2023 INVESTOR DAY EXPERIENCE THE FUTURE OF FOOD Exhibit 99.2

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 7:30 AM CT: Technology tour to ground you on our approach to seed genomics (for those first-time visitors that have requested this in their RSVP). 8:15 AM CT: Guests arrive, check in, and have a light breakfast/coffee. 9:30 AM CT: Live management presentations (which will also be webcast) to review our strategy, technology lead, product pipeline update, operational excellence, international strategy, and our path to profitability in 2025. 4:00 PM CT: A panel discussion centered on sustainability featuring current customers. 4:45 PM CT: A reception with Benson Hill management and subject matter experts to end the day with healthy dialogue and direct conversations. 6:30 PM CT: Guests depart. Noon CT: A deeper dive into four areas through case studies and live demos (in-person only): 1. CropOS® & Crop Accelerator: Optimizing the value of the meal and oil - all in one soybean. 2. Aquaculture & Farmer Partners: Leveraging CropOS to bring value-added soy meal products to the high-end salmon and trout markets. 3. Yellow pea & Food Science: Next proprietary crop and leveraging Food Science to provide unique data layers of information that CropOS uses for next-generation products. 4. Food Tasting: A culinary delight as we offer examples from the wide breadth of plant- based products powered by our soy portfolio. 2023 Investor Day Agenda

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 JASON BULL CHIEF TECHNOLOGY OFFICER BRUCE BENNETT PRESIDENT, INGREDIENTS DEAN FREEMAN CHIEF FINANCIAL OFFICER MATT CRISP CHIEF EXECUTIVE OFFICER ANDRES MARTIN EVP AND GENERAL MANAGER, INTERNATIONAL

Disclaimers CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS Certain statements in this presentation may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or the future financial or operating performance of Benson Hill Inc. (the “Company” or “Benson Hill”) and may be identified by words such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” or similar words. These forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements include, among other things, statements regarding plans to improve the Company’s capital structure and liquidity position; management’s strategy and plans for growth, including those intended to lower the cost of capital, increase return on capital and reduce costs; the Company’s current guidance regarding certain expected 2023 financial and operating results, including consolidated and proprietary revenues, consolidated gross profit, operating expense, net loss, Adjusted EBITDA, capital expenditures and free cash flow loss; plans to retire the Company’s existing debt early and replace it with a conventional lending facility; plans to raise capital using the Company’s existing shelf registration statement or through an alternative form of equity financing; plans to explore strategic options for the Company’s Seymour, Indiana facility; anticipated beneficiates of the Company’s existing and potential future strategic partnerships; the Company’s plans to fund the business to profitability in 2025; expectations regarding the sources of expected consolidated revenue and gross profit growth, including enhanced focus on higher margin product categories; the Company’s positioning, resources, capabilities, and expectations for future performance; management’s strategies and plans for growth; and projections of consumer preferences, industry trends and market opportunity. Factors that may cause actual results to differ materially from current expectations include, but are not limited to risks associated with the Company’s inability to improve its capital structure and liquidity position, or otherwise fail to execute on management’s plans to lower the cost of capital, increase return on capital and reduce costs; the risk that the Company’s actions intended to fund the business to profitability in 2025 will be insufficient to achieve such objective; risks associated with the Company’s ability to grow and achieve growth profitably, including continued access to the capital resources necessary for growth; the risk that the Company will be unable retire any of its existing or enter into a new lending facility in a timely manner, on favorable terms, or at all; the risk that the Company will fail to realize the anticipated benefits of its existing shelf registration statement, including at-the-market facility, or otherwise fail to raise equity capital to supplement its cash needs; risks relating to potential dilution; the risk that the Company will not complete and realize the anticipated benefits of the divestiture of the Fresh business a timely manner or at all; risks associated with managing capital resources; risks associated with maintaining relationships with customers and suppliers and developing and maintaining partnering and licensing relationships; risks associated with changing industry conditions and consumer preferences; risks associated with the Company’s ability to generally execute on its business strategy; risks associated with the effects of global and regional economic, agricultural, financial and commodities markets; risks associated with the Company’s transition to becoming a public company; the effectiveness of the Company’s risk management strategies; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in our filings with the SEC, which are available on the SEC’s website at www.sec.gov. Nothing in this press release should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward looking statements will be achieved, including without limitation, any expectations about our operational and financial performance or achievements through and including 2025. There may be additional risks about which the Company is presently unaware or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company expressly disclaim any duty to update these forward-looking statements, except as otherwise required by law. USE OF NON-GAAP FINANCIAL MEASURES In this presentation, the Company includes references to non-GAAP performance measures. The Company uses these non-GAAP financial measures to facilitate management’s financial and operational decision- making, including evaluation of the Company’s historical operating results. The Company’s management believes these non-GAAP measures are useful in evaluating the Company’s operating performance and are similar measures reported by publicly listed U.S. competitors, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends affecting the Company’s business. By referencing these non-GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s performance for the periods presented. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The Company’s definition of these non-GAAP measures may differ from similarly titled measures of performance used by other companies in other industries or within the same industry. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in their entirety. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the tables accompanying this presentation.

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 WHY BENSON HILL WINS MATT CRISP CEO AND DIRECTOR

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Others Advantage Source: Benson Hill internal estimates as of April 2022 Time Advantage World-leading ultra-high protein & high yield commercial germplasm No commercial ultra-high protein germplasm ~6-10 years R&D Advantage Limited or no protein testing Significant AI-breeding ~2-3 years Data Advantage Limited or no protein data Proprietary protein data yield & agronomic data Genomic data Expression data AI predictions ~2-3 years Business Model Traditional, siloed business model Beyond farm gate Ingredient model ~3 years Substantial Scale Limited or no quality focus ~200k acres contracted through 2022 ~3 years Estimated 6-10 Years Advantage With Multiple Differentiators Why Benson Hill Wins

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Sources: 1 Zintinus, Bain & Co. “Food Tech: Turning Promise into Opportunity”, JUNE 2022 2 Good Food Institute, Plant-Based Meat for a Growing World 3 Henchion et. al, “Future Protein Supply and Demand”, Foods 2017, 6, 53; doi:10.3390/foods6070053 Innovation is Key to Deliver Nutrition Security and Global Climate Goals We need to increase food production globally by 50% to feed 10 billion people by 2050, based on 2009 benchmark1 50% Up To 70% Agriculture emissions could reach 4x by 2050, missing our chance at a 2°C level world1 4x Plant-based protein alternatives use 47%–99% less land, emit 30%–90% less GHG, use 72%– 99% less water2 30-90% Protein needs to increase by up to 78% to keep up with exponential demand3

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Current Trends Amplify the Need for Innovation PERSISTENT INFLATION ENVIRONMENTAL IMPACT OF FOOD SUPPLY CHAIN DISRUPTION FOOD-DRIVEN HEALTH IMPLICATIONS 8

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 CONSUMER FOOD COMPANY REGULATION SEC Climate Disclosure (Q2’23 estimated) Consistent and specific GHG emissions reporting EU CSRD (begin ‘23) Consistent and specific ESG reporting Clear and material link between ESG-related claims and consumer spending1 6.4% CAGR for retail products with ESG-related claims, a +1.7% difference over products without them1 55% of consumers are more likely to purchase a packaged food labeled with a sustainability claim3 86% of top 50 food companies disclose their GHG emissions2 ~70-80% of GHG emissions of top 50 food companies are Scope 32 Brands with more sales from ESG- related product claims enjoy greater loyalty1 Sources: 1 McKinsey, 2023, Consumers Care about Sustainability 2 Hansen, 2022, Status of GHG Reporting in Food Sector 3 Cargill, 2022, FATitude Survey Increasing Societal Pressure to Address Negative Environmental Externalities

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Shifting from Food Security to Nutrition Security Helps Scale Value-Added Markets 10 PLANT-BASED PROTEIN • Market expected to broaden, with diverse applications • Soy & yellow pea are versatile and powerful • Processing is a drawback AQUACULTURE • Fast-growing food production sector • Feed is primary cost & environmental impact • Soy carbohydrates affect gut health • EU moving toward deforestation-free products SPECIALTY OIL • Consumers demand heart-healthy1 omega-9 fatty acids • Must be superior for cooking • Progressive grocers want local, seed-to- shelf solutions 1 Supportive but not conclusive scientific evidence suggests that daily consumption of about 1½ Tbsps (20g) of oils containing high levels of oleic acid, when replaced for fats and oils higher in saturated fat, may reduce the risk of coronary heart disease. To achieve this possible benefit, oleic acid-containing oils should not increase the total number of calories you eat in a day. One serving of high oleic soybean oil provides 10g of oleic acid (which is 11g of monounsaturated fatty acid).

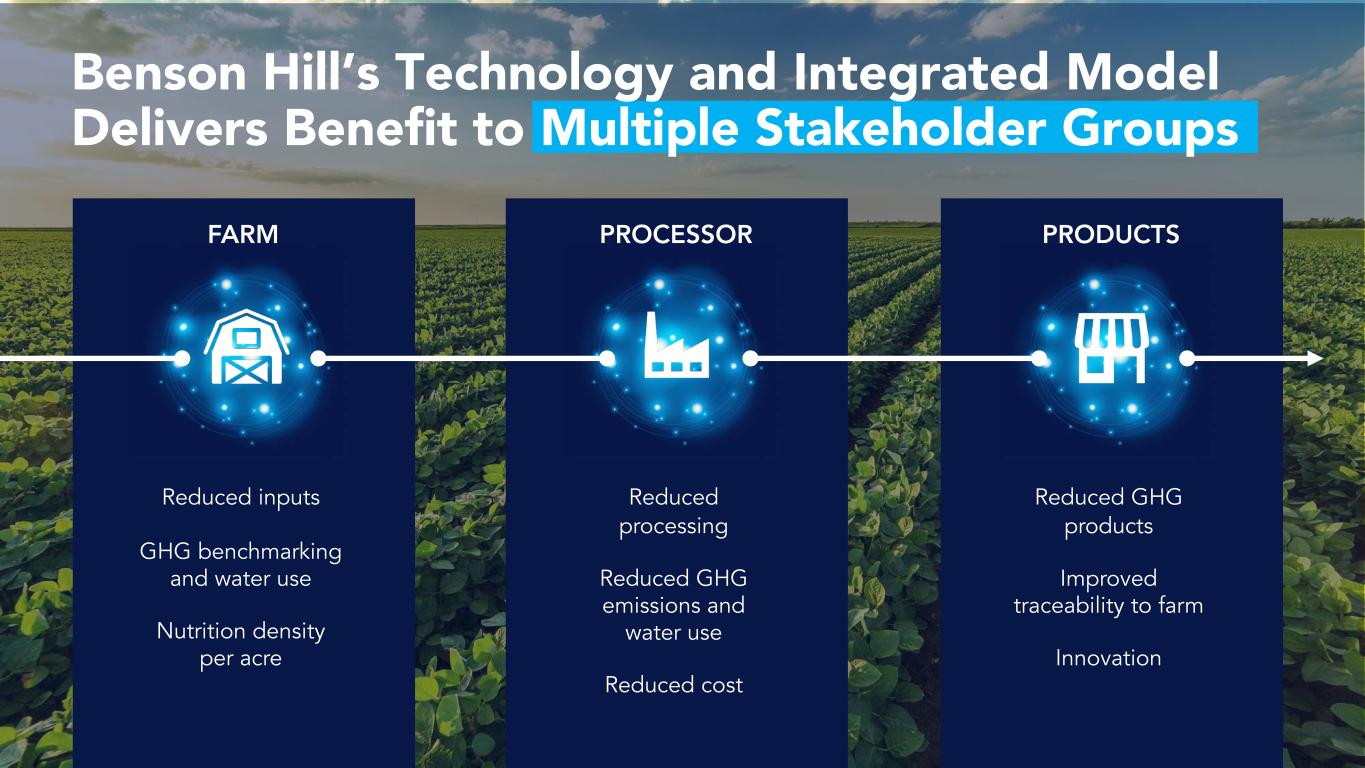

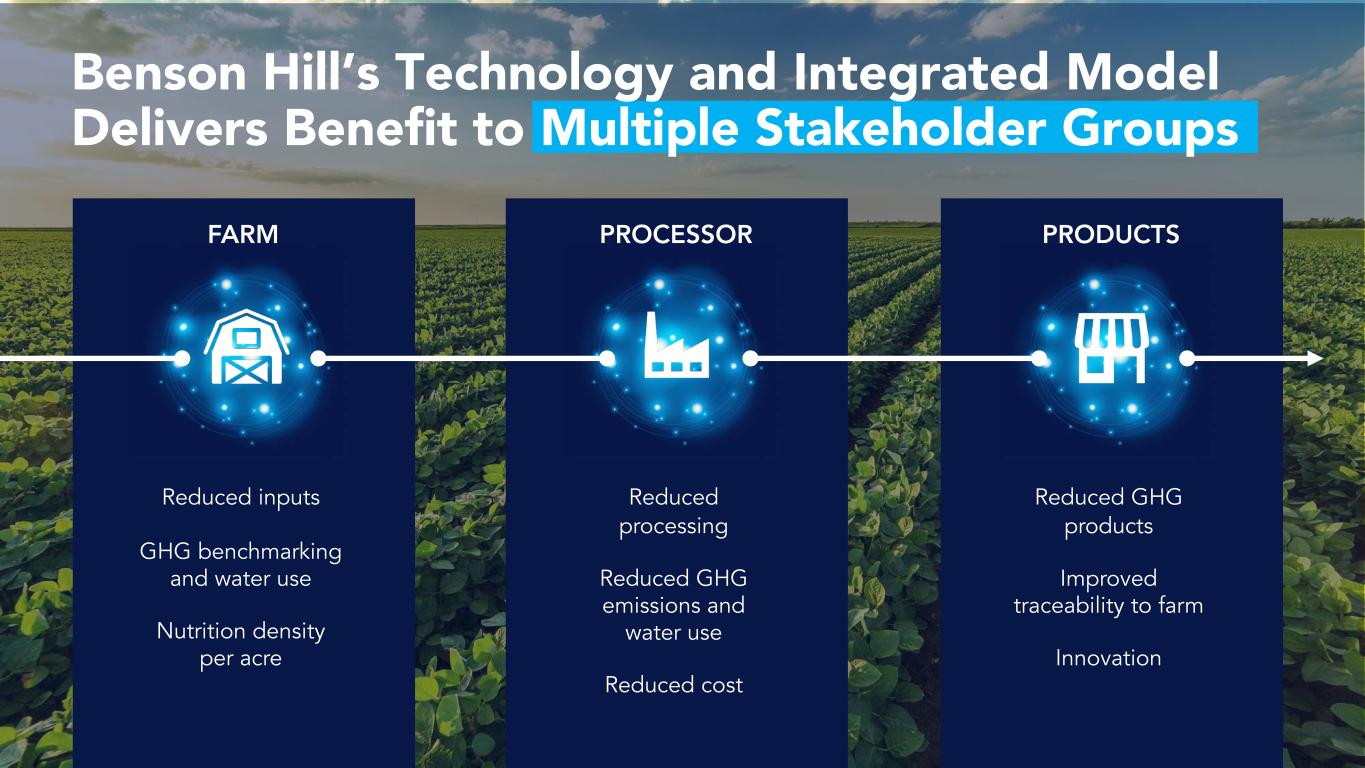

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Benson Hill’s Technology and Integrated Model Delivers Benefit to Multiple Stakeholder Groups PROCESSOR Reduced processing Reduced GHG emissions and water use Reduced cost FARM Reduced inputs GHG benchmarking and water use Nutrition density per acre PRODUCTS Reduced GHG products Improved traceability to farm Innovation

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 "I appreciate a company breeding for things beyond yield, and protein is an important quality trait overlooked by other companies. I'm happy to celebrate my 4th year growing Benson Hill varieties in 2023.” HENRY BUELL | BUELL FARMS TERRE HAUTE, INDIANA 12 "We've converted our entire operation to Benson Hill because we want to be a part of something bigger and something better – all while bringing value back to the farm." REID WEILAND | WEILAND FARMS GARNER, IOWA Partnerships with Farmers Lead to Scale

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Abundant and Diverse Market Opportunities TODAY FUTURE MEAT ALTERNATIVES AQUACULTURE SPORTS NUTRITION ANIMAL FEED PET FOOD SNACKS CEREALS EDIBLE OILS BAKED GOODS PROCESSED MEAT DAIRY ALTERNATIVES SPECIALTY FEED

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 FOOD SCIENCE DATA SCIENCE PLANT SCIENCE 170 R&D team members with diverse expertise: ~ Genomics Human Nutrition Data Analytics Food Engineering Plant Breeding Biotechnology Software Development Clinical Research Ingredient Manufacturing Agronomy

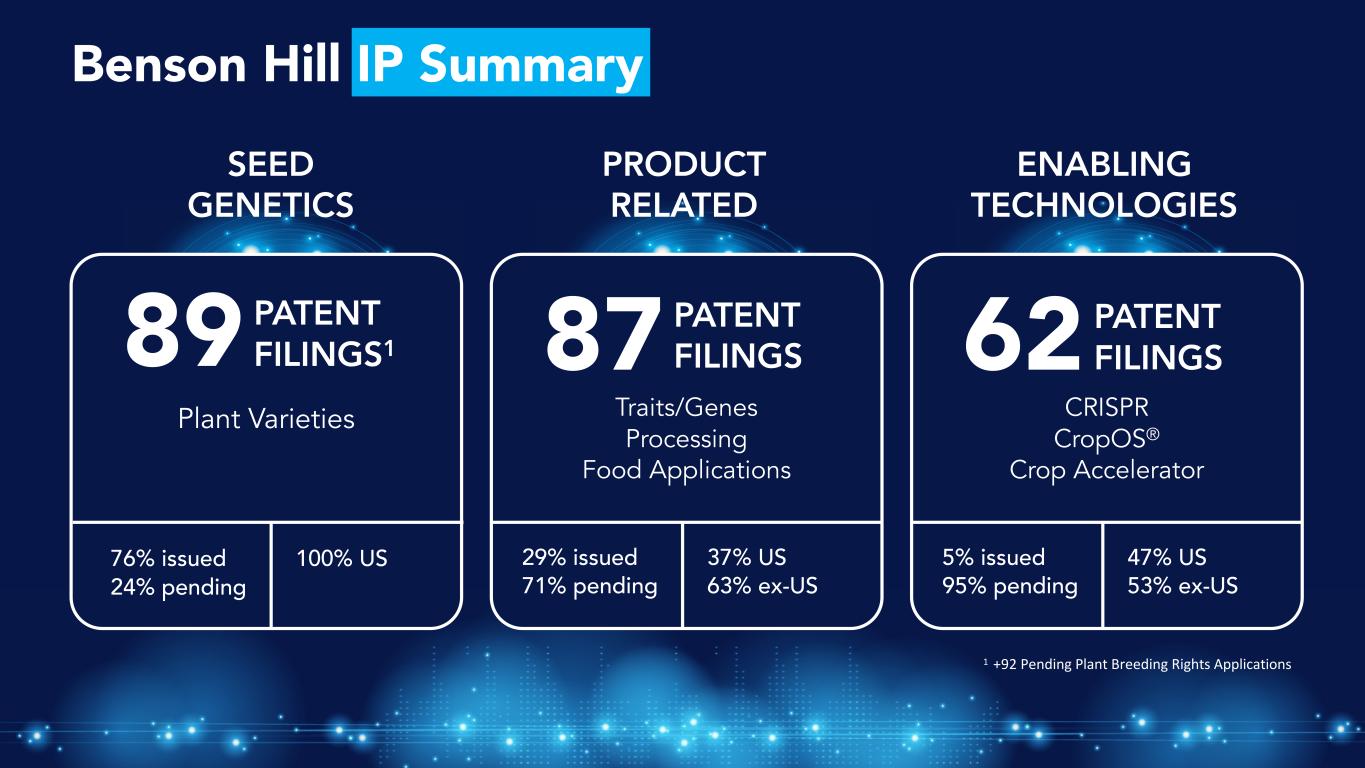

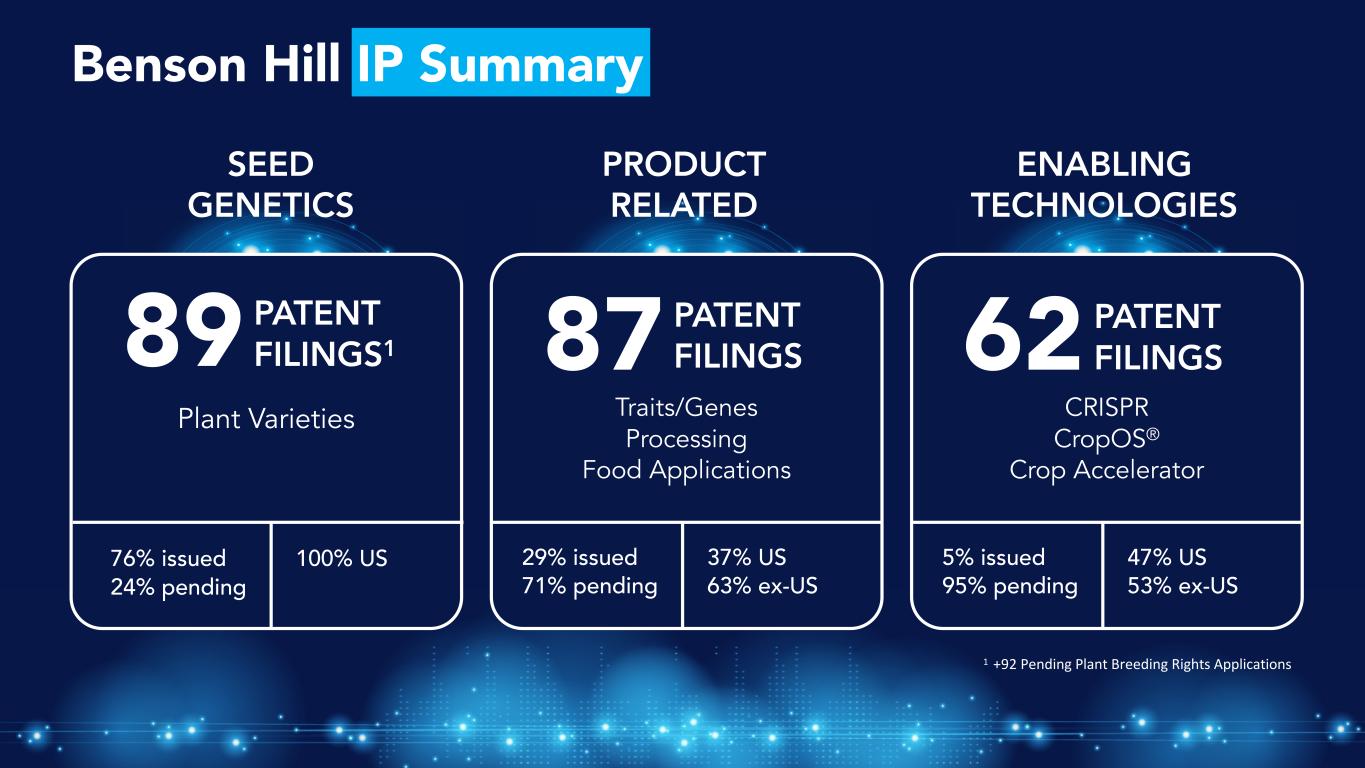

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 ENABLING TECHNOLOGIES Benson Hill IP Summary Plant Varieties 89 1 +92 Pending Plant Breeding Rights Applications SEED GENETICS PRODUCT RELATED Traits/Genes Processing Food Applications 87 PATENT FILINGS 29% issued 71% pending 37% US 63% ex-US CRISPR CropOS® Crop Accelerator 62 PATENT FILINGS 5% issued 95% pending 47% US 53% ex-US PATENT FILINGS1 76% issued 24% pending 100% US

