- RUM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Rumble (RUM) 424B3Prospectus supplement

Filed: 15 Nov 22, 6:10am

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-267936

PROSPECTUS

RUMBLE INC.

8,050,000 Shares of Class A Common Stock Underlying Warrants

333,568,989 Shares of Class A Common Stock by the Selling Holders

550,000 Warrants to Purchase Class A Common Stock by the Selling Holders

This prospectus relates to (a) the issuance by us of up to 8,050,000 shares of our common stock, par value $0.0001 per share (“Class A Common Stock”), upon the exercise of warrants, each exercisable for one share of Class A Common Stock at a price of $11.50 per share (“Warrants”) and (b) the resale from time to time by the selling securityholders named in this prospectus (each a “Selling Holder” and collectively, the “Selling Holders”) of (i) up to 333,568,989 shares of Class A Common Stock, consisting of 333,018,989 shares of Class A Common Stock and 550,000 shares of Class A Common Stock issuable upon the exercise of Warrants and (ii) 550,000 Warrants. With respect to the 333,568,989 shares of Class A Common Stock held by the Selling Holders, we are registering the resale of (i) 8,300,000 shares of Class A Common Stock that were issued on a private placement basis at a price of $10.00 per share in the PIPE Investment in connection with our Business Combination pursuant to customary registration rights that we granted to our PIPE Investors, (ii) 227,891,189 shares of Class A Common Stock that were previously registered on Form S-4 in connection with our Business Combination (as well as the resale of 86,752,800 shares underlying options to be registered on Form S-8) pursuant to the Registration Rights Agreement (as further described herein), which provides for, among other things, customary resale underwritten demand and related “piggyback rights” for certain Selling Holders and which shares of Class A Common Stock (including those shares of Class A Common Stock underlying options) were received by existing shareholders of Rumble Canada (as defined below) in exchange for their securities in Rumble Canada as part of the consummation of the Business Combination, (iii) 10,075,000 shares of Class A Common Stock held by the Sponsor and its related parties pursuant to the Registration Rights Agreement and/or certain registration rights granted in connection with CF VI’s initial public offering, which are comprised of (A) 1,875,000 shares of Class A Common Stock issued to the Sponsor pursuant to the Forward Purchase Contract at an effective price of $8.00 per share, (B) 7,500,000 shares of Class A Common Stock issued to the Sponsor and former independent directors of CF VI in exchange for the 7,500,000 shares of Class B Common Stock issued to them in connection with the formation of CF VI at a price of $0.003 per share, and (C) 700,000 shares of Class A Common Stock issued to the Sponsor in connection with a private placement at a price of $10.00 per share, and (iv) 550,000 shares of Class A Common Stock issuable upon the exercise of Warrants at an exercise price of $11.50 per Warrant.

As described above, the Selling Holders acquired the shares of Class A Common Stock covered by this prospectus at prices ranging from $0.003 per share to $10.00 per share of Class A Common Stock. By comparison, the offering price to public shareholders in the CF VI initial public offering was $10.00 per unit, which consisted of one share and one-fourth of one Warrant. Consequently, certain Selling Holders may realize a positive rate of return on the sale of their shares covered by this prospectus even if the market price per share of Class A Common Stock is below $10.00 per share, in which case the public shareholders may experience a negative rate of return on their investment. For example, a Selling Holder who sells 1,000,000 shares of Class A Common Stock (which it originally acquired as “founder shares” for $0.003 per share) at a price per share of $12.27 per share (the closing price of the Class A Common Stock on November 3, 2022) will earn a realized profit of $12,267,000, while a public stockholder who sells the same number of shares of Class A Common Stock (which it originally acquired for $10.00 per share in the initial public offering) will only earn a realized profit of $2,270,000.

Certain Selling Holders, including Rumble Chairman and CEO Christopher Pavlovski and other company insiders, are subject to contractual lock-up restrictions that prohibit them from selling stock at this time. The shares of Class A Common Stock held by the Sponsor (other than the 1,500,000 shares of Class A Common Stock constituting the Forward Purchase Shares and the 1,159,000 shares of Class A Common Stock that were acquired

by the Sponsor in the PIPE Investment) are also subject to contractual lock-up restrictions. See the section entitled “Plan of Distribution.” However, because the current market price of our Class A Common Stock, which was $12.27 per share at the closing on November 3, 2022, is higher than the price the Selling Holders paid for their shares of Class A Common Stock (ranging from $0.003 per share to $10.00 per share) or the exercise price of the Warrants ($11.50 per share), there is more likelihood that Selling Holders holding shares of Class A Common Stock or Warrants will sell their shares of Class A Common Stock after the registration statement that includes this prospectus is declared effective (subject, in the case of certain Selling Holders, to compliance with the contractual lock-up restrictions referred to above). Such sales, or the prospect of such sales, may have a material negative impact on the market price of our Class A Common Stock. After the effectiveness of the registration statement that includes this prospectus, (i) 25,447,437 shares of Class A Common Stock registered on the registration statement that includes this prospectus and that were purchased by Selling Holders for prices below current market prices will be able to be sold immediately pursuant to such registration statement without any contractual lock-up restrictions and (ii) an additional 315,621,552 shares of Class A Common Stock registered on the registration statement that includes this prospectus and that were purchased by Selling Holders for prices below current market prices will be able to be sold pursuant to such registration statement once the contractual lock-up restrictions that apply to such Selling Holders expire. It should be noted that the share numbers in the immediately preceding sentence are given on a fully diluted basis (inclusive of all shares of Class A Common Stock issuable upon exchange of ExchangeCo Shares, and which also includes shares of Class A Common Stock and ExchangeCo Shares placed in escrow pursuant to the terms of the BCA).

This prospectus provides you with a general description of such securities and the general manner in which the Selling Holders may offer or sell the securities. More specific terms of any securities that the Selling Holders may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

On September 16, 2022, we consummated the business combination (the “Business Combination”) contemplated by that certain Business Combination Agreement, dated as of December 1, 2021 (as amended, the “BCA”), by and between CF Acquisition Corp. VI, a Delaware corporation (“CF VI”), and Rumble Inc., a corporation formed under the laws of the Province of Ontario, Canada (“Rumble Canada”). In connection with the consummation of the Business Combination, CF VI changed its name from CF Acquisition Corp. VI to Rumble Inc. and Rumble Canada changed its name from Rumble Inc. to Rumble Canada Inc.

We will bear all costs, expenses and fees in connection with the registration of the securities offered pursuant to this prospectus and will not receive any proceeds from the sale of the securities offered pursuant to this prospectus. The Selling Holders will bear all commissions and discounts, if any, attributable to their sales of the securities offered pursuant to this prospectus.

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities. Our Class A Common Stock and Warrants are listed on The Nasdaq Global Market under the symbols “RUM” and “RUMBW”, respectively. On November 3, 2022, the closing sale prices of our Class A Common Stock and Warrants were $12.27 and $2.63, respectively. We are an “emerging growth company” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings.

Investing in our Class A Common Stock and Warrants involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 14, 2022.

Page | ||

ii | ||

iii | ||

1 | ||

7 | ||

9 | ||

29 | ||

30 | ||

MARKET INFORMATION FOR CLASS A COMMON STOCK AND DIVIDEND POLICY | 31 | |

32 | ||

44 | ||

54 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 60 | |

73 | ||

77 | ||

80 | ||

83 | ||

91 | ||

93 | ||

96 | ||

96 | ||

97 | ||

98 | ||

F-1 |

i

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Holders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale of the securities offered pursuant to this prospectus, except with respect to amounts received by us upon exercise of the Warrants offered hereby (to the extent such Warrants are exercised for cash).

Neither we nor the Selling Holders (as defined below) have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Holders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Holders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information.”

