Fourth Quarter 2024�Corporate Update February 27, 2025

Forward-Looking Statements This press release contains forward-looking statements, including statements about the continued expansion of PureCycle’s business plan, the expected time of commercial sales, the commercialization of Ironton operations, the expected increase in production of the Ironton operations, the planned compounding operations, the sourcing of materials, and planned future updates. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements generally relate to future events or PureCycle’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are often identified by future or conditional words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of PureCycle’s management and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this press release. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in each of PureCycle’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and PureCycle’s Quarterly Reports on Form 10-Q for various quarterly periods, those discussed and identified in other public filings made with the Securities and Exchange Commission by PureCycle and the following: PCT's ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s PureFive™ resin in food grade applications (including in the United States, Europe, Asia and other future international locations); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the PureFive™ resin and PCT’s facilities (including in the United States, Europe, Asia and other future international locations); expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; the ability of PCT’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) to be appropriately certified by Leidos, following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner or at all; PCT’s ability to meet, and to continue to meet, the requirements imposed upon it and its subsidiaries by the funding for its operations, including the funding for the Ironton Facility; PCT’s ability to minimize or eliminate the many hazards and operational risks at its manufacturing facilities that can result in potential injury to individuals, disrupt its business (including interruptions or disruptions in operations at its facilities), and subject PCT to liability and increased costs; PCT’s ability to complete the necessary funding with respect to, and complete the construction of, (i) its first U.S. multi-line facility, located in Augusta, Georgia, and (ii) its first commercial-scale European plant located in Antwerp, Belgium, in a timely and cost-effective manner; PCT’s ability to procure, sort and process polypropylene plastic waste at its planned plastic waste prep facilities; PCT’s ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT’s future capital requirements and sources and uses of cash; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action and putative class action cases; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including interest rates, availability of capital, economic cycles, and other macro-economic impacts; turnover in employees and increases in employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including inflation, supply chain conditions and its related impact on energy and raw materials, and PCT’s ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the conflict in the Middle East); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk.

PCT Highlights Commercial First meaningful purchase order in fiber with Drake Extrusion in January First commercial product line has been launched with Churchill Container More than 20 customer application trials in various stages of progress with positive results P&G granted exclusivity for North America and extended exclusivity periods for all other regions Expanded commercial team with key strategic hires Operations Exceeded 12.5 klbs./hr. feed rates (88% of nameplate) Meaningful progress on path to achieving nameplate capacity Reliability, onstream, and quality metrics continue to improve quarter over quarter Third-party PCR certification process underway Finance Raised $33MM from private placement in February Overview Commercial Operations Finance

