First Quarter 2022 Earnings Presentation May 16, 2022 Exhibit 99.2

Disclaimers Cautionary Note Regarding Forward-Looking Statements Certain statements in this presentation may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance and may be identified by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. These forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements include, among other things, statements regarding: the Company’s currently expected guidance regarding its full year 2022 financial and operating performance including, among others, statements regarding consolidated revenues, revenues for its proprietary soy portfolio, revenues from legacy activity at the Creston facility, segment revenues, gross profit, gross margins, net loss, Adjusted EBITDA, free cash flow and cash usage; expectations regarding the sufficiency of the Company’s cash and marketable securities on hand to fund the Company into 2024; expectations regarding the Company’s hedging and other risk management strategies, including expectations about future sales and purchases that relate to the Company’s mark-to-market adjustments; the Company’s expectations regarding the demand for, and the potential advantages and expected future performance of, its products, technology and integrated business model; any financial or other information based upon or otherwise incorporating judgments or estimates relating to future performance, events or expectations; the Company’s strategies and plans for and drivers of growth; the Company’s positioning, resources, capabilities, and expectations for future performance; estimates and forecasts of financial and other performance metrics; projections of market opportunity; and the Company’s outlook and financial and other guidance. Such forward-looking statements are based upon assumptions made by Benson Hill as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, the Company’s ability to achieve anticipated benefits of new and potential relationships with third parties, and business combinations, which may be affected by, among other things, competition, the ability of the Company to grow and achieve growth profitably, including continued access to the capital resources necessary for growth; the ability to deploy capital, including capital raised in the Company’s recent PIPE transaction, in a manner that furthers Benson Hill’s growth strategy, as well as the general ability to execute the Company’s business plans and leverage its technology; risks associated with maintaining relationships with customers, suppliers and strategic partners; risks associated with the Company’s ability to successfully manage leadership and organizational changes; risks associated with retaining key members of its management team, as well as the general ability to execute the Company’s business plans; industry conditions, including fluctuations in supply, demand and prices for agricultural commodities; the effects of weather conditions and the outbreak of crop disease on our business; global and regional economic, agricultural, financial and commodities market, political, social and health conditions; the effectiveness of our risk management strategies; risks associated with the Company’s transition to becoming a public company; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s filings with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Forward-looking statements are also subject to the risks and other issues described below under “Use of Non-GAAP Financial Measures,” which could cause actual results to differ materially from current expectations included in the Company’s forward-looking statements included in this presentation. The forward-looking statements included in this presentation are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved, including without limitation any expectations about our operational and financial performance or achievements through and including 2024. There may be additional risks about which the Company is presently unaware or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company anticipates that subsequent events and developments will cause its assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, it expressly disclaims any duty to update these forward-looking statements, except as otherwise required by law. Use of Non-GAAP Financial Measures In this presentation, the Company includes non-GAAP performance measures. The Company uses these non-GAAP financial measures to facilitate management's financial and operational decision-making, including evaluation of the Company’s historical operating results. The Company’s management believes these non-GAAP measures are useful in evaluating the Company’s operating performance and are similar measures reported by publicly listed U.S. competitors, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company's operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends affecting the Company’s business. By providing these non-GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s performance for the periods presented. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The Company's definition of these non-GAAP measures may differ from similarly titled measures of performance used by other companies in other industries or within the same industry. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company's reported results of operations, management strongly encourages investors to review the Company's consolidated financial statements and publicly filed reports in their entirety. A reconciliation of the non-GAAP financial measure to the most directly comparable GAAP financial measure is included in this presentation and in the tables accompanying this presentation.

FIRST QUARTER 2022 HIGHLIGHTS • Technology innovation and integrated go-to-market model uniquely positions Benson Hill in the sustainable food and plant-based food markets • Dynamic market conditions and macro tailwinds driving demand for Benson Hill’s proprietary soy portfolio • Building on the momentum achieved in 2021, first quarter performance was in line with expectations • Cash and marketable securities on hand were in line with the Company’s plan to fund the business into 2024 • Reaffirm 2022 guidance

Existing food system has no feedback from consumer back to seed breeder Disconnected, Different Objectives and Too Slow High yield Breeder, Seed Producer, Farmer Consistency & cost Processor/ Wholesale Supplier Cost and flavor (processing & additives) Food, Beverage Co Cheap, convenientConsumer Benson Hill connects data across the value chain to create Made from Better™ ingredients Connected, Shared Objectives and Designed for Consumer Affordable, less processed Flavorful & healthy Affordable, flavorful and functionality from ingredient Affordable, flavorful, healthySeed Designed for Consumer

3-step technology strategy unlocks the natural genetic diversity in plants Connecting data across the value chainGenomics is a proven lever for innovation CropOS® technology stack

