SECOND QUARTER 2023

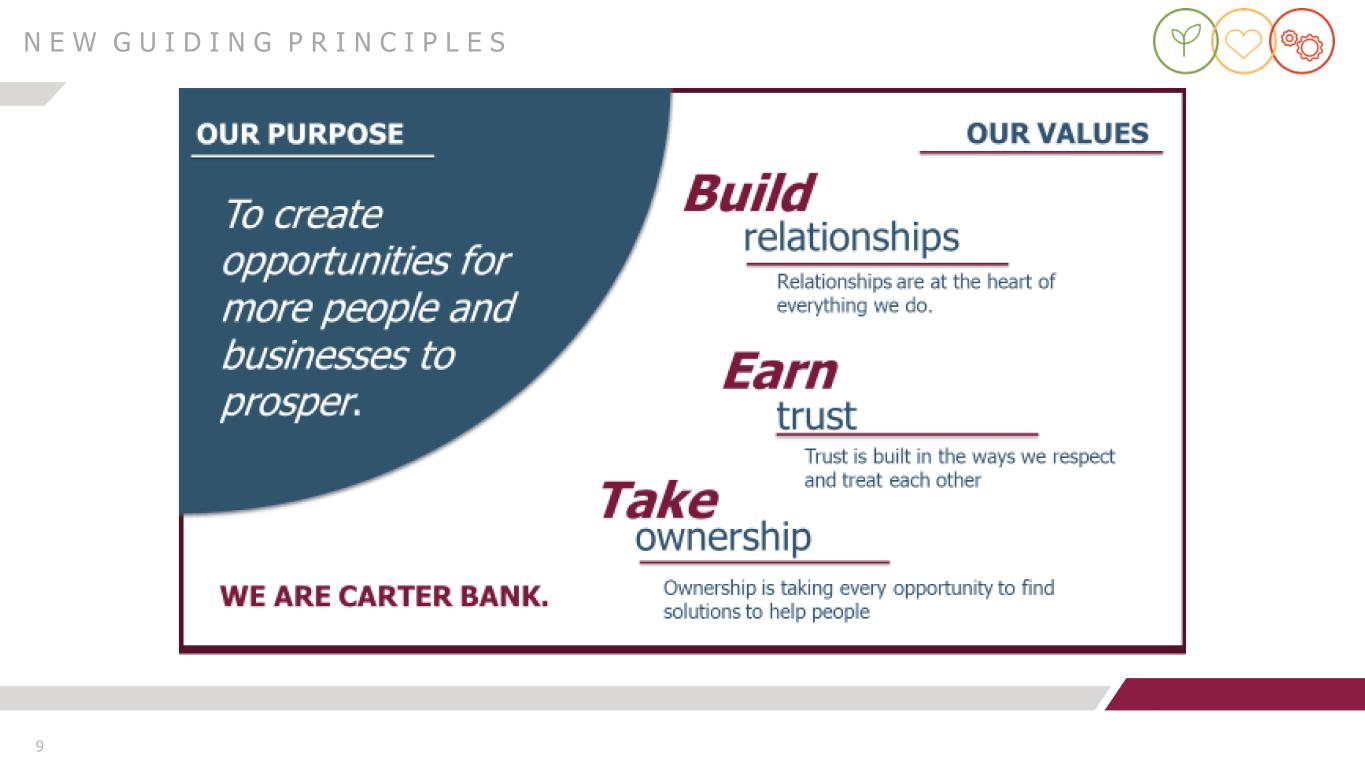

2 F O R W A R D - L O O K I N G S T A T E M E N T This information contains or incorporates certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements that relate to our financial condition, market conditions, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels and asset quality, including but not limited to statements regarding the interest rate environment, the impact of future changes in interest rates, and the impacts of the Company placing its largest lending relationship on nonaccrual status. Forward looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “ believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. These statements are not guarantees of future results or performance and involve certain risks, uncertainties and assumption that are difficult to predict and often are beyond the Company’s control. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward- looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements including, but not limited to the effects of: market interest rates and the impacts of market interest rates on economic conditions, customer behavior, and the Company’s loan and securities portfolios; inflation, market and monetary fluctuations; changes in trade, monetary and fiscal policies and laws of the U.S. Government, including policies of the Federal Reserve, Federal Deposit Insurance Corporation, (“FDIC”) and U.S. Department of the Treasury (the “Treasury Department”); changes in accounting policies, practices, or guidance, for example, our adoption of Current Expected Credit Losses (“CECL”) methodology, including potential volatility in the Company’s operating results due to application of the CECL methodology; cyber- security threats, attacks or events; rapid technological developments and changes; our ability to resolve our nonperforming assets, and our ability to secure collateral on loans that have entered nonaccrual status due to loan maturities and failure to pay in full; changes in the Company’s liquidity and capital positions; concentrations of loans secured by real estate, particularly commercial real estate, and the potential impacts of changes in market conditions on the value of real estate collateral; an insufficient allowance for credit losses; the potential adverse effects of unusual and infrequently occurring events, such as weather-related disasters, terrorist acts, war and other military conflicts (such as the ongoing war between Russia and Ukraine) or public health events (such as the COVID-19 pandemic), and of any governmental and societal responses thereto; these potential adverse effects may include, without limitation, adverse effects on the ability of the Company's borrowers to satisfy their obligations to the Company, on the value of collateral securing loans, on the demand for the Company's loans or its other products and services, on incidents of cyberattack and fraud, on the Company’s liquidity or capital positions, on risks posed by reliance on third- party service providers, on other aspects of the Company's business operations and on financial markets and economic growth; a change in spreads on interest-earning assets and interest-bearing liabilities; regulatory supervision and oversight, including our relationship with regulators and any actions that may be initiated by our regulators; legislation affecting the financial services industry as a whole (such as the Inflation Reduction Act of 2022), and the Company and the Bank, in particular; the outcome of pending and future litigation and/or governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult, disruptive or more costly than anticipated; the soundness of other financial institutions and any indirect exposure related to the closings of Silicon Valley Bank (“SVB”), Signature Bank, Silvergate Bank and First Republic Bank and their impact on the broader market through other customers, suppliers and partners or that the conditions which resulted in the liquidity concerns with SVB, Signature Bank, Silvergate Bank and First Republic Bank may also adversely impact, directly or indirectly, other financial institutions and market participants with which the Company has commercial or deposit relationships with; our ability to successfully execute and achieve the expected results of our business, brand strategies, brand awareness programs and marketing programs in the markets we serve, including, but not limited to, the Company’s guiding principles, including our new purpose statement: To create opportunities for more people and businesses to prosper; supported by our new set of core values: Build Relationships, Earn Trust and Take Ownership; material increases in costs and expenses; reliance on significant customer relationships; general economic or business conditions, including unemployment levels, continuing supply chain disruptions and slowdowns in economic growth; significant weakening of the local economies in which we operate; changes in customer behaviors, including consumer spending, borrowing and saving habits; changes in deposit flows and loan demand; our failure to attract or retain key employees; expansions or consolidations in the Company’s branch network, including that the anticipated benefits of the Company’s branch network optimization project are not fully realized in a timely manner or at all; deterioration of the housing market and reduced demand for mortgages; and re-emergence of turbulence in significant portions of the global financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to support our future businesses. Please also refer to such other factors as discussed throughout Part I, Item 1A, “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, Part II, Item 1A, “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2023, and in Part II, Item 1A, “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2023, and any of our subsequent filings with the Securities and Exchange Commission (“SEC”). All risk factors and uncertainties described herein and therein should be considered in evaluating the Company’s forward-looking statements. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are prepared. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events are expressed in or implied by a forward-looking statement may, and often do, differ materially from actual results. Any forward- looking statement speaks only as to the date on which it is made, and we undertake no obligation to update, revise or clarify any forward-looking statement to reflect developments occurring after the statement is made.

SECTION TITLE SLIDES 1 Overview 4-12 2 Financial Highlights 13-22 3 Balance Sheet Transformation 23-28 4 Asset Quality 29-34 5 Deposit Mix & Cost of Funds 35-37 6 Commercial Loan Portfolio Metrics 38-47 7 Non-GAAP Reconciliation 48-51 3

O V E R V I E W 4

5 As of June 30, 2023 FOCUSED ON THE FUTURE 66 CORPORATE CENTERS BRANCHES ◦ Launched new corporate Guiding Principles ◦ Launched new marketing campaign to drive awareness in key markets for core deposit growth ◦ Hosted internal leadership conference for 150 associates ◦ Continued strong capital and liquidity position ◦ Diversified and granular deposit base, approximately 77.5% Retail Customers. ◦ Approximately 88.3% of Deposits, including Collateralized Muni deposits are FDIC Insured. ◦ Continuing to expand Commercial Lending Team in higher growth markets ◦ Focus on talent management and acquisition with the launch of several new incentive plans including Retail and Credit Administration CORPORATE HIGHLIGHTS Carter Bank & Trust charter established in 2006 with the merger of ten banks Carter Bankshares, Inc. holding company established in Q4 2020 with the assets of Carter Bank & Trust Bank established denovo in 1974 as First National Bank of Rocky Mount, VA 1974 2006 2020 CORPORATE OFFICES IN VIRGINIA03 MARTINSVILLE, VIRGINIA LOANS 3.3B $4.4B ASSETS $3.6B DEPOSITS A Well-Capitalized Franchise with Momentum

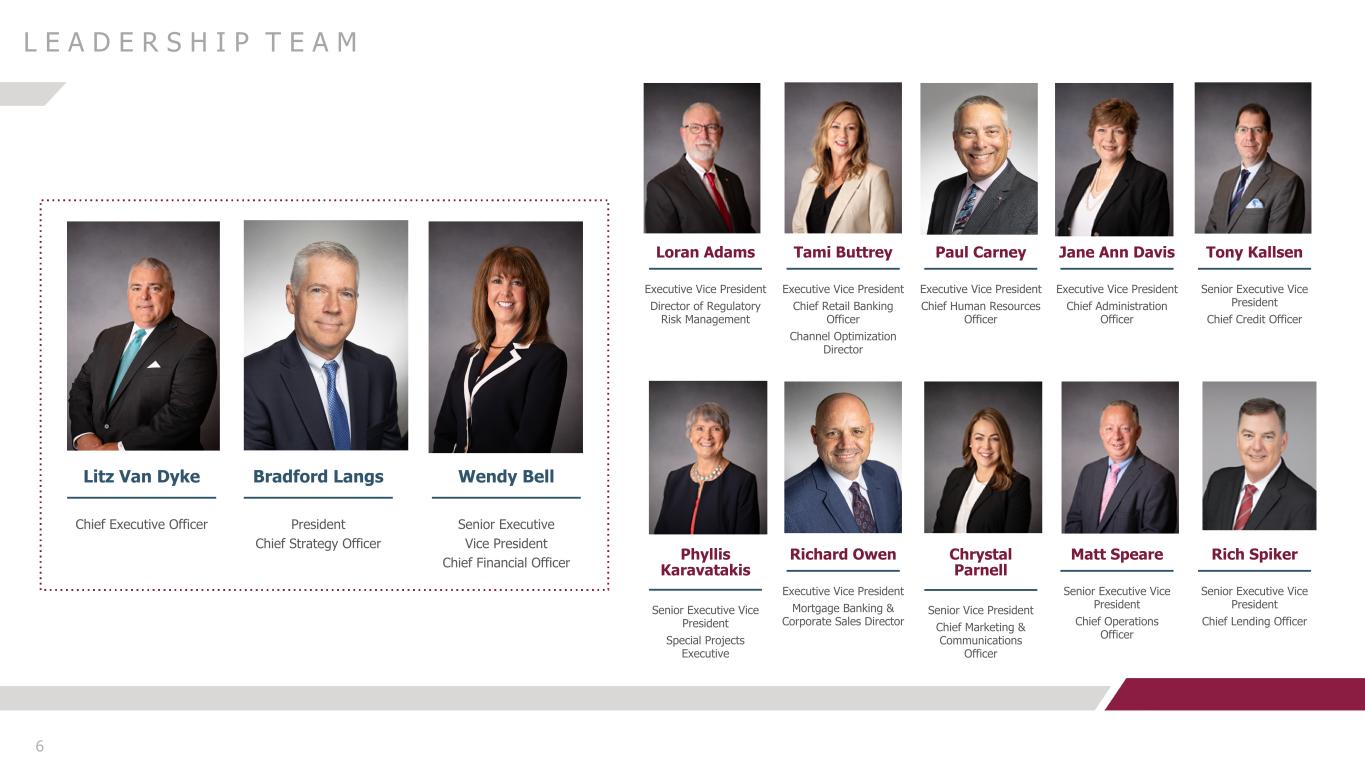

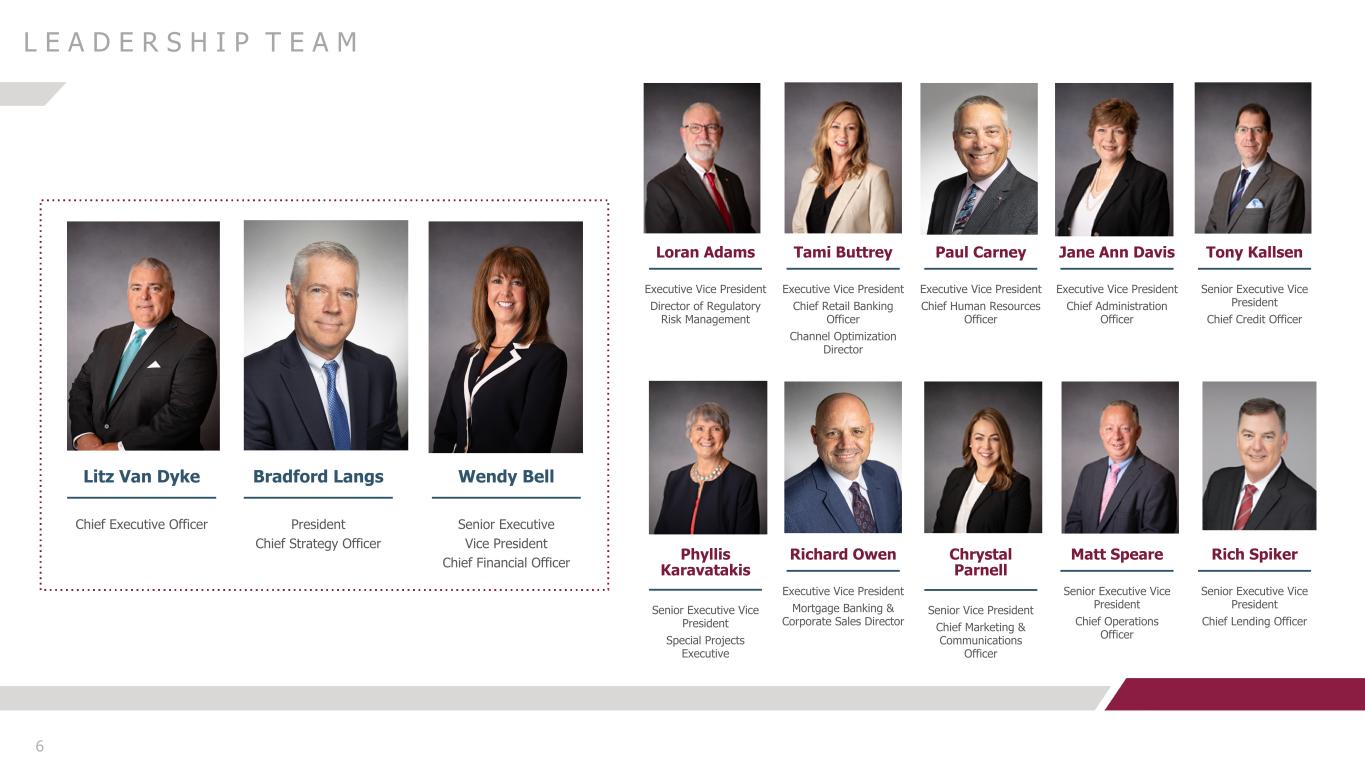

6 L E A D E R S H I P T E A M Litz Van Dyke Chief Executive Officer Bradford Langs President Chief Strategy Officer Wendy Bell Senior Executive Vice President Chief Financial Officer Loran Adams Tami Buttrey Executive Vice President Chief Retail Banking Officer Channel Optimization Director Paul Carney Executive Vice President Chief Human Resources Officer Jane Ann Davis Executive Vice President Chief Administration Officer Tony Kallsen Senior Executive Vice President Chief Credit Officer Phyllis Karavatakis Senior Executive Vice President Special Projects Executive Richard Owen Executive Vice President Mortgage Banking & Corporate Sales Director Chrystal Parnell Senior Vice President Chief Marketing & Communications Officer Matt Speare Senior Executive Vice President Chief Operations Officer Rich Spiker Senior Executive Vice President Chief Lending Officer Executive Vice President Director of Regulatory Risk Management

Branches in Metropolitan Statistical Areas 7 R E G I O N A L F O O T P R I NT V I R G I N I A N O R T H C A R O L I N A 53 BRANCHES TOTAL $3.2 DEPOSITS TOTAL BILLION Washington DC Roanoke Lynchburg Charlottesville Blacksburg- Christiansburg Non MSA VIRGINIA NORTH CAROLINA 13 BRANCHES TOTAL Charlotte Greensboro Raleigh Durham Fayetteville Non MSA $0.4 DEPOSITS TOTAL BILLION JUNE 30, 2023 YEAR END BRANCHES 2018 105 2019 101 2020 92 2021 69 2022 66 » » » » The following counties are also included in our CRA Assessment area: Randolph, NC: Greensboro MSA & Niagara, NY: Varsity Bank

8 We are committed to maintaining the highest standards of business conduct and governance to serve our customers and communities, create long-term value for our shareholders, and maintain our integrity in the marketplace. C O M M I T M E N T T O E S G Hosted a volunteer workday alongside members of the Bank-formed Eco Ambassador Council to bring 2.5 miles of new trails to the campus of Patrick & Henry Community College. This was followed up with an official ribbon cutting on National Trails Day. Carter Bank & Trust was named the 2023 Reader’s Choice Awards Best Bank and Favorite Place To Work from the Martinsville Bulletin. The company’s purpose and values have been refreshed and are being integrated into bank governance and operations.

9 N E W G U I D I N G P R I N C I P L E S

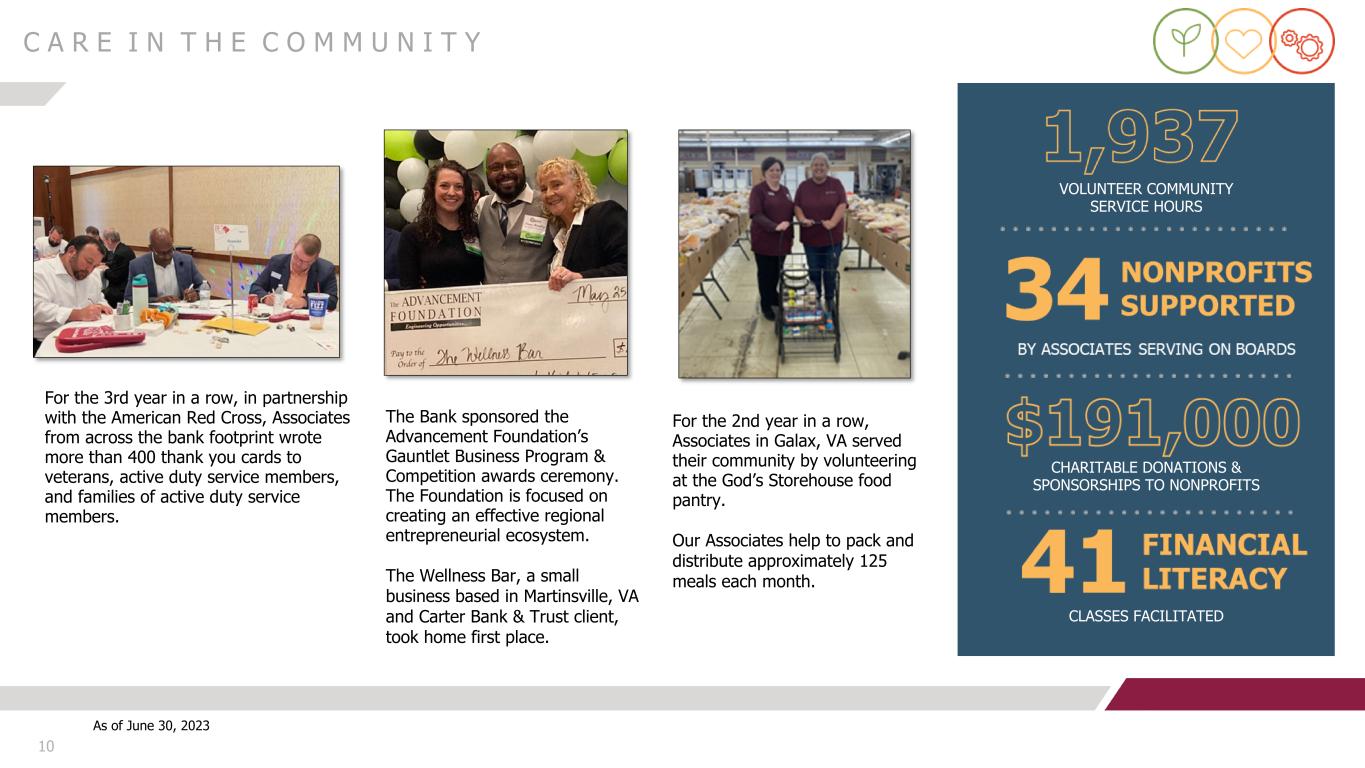

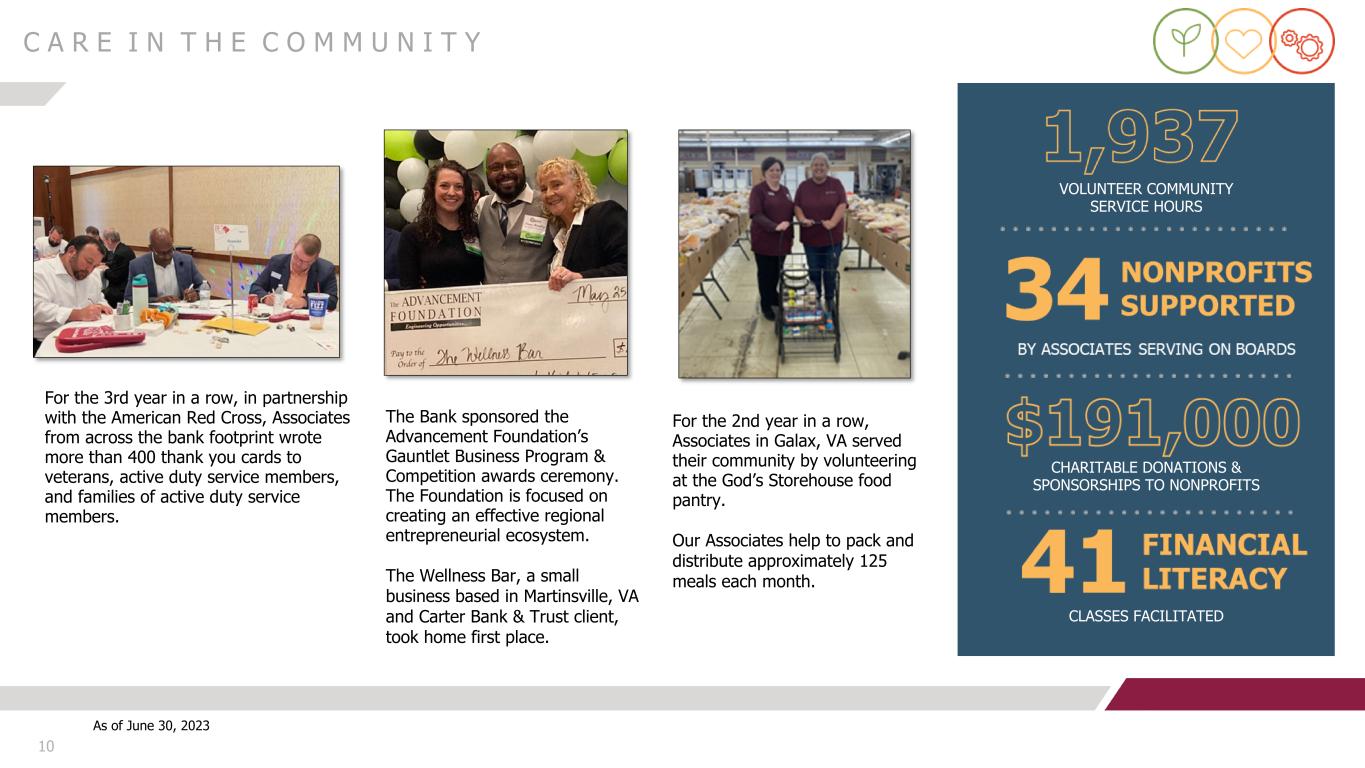

10 * C A R E I N T H E C O M M U N I T Y For the 3rd year in a row, in partnership with the American Red Cross, Associates from across the bank footprint wrote more than 400 thank you cards to veterans, active duty service members, and families of active duty service members. The Bank sponsored the Advancement Foundation’s Gauntlet Business Program & Competition awards ceremony. The Foundation is focused on creating an effective regional entrepreneurial ecosystem. The Wellness Bar, a small business based in Martinsville, VA and Carter Bank & Trust client, took home first place. For the 2nd year in a row, Associates in Galax, VA served their community by volunteering at the God’s Storehouse food pantry. Our Associates help to pack and distribute approximately 125 meals each month. VOLUNTEER COMMUNITY SERVICE HOURS CHARITABLE DONATIONS & SPONSORSHIPS TO NONPROFITS CLASSES FACILITATED As of June 30, 2023

11 S T R A T E G I C I N T I A T I V E S E N H A N C E E X P A N DI N V E S T We will invest in human capital strategies to enhance the associate experience. We will continue to drive efficiency and process improvement across all levels of the organization, leveraging technology and automation. We will make significant investments in the new brand strategy working on updating and enhancing the image and reputation of the Bank. We will continue to enhance the transformational work that has been done over the past five years. We will focus on initiatives around enhancing technology, operations, customer experience, C&I, CRA, ESG, DEI, channel delivery, and product development. We will strengthen change management systems and leverage the Board’s ERM Committee. We will continue strategies to deepen existing relationships and acquire new relationships in current markets as well as new markets. We will focus on increasing share of wallet in existing growth markets. We will focus on expanding through organic growth and opportunistic acquisition. S U P E R I O R F I N A N C I A L P E R F O R M A N C E & O P E R A T I O N A L E X C E L L E N C E

