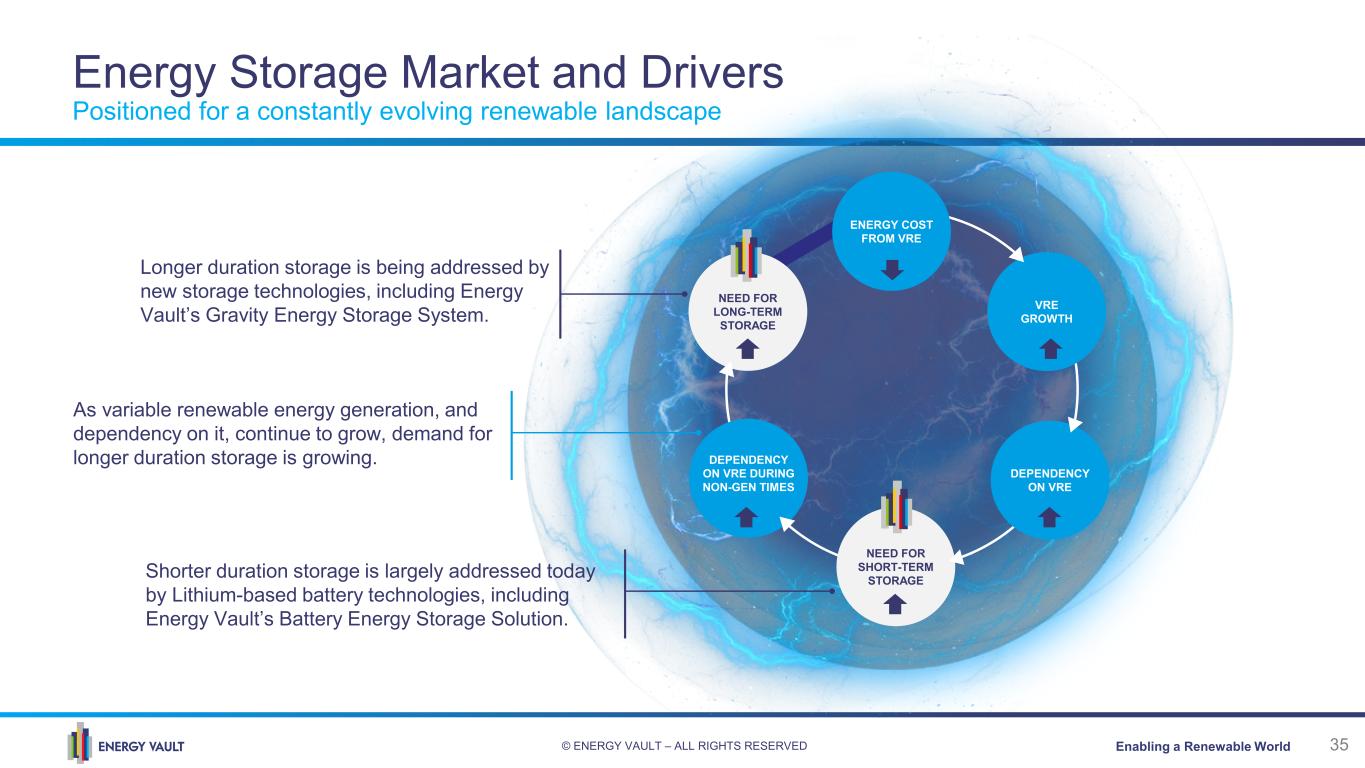

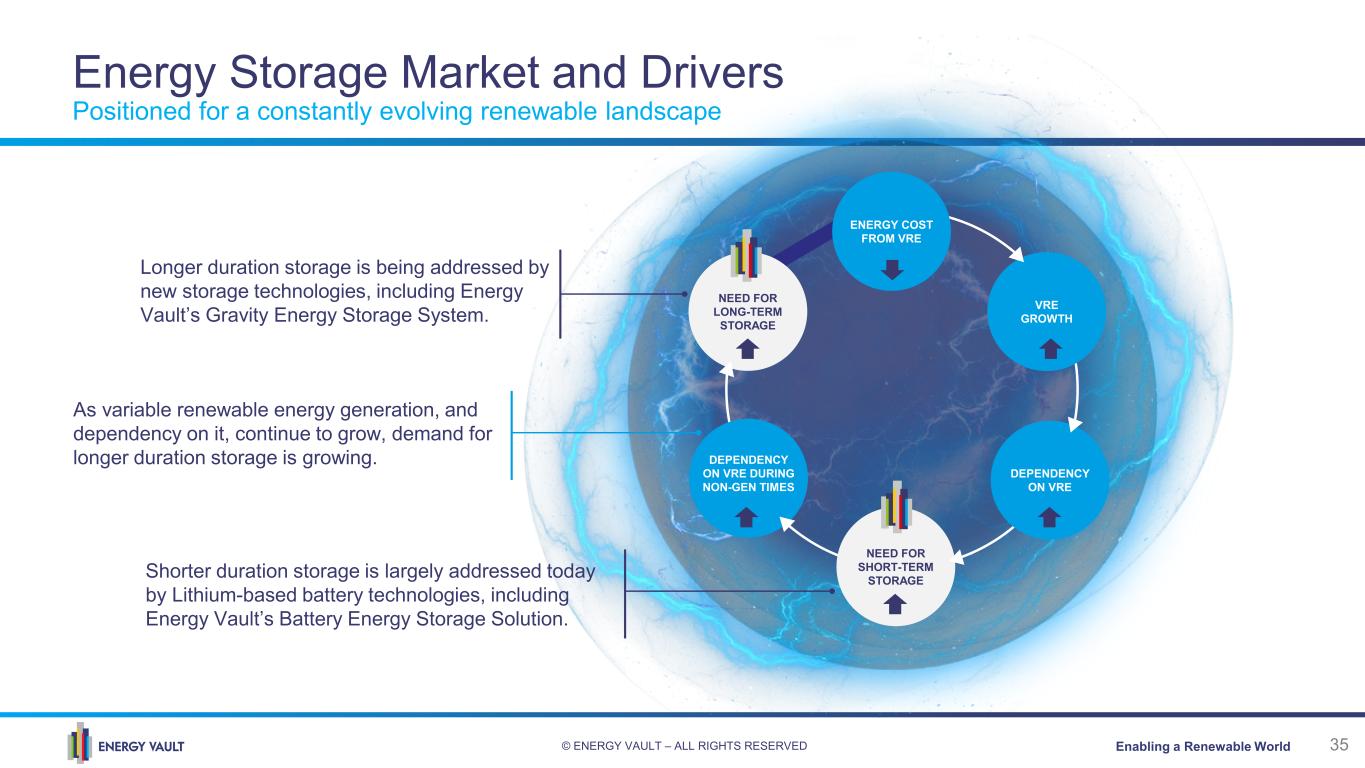

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 35 NEED FOR LONG-TERM STORAGE ENERGY COST FROM VRE VRE GROWTH DEPENDENCY ON VRE NEED FOR SHORT-TERM STORAGE DEPENDENCY ON VRE DURING NON-GEN TIMES Energy Storage Market and Drivers Positioned for a constantly evolving renewable landscape Longer duration storage is being addressed by new storage technologies, including Energy Vault’s Gravity Energy Storage System. As variable renewable energy generation, and dependency on it, continue to grow, demand for longer duration storage is growing. Shorter duration storage is largely addressed today by Lithium-based battery technologies, including Energy Vault’s Battery Energy Storage Solution.