On September 16, 2022, we consummated the business combination (the “Business Combination”) contemplated by that certain Business Combination Agreement, dated as of December 1, 2021 (as amended, the “BCA”), by and between CF Acquisition Corp. VI, a Delaware corporation (“CF VI”), and Rumble Inc., a corporation formed under the laws of the Province of Ontario, Canada (“Rumble Canada”). In connection with the consummation of the Business Combination, CF VI changed its name from CF Acquisition Corp. VI to Rumble Inc. and Rumble Canada changed its name from Rumble Inc. to Rumble Canada Inc. In connection with the Business Combination, we filed a definitive proxy statement/prospectus with the SEC on August 12, 2022 (the “Proxy Statement/Prospectus”). Capitalized terms not otherwise defined herein shall have the meanings set forth in the Proxy Statement/Prospectus.

Unless the section herein specifies otherwise, references to the “Company,” “we,” “us” or “our” are to, (a) prior to the closing of the Business Combination, either (i) CF VI or (ii) Rumble Canada, as the context may require, and (b) following the closing of the Business Combination, Rumble Inc., a Delaware corporation. Unless the section herein specifies otherwise, references to “Rumble” are to (x) prior to the closing of the Business Combination, Rumble Canada and (y) following the closing of the Business Combination, Rumble Inc., a Delaware corporation. References to “ExchangeCo” are to 1000045728 Ontario Inc., a corporation formed under the laws of the Province of Ontario, Canada, and an indirect, wholly owned subsidiary of Rumble, and references to “ExchangeCo Shares” are to the exchangeable shares of ExchangeCo.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements regarding, among other things, our plans, strategies and prospects, both business and financial. These statements are based on the beliefs and assumptions of our management. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot provide assurance that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Investors should read statements that contain these words carefully because they:

• discuss future expectations;

• contain projects of future results of operations or financial condition; or

• state other “forward-looking” information.

We believe it is important to communicate our expectations to our securityholders. However, there may be events in the future that management is not able to predict accurately or over which we have no control. The risk factors and cautionary language contained in this prospectus provide examples of risks, uncertainties, and events that may cause actual results to differ materially from the expectations described in such forward-looking statements, including among other things:

• Rumble’s ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, the ability of Rumble to grow and manage growth profitably, maintain relationships with customers, compete within its industry and retain its key employees;

• the possibility that Rumble may be adversely impacted by economic, business, and/or competitive factors;

• Rumble’s limited operating history makes it difficult to evaluate its business and prospects;

• Rumble’s recent and rapid growth may not be indicative of future performance;

• Rumble may not continue to grow or maintain its active user base, and may not be able to achieve or maintain profitability;

• Rumble collects, stores, and processes large amounts of user video content and personal information of its users and subscribers. If Rumble’s security measures are breached, its sites and applications may be perceived as not being secure, traffic and advertisers may curtail or stop viewing its content or using its services, its business and operating results could be harmed, and it could face legal claims from users and subscribers;

• Rumble may fail to comply with applicable privacy laws;

• Rumble is subject to cybersecurity risks and interruptions or failures in Rumble’s information technology systems and as it grows and gains recognition, it will likely need to expend additional resources to enhance Rumble’s protection from such risks. Notwithstanding Rumble’s efforts, a cyber incident could occur and result in information theft, data corruption, operational disruption and/or financial loss;

• Rumble may be found to have infringed on the intellectual property of others, which could expose Rumble to substantial losses or restrict its operations;

• Rumble may face liability for hosting a variety of tortious or unlawful materials uploaded by third parties, notwithstanding the liability protections of section 230 of the Communications Decency Act;

• Rumble may face negative publicity for removing, or declining to remove, certain content, regardless of whether such content violated any law;

iii

• Rumble’s traffic growth, engagement, and monetization depend upon effective operation within and compatibility with operating systems, networks, devices, web browsers and standards, including mobile operating systems, networks, and standards that it does not control;

• Rumble’s business depends on continued and unimpeded access to its content and services on the Internet. If Rumble or those who engage with its content experience disruptions in Internet service, or if Internet service providers are able to block, degrade or charge for access to Rumble’s content and services, Rumble could incur additional expenses and the loss of traffic and advertisers;

• Rumble faces significant market competition, and if Rumble is unable to compete effectively with its competitors for traffic and advertising spend, its business and operating results could be harmed;

• changes to Rumble’s existing content and services could fail to attract traffic and advertisers or fail to generate revenue;

• Rumble depends on third-party vendors, including Internet service providers, advertising networks, and data centers, to provide core services;

• hosting and delivery costs may increase unexpectedly;

• we have offered and intend to continue to offer incentives, including economic incentives, to content creators to join our platform, and these arrangements often involve fixed payment obligations that are not contingent on actual revenue or performance metrics generated by the applicable content creator but rather are typically based on our modeled financial projections for that creator, which if not satisfied may adversely impact our financial performance, results of operations and liquidity;

• changes in tax rates, changes in tax treatment of companies engaged in e-commerce, the adoption of new U.S. or international tax legislation, or exposure to additional tax liabilities may adversely impact Rumble’s financial results;

• compliance obligations imposed by new privacy laws, laws regulating social media platforms and online speech in the U.S. and Canada, or industry practices may adversely affect Rumble’s business;

• the ongoing COVID-19 pandemic has caused a global health crisis that has caused significant economic and social disruption, and its impact on Rumble’s business is uncertain; and

• other risks and uncertainties indicated in this prospectus, including those under “Risk Factors” herein, and other filings that have been made or will be made with the SEC by Rumble.

Forward-looking statements are based on information available as of the date of this prospectus and involve a number of judgments and assumptions, known and unknown risks and uncertainties and other factors, many of which are outside the control of Rumble and its management team. Accordingly, forward-looking statements should not be relied upon as representing Rumble’s views as of any subsequent date. Rumble does not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

Before you invest in our securities, you should be aware that the occurrence of one or more of the events described in the “Risk Factors” section and elsewhere in this prospectus may adversely affect us.

iv

This summary highlights selected information from this prospectus and may not contain all of the information that is important to you in making an investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the heading “Risk Factors.”

Company Overview

Unless the section herein specifies otherwise, references to the “Company,” “we,” “us” or “our” are to, (a) prior to the closing of the Business Combination, either (i) CF VI or (ii) Rumble Canada, as the context may require, and (b) following the closing of the Business Combination, Rumble Inc., a Delaware corporation. Unless the section herein specifies otherwise, references to “Rumble” are to (x) prior to the closing of the Business Combination, Rumble Canada and (y) following the closing of the Business Combination, Rumble Inc., a Delaware corporation.