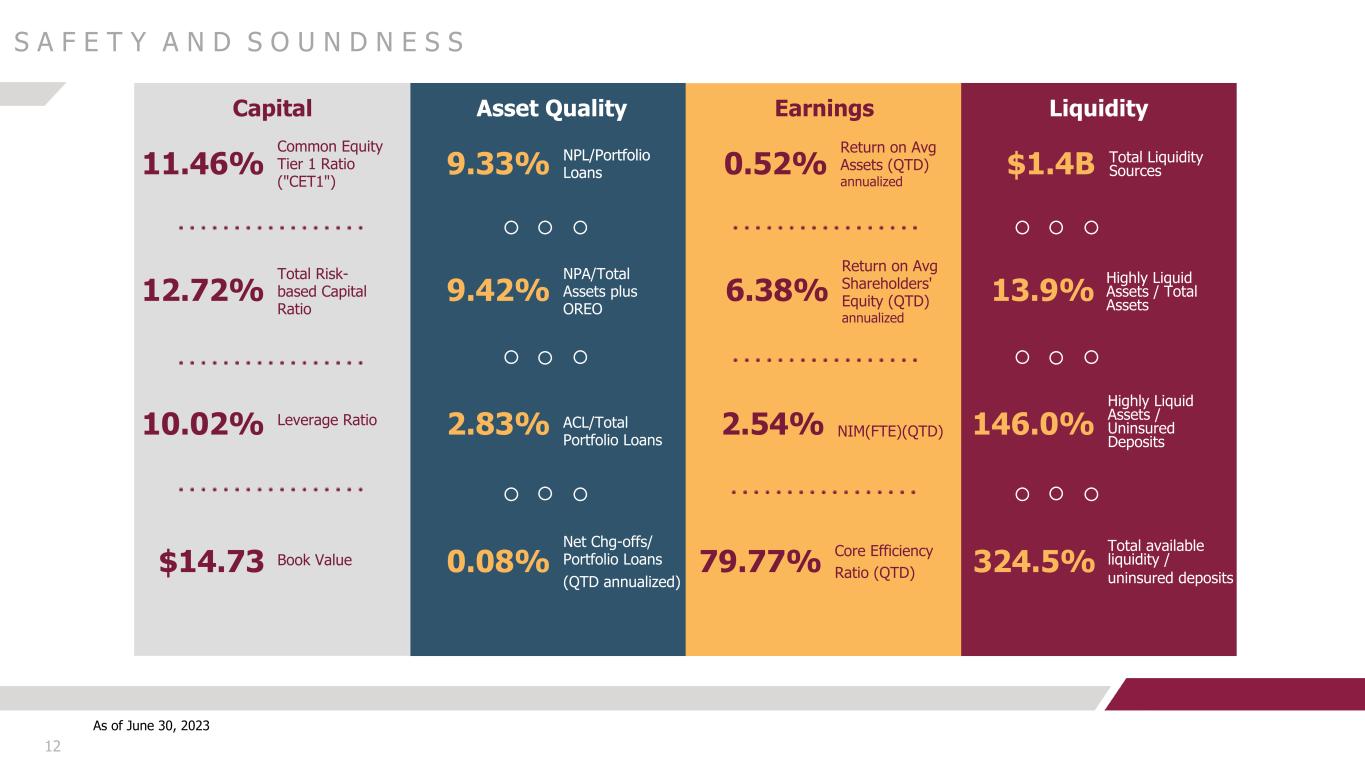

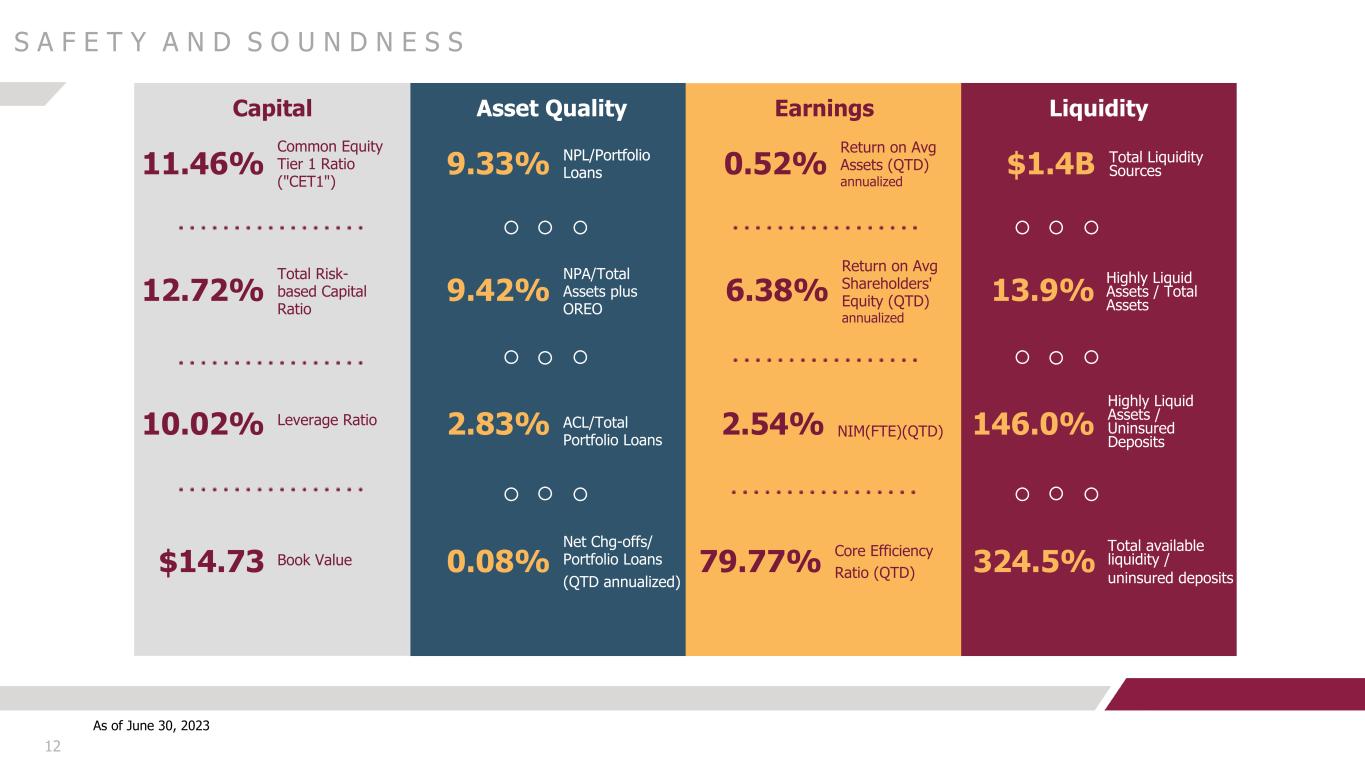

12 9.42% ACL/Total Portfolio Loans NPA/Total Assets plus OREO Net Chg-offs/ Portfolio Loans (QTD annualized) 0.08% NPL/Portfolio Loans S A F E T Y A N D S O U N D N E S S 2.83% 9.33% Asset Quality Earnings LiquidityCapital Return on Avg Assets (QTD) annualized 0.52% 6.38% Return on Avg Shareholders' Equity (QTD) annualized NIM(FTE)(QTD) 2.54% Core Efficiency Ratio (QTD) 79.77% Highly Liquid Assets / Uninsured Deposits Highly Liquid Assets / Total Assets Total available liquidity / uninsured deposits 13.9% 324.5% Total Liquidity Sources 146.0% $1.4B Leverage Ratio Total Risk- based Capital Ratio Book Value 12.72% $14.73 Common Equity Tier 1 Ratio ("CET1") 10.02% 11.46% As of June 30, 2023

F I N A N C I A L H I G H L I G H T S 13

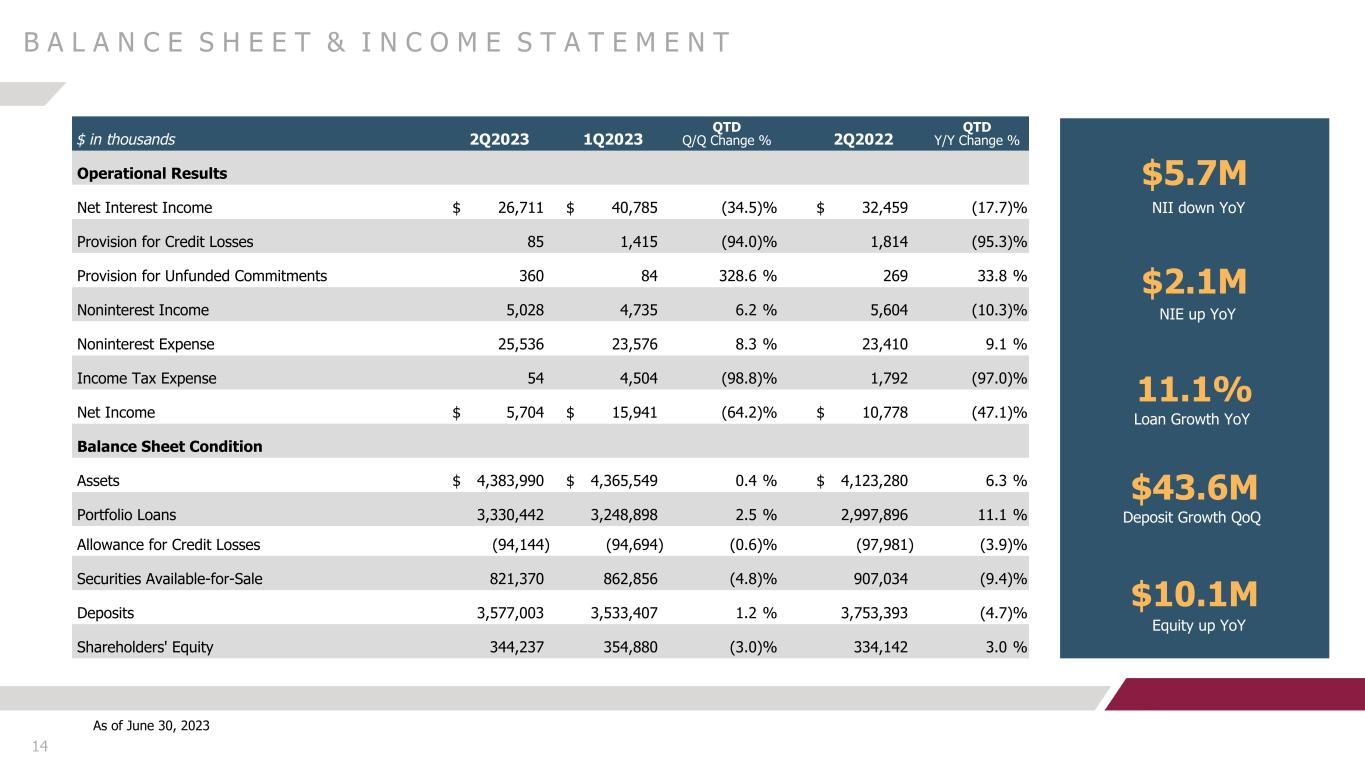

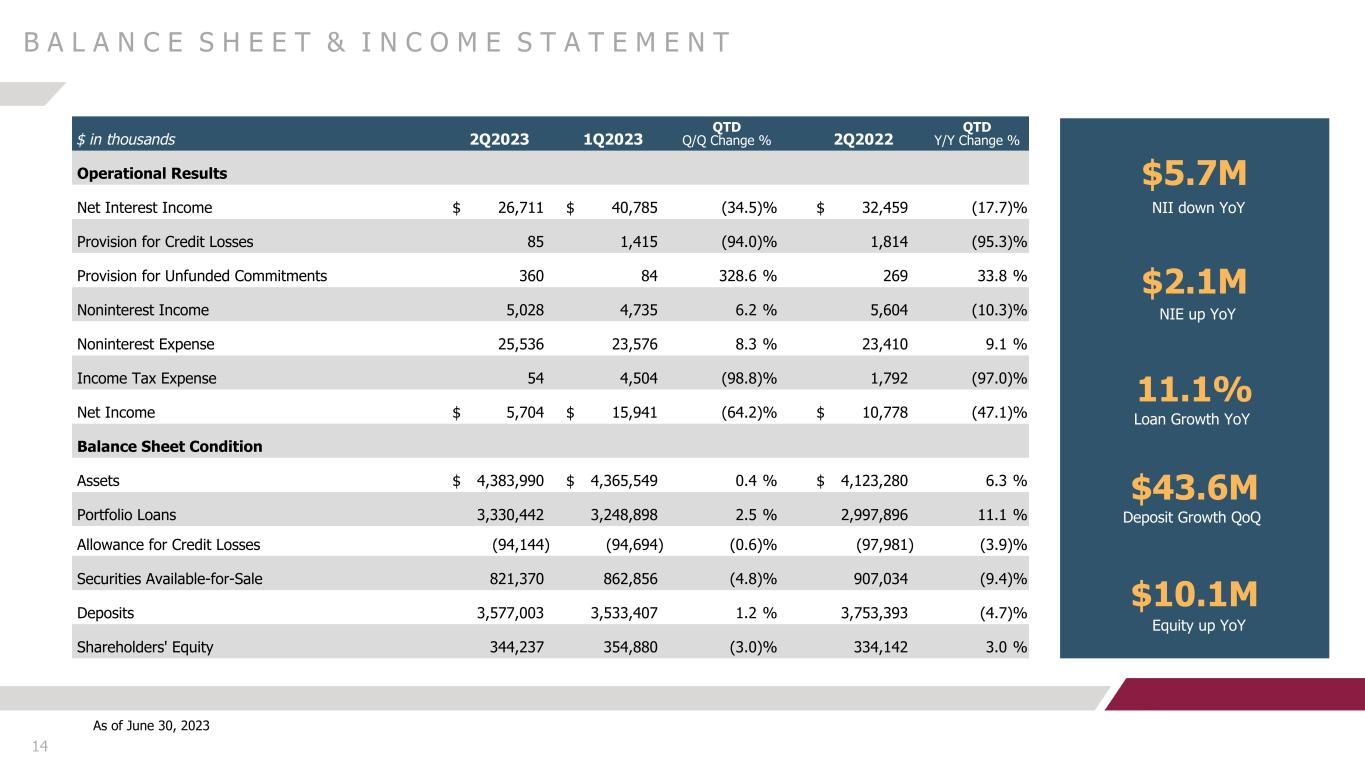

$5.7M 14 $ in thousands 2Q2023 1Q2023 QTD Q/Q Change % 2Q2022 QTD Y/Y Change % Operational Results Net Interest Income $ 26,711 $ 40,785 (34.5) % $ 32,459 (17.7) % Provision for Credit Losses 85 1,415 (94.0) % 1,814 (95.3) % Provision for Unfunded Commitments 360 84 328.6 % 269 33.8 % Noninterest Income 5,028 4,735 6.2 % 5,604 (10.3) % Noninterest Expense 25,536 23,576 8.3 % 23,410 9.1 % Income Tax Expense 54 4,504 (98.8) % 1,792 (97.0) % Net Income $ 5,704 $ 15,941 (64.2) % $ 10,778 (47.1) % Balance Sheet Condition Assets $ 4,383,990 $ 4,365,549 0.4 % $ 4,123,280 6.3 % Portfolio Loans 3,330,442 3,248,898 2.5 % 2,997,896 11.1 % Allowance for Credit Losses (94,144) (94,694) (0.6) % (97,981) (3.9) % Securities Available-for-Sale 821,370 862,856 (4.8) % 907,034 (9.4) % Deposits 3,577,003 3,533,407 1.2 % 3,753,393 (4.7) % Shareholders' Equity 344,237 354,880 (3.0) % 334,142 3.0 % B A L A N C E S H E E T & I N C O M E S T A T E M E N T NII down YoY $2.1M NIE up YoY 11.1% Loan Growth YoY $10.1M Equity up YoY As of June 30, 2023 $43.6M Deposit Growth QoQ

6.38% $0.24 QTD EPS ROA ROE 2Q2023 1Q2023 QTD Q/Q Change % 2Q2022 QTD Y/Y Change % Shareholder Ratios Diluted Earnings Per Share (QTD) $ 0.24 $ 0.67 (64.2) % $ 0.44 (45.5) % Financial Ratios Return on Avg Assets (QTD) 0.52 % 1.51 % (65.6) % 1.04 % (50.0) % Return on Avg Shareholders' Equity (QTD) 6.38 % 18.89 % (66.2) % 12.51 % (49.0) % Net Interest Margin (FTE)(QTD)1 2.54 % 3.98 % (36.2) % 3.27 % (22.3) % Core Efficiency Ratio (QTD)1 79.77 % 51.18 % 55.9 % 61.30 % 30.1 % Asset Quality Ratios NPL/Portfolio Loans 9.33 % 0.26 % 3,488.5 % 0.40 % 2,232.5 % NPA/Total Assets plus OREO 9.42 % 0.51 % 1,747.1 % 0.68 % 1,285.3 % ACL/Total Portfolio Loans 2.83 % 2.91 % (2.7) % 3.27 % (13.5) % Net Chg-offs/Portfolio Loans (QTD annualized) 0.08 % 0.07 % 14.3 % 0.03 % 166.7 % 15 F I N A N C I A L / S H A R E H O L D E R R A T I O S 0.52% 2.83% NIM 1 2.54% Efficiency Ratio 1 79.77% ACL / Total Loans As of June 30, 2023 1 Non-GAAP Financial measure - see Non-GAAP reconciliation 0.08% Net Chg-offs / Total Loans

Core Efficiency Ratio 71.62% 75.20% 73.51% 60.69% 79.77% 2019 2020 2021 2022 Q2 2023 Net Income, in millions $26,575 $(45,858) $31,590 $50,118 $43,649 2019 2020 2021 2022 Q2 2023 16 F I N A N C I A L P E R F O R M A N C E T R E N D S ROA 0.65% (1.12)% 0.76% 1.21% 0.52% 2019 2020 2021 2022 Q2 2023 TCE 11.81% 10.53% 9.86% 7.82% 7.85% 2019 2020 2021 2022 Q2 2023 (1) (1) (1) A loss of $57.7 million was recognized during the third quarter of 2020 related to a one-time charge resulting from goodwill impairment. This impairment charge reduced net income by $62.2 million, resulting in a net loss for the third quarter of 2020. (2) Net Income for the quarter ended June 30, 2023 is YTD annualized. (2)

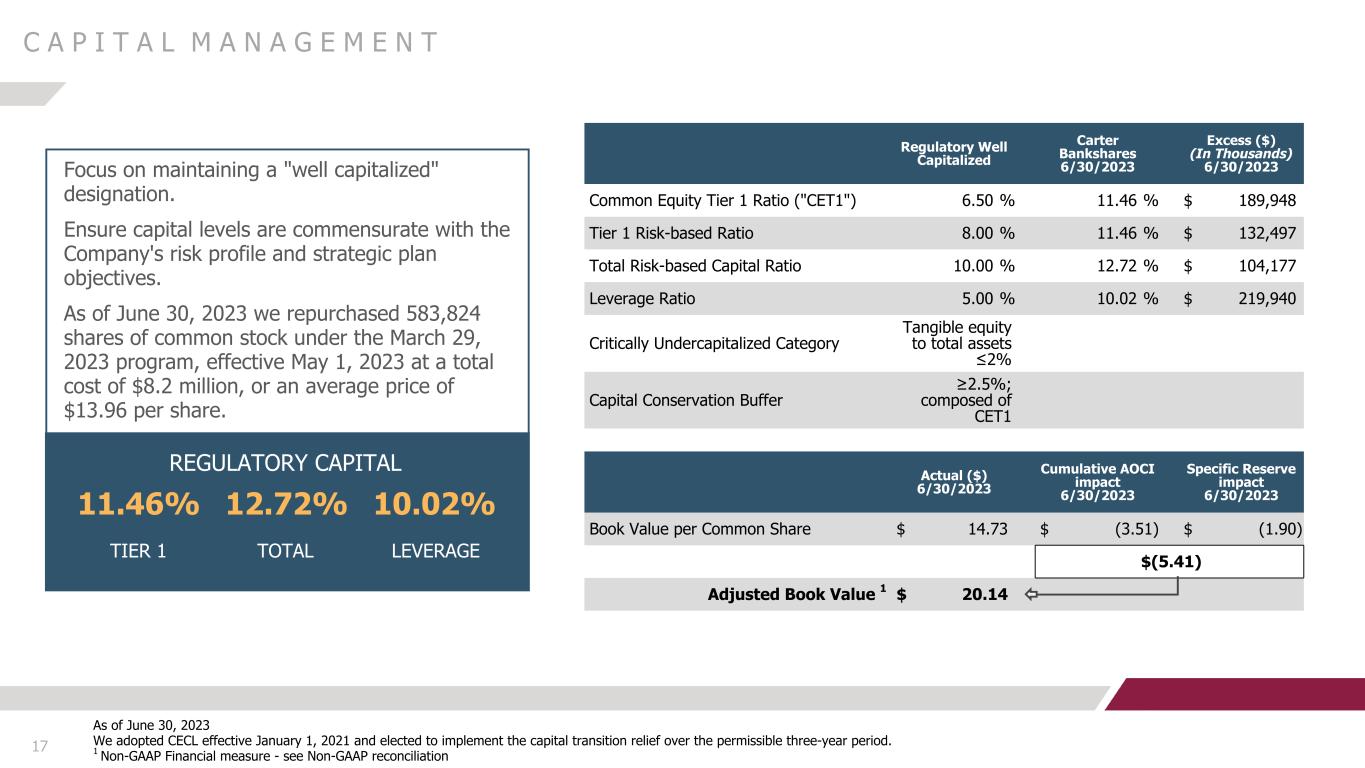

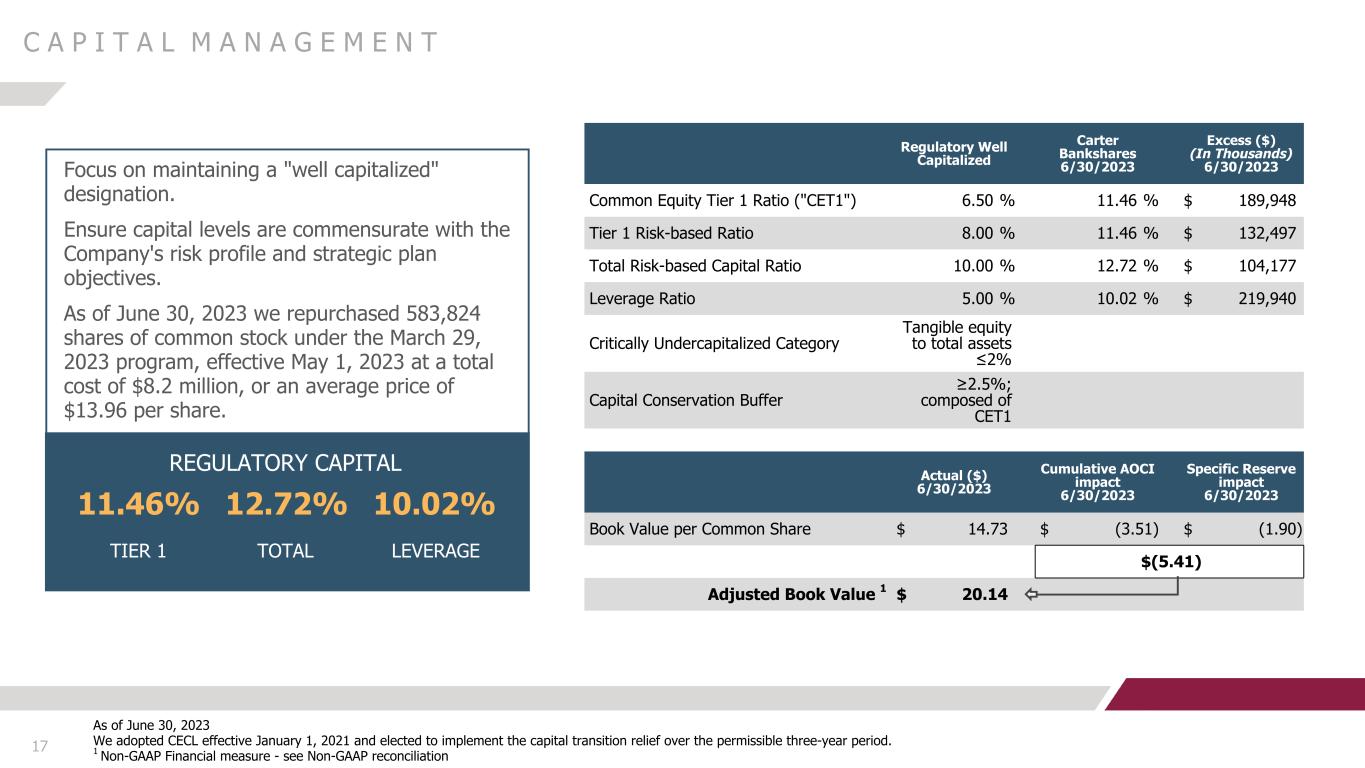

17 As of June 30, 2023 We adopted CECL effective January 1, 2021 and elected to implement the capital transition relief over the permissible three-year period. 1 Non-GAAP Financial measure - see Non-GAAP reconciliation Regulatory Well Capitalized Carter Bankshares 6/30/2023 Excess ($) (In Thousands) 6/30/2023 Common Equity Tier 1 Ratio ("CET1") 6.50 % 11.46 % $ 189,948 Tier 1 Risk-based Ratio 8.00 % 11.46 % $ 132,497 Total Risk-based Capital Ratio 10.00 % 12.72 % $ 104,177 Leverage Ratio 5.00 % 10.02 % $ 219,940 Critically Undercapitalized Category Tangible equity to total assets ≤2% Capital Conservation Buffer ≥2.5%; composed of CET1 Focus on maintaining a "well capitalized" designation. Ensure capital levels are commensurate with the Company's risk profile and strategic plan objectives. As of June 30, 2023 we repurchased 583,824 shares of common stock under the March 29, 2023 program, effective May 1, 2023 at a total cost of $8.2 million, or an average price of $13.96 per share. 11.46% TIER 1 TOTAL LEVERAGE C A P I T A L M A N A G E M E N T 12.72% 10.02% Actual ($) 6/30/2023 Cumulative AOCI impact 6/30/2023 Specific Reserve impact 6/30/2023 Book Value per Common Share $ 14.73 $ (3.51) $ (1.90) $(5.41) Adjusted Book Value 1 $ 20.14 REGULATORY CAPITAL

