- SNSE Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Sensei Biotherapeutics (SNSE) DEF 14ADefinitive proxy

Filed: 28 Apr 22, 4:13pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

Sensei Biotherapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

SENSEI BIOTHERAPEUTICS, INC.

451 D Street, Suite 710

Boston, Massachusetts 02210

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 10, 2022

Dear Stockholder:

The Annual Meeting of Stockholders of Sensei Biotherapeutics, Inc. (the “Company”) will be held on Friday, June 10, 2022 at 11:00 a.m. Eastern Standard Time. In light of public health concerns regarding the COVID-19 pandemic, to protect the health and safety of our stockholders and employees and facilitate stockholder participation in the Annual Meeting, the Annual Meeting will be held through a live webcast at www.proxydocs.com/SNSE. You will not be able to attend the meeting in person. The meeting will be held for the following purposes:

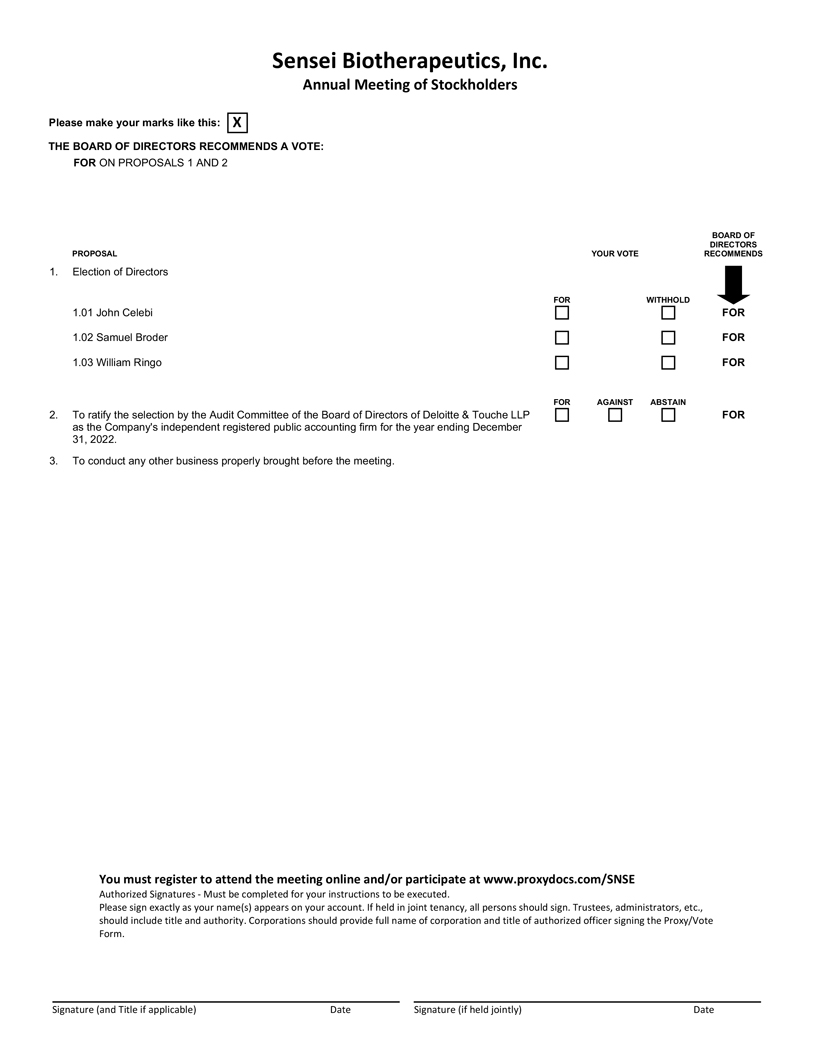

| 1. | To elect the Board’s nominees, John Celebi, Samuel Broder and William Ringo, to the Board of Directors to hold office until the 2025 Annual Meeting of Stockholders. |

| 2. | To ratify the selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022. |

| 3. | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice. This year’s Annual Meeting will be held virtually through a live webcast. You will be able to attend the Annual Meeting, submit questions and vote during the live webcast by visiting www.proxydocs.com/SNSE and entering the Control Number included in your proxy card, voting instruction form, or in the instructions that you received via email. Please refer to the additional logistical details and recommendations in the accompanying proxy statement. You may log-in beginning at 10:45 a.m. Eastern Standard Time, on Friday, June 10, 2022. The record date for the Annual Meeting is April 18, 2022. Only stockholders of record at the close of business on that date are entitled to notice of and to vote at the meeting or any adjournment thereof.

| By Order of the Board of Directors, |

| /s/ Erin Colgan |

| Erin Colgan |

| Secretary |

| Boston, Massachusetts |

| April 28, 2022 |

We are primarily providing access to our proxy materials over the Internet pursuant to the Securities and Exchange Commission’s notice and access rules. On or about April 28, 2022, we expect to mail to our stockholders of record as of April 18, 2022, a Notice of Internet Availability of Proxy Materials that will indicate how to access our 2022 Proxy Statement and 2021 Annual Report on the Internet and will include instructions on how you can receive a paper copy of the Annual Meeting materials, including the notice of annual meeting, proxy statement, and proxy card.

Whether or not you expect to attend the virtual Annual Meeting, please submit voting instructions for your shares promptly using the directions on your Notice, or, if you elected to receive printed proxy materials by mail, your proxy card, to vote by one of the following methods: (1) over the Internet before the Annual Meeting at www.proxypush.com/SNSE and during the Annual Meeting at www.proxydocs.com/SNSE, (2) by telephone by calling the toll-free number (866) 284-5317, or (3) if you elected to receive printed proxy materials by mail, by marking, dating, and signing your proxy card and returning it in the accompanying postage-paid envelope. Even if you have voted by proxy, you may still vote online if you attend the virtual Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank, or other nominee and you wish to vote online at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

|

SENSEI BIOTHERAPEUTICS, INC.

451 D Street, Suite 710

Boston, Massachusetts 02210

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 10, 2022

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because our Board of Directors is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders, including at any adjournments or postponements of the meeting. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about April 28, 2022 to all stockholders of record entitled to vote at the annual meeting.

