SECOND QUARTER 2023 FINANCIAL RESULTS AND OUTLOOK August 9, 2023 Exhibit 99.2

Disclaimers CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS Certain statements in this presentation may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward- looking statements generally relate to future events or the future financial or operating performance of Benson Hill Inc. (the “Company” or “Benson Hill”) and may be identified by words such as “ may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict” or similar words, as well as the negative of such statements. These forward-looking statements are based upon assumptions made by the Company as of the date hereof and are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements include, among other things, statements regarding plans to improve the Company’s capital structure and liquidity position; management’s strategy and plans for growth, including those expected to be associated with the Liquidity Improvement Plan and other cost saving measures; statements regarding the Company’s Liquidity Improvement Plan and other cost-saving measures, actions to implement such plans, and the anticipated benefits of such plans; the Company’s current guidance regarding certain expected 2023 financial and operating results, including consolidated and proprietary revenues, consolidated gross profit, operating expense, net loss from continuing operations, Adjusted EBITDA, capital expenditures and free cash flow loss; anticipated benefits of the Company’s existing and potential future strategic partnerships and licensing arrangements; expectations regarding the sources of expected consolidated revenue and gross profit growth, including greater contribution from higher margin product mix, the Company's ability to identify and evaluate its strategic alternatives and effect potential strategic opportunities in ways that maximize shareholder value; expectations regarding the Company's ability to continue as a going concern; statements regarding the execution of the Company's business plan, the strategic review of the Company's business, and the Company's executive leadership transition; the Company’s ability to evaluate its strategic alternatives and effect on potential strategic opportunities; partnerships and licensing; the Company’s positioning, resources, capabilities, and expectations for future performance; management’s strategies and plans for growth; and projections of consumer preferences, industry trends and market opportunity through and including 2028 and beyond. Factors that may cause actual results to differ materially from current expectations include, but are not limited to risks associated with the Company’s inability to improve its capital structure and liquidity position, or otherwise fail to execute on the actions expected to be associated with the Liquidity Improvement Plan and other cost-saving measures; the Company’s ability to continue as a going concern; liquidity and other risks relating to the Company’s ability to continue as a going concern; risks associated with the Company’s ability to grow and achieve growth profitably, including continued access to the capital resources necessary for growth; the risk that the Company will be unable to retire any of its existing debt early or enter into a new lending facility in a timely manner, on favorable terms, or at all; the risk that the Company will fail to realize the anticipated benefits of its existing shelf registration statement, including its existing at the market facility, or otherwise fail to raise equity capital to supplement its cash needs; risks relating to potential dilution, including in connection with the Company's existing at the market facility or any other equity offering; the risk that even if the actions expected to be associated with the Liquidity Improvement Plan are successful, such actions could have long term adverse effects on the Company's business, including the Company's research and development initiatives and the Company's ability to commercialize its product candidates; risks associated with the possibility that the Company could be forced to reduce expenses beyond current planned cost reduction initiatives, including the risk that the Company's growth strategy could be compromised as a result; the risk that the Company will not realize the anticipated benefits of the divestiture of the Fresh business in a timely manner or at all; risks associated with managing capital resources; risks associated with maintaining relationships with customers and suppliers and developing and maintaining partnering and licensing relationships; risks associated with changing industry conditions and consumer preferences; risks associated with the Company’s ability to generally execute on its business strategy; risks associated with the Company’s execution of its executive leadership transition, including among others, risks relating to maintaining key employee, customer, partner and supplier relationships; risks associated with the effects of global and regional economic, agricultural, financial and commodities markets; the effectiveness of the Company’s risk management strategies; and other risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in our filings with the SEC, which are available on the SEC’s website at www.sec.gov. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved, including, without limitation, any expectations about our operational and financial performance or achievements through and including 2028 and beyond. There may be additional risks about which the Company is presently unaware or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. The reader should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company expressly disclaims any duty to update these forward-looking statements except as otherwise required by law. In addition, the Company has and may in the future modify how it calculated non-GAAP performance measures. USE OF NON-GAAP FINANCIAL MEASURES In this presentation, the Company includes references to non-GAAP performance measures. The Company uses these non-GAAP financial measures to facilitate management’s financial and operational decision-making, including evaluation of the Company’s historical operating results. The Company’s management believes these non-GAAP measures are useful in evaluating the Company’s operating performance and are similar measures reported by publicly listed U.S. competitors, and regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to corresponding GAAP financial measures, may provide a more complete understanding of factors and trends affecting the Company’s business. By referencing these non- GAAP measures, the Company’s management intends to provide investors with a meaningful, consistent comparison of the Company’s performance for the periods presented. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, financial information prepared in accordance with GAAP. The Company’s definition of these non-GAAP measures may differ from similarly titled measures of performance used by other companies in other industries or within the same industry. Because non-GAAP financial measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, the Company's management strongly encourages investors to review the Company’s consolidated financial statements and publicly-filed reports in their entirety. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the tables accompanying this presentation.

OUR MISSION TO LEAD THE PACE OF INNOVATION IN .THE FOOD SYSTEM.

DATA SCIENCE / PLANT SCIENCE / FOOD SCIENCE

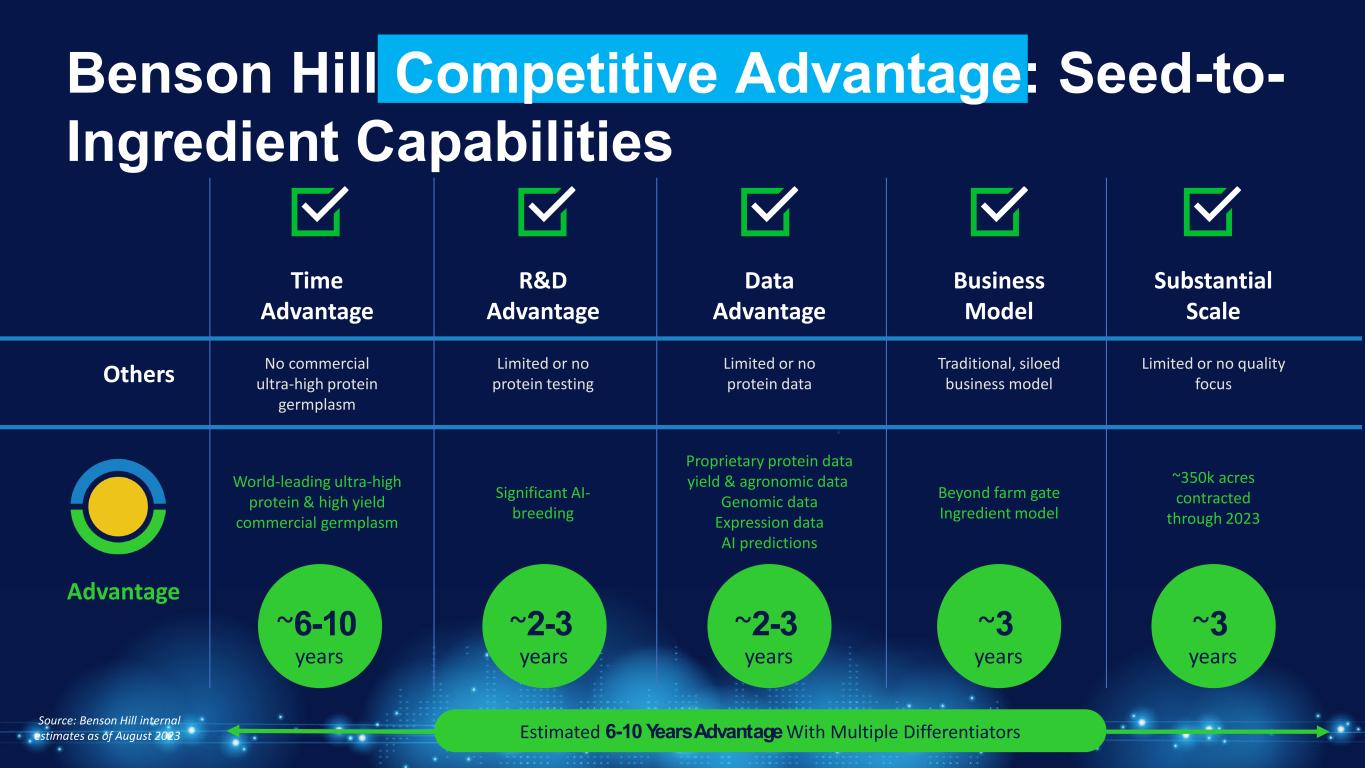

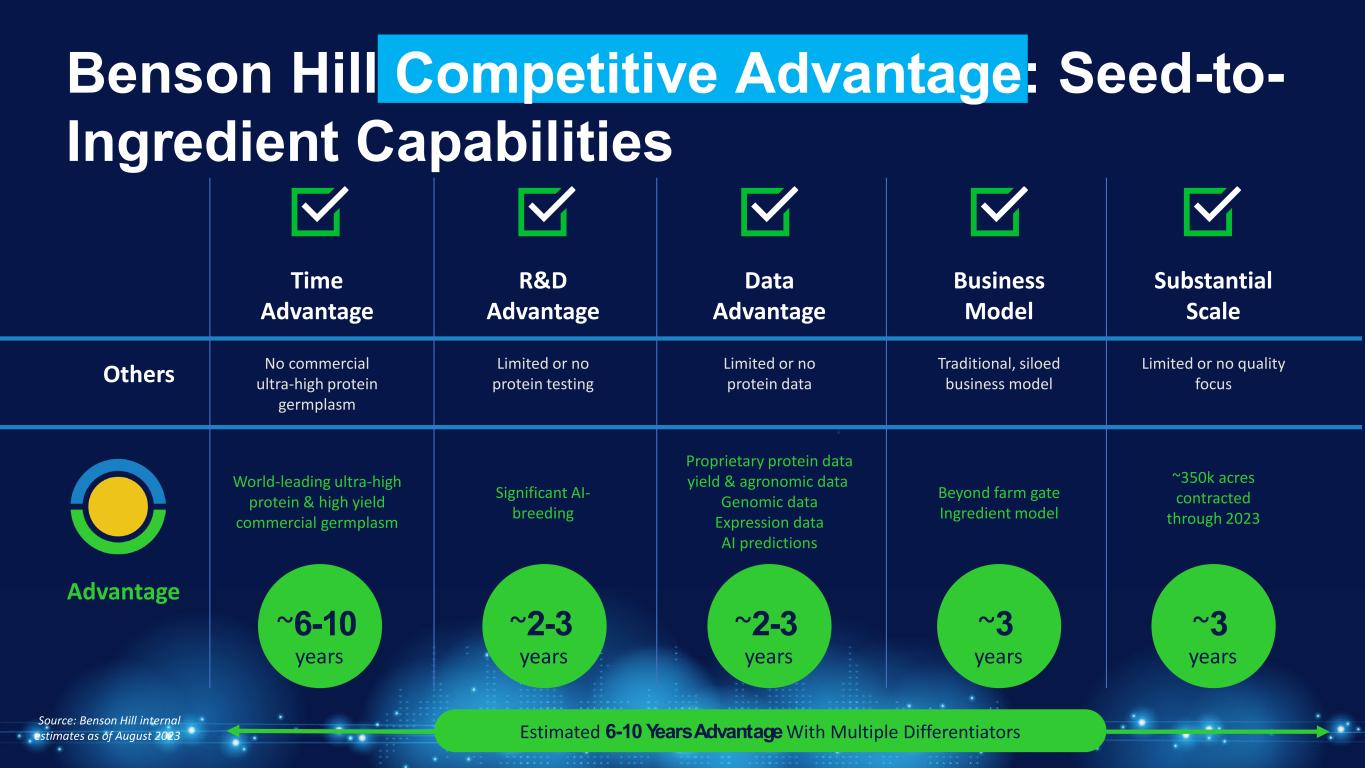

Others Advantage Source: Benson Hill internal estimates as of August 2023 Time Advantage World-leading ultra-high protein & high yield commercial germplasm No commercial ultra-high protein germplasm ~6-10 years R&D Advantage Limited or no protein testing Significant AI- breeding ~2-3 years Data Advantage Limited or no protein data Proprietary protein data yield & agronomic data Genomic data Expression data AI predictions ~2-3 years Business Model Traditional, siloed business model Beyond farm gate Ingredient model ~3 years Substantial Scale Limited or no quality focus ~350k acres contracted through 2023 ~3 years Estimated 6-10 YearsAdvantage With Multiple Differentiators Benson Hill Competitive Advantage: Seed-to- Ingredient Capabilities

. 3.