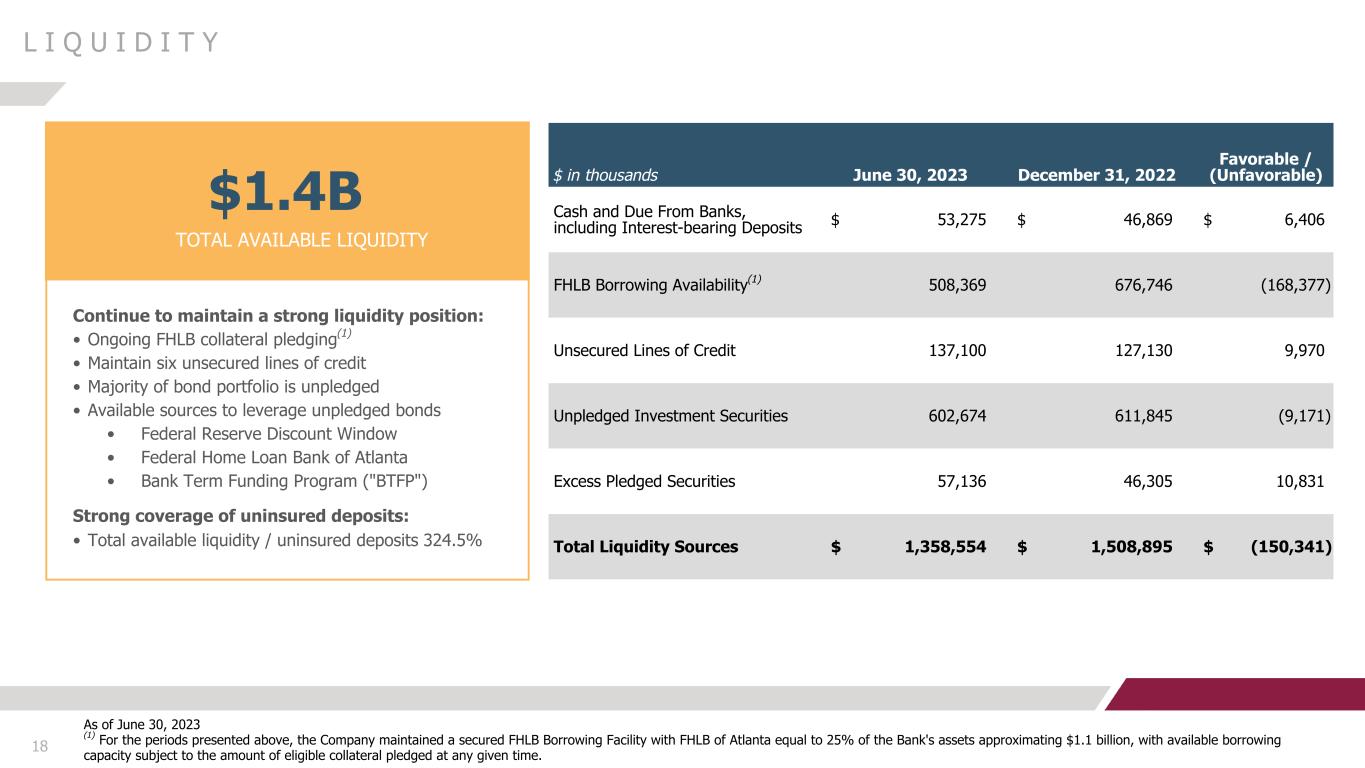

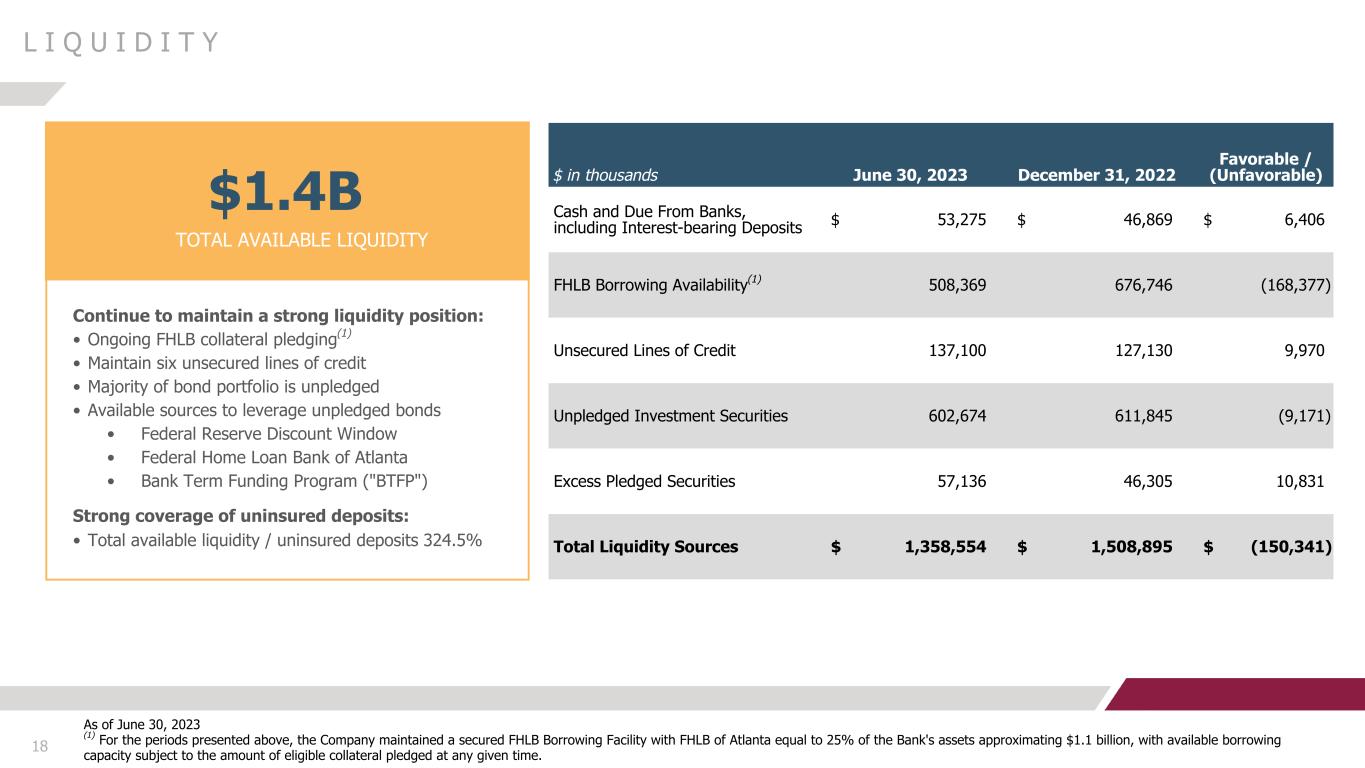

$ in thousands June 30, 2023 December 31, 2022 Favorable / (Unfavorable) Cash and Due From Banks, including Interest-bearing Deposits $ 53,275 $ 46,869 $ 6,406 FHLB Borrowing Availability(1) 508,369 676,746 (168,377) Unsecured Lines of Credit 137,100 127,130 9,970 Unpledged Investment Securities 602,674 611,845 (9,171) Excess Pledged Securities 57,136 46,305 10,831 Total Liquidity Sources $ 1,358,554 $ 1,508,895 $ (150,341) 18 As of June 30, 2023 (1) For the periods presented above, the Company maintained a secured FHLB Borrowing Facility with FHLB of Atlanta equal to 25% of the Bank's assets approximating $1.1 billion, with available borrowing capacity subject to the amount of eligible collateral pledged at any given time. Continue to maintain a strong liquidity position: • Ongoing FHLB collateral pledging(1) • Maintain six unsecured lines of credit • Majority of bond portfolio is unpledged • Available sources to leverage unpledged bonds • Federal Reserve Discount Window • Federal Home Loan Bank of Atlanta • Bank Term Funding Program ("BTFP") Strong coverage of uninsured deposits: • Total available liquidity / uninsured deposits 324.5% L I Q U I D I T Y $1.4B TOTAL AVAILABLE LIQUIDITY

19 For the Period Ending Variance $ in thousands 06/30/23 03/31/23 06/30/22 Quarter Year Lifetime Free Checking $ 686,124 $ 687,333 $ 704,323 $ (1,209) $ (18,199) Interest-Bearing Demand 489,971 500,749 499,282 (10,778) (9,311) Money Market 422,780 430,938 555,621 (8,158) (132,841) Savings 526,588 606,976 733,704 (80,388) (207,116) Certificates of Deposits 1,451,540 1,307,411 1,260,463 144,129 191,077 Total Deposits $ 3,577,003 $ 3,533,407 $ 3,753,393 $ 43,596 $ (176,390) D E P O S I T C O M P O S I T I O N Total Deposits Composition $3,504 $3,685 $3,698 $3,630 $3,577 555 709 748 703 686 2,949 2,976 2,950 2,927 2,891 Noninterest-bearing Deposits Interest-bearing Deposits YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 DEPOSIT STATISTICS • Total deposits increased $43.6M QoQ. • Diversified and granular deposit base, approximately 77.5% Retail Customers. • Approximately 88.3% of Deposits, including Collateralized Muni deposits are FDIC Insured. • Partnership with IntraFi for available coverage over $250K FDIC insured limit. DDA - Int. Free 19% DDA - Int.- Bearing 14% Money Market 12% Savings 15% CDs 40% (1) Period end balances at June 30, 2023, $ in millions (1)

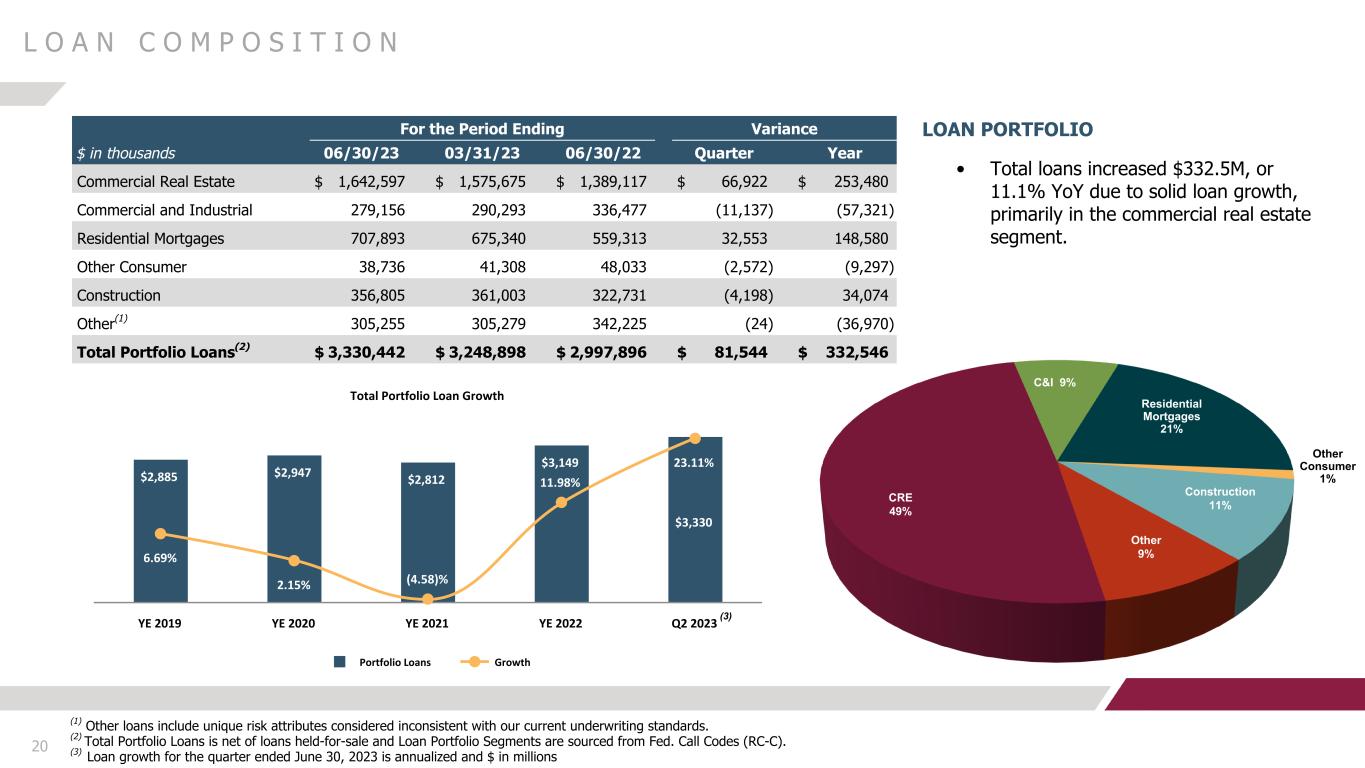

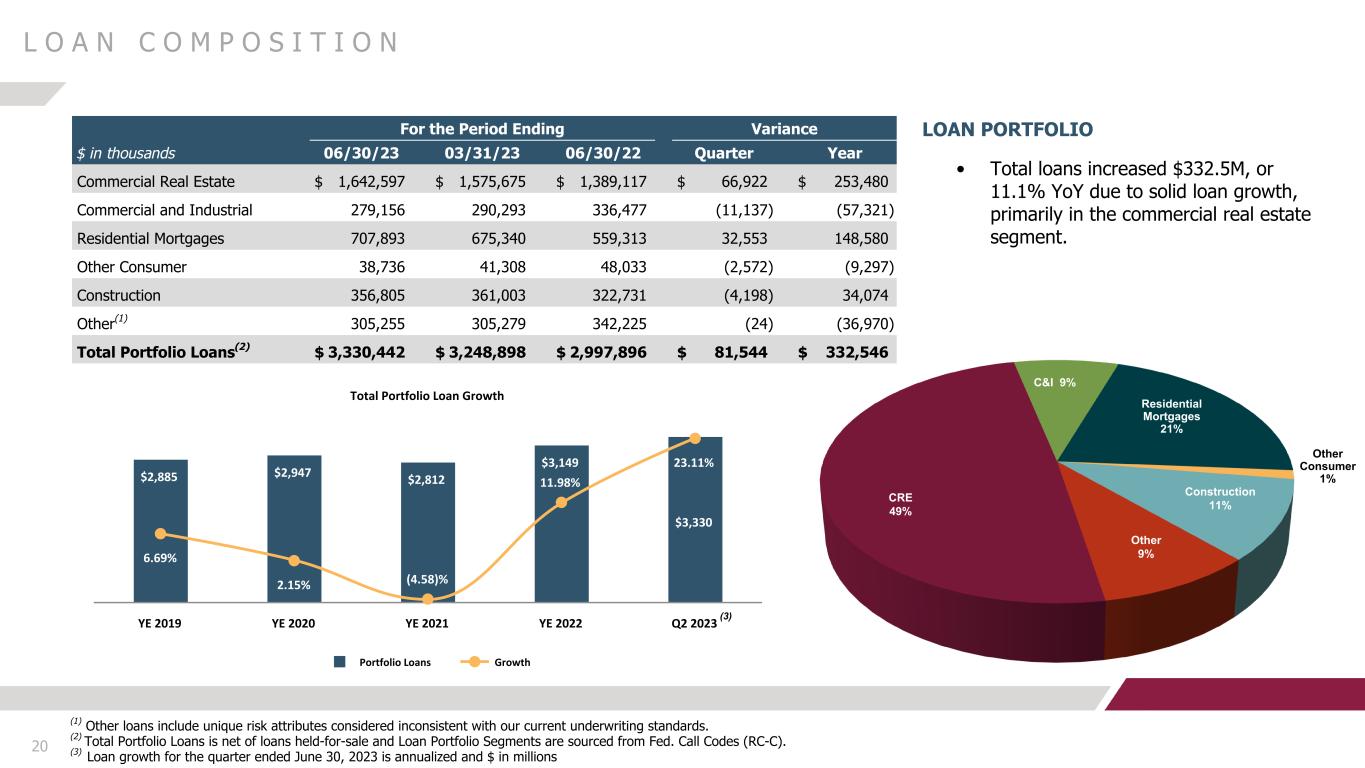

20 For the Period Ending Variance $ in thousands 06/30/23 03/31/23 06/30/22 Quarter Year Commercial Real Estate $ 1,642,597 $ 1,575,675 $ 1,389,117 $ 66,922 $ 253,480 Commercial and Industrial 279,156 290,293 336,477 (11,137) (57,321) Residential Mortgages 707,893 675,340 559,313 32,553 148,580 Other Consumer 38,736 41,308 48,033 (2,572) (9,297) Construction 356,805 361,003 322,731 (4,198) 34,074 Other(1) 305,255 305,279 342,225 (24) (36,970) Total Portfolio Loans(2) $ 3,330,442 $ 3,248,898 $ 2,997,896 $ 81,544 $ 332,546 L O A N C O M P O S I T I O N LOAN PORTFOLIO • Total loans increased $332.5M, or 11.1% YoY due to solid loan growth, primarily in the commercial real estate segment. (1) Other loans include unique risk attributes considered inconsistent with our current underwriting standards. (2) Total Portfolio Loans is net of loans held-for-sale and Loan Portfolio Segments are sourced from Fed. Call Codes (RC-C). (3) Loan growth for the quarter ended June 30, 2023 is annualized and $ in millions CRE 49% C&I 9% Residential Mortgages 21% Other Consumer 1% Construction 11% Other 9% Total Portfolio Loan Growth $2,885 $2,947 $2,812 $3,149 $3,330 6.69% 2.15% (4.58)% 11.98% 23.11% Portfolio Loans Growth YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 (3)

21 L O A N P O R T F O L I O R E P R I C I N G & I N D E X Q2 2023 (1) Floating Rate Loans are defined as loans with contractual interest rate terms that allow the loan to reprice at lease once each month. (2) Variable Rate Loans are defined as loans with contractual interest rate terms that allow the loan to reprice at least once during the life of the loan agreement, but not more frequently than once per quarter. $ in millions Loan Portfolio by Rate Type Fixed $1,100 33% Floating $844 25% Variable $1,386 42% Loan Portfolio by Rate Index Type Fixed $1,100 33% Libor $175 5% Sofr $240 7% Prime $447 14% Treasury $1,368 41% (2) (1) $3.3B $3.3B

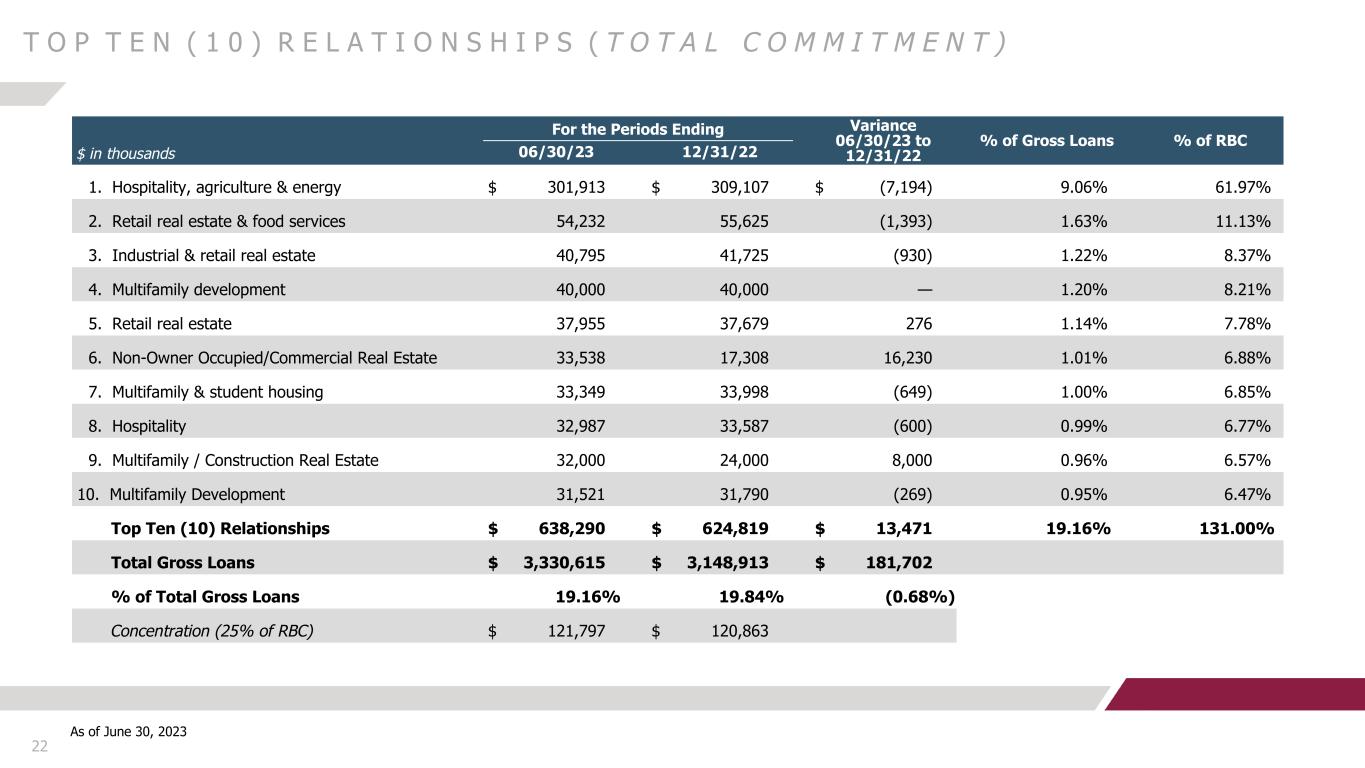

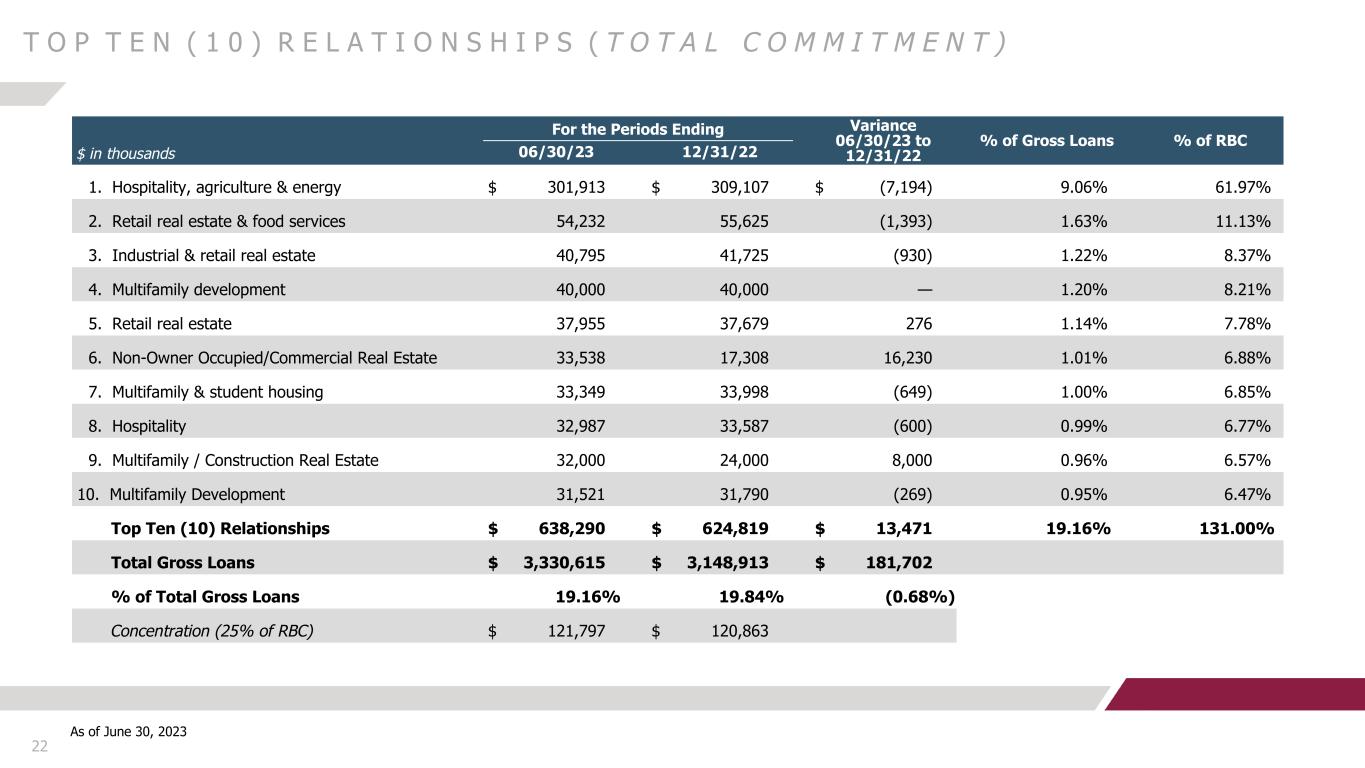

22 For the Periods Ending Variance 06/30/23 to 12/31/22 % of Gross Loans % of RBC $ in thousands 06/30/23 12/31/22 1. Hospitality, agriculture & energy $ 301,913 $ 309,107 $ (7,194) 9.06% 61.97% 2. Retail real estate & food services 54,232 55,625 (1,393) 1.63% 11.13% 3. Industrial & retail real estate 40,795 41,725 (930) 1.22% 8.37% 4. Multifamily development 40,000 40,000 — 1.20% 8.21% 5. Retail real estate 37,955 37,679 276 1.14% 7.78% 6. Non-Owner Occupied/Commercial Real Estate 33,538 17,308 16,230 1.01% 6.88% 7. Multifamily & student housing 33,349 33,998 (649) 1.00% 6.85% 8. Hospitality 32,987 33,587 (600) 0.99% 6.77% 9. Multifamily / Construction Real Estate 32,000 24,000 8,000 0.96% 6.57% 10. Multifamily Development 31,521 31,790 (269) 0.95% 6.47% Top Ten (10) Relationships $ 638,290 $ 624,819 $ 13,471 19.16% 131.00% Total Gross Loans $ 3,330,615 $ 3,148,913 $ 181,702 % of Total Gross Loans 19.16% 19.84% (0.68%) Concentration (25% of RBC) $ 121,797 $ 120,863 T O P T E N ( 1 0 ) R E L A T I O N S H I P S ( T O T A L C O M M I T M E N T ) As of June 30, 2023

B A L A N C E S H E E T T R A N S F O R M A T I O N 23

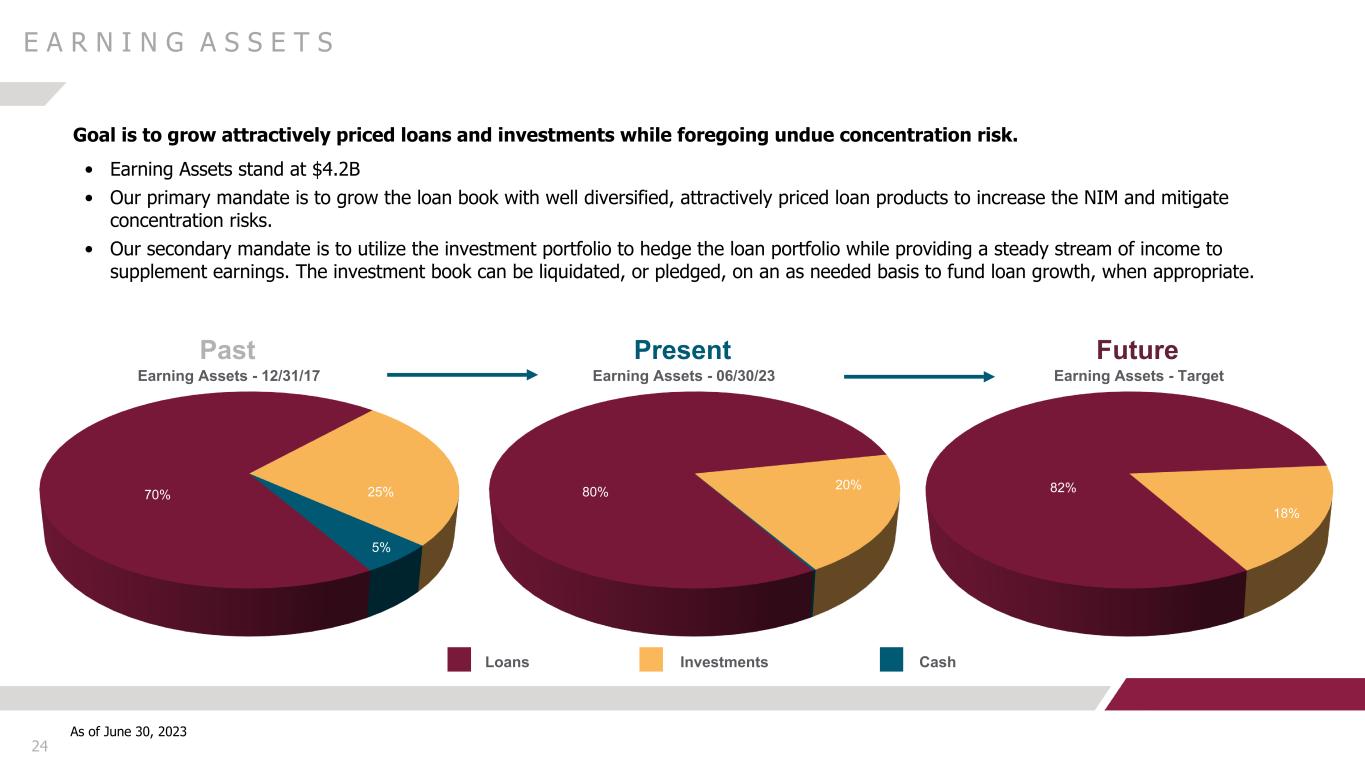

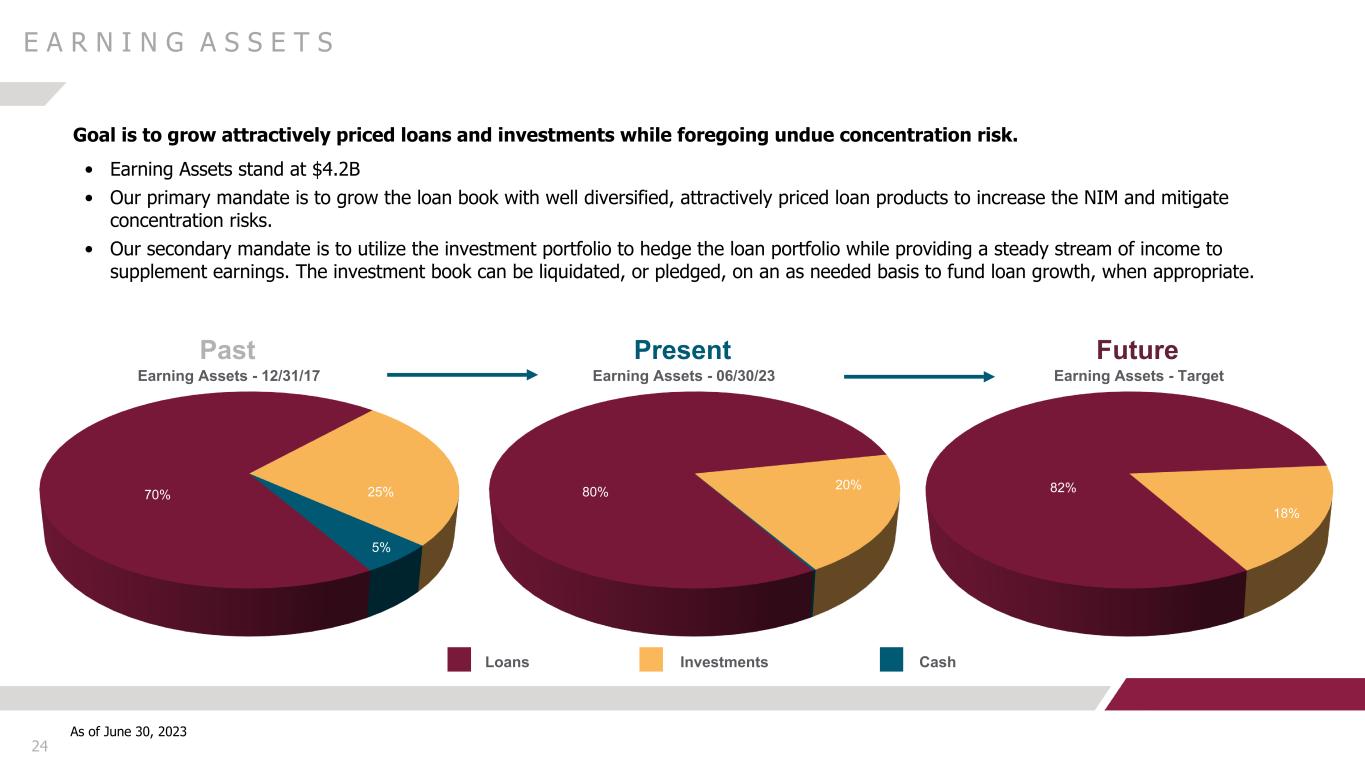

24 E A R N I N G A S S E T S Goal is to grow attractively priced loans and investments while foregoing undue concentration risk. • Earning Assets stand at $4.2B • Our primary mandate is to grow the loan book with well diversified, attractively priced loan products to increase the NIM and mitigate concentration risks. • Our secondary mandate is to utilize the investment portfolio to hedge the loan portfolio while providing a steady stream of income to supplement earnings. The investment book can be liquidated, or pledged, on an as needed basis to fund loan growth, when appropriate. Past Present Future Loans Investments Cash 70% 80% 82% 18% 20%25% 5% —% Earning Assets - 12/31/17 Earning Assets - 06/30/23 Earning Assets - Target As of June 30, 2023

