THE FUTURE OF TRAVEL, NOW Investor Presentation April 2023

© 2023 All Rights Reserved | 2 Safe Harbor Statement (Under the Private Securities Litigation Reform Act of 1995) This presentation contains “forward-looking statements” within the meaning of federal securities law. Forward-looking statements can be identified by words such as: “believe,” “can”, “"may,” “expects,” “intends,” “potential,” “plans,” “will” and similar references to future periods. Examples of forward- looking statements include, among others, statements we make regarding future growth, performance, business prospects and opportunities, future plans and intentions or other future events are forward looking statements. Such forward-looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Mondee Holdings, Inc. (the “Company”) and its management, are inherently uncertain. The Company cautions you that these forward-looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of the Company. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, the ability to implement business plans, forecasts, and other expectations after the recently completed business combination between ITHAX Acquisition Corp. and Mondee Holdings II, Inc., the outcome of any legal proceedings that may be instituted against the Company or others and any definitive agreements with respect thereto, the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the Company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees, the ability to meet Nasdaq’s listing standards, and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward- Looking Statements” in the Company’s registration statement in the Company’s Current Report on Form 8-K filed with the SEC on July 20, 2022, the registration statement on Form S-1 declared effective by the SEC on October 12, 2022, and in the Company’s subsequent filings with the SEC. There may be additional risks that the Company does not presently know of or that the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made, and the Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement to reflect events or circumstances after the date on which such statement is being made, or to reflect the occurrence of unanticipated events.

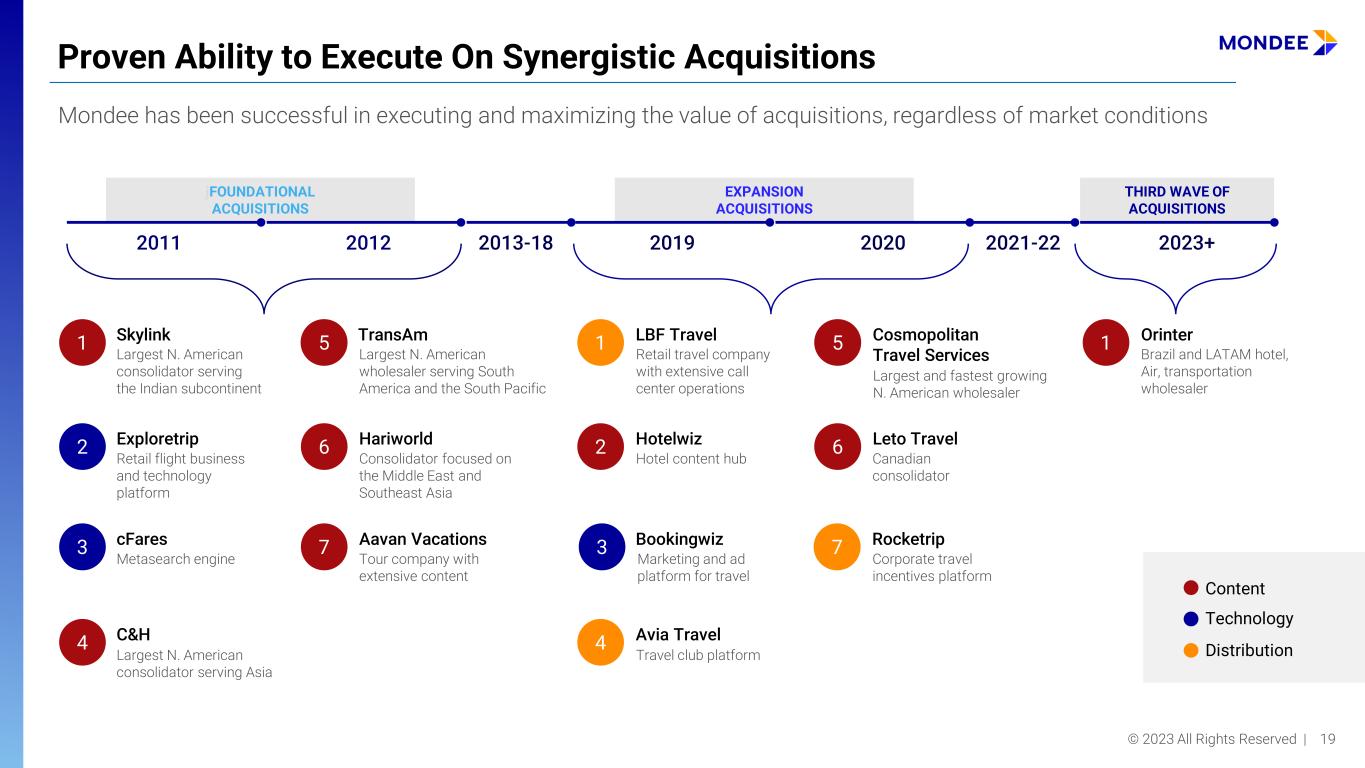

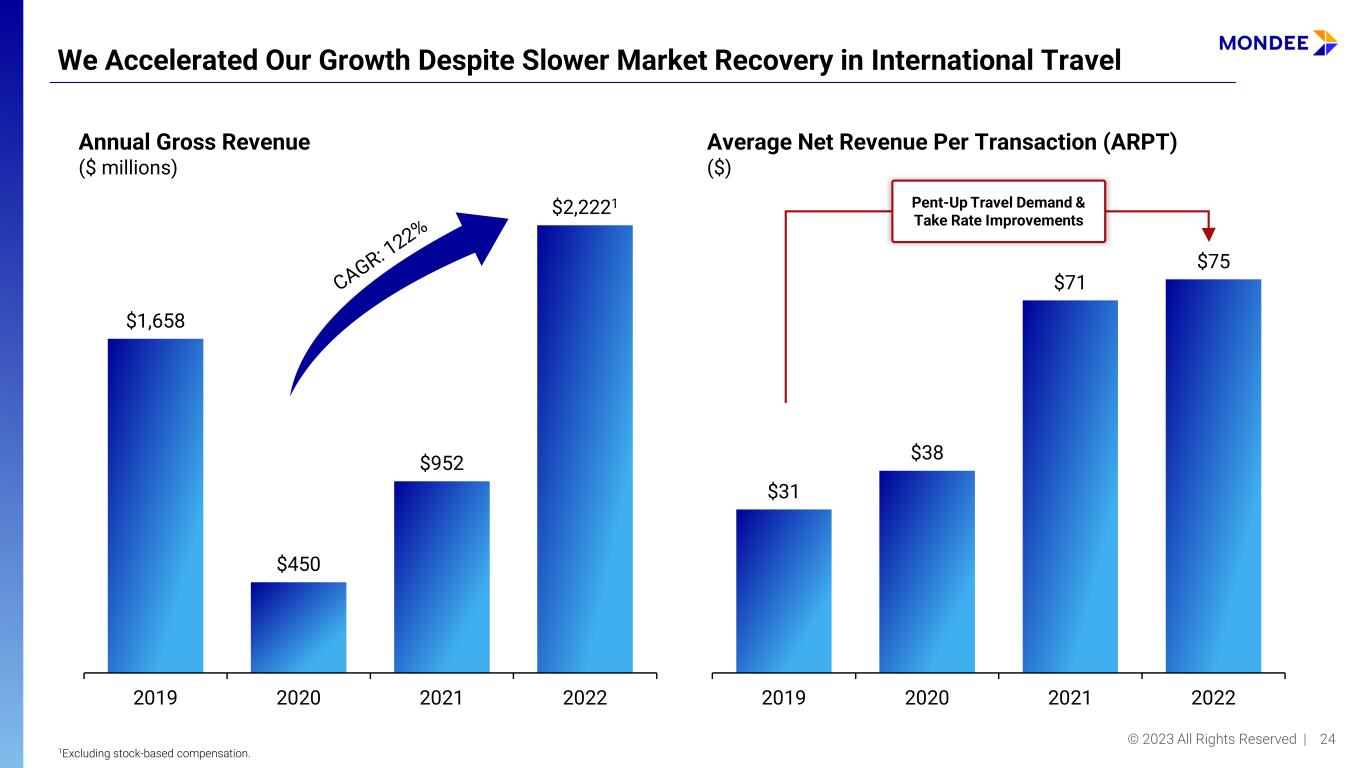

© 2023 All Rights Reserved | 3 Orinter Acquisition, Began Third Wave of Acquisitions ● In January 2023 acquired Orinter for approximately $40 million ● Expanded footprint in Brazil and LATAM Strengthened Capital Structure to Fuel Accretive M&A Strategy ● Debuted on The Nasdaq Global Market on July 19, 2022 ● Raised an additional $85 million of preferred equity to support M&A strategies ● Purchased 12 million public warrants, limiting potential common-equity dilution ● Fortified balance sheet, as of year end with $87.5 million cash, cash equivalents and restricted short- term investments Delivered Strong 2022 Results, Despite International Travel only 69% Recovered ● Gross revenue of $2.2 billion, 2.2x above 2021’s $966M ● Net revenue of over $159 million, 171% of 2021 ● Adjusted EBITDA1 of $12 million ($16 million including deferred items)2, improved approximately $18 million from 2021 Market Share Growth ● Agile platform and marketing strategies to expand market share in Europe and India ● Positioned well to benefit from China/Asia reopening Chairman’s Message Mondee’s fourth quarter and full-year 2022 accomplishments in key areas were marked by … 1Please refer to the Appendix of this presentation for non-GAAP reconciliation tables. 2See bridge in slide 32 and Form 8-K filed on April 10, 2023 Prasad Gundumogula Chairman, Chief Executive Officer, and Founder Launched Mondee Affiliate Network ● In January 2023, launched influencer and affiliate network to increase distribution and reach ● Affiliates utilize Mondee’s technology and marketplace while enhancing commissions

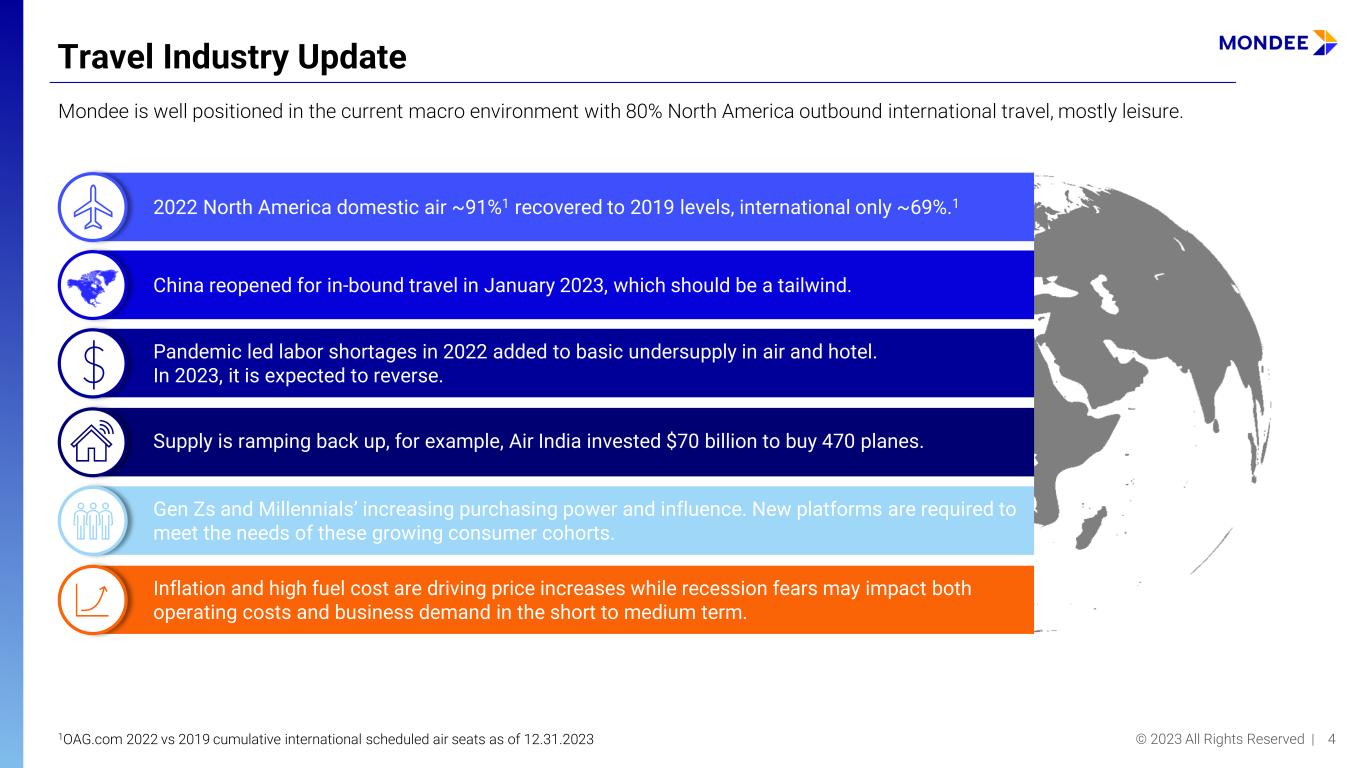

© 2023 All Rights Reserved | 4 Travel Industry Update 1OAG.com 2022 vs 2019 cumulative international scheduled air seats as of 12.31.2023 2022 North America domestic air ~91%1 recovered to 2019 levels, international only ~69%.1 Mondee is well positioned in the current macro environment with 80% North America outbound international travel, mostly leisure. China reopened for in-bound travel in January 2023, which should be a tailwind. Pandemic led labor shortages in 2022 added to basic undersupply in air and hotel. In 2023, it is expected to reverse. Supply is ramping back up, for example, Air India invested $70 billion to buy 470 planes. Inflation and high fuel cost are driving price increases while recession fears may impact both operating costs and business demand in the short to medium term. Gen Zs and Millennials’ increasing purchasing power and influence. New platforms are required to meet the needs of these growing consumer cohorts.