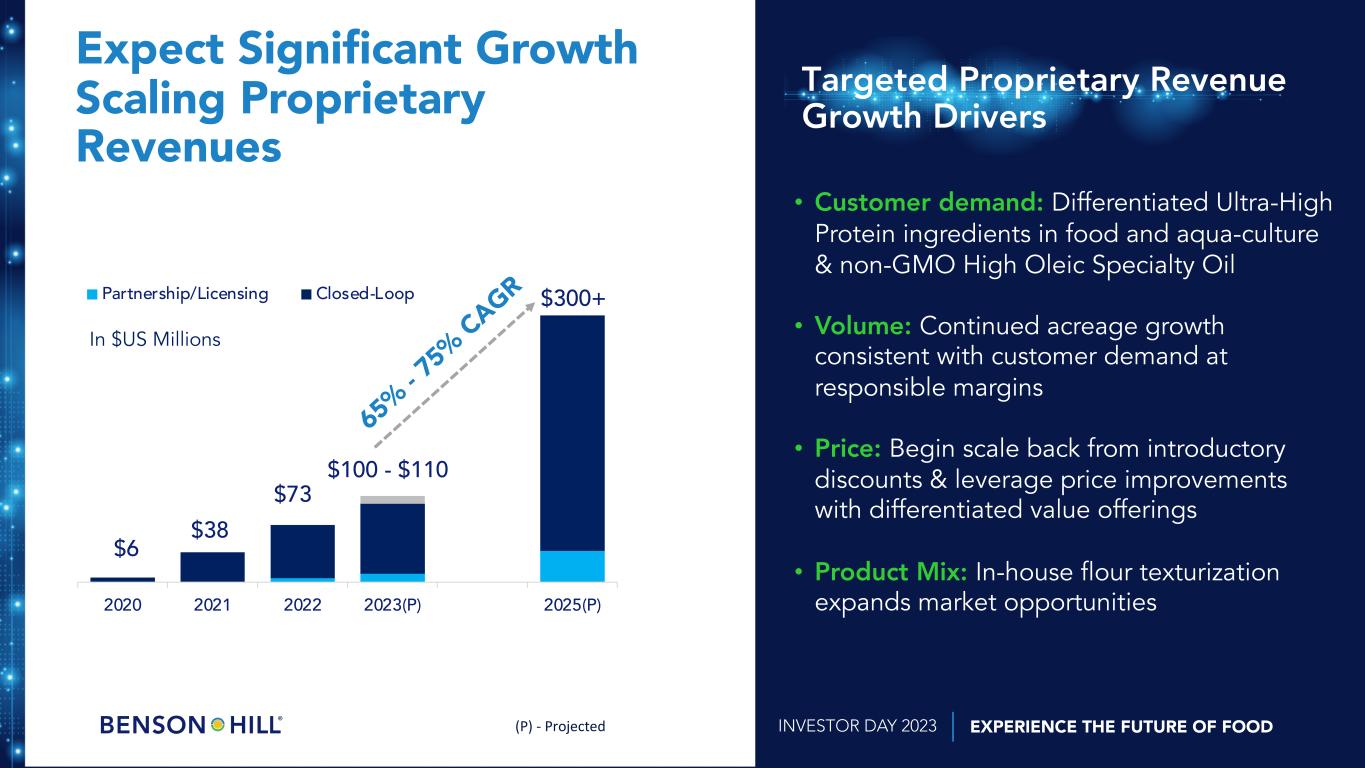

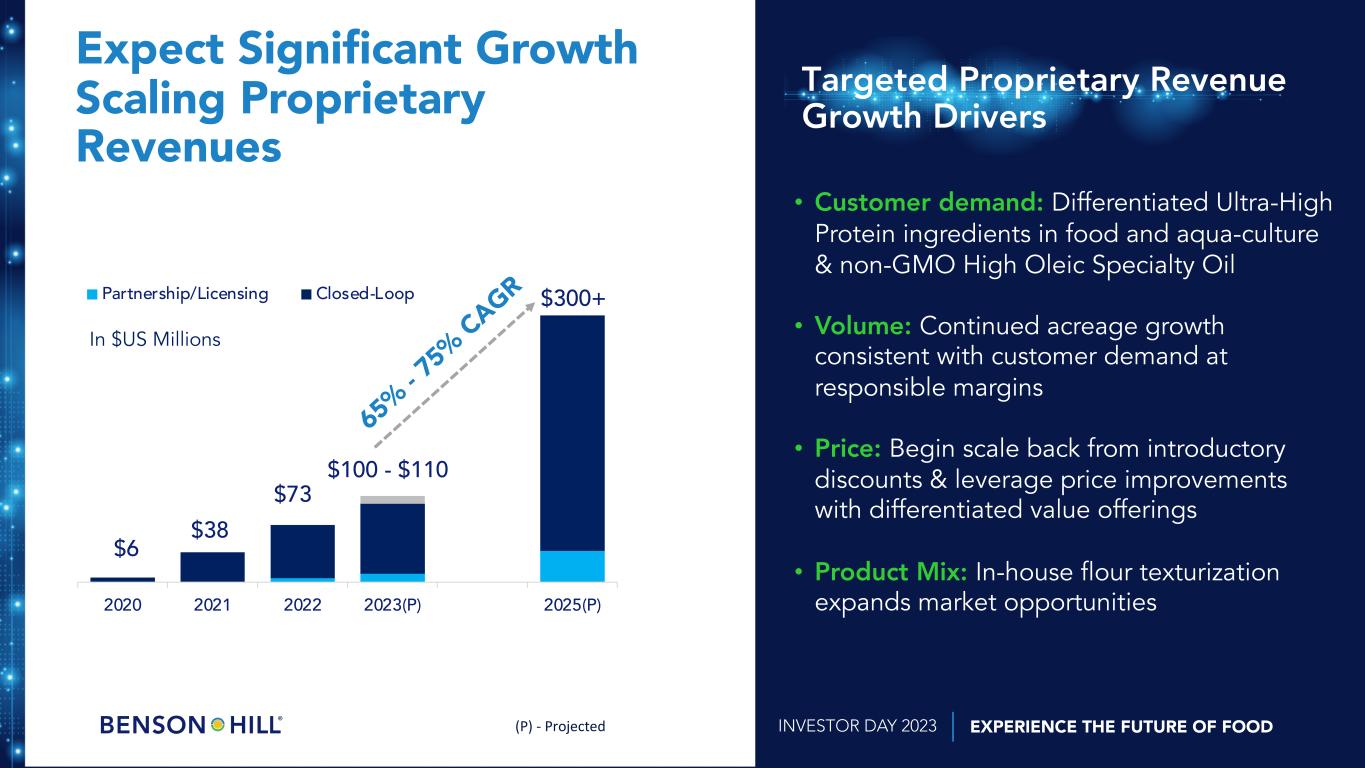

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Expect Significant Growth Scaling Proprietary Revenues 2020 2021 2022 2023(P) 2025(P) Partnership/Licensing Closed-Loop In $US Millions $300+ $6 65 % - 7 5% CAGR $38 $100 - $110 $73 • Customer demand: Differentiated Ultra-High Protein ingredients in food and aqua-culture & non-GMO High Oleic Specialty Oil • Volume: Continued acreage growth consistent with customer demand at responsible margins • Price: Begin scale back from introductory discounts & leverage price improvements with differentiated value offerings • Product Mix: In-house flour texturization expands market opportunities Targeted Proprietary Revenue Growth Drivers (P) - Projected

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Platform Products Pipeline People Partners Setting the Pace of Innovation in Food LONG-TERM TAILWINDS AND CONSUMER-DRIVEN TRENDS OUR WINNING COMBINATION

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 OUR ADVANTAGE DRIVEN BY TECHNOLOGY JASON BULL CHIEF TECHNOLOGY OFFICER

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Why We are Winning with Technology 19 LEADING VARIETIES – proprietary genetics and mountains of data1 5 GENETIC INNOVATION – multiplier effect on value NEW BUSINESS MODEL – feedback and feed forward from farmers and customers4 INDUSTRY LEADING PIPELINE – capable of value inflection in ~3-4 years*3 HIGH HIT RATE & LOW RISK – leading integrated AI predictive models2 *Depending on complexity of genetic traits

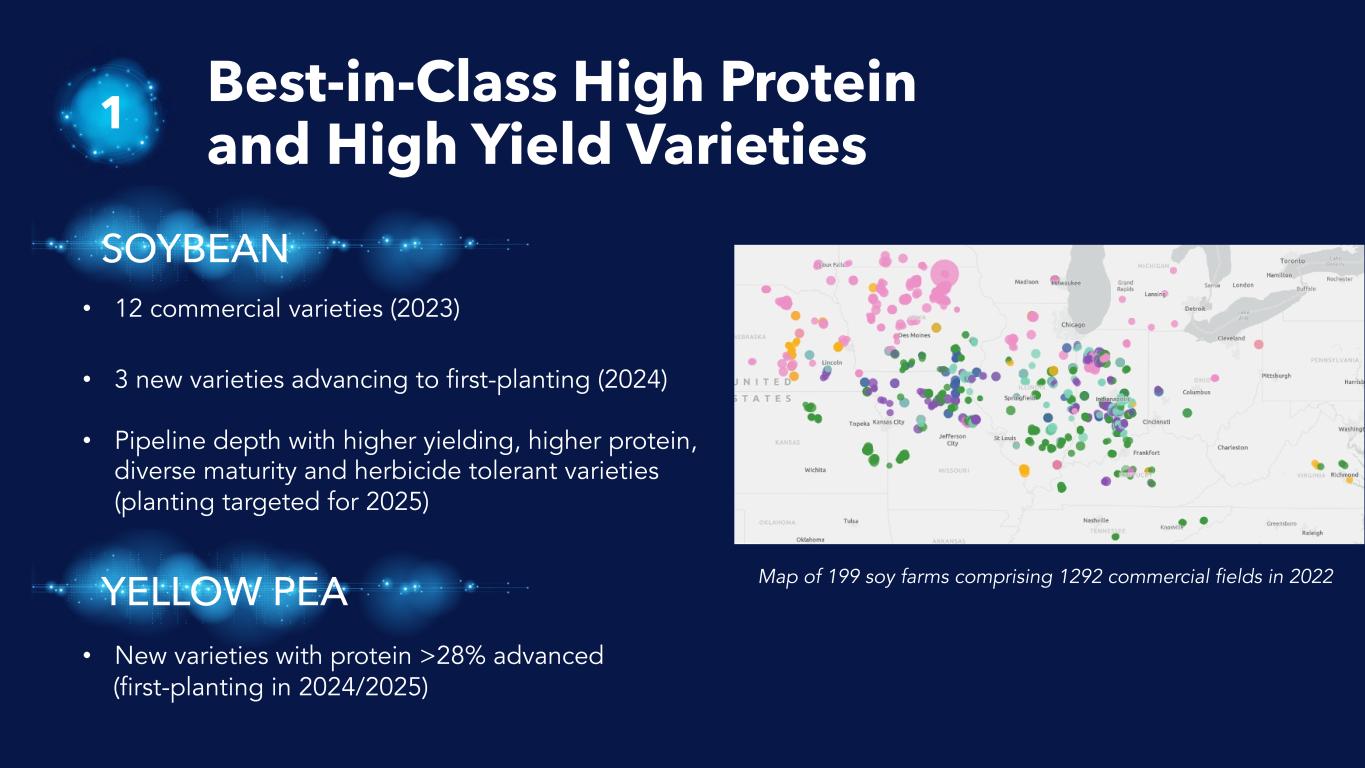

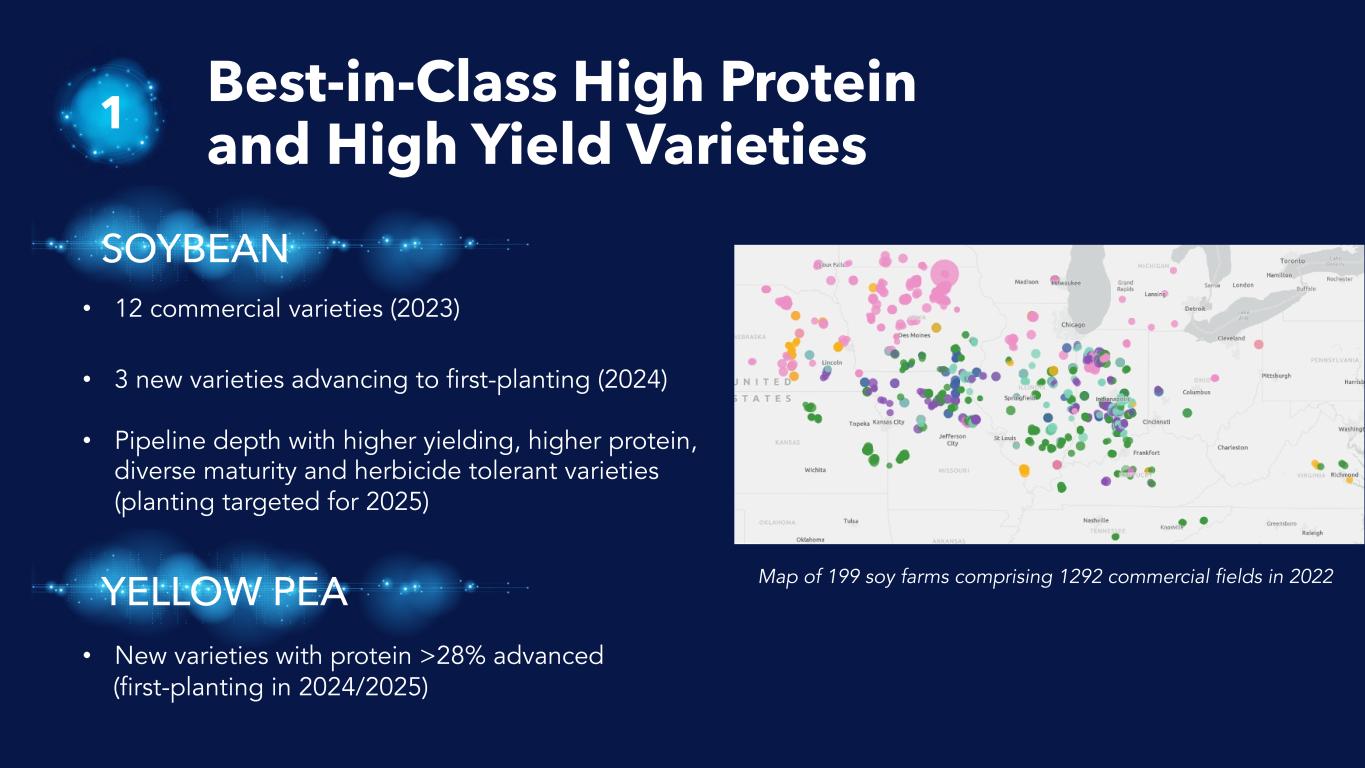

Map of 199 soy farms comprising 1292 commercial fields in 2022 Best-in-Class High Protein and High Yield Varieties 1 SOYBEAN YELLOW PEA • New varieties with protein >28% advanced (first-planting in 2024/2025) • 12 commercial varieties (2023) • 3 new varieties advancing to first-planting (2024) • Pipeline depth with higher yielding, higher protein, diverse maturity and herbicide tolerant varieties (planting targeted for 2025)

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Artificial Intelligence is at the Core of the CropOS® Platform 1 Recommendations Creation OUTCOMES Field trials Farm yields Genome sequences Flavor and sensory Ingredient functionality Seed development STRATEGIC DATA AI/ML APPLICATIONS

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Artificial Intelligence is Impacting our Lives1 STRATEGIC DATA Hotel Reviews Movies Artwork Music Internet browsing Flight schedules AI/ML APPLICATIONS OUTCOMES Recommendations Creation All trademarks are property of their respective owners and are not associated with Benson Hill

