UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

AMENDMENT NO. 2

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 CURRENT REPORT

AsiaFIN Holdings Corp.

(Exact name of registrant as specified in its charter)

Date: March 19, 2021

| Nevada | 7380 | 37-1950147 |

(State or Other Jurisdiction of Incorporation) | (Primary Standard Classification Code) | (IRS Employer Identification No.)

|

Suite 30.02, 30th Floor, Menara KH (Promet),

Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia

Issuer's telephone number: +603 21487170

Company email: AsiaFINinfo@asiafingroup.com

(Address, including zip code, and telephone number,

including area code, of registrant’s principal mailing address)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. |X|

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. |_|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.|_|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |_| | Accelerated filer |_| |

| Non-accelerated filer |X| | Smaller reporting company |X| |

| Emerging growth company |X| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. |_|

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Share(1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee (2) |

Common Stock, $0.0001 par value | 9,841,250 | $1.00 | 9,841,250 | 1,073.68 |

| (1) | The offering price has been arbitrarily determined by the Company and bears no relationship to assets, earnings, or any other valuation criteria. No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any price. |

| (2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY OUR EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT FOR THE OFFERING TO PROCEED.

SUBJECT TO COMPLETION, DATED March 19, 2021

PRELIMINARY PROSPECTUS

AsiaFIN Holdings Corp.

9,841,250 SHARES OF COMMON STOCK

$0.0001 PAR VALUE PER SHARE

Prior to this Offering, no public market has existed for the common stock of AsiaFIN Holdings Corp. Upon completion of this Offering, we will attempt to have the shares quoted on the OTCQB operated by OTC Markets Group, Inc. There is no assurance that the Shares will ever be quoted on the OTCQB. To be quoted on the OTCQB, a market maker must apply to make a market in our common stock. As of the date of this Prospectus, we have not made any arrangement with any market makers to quote our shares. Additionally, there is the possibility a market maker may not apply to make a market in our common stock.

In this public offering we, “AsiaFIN Holdings Corp.” are offering 1,000,000 shares of our common stock and our selling shareholders are offering 8,841,250 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the selling shareholders. The offering is being made on a self-underwritten, “best efforts” basis. There is no minimum number of shares required to be purchased by each investor. The shares offered by the Company will be sold on our behalf by our Chief Executive Officer, Mr. Wong Kai Cheong, who is deemed to be an underwriter of this offering. The selling shareholders are also deemed to be underwriters of this offering. There is uncertainty that we will be able to sell any of the 1,000,000 shares being offered herein by the Company. Mr. Wong will not receive any commissions or proceeds for selling the shares on our behalf. All of the shares being registered for sale by the Company will be sold at a fixed price of $1.00 per share for the duration of the Offering. Additionally, all of the shares offered by the selling shareholders will be sold at a fixed price of $1.00 for the duration of the Offering. Assuming all of the 1,000,000 shares being offered by the Company are sold, the Company will receive $1,000,000 in net proceeds. Assuming 750,000 shares (75%) being offered by the Company are sold, the Company will receive $750,000 in net proceeds. Assuming 500,000 shares (50%) being offered by the Company are sold, the Company will receive $500,000 in net proceeds. Assuming 250,000 shares (25%) being offered by the Company are sold, the Company will receive $250,000 in net proceeds. There is no minimum amount we are required to raise from the shares being offered by the Company and any funds received will be immediately available to us. There is no guarantee that we will sell any of the securities being offered in this offering. Additionally, there is no guarantee that this Offering will successfully raise enough funds to institute our Company's business plan. Additionally, there is no guarantee that a public market will ever develop and you may be unable to sell your shares.

We have no plans or intention to merge with an operating company. None of the Company’s shareholders or management have plans to enter into any agreement resulting in a change of control of the Company, subsequent to this offering.

Through our Malaysia and Hong Kong subsidiaries, we are currently providing market research studies and consulting services pertaining to system solutions and integration of unattended payment kiosks and payment processing to our clients. Our present clients , who are related parties, are payment solution companies located in Malaysia, although we intend to provide services to other geographic regions in the future.

We have additional plans to develop our own software, which we anticipate we will be able to be merge and integrate onto such Payment Processing or Unattended Payment Kiosk, to accept payments and also collect data. Additionally, we have plans, which we are still developing and exploring, to create Web-Based Solutions in four areas which include Payment Processing, Regulatory Technology (REGTECH), Robotic Process Automation (RPA) and Unattended Payment Kiosks for financial institutions, and other industries. We refer to the four pillars of our business as “Focus Solutions”. A further elaboration will be discussed under the “Description of Business” below.

This primary offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this Prospectus, unless extended by our directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

Our Chief Executive Officer, Wong Kai Cheong, will be selling shares of common stock on behalf of the Company simultaneously to selling shares of common stock in the Company from his own personal accounts. A conflict of interest may arise between Mr. Wong’s interest in selling shares for his own personal accounts, and in selling shares on the Company’s behalf.

Regarding the sale of Mr. Wong Kai Cheong’s shares, such shares will be sold at a fixed price of $1.00 for the duration of the offering.

The Company estimates the costs of this offering at approximately $27,500. All expenses incurred in this offering are being paid for by the Company. The Company intends to use available cash reserves to pay for any offering expenses. If insufficient funds are available to cover offering expenses with the proceeds raised from this offering, the Company’s officers and directors have informally agreed to cover any such expenses relating to this offering.

For the duration of the offering any and all sellers of the shares being registered herein agree to provide this prospectus to potential investors in its entirety.

