If we fail to develop, upgrade and apply our technologies to support and expand our business, our business may be materially and adversely affected.

We rely on our technology infrastructure and operating systems to carry out the key aspects of our business, including identifying market trends in lifestyle brands, selecting and partnering with quality brand partners, assisting in product designs for our private label brands, forecasting customers’ demands, supporting our product supply chain, enabling effective marketing and distribution, and refining customer services. Although we did not experience any material failure or breakdown of our operating systems in the past, we cannot guarantee that such risks are always under control. In addition, computer viruses, security breaches and information theft may lead to delays or errors in transaction processing, inability to fulfill purchase orders or loss of data. Any interruptions of our operating platform, whether caused by computer viruses, hacking or other security breaches, and errors encountered during platform upgrades or other issues resulting in the unavailability, or slowdown of our information technologies may, individually or collectively, materially and adversely affect our business and results of operations.

The lifestyle brand industry, and in particular combined with e-commerce, is subject to rapid technological changes and innovations. Our technologies may become obsolete or insufficient, and we may have difficulties in following and adapting to technological changes in the lifestyle brand industry in a timely and cost-effective manner, which could impact every key aspect of our business. New technologies developed and introduced by our competitors could render our products and services less attractive or obsolete, thus materially affecting our business and prospects. In addition, our substantial investments in technology may not produce expected results. If we fail to continue to develop, innovate and utilize our technologies or if our competitors develop or apply more advanced technologies, our business, financial condition and results of operations could be materially and adversely affected.

