- RUM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Rumble (RUM) 424B3Prospectus supplement

Filed: 21 Apr 23, 5:26pm

Filed Pursuant to Rule 424(b)(3) Registration No. 333-267936 |

PROSPECTUS

RUMBLE INC.

8,050,000 Shares of Class A Common Stock Underlying Warrants

333,568,989 Shares of Class A Common Stock by the Selling Holders

550,000 Warrants to Purchase Class A Common Stock by the Selling Holders

____________________

This prospectus relates to (a) the issuance by us of up to 8,050,000 shares of our common stock, par value $0.0001 per share (“Class A Common Stock”), upon the exercise of warrants, each exercisable for one share of Class A Common Stock at a price of $11.50 per share (“Warrants”) and (b) the resale from time to time by the selling securityholders named in this prospectus (each a “Selling Holder” and collectively, the “Selling Holders”) of (i) up to 333,568,989 shares of Class A Common Stock, consisting of 333,018,989 shares of Class A Common Stock and 550,000 shares of Class A Common Stock issuable upon the exercise of Warrants and (ii) 550,000 Warrants. With respect to the 333,568,989 shares of Class A Common Stock held by the Selling Holders, we are registering the resale of (i) 8,300,000 shares of Class A Common Stock that were issued on a private placement basis at a price of $10.00 per share in the PIPE Investment in connection with our Business Combination pursuant to customary registration rights that we granted to our PIPE Investors, (ii) 227,891,189 shares of Class A Common Stock that were previously issued and registered on Form S-4 in connection with our Business Combination (as well as the resale of 86,752,800 shares underlying options to be registered on Form S-8) pursuant to the Registration Rights Agreement (as further described herein), which provides for, among other things, customary resale underwritten demand and related “piggyback rights” for certain Selling Holders and which shares of Class A Common Stock (including those shares of Class A Common Stock underlying options) were received by existing shareholders of Rumble Canada (as defined below) in exchange for their securities in Rumble Canada as part of the consummation of the Business Combination, (iii) 10,075,000 shares of Class A Common Stock held by the Sponsor and its related parties pursuant to the Registration Rights Agreement and/or certain registration rights granted in connection with CF VI’s initial public offering, which are comprised of (A) 1,875,000 shares of Class A Common Stock issued to the Sponsor pursuant to the Forward Purchase Contract at an effective price of $8.00 per share, (B) 7,500,000 shares of Class A Common Stock issued to the Sponsor and former independent directors of CF VI in exchange for the 7,500,000 shares of Class B Common Stock issued to them in connection with the formation of CF VI at a price of $0.003 per share, and (C) 700,000 shares of Class A Common Stock issued to the Sponsor in connection with a private placement at a price of $10.00 per share, and (iv) 550,000 shares of Class A Common Stock issuable upon the exercise of Warrants at an exercise price of $11.50 per Warrant.

As described above, the Selling Holders acquired the shares of Class A Common Stock covered by this prospectus at prices ranging from $0.003 per share to $10.00 per share of Class A Common Stock. By comparison, the offering price to public shareholders in the CF VI initial public offering was $10.00 per unit, which consisted of one share and one-fourth of one Warrant. Consequently, certain Selling Holders may realize a positive rate of return on the sale of their shares covered by this prospectus even if the market price per share of Class A Common Stock is below $10.00 per share, in which case the public shareholders may experience a negative rate of return on their investment. For example, a Selling Holder who sells 1,000,000 shares of Class A Common Stock (which it originally acquired as “founder shares” for $0.003 per share) at a price per share of $8.99 (the closing price of the Class A Common Stock on April 12, 2023) will earn a realized profit of $8,987,000.00, while a public stockholder who sells the same number of shares of Class A Common Stock (which it originally acquired for $10.00 per share in the initial public offering) will realize a loss of $1,010,000.00.

Certain Selling Holders, including Rumble Chairman and CEO Christopher Pavlovski and other company insiders, are subject to contractual lock-up restrictions that prohibit them from selling stock at this time. The shares of Class A Common Stock held by the Sponsor (other than the 1,500,000 shares of Class A Common Stock constituting the Forward Purchase Shares and the 1,159,000 shares of Class A Common Stock that were acquired by the Sponsor in the PIPE Investment) are also subject to contractual lock-up restrictions. See the section entitled “Plan of Distribution.” However, because the current market price of our Class A Common Stock, which was $8.99 per share at the closing on April 12, 2023, is higher than certain of the prices the Selling Holders paid for their shares of Class A Common Stock (ranging from $0.003 per share to $10.00 per share), there is more likelihood that Selling Holders holding shares of Class A Common Stock that were acquired below the current market price will sell their shares of Class A Common Stock after the registration statement that includes this prospectus is declared effective (subject, in the case of certain Selling Holders, to compliance with the contractual lock-up restrictions referred to above). Such sales, or the prospect of such sales, may have a material negative impact on the market price of our Class A Common Stock. After the effectiveness of the registration statement that includes this prospectus, (i) 25,447,437 shares of Class A Common Stock registered on the registration statement that includes this prospectus and that were purchased by Selling Holders will be able to be sold immediately pursuant to such registration statement without any contractual lock-up restrictions and (ii) an additional 315,621,552 shares of Class A Common Stock registered on the registration statement that includes this prospectus and that were purchased by Selling Holders will be able to be sold pursuant to such registration statement once the contractual lock-up restrictions that apply to such Selling Holders expire. It should be noted that the share numbers in the immediately preceding sentence are given on a fully diluted basis (inclusive of all shares of Class A Common Stock issuable upon exchange of ExchangeCo Shares, and which also includes shares of Class A Common Stock and ExchangeCo Shares placed in escrow pursuant to the terms of the BCA).

This prospectus provides you with a general description of such securities and the general manner in which the Selling Holders may offer or sell the securities. More specific terms of any securities that the Selling Holders may offer or sell may be provided in a prospectus supplement that describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus.

On September 16, 2022, we consummated the business combination (the “Business Combination”) contemplated by that certain Business Combination Agreement, dated as of December 1, 2021 (as amended, the “BCA”), by and between CF Acquisition Corp. VI, a Delaware corporation (“CF VI”), and Rumble Inc., a corporation formed under the laws of the Province of Ontario, Canada (“Rumble Canada”). In connection with the consummation of the Business Combination, CF VI changed its name from CF Acquisition Corp. VI to Rumble Inc. and Rumble Canada changed its name from Rumble Inc. to Rumble Canada Inc.

We will bear all costs, expenses and fees in connection with the registration of the securities offered pursuant to this prospectus and will not receive any proceeds from the sale of the securities offered pursuant to this prospectus. The Selling Holders will bear all commissions and discounts, if any, attributable to their sales of the securities offered pursuant to this prospectus.

You should read this prospectus and any prospectus supplement or amendment carefully before you invest in our securities. Our Class A Common Stock and Warrants are listed on The Nasdaq Global Market under the symbols “RUM” and “RUMBW”, respectively. On April 12, 2023, the closing sale prices of our Class A Common Stock and Warrants were $8.99 and $2.02, respectively. We are an “emerging growth company” as defined under the U.S. federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements for this and future filings.

Investing in our Class A Common Stock and Warrants involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 10 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 21, 2023.

