- MOND Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Mondee (MOND) 425Business combination disclosure

Filed: 13 Apr 22, 12:00am

ANALYST BRIEFING April 2022 THE FUTURE OF TRAVEL, NOW Filed by ITHAX Acquisition Corp. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a - 12 of the Securities Exchange Act of 1934 Subject Company: Mondee Holdings II, Inc . Commission File No. 001 - 39943

© 2022 All Rights Reserved | Confidential | 2 Orestes Fintiklis ITHAX CEO & Chairman Ithaca Capital Founder Dimitrios Athanasopoulos ITHAX CFO, Treasurer & Director AXIA Ventures Founder Rahul Vir ITHAX Director Ex - Marriott CALA Vice President George Syllantavos ITHAX Director Serial SPAC Entrepreneur Carlos N. Guimarães ITHAX Director Invest Tur Brasil Founder ITHAX Acquisition Corp. is a strategic collaboration between the Founder of Ithaca Capital Partners and the Principals of AXIA Ventures Group ITHAX Acquisition Corp. Introduction ▪ Proven track record in travel and prime hospitality investments – five properties acquired and/or asset - managed since its founding in 2017 ▪ Positive returns to date, driven by refinancing and asset disposals ▪ Leading US and EU investment bank; active in the leisure real estate sector; market leader in peripheral Europe ▪ Recently concluded real estate transactions with market value of $3B, and non - RE transactions with deal value over $28B ▪ Management team has 40+ years of combined experience in real estate, hospitality investments, asset management and operations , i n addition to 70+ years combined experience in transaction, finance, and investment advisory experience ▪ ITHAX team has an established substantial track record in the hospitality sector, including the acquisition or development of ov er 70+ hotels and resorts, as well as asset management and operations of over 280 hotels and resorts ▪ Management has strong networks in the hospitality and real - estate space

© 2022 All Rights Reserved | Confidential | 3 Proven M&A platform Successfully acquired and integrated 14 companies, driving exponential revenue growth in the Mondee ecosystem and achieving significant synergies Mondee Business Summary Hi - Growth and Profitable Travel Technology Company and Marketplace Mondee is both a growth & value play $3B 1 Gross Revenue, approx. 40% Organic - 62% Inorganic CAGR 2 2015 - 19, 2019: $171M Adjusted Net Revenue, $40M Adjusted EBITDA 3 Modern Marketplace and Technology Platform disrupting the $1tn assisted/affiliated travel market Marketplace seamlessly connecting travel suppliers with gig agents, corporations and consumers on state - of - the - art operating system disrupting legacy incumbent platforms Attractive valuation Compelling risk adjusted trade when compared to travel marketplace and technology comps and entire spectrum of travel stocks in general

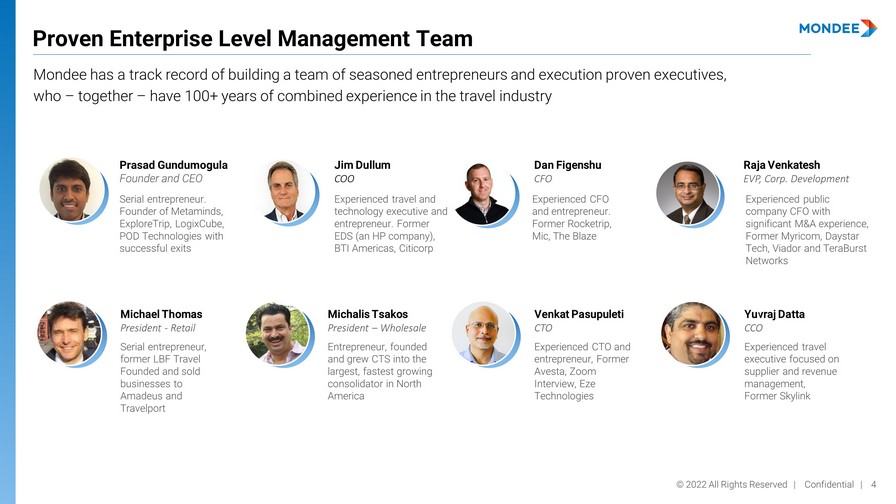

© 2022 All Rights Reserved | Confidential | 4 Prasad Gundumogula Founder and CEO Serial entrepreneur. Founder of Metaminds, ExploreTrip, LogixCube, POD Technologies with successful exits Dan Figenshu CFO Experienced CFO and entrepreneur. Former Rocketrip, Mic, The Blaze Raja Venkatesh EVP, Corp. Development Experienced public company CFO with significant M&A experience, Former Myricom, Daystar Tech, Viador and TeraBurst Networks Michael Thomas President - Retail Serial entrepreneur, former LBF Travel Founded and sold businesses to Amadeus and Travelport Michalis Tsakos President – Wholesale Entrepreneur, founded and grew CTS into the largest, fastest growing consolidator in North America Venkat Pasupuleti CTO Experienced CTO and entrepreneur, Former Avesta, Zoom Interview, Eze Technologies Yuvraj Datta CCO Experienced travel executive focused on supplier and revenue management, Former Skylink Mondee has a track record of building a team of seasoned entrepreneurs and execution proven executives, who – together – have 100+ years of combined experience in the travel industry Proven Enterprise Level Management Team Experienced travel and technology executive and entrepreneur. Former EDS (an HP company), BTI Americas, Citicorp Jim Dullum COO

Mondee Overview

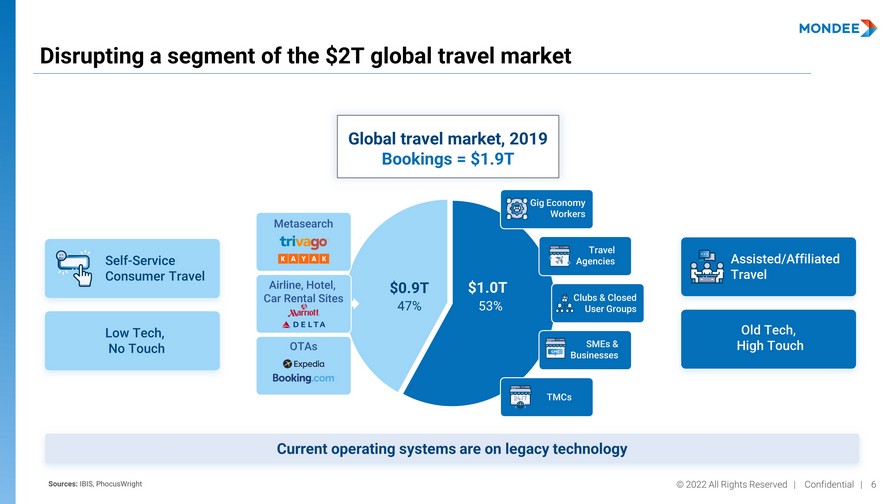

© 2022 All Rights Reserved | Confidential | 6 Disrupting a segment of the $2T global travel market Global travel market, 2019 Bookings = $1.9T 47% 53% $0.9T $1.0T Self - Service Consumer Travel Low Tech, No Touch Assisted/Affiliated Travel Old Tech, High Touch Metasearch Airline, Hotel, Car Rental Sites OTAs Gig Economy Workers Travel Agencies Clubs & Closed User Groups SMEs & Businesses TMCs Current operating systems are on legacy technology Sources: IBIS, PhocusWright