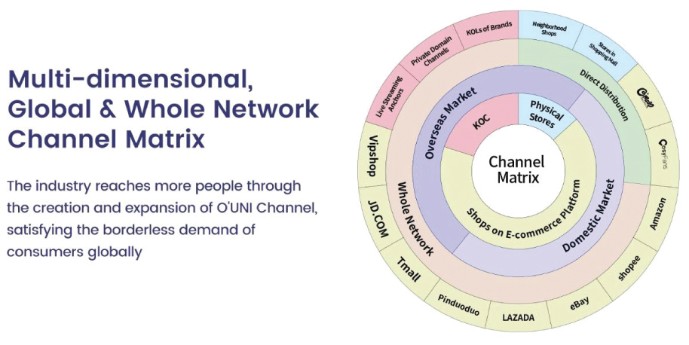

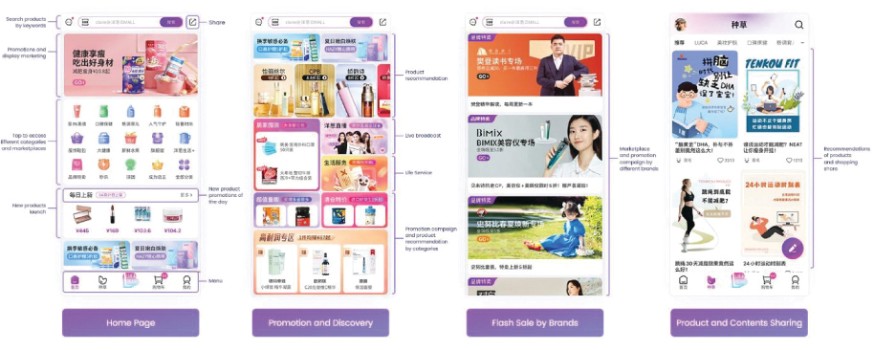

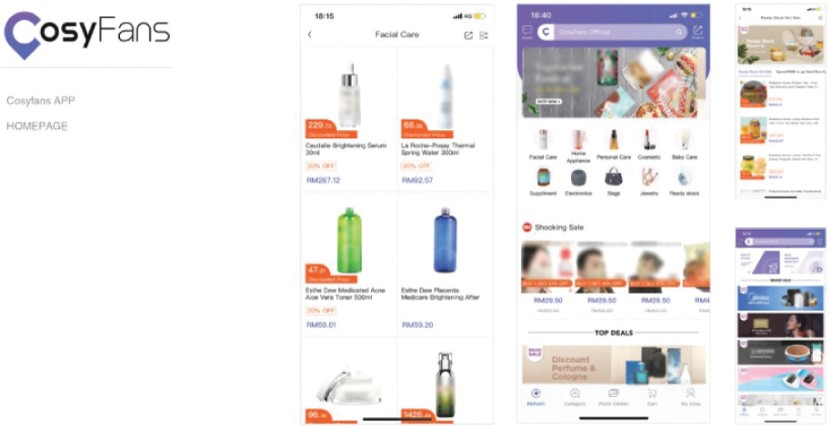

We conduct our business through e-commerce platforms and online social media platforms. The material disruption of those platforms or any adverse changes on our cooperation with them could harm our business and operation.

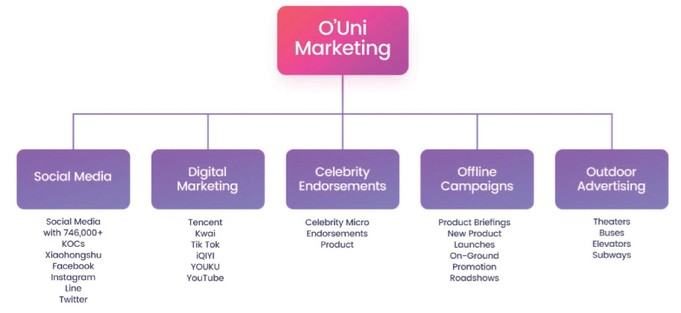

In fiscal years 2019, 2020 and 2021, we generated the majority of our sales from our self-operated e-commerce platform, O’Mall. Our active KOCs use social media platforms to promote our products. If we are unable to leverage social media platforms to effectively attract followers and convert them into active buyers, or if there is any change, disruption or discontinuity in the features and functions of such social media platforms, our ability to acquire new consumers and our financial condition may suffer.

Moreover, our growth is subject to aforesaid platforms’ traffic growth, account using terms and conditions and regulations, among other factors. If these platforms’ traffic fails to grow in the future, our growth may slow down as well. While these platforms are generally open to all users, they have no obligation to allow us or our KOCs to use their platforms in any circumstances. If we or our KOCs breach the using terms of such platforms, the platform operators may decide at any time to curtail or inhibit our ability to use such platforms. Meanwhile, these platforms may increase their fees or make changes to their respective business models, using terms, policies or systems, and those changes could impair or restrict our or our KOCs’ ability to post content or sell products. In addition, these platforms may be interrupted by regulatory restrictions, cease operations unexpectedly due to a number of events, or even shut down due to their operating problems. We also cannot guarantee we will be able to expand our operation into new emerging e-commerce platforms or online social media platforms in the future.

Any of the above could reduce sales of our self-owned online platforms, our end customers’ engagement time, our KOCs’ ability to post promotional content, and our ability to serve our self-owned online platforms and our brand partners, any of which could affect our ability to maintain profitability or have a material adverse effect on our business, financial condition or results of operations.

Order cancelation as well as merchandize return and exchange policies may adversely affect our business and results of operations.

We allow our customers to cancel orders within six hours after the payment and to return products, subject to our return policy. The order cancelation rate of our self-operated platform, O’Mall, measured by the number of cancelled orders before shipping as a percentage of the total number of orders placed, was approximately 5.3%, 5.5% and 5.3%, respectively, and the product return rate of our self-operated platform, O’Mall, measured by the number of orders returned to us after delivery to customers as a percentage of the total number of orders placed, was approximately 1.0%, 1.3% and 1.3%, respectively, in fiscal years of 2019, 2020 and 2021. Our low order cancelation rate and product return rate may fluctuate or even increase in the future due to various factors, many of which, including changing consumers’ habits and product quality, are beyond our control. In addition, as we diversify our marketing efforts, such as promotion through live streaming and social media, and expand to more sales channels, our order cancelation rate and product return rate may further increase. Moreover, our products might be damaged during transit from time to time, especially during the international transportation, which increases return rate and harms our brands as well. If the rate of order cancelation or product returns increases significantly, our inventory turnovers and cash flow could be adversely affected, and thus harm our financial condition and operating results.