Page | ||

ii | ||

iii | ||

1 | ||

8 | ||

10 | ||

30 | ||

31 | ||

MARKET INFORMATION FOR CLASS A COMMON STOCK AND DIVIDEND POLICY | 32 | |

33 | ||

42 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 50 | |

62 | ||

67 | ||

70 | ||

73 | ||

81 | ||

83 | ||

86 | ||

86 | ||

86 | ||

87 | ||

F-1 |

i

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. Under this shelf registration process, the Selling Holders may, from time to time, sell the securities offered by them described in this prospectus. We will not receive any proceeds from the sale of the securities offered pursuant to this prospectus, except with respect to amounts received by us upon exercise of the Warrants offered hereby (to the extent such Warrants are exercised for cash).

Neither we nor the Selling Holders (as defined below) have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Holders take responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling Holders will make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

We may also provide a prospectus supplement or an additional post-effective amendment to the registration statement to add information to, or update or change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information to which we refer you in the sections of this prospectus entitled “Where You Can Find More Information.”

On September 16, 2022, we consummated the business combination (the “Business Combination”) contemplated by that certain Business Combination Agreement, dated as of December 1, 2021 (as amended, the “BCA”), by and between CF Acquisition Corp. VI, a Delaware corporation (“CF VI”), and Rumble Inc., a corporation formed under the laws of the Province of Ontario, Canada (“Rumble Canada”). In connection with the consummation of the Business Combination, CF VI changed its name from CF Acquisition Corp. VI to Rumble Inc. and Rumble Canada changed its name from Rumble Inc. to Rumble Canada Inc. In connection with the Business Combination, we filed a definitive proxy statement/prospectus with the SEC on August 12, 2022 (the “Proxy Statement/Prospectus”). Capitalized terms not otherwise defined herein shall have the meanings set forth in the Proxy Statement/Prospectus.

Unless the section herein specifies otherwise, references to the “Company,” “we,” “us” or “our” are to, (a) prior to the closing of the Business Combination, either (i) CF VI or (ii) Rumble Canada, as the context may require, and (b) following the closing of the Business Combination, Rumble Inc., a Delaware corporation. Unless the section herein specifies otherwise, references to “Rumble” are to (x) prior to the closing of the Business Combination, Rumble Canada and (y) following the closing of the Business Combination, Rumble Inc., a Delaware corporation. References to “ExchangeCo” are to 1000045728 Ontario Inc., a corporation formed under the laws of the Province of Ontario, Canada, and an indirect, wholly owned subsidiary of Rumble, and references to “ExchangeCo Shares” are to the exchangeable shares of ExchangeCo.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements regarding, among other things, our plans, strategies and prospects, both business and financial. These statements are based on the beliefs and assumptions of our management. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot provide assurance that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Generally, statements that are not historical facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Investors should read statements that contain these words carefully because they:

• discuss future expectations;

• contain projects of future results of operations or financial condition; or

• state other “forward-looking” information.

We believe it is important to communicate our expectations to our securityholders. However, there may be events in the future that management is not able to predict accurately or over which we have no control. The risk factors and cautionary language contained in this prospectus provide examples of risks, uncertainties, and events that may cause actual results to differ materially from the expectations described in such forward-looking statements, including among other things:

• our ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, our ability to grow and manage growth profitably, maintain relationships with customers, compete within our industry and retain key employees;

• the possibility that we may be adversely impacted by economic, business, and/or competitive factors;

• our limited operating history makes it difficult to evaluate our business and prospects;

• our inability to effectively manage future growth and achieve operational efficiencies;

• our recent and rapid growth may not be indicative of future performance;

• we may not continue to grow or maintain our active user base, and may not be able to achieve or maintain profitability;

• spam activity, including inauthentic and fraudulent user activity, if undetected, may contribute, from time to time, to some amount of overstatement of our performance indicators;

• we collect, store, and process large amounts of user video content and personal information of our users and subscribers. If our security measures are breached, our sites and applications may be perceived as not being secure, traffic and advertisers may curtail or stop viewing our content or using our services, our business and operating results could be harmed, and we could face governmental investigations and legal claims from users and subscribers;

• we may fail to comply with applicable privacy laws;

• we are subject to cybersecurity risks and interruptions or failures in our information technology systems and as we grow and gains recognition, we likely need to expend additional resources to enhance our protection from such risks. Notwithstanding our efforts, a cyber incident could occur and result in information theft, data corruption, operational disruption and/or financial loss;

• we may be found to have infringed on the intellectual property of others, which could expose us to substantial losses or restrict our operations;

• we may face liability for hosting a variety of tortious or unlawful materials uploaded by third parties, notwithstanding the liability protections of Section 230 of the Communications Decency Act of 1996 (“Section 230”);

iii

• we may face negative publicity for removing, or declining to remove, certain content, regardless of whether such content violated any law;

• our traffic growth, engagement, and monetization depend upon effective operation within and compatibility with operating systems, networks, devices, web browsers and standards, including mobile operating systems, networks, and standards that we do not control;

• our business depends on continued and unimpeded access to our content and services on the internet. If we or those who engage with our content experience disruptions in internet service, or if internet service providers are able to block, degrade or charge for access to our content and services, we could incur additional expenses and the loss of traffic and advertisers;

• we face significant market competition, and if we are unable to compete effectively with our competitors for traffic and advertising spend, our business and operating results could be harmed;

• changes to our existing content and services could fail to attract traffic and advertisers or fail to generate revenue;

• we depend on third-party vendors, including Internet service providers, advertising networks, and data centers, to provide core services;

• hosting and delivery costs may increase unexpectedly;

• we have offered and intend to continue to offer incentives, including economic incentives, to content creators to join our platform, and these arrangements often involve fixed payment obligations that are not contingent on actual revenue or performance metrics generated by the applicable content creator but rather are typically based on our modeled financial projections for that creator, which if not satisfied may adversely impact our financial performance, results of operations and liquidity;

• we may be unable to develop or maintain effective internal controls;

• potential diversion of management’s attention and consumption of resources as a result of acquisitions of other companies and success in integrating and otherwise achieving the benefits of recent and potential acquisitions;

• we may fail to maintain adequate operational and financial resources or raise additional capital or generate sufficient cash flows;

• we may be adversely impacted by other economic, business, and/or competitive factors;

• changes in tax rates, changes in tax treatment of companies engaged in e-commerce, the adoption of new tax legislation, or exposure to additional tax liabilities may adversely impact our financial results;

• compliance obligations imposed by new privacy laws, laws regulating social media platforms and online speech in the U.S. and Canada, or industry practices may adversely affect our business;

• compliance obligations imposed by new privacy laws, laws regulating social media platforms and online speech in the U.S. and Canada, or industry practices may adversely affect our business; and

• other risks and uncertainties indicated in this prospectus, including those under “Risk Factors” herein, and other filings that we have made or will make with the SEC.

Forward-looking statements are based on information available as of the date of this prospectus and involve a number of judgments and assumptions, known and unknown risks and uncertainties and other factors, many of which are outside the control of Rumble and its management team. Accordingly, forward-looking statements should not be relied upon as representing Rumble’s views as of any subsequent date. Rumble does not undertake any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required under applicable securities laws.