The proceeds from the sale of the securities sold on behalf of the Company will be placed directly into the Company’s account, the account of one of its subsidiaries, and/or an escrow account that may be established in the future; any investor who purchases shares will have no assurance that any monies, beside their own, will be subscribed to the prospectus. All proceeds from the sale of the securities are non-refundable, except as may be required by applicable laws.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject to reduced public company reporting requirements.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained in this Prospectus and the information we have referred you to. We have not authorized any person to provide you with any information about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included in this Prospectus. If anyone provides you with different information, you should not rely on it.

The following table of contents has been designed to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

You should rely only on the information contained in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. We have not authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Through December 31, 2021 all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

The date of this prospectus is March 19, 2021.

In this Prospectus, ''AsiaFIN Holdings Corp.'' “AsiaFIN Holdings” the "Company,'' ''we,'' ''us,'' and ''our,'' refer to AsiaFIN Holdings Corp., unless the context otherwise requires. Unless otherwise indicated, the term ''fiscal year'' refers to our fiscal year ending August 31st. Unless otherwise indicated, the term ''common stock'' refers to shares of the Company's common stock.

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section and the “Management’s Discussion and Analysis of Financial Position and Results of Operations” section in this Prospectus.

This summary only highlights selected information contained in greater detail elsewhere in this Prospectus. This summary may not contain all of the information that you should consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors” beginning on Page 5, and the financial statements, before making an investment decision.

The Company

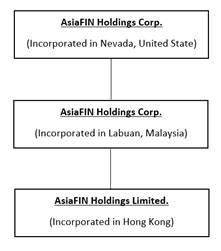

AsiaFIN Holdings Corp., a Nevada corporation (“the Company”) was incorporated under the laws of the State of Nevada on June 14, 2019.

On June 14, 2019, Mr. Wong Kai Cheong was appointed Chief Executive Officer, President, Secretary, Treasurer and Director.

On September 18, 2020 Mr. Seah Kok Wah was appointed Director of the Company.

On December 18, 2019, we, “the Company” acquired 100% of the equity interests of AsiaFIN Holdings Corp. (herein referred to as the “Malaysia Company”), a private limited company incorporated in Labuan, Malaysia. In consideration of the equity interests of AsiaFIN Holdings Corp. our Chief Executive Officer, Mr. Wong was compensated $1 HKD.

On December 23, 2019, AsiaFIN Holdings Corp., Malaysia Company acquired AsiaFIN Holdings Limited (herein referred to as the “Hong Kong Company”), a private limited company incorporated in Hong Kong. In consideration of the equity interests of AsiaFIN Holdings Limited our Chief Executive Officer, Mr. Wong was compensated $1 HKD.

Through our Malaysia and Hong Kong subsidiaries, we are currently providing market research studies and consulting services pertaining to system solutions and integration of unattended payment kiosks and payment processing to our clients. Our present clients, who are related parties, are payment solution companies located in Malaysia, although we intend to provide services to other geographic regions in the future.

We have additional plans to develop our own software, which we anticipate we will be able to be merge and integrate onto such Payment Processing or Unattended Payment Kiosk, to accept payments and also collect data. Additionally, we have plans, which we are still developing and exploring, to create Web-Based Solutions in four areas which include Payment Processing, Regulatory Technology (REGTECH), Robotic Process Automation (RPA) and Unattended Payment Kiosks for financial institutions, and other industries. We refer to the four pillars of our business as “Focus Solutions”. A further elaboration will be discussed under the “Description of Business” below.

At a later date we may decide to expand upon our current plans and may also explore options of developing additional software types. We intend to utilize existing and future relationships that may be gained by our officers and directors as a means to expand our reach across the South East Asia region, which has a population of approximately 660 million individuals. We believe this market provides us a large pool of businesses that may benefit from our current and future service offerings and or software that may become available as our business plan progresses.

- 1 -

Our Offering

We have authorized capital stock consisting of 600,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 200,000,000 shares of preferred stock, $0.0001 par value per share (“Preferred Stock”). We have 72,482,500 shares of Common Stock and no shares of Preferred Stock issued and outstanding. Through this offering we will register a total of 9,841,250 shares. These shares represent 1,000,000 additional shares of common stock to be issued by us and 8,841,250 shares of common stock by our selling stockholders. We may endeavor to sell all 1,000,000 shares of common stock after this registration becomes effective. Upon effectiveness of this Registration Statement, the selling stockholders may also sell their own shares. The price at which we, the company, offer these shares is at a fixed price of $1.00 per share for the duration of the offering. The selling stockholders will also sell shares at a fixed price of $1.00 for the duration of the offering. There is no arrangement to address the possible effect of the offering on the price of the stock. We will receive all proceeds from the sale of our common stock but we will not receive any proceeds from the selling stockholders.

Our Chief Executive Officer, Wong Kai Cheong, will be selling shares of common stock on behalf of the Company simultaneously to selling shares of common stock in the Company from his own personal accounts. A conflict of interest may arise between Mr. Wong’s interest in selling shares for his own personal accounts, and in selling shares on the Company’s behalf.

Regarding the sale of Wong Kai Cheong’s shares, such shares will be sold at a fixed price of $1.00 for the duration of the offering.

We do not believe that we are a shell Company. Currently, we do not have plans or intentions to engage in a merger or acquisition with an unidentified company, companies, entity or person. At this time, the company’s officers and directors, any company promoters, and or their affiliates do not intend for the company, once it is reporting, to be used as a vehicle for a private company to become a reporting company.”

*The primary offering on behalf of the Company is separate from the secondary offering of the selling stockholders in that the proceeds from the shares of stock sold by the selling stockholders will go directly to them, not the Company. The same idea applies if the Company approaches or is approached by investors who then subsequently decide to invest with the Company. Those proceeds would then go to the Company. Whomever the investors decide to purchase the shares from will be the beneficiary of the proceeds. None of the proceeds from the selling stockholder’s will be utilized or given to the Company. Mr. Wong will clarify for investors at the time of purchase whether the proceeds are going to the Company or directly to himself.

