Investor Presentation Third Quarter 2021

Forward-Looking Statements 2 This information contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to our financial condition, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting Carter Bankshares, Inc. and its future business and operations. Forward looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “ believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “believe,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. Although we believe the assumptions upon which these forward- looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to: changes in accounting policies, practices, or guidance, for example, our adoption of CECL; credit losses; cyber-security concerns; rapid technological developments and changes; the Company’s liquidity and capital positions; the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts or public health events (such as the current COVID-19 pandemic), and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of the Company's borrowers to satisfy their obligations to the Bank, on the value of collateral securing loans, on the demand for the Bank's loans or its other products and services, on incidents of cyberattack and fraud, on the Company’s liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of the Company's business operations and on financial markets and economic growth; sensitivity to the interest rate environment including a prolonged period of low interest rates, a rapid increase in interest rates or a change in the shape of the yield curve; a change in spreads on interest-earning assets and interest-bearing liabilities; regulatory supervision and oversight; legislation affecting the financial services industry as a whole, and Carter Bankshares, Inc., in particular; the outcome of pending and future litigation to which the Company is party and the potential impacts thereon, and governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult, disruptive or more costly than anticipated; containing costs and expenses; reliance on significant customer relationships; general economic or business conditions; deterioration of the housing market and reduced demand for mortgages; re-emergence of turbulence in significant portions of the global financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to support our future businesses. Many of these factors, as well as other factors, are described in our filings with the Securities and Exchange Commission. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

Non-GAAP Statements 3 Statements in this exhibit include non-GAAP financial measures and should be read along with the accompanying tables in our definitions and reconciliations of GAAP to non-GAAP financial measures. Management uses, and this exhibit references, net interest income and net interest margin, each on a fully taxable equivalent, or FTE, basis, which are non-GAAP financial measures. Management believes net interest income and net interest margin on an FTE basis provide information useful to investors in understanding our underlying business, operational performance and performance trends as they facilitate comparisons with the performance of other companies in the financial services industry. Although management believes that these non-GAAP financial measures enhance investors’ understanding of our business and performance, these non-GAAP financial measures should not be considered alternatives to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with non-GAAP measures which may be presented by other companies.

4 TABLE OF CONTENTS Section Title Slides 1 Overview 05-12 2 Financial Highlights 13-21 3 Balance Sheet Transformation 22-26 4 Asset Quality 27-34 5 Deposit Mix & Cost of Funds 35-39 6 Loan Deferral Update 40-41 7 Commercial Loan Portfolio Metrics 42-45 8 PPP Loan Update 46-47

Overview 01 5

Our Mission At Carter Bank & Trust, we strive to be the preferred lifetime financial partner for our customers and shareholders, and the employer of choice in the communities we are privileged to serve. Our Purpose Enrich lives and enhance communities today, to build a better tomorrow. Our Values Loyalty We serve to build lifetime relationships Care We care, it’s our tradition and what we do best Optimism We work collaboratively, as one team Trustworthiness We act with integrity and speak with respect Innovation We make bold decisions to continuously improve

Bank established denovo in 1974 as First National Bank of Rocky Mount, VA Carter Bank & Trust charter established in 2006 with the merger of ten banks Carter Bancshares, Inc. holding company established in 2020 with the assets of Carter Bank & Trust Our Company History 7 As of September 30, 2021 Headquartered in Martinsville, VA 69 Branches 7 Commercial Centers 3 Corporate Offices in VA and NC Assets $4.1B Loans $2.9B Deposits $3.7B Focused on the Future, a Well-Capitalized Franchise with Momentum New Branches / Markets • Greensboro, NC: Westridge Branch opened May 2021 • Charlottesville, VA: Mill Creek Branch opened Q4 2020 • Build-out underway for a new flagship location at East Morehead, Charlotte. Commercial offices open January 2022 - the Branch opening to follow in late Q1 2022.

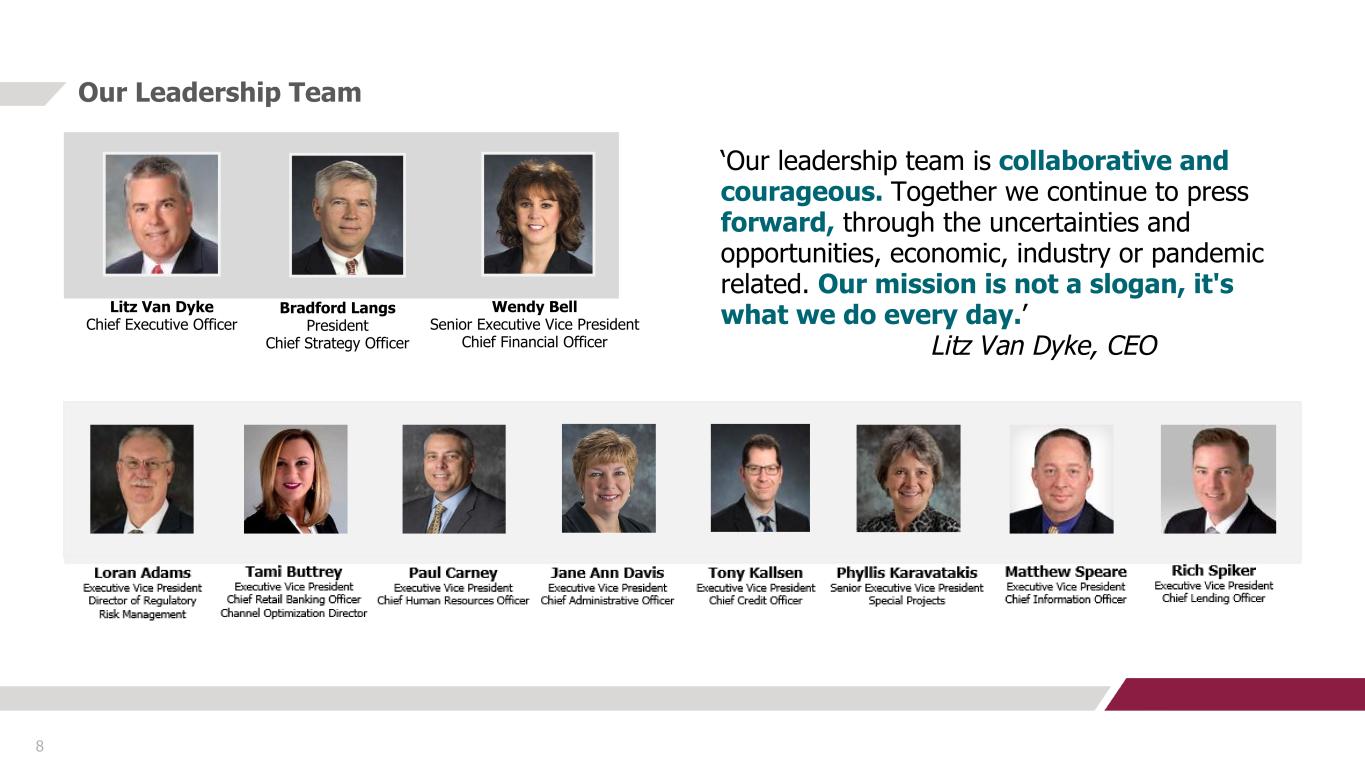

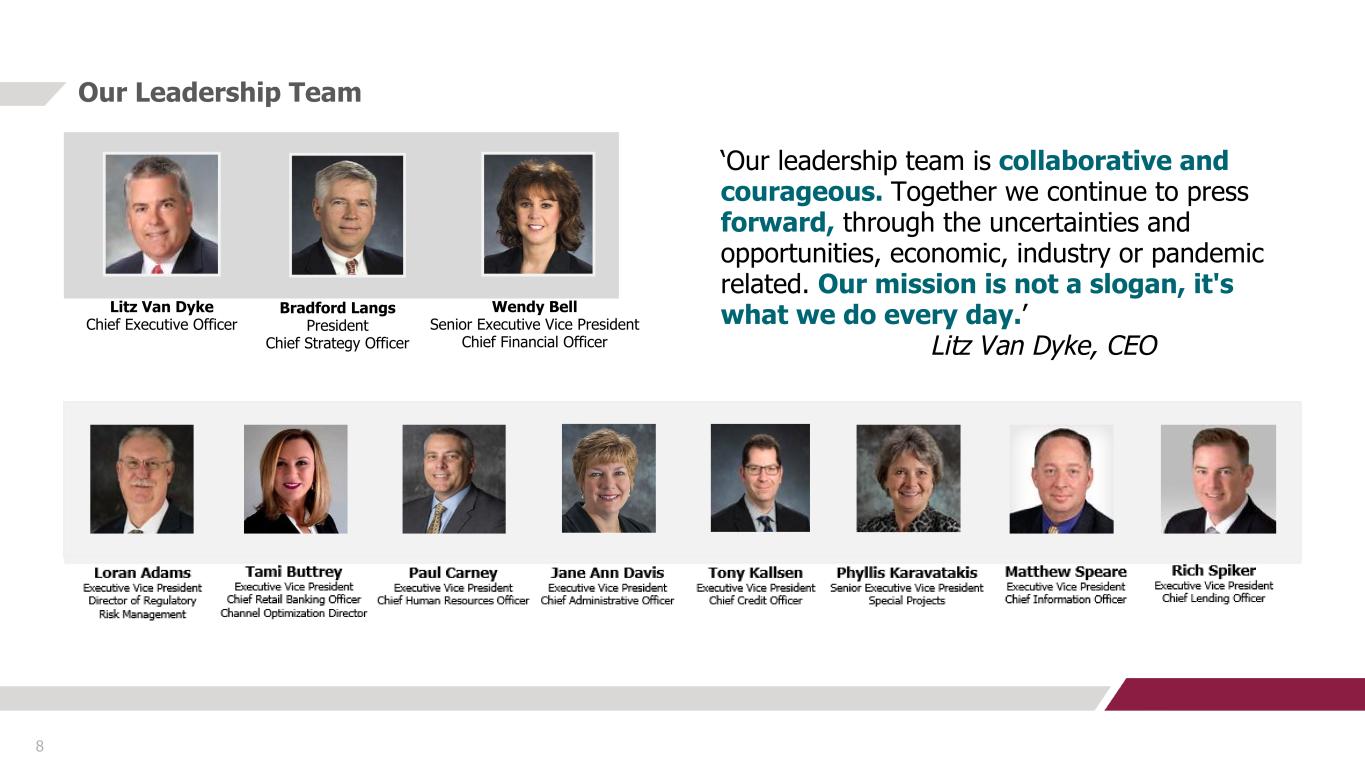

8 Our Leadership Team Litz Van Dyke Chief Executive Officer Wendy Bell Senior Executive Vice President Chief Financial Officer Bradford Langs President Chief Strategy Officer ‘Our leadership team is collaborative and courageous. Together we continue to press forward, through the uncertainties and opportunities, economic, industry or pandemic related. Our mission is not a slogan, it's what we do every day.’ Litz Van Dyke, CEO

North Carolina | Total Deposits: $0.4MM 1 5 2 1 4 13 Charlotte Greensboro Raleigh Durham Fayetteville Non MSA TOTAL The following counties are also included in our CRA Assessment area: Randolph, NC: Greensboro MSA Niagra, NY: Varsity Bank Our Footprint YE 2020 92 Branches YE 2019 101 Branches YE 2018 105 Branches September 2021 69 Branches Branches in VA and NC Metropolitan Statistical Areas September 30, 2021 "We are transforming facilities, talent and delivery in our legacy and strategic growth markets. Shrinking the branch banking footprint, as we grow our digital footprint, is how we will succeed." Wendy Bell, CFO Virginia | Total Deposits: $3.3MM 6 13 7 3 5 22 56 Washington DC Roanoke Lynchburg Charlottesville Blacksburg-Christiansburg Non MSA TOTAL 9

10 August 2021: Through FHLB membership, funded a $500,000 Affordable Housing Program (AHP) gap loan for Britton Village, a multifamily affordable housing project in North Carolina. Carter Bank & Trust is committed to the consideration and integration of environmental, social and governance factors alongside financial factors in lending and investment decision-making process. ESG is aligned with the Bank’s mission and values with initiatives integrated into: Strategic Planning; Policies and Procedures; Team Operations; and more September 2021: Extended a Line of Credit to George Washington Regional Commission. This organization covers a 5 city/ county region in Virginia addressing homelessness, revitalization, transportation needs, and other economic development initiatives. Environmental, Social, Governance ESG & DEI Advisory Working Groups Convened $140,000 paid in Donations/ Sponsorships for YTD 2021 1,020 Hours of Volunteer Service for YTD 2021 Diversity, Equity & Inclusion

Our Culture of Care 11 CARE Forward Q3 2021 focus: Financial Literacy and supporting local Boys & Girls Clubs $31,370 Contribution to 23 charities and the American Red Cross Q3 2021 Carter Bank & Trust is the Preferred Community Bank of Virginia Tech Athletics – Welcome HOKIE Nation! For the communities we serve For the communities we serve CARE Forward Q3 2021 topics focused on strengthening your body and mind with tips and techniques everyone can incorporate into their daily lives including: • Virtual exercise and workout training demonstrations • Healthy eating alternatives using herbs and plant based foods • Log-off Day: Replace time spent on Social Media and focus on L&B (Live & Breath) time with family and friends COVID Response – Carter Cares Task Force Update • Approved continuation of BAPL Program (Bank Approved Paid Leave) providing employees full pay and benefits to remain out of office when they or someone in their household has symptoms or tests positive • Conducted an all employee confidential survey to assess vaccination stats, gather feedback and understand individual sentiment