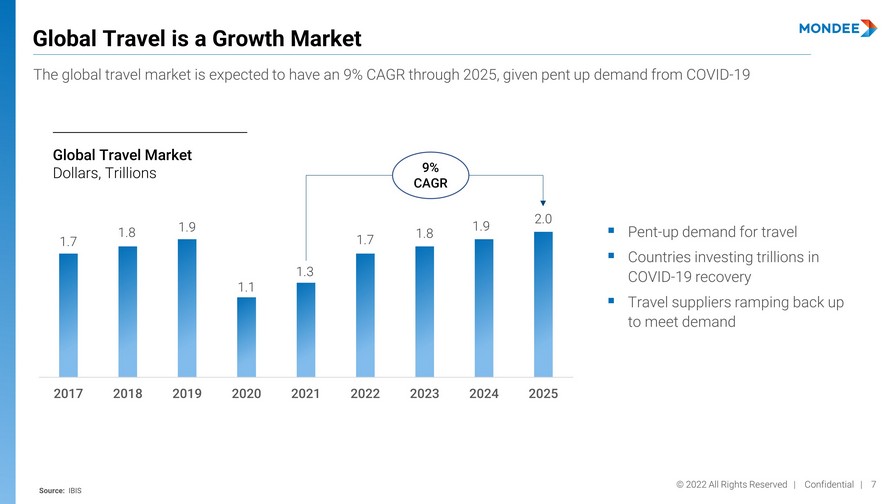

© 2022 All Rights Reserved | Confidential | 7 Global Travel Market Dollars, Trillions ▪ Pent - up demand for travel ▪ Countries investing trillions in COVID - 19 recovery ▪ Travel suppliers ramping back up to meet demand The global travel market is expected to have an 9% CAGR through 2025, given pent up demand from COVID - 19 Global Travel is a Growth Market 1.7 1.8 1.9 1.1 1.3 1.7 1.8 1.9 2.0 2017 2018 2019 2020 2021 2022 2023 2024 2025 9% CAGR Source: IBIS

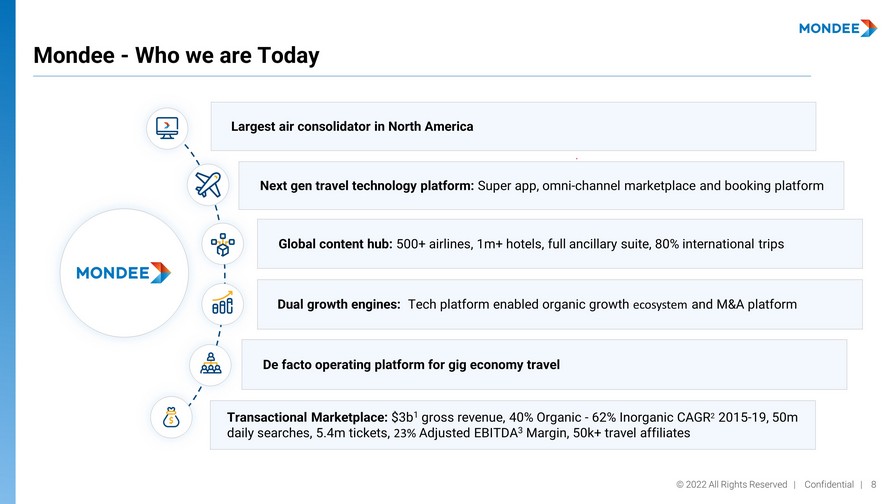

© 2022 All Rights Reserved | Confidential | 8 Dual growth engines: Tech platform enabled organic growth ecosystem and M&A platform Mondee - Who we are Today De facto operating platform for gig economy travel Largest air consolidator in North America Transactional Marketplace: $3b 1 gross revenue, 40% Organic - 62% Inorganic CAGR 2 2015 - 19, 50m daily searches, 5.4m tickets, 23% Adjusted EBITDA 3 Margin, 50k+ travel affiliates Next gen travel technology platform: Super app, omni - channel marketplace and booking platform Global content hub: 500+ airlines, 1m+ hotels, full ancillary suite, 80% international trips

© 2022 All Rights Reserved | Confidential | 9 Mondee’s Platform Overcoming Challenges – Mondee’s Modern Travel Marketplace Platform Mondee’s platform connects travel suppliers with consumers and their businesses, optimizing for all stakeholders Hoteliers Airlines Suppliers Wholesalers Ancillary providers Mondee helps suppliers optimize inventory and utilize excess capacity Legacy Distribution Technology Platforms COMAND ... xxxx COMAND ... xxxx COMAND COMAND ... xxxx COMAND COMAND COMAND ... xxxx COMAND ... xxxx COMAND ... xxxx Travel Agent 1. Incomplete content (e.g., no low - cost carriers, no alternative accommodations) 2. Text - based; not extendable to mobile 3. Lack of modern messaging capabilities 4. Credit - card focused for payments 5. Inability to link search results and marketing messaging Consumers Mondee helps customers modernize technology, gain access to broader content and narrowcast their distribution 1. Comprehensive global content 2. Modern user experience, extendable to Mobile 3. Full suite of communication tools – integrated phone, email, SMS, chat 4. Fintech platform, tailored to the travel market 5. Multi - channel marketing platform Corporations Travel Agents SME’s & Nonprofits Consumers (subscription members)

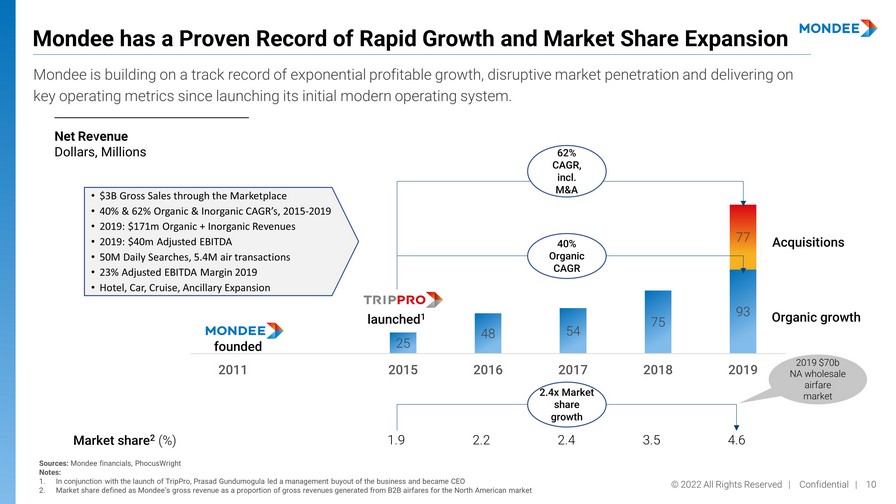

© 2022 All Rights Reserved | Confidential | 10 Mondee has a Proven Record of Rapid Growth and Market Share Expansion Net Revenue Dollars, Millions Acquisitions Organic growth Sources: Mondee financials, PhocusWright Notes: 1. In conjunction with the launch of TripPro, Prasad Gundumogula led a management buyout of the business and became CEO 2. Market share defined as Mondee’s gross revenue as a proportion of gross revenues generated from B2B airfares for the North Am eri can market Market share 2 (%) 1.9 2.2 2.4 3.5 4.6 25 48 54 75 93 77 2011 2012-14 2015 2016 2017 2018 2019 62% CAGR, incl. M&A founded 40% Organic CAGR launched 1 2.4x Market share growth Mondee is building on a track record of exponential profitable growth, disruptive market penetration and delivering on key operating metrics since launching its initial modern operating system. • $3B Gross Sales through the Marketplace • 40% & 62% Organic & Inorganic CAGR’s, 2015 - 2019 • 2019: $171m Organic + Inorganic Revenues • 2019: $40m Adjusted EBITDA • 50M Daily Searches, 5.4M air transactions • 23% Adjusted EBITDA Margin 2019 • Hotel, Car, Cruise, Ancillary Expansion 2019 $70b NA wholesale airfare market

