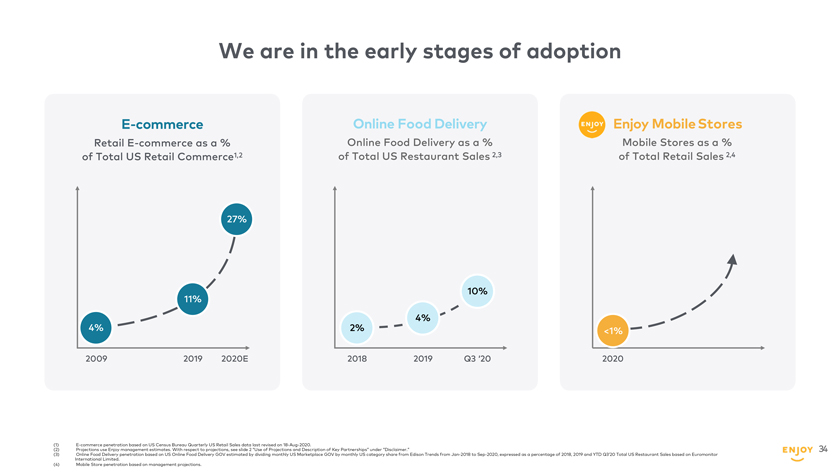

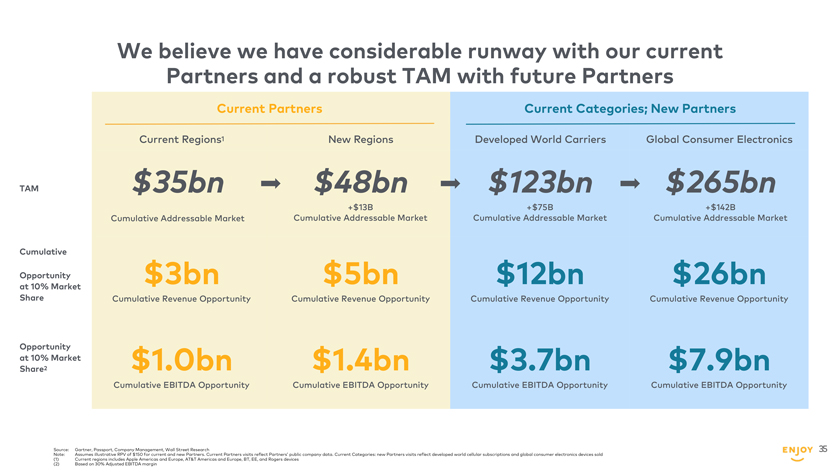

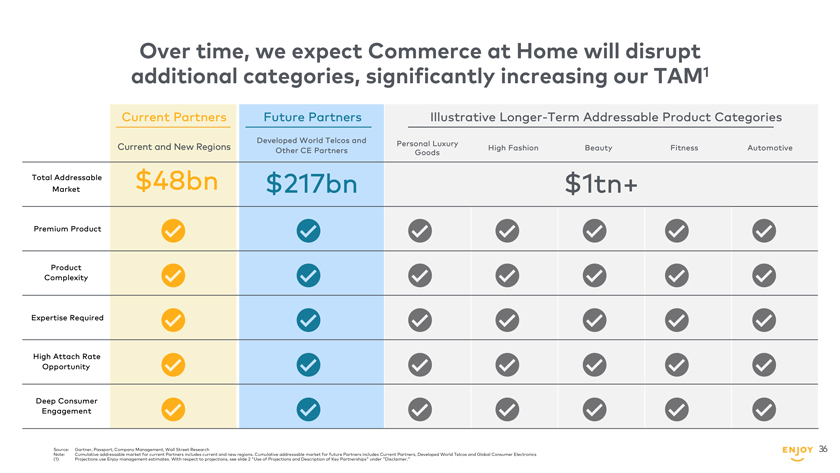

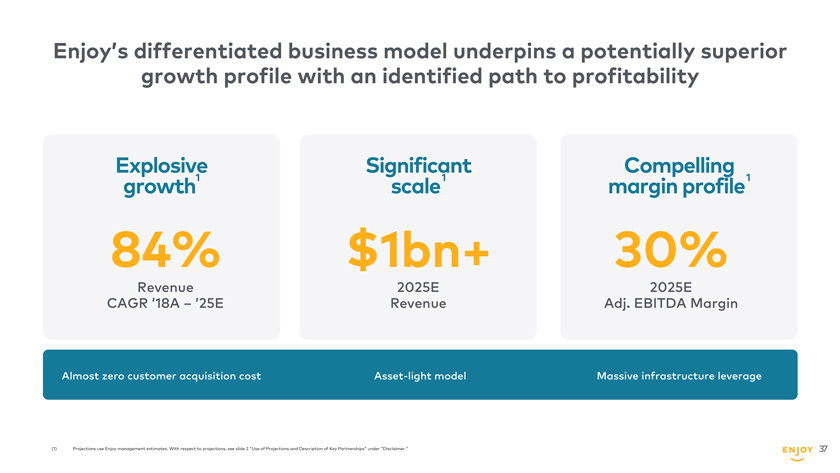

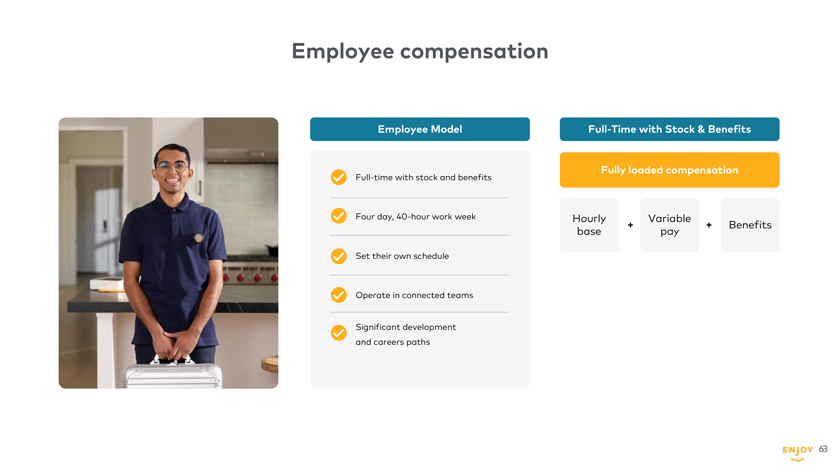

Certain Risks Related to Enjoy Technology Inc. All references to the “Company,” “Enjoy,” “we,” “us” or “our” in this presentation refer to the business of Enjoy Technology Inc. The risks presented below are certain of the general risks related to the Company’s business, industry and ownership structure and are not exhaustive. The list below has been prepared solely for purposes of the private placement transaction, and solely for potential private placement investors, and not for any other purpose. You should carefully consider these risks and uncertainties and carry out your own diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in this offering before making an investment decision. The list below is qualified in its entirety by disclosures contained in future filings by the Company, or by third parties (including MRAC.) with respect to the Company, with the United States Securities and Exchange Commission (“SEC”). These risks speak only as of the date of this presentation and we make no commitment to update such disclosure. The risks highlighted in future filings with the SEC may differ significantly from and will be more extensive than those presented below. • The COVID-19 pandemic is unprecedented and has impacted, and may continue to impact, our key metrics and results of operations in numerous ways that remain volatile and unpredictable. • We have a limited operating history with a new model and strategy for delivering product and services in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful. • We expect a number of factors to cause our results of operations to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance. • We rely on consumer discretionary spending, which is adversely affected by economic downturns, including economic recession or depression, and other macroeconomic conditions or trends. • We depend on our highly skilled employees to grow and operate our business, and if we are unable to hire, retain, manage, compensate appropriately, train, and motivate our employees, or if our employees do not perform as we anticipate, particularly in our productivity models, we may not be able to grow effectively and our business, financial condition, and results of operations could be adversely affected. • The loss of key senior management personnel could harm our business and future prospects. • The market for the mobile retail store is still in relatively early stages of growth, and if this market does not continue to grow, grow slower than we expect, or fail to grow as large as we expect, our business, financial condition, and results of operations could be adversely affected. • We are involved in and may pursue strategic relationships. We may have limited control over such relationships, and these relationships may not provide the anticipated benefits. • We are committed to expanding our services offering and enhancing the mobile retail experience, which will require significant operating expenditures, may not maximize short-term financial