How do I attend the annual meeting?

In light of public health concerns regarding the COVID-19 pandemic, to protect the health and safety of our stockholders and employees and facilitate stockholder participation in the Annual Meeting, this year, the Annual Meeting will be held through a live webcast at www.proxydocs.com/SNSE. You will not be able to attend the annual meeting in person. If you attend the annual meeting online, you will be able to vote and submit questions, at www.proxydocs.com/SNSE.

You are entitled to attend the annual meeting if you were a stockholder as of the close of business on April 18, 2022, the record date, or hold a valid proxy for the meeting. To be admitted to the annual meeting, you will need to visit www.proxydocs.com/SNSE and enter the Control Number found next to the label “Control Number” on your, proxy card, or voting instruction form, or in the email sending you the Proxy Statement. If you are a beneficial stockholder, you should contact the bank, broker or other institution where you hold your account well in advance of the meeting if you have questions about obtaining your control number/ proxy to vote.

Whether or not you participate in the annual meeting, it is important that you vote your shares.

We encourage you to access the annual meeting before it begins. Online check-in will start approximately 15 minutes before the meeting on June 10, 2022.

What if I cannot find my Control Number?

We will have access to a list of control numbers for registered stockholders in the event of a lost number. You may also consult your Mediant Relationship Manager for assistance. Typically, “guest” access is not permitted. Please consult with your Mediant Relationship Manager if you would like to permit guest access.

If you are a beneficial owner (that is, you hold your shares in an account at a bank, broker or other holder of record), you will need to contact that bank, broker or other holder of record to obtain your Control Number prior to the annual meeting.

1

Will a list of record stockholders as of the record date be available?

A list of our record stockholders as of the close of business on the record date will be made available to stockholders during the meeting at www.proxydocs.com/SNSE. The stockholder list will not be posted for viewing by the general public, and will only be available to meeting attendees inside of the virtual meeting platform.

Where can we get technical assistance?

We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting. If you encounter any difficulties accessing the virtual-only Annual Meeting platform, including any difficulties voting or submitting questions, you may call the technical support number that will be posted in your instructional email. The technical support number will not be posted publicly, it will be provided to meeting attendees via e-mail one hour prior to the meeting start time.

For the annual meeting, how do we ask questions of management and the board?

We plan to have a Q&A session at the annual meeting and will include as many stockholder questions as the allotted time permits. Stockholders may submit questions that are relevant to our business in advance of the annual meeting as well as live during the annual meeting. If you are a stockholder, you may submit a question in advance of the meeting at www/proxydocs.com/SNSE after logging in with your Control Number. Questions may be submitted during the annual meeting through the virtual annual meeting platform’s Q&A box.

We will post answers to stockholders’ questions that are relevant to our business received before and during the annual meeting on our Investor Relations website shortly after the meeting.

If I miss the annual meeting, will there be a copy posted online?

Yes, a replay of the annual meeting webcast will be available at our Investor Relations website at www.senseibio.com and remain for at least one year.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 18, 2022 will be entitled to vote at the annual meeting. On this record date, there were 30,682,813 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 18, 2022 your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote virtually at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 18, 2022 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares virtually at the meeting unless you request and obtain a valid legal proxy from your broker or other agent.

2

What am I voting on?

There are two matters scheduled for a vote:

| • | Proposal No. 1 – Election of three directors; and |

| • | Proposal No. 2 – Ratification of selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as independent registered public accounting firm of the Company for the year ending December 31, 2022. |

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” all of the nominees to the Board of Directors or you may “Withhold” your vote for any nominee you specify. For the other matter to be voted on, you may vote “For” or “Against” or abstain from voting.

The procedures for voting are:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote virtually at the Annual Meeting or vote by proxy in one of three ways: online, by telephone or using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote virtually even if you have already voted by proxy.

To vote during the annual meeting, if you are a stockholder of record as of the record date, follow the instructions provided via e-mail after registering at www.proxydocs.com/SNSE. You will need to enter the Control Number found on your Notice of Internet Availability or notice you receive or in the email sending you the Proxy Statement.

To vote prior to the annual meeting you may vote via the Internet at www.proxypush.com/SNSE; by telephone; or by completing and returning the proxy card or voting instruction form, as described below.

| • | To vote online, go to www.proxypush.com/SNSE. You will be asked to provide the Company number and control number from the Notice. Your vote must be received to be counted |

| • | To vote over the telephone, dial toll-free (866) 284-5317. You will be asked to provide the control number from the Notice. Your vote must be received to be counted. |

| • | To vote by mail if you requested printed proxy materials, you can vote by promptly completing and returning your signed proxy card in the envelope provided. You should mail your signed proxy card sufficiently in advance for it to be received by June 9, 2022. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a notice containing voting instructions from that organization rather than from us. Please follow the voting instructions in the notice to ensure that your vote is counted.

3

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 18, 2022.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone or through the internet at the annual meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (“NYSE”) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on Proposal No. 1, but may vote your shares on Proposal No. 2 even in the absence of your instruction.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of all nominees for director and “For” the ratification of Deloitte & Touche LLP as independent auditors for the year ending December 31, 2022. If any other matter is properly presented at the meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies virtually, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notice to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date. |

4

| • | You may grant a subsequent proxy by telephone or through the internet. |

| • | You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 451 D Street, Suite 710, Boston, Massachusetts 02210. |

| • | You may attend the annual meeting and vote online. Simply attending the meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s Annual Meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 29, 2022 to our Corporate Secretary at 451 D Street, Suite 710, Boston, Massachusetts 02210. If you wish to nominate an individual for election at, or bring business other than through a stockholder proposal before, the 2022 Annual Meeting, you must deliver your notice to our Corporate Secretary at the address above between February 10, 2023 and March 12, 2023. Your notice to the Corporate Secretary must set forth information specified in our bylaws, including your name and address and the class and number of shares of our stock that you beneficially own.