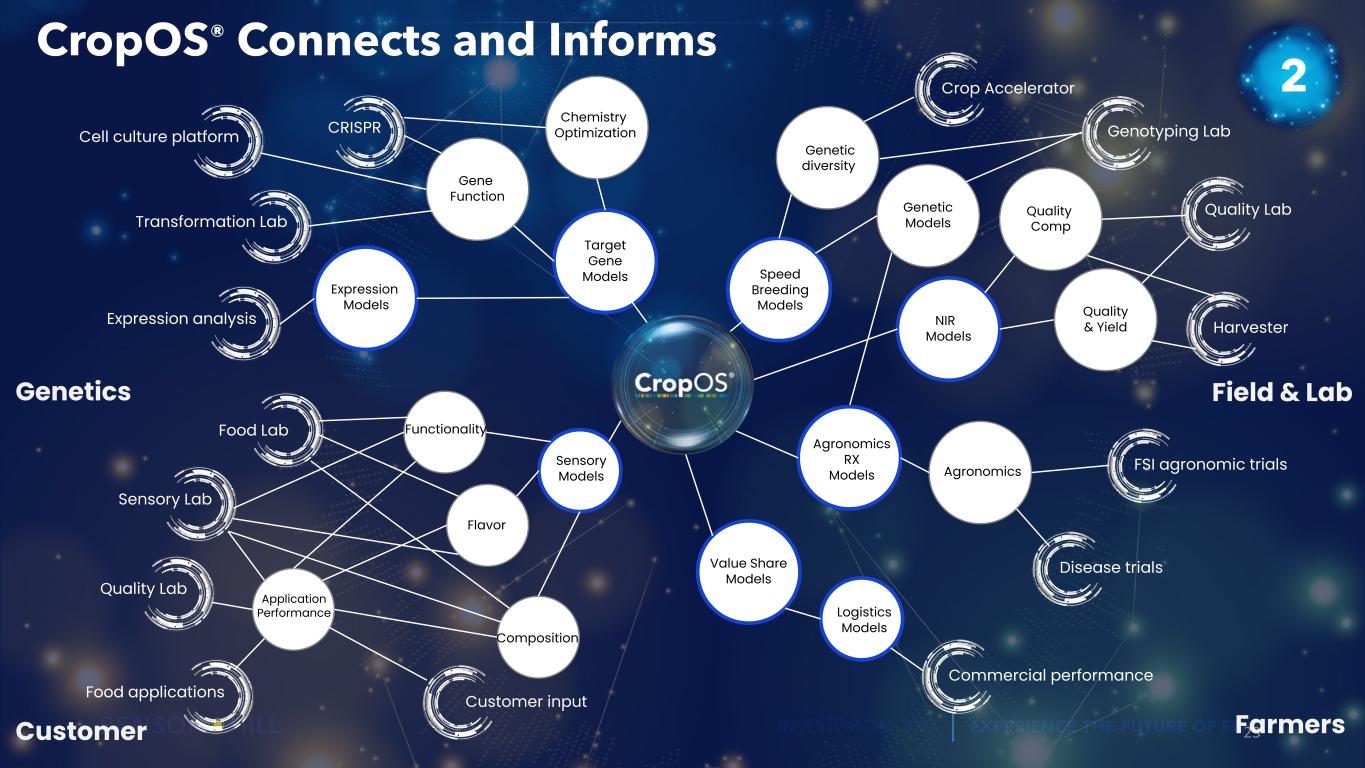

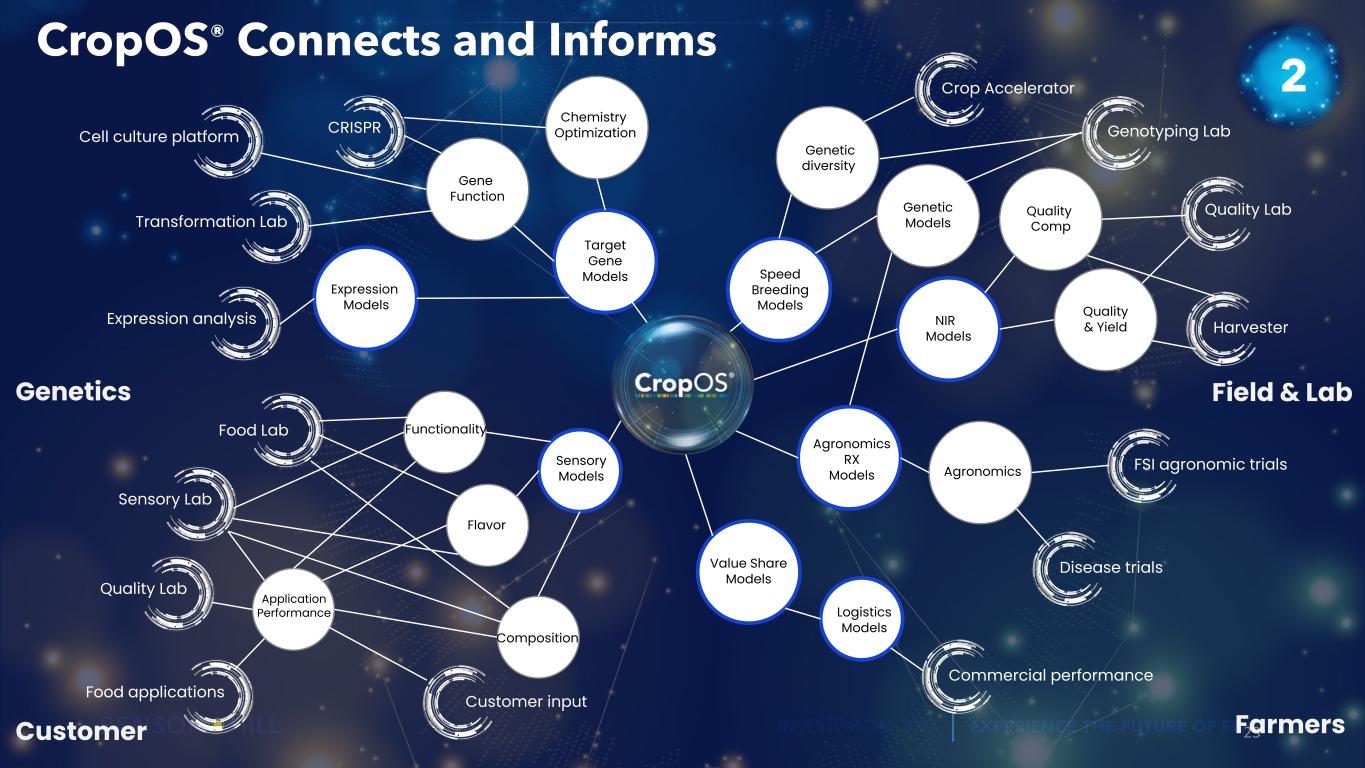

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Customer input Food Lab Sensory Lab Food applications Quality Lab Composition Flavor Functionality Sensory Models Application Performance FSI agronomic trials Disease trials Commercial performance Value Share Models Logistics Models Agronomics RX Models Agronomics CropOS® Connects and Informs 23 Genetics FarmersCustomer Target Gene Models Expression analysis CRISPR Transformation Lab Cell culture platform Gene Function Expression Models Chemistry Optimization Quality Comp NIR Models Quality & Yield Genetic Models Genotyping Lab Crop Accelerator Quality Lab Harvester Genetic diversity Speed Breeding Models Field & Lab 2

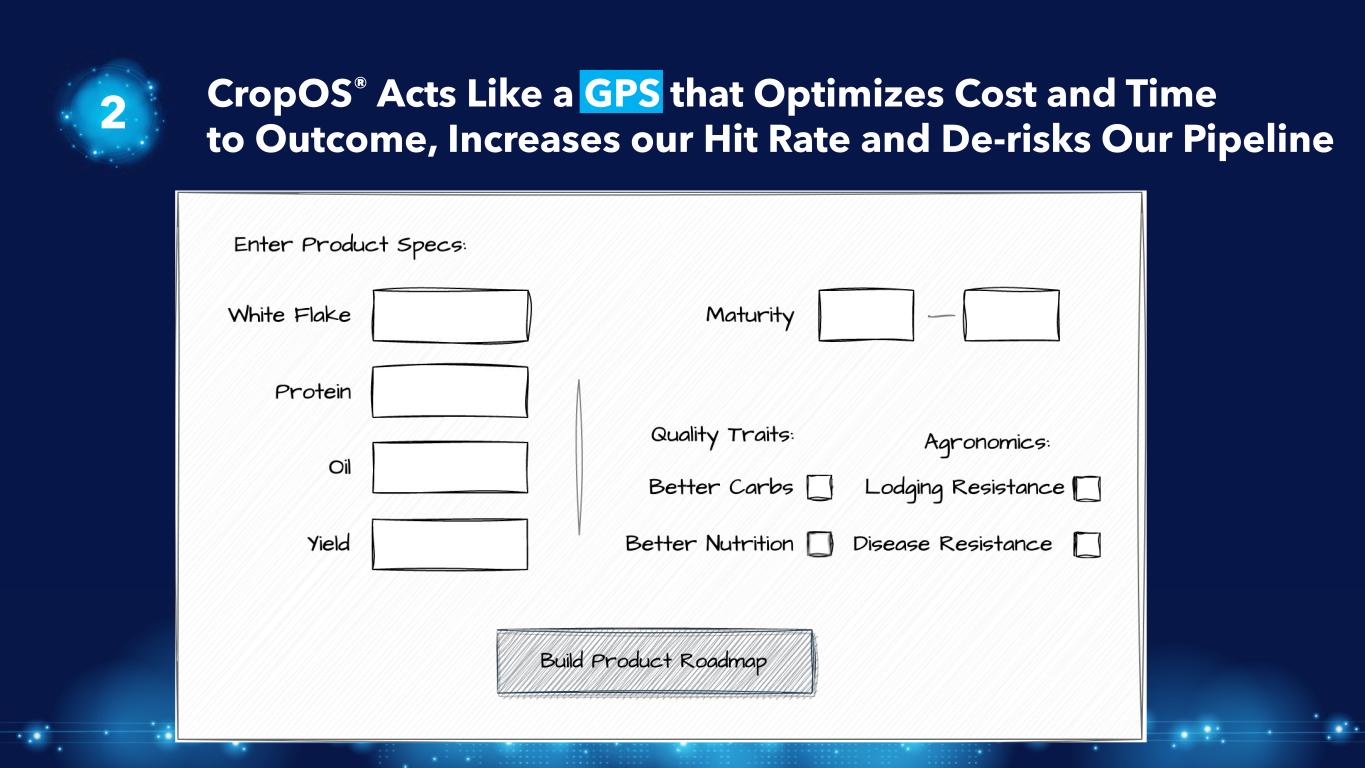

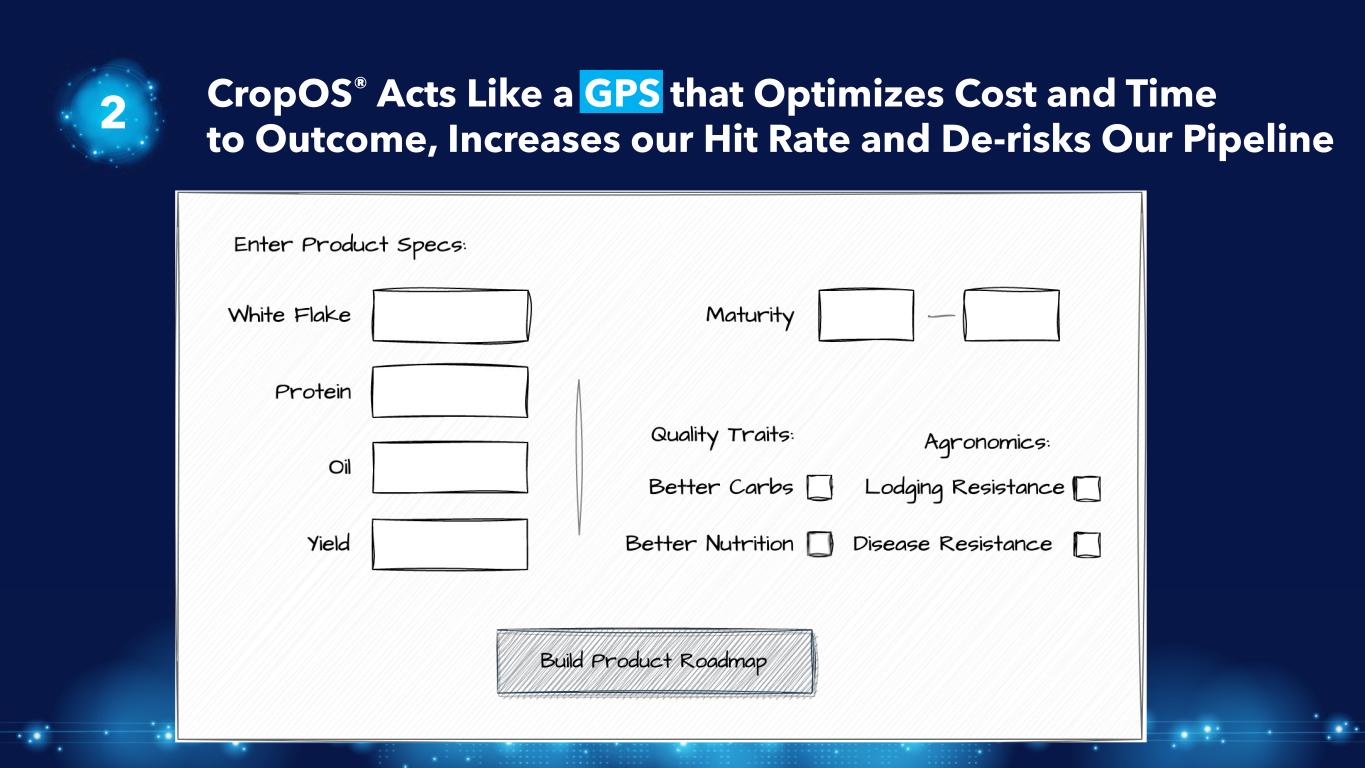

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 CropOS® Acts Like a GPS that Optimizes Cost and Time to Outcome, Increases our Hit Rate and De-risks Our Pipeline 2

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Protein Comp NIR Models Oil Comp Ops Recipe Functionality Sensory Models Application Performance Agronomics RX Models Agronomics Target Gene Models Gene Function Expression Models Genetic diversity CropOS® Connects and Ingests Data and Models Outcomes Genotyping Lab Crop Accelerator Quality Lab Harvester Customer input Food Lab Sensory Lab Food applications Quality Lab FSI agronomic trials Disease trials Commercial performance Expression analysis CRISPR Transformation Lab Cell culture platform Value Share Models Logistics Models Chemistry Optimization Flavor Composition Speed Breeding Models

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2 1000’s of Potential Roadmap Routes are Created that Achieve the Desired Outcome

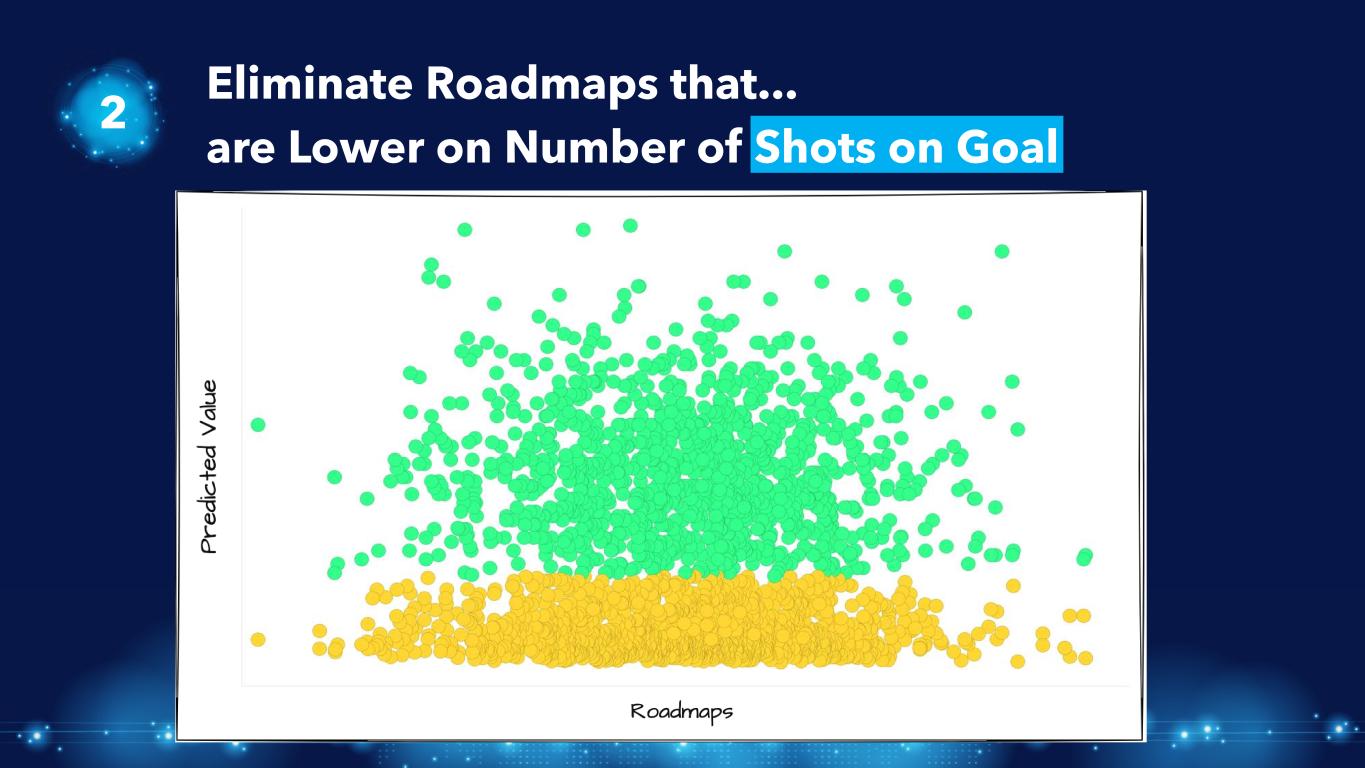

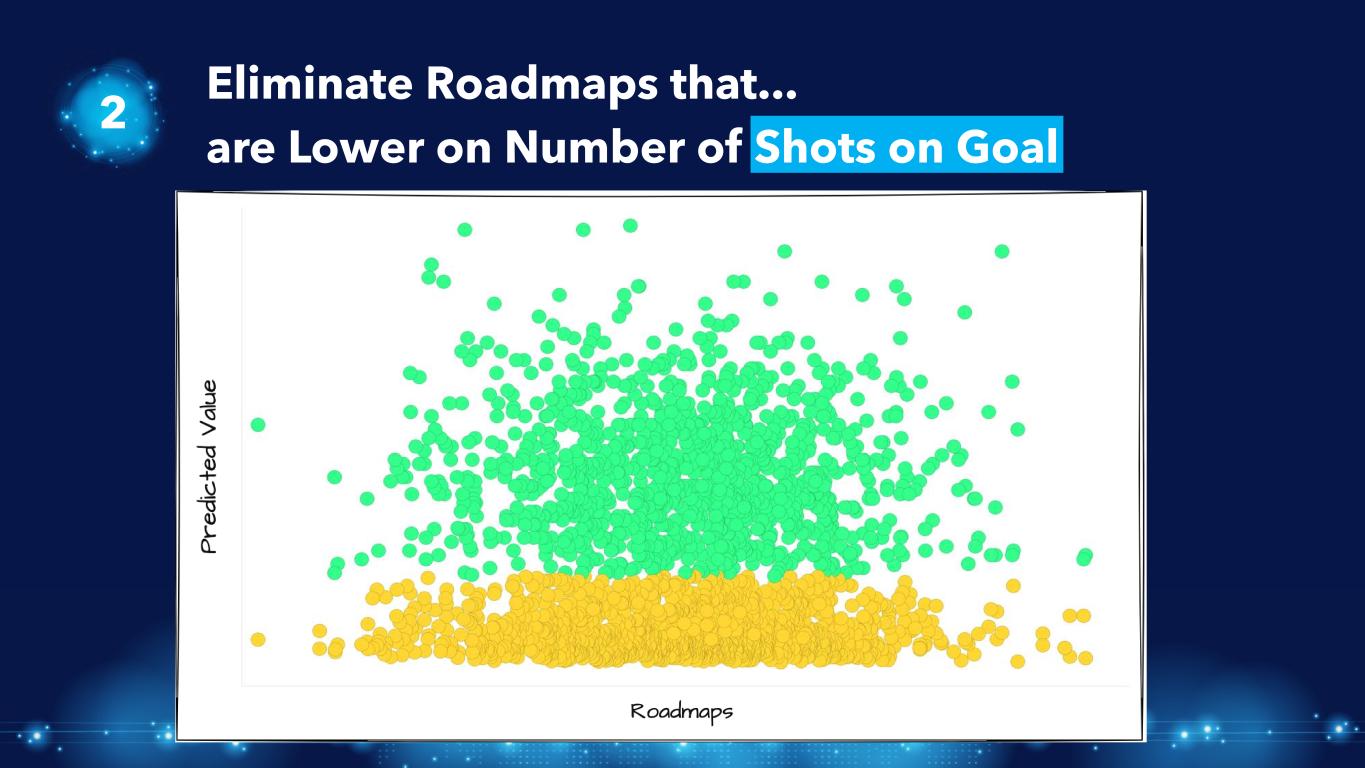

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2 Eliminate Roadmaps that... are Lower on Number of Shots on Goal

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2 Only High Number of Shots on Goal Roadmaps