Before you invest in our securities, you should be aware that the occurrence of one or more of the events described in the “Risk Factors” section and elsewhere in this prospectus may adversely affect us.

iv

This summary highlights selected information from this prospectus and may not contain all of the information that is important to you in making an investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our consolidated financial statements and the related notes included in this prospectus and the information set forth under the heading “Risk Factors.”

Company Overview

Unless the section herein specifies otherwise, references to the “Company,” “we,” “us” or “our” are to, (a) prior to the closing of the Business Combination, either (i) CF VI or (ii) Rumble Canada, as the context may require, and (b) following the closing of the Business Combination, Rumble Inc., a Delaware corporation. Unless the section herein specifies otherwise, references to “Rumble” are to (x) prior to the closing of the Business Combination, Rumble Canada and (y) following the closing of the Business Combination, Rumble Inc., a Delaware corporation.

Our Story

Rumble was founded in 2013, back when the concept of ‘preferencing’ on the internet was simple — it was big vs. small. At that time, it was clear that big tech social video platforms were beginning to preference large creators, influencers, and brands, while leaving the small creator behind and thus, creating a market opportunity. At that time, Rumble was founded based on the premise of providing small creators with the tools and distribution that they needed to succeed.

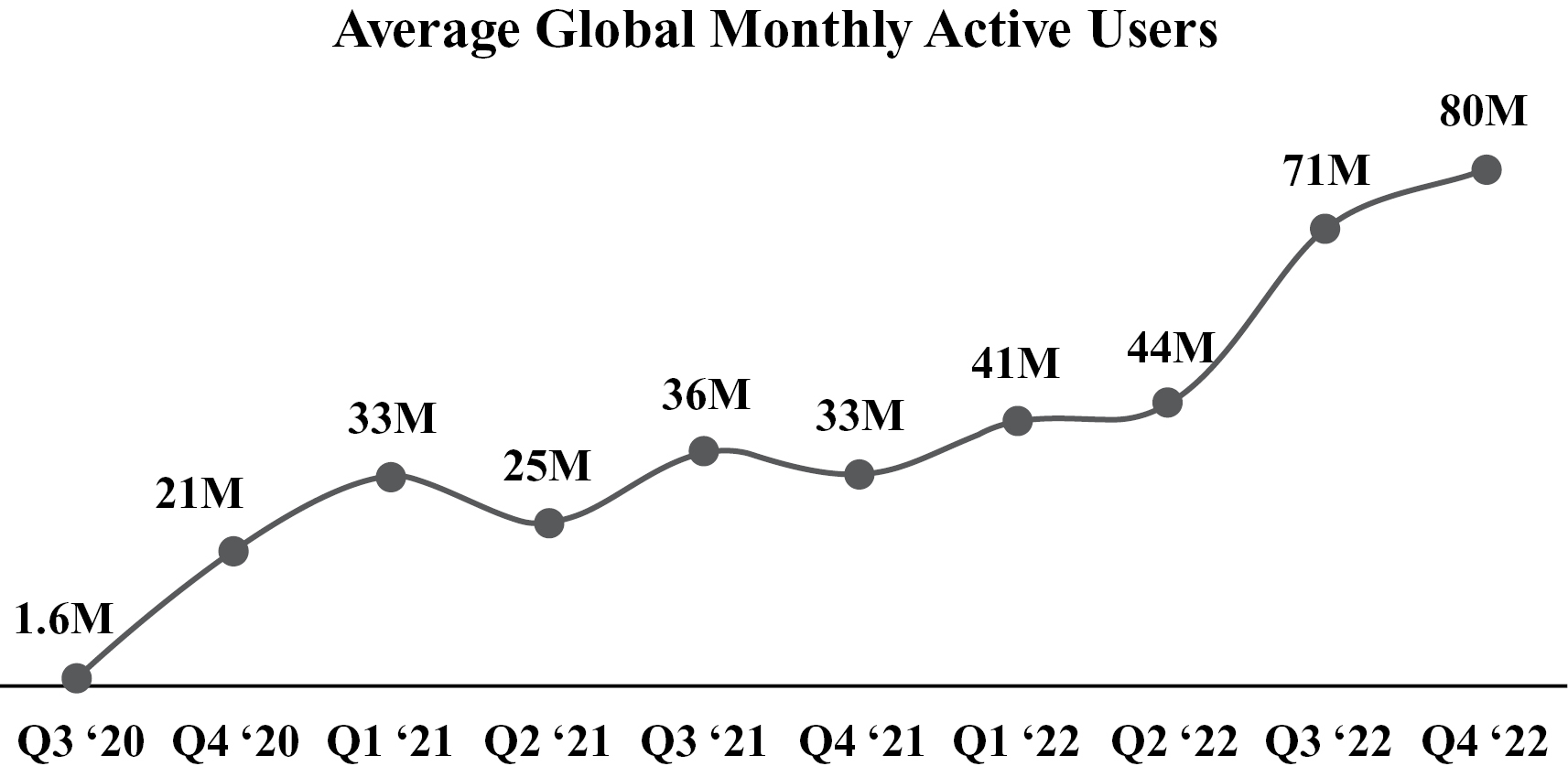

Fast forward to 2020, when a new, and much more nuanced world of ‘preferencing’ was evolving online, which included sophisticated algorithms used by the big tech incumbents for amplification and censorship. In contrast, Rumble never took the approach of black box algorithms to drive profit and, most importantly, we never moved the goal posts on content policies. This consistency and transparency, along with tailwinds from the 2020 U.S. election season, led to dramatic growth in our user base from 1.2 million monthly active users (“MAUs”) in Q2 2020 to 21 million MAUs in Q4 2020.

Soon after this, the preferencing and censorship enforced by big tech social platforms continued to expand into many other areas of content, including but not limited to the crypto-finance community and pop culture. As a result, more creators and their audiences found a new home on Rumble. These have included top creators, such as Dan Bongino, Russell Brand, Kim Iversen, Steve Will Do It, Dave Rubin, Kimberly Guilfoyle, Glenn Greenwald, Matt Kohrs, and Dana White, just to name a few. As a result, our user base has grown from 21 million MAUs in Q4 2020 to 80 million MAUs in Q4 2022, almost quadrupling in two years.

During this period of accelerated growth, Rumble announced a business combination with CF VI, a special purpose acquisition company, on December 1, 2021. The Business Combination was successfully completed on September 16, 2022, and our Class A Common Stock began trading on Nasdaq under the symbol RUM. The Business Combination and related PIPE investment provided Rumble with gross proceeds of approximately $400 million, prior to transaction expenses. This capital infusion helps Rumble compete with its big tech competitors. Ultimately, 99.9% of CF VI shareholders elected not to redeem their shares, which we believe was a strong expression of support for Rumble’s mission, its growth story to date and its future potential.

For further discussion of our key performance indicators, including definitions and explanations of the ways that management uses these metrics in managing the performance of the business, please refer to the section titled “Key Business Metrics” under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Our Growth Strategy

We are focused on the following areas in an effort to drive our growth:

Content Acquisition

Our user base and user engagement growth are directly driven by the content available on our platform. We have on-boarded several top content creators onto our platform over the last year which has enabled our significant consumption growth. Our goal is to attract even more top creators to our platform, further accelerating our platform’s

1

growth, and we have offered and intend to continue to offer incentives, including economic incentives, to content creators to join our platform. These incentives have included and may continue to include equity grants or cash payments, including arrangements under which we may agree to pay fixed compensation to content creators (in certain cases, for multiple years) irrespective of whether the actual revenue or user growth generated by the content creator on our platform meets our original modeled financial projections for that creator.