If you propose to bring business before an annual meeting other than a director nomination, your notice must also include, as to each matter proposed, the following: (1) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting that business at the annual meeting and (2) any material interest you have in that business. If you propose to nominate an individual for election as a director, your notice must also include, as to each person you propose to nominate for election as a director, the following: (1) the name, age, business address and residence address of the person, (2) the principal occupation or employment of the person, (3) the class and number of shares of our stock that are owned of record and beneficially owned by the person, (4) the date or dates on which the shares were acquired and the investment intent of the acquisition and (5) any other information concerning the person as would be required to be disclosed in a proxy statement soliciting proxies for the election of that person as a director in an election contest (even if an election contest is not involved), or that is otherwise required to be disclosed pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and regulations promulgated under the Exchange Act, including the person’s written consent to being named as a nominee and to serving as a director if elected. We may require any proposed nominee to furnish other information as we may reasonably require to determine the eligibility of the proposed nominee to serve as an independent director or that could be material to a reasonable stockholder’s understanding of the independence, or lack of independence, of the proposed nominee.

For more information, and for more detailed requirements, please refer to our Amended and Restated Bylaws, filed as Exhibit 3.2 to our Registration Statement on Form S-3, filed with the SEC on March 15, 2022.

How are votes counted?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes, and with respect to the ratification of independent auditors, votes “For,” “Against” and abstentions. For Proposal No. 1, broker non-votes will have no effect and will not be counted toward the vote total for any of the director nominees. For Proposal No. 2, abstentions will be counted and will have the same effect as “Against” votes.

5

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

Proposal Number | Proposal Description | Vote Required for Approval | Effect of Abstentions | Effect of Broker Non- Votes | ||||

| 1 | Election of Directors | Nominees receiving the most “For” votes. | No effect | No effect | ||||

| 2 | Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2022 | “For” votes from holders of a majority of the stock having voting power present virtually or represented by proxy at the 2022 Annual Meeting. | Against | Brokers have discretion to vote (1) | ||||

| (1) | This proposal is considered a “routine” matter under NYSE rules. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority under NYSE rules to vote your shares on this proposal. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum is present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the Annual Meeting virtually or represented by proxy. On the record date, there were 30,682,813 shares outstanding and entitled to vote. Thus, the holders of 15,341,407 shares must be present virtually or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairman of the Annual Meeting or the holders of a majority of shares present at the Annual Meeting virtually or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the annual meeting.

6

ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes and currently has nine members. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that class and until the director’s successor is duly elected and qualified.

There are three directors in the class whose term of office expires in 2022, John Celebi, Samuel Broder and William Ringo. Each of the nominees, except for Mr. Ringo, is currently a director of the Company who was previously elected by the stockholders. Mr. Ringo was recommended to the Nominating and Corporate Governance Committee for nomination by our Chief Executive Officer. If elected at the Annual Meeting, these nominees will serve until the 2025 annual meeting and until his successor has been duly elected and qualified, or, if sooner, until his death, resignation or removal. It is the Company’s policy to invite and encourage directors and nominees for director to attend the Annual Meeting. We elected directors by written consent of our stockholders during 2021 and therefore did not hold an Annual Meeting.

Directors are elected by a plurality of the votes of the holders of shares present virtually or represented by proxy and entitled to vote on the election of directors. Accordingly, the three nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the three nominees named below. If any of the nominees becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee may instead be voted for the election of a substitute nominee that we propose. Each person nominated for election has agreed to serve if elected. We have no reason to believe that any of the nominees will be unable to serve.

The Nominating and Corporate Governance Committee seeks to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience and capability in various areas necessary to oversee and direct the Company’s business. To that end, the Nominating and Corporate Governance Committee has identified and evaluated nominees in the broader context of the Board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also exhibit integrity, experience, judgment, commitment, skills, diversity, expertise and other qualities that the Nominating and Corporate Governance Committee views as critical to effective functioning of the Board. The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Nominating and Corporate Governance Committee to believe that nominee should continue to serve on the Board. However, each of the members of the Nominating and Corporate Governance Committee may have a variety of reasons why he or she believes a particular person would be an appropriate nominee for the Board, and these views may differ from the views of other members.

CLASS I DIRECTOR NOMINEES FOR ELECTION FOR A THREE-YEAR TERM EXPIRING AT THE 2025 ANNUAL MEETING

The following is a brief biography of each nominee for director and a discussion of the specific experience, qualifications, attributes or skills of each nominee that led the Nominating and Corporate Governance Committee to recommend that person as a nominee for director, as of the date of this proxy statement.

John Celebi, age 50

John Celebi has served as our President and Chief Executive Officer and a member of our board of directors since February 2018. Prior to joining us, from 2016 until February 2018, Mr. Celebi served as Chief Operating

7

Officer of X4 Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company. Prior to X4 Pharmaceuticals, from 2011 until 2016, he served as Chief Business Officer at Igenica Biotherapeutics, Inc., an immunotherapy company. Prior to joining Igenica Biotherapeutics, Mr. Celebi served in various roles at ArQule, Inc., a biotechnology and pharmaceutical company from 2003 until 2011, including as Vice President of Business Development and New Product Planning and Alliance Management. From 1995-1998 Mr. Celebi conducted drug discovery research at Tularik, Inc. Mr. Celebi received a B.S. in Biophysics from the University of California, San Diego and an M.B.A. from Carnegie Mellon University. We believe that Mr. Celebi’s perspective and deep experience in the biotechnology industry, as well as his experience leading our company as the President and Chief Executive Officer, qualifies him to serve on our board of directors.

Samuel Broder, age 77

Samuel Broder, M.D. has served as a member of our board of directors since April 2019. Prior to his retirement, Dr. Broder was Senior Vice President from 2012 to 2016 and Head of the Health Sector from 2015 to 2016 for Intrexon Corporation, a synthetic biology company. Prior to Intrexon, he served as the Executive Vice President for Medical Affairs and Chief Medical Officer at Celera Corporation from 1998 to 2010. Prior to Celera Dr. Broder served as Senior Vice President, Research and Development and Chief Scientific Officer at IVAX Corporation from l995 to l998. Dr. Broder served as the director of the National Cancer Institute from l989 to 1995 appointed by President Ronald Reagan, where he oversaw the development of numerous anticancer therapeutic agents. Dr. Broder received a B.S. from University of Michigan and an M.D. from the University of Michigan Medical School, with post-graduate training at Stanford University in Palo Alto. We believe that Dr. Broder’s significant scientific experience with therapeutic agents qualifies him to serve on our board of directors.

