Investor Presentation First Quarter 2022

Forward-Looking Statements 2 This information contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to our financial condition, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position, and other matters regarding or affecting Carter Bankshares, Inc. and its future business and operations. Forward looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “ believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “believe,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. Although we believe the assumptions upon which these forward- looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to: changes in accounting policies, practices, or guidance, for example, our adoption of CECL; credit losses; cyber-security concerns; rapid technological developments and changes; the Company’s liquidity and capital positions; the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts or public health events (such as the current COVID-19 pandemic), and of governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of the Company's borrowers to satisfy their obligations to the Bank, on the value of collateral securing loans, on the demand for the Bank's loans or its other products and services, on incidents of cyberattack and fraud, on the Company’s liquidity or capital positions, on risks posed by reliance on third-party service providers, on other aspects of the Company's business operations and on financial markets and economic growth; sensitivity to the interest rate environment including a prolonged period of low interest rates, a rapid increase in interest rates or a change in the shape of the yield curve; a change in spreads on interest-earning assets and interest-bearing liabilities; regulatory supervision and oversight; legislation affecting the financial services industry as a whole, and Carter Bankshares, Inc., in particular; the outcome of pending and future litigation to which the Company is party and the potential impacts thereon, and governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult, disruptive or more costly than anticipated; containing costs and expenses; reliance on significant customer relationships; general economic or business conditions; deterioration of the housing market and reduced demand for mortgages; re-emergence of turbulence in significant portions of the global financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to support our future businesses. Many of these factors, as well as other factors, are described in our filings with the Securities and Exchange Commission. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

Non-GAAP Statements 3 Statements in this exhibit include non-GAAP financial measures and should be read along with the accompanying tables in our definitions and reconciliations of GAAP to non-GAAP financial measures. Management uses, and this exhibit references, net interest income and net interest margin, each on a fully taxable equivalent, or FTE, basis, which are non-GAAP financial measures. Management believes net interest income and net interest margin on an FTE basis provide information useful to investors in understanding our underlying business, operational performance and performance trends as they facilitate comparisons with the performance of other companies in the financial services industry. Although management believes that these non-GAAP financial measures enhance investors’ understanding of our business and performance, these non-GAAP financial measures should not be considered alternatives to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with non-GAAP measures which may be presented by other companies.

4 TABLE OF CONTENTS Section Title Slides 1 Overview 05-13 2 Financial Highlights 14-22 3 Balance Sheet Transformation 23-27 4 Asset Quality 28-35 5 Deposit Mix & Cost of Funds 36-40 6 Commercial Loan Portfolio Metrics 41-44

Overview 01 5

Our Mission At Carter Bank & Trust, we strive to be the preferred lifetime financial partner for our customers and shareholders, and the employer of choice in the communities we are privileged to serve. Our Purpose Enrich lives and enhance communities today, to build a better tomorrow. Our Values Loyalty We serve to build lifetime relationships Care We care, it’s our tradition and what we do best Optimism We work collaboratively, as one team Trustworthiness We act with integrity and speak with respect Innovation We make bold decisions to continuously improve

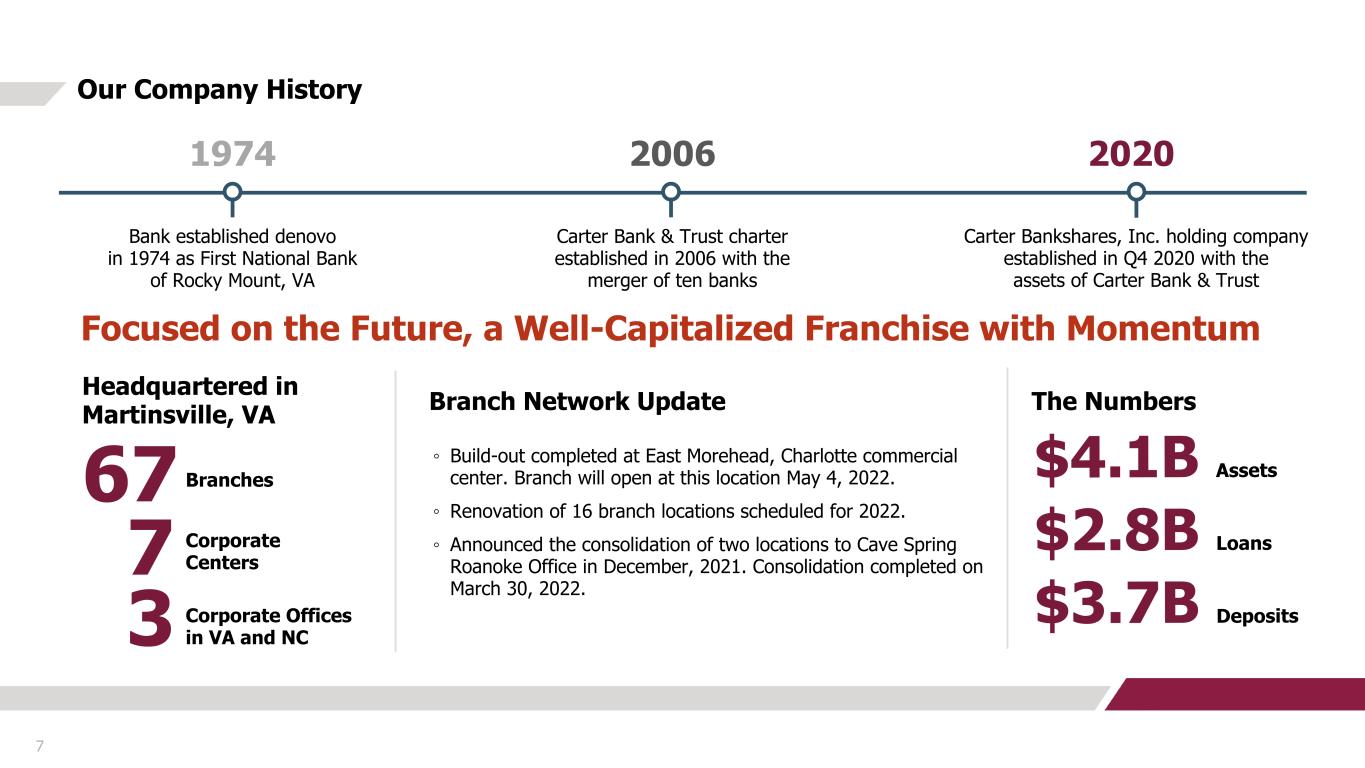

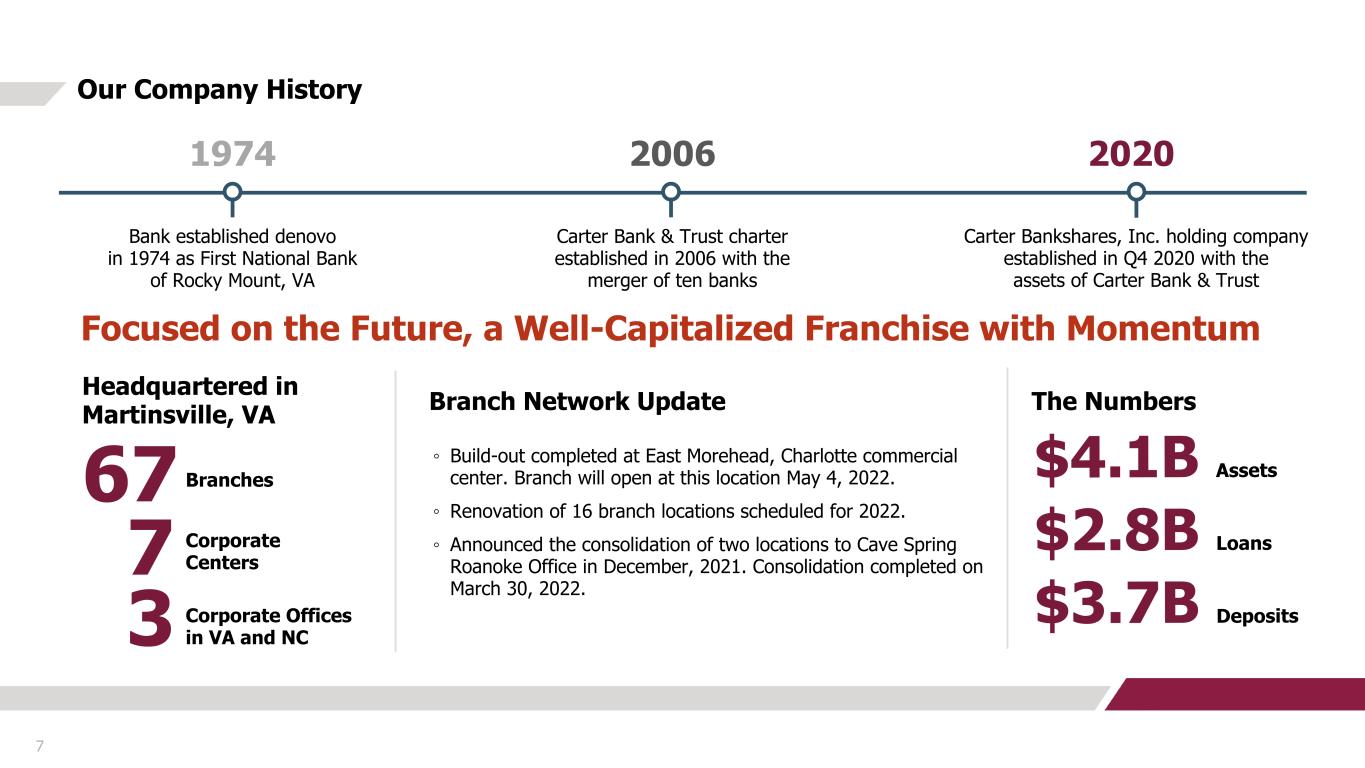

Our Company History 7 $4.1B Assets $2.8B Loans $3.7B Deposits Focused on the Future, a Well-Capitalized Franchise with Momentum ◦ Build-out completed at East Morehead, Charlotte commercial center. Branch will open at this location May 4, 2022. ◦ Renovation of 16 branch locations scheduled for 2022. ◦ Announced the consolidation of two locations to Cave Spring Roanoke Office in December, 2021. Consolidation completed on March 30, 2022. Carter Bank & Trust charter established in 2006 with the merger of ten banks Carter Bankshares, Inc. holding company established in Q4 2020 with the assets of Carter Bank & Trust Bank established denovo in 1974 as First National Bank of Rocky Mount, VA 1974 2006 2020 Headquartered in Martinsville, VA 67 7 3 Corporate Centers Corporate Offices in VA and NC Branches Branch Network Update The Numbers

8 Our Leadership Team Litz Van Dyke Chief Executive Officer Wendy Bell Senior Executive Vice President Chief Financial Officer Bradford Langs President Chief Strategy Officer ‘We are intentional and work with purpose to create a culture of leadership excellence - attracting, developing and retaining the best leaders - to achieve mission objectives and to experience break-out performances across the organization.’ Litz Van Dyke, CEO Loran Adams Executive Vice President Director of Regulatory Risk Management Tami Buttrey Executive Vice President Chief Retail Banking Officer Channel Optimization Director Paul Carney Executive Vice President Chief Human Resources Officer Jane Ann Davis Executive Vice President Chief Administration Officer Tony Kallsen Executive Vice President Chief Credit Risk Officer Phyllis Karavatakis Senior Executive Vice President Special Projects Richard Owen Executive Vice President Mortgage Banking & Corporate Sales Director Chrystal Parnell Senior Vice President Chief Marketing and Communications Officer Matt Speare Executive Vice President Chief Information Officer Rich Spiker Executive Vice President Chief Lending Officer

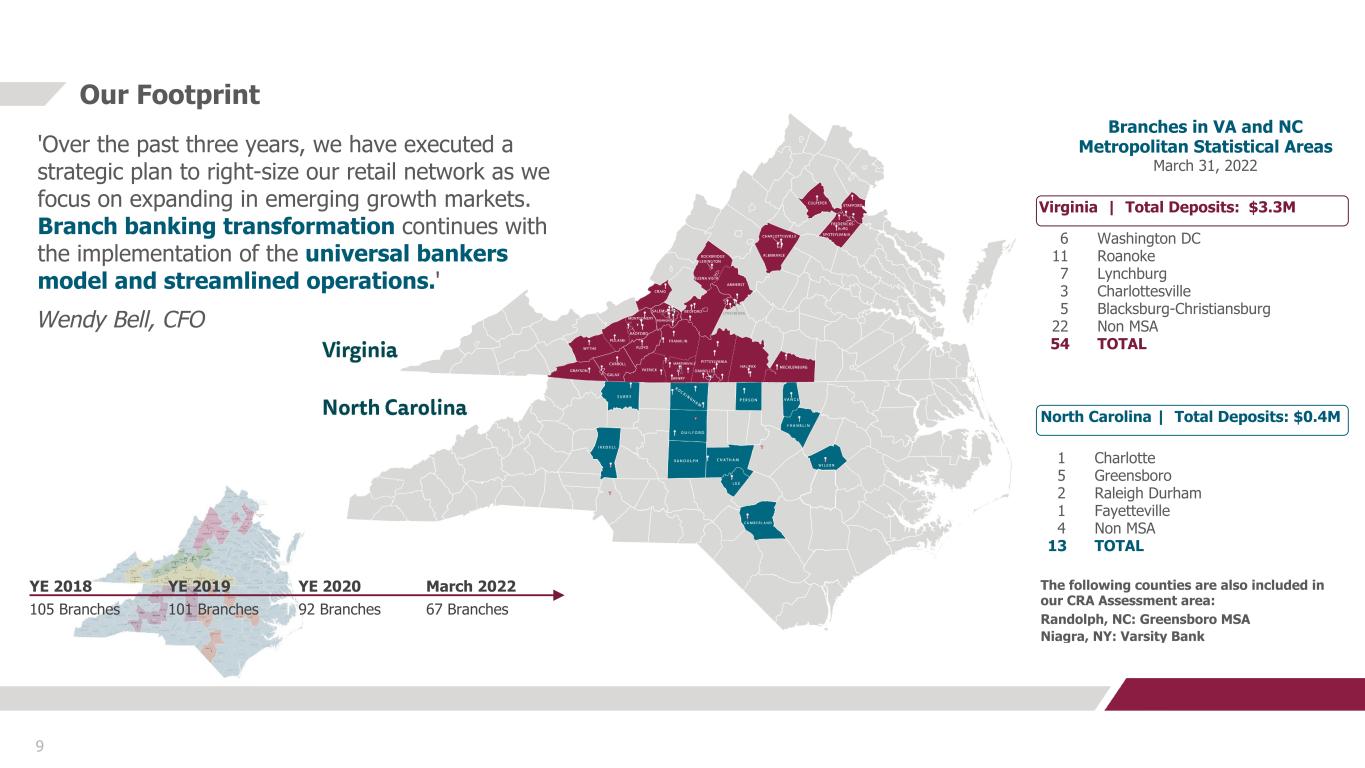

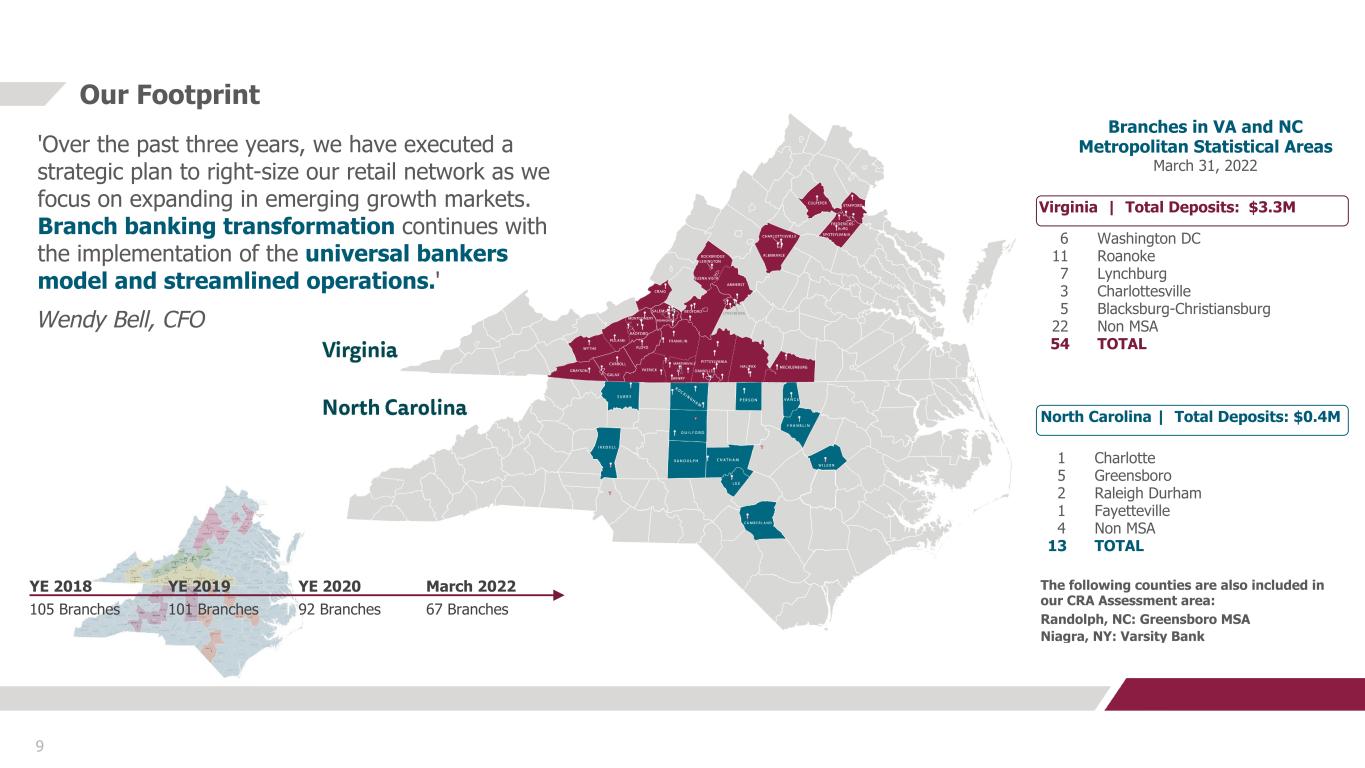

Our Footprint YE 2020 92 Branches YE 2019 101 Branches YE 2018 105 Branches March 2022 67 Branches Branches in VA and NC Metropolitan Statistical Areas March 31, 2022 'Over the past three years, we have executed a strategic plan to right-size our retail network as we focus on expanding in emerging growth markets. Branch banking transformation continues with the implementation of the universal bankers model and streamlined operations.' Wendy Bell, CFO 9 North Carolina | Total Deposits: $0.4M 1 5 2 1 4 13 Charlotte Greensboro Raleigh Durham Fayetteville Non MSA TOTAL The following counties are also included in our CRA Assessment area: Randolph, NC: Greensboro MSA Niagra, NY: Varsity Bank Virginia | Total Deposits: $3.3M 6 11 7 3 5 22 54 Washington DC Roanoke Lynchburg Charlottesville Blacksburg-Christiansburg Non MSA TOTAL

10 Our Commitment Installed iWaves Air Purifiers in all air handler units to clean & purify the air in buildings 400 Volunteer Community Service Hours Q1 2022 $150,000 Local & National Non- Profit Donations Q1 2022 'Our influence for positive change is in alignment with our purpose and mission. Our commitment to ESG actions benefit our communities, our organization, our environment, and our economy.' Brad Langs, President & CSO Closed & funded $500,000 Affordable Housing Program (AHP) FHLB Grant for Aaronfield at Old Folkstone in NC, an 80 unit low income housing tax credit project serving families at or below 60% of the Area Median income. Hosted a Free Community Shred Day on March 26 that served 90 people / vehicles, resulting in 3,680 lbs of paper shredded. 17 associates volunteered over 72 hours total. Hosted the American Red Cross Blood Drive in February at the Westridge Branch in Greensboro NC. 24 pints of blood were collected, and there were 11 first-time donors. The Bank's DEI Council held their second quarterly off site in Greensboro, NC on March 18 with interactive sessions to further build capacity and knowledge. Environmental Social Governance

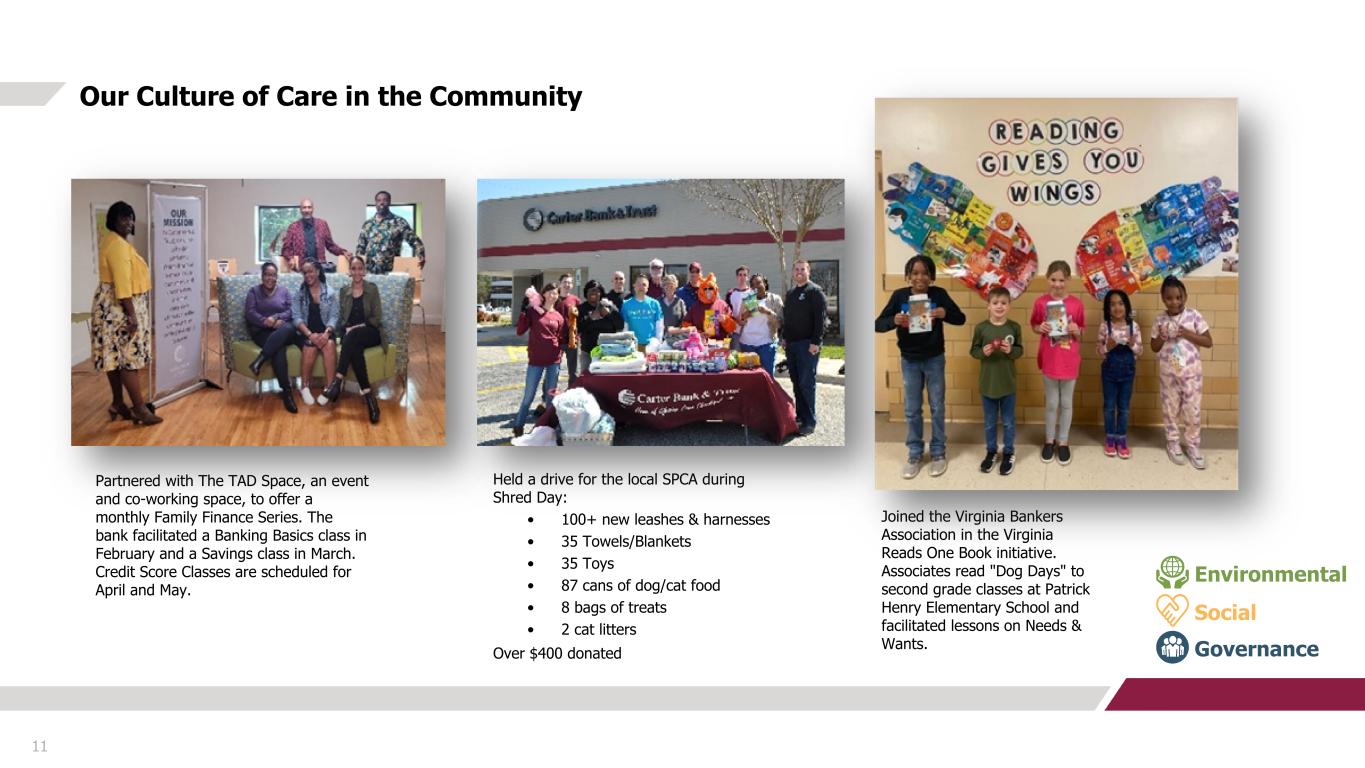

11 Our Culture of Care in the Community Partnered with The TAD Space, an event and co-working space, to offer a monthly Family Finance Series. The bank facilitated a Banking Basics class in February and a Savings class in March. Credit Score Classes are scheduled for April and May. Held a drive for the local SPCA during Shred Day: • 100+ new leashes & harnesses • 35 Towels/Blankets • 35 Toys • 87 cans of dog/cat food • 8 bags of treats • 2 cat litters Over $400 donated Joined the Virginia Bankers Association in the Virginia Reads One Book initiative. Associates read "Dog Days" to second grade classes at Patrick Henry Elementary School and facilitated lessons on Needs & Wants. Environmental Social Governance

12 Our Culture of Care in the Workplace Environmental Social Governance COVID-19 Response: Bank Approved Paid Leave (BAPL) continued to keep our associates and customers safe while maintaining bank operations. Wellness Programs: We now offer a premium-reduction program if the associate visits a primary care physician. Our bi-weekly Club Care webinar continues to promote health and wellness with a leading wellness authority, Sean Burch, who covers topics such as nutrition, mindfulness, fitness, sleep, and various “Kickstart Challenge” exercises. Healthcare Solutions: Based on associate feedback, we now provide multiple benefit levels for medical, dental, and vision services to meet the needs of the associates and their family. We also provide bank-paid basic life insurance to all associates, along with optional voluntary life, disability, and accident insurances to further protect the associates and their family. Retirement Assistance: We provide a bank match of up to 4% in addition to the associate’s 401K/Roth contribution and provided a retirement account discretionary distribution in 2021 to eligible associates with an average amount of 1.7%. BAPL Q1 2022: $168,000 9,800 Hours BAPL 2021 FY: $507,000 32,000 Hours Premium- Reduction Program for Medical Insurance