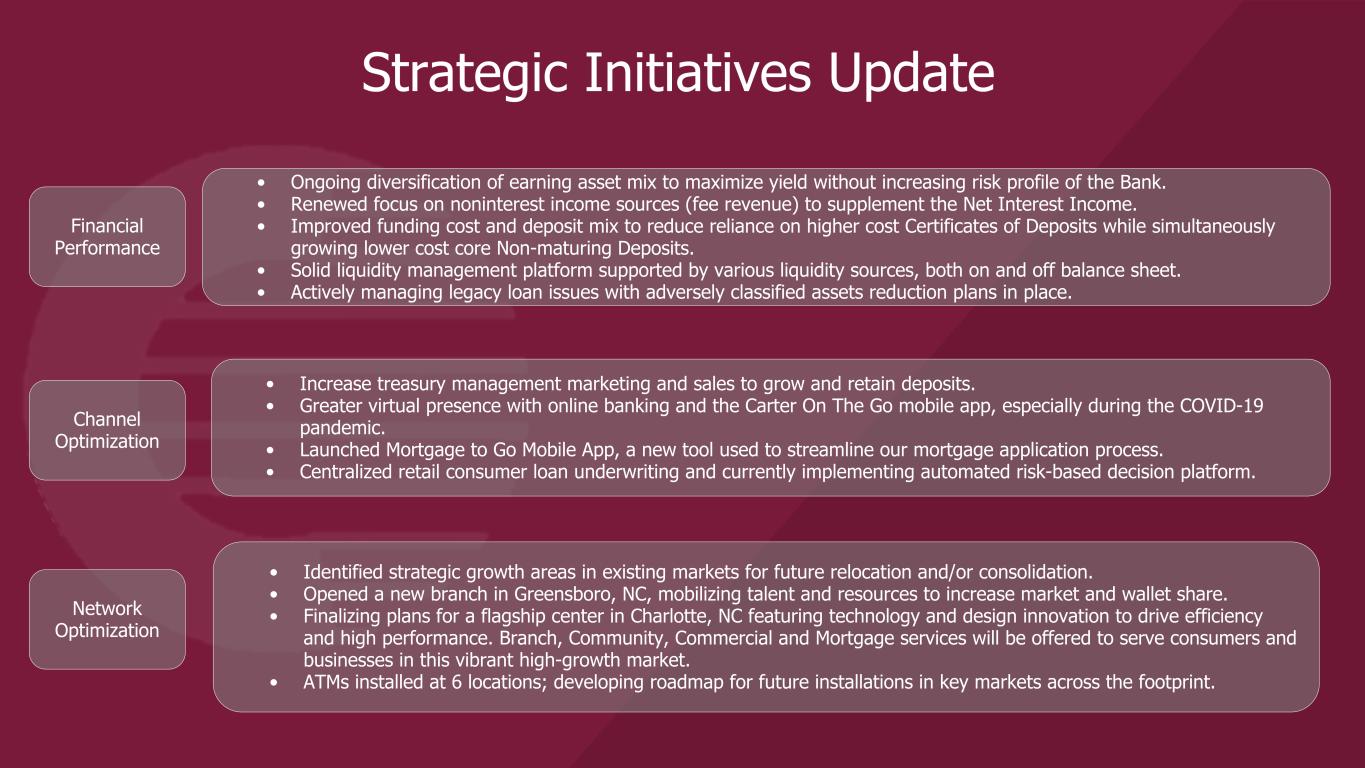

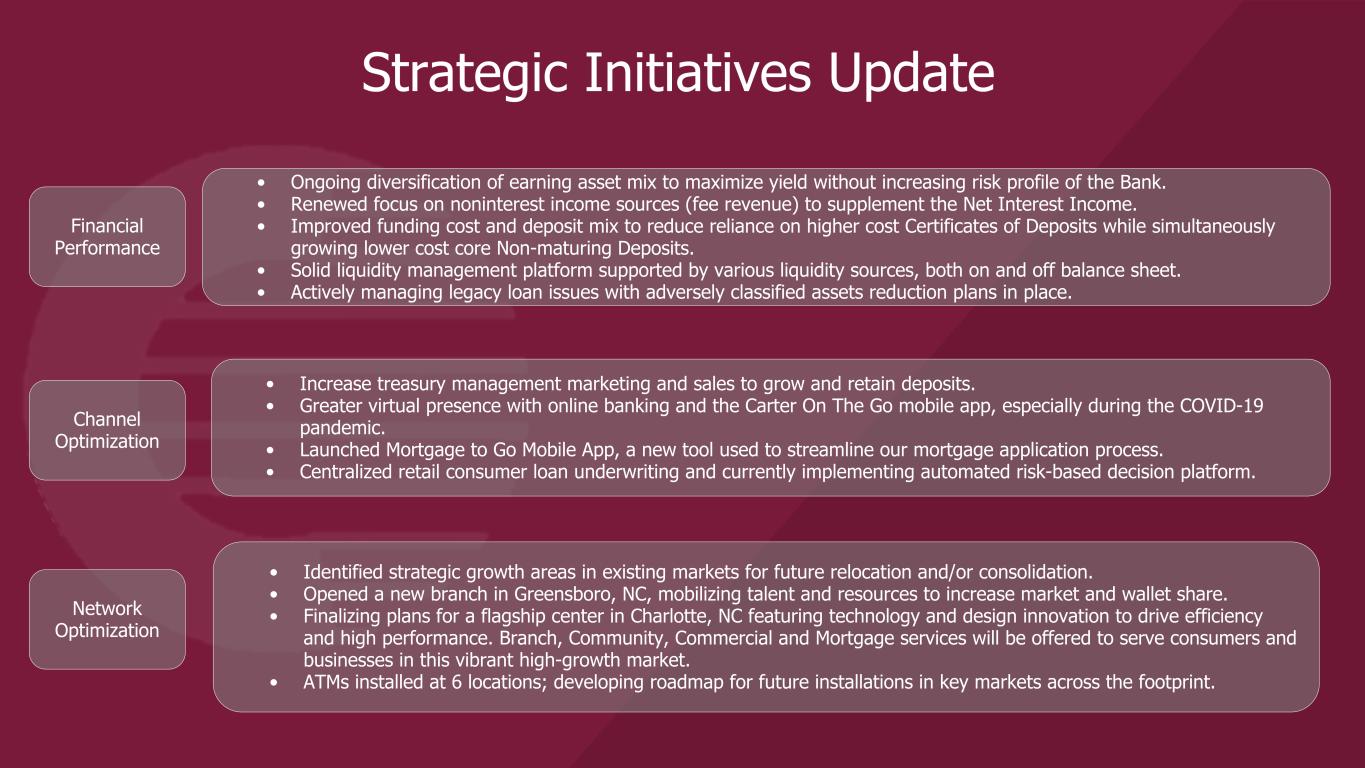

Strategic Initiatives Update • Ongoing diversification of earning asset mix to maximize yield without increasing risk profile of the Bank. • Renewed focus on noninterest income sources (fee revenue) to supplement the Net Interest Income. • Improved funding cost and deposit mix to reduce reliance on higher cost Certificates of Deposits while simultaneously growing lower cost core Non-maturing Deposits. • Solid liquidity management platform supported by various liquidity sources, both on and off balance sheet. • Actively managing legacy loan issues with adversely classified assets reduction plans in place. • Increase treasury management marketing and sales to grow and retain deposits. • Greater virtual presence with online banking and the Carter On The Go mobile app, especially during the COVID-19 pandemic. • Launched Mortgage to Go Mobile App, a new tool used to streamline our mortgage application process. • Centralized retail consumer loan underwriting and currently implementing automated risk-based decision platform. • Identified strategic growth areas in existing markets for future relocation and/or consolidation. • Opened a new branch in Greensboro, NC, mobilizing talent and resources to increase market and wallet share. • Finalizing plans for a flagship center in Charlotte, NC featuring technology and design innovation to drive efficiency and high performance. Branch, Community, Commercial and Mortgage services will be offered to serve consumers and businesses in this vibrant high-growth market. • ATMs installed at 6 locations; developing roadmap for future installations in key markets across the footprint. Financial Performance Channel Optimization Network Optimization

Financial Highlights 02 13 Insert CB&T photo here

3Q2021 2Q2021 3Q2020 Operational Results Net Interest Income $ 29,401 $ 27,203 $ 25,436 Provision for Credit Losses (413) 967 2,914 Provision for Unfunded Commitments (60) (603) — Noninterest income 6,915 7,238 7,975 Noninterest expense 24,685 27,759 87,300 Income tax expense 931 886 875 Net Income (Loss) $ 11,173 $ 5,432 $ (57,678) Balance Sheet Condition Assets $ 4,134,063 $ 4,120,513 $ 4,134,125 Portfolio loans, net 2,784,863 2,807,335 2,935,956 Securities 897,546 843,538 777,986 Deposits 3,666,473 3,659,341 3,613,795 Shareholders' equity 405,870 399,108 434,807 Balance Sheet and Income Statement 14 Favorable Net Interest Income increased $2.2M QoQ and $4.0M YoY due primarily to the collection of significant late fees, enhanced pricing on restructured loans in 3Q21 and the ongoing reduction in funding costs. Favorable Provision for credit losses declined $1.4M QoQ and $3.3M YoY driven by the sale of nine loans within two performing relationships in 3Q21 and the resolution of our two largest nonperforming credits in 2Q21. Favorable Noninterest Expense decreased $3.1M QoQ and $62.6M YoY driven by a $3.0M one-time write-down for bank branches closed in 2Q21 and transferred to OREO. As well as, $62.2M goodwill impairment charge in 3Q20. $ in thousands

3Q2021 2Q2021 3Q2020 Shareholder Ratios Diluted Earnings Per Share (QTD) $ 0.42 $ 0.21 $ (2.19) Diluted Earnings Per Share (YTD) $ 0.98 $ 0.56 $ (1.85) Financial Ratios Return on Assets (YTD) 0.84 % 0.72 % (1.59) % Return on Equity (YTD) 8.76 % 7.62 % (13.43) % Total Capital Ratio 15.11 % 14.66 % 14.33 % Tier I Capital 13.85 % 13.40 % 13.08 % Leverage Ratio 10.48 % 10.23 % 10.12 % Core Efficiency (QTD) 70.66 % 75.24 % 75.53 % Net Interest Margin (FTE)(QTD) 2.96 % 2.79 % 2.67 % Financial / Shareholder Ratios 15 Financial metrics have improved QoQ and YoY. The QoQ metrics were impacted by the $3.0 million write-down on closed bank branches in 2Q21 and YoY impacted by the $62.2 million goodwill impairment charge in 3Q20. The Company enhanced pricing on restructured loans in 3Q21 and continues to recognize a strategic shift in the deposit mix to lower cost funding due to an increase in non-maturing deposits. As a result, the Net Interest Margin (FTE) has shown improvement over the prior quarter.