*We will notify investors by filling a post-effective amendment to our registration statement that will be available for public viewing on the SEC Edgar Database of any such extension of the offering.

| Securities being offered by the Company | 1,000,000 shares of common stock, at a fixed price of $1.00 offered by us in a direct offering. Our offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering.

| |

| Securities being offered by the Selling Stockholders | 8,841,250 shares of common stock, at a fixed price of $1.00 offered by selling stockholders in a resale offering. As previously mentioned this fixed price applies at all times for the duration of the offering. The offering will terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days from the effective date of this prospectus, unless extended by our Board of Directors for an additional 90 days. We may however, at any time and for any reason terminate the offering. | |

| Offering price per share | We and the selling shareholders will sell the shares at a fixed price per share of $1.00 for the duration of this Offering. | |

| Number of shares of common stock outstanding before the offering of common stock | 72,482,500 common shares are currently issued and outstanding. | |

| Number of shares of common stock outstanding after the offering of common stock | 73,482,500 common shares will be issued and outstanding if we sell all of the shares we are offering. | |

| The minimum number of shares to be sold in this offering | None. | |

| Market for the common shares | There is no public market for the common shares. The price per share is $1.00. | |

| We may not be able to meet the requirement for a public listing or quotation of our common stock. Furthermore, even if our common stock is quoted or granted listing, a market for the common shares may not develop. | ||

| The offering price for the shares will remain at $1.00 per share for the duration of the offering. | ||

- 2 -

| Use of Proceeds | We intend to use the gross proceeds from this offering to us to fund our day to day operations, to attend regional and national exhibitions, to pay for marketing and promotional activities, to hire staff, to pay for ongoing Reporting Requirements and to cover any fees related to further business development. |

| Termination of the Offering | This offering will terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with the Securities and Exchange Commission, or (ii) the date on which all 9,841,250 shares registered hereunder have been sold. We may, at our discretion, extend the offering for an additional 90 days. At any time and for any reason we may also terminate the offering. |

| Terms of the Offering | Our Chief Executive Officer will sell the 1,000,000 shares of common stock on behalf of the company, upon effectiveness of this registration statement, on a BEST EFFORTS basis. |

| Subscriptions: | All subscriptions once accepted by us are irrevocable.

|

| Registration Costs | We estimate our total offering registration costs to be approximately $27,500.

|

| Risk Factors: | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained in this prospectus. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers and sales are permitted.

- 3 -

Please consider the following risk factors and other information in this prospectus relating to our business before deciding to invest in our common stock.

This offering and any investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

We consider the following to be the material risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature. An investment in our common stock may result in a complete loss of the invested amount.

An investment in our common stock is highly speculative, and should only be made by persons who can afford to lose their entire investment in us. You should carefully consider the following risk factors and other information in this report before deciding to become a holder of our common stock. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent.

Risks Relating to Our Company and Our Industry

Our business operations may be materially and adversely affected by the outbreak of the Coronavirus (“COVID-19”).

An outbreak of respiratory illness caused by the novel coronavirus, commonly referred as “COVID-19” emerged in late 2019 and has spread globally. The COVID-19 is considered to be highly contagious and poses a serious public health threat. The World Health Organization labeled the COVID-19 outbreak as a pandemic on March 11, 2020, given its threat beyond a public health emergency of international concern the organization had declared on January 30, 2020.

The epidemic has resulted in social-distancing restrictions, travel restrictions, and the temporary closure of stores and facilities during the past few months. The negative impacts of the COVID-19 outbreak on our business include:

| - | The uncertain economic conditions may refrain clients from engaging our services. |

| - | The operations of businesses in our industry have been, and could continue to be, negatively impacted by the epidemic, which may in turn adversely impact their business performance. |

We are unable to accurately predict the impact that the COVID-19 will have due to various uncertainties, including the ultimate geographic spread of the virus, the severity of the disease, the duration of the outbreak globally, and effectiveness of the actions that may be taken by governmental authorities. Additionally, it is possible that we may face similar difficulties from future should there be, at any point, another global pandemic.

If we are unable to hire qualified personnel and retain or motivate key personnel, we may not be able to grow effectively.

Our future success depends on our continuing ability to identify, hire, develop, motivate and retain skilled personnel for all areas of our organization. Competition in our industry for qualified employees is very intense. Our continued ability to compete effectively depends on our ability to attract new employees and to retain and motivate our existing employees.

Mr. Wong will be able to sell his shares at any time during the duration of this offering. This may pose a conflict of interest since Mr. Wong is also selling shares on behalf of the company in this offering. It is possible that this conflict of interest could affect the ultimate amount of funds raised by the Company. This could negatively affect your investment.

Mr. Wong is going to sell shares on behalf of the Company in this offering. Mr. Wong will be able to simultaneously sell shares of stock for his own accord that are registered for resale pursuant to this offering. This conflict of interest could divert Mr. Wong’s time and attention in selling shares on behalf of the Company since he will also be able to sell his own shares. This could result in less capital raised by the company, and a lessened desire for investors to purchase shares. As a result of this potential conflict of interest your investment could be adversely affected.

We might not implement successfully strategies to increase adoption of our Focus Solutions which would limit our growth.

Our future profitability will depend, in part, on our ability to successfully implement our strategy to increase adoption of our Focus Solutions. We cannot assure you that the relatively new market for our Focus Solutions will remain viable. We expect to invest substantial amounts to:

| - | Drive consumer and customers awareness of our Focus Solutions; |

| - | Encourage consumers and Customers to sign up for and use our Focus Solutions; |

| - | Enhance our infrastructure to handle customers data; |

| - | Continue to develop state of the art, easy-to-use technology; |

| - | Increase the number of customers to use our Focus Solutions; and |

| - | Diversify our customer base. |

Our investment in these programs will affect adversely our short-term profitability. Additionally, we may fail to implement successfully these programs or to increase substantially adoption of our product and services by customers who pay for the service. This would impact revenues adversely, and cause our business to suffer.

