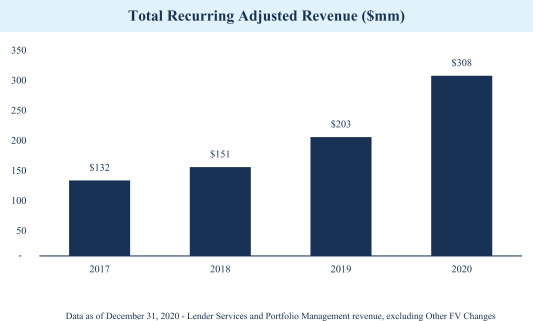

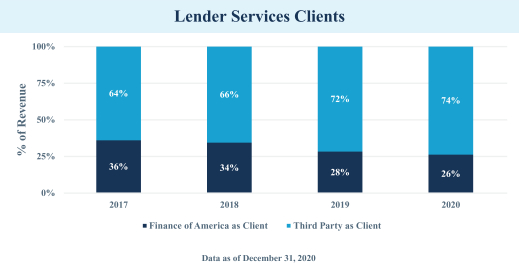

There is no guarantee that demand for the services offered by our Lender Services business will grow.

There is no guarantee that demand for the services offered by our Lender Services business will grow. The historical growth rate of our Lender Services business may not be an indication of future growth rates for such business generally. Although our lending businesses originate a large volume of loans, we may be unable to capture the related lending services business for these loans. For example, we may not be able to offer our title services for some of our originated loans because we may not be licensed as required in the state where the property is located. Additionally, borrowers are able to select their title company and may choose a third-party provider over us. We also face competition for our Lender Services business from third parties. If we cannot expand our services to meet the demands of this market, our revenue may decline, we may fail to grow our Lender Services business, and we may incur operating losses as a result.

Legal and Regulatory Risks

We operate in heavily regulated industries, and our mortgage loan origination and servicing activities (including lender services) expose us to risks of noncompliance with an increasing and inconsistent body of complex laws and regulations at the U.S. federal, state and local levels.

Due to the heavily regulated nature of the financial services industry, we are required to comply with a wide array of U.S. federal, state and local laws and regulations that regulate, among other things, the manner in which we conduct our loan origination, servicing and ancillary businesses and the fees that we may charge, and the collection, use, retention, protection, disclosure, transfer and other processing of personal information. Governmental authorities and various U.S. federal and state agencies have broad oversight and supervisory and enforcement authority over our businesses. From time to time, we may also receive requests (including requests in the form of subpoenas and civil investigative demands) from federal, state and local agencies for records, documents and information relating to our servicing and lending activities. The GSEs (and their conservator, the FHFA), Ginnie Mae, the United States Treasury Department, various investors, non-Agency securitization trustees and others also subject us to periodic reviews and audits. These laws, regulations and oversight can significantly affect the way that we do business, can restrict the scope of our existing businesses, limit our ability to expand our product offerings or to pursue acquisitions, or can make our costs to service or originate loans higher, which could impact our financial results. Failure to comply with applicable laws and regulatory requirements may result in, among other things, revocation of or inability to renew required licenses or registrations, loss of approval status, termination of contracts without compensation, administrative enforcement actions and fines, private lawsuits, including those styled as class actions, cease and desist orders and civil and criminal liability.

We must comply with a large number of federal, state and local consumer protection laws including, among others, the Mortgage Advertising Practices Rules and the Truth in Lending Act, as amended, together with its implementing regulations (Regulation Z) (“TILA”), the Fair Debt Collection Practices Act (“FDCPA”), the Real Estate Settlement Procedures Act, as amended, together with its implementing regulations (Regulation X) (“RESPA”), the Equal Credit Opportunity Act, as amended, together with its implementing regulations (Regulation B) (“ECOA”), the Fair Credit Reporting Act, as amended, and its implementing regulations (Regulation V) (“FCRA”), the Fair Housing Act, the Telephone Consumer Protection Act, as amended (“TCPA”), the Gramm-Leach-Bliley Act, together with its implementing regulations (Regulation P) (“GLBA”), the Electronic Funds Transfer Act, as amended, and its implementing regulations (Regulation E) (“EFTA”), the Servicemembers’ Civil Relief Act, as amended (“SCRA”), the Homeowners Protection Act, as amended (“HPA”), the Home Mortgage Disclosure Act, together with its implementing regulations (Regulation C) (“HMDA”), the S.A.F.E. Mortgage Licensing Act, as amended (the “SAFE Act”), the Federal Trade Commission Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act, as amended, together with its implementing regulations (the “Dodd-Frank Act”), U.S. federal and state laws prohibiting unfair, deceptive, or abusive acts or practices and state foreclosure laws. Antidiscrimination statutes, such as the Fair Housing Act and ECOA, prohibit creditors from discriminating against loan applicants and borrowers based on certain characteristics, such as race, religion and national origin. Various federal regulatory agencies and departments,

30