Market dynamics and macro tailwinds help to drive and even accelerate demand for Benson Hill’s innovative products ACCELERATING FOOD INFLATION ENVIRONMENTAL IMPACT OF THE FOOD SYSTEM FOOD SUPPLY CHAIN DISRUPTION FOOD-DRIVEN HEALTH IMPLICATIONS

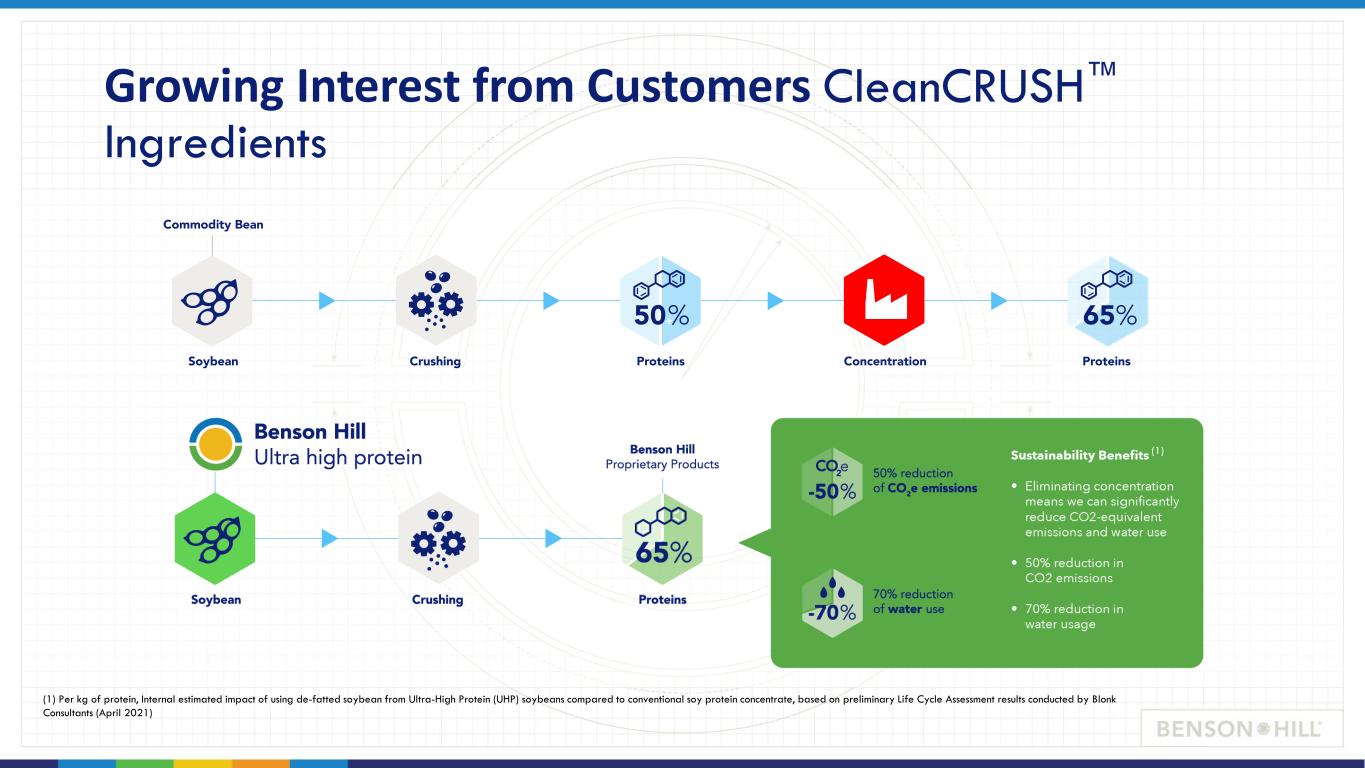

Growing Interest from Customers CleanCRUSH™ Ingredients (1) Per kg of protein, Internal estimated impact of using de-fatted soybean from Ultra-High Protein (UHP) soybeans compared to conventional soy protein concentrate, based on preliminary Life Cycle Assessment results conducted by Blonk Consultants (April 2021) (1)

First Quarter 2022 Financial Highlights Q1 2022 (in $M) Reported Versus Q1 2021 Impact of Open Mark- to-Market Timing Differences(2) Excl Open Mark-to- Market Timing Differences(2) Revenues $92.4 +191% $5.0 $97.4 Ingredients $66.1 +365% $5.0 $71.1 Fresh $26.3 +50% $ -- $26.3 Gross (loss) profit $(5.2) $(5.8) $8.2 $3.0 Operating Expense $35.4 +$14.6 $ -- $35.4 Total Adjusted EBITDA $(28.8)(1) $(14.0) $8.2 $(20.7) Capex $3.4 $(10.4) $ -- $3.4 Free Cash Flow $(56.6) $(15.3) $ -- $(56.6) Cash and Marketable Securities as of 3/31/22 $209.9 (1) See reconciliation table in the appendix (2) Management is presenting the impact of mark-to-market timing differences to show the underlying operating performance during the quarter. The net temporary unrealized period-end loss was $8.2 million. The impact on revenues and cost of sales was $5.0 million and $3.2 million, respectively. Management expects the loss to reverse primarily in the second and third quarters of 2022. S oybean C ommodity P rice R isk Management • Mark-to-market hedging losses of $8.2M are timing differences related to physical asset transactions in future periods • Expect these hedging losses to be offset by higher sales prices when physical asset transactions are completed, primarily in Q2 and Q3 of this year