Our Story

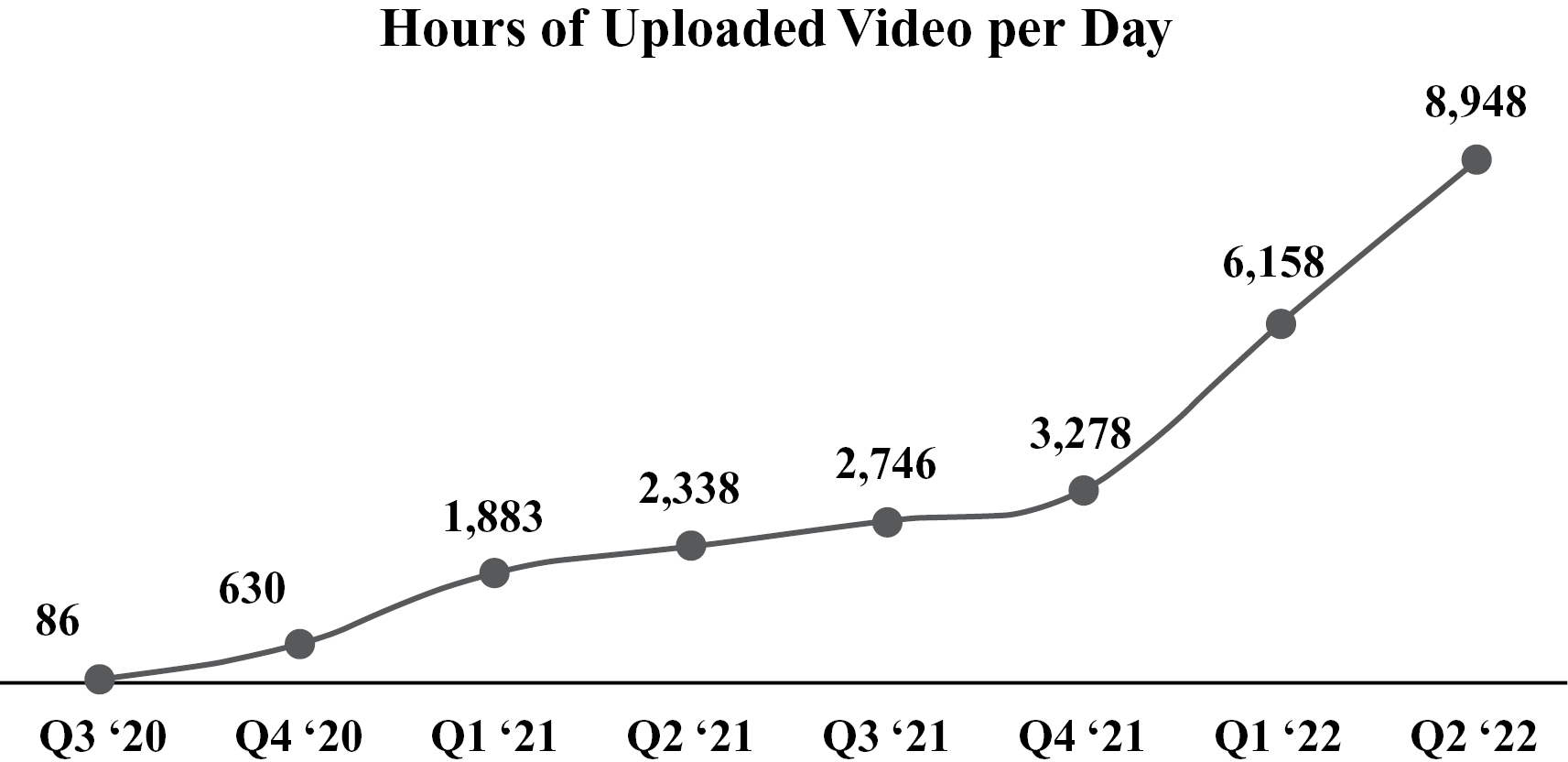

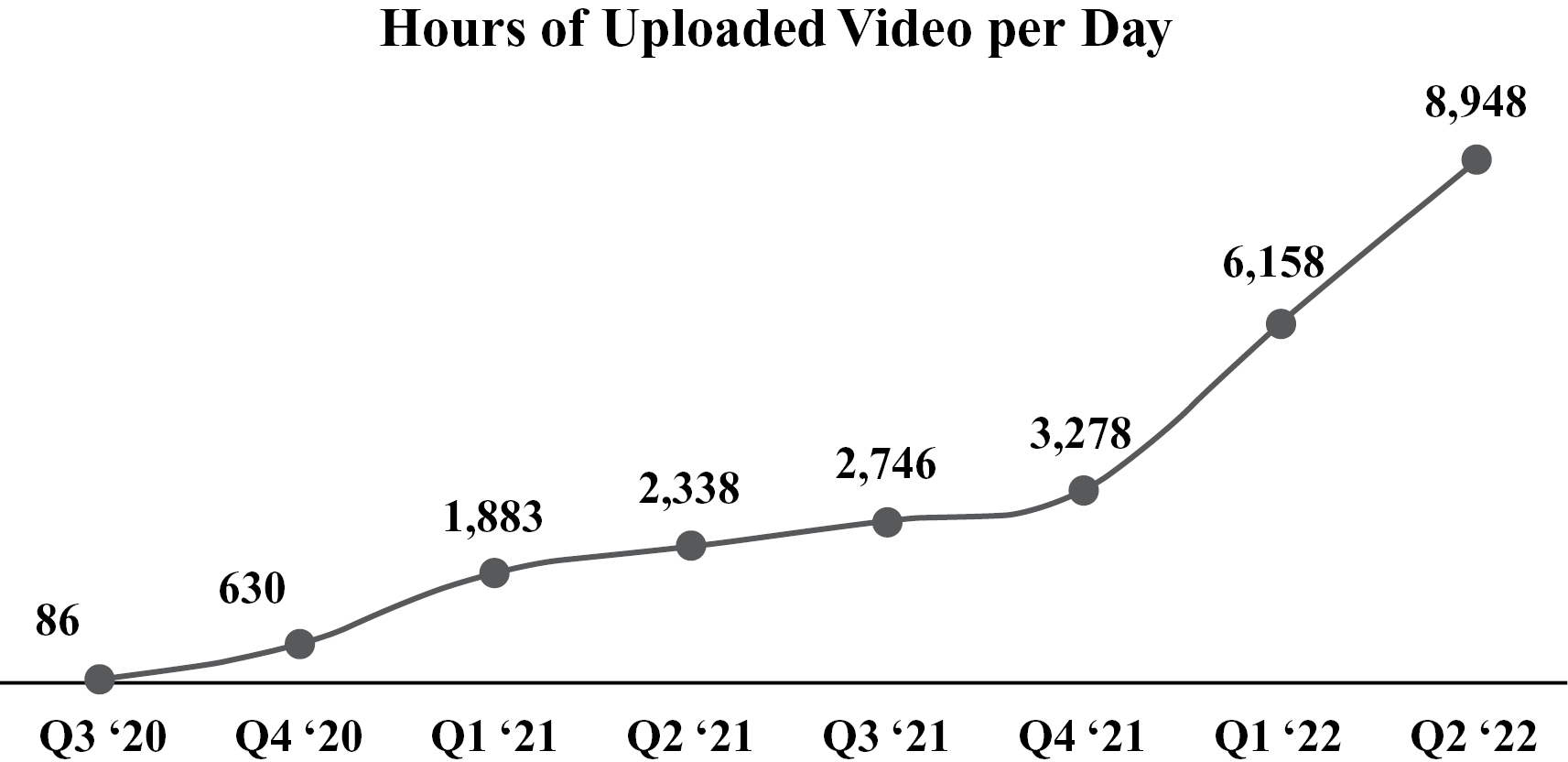

Rumble is a high-growth video sharing platform designed to help content creators manage, distribute, and monetize their content by connecting them with brands, publishers, and directly to their subscribers and followers. In the third quarter of 2020, we welcomed Devin Nunes, former U.S. Representative for California, and Dan Bongino, political commentator, to our platform. These additions, along with tailwinds from the U.S. election season, led to dramatic growth in our user base from 1.2 million monthly active users (“MAUs”) in Q2 2020 to 21 million MAUs in Q4 2020.1

Over the course of 2021 and into 2022, we have continued to strengthen our content offering with increasing adoption from top creators, such as Jorge Masvidal, Dr. Drew, Glenn Greenwald, finance analyst Matt Kohrs, and Russell Brand. In 2022, we added significant creators outside of North America, starting with “Monark,” a creator described by the New York Times as “Brazil’s Joe Rogan.” As a result, our user base has grown to 44 million MAUs on average in Q2 2022, an increase of 76% from Q2 2021. We have also made significant strides in scaling our business and our opportunity through the acquisition of Locals.com, a premier subscription-based service for multimedia content and community, in October 2021.