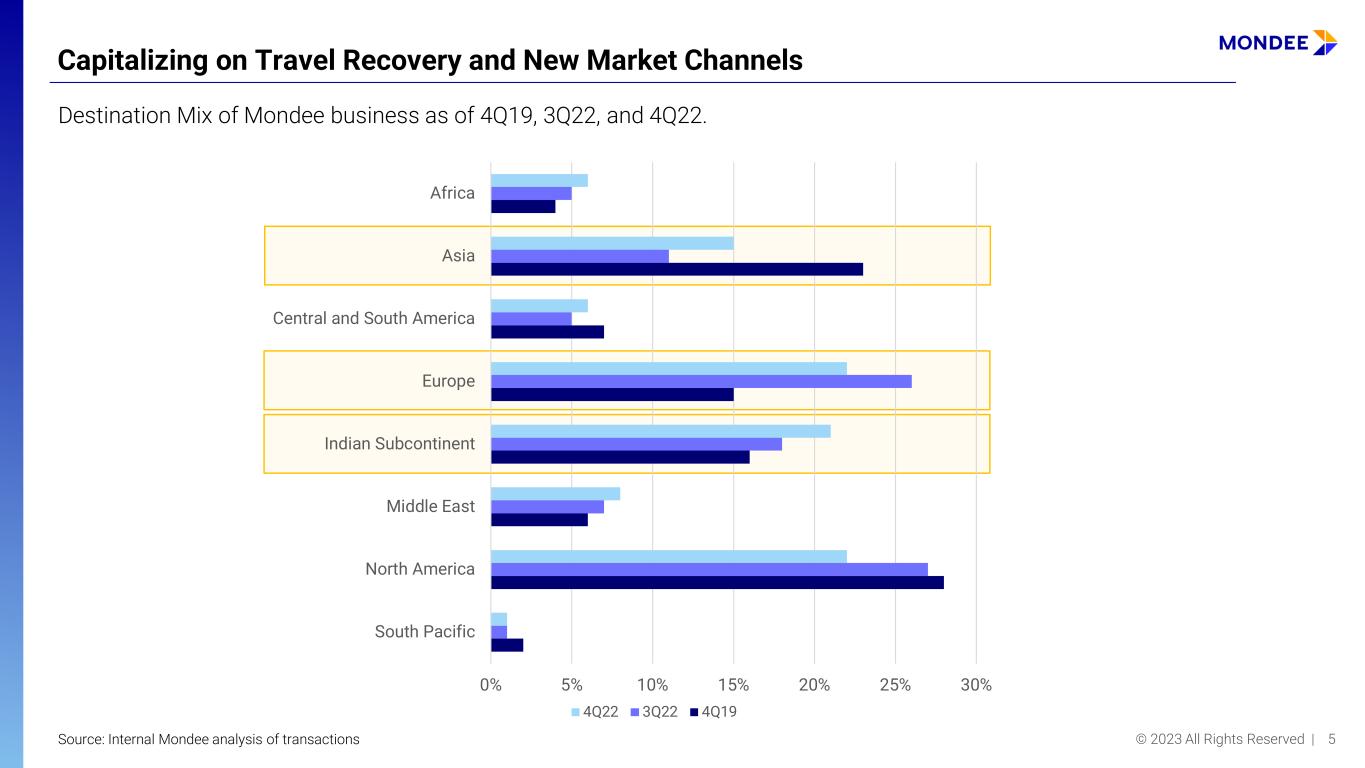

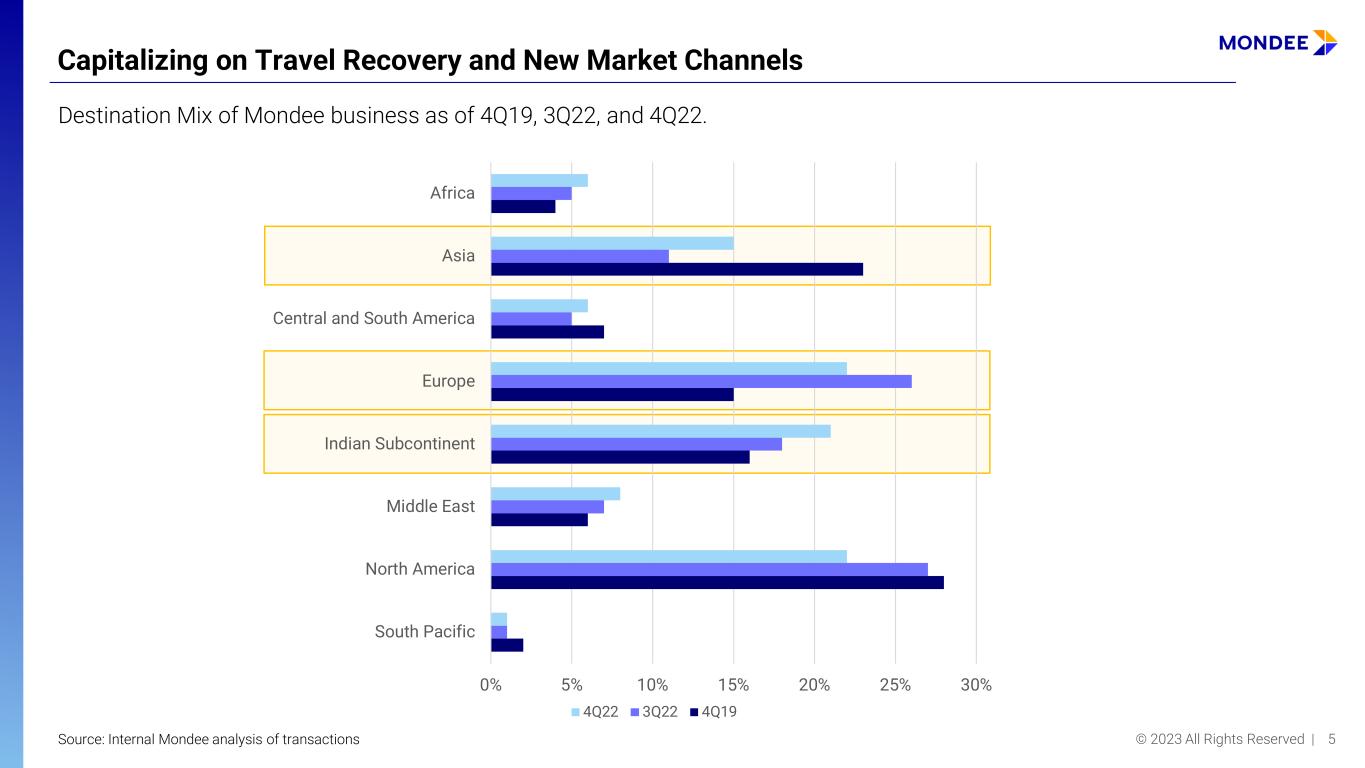

© 2023 All Rights Reserved | 5 Capitalizing on Travel Recovery and New Market Channels Destination Mix of Mondee business as of 4Q19, 3Q22, and 4Q22. Source: Internal Mondee analysis of transactions 0% 5% 10% 15% 20% 25% 30% South Pacific North America Middle East Indian Subcontinent Europe Central and South America Asia Africa 4Q22 3Q22 4Q19

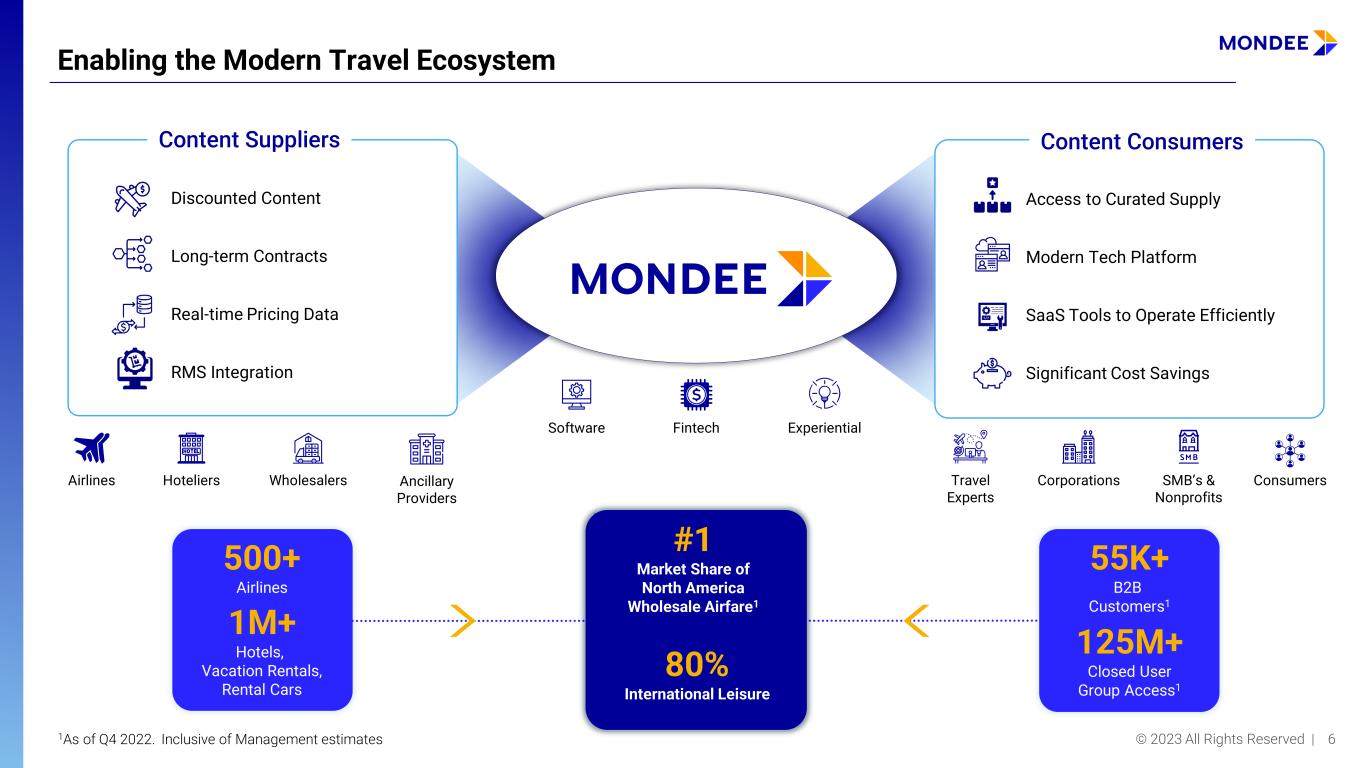

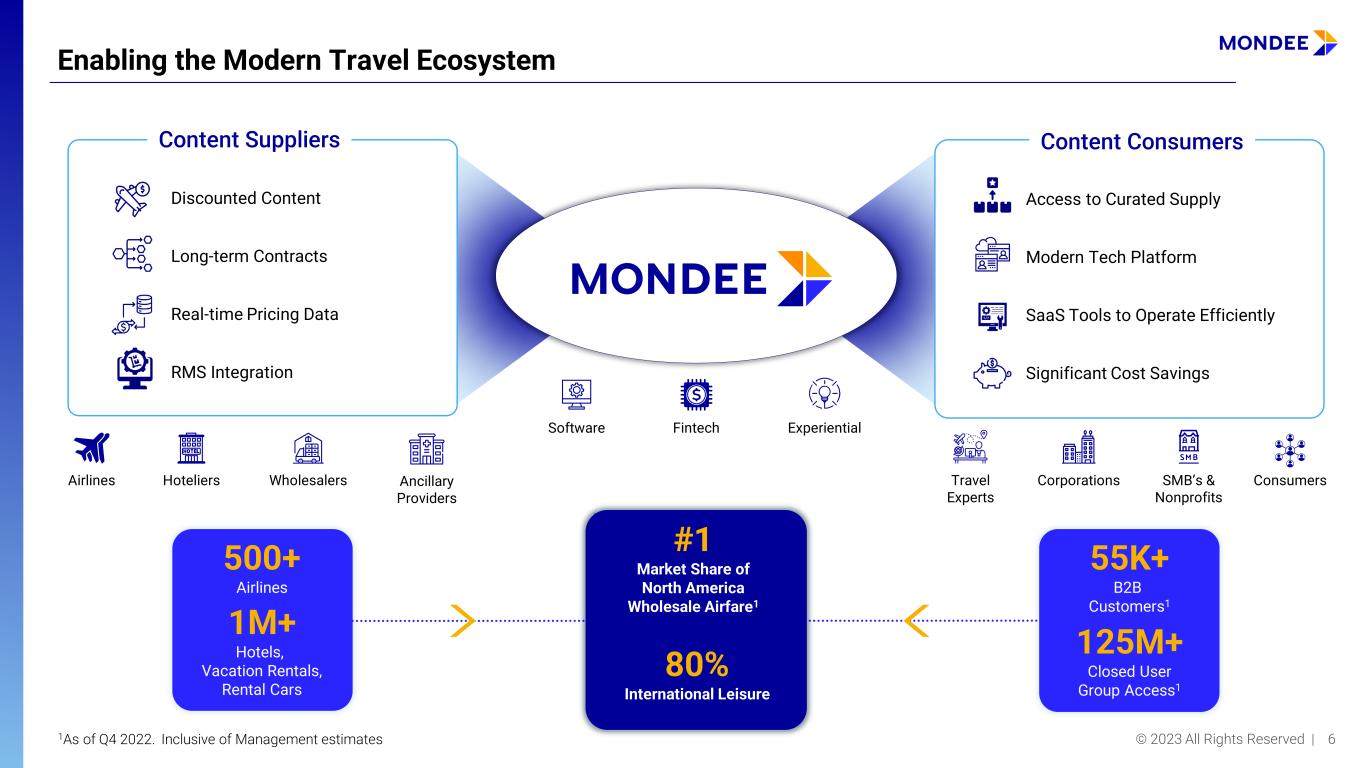

© 2023 All Rights Reserved | 6 Enabling the Modern Travel Ecosystem Discounted Content Long-term Contracts Real-time Pricing Data RMS Integration Access to Curated Supply Modern Tech Platform SaaS Tools to Operate Efficiently Significant Cost Savings Content Suppliers Content Consumers Software Fintech Experiential Airlines Hoteliers Wholesalers Ancillary Providers Travel Experts Corporations SMB’s & Nonprofits Consumers 500+ Airlines 1M+ Hotels, Vacation Rentals, Rental Cars #1 Market Share of North America Wholesale Airfare1 80% International Leisure 1As of Q4 2022. Inclusive of Management estimates 55K+ B2B Customers1 125M+ Closed User Group Access1

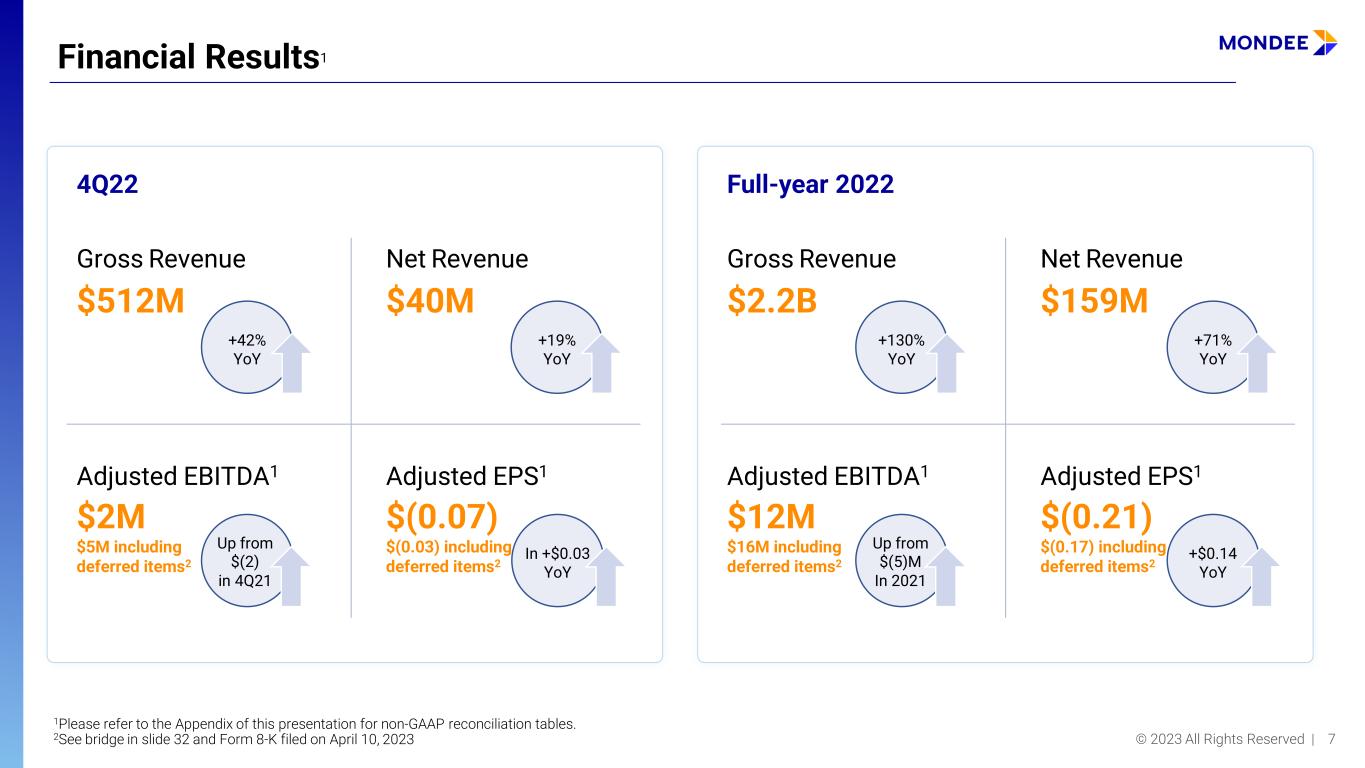

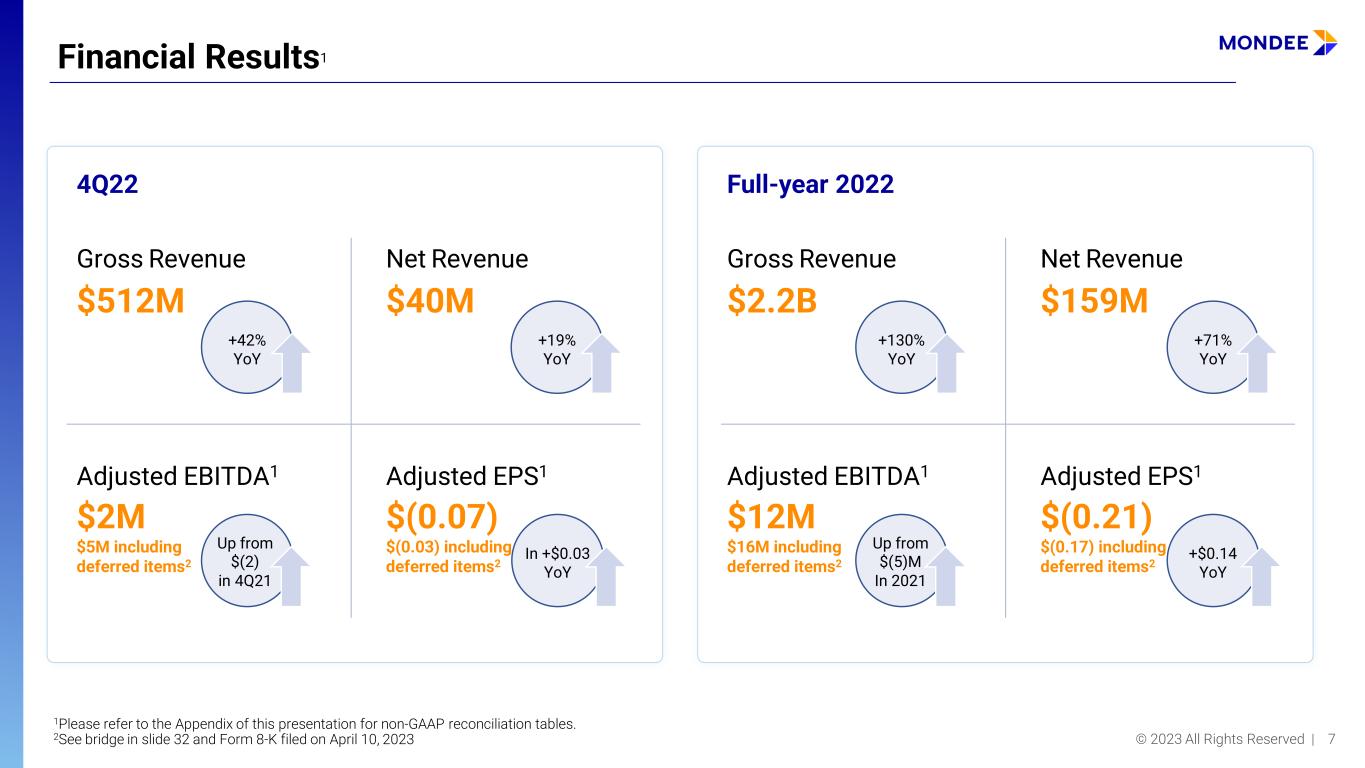

© 2023 All Rights Reserved | 7 Financial Results1 1Please refer to the Appendix of this presentation for non-GAAP reconciliation tables. 2See bridge in slide 32 and Form 8-K filed on April 10, 2023 Gross Revenue +42% YoY $512M Net Revenue +19% YoY $40M Adjusted EBITDA1 $2M $5M including deferred items2 Up from $(2) in 4Q21 Adjusted EPS1 $(0.07) $(0.03) including deferred items2 In +$0.03 YoY 4Q22 Full-year 2022 Gross Revenue +130% YoY $2.2B Net Revenue +71% YoY $159M Adjusted EBITDA1 $12M $16M including deferred items2 Up from $(5)M In 2021 Adjusted EPS1 $(0.21) $(0.17) including deferred items2 +$0.14 YoY

© 2023 All Rights Reserved | 8 2023 Financial Outlook Net Revenue increased to be in the range of $230 million to $240 million, representing YoY growth of 47%, measured at the midpoint. Adjusted EBITDA is projected to be in the range of $40 million to $45 million, Representing YoY growth of 171% and a margin of 18%, measured at the midpoint.