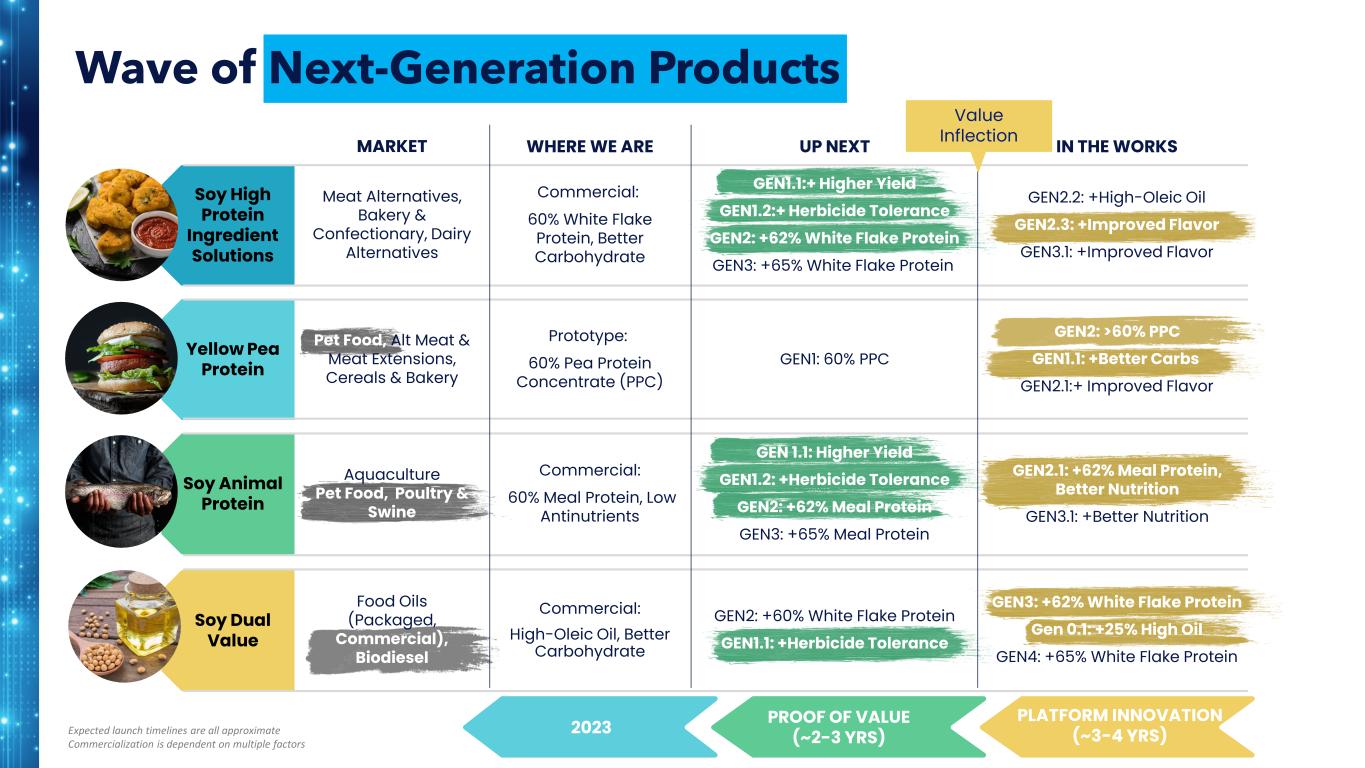

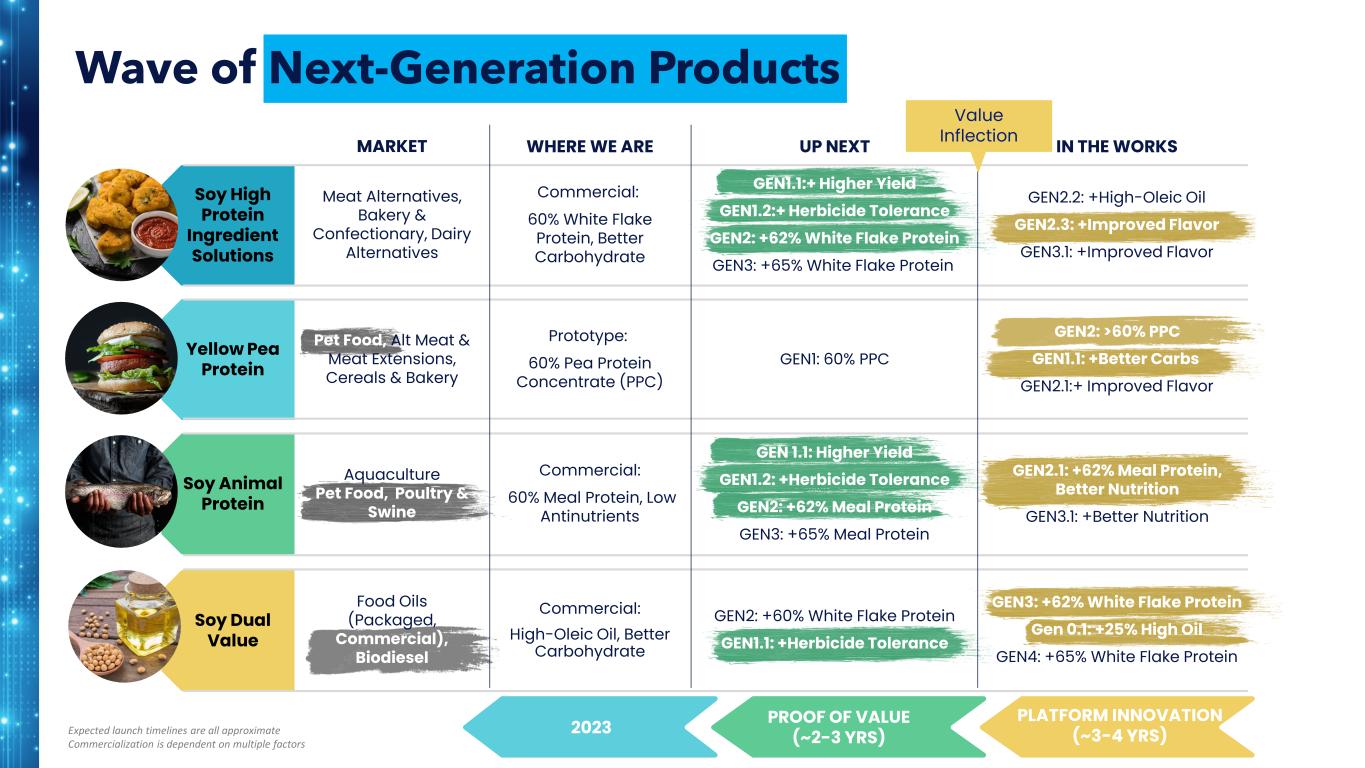

Wave of Next-Generation Products IN THE WORKS GEN2: >60% PPC GEN1.1: +Better Carbs GEN2.1:+ Improved Flavor UP NEXT GEN1: 60% PPC GEN2: +60% White Flake Protein GEN1.1: +Herbicide Tolerance WHERE WE ARE Commercial: 60% White Flake Protein, Better Carbohydrate Commercial: 60% Meal Protein, Low Antinutrients Commercial: High-Oleic Oil, Better Carbohydrate Prototype: 60% Pea Protein Concentrate (PPC) Soy High Protein Ingredient Solutions Yellow Pea Protein Soy Animal Protein Soy Dual Value MARKET Meat Alternatives, Bakery & Confectionary, Dairy Alternatives Value Inflection GEN2.1: +62% Meal Protein, Better Nutrition GEN3.1: +Better Nutrition GEN2.2: +High-Oleic Oil GEN2.3: +Improved Flavor GEN3.1: +Improved Flavor Pet Food, Alt Meat & Meat Extensions, Cereals & Bakery Aquaculture Pet Food, Poultry & Swine Food Oils (Packaged, Commercial), Biodiesel GEN1.1:+ Higher Yield GEN1.2:+ Herbicide Tolerance GEN2: +62% White Flake Protein GEN3: +65% White Flake Protein PLATFORM INNOVATION (~3-4 YRS) PROOF OF VALUE (~2-3 YRS)2023 GEN3: +62% White Flake Protein Gen 0.1: +25% High Oil GEN4: +65% White Flake Protein GEN 1.1: Higher Yield GEN1.2: +Herbicide Tolerance GEN2: +62% Meal Protein GEN3: +65% Meal Protein Expected launch timelines are all approximate Commercialization is dependent on multiple factors

• Market entry • Build relationships across the value chain • Low capital investment Step 1 The Foundation • Prove proprietary product concept • Ensure traceability • Capital investment and strategic partnerships Step 2 Integrated Route to Market • Pursue broad acre opportunity through partnerships/licensing • Scale beyond the initial proving ground acreage • Greatest capital efficiency Step 3 Broad Adoption Yellow Pea Soybean Growth Playbook Relies on Partnerships and Licensing

