UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 000-56421

ASIAFIN HOLDINGS CORP.

(Exact name of registrant issuer as specified in its charter)

| Nevada | 37-1950147 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Suite 30.02, 30th Floor, Menara KH (Promet), Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia.

Address of principal executive offices, including zip code

+(60)3 2148 7170

Registrant’s phone number, including area code

Securities registered pursuant to Section 12(b) of the Securities Exchange Act: None

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

N/A

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

N/A

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class | Outstanding at March 22, 2024 | |

| Common Stock, $0.0001 par value |

DOCUMENTS INCORPORATED BY REFERENCE

No documents are incorporated by reference.

ASIAFIN HOLDINGS CORP.

FORM 10-K

For the Fiscal Year Ended December 31, 2023

Index

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guarantee of future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; | |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; | |

| ● | Changes or developments in laws, regulations or taxes in our industry; | |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; | |

| ● | Competition in our industry; | |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; | |

| ● | Changes in our business strategy, capital improvements or development plans; | |

| ● | The availability of additional capital to support capital improvements and development; and | |

| ● | Other risks identified in this report and in our other filings with the Securities and Exchange Commission or the SEC. |

This report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this report are made as of the date of this report and should be evaluated with consideration of any changes occurring after the date of this Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this report to:

| ● | The “Company,” “we,” “us,” or “our,” “AsiaFIN” are references to AsiaFIN Holdings Corp., a Nevada corporation. | |

| ● | “Common Stock” refers to the common stock, par value $0.0001, of the Company; | |

| ● | “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

| 3 |

PART I

ITEM 1. BUSINESS

Corporate History

AsiaFIN Holdings Corp., a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on June 14, 2019.

On June 14, 2019, Mr. Wong Kai Cheong was appointed Chief Executive Officer, President, Secretary, Treasurer and Director.

On September 18, 2020, Mr. Seah Kok Wah was appointed Director of the Company.

On December 18, 2019, we, “the Company” acquired 100% of the equity interests of AsiaFIN Holdings Corp. (herein referred to as the “Malaysia Company”), a private limited company incorporated in Labuan, Malaysia. In consideration of the equity interests of AsiaFIN Holdings Corp., our Chief Executive Officer, Mr. Wong was compensated $1 HKD.

On December 23, 2019, AsiaFIN Holdings Corp., Malaysia Company acquired AsiaFIN Holdings Limited (herein referred to as the “Hong Kong Company”), a private limited company incorporated in Hong Kong. In consideration of the equity interests of AsiaFIN Holdings Limited, our Chief Executive Officer, Mr. Wong was compensated $1 HKD.

On December 22, 2022, AsiaFIN Holdings Corp. executed an Acquisition Agreement (herein referred to as the “Agreement”) with StarFIN Holdings Limited. (herein referred to as “SFHL”), a private limited company organized under the laws of British Virgin Islands, and the shareholders of SFHL. Pursuant to the Agreement, the Company purchased 10,000 shares of SFHL (herein referred to as the “SFHL Shares”), representing all of the issued and outstanding shares of common stock of SFHL. As consideration, the Company agreed to issue to the shareholders of SFHL 8,232,038 shares of our common stock, at a value of $1.10 per share, for an aggregate value of $9,055,242. We consummated the acquisition of SFHL on February 23, 2023.

Our Chief Executive Officer, President, Director, Secretary and Treasurer, Mr. Wong Kai Cheong is also the director of SFHL. Mr. Wong Kai Cheong holds 29.94% of our issued and outstanding securities and 57.10% of the issued and outstanding securities of SFHL. Hoo Swee Ping, the director of SFHL, holds 10.91% of our issued and outstanding securities and 40.22% of the issued and outstanding securities of SFHL. Cham Hui Yin, our Finance Manager, holds 0.48% of the issued and outstanding securities of SFHL. Upon the consummation of the acquisition, Mr. Wong Kai Cheong, Hoo Swee Ping and Cham Hui Yin received 8,051,511 shares of our restricted common stock collectively.

Initially, the Company, through its subsidiaries is in the business of providing market research studies and consulting services to its client, which are primarily in the payment solution industry.

After the acquisition of SFHL on December 22, 2022, we have broadened our service offerings in the information technology industry such as providing payment processing solution, software solution on regulatory and financial reporting (RegTech), and Robotic Process Automation (RPA) software solution across Asia.

| 4 |

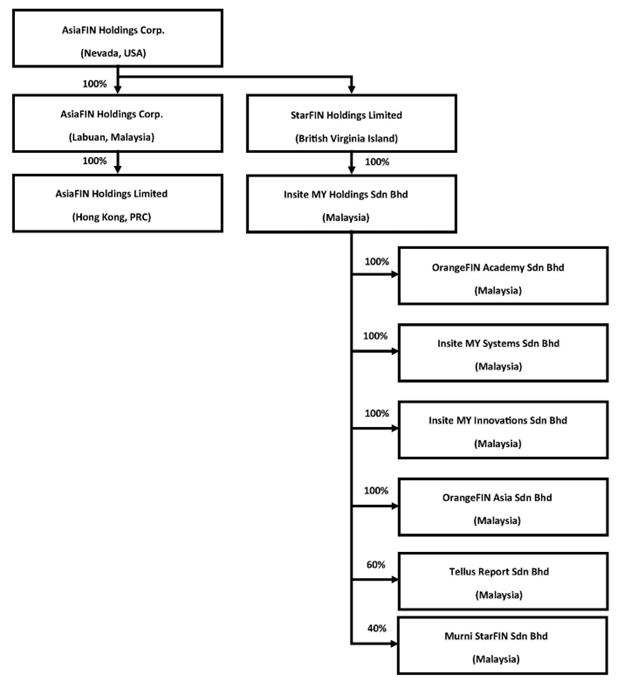

Details of the Company’s subsidiaries and associate:

| No. | Subsidiary Company Name | Domicile and Date of Incorporation | Particulars of Issued Capital | Principal Activities | ||||

| 1 | AsiaFIN Holdings Corp. | Labuan at July 15, 2019 | 1 shares of common stock | Investment holding company | ||||

| 2 | AsiaFIN Holdings Limited | Hong Kong at July 5, 2019 | 1 shares of common stock | Investment holding company | ||||

| 3 | StarFIN Holdings Limited | British Virgin Island at August 19, 2021 | 10,000 shares of common stock | Investment holding company | ||||