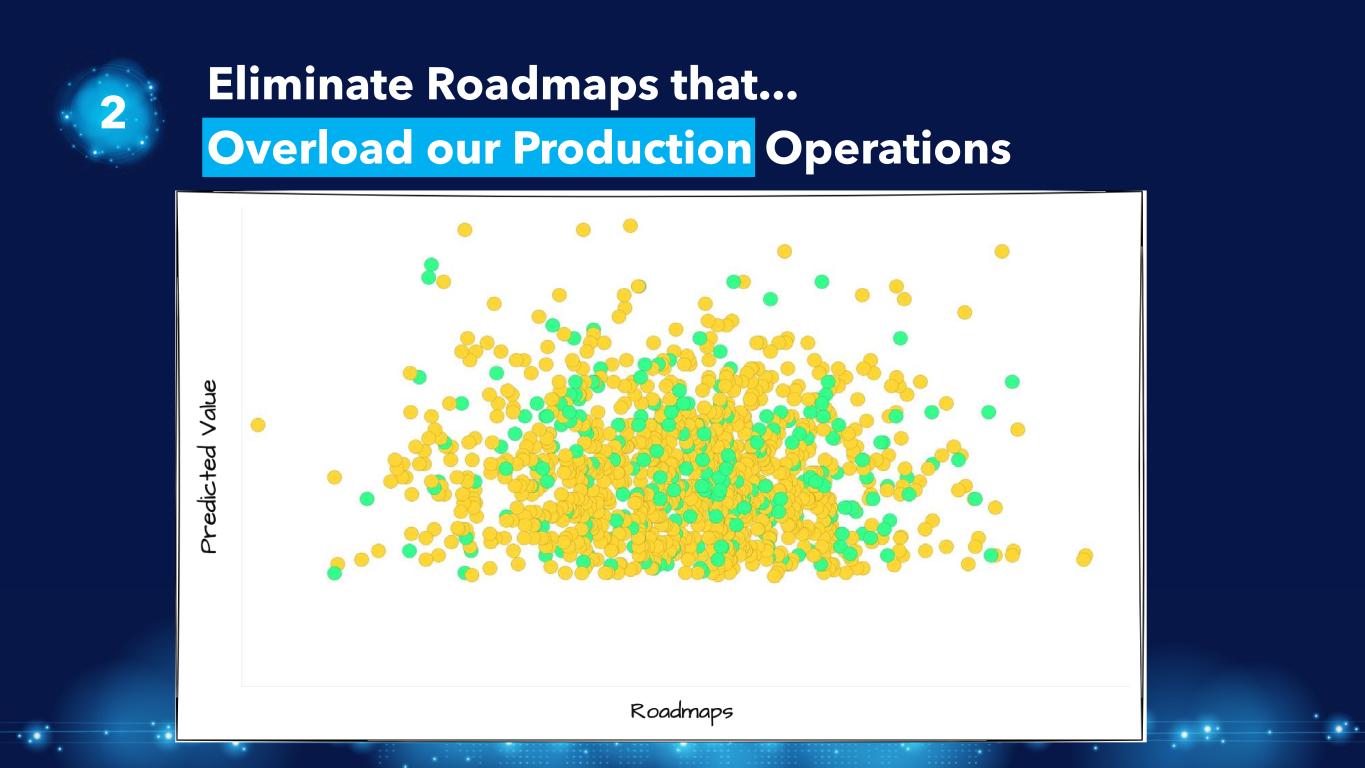

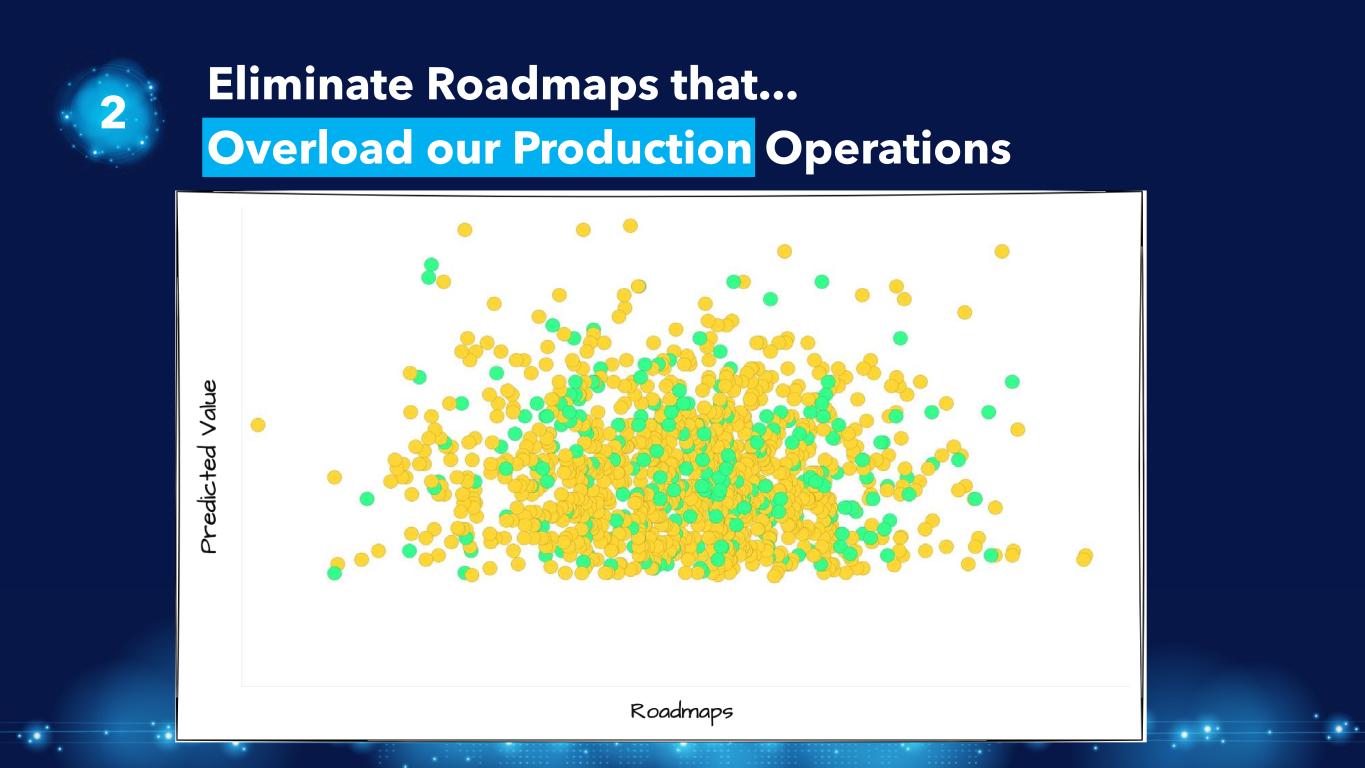

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Eliminate Roadmaps that... Overload our Production Operations 2

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2 Only Roadmaps that Fit Our Operational Capacity

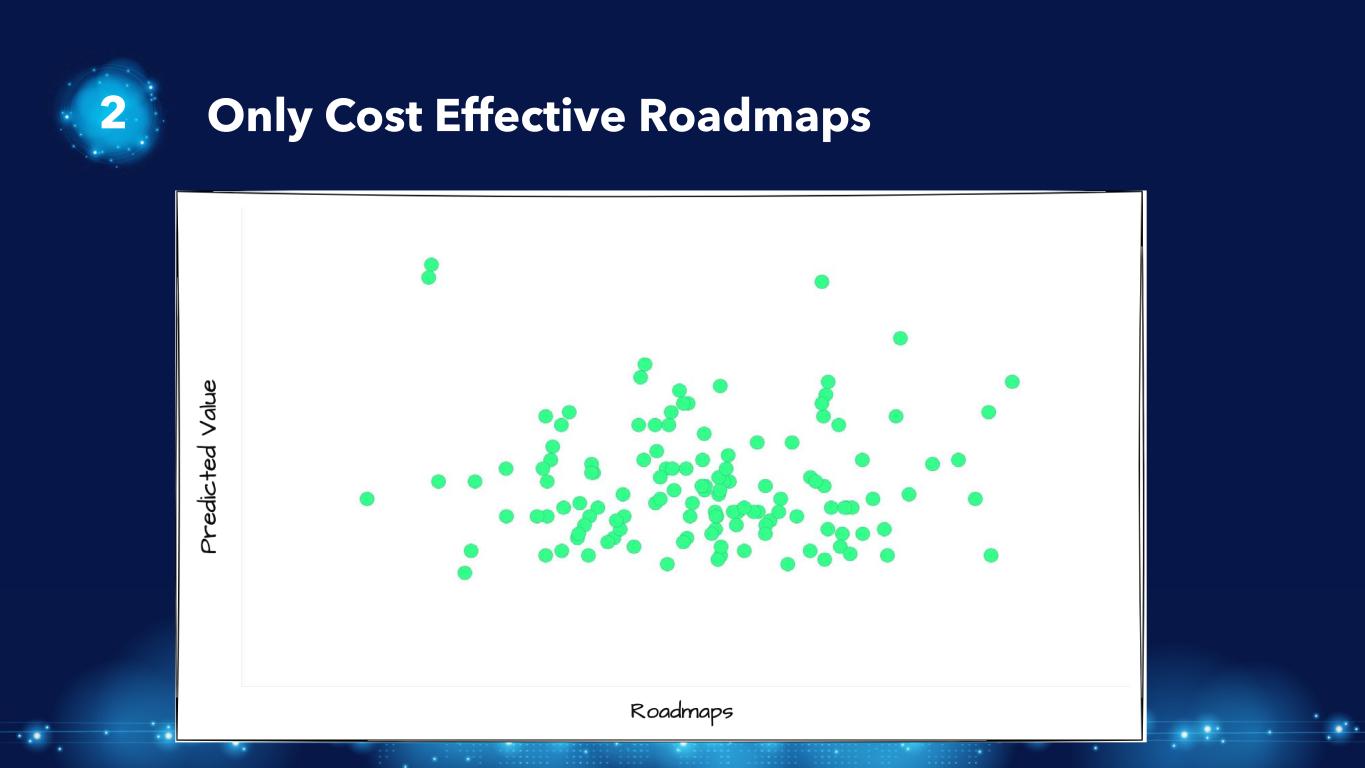

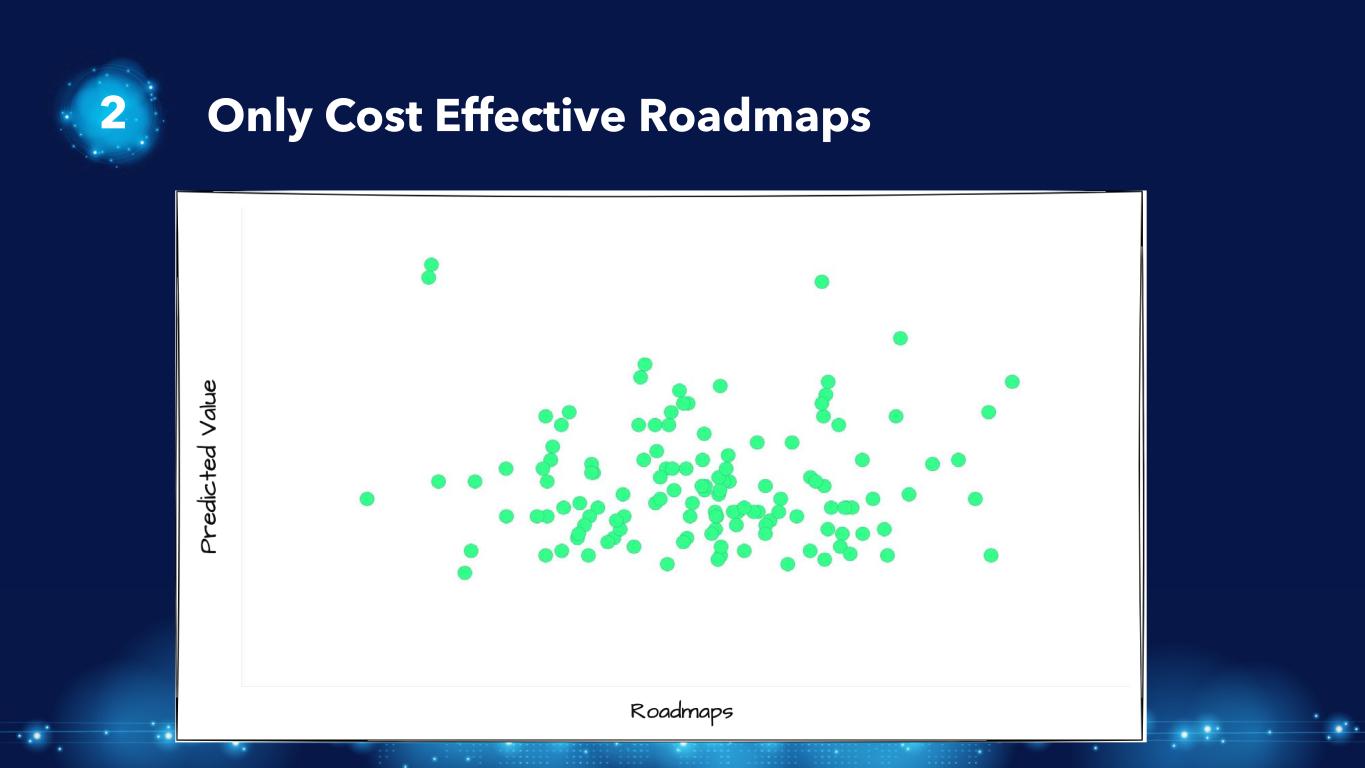

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Eliminate Roadmaps that... are Too High Cost 2

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2 Only Cost Effective Roadmaps

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Eliminate Roadmaps that... Take too Long to Launch 2

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2 Only Roadmaps that Hit the Commercial Launch Date

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2 Eliminate Roadmaps that... Reduce Long Term Genetic Diversity

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2 Finally, We Have a Handful of High Value Roadmaps that are Optimal for Our Pipeline and Expected Outcomes

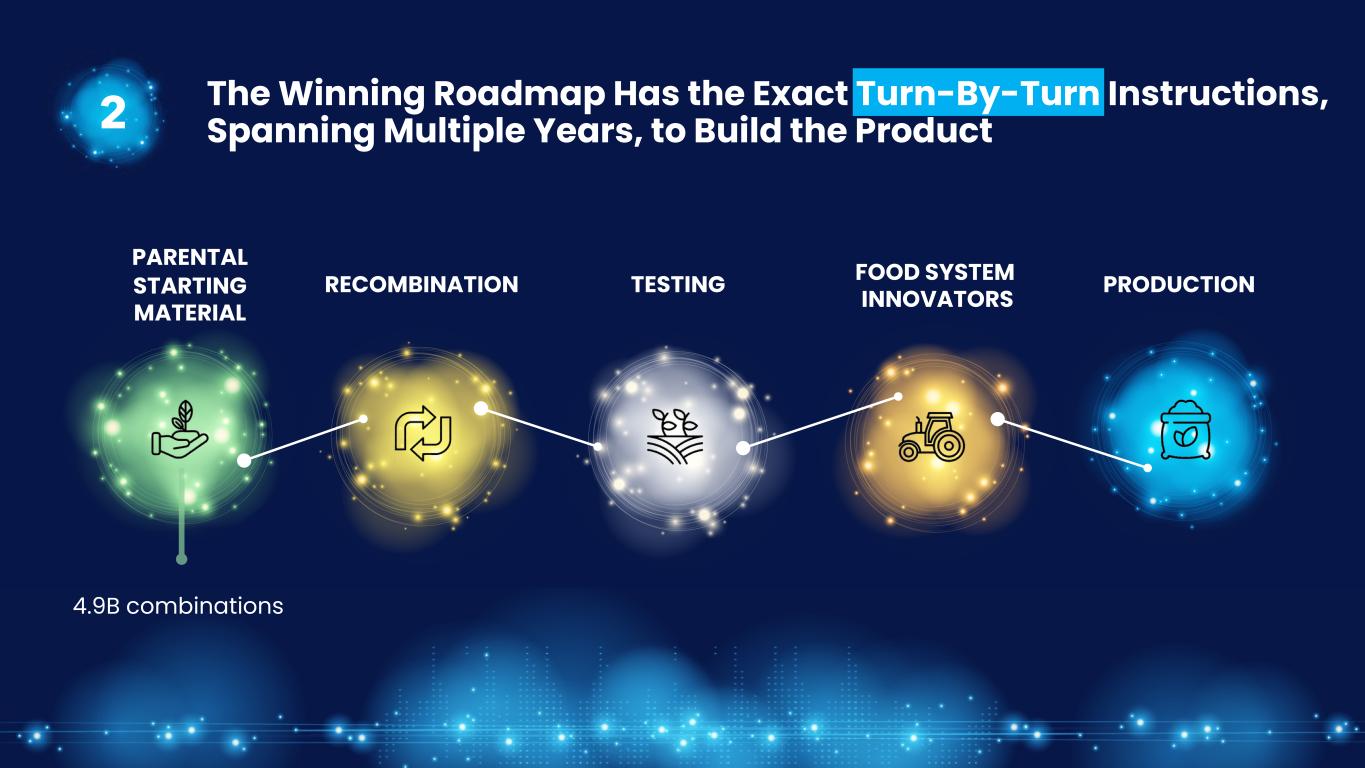

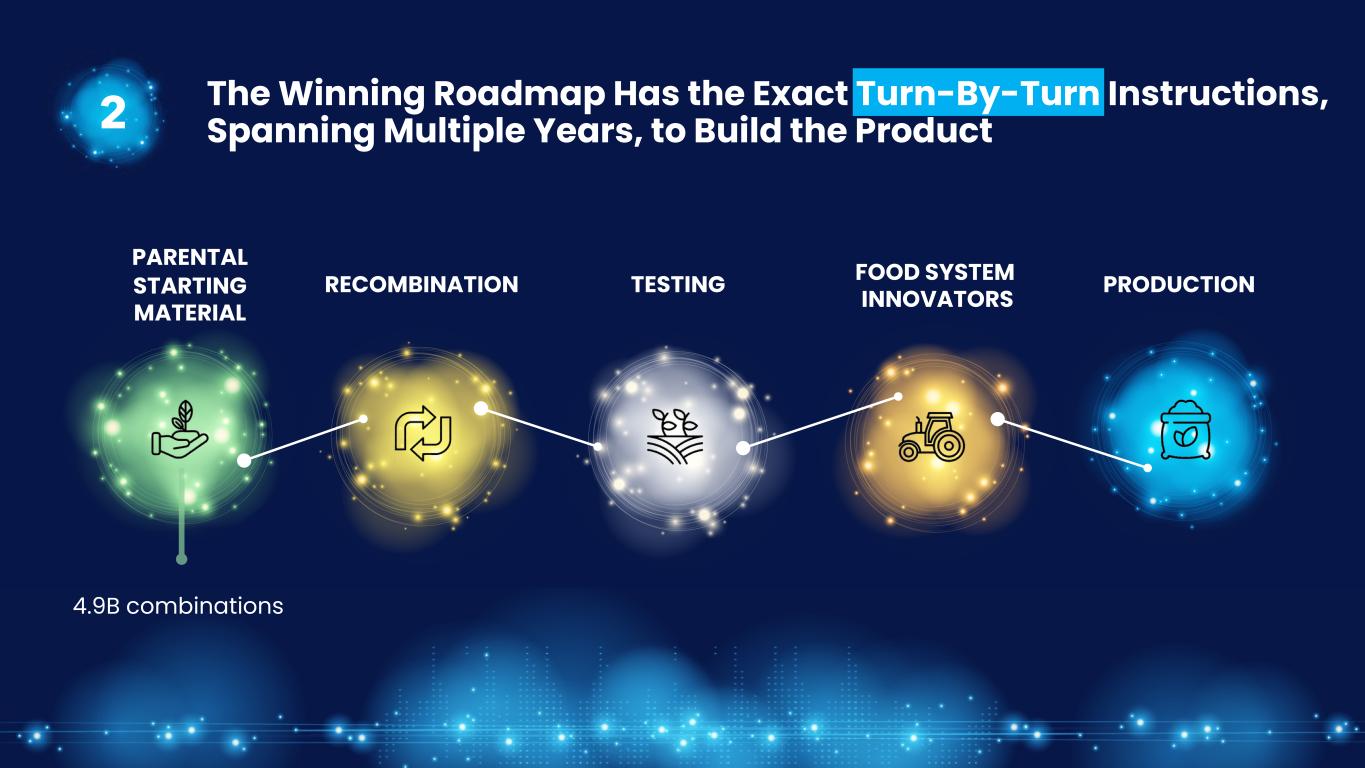

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 PRODUCTIONTESTING FOOD SYSTEM INNOVATORS PARENTAL STARTING MATERIAL RECOMBINATION 4.9B combinations 2 The Winning Roadmap Has the Exact Turn-By-Turn Instructions, Spanning Multiple Years, to Build the Product

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 PRODUCTIONTESTING PARENTAL STARTING MATERIAL RECOMBINATION 2 The Winning Roadmap Has the Exact Turn-By-Turn Instructions, Spanning Multiple Years, to Build the Product Recycling & diversity FOOD SYSTEM INNOVATORS

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 PRODUCTIONTESTING PARENTAL STARTING MATERIAL RECOMBINATION Yield, sensory & ingredient testing FOOD SYSTEM INNOVATORS 2 The Winning Roadmap Has the Exact Turn-By-Turn Instructions, Spanning Multiple Years, to Build the Product

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 PRODUCTIONTESTING PARENTAL STARTING MATERIAL RECOMBINATION Production & agronomic practices FOOD SYSTEM INNOVATORS 2 The Winning Roadmap Has the Exact Turn-By-Turn Instructions, Spanning Multiple Years, to Build the Product

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 PRODUCTIONTESTING FOOD SYSTEM INNOVATORS PARENTAL STARTING MATERIAL RECOMBINATION Portfolio mix & value share 2 The Winning Roadmap Has the Exact Turn-By-Turn Instructions, Spanning Multiple Years, to Build the Product

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 One of the few companies with plant science, food science and data science 3 Best-in-Class Seed-to-Plate Pipeline that Can Reach Value Inflection in ~3-4 years* Predictive design Parallelized testing 500M predicted genotypes 286K predicted gene targets 100K tested entities 710 genes tested ~400 - 5,000X Reduction Optimization Prescriptive build *Depending on complexity of genetic traits

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 "Win-win we both care about the same thing – farm profitability" • 100% Farmers shared data on closed-loop fields in 2022 • ~80% Farmers adopted recommendations in 2022 • Customer connection Input from ingredient suppliers and CPG customers directly impacts our genomics innovations 4 Feed-back and feed-forward from farmers and customers