2022 Financial Outlook (in $M) 2022 (Original Guidance)(1) 2022 (Current Guidance) Total Revenue $161 $315-$350 Ingredients $91 $250-$275 Fresh $66 $65-$75 Total Gross Profit $2 $9-$13 Opex $111 $135-$140(2) Total Adjusted EBITDA ($87) ($80-$85)(3) Capex $41 $12-$16 Free Cash Flow N/A ($120-$130)(3) 2022 Expectations Revenue • >100% year-over-year growth • Total and organic Ingredients revenue growth of >175% and >65%, respectively, driven by: − $90-$100mm legacy revenue from Creston acquisition − $70-$80mm proprietary soy ingredients revenue Gross margin improvement • Expanded soy portfolio and reduction in tolling costs, partially offset by compressed margins in Fresh segment Focus on free cash flow by disciplined Capex investment, cash operating expenses and working capital usage Creston acquisition accelerates integrated capability to commercialize proprietary soybean portfolio and reduces Capex requirements (1) Guidance at time of SPAC merger announcement (May 2021). (2) Includes an estimated $36 million in non-cash expense consisting of $21 million for stock-based compensation and $15 million for depreciation and amortization. (3) See reconciliation table in the appendix.

Why Benson Hill wins Data advantage ~2-3 yearsLimited or no protein data Business model ~3 yearsTraditional, siloed business model Substantial scale ~3 yearsLimited or no quality focus ~2-3 yearsR&D advantage Limited or no protein testing Minimum 6-10 Years Advantage With Multiple Differentiators Time advantage Others AdvantageBenson Hill Proprietary protein data yield & agronomic data Genomic data Expression data AI predictions Beyond farm gate Ingredient model 200k acres contracted to date Significant AI-breeding World-leading ultra-high protein & high yield commercial germplasmNo commercial ultra-high protein germplasm ~6-10 years Source: Benson Hill internal estimates

OUR TECHNOLOGY APPENDIX

Consolidated Statements of Operation (In Thousands, Except Per Share Information) Three Months Ended March 31, 2022 2021 Revenues $ 92,445 $ 31,802 Cost of sales 97,667 31,233 Gross (loss) profit (5,222) 569 Operating expenses: Research and development 12,306 7,127 Selling, general and administrative expenses 23,124 13,733 Total operating expenses 35,430 20,860 Loss from operations (40,652) (20,291) Other (income) expense: Interest expense, net 6,388 1,258 Change in fair value of warrants (31,741) 1,016 Other income, net 1,316 (218) Total other (income) expense, net (24,037) 2,056 Net loss before income tax (16,615) (22,347) Income tax (benefit) expense (39) — Net loss $ (16,576) $ (22,347) Net loss per common share: Basic and diluted loss per common share $ (0.10) $ (0.21) Weighted average shares outstanding: Basic and diluted weighted average shares outstanding 160,711 108,757

Consolidated Balance Sheet (In Thousands USD) March 31, December 31, 2022 2021 (Unaudited) Assets Current assets: Cash and cash equivalents $ 103,977 $ 78,963 Marketable securities 105,934 103,689 Accounts receivable, net 34,818 31,729 Inventories, net 54,700 48,724 Prepaid expenses and other current assets 20,687 20,253 Total current assets 320,116 283,358 Property and equipment, net 126,696 126,885 Right of use asset, net 74,521 77,452 Goodwill and intangible assets, net 43,181 42,664 Other assets 4,514 4,538 Total assets $ 569,028 $ 534,897 March 31, December 31, 2022 2021 (Unaudited) Liabilities and stockholders’ equity Current liabilities: Accounts payable $ 31,171 $ 35,508 Revolving line of credit 1,857 47 Current lease liability 2,490 2,422 Current maturities of long -term debt 14,178 6,934 Accrued expenses and other current liabilities 21,484 26,771 Total current liabilities 71,180 71,682 Long-term debt 75,696 77,170 Long-term lease liability 78,357 79,154 Warrant liabilities 36,809 46,051 Conversion option liability 12,888 8,783 Deferred tax liabilities 287 294 Other non-current liabilities 317 316 Total liabilities 275,534 283,450 Stockholders’ equity: Redeemable convertible preferred stock, $0.0001 par value; 1,000 and 1,000 shares authorized, 0 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively — — Common stock, $0.0001 par value, 440,000 and 440,000 shares authorized, 205,069 and 178,089 shares issued and outstanding as of March 31, 2022 and December 31, 2021, respectively 21 18 Additional paid-in capital 594,345 533,101 Accumulated deficit (297,145) (280,569) Accumulated other comprehensive loss (3,727) (1,103) Total stockholders’ equity 293,494 251,447 Total liabilities and stockholders’ equity $ 569,028 $ 534,897