Strategic Initiatives Update

Financial Highlights 02 14 Insert CB&T photo here

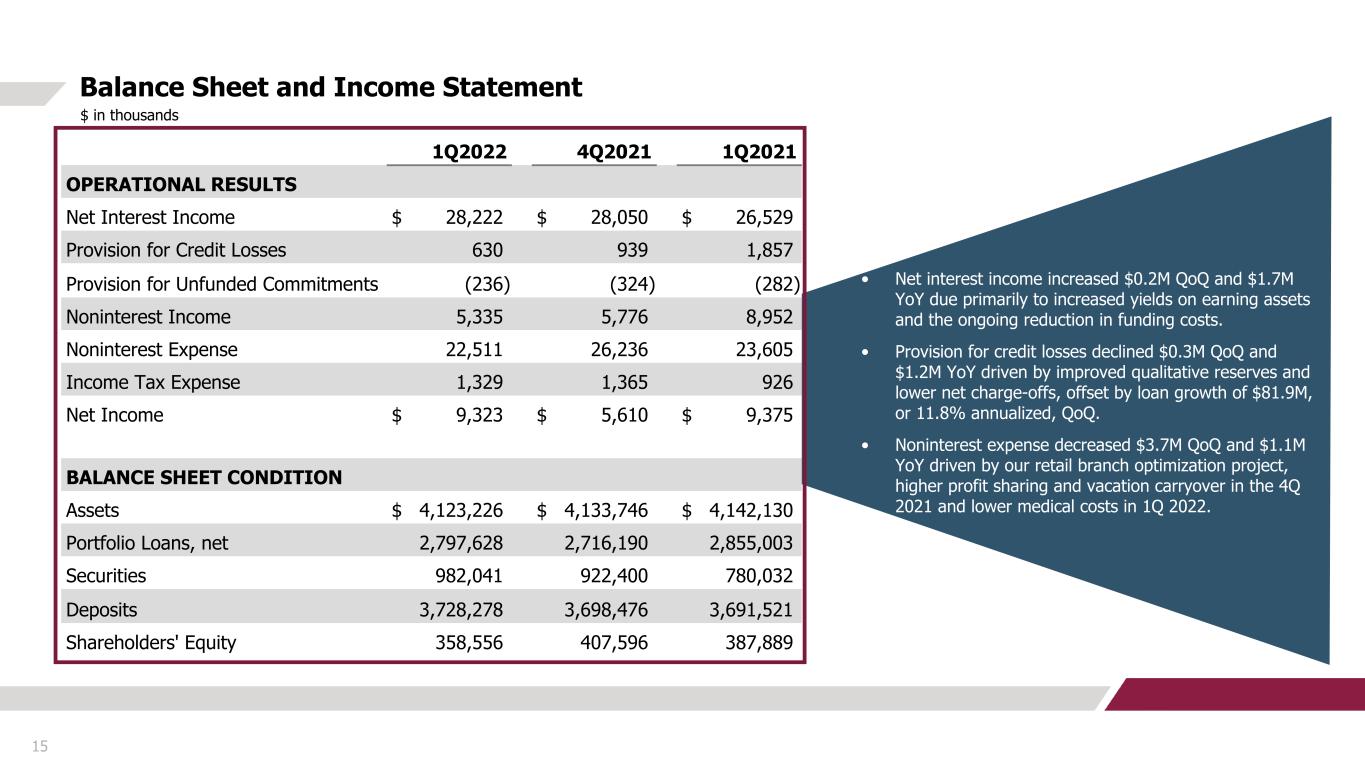

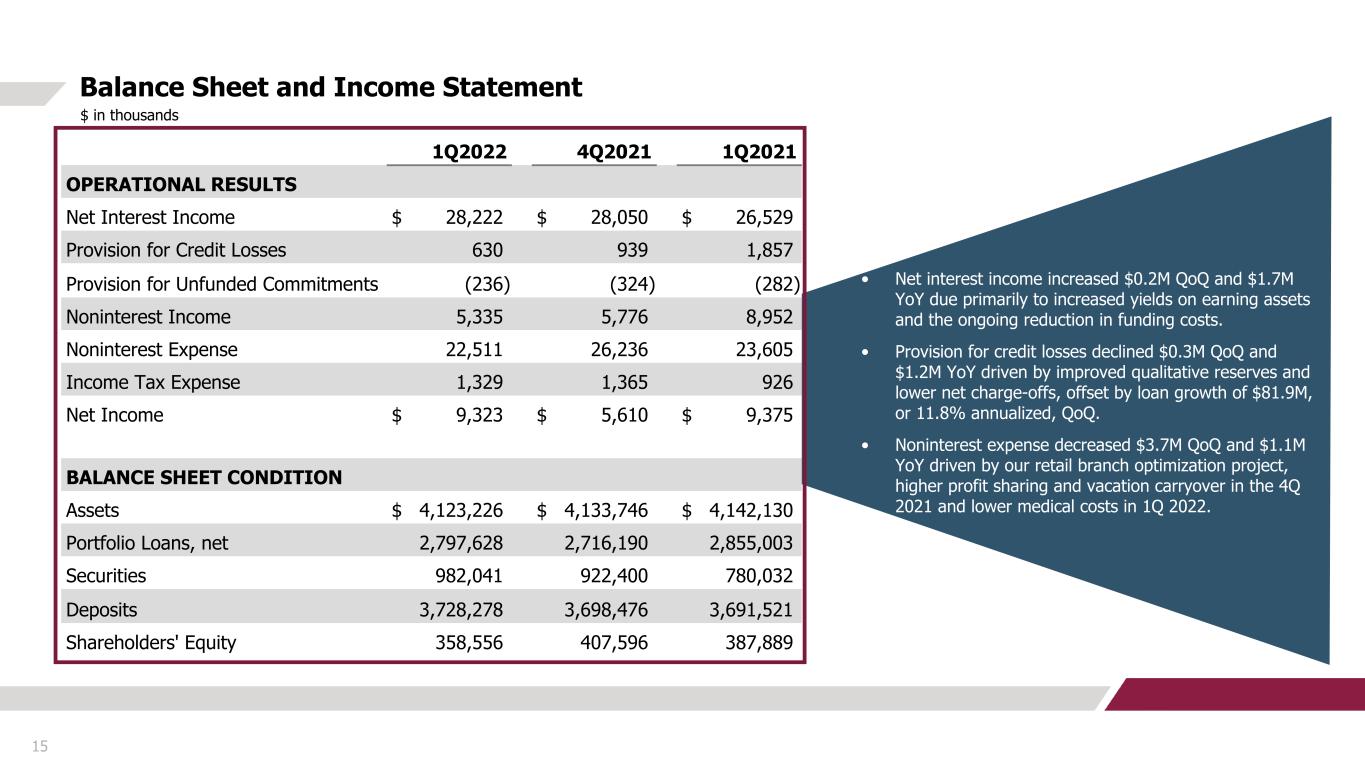

• Net interest income increased $0.2M QoQ and $1.7M YoY due primarily to increased yields on earning assets and the ongoing reduction in funding costs. • Provision for credit losses declined $0.3M QoQ and $1.2M YoY driven by improved qualitative reserves and lower net charge-offs, offset by loan growth of $81.9M, or 11.8% annualized, QoQ. • Noninterest expense decreased $3.7M QoQ and $1.1M YoY driven by our retail branch optimization project, higher profit sharing and vacation carryover in the 4Q 2021 and lower medical costs in 1Q 2022. 1Q2022 4Q2021 1Q2021 OPERATIONAL RESULTS Net Interest Income $ 28,222 $ 28,050 $ 26,529 Provision for Credit Losses 630 939 1,857 Provision for Unfunded Commitments (236) (324) (282) Noninterest Income 5,335 5,776 8,952 Noninterest Expense 22,511 26,236 23,605 Income Tax Expense 1,329 1,365 926 Net Income $ 9,323 $ 5,610 $ 9,375 BALANCE SHEET CONDITION Assets $ 4,123,226 $ 4,133,746 $ 4,142,130 Portfolio Loans, net 2,797,628 2,716,190 2,855,003 Securities 982,041 922,400 780,032 Deposits 3,728,278 3,698,476 3,691,521 Shareholders' Equity 358,556 407,596 387,889 Balance Sheet and Income Statement 15 $ in thousands

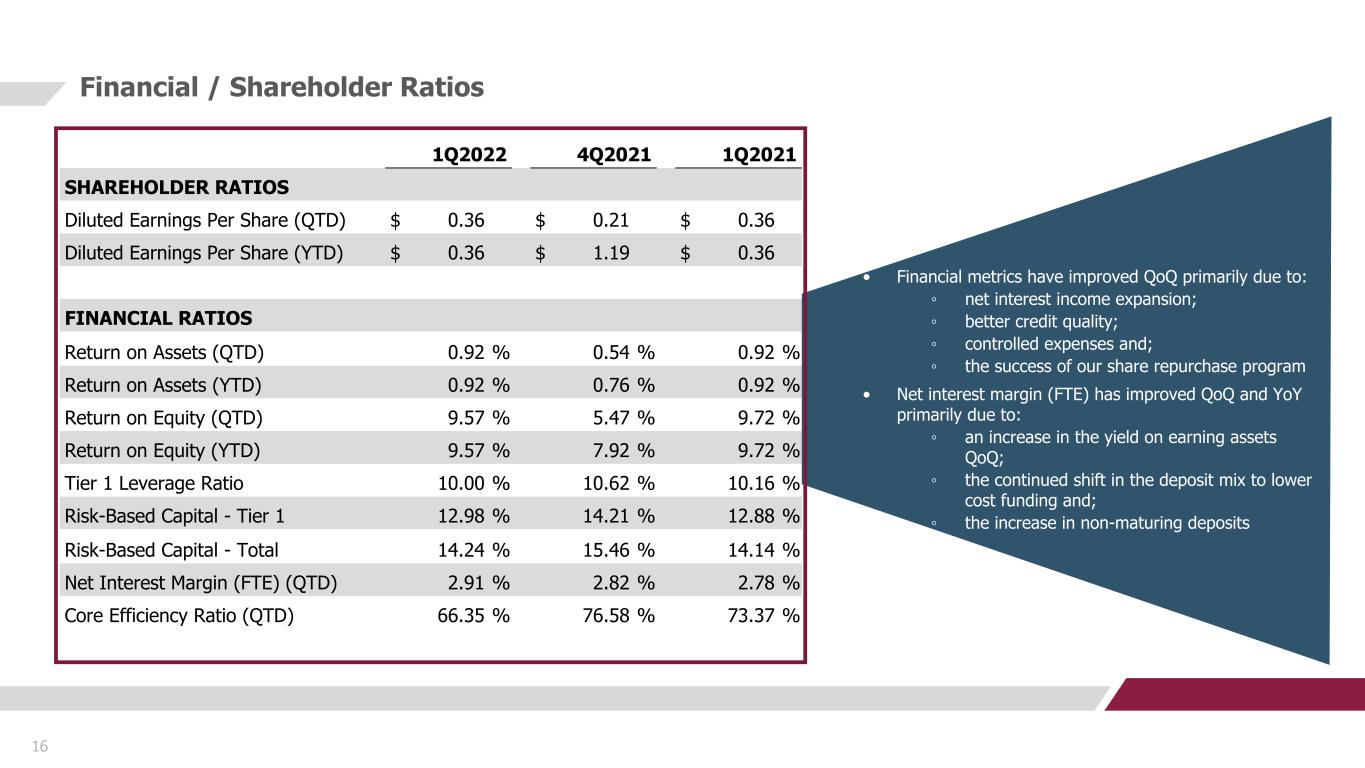

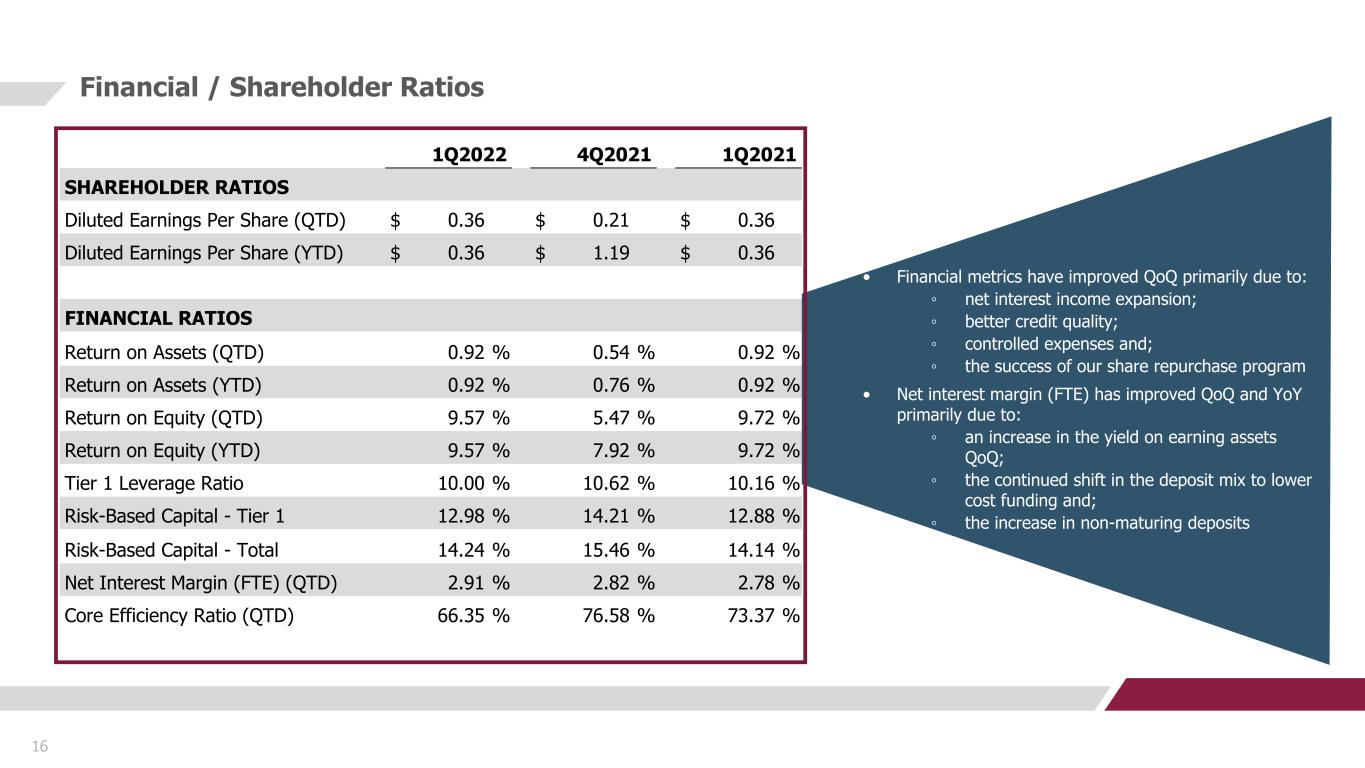

• Financial metrics have improved QoQ primarily due to: ◦ net interest income expansion; ◦ better credit quality; ◦ controlled expenses and; ◦ the success of our share repurchase program • Net interest margin (FTE) has improved QoQ and YoY primarily due to: ◦ an increase in the yield on earning assets QoQ; ◦ the continued shift in the deposit mix to lower cost funding and; ◦ the increase in non-maturing deposits 1Q2022 4Q2021 1Q2021 SHAREHOLDER RATIOS Diluted Earnings Per Share (QTD) $ 0.36 $ 0.21 $ 0.36 Diluted Earnings Per Share (YTD) $ 0.36 $ 1.19 $ 0.36 FINANCIAL RATIOS Return on Assets (QTD) 0.92 % 0.54 % 0.92 % Return on Assets (YTD) 0.92 % 0.76 % 0.92 % Return on Equity (QTD) 9.57 % 5.47 % 9.72 % Return on Equity (YTD) 9.57 % 7.92 % 9.72 % Tier 1 Leverage Ratio 10.00 % 10.62 % 10.16 % Risk-Based Capital - Tier 1 12.98 % 14.21 % 12.88 % Risk-Based Capital - Total 14.24 % 15.46 % 14.14 % Net Interest Margin (FTE) (QTD) 2.91 % 2.82 % 2.78 % Core Efficiency Ratio (QTD) 66.35 % 76.58 % 73.37 % Financial / Shareholder Ratios 16

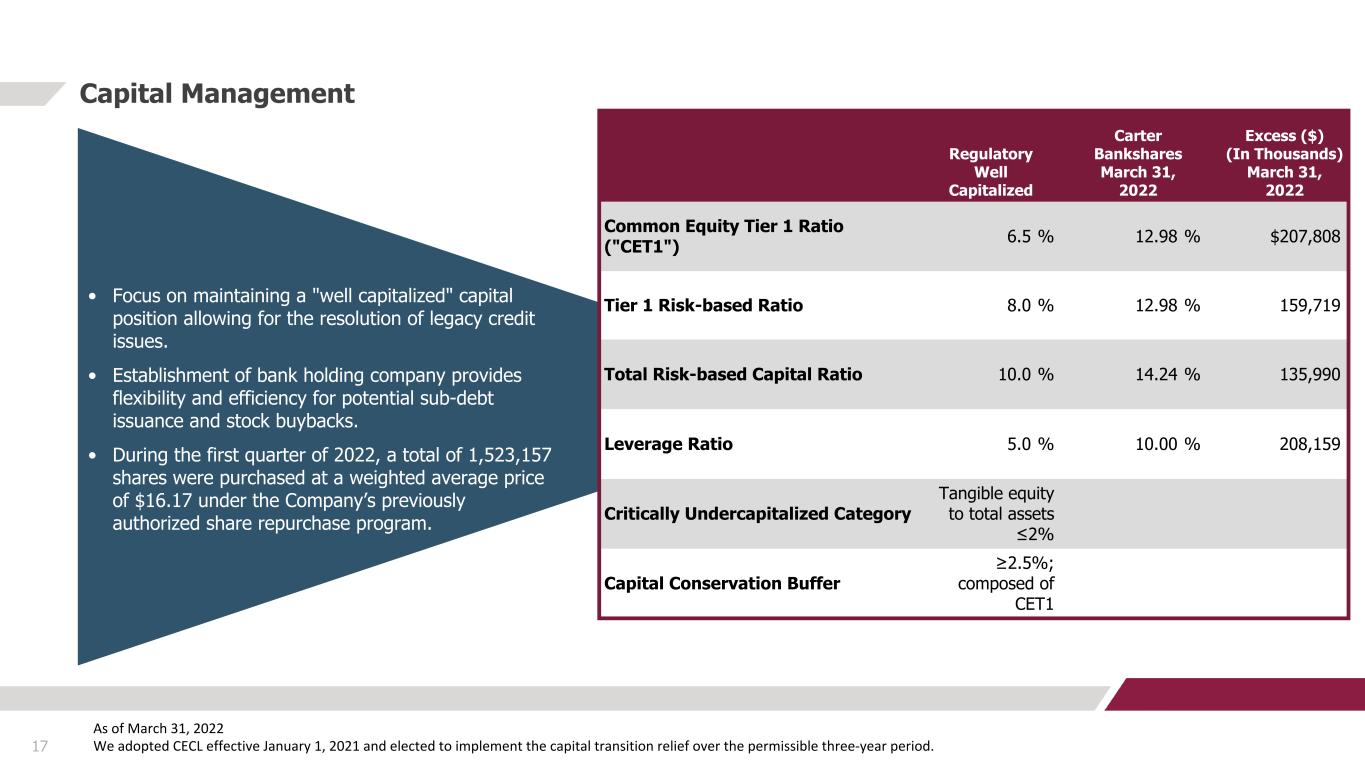

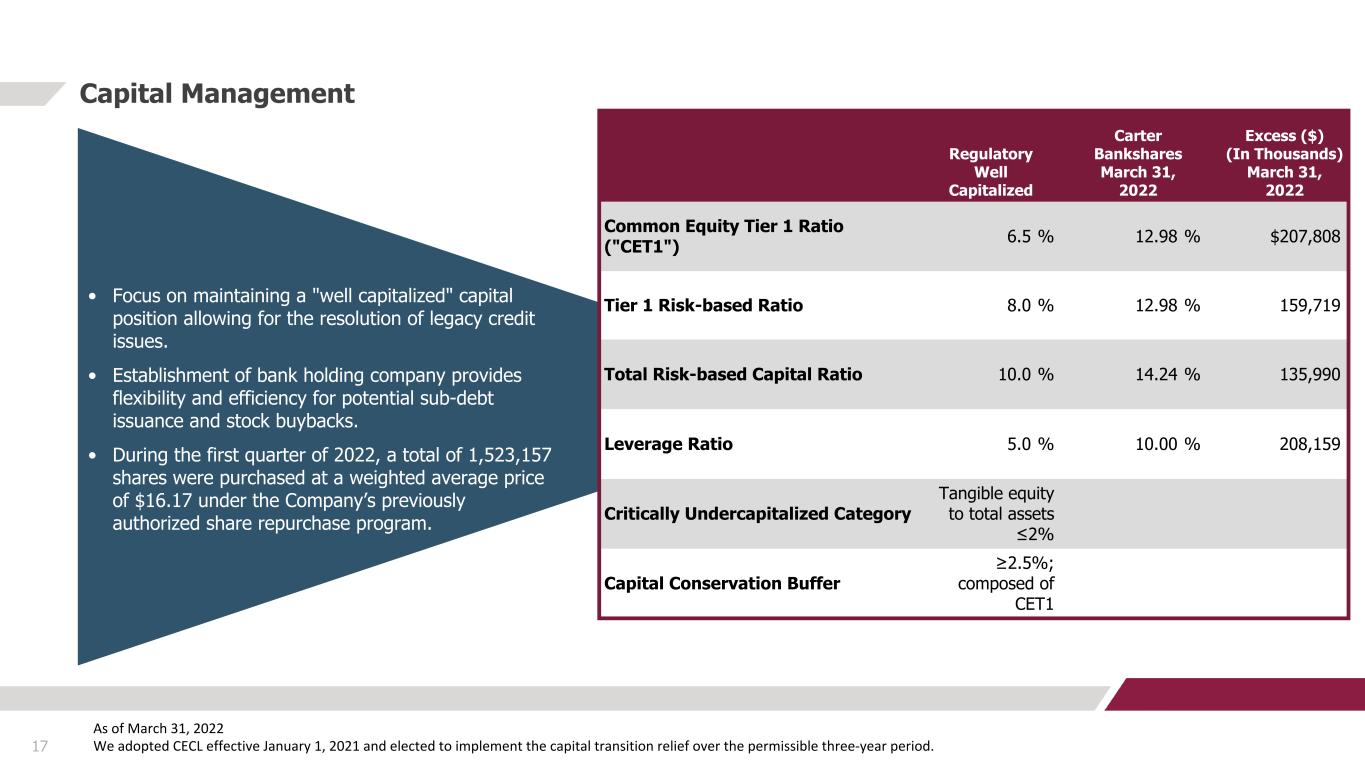

Capital Management 17 As of March 31, 2022 We adopted CECL effective January 1, 2021 and elected to implement the capital transition relief over the permissible three-year period. • Focus on maintaining a "well capitalized" capital position allowing for the resolution of legacy credit issues. • Establishment of bank holding company provides flexibility and efficiency for potential sub-debt issuance and stock buybacks. • During the first quarter of 2022, a total of 1,523,157 shares were purchased at a weighted average price of $16.17 under the Company’s previously authorized share repurchase program. Regulatory Well Capitalized Carter Bankshares March 31, 2022 Excess ($) (In Thousands) March 31, 2022 Common Equity Tier 1 Ratio ("CET1") 6.5 % 12.98 % $207,808 Tier 1 Risk-based Ratio 8.0 % 12.98 % 159,719 Total Risk-based Capital Ratio 10.0 % 14.24 % 135,990 Leverage Ratio 5.0 % 10.00 % 208,159 Critically Undercapitalized Category Tangible equity to total assets ≤2% Capital Conservation Buffer ≥2.5%; composed of CET1