Full Presentation

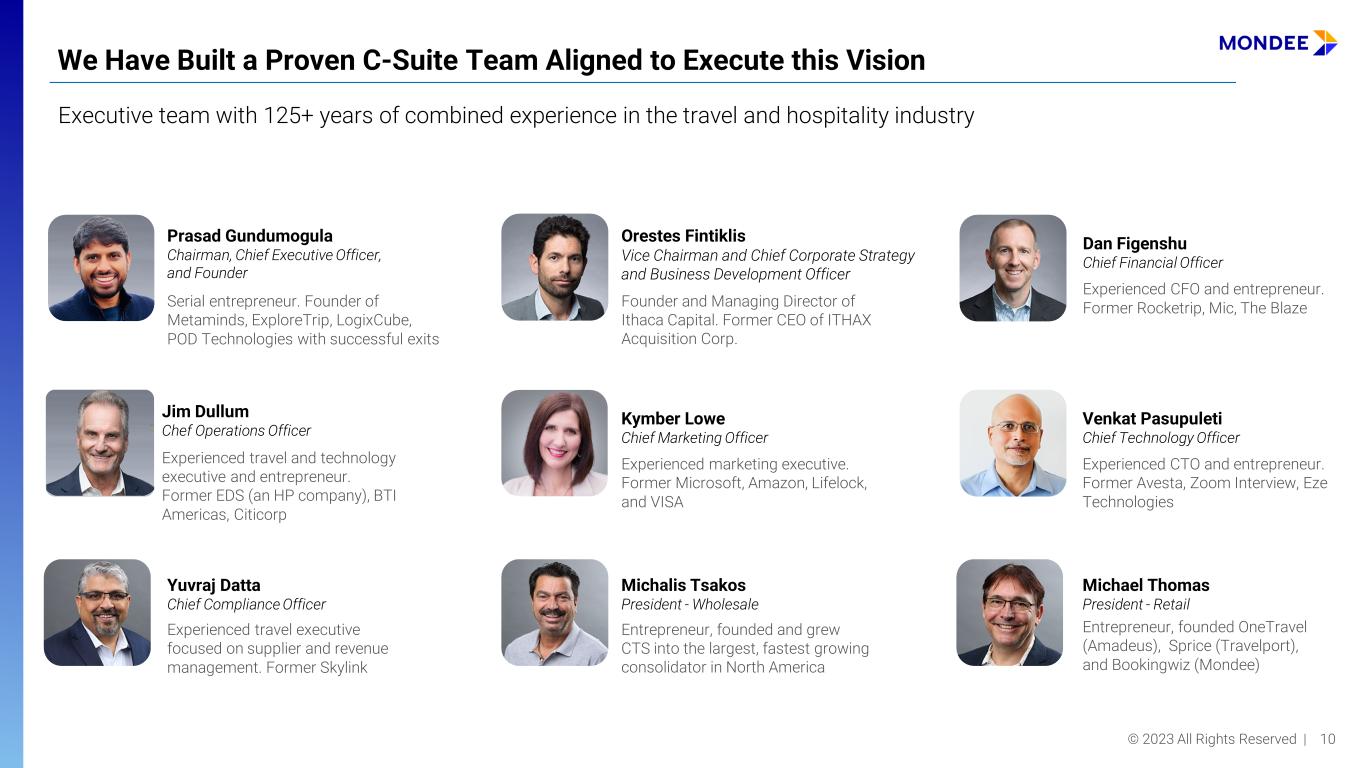

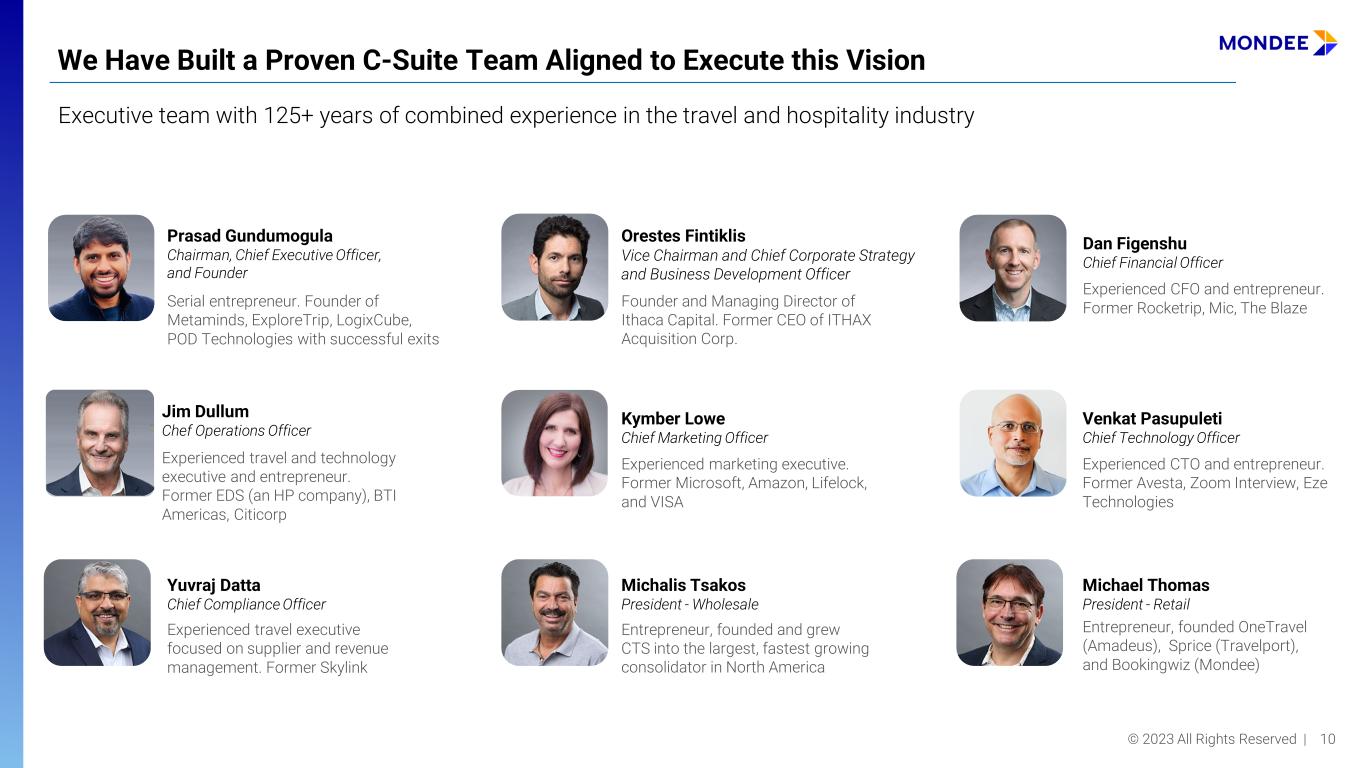

© 2023 All Rights Reserved | 10 Experienced travel and technology executive and entrepreneur. Former EDS (an HP company), BTI Americas, Citicorp Jim Dullum Chef Operations Officer Dan Figenshu Chief Financial Officer Experienced CFO and entrepreneur. Former Rocketrip, Mic, The Blaze Michael Thomas President - Retail Venkat Pasupuleti Chief Technology Officer Experienced CTO and entrepreneur. Former Avesta, Zoom Interview, Eze Technologies Yuvraj Datta Chief Compliance Officer Experienced travel executive focused on supplier and revenue management. Former Skylink Serial entrepreneur. Founder of Metaminds, ExploreTrip, LogixCube, POD Technologies with successful exits Prasad Gundumogula Chairman, Chief Executive Officer, and Founder Orestes Fintiklis Vice Chairman and Chief Corporate Strategy and Business Development Officer Michalis Tsakos President - Wholesale Entrepreneur, founded and grew CTS into the largest, fastest growing consolidator in North America We Have Built a Proven C-Suite Team Aligned to Execute this Vision Executive team with 125+ years of combined experience in the travel and hospitality industry Kymber Lowe Chief Marketing Officer Experienced marketing executive. Former Microsoft, Amazon, Lifelock, and VISA Founder and Managing Director of Ithaca Capital. Former CEO of ITHAX Acquisition Corp. Entrepreneur, founded OneTravel (Amadeus), Sprice (Travelport), and Bookingwiz (Mondee)

© 2023 All Rights Reserved | 11 We Are Disrupting the Massive Global Assisted / Affiliated Travel Market Mondee’s gross revenue TAM is primarily the $1T and growing Assisted/Affiliated travel market Sources: PhocusWright, IBIS, Management Estimates Global Travel Spending: ~$1.9T (2023E) 47% Mix 53% Mix ~$0.9T ~$1.0T Self Service • Good GUIs • Retail Prices • Low Tech • No Touch Assisted/Affiliated • Poor GUIs • Legacy • Low Tech • High-Touch Service Metasearch Airline, Hotel, Car Rental Sites OTAs ~50/50 business / leisure mix ~50/50 domestic / international mix Many users transact on both sides Gig Economy Workers Travel Agencies Clubs & Closed User Groups SMBs & Businesses Travel Management Companies (TMCs)

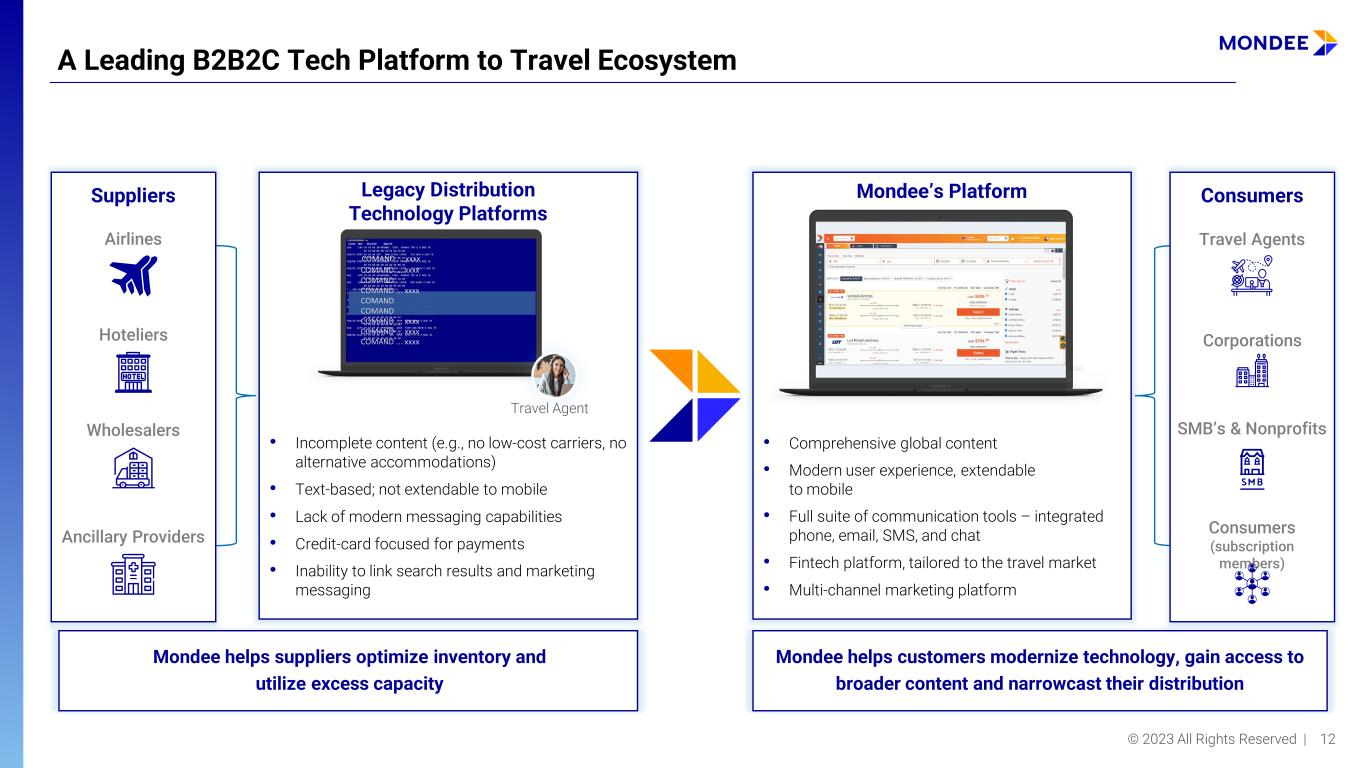

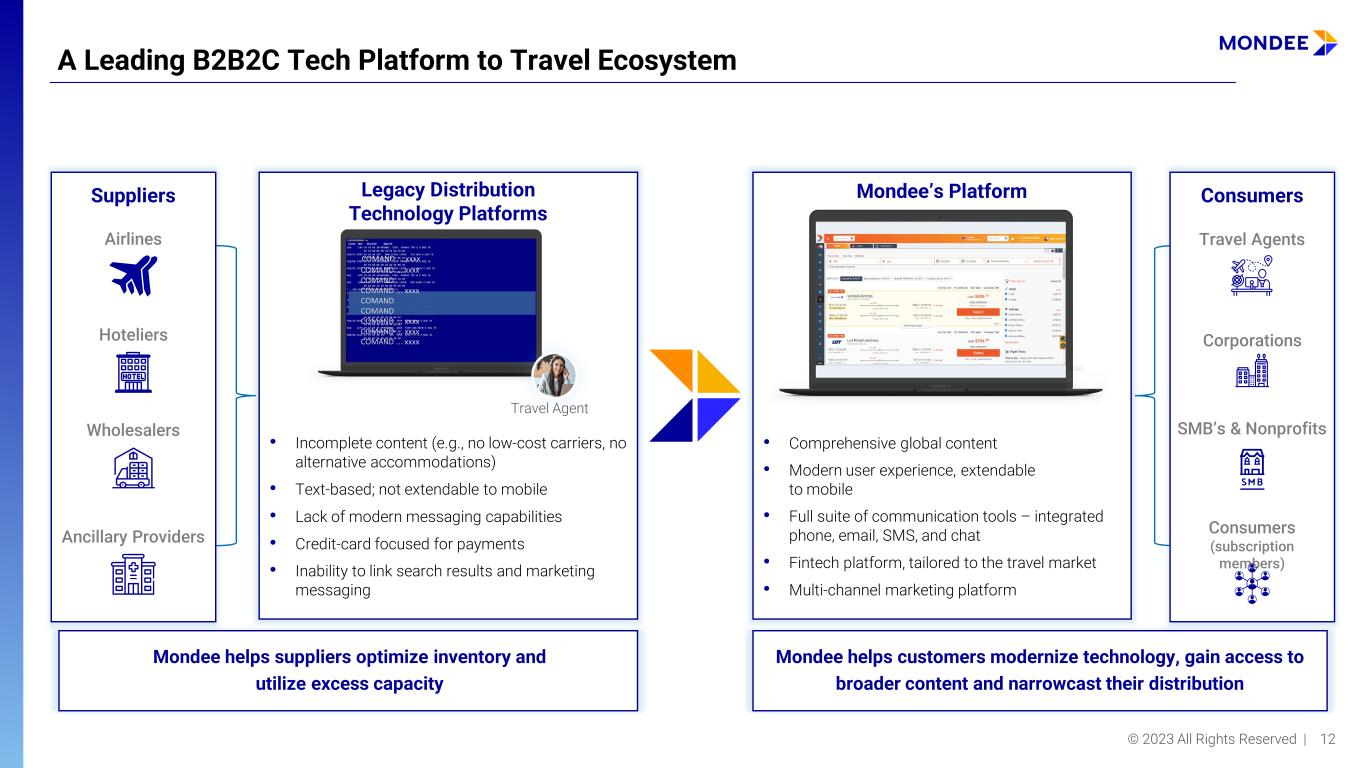

© 2023 All Rights Reserved | 12 Mondee’s PlatformSuppliers Mondee helps suppliers optimize inventory and utilize excess capacity Legacy Distribution Technology Platforms COMAND ... xxxx COMAND ... xxxx COMAND COMAND ... xxxx COMAND COMAND COMAND ... xxxx COMAND ... xxxx COMAND ... xxxx Travel Agent • Incomplete content (e.g., no low-cost carriers, no alternative accommodations) • Text-based; not extendable to mobile • Lack of modern messaging capabilities • Credit-card focused for payments • Inability to link search results and marketing messaging Consumers Mondee helps customers modernize technology, gain access to broader content and narrowcast their distribution • Comprehensive global content • Modern user experience, extendable to mobile • Full suite of communication tools – integrated phone, email, SMS, and chat • Fintech platform, tailored to the travel market • Multi-channel marketing platform A Leading B2B2C Tech Platform to Travel Ecosystem Airlines Hoteliers Wholesalers Ancillary Providers Travel Agents Consumers (subscription members) SMB’s & Nonprofits Corporations