| 4 | Insite MY Holdings Sdn Bhd (FKA StarFIN Asia Sdn Bhd) | Malaysia at May 24, 2018 | 11,400,102 shares of common stock | Investment holding company | ||||

| 5 | OrangeFIN Academy Sdn Bhd (FKA Insite MY.Com Sdn Bhd) | Malaysia at February 2, 2000 | 100,000 shares of common stock | Provision of business system integration and management services | ||||

| ` | ||||||||

| 6 | Insite MY Systems Sdn Bhd | Malaysia at January 18, 2000 | 500,000 shares of common stock | Provision of information technology services | ||||

| 7 | Insite MY Innovations Sdn Bhd | Malaysia at January 18, 2010 | 540,000 shares of common stock | Provision of information technology services | ||||

| 8 | OrangeFIN Asia Sdn Bhd | Malaysia at January 25, 2018 | 50,000 shares of common stock | Provision of computer programming activities and services | ||||

| 9 | TellUS Report Sdn Bhd | Malaysia at September 22, 2023 | 60 shares of common stock | Provision of information technology services |

| No. | Associate Company Name | Domicile and Date of Incorporation | Particulars of Issued Capital | Principal Activities | ||||

| 1 | Murni StarFIN Sdn Bhd | Malaysia at September 9, 2022 | 100,000 shares of common stock | Provision of information technology services |

Mr. Wong Kai Cheong is the common director of all of aforementioned companies.

The Company’s executive office is located at Suite 30.02, 30th Floor, Menara KH (Promet), Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia.

| 5 |

Business Overview

AsiaFIN Holdings Corp. operates through its wholly owned subsidiaries by offering a range of system solutions in Payment Processing, Robotic Process Automation (RPA), and Regulatory Technology (RegTech) to financial institutions, regulatory agencies, professional service providers and private enterprises from various industries, with existing client in the Asia region. SFHL has over 60 key bank customers on payment processing and Regtech and our Robotic Process Automation solution company has more than 100 customers in Asia.

Payment Processing

We have our own web-based payment processing system for check clearing used in central banks, financial institutions and payment system providers. This image-based check truncation system (CTS) is similar to the one used in the United States of America, under the CHECK21 standards. Our CTS systems are sold in Malaysia, Singapore, Indonesia, Philippines, Myanmar, Thailand, Pakistan and Bangladesh.

We also have a ISO20022 compliant payment gateway solutions for central bank and financial institutions that is capable of supporting the Straight Through Processing (STP) of all types of payment transactions (including SWIFT, Real-Time Gross Settlement (RTGS), GIRO (NACHA standards) and FAST payment and extendable to interface with various types of payment gateways. Our STP payment gateway are sold in Malaysia, Myanmar and Indonesia.

RegTech

We have a regulatory and financial reporting (RegTech) system which conform to XBRL reporting standards and other compliance reporting required by Regulatory agencies such as Central Bank, Securities Commission, Tax Authority Department and Companies Registry. Our reporting platform covers financial statistic reporting, credit risk exposure and analysis, risk management reports, FATCA & CRS reporting, external sector reporting, Goods and Services Tax (GST) reporting for reporting entities. We have more than 20 financial institutions using our platform.

Additionally, the company plans to further develop a RegTech Software as a Service (SaaS) solution for public listed companies and financial institution for Environmental Social and Governance (ESG) compliant reporting. ESG guidelines have already been issued by Bank Negara Malaysia, the central bank of Malaysia and Bursa Malaysia Stock Exchange for their members in reducing carbon footprint.

Robotic Process Automation

We have our own Artificial Intelligent (AI) based, Robotic Process Automation Software (RPA) solutions for financial institutions, large corporations and small medium enterprises. RPA utilises software Robots for the automation of mundane, labour intensive, manual computer operations. Robots are utilized for the processes where it helps to reduce operational costs and also costs arising from human error. Our system automates the capturing of customer information from identity cards, passports and other identification peripherals. Our solution will automatically extract data from customers’ identity card, passport, etc. and will immediately fill-in the forms, eliminating the friction and errors caused by manual input, through Intelligent Character Recognition technology and other AI based technologies. Information extracted from an official identification document will then be checked against existing financial institutions database for regulatory screening in Internal Blacklist Check, Anti Money Laundering, Credit Scoring Check, FATCA, Common Reporting Standard (CRS) and ESG reporting, etc.

| 6 |

Industry Overview

Payment Market

Southeast Asia’s booming digital payment market is expected to hit $2 trillion by transaction value in 2030, ballooning threefold over a decade earlier, as more fintech and digital banks emerge from the best-funded segment in the region, according to a new Google-led study. According to BlueWeave consulting firm, it expects the market size to grow at a robust CAGR of 21.1% during the forecast period (2022–2028) recording a value of $67.42 billion by 2028.

The growth in digital payments parallels the continued growth of internet users in Southeast Asia, who are expected to number 460 million this year. After years of acceleration, however, the report said digital adoption is “normalizing,” with new users expected to total 20 million in 2022, about half as many as were added in 2020 and 2021.

The rise of e-commerce and the O2O market has created many scenarios for people to adopt mobile payments in recent years. According to WorldPay, digital/mobile wallet is expected to occupy 60.2% of e-commerce payments by 2024 in the Asia-Pacific region, followed by credit card (16.1%).

Robotic Process Automation

Robotic Process Automation (RPA) also called “intelligent automation” or “smart automation” refers to advanced technologies that can be programmed to perform a series of tasks, like data manipulation, triggering responses, and creating necessary communication with other processes and systems. RPA is similar to traditional IT automation but the major difference between these technologies is that RPA is, itself, capable of learning and is adaptive to changing circumstances, while a traditional IT automation system is not. The Global Robotic Process Automation Market (RPA) Size accounted for $1.89 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 38.2% from 2022 to 2030.6

The Asia-Pacific region has the fastest-growing Robotic Process Automation market share, with significant growth being observed in countries such as China, India, and Australia. The increasing adoption of RPA by the manufacturing and business process outsourcing (BPO) sectors in the Asia-Pacific region is driving the growth of the RPA market in this region.7 The Asia-Pacific robotic process automation in information technology market is expected to develop with a CAGR of 25.95%, during the forecast years of 2021 to 2028.