Video Product Development

Our vision is to offer the best monetization toolkit for creators on the internet. To fulfill this vision, we plan to develop a seamless integration across Rumble, Locals Technology Inc. (“Locals”) and RAC. In doing so, we strive to unlock full monetization potential across programmatic advertising, host-read ads / sponsorships, tipping, subscription and pay-per-view. We anticipate that realization of this vision will greatly accelerate creator onboarding to the platform, providing incremental value to users and advertisers, and ultimately drive platform consumption and revenue. While we continue to develop new functionality on each component of the platform, we focus on integration that will drive value to users, creators, and advertisers.

Cloud Product Development

While our Cloud infrastructure services offerings are still in early stages of development, our tentative roadmap includes: video player (player and encoding), networking, storage, and cloud services (secure, sizable compute capacity). We expect Rumble Cloud to enter the beta stage in 2023, during which we will continue to refine our go to market approach and product in preparation for an expected commercial release in 2024.

International Expansion

Historically, we have focused on growing our U.S. and Canadian user base; any historic consumption from international countries has been purely opportunistic. We anticipate boosting our international expansion once the video product and associated integrations are ready for scale across multiple languages and markets. We believe that there is a significant opportunity for a global expansion of our content, user base and revenue.

Marketing and Advertising

Users and Creators

With the significant organic growth that we experienced to date, most of our marketing efforts have been focused on amplifying earned media and accelerating the word-of-mouth momentum through creator advocacy. As a result, we have been able to build our user base and brand with relatively minimal marketing costs. In the future, we will look to build our brand across multiple audiences, driving user growth and video consumption through (1) content creator partnerships and advocacy, including by offering incentives, including economic incentives, to content creators to join our platform, (2) continued earned media strategies, and (3) increased marketing spend, primarily through digital paid media channels. Like many other major social media companies, we rely on paid advertising in order to attract users to our platform; however, we cannot be certain that all or substantially all activity that results from such advertising is genuine.

Advertisers

We currently use several third-party advertisement networks and exchanges to fill our advertisement inventory. By developing our own network, we will be in position to drive our value proposition and expand our advertiser base. In January 2022, we announced the deployment of an alpha version of RAC, our own advertising marketplace. Several advertisers have begun using the new system, and eventually, we plan for all ads on the Rumble platform to be served through this marketplace. We further expect to drive significant and differentiated value to advertisers through the development of this independent advertising marketplace.

2

Human Capital

We believe that our employees are our most significant resource. As of December 31, 2022, we had 70 full-time employees, of whom 24 were based in Canada and 46 were based in the United States. None of our employees are covered by collective bargaining agreements. We believe we have good relationships with our employees. Our human capital resources objectives include identifying, recruiting, retaining, incentivizing, and integrating our existing and additional employees. The principal purposes of our equity incentive plans are to attract, retain, and motivate key employees and directors through the granting of stock-based compensation awards.

Competition

We compete primarily with companies (many of which are much larger and more well capitalized than us) that also provide video and streaming platforms to content creators, including YouTube, Roku, TikTok, Snapchat and Facebook. We compete with these companies to attract, engage and retain users and subscribers.

Government Regulation

We are subject to domestic and foreign laws that affect companies conducting business on the Internet generally, including laws relating to the liability of providers of online services for their operations and the activities of their users.

Because we host user-uploaded content, we may be subject to laws concerning such content. In the U.S., we rely, to a significant degree, on laws that limit the liability of online providers for user-uploaded content, including the Digital Millennium Copyright Act of 1998 (DMCA) and Section 230. Countries outside the U.S. generally do not provide as robust protections for online providers and may instead regulate such entities to a higher degree. For example, in certain countries, online providers may be liable for hosting certain types of content or may be required to remove such content within a short period of time upon notice. We or our customers may also be subject to laws that regulate streaming services or online platforms, such as the EU’s Audiovisual Media Services Directive or EU Regulation 2019/1150, which regulates platform-to-business relations.

Because we receive, store and use a substantial amount of information received from or generated by our users, we are also impacted by laws and regulations governing privacy and data security in the U.S. and worldwide. Examples of such regimes include Section 5 of the Federal Trade Commission Act, the EU’s General Data Protection Regulation (GDPR), and the California Consumer Privacy Act (CCPA). These laws generally regulate the collection, storage, transfer and use of personal information.

Because our platform facilitates online payments, including subscription fees and tipping, we are subject to a variety of laws governing online transactions, payment card transactions and the automatic renewal of online agreements. In the U.S., these matters are regulated by, among other things, the federal Restore Online Shoppers Confidence Act (ROSCA) and various state laws.

As a U.S.-based company with Canadian operations, we are subject to a variety of foreign laws governing our foreign operations, as well as Canadian and U.S. laws that restrict trade and certain practices.

Product Development

With relatively limited access to capital for most of the company’s history, our product and engineering teams have worked in an environment based on efficiency and speed with a stringent focus on end-user value. With new access to capital upon consummation of the Business Combination and the ability to scale, it will be critical to maintain this culture as we look to bring new innovations to our users and creators.

Infrastructure

Guided by our overarching philosophy to technology, our business plan contemplates spending considerable resources and investment on the underlying infrastructure that supports our products, such as building out and networking multiple points of presence (PoPs) and optimizing at a scale of billions of minutes of video consumption on our platform every month to millions of users, which requires significant investments in IT equipment, servers, bandwidth and data centers and data hosting/storage. Rumble has made initial investments in 2022 and, as our business continues to grow and scale, we expect such investments to grow proportionately over time.

3

Intellectual Property

Our intellectual property includes trademarks, such as RUMBLE in the United States and Canada, pending international trademarks for RUMBLE, and a pending U.S. trademark application for LOCALS; the domain names rumble.com and locals.com; copyrights in our source code, website, apps and creative assets; and trade secrets. In addition, our platforms are powered by a proprietary technology platform. We rely on, and expect to continue to rely on, a combination of work for hire, assignment, and confidentiality agreements with our employees, consultants, and third parties with whom we have relationships, as well as trademark, trade dress, domain name, copyright, and trade secret laws to protect our brands, proprietary technology, and other intellectual property rights. We intend to continue to file additional applications with respect to our intellectual property rights.

Acquisitions

In October 2021, we bolstered our value proposition for content creators by acquiring Locals, a solution for (1) creators looking to monetize their content through subscription, and (2) for users to gain access to premium content from their favorite content creators. The acquisition was designed to accelerate our subscription revenue model and brought approximately 86,000 subscribers to our platform. Prior to our acquisition of Locals, we did not offer a consumer-facing subscription service.

Facilities

We are headquartered in Longboat Key, Florida, and maintain offices in both the United States and Canada. A number of our U.S. employees work remotely. All of our facilities are leased. We believe that our current facilities are adequate to meet our current needs. We intend to procure additional space in the future as we continue to add employees and expand geographically. We also believe that, if we require additional space, we will be able to lease additional facilities on commercially reasonable terms.