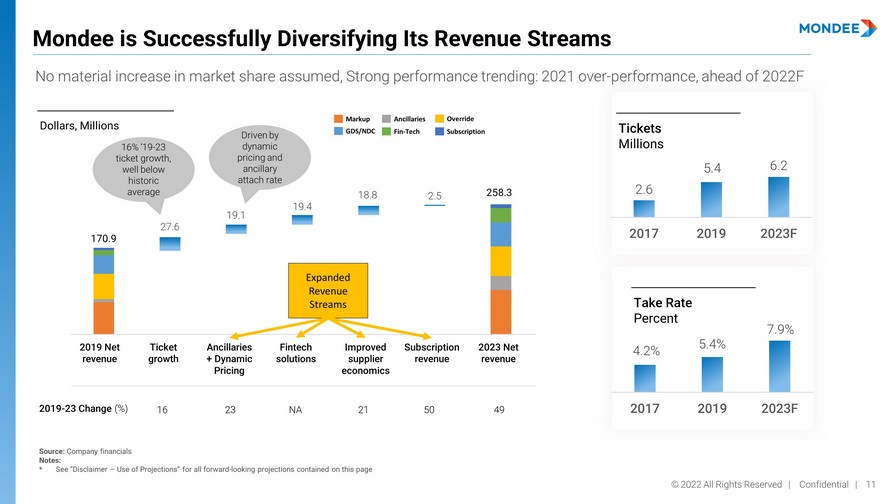

© 2022 All Rights Reserved | Confidential | 11 100.3 80.0 27.6 19.1 19.4 18.8 2.5 110.2 54.7 20.3 2019 Net Revenue Ticket growth Front-end markup + ancillaries increase Fintech platform revenue Improved supplier terms Subscription revenue 2023 Net revenue Sales and marketing Other expense 2023 EBITDA One-time adjustments 2023 Adjusted EBITDA 16% ‘19 - 23 ticket growth, well below historic average Driven by dynamic pricing and ancillary attach rate 2019 Net revenue Ticket growth Ancillaries + Dynamic Pricing Fintech solutions Improved supplier economics Subscription revenue 2023 Net revenue Sales and marketing Other expense 2023 EBITDA One - time adjustments 2023 Adjusted EBITDA 1 2019 - 23 Change (%) 16 23 NA 21 50 35 9 Source: Company financials Notes: * See “Disclaimer – Use of Projections” for all forward - looking projections contained on this page Dollars, Millions 49 170.9 258.3 Markup Ancillaries Override GDS/NDC Fin - Tech Subscription Expanded Revenue Streams Mondee is Successfully Diversifying Its Revenue Streams 2.6 5.4 6.2 2017 2019 2023F Tickets Millions No material increase in market share assumed, Strong performance trending: 2021 over - performance, ahead of 2022F 4.2% 5.4% 7.9% 2017 2019 2023F Take Rate Percent

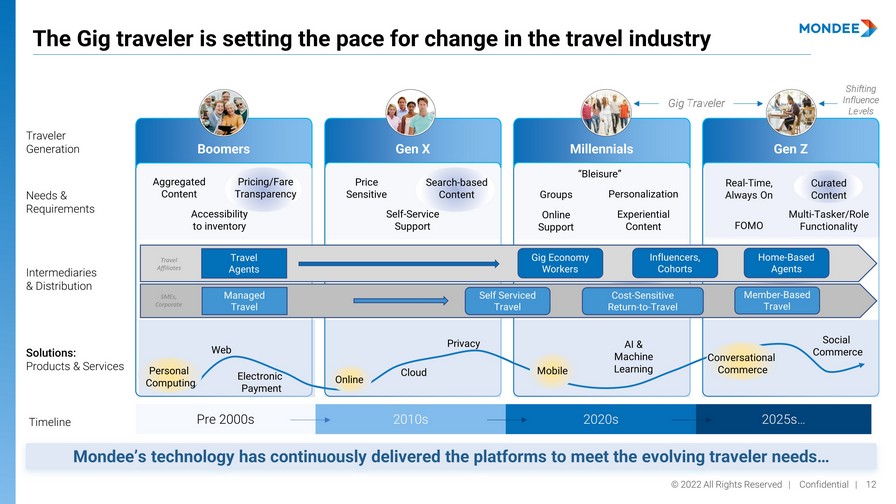

© 2022 All Rights Reserved | Confidential | 12 The Gig traveler is setting the pace for change in the travel industry Pre 2000s 2010s 2020s 2025s… Traveler Generation Needs & Requirements Intermediaries & Distribution Solutions: Products & Services Boomers Gen X Millennials Gen Z Gig Traveler Experiential Content Aggregated Content Real - Time, Always On “Bleisure” Groups Multi - Tasker/Role Functionality Personalization Price Sensitive Self - Service Support Accessibility to inventory Online Support FOMO Supplier Direct Email Online Agencies (OLA, OTA) Metasearch Engines NDC Text Travel Memberships & Clubs Gig Agents Social Commerce AI & Machine Learning Web Electronic Payment Cloud Privacy Timeline Pricing/Fare Transparency Travel Agencies Personal Computing Search - based Content Social Media Connected Consumer Curated Content Online Mobile Conversational Commerce GDSs Travel Agents Home - Based Agents Gig Economy Workers Influencers, Cohorts Shifting Influence Levels Travel Affiliates Managed Travel Cost - Sensitive Return - to - Travel Self Serviced Travel Member - Based Travel SMEs, Corporate Mondee’s technology has continuously delivered the platforms to meet the evolving traveler needs…

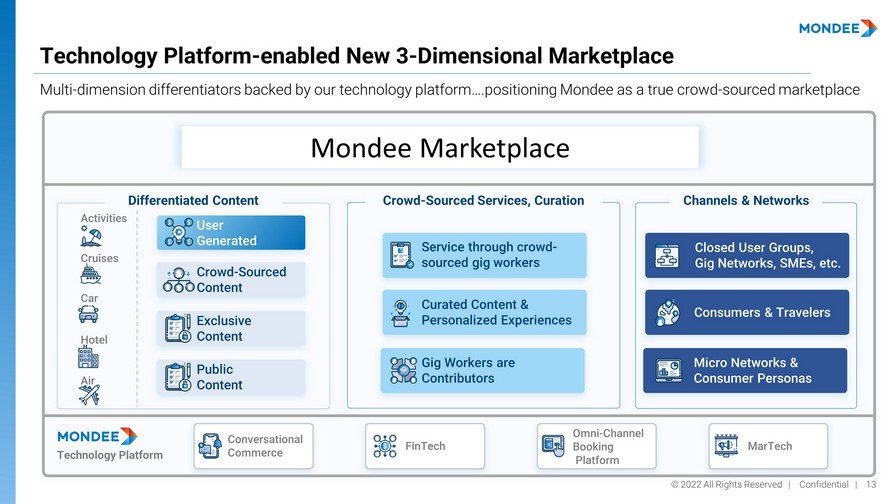

© 2022 All Rights Reserved | Confidential | 13 Mondee Marketplace Technology Platform - enabled New 3 - Dimensional Marketplace Multi - dimension differentiators backed by our technology platform….positioning Mondee as a true crowd - sourced marketplace Technology Platform Conversational Commerce FinTech Omni - Channel Booking Platform MarTech Channels & Networks Consumers & Travelers Closed User Groups, Gig Networks, SMEs, etc. Micro Networks & Consumer Personas Crowd - Sourced Services, Curation Differentiated Content Activities Cruises Car Hotel Air User Generated Public Content Exclusive Content Crowd - Sourced Content Service through crowd - sourced gig workers Curated Content & Personalized Experiences Gig Workers are Contributors