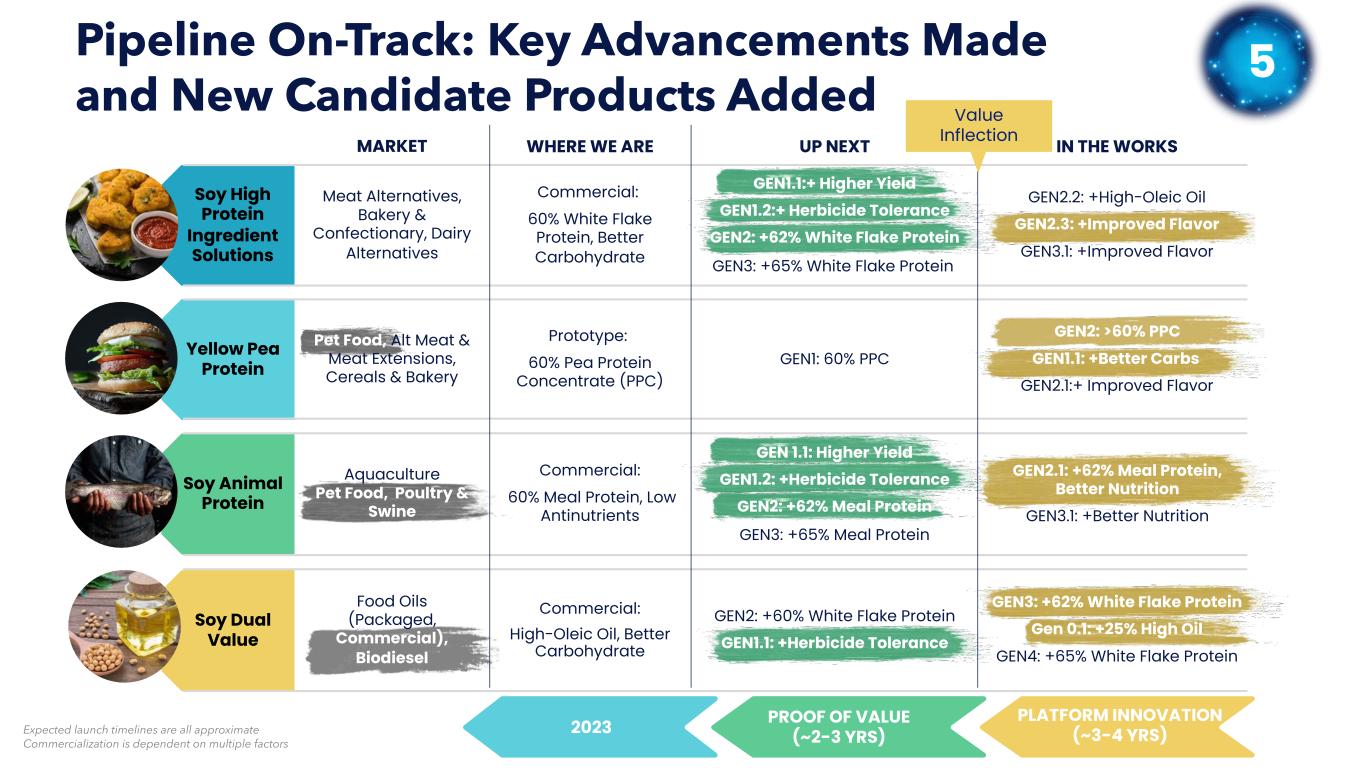

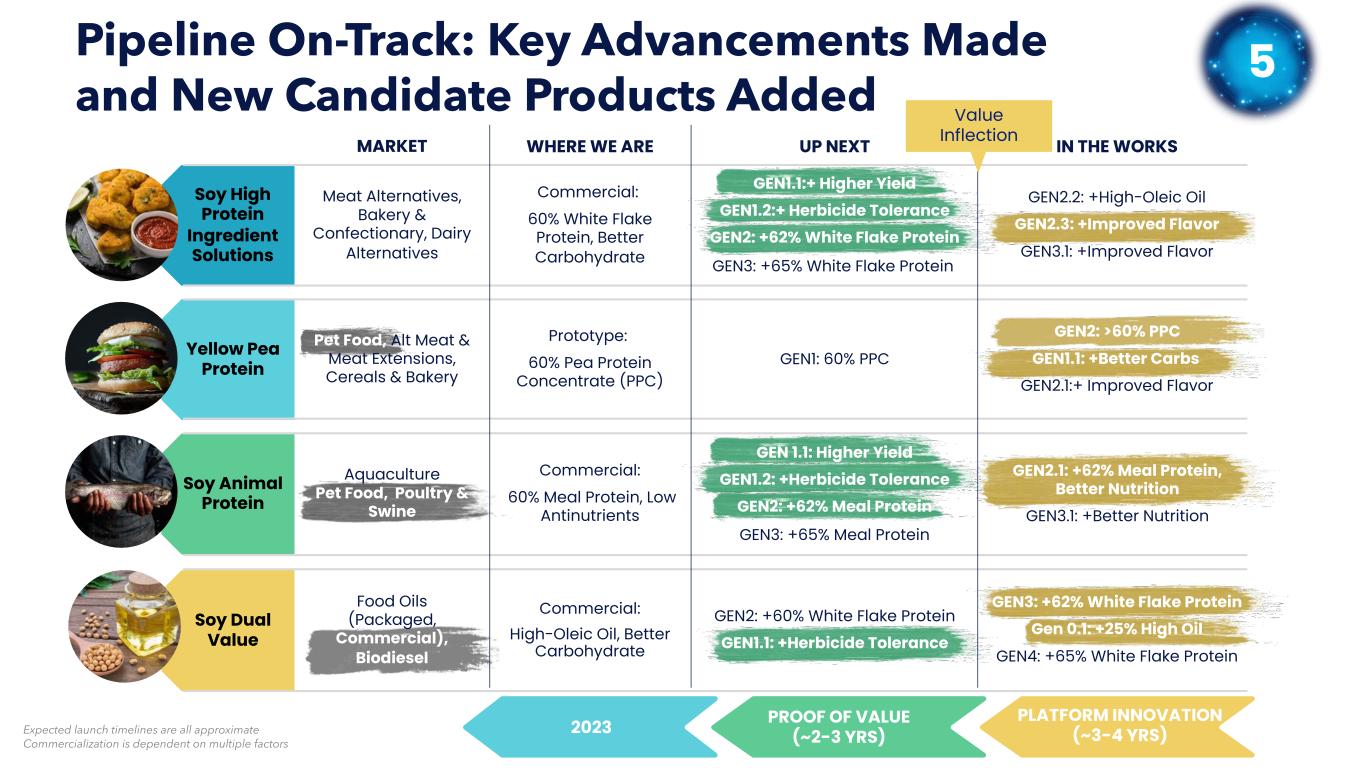

5 Pipeline On-Track: Key Advancements Made and New Candidate Products Added Expected launch timelines are all approximate. Commercialization is dependent on multiple factors. ®™Trademarks of Corteva Agriscience and its affiliated companies. The transgenic soybean event in Enlist E3® soybeans is jointly developed and owned by Corteva Agriscience and M.S. Technologies, L.L.C. IMPROVED YIELD, PROTEIN & MATURITIES New higher yielding Ultra High Protein varieties in near term EASY WEED CONTROL Enlist E3® Soybean Technology (Herbicide Tolerance) added to soybean pipeline with near term impact YELLOW PEA HIGH PROTEIN High protein varieties advanced for near term impact GENE EDITED VARIETIES IN FIELD TRIALS Higher protein & improved nutrition launch in near-mid term Meat Extensions Pet Food Poultry Swine Commercial oil Biodiesel MARKETS ADDED & EXPANDED Food oil

5 Serviceable Addressable Market Size of ~$27B* ASSUMPTIONS Ingredient Only Adjusted For Inclusion Rate NA Only; Aqua – EU Only Market Size In 2022 ANIMAL FEED BIODIESEL FOOD OILS PROCESSED MEAT DAIRY ALTERNATIVES CEREALS MEAT ALTERNATIVES AQUACULTURE BAKED GOODS PET FOOD CAGR Of High Single Digit Exception: Zero Growth In Poultry, Swine, Biodiesel *Source: Internal estimated market sizes based on data from USDA, third-party reports, and internal estimates, inclusive of current and future product opportunities.

5 Serviceable Obtainable Market Size of ~$6B* Cost Advantage Premium Products ~20% Market Share 8-10 Years Benson Hill has opportunity to obtain this market either through closed loop or partnerships ANIMAL FEED BIODIESEL FOOD OILS PROCESSED MEAT DAIRY ALTERNATIVES CEREALS MEAT ALTERNATIVES AQUACULTURE BAKED GOODS PET FOOD *Source: Internal estimated market sizes based on data from USDA, third-party reports, and internal estimates, inclusive of current and future product opportunities. ASSUMPTIONS

Pipeline On-Track: Key Advancements Made and New Candidate Products Added IN THE WORKS GEN2: >60% PPC GEN1.1: +Better Carbs GEN2.1:+ Improved Flavor UP NEXT GEN1: 60% PPC GEN2: +60% White Flake Protein GEN1.1: +Herbicide Tolerance WHERE WE ARE Commercial: 60% White Flake Protein, Better Carbohydrate Commercial: 60% Meal Protein, Low Antinutrients Commercial: High-Oleic Oil, Better Carbohydrate Prototype: 60% Pea Protein Concentrate (PPC) Soy High Protein Ingredient Solutions Yellow Pea Protein Soy Animal Protein Soy Dual Value MARKET Meat Alternatives, Bakery & Confectionary, Dairy Alternatives Value Inflection GEN2.1: +62% Meal Protein, Better Nutrition GEN3.1: +Better Nutrition GEN2.2: +High-Oleic Oil GEN2.3: +Improved Flavor GEN3.1: +Improved Flavor Pet Food, Alt Meat & Meat Extensions, Cereals & Bakery Aquaculture Pet Food, Poultry & Swine Food Oils (Packaged, Commercial), Biodiesel GEN1.1:+ Higher Yield GEN1.2:+ Herbicide Tolerance GEN2: +62% White Flake Protein GEN3: +65% White Flake Protein PLATFORM INNOVATION (~3-4 YRS) PROOF OF VALUE (~2-3 YRS)2023 GEN3: +62% White Flake Protein Gen 0.1: +25% High Oil GEN4: +65% White Flake Protein GEN 1.1: Higher Yield GEN1.2: +Herbicide Tolerance GEN2: +62% Meal Protein GEN3: +65% Meal Protein 5 Expected launch timelines are all approximate Commercialization is dependent on multiple factors

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 5 Specific Crop The Traditional Seed Industry leverages Genetics and GMOs for Input Traits Corn North America - Midwest Corn Rootworm Specific insect pest Specific Geography Incremental Ingredient Value Incremental Application Value

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Partners enable instant market access and global reach 5 Genetic Innovation has a Multiplier Effect on Value

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 OUR PEOPLE!

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 SETTING THE PACE OF INNOVATION IN FOOD THROUGH OPERATIONAL AND COMMERCIAL EXCELLENCE BRUCE BENNETT PRESIDENT, INGREDIENTS

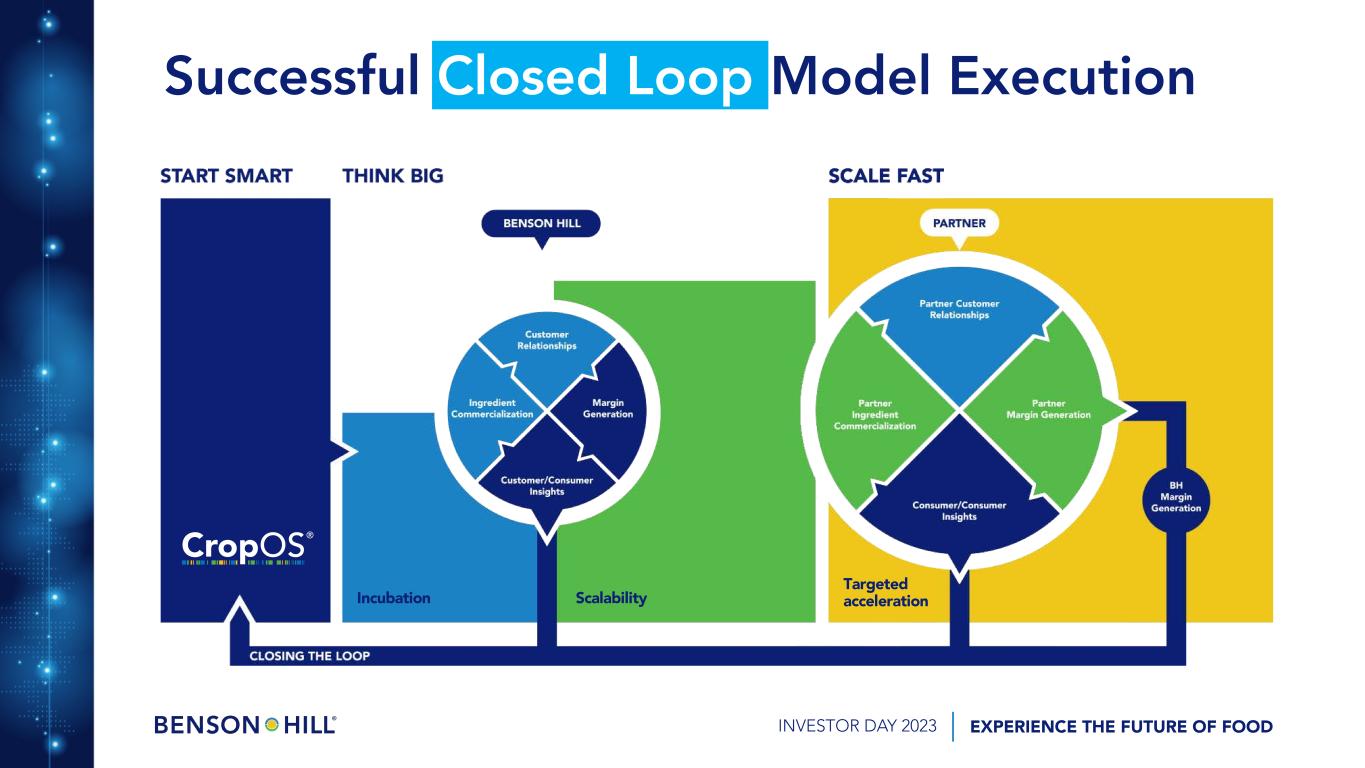

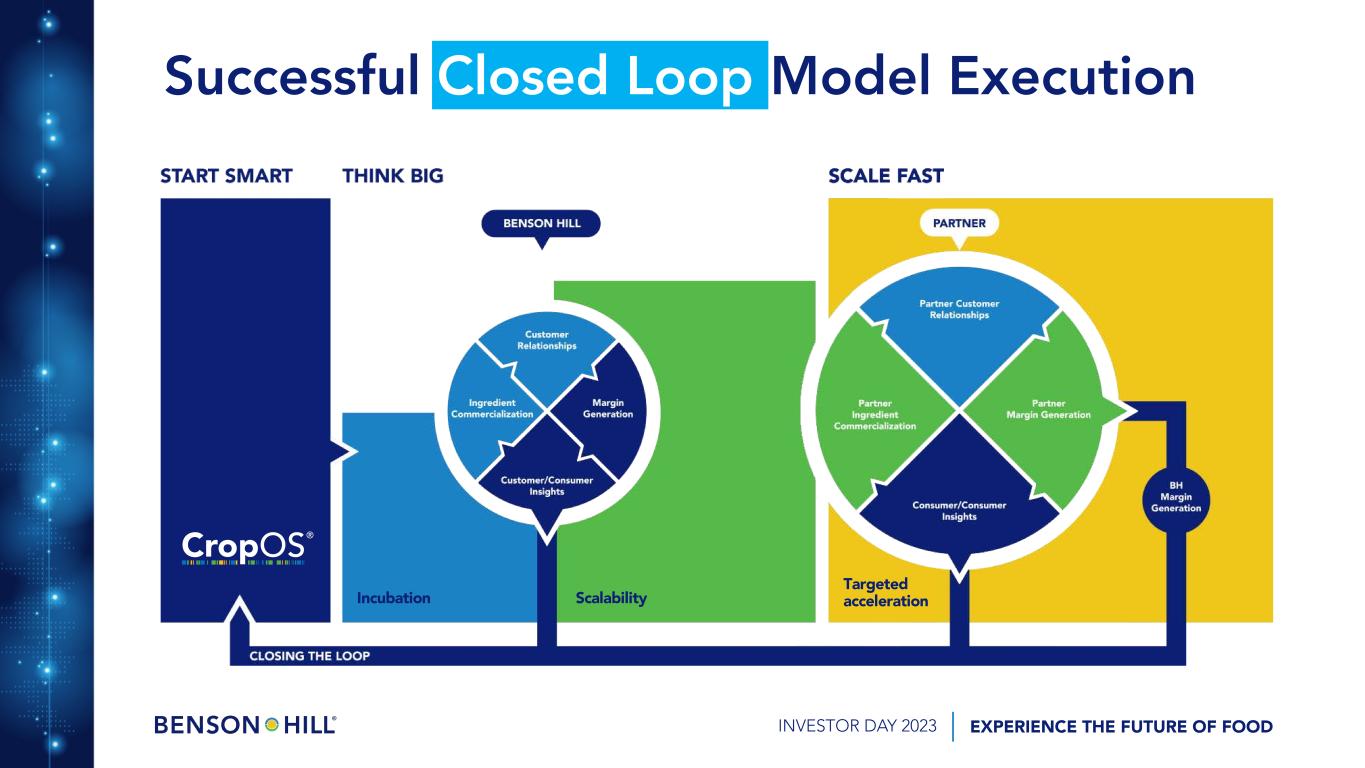

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Successful Closed Loop Model Execution Incubation Scalability Targeted acceleration

Year of Commercial Execution PRODUCTIVITY Asset Integration & Expansion Operational Excellence GROWTH & GO-TO-MARKET Revenue & Margin Drivers Winning with Customers Partnership Execution Seymour, IN Creston, IA Dakota Ingredients Capacity Utilization Process Optimization In-House Texturization Seed-to-fork System Supply Chain Execution Manufacturing Agility Continuous Improvement KPIs Proprietary Portfolio Sales Pipeline Lighthouse Customers Innovating w/Start-ups CPGs Regional Leaders Downstream Processors Scale with Infrastructure Broad Customer Reach Solidified Local Markets Enabling Destination Markets High Margin Targets Data Driven Solutions Sustainable Differentiators Market Channel Access World-Class Innovation Asset Light Model

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Through yield improvements and debottlenecking we’ve increased our combined capacity at Creston and Seymour by ~50% ADM partnership has further expanded global footprint Opportunity to optimize OPEX and deploy capital efficiently • Strong crush environment – favorable market conditions • Third-party interest in asset Optimizing Capacity Footprint: Seymour, IN

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Setting the Pace: High Growth & Established Markets PO RT FO LI O F IT CATEGORY GROWTH PROJECTIONS Bubble Size Indicates Estimated Market Size (2022) L H High-protein Low Oligosaccharide Food Broad Range of End Market Applications Oil Animal Nutrition High Oleic Low Linolenic High-protein Low Oligosaccharide Based on current commodity processed at Dakota Ingredients Develop Portfolio Alternative Dairy Processed Meat Bread Protein Sports Nutrition & Weight Management Breakfast Cereals Snacks Baked Goods Remain Opportunistic L H Meat Alternatives Pet

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Plant Based Lifestyle Better for You/Protein Centric Localization, Traceability Impacting Trends Drive Portfolio Opportunities

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Locally Sourced Optimized Functionality Identity Preserved Affordability Non-GMO Better for Me More Sustainable Supply Chain Transparency Consumer Choices Influence Upstream Innovation

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Genetics Unlocking New Market Segments Global Pet Food Market1 • $119 Billion Market Size • 7.4% CAGR Humanization of Pet Differentiated Value Propositions Deeply Entrenched Customer Base Full Portfolio Applicability (Pea, Soy, Oil) 1 Euromonitor Retail Value (2022)

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Optimal Functionality Creates Significant Value for Customers Oil Containing Heart-healthy1 Omega-9 Fatty-Acids Clean taste Extended fry life2 1 Supportive but not conclusive scientific evidence suggests that daily consumption of about 1½ Tbsps (20g) of oils containing high levels of oleic acid, when replaced for fats and oils higher in saturated fat, may reduce the risk of coronary heart disease. To achieve this possible benefit, oleic acid-containing oils should not increase the total number of calories you eat in a day. One serving of high oleic soybean oil provides 10g of oleic acid (which is 11g of monounsaturated fatty acid). 2 Compared to conventional soybean oil 3 Up to 70% less CO2e and up to 66% less water usage vs. Canola Oil, based on preliminary LCA results from Blonk Consultants (2021) using economic allocations and industry averages for expeller pressed oil. Sustainability Benefits3

Scaling Fast with ADM Partnership UHP B E A N P R O P R I E T A R Y G E N E T I C S B Y Asset Infrastructure Application Technology Go-to-Market Established Salesforce Innovation Centers Technical Service Team SEED TO FORK I N G R E D I E N T S L A U N C H

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Why Benson Hill Can Win with Operational Excellence CropOS® Platform Helps develop the technology and differentiating value propositions Closed Loop Model Incubator that will drive customer proof points and insights Partnerships Asset Light Model to overlay innovation on capital intensive food system chassis Talented & Experienced Management Team Built an Ag/Food ingredient business in <12 months

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 REPLICATING U.S. SUCCESS INTERNATIONAL EXPANSION ANDRES MARTIN EVP AND GENERAL MANAGER INTERNATIONAL

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Proven Proprietary Products are Well Suited for Global Expansion Plant-based meat AquaBenson Hill U.S. and International headquarters

1 STEP 3 STEP 2 STEP International Playbook to Smart, Phased Growth Proven product performance Adoption of Proprietary Products Local manufacturing (ship grain from US) Asset-Lite Approach for Growth Localized closed-loop business model Grow Varieties Locally Establish relationships across the value chain Low capital investment (export model) Low capital investment Partnership/licensing for improved logistics, lower carbon footprint, lower costs Moderate capital investment Establish farmer network and maximize sustainability benefits

BEANS PROCESSED IN U.S. BY BENSON HILL PRODUCT SHIPPED TO DESTINATION Adoption of U.S. Grown Proprietary Products1 STEP WHY THIS MATTERS • Validates global value prop • Enables BH to fully capitalize on sustainability value prop of products • De-risks investment in Step 2 and 3 WHAT IS NEEDED FOR SUCCESS: • Commercial adoption/acceptance • Export supply chain • Establish local distribution capabilities PRODUCT DELIVERED TO DESTINATION VARIETIES GROWN IN U.S.