We have limited operating history and face many of the risks and difficulties which are frequently encountered by company in the developmental stage.

We are a development stage company, and to date, our efforts have been focused primarily on the development and marketing of our business model. We have limited operating history for investors to evaluate the potential of our business development. We have a limited client base, as we are still in the development stages. In addition, we also face many of the risks and difficulties inherent in introducing our services. These risks include the ability to:

| · | Develop a feasible and effective business plan; |

| · | Attract clients with great prospects; |

| · | Meet clients’ standards; |

| · | Implement advertising and marketing plans; |

| · | Attain client loyalty; |

| · | Maintain current strategic relationships and develop new strategic relationships; |

| · | Respond effectively to competitive pressures; |

| · | Continue to develop and upgrade our service; and |

| · | Attract, retain and motivate qualified personnel. |

Our future will depend on our ability to bring our service to the market place and society, which requires proper and organized planning of providing a platform that is able to offer viable business solution, growth model and corporate development to the members in order to assist in their companies’ growth and expansion as well as increase every member’s loyalty towards the Company. The results of our operations can also be affected by our ability to enhance our services or to deliver consistent high quality services to increase our competitive presence.

If we are unable to compete successfully in our market place, it will harm our business.

There are similar services in current marketplace that compete with our core operating activities. Certain of these competitors and potential competitors have longer operating histories, substantially greater service development capabilities and financial, commercial and marketing resources. Competitors and potential competitors may also innovate services that are more effective or have other potential advantages compared to our service plan. In addition, research, development and commercialization efforts by others could render our services provided obsolete or non-competitive. Certain of our competitors and potential competitors have broader services offerings and extensive client bases, allowing them to adopt aggressive pricing policies that would enable them to gain market share. Competitive pressures could result in price reductions, reduced margins and loss of market share. We could encounter potential members that, due to existing relationships with our competitors, are committed to services offered by those competitors. As a result, those potential members may not consider utilizing our services.

Our operations are currently based primarily in Hong Kong. U.S. regulators, such as, but not limited to, the Department of Justice, the SEC, PCAOB, and other authorities would likely incur difficulties in any potential investigations or inspections into our business given the location of our operations in Hong Kong, and surrounding Asia regions.

We are a Nevada corporation, however most of our assets and operations are, and will be, located outside of the United States, specifically in Hong Kong.

As a result, it may be difficult for US Regulators of all kinds to investigate or carry out inspections, of any kind, into or regarding our operations due to the complex relationships between and among the United States, Hong Kong, and the People’s Republic of China (PRC). There are also logistical issues with enforcing any actions on Companies that operate overseas. There would likely be varying issues of jurisdiction, not withstanding the historically complex relationships among the PRC and United States, or between other nations and the United States. There is also uncertainty as to whether the courts of Hong Kong, the PRC or any other Asian countries, would recognize or enforce judgments of U.S. courts or US Regulators overseas within their own jurisdictions. These factors all create a risk that should be considered before investing in our Company.

- 4 -

Failure to comply with laws and regulations applicable to our business could subject us to fines and penalties and could also cause us to lose customers or otherwise harm our business.

Our business is subject to regulation by various governmental agencies in Hong Kong and Malaysia, including agencies responsible for monitoring and enforcing compliance with various legal obligations, such as privacy and data protection-related laws and regulations, intellectual property laws, employment and labor laws, workplace safety, governmental trade laws, import and export controls, anti-corruption and anti-bribery laws, and tax laws and regulations. In certain jurisdictions, these regulatory requirements may be more stringent than in Hong Kong and Malaysia. These laws and regulations impose added costs on our business. Noncompliance with applicable regulations or requirements could subject us to:

| - | investigations, enforcement actions, and sanctions; |

| - | mandatory changes to our network and products; |

| - | disgorgement of profits, fines, and damages; |

| - | civil and criminal penalties or injunctions; |

| - | claims for damages by our customers or channel partners; |

| - | termination of contracts; |

| - | failure to obtain, maintain or renew certain licenses, approvals, permits, registrations or filings necessary to conduct our operations; and |

| - | temporary or permanent debarment from sales to public service organizations. |

If any governmental sanctions are imposed, or if we do not prevail in any possible civil or criminal litigation, our business, results of operations, and financial condition could be adversely affected. In addition, responding to any action will likely result in a significant diversion of our management’s attention and resources and an increase in professional fees. Enforcement actions and sanctions could materially harm our business, results of operations, and financial condition.

Any reviews by regulatory agencies or legislatures may result in substantial regulatory fines, changes to our business practices, and other penalties, which could negatively affect our business and results of operations. Changes in social, political, and regulatory conditions or in laws and policies governing a wide range of topics may cause us to change our business practices. Further, our expansion into a variety of new fields also could raise a number of new regulatory issues. These factors could negatively affect our business and results of operations in material ways.

Moreover, we are exposed to the risk of misconduct, errors and failure to functions by our management, employees and parties that we collaborate with, who may from time to time be subject to litigation and regulatory investigations and proceedings or otherwise face potential liability and penalties in relation to noncompliance with applicable laws and regulations, which could harm our reputation and business.

We may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations.