Regulatory Technology

Regulatory Technology (RegTech) is the management of regulatory processes within the financial industry via technology, including regulatory monitoring, reporting and compliance. In recent years, there has been a strong regulatory focus on financial crime. The key drivers of RegTech adoption consist of compliance, cost and complexity. The ability of RegTech using technologies such as advanced analytics, robotic process automation and cognitive computing offer new efficiencies in compliance, which offers a lower cost.

As the global RegTech market is projected to grow at a rate of over 20% per year to $16 billion by 2025, up from $6.3 billion in 2020, the APAC region is expected to have the highest growth rate, growing at CAGR of 17.0% during the forecast period. Rising need for regulatory compliance, increasing penetration of advanced technologies such Artificial intelligence (AI), Machine Learning (ML), and cloud computing across the region, and implementation of these solution in fintech industries are some of the major driving factors for the regulatory technology market in Asia-Pacific.

| 7 |

Marketing

AsiaFIN plans to participate frequently in several international or regional scale industry roadshows, conferences, and exhibitions to promote its Focus Solutions to potential markets in Asia. And with planned participation in Award programs, AsiaFIN can be recognized as a premium solution provider in Asia. For example, Gulf Information Technology Exhibition (“GITEX”) Technology Week in Dubai, CES annual trade show organized by Consumer Technology Association in Las Vegas, Singapore Fintech Festival organized by Monetary Authority of Singapore in Singapore, and Robotic Process and Intelligence Automation Conference in ASEAN. We are also collaborating with the Malaysia Digital Economy Corporation, a Government agency, in their effort to expand Malaysian companies into the International market. We have participated in the ASEAN missions as well as the Australian mission. In future, we shall participate in the Middle East, Nordic and USA Select program.

We believe that while displaying our company through customized exhibition stands, banners, counters, brochures and leaflets at these events or exhibition, we will be able to draw attention from the participants. We will then network and register these participants into our prospective client list. Post event, we will utilize these connections by scheduling meetings in person with these prospects to demo our proposed solutions (these proposed solutions maybe currently owned by third party or own by us in future).

We have developed our website at https://asiafingroup.com/ to market our services, and we intend to utilize search engine marketing to improve the visibility of our corporate website once we have successfully raised some funds. We also plan to explore omnichannel marketing options through different social medias such as Instagram,Youtube, LinkedIn, and Facebook, to do a marketing campaign via direct messaging.

We also plan on reaching out to associations or any other organisations such as the FinTech Association of Malaysia (“FOAM”) once we have made contact thorough our marketing efforts. We also have joined the Regtech Association based in Sydney, Australia. We plan to start email marketing campaigns and send out emails to a large database associated with these organisations accumulated through their memberships, pending formalization of any collaboration with these associations or organisations.

In addition, AsiaFIN plans to create market expansion through joint ventures or strategic collaborations with software solution providers and unattended payment kiosk providers in ASEAN countries such as Philippines, Indonesia, Thailand, Singapore, Malaysia and will then further expand to the rest of countries in Asia, Nordics, Australia and USA. All of the above marketing plans have not yet been determined in sufficient detail to outline at this time and remain under development.

Competition

We operate in a highly competitive industry. We intend to focus on selling our solutions to companies in Asia, with a particular focus on ASEAN countries. Although there are numerous alternatives, we intend to distinguish ourselves by creating a strong relationship with our clients and by ensuring our commitment to provide exceptional solutions. In addition, we will continue to further develop our solutions to maintain our market position, keep pace with latest technological changes and compete effectively in the market we are in operating.

By ensuring high customer satisfaction for our clients, we hope to ensure repeat sales from the same group of customers and generate the referral of new clients. In addition, AsiaFIN will participate strongly in industry roadshows and conferences to promote our solutions to potential markets in Asia. We intend to participate in Award programs, so we can be recognised as a premium solution provider in Asia. We intend to use all available social media, for example LinkedIn, Instagram, YouTube and Facebook to promote our solutions. Lastly, the Company intends to encourage our existing clients to furnish recommendation letters and organize signing ceremonies to further increase awareness of our solutions and AsiaFIN in the future.

Government Regulation

We are subject to a variety of foreign, federal, state and local governmental laws and regulations related to data protection, anti-money laundering and intellectual property. If we fail to comply with present or future financial system laws and regulations, we could be subject to fines, suspension of production or a cessation of operations. In addition, under some foreign, federal, state and local statutes and regulations, a governmental agency may seek recovery and response costs from operators that violates the laws such as data breaching or illegal use of intellectual property, even if the operator was not responsible for the release or otherwise was not at fault.

| 8 |

If we become aware of the need for any permits necessary to conduct our operations, then we will apply for and attempt to receive all financial system related intellectual property or permits necessary to conduct our business. As of the current date, we are not aware of any intellectual property or license that need to be registered from foreign, federal, state or local agencies. Any failure by us to control the use of other’s intellectual property or data breaching could subject us to substantial financial liabilities, operational interruptions and adverse publicity, any of which could materially and adversely affect our business, results of operations and financial condition.

We have listed the primary, but not necessarily only, rules and regulations that we believe apply to our business below:

Malaysia

| 1) | Financial Services Act 2013 (FSA) and The Islamic Financial Services Act 2013 (IFSA) |

The FSA and IFSA came into force in 2013 replacing the repealed Payment System Act 2003 (PSA). The FSA and IFSA incorporates strengthened provisions to regulate payment system operators and payment instrument issuers in order to promote safe, efficient and reliable payment systems and instruments. Operators of systems that enable the transfer of funds from one banking account to another or provide payment instrument network operation will require approval from the Central Bank of Malaysia to operate such systems. As for those wishing to offer merchant acquiring services, such person is required to be registered with the Central Bank of Malaysia.

The FSA and IFSA contain provisions that enable Central Bank of Malaysia to effectively perform its oversight role. In general, this includes empowering the Bank to specify standards, as well as, to issue directions, for the purpose of ensuring the safety, integrity, efficiency and reliability of the payment systems and payment instruments

| 2) | Personal Data Protection Act 2010 (PDPA) |

Personal Data Protection Department (PDPD) is an agency under the Ministry of Communications and Multimedia Commission (MCMC) was established on May 16, 2011 after the Parliament passed the bill relating to the Personal Data Protection Act 2010 (PDPA) of Act 709. The main responsibility of this department is to oversee the processing of personal data of individuals involved in commercial transactions by User Data that is not misused and misapplied by the parties concerned.