Significant Events and Transactions

As previously announced, on December 1, 2021, CF VI, and Rumble Canada entered into the Business Combination. On September 16, 2022, CF VI and Rumble Canada consummated the business combination contemplated by the BCA. In connection with the consummation of the Business Combination, CF VI changed its name from CF Acquisition Corp. VI to Rumble Inc. and Rumble Canada changed its name from Rumble Inc. to Rumble Canada Inc.

Corporate Information

Rumble Inc. is a Delaware corporation. Our principal executive offices are located at 444 Gulf of Mexico Drive, Longboat Key, Florida, 34228, and our telephone number is (941) 210-0196. Our principal website address is https://rumble.com. Information contained in, or accessible through, our website is not a part of, and is not incorporated into, this prospectus.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. These provisions include:

• presenting only two years of audited financial statements and only two years of selected financial data;

• an exemption from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002(the “Sarbanes-Oxley Act”);

• reduced disclosure about our executive compensation arrangements in our periodic reports, proxy statements, and registration statements; and

• exemptions from the requirements of holding nonbinding advisory votes on executive compensation or golden parachute arrangements.

4

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this exemption from new or revised accounting standards, and therefore, we will not be subject to the same new or revised accounting standards at the same time as other public companies that are not emerging growth companies or those that have opted out of using such extended transition period, which may make comparison of our financial statements with such other public companies more difficult. We may take advantage of these reporting exemptions until we no longer qualify as an emerging growth company or, with respect to adoption of certain new or revised accounting standards, until we irrevocably elect to opt out of using the extended transition period.

We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of the CF VI initial public offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; and (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC. We may choose to take advantage of some but not all of these reduced reporting burdens.

Controlled Company Exemption

Chris Pavlovski, our CEO and Chairman, owns 85% of our outstanding voting power for the election of directors. As a result, we are a “controlled company” within the meaning of applicable Nasdaq rules and, consequently, qualify for exemptions from certain corporate governance requirements. Our stockholders do not have the same protections afforded to stockholders of companies that are subject to such requirements. Please see the section entitled “Management — Controlled Company”.

Risk Factor Summary

The following summarizes risks and uncertainties that could adversely affect our business, cash flows, financial condition and results of operations. You should read this summary together with the detailed description of each risk factor contained in the “Risk Factors” section of this prospectus. Such risks and uncertainties include, but are not limited to:

• weakened global economic conditions, including the effects of heightened inflation, may affect our business and operating results;

• our limited operating history makes it difficult to evaluate our business and prospects;

• we may not continue to grow or maintain our active user base, and may not be able to achieve or maintain profitability;

• we may fail to maintain adequate operational and financial resources;

• we may be unsuccessful in attracting new users to our mobile and connected TV offerings;

• our traffic growth, engagement, and monetization depend upon effective operation within and compatibility with operating systems, networks, devices, web browsers and standards, including mobile operating systems, networks, and standards that we do not control;

• our business depends on continued and unimpeded access to our content and services on the internet. If we or those who engage with our content experience disruptions in internet service, or if internet service providers are able to block, degrade or charge for access to our content and services, we could incur additional expenses and the loss of traffic and advertisers;

• we face significant market competition, and if we are unable to compete effectively with our competitors for traffic and advertising spend, our business and operating results could be harmed;

• changes to our existing content and services could fail to attract traffic and advertisers or fail to generate revenue;

5

• we derive a material portion of our revenue from advertising and its relationships with a small number of key advertising networks and advertisers, the loss of which could materially harm our results of operations;

• we depend on third-party vendors, including internet service providers, advertising networks, and data centers, to provide core services;

• new technologies have been developed that are able to block certain online advertisements or impair our ability to serve advertising, which could harm our operating results;

• if our users do not continue to contribute content or their contributions are not perceived as valuable to other users, we may experience a decline in user growth, retention, and engagement on Rumble, Locals or RAC, which could result in the loss of advertisers and revenue;

• we have offered and intend to continue to offer incentives, including economic incentives, to content creators to join our platform, and these arrangements often involve fixed payment obligations that are not contingent on actual revenue or performance metrics generated by the applicable content creator but rather are typically based on our modeled financial projections for that creator, which if not satisfied may adversely impact our financial performance, results of operations and liquidity;

• we are subject to cybersecurity risks and interruptions or failures in our information technology systems and as we grow and gain recognition, we will likely need to expend additional resources to enhance our protection from such risks. Notwithstanding our efforts, a cyber incident could occur and result in information theft, data corruption, operational disruption and/or financial loss;

• spam activity, including inauthentic and fraudulent user activity, if undetected, may contribute, from time to time, to some amount of overstatement of our performance indicators;

• our management team has limited experience managing a public company;

• we collect, store, and process large amounts of user video content and personal information of our users and subscribers. If our security measures are breached, our sites and applications may be perceived as not being secure, traffic and advertisers may curtail or stop viewing our content or using our services, our business and operating results could be harmed, and we could face legal claims from users and subscribers;

• we may fail to comply with applicable privacy laws;

• we may be found to have infringed on the intellectual property of others, which could expose us to substantial losses or restrict our operations;

• we may face liability for hosting a variety of tortious or unlawful materials uploaded by third parties, notwithstanding the liability protections of Section 230;

• the incentives that we offer to certain content creators may lead to liability based on the actions of those creators;

• changes in tax rates, changes in tax treatment of companies engaged in e-commerce, the adoption of new U.S. or international tax legislation, or exposure to additional tax liabilities may adversely impact our financial results;

• compliance obligations imposed by new privacy laws, laws regulating social media platforms and online speech in the U.S. and Canada, or industry practices may adversely affect our business;

• we may face negative publicity for removing, or declining to remove, certain content, regardless of whether such content violated any law;

• our Chief Executive Officer (“CEO”) will have control over key decision making as a result of his control of a majority of the voting power of our outstanding capital stock;

6

• our CEO may be incentivized to focus on the short-term share price as a result of his interest in shares placed in escrow and subject to forfeiture pursuant to the terms of the Business Combination Agreement;

• we have incurred and will incur significant increased expenses and administrative burdens as a public company, which could have an adverse effect on our business, financial condition and results of operations; and

• substantial future sales of our Class A Common Stock by the selling holders named in this prospectus, including by holders subject to lock-up agreements after the expiration of those agreements, could cause the market price of our Class A Common Stock to decline.