For the past year and for the immediate future our focus has been and will continue to be growing users and usage consumption, and not maximizing revenue. We will continue to focus on growing consumption by enhancing the user experience across all access modes, pursuing international growth, and expanding our content volume and variety. In the future, we expect to monetize this consumption by increasing ad load and increasing ad pricing by building our own ad ecosystem rather than today’s programmatic exchanges. Monetization has the potential to be further enhanced as we continue to expand into additional creator services that bring more value and earnings to our creators, such as subscriptions via Locals, tipping and licensing. Lastly, we also expect to drive revenue by offering Cloud Infrastructure-as-a-Service (“IaaS”) via our spare capacity in order to meet the unsolicited demand for cloud services many small and medium-sized enterprises (“SMEs”) have requested of us.

Our Growth Strategy

• Grow our platform’s consumption — Growth in our user base and user engagement is an important driver to our business’s growth, and we believe that there is a significant opportunity to expand user consumption on our platform. Since our inception, our user base has primarily grown organically.

• Content acquisition — Our user base and user engagement growth are directly driven by the content available on our platform. We have on-boarded a number of top content creators onto our platform over the last year which has enabled our significant consumption growth. Our goal is to attract even more top creators to our platform, further accelerating our platform’s growth, and we have offered and intend to continue to offer incentives, including economic incentives, to content creators to join our platform. These incentives have included and may continue to include equity grants or cash payments, including

____________

1 Operating metrics presented do not include Locals.com, which was acquired in October 2021.

1

arrangements under which we may agree to pay fixed compensation to content creators (in certain cases, for multiple years) irrespective of whether the actual revenue or user growth generated by the content creator on our platform meets our original modeled financial projections for that creator.

• Product development — We plan to continue to build new features and technologies to develop and improve our platform and value proposition. We are currently working on implementing and upgrading livestreaming, mobile application camera integration, gifting and tipping functionality, user interface enhancements, and deep linking into our products.

• Mobile application — We expect mobile application (“app”) users will be a key component of our user base and engagement in the future. An improved user interface and user experience will serve our existing app users, attract new app users to our platform, and grow app engagement.

• International expansion — Historically, we have focused on growing our U.S. and Canadian user base; any historic consumption from international countries has been purely opportunistic. Moving forward, we expect to focus on growing our international user base. The recent addition of “Monark,” a prominent Brazilian podcast host, marks Rumble’s first significant expansion outside of North America.

• Build in-house advertising ecosystem — Historically, we have used several third party ad networks and ad exchanges to fill our ad inventory. By developing our own advertising marketplace and direct ad sales team, we can reduce value leakage to exchanges, expand our advertiser base and drive better monetization. We introduced the alpha version of this marketplace in January 2022, and eventually all ads on Rumble’s platform will be served through Rumble’s own advertising system.

• Expand Locals subscription and tipping service — Locals.com’s platform allows us to provide content creators additional revenue streams besides advertising revenue share, thereby expanding our creator value proposition and monetization opportunities.

• Develop enterprise cloud IaaS opportunity — Our consumer business is supported by a network of in-house infrastructure which we plan on leveraging to offer an enterprise cloud solution to SMEs. We expect that our solution will include video streaming, email services, storage and cloud & website hosting and is expected to be cost-competitive to incumbent cloud players.

Marketing and Advertising

• Users & Creators — With the tremendous amount of organic growth experienced to date, most of our marketing efforts have been focused on amplifying earned media and accelerating the word-of-mouth momentum through creator advocacy. As a result, we have been able to build our user base and brand with relatively minimal marketing costs. In the future, we will look to drive user growth and video consumption through (1) content creator partnerships and advocacy, including by offering incentives, including economic incentives, to content creators to join our platform, (2) continued earned media strategies, and (3) increased marketing spend, primarily through digital paid media channels.

• Advertisers — We currently use several third party ad networks and ad exchanges to fill our ad inventory. By developing our own ad network, we will be in position to drive our value proposition and expand our advertiser base. In January 2022, we announced the deployment of an alpha version of our own advertising marketplace. Several advertisers have begun to run campaigns through the new system, and eventually, all ads on the Rumble platform will be served through its own advertising system. As we scale our platform, we expect to eventually drive significant and differentiated value to advertisers through the development of this independent advertising marketplace.

• Enterprise — As we look to expand into the IaaS space and offer Cloud Solutions to the enterprise segment, we plan to build out our business-to-business subscription-based marketing -model. We expect that these services will include video streaming, email services, storage and cloud & website hosting.

Human Capital

As a software technology company, we believe our employees are our number one resource. As of June 30, 2022, we had 50 full-time employees, of whom 18 were based in Canada and 32 were based in the U.S. None of our employees are covered by collective bargaining agreements. Overall, we consider our relations with our employees to be good.

2

Our Company Culture

First and foremost, we hire those who are united in our mission to protect a free and open Internet. Like the creators we exist to serve, our Rumble team is full of people who like to think, to question, to build, to listen, and who want to do work that will change the world. As a team, we are:

• Focused on our mission

• Free in our expression

• Fast in our execution

• Fearless in our pursuit

The collective passion in our mission is uniquely powerful. We see this passion shared every day not only by our employees, but by our users, creators, and our customers. It is this passion and our approach to business which we believe will continue to differentiate Rumble from our competition.

Competition

We compete in almost every aspect of our business with companies (many of which are much larger and more well capitalized than us) that also provide video streaming platforms to content creators, including YouTube, Roku, TikTok, Snapchat and Facebook. We compete with these companies to attract, engage and retain users and subscribers.

Government Regulation

We are subject to domestic and foreign laws that affect companies conducting business on the Internet generally, including laws relating to the liability of providers of online services for their operations and the activities of their users.

Because we host user-uploaded content, we may be subject to laws concerning such content. In the U.S., we rely, to a significant degree, on laws that limit the liability of online providers for user-uploaded content, including the Digital Millennium Copyright Act of 1998 (DMCA) and Section 230 of the Communications Decency Act of 1996. Countries outside the U.S. generally do not provide as robust protections for online providers and may instead regulate such entities to a higher degree. For example, in certain countries, online providers may be liable for hosting certain types of content or may be required to remove such content within a short period of time upon notice. We or our customers may also be subject to laws that regulate streaming services or online platforms, such as the EU’s Audiovisual Media Services Directive or EU Regulation 2019/1150, which regulates platform-to-business relations.

Because we receive, store and use a substantial amount of information received from or generated by our users, we are also impacted by laws and regulations governing privacy and data security in the U.S. and worldwide. Examples of such regimes include Section 5 of the Federal Trade Commission Act, the EU’s General Data Protection Regulation (GDPR), and the California Consumer Privacy Act (CCPA). These laws generally regulate the collection, storage, transfer and use of personal information.

Because our platform facilitates online payments, including subscription fees and tipping, we are subject to a variety of laws governing online transactions, payment card transactions and the automatic renewal of online agreements. In the U.S., these matters are regulated by, among other things, the federal Restore Online Shoppers Confidence Act (ROSCA) and various state laws.

As a U.S.-based company with Canadian operations, we are subject to a variety of foreign laws governing our foreign operations, as well as Canadian and U.S. laws that restrict trade and certain practices.

Product Development

With relatively limited access to capital for most of the company’s history, our product and engineering teams have worked in an environment based on efficiency and speed with a stringent focus on end-user value. With new access to capital upon consummation of the Business Combination and the ability to scale, it will be critical to maintain this culture as we look to bring new innovations to our users and creators.