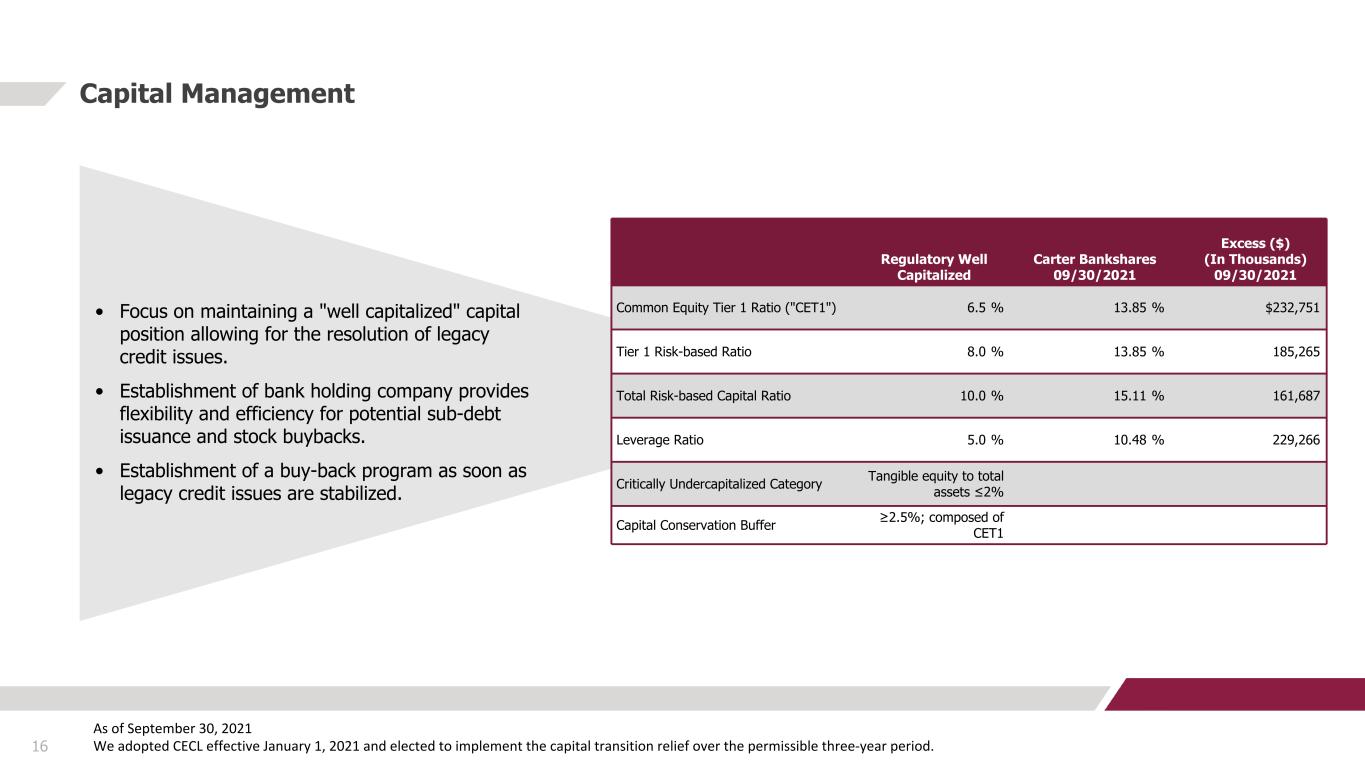

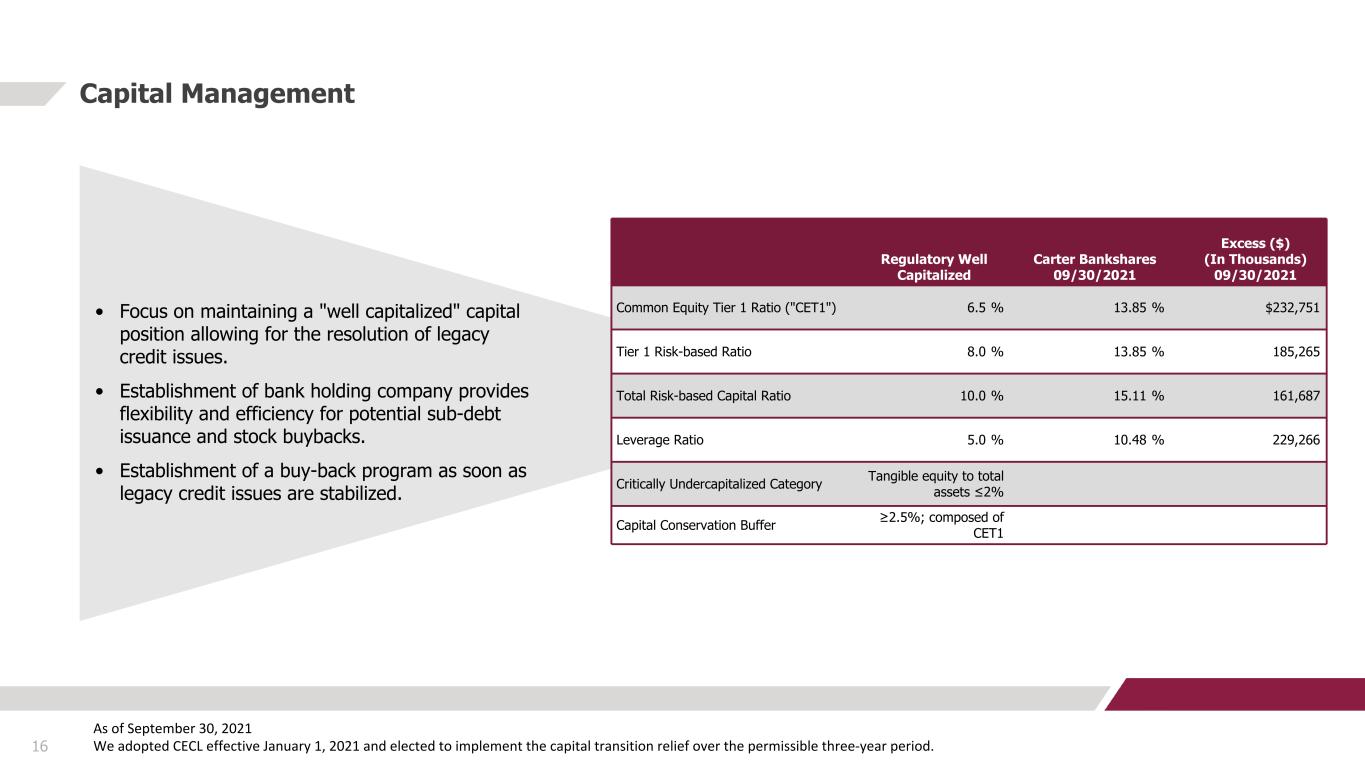

Capital Management 16 As of September 30, 2021 We adopted CECL effective January 1, 2021 and elected to implement the capital transition relief over the permissible three-year period. • Focus on maintaining a "well capitalized" capital position allowing for the resolution of legacy credit issues. • Establishment of bank holding company provides flexibility and efficiency for potential sub-debt issuance and stock buybacks. • Establishment of a buy-back program as soon as legacy credit issues are stabilized. Regulatory Well Capitalized Carter Bankshares 09/30/2021 Excess ($) (In Thousands) 09/30/2021 Common Equity Tier 1 Ratio ("CET1") 6.5 % 13.85 % $232,751 Tier 1 Risk-based Ratio 8.0 % 13.85 % 185,265 Total Risk-based Capital Ratio 10.0 % 15.11 % 161,687 Leverage Ratio 5.0 % 10.48 % 229,266 Critically Undercapitalized Category Tangible equity to total assets ≤2% Capital Conservation Buffer ≥2.5%; composed of CET1

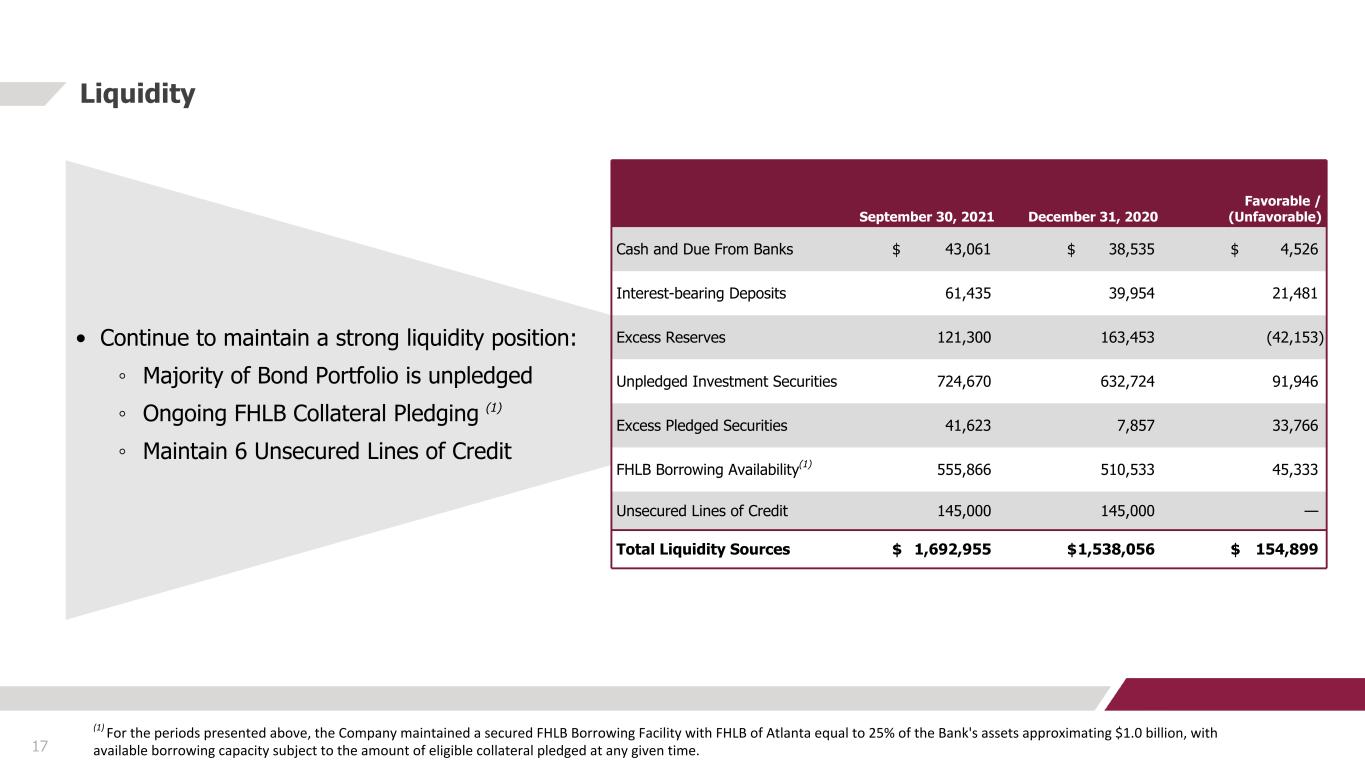

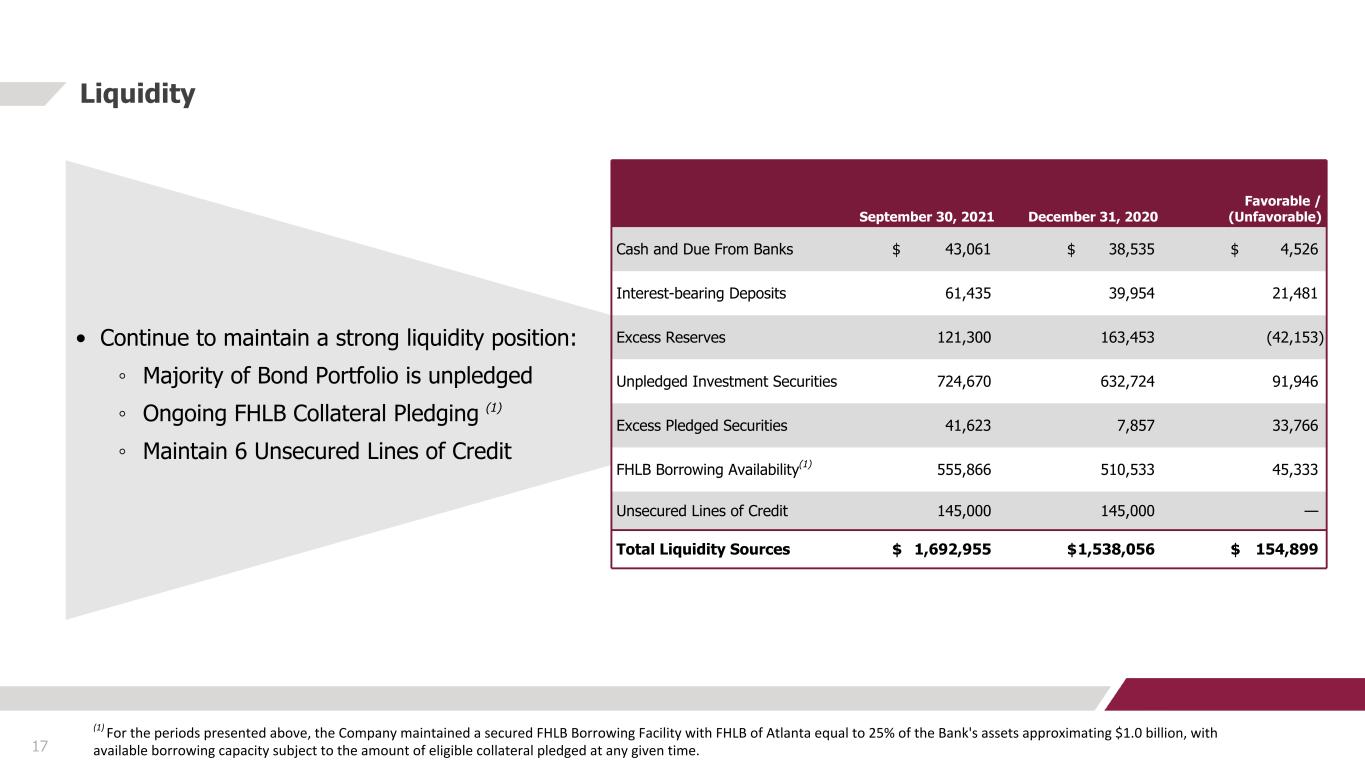

Liquidity 17 (1) For the periods presented above, the Company maintained a secured FHLB Borrowing Facility with FHLB of Atlanta equal to 25% of the Bank's assets approximating $1.0 billion, with available borrowing capacity subject to the amount of eligible collateral pledged at any given time. • Continue to maintain a strong liquidity position: ◦ Majority of Bond Portfolio is unpledged ◦ Ongoing FHLB Collateral Pledging (1) ◦ Maintain 6 Unsecured Lines of Credit September 30, 2021 December 31, 2020 Favorable / (Unfavorable) Cash and Due From Banks $ 43,061 $ 38,535 $ 4,526 Interest-bearing Deposits 61,435 39,954 21,481 Excess Reserves 121,300 163,453 (42,153) Unpledged Investment Securities 724,670 632,724 91,946 Excess Pledged Securities 41,623 7,857 33,766 FHLB Borrowing Availability(1) 555,866 510,533 45,333 Unsecured Lines of Credit 145,000 145,000 — Total Liquidity Sources $ 1,692,955 $ 1,538,056 $ 154,899

Deposit Composition 18 $ in thousands Improving Deposit Mix Reliance on Certificates of Deposit continues to decline with a net decrease of $359.7M (20.4%) from Q3 2020 to Q3 2021 while all Non-maturing Deposit categories showed an increase in ending balances for the same period. For the Period Ending Variance 09/30/21 06/30/21 09/30/20 Quarter Year Lifetime Free Checking $ 722,145 $ 720,231 $ 665,813 $ 1,914 $ 56,332 Interest-Bearing Demand 433,144 414,677 351,066 18,467 82,078 Money Market 432,167 405,962 211,465 26,205 220,702 Savings 676,035 661,303 622,806 14,732 53,229 Certificates of Deposits 1,402,982 1,457,168 1,762,645 (54,186) (359,663) Deposits Held-for-Assumption in Connection with Sale of Bank Branches — — — — — Total Deposits $ 3,666,473 $ 3,659,341 $ 3,613,795 $ 7,132 $ 52,678 Total Deposits Composition $3,670 $3,591 $3,504 $3,685 $3,666 3,140 3,066 2,949 2,976 2,944 530 525 555 709 722 Interest-bearing Deposits Noninterest-bearing Deposits YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 DDA - Int.- Bearing 12% CDs 38% DDA - Int. Free 20% Savings 18% Money Market 12% (1) Period end balances. (1)