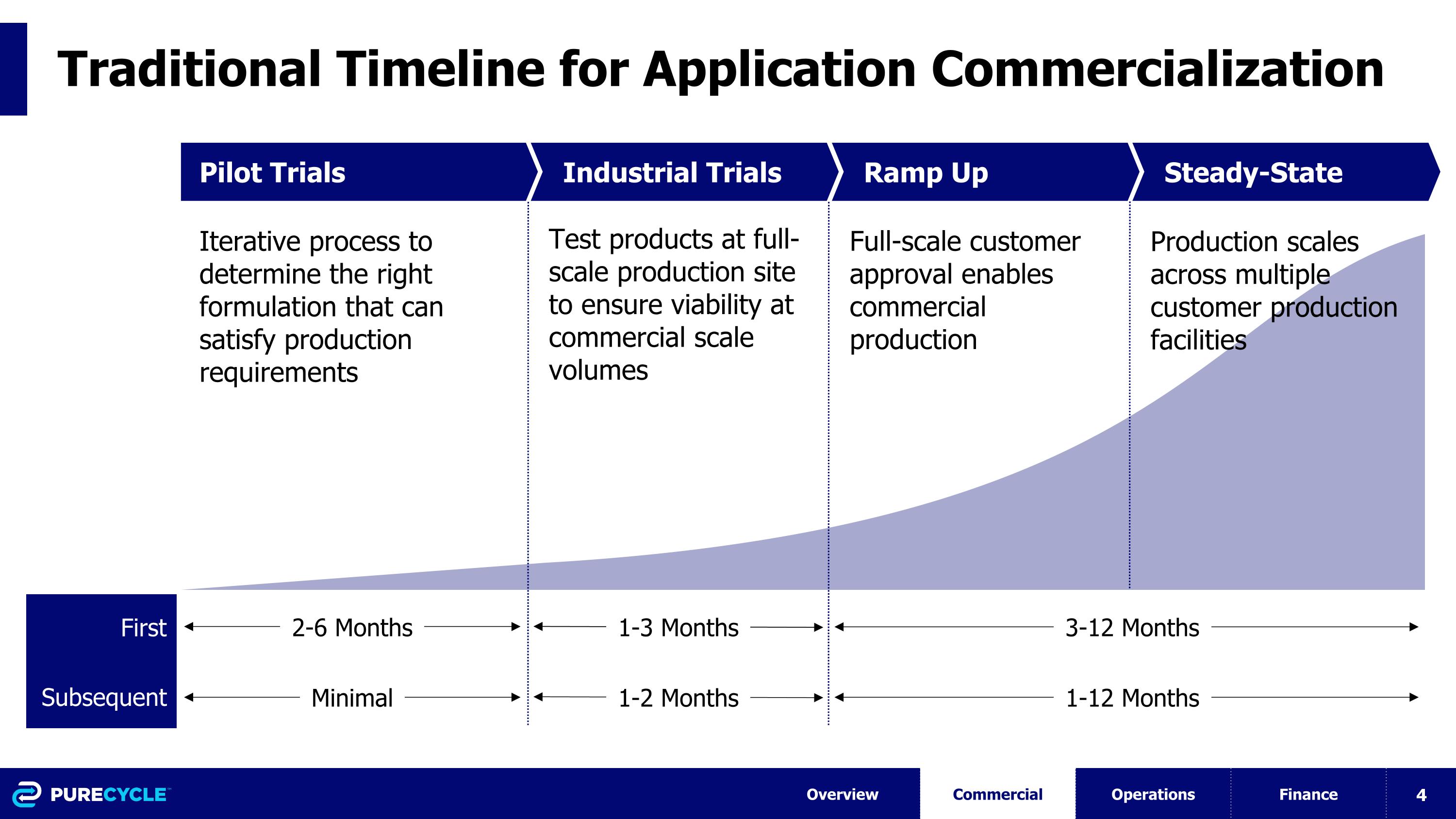

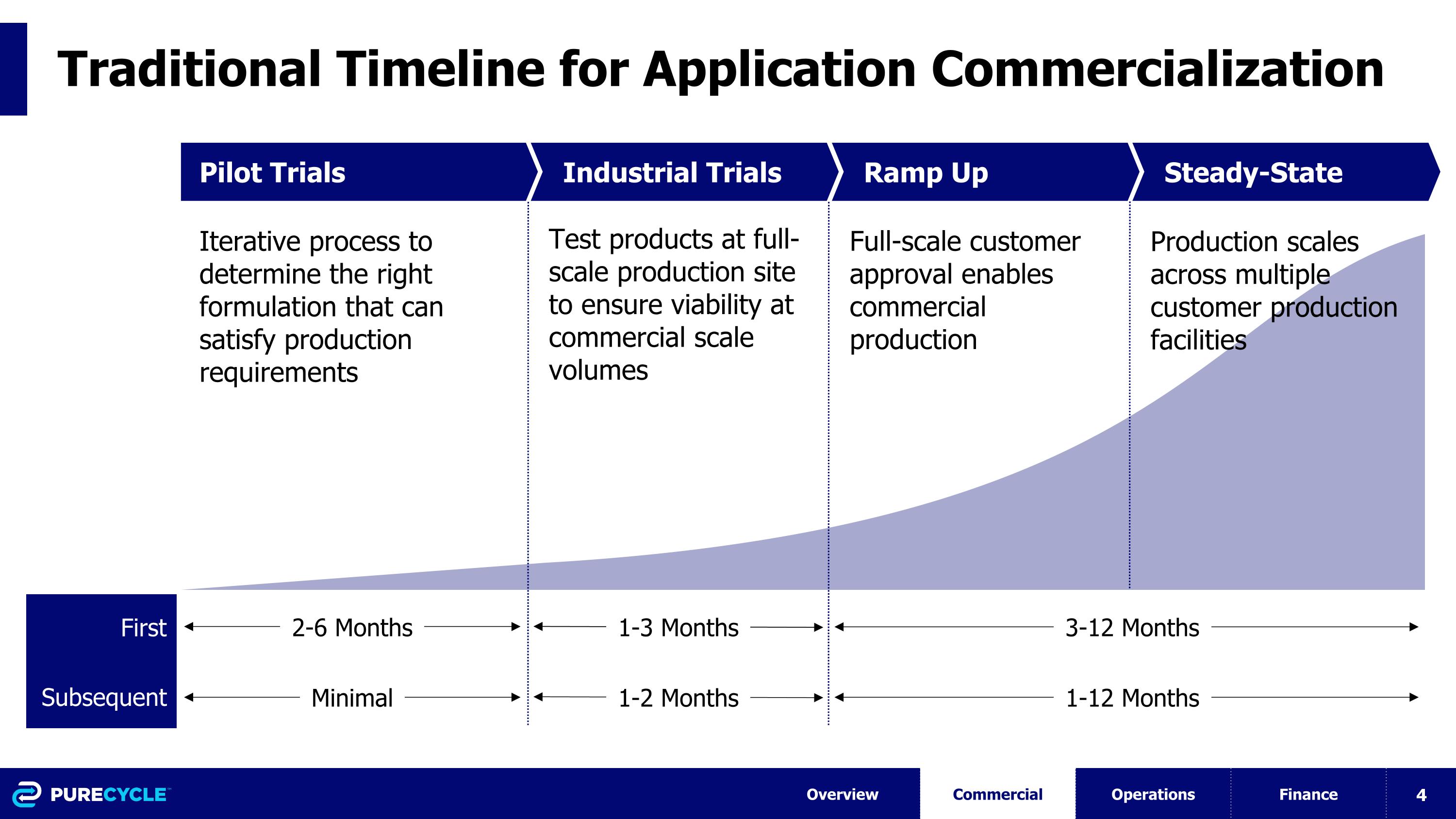

Traditional Timeline for Application Commercialization Pilot Trials Industrial Trials Ramp Up Steady-State Iterative process to determine the right formulation that can satisfy production requirements Test products at full-scale production site to ensure viability at commercial scale volumes Full-scale customer approval enables commercial production Production scales across multiple customer production facilities Overview Commercial Operations Finance 2-6 Months 1-3 Months 3-12 Months First Subsequent Minimal 1-2 Months 1-12 Months