3

Infrastructure

Guided by our overarching philosophy to technology, our business plan contemplates spending considerable resources and investment on the underlying infrastructure that supports our products, such as building out and networking multiple points of presence (PoPs) and optimizing at a scale of billions of minutes of video consumption on our platform every month to millions of users, which requires significant investments in IT equipment, servers, bandwidth and data centers and data hosting/storage. Rumble has made initial investments in the first half of 2022 and, as our business continues to grow and scale, we expect such investments to grow proportionately over time.

Intellectual Property

Our intellectual property includes trademarks, such as RUMBLE in the United States and Canada, pending international trademarks for RUMBLE, and a pending U.S. trademark application for LOCALS; the domain names rumble.com and locals.com; copyrights in our source code, website, apps and creative assets; and trade secrets. In addition, our platforms are powered by a proprietary technology platform. We rely on, and expect to continue to rely on, a combination of work for hire, assignment, and confidentiality agreements with our employees, consultants, and third parties with whom we have relationships, as well as trademark, trade dress, domain name, copyright, and trade secret laws to protect our brands, proprietary technology, and other intellectual property rights. We intend to continue to file additional applications with respect to our intellectual property rights.

Acquisitions

In October 2021, we bolstered our value proposition for content creators by acquiring Locals Technology Inc., a solution for (1) creators looking to monetize their content through subscription, and (2) for users to gain access to premium content from their favorite content creators. The acquisition was designed to accelerate our subscription revenue model and brought approximately 86,000 subscribers to our platform. Prior to our acquisition of Locals, we did not offer a consumer-facing subscription service.

Facilities

We are headquartered in Longboat Key, Florida, and maintain offices in both the United States and Canada. A number of our U.S. employees work remotely. All of our facilities are leased. We believe that our current facilities are adequate to meet our current needs. We intend to procure additional space in the future as we continue to add employees and expand geographically. We also believe that, if we require additional space, we will be able to lease additional facilities on commercially reasonable terms.

Recent Developments

The Business Combination

On September 16, 2022, we consummated the Business Combination between CF VI and Rumble Canada. In connection with the consummation of the Business Combination, CF VI changed its name from CF Acquisition Corp. VI to Rumble Inc. and Rumble Canada changed its name from Rumble Inc. to Rumble Canada Inc.

Corporate Information

Rumble Inc. is a Delaware corporation. Our principal executive offices are located at 444 Gulf of Mexico Drive, Longboat Key, Florida, 34228, and our telephone number is (941) 210-0196. Our principal website address is https://rumble.com. Information contained in, or accessible through, our website is not a part of, and is not incorporated into, this prospectus.

4

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. These provisions include:

• presenting only two years of audited financial statements and only two years of selected financial data;

• an exemption from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act;

• reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements, and registration statements; and

• exemptions from the requirements of holding nonbinding advisory votes on executive compensation or golden parachute arrangements.

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards, and therefore, we will not be subject to the same new or revised accounting standards at the same time as other public companies that are not emerging growth companies or those that have opted out of using such extended transition period, which may make comparison of our financial statements with such other public companies more difficult. We may take advantage of these reporting exemptions until we no longer qualify as an emerging growth company or, with respect to adoption of certain new or revised accounting standards, until we irrevocably elect to opt out of using the extended transition period.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of the CF VI initial public offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; and (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC. We may choose to take advantage of some but not all of these reduced reporting burdens.

Controlled Company Exemption

Chris Pavlovski, our CEO and Chairman, owns 85% of our outstanding voting power for the election of directors. As a result, we are a “controlled company” within the meaning of applicable Nasdaq rules and, consequently, qualify for exemptions from certain corporate governance requirements. Our stockholders do not have the same protections afforded to stockholders of companies that are subject to such requirements. Please see the section entitled “Management — Controlled Company”.

Risk Factor Summary

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors,” that represent challenges that we face in connection with the successful implementation of our strategy and growth of our business. The occurrence of one or more of the events or circumstances described in the section titled “Risk Factors,” alone or in combination with other events or circumstances, may adversely affect our ability to realize the anticipated benefits of the Business Combination, and may have an adverse effect on our business, cash flows, financial condition and results of operations. Such risks include, but are not limited to:

• we may not be able to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, our ability to grow and manage growth profitably, maintain relationships with customers, compete within our industry and retain our key employees;

• the possibility that we may be adversely impacted by economic, business, and/or competitive factors;

• our limited operating history makes it difficult to evaluate our business and prospects;

• our recent and rapid growth may not be indicative of future performance;

5

• we may not continue to grow or maintain our active user base, and may not be able to achieve or maintain profitability;

• we collect, store, and process large amounts of user video content and personal information of our users and subscribers. If our security measures are breached, our sites and applications may be perceived as not being secure, traffic and advertisers may curtail or stop viewing our content or using our services, our business and operating results could be harmed, and we could face legal claims from users and subscribers;

• we may fail to comply with applicable privacy laws;

• we are subject to cybersecurity risks and interruptions or failures in our information technology systems and as we grow and gain recognition, we will likely need to expend additional resources to enhance our protection from such risks. Notwithstanding our efforts, a cyber incident could occur and result in information theft, data corruption, operational disruption and/or financial loss;

• we may be found to have infringed on the intellectual property of others, which could expose us to substantial losses or restrict our operations;

• we may face liability for hosting a variety of tortious or unlawful materials uploaded by third parties, notwithstanding the liability protections of section 230 of the Communications Decency Act;

• we may face negative publicity for removing, or declining to remove, certain content, regardless of whether such content violated any law;

• our traffic growth, engagement, and monetization depend upon effective operation within and compatibility with operating systems, networks, devices, web browsers and standards, including mobile operating systems, networks, and standards that we do not control;

• our business depends on continued and unimpeded access to our content and services on the Internet. If we or those who engage with our content experience disruptions in Internet service, or if Internet service providers are able to block, degrade or charge for access to our content and services, we could incur additional expenses and the loss of traffic and advertisers;

• we face significant market competition, and if we are unable to compete effectively with our competitors for traffic and advertising spend, our business and operating results could be harmed;

• changes to our existing content and services could fail to attract traffic and advertisers or fail to generate revenue;

• we depend on third-party vendors, including Internet service providers, advertising networks, and data centers, to provide core services;

• hosting and delivery costs may increase unexpectedly;

• we have offered and intend to continue to offer incentives, including economic incentives, to content creators to join our platform, and these arrangements often involve fixed payment obligations that are not contingent on actual revenue or performance metrics generated by the applicable content creator but rather are typically based on our modeled financial projections for that creator, which if not satisfied may adversely impact our financial performance, results of operations and liquidity;

• changes in tax rates, changes in tax treatment of companies engaged in e-commerce, the adoption of new U.S. or international tax legislation, or exposure to additional tax liabilities may adversely impact our financial results;

• compliance obligations imposed by new privacy laws, laws regulating social media platforms and online speech in the U.S. and Canada, or industry practices may adversely affect our business;

• the ongoing COVID-19 pandemic has caused a global health crisis that has caused significant economic and social disruption, and its impact on our business is uncertain; and

• other risks and uncertainties indicated in this prospectus, including those under “Risk Factors” herein, and other filings that we have made or will make with the SEC.