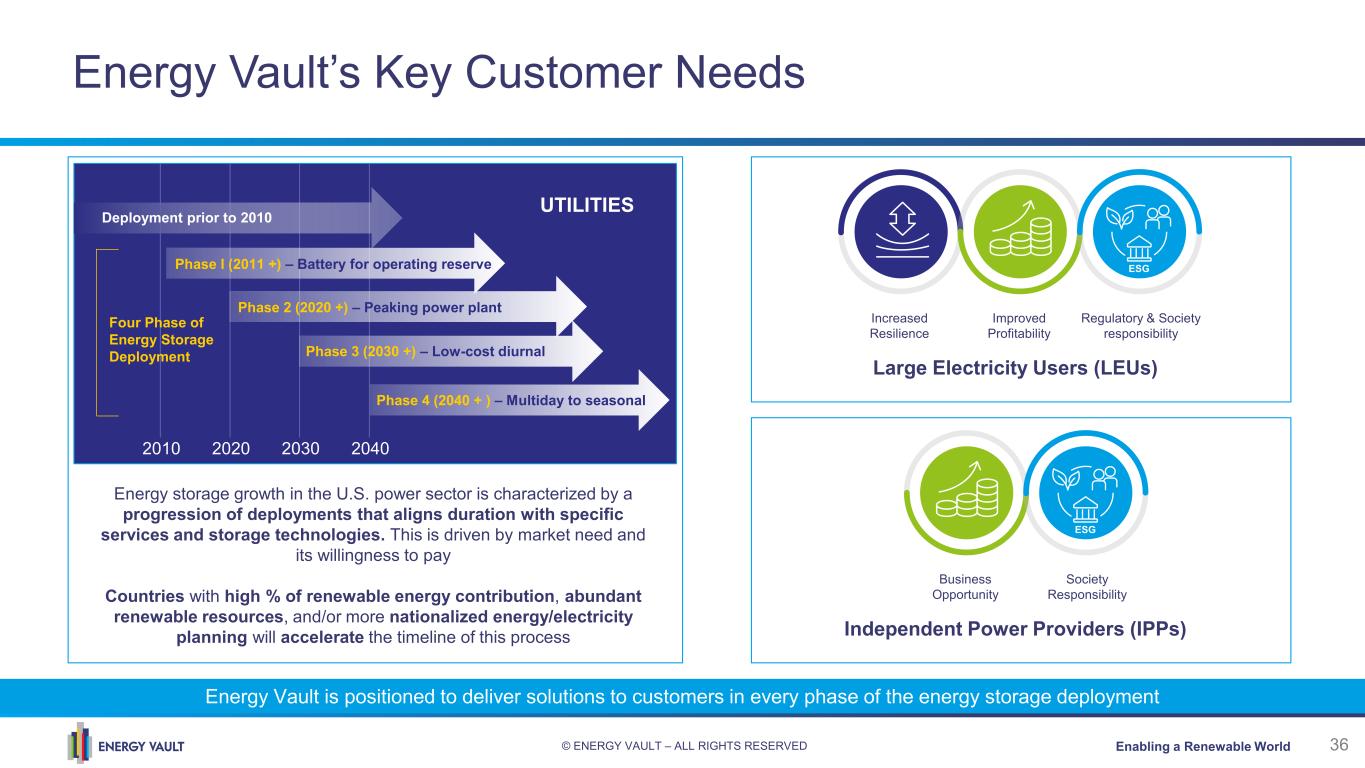

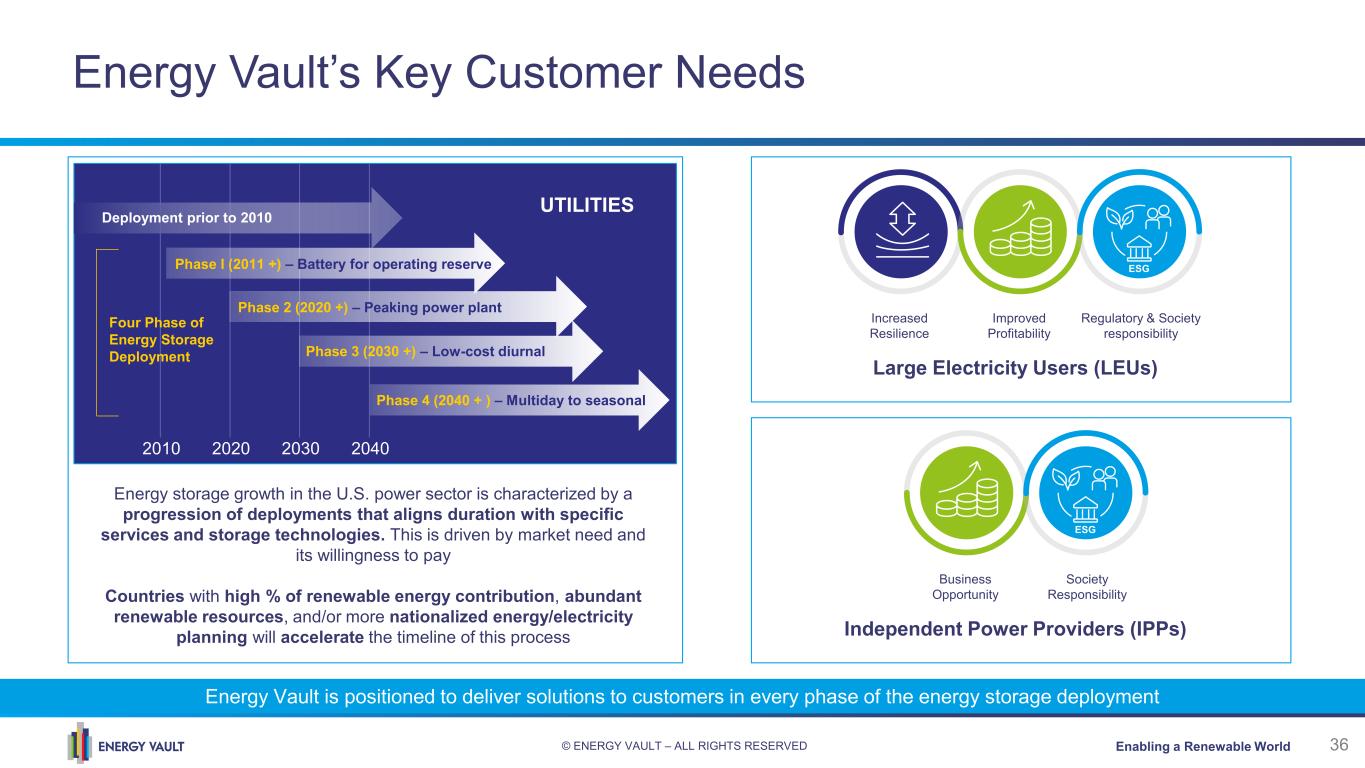

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 36 Energy Vault’s Key Customer Needs Energy storage growth in the U.S. power sector is characterized by a progression of deployments that aligns duration with specific services and storage technologies. This is driven by market need and its willingness to pay Countries with high % of renewable energy contribution, abundant renewable resources, and/or more nationalized energy/electricity planning will accelerate the timeline of this process 2010 2020 2030 2040 Deployment prior to 2010 Phase I (2011 +) – Battery for operating reserve Phase 3 (2030 +) – Low-cost diurnal Phase 4 (2040 + ) – Multiday to seasonal UTILITIES Phase 2 (2020 +) – Peaking power plant Four Phase of Energy Storage Deployment Increased Resilience Large Electricity Users (LEUs) Improved Profitability Regulatory & Society responsibility ESG Independent Power Providers (IPPs) Business Opportunity Society Responsibility ESG Energy Vault is positioned to deliver solutions to customers in every phase of the energy storage deployment

