- BHIL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Benson Hill (BHIL) 425Business combination disclosure

Filed: 10 May 21, 7:39am

Filed by Star Peak Corp II pursuant to

Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Star Peak Corp II

Commission File No. 001-39835

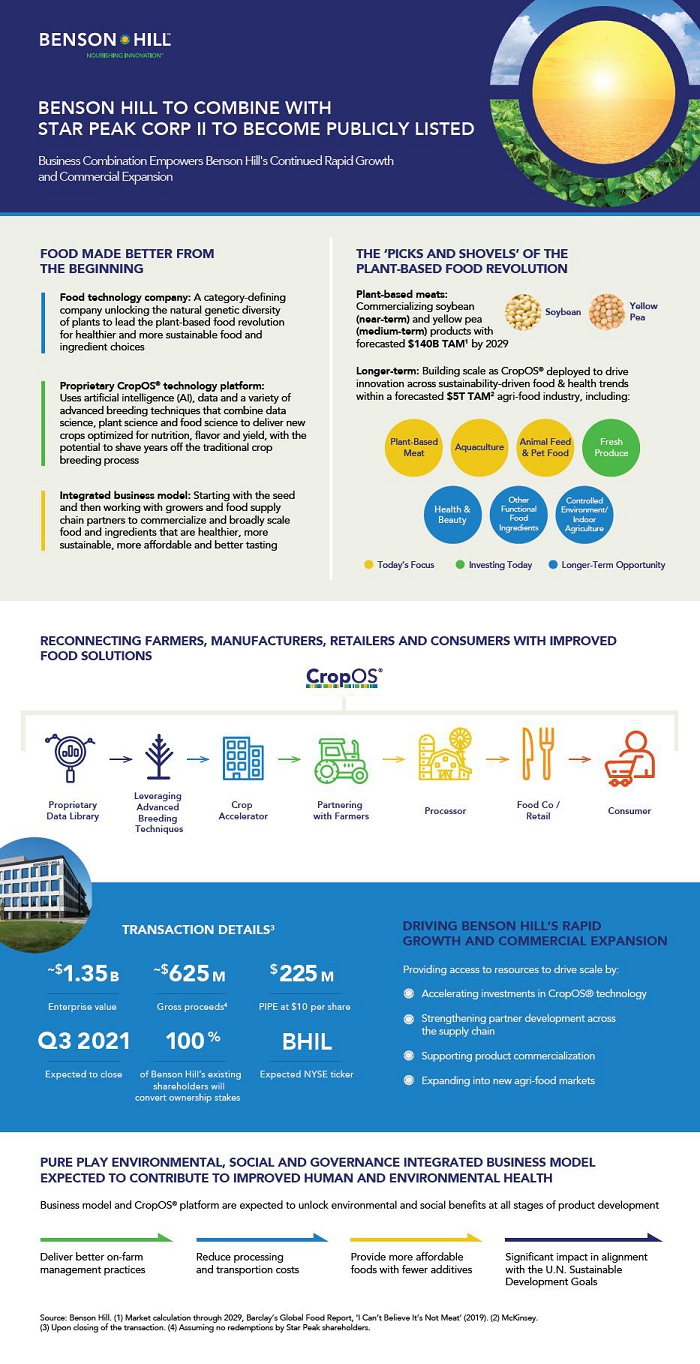

BENSON HILL TO COMBINE WITH STAR PEAK CORP II TO BECOME PUBLICLY LISTED Business Combination Empowers Benson Hill's Continued Rapid Growth and Commercial Expansion FOOD MADE BETTER FROM THE BEGINNING THE ‘PICKS AND SHOVELS’ OF THE PLANT-BASED FOOD REVOLUTION Plant-based meats: Commercializing soybean (near-term) and yellow pea (medium-term) products with forecasted $140B TAM1 by 2029 Food technology company: A category-defining company unlocking the natural genetic diversity of plants to lead the plant-based food revolution for healthier and more sustainable food and ingredient choices Yellow Pea Soybean Longer-term: Building scale as CropOS® deployed to drive innovation across sustainability-driven food & health trends within a forecasted $5T TAM2 agri-food industry, including: Proprietary CropOS® technology platform: Uses artificial intelligence (AI), data and a variety of advanced breeding techniques that combine data science, plant science and food science to deliver new crops optimized for nutrition, flavor and yield, with the potential to shave years off the traditional crop breeding process Plant-Based Meat Animal Feed & Pet Food Fresh Produce Aquaculture Integrated business model: Starting with the seed and then working with growers and food supply chain partners to commercialize and broadly scale food and ingredients that are healthier, more sustainable, more affordable and better tasting Other Functional Food Ingredients Controlled Environment/ Indoor Agriculture Health & Beauty Today’s Focus Investing Today Longer-Term Opportunity RECONNECTING FARMERS, MANUFACTURERS, RETAILERS AND CONSUMERS WITH IMPROVED FOOD SOLUTIONS Leveraging Advanced Breeding Techniques Proprietary Data Library Crop Accelerator Partnering with Farmers Food Co / Retail Processor Consumer DRIVING BENSON HILL’S RAPID GROWTH AND COMMERCIAL EXPANSION TRANSACTION DETAILS3 ~$1.35 B ~$625 M $ 225 M Providing access to resources to drive scale by: Accelerating investments in CropOS® technology Gross proceeds4 Enterprise value PIPE at $10 per share Strengthening partner development across the supply chain 100 % Q3 2021 BHIL Supporting product commercialization Expected to closeof Benson Hill’s existing shareholders will convert ownership stakes Expected NYSE ticker Expanding into new agri-food markets PURE PLAY ENVIRONMENTAL, SOCIAL AND GOVERNANCE INTEGRATED BUSINESS MODEL EXPECTED TO CONTRIBUTE TO IMPROVED HUMAN AND ENVIRONMENTAL HEALTH Business model and CropOS® platform are expected to unlock environmental and social benefits at all stages of product development Deliver better on-farm management practices Reduce processing and transportion costs Provide more affordable foods with fewer additives Significant impact in alignment with the U.N. Sustainable Development Goals Source: Benson Hill. (1) Market calculation through 2029, Barclay’s Global Food Report, ‘I Can’t Believe It’s Not Meat’ (2019). (2) McKinsey. (3) Upon closing of the transaction. (4) Assuming no redemptions by Star Peak shareholders.

IMPORTANT INFORMATION FOR INVESTORS AND STOCKHOLDERS The proposed transactions will be submitted to stockholders of Star Peak for their consideration and approval at a special meeting of stockholders. In addition, Benson Hill will solicit written consents from its stockholders for approval of the proposed transactions. In connection with the proposed transactions, Star Peak intends to file a Registration Statement on Form S-4 (the “Registration Statement”) with the SEC, which will include a proxy statement to be distributed to Star Peak stockholders in connection with Star Peak’s solicitation for proxies for the vote by Star Peak’s stockholders in connection with the proposed transactions and other matters as described in such Registration Statement, a consent solicitation statement of Benson Hill to solicit written consents from its stockholders in connection with the proposed transactions and a prospectus relating to the offer of the securities to be issued to Benson Hill’s stockholders