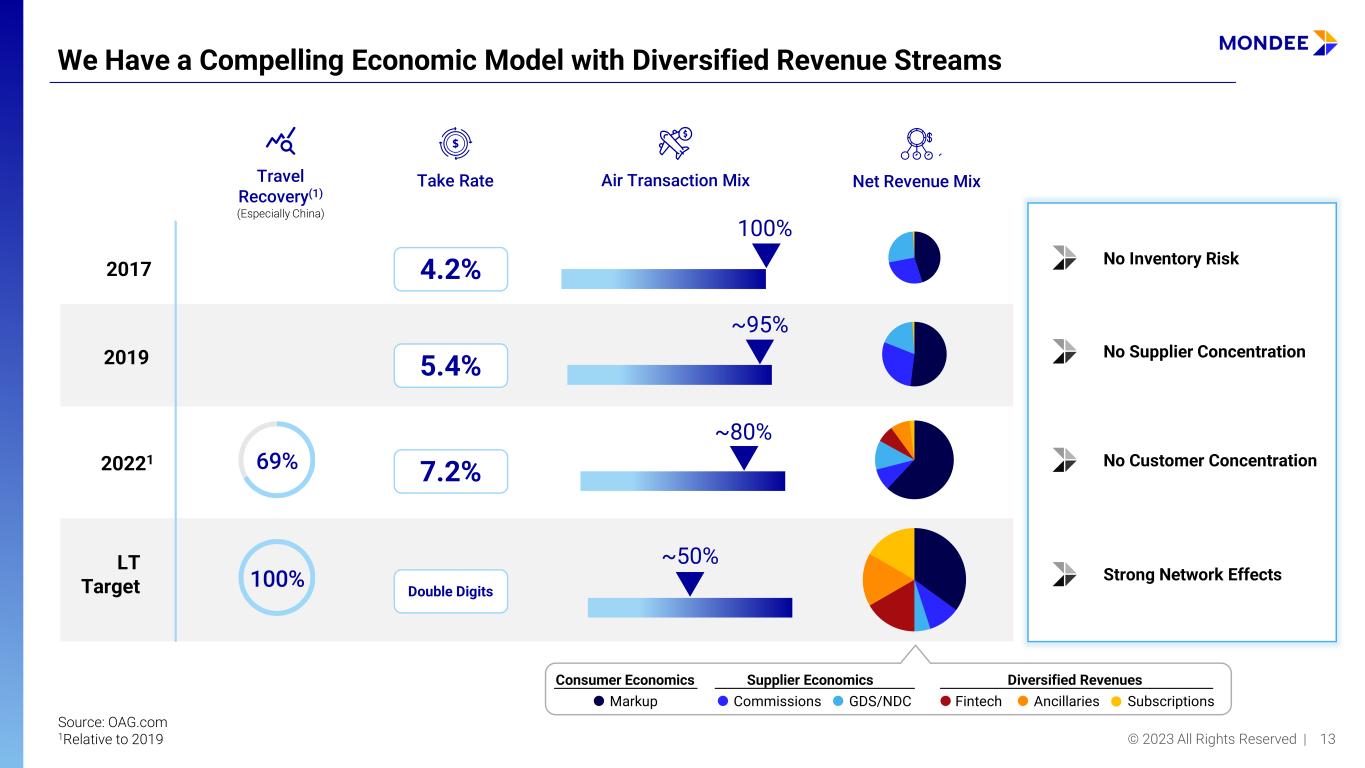

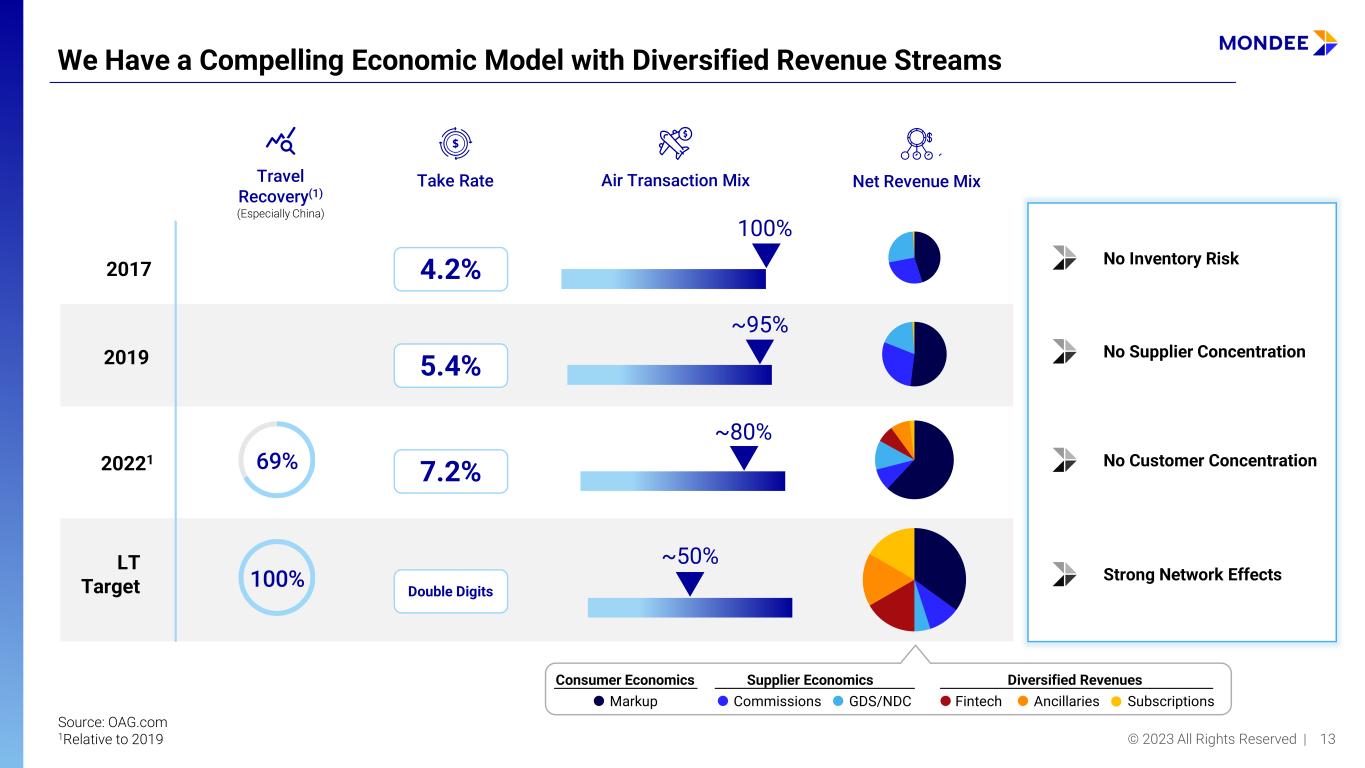

© 2023 All Rights Reserved | 13 ~95% ~80% 4.2% Double Digits LT Target 2017 Take Rate 7.2% 5.4%2019 ~50% We Have a Compelling Economic Model with Diversified Revenue Streams 20221 100% No Inventory Risk No Supplier Concentration No Customer Concentration Strong Network Effects Net Revenue MixAir Transaction Mix 100% 69% Travel Recovery(1) (Especially China) Consumer Economics Markup Supplier Economics Commissions GDS/NDC Diversified Revenues Fintech Ancillaries Subscriptions Source: OAG.com 1Relative to 2019

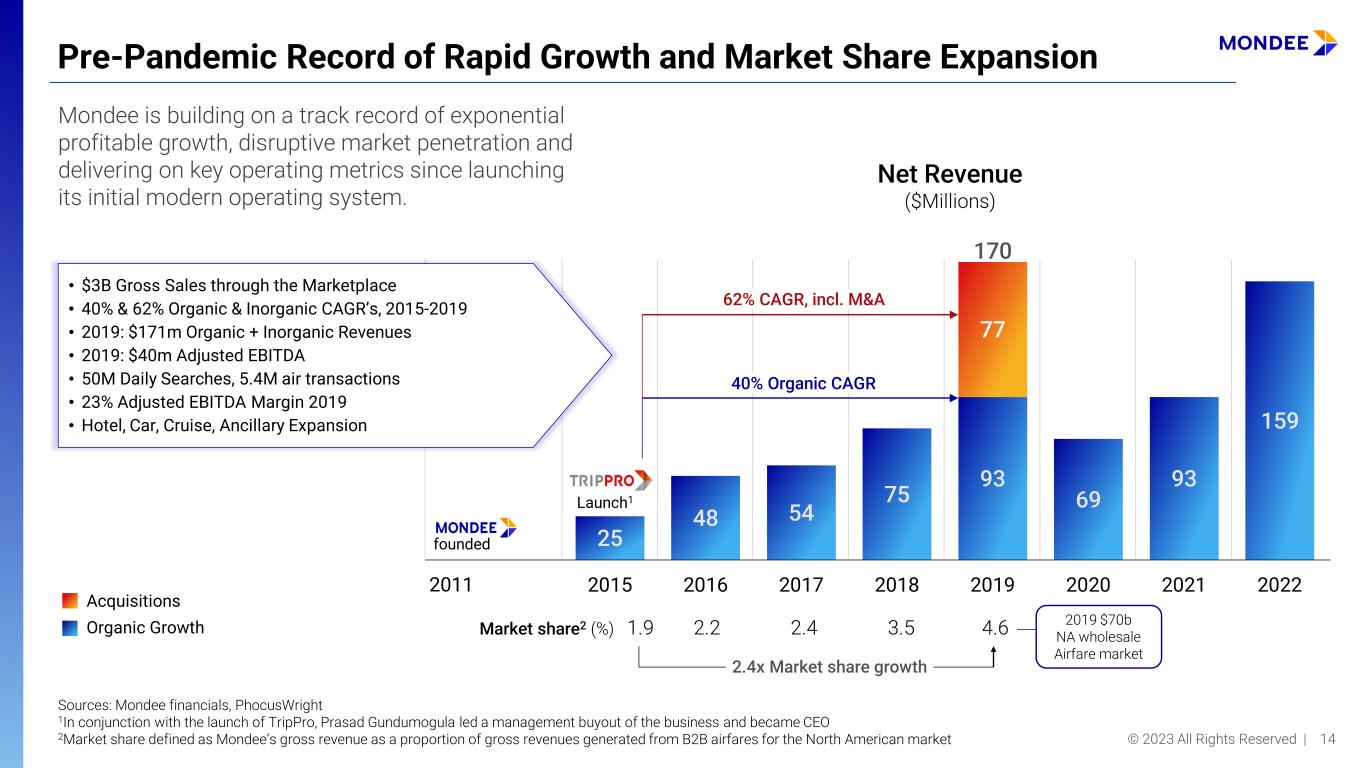

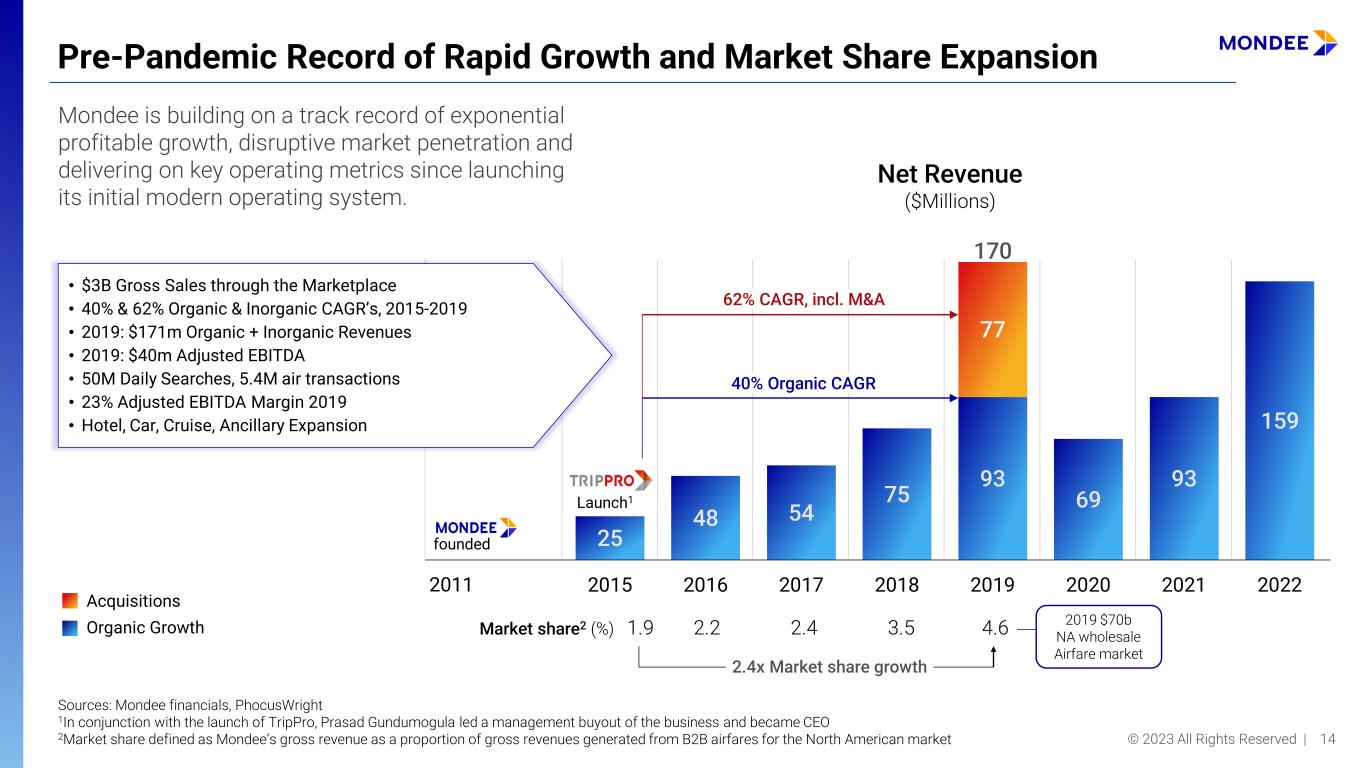

© 2023 All Rights Reserved | 14 25 48 54 75 93 69 93 159 77 2015 2016 2017 2018 2019 2020 2021 2022 founded Launch1 40% Organic CAGR 62% CAGR, incl. M&A Market share2 (%) 1.9 2.2 2.4 3.5 4.6 2019 $70b NA wholesale Airfare market 2011 2.4x Market share growth Net Revenue ($Millions) Pre-Pandemic Record of Rapid Growth and Market Share Expansion Mondee is building on a track record of exponential profitable growth, disruptive market penetration and delivering on key operating metrics since launching its initial modern operating system. Sources: Mondee financials, PhocusWright 1In conjunction with the launch of TripPro, Prasad Gundumogula led a management buyout of the business and became CEO 2Market share defined as Mondee’s gross revenue as a proportion of gross revenues generated from B2B airfares for the North American market 170 Organic Growth Acquisitions • $3B Gross Sales through the Marketplace • 40% & 62% Organic & Inorganic CAGR’s, 2015-2019 • 2019: $171m Organic + Inorganic Revenues • 2019: $40m Adjusted EBITDA • 50M Daily Searches, 5.4M air transactions • 23% Adjusted EBITDA Margin 2019 • Hotel, Car, Cruise, Ancillary Expansion