6

Issuer | Rumble Inc. | |

Shares of Class A Common Stock offered by us |

| |

Shares of Class A Common Stock offered by the Selling Holders |

| |

Warrants offered by the Selling Holders |

| |

Exercise Price of Warrants | $11.50 per share, subject to adjustment as described herein. | |

Shares of Class A Common Stock Outstanding |

| |

Use of Proceeds | We will not receive any proceeds from the sale of the securities offered pursuant to this prospectus, except with respect to amounts received by us upon exercise of the Warrants offered hereby (to the extent such Warrants are exercised for cash). We intend to use any such proceeds for general corporate purposes, although we believe we can fund our operations with cash on hand. | |

Liquidity | This offering involves the potential sale of up to 341,068,989 shares of our Class A Common Stock, which represents approximately 90.9% of our total outstanding shares of Class A Common Stock on a fully diluted basis (inclusive of all shares of Class A Common Stock issuable upon exchange of ExchangeCo Shares, and which also includes shares of Class A Common Stock and ExchangeCo Shares placed in escrow pursuant to the terms of the BCA). Once the registration statement that includes this prospectus is effective and during such time as it remains effective, the Selling Holders will be permitted (subject to compliance with the contractual lock-up restrictions that apply to certain Selling Holders, as described under “Plan of Distribution”) to sell the shares registered hereby. The resale, or anticipated or potential resale, of a substantial number of shares of our Class A Common Stock may have a material negative impact on the market price of our Class A Common Stock and could make it more difficult for our shareholders to sell their shares of Class A Common Stock at such times and at such prices as they deem desirable. |

7

Market for our Securities | Our Class A Common Stock and Warrants are currently traded on The Nasdaq Global Market under the symbols “RUM” and “RUMBW”, respectively. On November 3, 2022, the closing prices of our Class A Common Stock and Warrants were $12.27 per share and $2.63 per Warrant, respectively. | |

Risk Factors | Investing in our Class A Common Stock and Warrants involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” beginning on page 9 of this prospectus. |

8

An investment in the securities offered pursuant to this prospectus involves a high degree of risk. You should carefully consider the following risk factors, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” together with all of the other information included in this prospectus or any accompanying prospectus supplement, before making an investment decision. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may adversely affect our ability to realize the anticipated benefits of the Business Combination, and may have an adverse effect on our business, cash flows, financial condition and results of operations. We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business or financial condition. The following discussion should be read in conjunction with the financial statements and notes to the financial statements included elsewhere in this prospectus.

Risks Relating to Our Business

Rumble’s limited operating history makes it difficult to evaluate its business and prospects.

We have a limited operating history, which makes it difficult to evaluate our businesses and prospects or forecast our future results. We are subject to the same risks and uncertainties frequently encountered by companies in rapidly evolving markets. Our financial results in any given quarter can be influenced by numerous factors, many of which we are unable to predict or are outside of our control, including:

• our ability to maintain and grow traffic, content uploads, and engagement;

• changes made to social media and other platforms, or changes in the patterns of use of those channels by users;

• our ability to attract and retain advertisers in a particular period;

• the number of ads shown to our traffic;

• the pricing of our advertising products;

• the diversification and growth of revenue sources beyond current advertising products;

• the development and introduction of new content, products, or services by us or our competitors;

• increases in marketing, sales, and other operating expenses that we may incur to grow and expand our operations and to remain competitive;

• our reliance on key vendor relationships, including our relationship with Cosmic Inc. and Kosmik Development Skopje doo (“Cosmic”) to provide content moderation and software development services, and dependence on a small number of customer relationships;

• legislation in Canada, the European Union, or other jurisdictions that forces us to change our content moderation policies and practices;

• our ability to maintain gross margins and operating margins; and

• system failures or breaches of security or privacy.

Rumble may not continue to grow or maintain its active user base, may not be able to achieve or maintain profitability and may not be able to scale its systems, technology, or infrastructure effectively or grow its business at the same or similar rate as other comparable companies.

While Rumble’s key performance metrics, including MAUs and minutes watched per month have grown in recent periods, this growth rate may not be sustainable and should not be considered indicative of future levels of active viewers and future performance. In addition, Rumble may not realize sufficient revenue to achieve or, if achieved, maintain profitability. As Rumble grows its business, Rumble’s revenue growth rates may slow in future periods due to a number of reasons, which may include slowing demand for its service, increasing competition, a

9

decrease in the growth of its overall market, an inability to scale its systems, technology or infrastructure effectively, and its failure to capitalize on growth opportunities or the maturation of its business. Rumble may incur losses in the future for a number of reasons, including insufficient growth in the level of engagement, a failure to retain its existing level of engagement, increasing competition, the failure to continue to attract content creators with large followings, the payment of fixed payment obligations to content creators who join our platform that turn out to be unprofitable over the term of the applicable contract as a result of actual performance that does not meet our original modeled financial projections for that creator, as well as other risks described in these “Risk Factors,” and Rumble may encounter unforeseen expenses, difficulties, complications and delays and other unknown factors. Rumble expects to continue to make investments in the development and expansion of its business, which may not result in increased or sufficient revenue or growth, including relative to other comparable companies, as a result of which Rumble may not be able to achieve or maintain profitability.

If we fail to maintain adequate operational and financial resources, particularly if we continue to grow rapidly, we may be unable to execute our business plan or maintain high levels of service and customer satisfaction.

We have experienced, and expect to continue to experience, rapid growth, which has placed, and may continue to place, significant demands on our management and our operational and financial resources. Our organizational structure is becoming more complex as we scale our operational, financial, and management controls, as well as our reporting systems and procedures, and expand internationally. As we continue to grow, we face challenges of integrating, developing, training, and motivating a rapidly growing employee base in our various offices in multiple jurisdictions and navigating a complex multinational regulatory landscape. If we fail to manage our anticipated growth and change in a manner that preserves the functionality of our platforms and solutions, the quality of our products and services may suffer, which could negatively affect our brand and reputation and harm our ability to attract customers.

To manage growth in our operations and personnel, we will need to continue to grow and improve our operational, financial, and management controls and our reporting systems and procedures. We will require significant capital expenditures and the allocation of valuable management resources to grow and change in these areas. Our expansion has placed, and our expected future growth will continue to place, a significant drain on our management, customer experience, research and development, sales and marketing, administrative, financial, and other resources.

We anticipate that significant additional investments will be required to scale our operations and increase productivity, to address the needs of our customers, to further develop and enhance our products and services, to expand into new geographic areas and to scale with our overall growth. If additional investments are required due to significant growth, this will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term.

Rumble collects, stores, and processes large amounts of user video content and personal information of its users and subscribers. If Rumble’s security measures are breached, its sites and applications may be perceived as not being secure, traffic and advertisers may curtail or stop viewing its content or using its services, its business and operating results could be harmed, and it could face legal claims from users and subscribers.

Rumble collects, stores, and processes large amounts of video content (including videos that are not intended for public consumption) and personal information of its users and subscribers. Rumble also shares such information, where appropriate, with third parties that help it operate its business. Despite Rumble’s efforts, it may fail to properly secure its systems and its user and subscriber data. This could be caused by technical issues (bugs), obsolete technology, human error or internal or external malfeasance, undiscovered vulnerabilities, and could lead to unauthorized disclosure of data, unauthorized changes or data losses. For example, Rumble routinely receives reports from security researchers regarding potential vulnerabilities in its applications. Rumble also relies on open-source software for various functions, which may contain undiscovered security flaws and create additional technical vulnerabilities. In addition, despite Rumble’s ongoing and additional investments in cybersecurity, such improvements and review may not identify abuses of Rumble’s platforms and misuse of user data. The existence of such vulnerabilities, if undetected or detected but not remediated, could result in unauthorized access to Rumble systems or the data of Rumble users.

10

A data breach could expose Rumble to regulatory actions and litigation. Depending on the circumstances, Rumble may be required to disclose a suspected breach to regulators, affected individuals, and the public. This could lead to regulatory actions, including the possibility of fines, class action or traditional litigation by affected individuals, reputational harm, costly investigation and remedial efforts, the triggering of indemnification obligations under data-protection agreements with subscribers, vendors, and partners, higher premiums for cybersecurity insurance and other insurance policies, and the inability to obtain cybersecurity insurance or other forms of insurance. Given industry trends generally, we expect that the extension or renewal of cybersecurity insurance coverage beyond the current term will be difficult to obtain. The term of our existing cybersecurity coverage recently expired and, while we continue to pursue an extension, renewal or replacement thereof, we do not presently have cybersecurity insurance to compensate for any losses that may result from any breach of security. As a result, our results of operations or financial condition may be materially adversely affected if we are unable to secure an extension, renewal or replacement of our cybersecurity coverage.