BEANS PROCESSED AT DESTINATION BEANS SHIPPED TO DESTINATION Asset Light Approach for Growth2 STEP WHY THIS MATTERS WHAT IS NEEDED FOR SUCCESS: PRODUCT DELIVERED TO DESTINATION VARIETIES GROWN IN U.S. • Unlocks processing capacity • Leverages local market knowledge • Leverages benefit of local processing • Unlocks licensing margins • Unlocks new growing areas in the US for export • International logistic capabilities • Ensure IP protection • Like-minded partner • Strategic location

Grow Varieties Locally3 STEP WHY THIS MATTERS WHAT IS NEEDED FOR SUCCESS: PRODUCT DELIVERED TO DESTINATION BEANS PROCESSED AT DESTINATION BY PARTNER VARIETIES GROWN AT DESTINATION • Logistics cost savings • Further improves CO2 footprint of products • Localized closed-loop model • Locally-adapted varieties • Ensure IP protection • Farmer partners

EU Is Benson Hill’s Most Relevant Near-Term International Market 1 RaboResearch (2020) 2 USDA (2022) 3 Yara International ASA (2023) 4 Trading Economics (2023) 5 Miller, Carol D., Local Economies on Their Minds (2018) Soy 80% increase in plant-based meat consumption from 2014-20191 remains the #1 ingredient in plant-based meat applications in EU1 GROWING SOY DEMAND… …IN A PROTEIN DEFICIT REGION …THAT VALUES SUSTAINABILITY …AND LOCAL PRODUCTION 74% of Europeans say food companies need to work to lower emissions3 72% of Europeans say geographic origin is important when purchasing food5 30MMT of soy meal and beans are imported each year2 17X increase in the price of carbon credits in the EU in the last 10 years4

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Aquaculture is Benson Hill’s First Large-Scale Opportunity in EU Performance Sustainability Value Commodity Soybean Meal Soy Protein Concentrate Fat 1% Oligos *Typical values on a dry-weight basis 1% <1% <1% >5% <1% Protein*

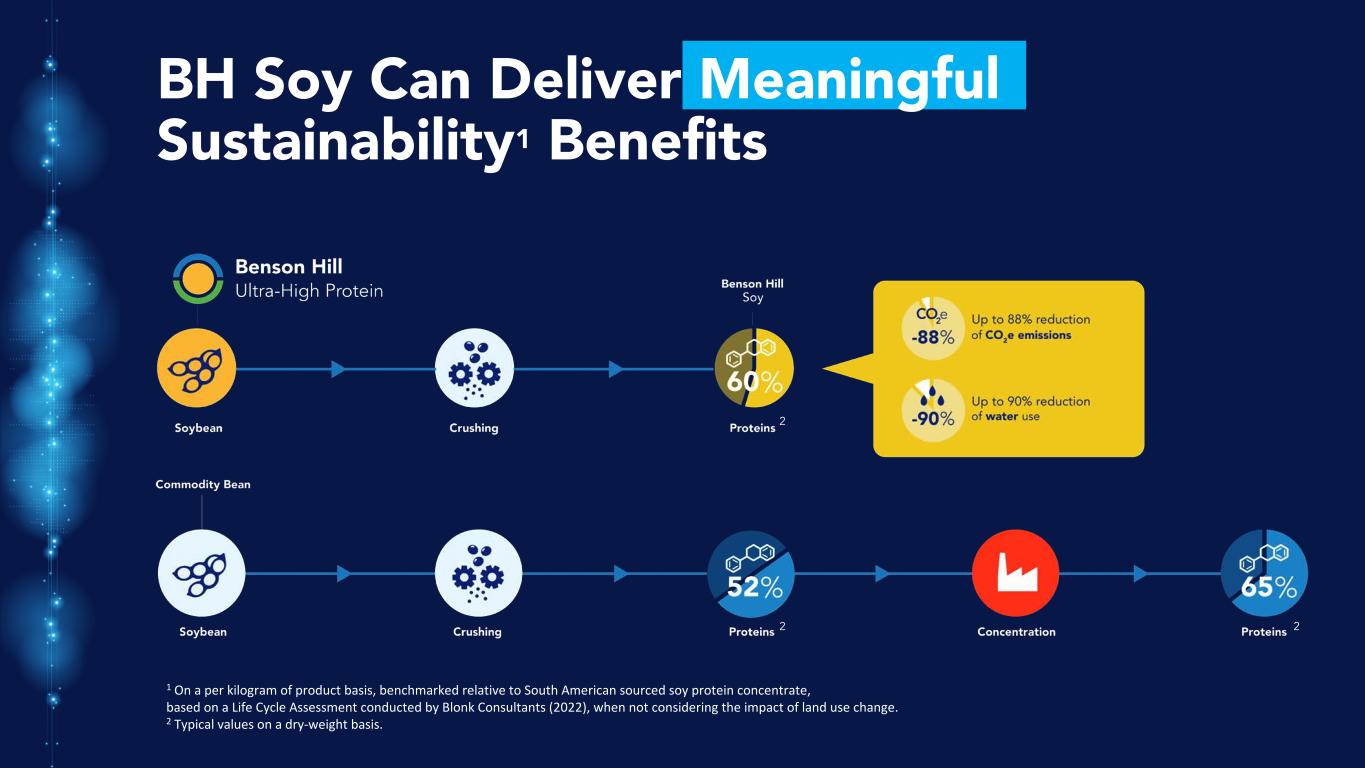

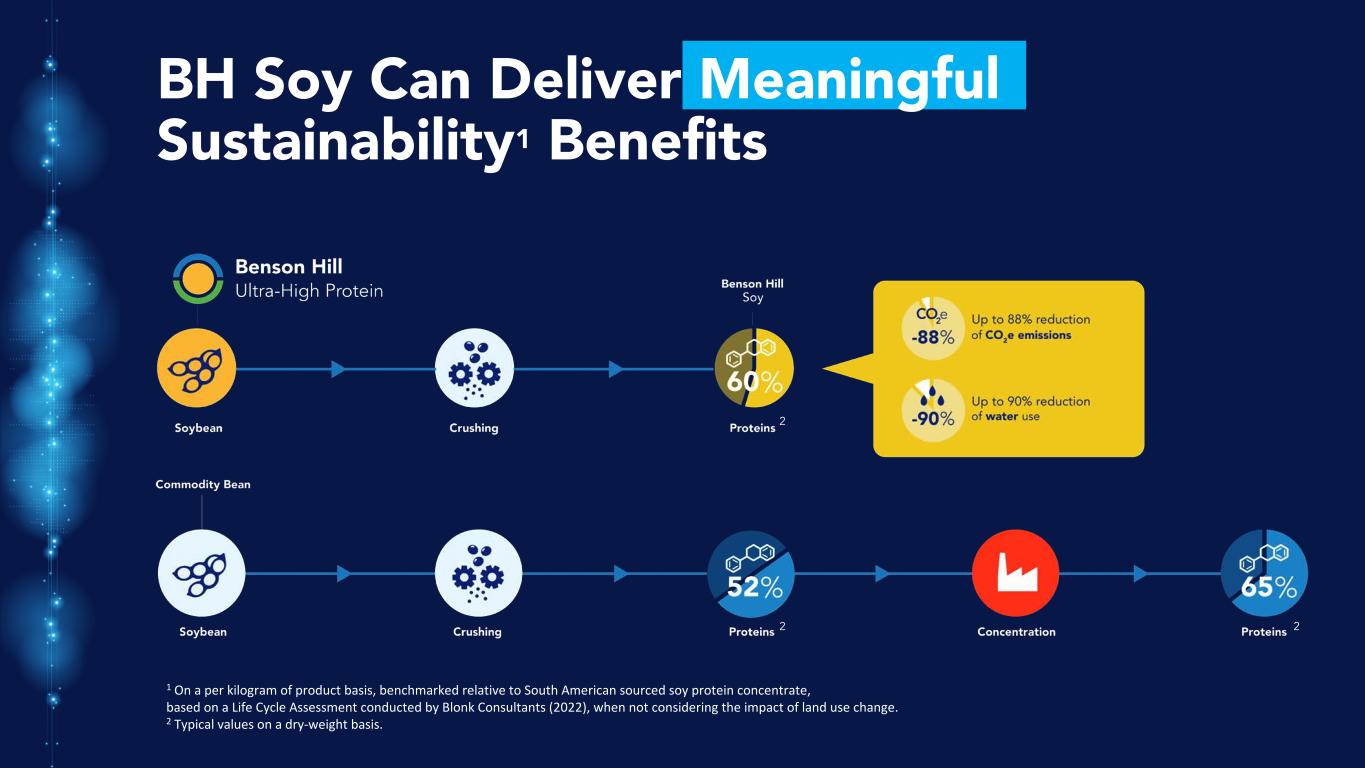

BH Soy Can Deliver Meaningful Sustainability1 Benefits 2 1 On a per kilogram of product basis, benchmarked relative to South American sourced soy protein concentrate, based on a Life Cycle Assessment conducted by Blonk Consultants (2022), when not considering the impact of land use change. 2 Typical values on a dry-weight basis. 2 2

Successful Implementation of Closed Loop Model in U.S. Helps Enable International Markets

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Abundant and Diverse Market Opportunities TODAY FUTURE MEAT ALTERNATIVES AQUACULTURE SPORTS NUTRITION ANIMAL FEED PET FOOD SNACKS CEREALS EDIBLE OILS BAKED GOODS PROCESSED MEAT DAIRY ALTERNATIVES SPECIALTY FEED

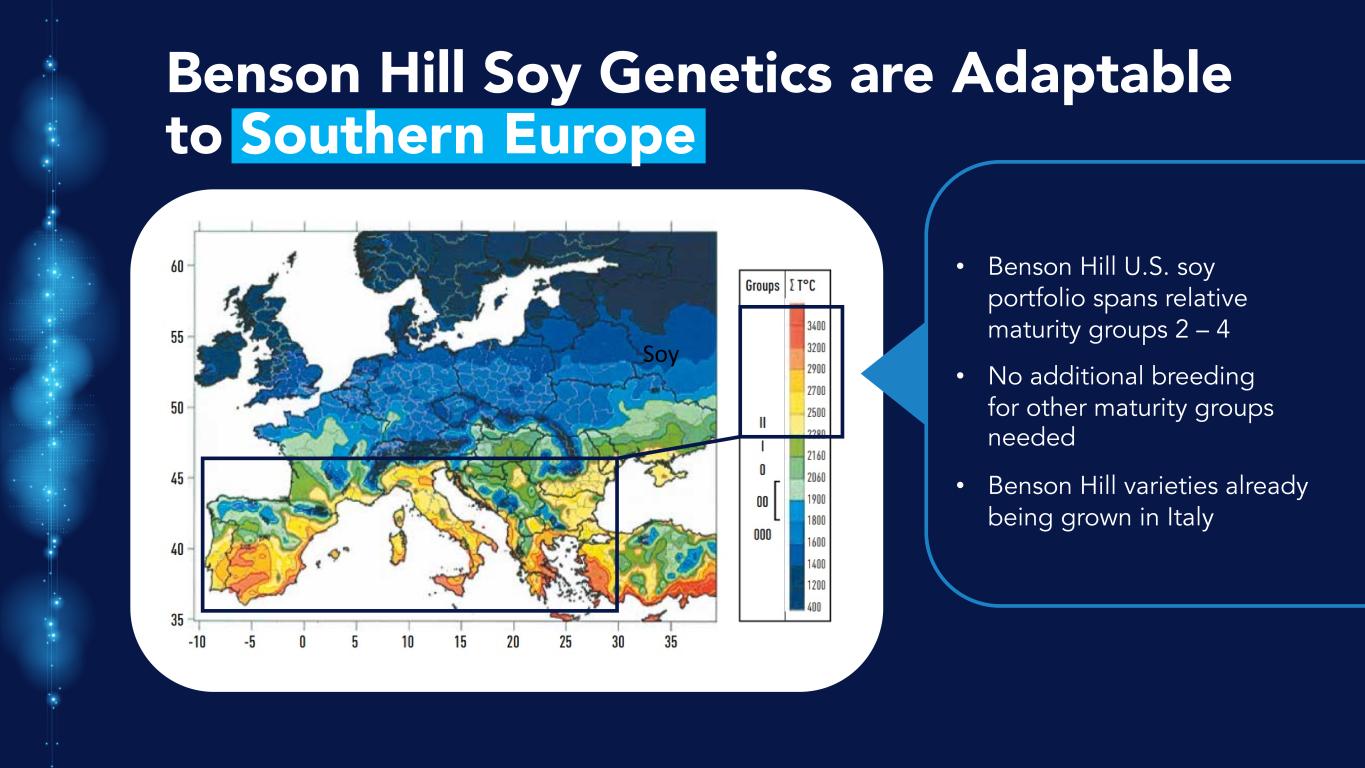

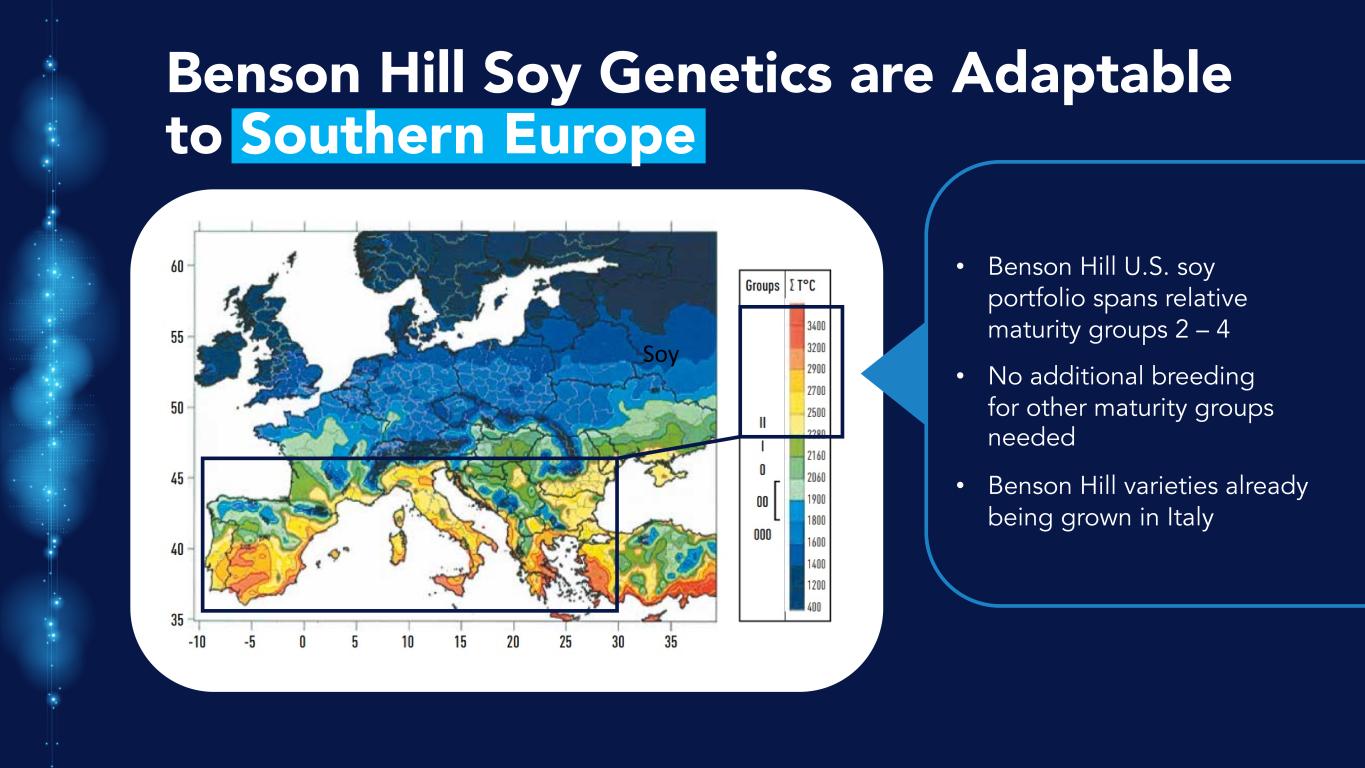

Benson Hill Soy Genetics are Adaptable to Southern Europe • Benson Hill U.S. soy portfolio spans relative maturity groups 2 – 4 • No additional breeding for other maturity groups needed • Benson Hill varieties already being grown in Italy Soy

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Why Benson Hill Can Win Internationally Increasing demand for plant-based protein is global requiring innovative solutions that are more sustainable Proving it today in Europe beginning with Aquaculture Constant innovation in new seed varieties adaptable to new international consumer needs

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2025: PATH TO PROFITABILITY PROPRIETARY REVENUE GROWTH AND GROSS MARGIN EXPANSION DEAN FREEMAN CHIEF FINANCIAL OFFICER