Consolidated Statement of Cash Flows (In Thousands USD) Three Months Ended March 31, 2022 2021 Operating activities Net loss $ (16,576) $ (22,347) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 5,404 2,591 Stock-based compensation expense 5,683 647 Bad debt expense 156 — Change in fair value of warrants and conversion option (31,741) 1,016 Accretion and amortization related to financing activities 2,907 344 Other 4,026 81 Changes in operating assets and liabilities: Accounts receivable (3,245) (3,980) Inventories (5,054) (2,508) Prepaid expenses and other current assets (540) (4,231) Accounts payable (7,540) 641 Accrued expenses (6,672) 203 Net cash used in operating activities (53,192) (27,543) Investing activities Purchases of marketable securities (84,991) (34,666) Proceeds from maturities of marketable securities 4,575 1,755 Proceeds from sales of marketable securities 73,196 76,064 Payments for acquisitions of property and equipment (3,360) (13,713) Payment made in connection with business acquisitions (1,034) — Net cash (used in) provided by investing activities (11,614) 29,440 Three Months Ended March 31, 2022 2021 Financing activities Principal payments on debt (1,316) (618) Proceeds from issuance of debt 4,078 — Borrowing under revolving line of credit 5,726 6,676 Repayments under revolving line of credit (3,916) (2,352) Repayments of financing lease obligations (290) (85) Payment of deferred offering costs — (408) Contributions from PIPE Investment, net of transaction costs of $18 84,967 — Proceeds from the exercise of stock options and warrants 636 52 Net cash provided by financing activities 89,885 3,265 Effect of exchange rate changes on cash (65) (71) Net increase in cash and cash equivalents 25,014 5,091 Cash and cash equivalents, beginning of period 78,963 9,743 Cash and cash equivalents, end of period $ 103,977 $ 14,834 Supplemental disclosure of cash flow information Cash paid for taxes $ — $ — Cash paid for interest $ 2,473 $ 1,488 Supplemental disclosure of non-cash activities PIPE Investment issuance costs included in accrued expenses and other current liabilities $ 4,143 $ — Purchases of property and equipment included in accounts payable and accrued expenses and other current liabilities $ 3,104 $ 802 Purchases of inventory included in accounts payable and accrued expenses and other current liabilities $ 2,776 $ —

First Quarter 2022 Segment Information and Non-GAAP Reconciliation Adjustments to reconcile consolidated net loss to Adjusted EBITDA: (In Thousands USD) The Company defines and calculates adjusted EBITDA as consolidated net loss before net interest expense, income tax provision and depreciation and amortization, further adjusted to exclude stock-based compensation, and the impact of significant non-recurring items. Three Months Ended March 31, 2022 Revenue Adjusted EBITDA Ingredients 66,074 (14,783) Fresh 26,319 2,228 Unallocated and other 52 (16,293) Total segment results $ 92,445 $ (28,848) Consolidated net loss $ (16,576) Interest expense, net 6,388 Income tax expense (benefit) (39) Depreciation and amortization 5,404 Stock-based compensation 5,683 Change in fair value of warrants and conversion option (31,741) Other nonrecurring costs, including acquisition and integration costs 18 Non-recurring SOX readiness costs 212 PIPE Investment transaction costs 705 Severance expense 165 Fresh segment restructuring expense 933 Total Adjusted EBITDA $ (28,848)

2022 Non-GAAP Reconciliations Adjustments to reconcile estimated 2022 Adjusted EBITDA (In Thousands USD) Consolidated net loss $ (148,000) – (153,000) Interest expense, net 23,000 Depreciation and amortization 23,000 Stock-based compensation 21,000 Other non-recurring costs 1,000 Total Adjusted EBITDA $ (80,000) – (85,000) Consolidated net loss $ (148,000) - $ (153,000) Depreciation and Amortization 23,000 23,000 Stock-Based Compensation 21,000 21,000 Changes in Working Capital (9,000) - (10,000) Other 5,000 5,000 Net cash used in operating activities $ (108,000) - $ (114,000) Payments for acquisitions of property and equipment (12,000) - (16,000) Free cash flow $ (120,000) - $ (130,000) Adjustments to reconcile estimated 2022 Free Cash Flow