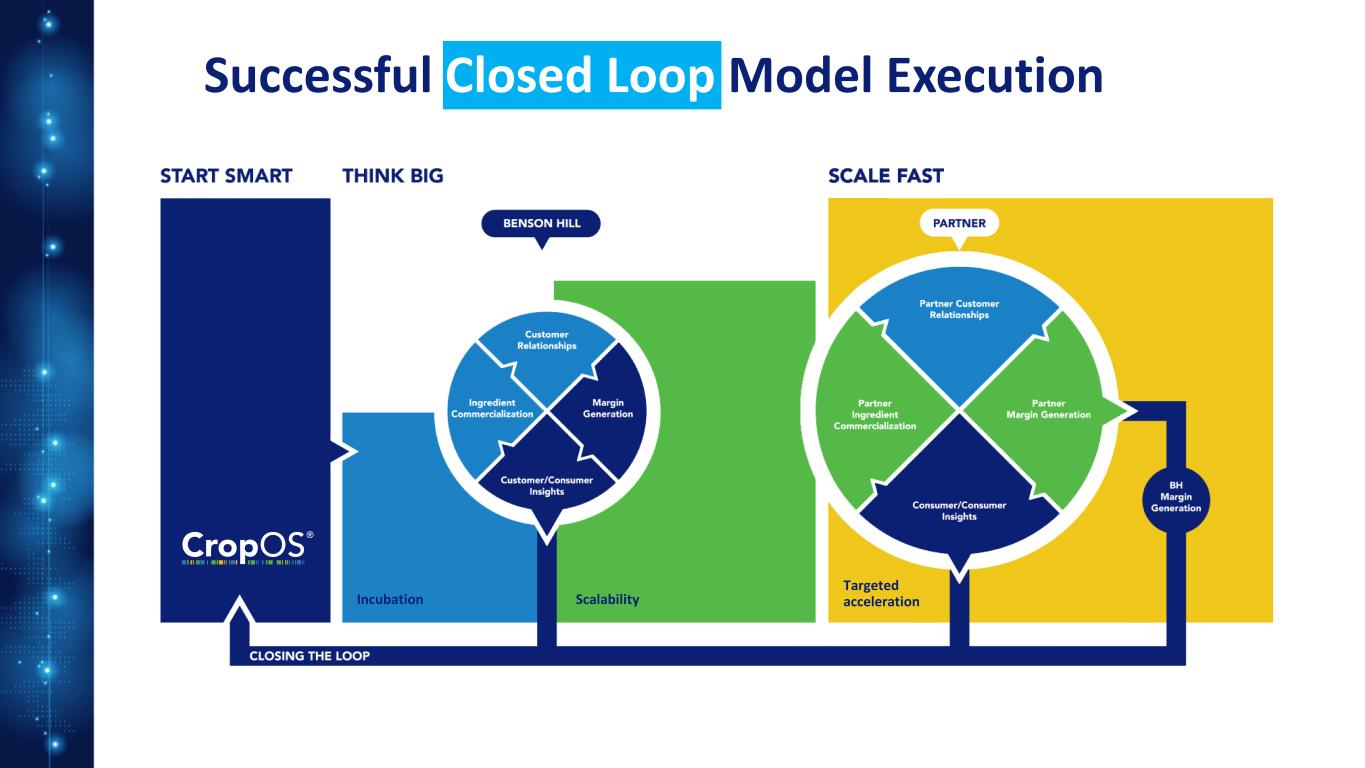

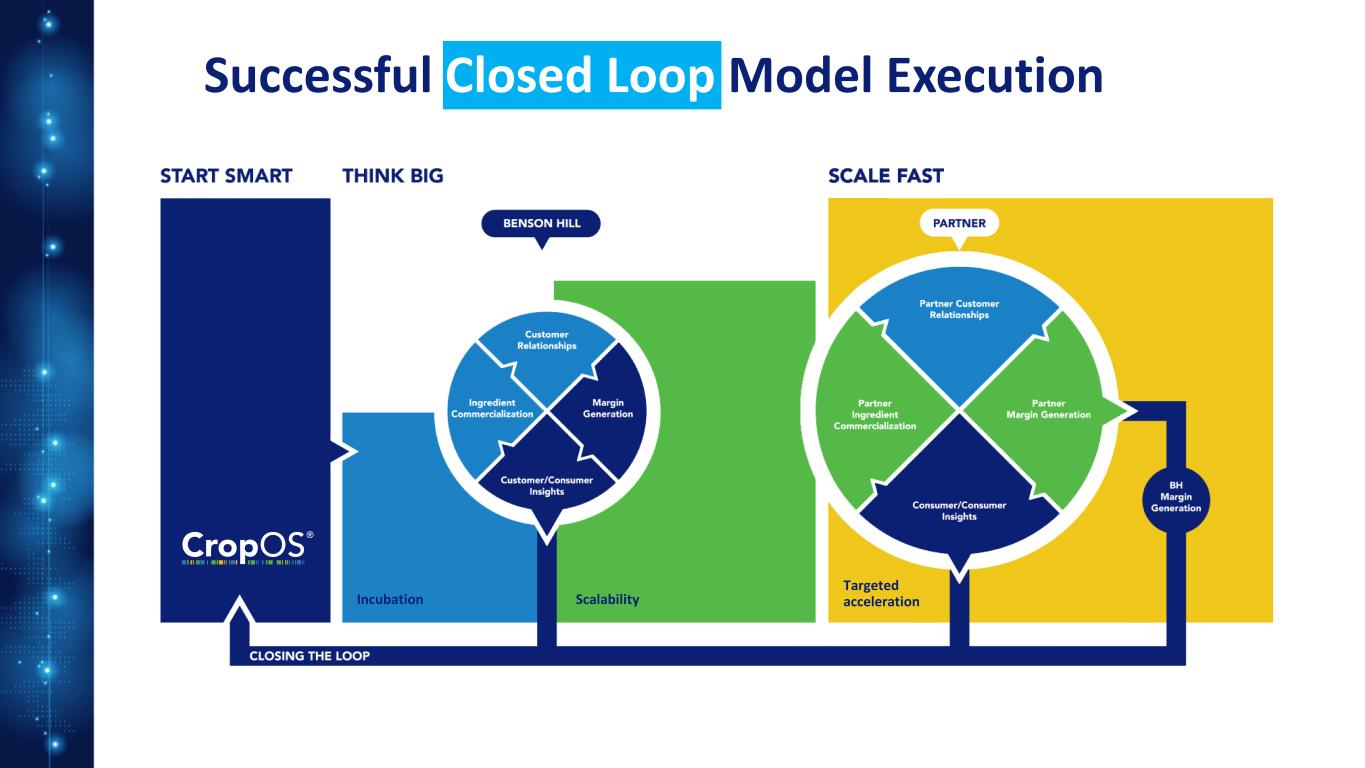

Successful Closed Loop Model Execution Incubation Scalability Targeted acceleration

IP ROBUST PARTNERSHIP MODELS EXISTING MARKETS NEW LARGE MARKET ADJACENCIES INTERNATIONAL MARKETS LARGE-ACRE LIVESTOCK FEED Evolution Through Technology

Attractive Market Fit UHP LO UHP Enlist E3® Ultra-High Protein with low oligosaccharides currently in market Ultra-High Protein with Enlist E3® varieties expected in 2025

Proven Proprietary Products are Well Suited for Global Expansion P lant-bas ed meat AquaBenson Hill U.S. and International headquarters

Strategic Levers for Value Creation Unique Seed to Ingredient Capabilities Effectively Validate and Rapidly Scale High-Value Innovative Ingredients License Powerful Platform into New Crops

Moderation in the specialty oils market from exceptional high-levels in 2022 and 2023 Market Dynamics Impacting Specialty Industry Bumper crop in Brazil are pressuring export prices into the EU for aquaculture Weaker demand in premium markets such as plant-based meat Reversal of supply chain dislocations are increasing imports from Asia/China into the U.S. 1. 2. 3. 4.

Platform Products Pipeline People Partners Next Evolution of Benson Hill’s Winning Combination EXPLORING A BROAD RANGE OF STRATEGIC ALTERNATIVES The Board has engaged Lazard Frères & Co. LLC to assist in exploring strategic alternatives. The Company is also exploring joint venture opportunities, partnerships with strategic and financial investors, asset sales, and licensing opportunities to unlock the Company’s full potential behind its technology platform and innovation pipeline.

OUR MISSION TO LEAD THE PACE OF INNOVATION IN .THE FOOD SYSTEM.

Company Milestones Established Infrastructure and Scaling Capability Source: Company filings, press releases. 20222021 April 5, 2022 Announced strategic alliance with Scandinavian protein producer Denofa to scale sustainable soy protein ingredients in the Northern European aquafeed sector August 8, 2022 Long-term strategic partnership with ADM to scale innovative UHP soy ingredients for North American food ingredients market October 27, 2021 Launch of Crop Accelerator, a 47,000 square-foot research facility located in St. Louis, MO December 15, 2021 First commercial harvest of ultra-high protein (“UHP”) soybean varieties January 4, 2022 Acquisition of ZFS Creston, an established food-grade soy flour manufacturing operation in Iowa, for ~$100 million February 2, 2022 Announced collaboration with trout farmer Riverence to provide soy ingredients for the aquaculture supply chain April 4, 2022 Partnership with MorningStar Farms® (part of Kellogg’s) to provide the Company with a sustainable, plant-based soy ingredient 2023 September 30, 2021 Business combination with Star Peak Corp II February 10, 2022 Launch of Benson Hill’s soy protein ingredients portfolio January 3, 2023 Announced disposal of Benson Hill’s Fresh business segment

MINIMIZE WORKING CAPITAL REQUIREMENTS REDUCE OPEX WHILE RETAINING VALUE FOCUSED ASSET BASE Executing Liquidity Improvement Plan • Explore strategic options for Seymour, IN, facility • Drive capacity utilization in Creston, IA, and with strategic partner assets • Expect ~$33 million of run rate savings by 2024 vs. previous target of at least $20 million • Maintain product focus and core value capabilities • Optimize acreage targets • Tightly control inventory levels Cost and operational improvements targeted to drive ~$65-$85 million in liquidity savings through 2024

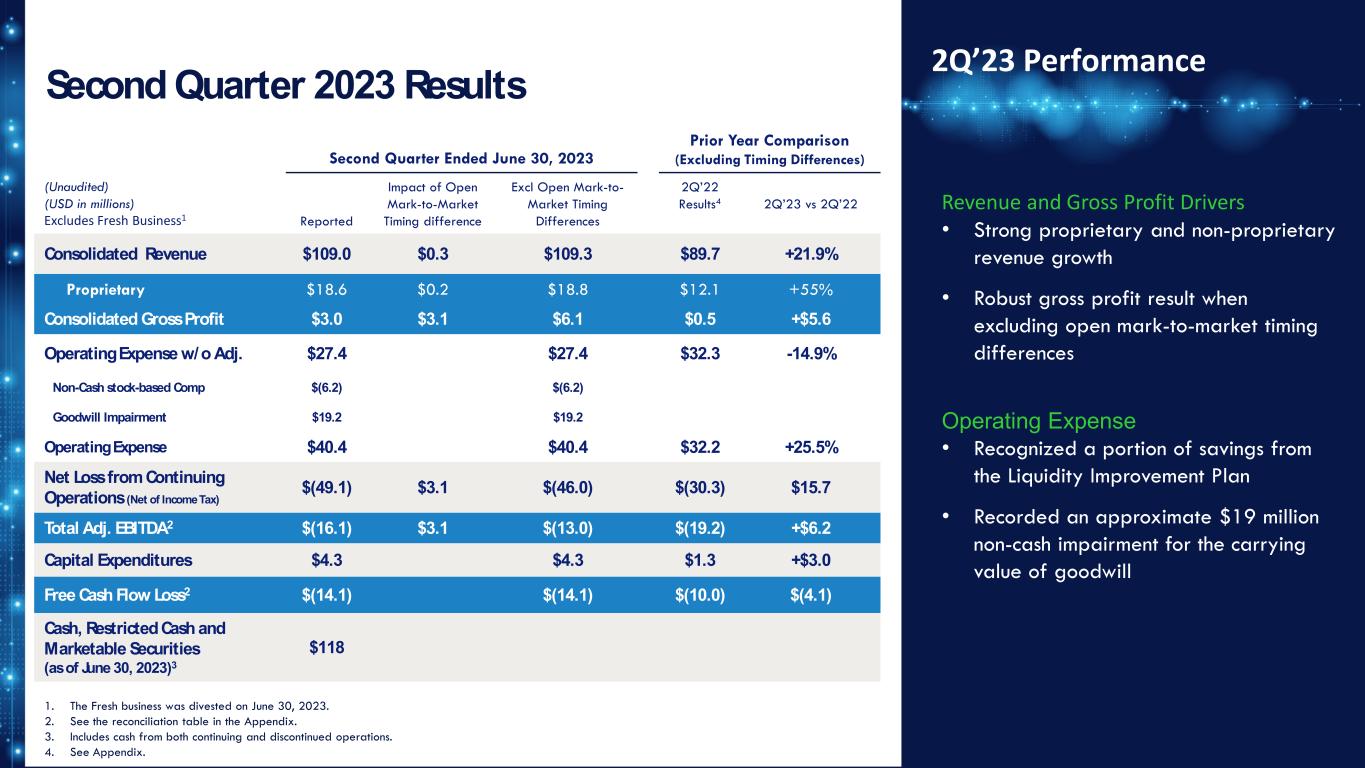

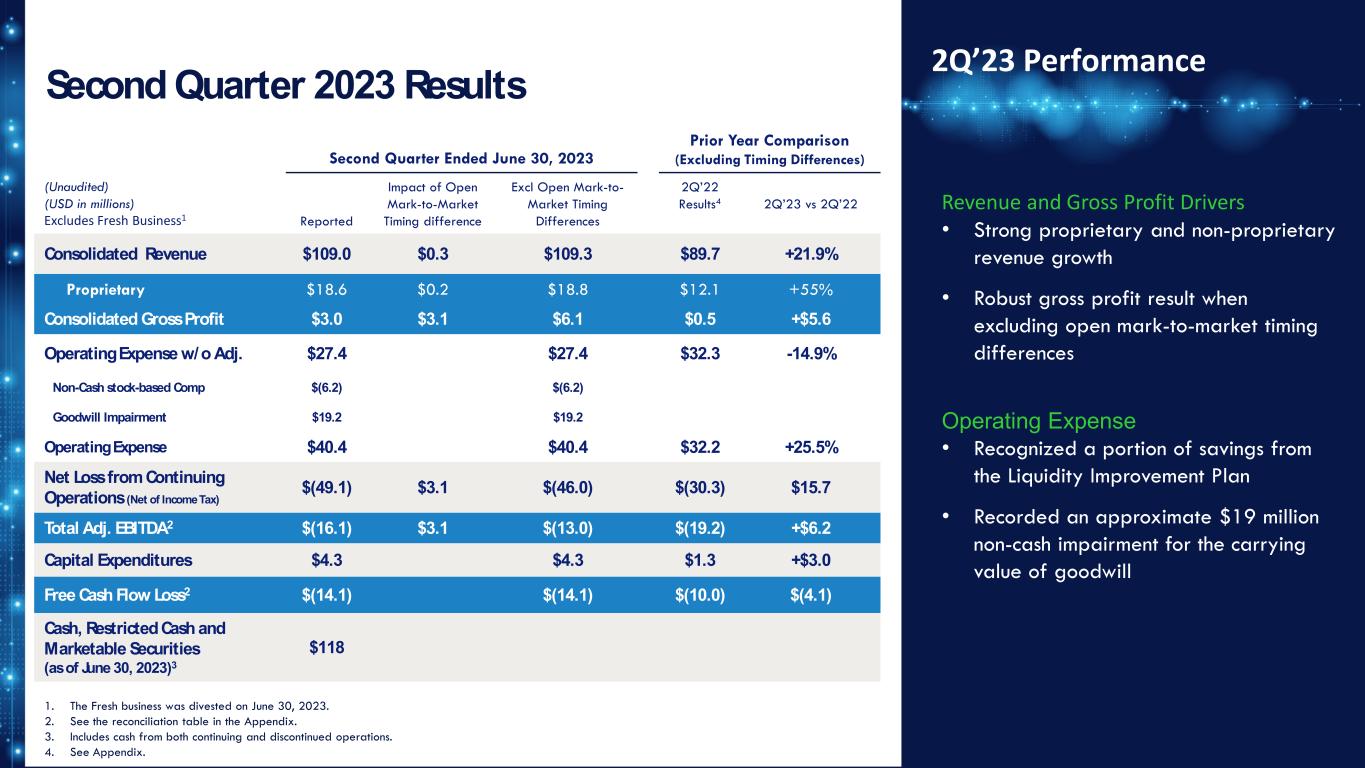

Second Quarter 2023 Results Second Quarter Ended June 30, 2023 Prior Year Comparison (Excluding Timing Differences) (Unaudited) (USD in millions) Excludes Fresh Business1 Reported Impact of Open Mark-to-Market Timing difference Excl Open Mark-to- Market Timing Differences 2Q’22 Results4 2Q’23 vs 2Q’22 Consolidated Revenue $109.0 $0.3 $109.3 $89.7 +21.9% Proprietary $18.6 $0.2 $18.8 $12.1 +55% Consolidated Gross Profit $3.0 $3.1 $6.1 $0.5 +$5.6 Operating Expense w/o Adj. $27.4 $27.4 $32.3 -14.9% Non-Cash stock-based Comp $(6.2) $(6.2) Goodwill Impairment $19.2 $19.2 Operating Expense $40.4 $40.4 $32.2 +25.5% Net Loss from Continuing Operations (Net of Income Tax) $(49.1) $3.1 $(46.0) $(30.3) $15.7 Total Adj. EBITDA2 $(16.1) $3.1 $(13.0) $(19.2) +$6.2 Capital Expenditures $4.3 $4.3 $1.3 +$3.0 Free Cash Flow Loss2 $(14.1) $(14.1) $(10.0) $(4.1) Cash, Restricted Cash and Marketable Securities (as of June 30, 2023)3 $118 1. The Fresh business was divested on June 30, 2023. 2. See the reconciliation table in the Appendix. 3. Includes cash from both continuing and discontinued operations. 4. See Appendix. Revenue and Gross Profit Drivers • Strong proprietary and non-proprietary revenue growth • Robust gross profit result when excluding open mark-to-market timing differences Operating Expense • Recognized a portion of savings from the Liquidity Improvement Plan • Recorded an approximate $19 million non-cash impairment for the carrying value of goodwill 2Q’23 Performance