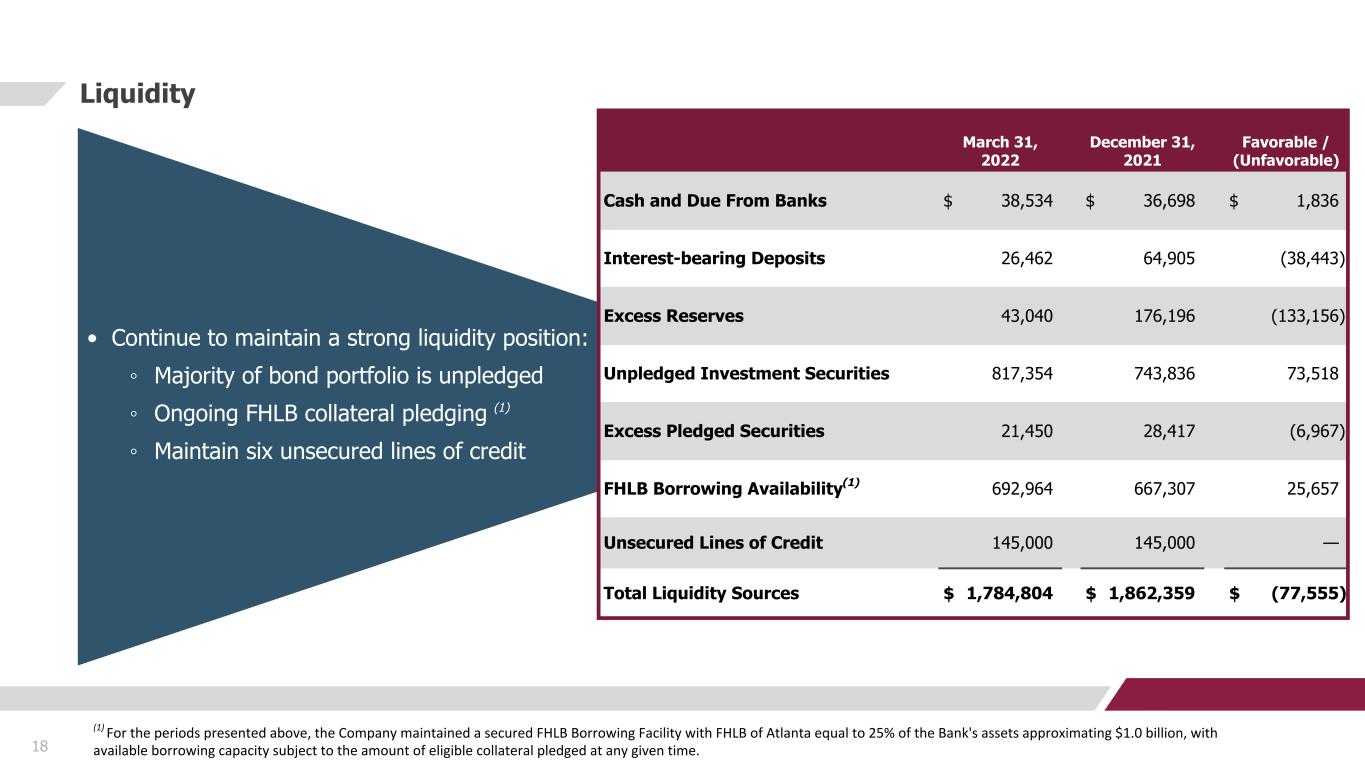

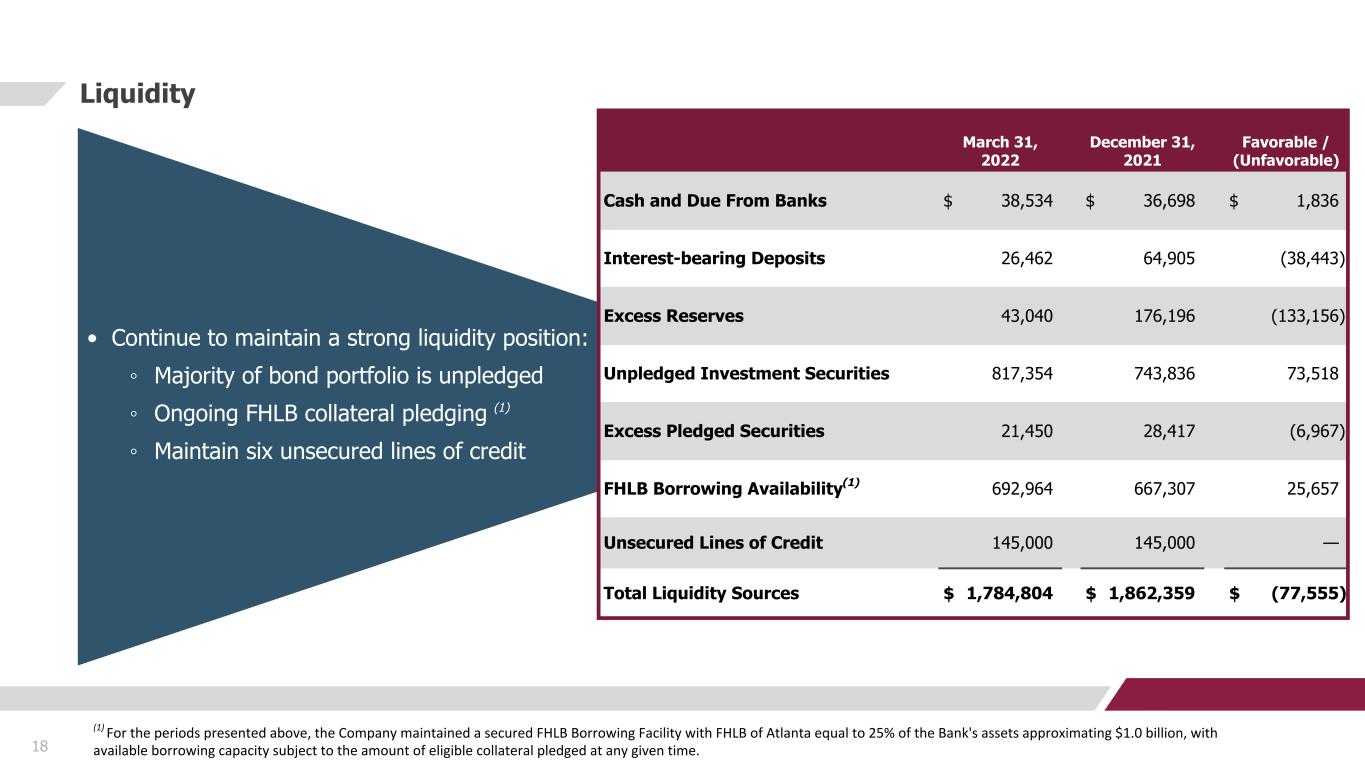

Liquidity 18 (1) For the periods presented above, the Company maintained a secured FHLB Borrowing Facility with FHLB of Atlanta equal to 25% of the Bank's assets approximating $1.0 billion, with available borrowing capacity subject to the amount of eligible collateral pledged at any given time. • Continue to maintain a strong liquidity position: ◦ Majority of bond portfolio is unpledged ◦ Ongoing FHLB collateral pledging (1) ◦ Maintain six unsecured lines of credit March 31, 2022 December 31, 2021 Favorable / (Unfavorable) Cash and Due From Banks $ 38,534 $ 36,698 $ 1,836 Interest-bearing Deposits 26,462 64,905 (38,443) Excess Reserves 43,040 176,196 (133,156) Unpledged Investment Securities 817,354 743,836 73,518 Excess Pledged Securities 21,450 28,417 (6,967) FHLB Borrowing Availability(1) 692,964 667,307 25,657 Unsecured Lines of Credit 145,000 145,000 — Total Liquidity Sources $ 1,784,804 $ 1,862,359 $ (77,555)

Deposit Composition 19 $ in thousands IMPROVING DEPOSIT MIX • Reliance on Certificates of Deposit continues to decline with a net decrease of $238.0M or (15.6)% YoY, as well as an increase in non-maturing deposits. For the Period Ending Variance 03/31/22 12/31/21 03/31/21 Quarter Year Lifetime Free Checking $ 708,353 $ 747,909 $ 733,291 $ (39,556) $ (24,938) Interest-Bearing Demand 480,192 452,644 384,425 27,548 95,767 Money Market 526,838 463,056 323,008 63,782 203,830 Savings 728,425 690,549 646,722 37,876 81,703 Certificates of Deposits 1,284,470 1,344,318 1,522,510 (59,848) (238,040) Deposits Held-for-Assumption in Connection with Sale of Bank Branches — — 81,565 — (81,565) Total Deposits $ 3,728,278 $ 3,698,476 $ 3,691,521 $ 29,802 $ 36,757 Total Deposits Composition $3,591 $3,504 $3,685 $3,698 $3,728 525 555 709 748 708 3,066 2,949 2,976 2,950 3,020 Noninterest-bearing Deposits Interest-bearing Deposits YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 DDA - Int.- Bearing 13% CDs 34% DDA - Int. Free 19% Savings 20% Money Market 14% (1) Period end balances. (1)

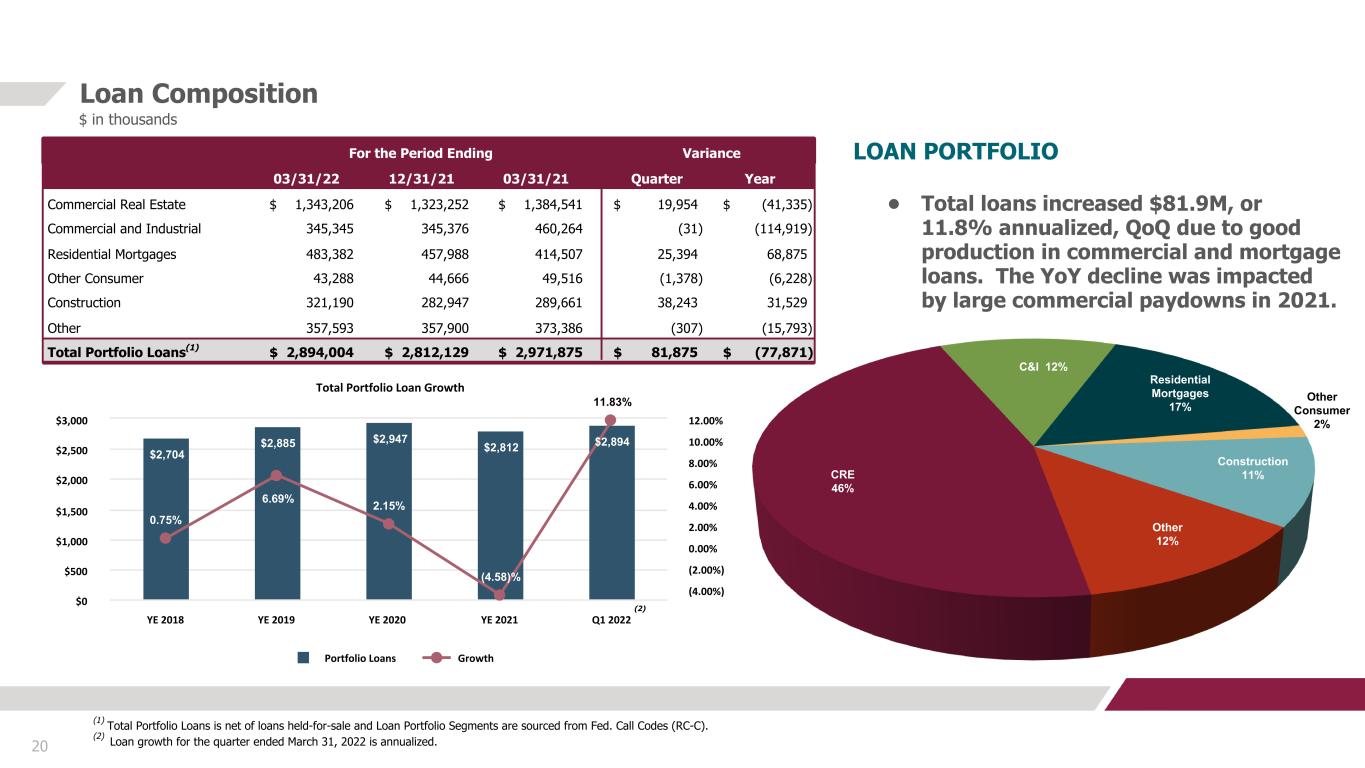

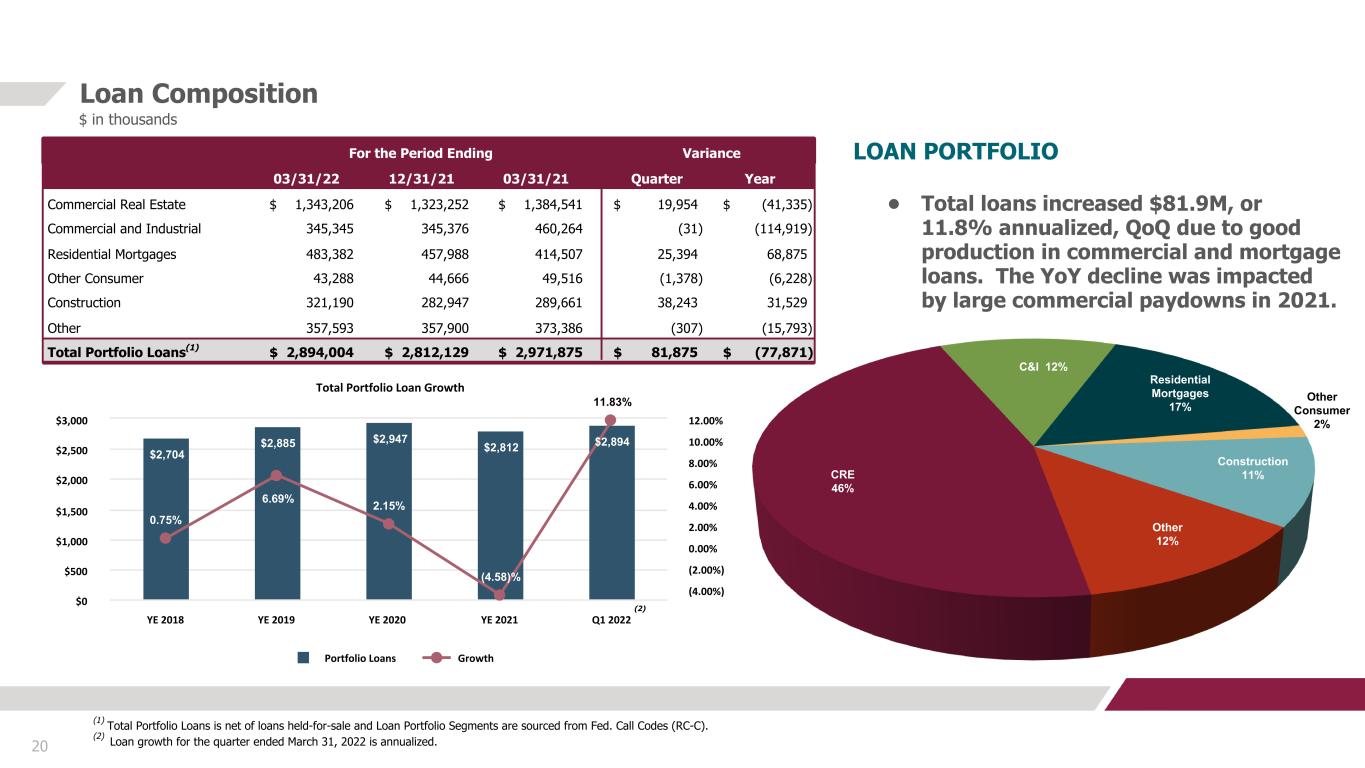

Total Portfolio Loan Growth $2,704 $2,885 $2,947 $2,812 $2,894 0.75% 6.69% 2.15% (4.58)% 11.83% Portfolio Loans Growth YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 (4.00%) (2.00%) 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% Loan Composition 20 $ in thousands LOAN PORTFOLIO • Total loans increased $81.9M, or 11.8% annualized, QoQ due to good production in commercial and mortgage loans. The YoY decline was impacted by large commercial paydowns in 2021. For the Period Ending Variance 03/31/22 12/31/21 03/31/21 Quarter Year Commercial Real Estate $ 1,343,206 $ 1,323,252 $ 1,384,541 $ 19,954 $ (41,335) Commercial and Industrial 345,345 345,376 460,264 (31) (114,919) Residential Mortgages 483,382 457,988 414,507 25,394 68,875 Other Consumer 43,288 44,666 49,516 (1,378) (6,228) Construction 321,190 282,947 289,661 38,243 31,529 Other 357,593 357,900 373,386 (307) (15,793) Total Portfolio Loans(1) $ 2,894,004 $ 2,812,129 $ 2,971,875 $ 81,875 $ (77,871) Other Consumer 2% CRE 46% C&I 12% Construction 11% Residential Mortgages 17% (1) Total Portfolio Loans is net of loans held-for-sale and Loan Portfolio Segments are sourced from Fed. Call Codes (RC-C). (2) Loan growth for the quarter ended March 31, 2022 is annualized. (2) Other 12%

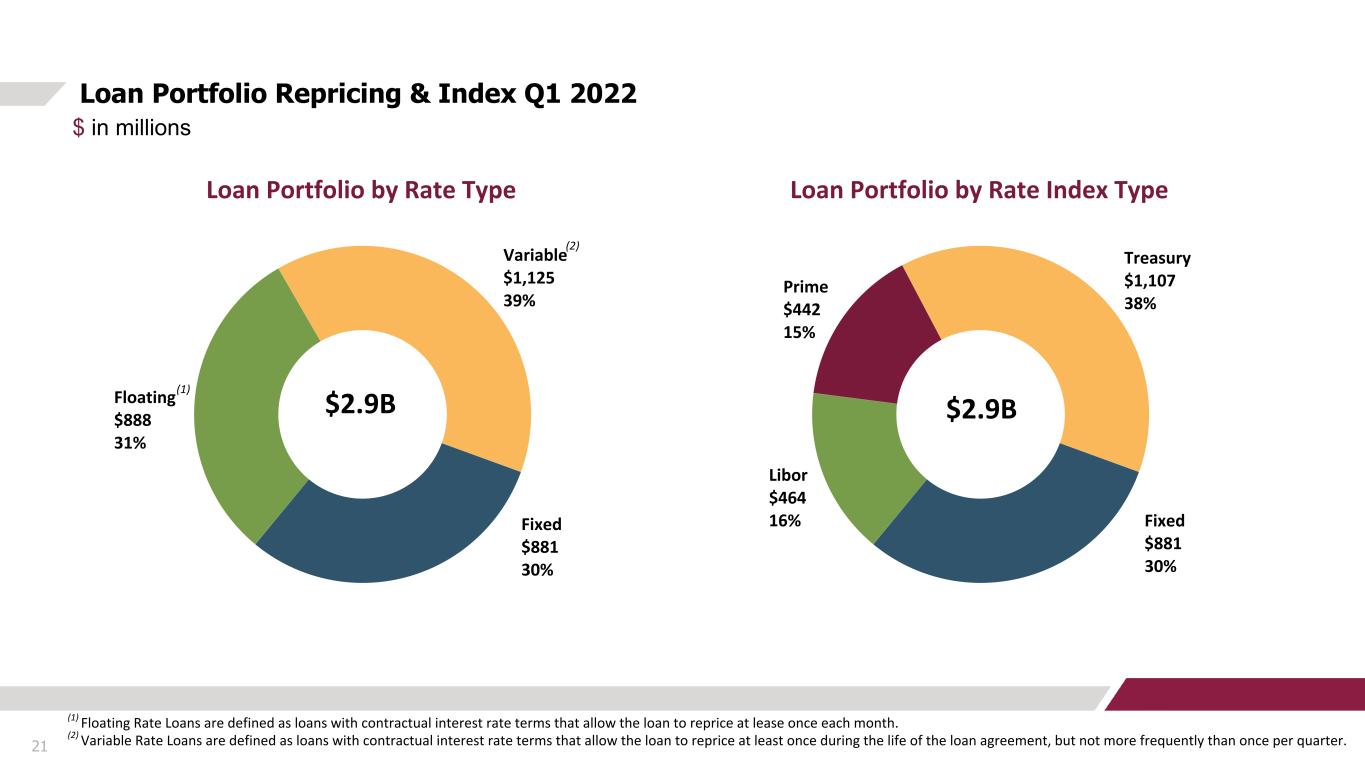

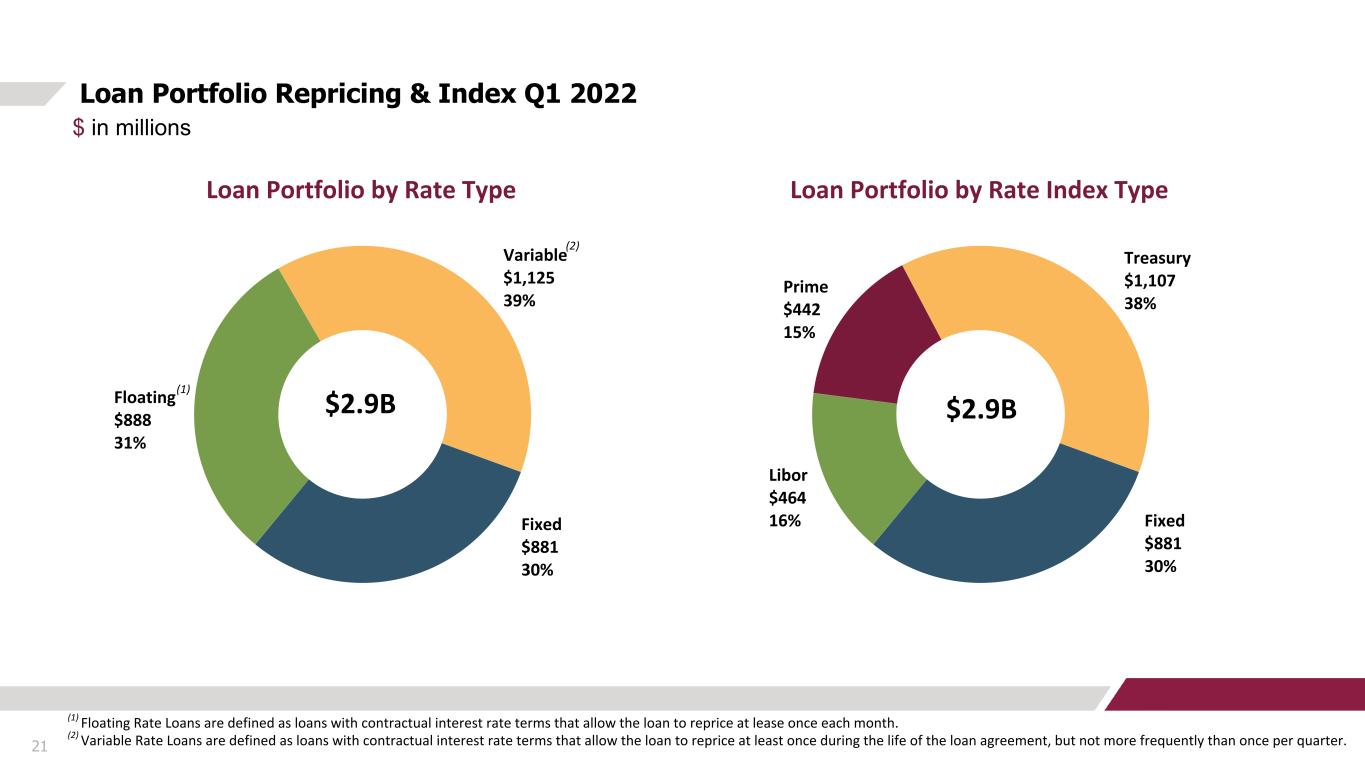

21 Loan Portfolio Repricing & Index Q1 2022 $ in millions (1) Floating Rate Loans are defined as loans with contractual interest rate terms that allow the loan to reprice at lease once each month. (2) Variable Rate Loans are defined as loans with contractual interest rate terms that allow the loan to reprice at least once during the life of the loan agreement, but not more frequently than once per quarter. Loan Portfolio by Rate Type Fixed $881 30% Floating $888 31% Variable $1,125 39% Loan Portfolio by Rate Index Type Fixed $881 30% Libor $464 16% Prime $442 15% Treasury $1,107 38% $2.9B $2.9B (1) (2)