© 2022 All Rights Reserved | Confidential | 14 Mondee’s products now serve a variety of different customer segments across the B2B travel landscape Best - in - Class Products Tailored for the Gig Economy Travel Market Launch date 2015 2013 (acquired in 2020) June 2021 August 2021 Target segment Travel agents TMCs Large corporations SMEs Nonprofits Membership organizations Subscribers, including consumer members Description Platform for travel search, booking, and more Incentive platform that reduces corporate travel spending Discount online booking site, with enhanced service Discount online subscription - based booking Customer base 50,000+ agents 50+ corporations 4M+ members Soft launch/testing

© 2022 All Rights Reserved | Confidential | 15 Sustainable Supplier Value Creation ▪ Private distribution channel to optimize perishable inventory ▪ Over 30% unsold rooms and seats in a peak year, 2019 ▪ Narrowcast vs broadcast distribution ▪ Optimize distribution costs on modern technology platform ▪ Direct connect – NDC Level 4 certified ▪ Increased ancillary revenues ▪ Enhanced marketing capabilities – rich content

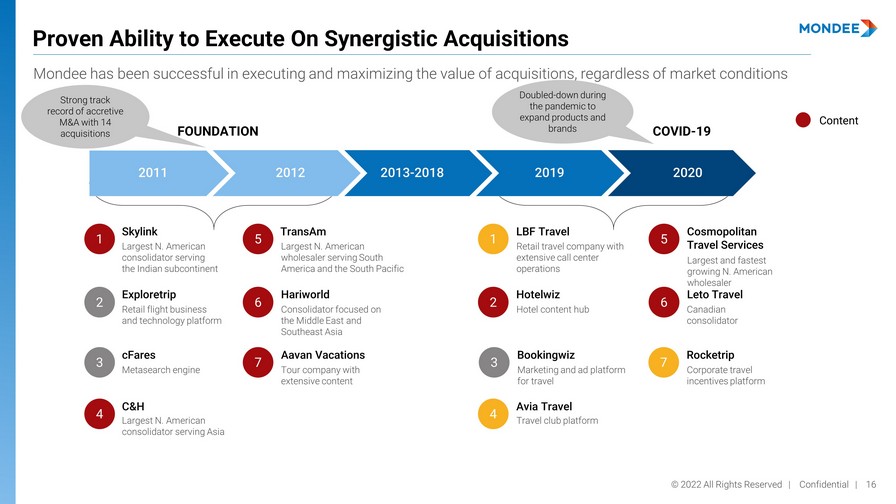

© 2022 All Rights Reserved | Confidential | 16 6 Consolidator focused on the Middle East and Southeast Asia Hariworld 7 Tour company with extensive content Aavan Vacations 1 Largest N. American consolidator serving the Indian subcontinent Skylink 2 Retail flight business and technology platform Exploretrip 3 Metasearch engine cFares 4 Largest N. American consolidator serving Asia C&H 6 Canadian consolidator Leto Travel 1 Retail travel company with extensive call center operations LBF Travel 2 Hotel content hub Hotelwiz 4 Travel club platform Avia Travel 5 Largest and fastest growing N. American wholesaler Cosmopolitan Travel Services 7 Corporate travel incentives platform Rocketrip 5 Largest N. American wholesaler serving South America and the South Pacific TransAm 2011 2012 2013 - 2018 2019 2020 FOUNDATION COVID - 19 Mondee has been successful in executing and maximizing the value of acquisitions, regardless of market conditions Proven Ability to Execute On Synergistic Acquisitions Content 3 Marketing and ad platform for travel Bookingwiz Strong track record of accretive M&A with 14 acquisitions Doubled - down during the pandemic to expand products and brands

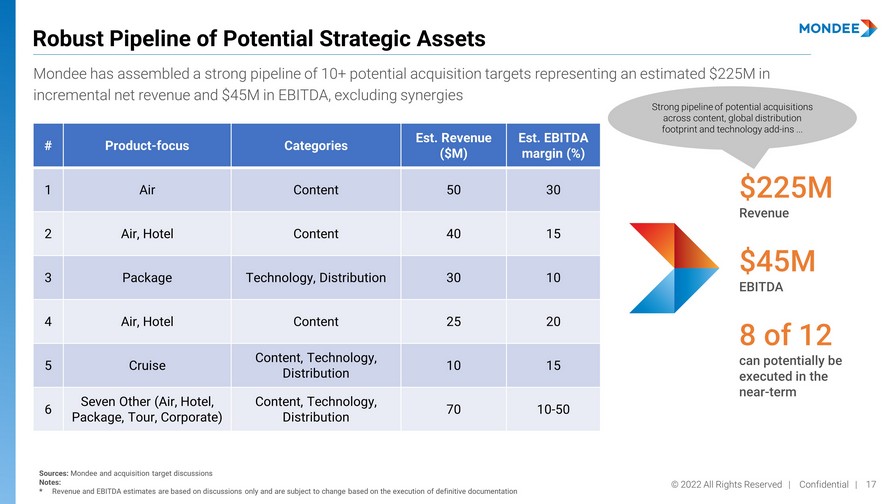

© 2022 All Rights Reserved | Confidential | 17 # Product - focus Categories Est. Revenue ($M) Est. EBITDA margin (%) 1 Air Content 50 30 2 Air, Hotel Content 40 15 3 Package Technology, Distribution 30 10 4 Air, Hotel Content 25 20 5 Cruise Content, Technology, Distribution 10 15 6 Seven Other (Air, Hotel, Package, Tour, Corporate) Content, Technology, Distribution 70 10 - 50 Sources: Monde e and acquisition target discussions Notes: * Revenue and EBITDA estimates are based on discussions only and are subject to change based on the execution of definitive doc ume ntation Mondee has assembled a strong pipeline of 10+ potential acquisition targets representing an estimated $225M in incremental net revenue and $45M in EBITDA, excluding synergies Robust Pipeline of Potential Strategic Assets $225M Revenue $45M EBITDA 8 of 12 can potentially be executed in the near - term Strong pipeline of potential acquisitions across content, global distribution footprint and technology add - ins ...

Product Platform Live Demonstration & Overview

Financial Review

© 2022 All Rights Reserved | Confidential | 20 Mondee is expected to return to positive Adjusted EBITDA in 2022, with strong increase in 2023 driven by higher revenue per ticket, higher sales and marketing spend, and a lean, post - COVID - 19 operating structure. Profit and Loss Statement Source: Company financials Notes: * See “Disclaimer – Use of Projections” for all forward - looking projections contained on this page 1. Adjusted EBITDA is a non - GAAP financial measure, calculated as Net Loss before depreciation and amortization, provision for inco me taxes, interest expense (net), other income net, stock - based compensation, and gain on forgiveness of PPP loans. Pro Forma EBITDA includes one - time adjustments. See “Discl aimer - Non - GAAP Financial Measures” 2. Pro Forma (PF) for acquisitions during the period; prepared in accordance with PCAOB standards.