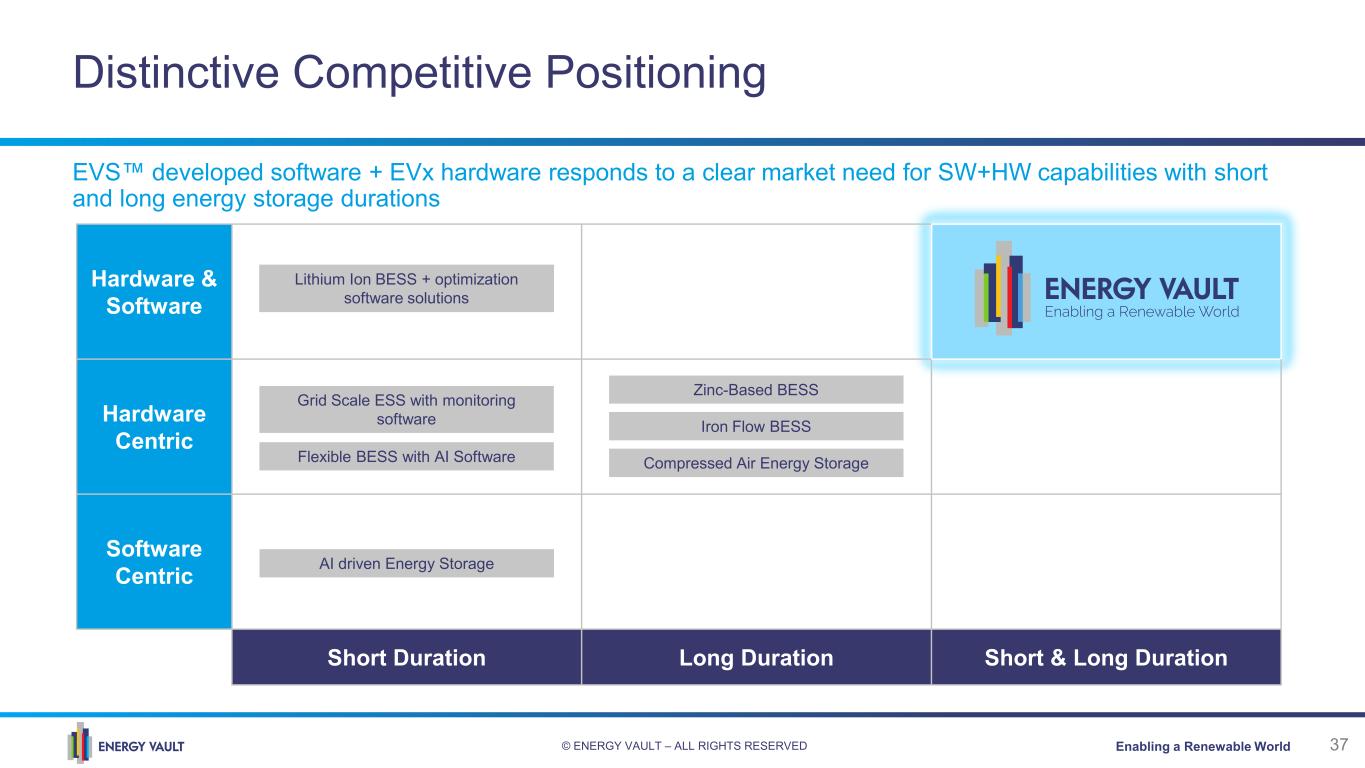

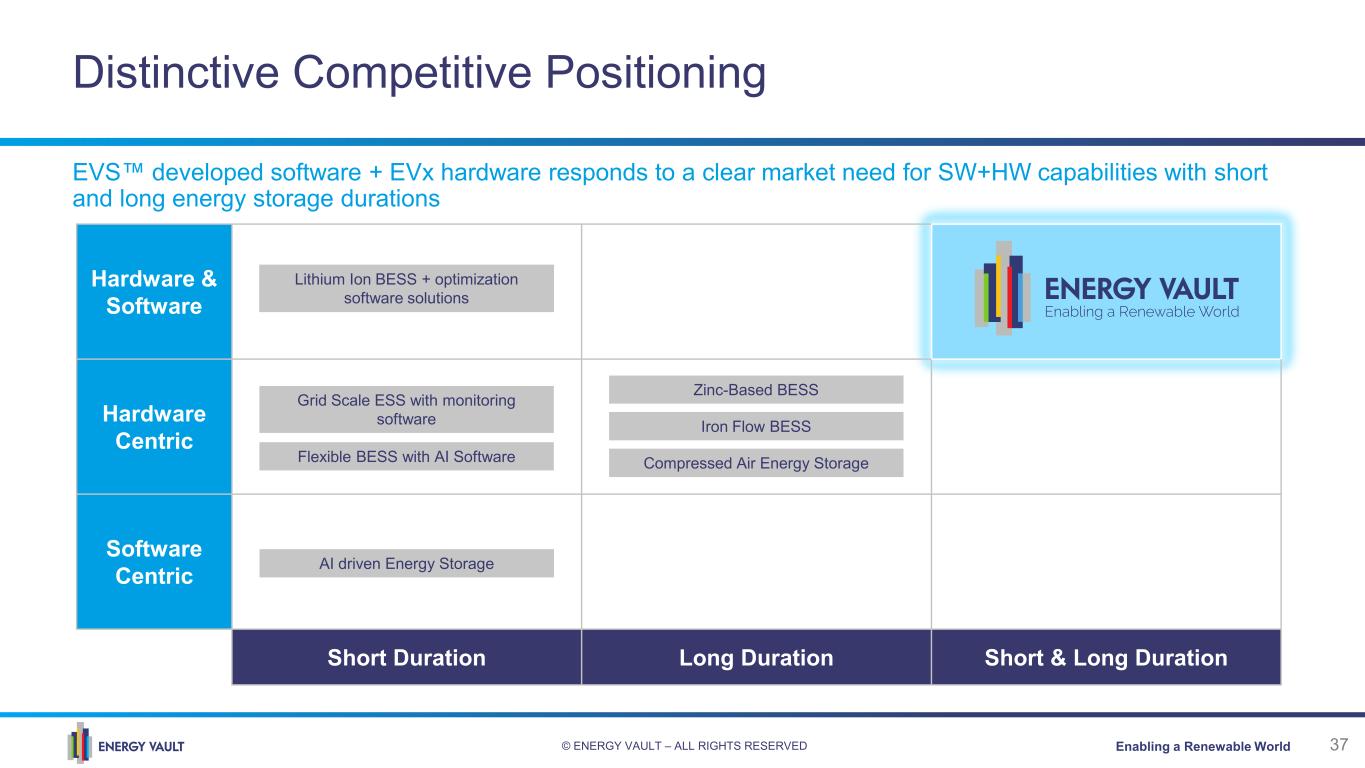

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 37 Distinctive Competitive Positioning EVS™ developed software + EVx hardware responds to a clear market need for SW+HW capabilities with short and long energy storage durations Hardware & Software Hardware Centric Software Centric Short Duration Long Duration Short & Long Duration C AP AB IL IT IE S Lithium Ion BESS + optimization software solutions Grid Scale ESS with monitoring software Flexible BESS with AI Software AI driven Energy Storage Zinc-Based BESS Iron Flow BESS Compressed Air Energy Storage