in connection with the completion of the Merger. After the Registration Statement has been filed and declared effective, Star Peak will mail a definitive proxy statement / consent solicitation statement / prospectus and other relevant documents to its stockholders as of the record date established for voting on the proposed transactions. Investors, Star Peak’s stockholders and other interested parties are advised to read, when available, the preliminary proxy statement, and any amend-ments thereto, and the definitive proxy statement in connection with Star Peak’s solicitation of proxies for its special meeting of stockholders to be held to approve the proposed transaction because the proxy statement / consent solicitation statement / prospectus will contain important information about the proposed transaction and the parties to the proposed transaction. Stock-holders will also be able to obtain copies of the proxy statement/consent solicitation statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov or by directing a request to: Star Peak Corp II, 1603 Orrington Avenue, 13th Floor, Evanston, Illinois 60201. NO OFFER OR SOLICITATION This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. PARTICIPANTS IN THE SOLICITATION Star Peak and Benson Hill and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of Star Peak’s stockholders in connection with the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Registration Statement to be filed with the SEC by Star Peak, which will include the proxy statement/consent solicitation statement / prospectus for the proposed transaction. Information regarding the directors and executive officers of Star Peak is contained in Star Peak’s Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on March 31, 2021. FORWARD-LOOKING STATEMENTS Certain statements in this communication may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Star Peak’s or Benson Hill’s future financial or operating performance. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Star Peak and its management, and Benson Hill and its management, as the case may be, are inherently uncertain factors that may cause actual results to differ materially from current expectations include, but are not limited to: 1) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive merger agreement with respect to the business combination; 2) the outcome of any legal proceedings that may be instituted against Star Peak, the combined company or others following the announcement of the business combination and any definitive agreements with respect thereto; 3) the inability to complete the business combination due to the failure to obtain approval of the stockholders of Star Peak, to obtain financing to complete the business combination or to satisfy other conditions to closing; 4) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination; 5) the ability to meet the NYSE’s listing standards following the consummation of the business combination; 6) the risk that the business combination disrupts current plans and operations of Benson Hill as a result of the announcement and consummation of the business combina-tion; 7) the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; 8) costs related to the business combination; 9) changes in applicable laws or regulations; 10) the possibility that Benson Hill or the combined company may be adversely affected by other economic, business and/or competitive factors; 11) Benson Hill’s estimates of its financial performance; 12) the impact of the COVID-19 pandemic and its effect on business and financial conditions; and 13) other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Star Peak’s Annual Report on Form 10-K for the year ended Decem-ber 31, 2020, filed with the SEC on March 31, 2021, in the proxy statement / consent solicitation statement / prospectus relating to the proposed business combination (when available), and other documents filed or to be filed with the SEC by Star Peak. Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved. There may be additional risks that Star Peak and Benson Hill presently do not know or that Star Peak and Benson Hill currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither Star Peak nor Benson Hill undertakes any duty to update these forward-looking statements, except as otherwise required by law.