results and may yield results that conflict with the market’s expectations, which could result in our stock price being adversely affected. • Risks associated with our current and future partners for whom we provide services and deliver product could adversely affect our financial performance as well as our reputation and strategic partnerships. • We may be unable to source new partners or strengthen our relationships with current partners. • We rely on third-party background check providers to screen potential employees, including members of our Mobile Retail sales team (“Experts”), and if such providers fail to provide accurate information or we do not maintain business relationships with them, our business, financial condition, and results of operations could be adversely affected. • Enjoy identified material weaknesses in its internal control over financial reporting. If Enjoy is unable to remediate these material weaknesses, or if it identifies additional material weaknesses in the future or otherwise fails to maintain an effective system of internal controls, it may not be able to accurately or timely report its financial condition or results of operations, which may adversely affect Enjoy’s business and stock price. • If we are unable to maintain effective internal control over financial reporting, investors may lose confidence in the accuracy of our financial reports. • Our ability to raise capital in the future may be limited, and our failure to raise capital when needed could inhibit our growth. • Our recent growth rates may not be sustainable or indicative of our future growth. • We may not succeed in promoting and sustaining our brand or strategic partnerships, which could subject us to litigation and have an adverse effect on our reputation and harm our business. • We have a history of net losses, we anticipate increasing expenses in the future, and we may not be able to maintain or increase profitability in the future. • We may face difficulties as we expand our operations into new local markets in which we have limited or no prior operating experience. • Our global operations involve additional risks, and our exposure to these risks will increase as our business continues to expand. • Failure to adequately protect, maintain or enforce our intellectual property rights could substantially harm our business and results of operations. • Our platform utilizes open source software, and any failure to comply with the terms of these open source licenses could negatively affect our business. • Defects, errors, or vulnerabilities in our applications, backend systems or other technology systems and those of third-party technology providers, including our logistics systems and procedures, could harm our reputation and strategic partnerships and adversely impact our business, financial condition, and results of operations. • We may be subject to general litigation, regulatory disputes and government inquiries. • Our use and processing of personal information and other data is subject to laws and obligations relating to privacy, data security and data protection, and the actual or perceived failure by us or our vendors to comply with such laws and obligations