We cannot be certain that our operations or any aspects of our business do not, or will not, infringe upon or otherwise violate trademarks, copyrights, know-how or other intellectual property rights held by third parties. We may be from time to time in the future subject to legal proceedings and claims relating to the intellectual property rights of others. In addition, there may be third-party trademarks, copyrights, know-how or other intellectual property rights that are infringed by our products, services or other aspects of our business without our awareness. Holders of such intellectual property rights may seek to enforce such rights against us in Hong Kong, Malaysia, the United States or other jurisdictions. If any third-party infringement claims are brought against us, we may be forced to divert some resources from our business and operations to defend against these claims, regardless of their merits.

Additionally, the application and interpretation of Hong Kong and Malaysia’s intellectual property right laws and the procedures and standards for granting trademarks, copyrights, know-how or other intellectual property rights in both Hong Kong and Malaysia are still evolving and are uncertain, and we cannot ensure that related courts or regulatory authorities would agree with our analysis. If we were found to be in violation of the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. As a result, our business and operating results may be materially and adversely affected.

Our business and marketing plans may be unsuccessful, which means that we may not be able to continue operations as a going concern.

Our ability to continue as a going concern is dependent upon our generating cash flow that is sufficient to fund operations or finding adequate investment or borrowed capital to support our operations. To date we have relied entirely on equity financing from our shareholders to fund our operations. Our business and marketing plans may not be successful in achieving a sustainable business and generating revenues. We have no arrangements in place for sufficient financing to be able to fully implement our business plan. If we are unable to continue as planned currently, we may have to curtail some or all of our business plan and operations. In such case, investors will lose all or a portion of their investment.

We currently have been generating operating losses, and we may never achieve profitability.

We have had and we expect to continue to have losses in the near term and will rely on capital funding or borrowings to fund our operations. To date, capital funding has been limited in amount. We cannot predict whether or not we will ever become profitable or be able to continue to find capital to support our development and business plan.

We will require additional capital in the future, which may not be available on terms acceptable to us, or at all.

Our future liquidity and capital requirements will depend upon numerous factors, including the success of our offerings and market developments. We will to need to raise funds through public or private financings, strategic relationships or other arrangements. There can be no assurance that such funding, will be available on terms acceptable to us, or at all. Furthermore, any equity financing will be dilutive to existing stockholders, and debt financing, if available, may involve restrictive covenants that may limit our operating flexibility with respect to certain business matters. If funds are raised through the issuance of equity securities, the percentage ownership of our stockholders will be reduced, stockholders may experience additional dilution in net book value per share, and such equity securities may have rights, preferences or privileges senior to those of the holders of our existing capital stock. If adequate funds are not available on acceptable terms, we may not be able to continue operating, develop or enhance Focus Solutions, take advantage of future opportunities or respond to competitive pressures, any of which could have a material adverse effect on our business, operating results and financial condition.

We do not currently have a fully developed marketing plan, and as such we may not generate as much revenue as we anticipate.

Presently, we do not have a definitive marketing plan to acquire customers. It will take us time to develop a concrete marketing plan, and in the interim we will likely not be generating significant revenue or, in a worst-case scenario, any revenue at all.

Our operating results may be variable, and therefore our future prospects may be difficult for investors and analysis to assess.

Our operating results are likely to fluctuate significantly in the future due to a variety of factors. Due to our limited operating history, we believe it will be difficult to accurately forecast our revenues and operating results in our market launch phases. Factors that may slow or harm our business or cause our operating results to fluctuate include the following:

• The market acceptance of, and demand for, our delivered services on financial ecosystem technology;

• Our inability to attract new clients and retain existing clients’ loyalty at a reasonable cost;

• Changes in alternative technologies, industry standards and clients’ preferences;

• Our inability to attract and retain key personnel;

• Economic conditions affecting our potential clients;

• Extraordinary expenses such as litigation; and

• Our failure to penetrate into new and different geographical markets.

Any change in one or more of these factors, as well as others, could cause our annual or quarterly operating results to fluctuate. Any change in one or more of these factors could reduce our gross margins in future periods.

American investors may have difficulty enforcing service of process, enforcing judgments, and bringing original actions in foreign courts to enforce liabilities against our Company, Officers and Directors.

We are a Nevada corporation and most of our assets are, and will be, located outside of the United States. Almost all of our operations will be conducted in Asia. In addition, our officers and directors are nationals and residents of a country other than the United States. As a result, it may be difficult for investors to effect service of process within the United States, or abroad, upon them. It may also be difficult to enforce court judgments on the civil liability provisions of the U.S. federal securities laws against our Company and our officers and directors, since our officers and directors are not residents in the United States. In addition, there is uncertainty as to whether the courts of Hong Kong, Malaysia, or other Asian countries would recognize or enforce judgments of U.S. courts.

- 5 -

The economy of the Asia region in general might not grow as quickly as expected, which could adversely affect our revenues and business prospects.

Our business and prospects depend on the continuing development and expansion of the consulting industry in the Asia region, which in turn depends upon the continuing growth of the economy of Asia in general, as well as product and service providers. We cannot assure you, however, that the Asia consulting industry will continue to grow at the same pace as in the past.

Due to the fact that a small number of existing shareholders own a large percentage of the Company’s voting shares, future investors will have minimal influence over shareholder decisions.

Existing management has significant share ownership in the Company and will retain control of the Company in the future. As a result of such ownership concentration, our officers and directors will have significant influence over the management and affairs of the Company and its business. It will also exert considerable, ongoing influence over matters subject to shareholder approval, including the election of directors and significant corporate transactions, such as a merger, sale of assets or other business combination or sale of the Company. This concentration of ownership may have the effect of delaying, deferring, or preventing a change in control, impeding a merger, consolidation, takeover or other business combination involving us, or discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of the Company, even if such a transaction would benefit other shareholders.

Currency exchange rate fluctuations may increase our costs.

The exchange rates between the U.S. dollar and non-U.S. currencies in which we conduct our business have and will likely fluctuate in the future. Any appreciation in the value of these non-U.S. currencies would result in higher expenses for our Company. We do not have any hedging arrangements to protect against such exchange rate exposures.