IMPORTANT INFORMATION FOR INVESTORS AND STOCKHOLDERS The proposed transactions will be submitted to stockholders of Star Peak for their consideration and approval at a special meeting of stockholders. In addition, Benson Hill will solicit written consents from its stockholders for approval of the proposed transactions. In connection with the proposed transactions, Star Peak intends to file a Registration Statement on Form S-4 (the “Registration Statement”) with the SEC, which will include a proxy statement to be distributed to Star Peak stockholders in connection with Star Peak’s solicitation for proxies for the vote by Star Peak’s stockholders in connection with the proposed transactions and other matters as described in such Registration Statement, a consent solicitation statement of Benson Hill to solicit written consents from its stockholders in connection with the proposed transactions and a prospectus relating to the offer of the securities to be issued to Benson Hill’s stockholders in connection with the completion of the Merger. After the Registration Statement has been filed and declared effective, Star Peak will mail a definitive proxy statement / consent solicitation statement / prospectus and other relevant documents to its stockholders as of the record date established for voting on the proposed transactions. Investors, Star Peak’s stockholders and other interested parties are advised to read, when available, the preliminary proxy statement, and any amend-ments thereto, and the definitive proxy statement in connection with Star Peak’s solicitation of proxies for its special meeting of stockholders to be held to approve the proposed transaction because the proxy statement / consent solicitation statement / prospectus will contain important information about the proposed transaction and the parties to the proposed transaction. Stock-holders will also be able to obtain copies of the proxy statement/consent solicitation statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov or by directing a request to: Star Peak Corp II, 1603 Orrington Avenue, 13th Floor, Evanston, Illinois 60201. NO OFFER OR SOLICITATION This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. PARTICIPANTS IN THE SOLICITATION Star Peak and Benson Hill and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of Star Peak’s stockholders in connection with the proposed transaction. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Registration Statement to be filed with the SEC by Star Peak, which will include the proxy statement/consent solicitation statement / prospectus for the proposed transaction. Information regarding the directors and executive officers of Star Peak is contained in Star Peak’s Annual Report on Form 10-K for the year ended December 31, 2020, filed with the SEC on March 31, 2021. FORWARD-LOOKING STATEMENTS Certain statements in this communication may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Star Peak’s or Benson Hill’s future financial or operating performance. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Star Peak and its management, and Benson Hill and its management, as the case may be, are inherently uncertain factors that may cause actual results to differ materially from current expectations include, but are not limited to: 1) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive merger agreement with respect to the business combination; 2) the outcome of any legal proceedings that may be instituted against Star Peak, the combined company or others following the announcement of the business combination and any definitive agreements with respect thereto; 3) the inability to complete the business combination due to the failure to obtain approval of the stockholders of Star Peak, to obtain financing to complete the business combination or to satisfy other conditions to closing; 4) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination; 5) the ability to meet the NYSE’s listing standards following the consummation of the business combination; 6) the risk that the business combination disrupts current plans and operations of Benson Hill as a result of the announcement and consummation of the business combina-tion; 7) the ability to recognize the anticipated benefits of the business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; 8) costs related to the business combination; 9) changes in applicable laws or regulations; 10) the possibility that Benson Hill or the combined company may be adversely affected by other economic, business and/or competitive factors; 11) Benson Hill’s estimates of its financial performance; 12) the impact of the COVID-19 pandemic and its effect on business and financial conditions; and 13) other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Star Peak’s Annual Report on Form 10-K for the year ended Decem-ber 31, 2020, filed with the SEC on March 31, 2021, in the proxy statement / consent solicitation statement / prospectus relating to the proposed business combination (when available), and other documents filed or to be filed with the SEC by Star Peak. Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved. There may be additional risks that Star Peak and Benson Hill presently do not know or that Star Peak and Benson Hill currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither Star Peak nor Benson Hill undertakes any duty to update these forward-looking statements, except as otherwise required by law.