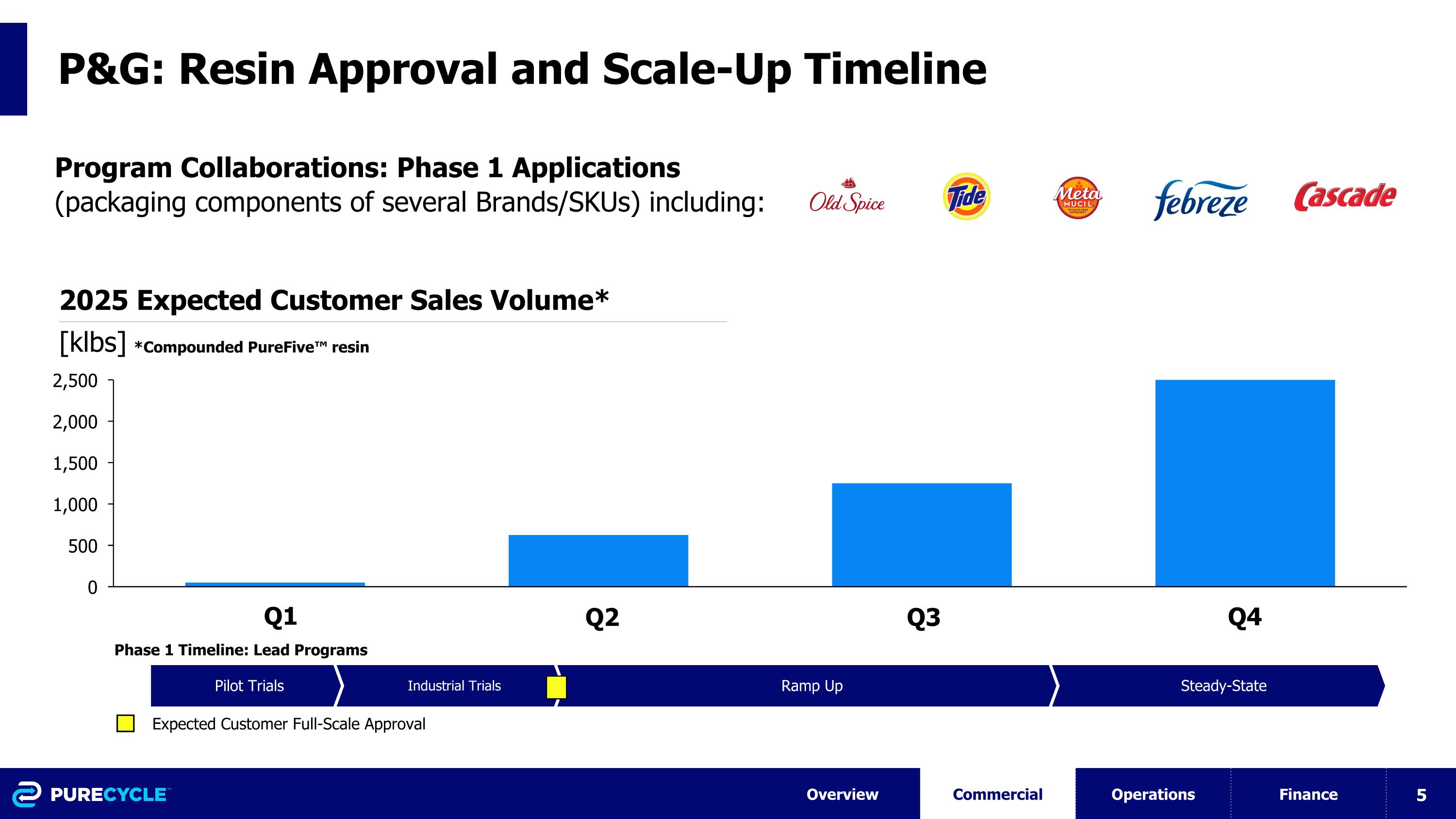

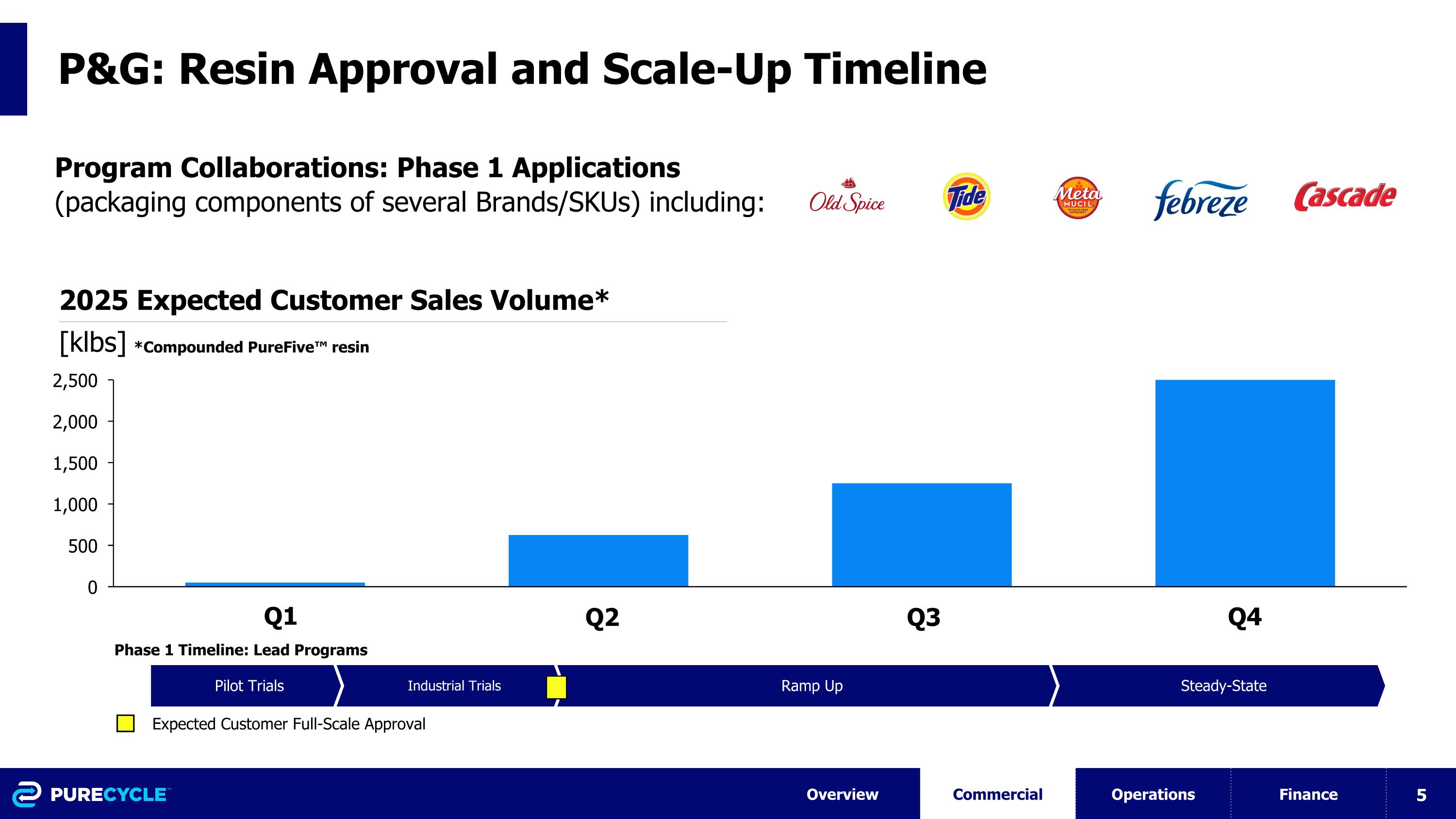

P&G: Resin Approval and Scale-Up Timeline 2025 Expected Customer Sales Volume* [klbs] Program Collaborations: Phase 1 Applications (packaging components of several Brands/SKUs) including: Q1 Q2 Q3 Q4 Steady-State Ramp Up Industrial Trials Pilot Trials Phase 1 Timeline: Lead Programs Expected Customer Full-Scale Approval *Compounded PureFive™ resin Overview Commercial Operations Finance