7

Issuer | Rumble Inc. | |

Shares of Class A Common Stock offered by us |

| |

Shares of Class A Common Stock offered by the Selling Holders |

| |

Warrants offered by the Selling Holders |

| |

Exercise Price of Warrants | $11.50 per share, subject to adjustment as described herein. | |

Shares of Class A Common Stock Outstanding |

| |

Use of Proceeds | We will not receive any proceeds from the sale of the securities offered pursuant to this prospectus, except with respect to amounts received by us upon exercise of the Warrants offered hereby (to the extent such Warrants are exercised for cash). We intend to use any such proceeds for general corporate purposes, although we believe we can fund our operations with cash on hand. | |

Liquidity | This offering involves the potential sale of up to 341,068,989 shares of our Class A Common Stock, which represents approximately 90.9% of our total outstanding shares of Class A Common Stock on a fully diluted basis (inclusive of all shares of Class A Common Stock issuable upon exchange of ExchangeCo Shares, and which also includes shares of Class A Common Stock and ExchangeCo Shares placed in escrow pursuant to the terms of the BCA). Once the registration statement that includes this prospectus is effective and during such time as it remains effective, the Selling Holders will be permitted (subject to compliance with the contractual lock-up restrictions that apply to certain Selling Holders, as described under “Plan of Distribution”) to sell the shares registered hereby. The resale, or anticipated or potential resale, of a substantial number of shares of our Class A Common Stock may have a material negative impact on the market price of our Class A Common Stock and could make it more difficult for our shareholders to sell their shares of Class A Common Stock at such times and at such prices as they deem desirable. |

8

Market for our Securities | Our Class A Common Stock and Warrants are currently traded on The Nasdaq Global Market under the symbols “RUM” and “RUMBW”, respectively. On April 12, 2023, the closing prices of our Class A Common Stock and Warrants were $8.99 per share and $2.02 per Warrant, respectively. | |

Risk Factors | Investing in our Class A Common Stock and Warrants involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” beginning on page 10 of this prospectus. |

9

An investment in the securities offered pursuant to this prospectus involves a high degree of risk. You should carefully consider the following risk factors, in addition to the risks and uncertainties discussed above under “Cautionary Note Regarding Forward-Looking Statements,” together with all of the other information included in this prospectus or any accompanying prospectus supplement, before making an investment decision. The occurrence of one or more of the events or circumstances described in these risk factors, alone or in combination with other events or circumstances, may adversely affect our ability to realize the anticipated benefits of the Business Combination, and may have an adverse effect on our business, cash flows, financial condition and results of operations. We may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial, which may also impair our business, cash flows, financial condition and results of operations. The following discussion should be read in conjunction with our condensed consolidated financial statements and our notes to the consolidated financial statements, which are included elsewhere in this prospectus.

Risks Relating to Our Business

Weakened global economic conditions, including the effects of heightened inflation, may affect our business and operating results.

Our overall performance depends in part on worldwide economic conditions. Global financial developments and downturns seemingly unrelated to us or our industry may negatively affect us. The U.S. and other key international economies have been affected from time to time by falling demand for a variety of goods and services, restricted credit, reduced liquidity, reduced corporate profitability, weak economic growth, volatility in credit, equity and foreign exchange markets, bankruptcies, inflation and overall uncertainty with respect to the economy. Weak economic conditions or the perception thereof, or significant uncertainty regarding the stability of financial markets related to stock market volatility, inflation, recession, changes in governmental fiscal, monetary and tax policies, among others, could adversely impact our business and operating results.

More recently, inflation rates in the U.S. have been higher than in previous years, which may result in reduced consumer confidence and discretionary spending, decreased demand by advertisers for our products and services, increases in our labor and other operating costs, constrained credit and liquidity, reduced government spending and volatility in financial markets. The Federal Reserve has raised, and may again raise, interest rates in response to concerns over inflation risk. Increases in interest rates on credit and debt that would increase the cost of any borrowing that we may make from time to time and could impact our ability to access the capital markets. Increases in interest rates, especially if coupled with reduced government spending and volatility in financial markets, may have the effect of further increasing economic uncertainty and heightening these risks. In an inflationary environment, we may be unable to increase our revenues at or above the rate at which our costs increase, which could negatively impact our operating margins and could have a material adverse effect on our business and operating results. In such an environment, in which we also face significant competition from larger and well-capitalized competitors, we may experience rising costs to secure the services of top content creators. We also may experience lower than expected advertising sales and potential adverse impacts on our competitive position if there is a decrease in consumer spending.

Our limited operating history makes it difficult to evaluate our business and prospects.

We have a limited operating history, which makes it difficult to evaluate our businesses and prospects or forecast our future results. We are subject to the same risks and uncertainties frequently encountered by companies in rapidly evolving markets. Our financial results in any given quarter can be influenced by numerous factors, many of which we are unable to predict or are outside of our control, including:

• our ability to maintain and grow traffic, content uploads, and engagement;

• changes made to social media and other platforms, or changes in the patterns of use of those channels by users;

• our ability to attract and retain advertisers in a particular period;

• the number of ads shown to our traffic;

10

• the pricing of our advertising products;

• the diversification and growth of revenue sources beyond current advertising products;

• the development and introduction of new content, products, or services by us or our competitors;

• increases in marketing, sales, and other operating expenses that we may incur to grow and expand our operations and to remain competitive;

• our reliance on key vendor relationships, including our relationship with Cosmic Inc. and Kosmik Development Skopje doo (“Cosmic”) to provide content moderation and software development services, and dependence on a small number of customer relationships;

• legislation in Canada, the European Union, or other jurisdictions that forces us to change our content moderation policies and practices or make our platforms unavailable in those jurisdictions;

• our ability to maintain gross margins and operating margins; and

• system failures or breaches of security or privacy.

We may not continue to grow or maintain our active user base, may not be able to achieve or maintain profitability and may not be able to scale our systems, technology, or infrastructure effectively or grow our business at the same or similar rate as other comparable companies.

While our key performance metrics, including MAUs and minutes watched per month, have grown in recent periods, this growth rate may not be sustainable and should not be considered indicative of future levels of active viewers and future performance. In addition, Rumble may not realize sufficient revenue to achieve or, if achieved, maintain profitability. As we grow our business, our revenue growth rates may slow or reverse in future periods due to several reasons, which may include slowing demand for our service, increasing competition, a decrease in the growth of our overall market, an inability to scale our systems, technology or infrastructure effectively, and the failure to capitalize on growth opportunities or the maturation of our business. We may incur losses in the future for several reasons, including insufficient growth in the level of engagement, a failure to retain its existing level of engagement, increasing competition, the failure to continue to attract content creators with large followings, the payment of fixed payment obligations to content creators who join our platform that turn out to be unprofitable over the term of the applicable contract as a result of actual performance that does not meet our original modeled financial projections for that creator, as well as other risks described in these “Risk Factors,” and we may encounter unforeseen expenses, difficulties, complications and delays and other unknown factors. We expect to continue to make investments in the development and expansion of our business, which may not result in increased or sufficient revenue or growth, including relative to other comparable companies, as a result of which we may not be able to achieve or maintain profitability.

If we fail to maintain adequate operational and financial resources, particularly if we continue to grow rapidly, we may be unable to execute our business plan or maintain high levels of service and customer satisfaction.

We have experienced, and expect to continue to experience, rapid growth, which has placed, and may continue to place, significant demands on our management and our operational and financial resources. Our organizational structure is becoming more complex as we scale our operational, financial, and management controls, as well as our reporting systems and procedures, and expand internationally. As we continue to grow, we face challenges of integrating, developing, training, and motivating a rapidly growing employee base in our various offices in multiple jurisdictions and navigating a complex multinational regulatory landscape. If we fail to manage our anticipated growth and change in a manner that preserves the functionality of our platforms and solutions, the quality of our products and services may suffer, which could negatively affect our brand and reputation and harm our ability to attract customers.