William Ringo, age 76

William Ringo has served as a chairman of our board of directors since March 2022. Mr. Ringo most recently served as Interim Chief Executive Officer of Five Prime Therapeutics, Inc. (Five Prime) from September 2019 until April 2020. From 2010 until 2015, Mr. Ringo was a senior advisor with Barclays Capital, the global investment banking division of Barclays Bank PLC. From 2010 until 2015, Mr. Ringo served as a strategic advisor with Sofinnova Ventures, a life sciences-focused investment firm. Prior to his advisory roles with Barclays Capital and Sofinnova Ventures, Mr. Ringo served as Senior Vice President of Strategy and Business Development for Pfizer Inc., a biopharmaceutical company, from 2008 until his retirement in 2010. From 2004 to 2006, Mr. Ringo served as President and Chief Executive Officer of Abgenix, Inc., a biotechnology company acquired by Amgen, Inc. His experience in the global pharmaceutical sector also includes nearly 30 years with Lilly. Over the course of his career with Lilly, Mr. Ringo served in numerous executive roles, including Product Group President for oncology and critical care, President of internal medicine products, President of the infectious diseases business unit, and Vice President of sales and marketing for U.S. pharmaceuticals. He also was a member of Lilly’s operating committee. Mr. Ringo has been a director of Assembly Biosciences, Inc. since 2014 and has served as non-executive Chairman of the Board since 2015. In the last five years, Mr. Ringo was formerly a director of Five Prime, Immune Design Corp., Sangamo Biosciences, Inc., Mirati Technologies, Inc. and, prior to its being acquired by Lilly, Dermira, Inc. Mr. Ringo received a B.S. in business administration and an M.B.A. from the University of Dayton. We believe that Mr. Ringo’s significant scientific and board experience qualifies him to serve on our board of directors.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” EACH NAMED NOMINEE.

CLASS II DIRECTORS CONTINUING IN OFFICE UNTIL THE 2023 ANNUAL MEETING

Bob Holmen, age 58

Bob Holmen has served as a member of our board of directors since January 2017. Mr. Holmen provides legal services focused on venture capital and private equity markets to investors through his boutique law firm Investor

8

Counsel, where he has served as a Principal since 2016. Mr. Holmen has also served as a Managing Director since 2001 and Chief Financial Officer since 2002 at Miramar Venture Partners, a venture capital firm, and as a Principal of Holmen Ventures, a strategic financial consulting firm, since 2013. Prior to Miramar, Mr. Holmen served as an Executive Officer for CoCensys, Inc., a biopharmaceutical company, and First Consulting Group, Inc., a healthcare consulting firm. Mr. Holmen received a B.S. in Electrical Engineering from Stanford University and a J.D. from University of California, Berkeley School of Law. We believe that Mr. Holmen’s education and professional background in advising companies in the biotechnology industry qualifies him to serve on our board of directors.

Deneen Vojta, age 57

Deneen Vojta, M.D. has served as a member of our board of directors since January 2021. Dr. Vojta has served in various roles at UnitedHealth Group since 2006, including most recently as the Executive Vice President for Global Research & Development since 2016. Prior to UnitedHealth, she founded Mynetico, a company focused on the childhood obesity epidemic, and served as its Chief Executive Officer from 2003 to 2006. Prior to that, she served as the Chief Medical Officer of Health Partners from 1997 to 2000 and Frankford Health System from 2000 to 2003. Dr. Vojta received a B.S. from the University of Pittsburgh and an M.D. from Temple University School of Medicine. We believe that Dr. Vojta’s significant clinical and scientific experience and experience as an executive of health benefits and management companies qualifies her to serve on our board of directors.

Kristian Humer, age 47

Kristian Humer has served as a member of our board of directors since July 2021. Mr. Humer has served as the Chief Financial Officer and Chief Business Officer of Viridian Therapeutics Inc. since July 2021. Prior to Veridian, Mr. Humer served as Managing Director of Banking, Capital Markets and Advisory for the Global Healthcare team at Citigroup Inc., from 2017 to July 2021, where he helped lead the firm’s investment banking advisory engagements for small- and mid-sized biopharma and select large cap pharmaceutical companies. He previously served in a number of roles at Citigroup Inc., including Director, Healthcare Investment Banking from 2014 to 2016, Vice President, Healthcare Investment Banking from 2011 to 2013 and Associate, Healthcare Investment Banking in 2010. Prior to joining Citigroup Inc., Mr. Humer served as Vice President and Associate in the Investment Banking Division for the Global Healthcare team at Lehman Brothers, Inc. from 2007 to 2009. Mr. Humer started his career serving positions of increasing responsibility in the investment banking and private banking divisions of UBS AG and Merrill Lynch (a Bank of America company). He received an MBA from the Fuqua School of Business at Duke University and a B.A. (Hons) in Accounting & Economics from the University of Reading, United Kingdom. We believe that Mr. Humer’s experience in the biopharmaceutical industry and his years of investment banking and leadership experience qualify him to serve on our board of directors.

CLASS III DIRECTORS CONTINUING IN OFFICE UNTIL THE 2024 ANNUAL MEETING

James Peyer, age 35

James Peyer, Ph.D. has served as a member of our board of directors since January 2020. In September 2019, Dr. Peyer founded Cambrian Biopharma, where he serves as the Chief Executive Officer. In 2018, Dr. Peyer founded Cleara Biotech, a biopharmaceutical company, where he served as Executive Director from February 2018 to June 2019. Dr. Peyer also founded and served as Managing Partner at Apollo Health Ventures GmbH from June 2016 until March 2019. Prior to his service at Apollo Ventures, Dr. Peyer served as a consultant at McKinsey & Company from 2015 until 2016. Dr. Peyer received a B.A. in Biology from the University of Chicago and a Ph.D. in Stem Cell Biology at The University of Texas Southwestern Medical Center at Dallas. We believe that Dr. Peyer’s experience in the biopharmaceutical industry, his years of business and leadership experience and expertise qualifies him to serve on our board of directors.