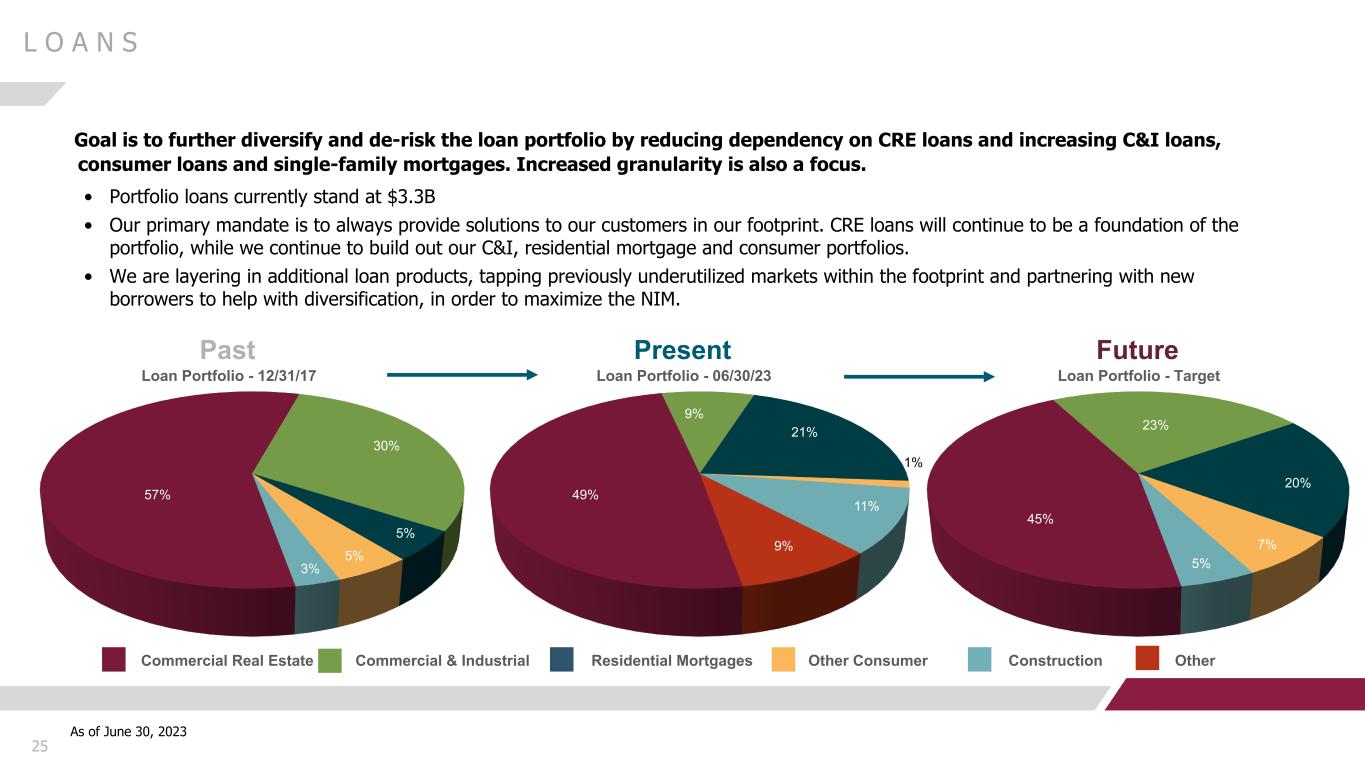

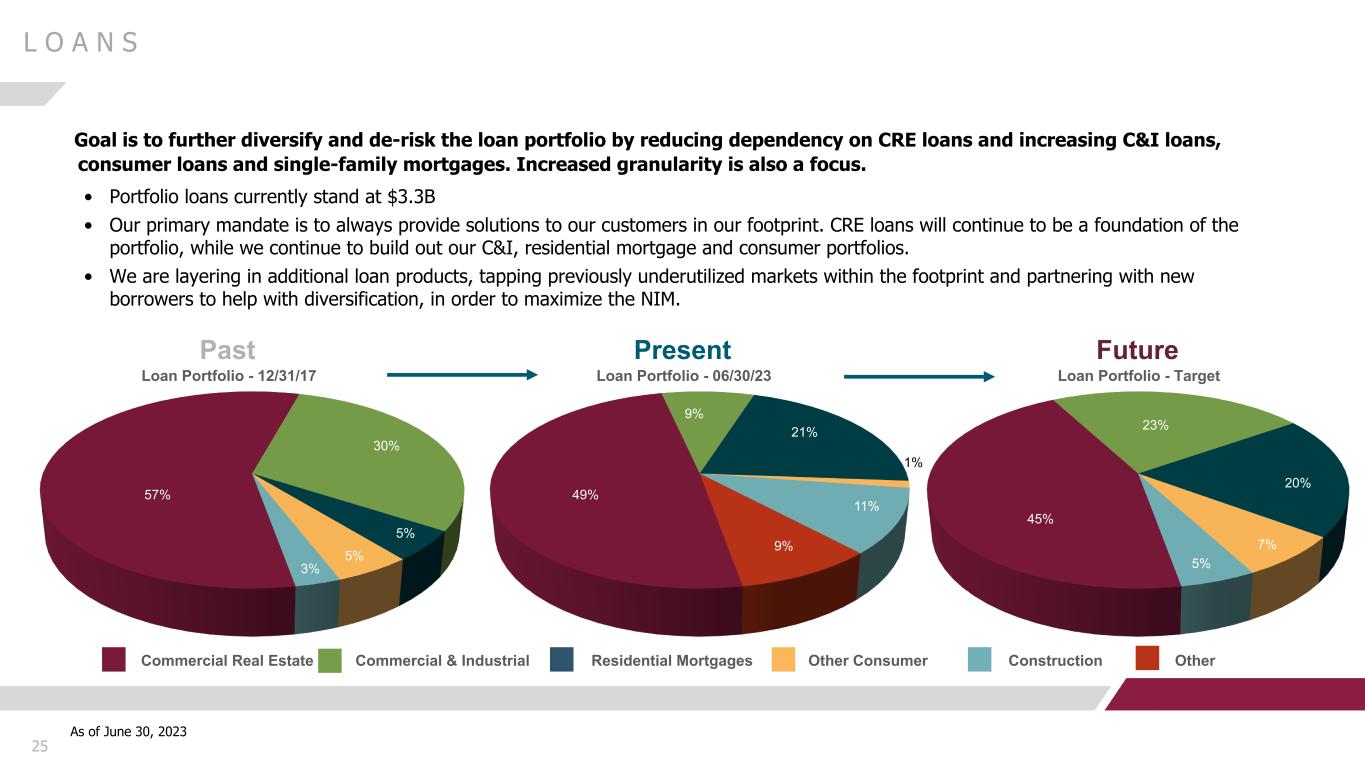

25 L O A N S Goal is to further diversify and de-risk the loan portfolio by reducing dependency on CRE loans and increasing C&I loans, consumer loans and single-family mortgages. Increased granularity is also a focus. • Portfolio loans currently stand at $3.3B • Our primary mandate is to always provide solutions to our customers in our footprint. CRE loans will continue to be a foundation of the portfolio, while we continue to build out our C&I, residential mortgage and consumer portfolios. • We are layering in additional loan products, tapping previously underutilized markets within the footprint and partnering with new borrowers to help with diversification, in order to maximize the NIM. Commercial Real Estate Commercial & Industrial Residential Mortgages Other Consumer Construction Other Past Present Future 57% 49% 45% 20% 21% 5% 3% 1% 7% Loan Portfolio - 12/31/17 Loan Portfolio - 06/30/23 Loan Portfolio - Target 5% 11% 5% 30% 9% 23% 9% As of June 30, 2023

26 B O N D P O R T F O L I O Goal is to maintain diversification and strong credit quality, while delivering above peer performance. • Portfolio stands at $821.4M, or about 18.7% of total assets, target is 15-25% of total assets • Per the charts, diversification has improved significantly over the past several years • The portfolio is now about 50% floating rate (versus 0% floating rate several years ago) • All bonds are “available-for-sale”, and can be used for liquidity and pledging purposes as needed Muni MBS Corporates Agencies & Treasuries ABS SBA CMBS CMO Past Present Future 12% 8% 25% 41% 10% Bond Portfolio - 06/30/17 Bond Portfolio - 06/30/23 Bond Portfolio - Target 10% 34% 28% 28% 15% 7% 21% 17% 25% 8% 2% 2% (1) 7% As of June 30, 2023

27 6/30/2023 12/31/2022 $ in thousands Number of Securities Fair Value Unrealized Losses Number of Securities Fair Value Unrealized Losses U.S. Treasury Securities 4 $ 13,174 $ (1,197) 5 $ 17,866 $ (1,452) U.S. Government Agency Securities 20 23,574 (803) 15 20,913 (788) Residential Mortgage-Backed Securities 43 100,163 (13,055) 43 103,685 (12,009) Commercial Mortgage-Backed Securities 54 21,469 (868) 56 23,518 (936) Other Commercial Mortgage-Backed Securities 9 21,583 (3,256) 8 19,862 (2,597) Asset Backed Securities 53 138,026 (13,964) 54 139,383 (15,169) Collateralized Mortgage Obligations 85 169,077 (14,116) 85 176,622 (14,159) States and Political Subdivisions 161 233,231 (46,066) 164 227,946 (53,607) Corporate Notes 21 58,310 (12,440) 21 61,733 (9,017) Total Debt Securities 450 $ 778,607 $ (105,765) 451 $ 791,528 $ (109,734) B O N D P O R T F O L I O BOND OVERVIEW • The bond portfolio is 100% available-for-sale. • Our portfolio consists of 48.5% of securities issued by United States government sponsored entities and carry an implicit government guarantee. • States and political subdivisions comprise 28.4% of the portfolio and are largely general obligation or essential purpose revenue bonds, which have performed very well historically over all business cycles, and are rated AA and AAA. • At June 30, 2023, the Company held 53.1% fixed rate and 46.9% floating rate securities. • Year-to-date improvement of $3.6 million in AOCI given the positive changes in fair value of the available-for-sale bond portfolio. • Securities comprise 18.7% of total assets at June 30, 2023. • Shorter maturity profile with an average life of 5.9 years; less interest rate risk with an effective duration of 4.5. CMO 21% Muni 28% 17% ABS Corporates 7%Agencies & Treasuries 8% MBS 12% CMBS 7% As of June 30, 2023

28 D E P O S I T S Goal is to enhance and diversify funding sources with a focus on lower cost/core relationships (both retail and commercial): • Deposits currently stand at $3.6B • CD Portfolio ($1.45B) is relatively short with 92% of the Portfolio scheduled to mature and reprice over the next 24 months allowing for opportunities to lower deposit costs quickly when short term rates begin to ease • Multiple strategies are in place to grow all non maturity deposit accounts with a focus on lower cost of funds • Established product road map and working to expand deposit offerings for retail and commercial customers CDs DDA - Int. Free DDA - Int. Bearing Money Markets Savings Past Present Future 56% 40% 30% 15% 12%3% 10% Deposit Mix - 12/31/17 Deposit Mix - 06/30/23 Deposit Mix - Target 20% 15% 20% 7% 19% 25% 14% 14% As of June 30, 2023

A S S E T Q U A L I T Y 29

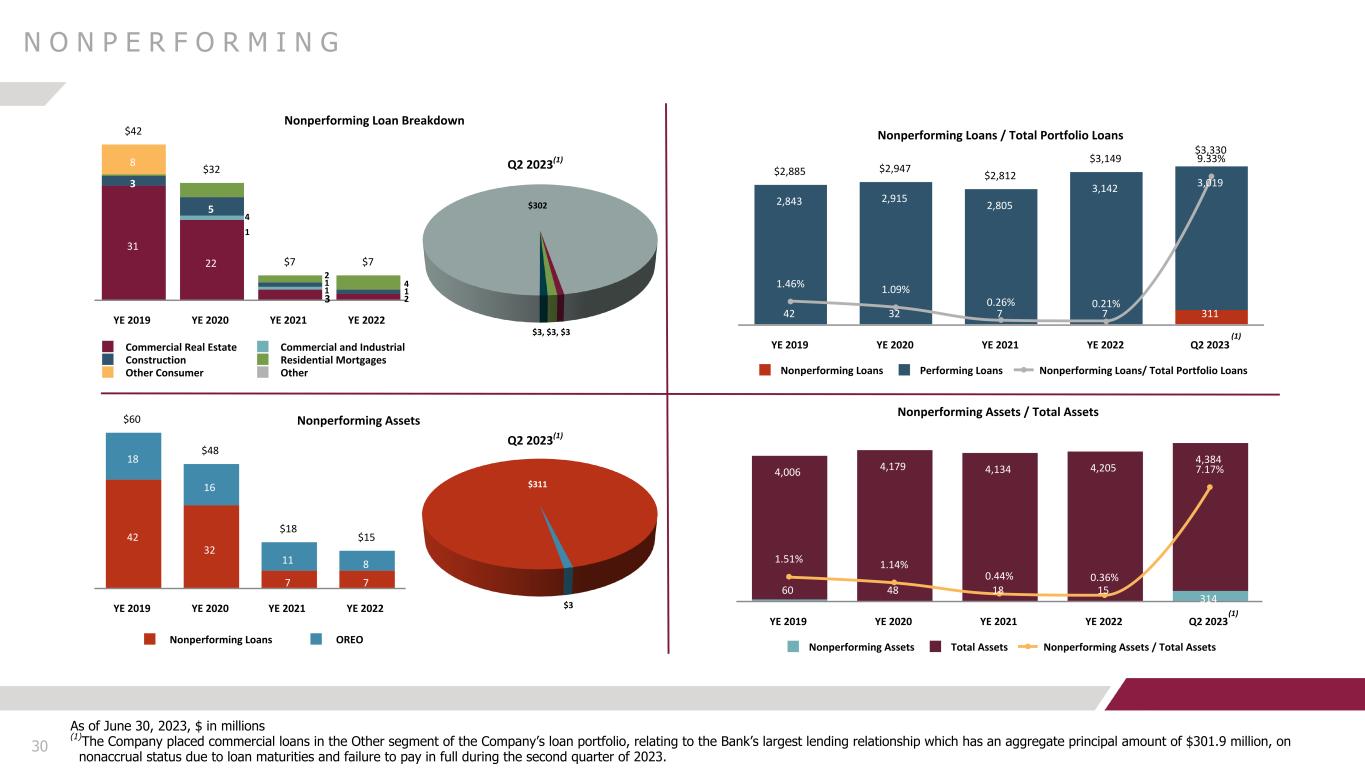

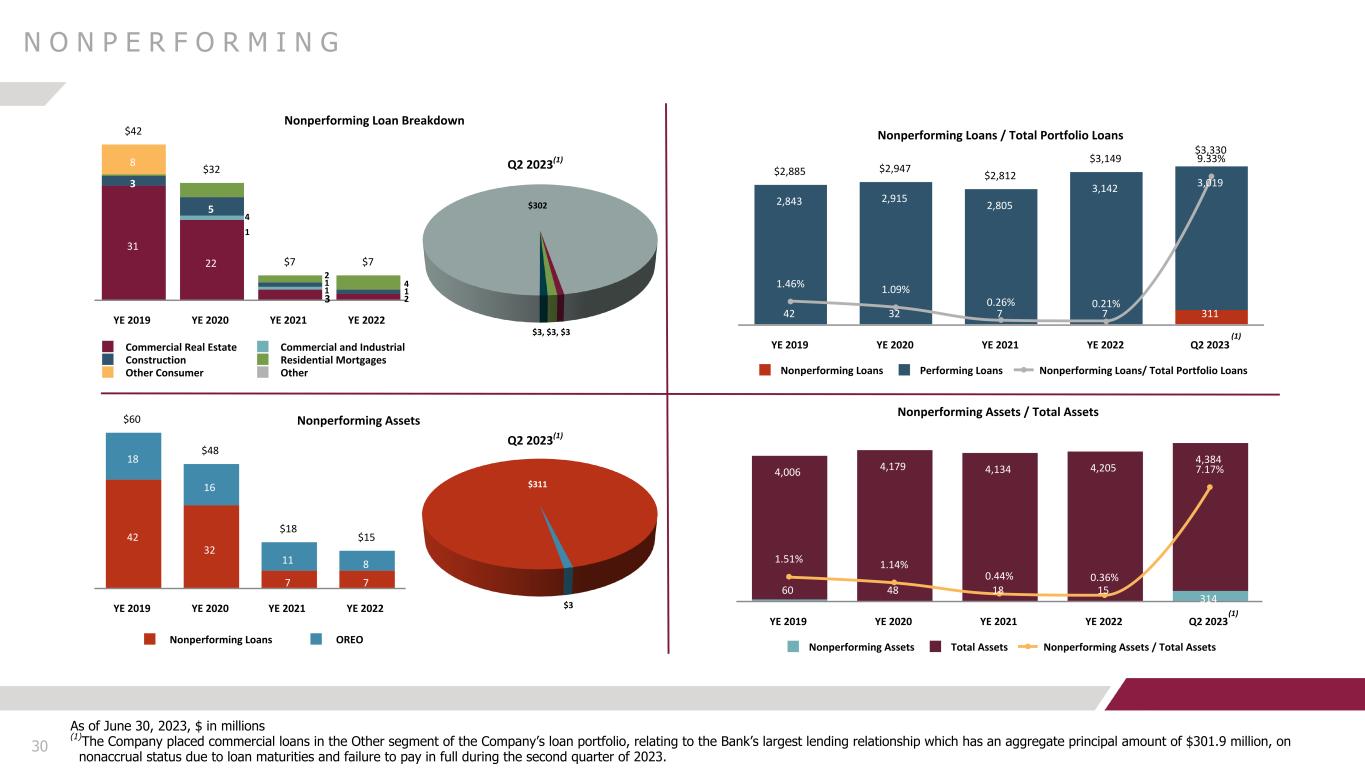

$42 $32 $7 $7 31 22 3 5 8 Commercial Real Estate Commercial and Industrial Construction Residential Mortgages Other Consumer Other YE 2019 YE 2020 YE 2021 YE 2022 30 N O N P E R F O R M I N G Nonperforming Loans / Total Portfolio Loans $2,885 $2,947 $2,812 $3,149 $3,330 42 32 7 7 311 2,843 2,915 2,805 3,142 3,019 1.46% 1.09% 0.26% 0.21% 9.33% Nonperforming Loans Performing Loans Nonperforming Loans/ Total Portfolio Loans YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 $60 $48 $18 $1542 32 7 7 18 16 11 8 Nonperforming Loans OREO YE 2019 YE 2020 YE 2021 YE 2022 Nonperforming Assets / Total Assets 60 48 18 15 314 4,006 4,179 4,134 4,205 4,384 1.51% 1.14% 0.44% 0.36% 7.17% Nonperforming Assets Total Assets Nonperforming Assets / Total Assets YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 As of June 30, 2023, $ in millions (1)The Company placed commercial loans in the Other segment of the Company’s loan portfolio, relating to the Bank’s largest lending relationship which has an aggregate principal amount of $301.9 million, on nonaccrual status due to loan maturities and failure to pay in full during the second quarter of 2023. 4 1 2 2 1 1 3 4 1 $302 $3, $3, $3 Q2 2023(1) Nonperforming Loan Breakdown $311 $3 Q2 2023(1) Nonperforming Assets (1) (1)

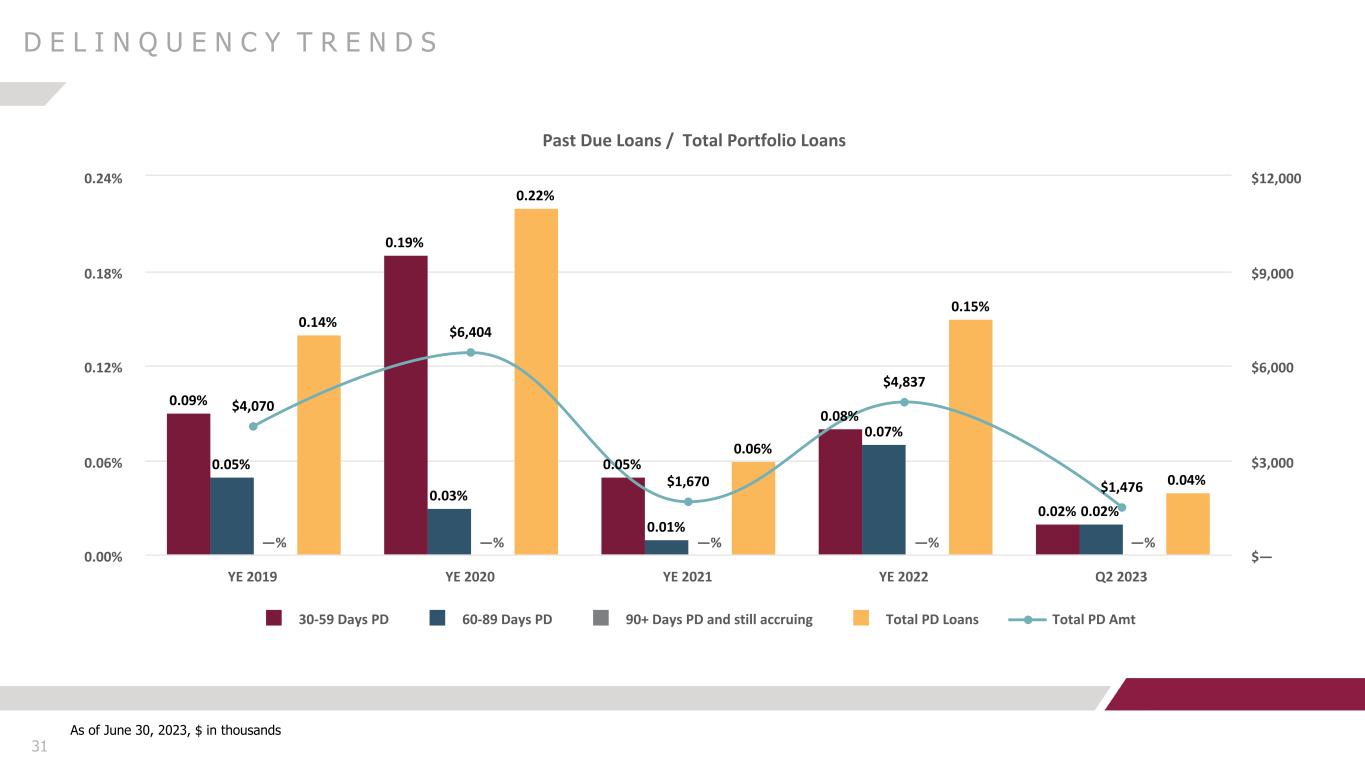

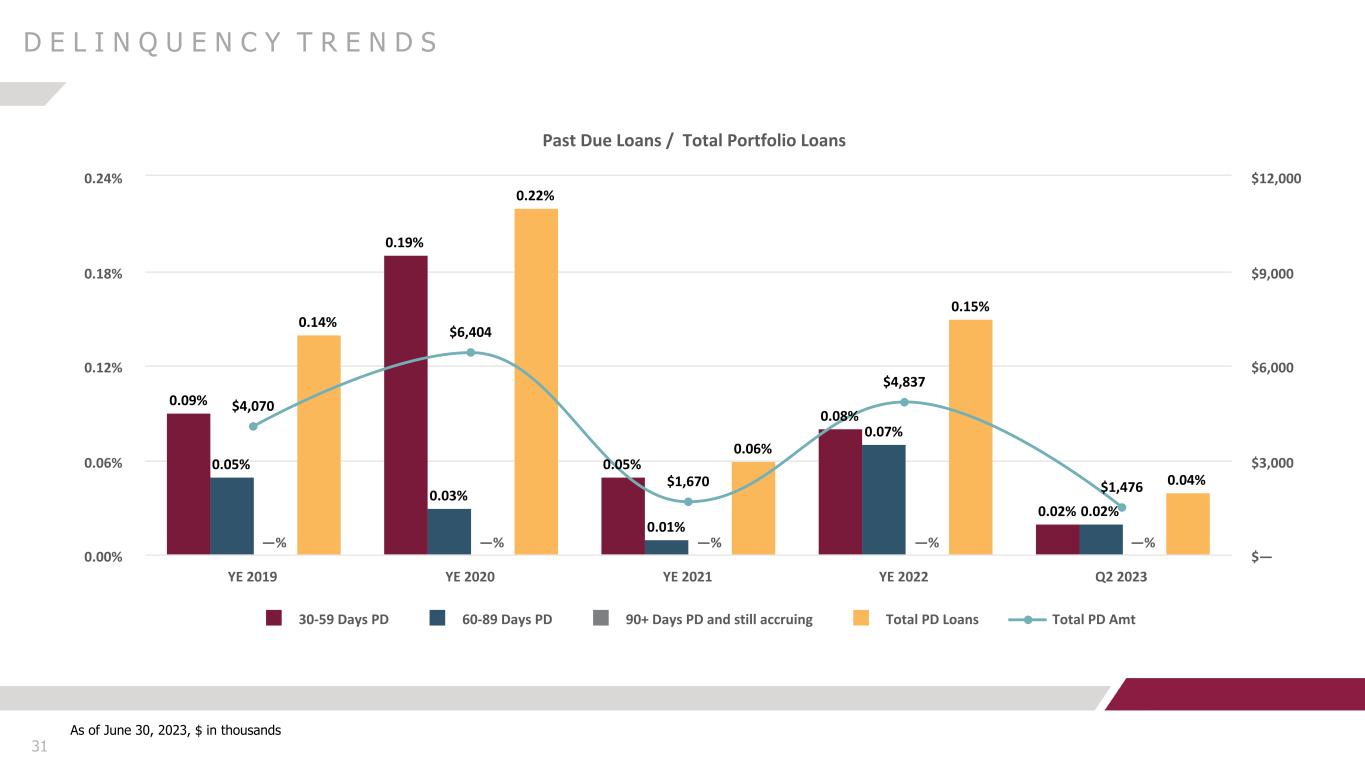

31 D E L I N Q U E N C Y T R E N D S Past Due Loans / Total Portfolio Loans 0.09% 0.19% 0.05% 0.08% 0.02% 0.05% 0.03% 0.01% 0.07% 0.02% —% —% —% —% —% 0.14% 0.22% 0.06% 0.15% 0.04% $4,070 $6,404 $1,670 $4,837 $1,476 30-59 Days PD 60-89 Days PD 90+ Days PD and still accruing Total PD Loans Total PD Amt YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 0.00% 0.06% 0.12% 0.18% 0.24% $— $3,000 $6,000 $9,000 $12,000 As of June 30, 2023, $ in thousands