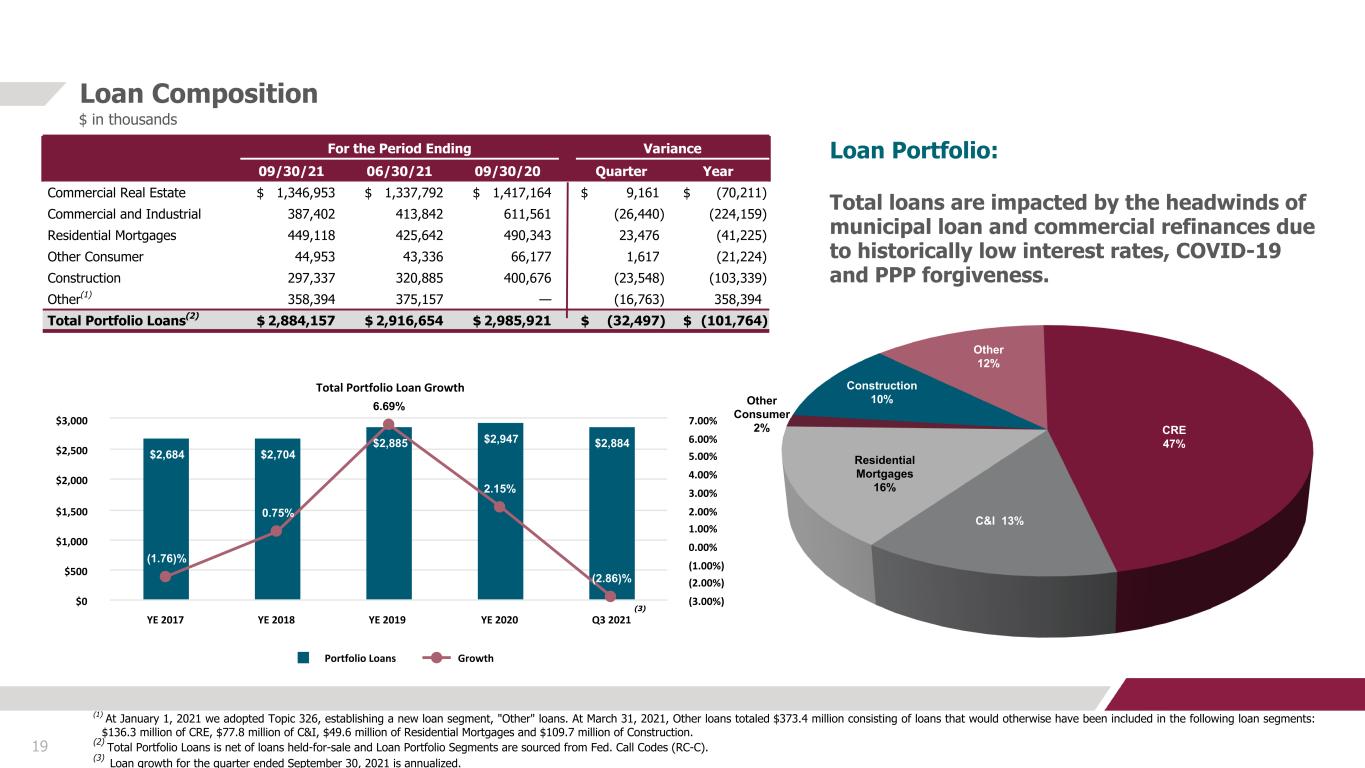

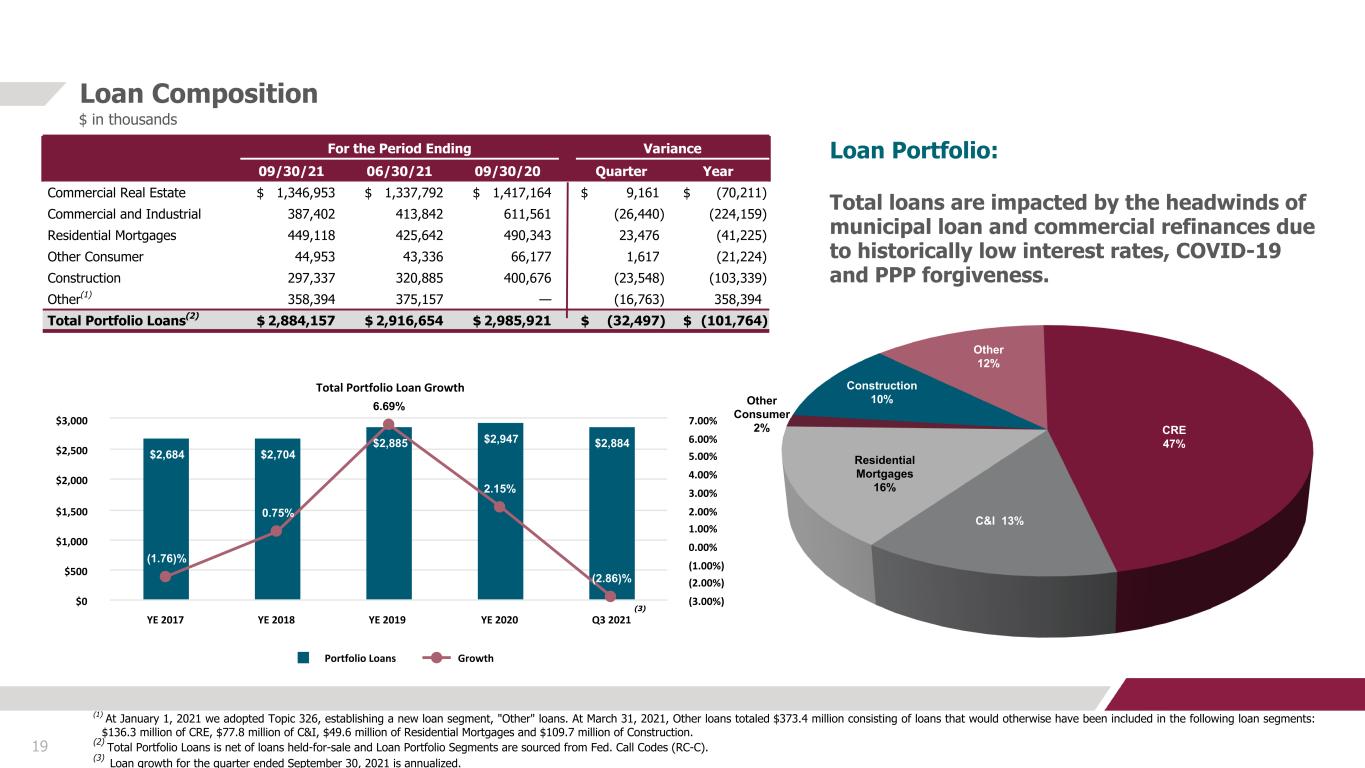

Total Portfolio Loan Growth $2,684 $2,704 $2,885 $2,947 $2,884 (1.76)% 0.75% 6.69% 2.15% (2.86)% Portfolio Loans Growth YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 (3.00%) (2.00%) (1.00%) 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% Loan Composition 19 $ in thousands Loan Portfolio: Total loans are impacted by the headwinds of municipal loan and commercial refinances due to historically low interest rates, COVID-19 and PPP forgiveness. For the Period Ending Variance 09/30/21 06/30/21 09/30/20 Quarter Year Commercial Real Estate $ 1,346,953 $ 1,337,792 $ 1,417,164 $ 9,161 $ (70,211) Commercial and Industrial 387,402 413,842 611,561 (26,440) (224,159) Residential Mortgages 449,118 425,642 490,343 23,476 (41,225) Other Consumer 44,953 43,336 66,177 1,617 (21,224) Construction 297,337 320,885 400,676 (23,548) (103,339) Other(1) 358,394 375,157 — (16,763) 358,394 Total Portfolio Loans(2) $ 2,884,157 $ 2,916,654 $ 2,985,921 $ (32,497) $ (101,764) Other Consumer 2% CRE 47% C&I 13% Construction 10% Residential Mortgages 16% (1) At January 1, 2021 we adopted Topic 326, establishing a new loan segment, "Other" loans. At March 31, 2021, Other loans totaled $373.4 million consisting of loans that would otherwise have been included in the following loan segments: $136.3 million of CRE, $77.8 million of C&I, $49.6 million of Residential Mortgages and $109.7 million of Construction. (2) Total Portfolio Loans is net of loans held-for-sale and Loan Portfolio Segments are sourced from Fed. Call Codes (RC-C). (3) Loan growth for the quarter ended September 30, 2021 is annualized. (3) Other 12%