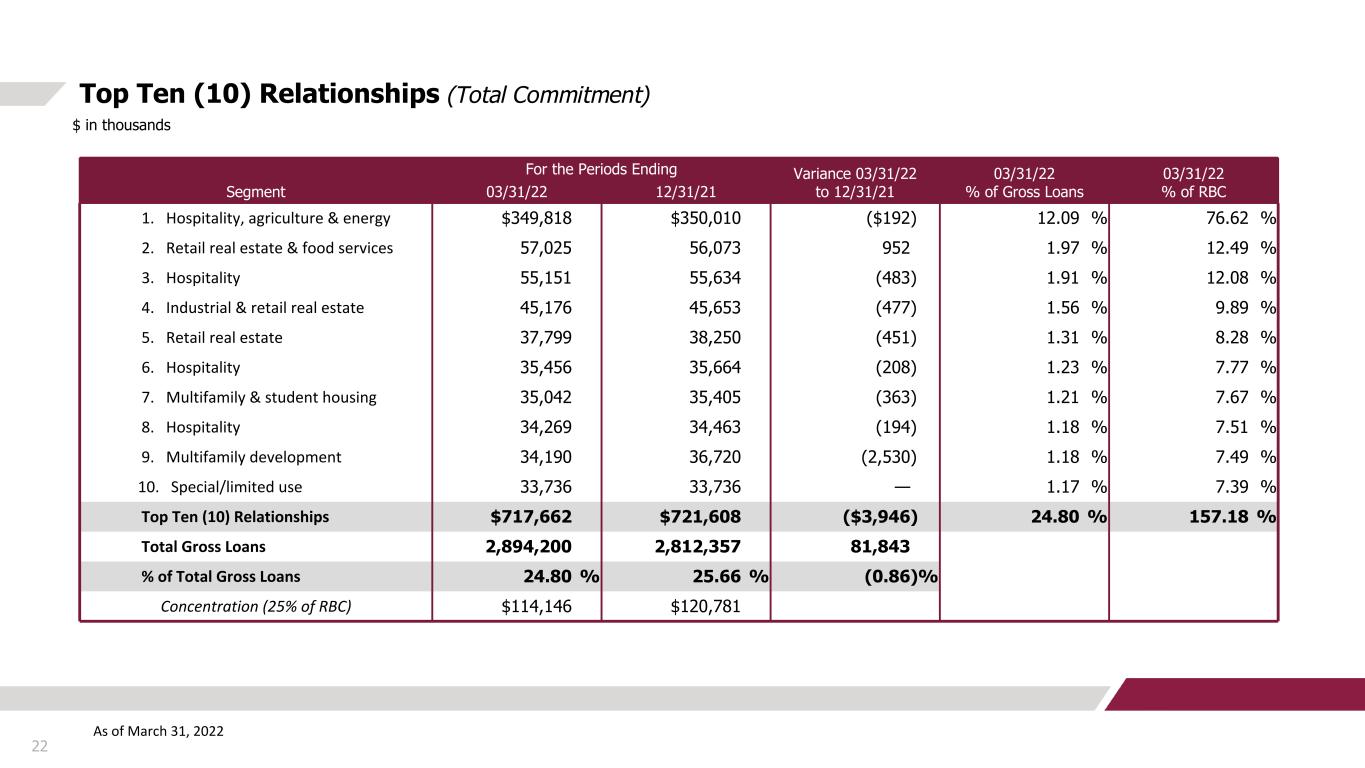

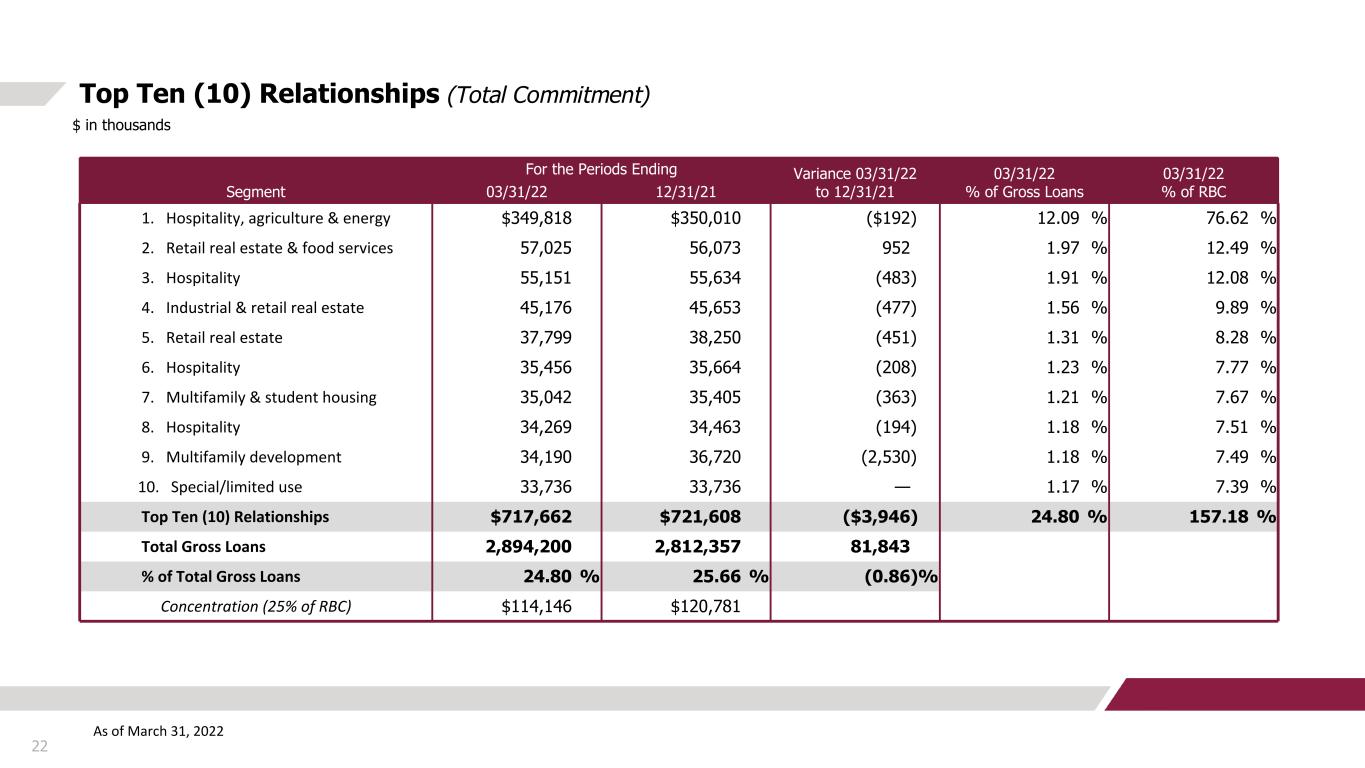

22 Top Ten (10) Relationships (Total Commitment) $ in thousands Segment For the Periods Ending Variance 03/31/22 to 12/31/21 03/31/22 % of Gross Loans 03/31/22 % of RBC03/31/22 12/31/21 1. Hospitality, agriculture & energy $349,818 $350,010 ($192) 12.09 % 76.62 % 2. Retail real estate & food services 57,025 56,073 952 1.97 % 12.49 % 3. Hospitality 55,151 55,634 (483) 1.91 % 12.08 % 4. Industrial & retail real estate 45,176 45,653 (477) 1.56 % 9.89 % 5. Retail real estate 37,799 38,250 (451) 1.31 % 8.28 % 6. Hospitality 35,456 35,664 (208) 1.23 % 7.77 % 7. Multifamily & student housing 35,042 35,405 (363) 1.21 % 7.67 % 8. Hospitality 34,269 34,463 (194) 1.18 % 7.51 % 9. Multifamily development 34,190 36,720 (2,530) 1.18 % 7.49 % 10. Special/limited use 33,736 33,736 — 1.17 % 7.39 % Top Ten (10) Relationships $717,662 $721,608 ($3,946) 24.80 % 157.18 % Total Gross Loans 2,894,200 2,812,357 81,843 % of Total Gross Loans 24.80 % 25.66 % (0.86) % Concentration (25% of RBC) $114,146 $120,781 As of March 31, 2022

23 Balance Sheet Transformation 03

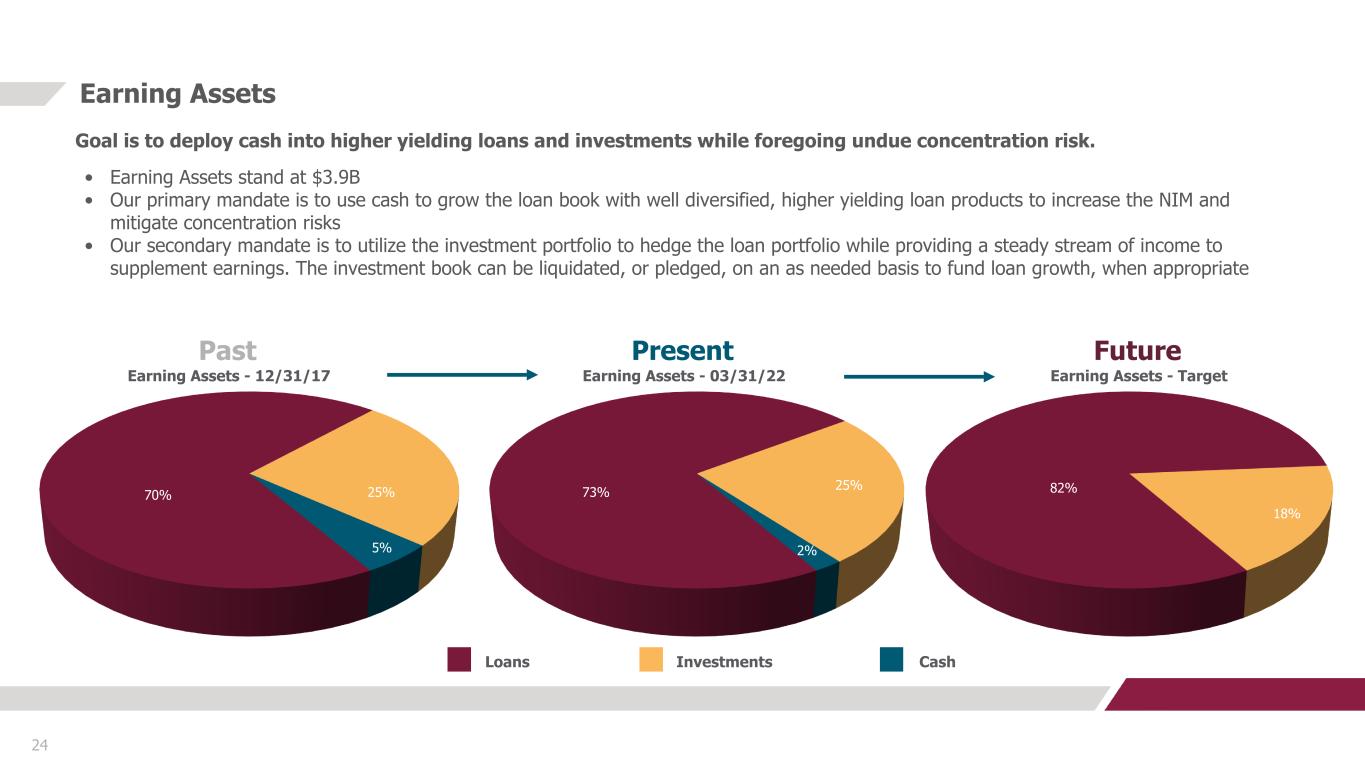

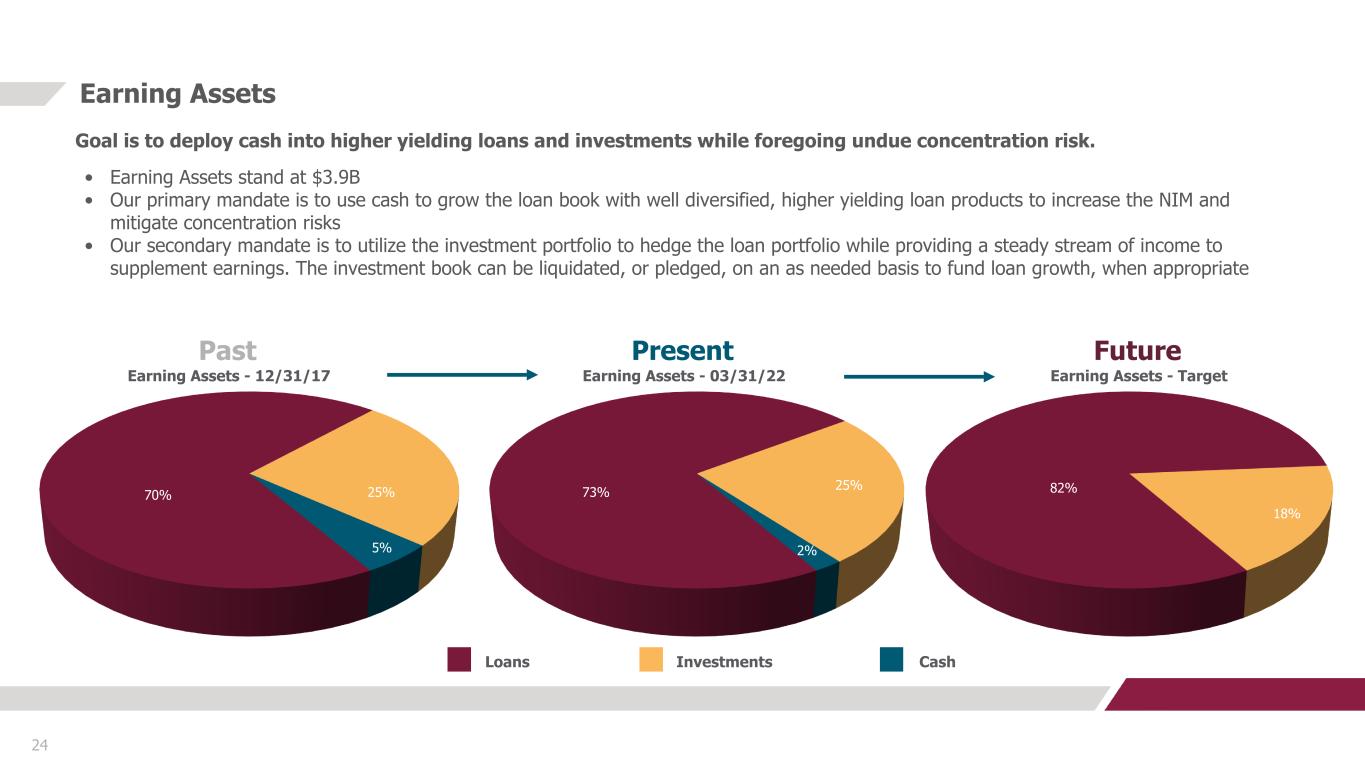

24 Earning Assets Goal is to deploy cash into higher yielding loans and investments while foregoing undue concentration risk. • Earning Assets stand at $3.9B • Our primary mandate is to use cash to grow the loan book with well diversified, higher yielding loan products to increase the NIM and mitigate concentration risks • Our secondary mandate is to utilize the investment portfolio to hedge the loan portfolio while providing a steady stream of income to supplement earnings. The investment book can be liquidated, or pledged, on an as needed basis to fund loan growth, when appropriate Past Present Future Loans Investments Cash 70% 73% 82% 18% 25%25% 5% 2% Earning Assets - 12/31/17 Earning Assets - 03/31/22 Earning Assets - Target

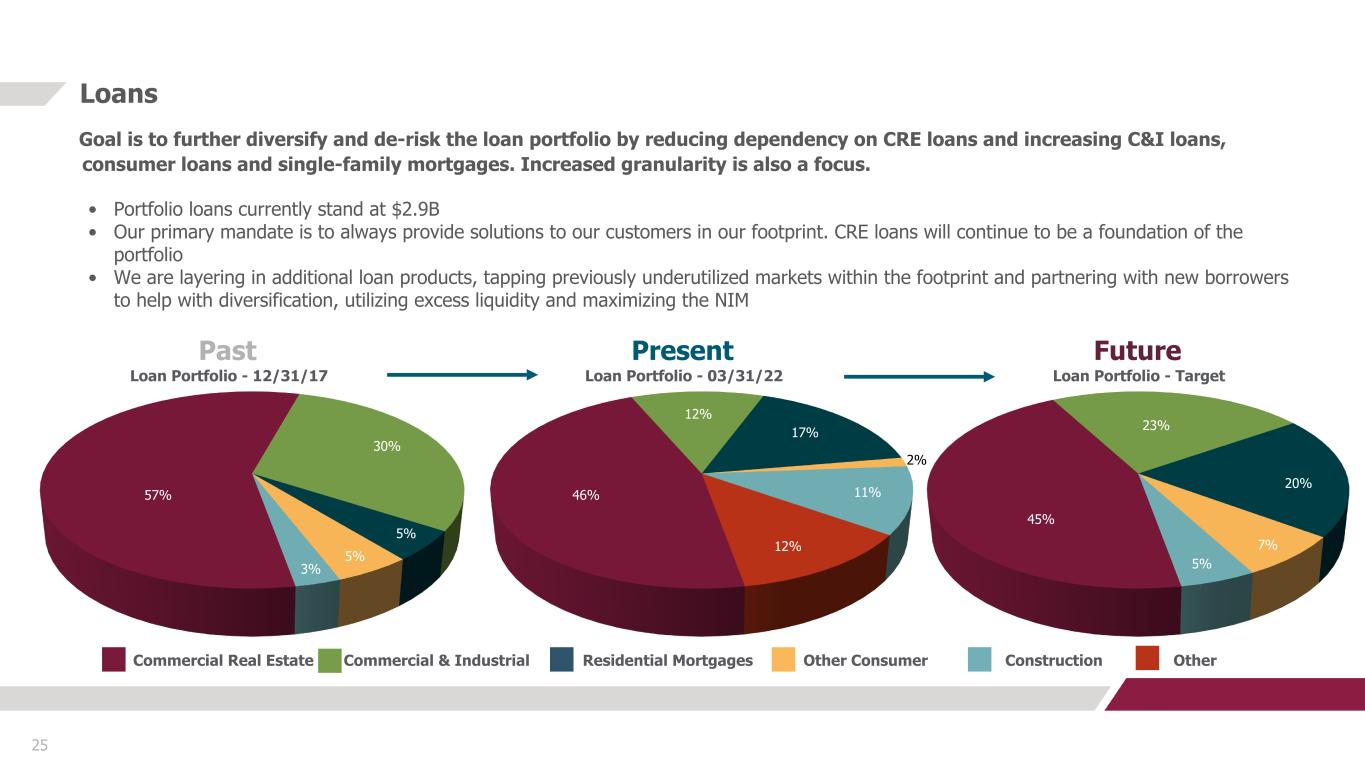

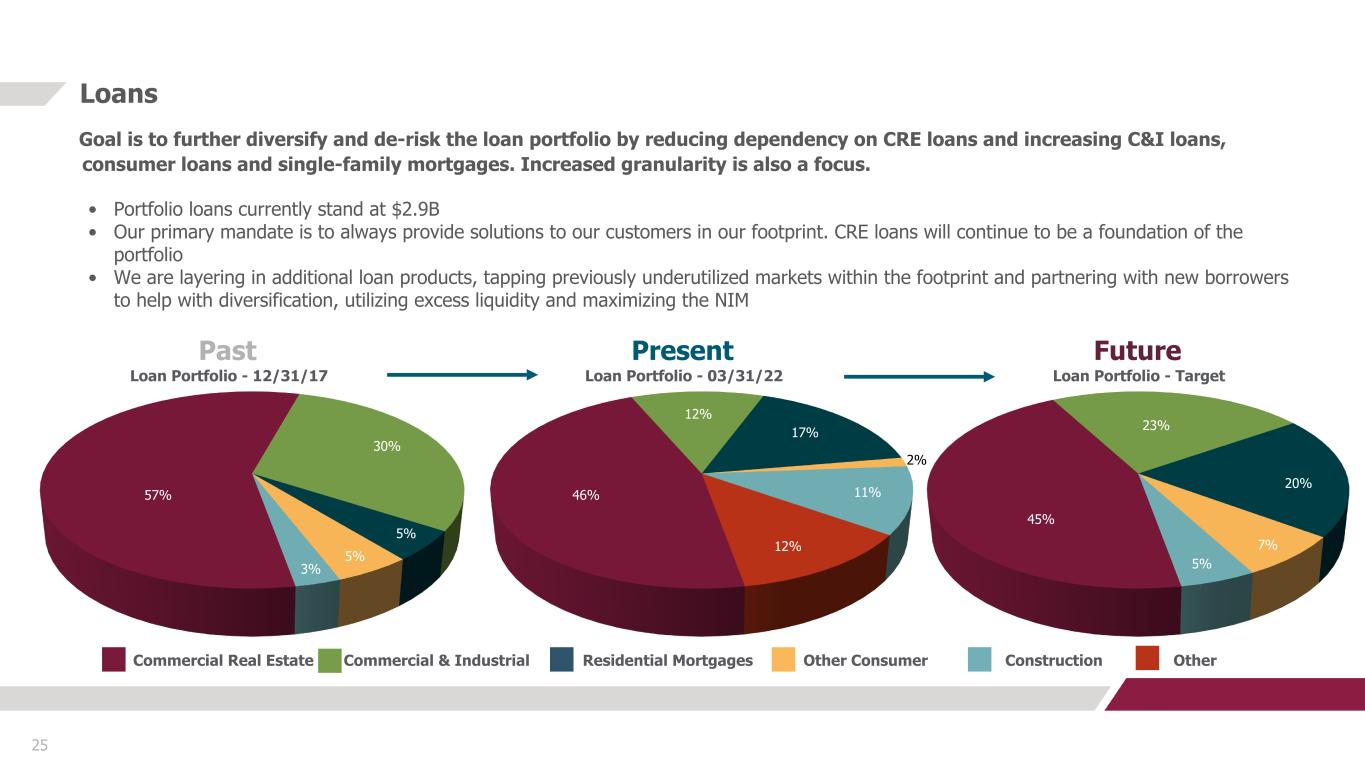

Commercial Real Estate Commercial & Industrial Residential Mortgages Other Consumer Construction Other 25 Loans Past Present Future 57% 46% 45% 20% 17% 5% 3% 2% 7% Loan Portfolio - 12/31/17 Loan Portfolio - 03/31/22 Loan Portfolio - Target 5% 11% 5% 30% 12% 23% Goal is to further diversify and de-risk the loan portfolio by reducing dependency on CRE loans and increasing C&I loans, consumer loans and single-family mortgages. Increased granularity is also a focus. • Portfolio loans currently stand at $2.9B • Our primary mandate is to always provide solutions to our customers in our footprint. CRE loans will continue to be a foundation of the portfolio • We are layering in additional loan products, tapping previously underutilized markets within the footprint and partnering with new borrowers to help with diversification, utilizing excess liquidity and maximizing the NIM 12%

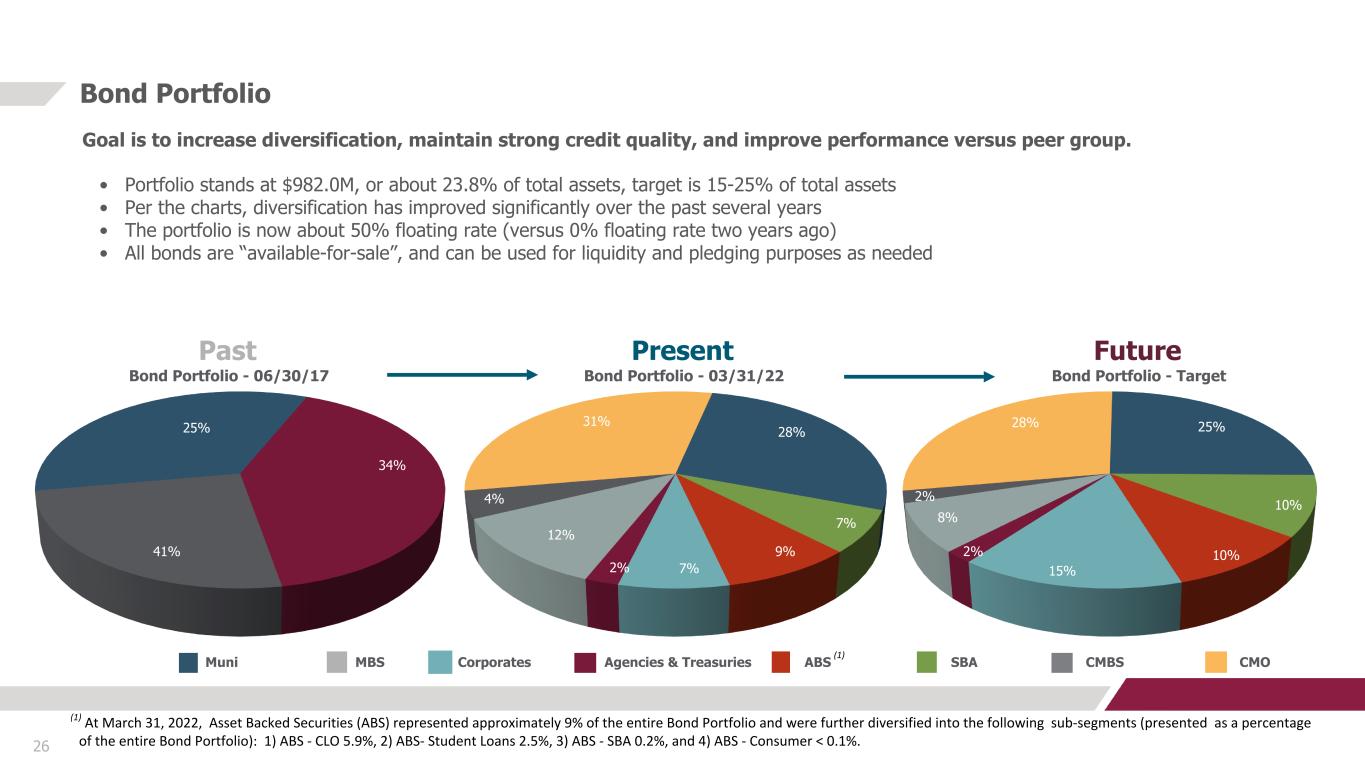

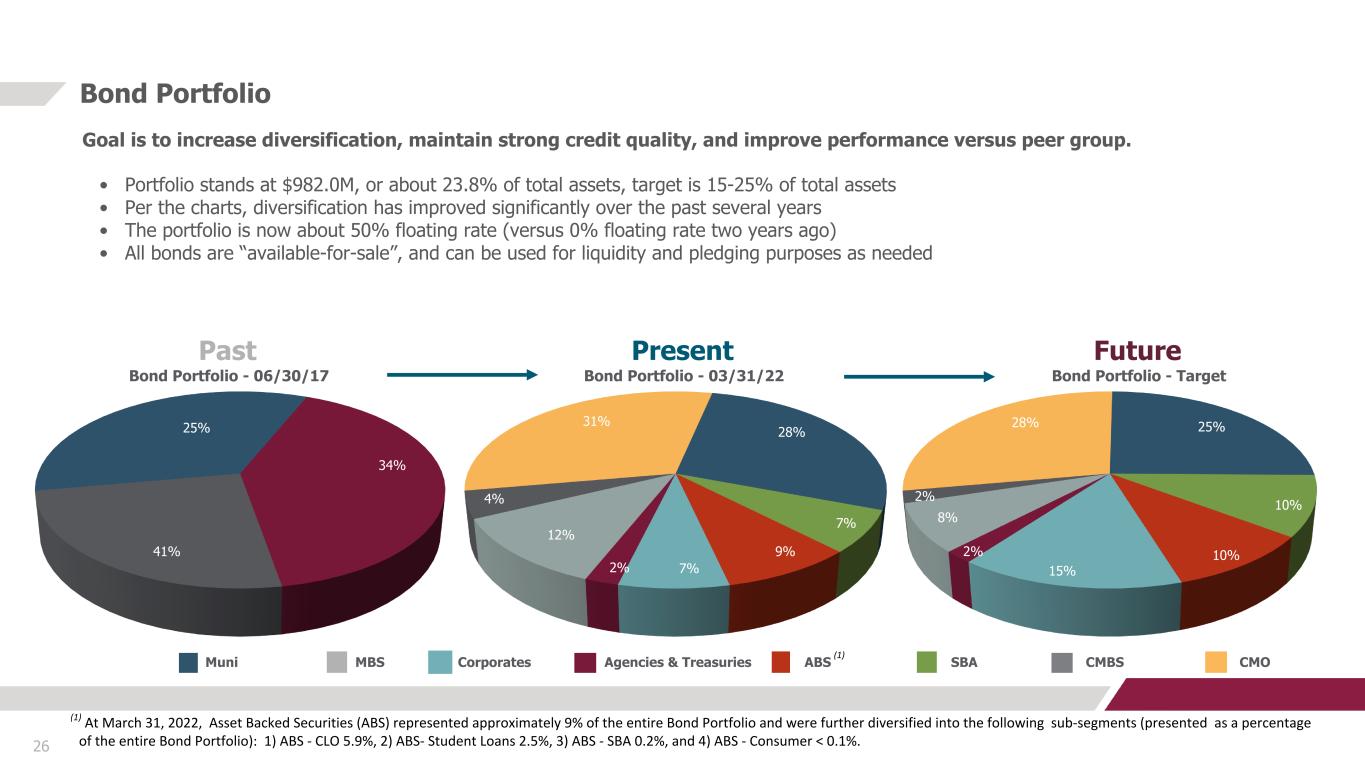

Muni MBS Corporates Agencies & Treasuries ABS SBA CMBS CMO 26 Bond Portfolio Past Present Future 12% 8% 25% 41% 9% 10% Bond Portfolio - 06/30/17 Bond Portfolio - 03/31/22 Bond Portfolio - Target 10% 34% 28% 28% 15%7% 31% 7% 25% Goal is to increase diversification, maintain strong credit quality, and improve performance versus peer group. • Portfolio stands at $982.0M, or about 23.8% of total assets, target is 15-25% of total assets • Per the charts, diversification has improved significantly over the past several years • The portfolio is now about 50% floating rate (versus 0% floating rate two years ago) • All bonds are “available-for-sale”, and can be used for liquidity and pledging purposes as needed (1) At March 31, 2022, Asset Backed Securities (ABS) represented approximately 9% of the entire Bond Portfolio and were further diversified into the following sub-segments (presented as a percentage of the entire Bond Portfolio): 1) ABS - CLO 5.9%, 2) ABS- Student Loans 2.5%, 3) ABS - SBA 0.2%, and 4) ABS - Consumer < 0.1%. 2% 2% 2% (1) 4%