9

Thomas Ricks, age 69

Thomas Ricks has served as a member of our board of directors since 2015. Mr. Ricks served as former Chief Investment Officer of H&S Ventures, LLC, a Forbes 150 family office, from 2001 until his retirement in 2018. Prior to his service, Mr. Ricks served as Chief Executive Officer of The University of Texas Investment Management Company from 1996 to 2001. Mr. Ricks has been a director of Ovintiv, Inc. since 2019 and currently serves as Chair of the Human Resources and Compensation Committee, and on the Corporate Responsibility and Governance Committee. He was a director of Newfield Exploration Company from 1992 to 2019 and most recently served as Chair of its Audit Committee. Mr. Ricks also served on the boards of several privately-held companies; BDM International (acquired by TRW), LifeCell Corporation, and Argus Pharmaceuticals. Mr. Ricks is a former director of the Ocean Institute, and a former member of the Investment Committees for St. David’s Foundation and the University of California – Irvine Foundation. Mr. Ricks received a B.A. in Economics from Trinity College and an M.B.A. from the University of Chicago. We believe Mr. Ricks’ extensive experience as a director of public company and private companies in the healthcare industry qualifies him to serve on our board of directors.

Jessie English, age 58

Jessie M. English, Ph.D. has served as a member of our board of directors since April 2021. Dr. English has served as the Chief Scientific Officer of Bakx Therapeutics, Inc. since November 2020. Prior to Bakx, Dr. English was the Chief Scientific officer at Tilos Therapeutics, Inc. from June 2018 to November 2019. Prior to that, she was the Vice President and Head of Discovery TIP-IO at EMD Serono, Merck KGaA from 2016 to May 2018. From 2012 to 2016, Dr. English served as the Head of Research at the Belfer Center Dana-Farber Cancer Institute, Harvard Medical School. Earlier in her career, she held various positions in the Department of Oncology Discovery at Schering-Plough Research Institute from 1998 to 2004, held various positions at Pfizer Research Technology Center from 2004 to 2008, was the Senior Director and External Discovery Oncology Lead at Merck Research Laboratories from 2008 to 2010 and was the Vice President, Kinase Biology at ArQule Inc. from 2010 to 2011. Dr. English received a B.S. in Biochemistry from Kansas State University, a Ph.D. in Neurobiology from the University of North Carolina at Chapel Hill and was a Postdoctoral Fellow at the University of Texas Southwestern Medical Center at Dallas. We believe that Dr. English’s significant scientific experience and experience as an executive of life sciences companies qualifies her to serve on our board of directors.

10

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

INDEPENDENCE OF THE BOARD OF DIRECTORS

Our Board of Directors has undertaken a review of the independence of the directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning such director’s background, employment and affiliations, including family relationships, our Board of Directors determined that all of our directors except for Mr. Celebi, representing eight of our nine directors, are “independent directors” as defined under current rules and regulations of the SEC and the listing standards of the Nasdaq Stock Market. In making these determinations, our Board of Directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances that our Board of Directors deemed relevant in determining their independence. There are no family relationships among any of our directors or executive officers.

BOARD LEADERSHIP STRUCTURE

The Board of Directors of the Company has a Chairman, Mr. Ringo, who has authority, among other things, to call and preside over Board meetings, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Board Chairman has substantial ability to shape the work of the Board. We believe that separation of the positions of Board Chairman and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, we believe that having a Board Chairman creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and our stockholders. As a result, we believe that having a Board Chairman can enhance the effectiveness of the Board as a whole.

BOARD DIVERSITY

Board Diversity Matrix (As of April 28, 2022) | ||||||||||||

| Board size | 9 | |||||||||||

Gender | Male | Female | Non-Binary | Gender Undisclosed | ||||||||

Number of directors based on gender identity | 6 | 2 | 1 | |||||||||

Number of directors who identify in any of the categories below | ||||||||||||

African American or Black | ||||||||||||

Alaskan Native or American Indian | ||||||||||||

Asian | ||||||||||||

Native Hawaiian or Pacific Islander | ||||||||||||

White | 6 | 2 | ||||||||||

Two or More Races or Ethnicities | ||||||||||||

LGBTQ+ | ||||||||||||

Undisclosed | 1 | |||||||||||

ROLE OF THE BOARD IN RISK OVERSIGHT

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, cybersecurity and reputational. One of the key functions of our Board of Directors is informed oversight of our risk management process. Our Board of Directors does not have a standing risk management committee, but rather administers this oversight function directly through the Board of Directors as a whole, as well as through various standing committees of our Board of Directors that address risks inherent in their respective areas of oversight. In particular, our Board of Directors is responsible for monitoring and assessing strategic risk exposure and our Audit Committee has the responsibility to consider and discuss our

11

major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements. Our Nominating and Corporate Governance Committee monitors the effectiveness of our corporate governance guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. It is the responsibility of the committee chairs to report findings regarding material risk exposures to the Board as quickly as possible. The Board Chairman coordinates between the Board and management with regard to the determination and implementation of responses to any problematic risk management issues.

MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors met six times during the last fiscal year. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

As required under applicable Nasdaq listing standards, during the last fiscal year, the Company’s independent directors met four times in regularly scheduled executive sessions at which only independent directors were present.