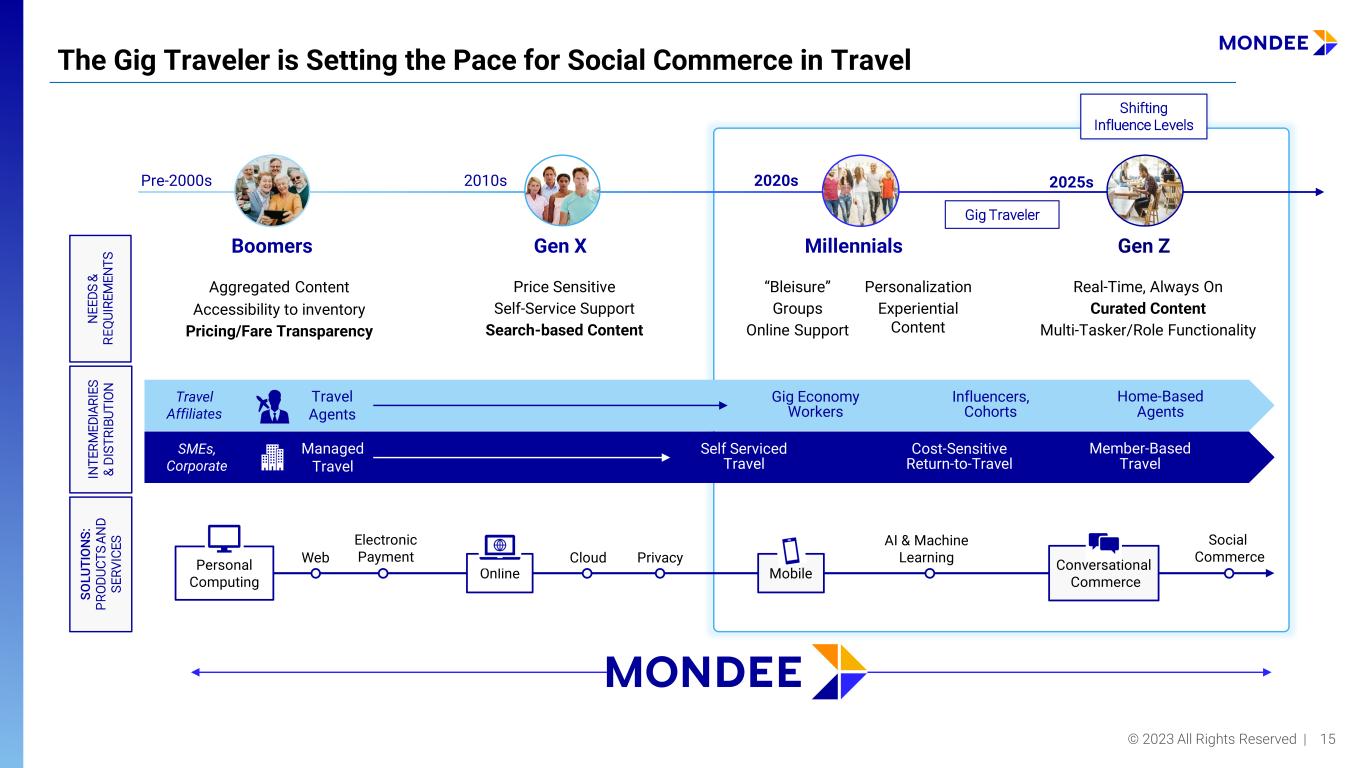

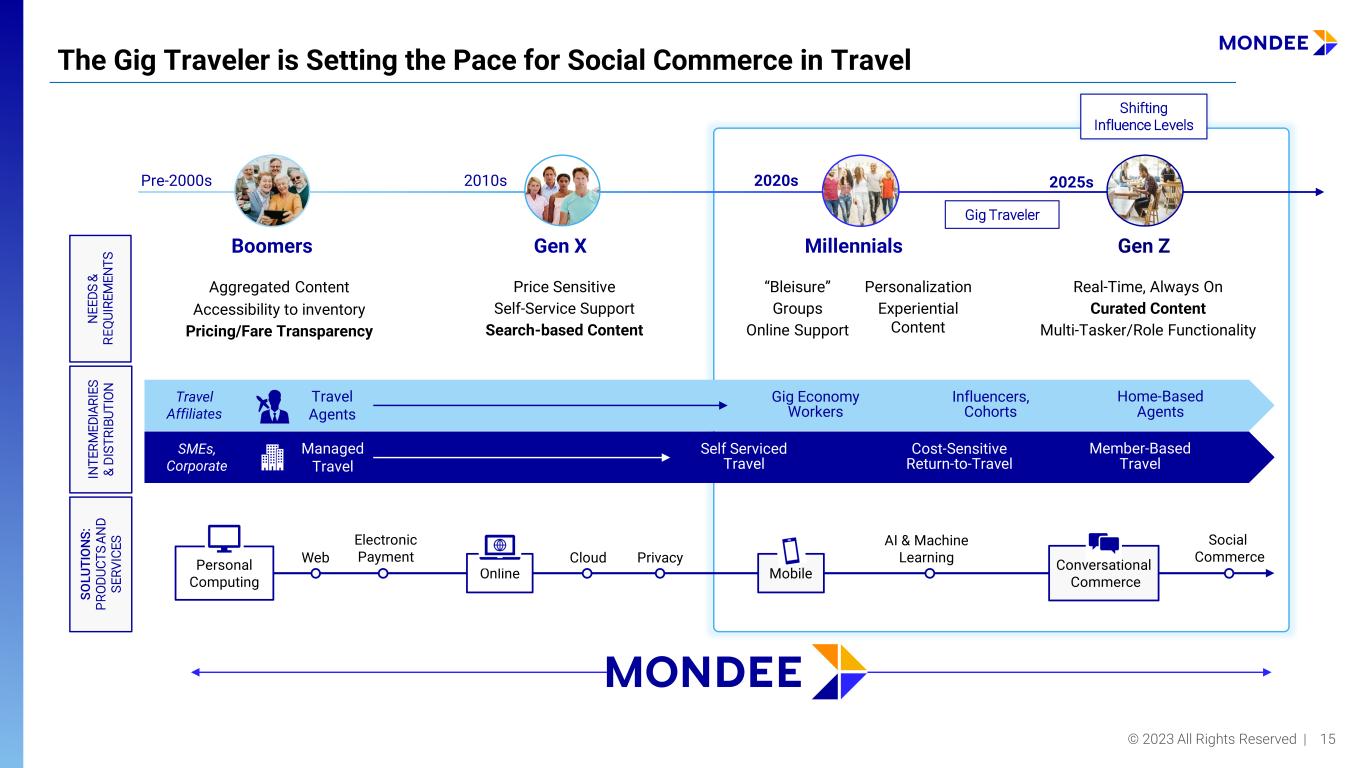

© 2023 All Rights Reserved | 15 The Gig Traveler is Setting the Pace for Social Commerce in Travel Pre-2000s N EE DS & R EQ UI RE M EN TS IN TE RM ED IA RI ES & D IS TR IB UT IO N SO LU TI O N S: PR O DU CT S AN D SE RV IC ES Boomers Gen X Millennials Gen Z 2010s 2020s 2025s Aggregated Content Accessibility to inventory Pricing/Fare Transparency Price Sensitive Self-Service Support Search-based Content “Bleisure” Groups Online Support Personalization Experiential Content Real-Time, Always On Curated Content Multi-Tasker/Role Functionality Social Commerce AI & Machine LearningWeb Electronic Payment Cloud PrivacyPersonal Computing Online Mobile Conversational Commerce Travel Agents Travel Affiliates Managed Travel SMEs, Corporate Home-Based Agents Gig Economy Workers Influencers, Cohorts Cost-Sensitive Return-to-Travel Self Serviced Travel Member-Based Travel Gig Traveler Shifting Influence Levels

© 2023 All Rights Reserved | 16 We Have a Demonstrated Track Record of Recovery and Product Expansion FOUNDATIONAL ACQUISITIONS LAUNCHED MODERN TECH PLATFORM Nasdaq: MOND EXPANSION ACQUISITIONS LAUNCHED CLOSED USER GROUP BRAND PUBLICLY LISTED ON NASDAQ CONTENT: AIR HOTELS & CAR RENTAL CRUISES & THEME PARKS ALL TRAVEL CONTENT $25M $159M 2011-2014 2015-2018 2019 2020 2021 2022 TRANSFORMATION GEOGRAPHIES: NORTH AMERICA OUTBOUND INTERNATIONAL OUTBOUND DISTRIBUTION: TRAVEL AGENTS GIG ECONOMY SMBs & MEMBER ORGANIZATIONS INFLUENCERS CLOSED GROUPS GLOBAL $170M1 1Pro Forma for 2019 and 2020 acquisitions. Note: Figures denote Net Revenues $93M

© 2023 All Rights Reserved | 17 Fintech Software Experiential The Next Mondee Frontier Includes the Full Suite of B2B2C Travel Tech Tools Enterprise Travel Software Platform Self-Service Travel CRM / SaaS for Travel Managers Monetization for Travel Experts User Generated Content Mobile Super App Virtual Cards Essential Modern Travel Platform for Experts, Travelers, & Enterprises In-House Clearing Platform

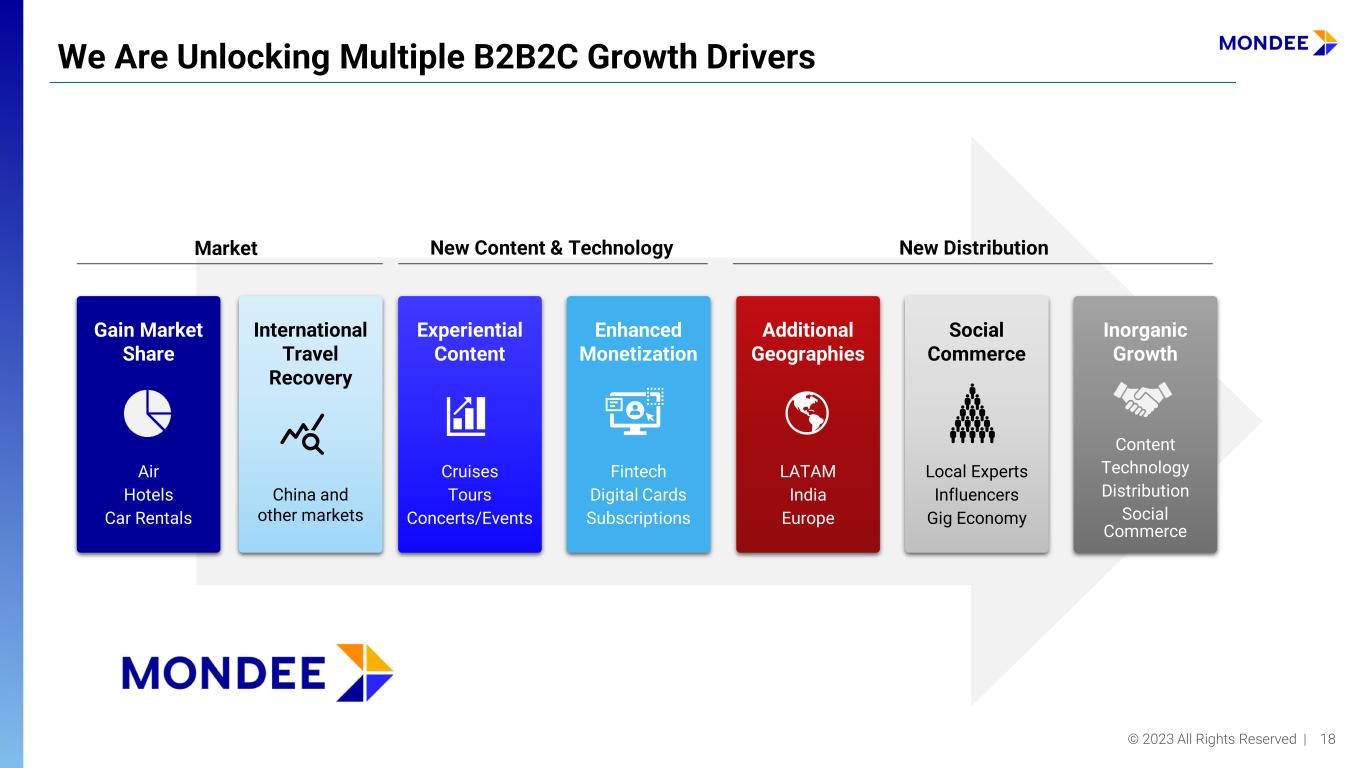

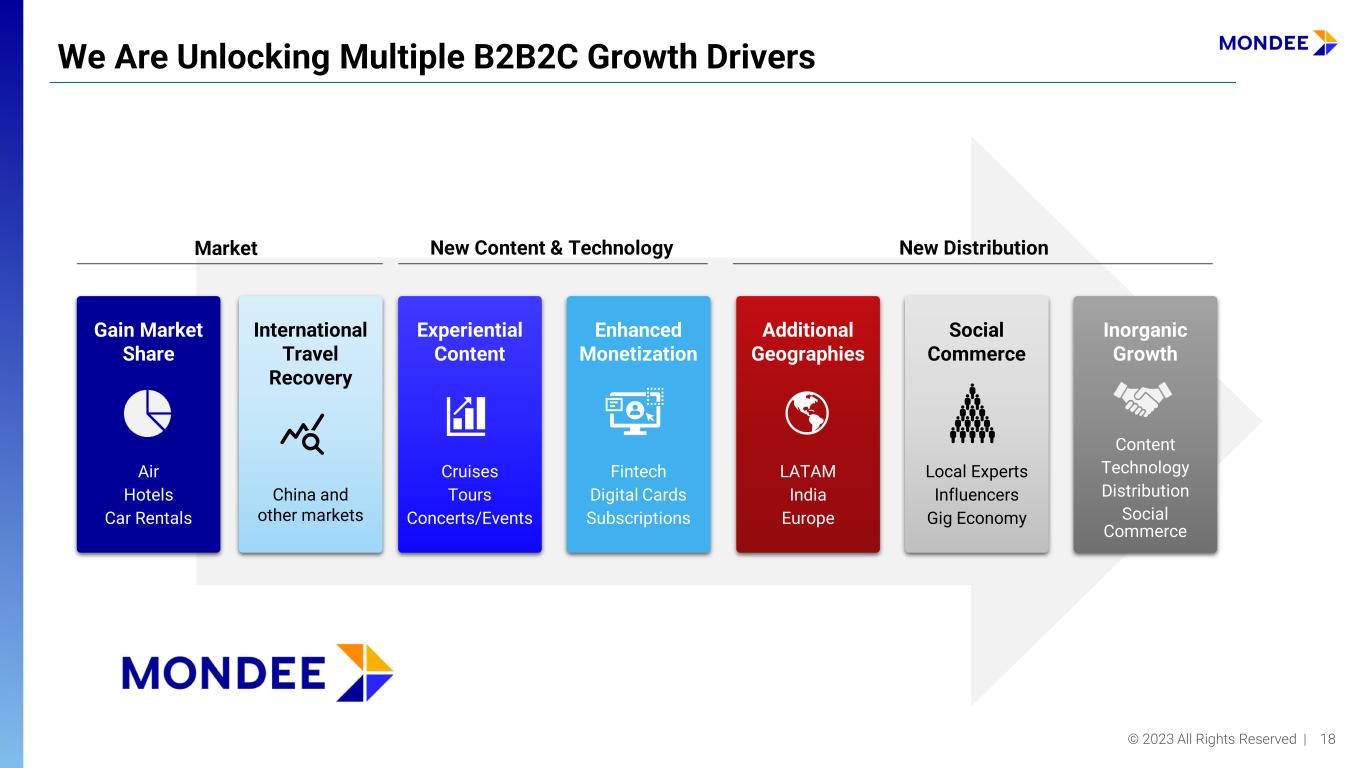

© 2023 All Rights Reserved | 18 Experiential Content Cruises Tours Concerts/Events Enhanced Monetization Fintech Digital Cards Subscriptions Additional Geographies LATAM India Europe Social Commerce Local Experts Influencers Gig Economy Inorganic Growth Content Technology Distribution Social Commerce International Travel Recovery China and other markets We Are Unlocking Multiple B2B2C Growth Drivers New DistributionNew Content & TechnologyMarket Gain Market Share Air Hotels Car Rentals

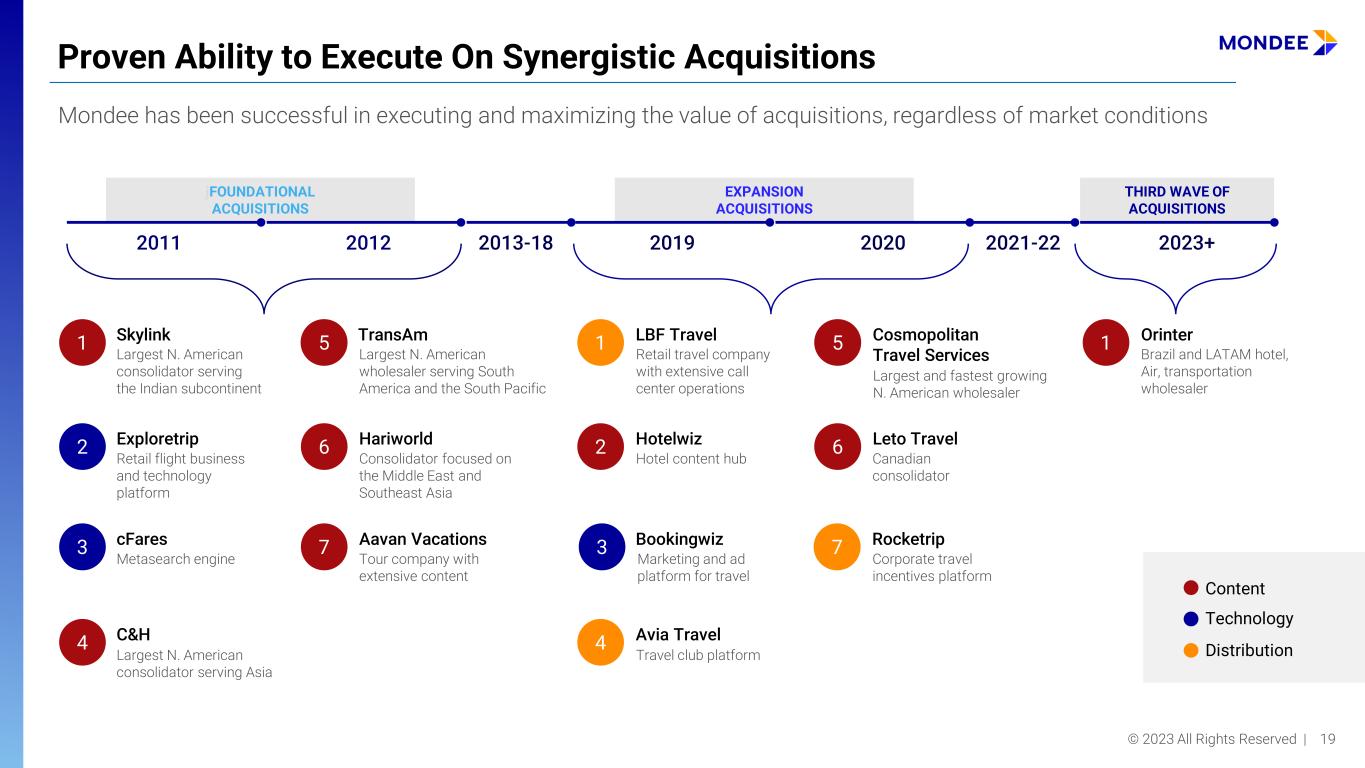

© 2023 All Rights Reserved | 19 Proven Ability to Execute On Synergistic Acquisitions Mondee has been successful in executing and maximizing the value of acquisitions, regardless of market conditions THIRD WAVE OF ACQUISITIONS 6 Consolidator focused on the Middle East and Southeast Asia Hariworld 7 Tour company with extensive content Aavan Vacations 1 Largest N. American consolidator serving the Indian subcontinent Skylink 2 Retail flight business and technology platform Exploretrip 3 Metasearch engine cFares 4 Largest N. American consolidator serving Asia C&H 6 Canadian consolidator Leto Travel 1 Retail travel company with extensive call center operations LBF Travel 2 Hotel content hub Hotelwiz 4 Travel club platform Avia Travel 5 Largest and fastest growing N. American wholesaler Cosmopolitan Travel Services 7 Corporate travel incentives platform Rocketrip 5 Largest N. American wholesaler serving South America and the South Pacific TransAm 2011 2012 2019 2020 Content Technology Distribution 3 Marketing and ad platform for travel Bookingwiz jFOUNDATIONAL ACQUISITIONS EXPANSION ACQUISITIONS 2013-18 2021-22 2023+ 1 Brazil and LATAM hotel, Air, transportation wholesaler Orinter