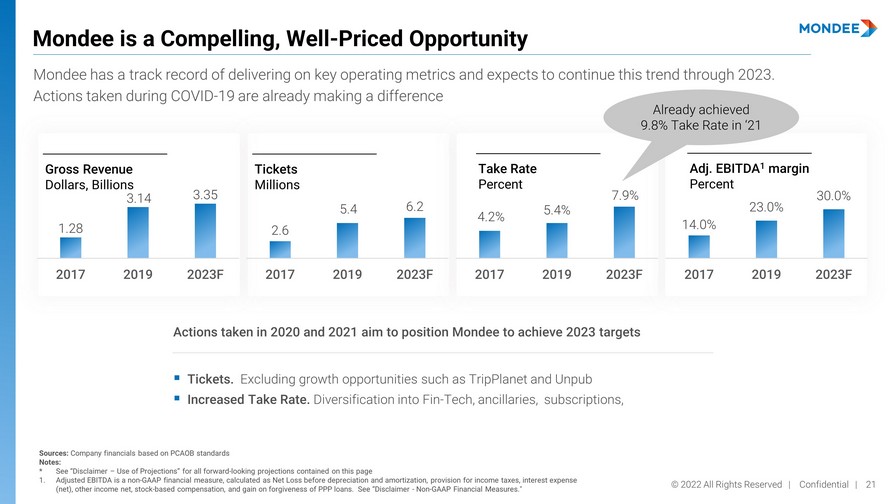

© 2022 All Rights Reserved | Confidential | 21 Mondee is a Compelling, Well - Priced Opportunity Sources: Company financials based on PCAOB standards Notes: * See “Disclaimer – Use of Projections” for all forward - looking projections contained on this page 1. Adjusted EBITDA is a non - GAAP financial measure, calculated as Net Loss before depreciation and amortization, provision for inco me taxes, interest expense (net), other income net, stock - based compensation, and gain on forgiveness of PPP loans. See “Disclaimer - Non - GAAP Financial M easures." 2.6 5.4 6.2 2017 2019 2023F Tickets Millions 4.2% 5.4% 7.9% 2017 2019 2023F Take Rate Percent 14.0% 23.0% 30.0% 2017 2019 2023F Adj. EBITDA 1 margin Percent Mondee has a track record of delivering on key operating metrics and expects to continue this trend through 2023. Actions taken during COVID - 19 are already making a difference Actions taken in 2020 and 2021 aim to position Mondee to achieve 2023 targets ▪ Tickets. Excluding growth opportunities such as TripPlanet and Unpub ▪ Increased Take Rate. Diversification into Fin - Tech, ancillaries, subscriptions, Already achieved 9.8% Take Rate in ‘21 1.28 3.14 3.35 2017 2019 2023F Gross Revenue Dollars, Billions

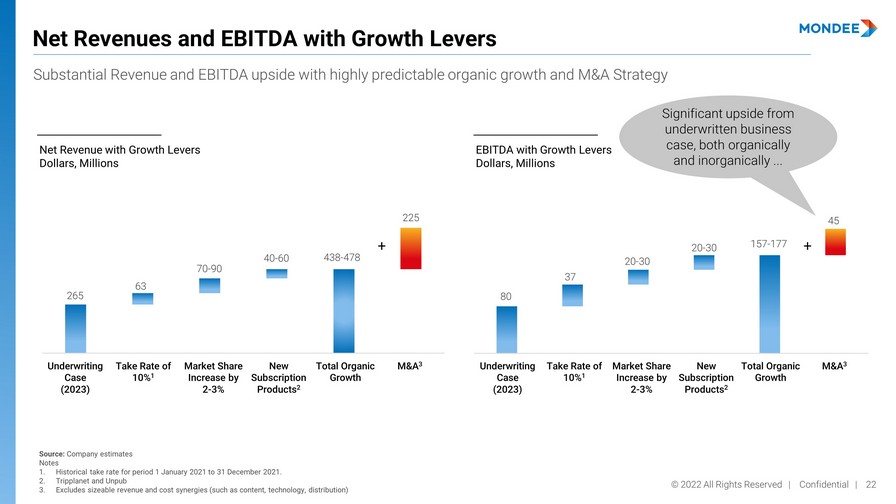

© 2022 All Rights Reserved | Confidential | 22 265 438 - 478 63 70 - 90 40 - 60 225 Management Case Revenue per Ticket of $52 Market Share Increase by 2-3% New Subscription Products1 Total Organic Growth M&A 80 157 - 177 37 20 - 30 20 - 30 45 Management Case Revenue per ticket of $52 Market Share Growth by 2-3% New Subscription Product Total M&A Net Revenues and EBITDA with Growth Levers Source: Company estimates Notes 1. Historical take rate for period 1 January 2021 to 31 December 2021. 2. Tripplanet and Unpub 3. E xcl udes sizeable revenue and cost synergies (such as content, technology, distribution) Net Revenue with Growth Levers Dollars, Millions EBITDA with Growth Levers Dollars, Millions Substantial Revenue and EBITDA upside with highly predictable organic growth and M&A Strategy Underwriting Case (2023) Take Rate of 10% 1 New Subscription Products 2 Market Share Increase by 2 - 3% Total Organic Growth M&A 3 Underwriting Case (2023) Take Rate of 10% 1 New Subscription Products 2 Market Share Increase by 2 - 3% Total Organic Growth M&A 3 Significant upside from underwritten business case, both organically and inorganically ... + +