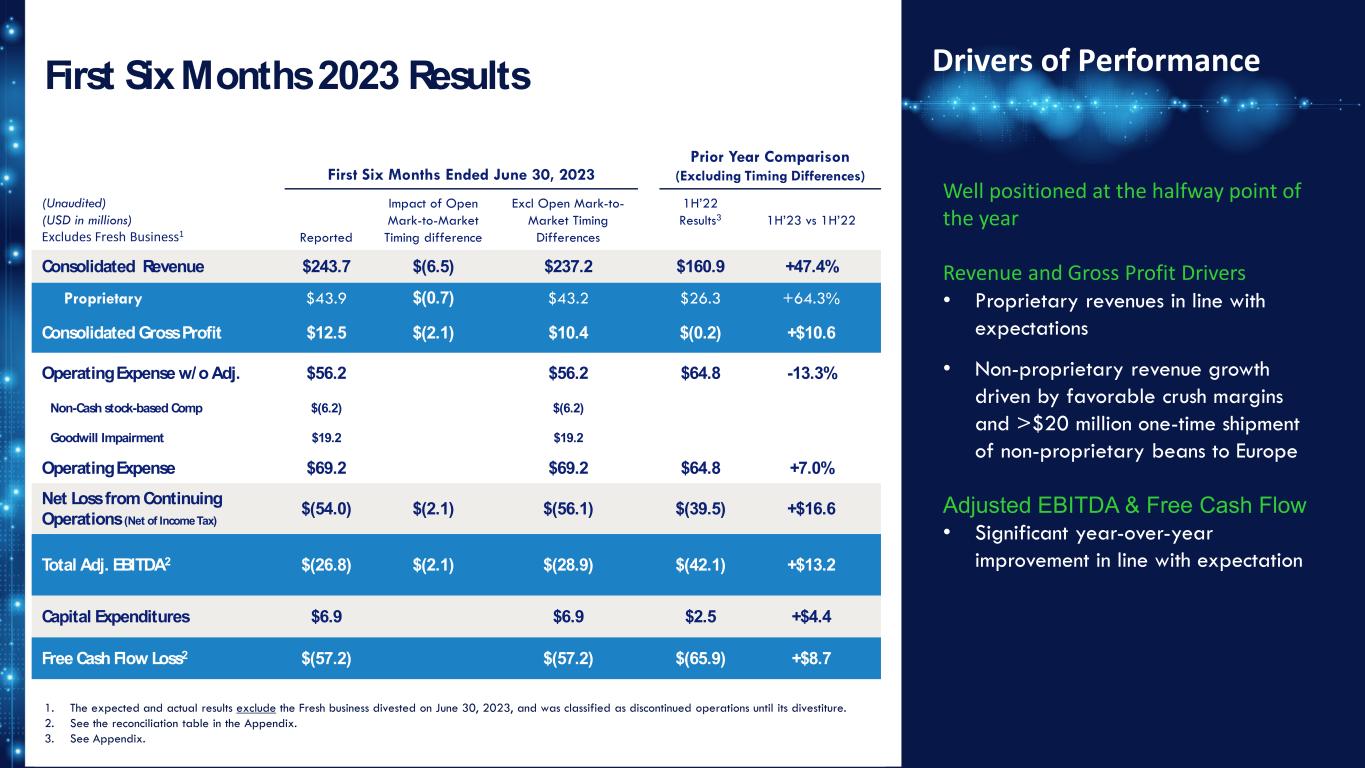

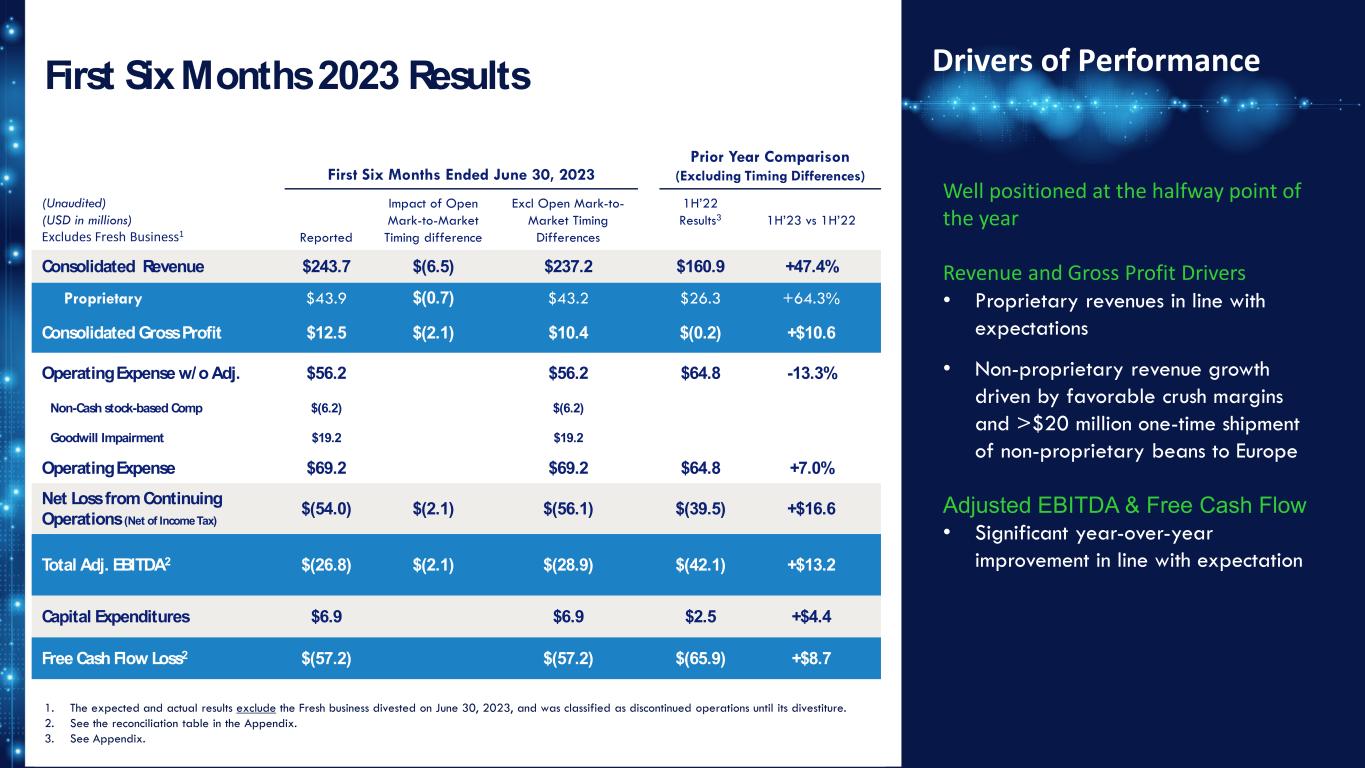

First Six Months 2023 Results First Six Months Ended June 30, 2023 Prior Year Comparison (Excluding Timing Differences) (Unaudited) (USD in millions) Excludes Fresh Business1 Reported Impact of Open Mark-to-Market Timing difference Excl Open Mark-to- Market Timing Differences 1H’22 Results3 1H’23 vs 1H’22 Consolidated Revenue $243.7 $(6.5) $237.2 $160.9 +47.4% Proprietary $43.9 $(0.7) $43.2 $26.3 +64.3% Consolidated Gross Profit $12.5 $(2.1) $10.4 $(0.2) +$10.6 Operating Expense w/o Adj. $56.2 $56.2 $64.8 -13.3% Non-Cash stock-based Comp $(6.2) $(6.2) Goodwill Impairment $19.2 $19.2 Operating Expense $69.2 $69.2 $64.8 +7.0% Net Loss from Continuing Operations (Net of Income Tax) $(54.0) $(2.1) $(56.1) $(39.5) +$16.6 Total Adj. EBITDA2 $(26.8) $(2.1) $(28.9) $(42.1) +$13.2 Capital Expenditures $6.9 $6.9 $2.5 +$4.4 Free Cash Flow Loss2 $(57.2) $(57.2) $(65.9) +$8.7 Well positioned at the halfway point of the year Revenue and Gross Profit Drivers • Proprietary revenues in line with expectations • Non-proprietary revenue growth driven by favorable crush margins and >$20 million one-time shipment of non-proprietary beans to Europe Adjusted EBITDA & Free Cash Flow • Significant year-over-year improvement in line with expectation Drivers of Performance 1. The expected and actual results exclude the Fresh business divested on June 30, 2023, and was classified as discontinued operations until its divestiture. 2. See the reconciliation table in the Appendix. 3. See Appendix.