Rumble may fail to comply with applicable privacy laws.

We are subject to data privacy and security laws and regulations that apply to the collection, transmission, storage, use, processing, destruction, retention and security of personal information, including additional laws or regulations relating to health information. Rumble’s current privacy policies and practices, which are publicly available at rumble.com/s/privacy, are designed to comply with privacy and data protection laws in the United States and Canada. These policies and practices inform users how Rumble handles their personal information and, as permitted by law, allow users to change or delete the personal information in their user accounts. The legislative and regulatory landscape for privacy and data protection continues to evolve in jurisdictions worldwide, and these laws may at times be conflicting. It is possible that these laws may be interpreted and applied in a manner that is inconsistent with our practices, and our efforts to comply with the evolving data protection rules may be unsuccessful. We must devote significant resources to understanding and complying with this changing landscape. Failure to comply with federal, state, provincial and international laws regarding privacy and security of personal information could expose us to penalties under such laws, orders requiring that we change our practices, claims for damages or other liabilities, regulatory investigations and enforcement action (including fines and criminal prosecution of employees), litigation, significant costs for remediation, and damage to our reputation and loss of goodwill, any of which could have a material adverse effect on our business, financial condition, results of operations and prospects. Even if we have not violated these laws, government investigations into these issues typically require the expenditure of significant resources and generate negative publicity, which could have a material adverse effect on our business, financial condition, results of operations and prospects. Additionally, if we are unable to properly protect the privacy and security of personal information, including protected health information, we could be found to have breached our contracts with certain third parties.

There are numerous U.S. and Canadian federal, state, and provincial laws and regulations related to the privacy and security of personal information. Determining whether protected information has been handled in compliance with applicable privacy standards and our contractual obligations can be complex and may be subject to changing interpretation. If we fail to comply with applicable privacy laws, we could face civil and criminal penalties. Failing to take appropriate steps to keep consumers’ personal information secure can also constitute unfair acts or practices in or affecting commerce and be construed as a violation of Section 5(a) of the Federal Trade Commission Act (the “FTCA”), 15 U.S.C. § 45(a). The FTC expects a company’s data security measures to be reasonable and appropriate in light of the sensitivity and volume of consumer information it holds, the size and complexity of its business, and the cost of available tools to improve security and reduce vulnerabilities. In addition, state attorneys general are authorized to bring civil actions seeking either injunctions or damages in response to violations that threaten the privacy of state residents. We cannot be sure how these regulations will be interpreted, enforced or applied to our operations. In addition to the risks associated with enforcement activities and potential contractual liabilities, our ongoing efforts to comply with evolving laws and regulations at the federal and state level may be costly and require ongoing modifications to our policies, procedures and systems.

Internationally, laws, regulations and standards in many jurisdictions apply broadly to the collection, transmission, storage, use, processing, destruction, retention and security of personal information. For example, in the European Union, the collection, transmission, storage, use, processing, destruction, retention and security of personal data is governed by the provisions of the General Data Protection Regulation (the “GDPR”) in addition to other applicable laws and regulations. The GDPR came into effect in May 2018, repealing and replacing the European Union Data Protection Directive, and imposing revised data privacy and security requirements on companies in relation to the

11

processing of personal data of European Union data subjects. The GDPR, together with national legislation, regulations and guidelines of the European Union Member States governing the collection, transmission, storage, use, processing, destruction, retention and security of personal data, impose strict obligations with respect to, and restrictions on, the collection, use, retention, protection, disclosure, transfer and processing of personal data. The GDPR also imposes strict rules on the transfer of personal data to countries outside the European Union that are not deemed to have protections for personal information, including the United States. The GDPR authorizes fines for certain violations of up to 4% of the total global annual turnover of the preceding financial year or €20 million, whichever is greater. Such fines are in addition to any civil litigation claims by data subjects. Separately, Brexit has led and could also lead to legislative and regulatory changes and may increase our compliance costs. As of January 1, 2021, and the expiry of transitional arrangements agreed to between the United Kingdom and the European Union, data processing in the United Kingdom is governed by a United Kingdom version of the GDPR (combining the GDPR and the Data Protection Act 2018), exposing us to two parallel regimes, each of which authorizes similar fines and other potentially divergent enforcement actions for certain violations. On June 28, 2021, the European Commission adopted an adequacy decision for the United Kingdom, allowing for the relatively free exchange of personal information between the European Union and the United Kingdom. Other jurisdictions outside the European Union are similarly introducing or enhancing privacy and data security laws, rules and regulations, which could increase our compliance costs and the risks associated with noncompliance. We cannot guarantee that we are, or will be, in compliance with all applicable U.S., Canadian, or other international regulations as they are enforced now or as they evolve.

Rumble operates across many different markets both domestically and internationally which may subject it to cybersecurity, privacy, data security, data protection, and online content laws with uncertain interpretations, as well as impose conflicting obligations on Rumble.

International laws and regulations relating to cybersecurity, privacy, data security, data protection, and online content often are more restrictive than those in the United States. There is no harmonized approach to these laws and regulations globally. Consequently, as Rumble expands internationally from Canada and the United States, we increase our risk of non-compliance with applicable foreign data protection and online content laws, including laws that expose us to civil or criminal penalties in certain jurisdictions for our content moderation decisions. For example, in October 2022, the French government notified us of its belief that Rumble was in violation of EU regulations due to the hosting of content on the Rumble platform by certain users sanctioned in the EU. We believe the scope of the cited EU regulations is uncertain with respect to businesses like Rumble that do not have a permanent establishment in the EU and conduct their business exclusively outside of the EU. In response, we proactively decided to disable access to the Rumble platform for all users in France pending discussions with the French government and a legal challenge to the scope of the EU regulations. While this decision will not have a material effect on our business, as France represents less than one percent of our users, it is possible that similar circumstances in other jurisdictions may require us to disable access to our content to users in such jurisdictions, either temporarily or permanently, which may have an adverse effect on our business, cash flows, financial condition and results of operations.

In addition, various federal, state, provincial, and foreign legislative and regulatory bodies, or self-regulatory organizations, may expand current laws or regulations, enact new laws or regulations or issue revised rules or guidance regarding cybersecurity, privacy, data security, data protection and online content. For example, Rumble may need to change and limit the way it uses personal information in operating its business and may have difficulty maintaining a single operating model that is compliant. In 2018, California enacted the California Consumer Privacy Act (“CCPA”), which, among other things, requires new disclosures to California consumers and affords such consumers new abilities to opt out of certain sales of information and may restrict the use of cookies and similar technologies for advertising purposes. The CCPA, which became effective on January 1, 2020, was amended on multiple occasions and is the subject of regulations issued by the California Attorney General regarding certain aspects of the law and its application. Moreover, California voters approved the California Privacy Rights Act (the “CPRA”) in November 2020. The CPRA significantly modifies the CCPA, creating obligations relating to consumer data beginning on January 1, 2022, with implementing regulations expected on or before July 1, 2022, and enforcement beginning July 1, 2023. Aspects of the CCPA and CPRA remain unclear, resulting in further uncertainty and potentially requiring us to modify our data practices and policies and to incur substantial additional costs and expenses in an effort to comply. Similar laws have been proposed, and likely will be proposed, in other states and at the federal level, and if passed, such laws may have potentially conflicting requirements that would make compliance challenging. For example, on March 2, 2021, the Virginia Consumer Data Protection Act (“CDPA”) was signed into law. The CDPA becomes effective January 1, 2023 and contains provisions that, in addition to other mandates, require businesses subject to the legislation to conduct data protection assessments in certain circumstances and that require opt-in consent from Virginia consumers to process certain sensitive personal information.