INFORMATION REGARDING COMMITTEES OF THE BOARD OF DIRECTORS

The Board has four committees: an Audit Committee, a Compensation Committee a Nominating and Corporate Governance Committee, and a Science and Technology Committee, which was formed in April 2022. The following table provides membership and the number of meetings for the year ended December 31, 2021 for each of the Board committees:

Name | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||||||||

John Celebi | ||||||||||||

James Peyer | X | (1) | X | |||||||||

Bob Holmen | X | X | * | |||||||||

Samuel Broder | X | * | ||||||||||

Thomas Ricks | X | * | X | |||||||||

Deneen Vojta | X | (2) | X | |||||||||

Jessie English | X | (3) | ||||||||||

Kristian Humer | X | (1) | ||||||||||

Number of meetings in 2021 | 4 | 3 | 3 | |||||||||

| * | Committee chair. |

| (1) | Mr. Humer replaced Dr. Peyer as a member of the Audit Committee in July 2021. |

| (2) | Dr. Vojta was appointed as a member of the Compensation Committee in December 2021. |

| (3) | Dr. English was appointed as a member of the Nominating and Corporate Governance Committee in June 2021. |

Below is a description of each committee of the Board. Each of the committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that each current member of each committee meets the applicable Nasdaq rules and regulations regarding “independence” and each current member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

12

Audit Committee

The Audit Committee of the Board of Directors was established by the Board in accordance with Section 3(a)(58)(A) of the Exchange Act to oversee the Company’s corporate accounting, disclosure controls and procedures and financial reporting processes and audits of its financial statements. The Audit Committee is currently composed of three directors: Thomas Ricks, Kristian Humer and Bob Holmen. Thomas Ricks serves as the Chair of the Audit Committee. The Audit Committee met four times during 2021. The Board has adopted a written Audit Committee charter that is available to stockholders on our website at www.senseibio.com.

The Board of Directors reviews the Nasdaq listing standards definition of independence for Audit Committee members on an annual basis and has determined that all members of our Audit Committee are independent, as independence is currently defined in Rule 5605(c)(2)(A)(i) and (ii) of the Nasdaq listing standards. The Board of Directors has also determined that Mr. Ricks qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of Mr. Ricks’s level of knowledge and experience based on a number of factors, including his formal education and experience as a chief financial officer for public reporting companies.

The principal duties and responsibilities of our Audit Committee include:

| • | evaluating the performance, independence and qualifications of our independent auditors and determining whether to retain our existing independent auditors or engage new independent auditors; |

| • | reviewing and approving the engagement of our independent auditors to perform audit services and any permissible non-audit services; |

| • | reviewing related party transactions; |

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding financial controls, accounting or auditing matters and other matter; |

| • | reviewing our annual and quarterly financial statements and reports, including the disclosures contained under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and discussing the statements and reports with our independent auditors and management; |

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding financial controls, accounting or auditing matters and other matters; |

| • | reviewing with our independent auditors and management significant issues that arise regarding accounting principles and financial statement presentation and matters concerning the scope, adequacy and effectiveness of our financial controls; and |

| • | reviewing and evaluating on an annual basis the performance of the Audit Committee and the Audit Committee charter. |

Report of the Audit Committee of the Board of Directors

The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 2021 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”). The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firm’s independence. Based on the foregoing, the

13

Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Thomas Ricks, Chair

Kristian Humer

Bob Holmen

| * | The material in this report is not “soliciting material,” is not deemed “filed” with the Commission and is not to be incorporated by reference in any filing of the Company under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

Compensation Committee

The Compensation Committee is composed of five directors: Messrs. Ringo, Ricks and Holmen, and Drs. Peyer and Vojta. Mr. Holmen serves as the Chair of the Compensation Committee. Each of the committee members are non-employee directors, as defined in Rule 16b-3 promulgated under the Exchange Act and are “outside directors,” as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Our Board of Directors has determined that each of the committee members are “independent” as defined under the applicable Nasdaq listing standards, including the standards specific to members of a compensation committee. The Compensation Committee met three times during 2021. The Board has adopted a written Compensation Committee charter that is available to stockholders on our website at www.senseibio.com.

The principal duties and responsibilities of our Compensation Committee include:

| • | reviewing and making recommendations to the full Board of Directors regarding the type and amount of compensation to be paid or awarded to our non-employee board members; |

| • | setting the compensation and other terms of employment of our Chief Executive Officer and our other executive officers; |

| • | reviewing, modifying and approving (or if it deems appropriate, making recommendations to the full Board of Directors regarding) our overall compensation strategy and policies; |

| • | reviewing and approving (or if it deems it appropriate, making recommendations to the full Board of Directors regarding) the equity incentive plans, compensation plans and similar programs advisable for us, as well as modifying, amending or terminating existing plans and programs; and |

| • | reviewing and evaluating on an annual basis the performance of the Compensation Committee and the Compensation Committee charter. |

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets an average of once every quarter and with greater frequency if necessary. The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with our Chief Executive Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. Our Compensation Committee typically reviews and discusses management’s proposed compensation with the Chief Executive Officer for all executives other than the Chief Executive Officer. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the

14

Company. In addition, under the charter, the Compensation Committee has the authority to obtain, at the expense of the Company, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee has direct responsibility for the oversight of the work of any consultants or advisers engaged for the purpose of advising the Compensation Committee. In particular, the Compensation Committee has the sole authority to retain, in its sole discretion, compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, independent legal counsel or other adviser to the Compensation Committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and Nasdaq, that bear upon the adviser’s independence.

During the past fiscal year, after taking into consideration the six factors prescribed by the SEC and Nasdaq described above, the Compensation Committee engaged the Human Capital Solutions (HCS) Practice of Aon Corporation (formerly named) as compensation consultants. Our Compensation Committee identified Radford based on HCS’s general reputation in the industry. The Compensation Committee requested that HCS:

| • | assist in providing competitive compensation data for all of the Company’s executive positions; |

| • | assess the degree to which the Company’s current compensation strategy and practices aligns with market practices for all of the Company’s executive positions; |

| • | review all elements of pay including base salary, short-term incentives, total cash compensation, long-term incentives, pay mix, ownership levels and equity retention for all of the Company’s executive positions; and |

| • | propose go-forward changes relating to executive cash and equity compensation. |

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is composed of five directors: Mr. Ringo and Drs. Broder, Vojta, Peyer and English. Dr. Broder serves as the Chair of the Nominating and Corporate Governance Committee. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the Nasdaq listing standards). The Nominating and Corporate Governance Committee met three times during 2021. The Board has adopted a written Nominating and Corporate Governance Committee charter that is available to stockholders on the Company’s website at www.senseibio.com.