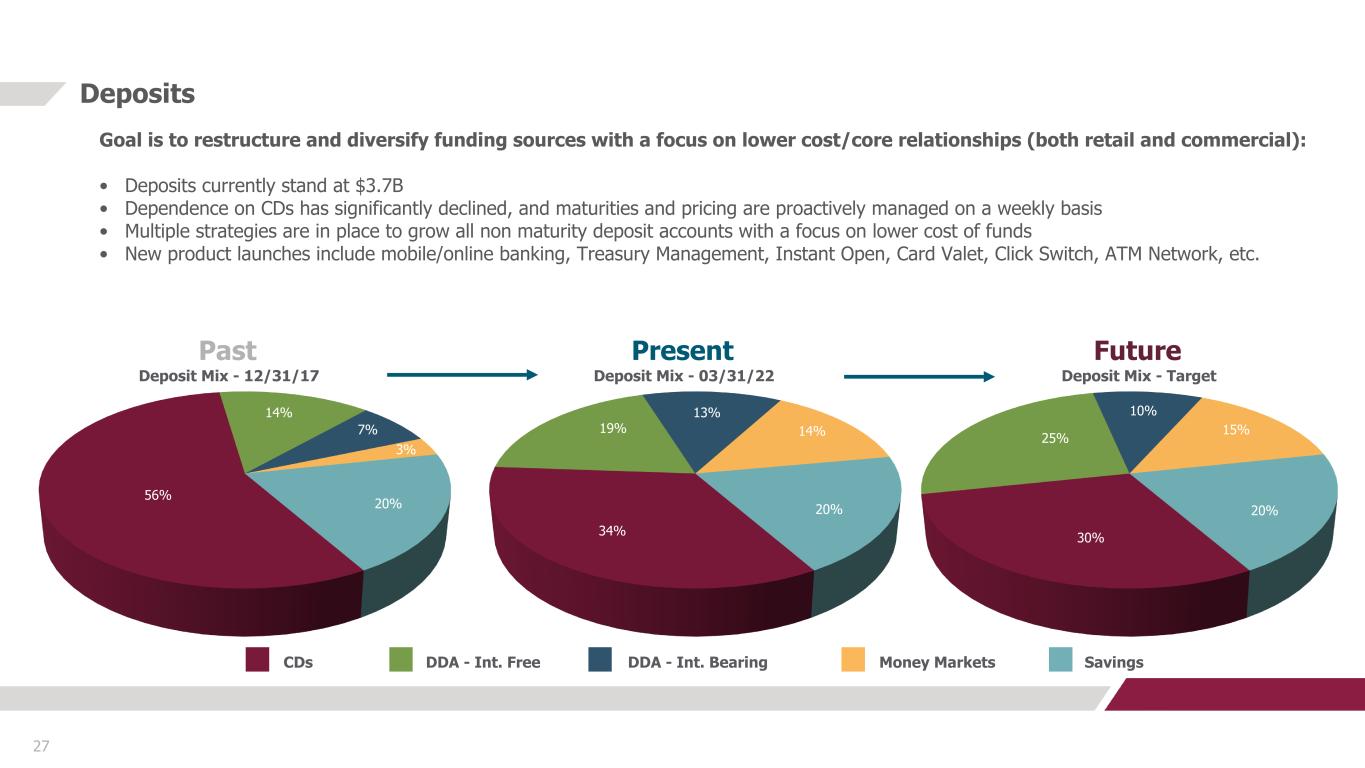

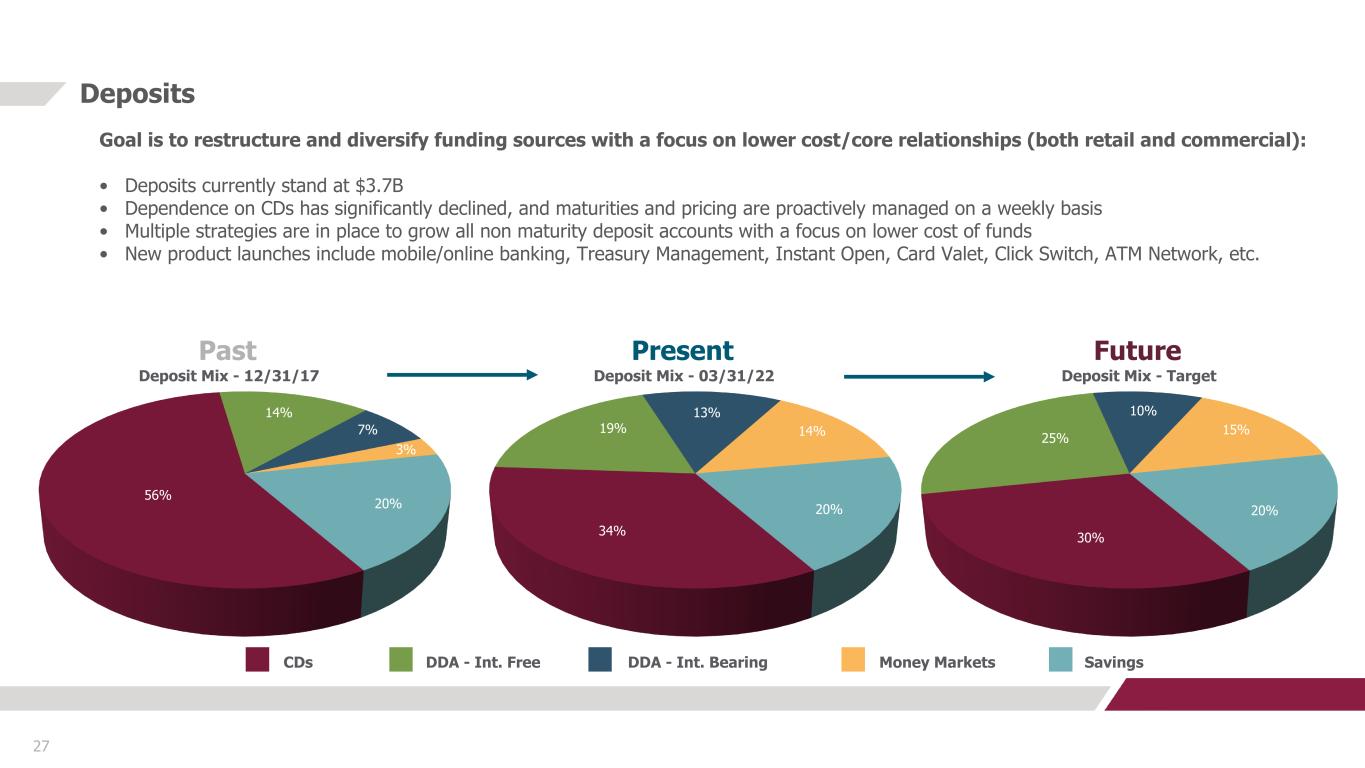

CDs DDA - Int. Free DDA - Int. Bearing Money Markets Savings 27 Deposits Past Present Future 56% 34% 30% 15%14% 3% 10% Deposit Mix - 12/31/17 Deposit Mix - 03/31/22 Deposit Mix - Target 20% 20% 20% 7% 19% 25% 14% 13% Goal is to restructure and diversify funding sources with a focus on lower cost/core relationships (both retail and commercial): • Deposits currently stand at $3.7B • Dependence on CDs has significantly declined, and maturities and pricing are proactively managed on a weekly basis • Multiple strategies are in place to grow all non maturity deposit accounts with a focus on lower cost of funds • New product launches include mobile/online banking, Treasury Management, Instant Open, Card Valet, Click Switch, ATM Network, etc.

Asset Quality 04 28 Insert CB&T photo here

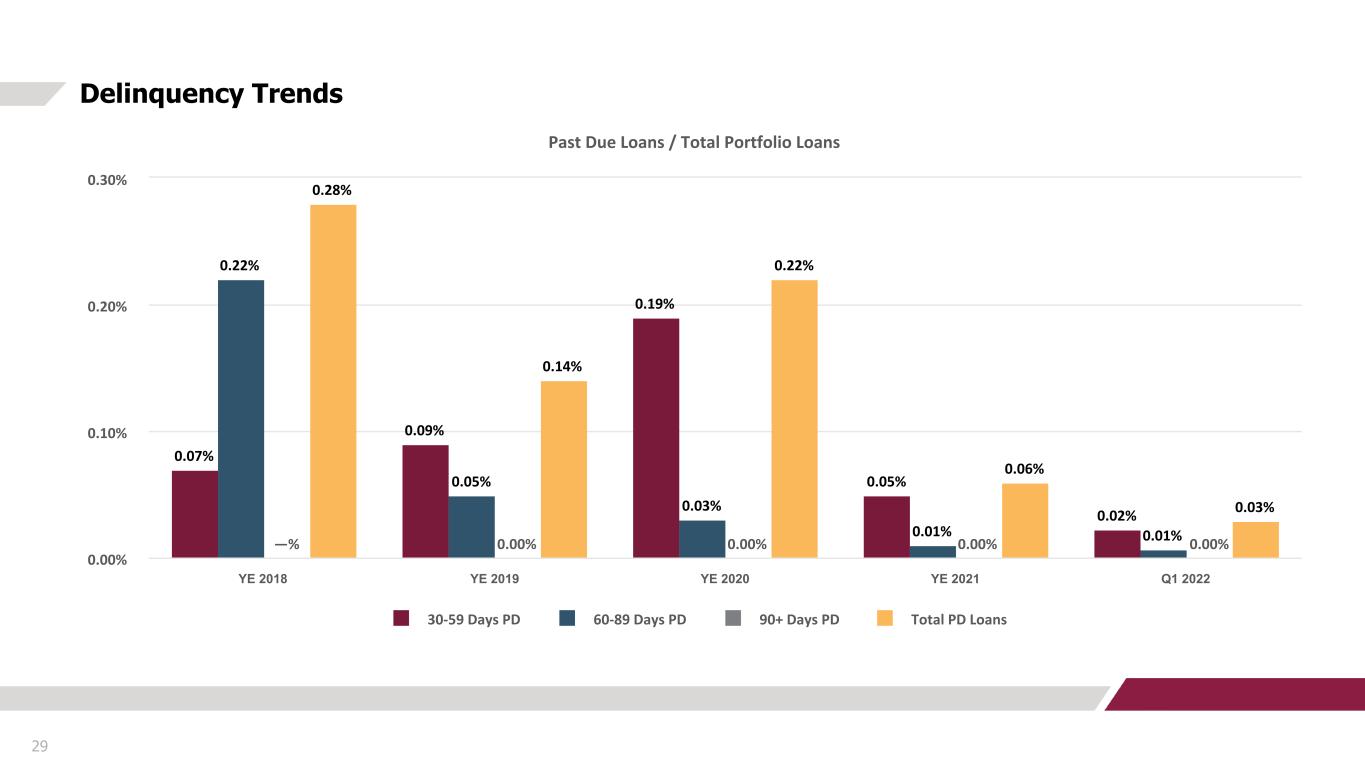

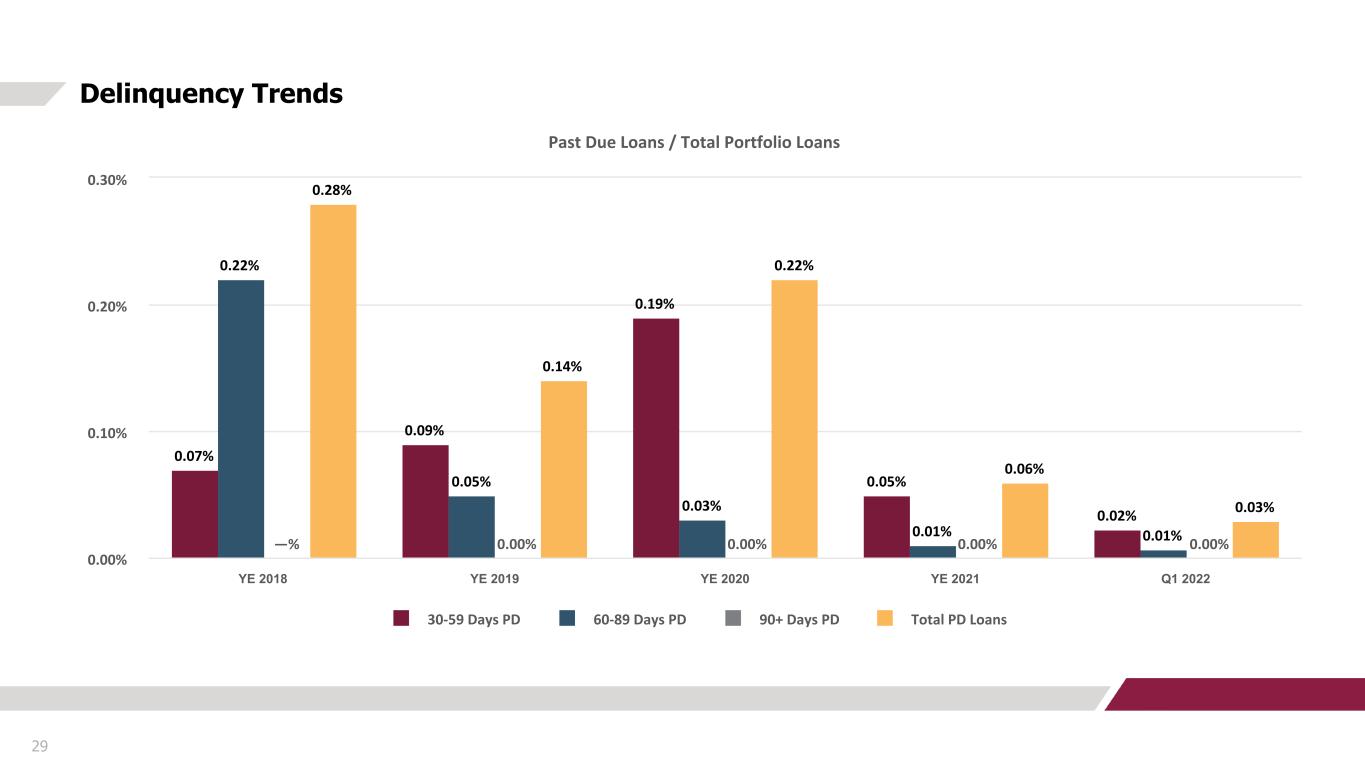

29 Delinquency Trends Past Due Loans / Total Portfolio Loans 0.07% 0.09% 0.19% 0.05% 0.02% 0.22% 0.05% 0.03% 0.01% 0.01%—% 0.00% 0.00% 0.00% 0.00% 0.28% 0.14% 0.22% 0.06% 0.03% 30-59 Days PD 60-89 Days PD 90+ Days PD Total PD Loans YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 0.00% 0.10% 0.20% 0.30%

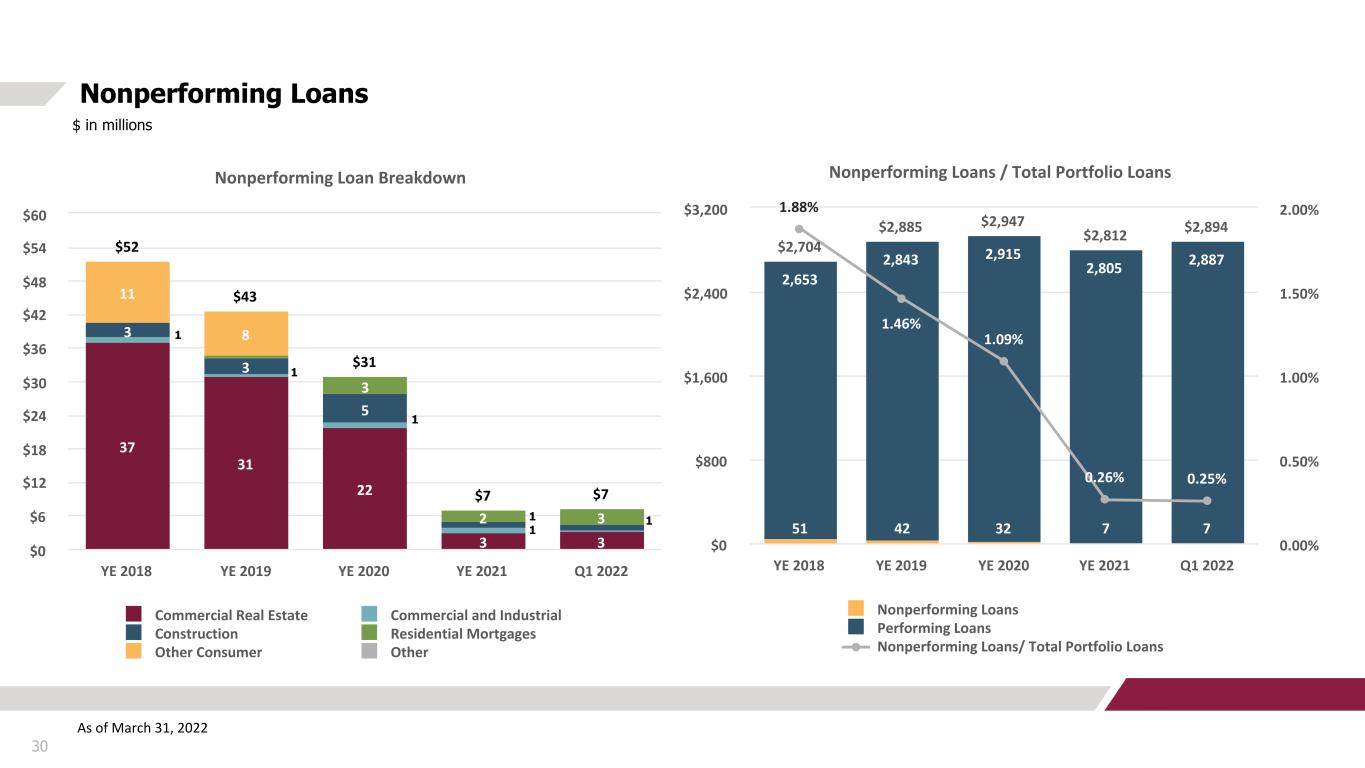

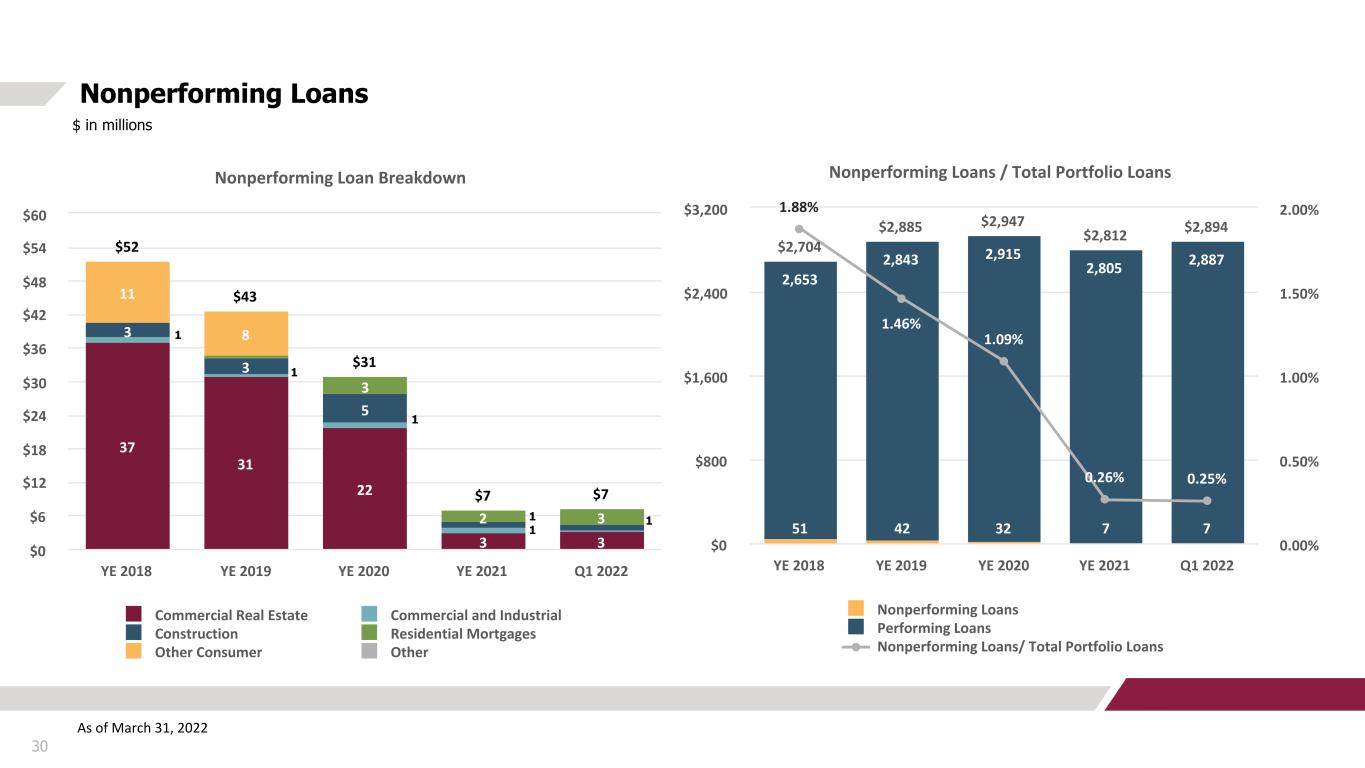

Nonperforming Loan Breakdown $52 $43 $31 $7 $7 37 31 22 3 3 3 3 5 3 2 3 11 8 Commercial Real Estate Commercial and Industrial Construction Residential Mortgages Other Consumer Other YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $6 $12 $18 $24 $30 $36 $42 $48 $54 $60 30 Nonperforming Loans $ in millions As of March 31, 2022 Nonperforming Loans / Total Portfolio Loans $2,704 $2,885 $2,947 $2,812 $2,894 51 42 32 7 7 2,653 2,843 2,915 2,805 2,887 1.88% 1.46% 1.09% 0.26% 0.25% Nonperforming Loans Performing Loans Nonperforming Loans/ Total Portfolio Loans YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $800 $1,600 $2,400 $3,200 0.00% 0.50% 1.00% 1.50% 2.00% 11 1 1 1 1