could harm our business. • We may be subject to cybersecurity attacks. Any actual or perceived security or privacy breach could interrupt our operations, harm our brand, and adversely affect our reputation, brand, business, financial condition and results of operations. • Our ability to use our net operating loss carryforwards and certain other tax attributes to offset taxable income or reduce our taxes may be limited. • Enjoy may be subject to securities litigation, which is expensive and could divert management attention. • Future resales of common stock after the consummation of the proposed business combination may cause the market price of Enjoy’s securities to drop significantly, even if Enjoy’s business is doing well. • Enjoy’s business and service model are new and untested, without a proven precedent, and we may fail to achieve the degree of market acceptance by partners and consumers necessary for commercial success and meeting our financial forecast. • Our ability to scale and meet the expectations of our partners may be adversely impacted due to factors beyond our control, which could have an adverse effect on our business, reputation, financial performance, financial condition and cash flows, and could expose us to liability. • Two partners account for a significant portion of our revenue, and loss of or reduction in business from, or consolidation of, these or any other major partners could have a material adverse effect on our business, financial condition, financial performance and prospects. • Our SaaS platform relies on specific third-party logistics and mapping software and any inability to license or use such software from third parties could render our platform inoperable. • Our partners do not currently depend on a local, in-home sales team, and the development of their own sales team, rather than their reliance on Enjoy, could negatively affect our business. • Our policies, procedures and programs to safeguard the health, safety and security of our team members, customers and others may not be adequate. Any actual or alleged improper conduct by our team members, including as a result of motor vehicle accidents or the improper conduct of Experts that have in the past resulted in inquiries, legal proceedings and/or damages, may in the future expose us to legal risk and damage our reputation. • We may need additional capital to pursue our business objectives and respond to business opportunities, challenges or unforeseen circumstances, and we cannot be certain that additional financing will be available, which could limit our ability to grow and jeopardize our ability to continue our business operations. • We distribute products from a limited number of suppliers. We may experience unexpected supply shortages and may have difficulty obtaining the products that we need from suppliers as a result of unexpected demand or production difficulties that might extend lead times. Also, products may not be available to us in quantities enough to meet our customer demand. Our inability to obtain products from suppliers in sufficient quantities, or at all, could adversely affect our product offerings and our business and impact our financial forecasts