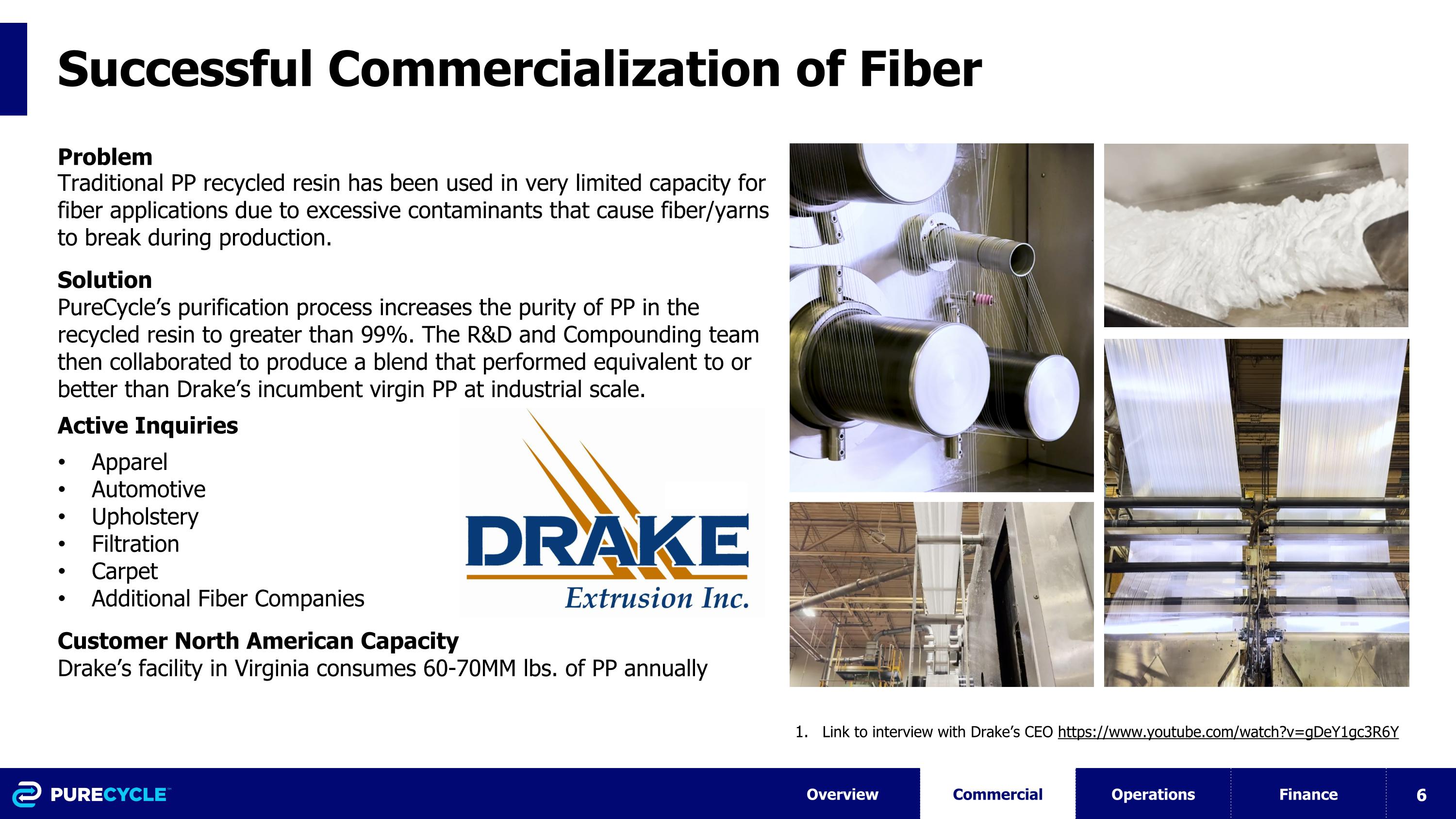

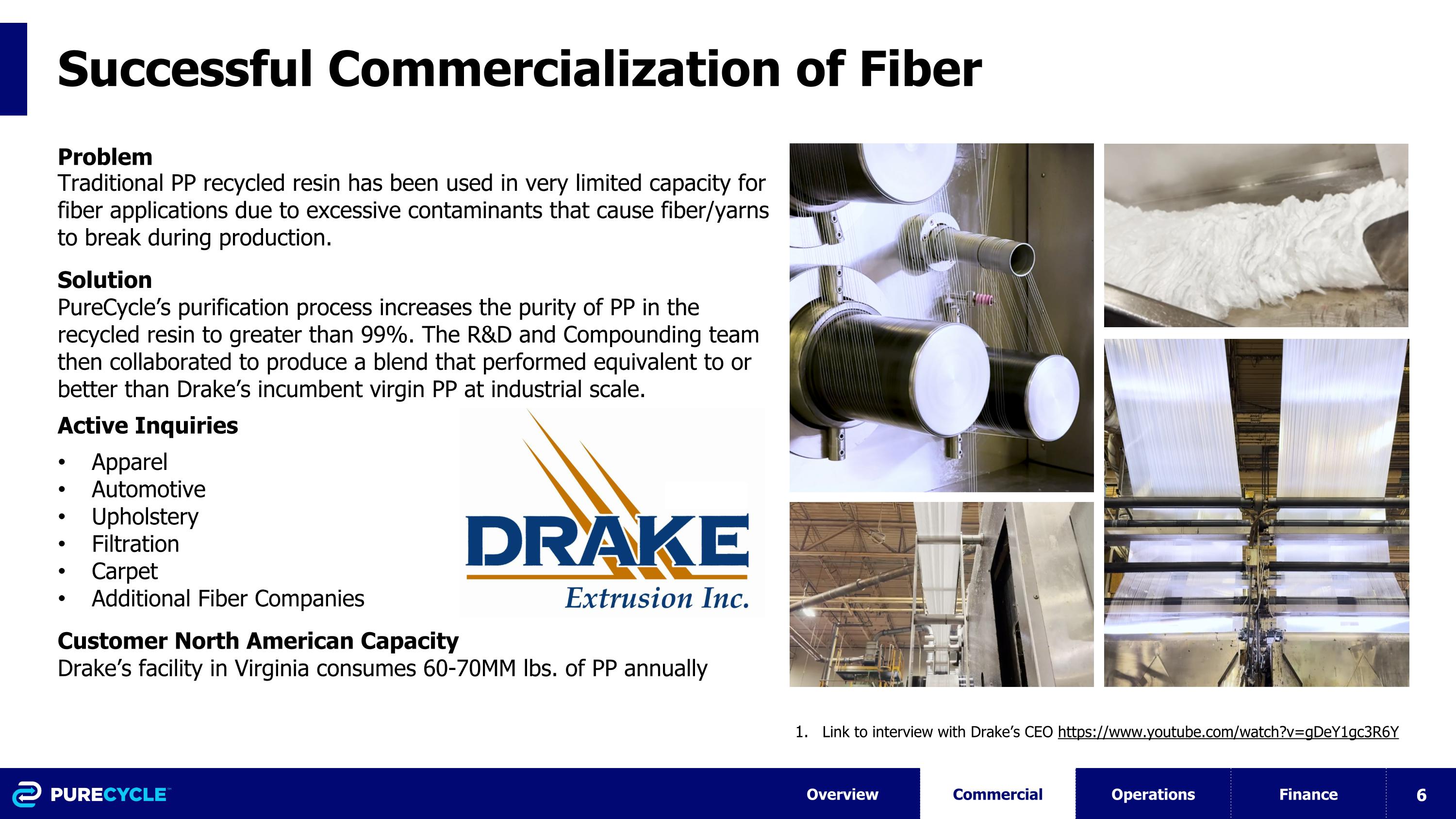

Successful Commercialization of Fiber Problem Traditional PP recycled resin has been used in very limited capacity for fiber applications due to excessive contaminants that cause fiber/yarns to break during production. Solution PureCycle’s purification process increases the purity of PP in the recycled resin to greater than 99%. The R&D and Compounding team then collaborated to produce a blend that performed equivalent to or better than Drake’s incumbent virgin PP at industrial scale. Active Inquiries Apparel Automotive Upholstery Filtration Carpet Additional Fiber Companies Customer North American Capacity Drake’s facility in Virginia consumes 60-70MM lbs. of PP annually Link to interview with Drake’s CEO https://www.youtube.com/watch?v=gDeY1gc3R6Y Overview Commercial Operations Finance