12

Rumble is subject to cybersecurity risks and interruptions or failures in Rumble’s information technology systems and as it grows and gains recognition, it will likely need to expend additional resources to enhance Rumble’s protection from such risks. Notwithstanding Rumble’s efforts, a cyber incident could occur and result in information theft, data corruption, operational disruption and/or financial loss.

Rumble relies on sophisticated information technology systems and infrastructure to support its business. At the same time, cyber incidents, including deliberate attacks, are prevalent and have increased, including due to the possibility that the ongoing conflict between Russia and Ukraine could result in increased cyber-attacks or cybersecurity incidents by state actors or others. Rumble’s technologies, systems and networks and those of its vendors, suppliers and other business partners may become the target of cyberattacks or information security breaches that could result in the unauthorized release, gathering, monitoring, misuse, loss or destruction of proprietary and other information, or other disruption of business operations. In addition, certain cyber incidents, such as surveillance or vulnerabilities in widely used open source software, may remain undetected for an extended period. Rumble’s systems for protecting against cybersecurity risks may not be sufficient. Like most major social media platforms, Rumble is routinely targeted by cyberattacks that can result in interruptions to its services. Rumble expects these attacks will continue in the future. As the sophistication of cyber incidents continues to evolve, Rumble is and will likely continue to be required to expend additional resources to continue to modify or enhance its protective measures or to investigate and remediate any vulnerability to cyber incidents. Additionally, any of these systems may be susceptible to outages due to fire, floods, power loss, telecommunications failures, usage errors by employees, computer viruses, cyber-attacks or other security breaches or similar events. The failure of any of Rumble’s information technology systems may cause disruptions in its operations, which could adversely affect its revenues and profitability, and lead to claims related to the disruption of our services from users of the Rumble platform, advertisers, and customers of Rumble’s cloud services.

Inadequate technical and legal intellectual property (IP) protections could prevent Rumble from defending or securing its proprietary technology and IP.

Our success is dependent, in part, upon protecting our proprietary information and technology. We may be unsuccessful in adequately protecting our intellectual property. No assurance can be given that confidentiality, non-disclosure, or invention assignment agreements with employees, consultants, or other parties will not be breached and will otherwise be effective in controlling access to and distribution of our platform or solutions, or certain aspects of our platform or solutions, and proprietary information. Further, these agreements do not prevent our competitors from independently developing technologies that are substantially equivalent or superior to our platform or solutions. Additionally, certain unauthorized use of our intellectual property may go undetected, or we may face legal or practical barriers to enforcing our legal rights even where unauthorized use is detected.

Current law may not provide for adequate protection of our platform or data. In addition, legal standards relating to the validity, enforceability, and scope of protection of proprietary rights in Internet-related businesses are uncertain and evolving, and changes in these standards may adversely impact the viability or value of our proprietary rights. Some license provisions protecting against unauthorized use, copying, transfer, and disclosure of our platform, or certain aspects of our platform, or our data may be unenforceable under the laws of certain jurisdictions. Further, the laws of some countries do not protect proprietary rights to the same extent as the laws of the United States, and mechanisms for enforcement of intellectual property rights in some foreign countries may be inadequate. To the extent we expand our international activities, our exposure to unauthorized copying and use of our data or certain aspects of our platform, or our data may increase. Competitors, foreign governments, foreign government-backed actors, criminals, or other third parties may gain unauthorized access to our proprietary information and technology. Accordingly, despite our efforts, we may be unable to prevent third parties from infringing upon or misappropriating our technology and intellectual property.

To protect our intellectual property rights, we will be required to spend significant resources to monitor and protect these rights, and we may or may not be able to detect infringement by our customers or third parties. Litigation has been and may be necessary in the future to enforce our intellectual property rights and to protect our trade secrets. Such litigation could be costly, time consuming, and distracting to management and could result in the impairment or loss of portions of our intellectual property. Furthermore, our efforts to enforce our intellectual property rights may be met with defenses, counterclaims, and countersuits attacking the validity and enforceability of our intellectual property rights. Our inability to protect our proprietary technology against unauthorized copying or use, as well as any costly litigation or diversion of our management’s attention and resources, could delay further

13

sales or the implementation of our platform or solutions, impair the functionality of our platform or solutions, delay introductions of new features, integrations, and capabilities, result in our substituting inferior or more costly technologies into our platform or solutions, or injure our reputation. In addition, we may be required to license additional technology from third parties to develop and market new features, integrations, and capabilities, and we cannot be certain that we could license that technology on commercially reasonable terms or at all, and our inability to license this technology could harm our ability to compete.

Rumble may be found to have infringed on the IP of others, which could expose Rumble to substantial losses or restrict its operations.

We expect to be subject to legal claims that we have infringed the IP rights of others. To date, we have not fully evaluated the extent to which other parties may bring claims that our technology, including our use of open source software, infringes on the IP rights of others. The availability of damages and royalties and the potential for injunctive relief have increased the costs associated with litigating and settling patent infringement claims. Any claims, whether or not meritorious, could require us to spend significant time, money, and other resources in litigation, pay damages and royalties, develop new IP, modify, design around, or discontinue existing products, services, or features, or acquire licenses to the IP that is the subject of the infringement claims. These licenses, if required, may not be available at all or have acceptable terms. As a result, IP claims against us could have a material adverse effect on our business, prospects, financial condition, operating results and cash flows.

Rumble may face liability for hosting content that allegedly infringes on third-party copyright laws.

If content providers do not have sufficient rights to the video content or other material that they upload or make available to Rumble, or if such video content or other material infringes or is alleged to infringe the intellectual property rights of third parties, Rumble could be subject to claims from those third parties, which could adversely affect its business, results of operations and financial condition. Although our content policies prohibit users from submitting infringing content to Rumble, and require users to indemnify Rumble for claims related to the violations of the rights of third parties arising from the submission of content to Rumble (including with respect to infringements of IP rights), Rumble does not verify that content providers own or have rights to all of the video content or other material that they upload or make available. As a result, Rumble may face potential liability for copyright or other intellectual property infringement, or other claims. Litigation to defend these claims could be costly and have an adverse effect on Rumble’s business, results of operations and financial condition. Rumble can provide no assurance that it is adequately insured to cover claims related to user content or that its indemnification provisions will be adequate to mitigate all liability that may be imposed on it as a result of claims related to user content.

Rumble may face liability for hosting a variety of tortious or unlawful materials uploaded by third parties, notwithstanding the liability protections of Section 230 of the Communications Decency Act.

In the United States, Section 230 of the Communications Decency Act generally limits Rumble’s liability for hosting tortious and otherwise illegal content. The immunities conferred by Section 230 could be narrowed or eliminated through amendment, regulatory action or judicial interpretation. In 2018, Congress amended Section 230 to remove immunities for content that promotes or facilitates sex trafficking and prostitution. In 2020, various members of Congress introduced bills to further limit Section 230, and a petition was filed by a Department of Commerce entity with the Federal Communications Commission to commence a rulemaking to further limit Section 230.

Laws like Section 230 generally do not exist outside of the United States, and some countries have enacted laws that require online content providers to remove certain pieces of content within short time frames. For example, in 2020, France enacted a law requiring covered social media networks to remove terror content within one hour upon receiving notice. If Rumble fails to comply with such laws, it could be subject to prosecution or regulatory proceedings. In addition, some countries may decide to ban Rumble’s service based upon a single piece of content.