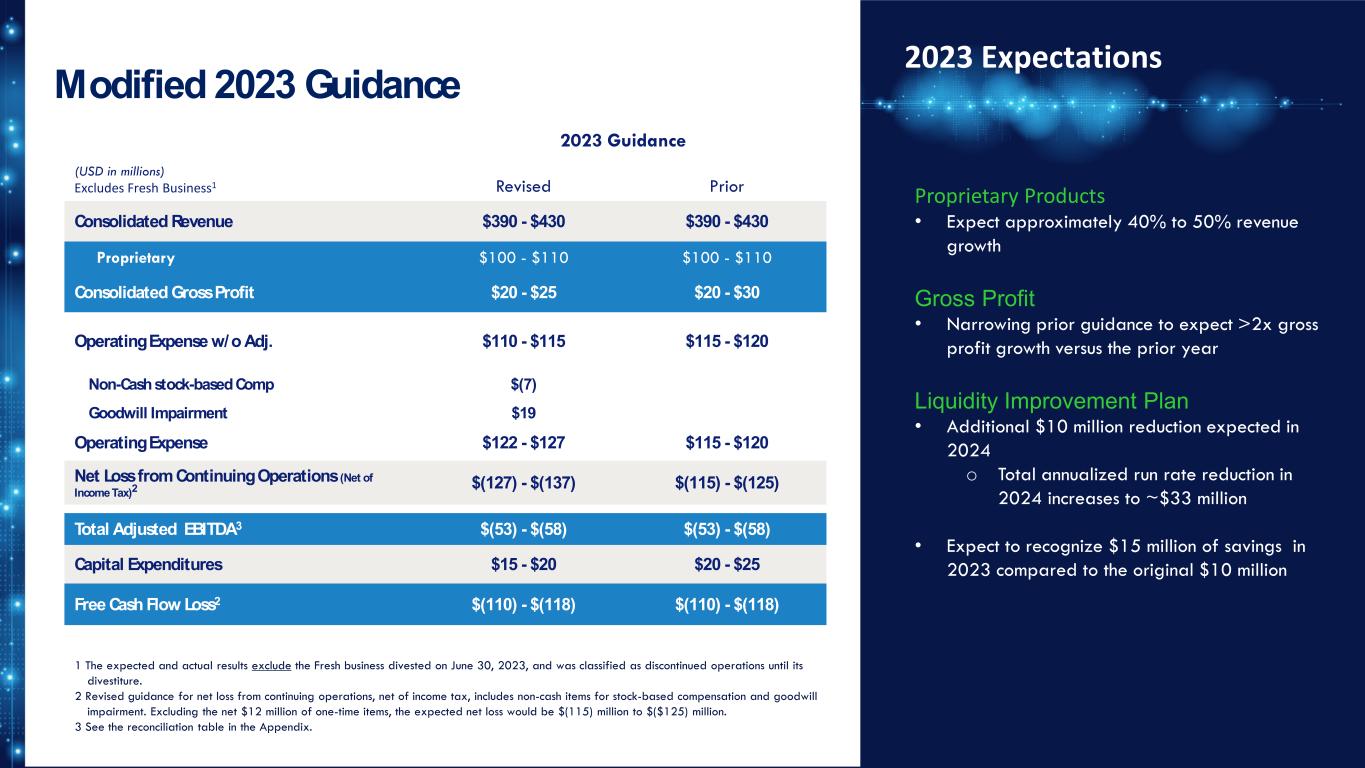

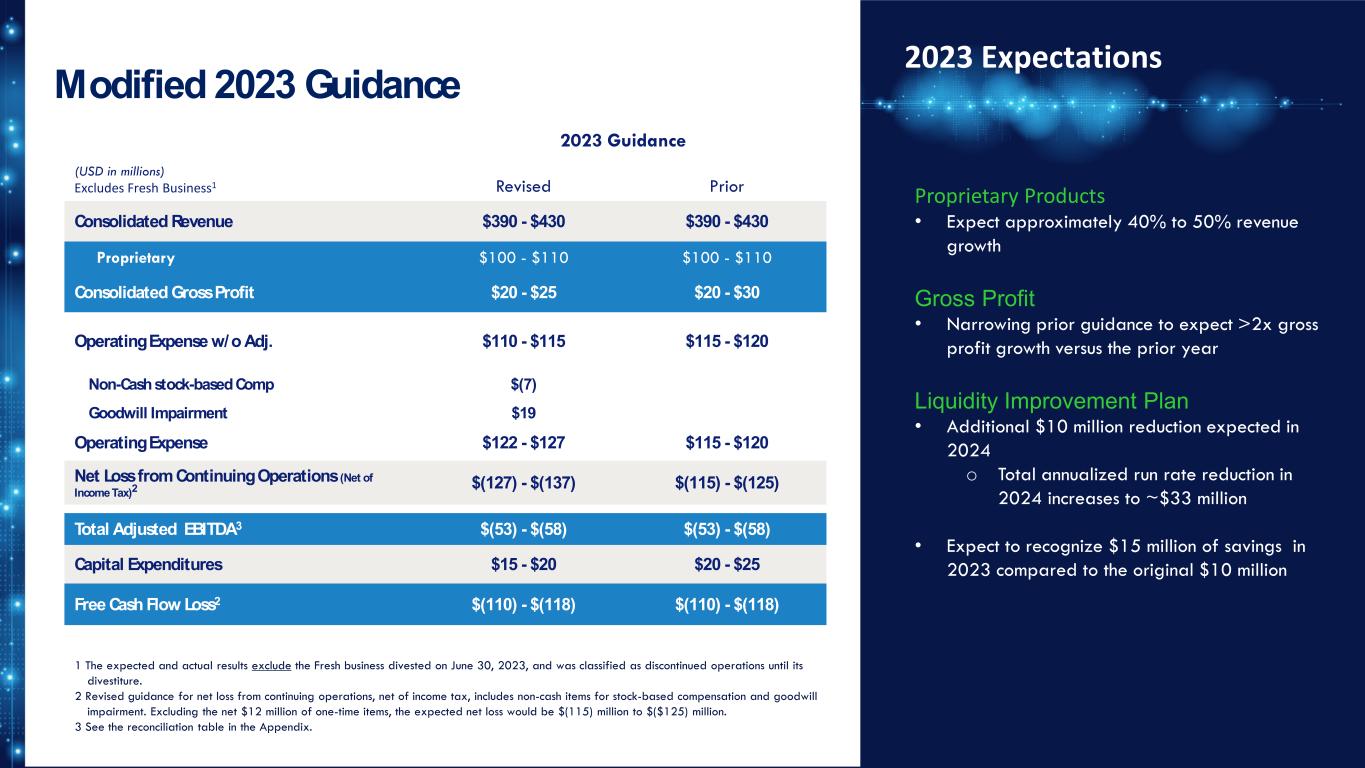

Modified 2023 Guidance 2023 Guidance (USD in millions) Excludes Fresh Business1 Revised Prior Consolidated Revenue $390 - $430 $390 - $430 Proprietary $100 - $110 $100 - $110 Consolidated Gross Profit $20 - $25 $20 - $30 Operating Expense w/o Adj. $110 - $115 $115 - $120 Non-Cash stock-based Comp $(7) Goodwill Impairment $19 Operating Expense $122 - $127 $115 - $120 Net Loss from Continuing Operations (Net of Income Tax)2 $(127) - $(137) $(115) - $(125) Total Adjusted EBITDA3 $(53) - $(58) $(53) - $(58) Capital Expenditures $15 - $20 $20 - $25 Free Cash Flow Loss2 $(110) - $(118) $(110) - $(118) 1 The expected and actual results exclude the Fresh business divested on June 30, 2023, and was classified as discontinued operations until its divestiture. 2 Revised guidance for net loss from continuing operations, net of income tax, includes non-cash items for stock-based compensation and goodwill impairment. Excluding the net $12 million of one-time items, the expected net loss would be $(115) million to $($125) million. 3 See the reconciliation table in the Appendix. 2023 Expectations Proprietary Products • Expect approximately 40% to 50% revenue growth Gross Profit • Narrowing prior guidance to expect >2x gross profit growth versus the prior year Liquidity Improvement Plan • Additional $10 million reduction expected in 2024 o Total annualized run rate reduction in 2024 increases to ~$33 million • Expect to recognize $15 million of savings in 2023 compared to the original $10 million

On Trac k for S trong P erformanc e in 2023 SECOND QUARTER Strong proprietary and non-proprietary revenue growth Favorable gross profit result Realized savings from the Liquidity Improvement Plan One-time non-cash items recorded in operating expense SECOND HALF OUTLOOK Well-positioned at the halfway point of the year Executing plan to realize an expected additional $10 million in annual cost reductions in 2024 Updated guidance to include ~$5 million of OPEX savings and ~$5 million of CAPEX savings Harvest of 2023 proprietary crop

Q&A

Appendix

Second Quarter 2022 Results Second Quarter Ended June 30, 2022 (Unaudited) (USD in millions) Excludes Fresh Business Reported Impact of Open Mark-to-Market Timing difference Excl Open Mark-to- Market Timing Differences Consolidated Revenue $93.6 $(3.9) $89.7 Proprietary $12.1 $12.1 Consolidated Gross Profit $5.7 $(5.2) $0.5 Operating Expense $32.3 $32.3 Net Loss from Continuing Operations $(25.1) $(5.2) $(30.3) Total Adj. EBITDA $(14.0) $(5.2) $(19.2) First Six Months 2022 Results First Six Months Ended June 30, 2022 (Unaudited) (USD in millions) Excludes Fresh Business Reported Impact of Open Mark-to-Market Timing difference Excl Open Mark-to- Market Timing Differences Consolidated Revenue $159.8 $1.2 $161.0 Proprietary $26.3 $26.3 Consolidated Gross Profit $(3.2) $3.0 $(0.2) Operating Expense $64.8 $64.8 Net Loss from Continuing Operations $(42.5) $3.0 $(39.5) Total Adj. EBITDA $(45.1) $3.0 $(42.1) Actual results shown here exclude the Fresh business divested on June 30, 2023, and was classified as discontinued operations until its divestiture.