Transaction Overview

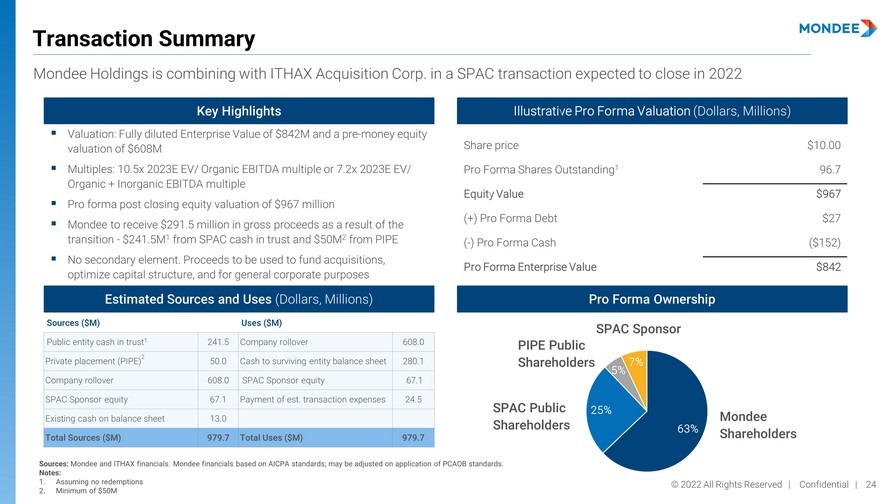

© 2022 All Rights Reserved | Confidential | 24 63% 25% 5% 7% Mondee Holdings is combining with ITHAX Acquisition Corp. in a SPAC transaction expected to close in 2022 Transaction Summary Key Highlights Illustrative Pro Forma Valuation (Dollars, Millions) ▪ Valuation: Fully diluted Enterprise Value of $842M and a pre - money equity valuation of $608M ▪ Multiples: 10.5x 2023E EV/ Organic EBITDA multiple or 7.2x 2023E EV/ Organic + Inorganic EBITDA multiple ▪ Pro forma post closing equity valuation of $967 million ▪ Mondee to receive $291.5 million in gross proceeds as a result of the transition - $241.5M 1 from SPAC cash in trust and $50M 2 from PIPE ▪ No secondary element. Proceeds to be used to fund acquisitions, optimize capital structure, and for general corporate purposes Sources ($M) Uses ($M) Public entity cash in trust 1 241.5 Company rollover 608.0 Private placement (PIPE) 2 50.0 Cash to surviving entity balance sheet 280.1 Company rollover 608.0 SPAC Sponsor equity 67.1 SPAC Sponsor equity 67.1 Payment of est. transaction expenses 24.5 Existing cash on balance sheet 13.0 Total Sources ($M) 979.7 Total Uses ($M) 979.7 Pro Forma Ownership Mondee Shareholders SPAC Public Shareholders PIPE Public Shareholders SPAC Sponsor Sources: Mondee and ITHAX financials. Mondee financials based on AICPA standards; may be adjusted on application of PCAOB standards. Notes: 1. Assuming no redemptions 2. Minimum of $50M Estimated Sources and Uses (Dollars, Millions) Share price $10.00 Pro Forma Shares Outstanding 1 96.7 Equity Value $967 (+) Pro Forma Debt $27 ( - ) Pro Forma Cash ($152) Pro Forma Enterprise Value $842

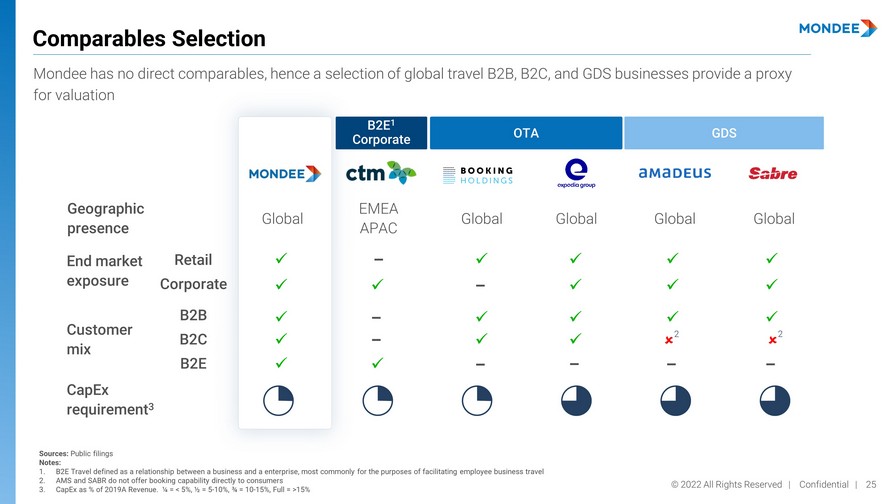

© 2022 All Rights Reserved | Confidential | 25 OTA GDS B2E 1 Corporate Mondee has no direct comparables, hence a selection of global travel B2B, B2C, and GDS businesses provide a proxy for valuation Comparables Selection Sources: Public filings Notes: 1. B2E Travel defined as a relationship between a business and a enterprise, most commonly for the purposes of facilitating empl oye e business travel 2. AMS and SABR do not offer booking capability directly to consumers 3. CapEx as % of 2019A Revenue. ¼ = < 5%, ½ = 5 - 10%, ¾ = 10 - 15%, Full = >15% Geographic presence End market exposure Customer mix CapEx requirement 3 Retail Corporate B2B B2C B2E x Global EMEA APAC Global Global Global Global x x x x x – x – – – x – x x – x x x x – x x x 2 – x x x 2

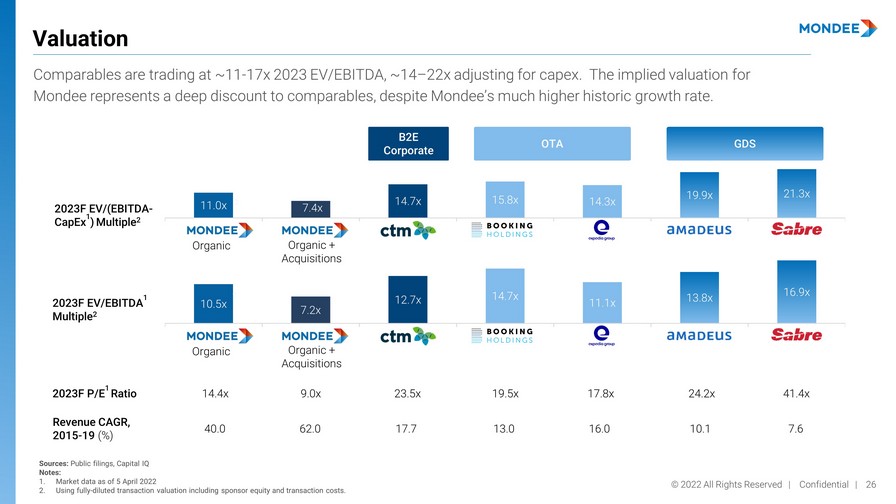

© 2022 All Rights Reserved | Confidential | 26 11.0x 7.4x 14.7x 15.8x 14.3x 19.9x 21.3x Mondee Mondee CTM Booking Expedia Amadeus Sabre 10.5x 7.2x 12.7x 14.7x 11.1x 13.8x 16.9x Mondee Mondee CTM Booking Expedia Amadeus Sabre 2 2 Comparables are trading at ~11 - 17x 2023 EV/EBITDA, ~14 – 22x adjusting for capex. The implied valuation for Mondee represents a deep discount to comparables, despite Mondee’s much higher historic growth rate. Valuation OTA B2E Corporate GDS 2023F EV/EBITDA 1 Multiple 2 2023F P/E 1 Ratio 40.0 17.7 13.0 16.0 10.1 7.6 Revenue CAGR, 2015 - 19 (%) Sources: Public filings, Capital IQ Notes: 1. Market data as of 5 April 2022 2. Using fully - diluted transaction valuation including sponsor equity and transaction costs. Organic Organic Organic + Acquisitions Organic + Acquisitions 62.0 2023F EV/(EBITDA - CapEx 1 ) Multiple 2 14.4x 23.5x 19.5x 17.8x 24.2x 41.4x 9.0x

© 2022 All Rights Reserved | Confidential | 27 14.4x 22.1x 31.0x 8.3x 9.6x 30.9x 12.9x OTAs / Travel Business Svcs Business Airlines Leisure Airlines Hotels Cruise 10.5x 15.1x 17.5x 5.8x 4.9x 14.4x 9.7x OTAs / Travel Business Svcs Business Airlines Leisure Airlines Hotels Cruise Travel - Sector Public Companies – Current Valuation Levels 2023F EV/EBITDA 1 Multiple 2023F P/E 1 Ratio nm 2.6x 3.5x 1.2x 3.2x 5.1x 22.6 7.6 5.0 8.7 4.3 8.0 Sources: Public filings, Capital IQ Notes: 1. Market data as of 5 April 2022 Organic Organic 1.4x 2023F Net Leverage Ratio 4 0 .0 Revenue CAGR, 2015 - 19 (%)