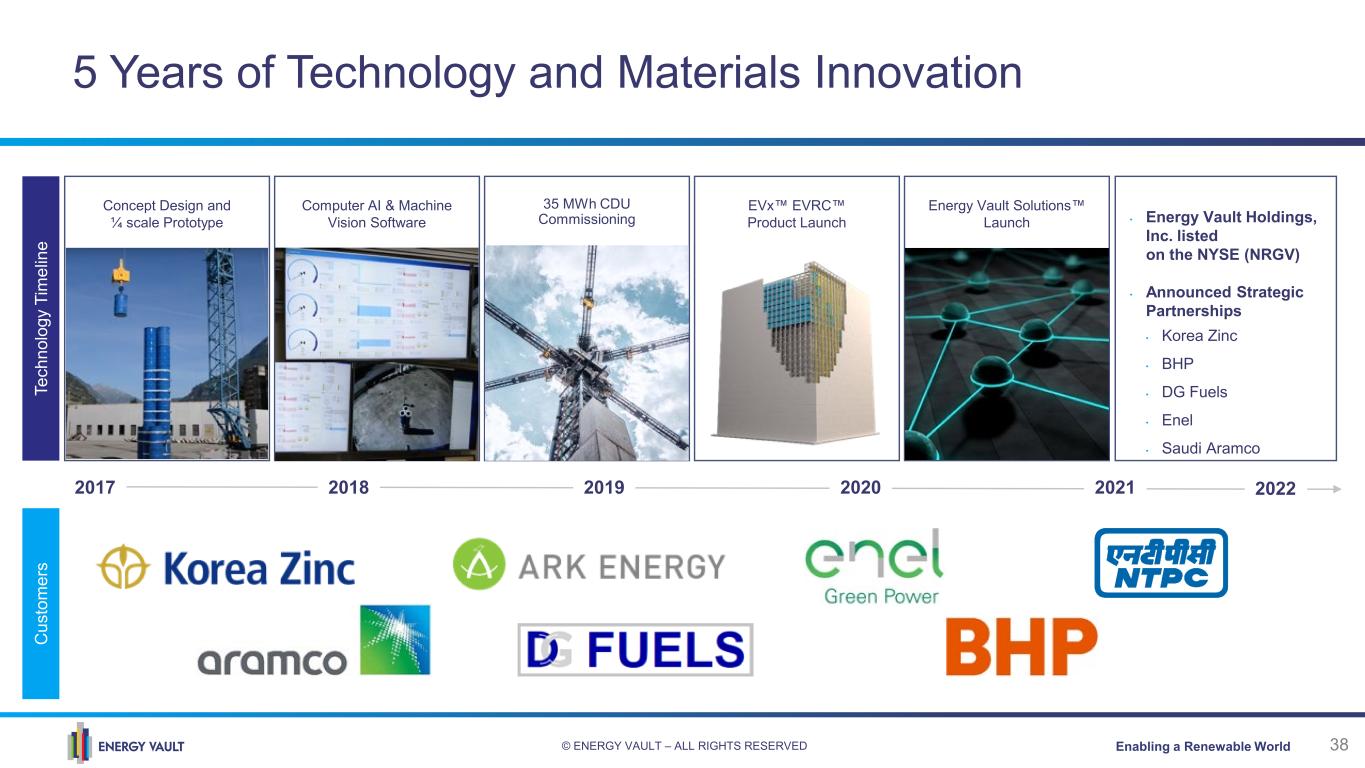

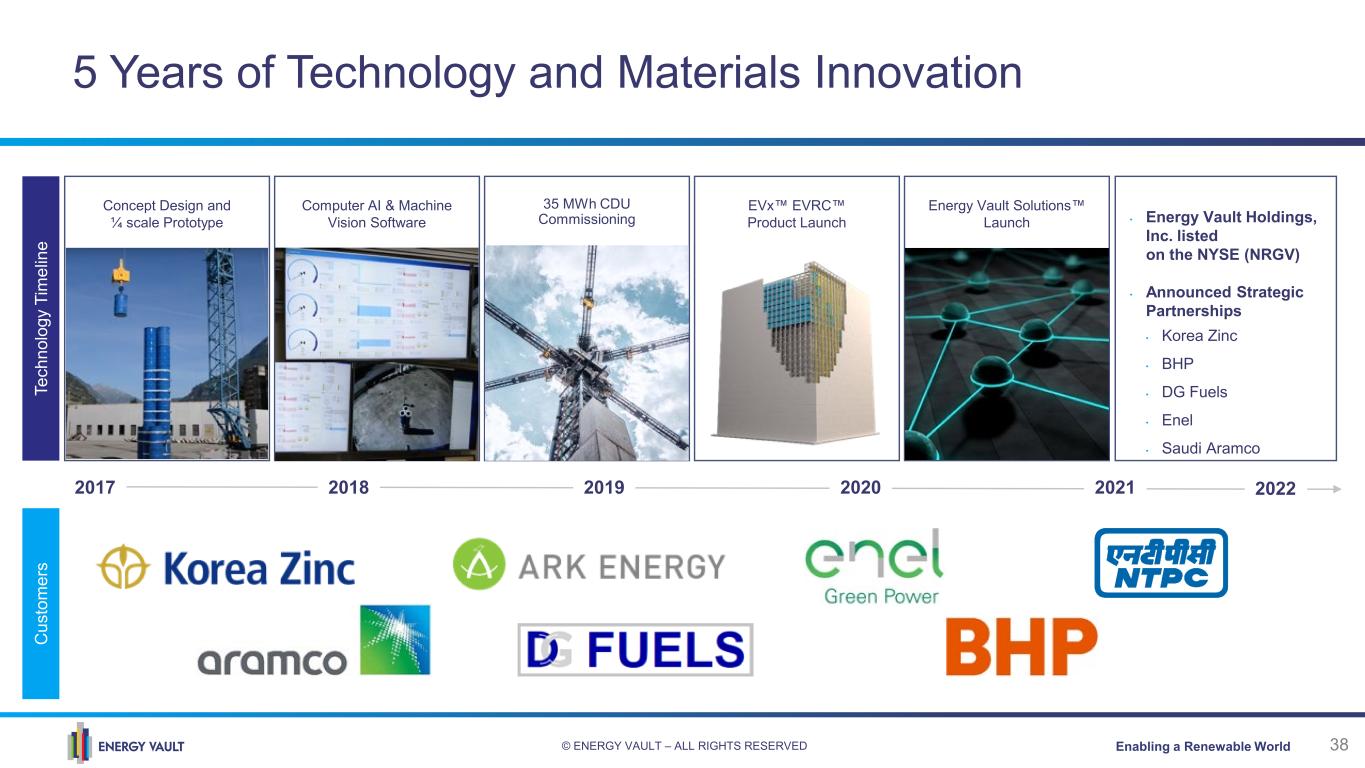

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 38 5 Years of Technology and Materials Innovation 2017 2018 2019 2020 2021 Computer AI & Machine Vision Software Concept Design and ¼ scale Prototype Te ch no lo gy T im el in e EVx™ EVRC™ Product Launch 35 MWh CDU Commissioning Grid-Connected July 2020 Energy Vault Solutions™ Launch 2022 C us to m er s • Energy Vault Holdings, Inc. listed on the NYSE (NRGV) • Announced Strategic Partnerships • Korea Zinc • BHP • DG Fuels • Enel • Saudi Aramco

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 39 Patent Portfolio and Key Intellectual Property Overview Energy Vault has taken a deliberate and thoughtful approach to protecting its IP and trade secrets Our patents and pending patent applications provide a competitive advantage over competitors and protect certain key elements of our technologies Structural engineering study completed Patents protect visible components, AI software kept as proprietary trade secret 20 Pending¹ patents, 18 of which are international 4 Issued patents in the US ¹ Includes 1 allowed patent. Patents focus on four primary aspects of our technology and process: 2 1 4 EVx System EV 1 System 1 3 2 4 1 Using blocks to store energy 2 Generating electricity by lowering the blocks 3 Grabbing mechanism and method for lifting and lowering blocks 4 Damped self-centering mechanism