First Commercial Product Line with PureFive™ Resin Active Inquiries Professional Football Professional Baseball Professional Soccer University Programs Market Opportunity Each team represents 50k-100k lbs. of volume Solution PureFive™ resin proved to be a drop-in replacement for Churchill's virgin resin and was able to quickly pass internal testing. The opportunity is being launched in the marketplace and can expand into customer applications including: sports venues, movie theaters, restaurants, conventions, convenience stores. Problem Churchill Container could not find recycled content to produce cups for customers that met their strict requirements. Issues included: Odor Color Processability

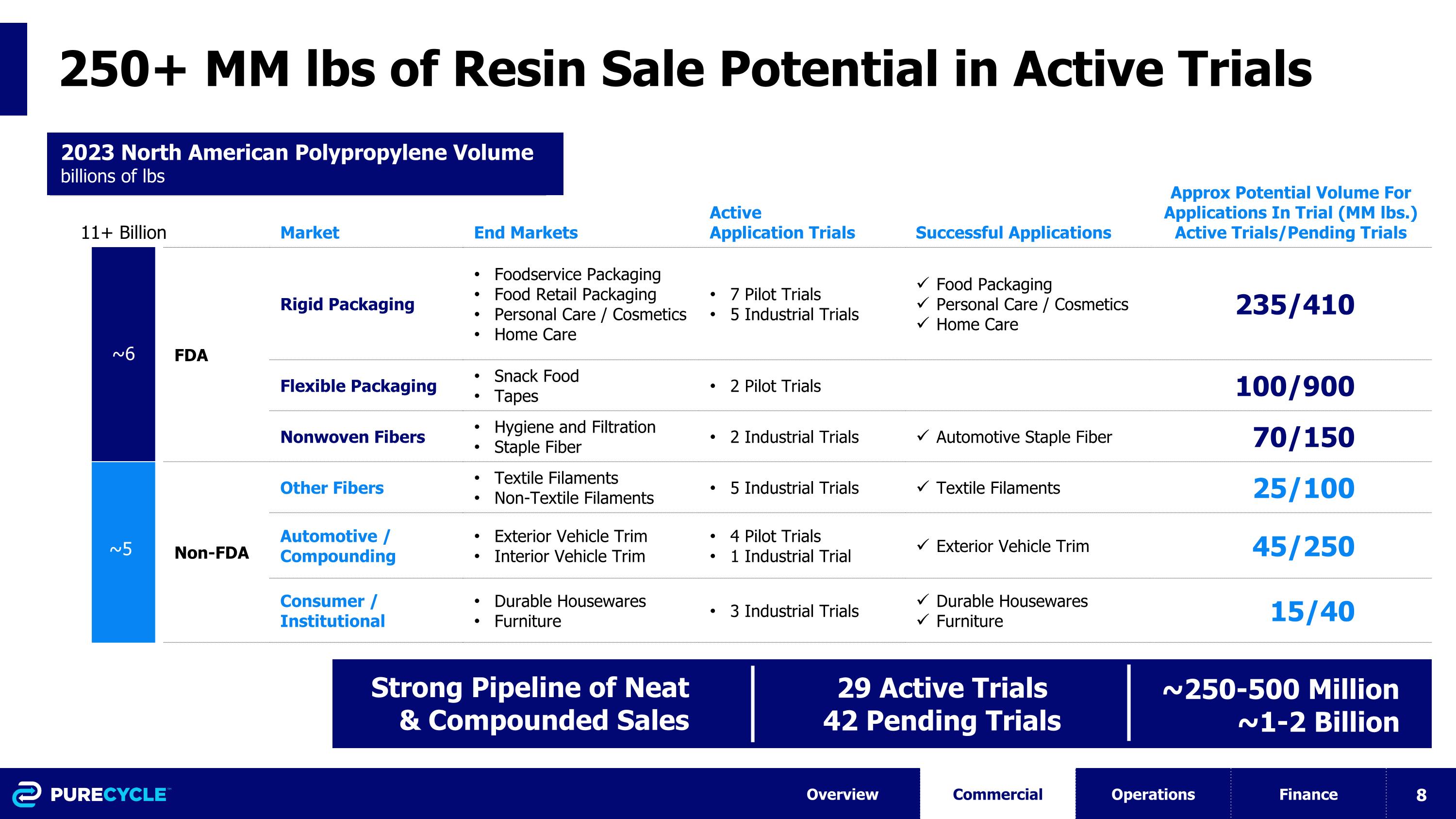

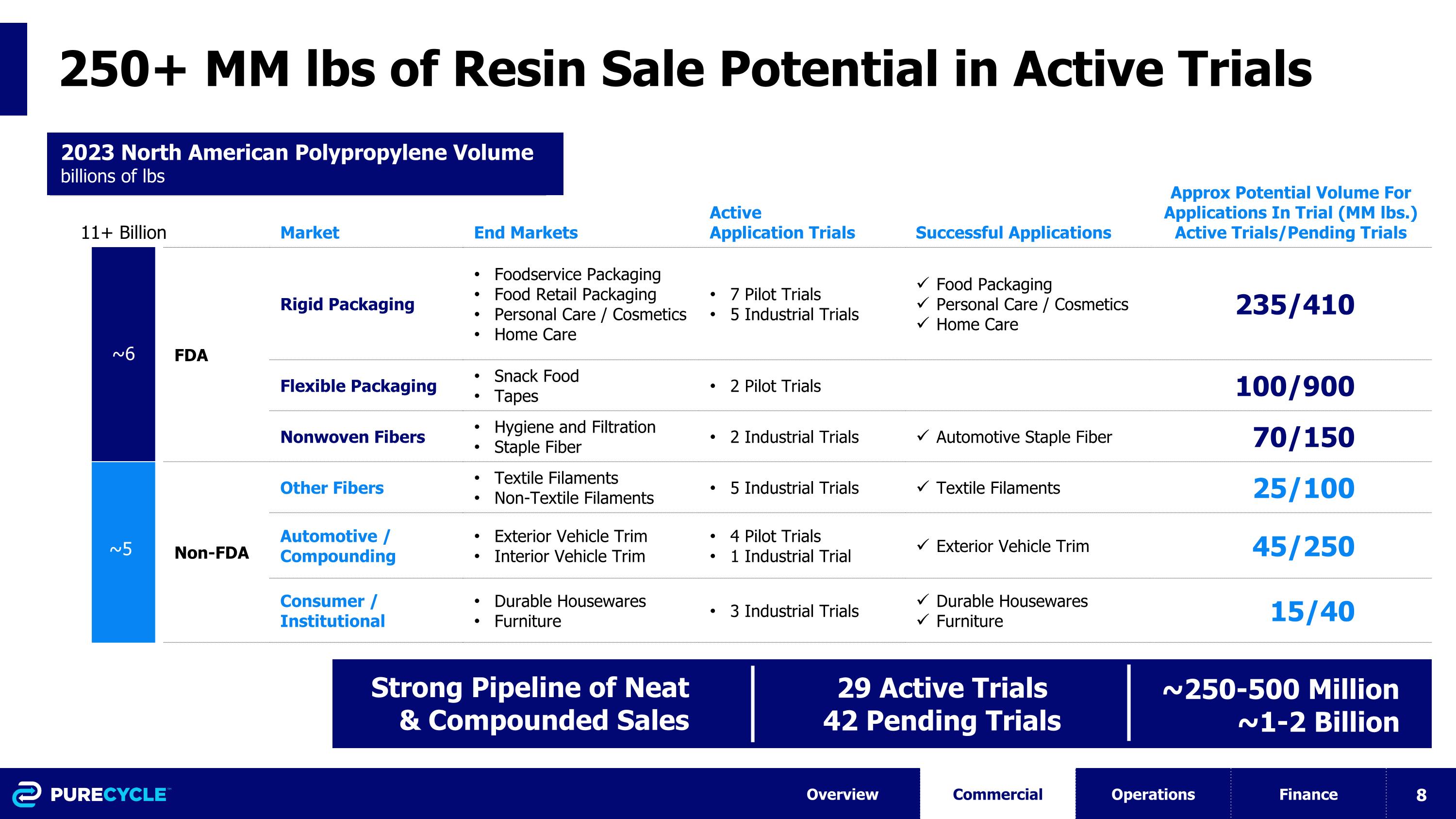

250+ MM lbs of Resin Sale Potential in Active Trials 11+ Billion Market End Markets Active Application Trials Successful Applications Approx Potential Volume For Applications In Trial (MM lbs.) Active Trials/Pending Trials FDA Rigid Packaging Foodservice Packaging Food Retail Packaging Personal Care / Cosmetics Home Care 7 Pilot Trials 5 Industrial Trials Food Packaging Personal Care / Cosmetics Home Care 235/410 Flexible Packaging Snack Food Tapes 2 Pilot Trials 100/900 Nonwoven Fibers Hygiene and Filtration Staple Fiber 2 Industrial Trials Automotive Staple Fiber 70/150 Non-FDA Other Fibers Textile Filaments Non-Textile Filaments 5 Industrial Trials Textile Filaments 25/100 Automotive / Compounding Exterior Vehicle Trim Interior Vehicle Trim 4 Pilot Trials 1 Industrial Trial Exterior Vehicle Trim 45/250 Consumer / Institutional Durable Housewares Furniture 3 Industrial Trials Durable Housewares Furniture 15/40 Overview Commercial Operations Finance 29 Active Trials 42 Pending Trials 2023 North American Polypropylene Volume billions of lbs Strong Pipeline of Neat & Compounded Sales ~6 ~5 ~250-500 Million ~1-2 Billion