We lack risk management methods, our business, reputation and financial results may be adversely affected.

We currently do not have methods to identify, monitor and manage risks with respect to our financial ecosystem provider business model. If any of such risks were to materialize, our business, reputation, financial condition and operating results could be materially and adversely affected. In addition, our insurance policies may not provide adequate coverage.

If our Chief Executive Officer (CEO) and our Director leave the company prior to securing suitable replacements, we will be left without management and our business operations might need to be suspended or cease entirely all together.

We depend on the services of our CEO, Mr. Wong, and our Director, Mr. Seah, who are responsible for making corporate decisions which have significant impact on our operations. The loss of the services of our CEO and Director could have an adverse effect on our business, financial condition and results of operations. There is no assurance that they will not leave the company or compete against us in the future, as we presently have no employment agreement with him. In such circumstance, we may have to recruit qualified personnel with competitive compensation packages, equity participation and other benefits that may affect the working capital available for our operations. Our failure to attract additional qualified employees or to retain the services of our CEO and Director could have a material adverse effect on our operating results and financial condition. We will fail without appropriate replacements.

Due to the fact that we are a publicly reporting company we will continue to incur significant costs in staying current with reporting requirements. Our management will be required to devote substantial time to compliance initiatives. Additionally, the lack of an internal audit group may result in material misstatements to our financial statements and ability to provide accurate financial information to our shareholders.

Our management and other personnel will need to devote a substantial amount of time to compliance initiatives to maintain reporting status. Moreover, these rules and regulations, which are necessary to remain as an SEC reporting Company, will be costly because an external third-party consultant(s), attorney, or firm, may have to assist us in following the applicable rules and regulations for each filing on behalf of the company.

We currently do not have an internal audit group, and we may eventually need to hire additional accounting and financial staff with appropriate public company experience and technical accounting knowledge to have effective internal controls for financial reporting. Additionally, due to the fact that our officers and director have limited experience as an officer or director of a reporting company, such lack of experience may impair our ability to maintain effective internal controls over financial reporting and disclosure controls and procedures, which may result in material misstatements to our financial statements and an inability to provide accurate financial information to our stockholders

- 6 -

We will need to increase the size of our organization, and we may encounter difficulties managing our growth, which could adversely affect our results of operations.

We are currently a development stage company. We will need to effectively manage our managerial, operational, financial and other resources in order to successfully pursue expansion, development and commercialization effort. To manage any growth, we will be required to continue to improve our operational, financial and management controls, reporting systems and procedures and to attract and retain sufficient numbers of talented employees. We may be unable to successfully manage the expansion of our operations or operate on a larger scale and, accordingly, may not achieve our expansion, development and commercialization goals.

The recently enacted JOBS Act will allow the Company to postpone the date by which it must comply with certain laws and regulations intended to protect investors and to reduce the amount of information provided in reports filed with the SEC.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. The Company meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will, among other things:

-be exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that its independent registered public accounting firm provide an attestation report on the effectiveness of its internal control over financial reporting;

-be exempt from the "say on pay” provisions (requiring a non-binding shareholder vote to approve compensation of certain executive officers) and the "say on golden parachute” provisions (requiring a non-binding shareholder vote to approve golden parachute arrangements for certain executive officers in connection with mergers and certain other business combinations) of The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and certain disclosure requirements of the Dodd-Frank Act relating to compensation of Chief Executive Officers;

-be permitted to omit the detailed compensation discussion and analysis from proxy statements and reports filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and instead provide a reduced level of disclosure concerning executive compensation; and

-be exempt from any rules that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) requiring mandatory audit firm rotation or a supplement to the auditor’s report on the financial statements.

Although the Company is still evaluating the JOBS Act, it currently intends to take advantage of all of the reduced regulatory and reporting requirements that will be available to it so long as it qualifies as an “emerging growth company”. The Company has elected not to opt out of the extension of time to comply with new or revised financial accounting standards available under Section 102(b)(1) of the JOBS Act. Among other things, this means that the Company's independent registered public accounting firm will not be required to provide an attestation report on the effectiveness of the Company's internal control over financial reporting so long as it qualifies as an “emerging growth company”, which may increase the risk that weaknesses or deficiencies in the internal control over financial reporting go undetected. Likewise, so long as it qualifies as an “emerging growth company”, the Company may elect not to provide certain information, including certain financial information and certain information regarding compensation of executive officers, which would otherwise have been required to provide in filings with the SEC, which may make it more difficult for investors and securities analysts to evaluate the Company. As a result, investor confidence in the Company and the market price of its common stock may be adversely affected.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $250 million and annual revenues of less than $100 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time are we cease being an “emerging growth company”, the disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we were not considered either an “emerging growth company” or a “smaller reporting company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, being required to provide only two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards. As a result, our financial statements may not be comparable to those of companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1.07 billion, if we issue more than $1 billion in non-convertible debt in a three-year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million.

Security and privacy breaches in our Focus Solutions may expose us to additional liability and result in the loss of customers, either of which events could harm our business and cause our stock price to decline.

Any inability on our part to protect the security and privacy of our Focus Solutions could have a material adverse effect on our profitability. A security or privacy breach could:

| - | Expose us to additional liability; |

| - | Increase our expenses relating to resolution of these breaches; and |

| - | Deter customers from using our product. |

We cannot assure you that our use of applications designed for data security will effectively counter evolving security risks or address the security and privacy concerns of existing and potential customers. Any failures in our security and privacy measures could have a material adverse effect on our business, financial condition and results of operations.

We could incur substantial losses from employee fraud and, as a result, our business would suffer.