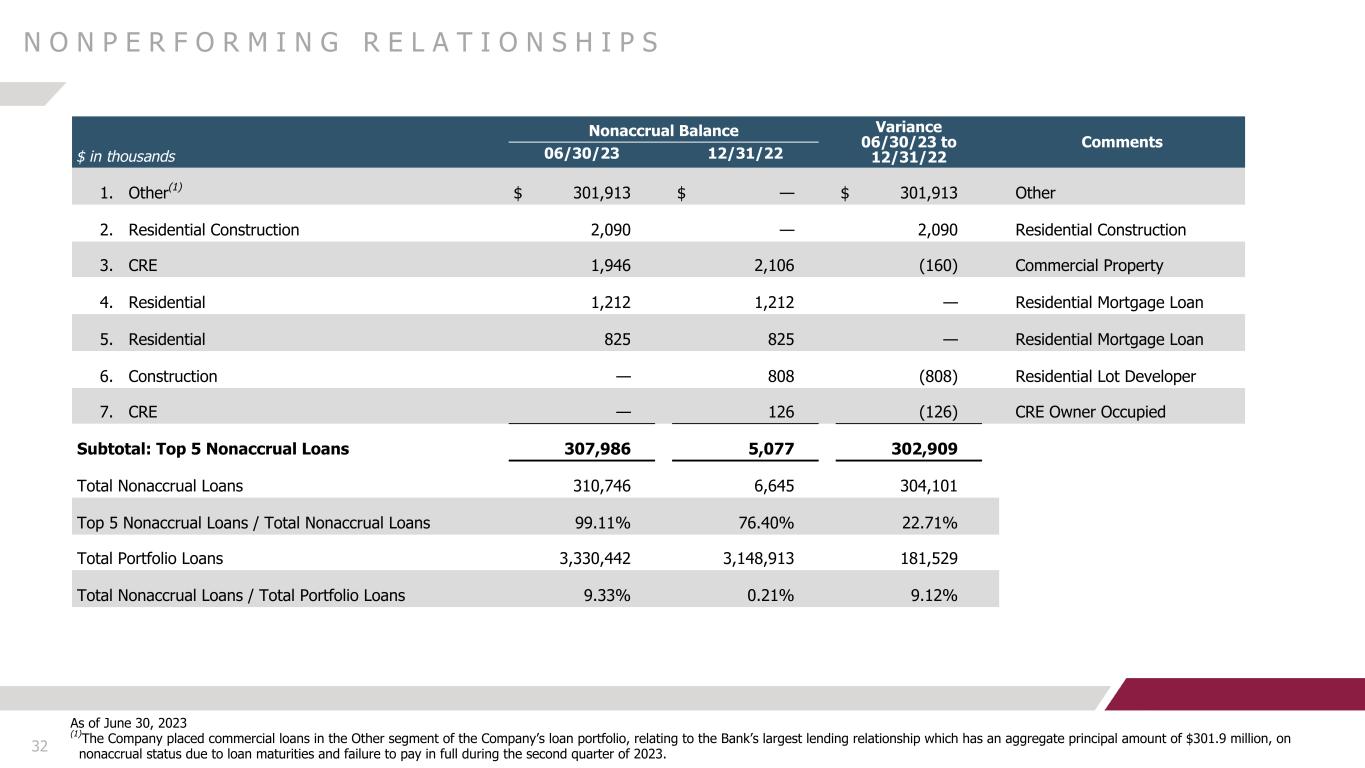

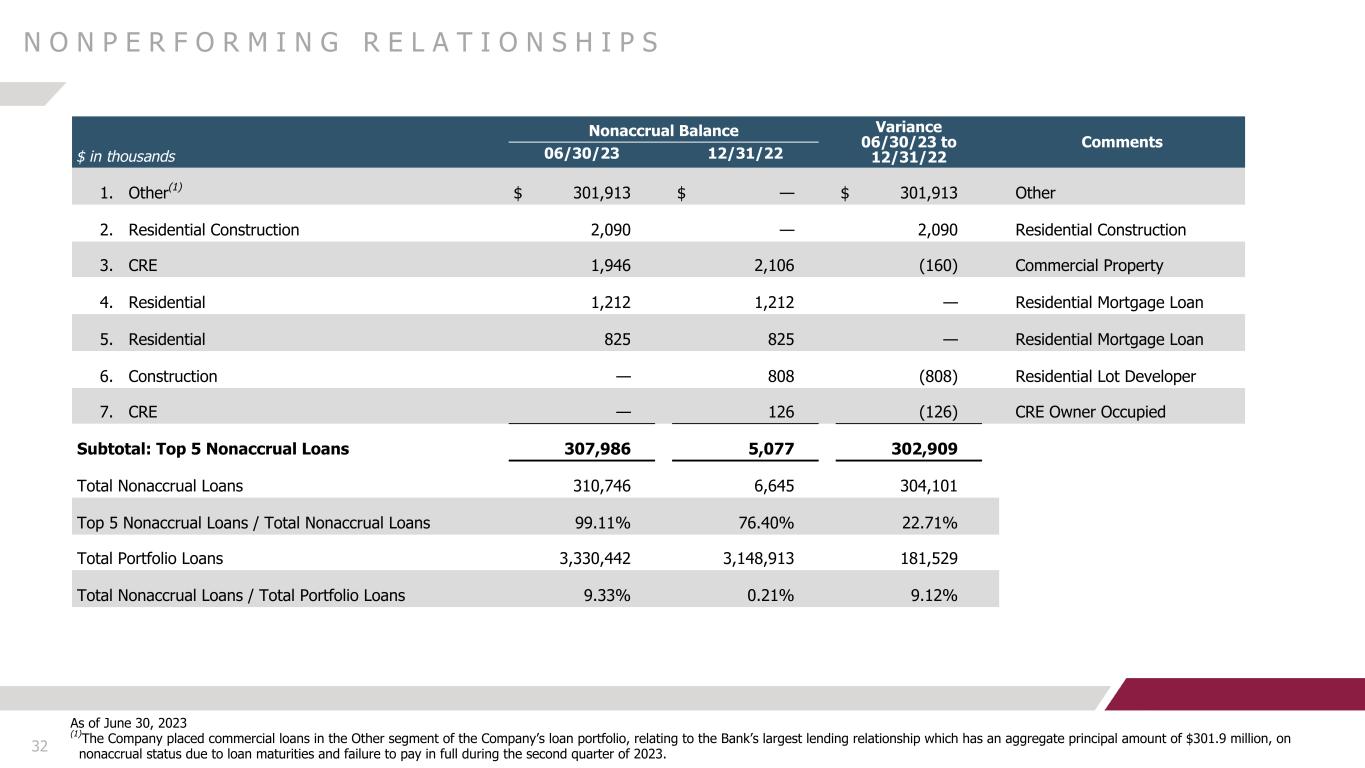

32 Nonaccrual Balance Variance 06/30/23 to 12/31/22 Comments $ in thousands 06/30/23 12/31/22 1. Other(1) $ 301,913 $ — $ 301,913 Other 2. Residential Construction 2,090 — 2,090 Residential Construction 3. CRE 1,946 2,106 (160) Commercial Property 4. Residential 1,212 1,212 — Residential Mortgage Loan 5. Residential 825 825 — Residential Mortgage Loan 6. Construction — 808 (808) Residential Lot Developer 7. CRE — 126 (126) CRE Owner Occupied Subtotal: Top 5 Nonaccrual Loans 307,986 5,077 302,909 Total Nonaccrual Loans 310,746 6,645 304,101 Top 5 Nonaccrual Loans / Total Nonaccrual Loans 99.11 % 76.40 % 22.71 % Total Portfolio Loans 3,330,442 3,148,913 181,529 Total Nonaccrual Loans / Total Portfolio Loans 9.33 % 0.21 % 9.12 % N O N P E R F O R M I N G R E L A T I O N S H I P S As of June 30, 2023 (1)The Company placed commercial loans in the Other segment of the Company’s loan portfolio, relating to the Bank’s largest lending relationship which has an aggregate principal amount of $301.9 million, on nonaccrual status due to loan maturities and failure to pay in full during the second quarter of 2023.

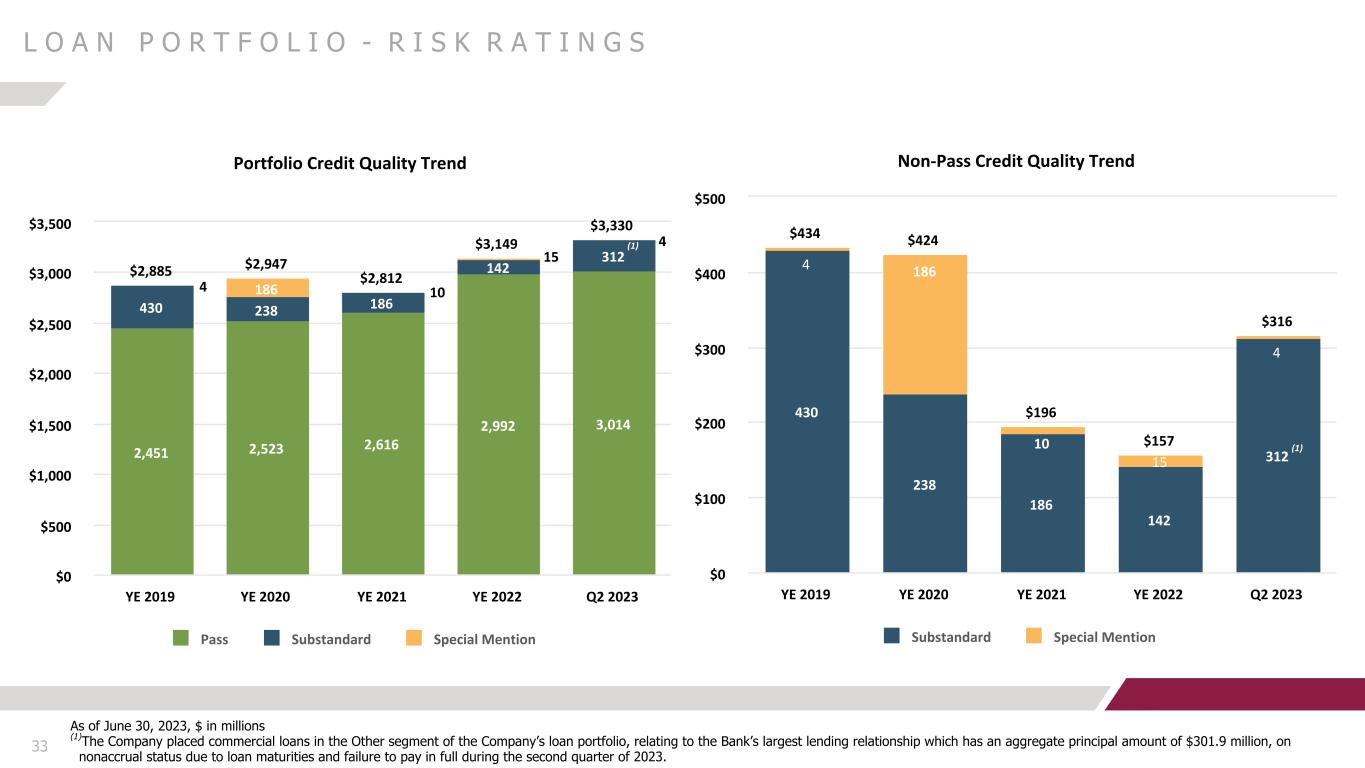

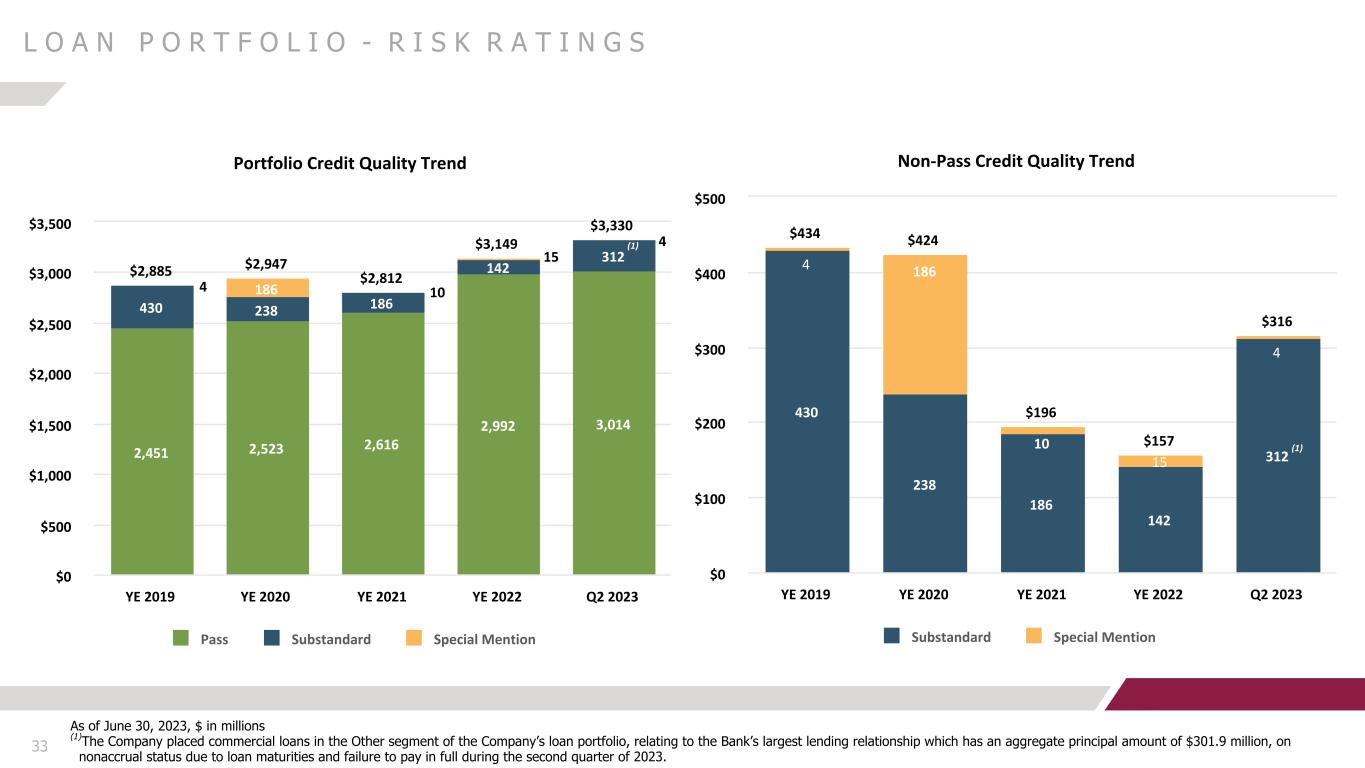

Portfolio Credit Quality Trend $2,885 $2,947 $2,812 $3,149 $3,330 2,451 2,523 2,616 2,992 3,014 430 238 186 142 312 186 Pass Substandard Special Mention YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 33 L O A N P O R T F O L I O - R I S K R A T I N G S Non-Pass Credit Quality Trend $434 $424 $196 $157 $316 430 238 186 142 312 4 186 10 15 4 Substandard Special Mention YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 $0 $100 $200 $300 $400 $500 4 10 15 4 As of June 30, 2023, $ in millions (1)The Company placed commercial loans in the Other segment of the Company’s loan portfolio, relating to the Bank’s largest lending relationship which has an aggregate principal amount of $301.9 million, on nonaccrual status due to loan maturities and failure to pay in full during the second quarter of 2023. (1) (1)

34 A C L, N E T C H A R G E - O F F S & P R O V I S I O N E X P E N S E Net Charge-offs & Provision Expense $3,841 $2,694 $23,127 $4,506 $635 $3,404 $18,006 $3,350 $2,419 $850.13% 0.09% 0.79% 0.15% 0.08% Net Charge-offs Provision Expense Net Charge-offs (annualized)/ Average Loans YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 ACL Composition & ACL Coverage Ratio $38,762 $54,074 $95,939 $93,852 $94,144 32,593 38,824 94,974 93,183 40,224 6,169 15,250 965 669 53,920 1.34% 1.83% 3.41% 2.98% 2.83% General Reserves Specific Reserves ACL to Total Portfolio Loans YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 (2) As of June 30, 2023, $ in thousands (1) Included in the three months ended March 31, 2021 is the $61.6 million Day 1 adjustment related to the adoption ASU No. 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments”. Refer to the Company's Form 10-Q filed with the Securities and Exchange Commission ("SEC") for more details. (2) YTD Net charge-offs for 2021 consist of $9.2 million for nine sold loans that were a part of two relationships in 3Q21 and $6.3 million and $1.9 million in 2Q21 for the resolution of our two largest nonperforming credits, which were previously reserved. (3) The specific reserves increased $53.6 million during the second quarter of 2023 due to our largest lending relationship, that was previously reserved in general reserves within the Other segment, moved to nonperforming status and is currently individually evaluated. (1) (3)

D E P O S I T M I X & C O S T O F F U N D S 35

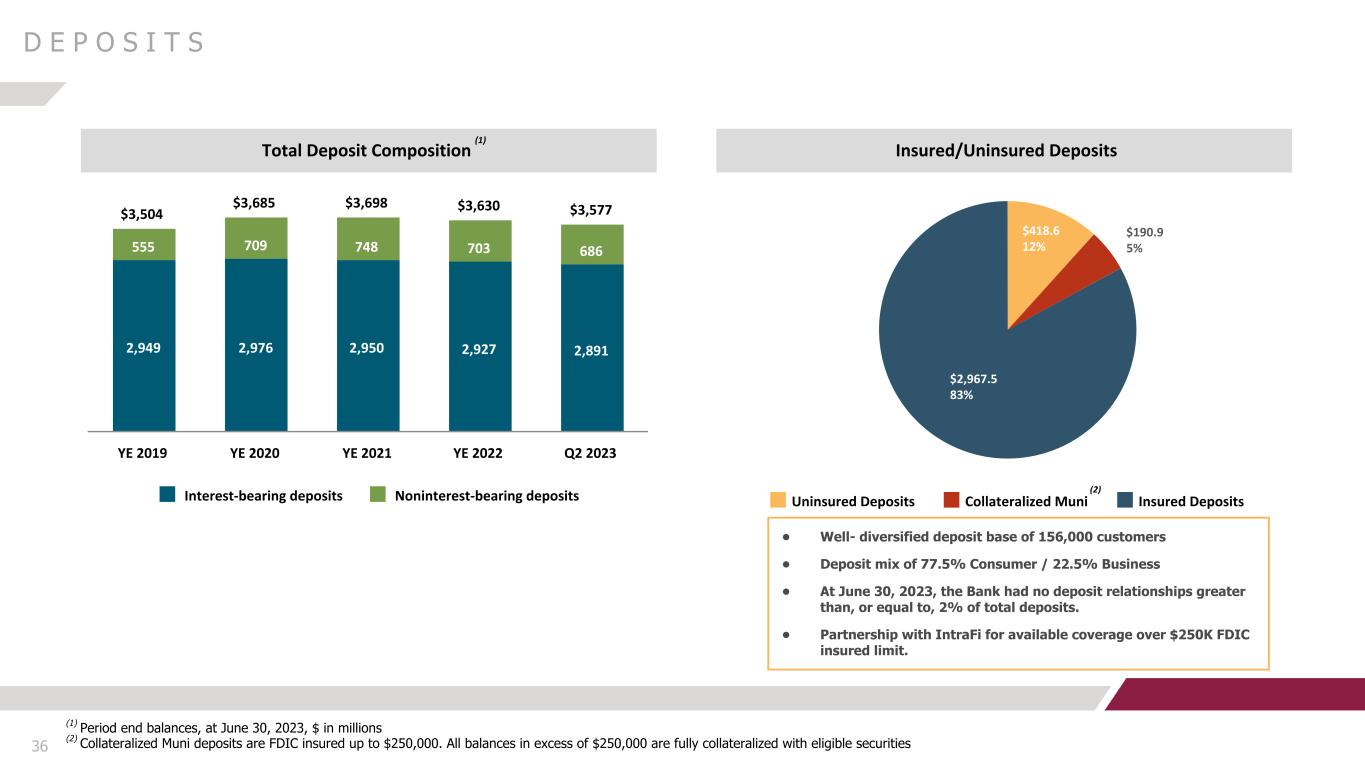

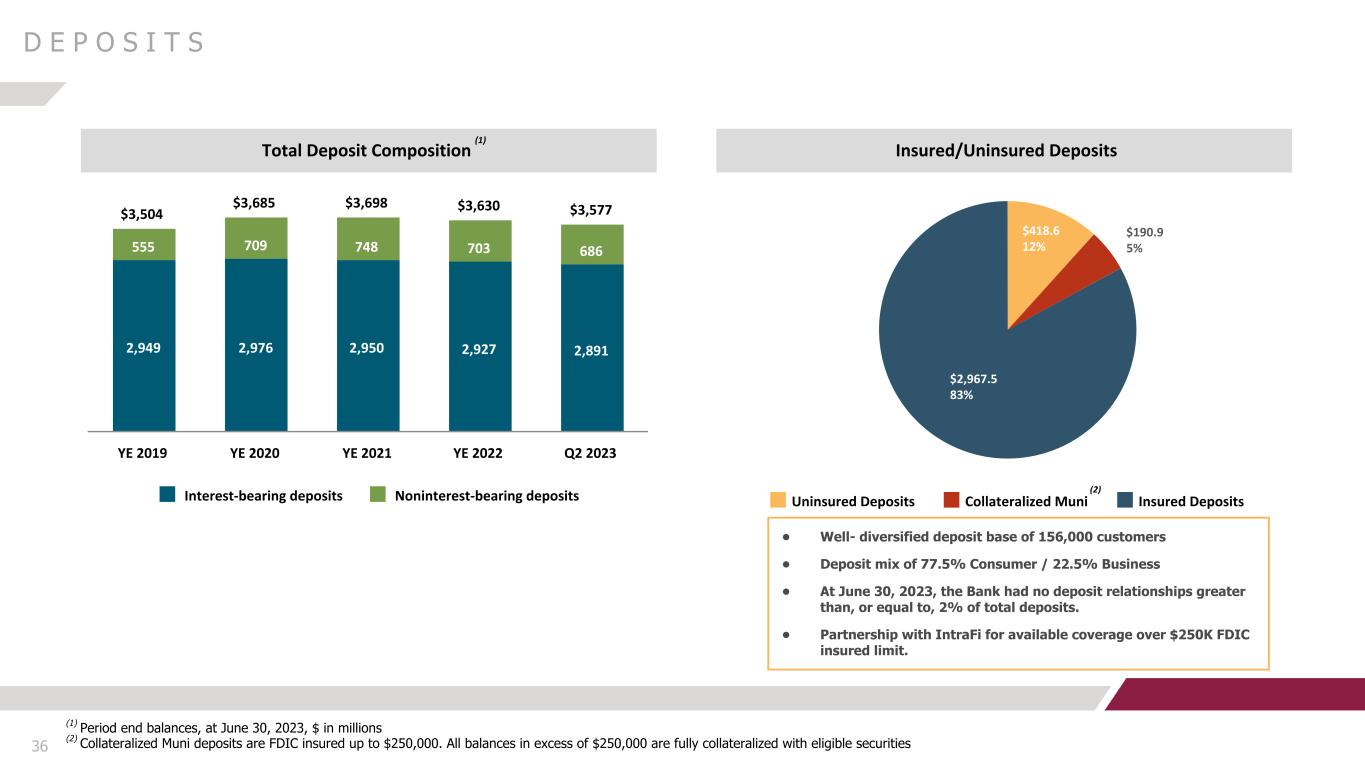

Total Deposit Composition $3,504 $3,685 $3,698 $3,630 $3,577 2,949 2,976 2,950 2,927 2,891 555 709 748 703 686 Interest-bearing deposits Noninterest-bearing deposits YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 36 D E P O S I T S (1) Period end balances, at June 30, 2023, $ in millions (2) Collateralized Muni deposits are FDIC insured up to $250,000. All balances in excess of $250,000 are fully collateralized with eligible securities (1) Insured/Uninsured Deposits $418.6 12% $190.9 5% $2,967.5 83% Uninsured Deposits Collateralized Muni Insured Deposits (2) • Well- diversified deposit base of 156,000 customers • Deposit mix of 77.5% Consumer / 22.5% Business • At June 30, 2023, the Bank had no deposit relationships greater than, or equal to, 2% of total deposits. • Partnership with IntraFi for available coverage over $250K FDIC insured limit.

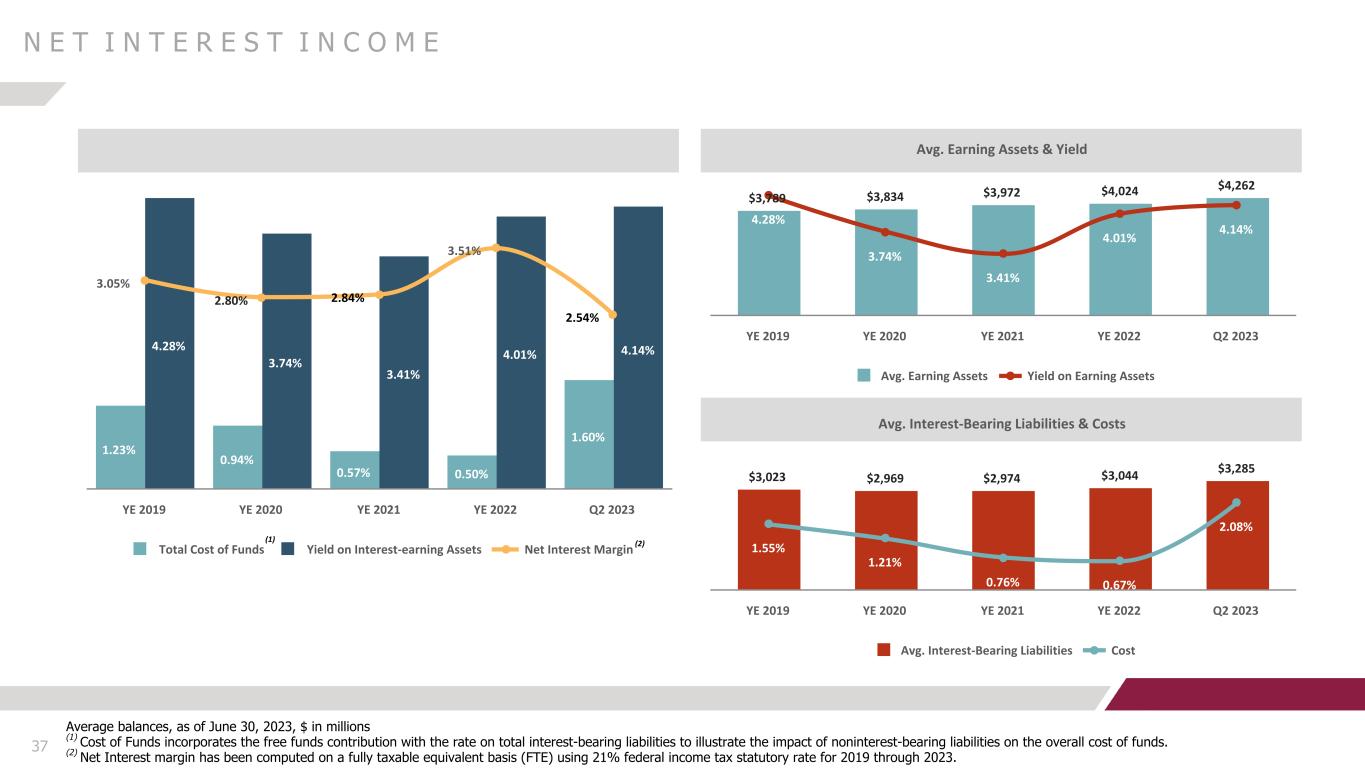

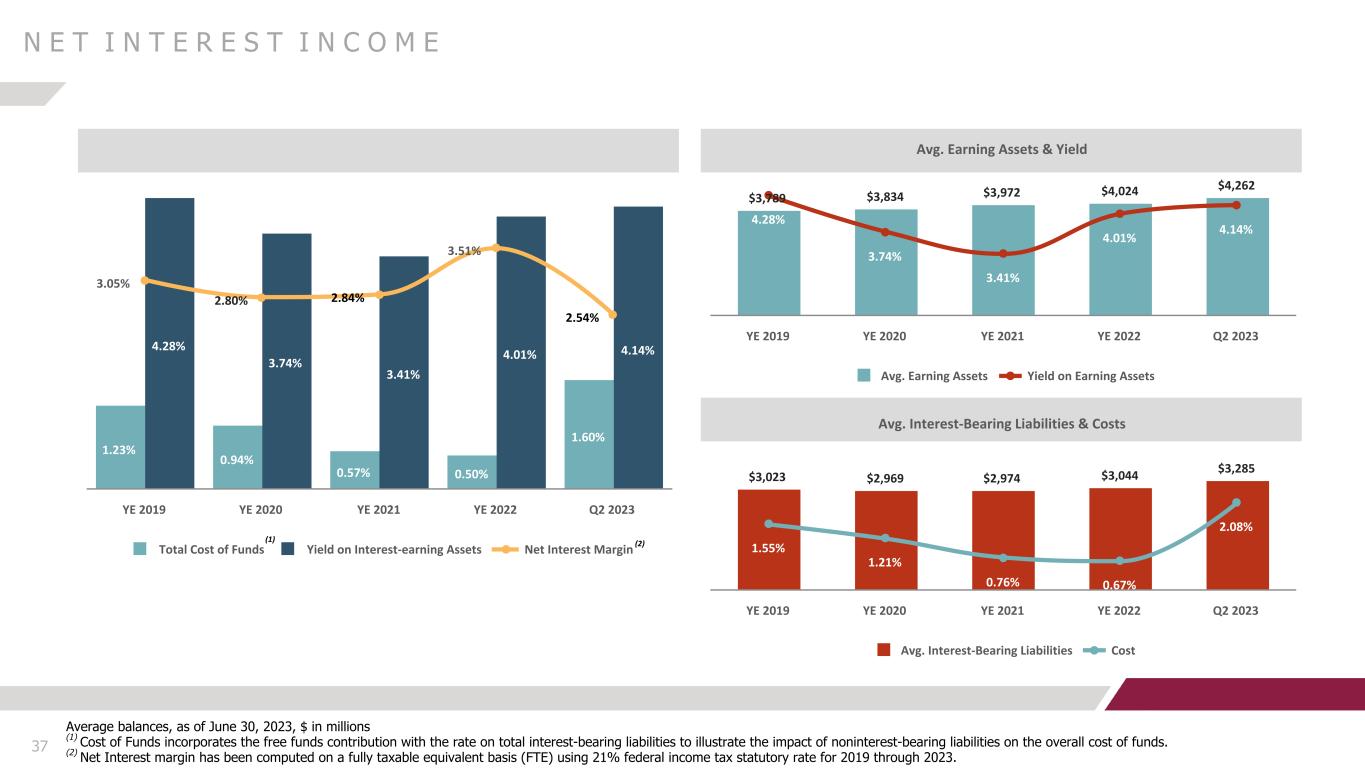

Net Interest Income & NIM 1.23% 0.94% 0.57% 0.50% 1.60% 4.28% 3.74% 3.41% 4.01% 4.14% 3.05% 2.80% 2.84% 3.51% 2.54% Total Cost of Funds Yield on Interest-earning Assets Net Interest Margin YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 Avg. Earning Assets & Yield $3,789 $3,834 $3,972 $4,024 $4,262 4.28% 3.74% 3.41% 4.01% 4.14% Avg. Earning Assets Yield on Earning Assets YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 37 N E T I N T E R E S T I N C O M E Avg. Interest-Bearing Liabilities & Costs $3,023 $2,969 $2,974 $3,044 $3,285 1.55% 1.21% 0.76% 0.67% 2.08% Avg. Interest-Bearing Liabilities Cost YE 2019 YE 2020 YE 2021 YE 2022 Q2 2023 (1) (2) Average balances, as of June 30, 2023, $ in millions (1) Cost of Funds incorporates the free funds contribution with the rate on total interest-bearing liabilities to illustrate the impact of noninterest-bearing liabilities on the overall cost of funds. (2) Net Interest margin has been computed on a fully taxable equivalent basis (FTE) using 21% federal income tax statutory rate for 2019 through 2023.