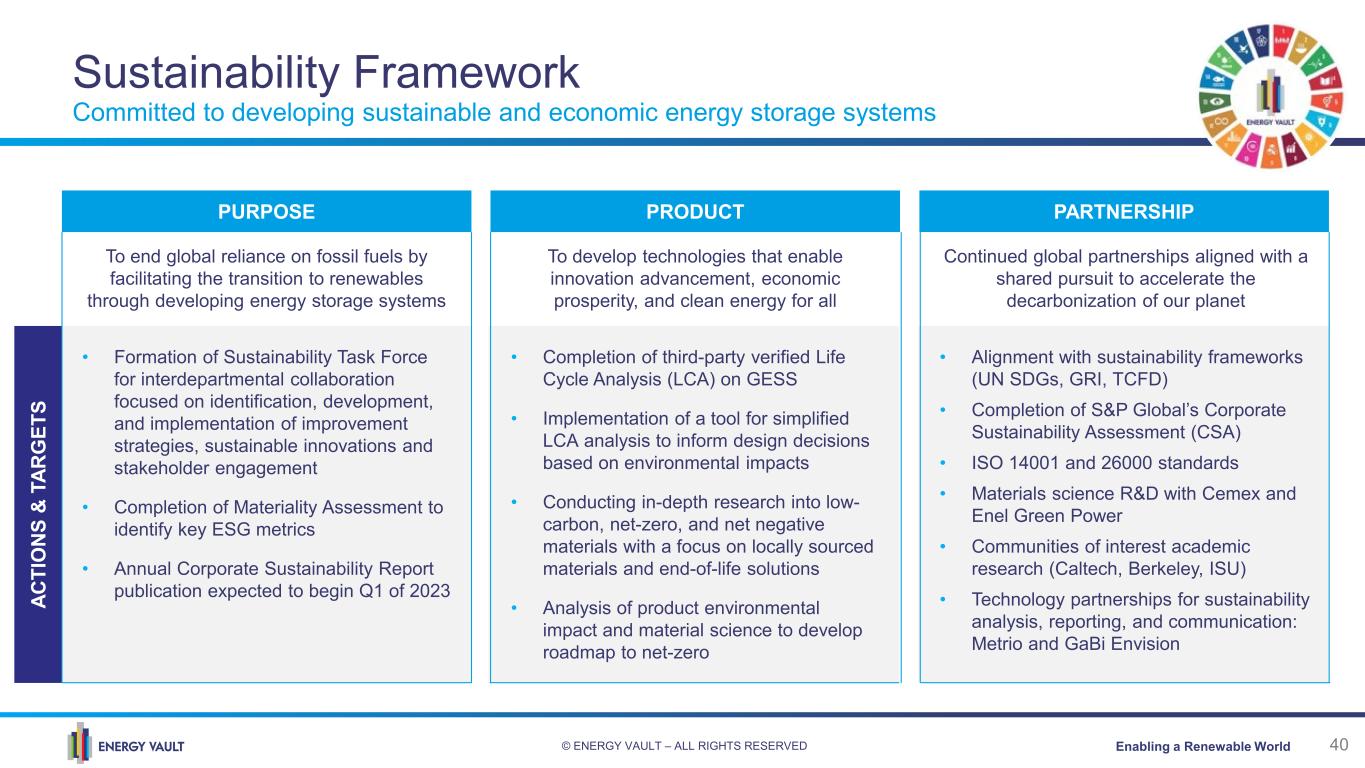

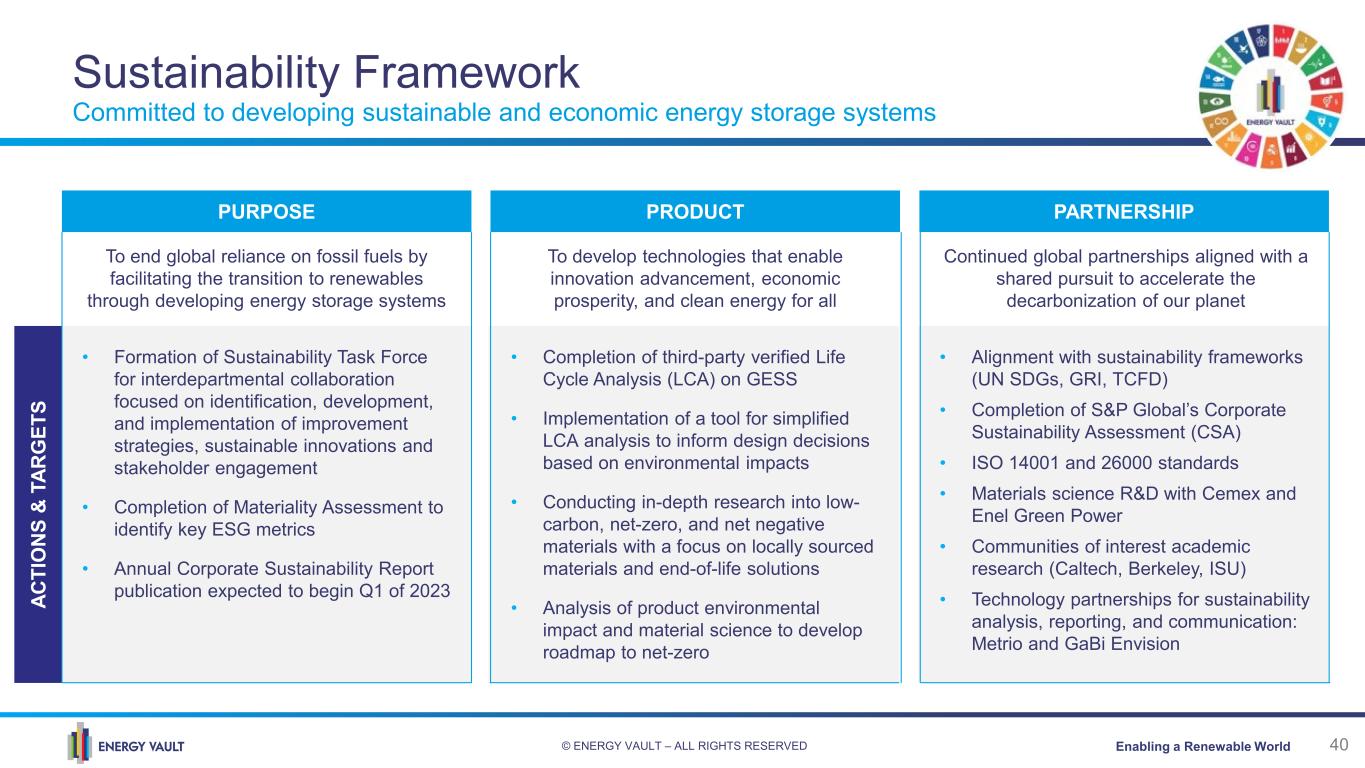

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 40 Sustainability Framework Committed to developing sustainable and economic energy storage systems To end global reliance on fossil fuels by facilitating the transition to renewables through developing energy storage systems • Formation of Sustainability Task Force for interdepartmental collaboration focused on identification, development, and implementation of improvement strategies, sustainable innovations and stakeholder engagement • Completion of Materiality Assessment to identify key ESG metrics • Annual Corporate Sustainability Report publication expected to begin Q1 of 2023 Continued global partnerships aligned with a shared pursuit to accelerate the decarbonization of our planet • Alignment with sustainability frameworks (UN SDGs, GRI, TCFD) • Completion of S&P Global’s Corporate Sustainability Assessment (CSA) • ISO 14001 and 26000 standards • Materials science R&D with Cemex and Enel Green Power • Communities of interest academic research (Caltech, Berkeley, ISU) • Technology partnerships for sustainability analysis, reporting, and communication: Metrio and GaBi Envision To develop technologies that enable innovation advancement, economic prosperity, and clean energy for all • Completion of third-party verified Life Cycle Analysis (LCA) on GESS • Implementation of a tool for simplified LCA analysis to inform design decisions based on environmental impacts • Conducting in-depth research into low- carbon, net-zero, and net negative materials with a focus on locally sourced materials and end-of-life solutions • Analysis of product environmental impact and material science to develop roadmap to net-zero PURPOSE PRODUCT PARTNERSHIP AC TI O N S & T AR G ET S