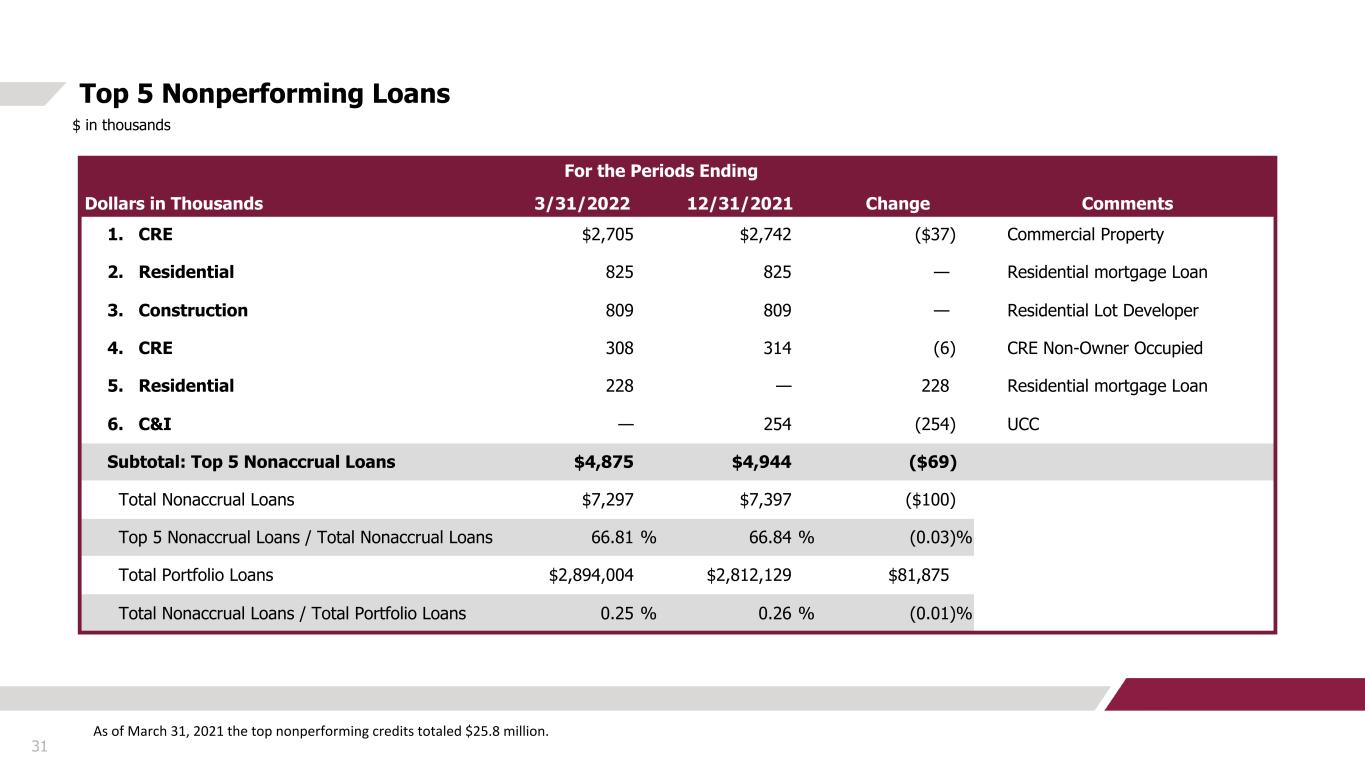

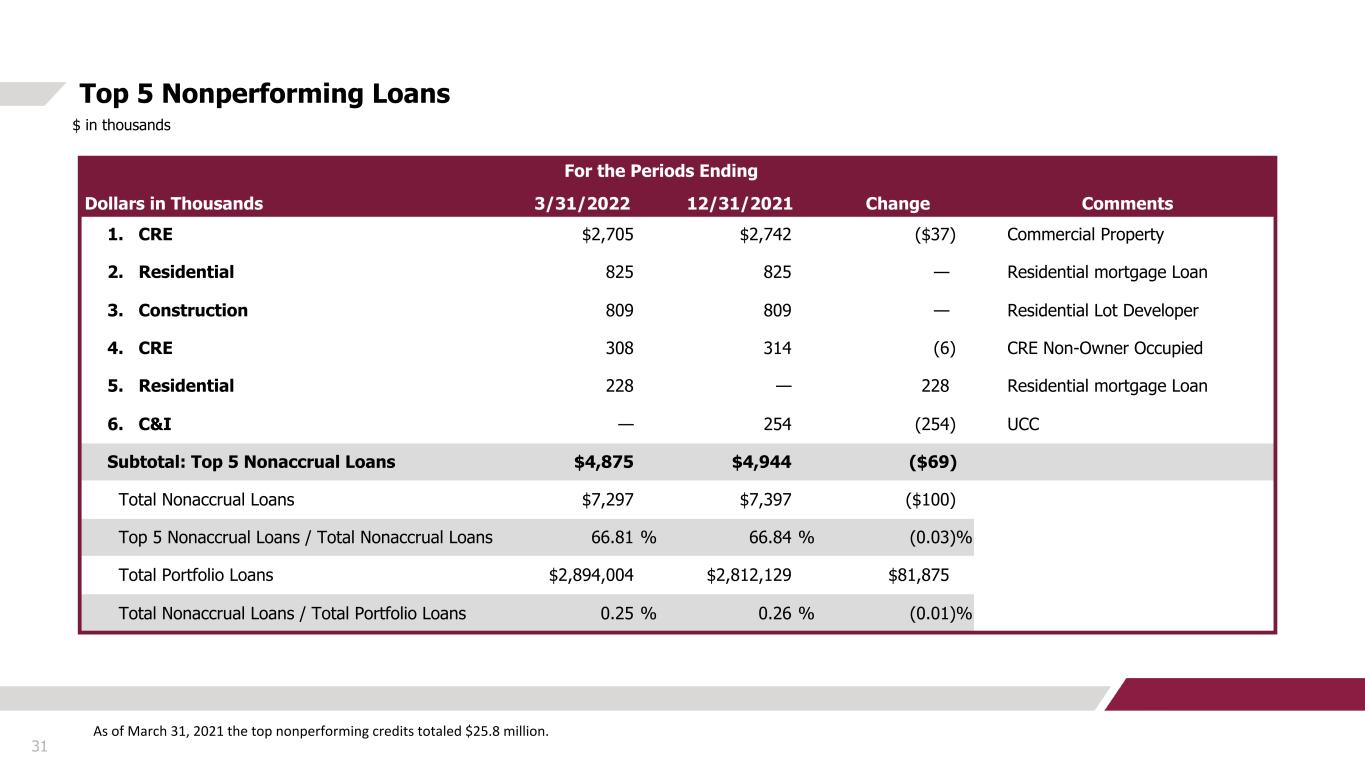

31 Top 5 Nonperforming Loans $ in thousands Dollars in Thousands For the Periods Ending Change Comments3/31/2022 12/31/2021 1. CRE $2,705 $2,742 ($37) Commercial Property 2. Residential 825 825 — Residential mortgage Loan 3. Construction 809 809 — Residential Lot Developer 4. CRE 308 314 (6) CRE Non-Owner Occupied 5. Residential 228 — 228 Residential mortgage Loan 6. C&I — 254 (254) UCC Subtotal: Top 5 Nonaccrual Loans $4,875 $4,944 ($69) Total Nonaccrual Loans $7,297 $7,397 ($100) Top 5 Nonaccrual Loans / Total Nonaccrual Loans 66.81 % 66.84 % (0.03) % Total Portfolio Loans $2,894,004 $2,812,129 $81,875 Total Nonaccrual Loans / Total Portfolio Loans 0.25 % 0.26 % (0.01) % As of March 31, 2021 the top nonperforming credits totaled $25.8 million.

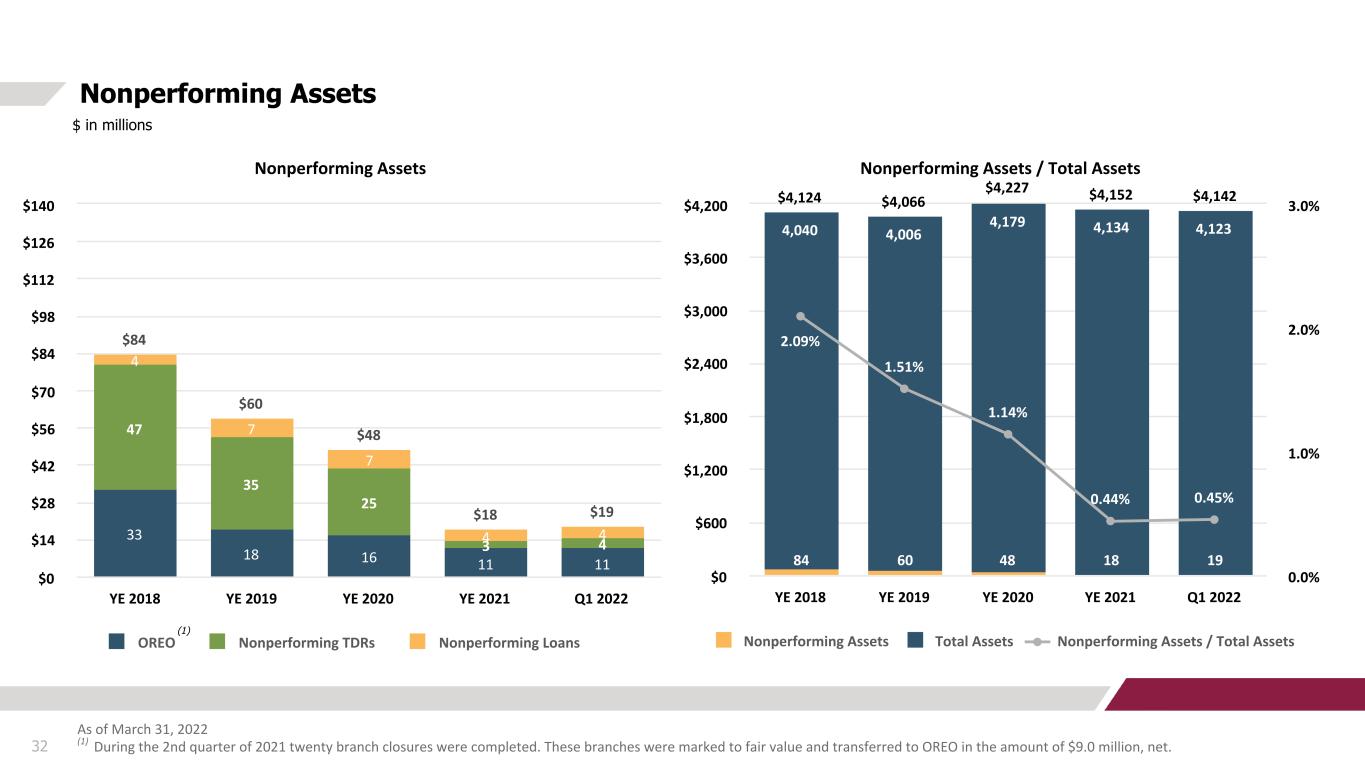

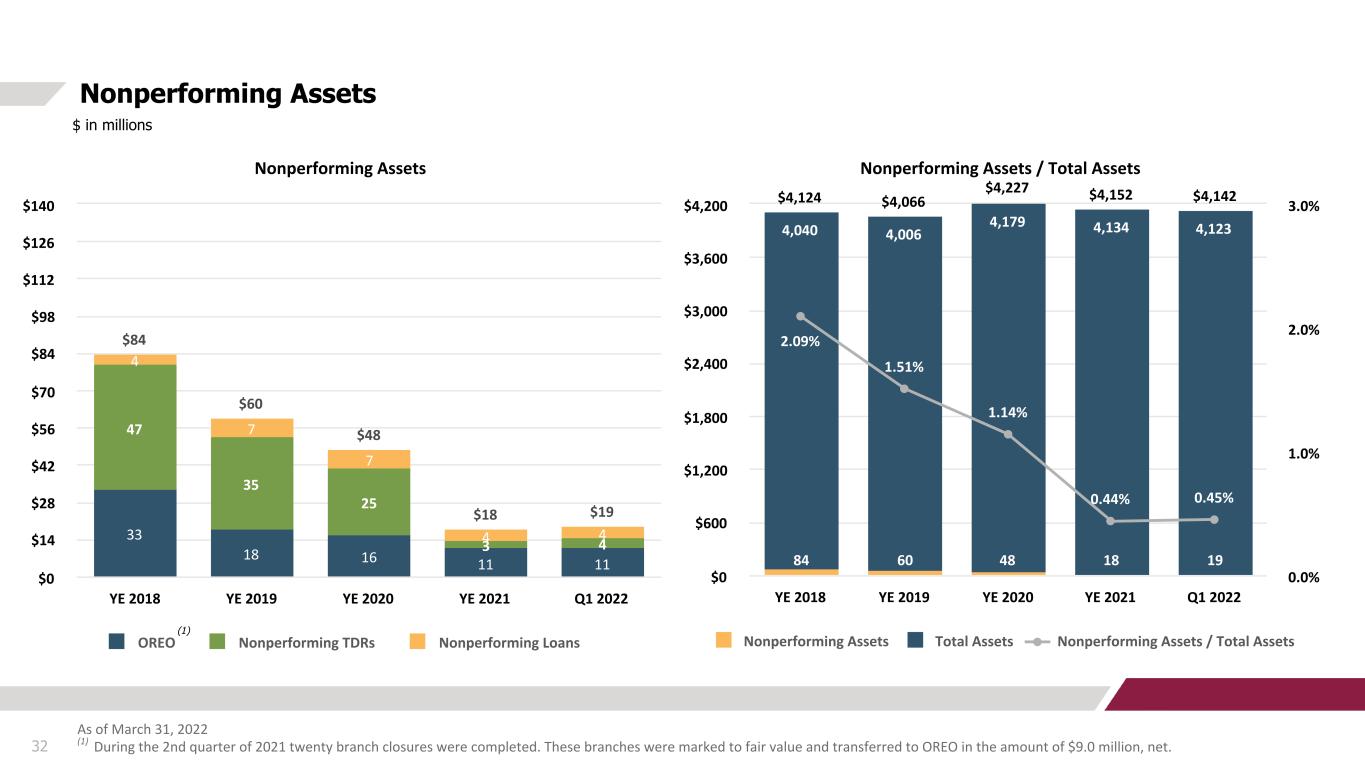

Nonperforming Assets $84 $60 $48 $18 $19 33 18 16 11 11 47 35 25 3 4 4 7 7 4 4 OREO Nonperforming TDRs Nonperforming Loans YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $14 $28 $42 $56 $70 $84 $98 $112 $126 $140 32 Nonperforming Assets $ in millions As of March 31, 2022 (1) During the 2nd quarter of 2021 twenty branch closures were completed. These branches were marked to fair value and transferred to OREO in the amount of $9.0 million, net. Nonperforming Assets / Total Assets $4,124 $4,066 $4,227 $4,152 $4,142 84 60 48 18 19 4,040 4,006 4,179 4,134 4,123 2.09% 1.51% 1.14% 0.44% 0.45% Nonperforming Assets Total Assets Nonperforming Assets / Total Assets YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $600 $1,200 $1,800 $2,400 $3,000 $3,600 $4,200 0.0% 1.0% 2.0% 3.0% (1)

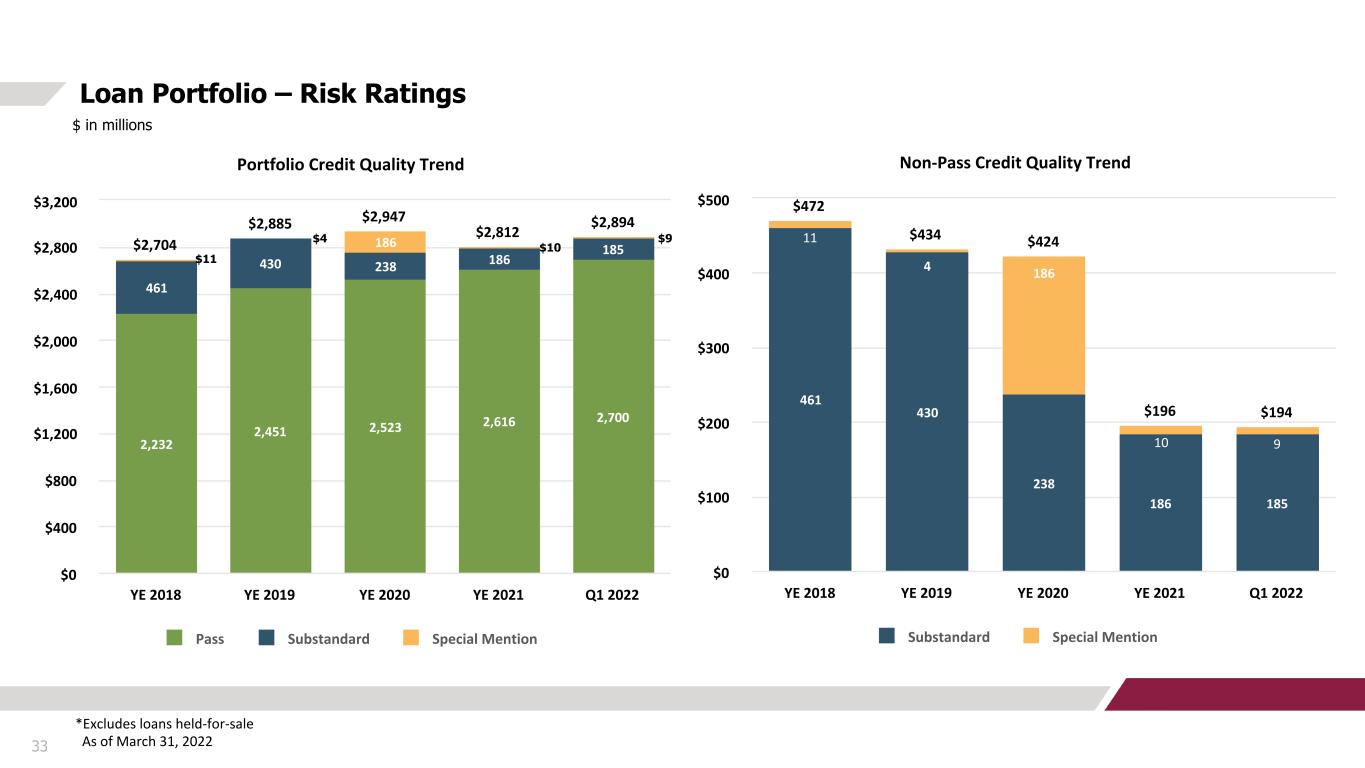

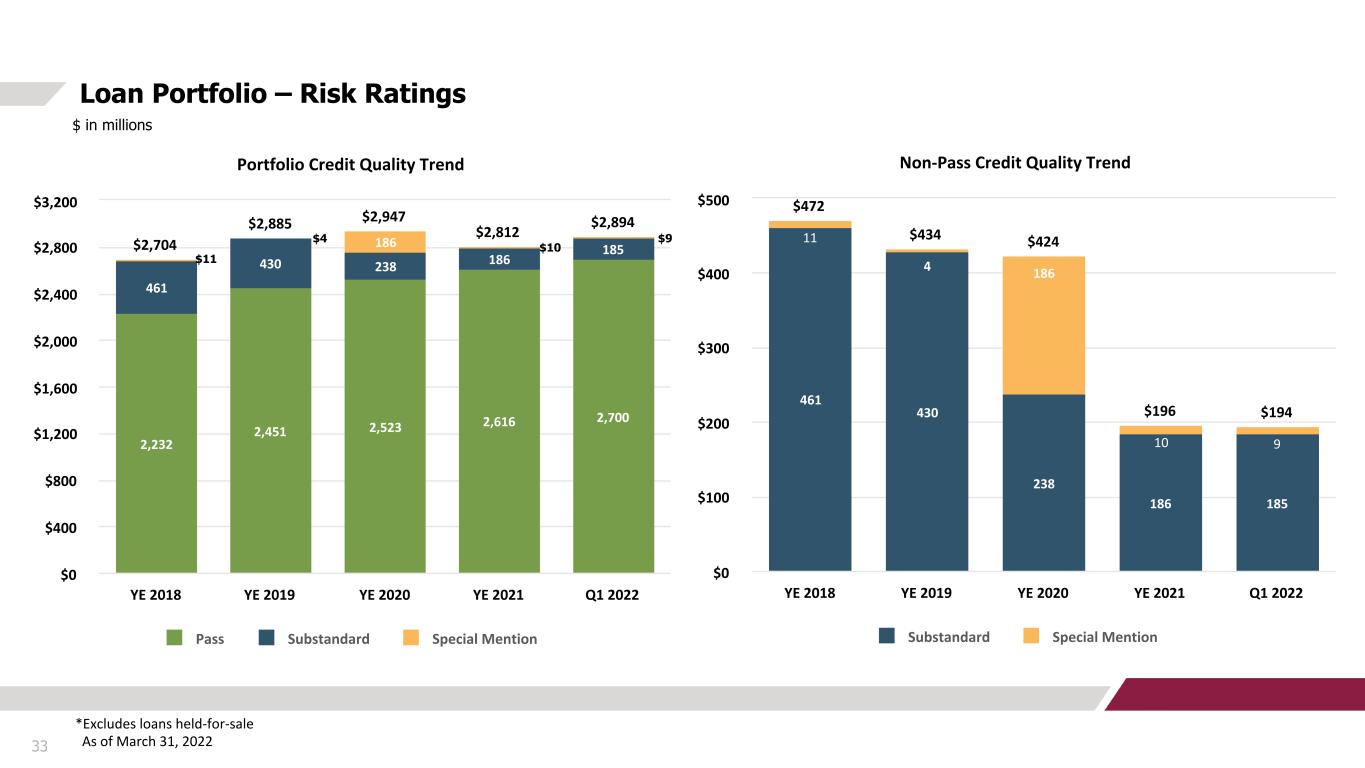

Portfolio Credit Quality Trend $2,704 $2,885 $2,947 $2,812 $2,894 2,232 2,451 2,523 2,616 2,700 461 430 238 186 185186 Pass Substandard Special Mention YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $400 $800 $1,200 $1,600 $2,000 $2,400 $2,800 $3,200 Non-Pass Credit Quality Trend $472 $434 $424 $196 $194 461 430 238 186 185 11 4 186 10 9 Substandard Special Mention YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $100 $200 $300 $400 $500 33 Loan Portfolio – Risk Ratings $ in millions *Excludes loans held-for-sale As of March 31, 2022 $9 $10 $4 $11