© 2023 All Rights Reserved | 20 Mondee M&A Strategy and Orinter Acquisition Rationale • Expanding the company's presence in key markets • Accelerating organic growth • Delivering synergies • Transacting at accretive valuations Expand content and distribution in Brazil and Latin America Natural expansion to Mondee’s North American footprint Accelerate Organic Growth • Unique product, distribution and tech that Mondee can plug into its ecosystem • Accelerate organic growth through product faster than developing those components internally Access to Orinter’s valuable direct hotel contacts Leverage Orinter’s local expertise and distribution of 4,800+ travel experts Synergies • Realizing material revenue and cost synergies Cross Selling opportunities (i.e., sell Orinter’s content to Mondee’s 55,000+ travel experts and vice versa) Revenue and cost synergies through the deployment of Mondee’s superior tech Accretive Valuation • Acquiring Companies that improve Mondee’s metrics at accretive valuations (relative to Mondee’s market cap) Orinter enjoys 13% take rate and 30% EBITDA margin Purchase price of ~$40 million implies multiple of ~4X Orinter’s 2022 EBITDA of $9.3 million M&A Strategy Acquisition

Financial Overview

© 2023 All Rights Reserved | 22 2022 Financial Highlights $2.2B | 130% Gross Revenue and Growth1 $159M | 71% Net Revenue and Growth1 $12M | 7% Adjusted EBITDA and Adjusted EBITDA Margin2 ($16M | 10% EBITDA including deferred items3) 7.2% Take Rate 1,330 bps Adjusted EBITDA Margin Expansion1 (1,570 bps including deferred items3) 2.1M+ Transactions All figures as of and for the year ended December 31, 2022 unless otherwise noted 12022 Compared with 2021 2As a percentage of net revenue 3See bridge in slide 32 and Form 8-K filed on April 10, 2023

© 2023 All Rights Reserved | 23 We Are a Travel Market Leader with a Superior Combination of Growth and Margin 58% 52% 52% 47% 45% 38% 36% 32% 31% 30% 2024E Revenue Growth + 2024E EBITDA Margin Rule of 40 Source: Wall Street estimates via FactSet as of 4/6/23

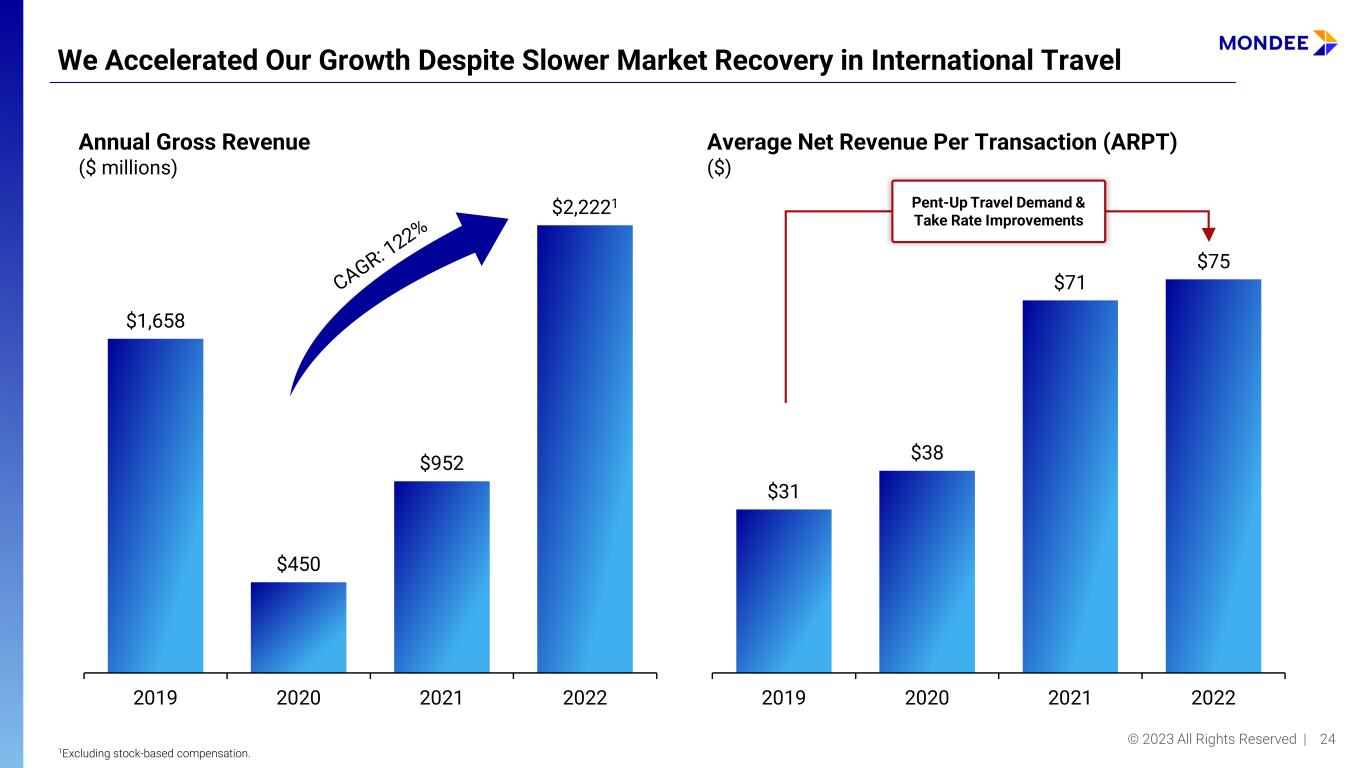

© 2023 All Rights Reserved | 24 We Accelerated Our Growth Despite Slower Market Recovery in International Travel $1,658 $450 $952 $2,2221 2019 2020 2021 2022 Annual Gross Revenue ($ millions) $31 $38 $71 $75 2019 2020 2021 2022 Average Net Revenue Per Transaction (ARPT) ($) Pent-Up Travel Demand & Take Rate Improvements 1Excluding stock-based compensation.

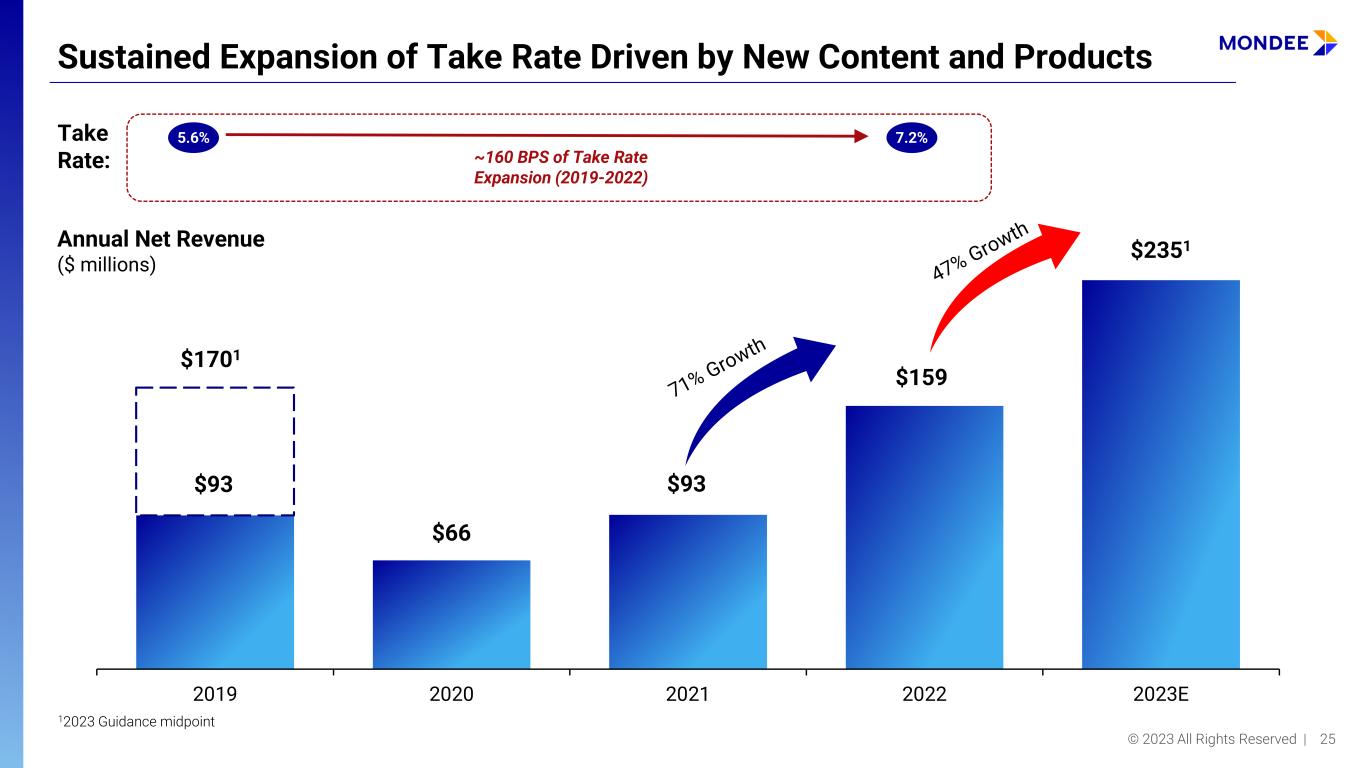

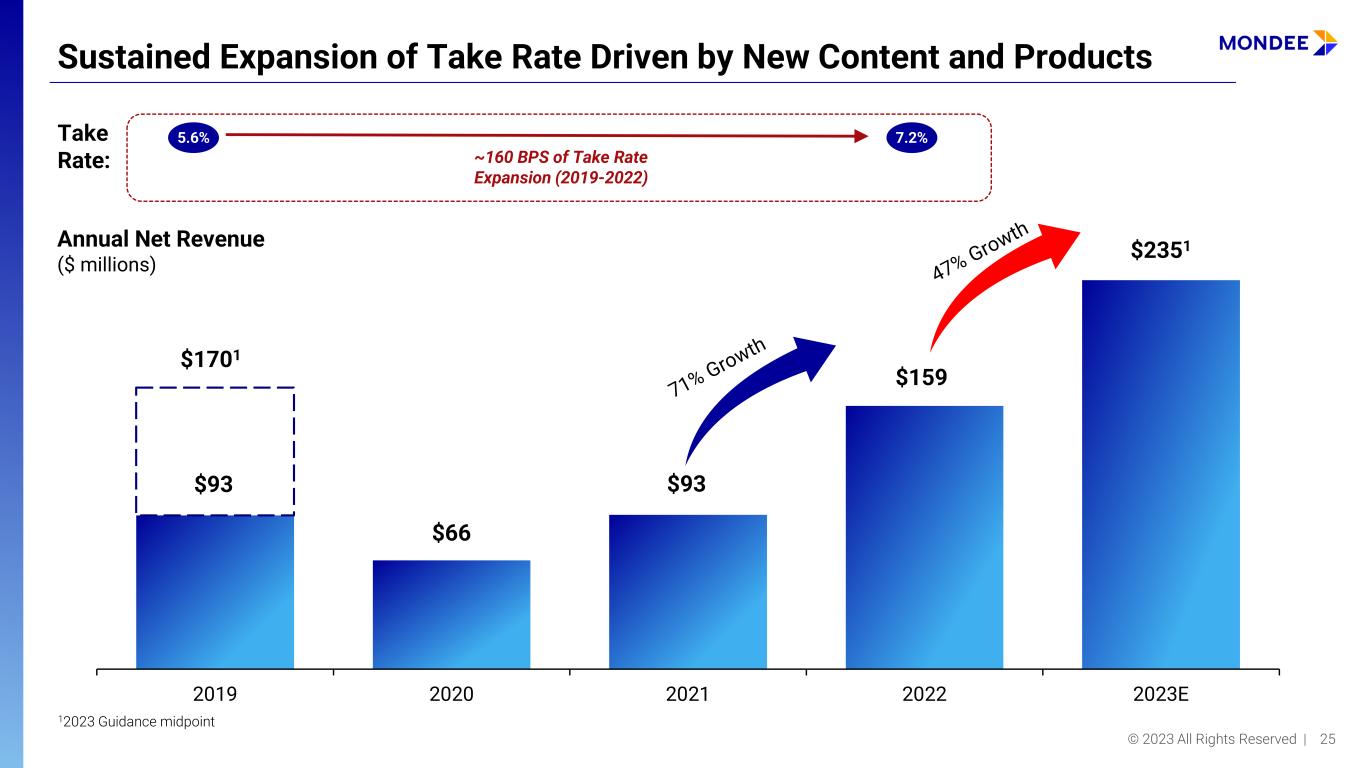

© 2023 All Rights Reserved | 25 Sustained Expansion of Take Rate Driven by New Content and Products Take Rate: 5.6% 7.2% ~160 BPS of Take Rate Expansion (2019-2022) Annual Net Revenue ($ millions) 12023 Guidance midpoint $93 $66 $93 $159 $2351 $1701 2019 2020 2021 2022 2023E

© 2023 All Rights Reserved | 26 We are Supported by Improving Operating Leverage $86 $102 $112 $162 2019 2020 2021 2022 Annual GAAP Opex ($ millions) GAAP Opex as % of Net Revenue: 113%120%154%92% 1 Excludes stock-based compensation expense. 2 Also excludes a one-time $2.1 million restructuring expense. Personnel Information Technology OtherSales & Marketing G&A 2

© 2023 All Rights Reserved | 27 Driving Towards Growing Profitability $13 ($25) ($5) $12 2 $43 3 $401 2019 2020 2021 2022 2023E Adjusted EBITDA and Margin ($ millions) 14% (37%) (6%) 7%2 18%3 23%1 1Represents EBITDA and margin pro-forma of acquisitions done in 2019 and 2020. 2$16 million and 10% margin including deferred items, see bridge in slide 32 and Form 8-K filed on April 10, 2023 32023 Guidance midpoint Fintech & Subscription Products Operating Leverage Take Rate Expansion Market Share Gain Disciplined, Accretive M&A Drivers of Margin Expansion