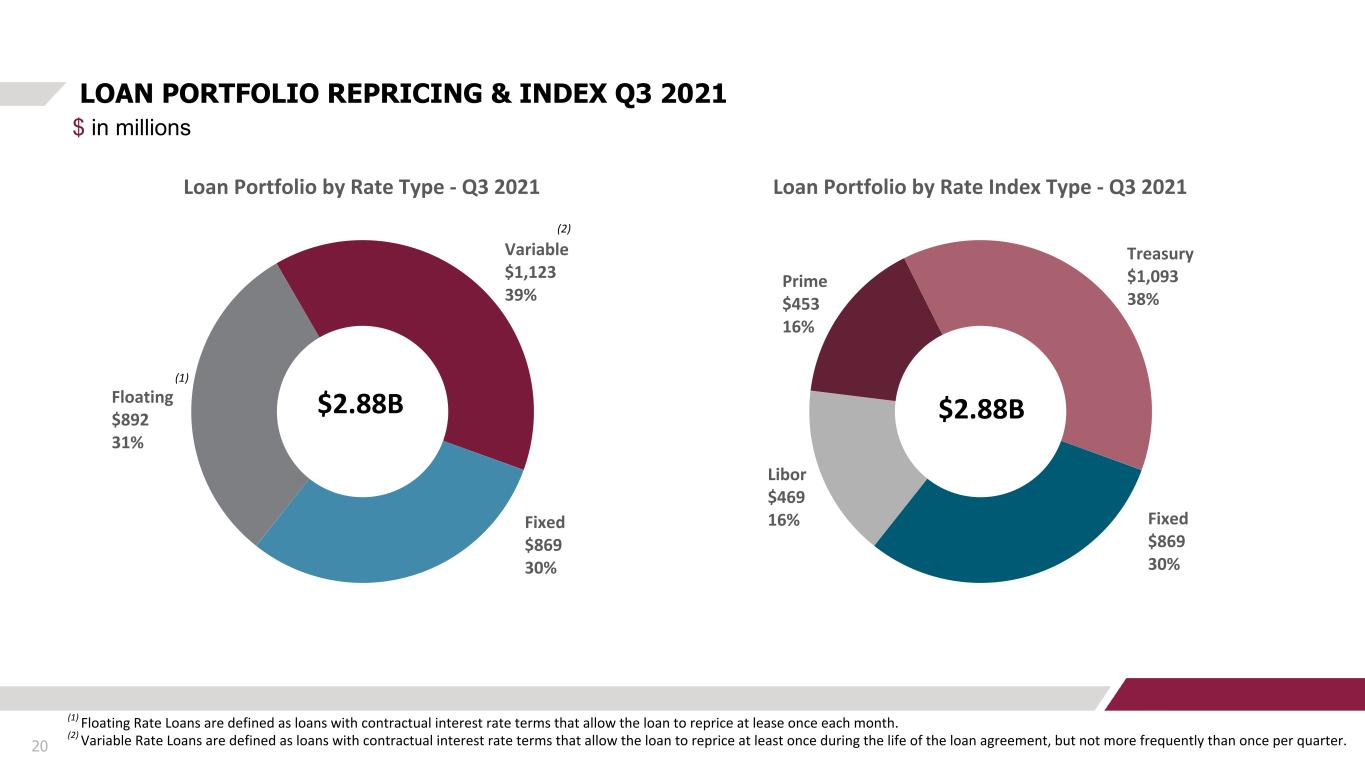

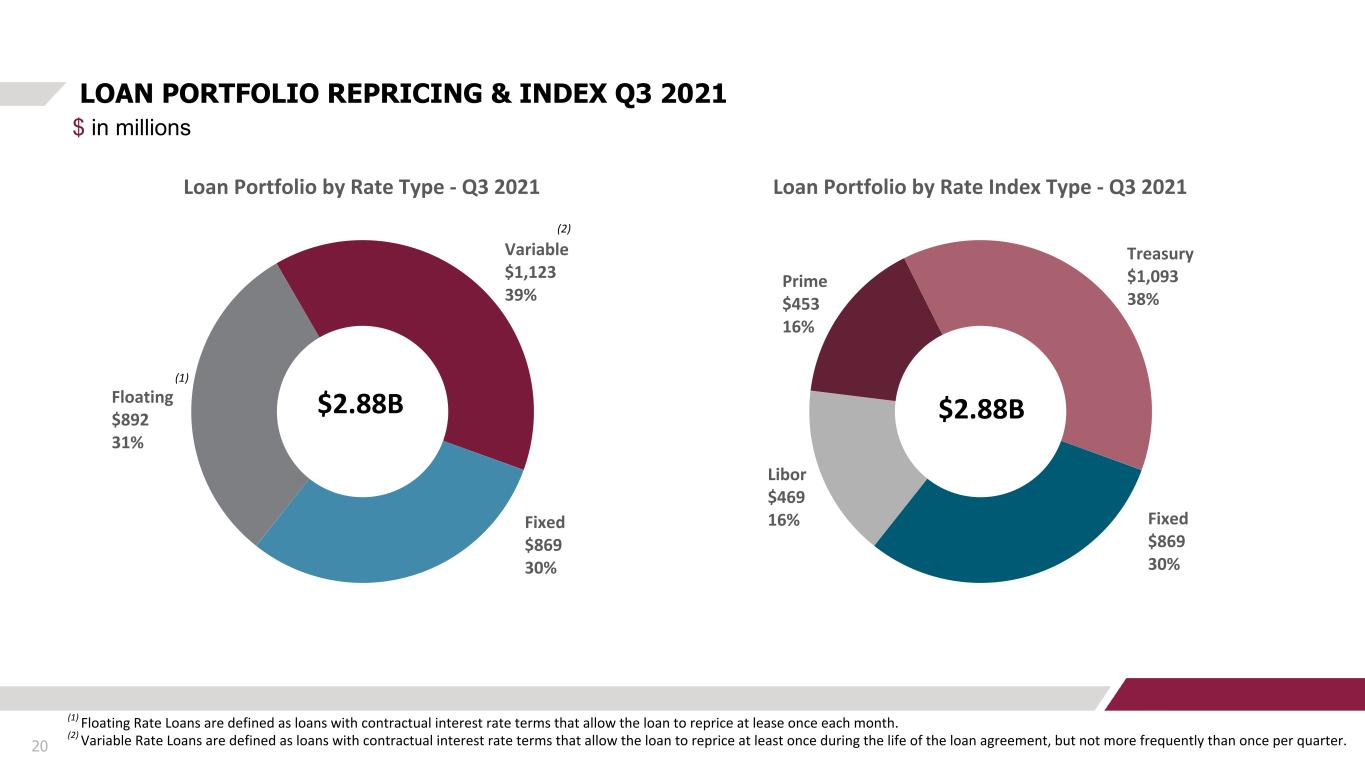

20 LOAN PORTFOLIO REPRICING & INDEX Q3 2021 $ in millions (1) Floating Rate Loans are defined as loans with contractual interest rate terms that allow the loan to reprice at lease once each month. (2) Variable Rate Loans are defined as loans with contractual interest rate terms that allow the loan to reprice at least once during the life of the loan agreement, but not more frequently than once per quarter. Loan Portfolio by Rate Type - Q3 2021 Fixed $869 30% Floating $892 31% Variable $1,123 39% Loan Portfolio by Rate Index Type - Q3 2021 Fixed $869 30% Libor $469 16% Prime $453 16% Treasury $1,093 38% $2.88B $2.88B (1) (2)

21 Top Ten (10) Relationships (Total Commitment) $ in thousands Segment For the Periods Ending Variance 9/30/21 to 12/31/20 09/30/2021 % of Gross Loans 09/30/2021 % of RBC09/30/21 12/31/20 1. Hospitality, agriculture & energy $354,240 $375,990 ($21,750) 12.26 % 74.07 % 2. Hospitality 63,855 61,691 2,164 2.21 % 13.35 % 3. Retail real estate & food services 56,258 55,373 885 1.95 % 11.76 % 4. Industrial & retail real estate 47,425 41,439 5,986 1.64 % 9.92 % 5. Multifamily, lumber & retail 44,008 35,322 8,686 1.52 % 9.20 % 6. Hospitality 37,584 37,435 149 1.30 % 7.86 % 7. Multifamily development 36,720 40,874 (4,154) 1.27 % 7.68 % 8. Retail real estate 36,619 35,388 1,231 1.27 % 7.66 % 9. Multifamily & student housing 35,749 38,787 (3,038) 1.24 % 7.47 % 10. Hospitality 34,591 36,086 (1,495) 1.20 % 7.23 % Top Ten (10) Relationships 747,049 758,385 (11,336) 25.86 % 156.20 % Total Gross Loans 2,889,046 2,982,442 (93,396) % of Total Gross Loans 25.86 % 25.43 % 12.14 % Concentration (25% of RBC) $119,565 $116,300 As of September 30, 2021

22 Balance Sheet Transformation 03

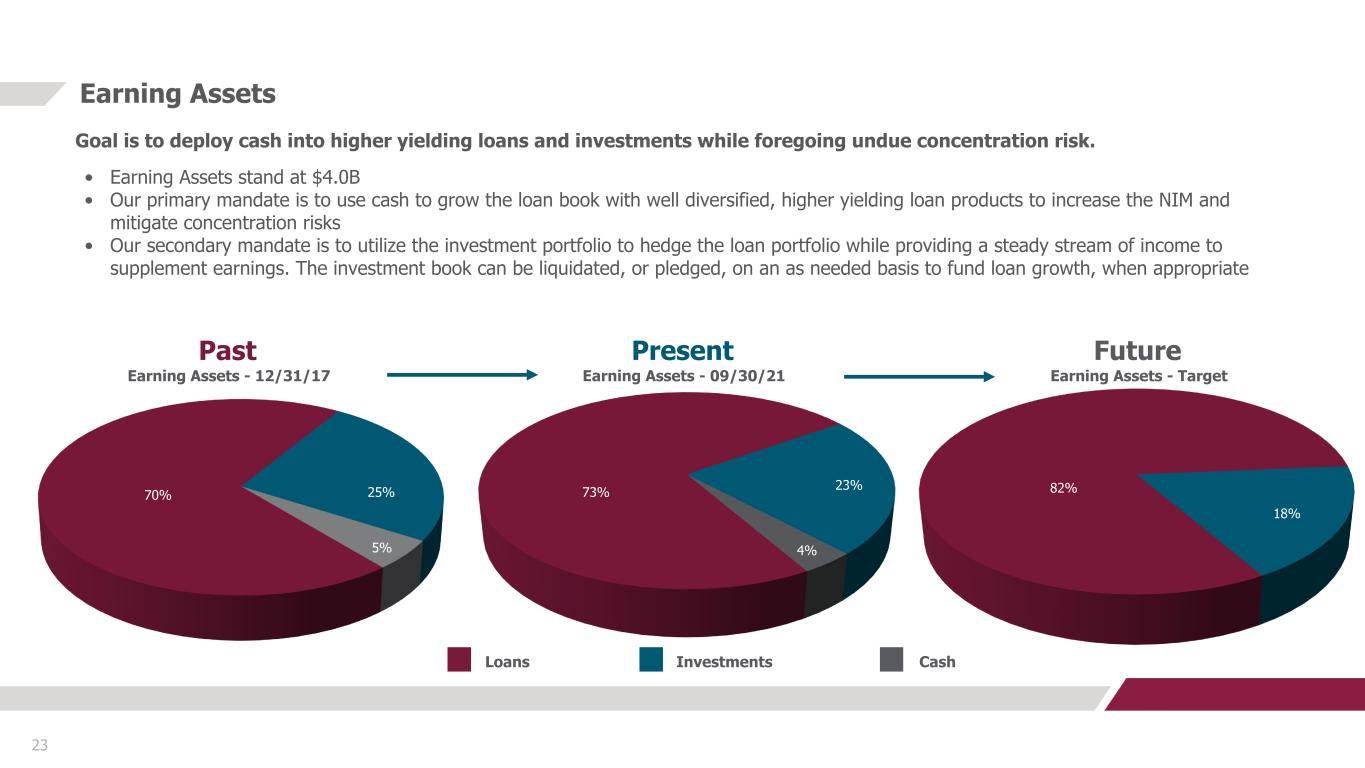

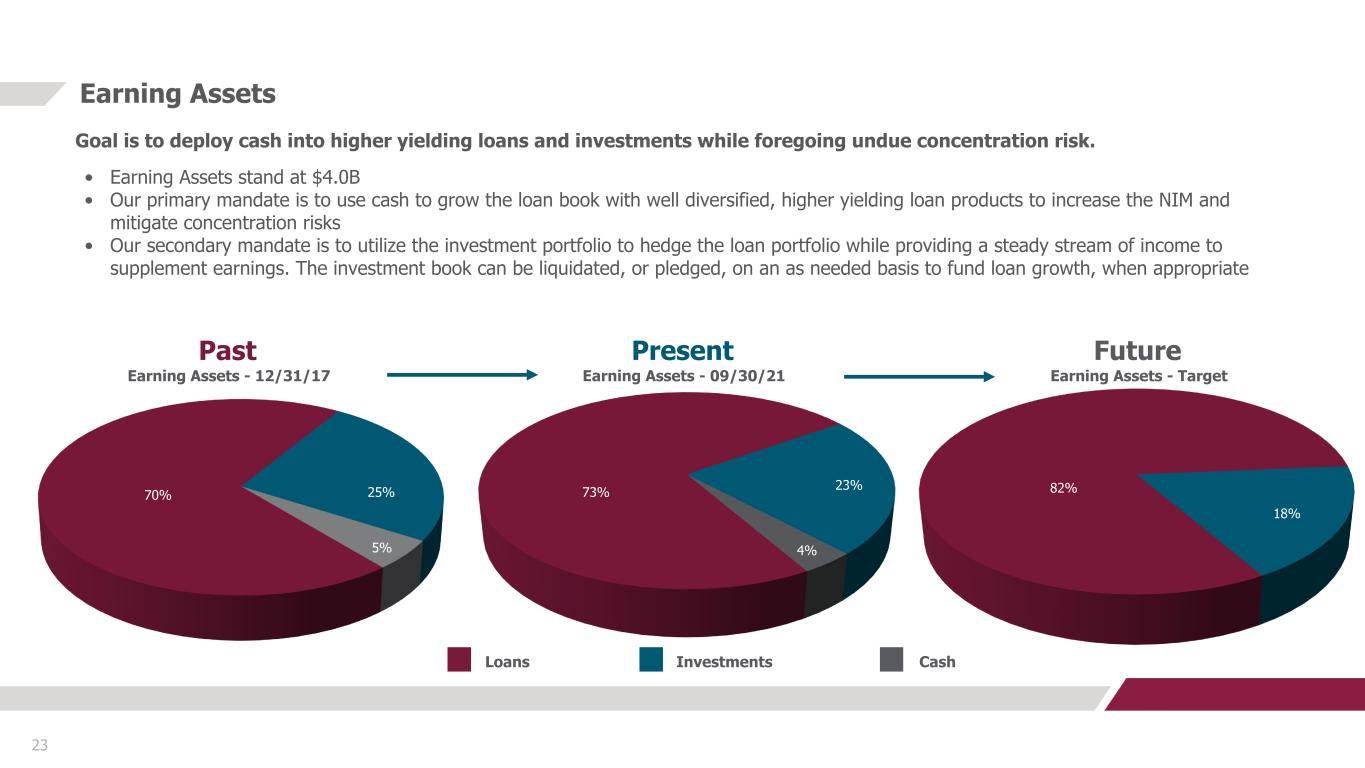

23 Earning Assets Goal is to deploy cash into higher yielding loans and investments while foregoing undue concentration risk. • Earning Assets stand at $4.0B • Our primary mandate is to use cash to grow the loan book with well diversified, higher yielding loan products to increase the NIM and mitigate concentration risks • Our secondary mandate is to utilize the investment portfolio to hedge the loan portfolio while providing a steady stream of income to supplement earnings. The investment book can be liquidated, or pledged, on an as needed basis to fund loan growth, when appropriate Past Present Future Loans Investments Cash 70% 73% 82% 18% 23%25% 5% 4% Earning Assets - 12/31/17 Earning Assets - 09/30/21 Earning Assets - Target

Commercial Real Estate Commercial & Industrial Residential Mortgages Construction Other Consumer Other(1) 24 Loans Past Present Future 57% 47% 45% 20% 16% 5% 3% 2% 7% Loan Portfolio - 12/31/17 Loan Portfolio - 09/30/21 Loan Portfolio - Target 5% 10% 5% 30% 13% 23% Goal is to further diversify and de-risk the loan portfolio by reducing dependency on CRE loans and increasing C&I loans, consumer loans and single-family mortgages. Increased granularity is also a focus. • Portfolio loans currently stand at $2.9B • Our primary mandate is to always provide solutions to our customers in our footprint. CRE loans will continue to be a foundation of the portfolio • We are layering in additional loan products, tapping previously underutilized markets within the footprint and partnering with new borrowers to help with diversification, utilizing excess liquidity and maximizing the NIM 12% (1) In connection with our adoption of Topic 326, we made changes to our loan portfolio segments to align with the methodology applied in determining the allowance under CECL. Our new segmentation breaks out Other loans from our original loan segments: CRE, C&I , residential mortgages and construction.