The Nominating and Corporate Governance Committee’s responsibilities include:

| • | identifying, reviewing, evaluating and recommending candidates to serve on our Board of Directors; |

| • | determining the minimum qualifications for service on our board of director; |

| • | evaluating director performance on the board and applicable committees of the board and determining whether continued service on our board is appropriate; |

| • | evaluating nominations by stockholders of candidates for election to our Board of Directors; |

| • | considering and assessing the independence of members of our Board of Directors; |

| • | evaluating our set of corporate governance policies and principles and recommending to our Board of Directors any changes to such policies and principles; |

| • | reviewing and making recommendations to the Board of Directors with respect to management succession planning; |

15

| • | considering questions of possible conflicts of interest of directors as such questions arise; and |

| • | reviewing and evaluating on an annual basis the performance of the Nominating and Corporate Governance Committee and the Nominating and Corporate Governance Committee charter. |

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics. The Nominating and Corporate Governance Committee also intends to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of the Company, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of the Company’s stockholders. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of the Company and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity (including gender, racial and ethnic diversity), age, skills and such other factors as it deems appropriate, given the current needs of the Board and the Company, to maintain a balance of knowledge, experience and capability.

Diversity is one of a number of factors, however, that the committee takes into account in identifying nominees, and the Nominating and Corporate Governance Committee believes that it is essential that the board members represent diverse viewpoints. To accomplish the Board’s diversity objectives, the Nominating and Governance Committee may retain an executive search firm to help identify potential directors that meet these objectives.

In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. The Nominating and Corporate Governance Committee also takes into account the results of the Board’s self-evaluation, conducted annually on a group and individual basis. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates’ qualifications and then selects a nominee for recommendation to the Board by majority vote.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: Secretary, Sensei Biotherapeutics, Inc., 451 D Street, Suite 710, Boston, Massachusetts 02210, at least 90 days, but not more than 120 days, prior to the anniversary date of the mailing of our proxy statement for the preceding year’s annual meeting of stockholders. Submissions must include: (1) the name and address of the Company stockholder on whose behalf the submission is made; (2) the number of Company shares that are owned beneficially by such stockholder as of the date of the submission; (3) the full name, age, business address and residence address of the proposed candidate; (4) a description of the proposed candidate’s principal occupation or employment; (5) the class and number of shares of each class of capital stock

16

of the corporation which are owned of record and beneficially by such proposed candidate; and (6) such additional information as is required by our bylaws. Each submission must be accompanied by the written consent of the proposed candidate to be named as a nominee and to serve as a director if elected.

STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS

The Board has adopted a formal process by which stockholders may communicate with the Board or any of its directors. Stockholders who wish to communicate with the Board may do so by sending written communications addressed to the Board or the director in care of Sensei Biotherapeutics, Inc., 451 D Street, Suite 710, Boston Massachusetts 02210, Attn: Secretary. Each communication must set forth the name and address of the stockholder on whose behalf the communication is sent and the number and class of shares of our stock that are owned beneficially by the stockholder as of the date of the communication.

These communications will be reviewed by our Secretary, who will determine whether they should be presented to the Board. The purpose of this screening is to allow the Board to avoid having to consider communications that contain advertisements or solicitations or are unduly hostile, threatening or similarly inappropriate. All communications directed to the audit committee in accordance with our Open Door Policy for Reporting Complaints Regarding Accounting and Auditing Matters that relate to questionable accounting or auditing matters involving the Company will be promptly and directly forwarded to the Audit Committee.

Any interested person may communicate directly with the non-management directors. Persons interested in communicating directly with the non-management directors regarding their concerns or issues may do so by addressing correspondence to a particular director, or to the non-management directors generally, in care of Sensei Biotherapeutics, Inc., 451 D Street, Suite 710, Boston Massachusetts 02210. If no particular director is named, letters will be forwarded, depending upon the subject matter, to the chair of the Audit, Compensation, or Nominating and Corporate Governance Committee.

CODE OF BUSINESS CONDUCT AND ETHICS

We have adopted a Code of Business Conduct and Ethics (the “Code of Conduct”) applicable to all of our employees, executive officers and directors. The Code of Conduct is available on our website at www.senseibio.com. The Nominating and Corporate Governance Committee is responsible for overseeing the Code of Conduct and must approve any waivers of the Code of Conduct for executive officers and directors. If we make any substantive amendments to the Code of Conduct or grants any waiver from a provision of the Code of Conduct to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

CORPORATE GOVERNANCE GUIDELINES

In connection with our initial public offering, the Board documented the governance practices followed by the Company by adopting Corporate Governance Guidelines to assure that the Board will have the necessary authority and practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The Corporate Governance Guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the practices the Board intends to follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer performance evaluation and succession planning, and board committees and compensation. The Nominating and Corporate Governance Committee regularly reviews the Corporate Governance Guidelines, seeks advice and recommendations from outside advisors, and considers corporate governance trends and best practices in our industry.

17

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2022 and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the annual meeting. Deloitte & Touche LLP has audited the Company’s financial statements since 2016. Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the Company’s Bylaws nor other governing documents or law require stockholder ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of Deloitte & Touche LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present virtually or represented by proxy and entitled to vote on the matter at the annual meeting will be required to ratify the selection of Deloitte & Touche LLP.

FEES FOR SERVICES PROVIDED BY THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The following table represents aggregate fees for professional services rendered to the Company for the years ended December 31, 2021 and 2020 by Deloitte & Touche LLP, the Company’s independent registered public accounting firm.

| Years Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

Audit fees(1) | $ | 617 | $ | 412 | ||||

Audit-related fees(2) | 1,304 | |||||||

Tax fees(3) | 44 | 30 | ||||||

Total fees | $ | 661 | $ | 1,746 | ||||

| (1) | Audit fees consists of fees billed or incurred for professional services rendered in connection with the audit of our consolidated financial statements and review of the interim condensed consolidated financial statements included in our quarterly reports. |

| (2) | Audit-related fees in 2020 includes fees billed or incurred for professional services rendered in connection with our initial public offering. |

| (3) | Tax fees includes services related to the preparation or review of the U.S. federal, state and local tax returns, and other advisory and professional services. |

There were no other fees for the years ended December 31, 2021 and 2020.