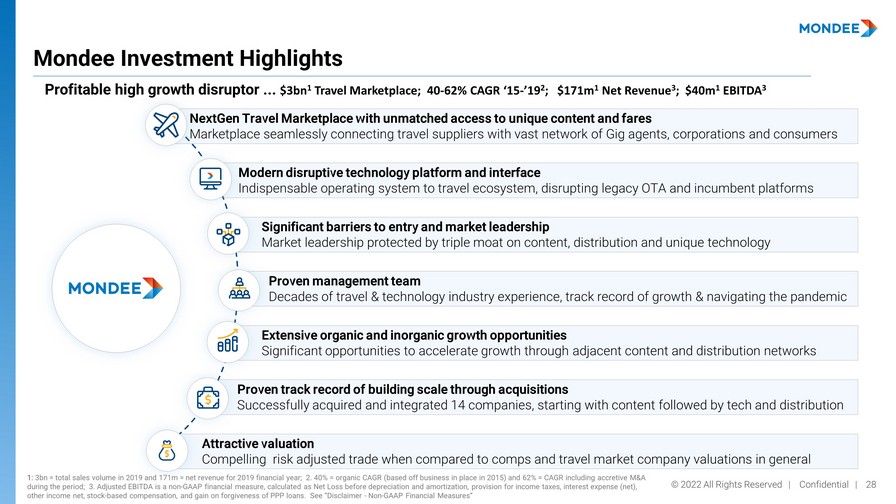

© 2022 All Rights Reserved | Confidential | 28 Proven management team Decades of travel & technology industry experience, track record of growth & navigating the pandemic NextGen Travel Marketplace with unmatched access to unique content and fares Marketplace seamlessly connecting travel suppliers with vast network of Gig agents, corporations and consumers Modern disruptive technology platform and interface Indispensable operating system to travel ecosystem, disrupting legacy OTA and incumbent platforms Significant barriers to entry and market leadership Market leadership protected by triple moat on content, distribution and unique technology Extensive organic and inorganic growth opportunities Significant opportunities to accelerate growth through adjacent content and distribution networks Proven track record of building scale through acquisitions Successfully acquired and integrated 14 companies, starting with content followed by tech and distribution Attractive valuation Compelling risk adjusted trade when compared to comps and travel market company valuations in general Mondee Investment Highlights Profitable high growth disruptor ... $3bn 1 Travel Marketplace; 40 - 62% CAGR ‘15 - ’19 2 ; $171m 1 Net Revenue 3 ; $40m 1 EBITDA 3 1: 3bn = total sales volume in 2019 and 171m = net revenue for 2019 financial year; 2. 40% = organic CAGR (based off business in p lace in 2015) and 62% = CAGR including accretive M&A during the period; 3. Adjusted EBITDA is a non - GAAP financial measure, calculated as Net Loss before depreciation and amortizat ion, provision for income taxes, interest expense (net), other income net, stock - based compensation, and gain on forgiveness of PPP loans. See “Disclaimer - Non - GAAP Financial Measures ”

© 2022 All Rights Reserved | Confidential | 29 This presentation (the “Document”) has been prepared by Mondee Inc . (“Mondee”), ITHAX Acquisition Corp (“ITHAX”), AXIA Ventures Group Limited (“AXIA”) and Ithaca Capital Partners (“Ithaca” and together with Mondee, ITHAX and AXIA, the “Authors”) . This Document is for informational purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between Mondee and ITHAX . The information contained herein does not purport to be all - inclusive and and none of the Authors or their respective directors, officers, shareholders or affiliates make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Document or any other written or oral communication communicated to the recipient in the course of the recipient's evaluation of Mondee or ITHAX . The information contained herein is preliminary and is subject to change and such changes may be material . This Document does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of ITHAX, Mondee, or any of their respective affiliates . ITHAX is a blank check company listed on NASDAQ . AXIA, incorporated in Cyprus, is authorised to provide investment and ancillary services and is regulated by the Cyprus Securities and Exchange Commission (CySEC license 086 / 07 ) . AXIA has an established presence in a number of jurisdictions and may provide investment and ancillary services in other EU and third countries through subsidiaries, branches or on a cross border basis (as appropriate) subject to applicable legislation . Ithaca and Mondee are incorporated in Delaware . Disclaimer

© 2022 All Rights Reserved | Confidential | 30 This Document includes certain audited financials that are based on AICPA accounting standards and may be subject to change in connection with the application of PCAOB accounting standards . This Document includes certain financial measures not presented in accordance with U . S . GAAP including, but not limited to, Adjusted EBITDA and certain ratios and other metrics derived therefrom . These non - GAAP financial measures are not measures of financial performance in accordance with U . S . GAAP and may exclude items that are significant in understanding and assessing Mondee’s financial results . Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under U . S . GAAP . You should be aware that Mondee’s presentation of these measures may not be comparable to similarly - titled measures used by other companies . Mondee believes these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Mondee’s financial condition and results of operations . Mondee believes that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in and in comparing Mondee’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors . These non - GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non - GAAP financial measures . Please refer to footnotes where presented on each page of this Document . This Document also includes certain projections of non - GAAP financial measures . Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Mondee is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort . Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward - looking non - GAAP financial measures is included . Non - GAAP Financial Measures

© 2022 All Rights Reserved | Confidential | 31 All statements of opinion contained in this Document, all views expressed and all projections, including Revenue and Adjusted EBITDA, forecasts and/or statements relating to expectations regarding future events or the possible future performance represent Author’s own assessment based on information available to them as at the date of this Document . Neither Mondee’s nor ITHAX's independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Document, and accordingly, they did not express an opinion or provide any other form of assurance with respect thereto for the purpose of this Document . These projections should not be relied upon as being necessarily indicative of future results . The projections, views, statements and forecasts herein are based upon various assumptions and estimates, which Author considers to be reasonable assumptions and estimates, which involve significant elements of subjective judgement and analysis and which are subject to a wide variety of significant business, economic and competitive risks and uncertainties and contingencies ; there are several risks, uncertainties and factors that may cause actual results to differ materially from those set forth in any such projections, views, statements and forecasts that are, expressly or implicitly, provided by Author . The mentioned statements reflect Author’s current expectations regarding the relevant subject matters and are subject to the above mentioned risks, uncertainties and factors . Accordingly, no representation, express or implied, is made or warranty, guarantee or assurance of any kind is given by the Authors or any of their respective affiliates, shareholders, directors, officers and employees as to the accuracy, completeness, reliability, achievability or reasonableness of any such projections, views, statements, or forecasts which are, by their own nature, implicitly predictive and speculative and involve risk and uncertainty . Inclusion of the prospective financial information in this Document should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved . Use of Projections

© 2022 All Rights Reserved | Confidential | 32 In preparing the Document, the Authors have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources, including certain information and statistics obtained from third - party sources which they believe to be reliable . You are cautioned not to give undue weight to such information, including industry and market data . This Document may include trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners . Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Document may be listed without the TM, SM, (c), (r) or TM symbols, but Mondee and ITHAX will assert, to the fullest extent under applicable law, the right of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights . Industry and Market Data