The nature of our Focus Solutions makes us vulnerable to employee fraud or other internal security breaches. We cannot assure you that our internal security systems will prevent material losses from employees’ fraud. Although we will take every reasonable effort to ensure that employee fraud does not take place, we cannot make assurances that our efforts will be successful.

Our Focus Solutions might be used for illegal or improper purposes, which could expose us to additional liability and harm our business.

Despite measures we have taken to detect and prevent identify theft, unauthorized uses of credit cards and similar misconduct, our Focus Solutions remain susceptible to potentially illegal or improper uses. Despite measures we have taken to detect and lessen the risk of this kind of conduct, we cannot assure you that these measures will succeed. Our business could suffer if customers use our system for illegal or improper purposes.

We may experience breakdowns in our Focus Solutions that could damage customer relations and expose us to liability, which could affect adversely our ability to become profitable.

A system outage or data loss could have a material adverse effect on our business, financial condition and results of operations. To operate our business successfully, we must protect our payment processing and other systems from interruption by events beyond our control. Events that could cause system interruptions include:

| - | Fire; |

| - | Flood |

| - | Earthquake; |

| - | Terrorist attacks; |

| - | Natural disasters; |

| - | Computer viruses; |

| - | Unauthorized entry; |

| - | Telecommunications failure; |

| - | Computer denial of service attacks; and |

| - | Power loss and country blackouts and lockdown. |

We may not protect our proprietary technology effectively, which would allow competitors to duplicate our Focus Solutions. This would make it more difficult for us to compete with them.

Our success and ability to compete in our markets depend, in part, upon our proprietary technology. We rely primarily on copyright, trade secret and trademark laws to protect our technology including the source code for our proprietary software, and documentation and other proprietary information. We have not been granted any patents for features of our Focus Solutions. We cannot assure you that any of our patent applications will be granted or that if they are granted, they will be valid. A third party might try to reverse engineer or otherwise obtain and use our technology without our permission, allowing competitors to duplicate our product and services.

- 7 -

Risks Relating to the Company’s Securities

We do not intend to pay dividends on our common stock.

We have no intention to declare or pay any cash dividend on our capital stock. We currently intend to retain any future earnings and do not expect to pay any dividends in the foreseeable future.

Our securities have no prior market and an active trading market may not develop, which may cause our common stock to trade at a discount from the initial public offering price.

Prior to this offering there has been no public market for our common stock. The initial public offering price for our common stock will be determined through negotiations between us and the representatives of the underwriters and may not be indicative of the market price of our common stock after this offering. If you purchase shares of our common stock, you may not be able to resell those shares at or above the initial public offering price. We cannot predict the extent to which investor interest in us will lead to the development of an active trading market on or otherwise or how liquid that market might become. An active public market for our common stock may not develop or be sustained after the offering. If an active public market does not develop or is not sustained, it may be difficult for you to sell your shares of common stock at a price that is attractive to you, or at all.

We may never have a public market for our common stock or may never trade on a recognized exchange. Therefore, you may be unable to liquidate your investment in our stock.

There is no established public trading market for our securities. Our shares are not and have not been listed or quoted on any exchange or quotation system.

In order for our shares to be quoted, a market maker must agree to file the necessary documents with the National Association of Securities Dealers, which operates the OTCQB. In addition, it is possible that such application for quotation may not be approved and even if approved it is possible that a regular trading market will not develop or that if it did develop, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

Even if our shares become publicly quoted, your shares may not be “free-trading”.

Investors should understand that their shares of our common stock will not become “free-trading” merely because our Company is a publicly-quoted company. In order for the shares to become “free-trading”, the shares must be registered, or entitled to an exemption from registration under applicable law.

There may be future sales of our securities or other dilution of our equity, which may adversely affect the market price of our common stock.

We are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable for, or that represent the right to receive, common stock. The market price of our common stock could decline as a result of sales of common stock or securities that are convertible into or exchangeable for, or that represent the right to receive, common stock after this offering or the perception that such sales could occur.

- 8 -

A large number of shares issued in this offering may be sold in the market following this offering, which may depress the market price of our common stock.

A large number of shares issued in this offering may be sold in the market following this offering, which may depress the market price of our common stock. Sales of a substantial number of shares of our common stock in the public market following this offering could cause the market price of our common stock to decline. If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and sellers remain willing to sell the shares. All of the securities issued in the offering will be freely tradable without restriction or further registration under the Securities Act.

We may issue shares of preferred stock in the future which may adversely impact your rights as holders of our common stock.

Our Certificate of Incorporation authorizes us to issue up to 200,000,000 shares of preferred stock. Accordingly, our board of directors will have the authority to fix and determine the relative rights and preferences of preferred shares, as well as the authority to issue such shares, without further stockholder approval. At this time we have no shares of preferred stock issued and outstanding.

Our preferred stock does not have any dividend, conversion, liquidation, or other rights or preferences, including redemption or sinking fund provisions. However, our board of directors could authorize the issuance of a series of preferred stock that would grant to holders preferred rights to our assets upon liquidation, the right to receive dividends before dividends are declared to holders of our common stock, and the right to the redemption of such preferred shares, together with a premium, prior to the redemption of the common stock. To the extent that we do issue such additional shares of preferred stock, your rights as holders of common stock could be impaired thereby, including, without limitation, dilution of your ownership interests in us. In addition, shares of preferred stock could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult, which may not be in your interest as holders of common stock.

The costs to meet our reporting and other requirements as a public company subject to the Exchange Act of 1934 and will be substantial, which may result in us having insufficient funds to expand our business or even to meet routine business obligations.

As a public entity, subject to the reporting requirements of the Exchange Act of 1934, we will continue to incur ongoing expenses associated with professional fees for accounting, legal and a host of other expenses for annual reports and proxy statements. We estimate that these costs will range up to $35,000 per year for the next few years and will be higher if our business volume and activity increases. As a result, we may not have sufficient funds to grow our operations.