C O M M E R C I A L L O A N P O R T F O L I O M I X 38

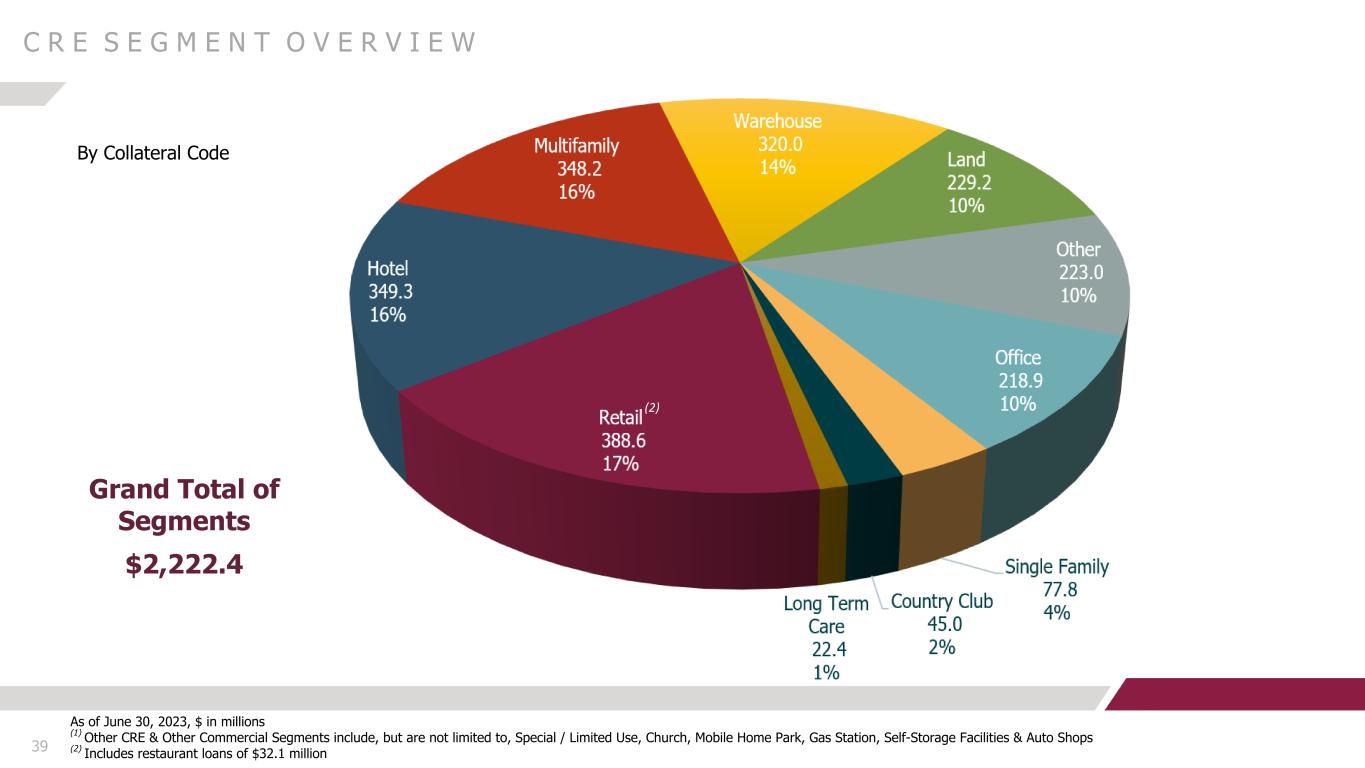

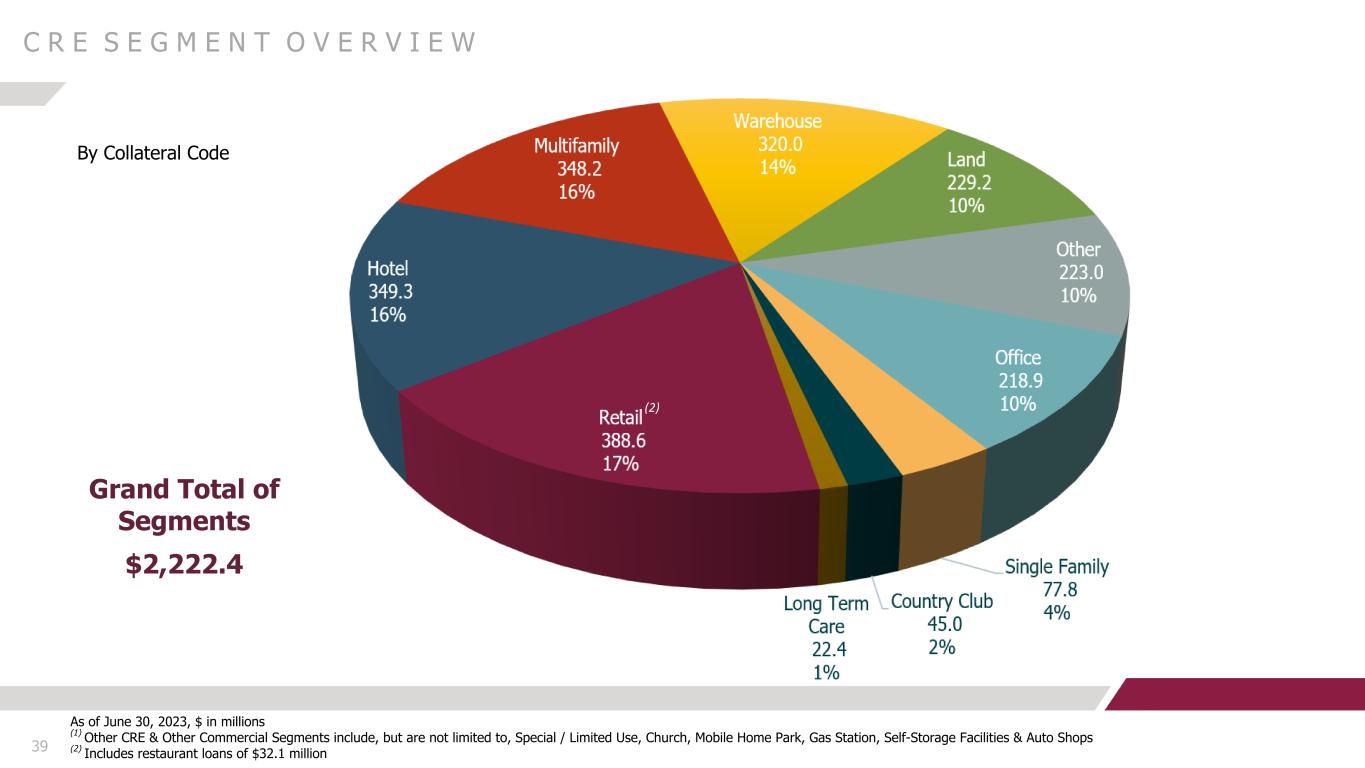

39 C R E S E G M E N T O V E R V I E W As of June 30, 2023, $ in millions (1) Other CRE & Other Commercial Segments include, but are not limited to, Special / Limited Use, Church, Mobile Home Park, Gas Station, Self-Storage Facilities & Auto Shops (2) Includes restaurant loans of $32.1 million By Collateral Code Grand Total of Segments $2,222.4 (2)

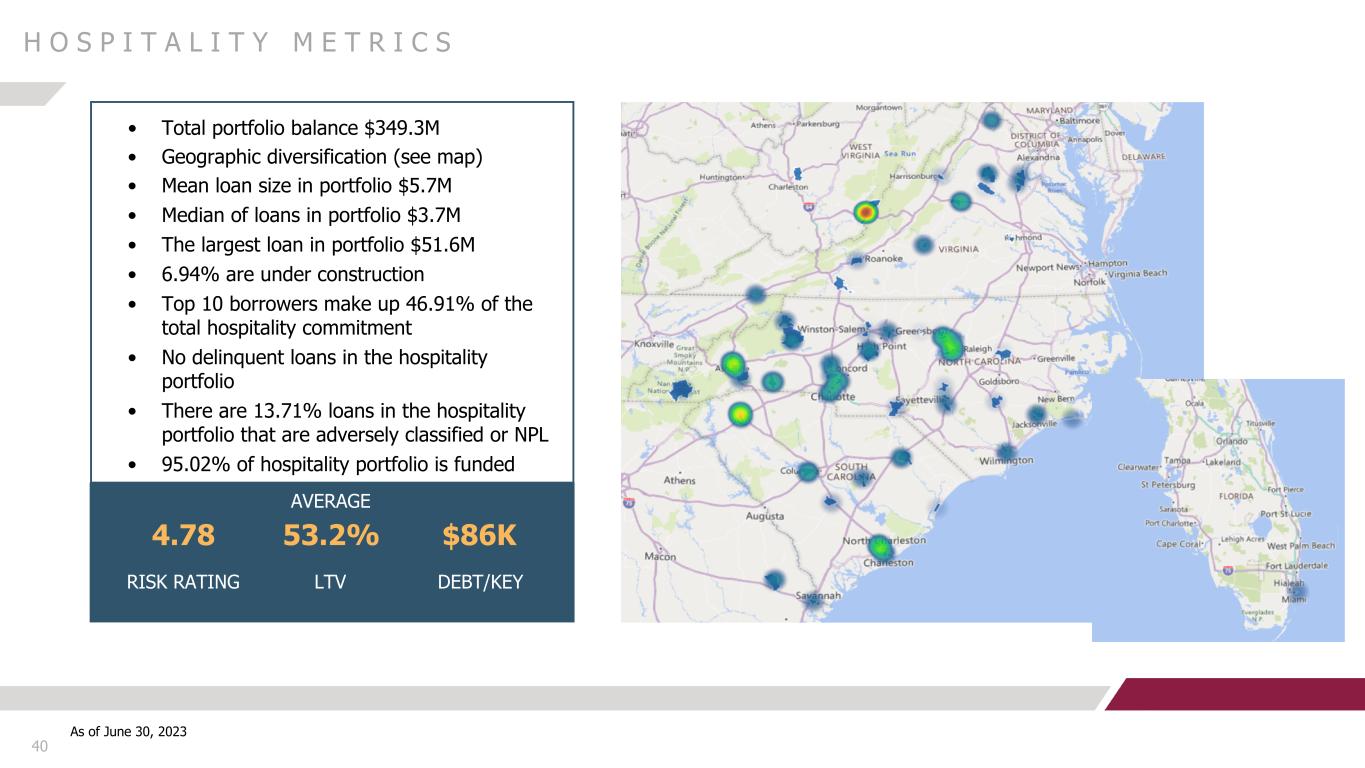

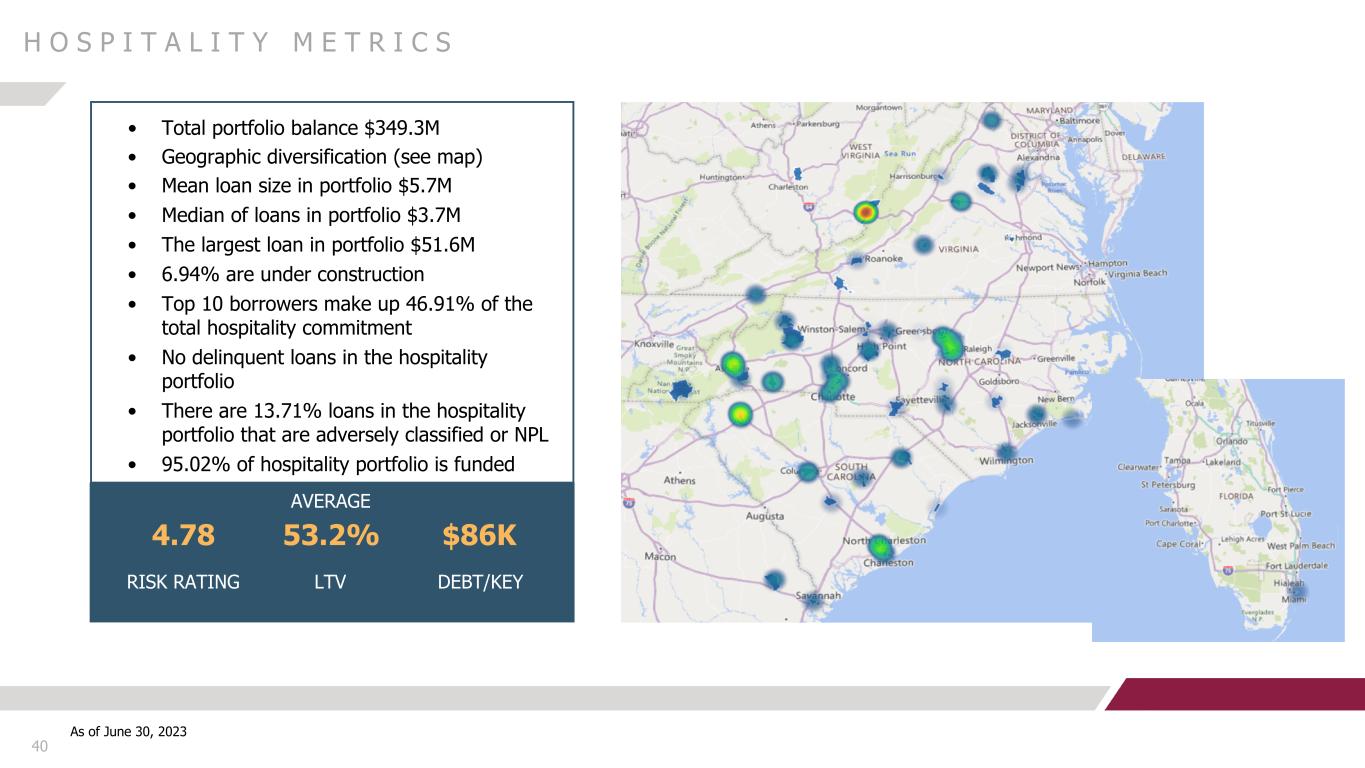

40 H O S P I T A L I T Y M E T R I C S As of June 30, 2023 • Total portfolio balance $349.3M • Geographic diversification (see map) • Mean loan size in portfolio $5.7M • Median of loans in portfolio $3.7M • The largest loan in portfolio $51.6M • 6.94% are under construction • Top 10 borrowers make up 46.91% of the total hospitality commitment • No delinquent loans in the hospitality portfolio • There are 13.71% loans in the hospitality portfolio that are adversely classified or NPL • 95.02% of hospitality portfolio is funded 4.78 RISK RATING LTV DEBT/KEY 53.2% $86K AVERAGE

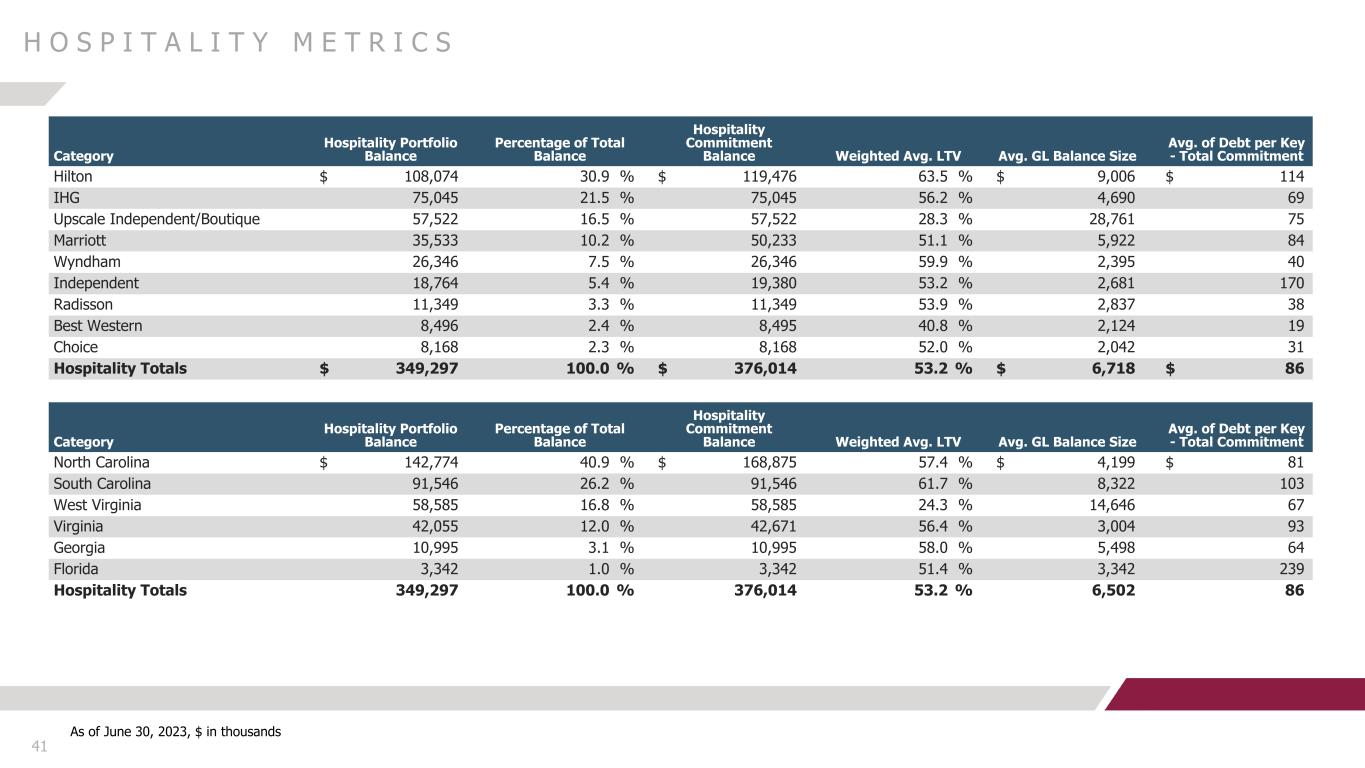

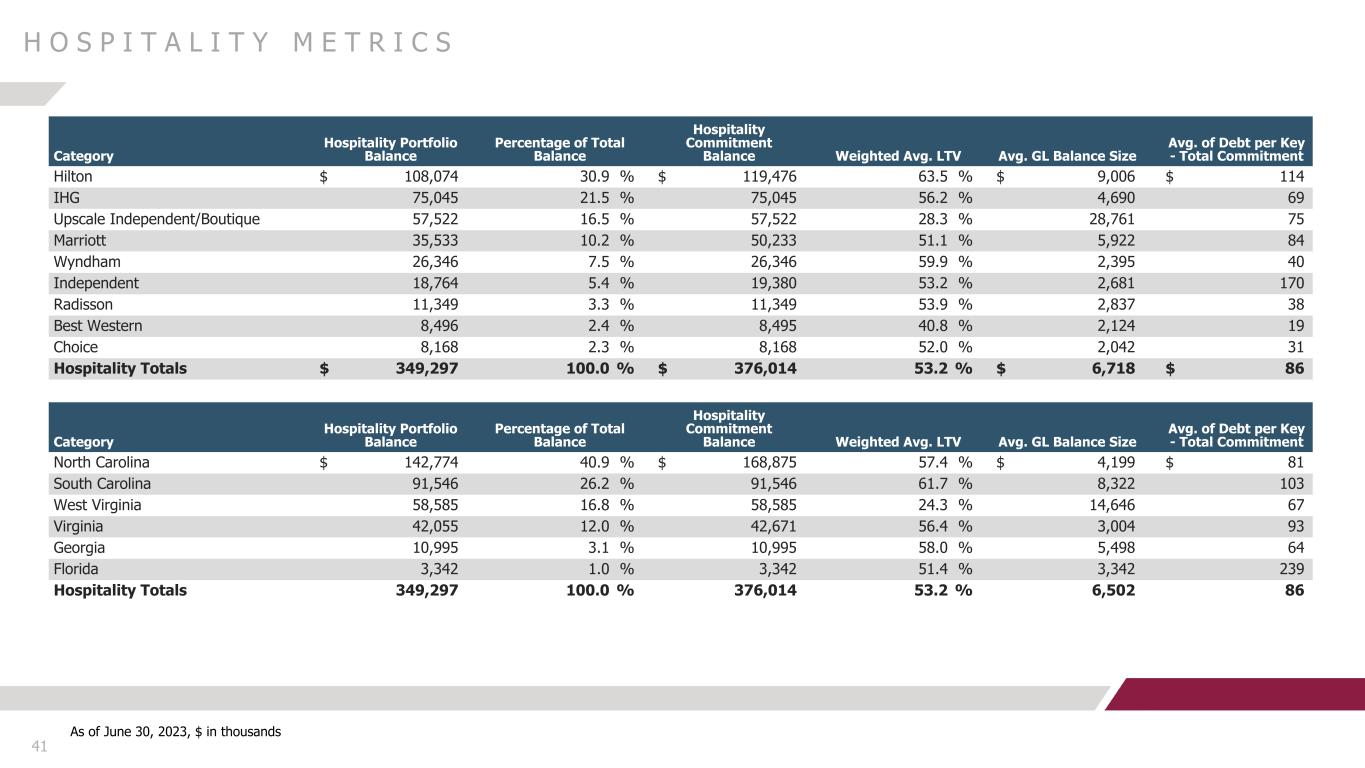

41 H O S P I T A L I T Y M E T R I C S As of June 30, 2023, $ in thousands Category Hospitality Portfolio Balance Percentage of Total Balance Hospitality Commitment Balance Weighted Avg. LTV Avg. GL Balance Size Avg. of Debt per Key - Total Commitment Hilton $ 108,074 30.9 % $ 119,476 63.5 % $ 9,006 $ 114 IHG 75,045 21.5 % 75,045 56.2 % 4,690 69 Upscale Independent/Boutique 57,522 16.5 % 57,522 28.3 % 28,761 75 Marriott 35,533 10.2 % 50,233 51.1 % 5,922 84 Wyndham 26,346 7.5 % 26,346 59.9 % 2,395 40 Independent 18,764 5.4 % 19,380 53.2 % 2,681 170 Radisson 11,349 3.3 % 11,349 53.9 % 2,837 38 Best Western 8,496 2.4 % 8,495 40.8 % 2,124 19 Choice 8,168 2.3 % 8,168 52.0 % 2,042 31 Hospitality Totals $ 349,297 100.0 % $ 376,014 53.2 % $ 6,718 $ 86 Category Hospitality Portfolio Balance Percentage of Total Balance Hospitality Commitment Balance Weighted Avg. LTV Avg. GL Balance Size Avg. of Debt per Key - Total Commitment North Carolina $ 142,774 40.9 % $ 168,875 57.4 % $ 4,199 $ 81 South Carolina 91,546 26.2 % 91,546 61.7 % 8,322 103 West Virginia 58,585 16.8 % 58,585 24.3 % 14,646 67 Virginia 42,055 12.0 % 42,671 56.4 % 3,004 93 Georgia 10,995 3.1 % 10,995 58.0 % 5,498 64 Florida 3,342 1.0 % 3,342 51.4 % 3,342 239 Hospitality Totals 349,297 100.0 % 376,014 53.2 % 6,502 86