To manage growth in our operations and personnel, we will need to continue to grow and improve our operational, financial, and management controls and our reporting systems and procedures. We will require significant capital expenditures and the allocation of valuable management resources to grow and change in these areas. Our expansion has placed, and our expected future growth will continue to place, a significant drain on our management, customer experience, research and development, sales and marketing, administrative, financial, and other resources.

11

We anticipate that significant additional investments will be required to scale our operations and increase productivity, to address the needs of our customers, to further develop and enhance our products and services, to expand into new geographic areas and to scale with our overall growth. If additional investments are required due to significant growth, this will increase our cost base, which will make it more difficult for us to offset any future revenue shortfalls by reducing expenses in the short term.

Users are increasingly using mobile devices and connected TV apps to access content within digital media and adjacent businesses, and if we are unsuccessful in attracting new users to our mobile and connected TV offerings and expanding the capabilities of our content and other offerings with respect to our mobile and connected TV platforms, our business could be adversely affected.

Our future success depends in part on the continued growth in the use of our mobile apps and platforms by our users. The use of mobile technology may not continue to grow at historical rates, users may not continue to use mobile technology to access digital media and adjacent businesses, and monetization rates for content on mobile devices and connected TV apps may be lower than monetization rates on traditional desktop platforms. Further, mobile devices may not be accepted as a viable long-term platform for several reasons, including actual or perceived lack of security of information and possible disruptions of service or connectivity. In addition, traffic on our mobile platforms may not continue to grow if we do not continue to innovate and introduce enhanced products on such platforms, or if users believe that our competitors offer superior mobile products. The growth of traffic on our mobile products may also slow or decline if our mobile applications are no longer compatible with operating systems such as iOS, Android, Windows or the devices they support. If use of our mobile platforms does not continue to grow, our business and operating results could be harmed.

Our traffic growth, engagement, and monetization depend upon effective operation within and compatibility with operating systems, networks, devices, web browsers and standards, including mobile operating systems, networks, and standards that we do not control.

We make our content available across a variety of operating systems and through websites. We are dependent on the compatibility of our content with popular devices, streaming tools, desktop and mobile operating systems, connected TV systems, web browsers that we do not control, such as Mac OS, Windows, Android, iOS, Chrome and Firefox, and mobile application stores, such as Apple’s App Store and the Google Play Store. Any changes in such systems, devices or web browsers that degrade the functionality of our content or give preferential treatment to competitive content could adversely affect usage of our content.

A significant portion of our traffic accesses our content and services through mobile devices and, as a result, our ability to grow traffic, engagement and advertising revenue is increasingly dependent on our ability to generate revenue from content viewed and engaged with on mobile devices. A key element of our strategy is focusing on mobile apps and connected TV apps, and we expect to continue to devote significant resources to the creation and support of developing new and innovative mobile and connected TV products, services and apps. We are dependent on the interoperability of our content and our apps with popular mobile operating systems, streaming tools, networks and standards that we do not control, such as the Android and iOS operating systems. We also depend on the availability of the Rumble app on mobile app stores, such as Apple’s App Store and the Google Play Store, and if our access to such stores is limited or terminated, regardless of the legitimacy of the stated reasons, our ability to reach users through our mobile app will be negatively impacted. We may not be successful in maintaining or developing relationships with key participants in the mobile and connected TV industries or in developing content that operates effectively with these technologies, systems, tools, networks, or standards. Any changes in such systems, or changes in our relationships with mobile operating system partners, handset and connected TV manufacturers, or mobile carriers, or in their terms of service or policies that reduce or eliminate our ability to distribute and monetize our content, impair access to our content by blocking access through mobile devices, make it hard to readily discover, install, update or access our content and apps on mobile devices and connected TVs, limit the effectiveness of advertisements, give preferential treatment to competitive, or their own, content or apps, limit our ability to measure the effectiveness of branded content, or charge fees related to the distribution of our content or apps could adversely affect the consumption and monetization of our content on mobile devices. Additionally, if the number of platforms for which we develop our product expands, it will result in an increase in our operating expenses. In the event that it is more difficult to access our content or use our apps and services, particularly on mobile devices and connected

12

TVs, or if our users choose not to access our content or use our apps on their mobile devices and connected TVs or choose to use mobile products or connected TVs that do not offer access to our content or our apps, or if the preferences of our traffic require us to increase the number of platforms on which our product is made available to our traffic, our traffic growth, engagement, ad targeting and monetization could be harmed and our business and operating results could be adversely affected.

Our business depends on continued and unimpeded access to our content and services on the internet. If we or those who engage with our content experience disruptions in internet service, or if internet service providers are able to block, degrade or charge for access to our content and services, we could incur additional expenses and the loss of traffic and advertisers.

Our products and services depend on the ability of users to access our content and services on the internet. Currently, this access is provided by companies that have significant market power in the broadband and internet access marketplace, including incumbent telephone companies, cable companies, mobile communications companies and government-owned service providers. Laws or regulations that adversely affect the growth, popularity or use of the internet, including changes to laws or regulations impacting internet neutrality, could decrease the demand for our products or offerings, increase our operating costs, require us to alter the manner in which we conduct our business and/or otherwise adversely affect our business. We could experience discriminatory or anti-competitive practices that could impede our growth, cause us to incur additional expense or otherwise negatively affect our business. For example, paid prioritization could enable internet service providers, or ISPs, to impose higher fees and otherwise adversely impact our business. Internationally, government regulation concerning the internet, and in particular, network neutrality, may be developing or may not exist at all. Within such an environment, without network neutrality regulations, we could experience discriminatory or anti-competitive practices that could impede both our and our customers’ domestic and international growth, increase our costs or adversely affect our business.

We face significant market competition, and if we are unable to compete effectively with our competitors for traffic and advertising spend, our business and operating results could be harmed.

Competition for traffic and engagement with our content, products and services is intense. We compete against many companies to attract and engage traffic, including companies that have greater financial resources and larger user bases, and companies that offer a variety of internet and mobile device-based content, products and services. As a result, our competitors may acquire and engage traffic at the expense of the growth or engagement of our traffic, which would negatively affect our business. We believe that our ability to compete effectively for traffic depends upon many factors both within and beyond our control, including:

• the popularity, usefulness and reliability of our content compared to that of our competitors;

• the timing and market acceptance of our content;

• the continued expansion and adoption of our content;

• our ability, and the ability of our competitors, to develop new content and enhancements to existing content;

• our ability, and the ability of our competitors, to attract, develop and retain influencers and creative talent;

• the frequency, relative prominence and appeal of the advertising displayed by us or our competitors;

• public perceptions about the predominance of certain political viewpoints on our platform, regardless of whether those perceptions are accurate;

• changes mandated by, or that we elect to make to address, legislation, regulatory constraints or litigation, including settlements and consent decrees, some of which may have a disproportionate impact on us;

• our ability to attract, retain and motivate talented employees;

• the costs of developing and procuring new content, relative to those of our competitors;

13

• acquisitions or consolidation within our industry, which may result in more formidable competitors; and

• our reputation and brand strength relative to our competitors.