Muni MBS Corporates Agencies & Treasuries ABS SBA CMBS CMO 25 Bond Portfolio Past Present Future 9% 8% 25% 41% 16% 10% Bond Portfolio - 06/30/17 Bond Portfolio - 09/30/21 Bond Portfolio - Target 10% 34% 26% 28% 15% 5% 30% 12% 25% Goal is to increase diversification, maintain strong credit quality, and improve performance versus peer group. • Portfolio stands at $897.5M, or about 21.7% of total assets, target is 15-25% of total assets • Per the charts, diversification has improved significantly over the past several years • The portfolio is now about 50% floating rate (versus 0% floating rate two years ago) • All bonds are “available-for-sale”, and can be used for liquidity and pledging purposes as needed (1) At September 30, 2021, Asset Backed Securities (ABS) represented approximately 15.4% of the entire Bond Portfolio and were further diversified into the following sub-segments (presented as a percentage of the entire Bond Portfolio): 1) ABS- Student Loans 9.7%, 2) ABS - CLO 5.3%, 3) ABS - Consumer 0.3%, and 4) ABS - SBA 0.1%. 1% 2% 2% (1) 1%

CDs DDA - Int. Free DDA - Int. Bearing Money Markets Savings 26 Deposits Past Present Future 56% 38% 30% 15% 12%3% 10% Deposit Mix - 12/31/17 Deposit Mix - 09/30/21 Deposit Mix - Target 20% 18% 20% 7% 20% 25% 14% 12% Goal is to restructure and diversify funding sources with a focus on lower cost/core relationships (both retail and commercial): • Deposits currently stand at $3.7B • Dependence on CDs has significantly declined, and maturities and pricing are proactively managed on a weekly basis • Multiple strategies are in place to grow all non maturity deposit accounts with a focus on lower cost of funds • New product launches include mobile/online banking, Treasury Management, Instant Open, Card Valet, Click Switch, ATM Network, etc.

Asset Quality 04 27 Insert CB&T photo here

28 Delinquency Trends Past Due Loans / Total Portfolio Loans 0.21% 0.07% 0.09% 0.19% 0.07% 0.01% 0.22% 0.05% 0.03% 0.24% 0.02% 0.00% 0.00% 0.00% 0.00% 0.24% 0.28% 0.14% 0.22% 0.31% 30-59 Days PD 60-89 Days PD 90+ Days PD Total PD Loans YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 0.00% 0.10% 0.20% 0.30% 0.40%

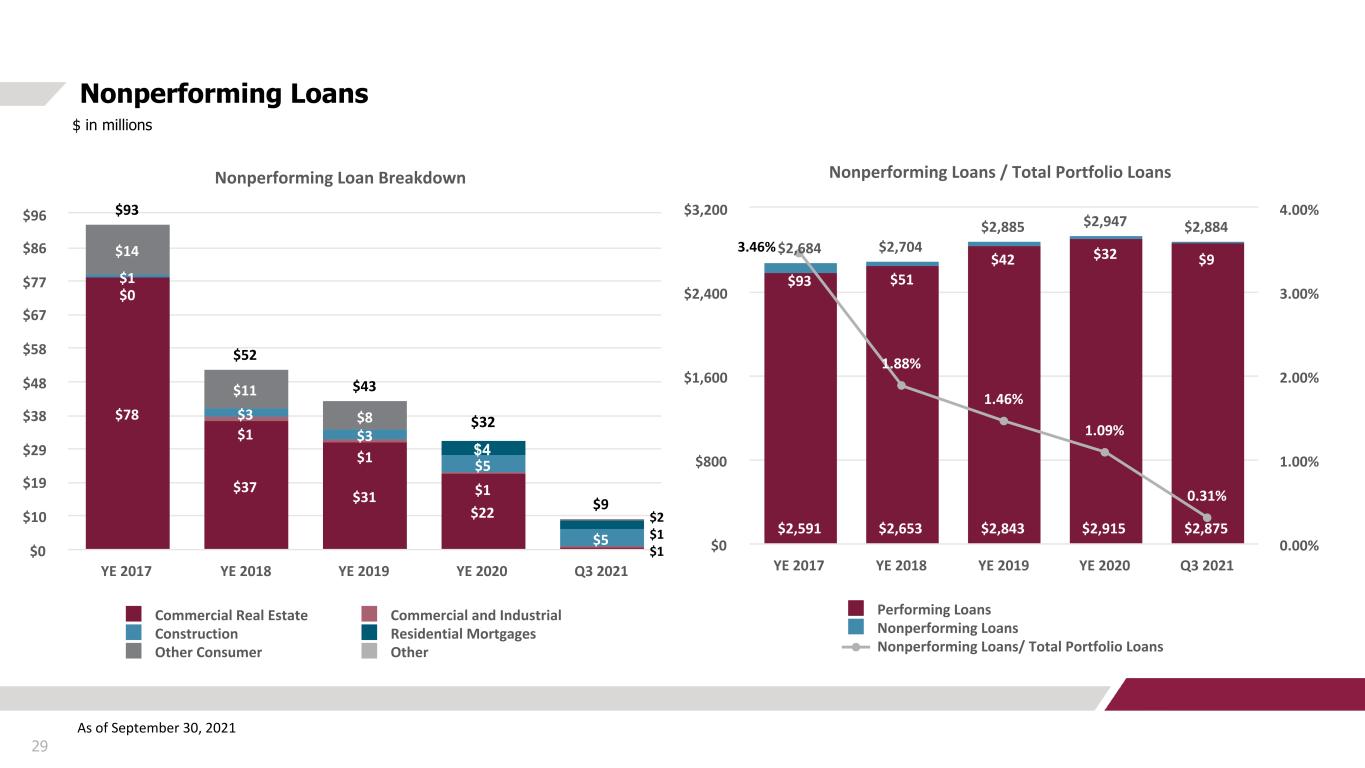

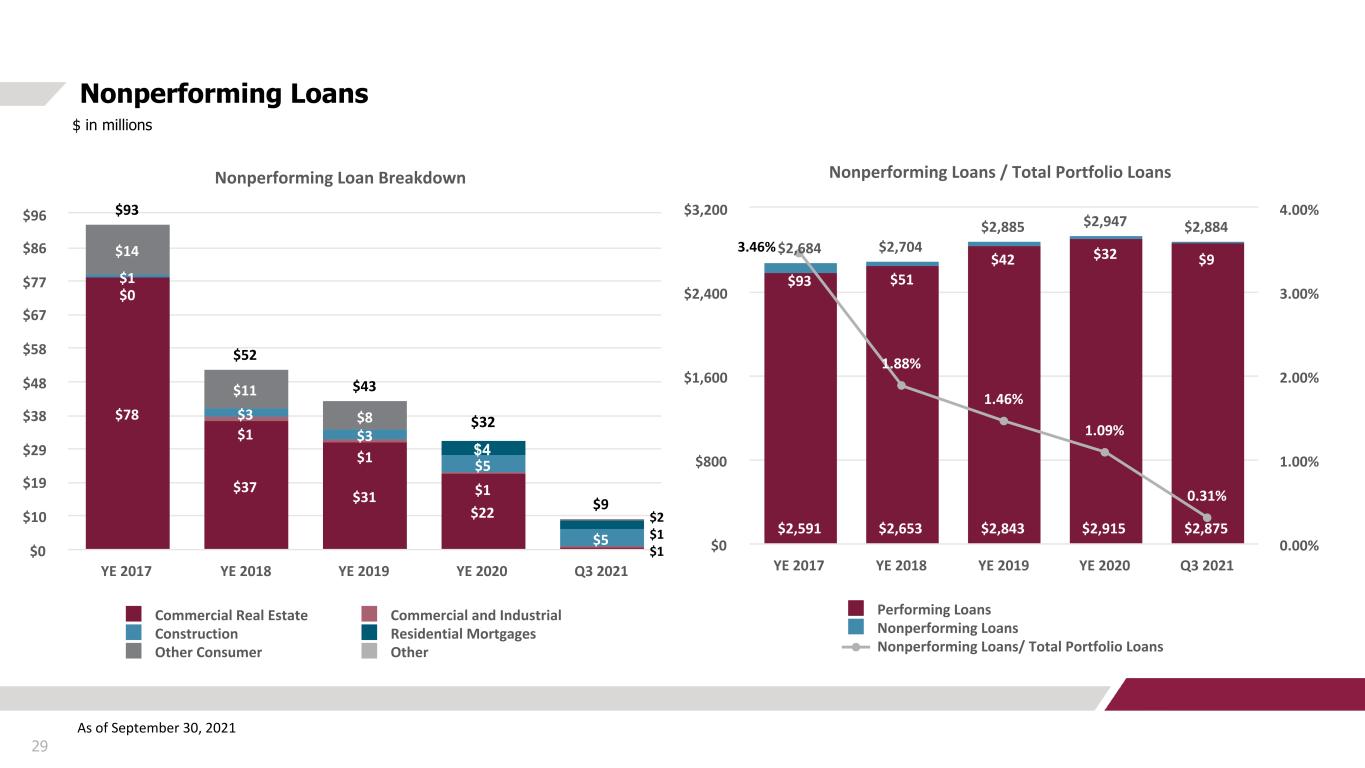

Nonperforming Loan Breakdown $93 $52 $43 $9 $78 $37 $31 $22 $0 $1 $1 $1 $1 $1 $3 $3 $5 $5 $4 $14 $11 $8 Commercial Real Estate Commercial and Industrial Construction Residential Mortgages Other Consumer Other YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $10 $19 $29 $38 $48 $58 $67 $77 $86 $96 29 Nonperforming Loans $ in millions As of September 30, 2021 Nonperforming Loans / Total Portfolio Loans $2,684 $2,704 $2,885 $2,947 $2,884 $2,591 $2,653 $2,843 $2,915 $2,875 $93 $51 $42 $32 $9 1.88% 1.46% 1.09% 0.31% Performing Loans Nonperforming Loans Nonperforming Loans/ Total Portfolio Loans YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $800 $1,600 $2,400 $3,200 0.00% 1.00% 2.00% 3.00% 4.00% 3.46% $2 $1 $1 $32

30 Nonperforming Relationships $ in thousands Type Nonaccrual Balance 9/30/21 Nonaccrual Balance 6/30/21 Variance 9/30/21 to 6/30/21 Comments 1. Construction $1,741 $1,741 $0 Commercial lot development 2. Construction $1,739 $1,739 $0 Residential lot developer 3. Construction $1,332 $1,332 $0 Residential lot developer 4. Residential $838 $846 ($8) Residential mortgage loan 5. CRE $321 $324 ($3) CRE Non-Owner Occupied Subtotal: Top 5 Nonaccrual Loans $5,971 $5,982 ($11) Total Nonaccrual Loans $8,867 $9,568 ($701) Top 5 Nonaccrual Loans / Total Nonaccrual Loans 67.34 % 62.52 % 4.82 % Total Portfolio Loans $2,884,157 $2,916,654 ($32,497) Total Nonaccrual Loans / Total Portfolio Loans 0.31 % 0.33 % (0.02) % As of September 30, 2020 the top five nonperforming credits totaled $35.6 million.

Nonperforming Assets $133 $84 $60 $48 $22 $40 $33 $18 $16 $13 $42 $47 $35 $25 $3 $51 $4 $7 $7 $6 OREO Nonperforming TDRs Nonperforming Loans YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $14 $28 $42 $56 $70 $84 $98 $112 $126 $140 31 Nonperforming Assets $ in millions As of September 30, 2021 (1) During the 2nd quarter of 2021 twenty branch closures were completed. These branches were marked to fair value and transferred to OREO in the amount of $9.0 million, net. Nonperforming Assets / Total Assets $4,112 $4,040 $4,006 $4,179 $4,134 $133 $84 $60 $48 $22 3.23% 2.09% 1.51% 1.14% 0.54% Total Assets Nonperforming Assets Nonperforming Assets / Total Assets YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $600 $1,200 $1,800 $2,400 $3,000 $3,600 $4,200 $4,800 0.0% 1.0% 2.0% 3.0% 4.0% (1)

Portfolio Credit Quality Trend $2,684 $2,704 $2,885 $2,947 $2,884 $1,868 $2,232 $2,451 $2,523 $2,679 $719 $461 $430 $238 $185 $97 $186 Pass Substandard Special Mention YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $1,000 $2,000 $3,000 $4,000 Non-Pass Credit Quality Trend $816 $472 $434 $424 $205 $719 $461 $430 $238 $185 $97 $186 $20 Substandard Special Mention YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $250 $500 $750 $1,000 32 Loan Portfolio – Risk Ratings $ in millions *Excludes loans held-for-sale As of September 30, 2021 $11 $4 $11 $4 $20

33 Net Charge-off & Provision Expense Trends $ in thousands As of September 30, 2021 (1) YTD Net charge-offs for 2021 consist of $9.2 million for nine sold loans that were a part of two relationships in 3Q21 and $6.3 million and $1.9 million in 2Q21 for the resolution of our two largest nonperforming credits all of which were previously reserved. $42,379 $12,989 $3,841 $2,694 $18,833 $43,197 $16,870 $3,404 $18,006 2,411 1.56% 0.47% 0.13% 0.09% 0.85% Net Charge-offs Provision Expense Net Charge-offs (annualized)/ Average Loans YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 0.00% 0.50% 1.00% 1.50% 2.00% (1)