Based on laws and regulations regarding PDPA requires that an individual must consent to the processing and disclosure of his/her personal data. In processing personal data, we are also required to take steps and implement measures to protect the personal data from loss, misuse and modification and maintain the integrity of the personal data processed. The personal data processed should not be kept longer than is necessary for the fulfilment of the purpose for which it was collected and generally cannot be transferred offshore without the consent of the individual to whom it relates.

| 3) | Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLATFA) |

The AMLATFA provides for the offence of money laundering, the measures to be taken for the prevention of money laundering and terrorism financing offenses, investigation powers and the forfeiture of property involved in or derived from money laundering and terrorism financing offenses, as well as terrorist property, proceeds of an unlawful activity and instrumentalities of an offenses.

Under the Guidelines, the level and frequency of due diligence required should be commensurate with the level of money laundering and terrorism financing risk posed by the customer based on the risk profiles and nature of the transactions. AMLATFA provides for substantial monetary and imprisonment penalties for the failure to comply with the preventive measures laid down in AMLATFA. Similarly, failure to comply with the Guidelines may be an offense.

| 4) | Intellectual Property Protection |

Intellectual property system in Malaysia is administered by the Intellectual Property Corporation of Malaysia (MyIPO), an agency under the Ministry of Domestic Trade and Consumer Affairs. Intellectual property protection in Malaysia comprises of patents, trademarks, industrial designs, copyright and etc.

| 9 |

| a. | Patents |

The Patents Act 1983 and the Patents Regulations 1986 govern patent protection in Malaysia. An applicant may file a patent application directly if he is domicile or resident in Malaysia. A foreign application can only be filed through a registered patent agent in Malaysia acting on behalf of the applicant. Under the Act, the utility innovation certificate provides for an initial duration of ten years protection from the date of filing of the application and renewable for further two consecutive terms of five years each subject to use.

| b. | Trademarks |

Trademark protection is governed by the Trademarks Act 1976 and the Trademarks Regulations 1997. The Act provides protection for registered trademarks and service marks in Malaysia. Once registered, no person or enterprise other than its proprietor or authorized users may use them. Infringement action can be initiated against abusers. The period of protection is ten years, renewable for a period of every ten years thereafter. The proprietor of the trademark or service mark has the right to deal or assign as well as to license its use. As with patents, while local applicant may file applications on their own, foreign applicants will have to do so through registered trademark agents.

| c. | Copyright |

The Copyright Act 1987 provides comprehensive protection for copyright works. The Act outlines the nature of works eligible for copyright (which includes computer programs), the scope of protection, and the manner in which the protection is accorded. Copyright subsists in every work eligible for copyright protection of which the author is a qualified person.

The Copyright (Amendment) Act 2012 entered into force on 1 March 2012. The Act was amended to be in line with technological development and to adhere to the international IP conventions/treaties relating to copyright and related rights.

| 5) | Tax Treatments |

| a. | Digital tax |

Malaysia’s transition to a digital economy, the imposition of 6% service tax on foreign digital services (“Digital Tax”) came into force on 1 January 2020 pursuant to the Service Tax (Amendment) Act 2019. With the inception of this Digital Tax, foreign service providers (“FSPs”) are now required to account and pay a service tax of 6% on any digital services provided by an FSP to consumers in Malaysia, including services provided by businesses to consumers.

The Act defines “digital service” as any service that is delivered or subscribed over the internet or other electronic network and which cannot be obtained without the use of information technology and where the delivery of the service is essentially automated. Under the Guide, it further is stated that digital services mean services that is to be delivered through information technology medium with minimal or no human intervention from service provider.”

The Service Tax Policy 10/2020 (dated 17 April 2020) has revised to provide service tax exemption on provision of digital payment services by local non-bank providers. In relation thereto, Local non-bank payment instrument issuers; Local non-bank merchant acquirers; and Local non-bank payment system operators are exempted from charging Service Tax due and payable on such digital payment services. This exemption is effective from 1 January 2020.

Hong Kong

| 1) | Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) (Cap. 615) |

This Ordinance provides for the statutory requirements relating to customer due diligence (CDD) and record-keeping for all financial institutions, which include money remitters and money exchangers (collectively referred to as money service operators and making such an obligation legally enforceable.

| 10 |

In the event that the CDD requirements are not met, this would be classified as an offence under the AMLO. Enforcement action would then be taken by the relevant regulator, such as Hong Kong Monetary Authority and Securities and Futures Commission (Hong Kong), depending on the financial institution involved in the breach. In addition, in regard to money service operators, the Customs and Excise Department will be the regulator and will be responsible for taking enforcement action for any breach of the CDD requirements.

| 2) | Intellectual Property Protection |

To underline the commitment of intellectual property protection, the Government established the Intellectual Property Department on 2 July 1990. The Intellectual Property Department is responsible for advising the Secretary for Commerce and Economic Development on policies and legislation to protect intellectual property in the Hong Kong SAR; for operating the Hong Kong SAR’s Trademarks, Patents, Designs and Copyright Licensing Bodies Registries; for promoting awareness and protection of intellectual property through public education; and for facilitating the development of Hong Kong SAR as an intellectual property trading hub in the region.

| a. | Patents |

Hong Kong SAR patent law is territorial. Patents granted in the Hong Kong SAR will only get protection in the Hong Kong SAR. The Hong Kong SAR patent system is separate from the other patent systems in the Mainland China or elsewhere in the world. In other words, patents granted by the State Intellectual Property Office in the Mainland China or other patent offices elsewhere do not automatically enjoy protection in Hong Kong.

| b. | Trademarks |

The Hong Kong SAR’s trademark registration system is separate from the other trademark systems in the Mainland China or elsewhere in the world. Trademarks registered with the Trademark Office under the State Administration for Industry and Commerce of the People’s Republic of China or trademarks registries of other countries or regions do not automatically receive protection in the Hong Kong SAR. In order to obtain protection as registered trademarks in the Hong Kong SAR, trademarks must be registered under the Trademarks Ordinance (Cap 559).

| 3) | Personal Data (Privacy) Ordinance (PDPO) (Cap. 486) |

The Personal Data (Privacy) Ordinance (PDPO) is the main legislation in Hong Kong that regulates the collection, use, transfer, processing and storage of personal data and regulates both private and public sectors. However, some data users may be exempt from certain requirements under the PDPO, for instance, where personal data is held/disclosed:

| ● | for domestic or recreational purposes; | |

| ● | by a court, magistrate or a judicial officer in the course of performing judicial functions; | |

| ● | by or on behalf of the government to safeguard Hong Kong’s security, defence or international relations; | |

| ● | to prevent or detect crime; or | |

| ● | solely for the purpose of a news activity. |

The Office of the Privacy Commissioner for Personal Data (PCPD) has issued codes of practice, guidance notes and information leaflets that provide data protection guidance in relation to specific industry sectors and activities, for instance, employee monitoring and the collection and use of personal data through the Internet. Although these guidelines are not legally binding, the PCPD may take into consideration any non-compliance with these guidelines when determining whether a data user has contravened the data protection principles of the PDPO.

| 11 |

The Personal Data (Privacy) (Amendment) Ordinance 2021 (the Ordinance) has been published in the Gazette with the purpose of creating offences to curb doxing acts, and empowers the Privacy Commissioner for Personal Data (“Commissioner”) to carry out criminal investigations, institute prosecutions and issue cessation notices.

