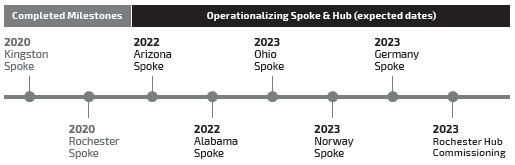

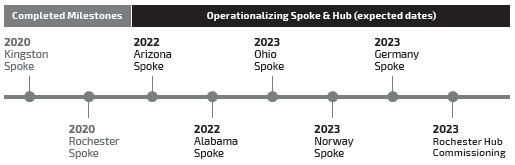

OUR OPERATIONAL PROGRESS. Li-Cycle’s business model can scale efficiently with growth in customer demand. Our Spoke technology is capital-light, has a small footprint, and is replicable in a modular build fashion. We have made significant operational progress, with Spoke processing capacity currently totaling up to 65,000 tonnes in operation, construction or advanced development. Our Kingston and Rochester Spokes are fully operational, Arizona is currently being commissioned and Alabama is on track for operation in 2022. We are also in advanced development for three additional Spokes in 2023. The Ohio Spoke is to be co-located on Ultium Cells, LLC’s battery manufacturing site, and the Norway and Germany Spokes are strategically planned close to demand centers. Importantly, we commenced construction of our Rochester Hub, the first hydrometallurgical facility for post-processing materials from lithium-ion batteries in North America. As compared with incumbent pyrometallurgical processing, we expect our Hub facility to have higher resource recovery, lower capital intensity, a smaller environmental footprint, and greater employee safety. On track for commissioning in 2023, our Rochester Hub facility will produce critical battery materials, including nickel sulphate, lithium carbonate, and cobalt sulphate. OUR STRATEGIC PARTNERSHIPS. We have entered into long-term strategic partnerships with two leading global participants, validating the Li-Cycle business model and technology. The first, Koch Strategic Platforms (KSP), invested $100 million through the purchase of a convertible note. KSP has been rapidly growing its investments related to energy transformation, specifically within the electrification ecosystem. In addition, Li-Cycle is deploying KSP’s engineering prowess in the execution of our Spoke & Hub processes, through fabrication and operational readiness support. The second, LG Chem (LGC) and LG Energy Solution (LGES), have plans to invest a total of $50 million in Li-Cycle, upon completion of commercial agreements for battery supply to our Spokes and off-take for nickel sulphate from our Rochester Hub. LGC is a leading global chemical company with expertise in active battery materials manufacturing. LGES is the largest global lithium-ion battery manufacturer for electric vehicles outside of China. OUR FINANCIAL STRENGTH. We ended the year (October 31, 2021) with cash on hand of more than $595 million. With this strong balance sheet position, we believe we are well funded for our current pipeline of growth projects. 2021 WAS A FOUNDATIONAL YEAR FOR LI-CYCLE. We advanced the strategy and execution on our integrated Spoke & Hub business model. • We experienced a growth inflection point in the battery materials supply chain; • We moved strategically and expeditiously with our customers and market demand; • We established our business model and technology with leading global participants; and • We strengthened our balance sheet for our pipeline of growth projects. LOOKING AHEAD IN 2022. Our leadership team is directly aligned with shareholders. Our key objectives are: • Prioritize HSEQ at all our locations from development through operation; • Deliver on our black mass production target of 6,500 to 7,500 tonnes in fiscal year 2022; • Progress execution of the Rochester Hub for commissioning in 2023; and • Maintain a strong balance sheet position. We appreciate and are thankful for the immense support from our employees, customers and shareholders as we are Empowering a Sustainable Future through a focus on People, Planet, Profit. |