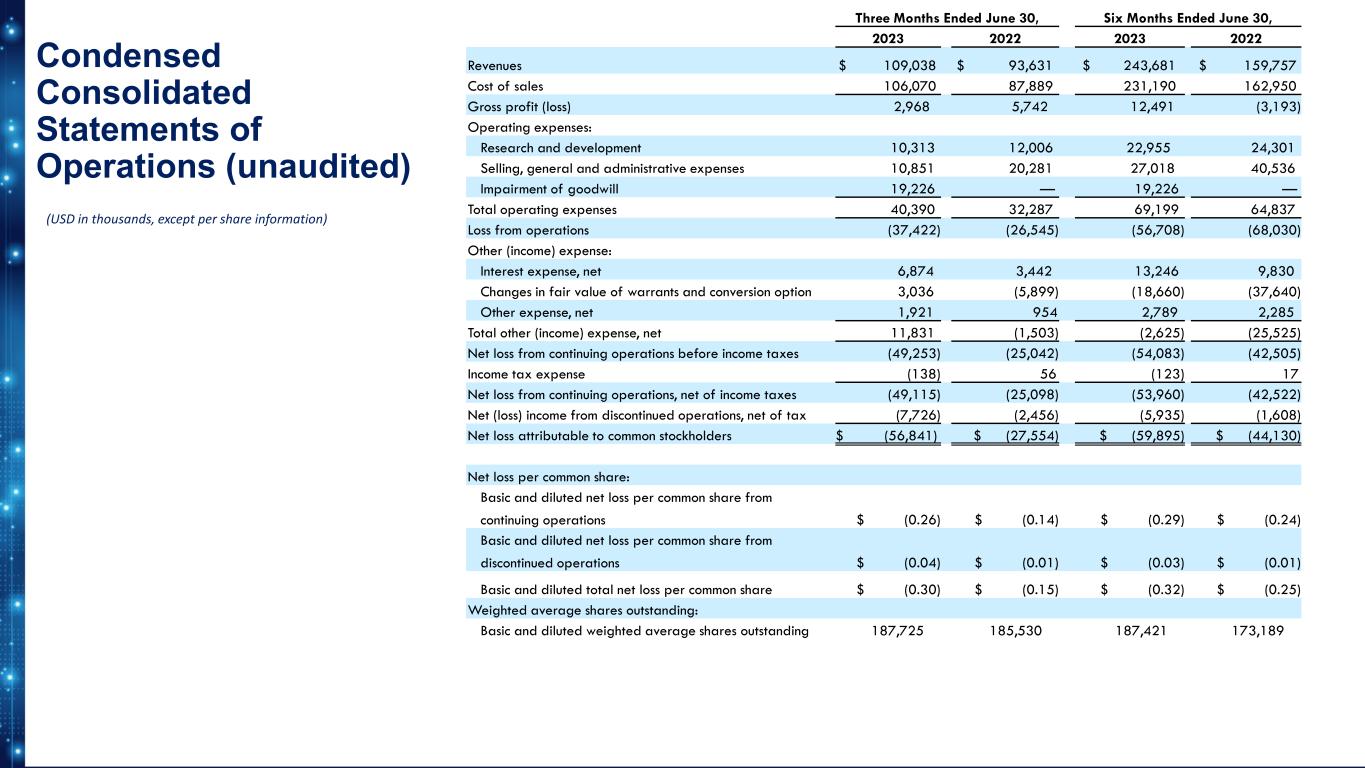

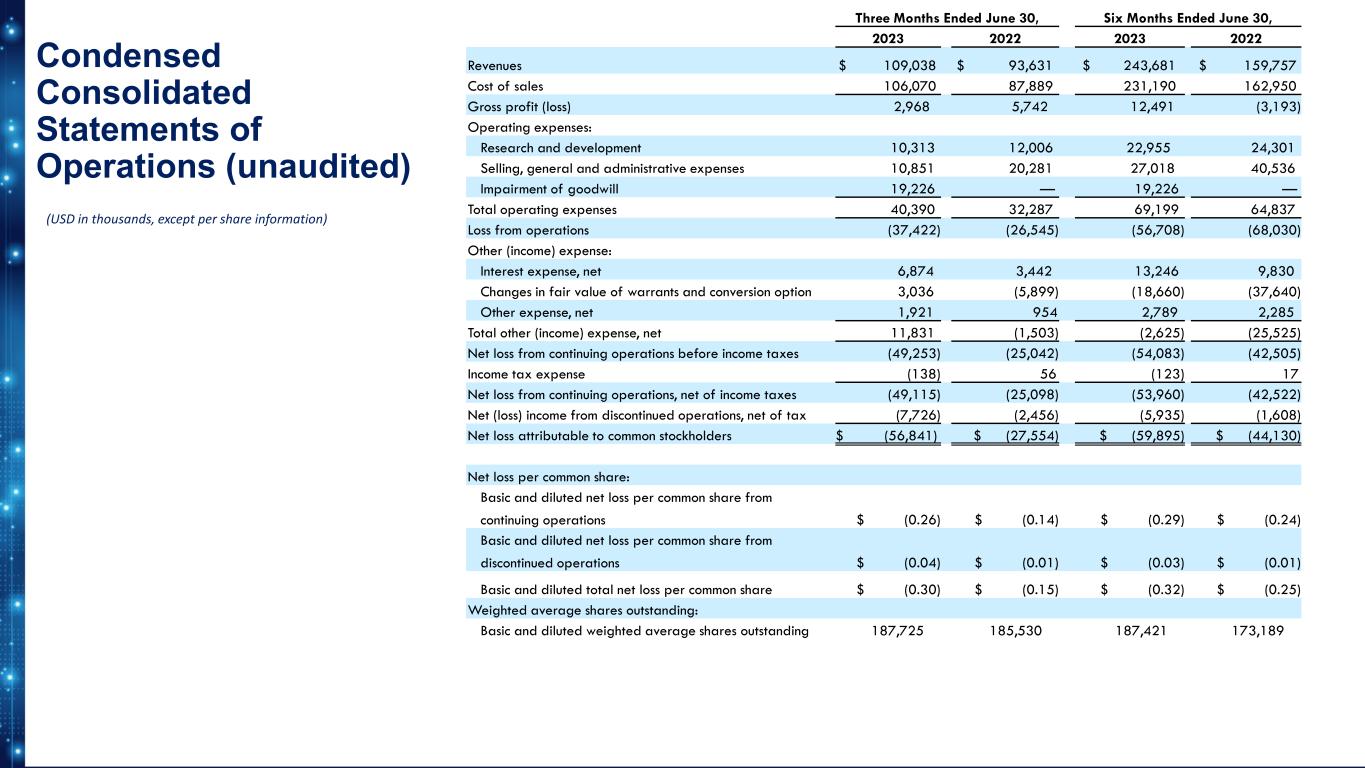

Condensed Consolidated Statements of Operations (unaudited) (USD in thousands, except per share information) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Revenues $ 109,038 $ 93,631 $ 243,681 $ 159,757 Cost of sales 106,070 87,889 231,190 162,950 Gross profit (loss) 2,968 5,742 12,491 (3,193) Operating expenses: Research and development 10,313 12,006 22,955 24,301 Selling, general and administrative expenses 10,851 20,281 27,018 40,536 Impairment of goodwill 19,226 — 19,226 — Total operating expenses 40,390 32,287 69,199 64,837 Loss from operations (37,422) (26,545) (56,708) (68,030) Other (income) expense: Interest expense, net 6,874 3,442 13,246 9,830 Changes in fair value of warrants and conversion option 3,036 (5,899) (18,660) (37,640) Other expense, net 1,921 954 2,789 2,285 Total other (income) expense, net 11,831 (1,503) (2,625) (25,525) Net loss from continuing operations before income taxes (49,253) (25,042) (54,083) (42,505) Income tax expense (138) 56 (123) 17 Net loss from continuing operations, net of income taxes (49,115) (25,098) (53,960) (42,522) Net (loss) income from discontinued operations, net of tax (7,726) (2,456) (5,935) (1,608) Net loss attributable to common stockholders $ (56,841) $ (27,554) $ (59,895) $ (44,130) Net loss per common share: Basic and diluted net loss per common share from continuing operations $ (0.26) $ (0.14) $ (0.29) $ (0.24) Basic and diluted net loss per common share from discontinued operations $ (0.04) $ (0.01) $ (0.03) $ (0.01) Basic and diluted total net loss per common share $ (0.30) $ (0.15) $ (0.32) $ (0.25) Weighted average shares outstanding: Basic and diluted weighted average shares outstanding 187,725 185,530 187,421 173,189

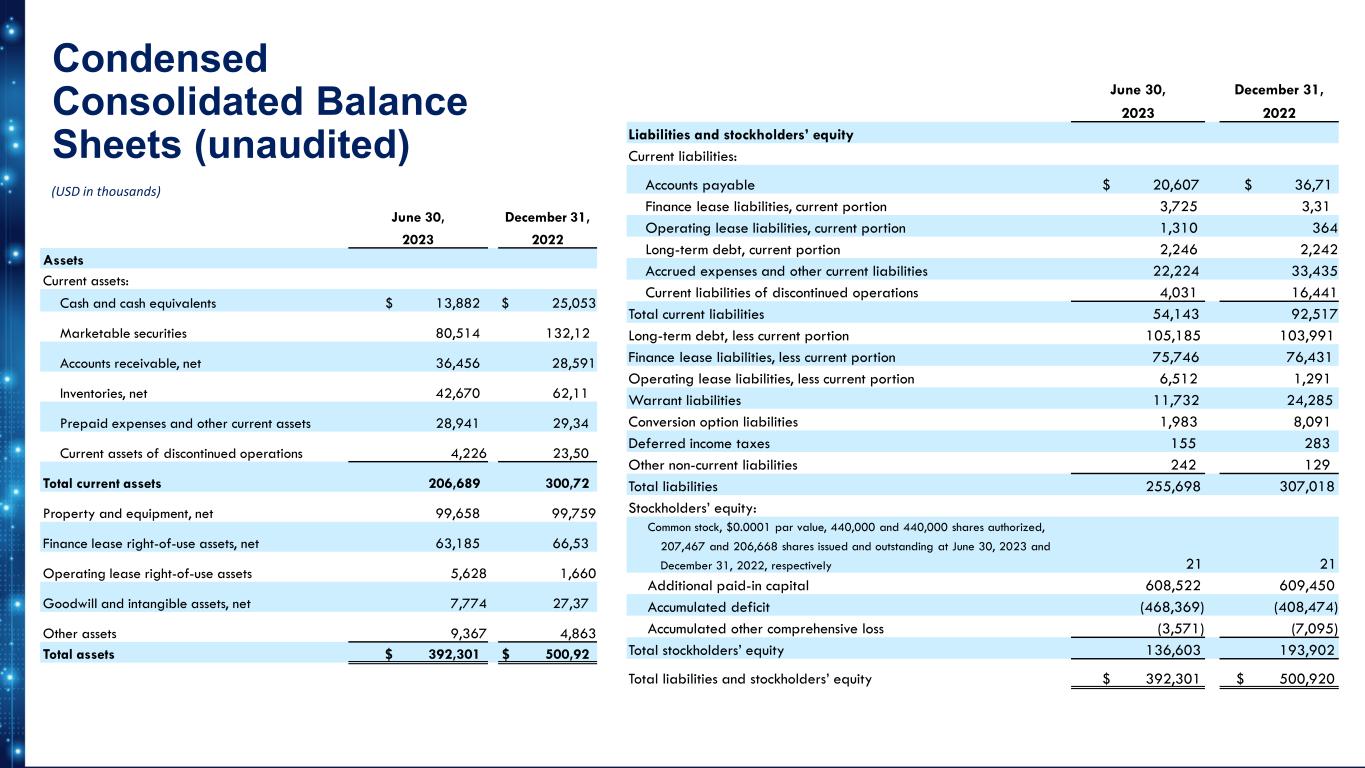

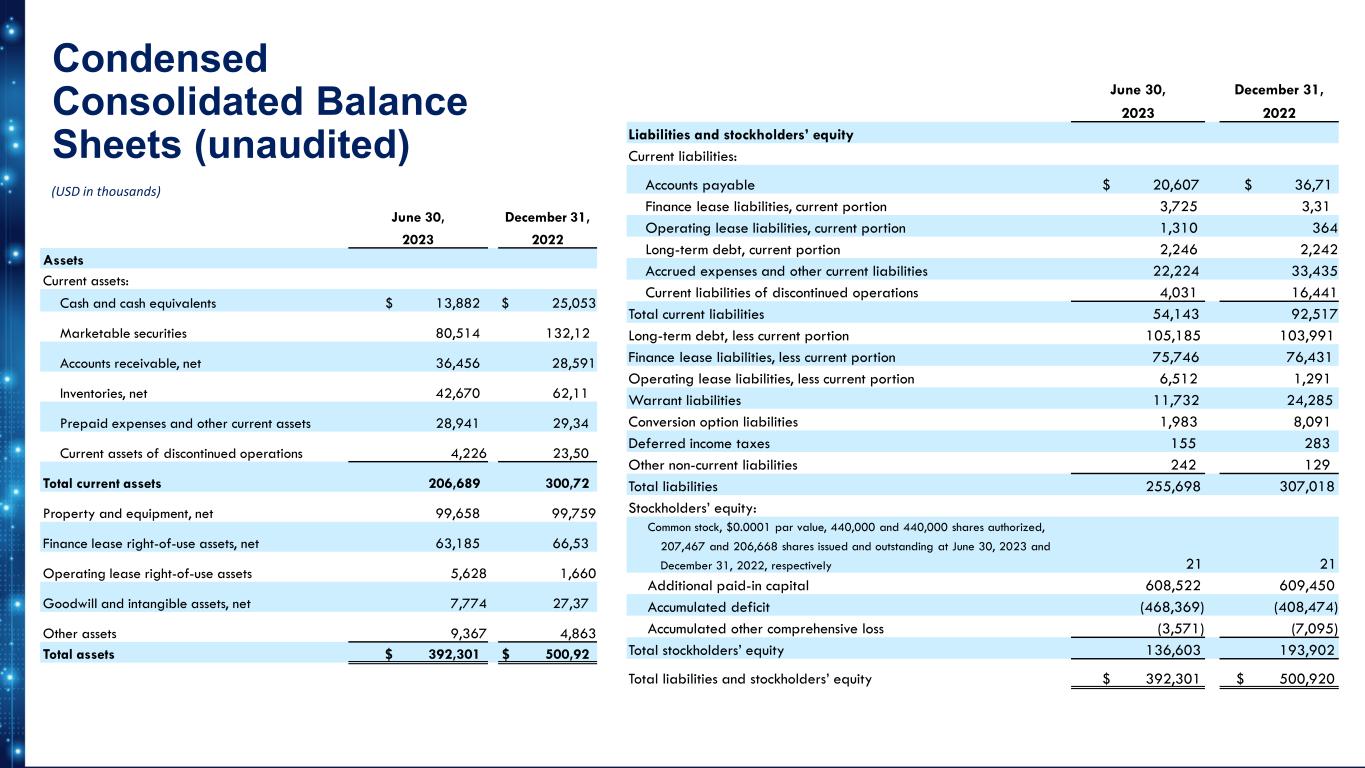

Condensed Consolidated Balance Sheets (unaudited) (USD in thousands) June 30, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 13,882 $ 25,053 Marketable securities 80,514 132,12 Accounts receivable, net 36,456 28,591 Inventories, net 42,670 62,11 Prepaid expenses and other current assets 28,941 29,34 Current assets of discontinued operations 4,226 23,50 Total current assets 206,689 300,72 Property and equipment, net 99,658 99,759 Finance lease right-of-use assets, net 63,185 66,53 Operating lease right-of-use assets 5,628 1,660 Goodwill and intangible assets, net 7,774 27,37 Other assets 9,367 4,863 Total assets $ 392,301 $ 500,92 June 30, 2023 December 31, 2022 Liabilities and stockholders’ equity Current liabilities: Accounts payable $ 20,607 $ 36,71 Finance lease liabilities, current portion 3,725 3,31 Operating lease liabilities, current portion 1,310 364 Long-term debt, current portion 2,246 2,242 Accrued expenses and other current liabilities 22,224 33,435 Current liabilities of discontinued operations 4,031 16,441 Total current liabilities 54,143 92,517 Long-term debt, less current portion 105,185 103,991 Finance lease liabilities, less current portion 75,746 76,431 Operating lease liabilities, less current portion 6,512 1,291 Warrant liabilities 11,732 24,285 Conversion option liabilities 1,983 8,091 Deferred income taxes 155 283 Other non-current liabilities 242 129 Total liabilities 255,698 307,018 Stockholders’ equity: Common stock, $0.0001 par value, 440,000 and 440,000 shares authorized, 207,467 and 206,668 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively 21 21 Additional paid-in capital 608,522 609,450 Accumulated deficit (468,369) (408,474) Accumulated other comprehensive loss (3,571) (7,095) Total stockholders’ equity 136,603 193,902 Total liabilities and stockholders’ equity $ 392,301 $ 500,920