Where doxing occurs on or via their platforms or services, they may be the recipient of a cessation notice from the Commissioner, which requests the removal of doxing messages, and it is a criminal offence to contravene a cessation notice. However, the law does not impose any obligation on platform/online service operators to proactively monitor or censor content on their platforms/services.

Where the platform or online service operator has knowledge of potentially incriminating doxing content but does not remove it, there is a risk of investigation into the content by the Commissioner which can prosecute offences in its own name where it suspects that an offence has been committed, and the platform/online service operator may be the recipient of a cessation notice from the Commissioner.

Seasonality

Our management believes that our operations are generally not subject to seasonal influences.

Regulation Regarding Labor and Social Insurance

Employment Act 1955 (Act 265)

The Employment Act 1955 (Act 265) (“the 1955 Act) is the primary legislation on labour matters in Malaysia. The 1955 Act provides for minimum work requirements and benefits of employment, such as maximum working hours, overtime entitlement, leave entitlement, maternity protection and termination benefits. Following the implementation of the Employment (Amendment of First Schedule) Order 2022, which came into force on January 1, 2023, the applicability of the EA 1955 has been expanded to include any person who has entered into a contract of service with an employer, irrespective of their monthly wages, is engaged in manual labor, serves as a supervisor of such manual labour, serves as a domestic employee, or is engaged in any capacity in any vessel registered in Malaysia subject to certain conditions..

Employee Provident Fund Act 1991 (EPF)

The Employees’ Provident Fund Act 1991 (Act 452) (“the 1991 Act”) imposes the statutory obligations on employers and employees to make contribution towards the Employees Provident Fund, which is essentially a fund established as a scheme of savings for employees’ retirement and the management of savings for the retirement purposes. Under the 1991 Act, any employer who fails to pay the necessary contributions by the 15th of every month shall be liable to imprisonment for a term not exceeding three years or to a fine not exceeding ten thousand ringgit or to both.

Employee Social Security Act 1969

The Employee’s Social Security Act 1969 (Act 4) (“the 1969 Act’) was implemented to provide protection for employees and their families against economic and social distress in situations where the employees sustain injury or death. The schemes of social security under the 1969 Act are administered by Social Security Organization (“SOCSO”) and are financed by compulsory contributions made by the employers and the employees. Under the 1969 Act, any person who fails to make contribution shall be all be punishable with imprisonment for a term which may extend to two years, or with fine not exceeding ten thousand Ringgit, or with both.

Employees

As of December 31, 2023, we have the following full-time employees:

| Management | 4 | |||

| Analyst Programmer | 51 | |||

| Project Manager and Quality Assurance | 17 | |||

| Sales and Marketing | 10 | |||

| Administration, Human Resources and Finance | 13 | |||

| Total | 95 |

We believe that we maintain good relationships with our employees and have not experienced any strikes or shutdowns and have not been involved in any labor disputes.

| 12 |

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 1C. CYBERSECURITY

Risk management and strategy

AsiaFIN Holdings Corp. acknowledges the crucial necessity of establishing, executing, and sustaining strong cybersecurity measures to secure our information systems. This is undertaken to uphold the confidentiality, integrity, and accessibility of our data.

We plan to strategically incorporate cybersecurity risk management into all our comprehensive risk management framework, fostering a corporate culture that prioritizes cybersecurity at all levels. This integration shall be done in stages so as to guarantee that cybersecurity factors are ingrained in our decision-making processes throughout the organization. We plan to incorporate a risk management team to collaborate closely with the IT department, consistently assessing and mitigating cybersecurity risks in alignment with our business goals and operational requirements.

We recognize the intricate and ever-changing nature of cybersecurity threats. To address this, we shall collaborate with external experts, including cybersecurity assessors, consultants, and auditors. This cooperation shall involve regular audits, threat assessments, and consultations to enhance our security measures. These efforts ensure that our cybersecurity strategies adhere to industry best practices and remain effective in safeguarding our systems.

Understanding the potential risks associated with third-party service providers, we shall implemented stringent processes to oversee and manage these concerns. We shall conduct thorough security assessments before engaging with any third-party provider and maintain ongoing monitoring to ensure compliance with our cybersecurity standards. This involves quarterly assessments by our management and continuous evaluations by our security engineers. This approach is designed to mitigate the risks of data breaches or other security incidents originating from third-party sources.

We have not encountered cybersecurity issues that have significantly impacted our operational performance or financial status.

Governance

The Board of Directors is fully aware of the vital importance of managing cybersecurity risks. To ensure effective governance in handling these risks, the Board shall implement a strong oversight mechanisms. This reflects our understanding of the significant impact these threats can have on operational integrity and stakeholder confidence.

Our Board of Directors is tasked with overseeing data privacy and cybersecurity risks. They regularly review the Company’s cybersecurity program with management, evaluating the adequacy of controls and security for our information technology systems. Additionally, they assess the Company’s response plan in case of a security breach affecting these systems. Annually, the Board of Directors receives updates on potential cybersecurity incidents, data privacy, and compliance programs, engaging in active discussions with management on cybersecurity risks.