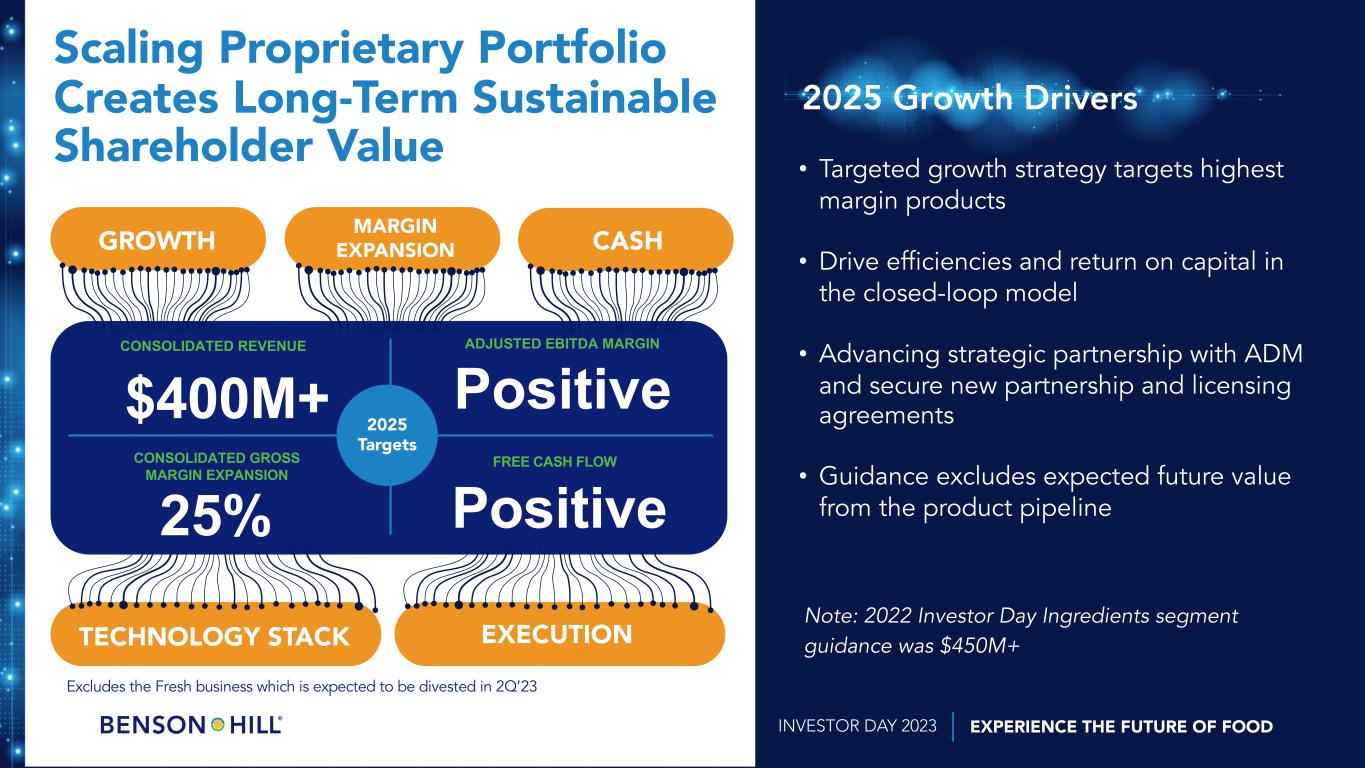

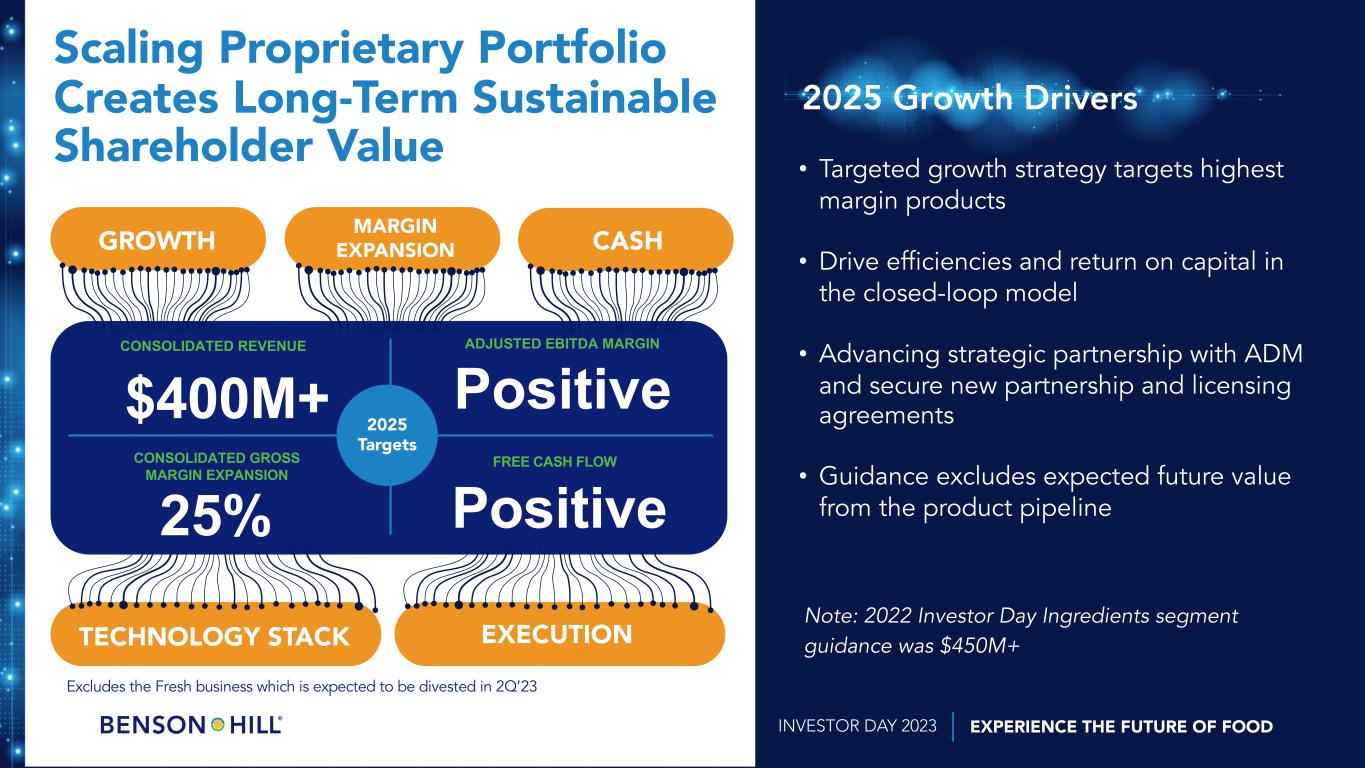

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Scaling Proprietary Portfolio Creates Long-Term Sustainable Shareholder Value MARGIN EXPANSION TECHNOLOGY STACK EXECUTION CASHGROWTH CONSOLIDATED REVENUE CONSOLIDATED GROSS MARGIN EXPANSION ADJUSTED EBITDA MARGIN FREE CASH FLOW $400M+ 25% Positive Positive 2025 Targets Excludes the Fresh business which is expected to be divested in 2Q’23 2025 Growth Drivers • Targeted growth strategy targets highest margin products • Drive efficiencies and return on capital in the closed-loop model • Advancing strategic partnership with ADM and secure new partnership and licensing agreements • Guidance excludes expected future value from the product pipeline Note: 2022 Investor Day Ingredients segment guidance was $450M+

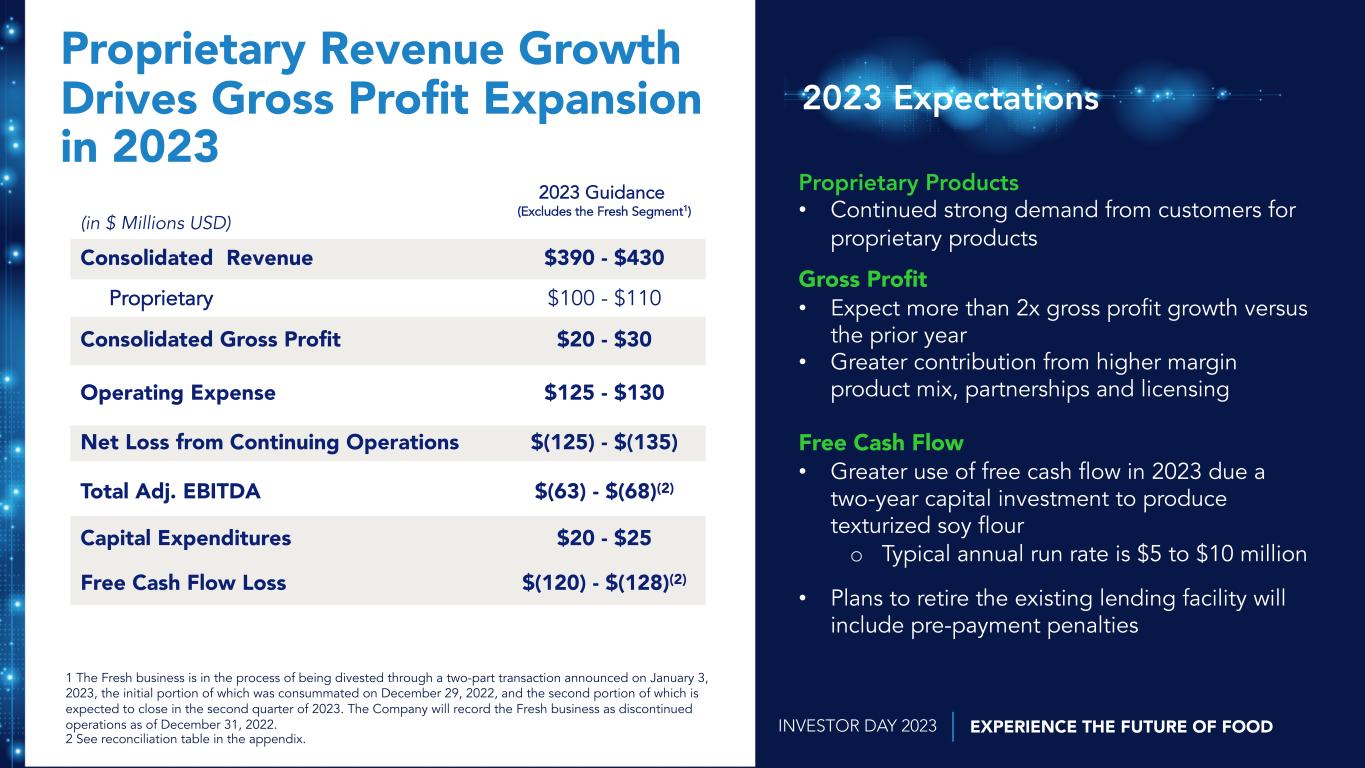

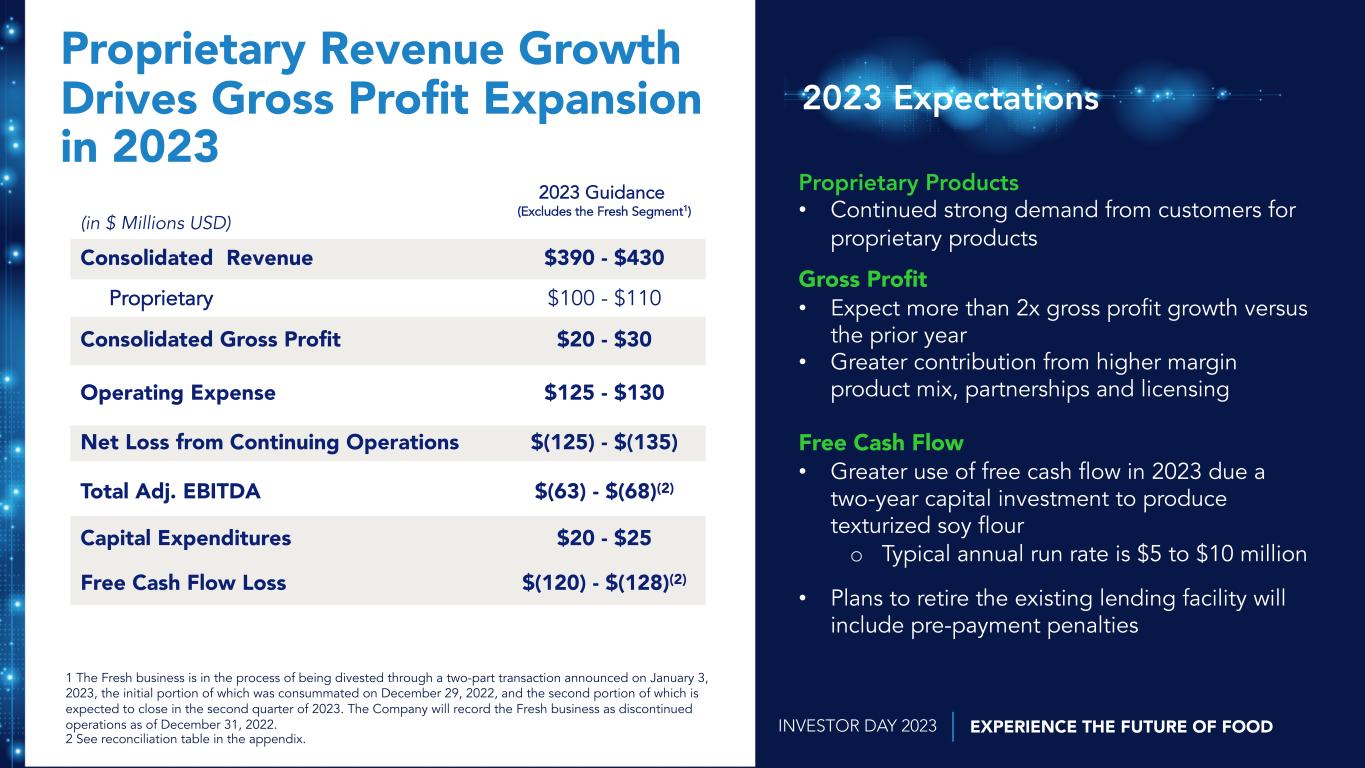

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Proprietary Revenue Growth Drives Gross Profit Expansion in 2023 (in $ Millions USD) 2023 Guidance (Excludes the Fresh Segment1) Consolidated Revenue $390 - $430 Proprietary $100 - $110 Consolidated Gross Profit $20 - $30 Operating Expense $125 - $130 Net Loss from Continuing Operations $(125) - $(135) Total Adj. EBITDA $(63) - $(68)(2) Capital Expenditures $20 - $25 Free Cash Flow Loss $(120) - $(128)(2) 1 The Fresh business is in the process of being divested through a two-part transaction announced on January 3, 2023, the initial portion of which was consummated on December 29, 2022, and the second portion of which is expected to close in the second quarter of 2023. The Company will record the Fresh business as discontinued operations as of December 31, 2022. 2 See reconciliation table in the appendix. 2023 Expectations Proprietary Products • Continued strong demand from customers for proprietary products Gross Profit • Expect more than 2x gross profit growth versus the prior year • Greater contribution from higher margin product mix, partnerships and licensing Free Cash Flow • Greater use of free cash flow in 2023 due a two-year capital investment to produce texturized soy flour o Typical annual run rate is $5 to $10 million • Plans to retire the existing lending facility will include pre-payment penalties

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Expect Significant Growth Scaling Proprietary Revenues 2020 2021 2022 2023(P) 2025(P) Partnership/Licensing Closed-Loop In $US Millions $300+ $6 65 % - 7 5% CAGR $38 $100 - $110 $73 • Customer demand: Differentiated Ultra-High Protein ingredients in food and aqua-culture & non-GMO High Oleic Specialty Oil • Volume: Continued acreage growth consistent with customer demand at responsible margins • Price: Begin scale back from introductory discounts & leverage price improvements with differentiated value offerings • Product Mix: In-house flour texturization expands market opportunities Targeted Proprietary Revenue Growth Drivers (P) - Projected

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Crush Margins Premium Highest Margin Proprietary Soy Products Deliver Value in any Commodity Cycle Historical: commodity crush margin1 Current: Peak commodity crush margin Future: Benson Hill Proprietary premium post-peak commodity crush margin Current: Benson Hill Proprietary premium at peak commodity crush margin Executing on value creation from high oleic specialty oil and Ultra- High Protein Flake, Flour, and Meal Note: Numbers are for illustrative purposes only, but representative ~$1.00 ~$1.75-$2.50 ~$1.75-$2.50 ~$0.90-$1.10 ~$1.50-$2.25 ~$3.00-$4.50 1 Pre-2022 commodity crush margins represents 3-year average (2019-2021) On a per bushel basis

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Targeted Proprietary Revenue Growth and Margin Expansion Proprietary and Non-Proprietary revenue mix shift is anticipated to drive margin expansion Proprietary Closed-Loop Licensing Partnerships Non-Proprietary~75% ~22% ~80% ~12% ~12-15% ~25-35% ~60%-90% TARGET REVENUE MIX 2025 - 2027 TARGET CONTRIBUTION MARGIN%*2022 REVENUE RESULTS CONTRIBUTION MARGIN%* REVENUE GUIDANCE ~18% ~81% 2023 ~3%~1% ~14-17% ~25-30%~8% * Defined as revenue less direct product costs (determined on a non-GAAP basis), which excludes facility overhead costs (labor, utilities, R&M, depreciation).

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Closed-Loop Proprietary Contribution Margin Expansion Plans Remain in Place Crop Performance Improvement Value Chain Optimization Product Mix & Volume Product Pricing Expected 2025-2027 Contribution Margin%* 2022 Guidance Contribution Margin%* * Defined as revenue less direct product costs (determined on a non-GAAP basis), which excludes facility overhead costs (labor, utilities, R&M, depreciation). 2022 Guidance for Total Ingredients Contribution Margin is 8% - 11%, which excludes 8% - 9% of facility overhead costs. Total Ingredients gross margin guidance is 0% to 2%. 2022 Investor Day Crop Performance Improvement Value Chain Optimization Product Mix & Volume Product Pricing Expected 2025-2027 Contribution Margin%* 2022 Actuals Contribution Margin%* * Defined as revenue less direct product costs (determined on a non-GAAP basis), which excludes facility overhead costs (labor, utilities, R&M, depreciation). 2023 Guidance for Total Ingredients Contribution Margin is 14% - 16%, which excludes 8% - 10% of facility overhead costs. Total Ingredients gross margin guidance is 5% to 7%. 2023 Investor Day +9-11 pts +5-8 pts +3-6 pts +1-2 pts 7% Crop performance improvements anticipated to result in elimination of isolate spiking cost Crop contracting, logistics, and supply chain efficiencies Scaling up higher margin products Reduce introductory discounts and higher prices from differentiated offerings 25%-35% +8-10 pts +7-9 pts +6-8 pts +3-5 pts 1%-3% Crop performance improvements anticipated to result in elimination of isolate spiking cost Crop contracting, logistics, and supply chain efficiencies Scaling up higher margin products Reduce introductory discounts and higher prices from differentiated offerings 25%-35%

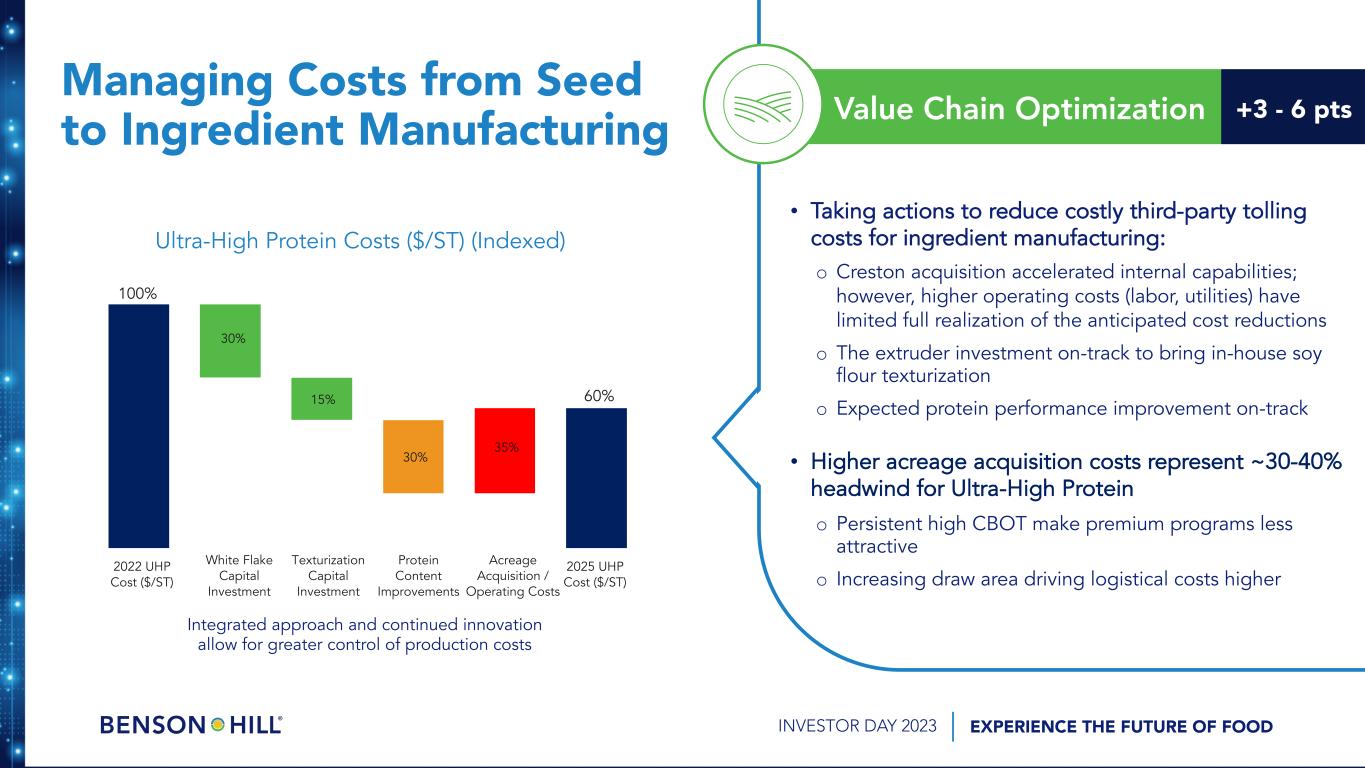

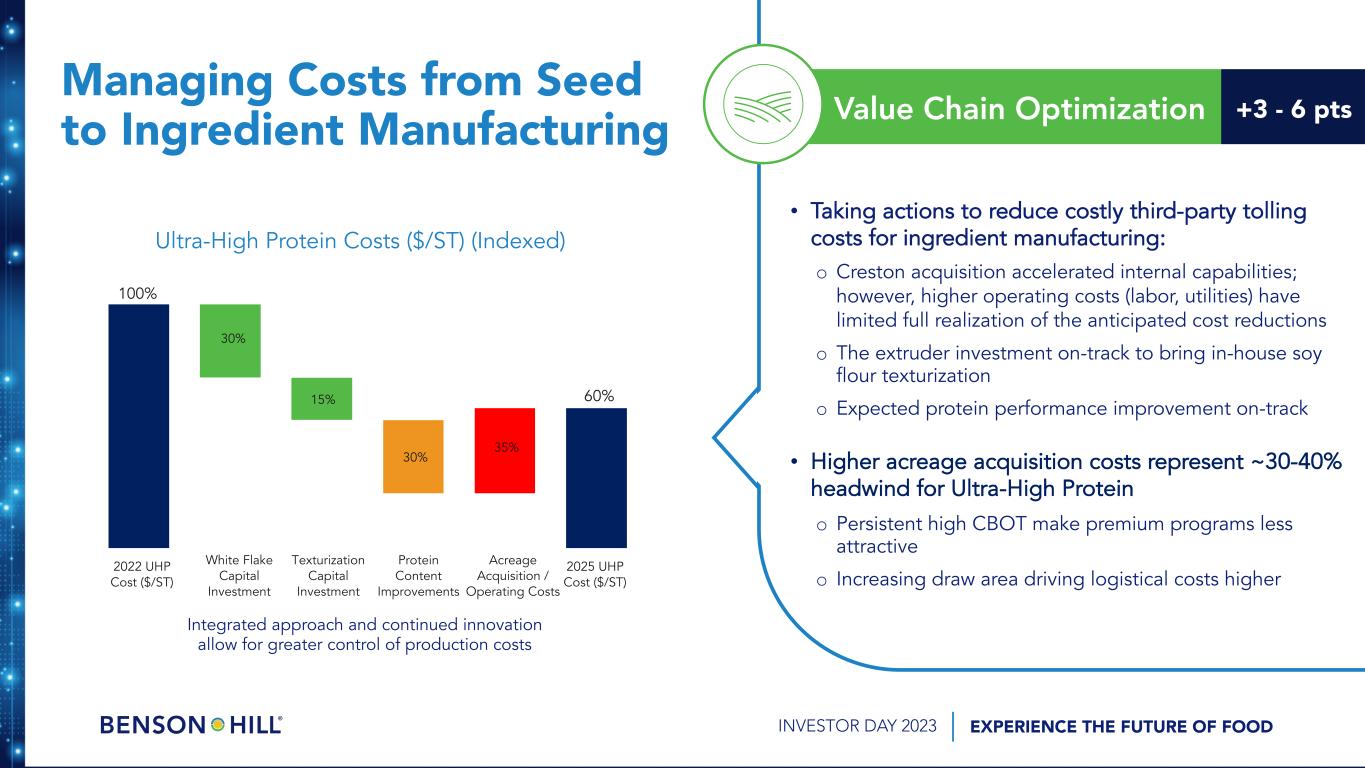

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Managing Costs from Seed to Ingredient Manufacturing Ultra-High Protein Costs ($/ST) (Indexed) Integrated approach and continued innovation allow for greater control of production costs • Taking actions to reduce costly third-party tolling costs for ingredient manufacturing: o Creston acquisition accelerated internal capabilities; however, higher operating costs (labor, utilities) have limited full realization of the anticipated cost reductions o The extruder investment on-track to bring in-house soy flour texturization o Expected protein performance improvement on-track • Higher acreage acquisition costs represent ~30-40% headwind for Ultra-High Protein o Persistent high CBOT make premium programs less attractive o Increasing draw area driving logistical costs higher Value Chain Optimization +3 - 6 pts Acreage Acquisition / Operating Costs 30% 15% 30% 35% 2025 UHP Cost ($/ST) 100% 60% 2022 UHP Cost ($/ST) White Flake Capital Investment Texturization Capital Investment Protein Content Improvements