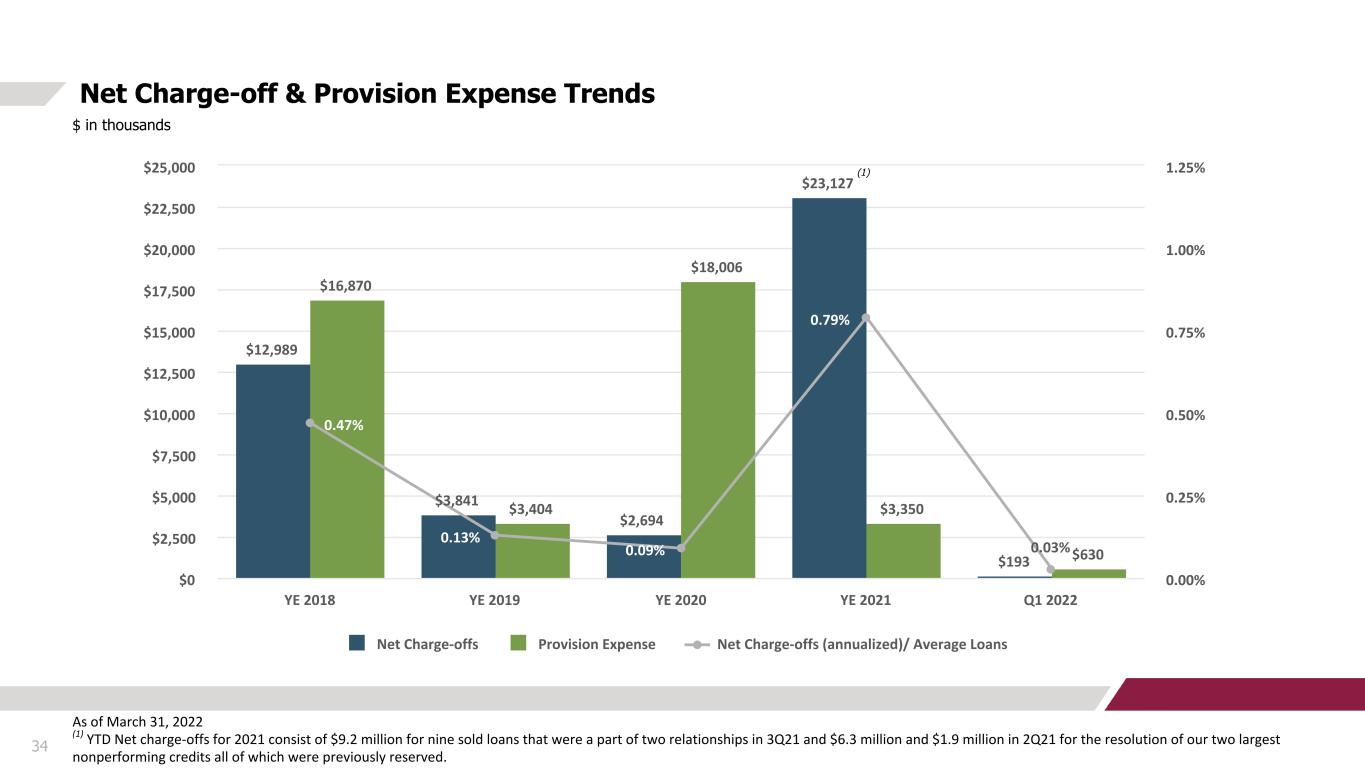

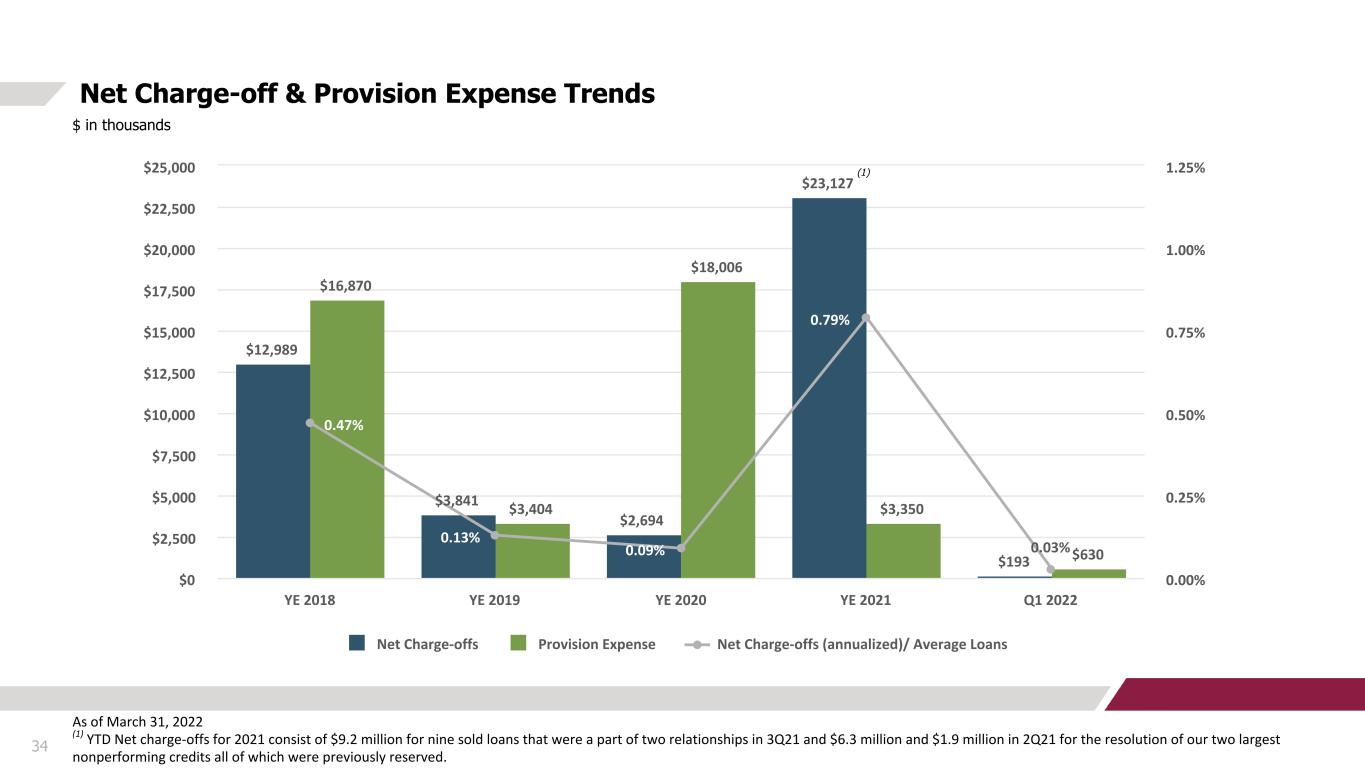

34 Net Charge-off & Provision Expense Trends $ in thousands As of March 31, 2022 (1) YTD Net charge-offs for 2021 consist of $9.2 million for nine sold loans that were a part of two relationships in 3Q21 and $6.3 million and $1.9 million in 2Q21 for the resolution of our two largest nonperforming credits all of which were previously reserved. $12,989 $3,841 $2,694 $23,127 $193 $16,870 $3,404 $18,006 $3,350 $630 0.47% 0.13% 0.09% 0.79% 0.03% Net Charge-offs Provision Expense Net Charge-offs (annualized)/ Average Loans YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $2,500 $5,000 $7,500 $10,000 $12,500 $15,000 $17,500 $20,000 $22,500 $25,000 0.00% 0.25% 0.50% 0.75% 1.00% 1.25%(1)

35 ACL Composition & ACL Coverage Ratio Trends $ in thousands As of March 31, 2022 (1) Included in the three months ended March 31, 2021 is the $61.6 million Day 1 adjustment related to the adoption ASU No. 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”. Refer to the Company's Form 10-Q filed with the Securities and Exchange Commission ("SEC") for more details. $116,872 $109,319 $99,294 $95,939 $96,376 101,870 107,446 96,619 94,974 95,448 15,002 1,873 2,675 965 9283.93% 3.75% 3.44% 3.41% 3.33% General Reserves Specific Reserves ACL to Total Portfolio Loans Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 $0 $25,000 $50,000 $75,000 $100,000 $125,000 0.0% 2.0% 4.0% 6.0% (1)

36 Deposit Mix and Cost of Funds 05

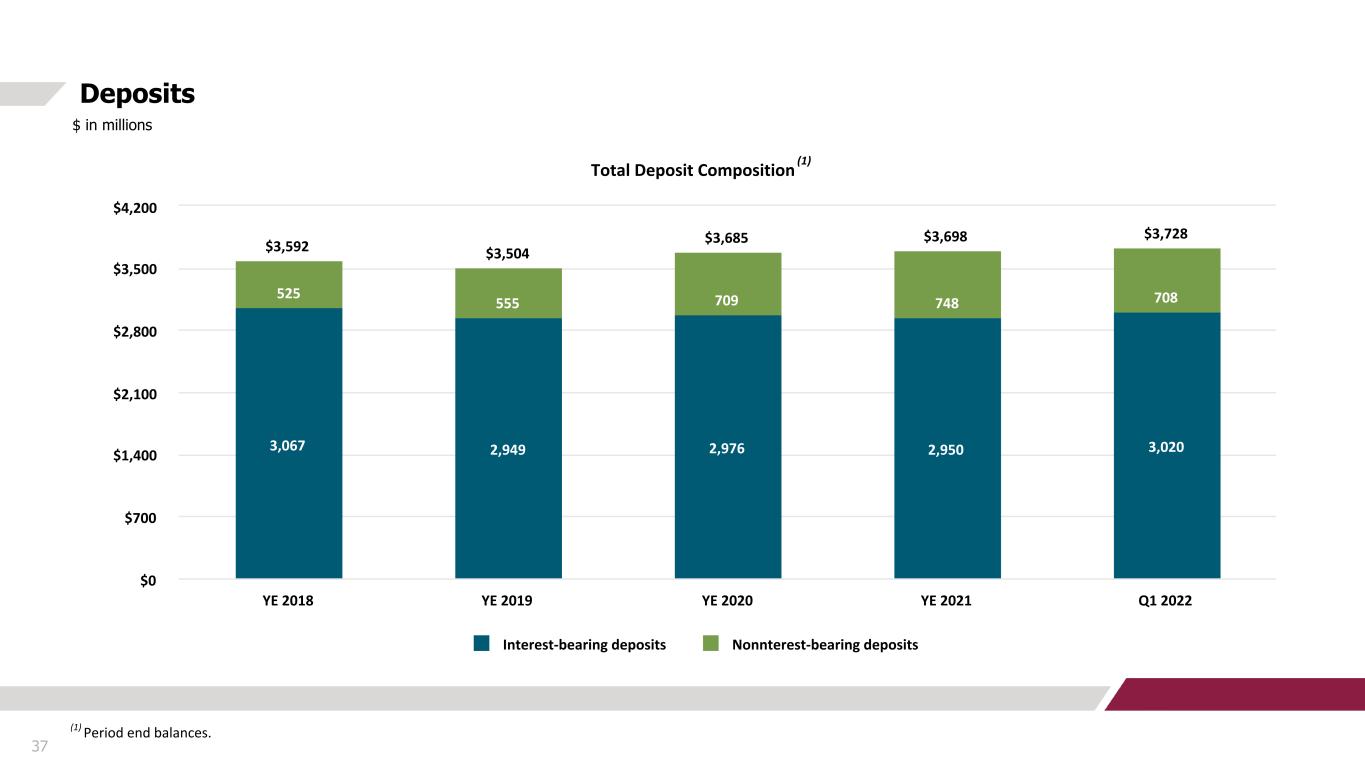

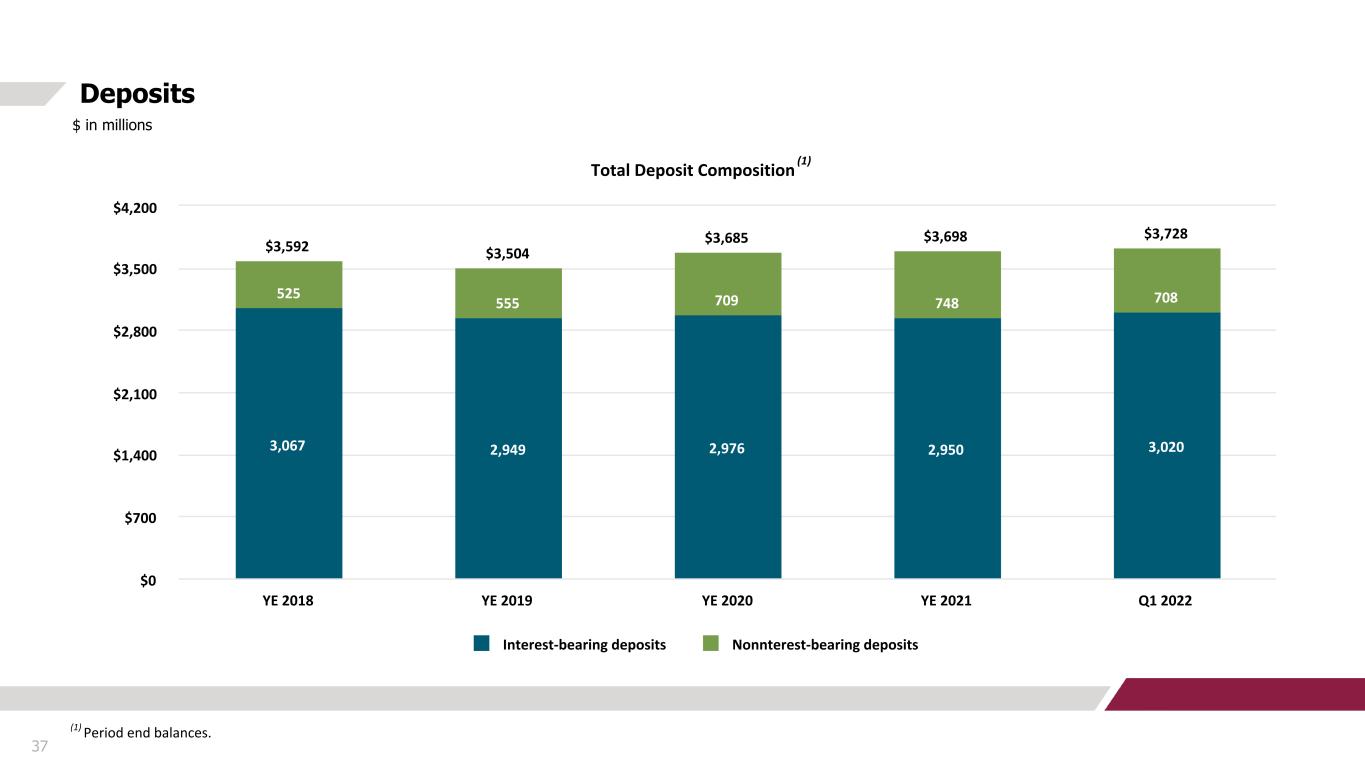

Total Deposit Composition $3,592 $3,504 $3,685 $3,698 $3,728 3,067 2,949 2,976 2,950 3,020 525 555 709 748 708 Interest-bearing deposits Nonnterest-bearing deposits YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $700 $1,400 $2,100 $2,800 $3,500 $4,200 37 Deposits $ in millions (1) (1) Period end balances.

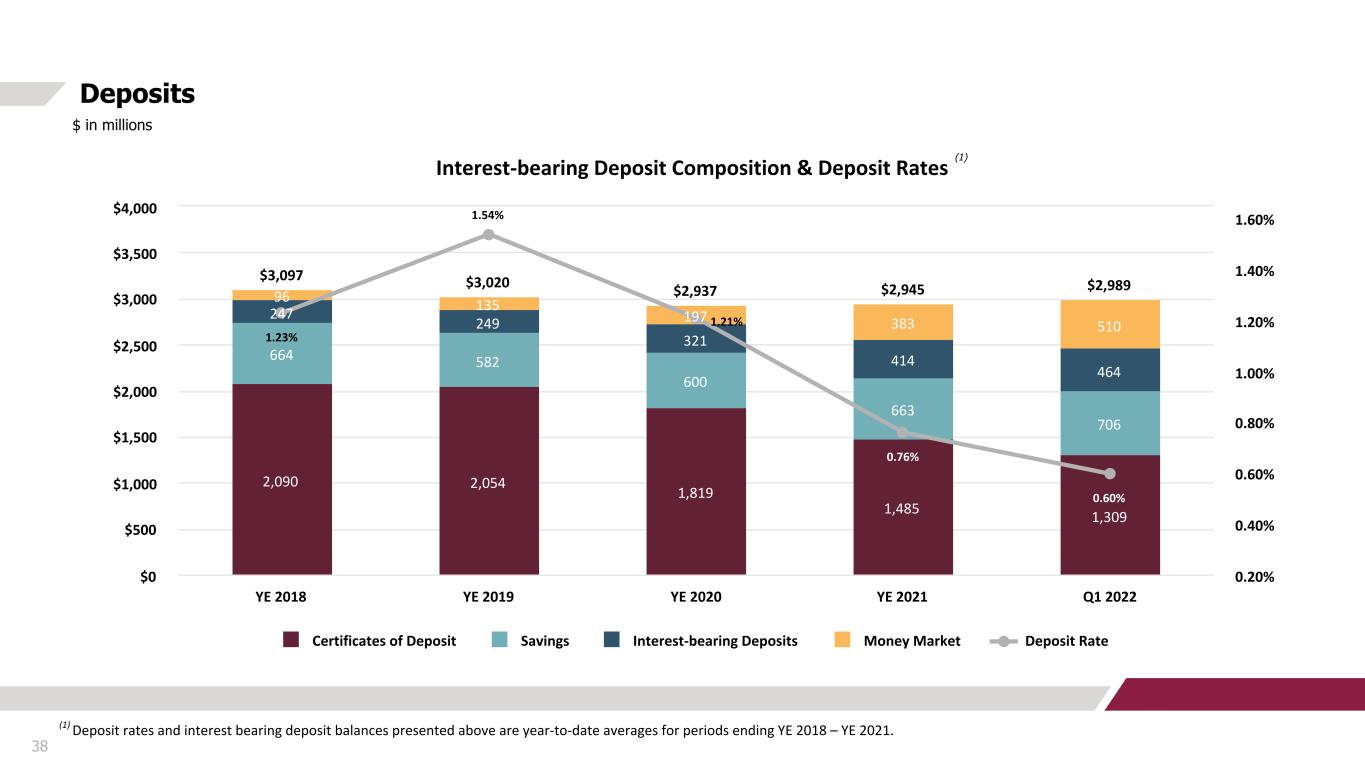

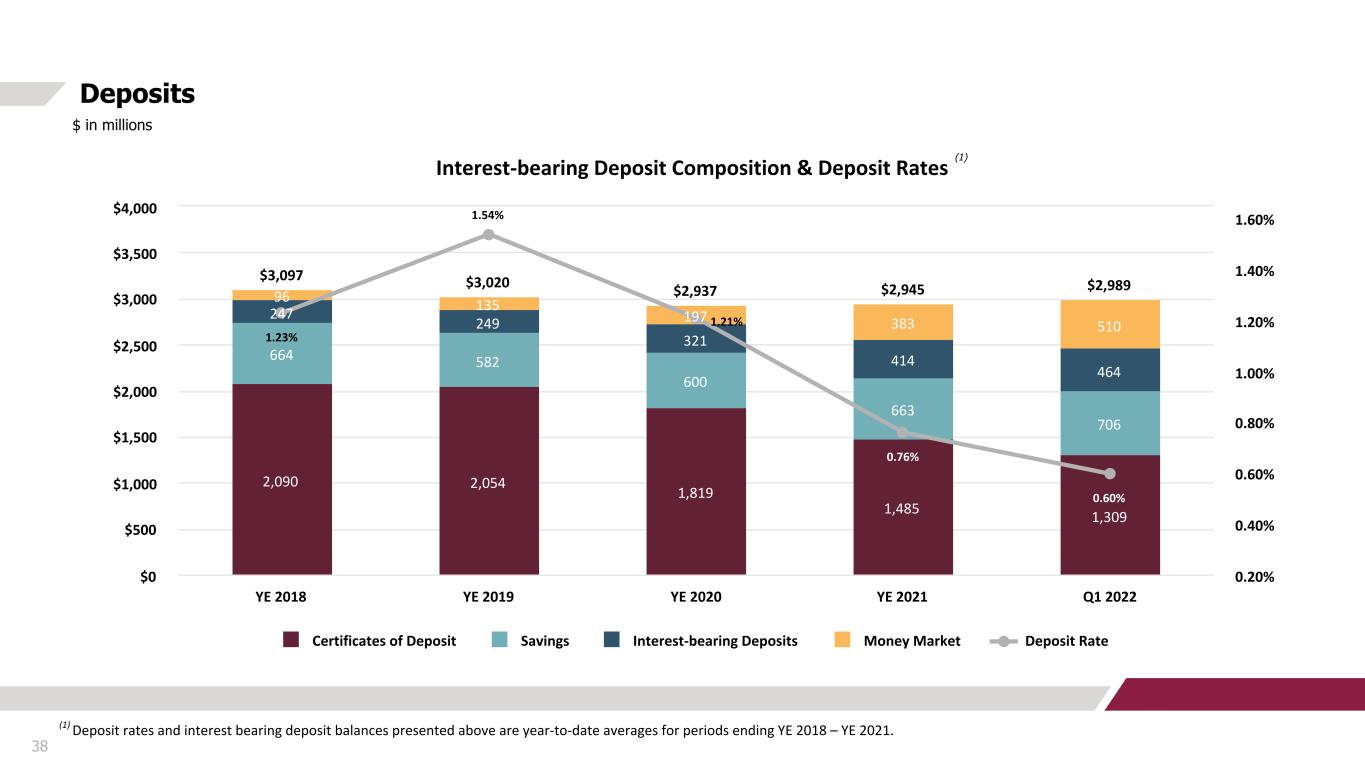

Interest-bearing Deposit Composition & Deposit Rates $3,097 $3,020 $2,937 $2,945 $2,989 2,090 2,054 1,819 1,485 1,309 664 582 600 663 706 247 249 321 414 464 96 135 197 383 510 1.23% 1.54% 1.21% 0.76% 0.60% Certificates of Deposit Savings Interest-bearing Deposits Money Market Deposit Rate YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 1.40% 1.60% 38 Deposits $ in millions (1) Deposit rates and interest bearing deposit balances presented above are year-to-date averages for periods ending YE 2018 – YE 2021. (1)

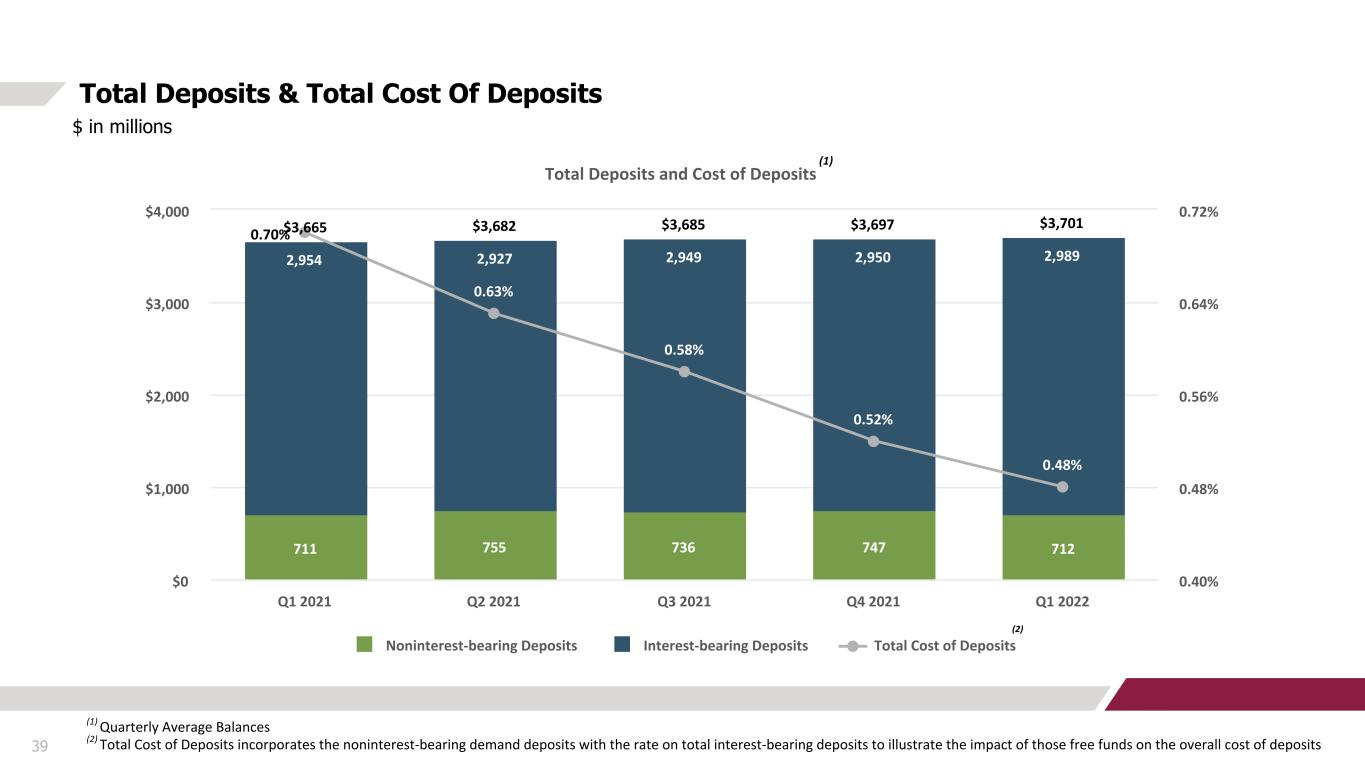

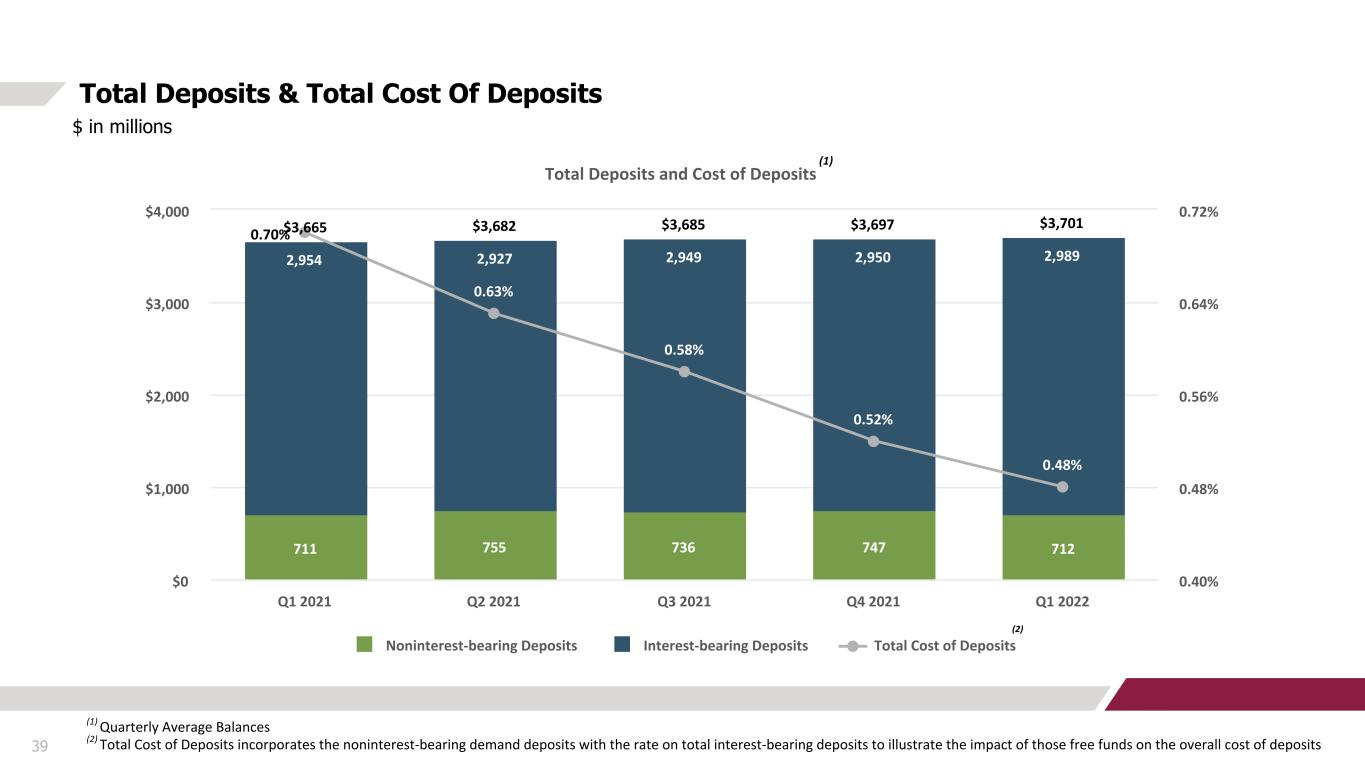

Total Deposits and Cost of Deposits $3,665 $3,682 $3,685 $3,697 $3,701 711 755 736 747 712 2,954 2,927 2,949 2,950 2,989 0.70% 0.63% 0.58% 0.52% 0.48% Noninterest-bearing Deposits Interest-bearing Deposits Total Cost of Deposits Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 $0 $1,000 $2,000 $3,000 $4,000 0.40% 0.48% 0.56% 0.64% 0.72% 39 Total Deposits & Total Cost Of Deposits $ in millions (1) Quarterly Average Balances (2) Total Cost of Deposits incorporates the noninterest-bearing demand deposits with the rate on total interest-bearing deposits to illustrate the impact of those free funds on the overall cost of deposits (2) (1)