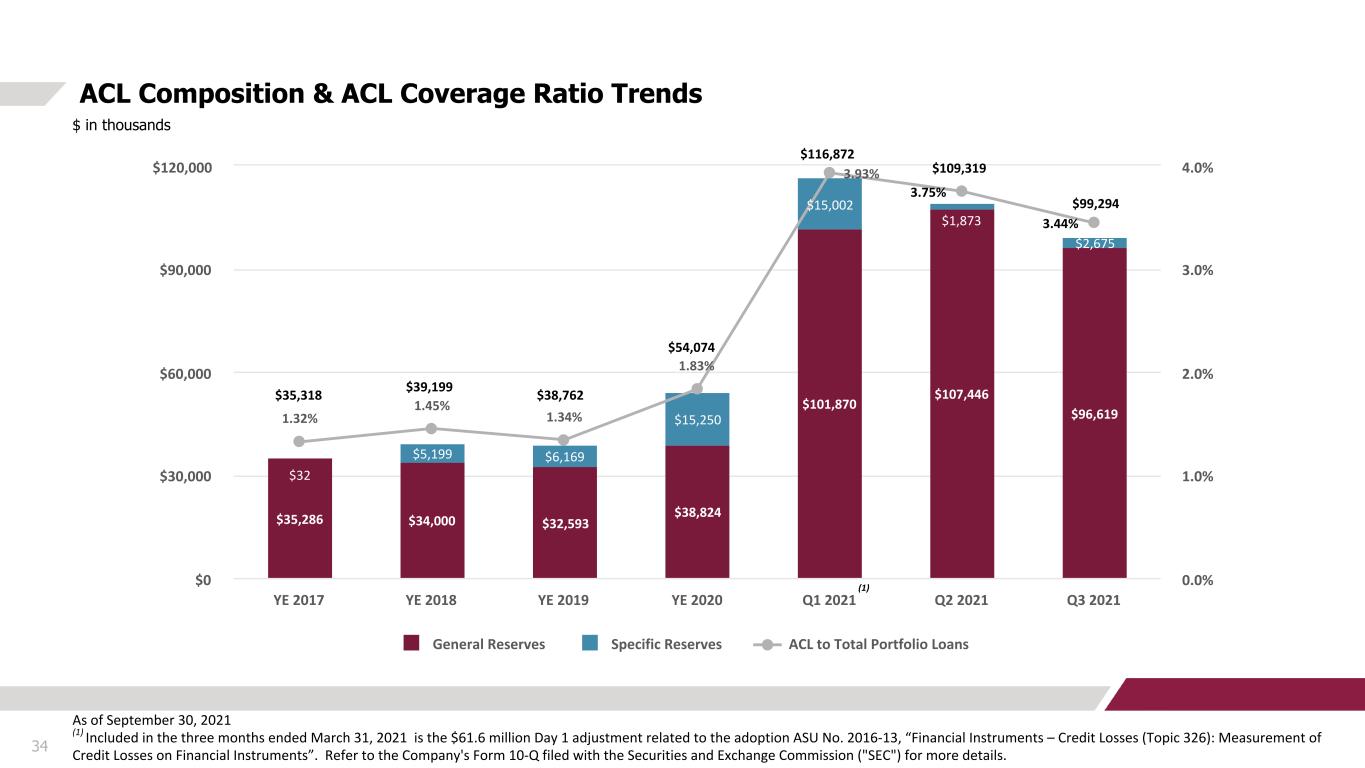

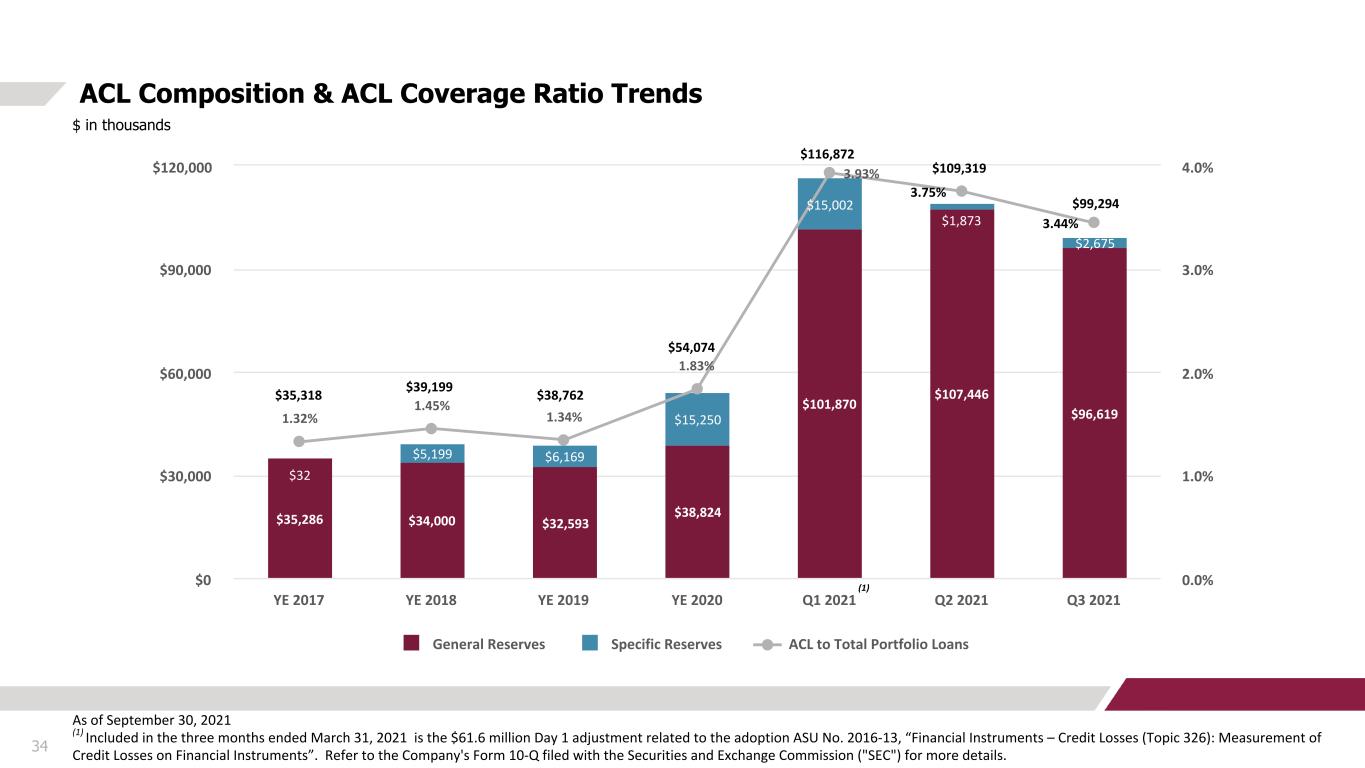

34 ACL Composition & ACL Coverage Ratio Trends $ in thousands As of September 30, 2021 (1) Included in the three months ended March 31, 2021 is the $61.6 million Day 1 adjustment related to the adoption ASU No. 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”. Refer to the Company's Form 10-Q filed with the Securities and Exchange Commission ("SEC") for more details. $35,286 $34,000 $32,593 $38,824 $101,870 $107,446 $96,619 $32 $5,199 $6,169 $15,250 $15,002 $1,873 $2,675 1.32% 1.45% 1.34% 1.83% 3.93% 3.75% 3.44% General Reserves Specific Reserves ACL to Total Portfolio Loans YE 2017 YE 2018 YE 2019 YE 2020 Q1 2021 Q2 2021 Q3 2021 $0 $30,000 $60,000 $90,000 $120,000 0.0% 1.0% 2.0% 3.0% 4.0% $35,318 $39,199 $38,762 $54,074 $116,872 (1) $109,319 $99,294

35 Deposit Mix and Cost of Funds 05

Total Deposit Composition $3,669 $3,592 $3,504 $3,685 $3,666 3,139 3,067 2,949 2,976 2,944 530 525 555 709 722 Interest-bearing deposits Nonnterest-bearing deposits YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $700 $1,400 $2,100 $2,800 $3,500 $4,200 36 Deposits $ in millions (1) (1) Period end balances.

Interest-bearing Deposit Composition & Deposit Rates $3,312 $3,097 $3,020 $2,937 $2,943 $2,199 $2,090 $2,054 $1,819 $1,522 $727 $664 $582 $600 $657 $245 $247 $249 $321 $403 $141 $96 $135 $197 $361 Certificates of Deposit Savings Interest-bearing Deposits Money Market Deposit Rate YE 2017 YE 2018 YE 2019 YE 2020 Q3 2021 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 37 Deposits $ in millions (1) Deposit rates and interest bearing deposit balances presented above are year-to-date averages for periods ending YE 2017 – YE 2020. (1) 1.12% 1.23% 1.21% 0.79% 1.54%

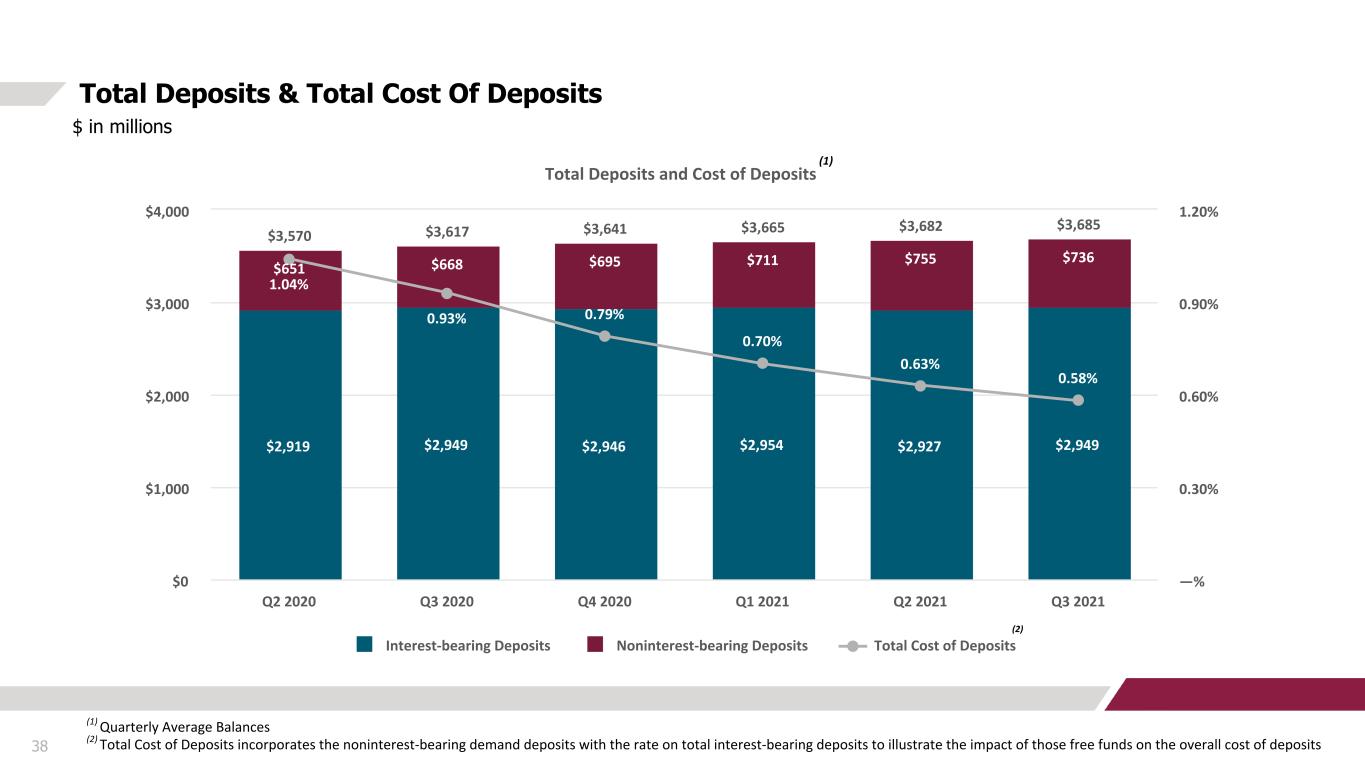

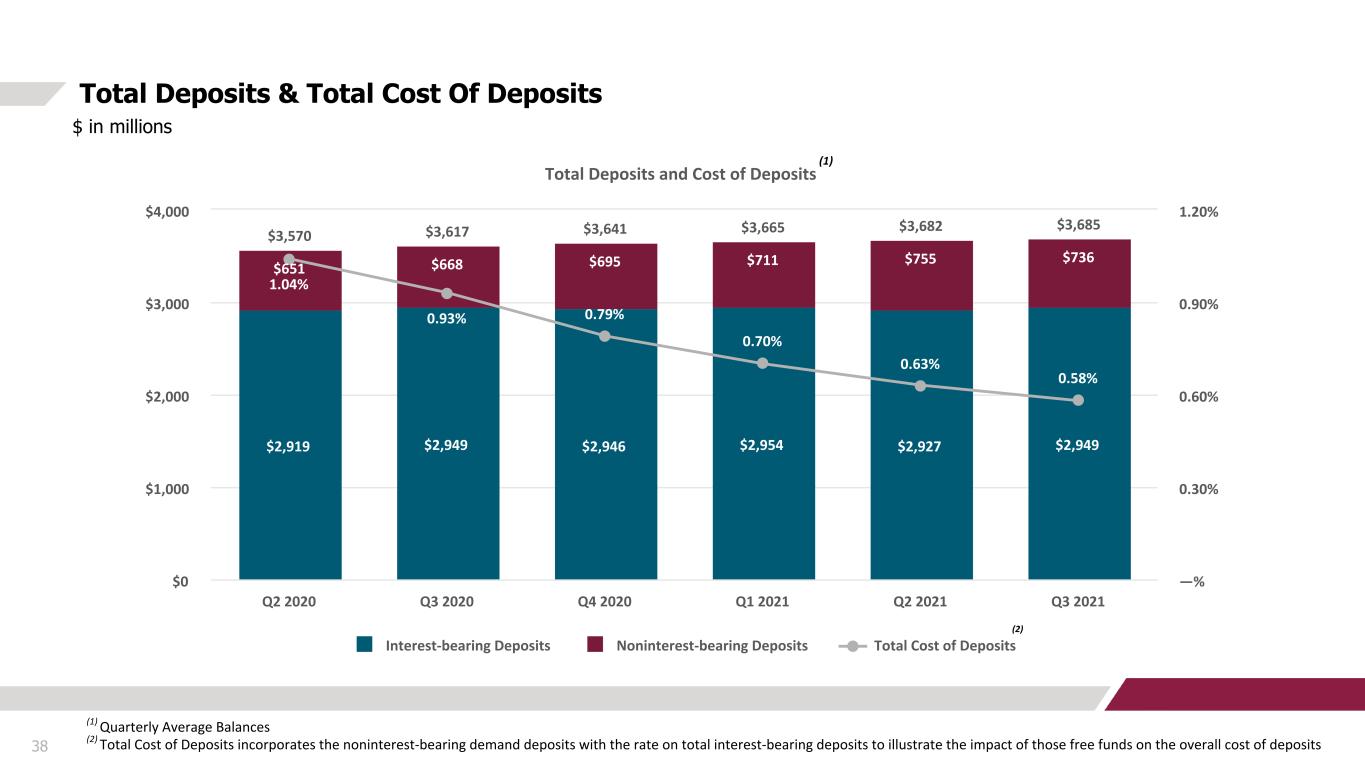

Total Deposits and Cost of Deposits $3,570 $3,617 $3,641 $3,665 $3,682 $3,685 $2,919 $2,949 $2,946 $2,954 $2,927 $2,949 $651 $668 $695 $711 $755 $736 1.04% 0.93% 0.79% 0.70% 0.63% 0.58% Interest-bearing Deposits Noninterest-bearing Deposits Total Cost of Deposits Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 $0 $1,000 $2,000 $3,000 $4,000 —% 0.30% 0.60% 0.90% 1.20% 38 Total Deposits & Total Cost Of Deposits $ in millions (1) Quarterly Average Balances (2) Total Cost of Deposits incorporates the noninterest-bearing demand deposits with the rate on total interest-bearing deposits to illustrate the impact of those free funds on the overall cost of deposits (2) (1)