State Securities Laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell Shares.

Secondary trading in our common stock may not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock cannot be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted.

- 9 -

Risks Relating to this Offering

Investors cannot withdraw funds once invested and will not receive a refund.

Investors do not have the right to withdraw invested funds. Subscription payments will be paid to AsiaFIN Holdings Corp. and held in our corporate bank account if the Subscription Agreements are in good order and the Company accepts the investor’s investment. Therefore, once an investment is made, investors will not have the use or right to return of such funds.

There is the risk that investors may lose their investment.

If our securities are not eligible for initial quotation, or if quoted, are not eligible for continued quotation on the OTCMarkets.com, OTC Marketplace, or a public trading market does not develop, purchasers of the shares of common stock may have difficulty selling or be unable to sell their securities, rendering their shares effectively worthless and resulting in a partial or complete loss of their investment.

Our management will have considerable discretion in how we use the net proceeds from this offering, and no representation can be made that use of proceeds will generate material revenues or materially improve our ability to further develop our services.

Our management will have considerable discretion in how we use the net proceeds from this offering, and no representation can be made that use of proceeds will generate material revenues or materially improve our ability to further develop our services and our platform. We intend to use the net proceeds for working capital, general corporate purposes, construction of our platform and the costs of continuing disclosure compliance. Even if we generate material revenues, we currently plan to seek additional capital following this offering. No assurance can be given that any source of additional cash will be available to us. If no source of additional cash is available to us, we may have to significantly reduce the scope of our operations.

If an active, liquid trading market for our common stock does not develop, you may not be able to sell your shares quickly or at or above the initial offering price.

There has not been a public market for our common stock. An active and liquid trading market for our common stock may not develop or be sustained following this offering. The lack of an active market may impair your ability to sell your shares at the time you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair market value of your shares. An inactive market may also impair our ability to raise capital to continue to fund operations by selling shares and may impair our ability to acquire other companies or technologies by using our shares as consideration. You may not be able to sell your shares quickly or at or above the initial offering price. The initial public offering price will be determined by negotiations with the representatives of the underwriters. This price may not be indicative of the price at which our common stock will trade after this offering, and our common stock could trade below the initial public offering price.

Our stock price may be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at, or above, the initial public offering price and the price of our common stock may fluctuate significantly.

After this offering, the market price for our common stock is likely to be volatile, in part because our shares have not been traded publicly. In addition, the market price of our common stock may fluctuate significantly in response to a number of factors, most of which we cannot control, including:

- Changes in general economic or market conditions or trends in our industry or the economy as a whole and, in particular, in the leisure travel environment;

- Changes in key personnel;

- Entry into new geographic markets;

- Actions and announcements by us or our competitors or significant acquisitions, divestitures, strategic partnerships, joint ventures or capital commitments;

- Fluctuations in quarterly operating results, as well as differences between our actual financial and operating results and those expected by investors;

- The public’s response to press releases or other public announcements by us or third parties, including our filings with the SEC;

- Announcements relating to litigation;

- Guidance, if any, that we provide to the public, any changes in this guidance or our failure to meet this guidance;

- Changes in financial estimates or ratings by any securities analysts who follow our common stock, our failure to meet these estimates or failure of those analysts to initiate or maintain coverage of our common stock;

- The development and sustainability of an active trading market for our common stock;

- Future sales of our common stock by our officers, directors and significant stockholders; and

- Changes in accounting principles.

These and other factors may lower the market price of our common stock regardless of our actual operating performance. As a result, our common stock may trade at prices significantly below the initial public offering price.

We will have broad discretion in how we use the proceeds of this offering, and we may not use these proceeds effectively. This could affect our profitability and cause our stock price to decline.

Our management will have considerable discretion in the application of the net proceeds of this offering, and you will not have the opportunity, as part of your investment decision, to assess whether we are using the proceeds appropriately. We currently intend to use the net proceeds for collateral requirements to support our transaction processing activities, capital expenditures and other general corporate purposes including continued international expansion and development of additional product functionality. We have not finalized yet the amount of net proceeds that we will use specifically for each of these purposes. We may use the net proceeds for corporate purposes that do not result in our profitability or increase our market value.

- 10 -

FINRA sales requirements may limit a stockholder’s ability to buy and sell our stock.

FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for certain customers. FINRA requirements will likely make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder’s ability to resell shares of our common stock.

We may be subject to the penny stock rules which will make shares of our common stock more difficult to sell.

We may be subject now and in the future to the SEC’s “penny stock” rules if our shares of common stock sell below $5.00 per share. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker-dealers to deliver a standardized risk disclosure document prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction, the broker dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. The penny stock rules are burdensome and may reduce purchases of any offerings and reduce the trading activity for shares of our common stock. As long as our shares of common stock are subject to the penny stock rules, the holders of such shares of common stock may find it more difficult to sell their securities.

We are selling the shares of this offering without an underwriter and may be unable to sell any shares.

This offering is self-underwritten, which means that we are not going to engage the services of an underwriter to sell the shares. We intend to sell our shares through our Chief Executive Officer Mr. Wong, who will receive no commission. There is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling all of the shares of our Company’s offering, we may have to seek alternative financing to implement our business plan.

Shares sold by the selling shareholders may limit the amount of proceeds raised in the primary offering

As the Company is only selling 1,000,000 of the 9,841,250 shares being registered in this offering, this may result in competition between the Company and the Selling Shareholders who may offer to the same investor groups. As such, it may limit the amount the Company is able to raise in the primary offering.

We will require additional funding to satisfy our future capital needs, and future financing strategies may adversely affect holders of our common stock.