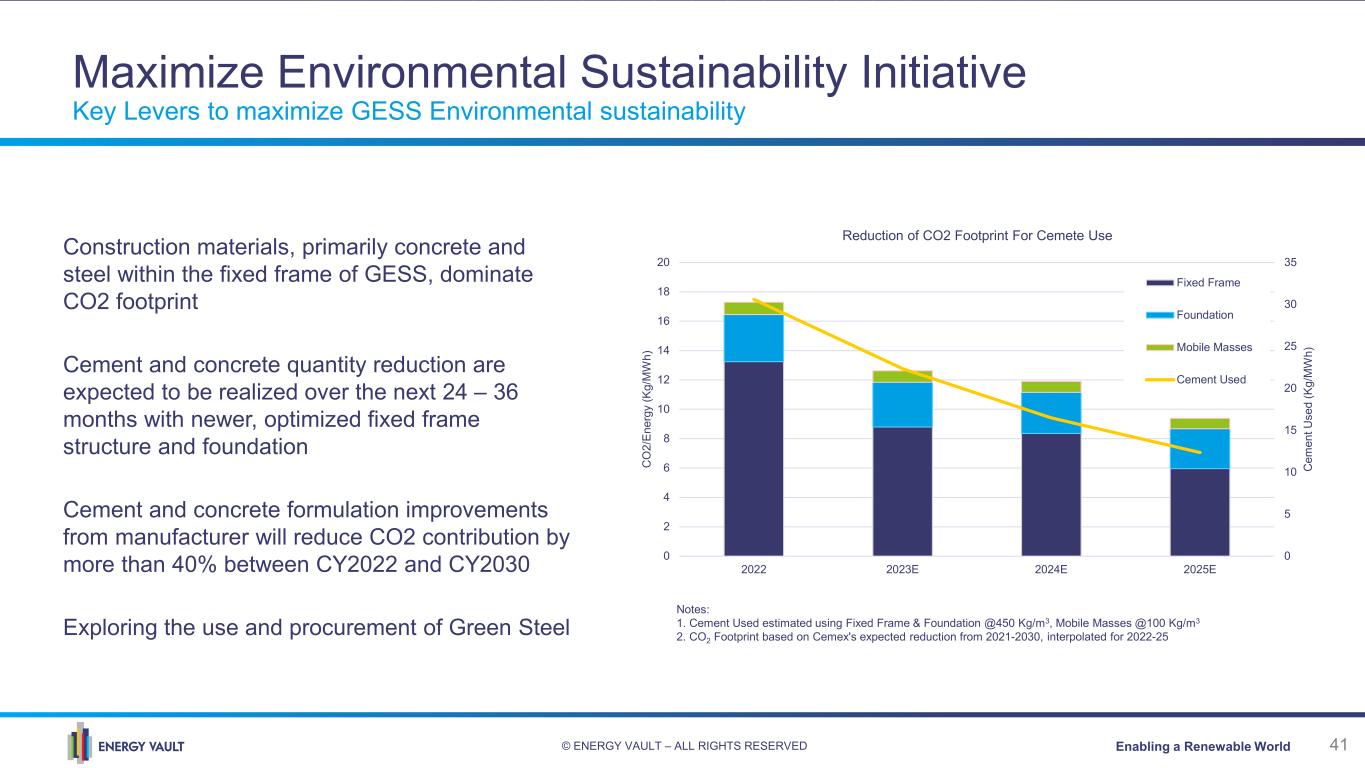

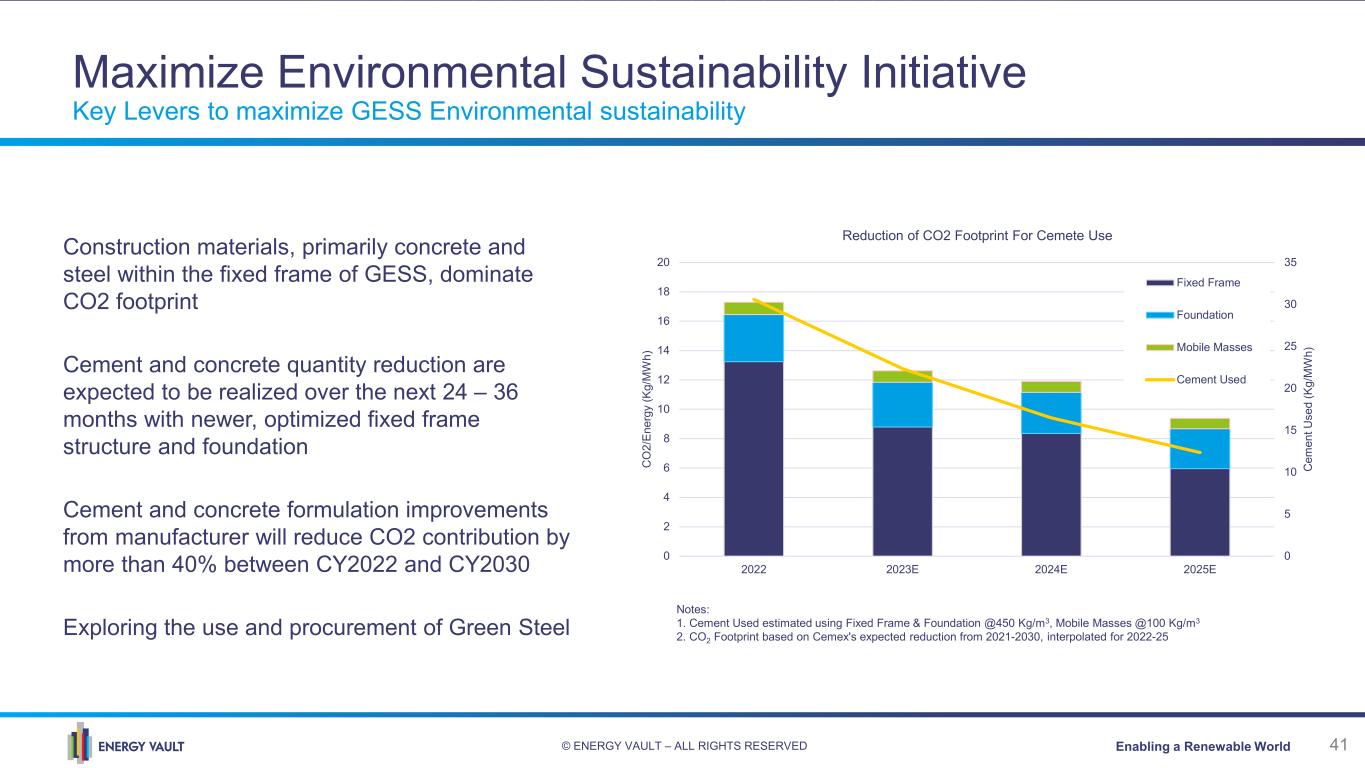

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 41 Maximize Environmental Sustainability Initiative Key Levers to maximize GESS Environmental sustainability Construction materials, primarily concrete and steel within the fixed frame of GESS, dominate CO2 footprint Cement and concrete quantity reduction are expected to be realized over the next 24 – 36 months with newer, optimized fixed frame structure and foundation Cement and concrete formulation improvements from manufacturer will reduce CO2 contribution by more than 40% between CY2022 and CY2030 Exploring the use and procurement of Green Steel 0 5 10 15 20 25 30 35 0 2 4 6 8 10 12 14 16 18 20 2022 2023E 2024E 2025E C em en t U se d (K g/ M W h) C O 2/ En er gy (K g/ M W h) Reduction of CO2 Footprint For Cemete Use Fixed Frame Foundation Mobile Masses Cement Used Notes: 1. Cement Used estimated using Fixed Frame & Foundation @450 Kg/m3, Mobile Masses @100 Kg/m3 2. CO2 Footprint based on Cemex's expected reduction from 2021-2030, interpolated for 2022-25