We also face significant competition for advertiser spend. We compete against online and mobile businesses and traditional media outlets, such as television, radio and print, for advertising budgets. In determining whether to buy advertising, our advertisers will consider the demand for our content, demographics of our traffic, advertising rates, results observed by advertisers, and alternative advertising options. The increasing number of digital media options available, through social networking tools and news aggregation websites, has expanded consumer choice significantly, resulting in traffic fragmentation and increased competition for advertising. In addition, some of our larger competitors have substantially broader content, product or service offerings and leverage their relationships based on other products or services to gain additional share of advertising budgets. We will need to continue to innovate and improve the monetization capabilities of our websites and our mobile products in order to remain competitive. We believe that our ability to compete effectively for advertiser spend depends upon many factors both within and beyond our control, including:

• the size and composition of our user base relative to those of our competitors;

• our ad targeting capabilities, and those of our competitors;

• our ability, and the ability of our competitors, to adapt our respective models to the increasing power and significance of influencers to the advertising community;

• the timing and market acceptance of our advertising content and advertising products, and those of our competitors;

• our marketing and selling efforts, and those of our competitors;

• public perceptions about the predominance of certain political viewpoints on our platform, regardless of whether those perceptions are accurate;

• the pricing for our advertising products and services relative to those of our competitors;

• the return our advertisers receive from our advertising products and services, and those of our competitors; and

• our reputation and the strength of our brand relative to our competitors.

Changes to our existing content and services could fail to attract traffic and advertisers or fail to generate revenue.

We may introduce significant changes to our existing content. The success of our new content depends substantially on consumer tastes and preferences that change in often unpredictable ways. If this new content fails to engage traffic and advertisers, we may fail to generate sufficient revenue or operating profit to justify our investments, and our business and operating results could be adversely affected. In addition, we have launched and expect to continue to launch strategic initiatives, which do not directly generate revenue but which we believe will enhance our attractiveness to traffic and advertisers. In the future, we may invest in new content, products, services, and initiatives to generate revenue, but there is no guarantee these approaches will be successful or that the costs associated with these efforts will not exceed the revenue generated. If our strategic initiatives do not enhance our ability to monetize our existing content or enable us to develop new approaches to monetization, we may not be able to maintain or grow our revenue or recover any associated development costs and our operating results could be adversely affected.

We derive a material portion of our revenue from advertisers and their relationships with a small number of key advertising networks and other advertisers, the loss of which could materially harm our results of operations.

A material portion of our revenue is generated from a small number of advertisers. External advertising networks and other advertising partners, including publishers that are a part of our advertising network and key sponsors of host-read advertisements, may not continue to do business with us, or they may reduce the prices they are willing to pay to advertise with us, if we do not deliver ads in an effective manner, or if they do not believe

14

that their investment in advertising with Rumble will generate a competitive return relative to alternatives. If our relationship with any third-party advertiser terminates for any reason, or if the commercial terms of our relationships are changed or do not continue to be renewed on favorable terms, we would need to secure and integrate new advertising partners or expand the use of our own advertising platform, which could negatively impact its revenues and profitability.

We depend on third-party vendors, including internet service providers and data centers, to provide core services.

Although we are building our own technical infrastructure, we depend on third-party vendors, including internet service providers and data centers to, among other things, provide customer support, develop software, host videos uploaded by our users, transcode videos (compressing a video file and converting it into a standard format optimized for streaming), stream videos to viewers, and process payments. These vendors provide certain critical services to our technical infrastructure that are time-consuming and costly for us to develop independently. Outages in those services would materially affect our video services and our ability to provide cloud services. Outages may expose us to having to offer credits to subscribers, loss of subscribers, and reputational damage. We are unlikely to be able to fully offset these losses with any credits we might receive from our vendors.

Technologies that enable blocking of certain online advertisements or impair our ability to serve advertising, which could harm our operating results.

Newly developed technologies could block or obscure the display of or targeting of our content. For example, in June 2020, Apple announced plans to require applications using its mobile operating systems to obtain an end-user’s permission to track them or access their device’s advertising identifier for advertising and advertising measurement purposes, as well as other restrictions that could adversely affect our ability to serve advertising, which could harm our operating results. Additionally, some providers of consumer mobile devices and web browsers have implemented, or announced plans to implement, means to make it easier for internet users to prevent the placement of cookies or to block other tracking technologies, which could, if widely adopted, result in the use of third-party cookies and other methods of online tracking becoming significantly less effective and have a significant impact on our ability to monetize our user base.

Our future business activities in the cloud services space may revolve around a small number of key third-party service providers and a small number of customer relationships, the disruption of which could harm our operating results.

In order to build our cloud services offerings, we have entered into agreements with certain third-party service providers. The success of our future business activities in the cloud services space may depend upon such existing third-party providers, some of whom may compete with us in other lines of business. If our existing third-party service agreements terminate for any reason, or if the commercial terms of such agreements are changed or do not continue to be renewed on favorable terms, we would need to enter into new third-party service agreements, which could negatively impact our revenues, ability to attract future cloud services customers, public reputation, and profitability.

In addition, our initial cloud service offerings revolve around a small number of customer relationships, including our relationship with the Trump Media & Technology Group. If we fail to deliver our product to the desired specifications of these initial customers, or if these initial customers terminate their cloud services agreements for any reason, future customers may doubt our ability to offer cloud services, which would negatively impact our revenues, public reputation, and profitability.

The loss of key personnel, or failure to attract and retain other highly qualified personnel in the future, could harm our business.

Our success depends upon our ability to attract and retain our senior officers and to attract and retain additional qualified personnel in the future. The loss of services of members of our senior management team and the uncertain transition of new members of our senior management team may strain our ability to execute our strategic initiatives, or make it more difficult to retain customers, attract or maintain our capital support, or meet other needs of our business. We may incur significant costs to attract and retain qualified personnel, and we may lose new employees to our competitors before we realize the benefit of our investment in recruiting them. If we fail to attract

15

new personnel or if we suffer increases in costs or business operations interruptions as a result of a labor dispute, or fail to retain and motivate our current personnel, we might not be able to operate our business effectively or efficiently, serve our customers properly or maintain the quality of our content and services. We do not maintain key person life insurance policies with respect to our employees.

If our users do not continue to contribute content or their contributions are not perceived as valuable to other users, we may experience a decline in user growth, retention, and engagement on Rumble, Locals or RAC, which could result in the loss of advertisers and revenue.

Our success depends on our ability to provide Rumble users with engaging content, which in part depends on the content contributed by our users. If users, including influential users, do not continue to contribute engaging content to Rumble, our user growth, retention, and engagement may decline. That, in turn, may impair our ability to maintain good relationships with our advertisers or to attract new advertisers, which may seriously harm our business and operating results.

The loss of a material portion of our existing content creators, or our failure to recruit new providers, may materially harm our business and results of operations.

We rely on our existing content creators, and on the recruiting of new content creators. The loss of a material portion of our existing content creators could result in material harm to our business and results of operations. In the recent past, our ability to recruit and maintain content creators may have been in part due to trends in American politics, where certain commentators have sought a neutral internet platform. A change in such trends, including possible changes to competing platforms’ moderation policies that make those platforms more hospitable to a diverse range of viewpoints, could result in the loss of existing content creators or a failure to recruit new providers, which may materially harm our business and results of operations. Additionally, as we expand into international markets, we may fail to recruit new content creators in those markets, limiting our appeal to international audiences.