ITEM 2. PROPERTY

We have four physical office, which is located at:

| 1. | Suite 30.02, 30th Floor, Menara KH (Promet), Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia. | |

| 2. | Unit 17-11, Level 17, Tower A, Vertical Business Suites, Avenue 3 Bangsar South, No.8, Jalan Kerinchi, 59200 Kuala Lumpur, Malaysia. | |

| 3. | Unit 17-12, Level 17, Tower A, Vertical Business Suites, Avenue 3 Bangsar South, No.8, Jalan Kerinchi, 59200 Kuala Lumpur, Malaysia. | |

| 4. | A2-17-1, St Mary Residence, Jalan Tengah, 50250 Kuala Lumpur, Malaysia. |

ITEM 3. LEGAL PROCEEDINGS

From time to time, we may become party to litigation or other legal proceedings that we consider to be a part of the ordinary course of our business. We are not currently involved in legal proceedings that could reasonably be expected to have a material adverse effect on our business, prospects, financial condition, or results of operations. We may become involved in material legal proceedings in the future.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

| 13 |

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

The Company sole class of common equity is currently quoted under OTC Markets under symbol ASFH since March 31, 2021. The Company believes that we do not have an established public trading market and we cannot assure you that there will be any liquidity for our common stock in the future and such quotation reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year 2023 | High Bid | Low Bid | ||||||

| First Quarter | $ | 1.20 | $ | 1.20 | ||||

| Second Quarter | $ | 1.20 | $ | 1.20 | ||||

| Third Quarter | $ | 1.20 | $ | 1.20 | ||||

| Fourth Quarter | $ | 1.20 | $ | 1.20 | ||||

| Fiscal Year 2022 | High Bid | Low Bid | ||||||

| First Quarter | $ | 1.20 | $ | 1.20 | ||||

| Second Quarter | $ | 1.20 | $ | 1.20 | ||||

| Third Quarter | $ | 1.20 | $ | 1.20 | ||||

| Fourth Quarter | $ | 1.20 | $ | 1.20 | ||||

Holders

As of December 31, 2023, we had 81,551,838 shares of our Common Stock par value, $0.0001 issued and outstanding. There were 156 beneficial owners of our Common Stock.

Transfer Agent and Registrar

The transfer agent for our capital stock is VStock Transfer, LLC, with an address at 18, Lafayette Place, Woodmere, New York 11598 and telephone number is +1 (212)828-843.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1,000,000, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the investors’ ability to buy and sell our stock.

| 14 |

Dividend Policy

Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends. Our board of directors currently intends to retain all earnings for use in the business for the foreseeable future.

Equity Compensation Plan Information

Currently, there is no equity compensation plan in place.

Unregistered Sales of Equity Securities

Currently, there is no unregistered sales of equity securities.

Purchase of Equity Securities by the Registrant and Affiliated Purchasers

We have not repurchased any shares of our common stock during the year ended December 31, 2023.

ITEM 6. SELECTED FINANCIAL DATA

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our audited consolidated financial statements and the notes to those financial statements appearing elsewhere in this Report.

Certain statements in this Report constitute forward-looking statements. These forward-looking statements include statements, which involve risks and uncertainties, regarding, among other things, (a) our projected sales, profitability, and cash flows, (b) our growth strategy, (c) anticipated trends in our industry, (d) our future financing plans, and (e) our anticipated needs for, and use of, working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “project,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend,” or the negative of these words or other variations on these words or comparable terminology. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. You should not place undue reliance on these forward-looking statements.

The forward-looking statements speak only as of the date on which they are made, and, except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

| 15 |

Overview

AsiaFIN Holdings Corp. operates through its wholly owned subsidiaries by offering a range of system solutions in Payment Processing, Robotic Process Automation (RPA), and Regulatory Technology (RegTech) to financial institutions, regulatory agencies, professional service providers and private enterprises from various industries, with existing client in the Asia region. SFHL has over 80 key bank customers on payment processing and RegTech and our Robotic Process Automation solution company has more than 100 customers in Asia.

Results of Operations

Revenue

For the year ended December 31, 2023, the Company generated revenue in the amount of $3,109,515. The revenue was generated as a result of the Company having provided services related to information technology business to the customers.

For the year ended December 31, 2022, the Company does not generate any revenue.

Selling, General and Administrative Expenses

For the year ended December 31, 2023, the Company had selling, general and administrative expenses in the amount of $2,901,636. These were primarily comprised of salary expenses, audit fees, insurance and other professional fees.

For the year ended December 31, 2022, the Company had general and administrative expenses in the amount of $122,283. These were primarily comprised of audit fees and other professional fees.

The significant increase of the general and administrative expenses was the result of the significant increase in salary expenses as the Company hired more employees to expand their business.

Net Loss

For the year ended December 31, 2023, the Company has generated a net income of $19,214.

For the year ended December 31, 2022, the Company has incurred a net loss of $112,202.

Liquidity and Capital Resources

As of December 31, 2023 and 2022, we had cash and cash equivalents of $1,234,188 and $874,690 respectively. We expect increased levels of operations going forward will result in more significant cash flows and in turn working.

We depend substantially on financing activities to provide us with the liquidity and capital resources we need to meet our working capital requirements and to make capital investments in connection with ongoing operations.

Cash Used in Operating Activities

For the year ended December 31, 2023, the Company has used $210,454 in operating activity, of which primarily consist of minority interest, increase in account receivable, decrease in other payables and accrued liabilities, decrease in deferred revenue, decrease in income tax payable and reduction in lease liability contra by net income, share of loss from operation of associate, depreciation and amortization, provision for credit loss allowance, increase in account payable, decrease in prepayment, deposits and other receivables, increase in tax assets and increase in deferred income tax assets.

For the year ended December 31, 2022, the Company has used $105,991 in operating activity, of which primarily consist of net loss, decrease in accounts payable, increase in deposits and other receivables contra by increase in income tax payable and increase in other payables and accrued liabilities.

Cash Used in Investing Activities

For the year ended December 31, 2023 and 2022, the Company has invested $32,479 and $0 in investing activities, respectively for the acquisition of computer systems and office equipment.

Cash Provided by Financing Activities

For the year ended December 31, 2023, the Company has used $74,578 in financing activities, primarily consist of advances to director.

For the year ended December 31, 2022, the Company did not receive nor used any cash in financing activity.

Off-Balance Sheet Arrangement

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders as of December 31, 2023 and December 31, 2022.

Contractual Obligation

As a smaller reporting company, we are not required to provide the aforementioned information.

| 16 |

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The financial statements required by this item are located following the signature page of this Annual Report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Disclosures Control and Procedures

We maintain disclosure controls and procedures, as defined in Rule 13a-15(e) promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”), that are designed to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms and that such information is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure.