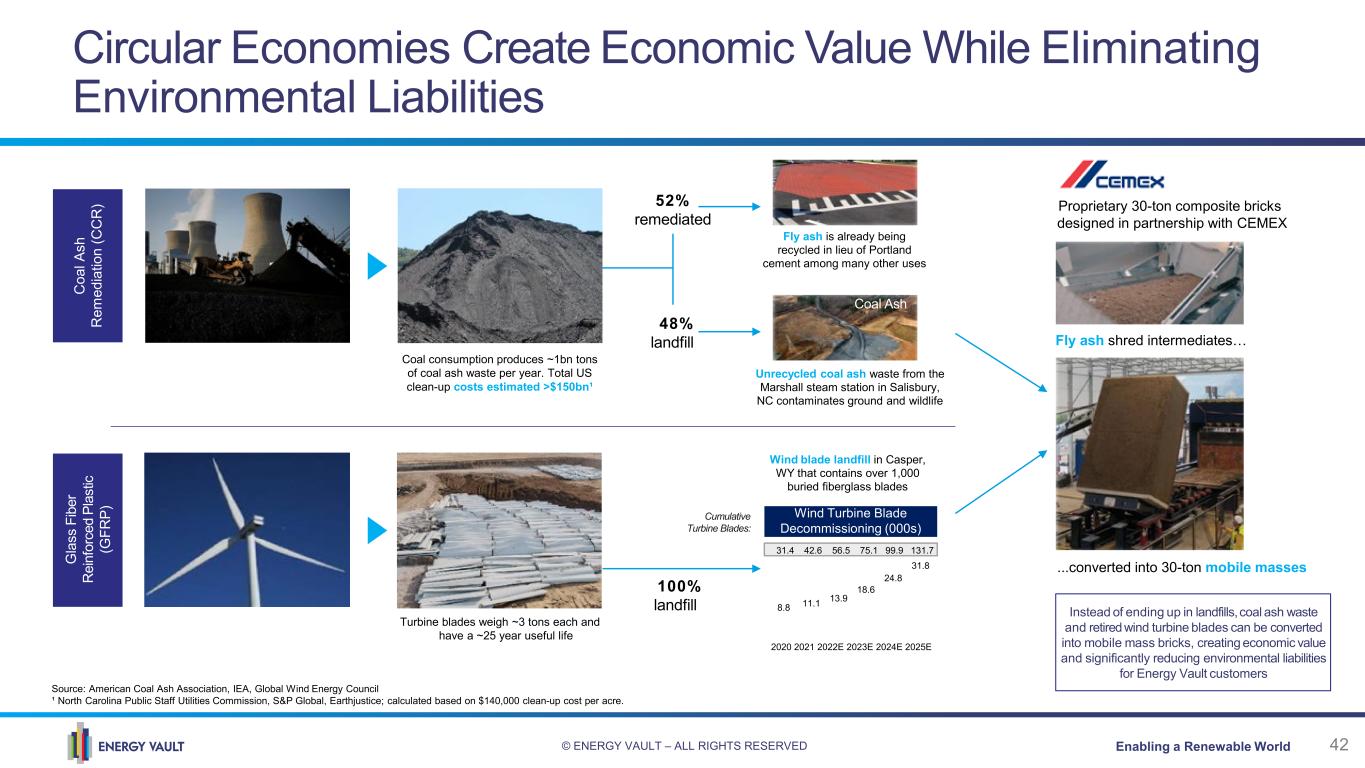

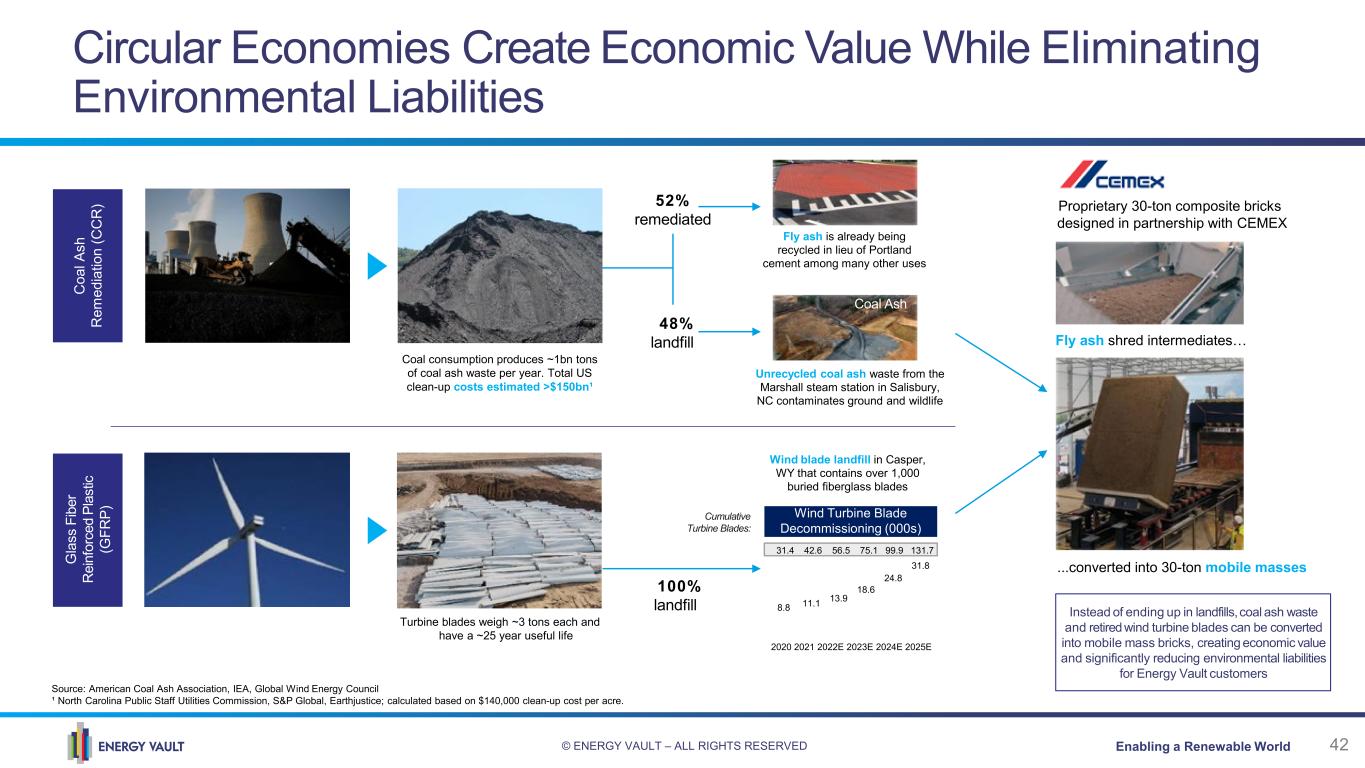

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 42 Circular Economies Create Economic Value While Eliminating Environmental Liabilities C oa l A sh R em ed ia tio n (C C R ) Unrecycled coal ash waste from the Marshall steam station in Salisbury, NC contaminates ground and wildlife Fly ash is already being recycled in lieu of Portland cement among many other uses 48% landfill 52% remediated Coal consumption produces ~1bn tons of coal ash waste per year. Total US clean-up costs estimated >$150bn¹ Turbine blades weigh ~3 tons each and have a ~25 year useful life Wind blade landfill in Casper, WY that contains over 1,000 buried fiberglass blades Wind Turbine Blade Decommissioning (000s) 8.8 11.1 13.9 18.6 31.8 24.8 31.4 42.6 56.5 75.1 99.9 131.7 2020 2021 2022E 2023E 2024E 2025E Cumulative Turbine Blades: Source: American Coal Ash Association, IEA, Global Wind Energy Council ¹ North Carolina Public Staff Utilities Commission, S&P Global, Earthjustice; calculated based on $140,000 clean-up cost per acre. Instead of ending up in landfills,coal ash waste and retiredwind turbine blades can be converted into mobile mass bricks, creating economic value and significantly reducing environmental liabilities for Energy Vault customers Proprietary 30-ton composite bricks designed in partnership with CEMEX Fly ash shred intermediates… ...converted into 30-ton mobile masses Coal Ash G la ss Fi be r R ei nf or ce d Pl as tic (G FR P) 100% landfill

© ENERGY VAULT – ALL RIGHTS RESERVED Enabling a Renewable World 43