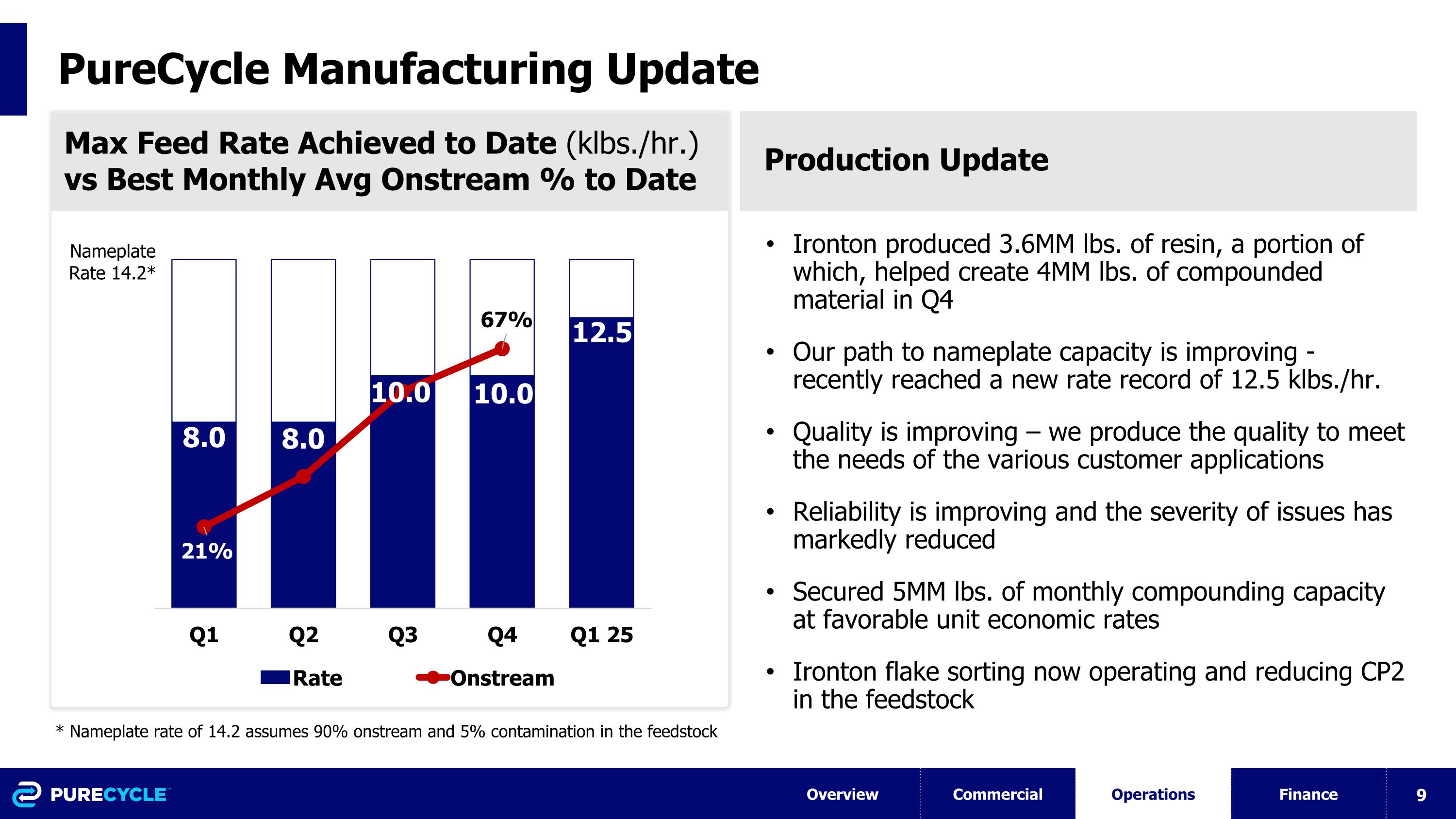

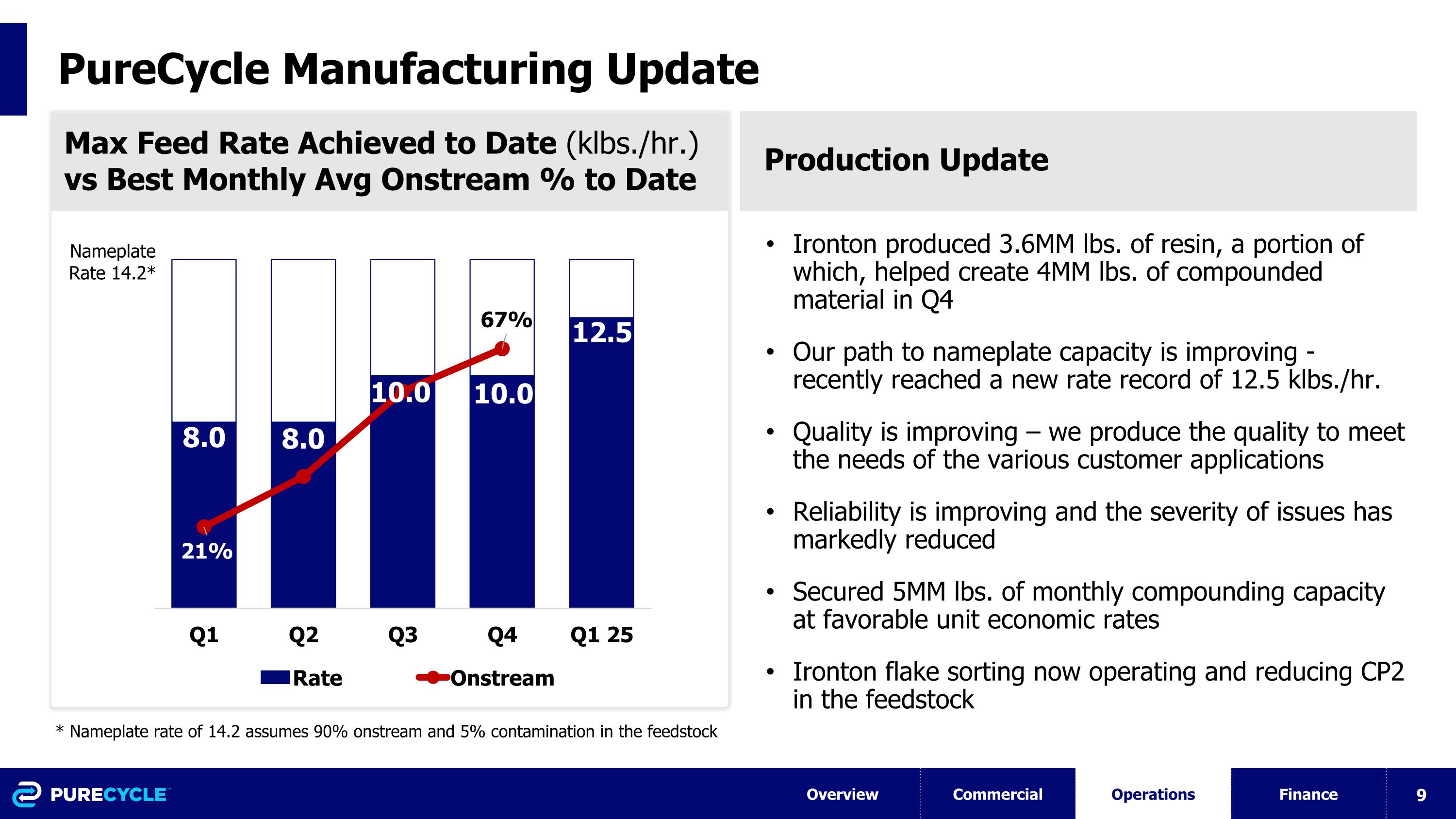

PureCycle Manufacturing Update Ironton produced 3.6MM lbs. of resin, a portion of which, helped create 4MM lbs. of compounded material in Q4 Our path to nameplate capacity is improving - recently reached a new rate record of 12.5 klbs./hr. Quality is improving – we produce the quality to meet the needs of the various customer applications Reliability is improving and the severity of issues has markedly reduced Secured 5MM lbs. of monthly compounding capacity at favorable unit economic rates Ironton flake sorting now operating and reducing CP2 in the feedstock Overview Commercial Operations Finance Max Feed Rate Achieved to Date (klbs./hr.) vs Best Monthly Avg Onstream % to Date Nameplate Rate 14.2* Production Update * Nameplate rate of 14.2 assumes 90% onstream and 5% contamination in the feedstock