PRE-APPROVAL POLICIES AND PROCEDURES

The Audit Committee has adopted a policy and procedures for the pre-approval of audit and non-audit services rendered by the Company’s independent auditors, Deloitte & Touche LLP. The Audit Committee generally

18

pre-approves specified services in the defined categories of audit services, audit-related services and tax services up to specified amounts. Pre-approval may also be given as part of the Audit Committee’s approval of the scope of the engagement of the independent auditor or on an individual, explicit, case-by-case basis before the independent auditor is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committee’s members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

All of the services of Deloitte & Touche LLP for the years ended December 31, 2021 and 2020 described above were pre-approved in accordance with the Audit Committee Pre-Approval Policy.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE “FOR” PROPOSAL NO. 2.

19

The following table sets forth information concerning our executive officers:

| Name | Position | |

John Celebi | President and Chief Executive Officer and Director | |

Erin Colgan | Chief Financial Officer | |

Robert Pierce | Chief Research and Development Officer |

EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

The following sets forth certain information with respect to our executive officers who are not directors:

Erin Colgan, age 41

Erin Colgan has served as our Chief Financial Officer since December 2021 and previously served as our Senior Vice President of Finance and Administration from July 2020 to December 2021. Prior to joining us, Ms. Colgan served as the Vice President of FP+A and Commercial Planning at Intarcia Therapeutics from August 2019 to June 2020. Prior to Intarcia, from August 2010 to August 2019, Ms. Colgan held various roles of increasing responsibility at Vertex Pharmaceuticals, most recently as Senior Director, FP+A and Global Revenue. Ms. Colgan began her career in public accounting at PricewaterhouseCoopers where she worked in both audit and business development. Ms. Colgan holds a B.A. in Accounting from the University of Massachusetts, Amherst.

Robert Pierce, age 58

Robert Pierce, M.D. has served as our Chief Research and Development Officer since December 2021 and previously served as our Chief Scientific Officer from March 2020 to December 2021. Prior to joining us, Dr. Pierce served as Scientific Director of the Immunopathology Lab in the Clinical Research Division of the Fred Hutchinson Cancer Research Center from 2016 until March 2020. Prior to that, Dr. Pierce served as Chief Scientific Officer of OncoSec Medical Incorporated, a biotechnology company, from 2014 until 2016. Dr. Pierce received a B.A. in Philosophy from Yale College and an M.D. from Brown University.

20

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our common stock as of January 31, 2022 for:

| • | each person, or group of affiliated persons, who is known by us to beneficially own more than 5% of our common stock; |

| • | each of our named executive officers; |

| • | each of our directors; and |

| • | all of our executive officers and directors as a group. |

The percentage ownership information shown in the table below is based upon 30,609,029 shares of common stock outstanding as of January 31, 2022.

We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities. In addition, these rules require that we include shares of common stock issuable pursuant to the vesting of restricted stock units and the exercise of stock options that are either immediately exercisable or exercisable within 60 days of January 31, 2022. These shares are deemed to be outstanding and beneficially owned by the person holding those options for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. This table is based on information supplied by officers, directors and principal stockholders and Schedule 13D and Schedule 13G and Section 16 filings, if any, with the SEC. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

Except as otherwise noted below, the address for persons listed in the table is c/o Sensei Biotherapeutics, Inc., 451 D Street, Suite 710, Boston Massachusetts 02210.

Name of Beneficial Owner | Number of Shares Beneficially Owned | Percentage of Shares Beneficially Owned | ||||||

5% or greater stockholders: | ||||||||

Cambrian Biopharma Inc.(1) | 5,153,824 | 16.8 | ||||||

H&S Investments I LP(2) | 4,441,624 | 14.5 | ||||||

Presight Co-Invest Fund, L.P.(3) | 4,185,199 | 13.7 | ||||||

Named executive officers and directors: | ||||||||

John Celebi(4) | 430,848 | 1.4 | ||||||

Erin Colgan(5) | 40,832 | * | ||||||

Robert Pierce(4) | 134,591 | * | ||||||

Marie-Louise Fjaellskog | — | — | ||||||

Anupama Hoey | — | — | ||||||

Samuel Broder(4) | 26,163 | * | ||||||

Jessie English(4) | 5,556 | * | ||||||

Bob Holmen(6) | 65,829 | * | ||||||

Kristian Humer(4) | 3,704 | * | ||||||

James Peyer(1) | 5,153,824 | 16.8 | ||||||

Thomas Ricks(7) | 363,176 | 1.2 | ||||||

William Ringo | — | — | ||||||

Deneen Vojta (4) | 6,018 | * | ||||||

All current executive officers and directors as a group (11 persons) | 6,230,541 | 19.9 | ||||||

| * | Represents beneficial ownership of less than 1% |

21

| (1) | Consists of 5,128,286 shares of common stock and 25,538 shares issuable pursuant to stock options exercisable within 60 days following March 1, 2021 held by Cambrian Biopharma Inc. (“Cambrian”). Cambrian is a Delaware corporation and Dr. Peyer serves as Cambrian’s Chief Executive Officer. In such capacity Dr. Peyer may direct the voting and disposition of the shares held by Cambrian, subject in certain instances to the approval of Cambrian’s Board of Directors. Cambrian’s business address is 19 Morris Avenue, Brooklyn Navy Yard, Building 128, Brooklyn, New York 11025. |

| (2) | This information has been obtained from a Schedule 13G filed on February 14, 2022 by entities and individuals associated with H&S Investments I LP (“H&S”). Consists of 4,426,000 shares of common stock and warrants exercisable for 15,624 shares of common stock held by H&S Investments I, L.P. H&S Ventures, LLC, its general partner, and Michael Schulman, manager of H&S Ventures, may be deemed to have voting and dispositive power with respect to the shares held. The principal business address of H&S Investments I, L.P. is 2101 E Coast Highway 3rd Floor Corona Del Mar, CA 92625. |