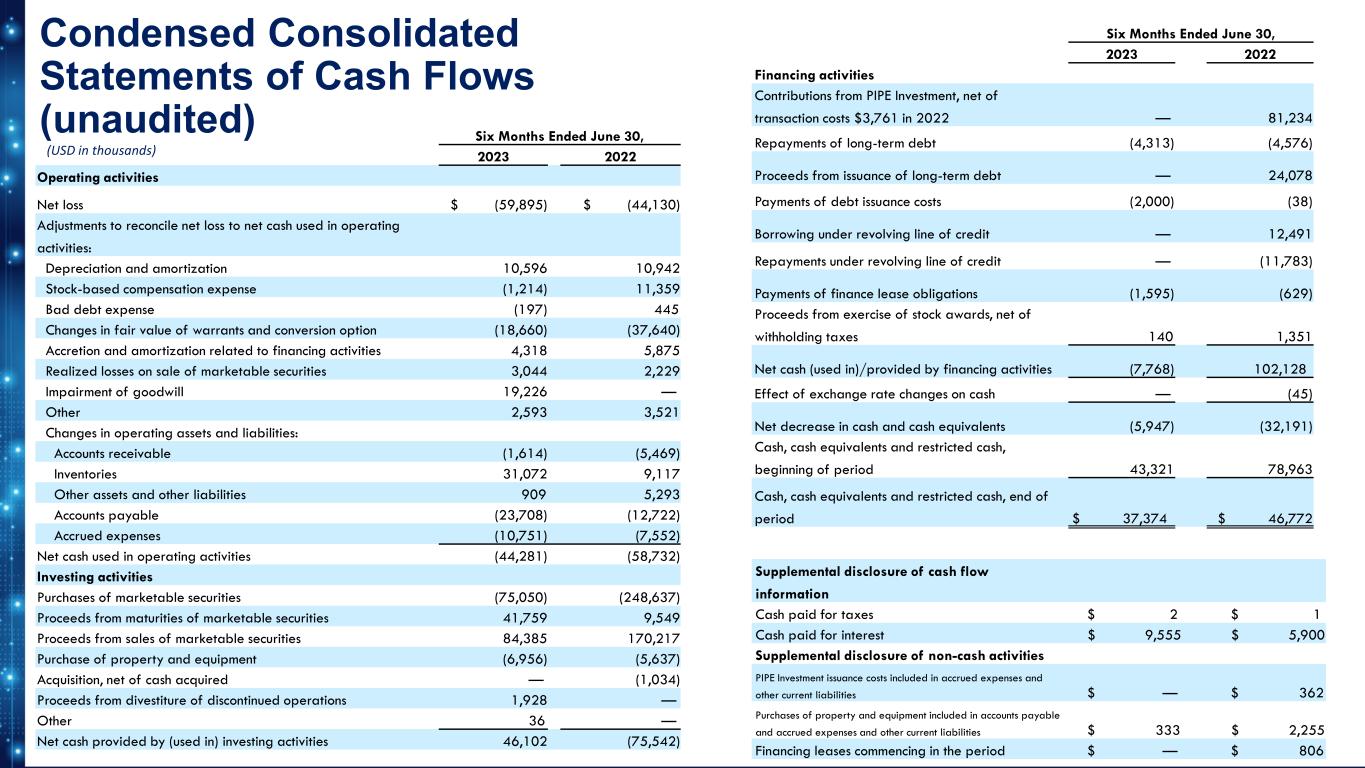

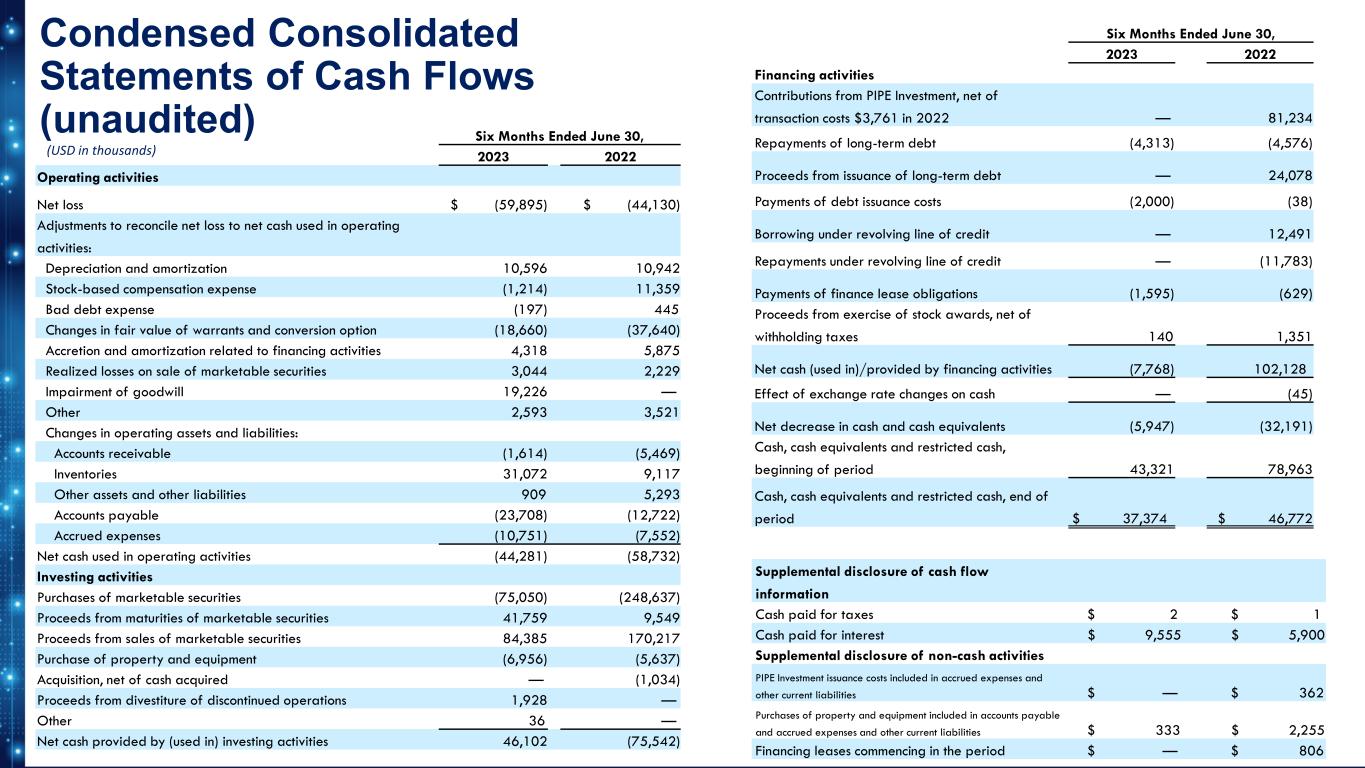

Condensed Consolidated Statements of Cash Flows (unaudited) (USD in thousands) Six Months Ended June 30, 2023 2022 Operating activities Net loss $ (59,895) $ (44,130) Adjustments to reconcile net loss to net cash used in operating activities: Depreciation and amortization 10,596 10,942 Stock-based compensation expense (1,214) 11,359 Bad debt expense (197) 445 Changes in fair value of warrants and conversion option (18,660) (37,640) Accretion and amortization related to financing activities 4,318 5,875 Realized losses on sale of marketable securities 3,044 2,229 Impairment of goodwill 19,226 — Other 2,593 3,521 Changes in operating assets and liabilities: Accounts receivable (1,614) (5,469) Inventories 31,072 9,117 Other assets and other liabilities 909 5,293 Accounts payable (23,708) (12,722) Accrued expenses (10,751) (7,552) Net cash used in operating activities (44,281) (58,732) Investing activities Purchases of marketable securities (75,050) (248,637) Proceeds from maturities of marketable securities 41,759 9,549 Proceeds from sales of marketable securities 84,385 170,217 Purchase of property and equipment (6,956) (5,637) Acquisition, net of cash acquired — (1,034) Proceeds from divestiture of discontinued operations 1,928 — Other 36 — Net cash provided by (used in) investing activities 46,102 (75,542) Six Months Ended June 30, 2023 2022 Financing activities Contributions from PIPE Investment, net of transaction costs $3,761 in 2022 — 81,234 Repayments of long-term debt (4,313) (4,576) Proceeds from issuance of long-term debt — 24,078 Payments of debt issuance costs (2,000) (38) Borrowing under revolving line of credit — 12,491 Repayments under revolving line of credit — (11,783) Payments of finance lease obligations (1,595) (629) Proceeds from exercise of stock awards, net of withholding taxes 140 1,351 Net cash (used in)/provided by financing activities (7,768) 102,128 Effect of exchange rate changes on cash — (45) Net decrease in cash and cash equivalents (5,947) (32,191) Cash, cash equivalents and restricted cash, beginning of period 43,321 78,963 Cash, cash equivalents and restricted cash, end of period $ 37,374 $ 46,772 Supplemental disclosure of cash flow information Cash paid for taxes $ 2 $ 1 Cash paid for interest $ 9,555 $ 5,900 Supplemental disclosure of non-cash activities PIPE Investment issuance costs included in accrued expenses and other current liabilities $ — $ 362 Purchases of property and equipment included in accounts payable and accrued expenses and other current liabilities $ 333 $ 2,255 Financing leases commencing in the period $ — $ 806