© 2022 All Rights Reserved | Confidential | 33 Certain statements in this Document may be considered “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements, other than statements of present or historical fact included herein, regarding the proposed business combination between ITHAX Acquisition Corp . , an exempted company incorporated in the Cayman Islands with limited liability under company number 366718 (“ITHAX”) and Mondee Holdings II, Inc . , a Delaware corporation (“Mondee”), ITHAX’s and Mondee’s ability to consummate the transaction, the expected closing date for the transaction, the benefits of the transaction and the public company’s future financial performance following the transaction, as well as ITHAX’s and Mondee’s strategy, future operations, financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward looking statements . When used herein, including any oral statements made in connection herewith, the words “anticipates,” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “forecast,” “future, ” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “propose,” “should,” “seeks,” “will,” or the negative of such terms and other similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words . Such forward - looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ materially from those expressed or implied by such forward - looking statements . These forward - looking statements are based upon estimates and assumptions that, while considered reasonable by both ITHAX and its management, and Mondee and its management, as the case may be, are inherently uncertain . Except as otherwise required by applicable law, ITHAX disclaims any duty to update any forward - looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof . ITHAX cautions you that these forward - looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of ITHAX . Factors that may cause actual results to differ materially from current expectations include, but are not limited to : ( 1 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the business combination ; ( 2 ) the outcome of any legal proceedings that may be instituted against ITHAX, Mondee, the combined company or others following the announcement of the business combination and any definitive agreements with respect thereto ; ( 3 ) the inability to complete the business combination due to the failure to obtain approval of the shareholders of ITHAX, to obtain financing to complete the business combination or to satisfy other conditions to closing ; ( 4 ) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination ; ( 5 ) the ability to meet stock exchange listing standards following the consummation of the business combination ; ( 6 ) the risk that the business combination disrupts current plans and operations of ITHAX or Mondee as a result of the announcement and consummation of the business combination ; ( 7 ) the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees ; ( 8 ) costs related to the business combination ; ( 9 ) changes in applicable laws or regulations and delays in obtaining, adverse conditions contained in, or the inability to obtain regulatory approvals required to complete the business combination ; ( 10 ) the possibility that ITHAX, Mondee or the combined company may be adversely affected by other economic, business, and/or competitive factors ; ( 11 ) the impact of COVID - 19 on the combined company’s business and/or the ability of the parties to complete the proposed business combination ; ( 12 ) Mondee’s estimates of expenses and profitability and underlying assumptions with respect to stockholder redemptions and purchase price and other adjustments ; ( 13 ) adverse changes in general market conditions for travel services, including the effects of macroeconomic conditions, terrorist attacks, natural disasters, health concerns, civil or political unrest or other events outside the control of the parties ; ( 14 ) significant fluctuations in the combined company’s operating results and rates of growth ; ( 15 ) dependency on the combined company’s relationships with travel agencies, travel management companies and other travel businesses and third parties ; ( 16 ) payment - related risks ; ( 17 ) the combined company’s failure to quickly identify and adapt to changing industry conditions, trends or technological developments ; ( 18 ) unlawful or fraudulent activities in the combined company’s operations ; ( 19 ) any significant IT systems - related failures, interruptions or security breaches or any undetected errors or design faults in IT systems of the combined company ; ( 20 ) exchange rate fluctuations ; and ( 21 ) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements and Risk Factor Summary” in ITHAX’s final prospectus relating to its initial public offering dated February 1 , 2021 and in subsequent filings with the U . S . Securities and Exchange Commission (the “SEC”), including the registration statement on Form S - 4 relating to the business combination that ITHAX filed with the SEC on March 21 , 2022 , which included a prospectus/proxy statement of ITHAX . There may be additional risks that neither ITHAX nor Mondee presently know of or that ITHAX or Mondee currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . Nothing in this communication should be regarded as a representation by any person that the forward - looking statements set forth herein will be achieved or that any of the contemplated results of such forward - looking statements will be achieved . You should not place undue reliance on forward - looking statements, which speak only as of the date they are made . Author and any of their affiliates, directors, officers and employees expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward - looking statement to reflect events or circumstances after the date on which such statement is being made, or to reflect the occurrence of unanticipated events . Forward - Looking Statements

© 2022 All Rights Reserved | Confidential | 34 No Offer or Solicitation This communication is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed business combination or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction . No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act . Important Information for Investors and Shareholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval . In connection with the proposed business combination, ITHAX filed a registration statement on Form S - 4 with the SEC on March 21 , 2022 , which included a prospectus/proxy statement of ITHAX . ITHAX also plans to submit or file other documents with the SEC regarding the proposed transaction . After the registration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the shareholders of ITHAX . INVESTORS AND SHAREHOLDERS OF ITHAX ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION, WHICH WILL BE FILED WITH THE SEC, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION . Investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about Mondee and ITHAX once such documents are filed with the SEC, through the website maintained by the SEC at http : //www . sec . gov . Participants in the Solicitation ITHAX, Mondee, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of ITHAX in connection with the proposed transaction . Information about the directors and executive officers of ITHAX is disclosed in ITHAX’s initial public offering prospectus, which was filed with the SEC on February 1 , 2021 . Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available . Additional Information about the Business Combination and Where to Find It Additional information about the proposed business combination, including a copy of the business combination agreement and investor presentation, was disclosed in a Current Report on Form 8 - K that ITHAX filed with the SEC on December 20 , 2021 and is available at www . sec . gov . In connection with the proposed business combination, ITHAX filed a registration statement on Form S - 4 and the related proxy statement/prospectus with the SEC on March 21 , 2022 . Additionally, ITHAX will file other relevant materials with the SEC in connection with the proposed business combination of ITHAX with Mondee . The materials to be filed by ITHAX with the SEC may be obtained free of charge at the SEC’s website at www . sec . gov . Investors and security holders of ITHAX are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed business combination because they will contain important information about the business combination and the parties to the business combination

© 2022 All Rights Reserved | Confidential | 35 Risks Related to Our Business and Industry • The COVID - 19 pandemic has had, and may continue to have, a material adverse impact on the travel industry, which could materially affect our business, liquidity, financial condition and operating results . • Adverse changes in general market conditions for travel services, including the effects of macroeconomic conditions, terrorist attacks, natural disasters, health concerns, civil or political unrest or other events outside our control could materially affect our business, liquidity, financial condition and operating results . • We may experience significant fluctuations in our operating results and rates of growth . • If we are unable to manage and expand our growth or execute our growth strategies effectively, our business and prospects may be materially and adversely affected . • We operate in an increasingly competitive global environment and could fail to gain, or could lose, market share if we are unable to compete effectively with our current or future competitors . • Our business depends on our relationships with travel agencies, travel management companies and other travel businesses and third parties . • We are subject to payment - related risks . • Our failure to quickly identify and adapt to changing industry conditions, trends or technological developments may have a material and adverse effect on us . • Our business depends on our marketing efficiency and the general effectiveness of our marketing efforts . • We may be unable to prevent unlawful or fraudulent activities in our operations, and we could be liable for such fraudulent or unlawful activities . • We rely on the internet and internet infrastructure for our operations and in order to generate revenues . • Any significant IT systems - related failures, interruptions or security breaches or any undetected errors or design faults in IT systems could result in limited capacity, reduced demand, processing delays, privacy risks and loss of customers, suppliers or marketplace merchants and a reduction of commercial activity . • Our success is subject to the development of new products and services over time . • Our success depends in large part on our ability to attract and retain high quality management and operating personnel, and if we are unable to attract, retain and motivate well - qualified employees, our business could be negatively impacted . • We may be unable to successfully close potential acquisitions, or successfully integrate the operations of such target businesses, if acquired, which could have an adverse impact on our business . • Exchange rate fluctuations may negatively affect our results of operations .