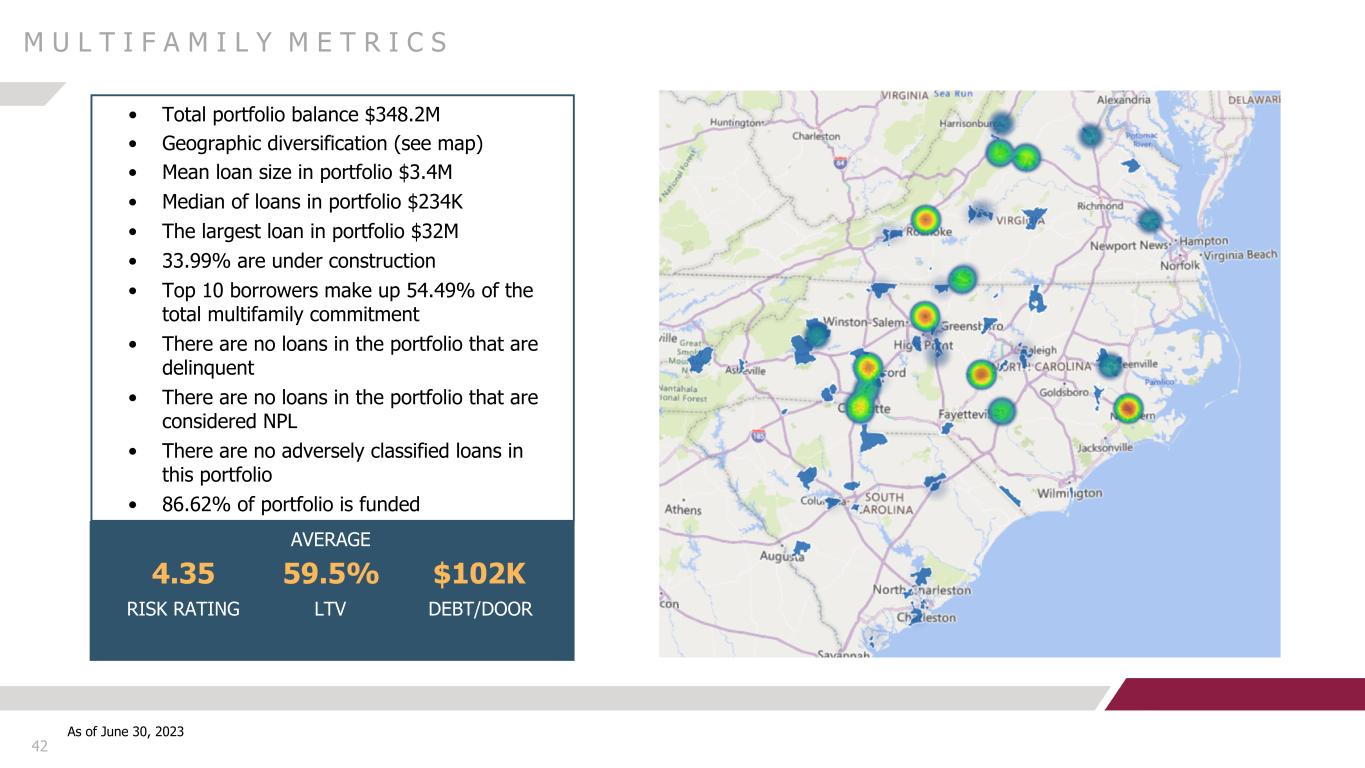

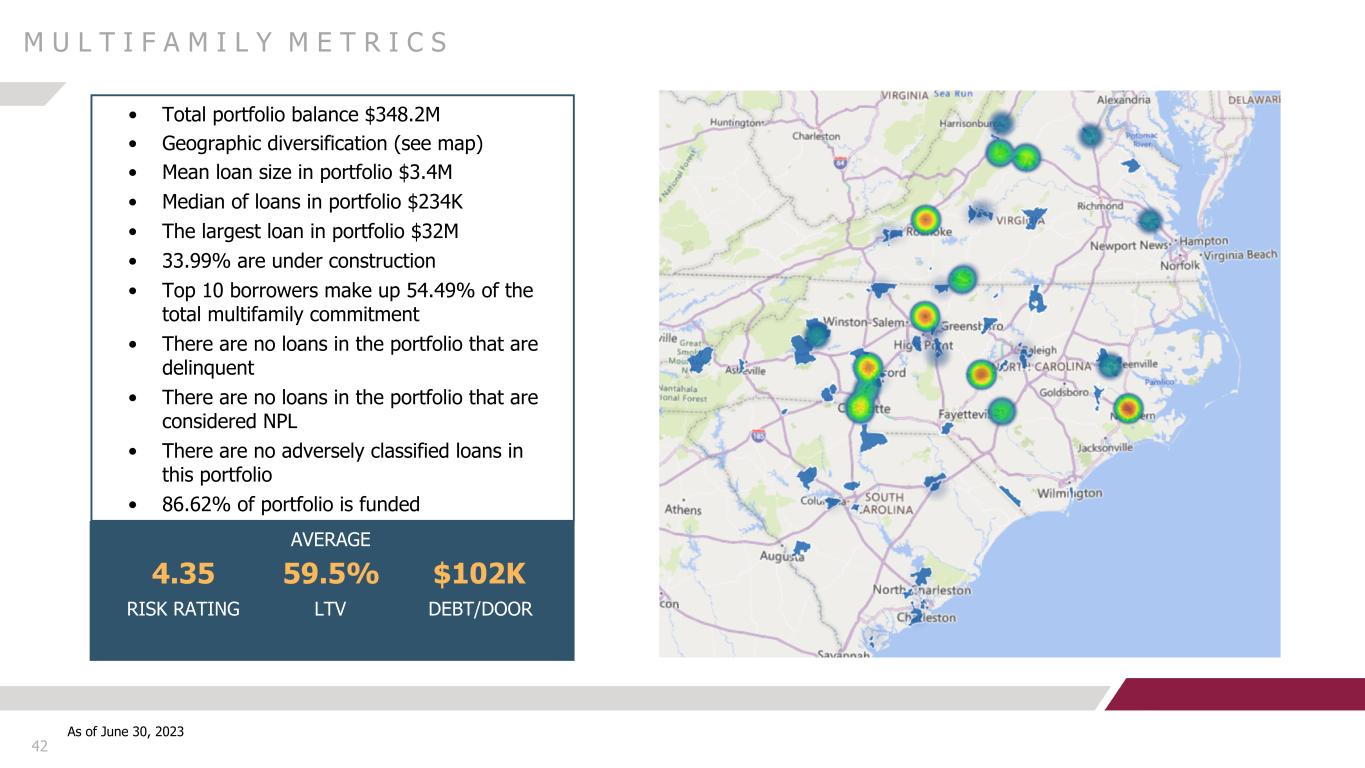

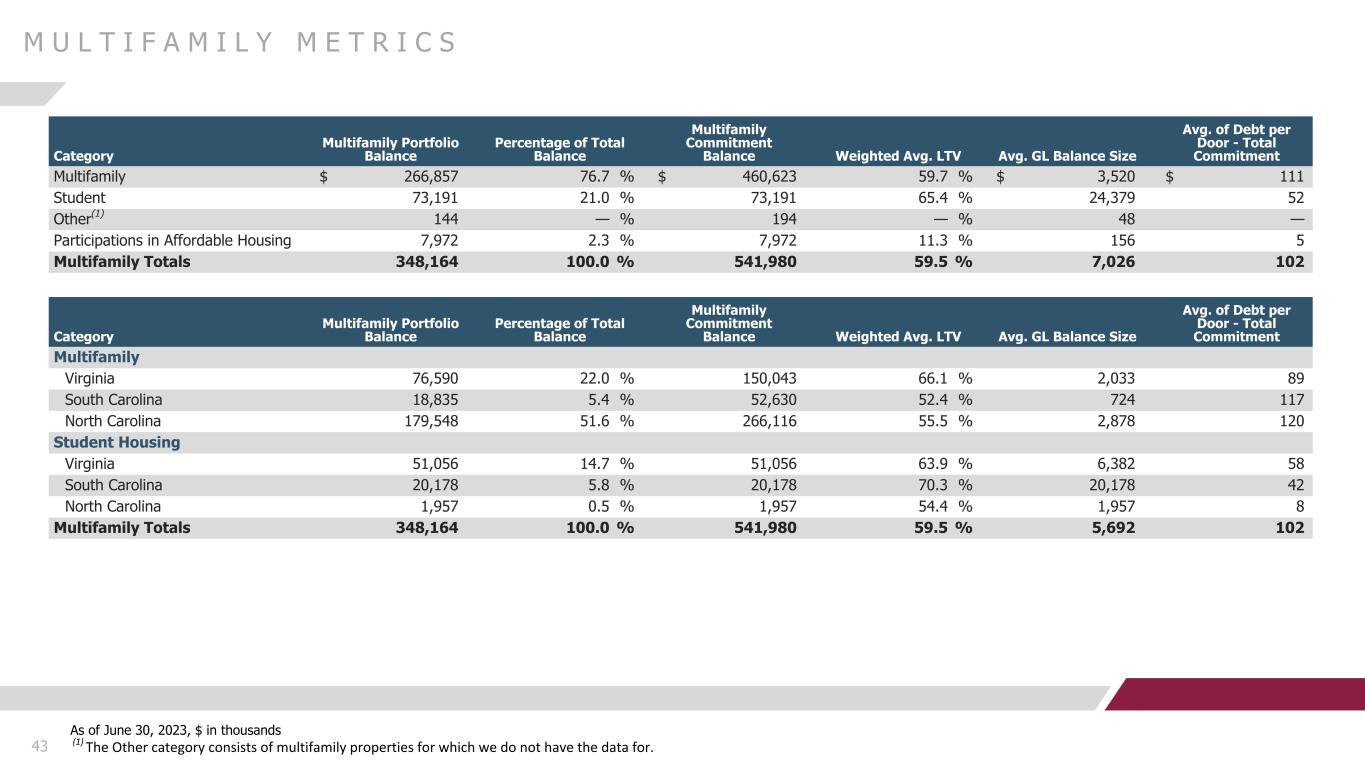

42 M U L T I F A M I L Y M E T R I C S As of June 30, 2023 • Total portfolio balance $348.2M • Geographic diversification (see map) • Mean loan size in portfolio $3.4M • Median of loans in portfolio $234K • The largest loan in portfolio $32M • 33.99% are under construction • Top 10 borrowers make up 54.49% of the total multifamily commitment • There are no loans in the portfolio that are delinquent • There are no loans in the portfolio that are considered NPL • There are no adversely classified loans in this portfolio • 86.62% of portfolio is funded 4.35 RISK RATING LTV DEBT/DOOR 59.5% $102K AVERAGE

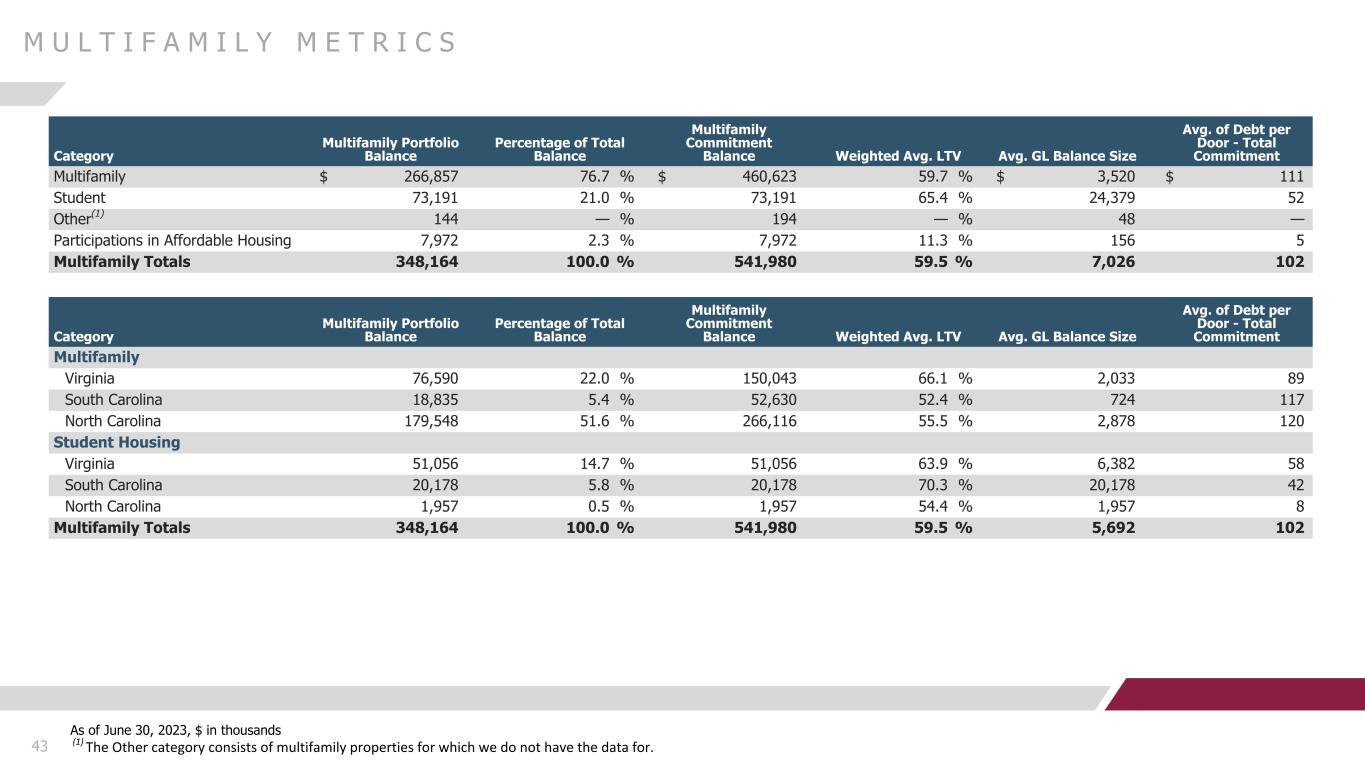

43 M U L T I F A M I L Y M E T R I C S As of June 30, 2023, $ in thousands (1) The Other category consists of multifamily properties for which we do not have the data for. Category Multifamily Portfolio Balance Percentage of Total Balance Multifamily Commitment Balance Weighted Avg. LTV Avg. GL Balance Size Avg. of Debt per Door - Total Commitment Multifamily $ 266,857 76.7 % $ 460,623 59.7 % $ 3,520 $ 111 Student 73,191 21.0 % 73,191 65.4 % 24,379 52 Other(1) 144 — % 194 — % 48 — Participations in Affordable Housing 7,972 2.3 % 7,972 11.3 % 156 5 Multifamily Totals 348,164 100.0 % 541,980 59.5 % 7,026 102 Category Multifamily Portfolio Balance Percentage of Total Balance Multifamily Commitment Balance Weighted Avg. LTV Avg. GL Balance Size Avg. of Debt per Door - Total Commitment Multifamily Virginia 76,590 22.0 % 150,043 66.1 % 2,033 89 South Carolina 18,835 5.4 % 52,630 52.4 % 724 117 North Carolina 179,548 51.6 % 266,116 55.5 % 2,878 120 Student Housing Virginia 51,056 14.7 % 51,056 63.9 % 6,382 58 South Carolina 20,178 5.8 % 20,178 70.3 % 20,178 42 North Carolina 1,957 0.5 % 1,957 54.4 % 1,957 8 Multifamily Totals 348,164 100.0 % 541,980 59.5 % 5,692 102

44 R E T A I L M E T R I C S As of June 30, 2023 (1) Excludes restaurant loans of $32.1 million • Total portfolio balance $356.5M(1) • Geographic diversification (see map) • Mean loan size in portfolio $2.73M • Median of loans in portfolio $1.05M • The largest loan in portfolio $29M • 13.81% are under construction • Top 10 borrowers make up 40.28% of the total retail commitment • There are no delinquent loans in the portfolio • 0.10% of loans are primarily rated special mention • 0.01% are in NPL status • 94.90% of retail portfolio is funded 4.18 RISK RATING LTV DEBT/SQ FT 57.7% $138K AVERAGE

45 R E T A I L M E T R I C S As of June 30, 2023, $ in thousands (1) Excludes restaurant loans of $32.1 million (2) A Power Center is a large outdoor shopping mall that usually includes three or more "Big Box" stores. Category Retail Portfolio Balance Percentage of Total Balance Retail Commitment Balance Weighted Avg. LTV Avg. GL Balance Size Avg. of Debt per Square Ft- Total Commitment Anchored Strip Centers $ 176,195 49.4 % $ 217,748 61.5 % $ 4,405 $ 128 Unanchored Strip Centers 79,134 22.2 % 84,671 50.0 % 1,522 157 Outparcels/Single Tenant 69,461 19.5 % 69,508 52.7 % 1,447 163 Power Centers 29,422 8.3 % 29,971 63.7 % 7,356 106 Big Box 2,321 0.7 % 2,321 51.4 % 774 45 Other Centers — — % 2 — % — — Retail Totals $ 356,533 100.0 % $ 404,222 57.7 % $ 2,584 $ 138 Category Retail Portfolio Balance Percentage of Total Balance Retail Commitment Balance Weighted Avg. LTV Avg. GL Balance Size North Carolina $ 195,920 55.0 % $ 242,306 53.6 % $ 2,480 Virginia 89,125 25.0 % 90,425 65.4 % 1,714 Georgia 32,196 9.0 % 32,196 65.5 % 6,439 South Carolina 14,331 4.0 % 14,331 51.8 % 2,047 Ohio 10,751 3.0 % 10,751 59.4 % 10,751 Florida 10,103 2.8 % 10,103 78.3 % 10,103 Maryland 3,697 1.0 % 3,697 33.6 % 3,697 West Virginia 410 0.1 % 410 49.7 % 410 Other States — — % 2 — % — Retail Totals $ 356,533 100.0 % $ 404,222 57.7 % $ 4,182

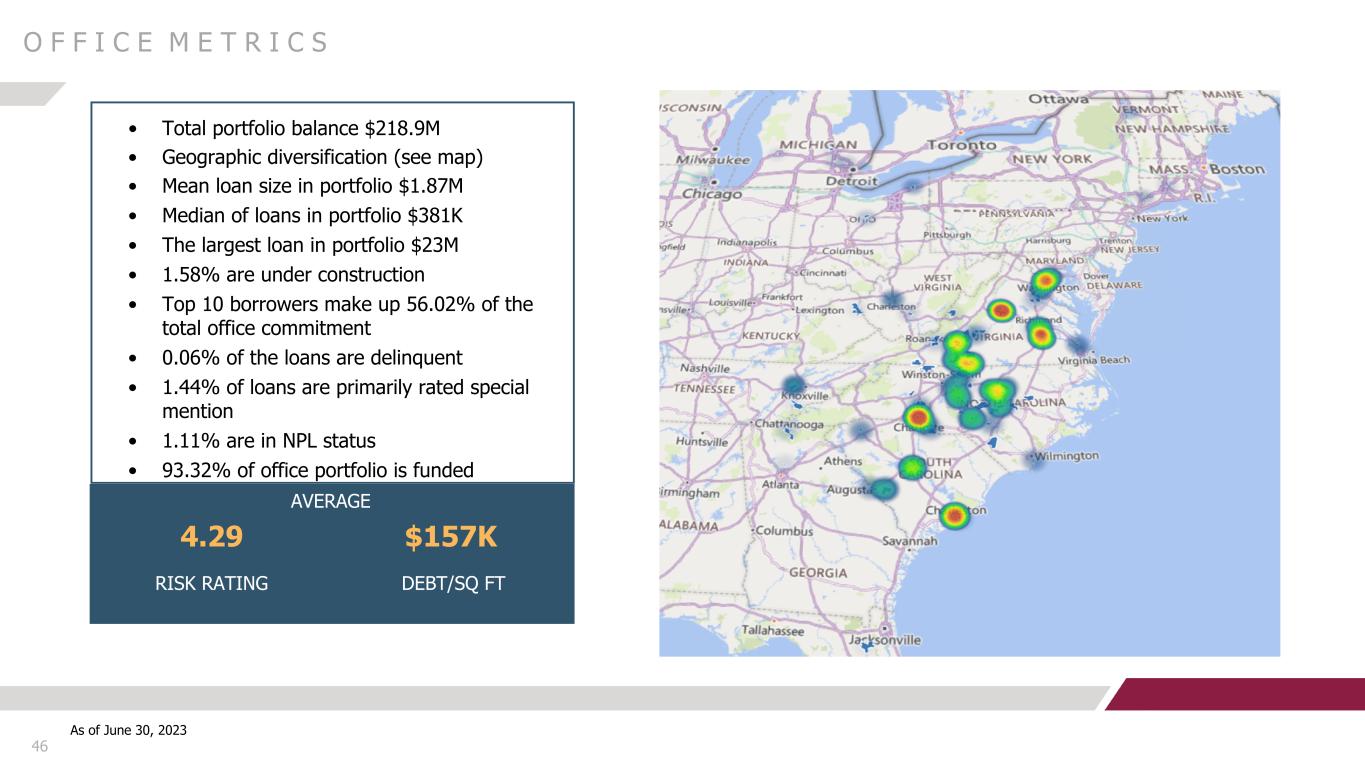

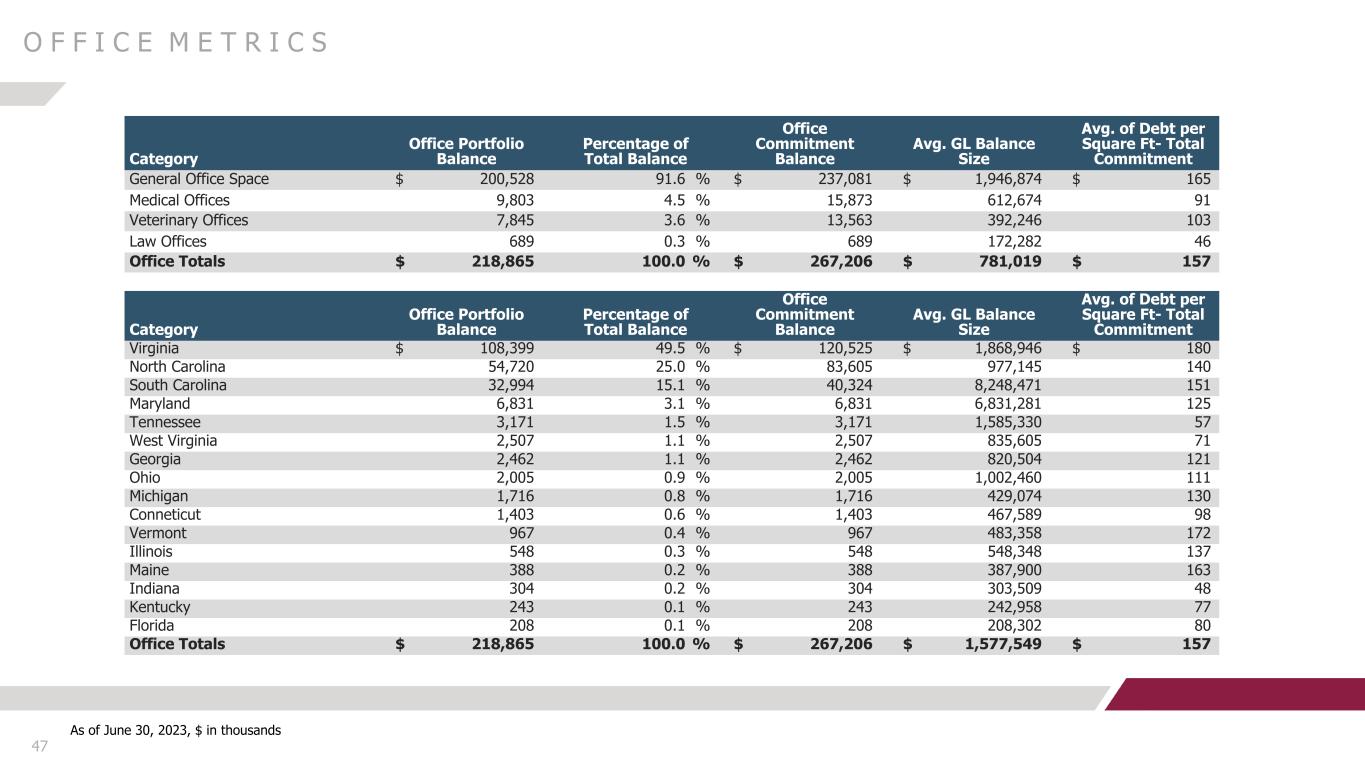

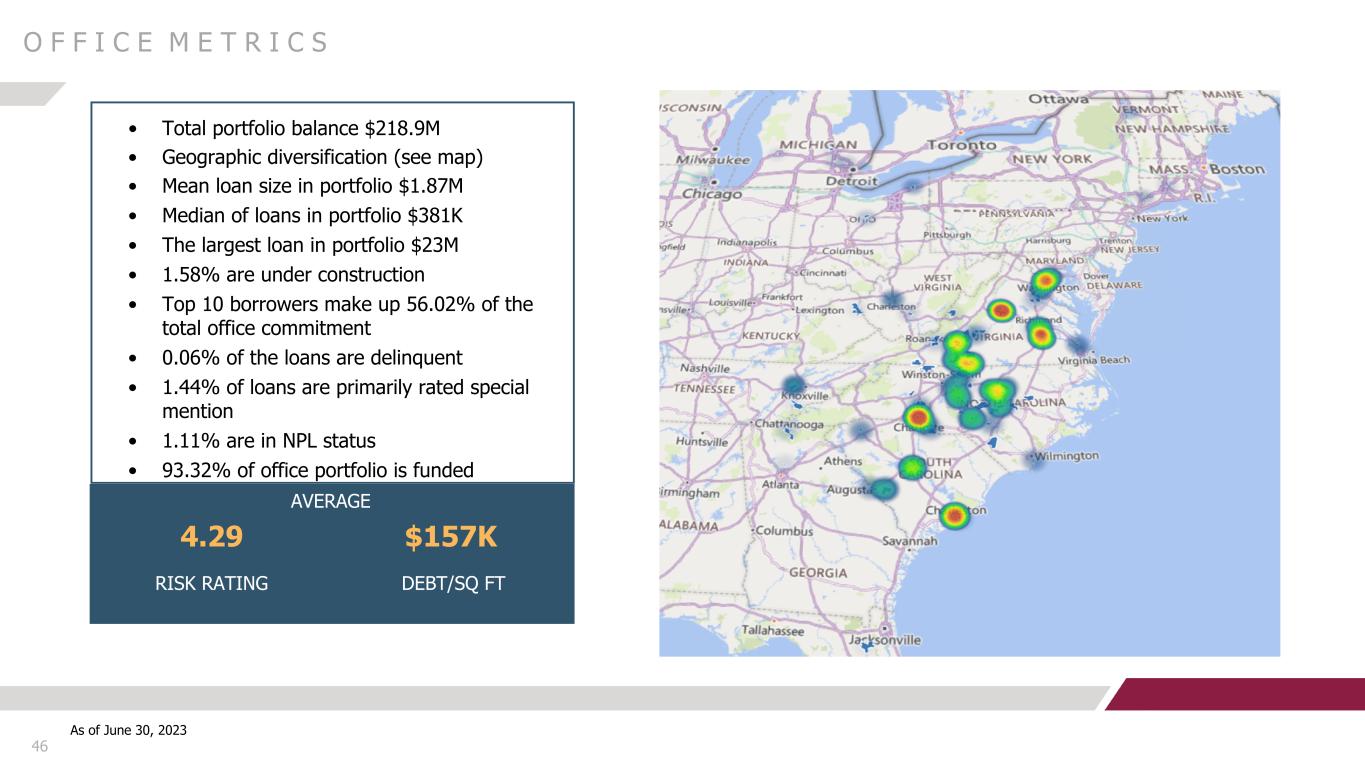

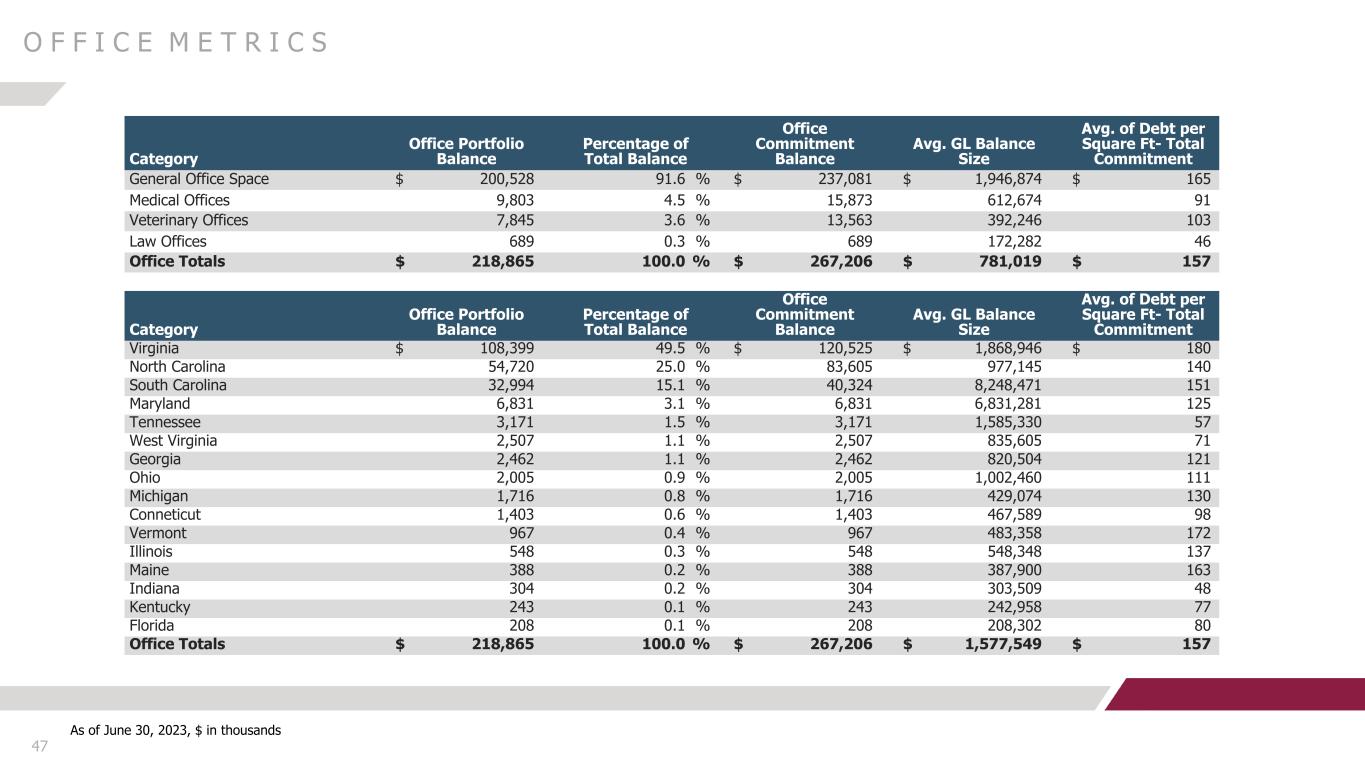

46 O F F I C E M E T R I C S As of June 30, 2023 • Total portfolio balance $218.9M • Geographic diversification (see map) • Mean loan size in portfolio $1.87M • Median of loans in portfolio $381K • The largest loan in portfolio $23M • 1.58% are under construction • Top 10 borrowers make up 56.02% of the total office commitment • 0.06% of the loans are delinquent • 1.44% of loans are primarily rated special mention • 1.11% are in NPL status • 93.32% of office portfolio is funded 4.29 RISK RATING DEBT/SQ FT $157K AVERAGE