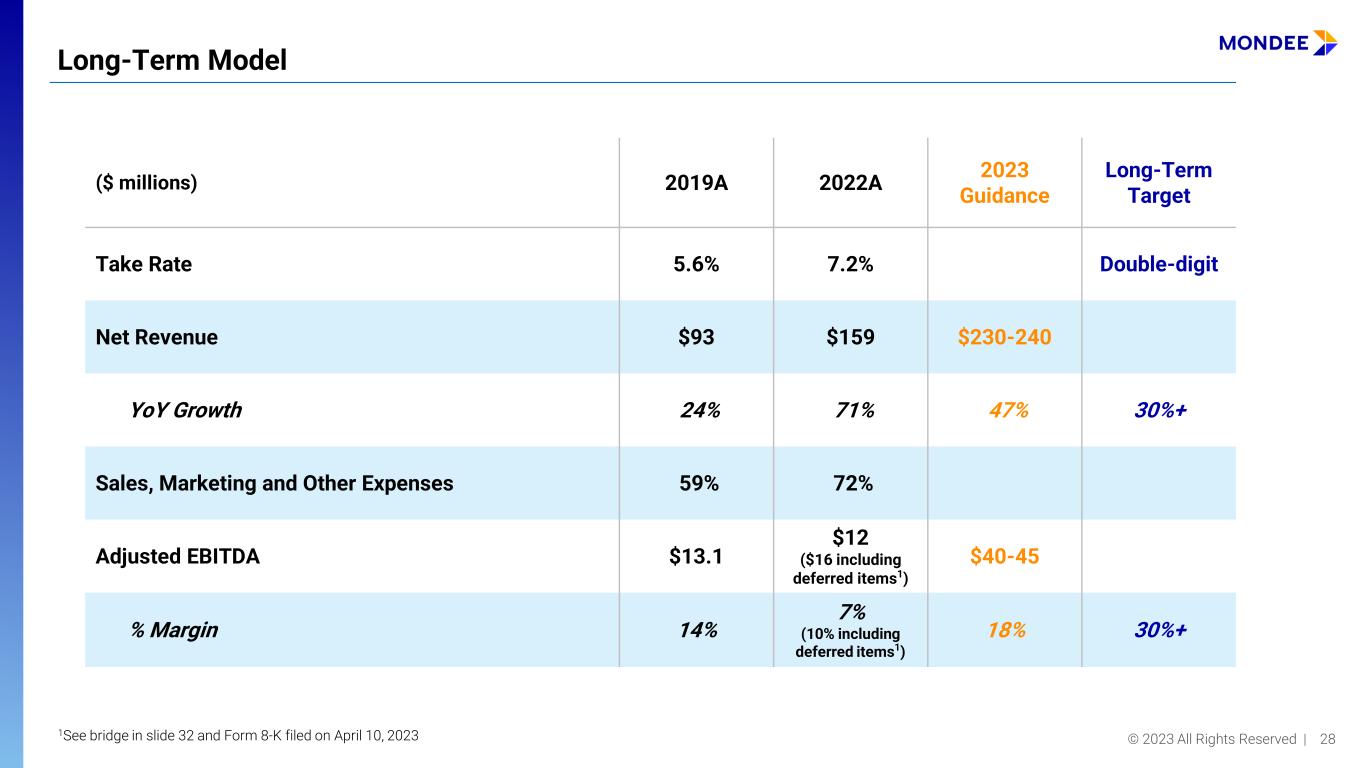

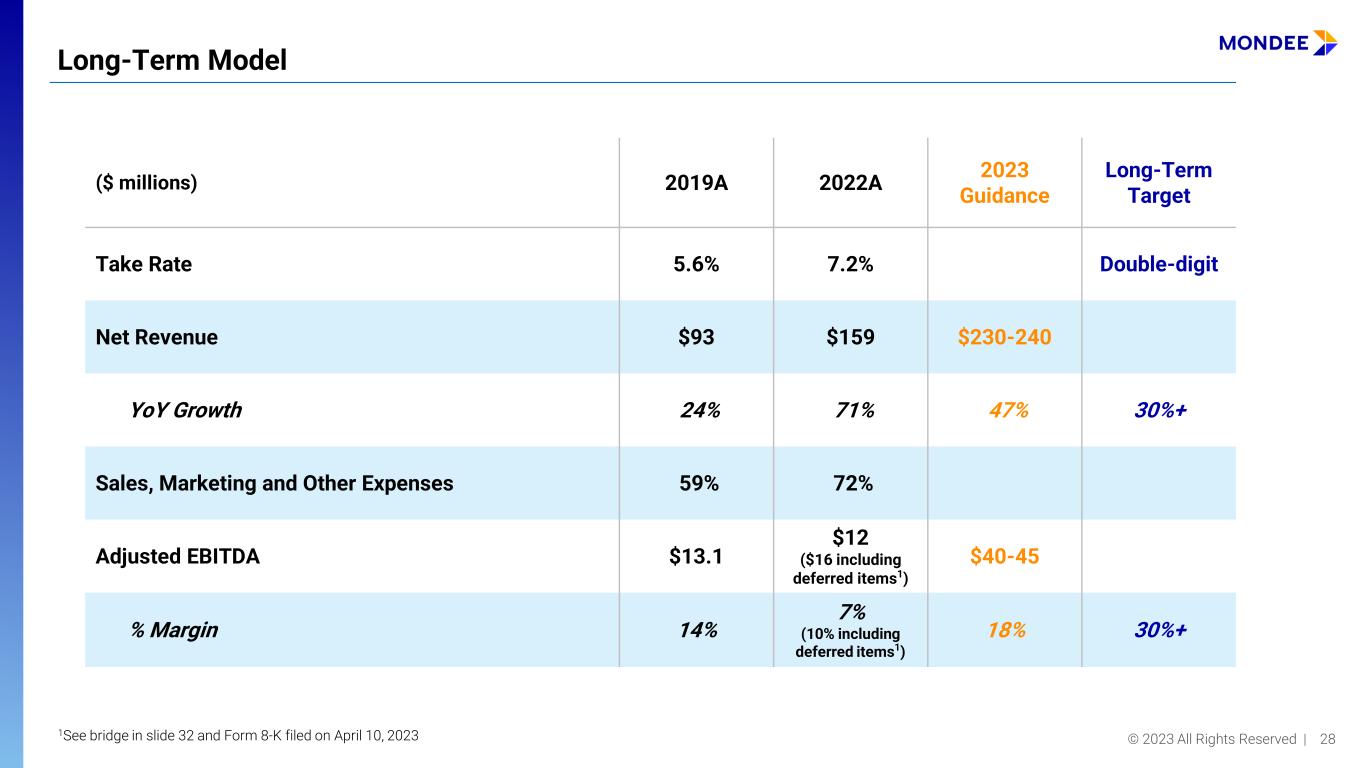

© 2023 All Rights Reserved | 28 ($ millions) 2019A 2022A 2023 Guidance Long-Term Target Take Rate 5.6% 7.2% Double-digit Net Revenue $93 $159 $230-240 YoY Growth 24% 71% 47% 30%+ Sales, Marketing and Other Expenses 59% 72% Adjusted EBITDA $13.1 $12 ($16 including deferred items1) $40-45 % Margin 14% 7% (10% including deferred items1) 18% 30%+ Long-Term Model 1See bridge in slide 32 and Form 8-K filed on April 10, 2023

© 2023 All Rights Reserved | 29 ($ millions, except share numbers) 4Q21 4Q22 Cash, Cash Equivalents and Restricted Short-Term Investments $24.0 (includes $8.5 in restricted cash) $87.5 (includes $8.6 in restricted cash and short-term investments) Total Debt $173.2 (includes $11 of current portion of LTD) $134.4 (includes $7.5 of current portion of LTD) Redeemable Preferred Stock N/A $85.0 Common Shares Outstanding N/A 82,266,160 Balance Sheet Summary

© 2023 All Rights Reserved | 30 Key Investment Highlights Disrupting the Massive Global Travel Market Multiple Levers of Growth Proven Leadership Team Profitable Growth with Expanding Margins Significant Barriers to Entry Next-Gen Travel Tech Platform

Appendix

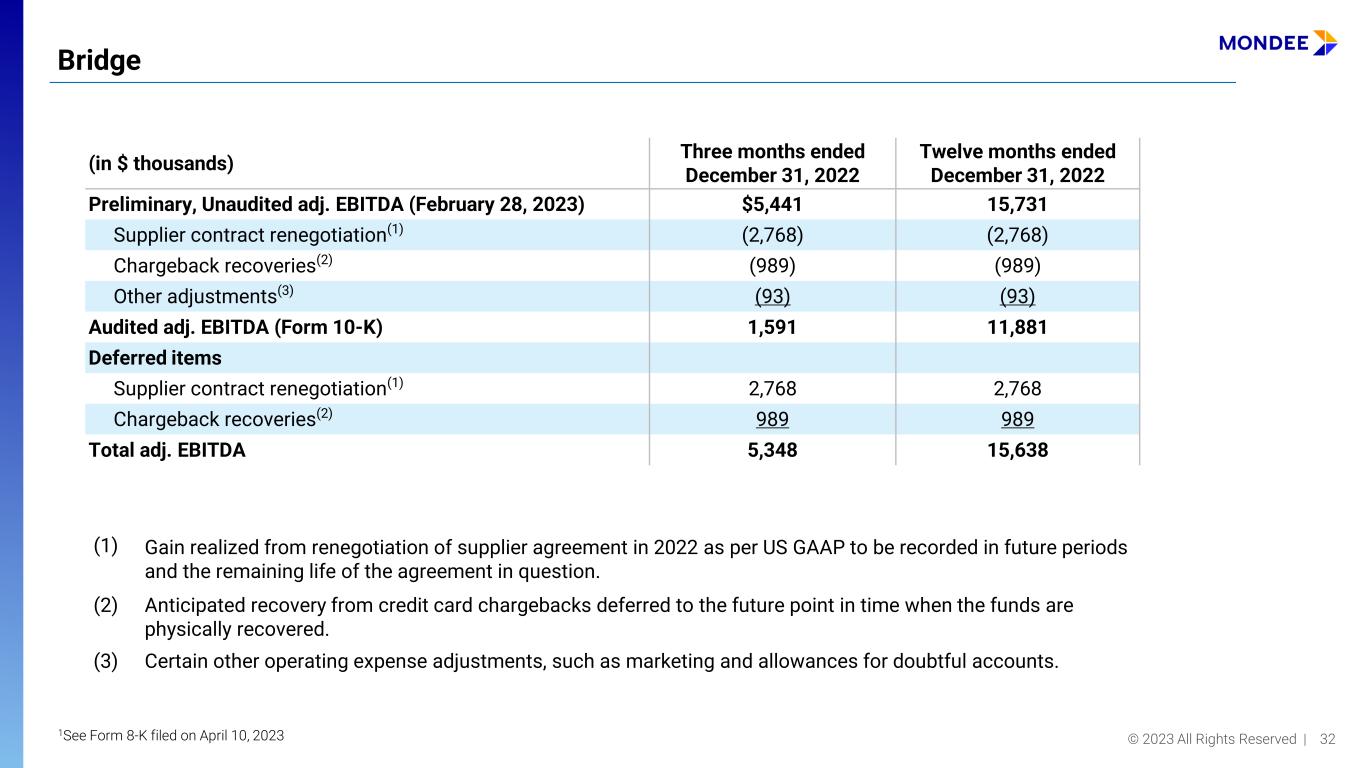

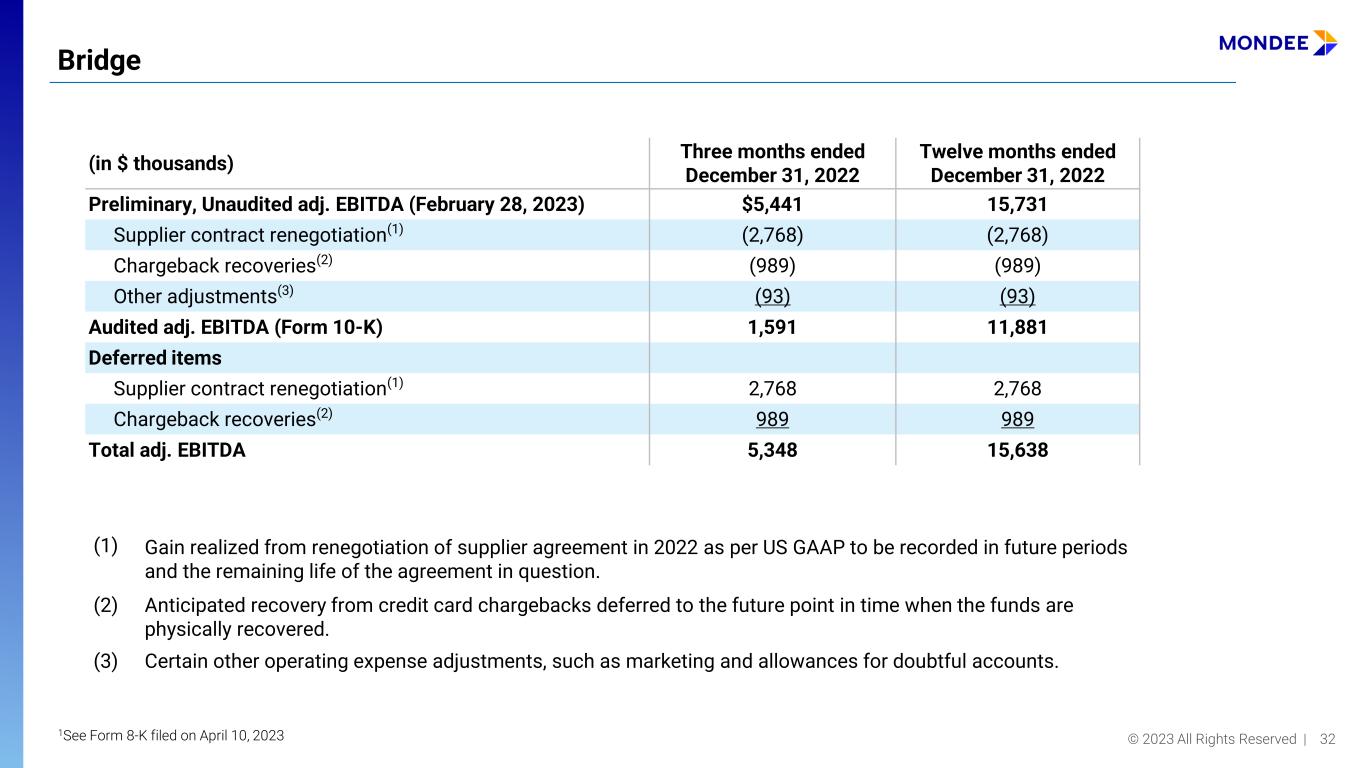

© 2023 All Rights Reserved | 32 (in $ thousands) Three months ended December 31, 2022 Twelve months ended December 31, 2022 Preliminary, Unaudited adj. EBITDA (February 28, 2023) $5,441 15,731 Supplier contract renegotiation(1) (2,768) (2,768) Chargeback recoveries(2) (989) (989) Other adjustments(3) (93) (93) Audited adj. EBITDA (Form 10-K) 1,591 11,881 Deferred items Supplier contract renegotiation(1) 2,768 2,768 Chargeback recoveries(2) 989 989 Total adj. EBITDA 5,348 15,638 Bridge 1See Form 8-K filed on April 10, 2023 (1) Gain realized from renegotiation of supplier agreement in 2022 as per US GAAP to be recorded in future periods and the remaining life of the agreement in question. (2) Anticipated recovery from credit card chargebacks deferred to the future point in time when the funds are physically recovered. (3) Certain other operating expense adjustments, such as marketing and allowances for doubtful accounts.