We carried out an evaluation, under the supervision and with the participation of our management, including our chief executive officer, of the effectiveness of our disclosure controls and procedures as of December 31, 2023. Based on the evaluation of these disclosure controls and procedures, and in light of the material weaknesses found in our internal controls over financial reporting, our chief executive officer concluded that our disclosure controls and procedures were not effective.

The matters involving internal controls and procedures that our management considered to be material weaknesses under the standards of the Public Company Accounting Oversight Board were: (1) lack of a functioning audit committee due to a lack of a majority of independent members and a lack of a majority of outside directors on our board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; (2) inadequate segregation of duties and effective risk assessment; (3) insufficient written policies and procedures for accounting and financial reporting with respect to the requirements and application of both US GAAP and SEC guidelines; and (4) lack of internal audit function due to the fact that the Company lacks qualified resources to perform the internal audit functions properly and that the scope and effectiveness of the internal audit function are yet to be developed. The aforementioned material weaknesses were identified by our chief executive officer in connection with the review of our financial statements as of December 31, 2023.

Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The internal controls for the Company are provided by executive management’s review and approval of all transactions. Our internal control over financial reporting also includes those policies and procedures that:

| ● | Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company; | |

| ● | Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with accounting principles generally accepted in the United States of America and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and | |

| ● | Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the company’s assets that could have a material effect on the financial statements. |

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2023. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control-Integrated Framework. Management’s assessment included an evaluation of the design of our internal control over financial reporting and testing of the operational effectiveness of these controls.

| 17 |

As of December 31, 2023, management assessed the effectiveness of our internal control over financial reporting based on the criteria for effective internal control over financial reporting established in Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in 2013 and SEC guidance on conducting such assessments. Based on such evaluation, the Company’s management concluded that, during the period covered by this Report, our internal control over financial reporting were not effective.

Identified Material Weaknesses

A material weakness in internal control over financial reporting is a control deficiency, or combination of control deficiencies, that results in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected.

Management identified the following material weaknesses during its assessment of internal controls over financial reporting as of December 31, 2023.

| 1. | We do not have an Audit Committee. While not being legally obligated to have an audit committee, it is the management’s view that such a committee, including a financial expert member, is an utmost important entity level control over the Company’s financial statement. Currently the Chief Executive Officer and Director act in the capacity of the Audit Committee and does not include a member that is considered to be independent of management to provide the necessary oversight over management’s activities. |

| 2. | We do not have Written Policies & Procedures. Due to lack of written policies and procedures for accounting and financial reporting, the Company did not establish a formal process to close our books monthly and account for all transactions and thus failed to properly record the Private Placement or disclose such transactions in its SEC filings in a timely manner. |

| 3. | We do not have adequate segregation of duties and effective risk assessment, lack of segregation of duties and effective risk assessment may cause the Company to face the likelihood of fraud or theft, due to poor oversight, governance and review to detect errors. |

Accordingly, the Company concluded that these control deficiencies resulted in a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis by the company’s internal controls.

As a result of the material weaknesses described above, management has concluded that the Company did not maintain effective internal control over financial reporting as of December 31, 2023 based on criteria established in Internal Control—Integrated Framework issued by COSO.

| 18 |

Management’s Remediation Initiatives

In an effort to remediate the identified material weaknesses and other deficiencies and enhance our internal controls, we also plan to initiate the following series of measures to further strengthen the Company’s internal controls going forward:

| 1. | intend to establish an internal audit function with assessment to improve internal control; |

| 2. | plan to hire a reporting manager (“Internal Finance Manager”) who has the requisite relevant U.S. GAAP and SEC reporting experience and qualifications; |

| 3. | intend to add staff members to our management team for making sure that information required to be disclosed in our reports filed and submitted under the Exchange Act is recorded, processed, summarized and reported as and when required and will the staff members will have segregated responsibilities with regard to these responsibilities; and |

| 4. | plan to create a position to segregate duties consistent with control objectives and will increase our personnel resources and technical accounting expertise within the accounting function. The accounting personnel is responsible for reviewing the financing activities, facilitate the approval of the financing, record the information regarding the financing, and submit SEC filing related documents to our legal counsel in order to comply with the filing requirements of SEC. |

We anticipate that these initiatives will be at least partially, if not fully, implemented by the end of fiscal year 2024.

Changes in Internal Controls over Financial Reporting

There was no change in our internal controls over financial reporting that occurred during the period covered by this Report, which has materially affected, or is reasonably likely to materially affect, our internal controls over financial reporting:

This annual report does not include an attestation report of the Company’s registered independent public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s registered independent public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this Annual Report on Form 10-K.

ITEM 9B. OTHER INFORMATION

Insider Trading Arrangements

During the quarter ended December 31, 2023, none of our directors or officers adopted or terminated any contract, instruction or written plan for the purchase or sale of our securities to satisfy the affirmative defense conditions of “Rule 10b5-1 trading arrangement” or any “non-Rule 10b5-1 trading arrangement”.

ITEM 9C. DISCLOSURE REGARDING FOREIGN JURISDICTION THAT PREVENT INSPECTIONS.

Not applicable.

| 19 |

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Our executive officer’s and director’s and their respective ages as of the date hereof are as follows:

| NAME | AGE | POSITION | ||

| Wong Kai Cheong | 61 | Chief Executive Officer, President, Secretary, Treasurer, Director | ||

| Seah Kok Wah | 56 | Director | ||

| Cham Hui Yin | 44 | Finance Manager |

Set forth below is a brief description of the background and business experience of our executive officer and director.

Wong Kai Cheong – President, Chief Executive Officer, Secretary, Treasurer, Director

Mr. Wong Kai Cheong was recognized as a Professional Electrical Engineer from the Engineering Council of the United Kingdom. Throughout his career path, we believe he has achieved astounding results and success in this field.

Mr. Wong started his career in the Financial IT industry as a hardware engineer in Sime Darby Systems Sdn. Bhd. to the position of General Manager in AIMS Sdn. Bhd. After having 15 years of experience, he started the Insite MY Group of Companies (InsiteMY) in the year 2002. Today, after 21 years, InsiteMY has more than 100 staffs with offices in Malaysia and with customers covering from Malaysia, Philippines, Bangladesh, Pakistan, Thailand, Singapore, Indonesia and Myanmar.

Besides having a technical background, Mr. Wong has strong domain knowledge in payments and recently in cheque clearing and cheque truncation in particular. He travels the world educating customers and partners on the benefits and advantages of cheque truncation and other payment methods.