40 Net Interest Margin (1) Cost of Funds incorporates the free funds contribution with the rate on total interest-bearing liabilities to illustrate the impact of noninterest-bearing liabilities on the overall cost of funds (2) Net Interest Margin has been computed on a fully taxable equivalent basis (FTE) using 21% federal income tax statutory rate for 2018 through 2022. N et In te re st M ar gi n 1.01% 1.23% 0.94% 0.57% 0.45% 4.11% 4.28% 3.74% 3.41% 3.36% 3.10% 3.05% 2.80% 2.84% 2.91% Total Cost of Funds Yield on Interest-earning Assets Net Interest Margin YE 2018 YE 2019 YE 2020 YE 2021 Q1 2022 0.00% 0.80% 1.60% 2.40% 3.20% 4.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% (1) (2)

41 Commercial Loan Portfolio Metrics 06

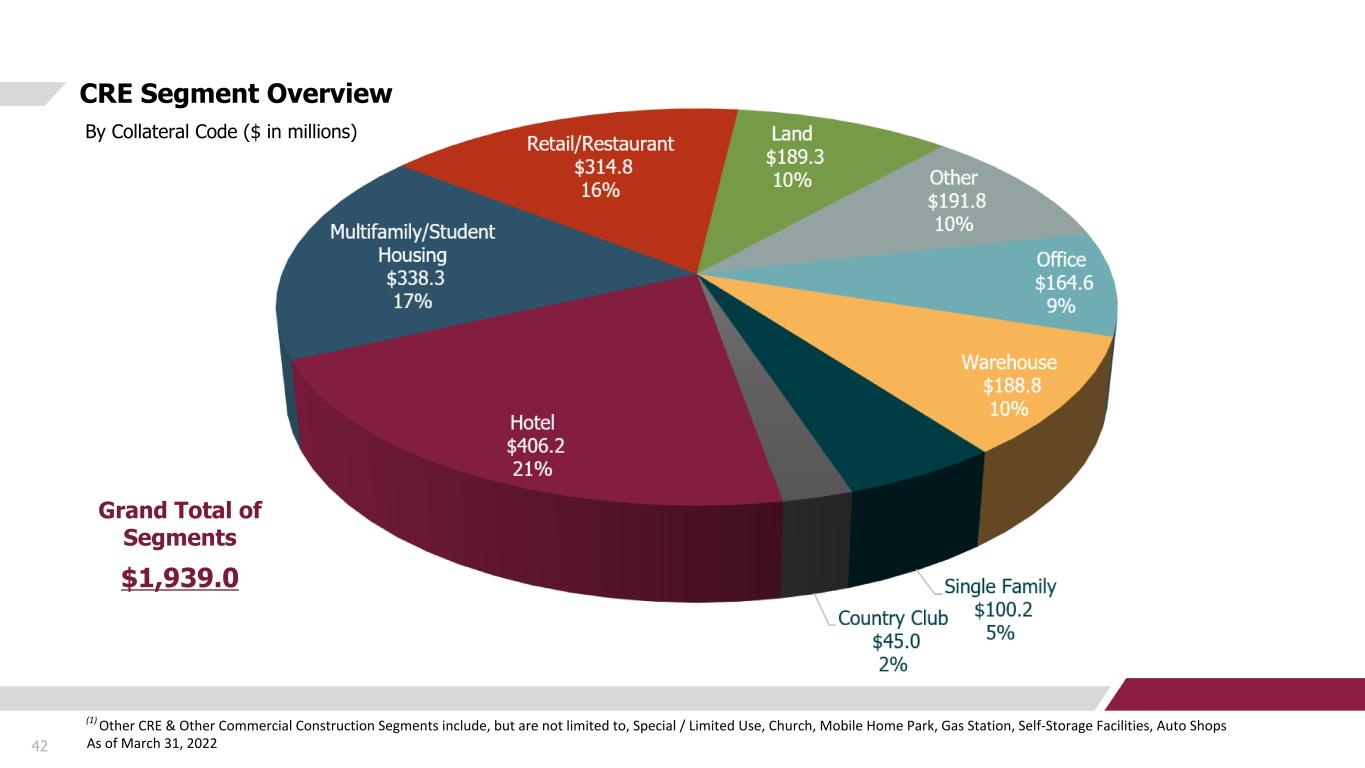

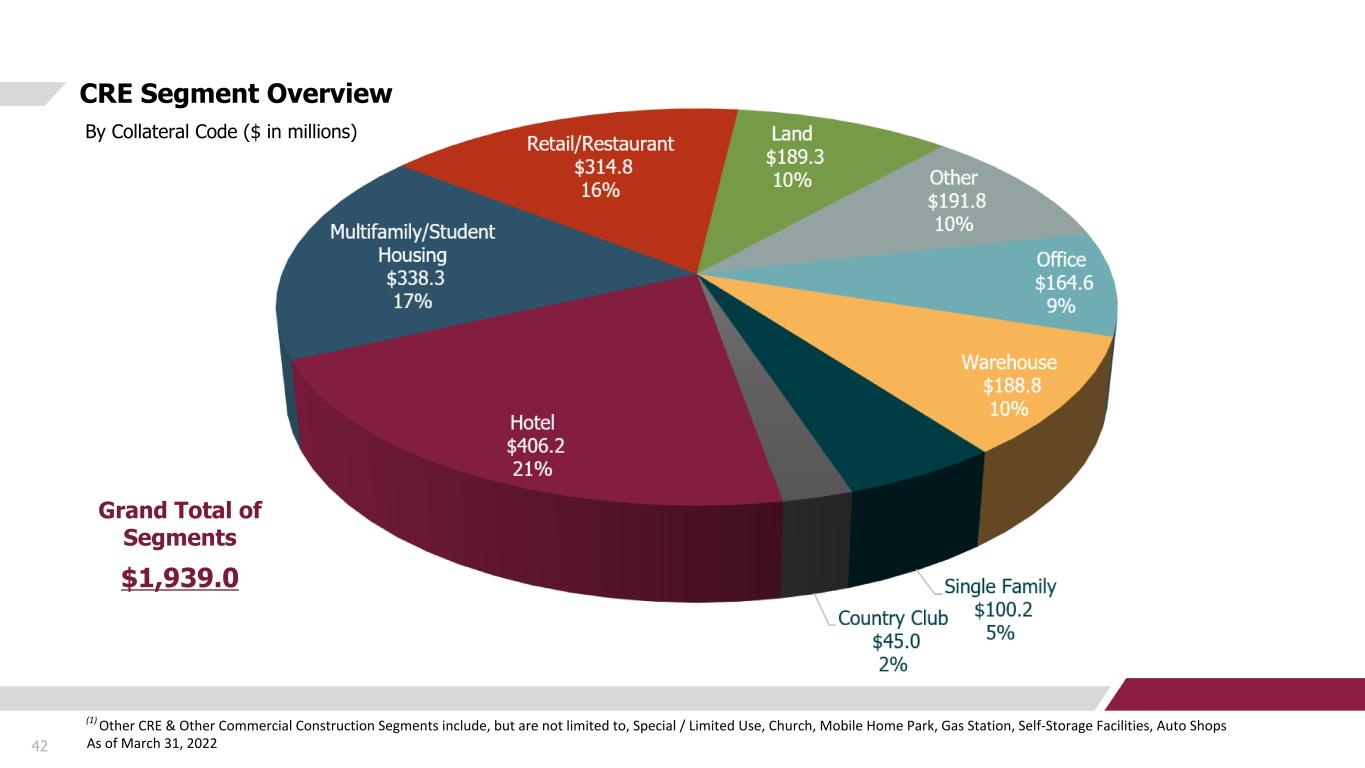

42 CRE Segment Overview By Collateral Code ($ in millions) (1) Other CRE & Other Commercial Construction Segments include, but are not limited to, Special / Limited Use, Church, Mobile Home Park, Gas Station, Self-Storage Facilities, Auto Shops As of March 31, 2022 (1) Grand Total of Segments $1,939.0

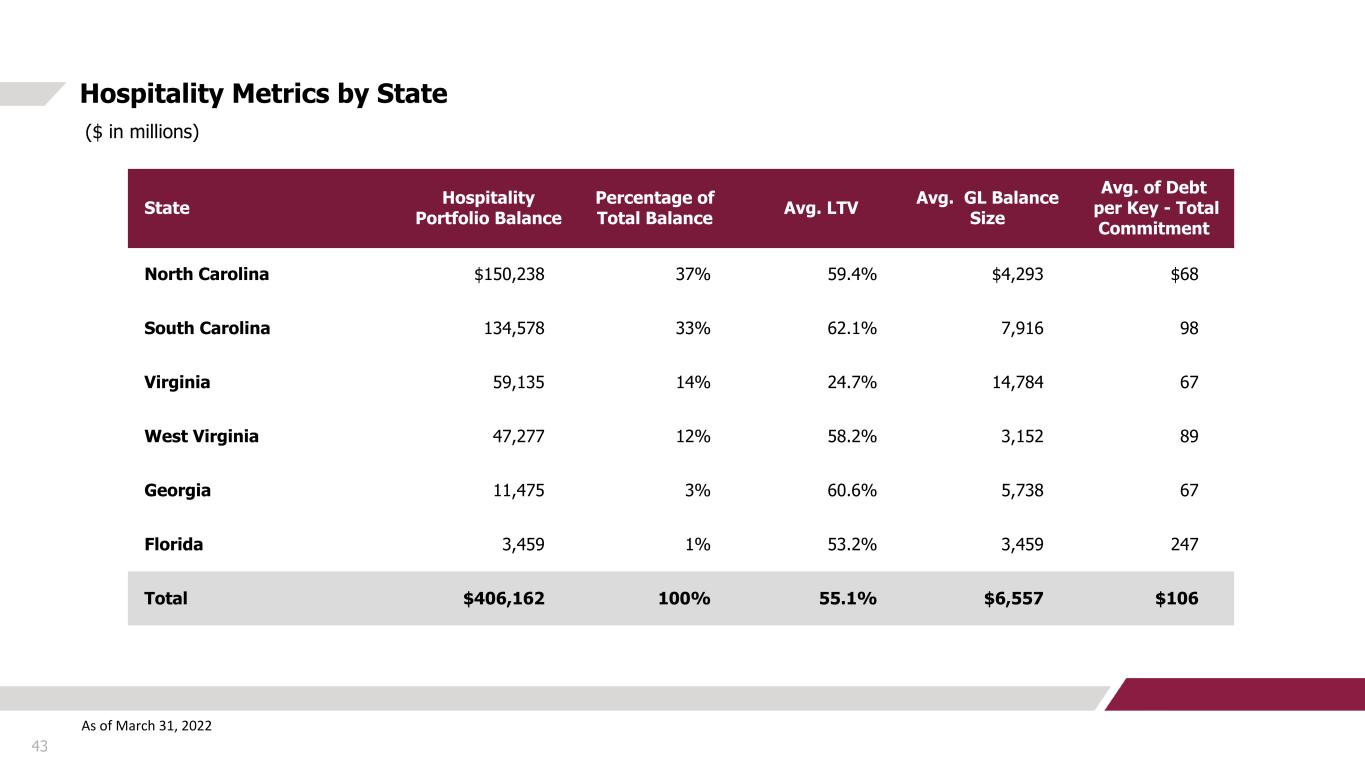

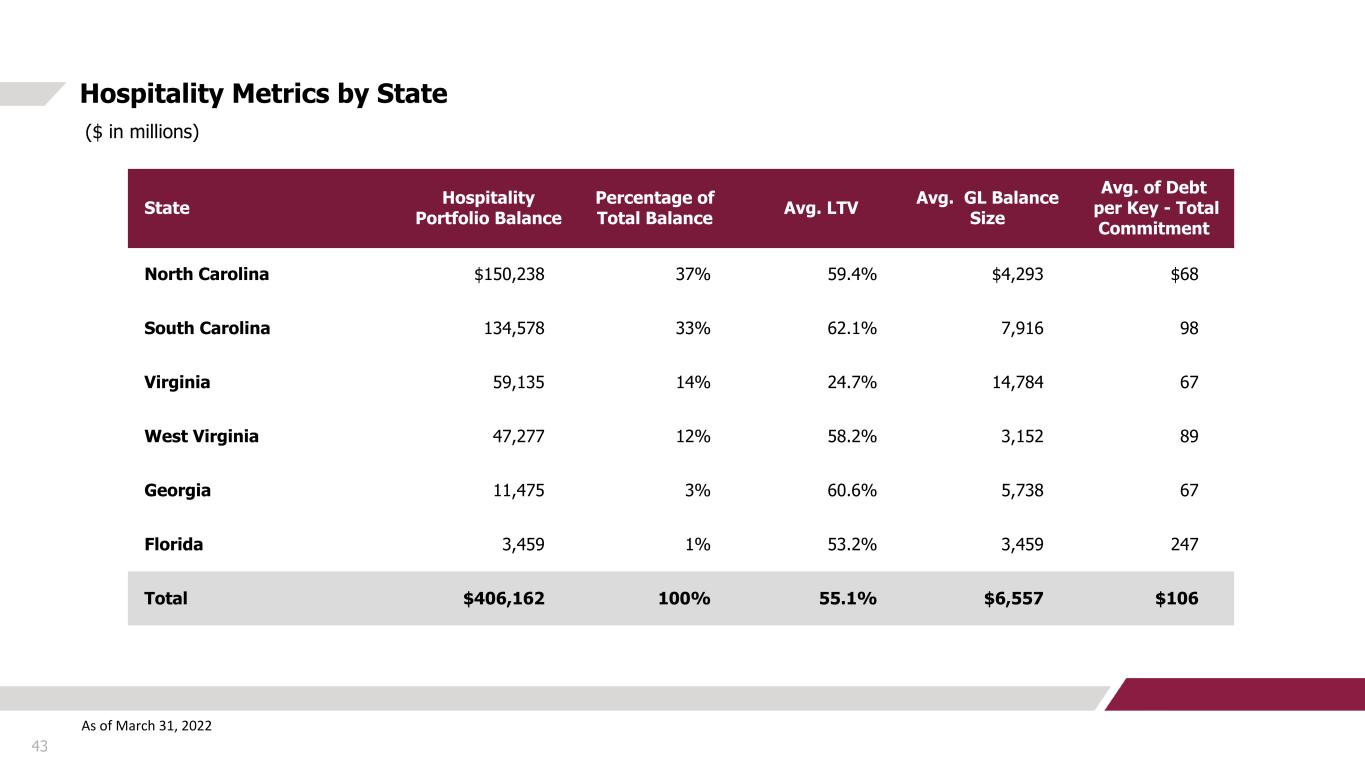

43 Hospitality Metrics by State ($ in millions) As of March 31, 2022 (1) (1) State Hospitality Portfolio Balance Percentage of Total Balance Avg. LTV Avg. GL Balance Size Avg. of Debt per Key - Total Commitment North Carolina $150,238 37 % 59.4 % $4,293 $68 South Carolina 134,578 33 % 62.1 % 7,916 98 Virginia 59,135 14 % 24.7 % 14,784 67 West Virginia 47,277 12 % 58.2 % 3,152 89 Georgia 11,475 3 % 60.6 % 5,738 67 Florida 3,459 1 % 53.2 % 3,459 247 Total $406,162 100 % 55.1 % $6,557 $106

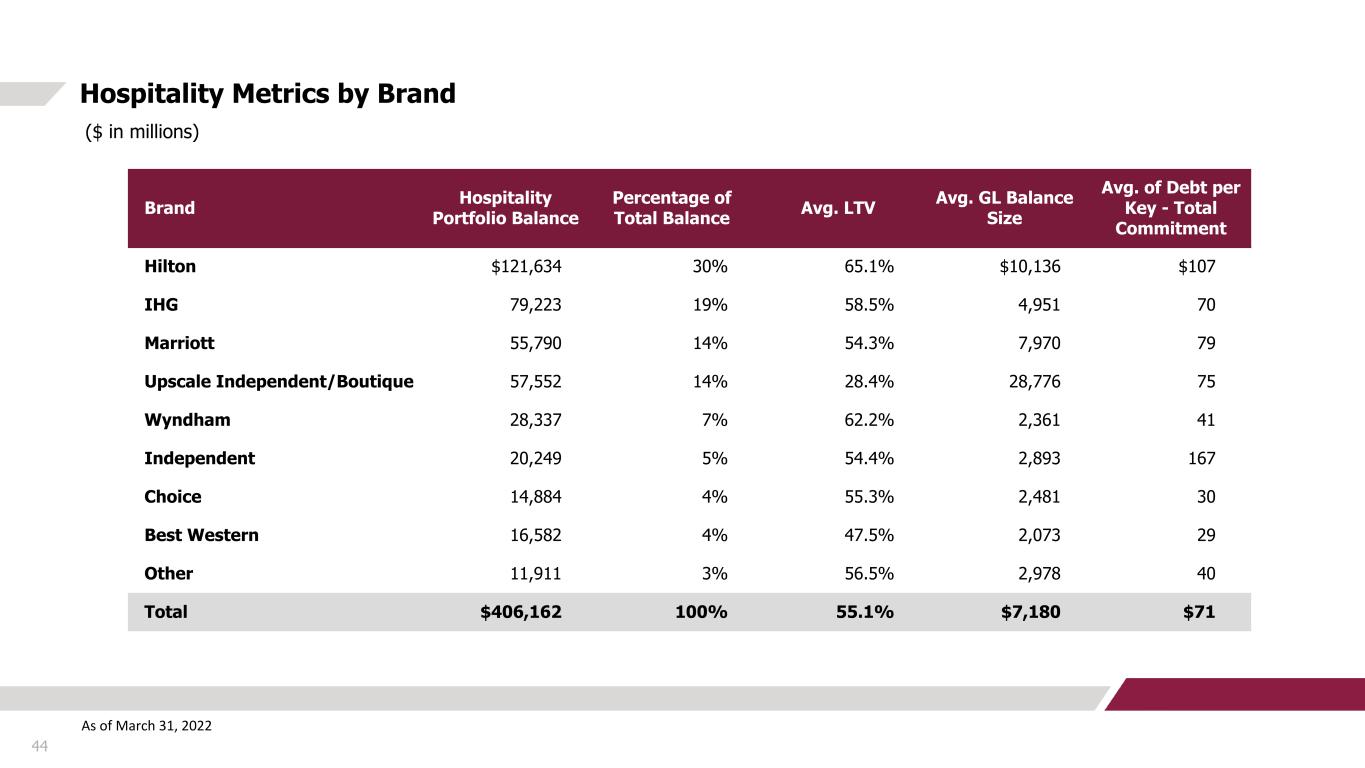

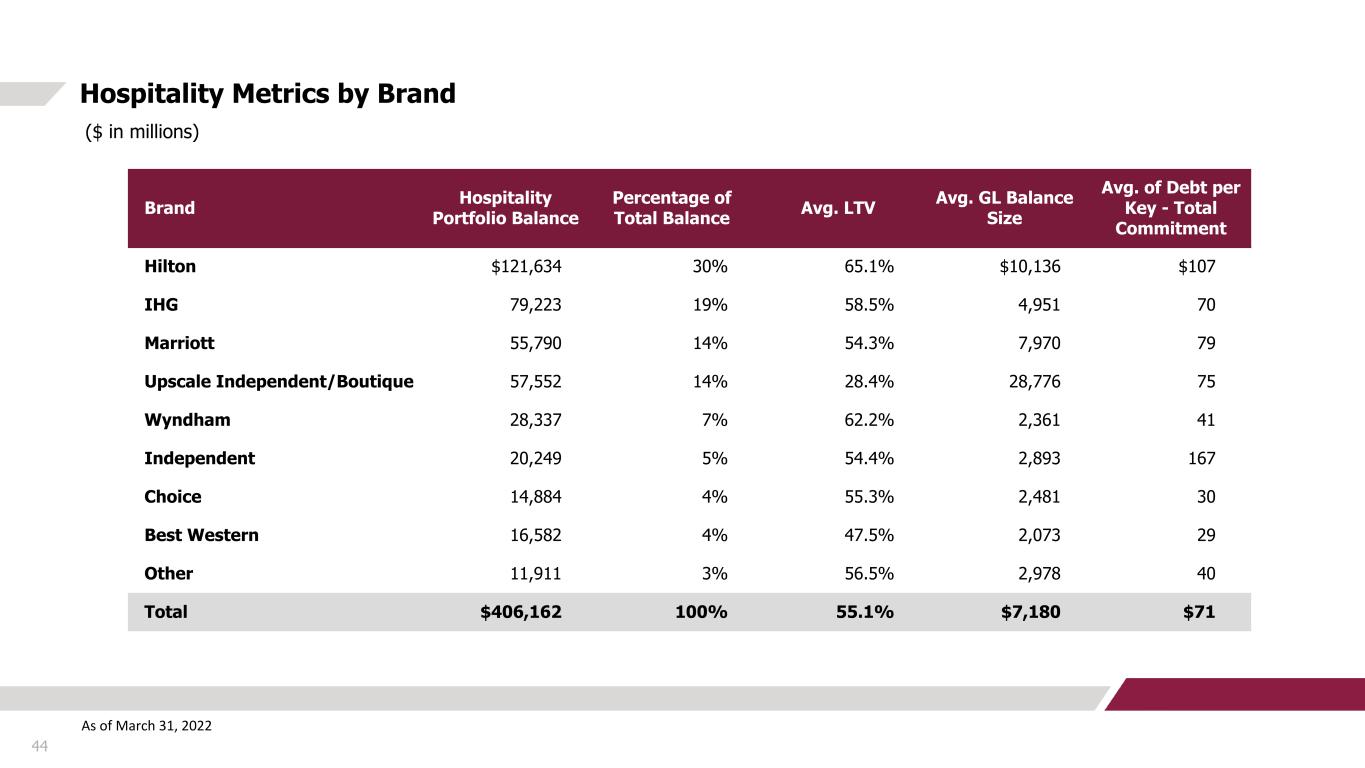

44 Hospitality Metrics by Brand ($ in millions) As of March 31, 2022 (1) (1) Brand Hospitality Portfolio Balance Percentage of Total Balance Avg. LTV Avg. GL Balance Size Avg. of Debt per Key - Total Commitment Hilton $121,634 30 % 65.1 % $10,136 $107 IHG 79,223 19 % 58.5 % 4,951 70 Marriott 55,790 14 % 54.3 % 7,970 79 Upscale Independent/Boutique 57,552 14 % 28.4 % 28,776 75 Wyndham 28,337 7 % 62.2 % 2,361 41 Independent 20,249 5 % 54.4 % 2,893 167 Choice 14,884 4 % 55.3 % 2,481 30 Best Western 16,582 4 % 47.5 % 2,073 29 Other 11,911 3 % 56.5 % 2,978 40 Total $406,162 100 % 55.1 % $7,180 $71