47 O F F I C E M E T R I C S As of June 30, 2023, $ in thousands Category Office Portfolio Balance Percentage of Total Balance Office Commitment Balance Avg. GL Balance Size Avg. of Debt per Square Ft- Total Commitment General Office Space $ 200,528 91.6 % $ 237,081 $ 1,946,874 $ 165 Medical Offices 9,803 4.5 % 15,873 612,674 91 Veterinary Offices 7,845 3.6 % 13,563 392,246 103 Law Offices 689 0.3 % 689 172,282 46 Office Totals $ 218,865 100.0 % $ 267,206 $ 781,019 $ 157 Category Office Portfolio Balance Percentage of Total Balance Office Commitment Balance Avg. GL Balance Size Avg. of Debt per Square Ft- Total Commitment Virginia $ 108,399 49.5 % $ 120,525 $ 1,868,946 $ 180 North Carolina 54,720 25.0 % 83,605 977,145 140 South Carolina 32,994 15.1 % 40,324 8,248,471 151 Maryland 6,831 3.1 % 6,831 6,831,281 125 Tennessee 3,171 1.5 % 3,171 1,585,330 57 West Virginia 2,507 1.1 % 2,507 835,605 71 Georgia 2,462 1.1 % 2,462 820,504 121 Ohio 2,005 0.9 % 2,005 1,002,460 111 Michigan 1,716 0.8 % 1,716 429,074 130 Conneticut 1,403 0.6 % 1,403 467,589 98 Vermont 967 0.4 % 967 483,358 172 Illinois 548 0.3 % 548 548,348 137 Maine 388 0.2 % 388 387,900 163 Indiana 304 0.2 % 304 303,509 48 Kentucky 243 0.1 % 243 242,958 77 Florida 208 0.1 % 208 208,302 80 Office Totals $ 218,865 100.0 % $ 267,206 $ 1,577,549 $ 157

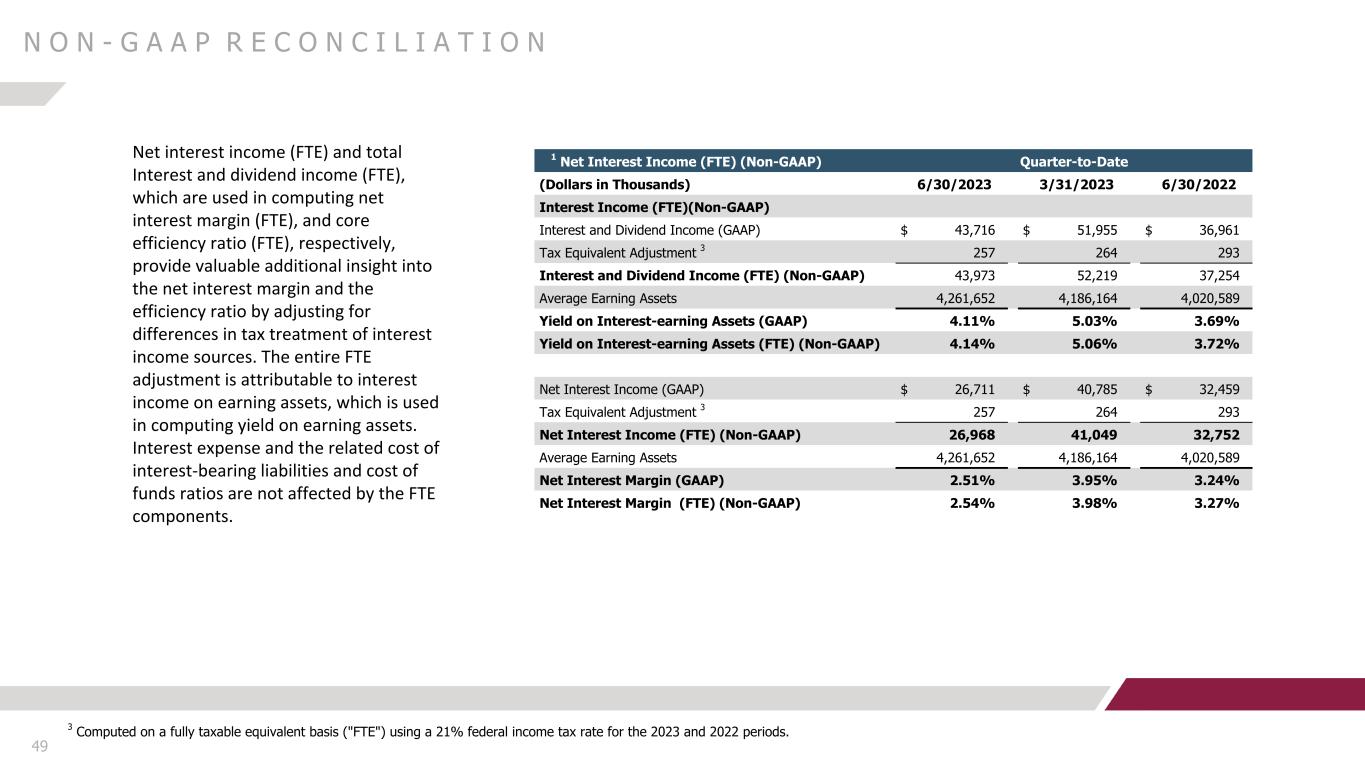

48 N O N - G A A P S T A T E M E N T Statements in this exhibit include non-GAAP financial measures and should be read along with the accompanying tables in our definitions and reconciliations of GAAP to non-GAAP financial measures. Management uses, and this exhibit references, the efficiency ratio, the adjusted book value, net interest income and net interest margin, each on a fully taxable equivalent, or FTE, basis, which are non-GAAP financial measures. Management believes the efficiency ratio, adjusted book value, net interest income and net interest margin on an FTE basis provide information useful to investors in understanding our underlying business, operational performance and performance trends as they facilitate comparisons with the performance of other companies in the financial services industry. Although management believes that these non-GAAP financial measures enhance investors’ understanding of our business and performance, these non-GAAP financial measures should not be considered alternatives to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with non-GAAP measures which may be presented by other companies.

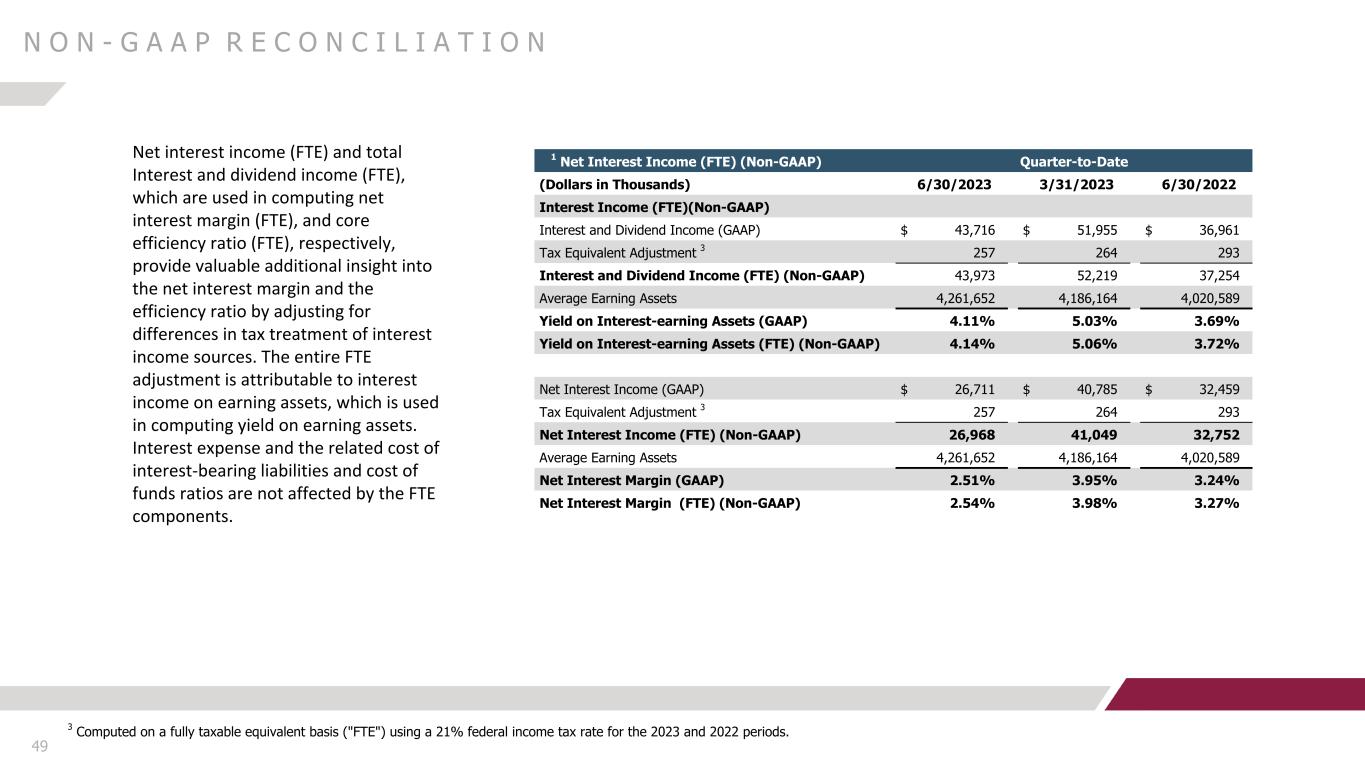

49 N O N - G A A P R E C O N C I L I A T I O N 1 Net Interest Income (FTE) (Non-GAAP) Quarter-to-Date (Dollars in Thousands) 6/30/2023 3/31/2023 6/30/2022 Interest Income (FTE)(Non-GAAP) Interest and Dividend Income (GAAP) $ 43,716 $ 51,955 $ 36,961 Tax Equivalent Adjustment 3 257 264 293 Interest and Dividend Income (FTE) (Non-GAAP) 43,973 52,219 37,254 Average Earning Assets 4,261,652 4,186,164 4,020,589 Yield on Interest-earning Assets (GAAP) 4.11 % 5.03 % 3.69 % Yield on Interest-earning Assets (FTE) (Non-GAAP) 4.14 % 5.06 % 3.72 % Net Interest Income (GAAP) $ 26,711 $ 40,785 $ 32,459 Tax Equivalent Adjustment 3 257 264 293 Net Interest Income (FTE) (Non-GAAP) 26,968 41,049 32,752 Average Earning Assets 4,261,652 4,186,164 4,020,589 Net Interest Margin (GAAP) 2.51 % 3.95 % 3.24 % Net Interest Margin (FTE) (Non-GAAP) 2.54 % 3.98 % 3.27 % 3 Computed on a fully taxable equivalent basis ("FTE") using a 21% federal income tax rate for the 2023 and 2022 periods. Net interest income (FTE) and total Interest and dividend income (FTE), which are used in computing net interest margin (FTE), and core efficiency ratio (FTE), respectively, provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing yield on earning assets. Interest expense and the related cost of interest-bearing liabilities and cost of funds ratios are not affected by the FTE components.

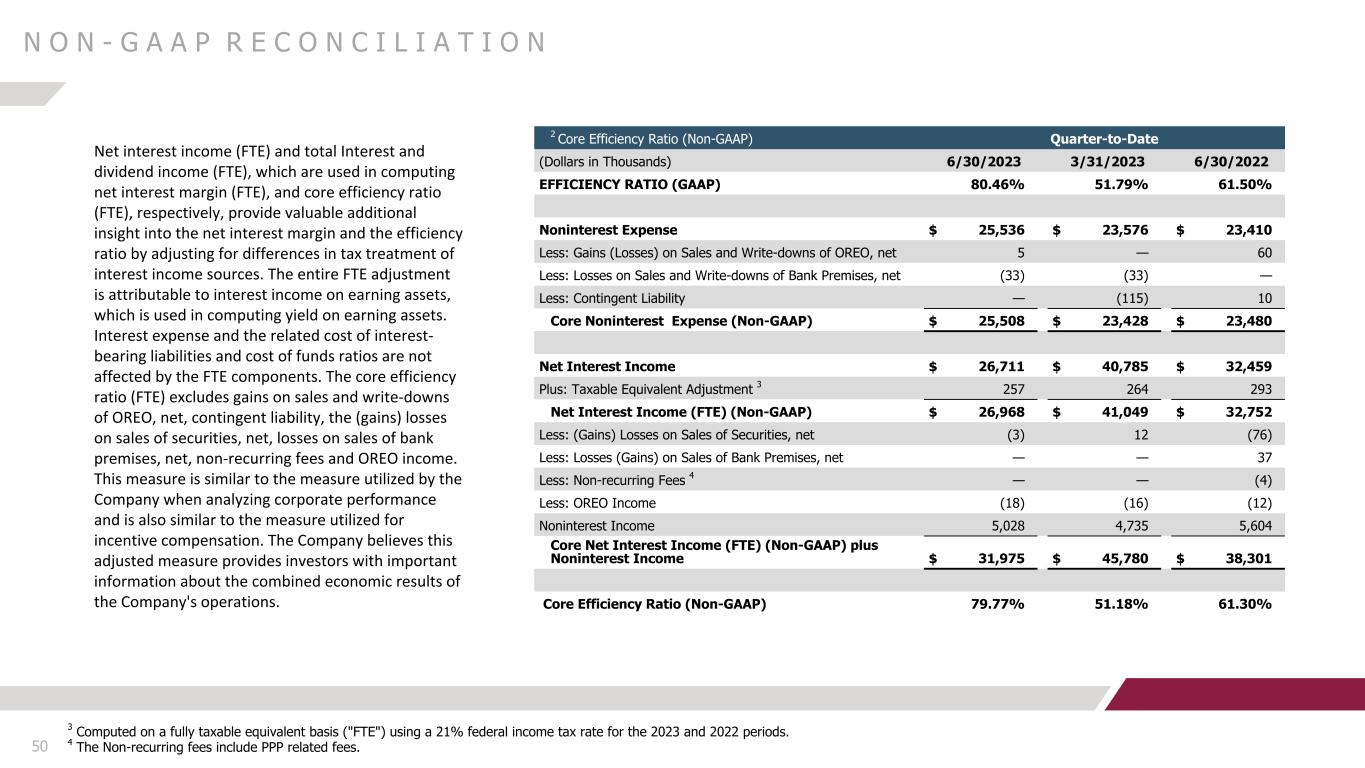

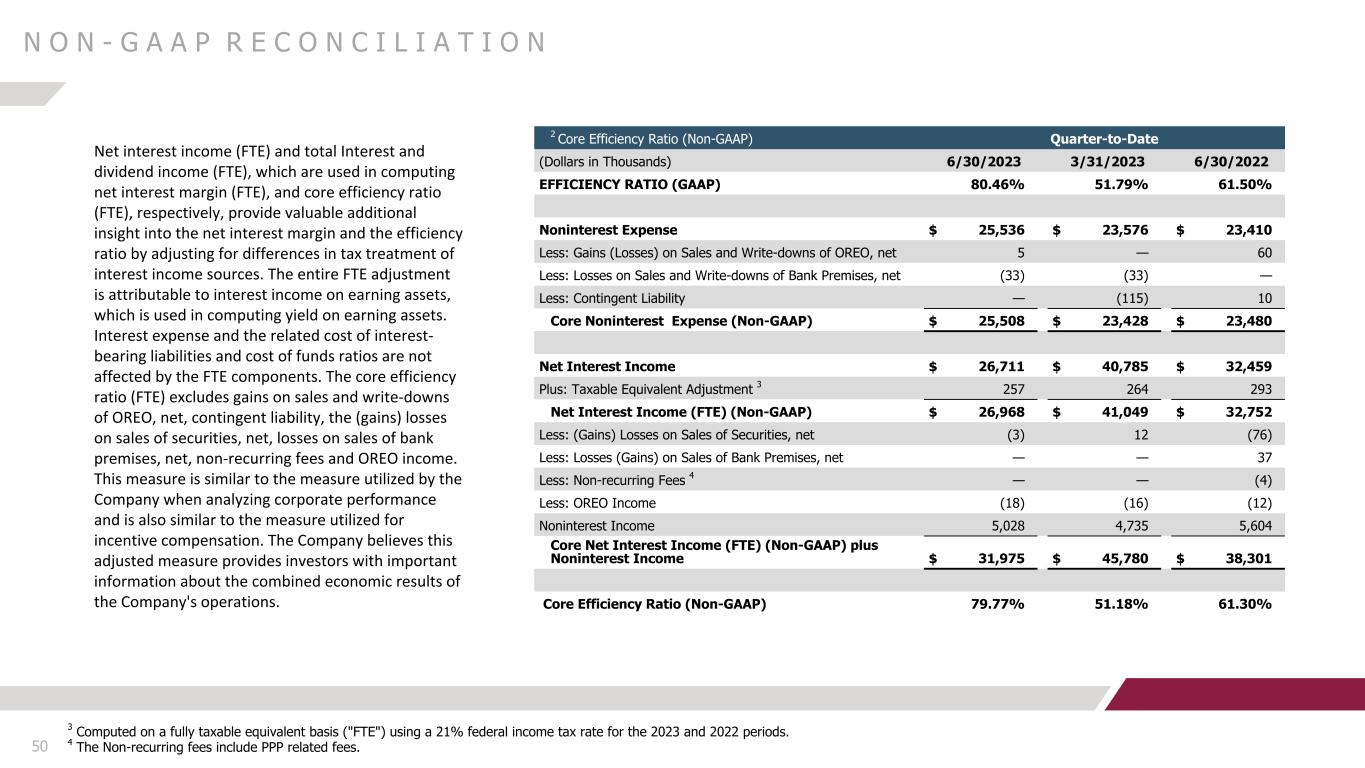

50 2 Core Efficiency Ratio (Non-GAAP) Quarter-to-Date (Dollars in Thousands) 6/30/2023 3/31/2023 6/30/2022 EFFICIENCY RATIO (GAAP) 80.46 % 51.79 % 61.50 % Noninterest Expense $ 25,536 $ 23,576 $ 23,410 Less: Gains (Losses) on Sales and Write-downs of OREO, net 5 — 60 Less: Losses on Sales and Write-downs of Bank Premises, net (33) (33) — Less: Contingent Liability — (115) 10 Core Noninterest Expense (Non-GAAP) $ 25,508 $ 23,428 $ 23,480 Net Interest Income $ 26,711 $ 40,785 $ 32,459 Plus: Taxable Equivalent Adjustment 3 257 264 293 Net Interest Income (FTE) (Non-GAAP) $ 26,968 $ 41,049 $ 32,752 Less: (Gains) Losses on Sales of Securities, net (3) 12 (76) Less: Losses (Gains) on Sales of Bank Premises, net — — 37 Less: Non-recurring Fees 4 — — (4) Less: OREO Income (18) (16) (12) Noninterest Income 5,028 4,735 5,604 Core Net Interest Income (FTE) (Non-GAAP) plus Noninterest Income $ 31,975 $ 45,780 $ 38,301 Core Efficiency Ratio (Non-GAAP) 79.77 % 51.18 % 61.30 % N O N - G A A P R E C O N C I L I A T I O N 3 Computed on a fully taxable equivalent basis ("FTE") using a 21% federal income tax rate for the 2023 and 2022 periods. 4 The Non-recurring fees include PPP related fees. Net interest income (FTE) and total Interest and dividend income (FTE), which are used in computing net interest margin (FTE), and core efficiency ratio (FTE), respectively, provide valuable additional insight into the net interest margin and the efficiency ratio by adjusting for differences in tax treatment of interest income sources. The entire FTE adjustment is attributable to interest income on earning assets, which is used in computing yield on earning assets. Interest expense and the related cost of interest- bearing liabilities and cost of funds ratios are not affected by the FTE components. The core efficiency ratio (FTE) excludes gains on sales and write-downs of OREO, net, contingent liability, the (gains) losses on sales of securities, net, losses on sales of bank premises, net, non-recurring fees and OREO income. This measure is similar to the measure utilized by the Company when analyzing corporate performance and is also similar to the measure utilized for incentive compensation. The Company believes this adjusted measure provides investors with important information about the combined economic results of the Company's operations.

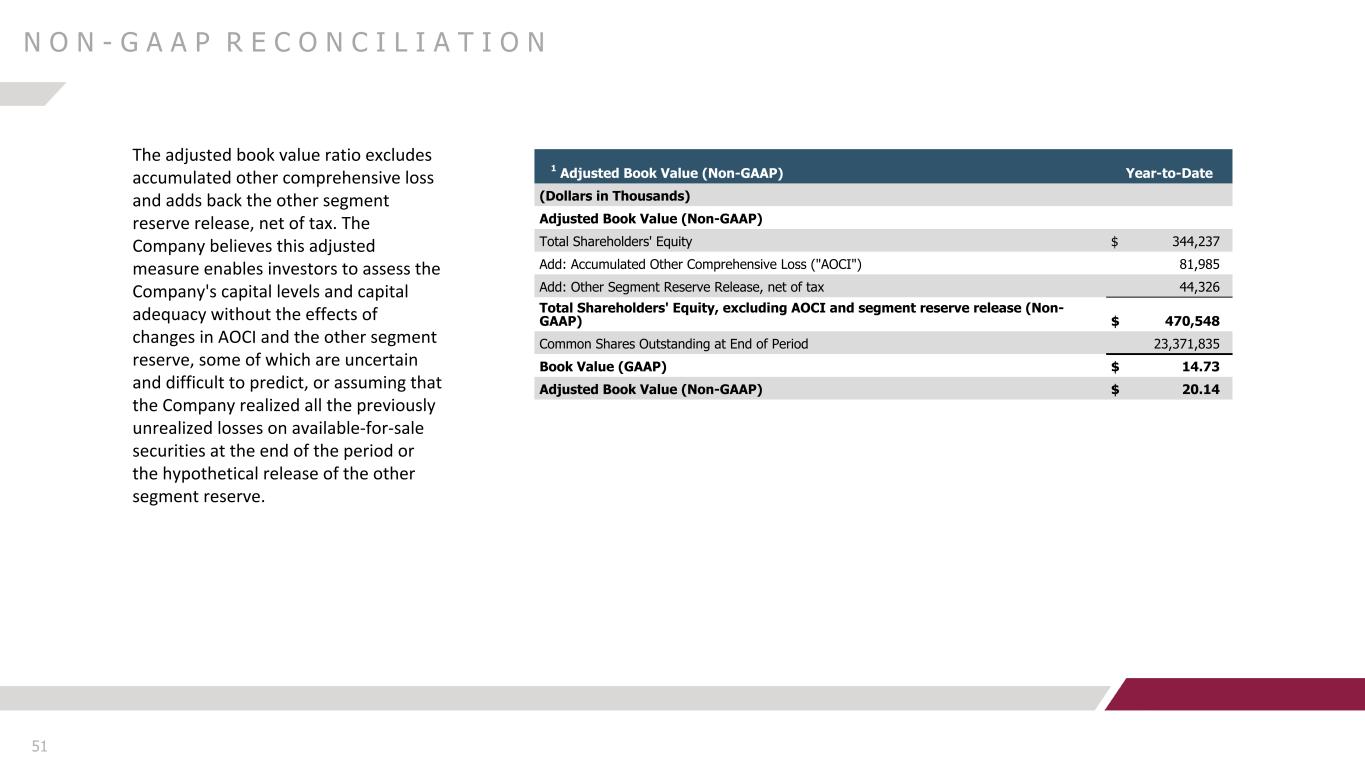

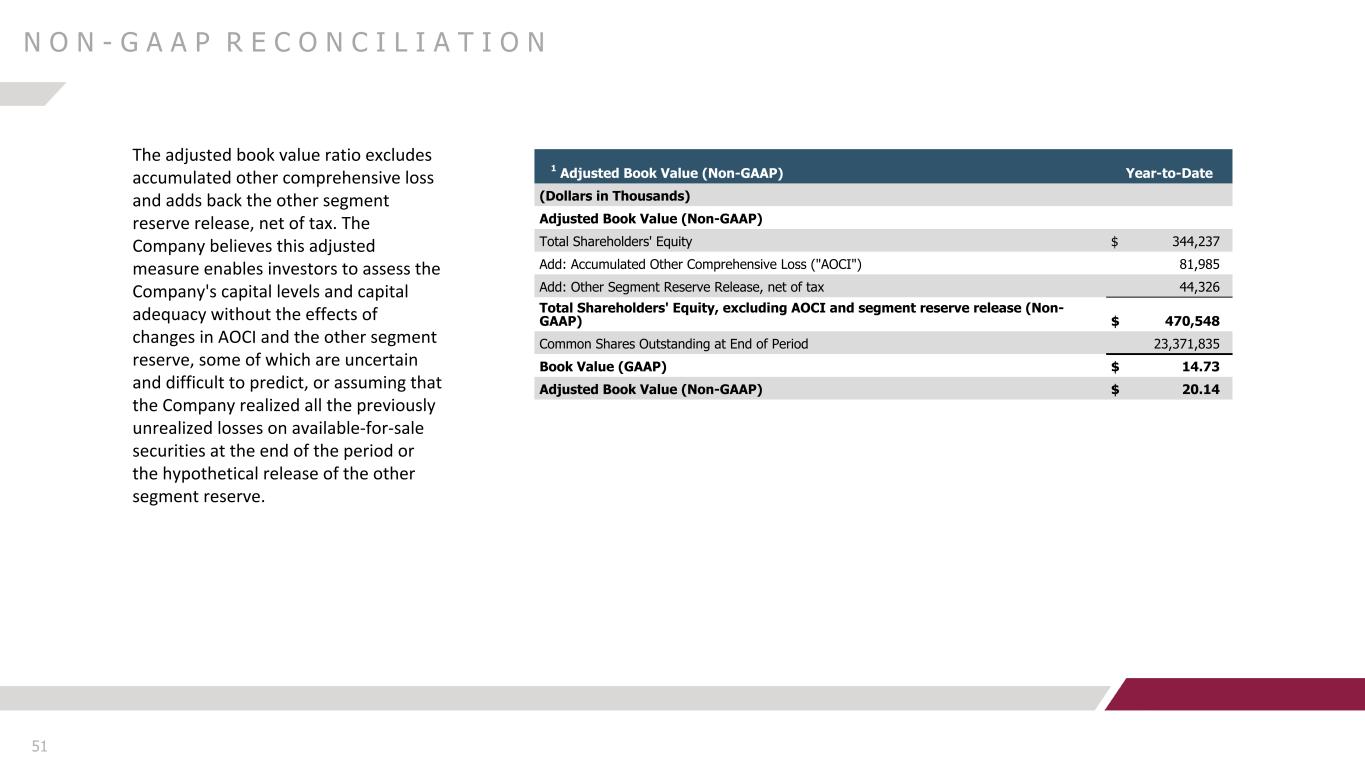

51 N O N - G A A P R E C O N C I L I A T I O N 1 Adjusted Book Value (Non-GAAP) Year-to-Date (Dollars in Thousands) Adjusted Book Value (Non-GAAP) Total Shareholders' Equity 0 0$ 344,237 Add: Accumulated Other Comprehensive Loss ("AOCI") 81,985 Add: Other Segment Reserve Release, net of tax 44,326 Total Shareholders' Equity, excluding AOCI and segment reserve release (Non- GAAP) $ 470,548 Common Shares Outstanding at End of Period 23,371,835 Book Value (GAAP) $ 14.73 Adjusted Book Value (Non-GAAP) $ 20.14 The adjusted book value ratio excludes accumulated other comprehensive loss and adds back the other segment reserve release, net of tax. The Company believes this adjusted measure enables investors to assess the Company's capital levels and capital adequacy without the effects of changes in AOCI and the other segment reserve, some of which are uncertain and difficult to predict, or assuming that the Company realized all the previously unrealized losses on available-for-sale securities at the end of the period or the hypothetical release of the other segment reserve.