Through him and his team, InsiteMY has established themselves as a reliable solution partner to the banking industry for payments, reporting, risk management and compliance in Malaysia. All products developed by InsiteMY are under the purview of the Malaysia Digital Economy Corporation (MDEC) as local home-grown IT products. All research and development are done by the local Malaysian expertise under the guidance of MDEC.

Once again in 2018, he cofounded another R&D company called OrangeFIN Asia Sdn. Bhd., focusing on Robotics Process Automation (RPA). These software robots were developed first for cheque clearing functions with artificial intelligence. These robots replace humans in making decisions for approving and clearing cheques for a local bank in Malaysia. Now OrangeFIN aims to put a robot in every organisation in Malaysia and throughout Southeast Asia.

Seah Kok Wah – Director

Dato’ Dr. Sean SEAH Kok Wah (Dato’ SEAH), a Malaysian, currently serves as the Executive Director of AsiaFIN Holdings Corp. (OTC-QB: ASFH) and the Executive Chairman of Angkasa-X Holdings Corp..

Dato’ SEAH was graduated from the California State University, Chico, California USA with a Bachelor’s Degree in Computer Engineering and a Master’s Degree in Computer Science (with Distinction). He also holds a Doctorate of Business Administration (International Business) from Riviera University. In 1994, He began his tech-career in Silicon Valley as a software developer for Software Publishing Corporation and Netscape Communications Corporation. He returned to Malaysia in 1997, recruited by Sun Microsystems to provide technical-consultancy to Malaysia MSC flagship projects.

Dato’ SEAH started his entrepreneurship journey in 2001. In the past 2 decades, he has co-founded and floated several tech companies; including Epicenter Holdings Ltd (SGX:5MQ) in Singapore, Galasys PLC (LSE:GLS) in the United Kingdom, SEATech Ventures Corp. (OTC-PINK:SEAV), AsiaFIN Holdings Corp. (OTC-QB:ASFH) and Angkasa-X Holdings Corp. in the U.S.

Currently, Dato’ SEAH is the Chairman of The World Information Technology and Services Alliance (WITSA), a leading global consortium of tech-industry association-members from over 80 countries and economies. He is also the Chairman of SpaceTech Malaysia Association (SPA), the Vice-President of Malaysia Space Industry Corporation (MASIC), the Advisor of the National Tech Association of Malaysia (PIKOM) and a Committee Member of the 88-Captains Penang Welfare Society, a charitable non-governmental organisation founded for the purpose of sustaining talent development.

| 20 |

Cham Hui Yin - Finance Manager

Cham Hui Yin, a Malaysian, currently serves as the Finance Manager of AsiaFIN Holdings Corp..

Ms. Cham graduated from University Kebangsaan Malaysia in 2003 with a Bachelor of Accounting (Hons.). She began her career as an auditor in KPMG Malaysia.

In 2004, Ms. Cham joined Actis Capital LLP, a leading global investor in sustainable infrastructure, during the splitting of Actis from CDC Group plc. She served as Office Manager for the Malaysia Office.

In 2009, Ms. Cham joined InsiteMY Group of Companies as Finance & Admin Manager and gradually move up to the position of Chief Financial Officer for the group.

In 2016, Ms. Cham was hired by Nettium Sdn Bhd in Malaysia as the Director of Finance, Human Resources and Admin. Nettium Sdn. Bhd., is a software company providing online gaming platform with 250 headcounts.

She later was recruited by Juris Technologies Sdn. Bhd., a software house focusing on the financial industry, with 300 staff. She assumed the role of Director of Finance, Human Resources & Admin in 2018. During her tenure in Juris, she played a key role in the acquisition and the restructuring of iMoney Group.

In 2021, Ms. Cham joined InsiteMY Group, as the Chief Financial Officer.

Corporate Governance

The Company promotes accountability for adherence to honest and ethical conduct; endeavors to provide full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission and in other public communications made by the Company; and strives to be compliant with applicable governmental laws, rules and regulations. The Company has not formally adopted a written code of business conduct and ethics that governs the Company’s employees, officers and Directors as the Company is not required to do so.

In lieu of an Audit Committee, the Company’s Board of Directors, is responsible for reviewing and making recommendations concerning the selection of outside auditors, reviewing the scope, results and effectiveness of the annual audit of the Company’s financial statements and other services provided by the Company’s independent public accountants. The Board of Directors, the Chief Executive Officer and the Finance Manager of the Company review the Company’s internal accounting controls, practices and policies.

| 21 |

Committees of the Board

Our Company currently does not have nominating, compensation, or audit committees or committees performing similar functions nor does our Company have a written nominating, compensation or audit committee charter. Our Directors believe that it is not necessary to have such committees, at this time, because the Director(s) can adequately perform the functions of such committees.

Audit Committee Financial Expert

Our Board of Directors has determined that we do not have a board member that qualifies as an “audit committee financial expert” as defined in Item 407(D)(5) of Regulation S-K, nor do we have a Board member that qualifies as “independent” as the term is used in Item 7(d)(3)(iv)(B) of Schedule 14A under the Securities Exchange Act of 1934, as amended, and as defined by Rule 4200(a)(14) of the FINRA Rules.

We believe that our Director(s) are capable of analyzing and evaluating our financial statements and understanding internal controls and procedures for financial reporting. The Director(s) of our Company does not believe that it is necessary to have an audit committee because management believes that the Board of Directors can adequately perform the functions of an audit committee. In addition, we believe that retaining an independent Director who would qualify as an “audit committee financial expert” would be overly costly and burdensome and is not warranted in our circumstances given the stage of our development and the fact that we have not generated any positive cash flows from operations to date.

Involvement in Certain Legal Proceedings

Our Directors and our Executive officers have not been involved in any of the following events during the past ten years:

| 1. | bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time; |

| 2. | any conviction in a criminal proceeding or being subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| 3. | being subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his/her involvement in any type of business, securities or banking activities; or |

| 4. | being found by a court of competent jurisdiction (in a civil action), the Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated. |

| 5. | Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated; |

| 22 |

| 6. | Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated; |

| 7. | Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of: (i) Any Federal or State securities or commodities law or regulation; or(ii) Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or(iii) Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| 8. | Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Independence of Directors

We are not required to have independent members of our Board of Directors, and do not anticipate having independent Directors until such time as we are required to do so.

Code of Ethics