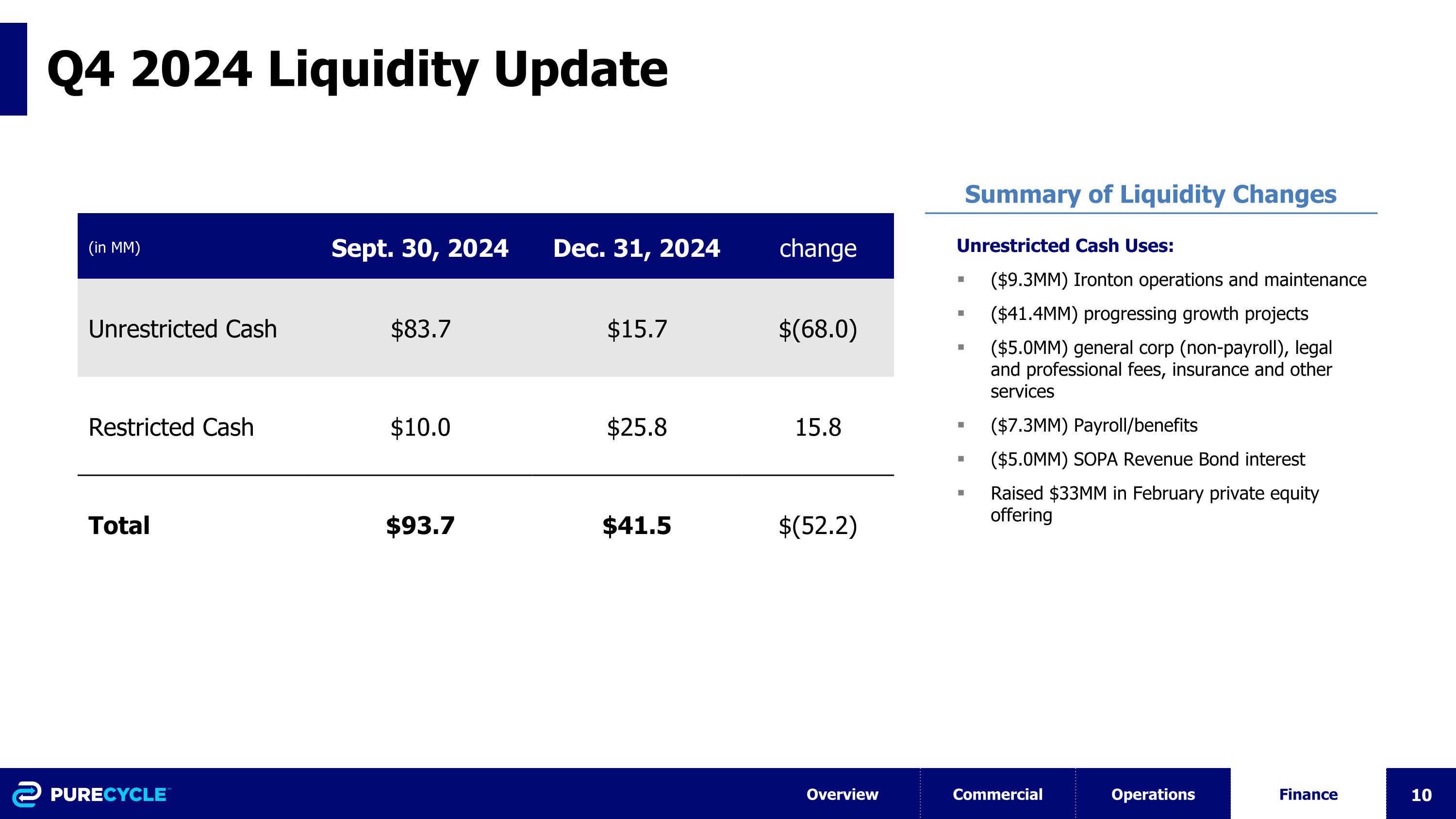

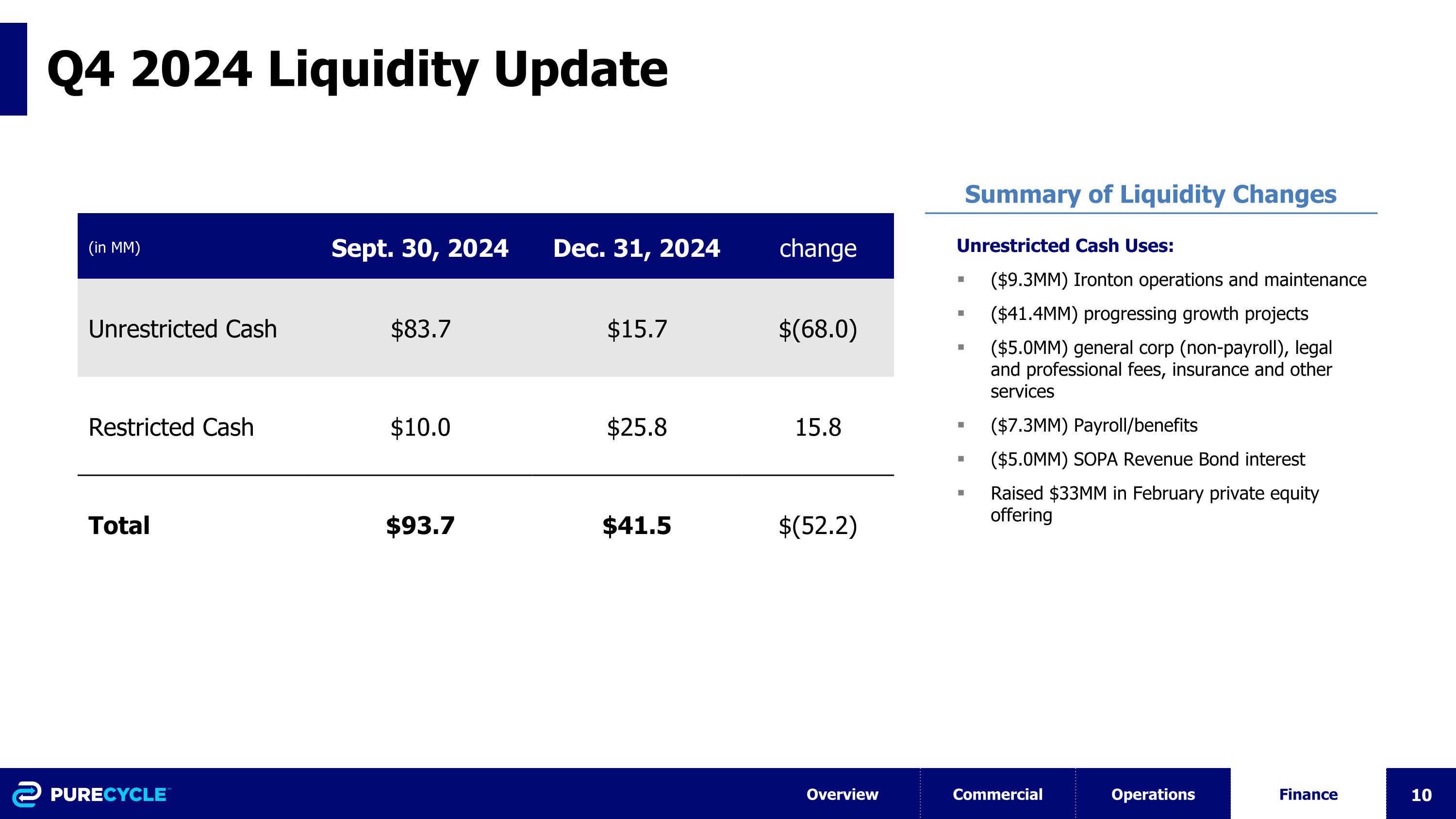

Q4 2024 Liquidity Update Unrestricted Cash Uses: ($9.3MM) Ironton operations and maintenance ($41.4MM) progressing growth projects ($5.0MM) general corp (non-payroll), legal and professional fees, insurance and other services ($7.3MM) Payroll/benefits ($5.0MM) SOPA Revenue Bond interest Raised $33MM in February private equity offering Summary of Liquidity Changes (in MM) Sept. 30, 2024 Dec. 31, 2024 change Unrestricted Cash $83.7 $15.7 $(68.0) Restricted Cash $10.0 $25.8 15.8 Total $93.7 $41.5 $(52.2) Overview Commercial Operations Finance

Fourth Quarter 2024�Corporate Update February 27, 2025