39 Net Interest Margin (1) Cost of Funds incorporates the free funds contribution with the rate on total interest-bearing liabilities to illustrate the impact of noninterest-bearing liabilities on the overall cost of funds (2) Net Interest Margin has been computed on a fully taxable equivalent basis (FTE) using 35% federal income tax statutory rate for 2017 and 21% federal income tax statutory rate for 2018 through 2021. N et In te re st M ar gi n 0.90% 1.01% 1.23% 0.94% 0.60% 3.70% 4.11% 4.28% 3.74% 3.44% 2.80% 3.10% 3.05% 2.80% 2.84% Total Cost of Funds Yield on Interest-earning Assets Net Interest Margin YE 2017 YE 2018 YE 2019 YE 2020 YTD Q3 2021 0.00% 0.80% 1.60% 2.40% 3.20% 4.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% (1) (2)

40 Loan Deferral Update 06

41 COVID-19 Loan Deferral Program Update The Company has offered loan deferrals in three parts: ◦ Deferrals allow the operating company and its principals to preserve liquidity and develop strategies to operate at a lower break even level to ensure long term survival ◦ The Part I program began in March 2020 and expired August 31, 2020 ◦ The Part II program began in August 2020 and expired on December 31, 2020 ◦ The Part III program began in December 2020 and expired on June 30, 2021 ◦ Operating companies in the Part III program were required to provide monthly statements and were subject to cash flow recapture payments ◦ Majority of our clients have resumed regularly scheduled payments as of September 30, 2021 ◦ During the third quarter of 2021, management observed that $62.0 million of loans that were previously in the deferral program were recovering at rates much lower than peers. Accordingly, management sold $50.0 million of these loans in the third quarter and has developed a workout strategy with the remaining two loan relationships with an aggregate unpaid balance of $12.0 million remaining that were previously on deferral.

42 Commercial Loan Portfolio Metrics 07

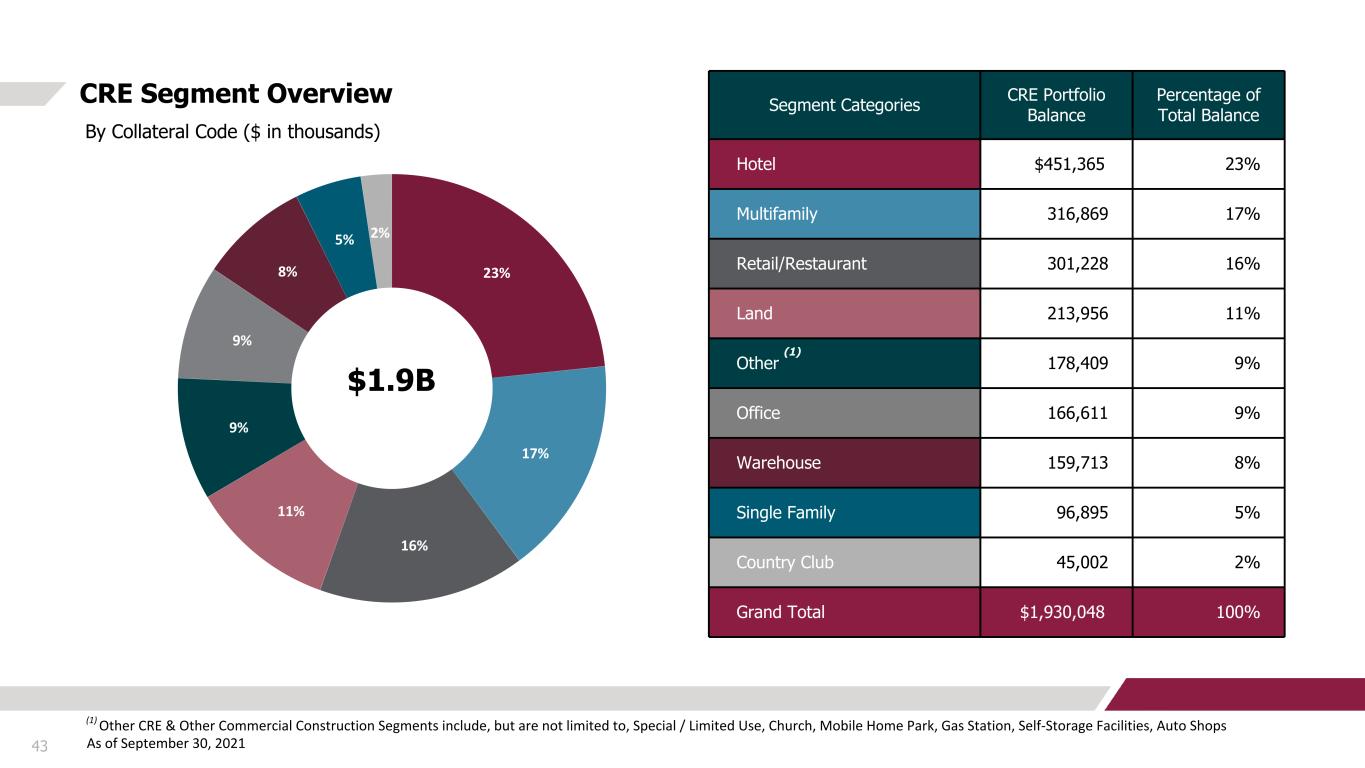

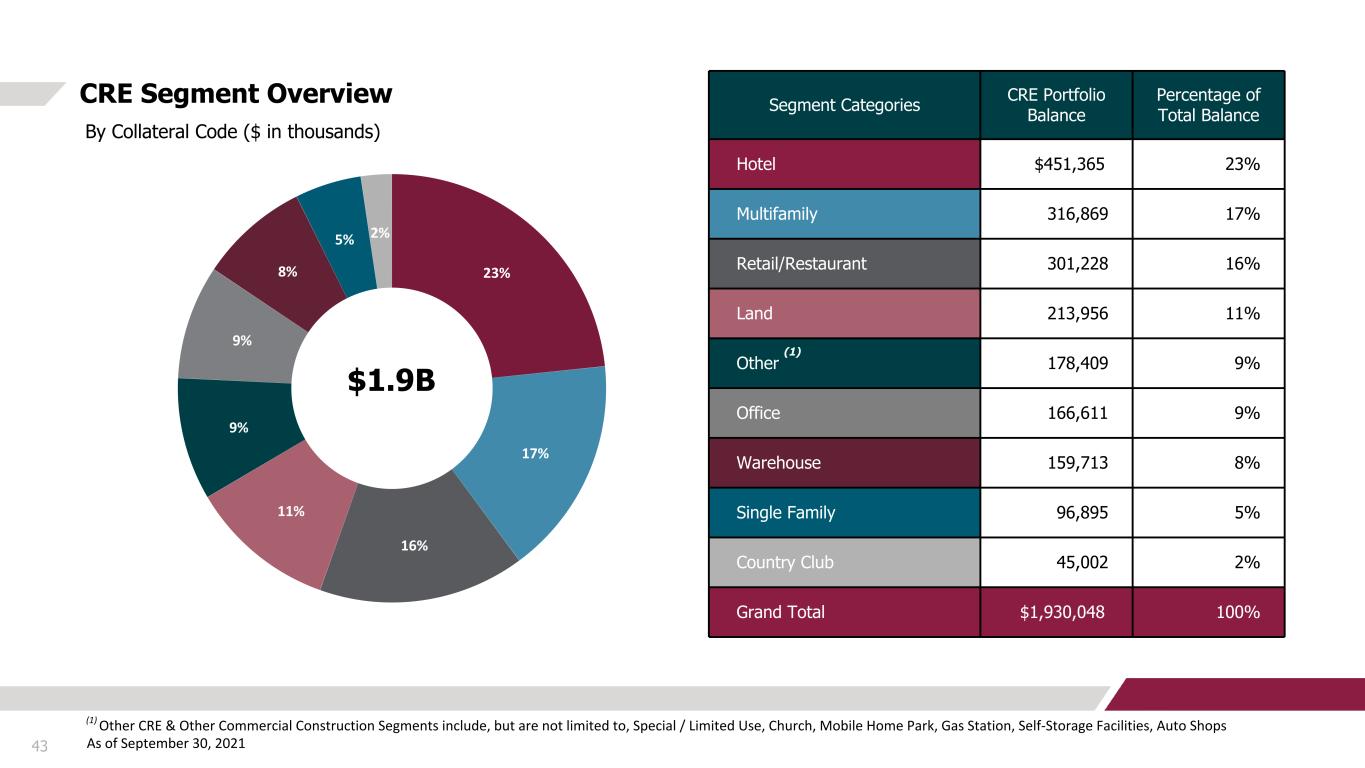

23% 17% 16% 11% 9% 9% 8% 5% 2% 43 CRE Segment Overview By Collateral Code ($ in thousands) (1) Other CRE & Other Commercial Construction Segments include, but are not limited to, Special / Limited Use, Church, Mobile Home Park, Gas Station, Self-Storage Facilities, Auto Shops As of September 30, 2021 Segment Categories CRE Portfolio Balance Percentage of Total Balance Hotel $451,365 23 % Multifamily 316,869 17 % Retail/Restaurant 301,228 16 % Land 213,956 11 % Other 178,409 9 % Office 166,611 9 % Warehouse 159,713 8 % Single Family 96,895 5 % Country Club 45,002 2 % Grand Total $1,930,048 100 % $1.9B (1)

37% 35% 13% 11% 1% 3% 44 Hospitality Metrics By State $ in thousands As of September 30, 2021 State Hospitality Portfolio Balance Percentage of Total Balance Avg. LTV Avg. GL Balance Size Avg. of Debt per Key - Total Commitment NC $169,023 37 % 61.5 % $4,448 $69 SC 157,330 35 % 63.3 % 6,840 93 VA 59,339 13 % 24.8 % 19,780 67 WV 50,522 11 % 58.3 % 3,158 87 FL 3,482 1 % 53.6 % 3,482 249 GA 11,669 3 % 61.6 % 5,834 68 Total $451,365 100 % 56.9 % $5,170 $76 $451.4M

30% 20% 14% 13% 8% 5% 4% 3% 3% 45 Hospitality Metrics By Brand $ in thousands Brand Hospitality Portfolio Balance Percentage of Total Balance Avg. LTV Avg. GL Balance Size Avg. of Debt per Key - Total Commitment Hilton $134,110 30 % 65.8 % $9,579 $104 IHG 89,180 20 % 62.4 % 5,246 72 Marriott 61,927 14 % 55.4 % 7,741 78 Upscale Independent/ Boutique 57,552 13 % 28.4 % 28,776 75 Wyndham 36,467 8 % 63.1 % 2,805 46 Independent 22,208 5 % 56.2 % 3,173 158 Choice 19,307 4 % 54.3 % 2,145 31 Best Western 17,127 3 % 48.7 % 2,141 29 Other 13,487 3 % 57.2 % 2,697 42 Total $451,365 100 % 56.9 % $5,170 $76 As of September 30, 2021 $451.4M

46 Paycheck Protection Program 08

Paycheck Protection Program PROGRAM TIMING APPLICATIONS APPROVED FUNDS APPROVED (1) ($ in millions) TOTAL IN FEES ($ in millions) ROUND ONE: April 3 - 16, 2020 451 $17.9 $1.5 ROUND TWO: April 29 - June 30, 2020 515 $39.9 ROUND THREE: January 22, 2021 - June 30, 2021 136 $11.0 $0.6 TOTAL 1,102 $68.8 $2.1 47 The Paycheck Protection Program is part of the CARES Act Stimulus Package, and is a federal loan program aimed at helping businesses impacted by COVID-19. With all hands on deck, Carter Bank & Trust was able to accept applications in the first, second and third round of funding to date. (1) Round One PPP loans totaling $17.9 million were largely referred to a third-party lender, Kabbage, for origination and servicing. (2) As of September 30, 2021, 69 PPP loans remained in the portfolio with total outstanding principal balances of $6.2MM (gross of deferred fees of costs).