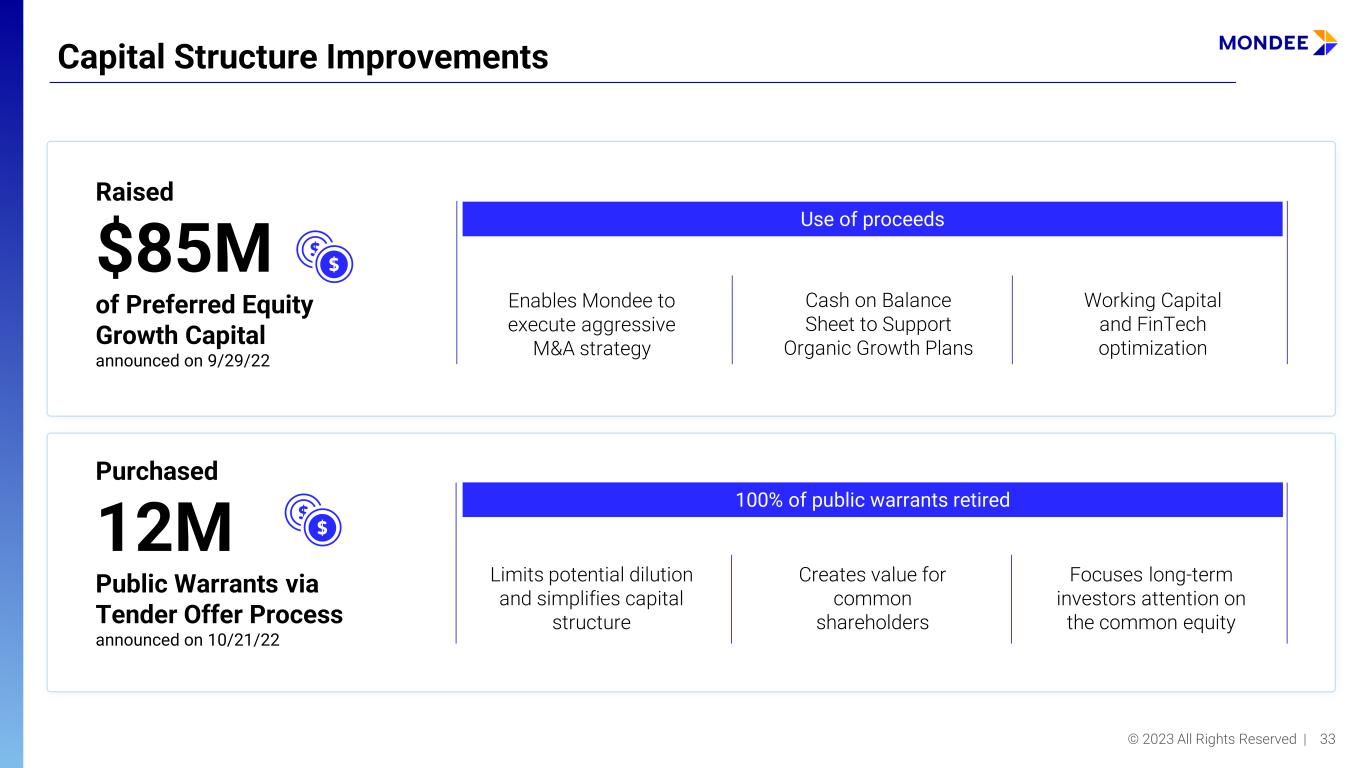

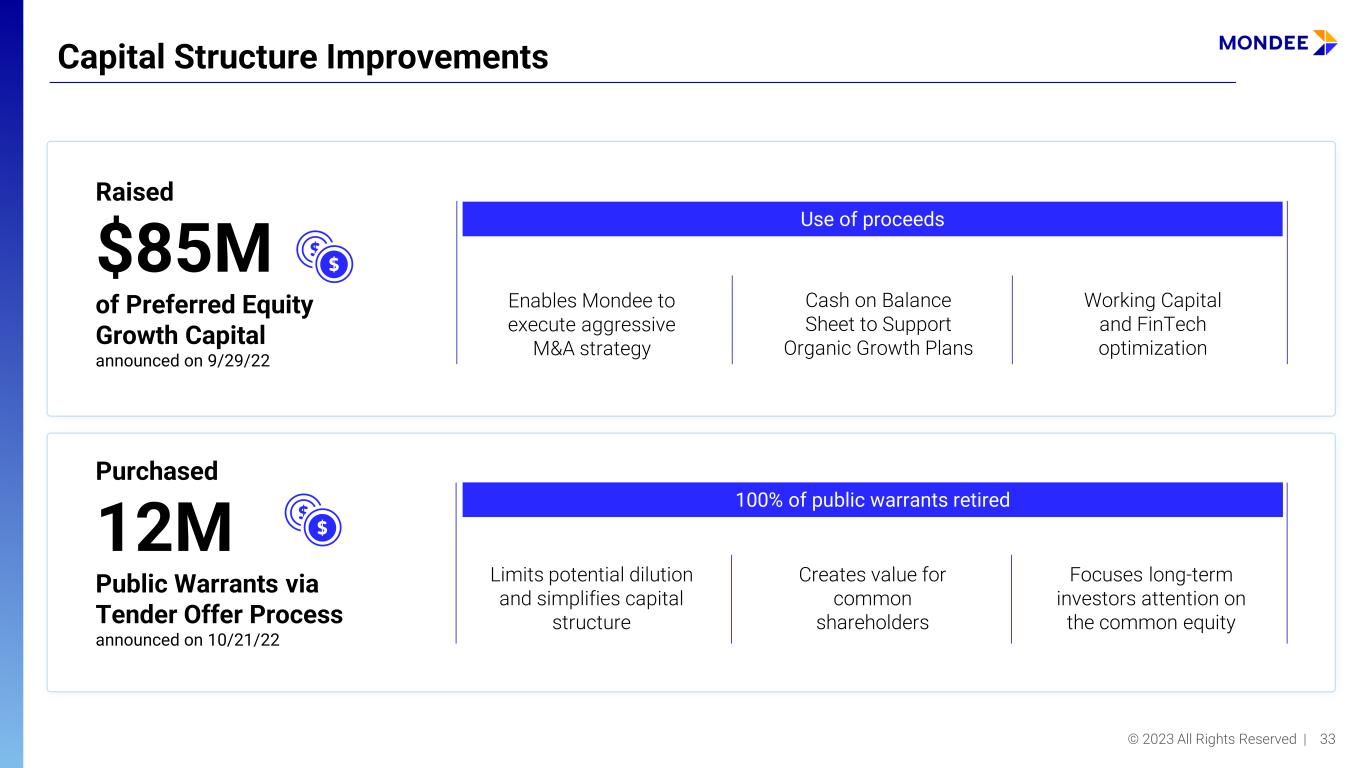

© 2023 All Rights Reserved | 33 Capital Structure Improvements Raised $85M of Preferred Equity Growth Capital announced on 9/29/22 Enables Mondee to execute aggressive M&A strategy Cash on Balance Sheet to Support Organic Growth Plans Working Capital and FinTech optimization Purchased 12M Public Warrants via Tender Offer Process announced on 10/21/22 Use of proceeds Limits potential dilution and simplifies capital structure Focuses long-term investors attention on the common equity 100% of public warrants retired Creates value for common shareholders

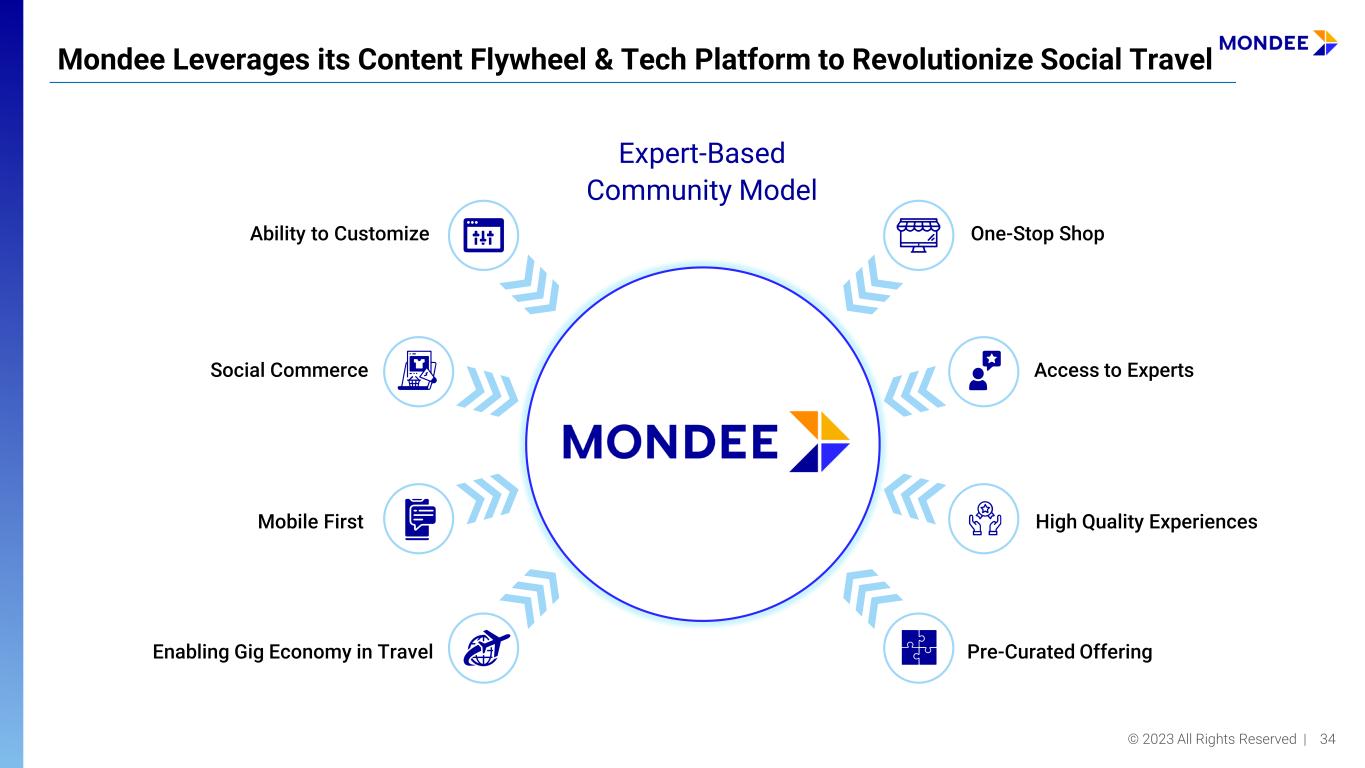

© 2023 All Rights Reserved | 34 Mondee Leverages its Content Flywheel & Tech Platform to Revolutionize Social Travel Ability to Customize Enabling Gig Economy in Travel Social Commerce Mobile First One-Stop Shop Pre-Curated Offering Access to Experts High Quality Experiences Expert-Based Community Model

© 2023 All Rights Reserved | 35 Without Mondee, Booking a Curated Trip is a Never Ending Headache Air Lodging Car Rental Tours / ExperiencesReservations Tickets The average person searches 20+ sites when planning a curated trip

© 2023 All Rights Reserved | 36 Asi Ginio Co-Founder, Former CPO, COO, CEO, Tourico Holidays Inc. Noor Sweid Founder, General Partner, Global Ventures Pradeep Udhas Co-Founder, Senior Advisor, KPMG India Roopa Purushothaman Chief Economist, Head of Policy Advocacy, Tata Sons Private Limited Mona Aboelnaga Kanaan Managing Partner, K6 Investments LLC Board of Directors with Diverse Experience Mondee’s Board of Directors with diverse and extensive experiences in public companies. Prasad Gundumogula Chairman, Chief Executive Officer, and Founder Orestes Fintiklis Vice Chairman and Chief Corporate Strategy and Business Development Officer

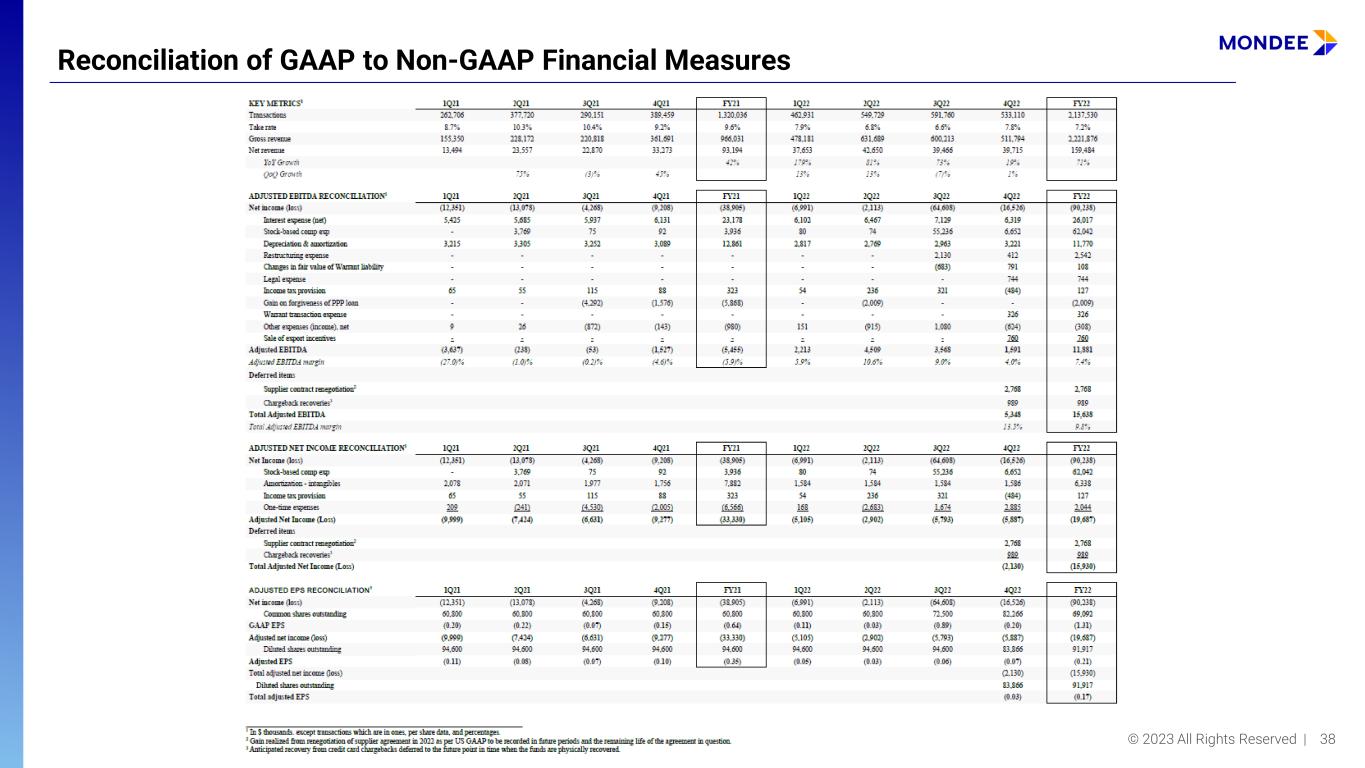

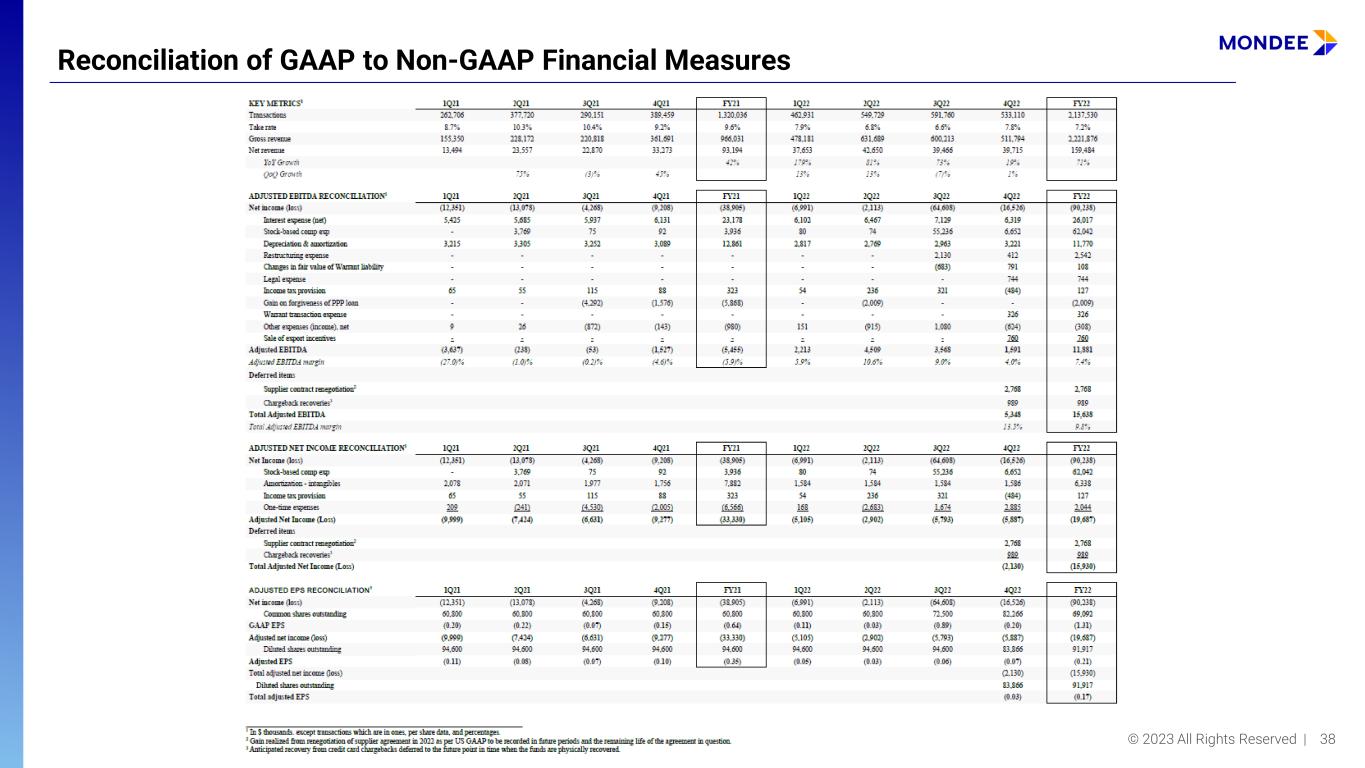

© 2023 All Rights Reserved | 37 Non-GAAP Measurements In addition to disclosing financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP), this presentation and the accompanying tables include adjusted EBITDA non-GAAP net income, and non-GAAP EPS. These non-GAAP financial measures are not calculated in accordance with GAAP as they have been adjusted to exclude the effects of stock-based compensation expenses, provision for income taxes, and the impacts of depreciation and amortization. We define Adjusted EBITDA as net loss before depreciation and amortization, provision for income taxes, interest expense (net), other income net, stock-based compensation, and gain on forgiveness of PPP loans. Non-GAAP net income (loss) is defined as net loss before the impacts of amortization of intangibles, provision for income taxes, stock-based compensation, and one time items. Non-GAAP net income (loss) per share is defined as non-GAAP net income (loss) on a per share basis. See "Reconciliation of GAAP to Non-GAAP Financial Measures" for a discussion of the applicable weighted-average shares outstanding. We believe these non-GAAP financial measures provide investors and other users of our financial information consistency and comparability with our past financial performance and facilitate period-to-period comparisons of our results of operations. With respect to adjusted EBITDA and non-GAAP net loss/ income, we believe these non-GAAP financial measures are useful in evaluating our profitability relative to the amount of revenue generated, excluding the impact of stock-based compensation expense and other one-time expenses. We also believe non-GAAP financial measures are useful in evaluating our operating performance compared to that of other companies in our industry, as these metrics eliminate the effects of stock-based compensation, which may vary for reasons unrelated to overall operating performance. We use these non-GAAP financial measures in conjunction with traditional GAAP measures as part of our overall assesSMBnt of our performance, including the preparation of our annual operating budget and quarterly forecasts, and to evaluate the effectiveness of our business strategies. Our definition may differ from the definitions used by other companies and therefore comparability may be limited. In addition, other companies may not publish this or similar metrics. Thus, our non-GAAP financial measures should be considered in addition to, not as a substitute for, nor superior to or in isolation from, measures prepared in accordance with GAAP. These non-GAAP financial measures may be limited in their usefulness because they do not present the full economic effect of our use of stock-based compensation. We compensate for these limitations by providing investors and other users of our financial information a reconciliation of the non-GAAP financial measure to the most closely related GAAP financial measures. However, we have not reconciled the non-GAAP guidance measures disclosed under "Financial Outlook" to their corresponding GAAP measures because certain reconciling items such as stock-based compensation and the corresponding provision for income taxes depend on factors such as the stock price at the time of award of future grants and thus cannot be reasonably predicted. Accordingly, reconciliations to the non-GAAP guidance measures is not available without unreasonable effort. We encourage investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view non-GAAP net loss/ income and non-GAAP net loss/ income per share in conjunction with net loss and net loss per share.

© 2023 All Rights Reserved | 38 Reconciliation of GAAP to Non-GAAP Financial Measures