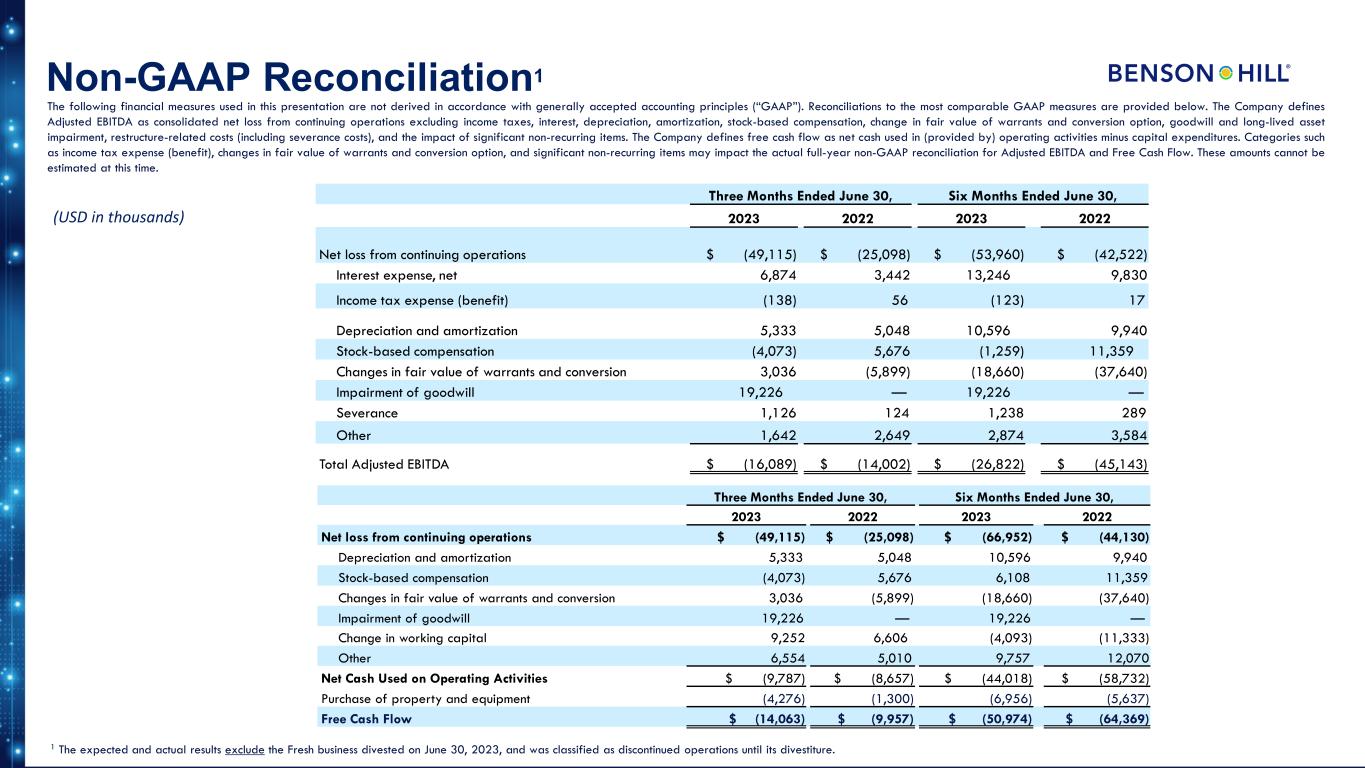

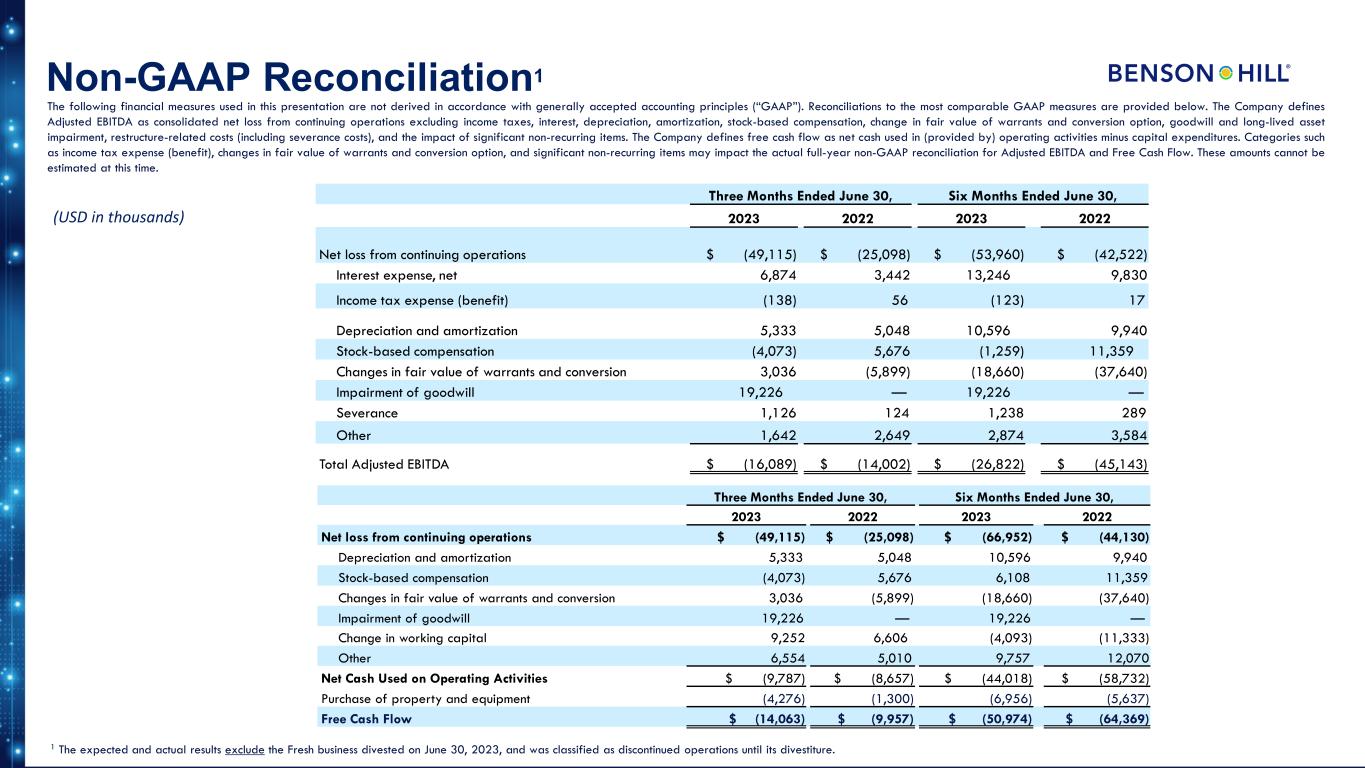

Non-GAAP Reconciliation1 (USD in thousands) 1 The expected and actual results exclude the Fresh business divested on June 30, 2023, and was classified as discontinued operations until its divestiture. The following financial measures used in this presentation are not derived in accordance with generally accepted accounting principles (“GAAP”). Reconciliations to the most comparable GAAP measures are provided below. The Company defines Adjusted EBITDA as consolidated net loss from continuing operations excluding income taxes, interest, depreciation, amortization, stock-based compensation, change in fair value of warrants and conversion option, goodwill and long-lived asset impairment, restructure-related costs (including severance costs), and the impact of significant non-recurring items. The Company defines free cash flow as net cash used in (provided by) operating activities minus capital expenditures. Categories such as income tax expense (benefit), changes in fair value of warrants and conversion option, and significant non-recurring items may impact the actual full-year non-GAAP reconciliation for Adjusted EBITDA and Free Cash Flow. These amounts cannot be estimated at this time. Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Net loss from continuing operations $ (49,115) $ (25,098) $ (66,952) $ (44,130) Depreciation and amortization 5,333 5,048 10,596 9,940 Stock-based compensation (4,073) 5,676 6,108 11,359 Changes in fair value of warrants and conversion 3,036 (5,899) (18,660) (37,640) Impairment of goodwill 19,226 — 19,226 — Change in working capital 9,252 6,606 (4,093) (11,333) Other 6,554 5,010 9,757 12,070 Net Cash Used on Operating Activities $ (9,787) $ (8,657) $ (44,018) $ (58,732) Purchase of property and equipment (4,276) (1,300) (6,956) (5,637) Free Cash Flow $ (14,063) $ (9,957) $ (50,974) $ (64,369) Three Months Ended June 30, Six Months Ended June 30, 2023 2022 2023 2022 Net loss from continuing operations $ (49,115) $ (25,098) $ (53,960) $ (42,522) Interest expense, net 6,874 3,442 13,246 9,830 Income tax expense (benefit) (138) 56 (123) 17 Depreciation and amortization 5,333 5,048 10,596 9,940 Stock-based compensation (4,073) 5,676 (1,259) 11,359 Changes in fair value of warrants and conversion 3,036 (5,899) (18,660) (37,640) Impairment of goodwill 19,226 — 19,226 — Severance 1,126 124 1,238 289 Other 1,642 2,649 2,874 3,584 Total Adjusted EBITDA $ (16,089) $ (14,002) $ (26,822) $ (45,143)

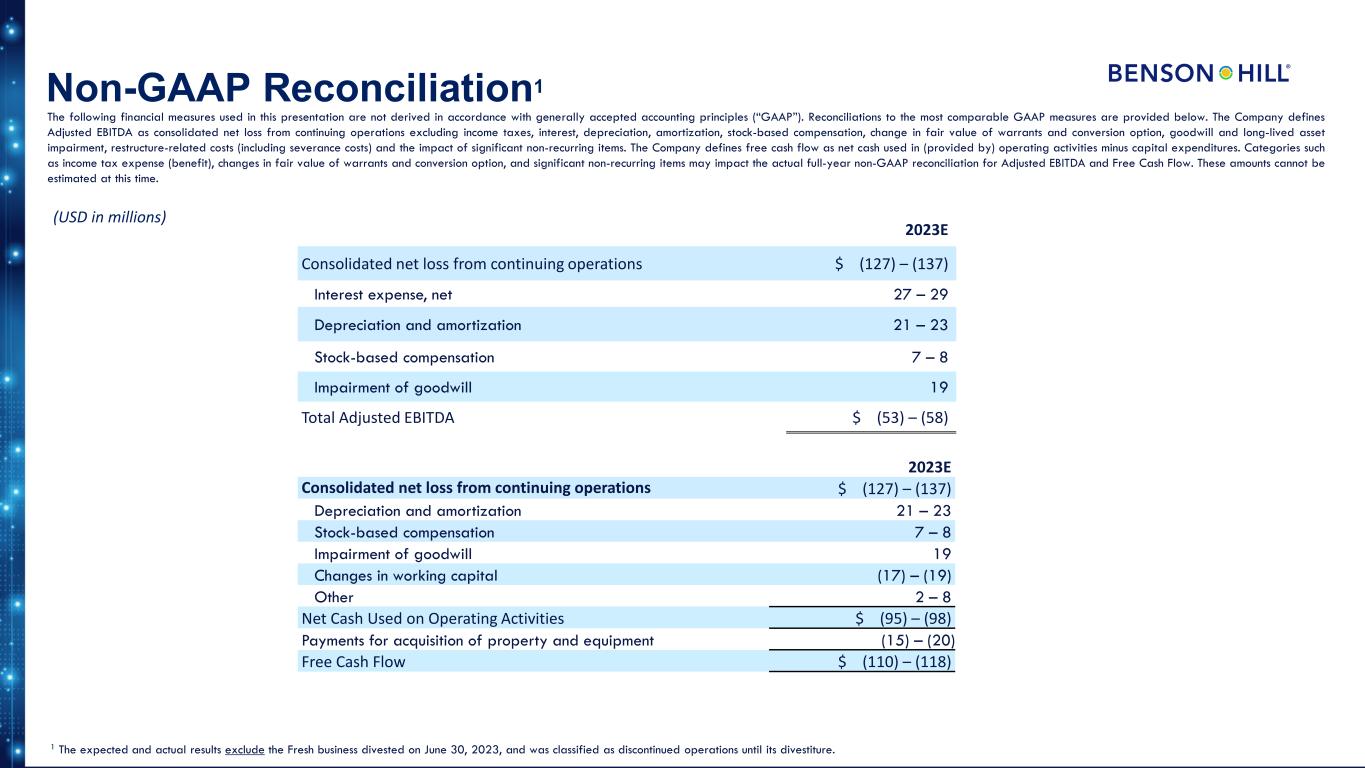

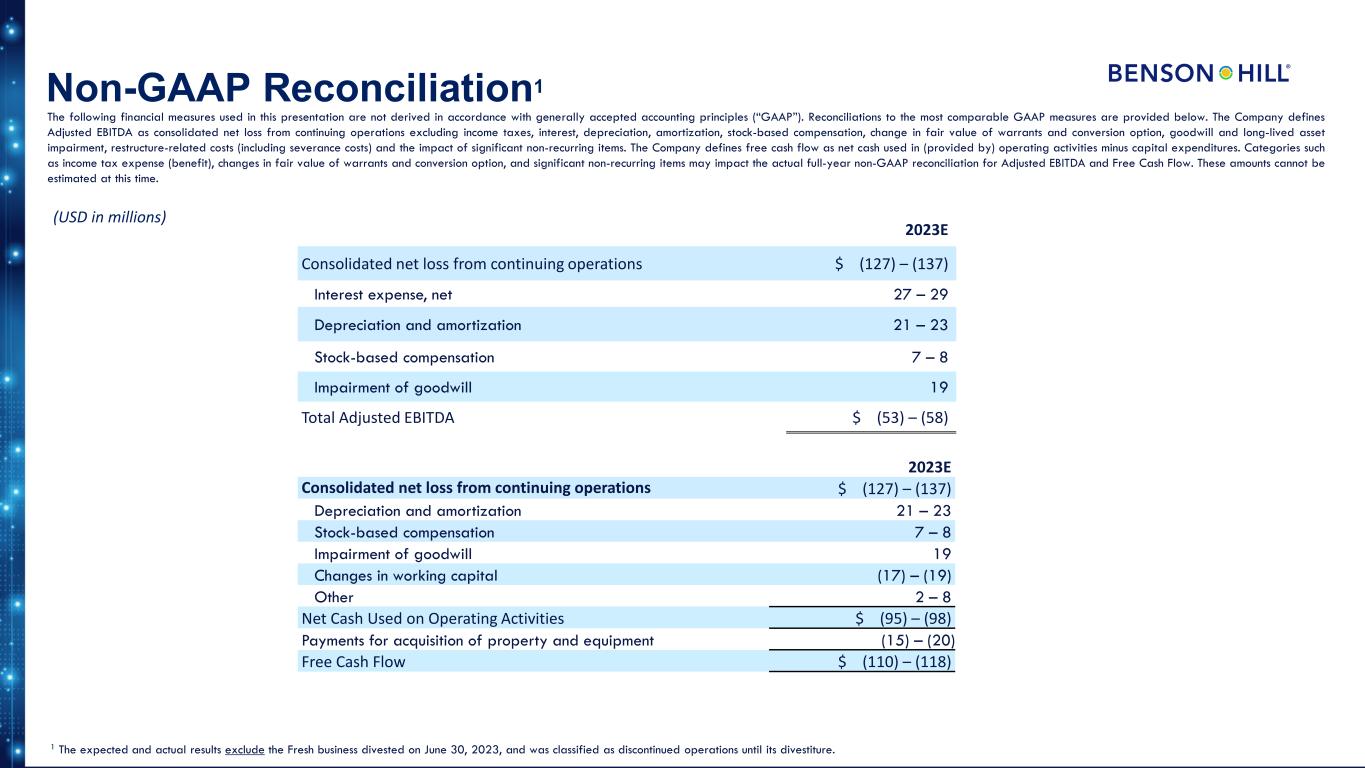

Non-GAAP Reconciliation1 (USD in millions) 2023E Consolidated net loss from continuing operations $ (127) – (137) Interest expense, net 27 – 29 Depreciation and amortization 21 – 23 Stock-based compensation 7 – 8 Impairment of goodwill 19 Total Adjusted EBITDA $ (53) – (58) 2023E Consolidated net loss from continuing operations $ (127) – (137) Depreciation and amortization 21 – 23 Stock-based compensation 7 – 8 Impairment of goodwill 19 Changes in working capital (17) – (19) Other 2 – 8 Net Cash Used on Operating Activities $ (95) – (98) Payments for acquisition of property and equipment (15) – (20) Free Cash Flow $ (110) – (118) The following financial measures used in this presentation are not derived in accordance with generally accepted accounting principles (“GAAP”). Reconciliations to the most comparable GAAP measures are provided below. The Company defines Adjusted EBITDA as consolidated net loss from continuing operations excluding income taxes, interest, depreciation, amortization, stock-based compensation, change in fair value of warrants and conversion option, goodwill and long-lived asset impairment, restructure-related costs (including severance costs) and the impact of significant non-recurring items. The Company defines free cash flow as net cash used in (provided by) operating activities minus capital expenditures. Categories such as income tax expense (benefit), changes in fair value of warrants and conversion option, and significant non-recurring items may impact the actual full-year non-GAAP reconciliation for Adjusted EBITDA and Free Cash Flow. These amounts cannot be estimated at this time. 1 The expected and actual results exclude the Fresh business divested on June 30, 2023, and was classified as discontinued operations until its divestiture.