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Targeted Gross Profit Improvement Driven by Broad Market Opportunities Partnerships Partnerships Specialty Oils Specialty Oils Aqua Meal Aqua Meal Human & Animal Nutrition Human & Animal Nutrition Other* Other* 2023(P) 2025(P) Sca lin g th e proprie tar y p ortf olio *Other includes yellow pea & non-proprietary products (P)-Projected $20 - $30 In $US Millions ~$100

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Seed to proprietary ingredient cash conversion cycle Seed sent to farmers Year 1 Q1 Year 1 Source Cash Flow Use Q3 Year 1 Q1 Year 2 Q3 Year 2 Harvest Grain purchased from farmers Year 1 Manufacturing high value add products Year 1 Products Sold Benson Hill/Farmer Relationship Early working capital use

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 MINIMIZE WORKING CAPITAL REQUIREMENTS REDUCE OPEX WHILE RETAINING VALUE FOCUSED ASSET BASE Liquidity Improvement Actions Funding proceeds targeted at $35-$45 million • Explore strategic options for Seymour in 2023 • Drive capacity utilization in Creston, IA and with strategic partner assets • Implementing operating cost reduction, targeted to deliver at least $20M of run-rate savings by 2024 • Target cost savings aligned with product focus and retaining core value capability • Acreage targets optimized to improve free cash flow, but still meet 2025 revenue targets • Working capital reduced, inventory levels optimized and tightly controlled Cost and operational improvements targeted to drive ~$65-$75 million in liquidity savings through 2024

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 2022–2025: Expected Path to Positive Cash Flow 2022 Ending Cash Free Cash Flow Use1 Repayment of Current Term Loan Other Principal Payments Cost / Operational Improvement & Equity Proceeds $175 Proprietary portfolio growth expected to reduce cash burn 2025 Ending Cash Conventional Lending Facility with FNBO Line of Credit: $50 Equipment Loan: $20 Syndicated Term Debt: $30 $(160)-$(180) $(115) $(40)-$(45) $100-$120 $10-$50 Additional Cash Proceeds Cost & Operational Improvements: $65-$75 Equity Proceeds: $35-$45 1 Excludes free cash flow benefits from liquidity improvement initiatives and excludes interest payments related to repayment of current term loan Net Proceeds from New Debt $75-$85 In $US Millions FCF=Free cash flow defined as cash flow from operating activities minus capital expenditures Expected completion of debt refinancing as early as 3Q’23

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 Targeting Positive Free Cash Flow in 2025 Gross Profit Executing target growth strategy & scaling the proprietary portfolio to improve cash flow Cash OPEX Driven by liquidity improvement initiatives Interest Expense(1) Conventional loan facility planned to reduce annualized interest expense by ~40% 2023 FCF Guidance Net Working Capital/Other Managed tightly as production volumes grow $(120)-$(128) CAPEX Completion of in house texturization 2025 Target $0-$20 $70-$80 $20 $7-$15 $(5)-$(10) $30-$35 FCF=Free cash flow defined as cash flow from operating activities minus capital expenditures (1) Approximately 50% of 2023 interest expense includes one-time expenses related to refinancing of current term loan In $US Millions

EXPERIENCE THE FUTURE OF FOODINVESTOR DAY 2023 MARGIN EXPANSION Focus on highest-margin product opportunities in food ingredients, aquaculture, and edible oils Operating efficiency gains and focus on improving return on capital Why Benson Hill Wins PROPRIETARY GROWTH Customer demand for Benson Hill innovations expected to drive closed- loop revenue growth and increasing partnership revenue contribution CASH GENERATION Successful execution of strategic plan, completion of debt refinancing, and modest equity raise in 2023 intended to achieve planned positive adjusted EBITDA and positive free cash flow in 2025

Thank you

Appendix

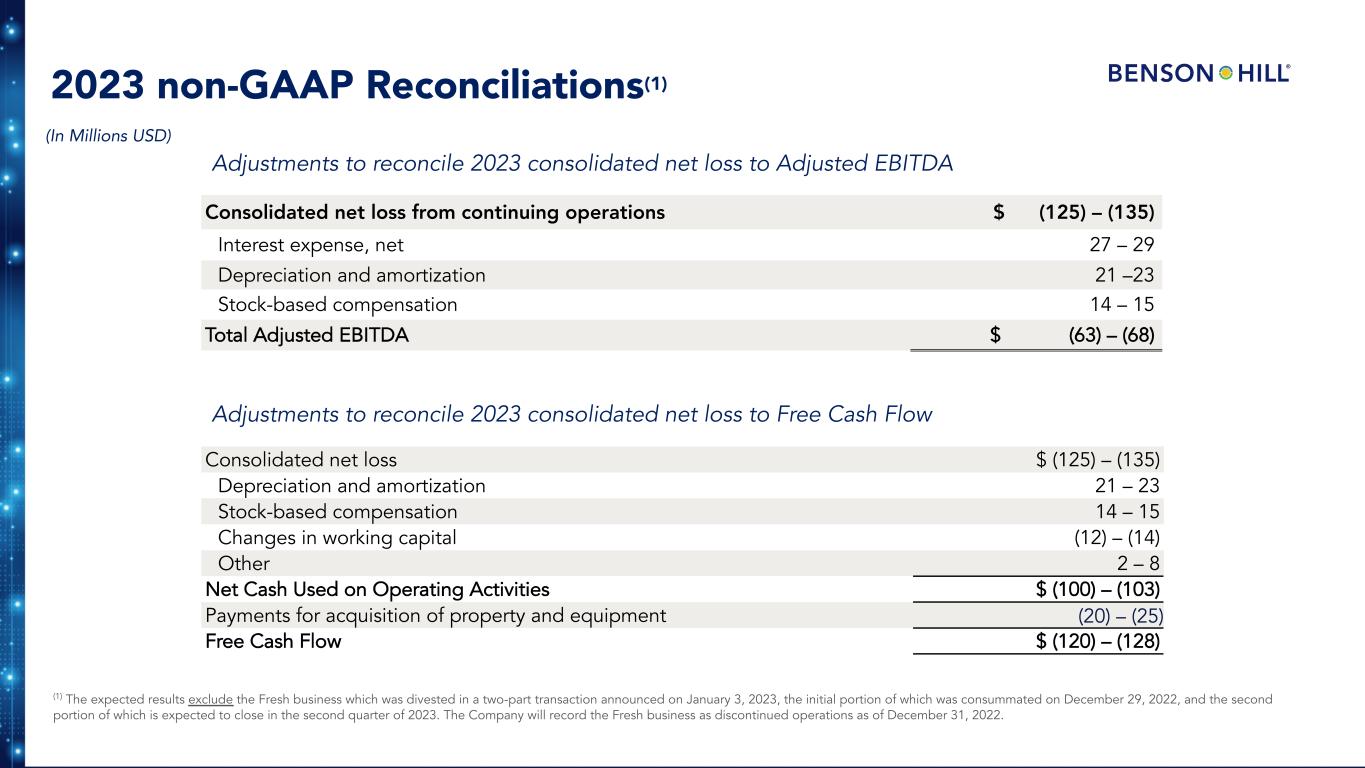

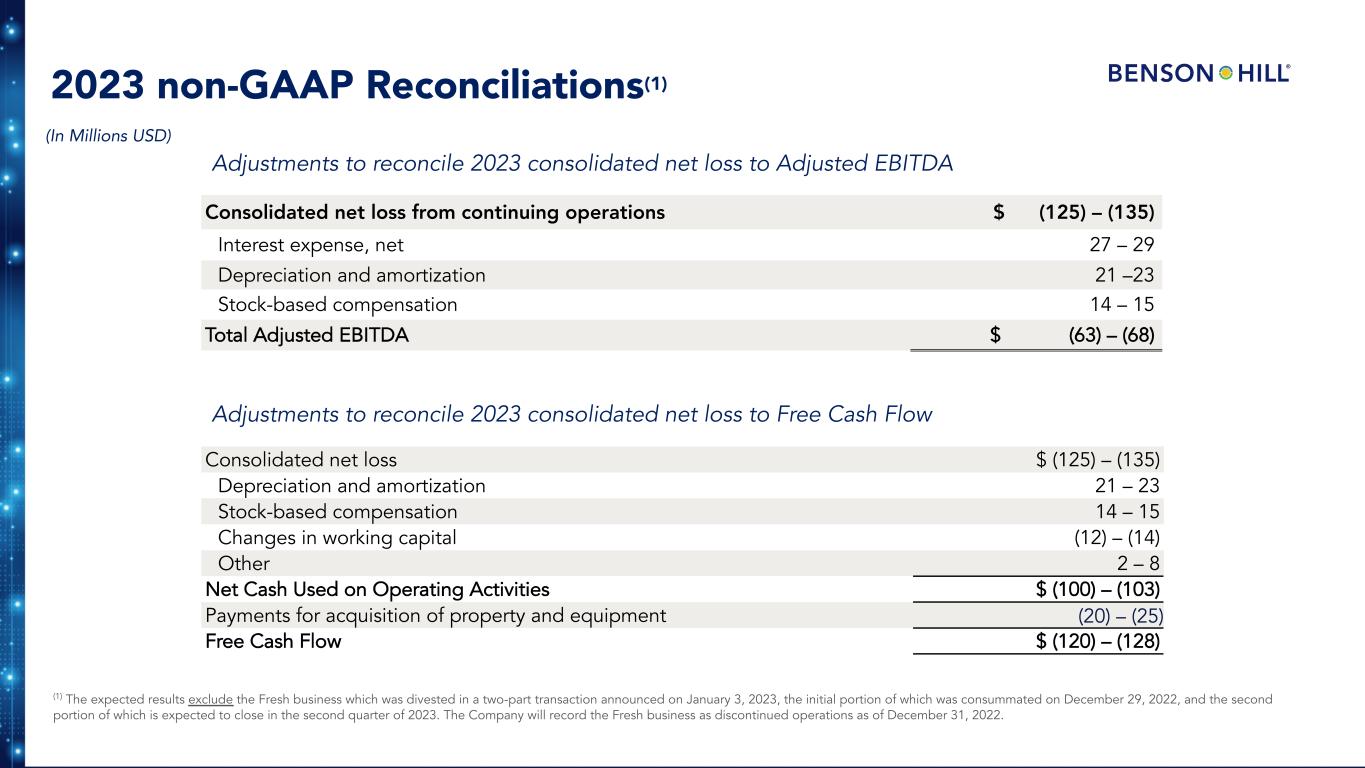

2023 non-GAAP Reconciliations(1) Adjustments to reconcile 2023 consolidated net loss to Adjusted EBITDA (In Millions USD) Consolidated net loss from continuing operations $ (125) – (135) Interest expense, net 27 – 29 Depreciation and amortization 21 –23 Stock-based compensation 14 – 15 Total Adjusted EBITDA $ (63) – (68) (1) The expected results exclude the Fresh business which was divested in a two-part transaction announced on January 3, 2023, the initial portion of which was consummated on December 29, 2022, and the second portion of which is expected to close in the second quarter of 2023. The Company will record the Fresh business as discontinued operations as of December 31, 2022. Adjustments to reconcile 2023 consolidated net loss to Free Cash Flow Consolidated net loss $ (125) – (135) Depreciation and amortization 21 – 23 Stock-based compensation 14 – 15 Changes in working capital (12) – (14) Other 2 – 8 Net Cash Used on Operating Activities $ (100) – (103) Payments for acquisition of property and equipment (20) – (25) Free Cash Flow $ (120) – (128)

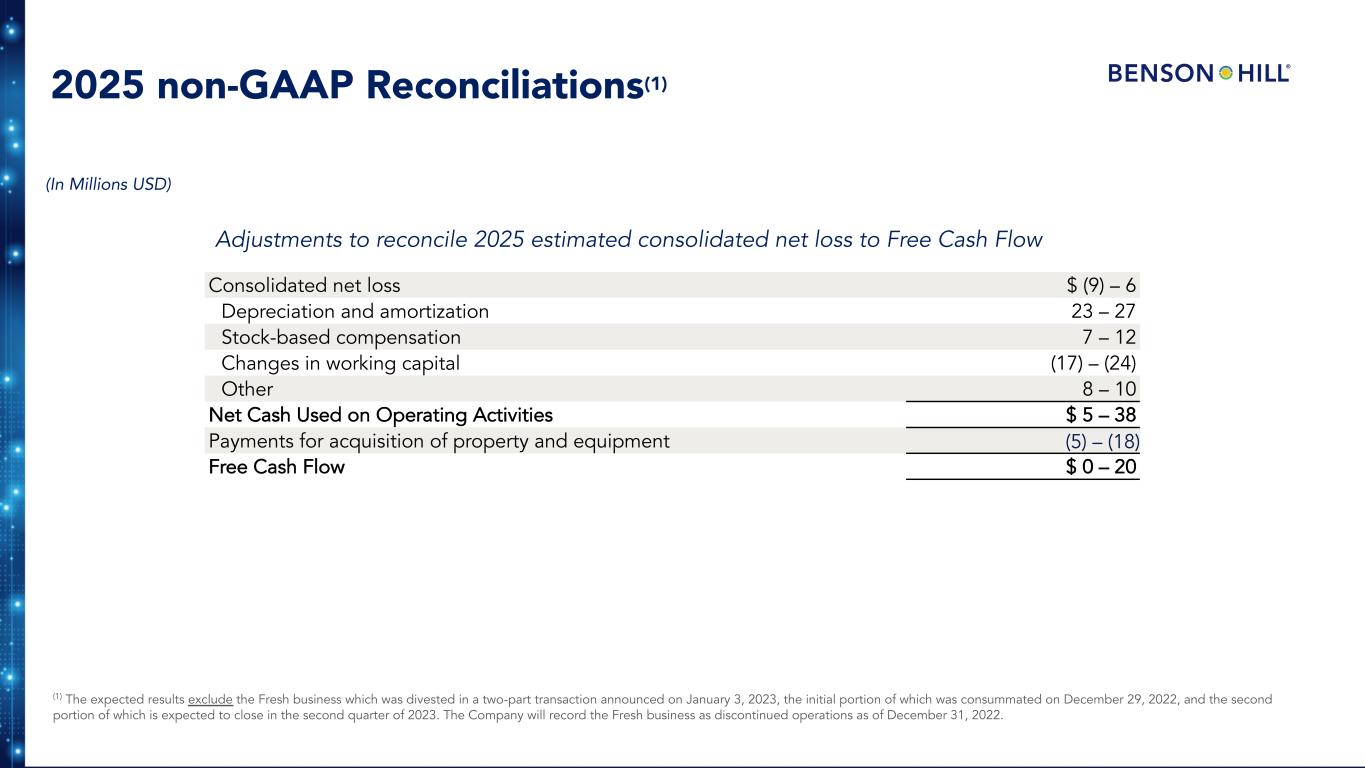

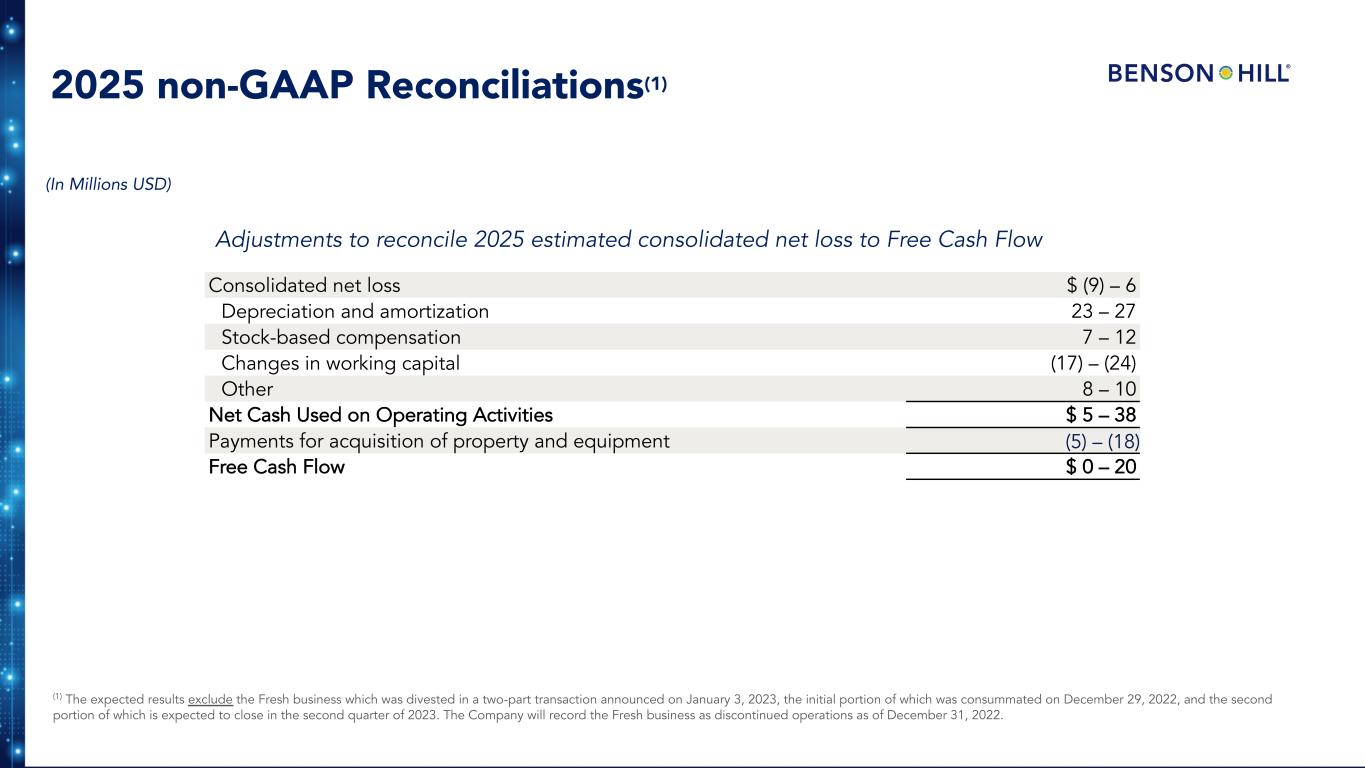

2025 non-GAAP Reconciliations(1) (In Millions USD) (1) The expected results exclude the Fresh business which was divested in a two-part transaction announced on January 3, 2023, the initial portion of which was consummated on December 29, 2022, and the second portion of which is expected to close in the second quarter of 2023. The Company will record the Fresh business as discontinued operations as of December 31, 2022. Adjustments to reconcile 2025 estimated consolidated net loss to Free Cash Flow Consolidated net loss $ (9) – 6 Depreciation and amortization 23 – 27 Stock-based compensation 7 – 12 Changes in working capital (17) – (24) Other 8 – 10 Net Cash Used on Operating Activities $ 5 – 38 Payments for acquisition of property and equipment (5) – (18) Free Cash Flow $ 0 – 20