Exhibit 99.2

1 Confidential Wh

2 Confidential Disclaimer This document contains confidential information regarding Perfect Corp. (the “Company”) Provident Acquisition Corp. (“PAQC”) and their respective subsidiaries shareholders (the “Shareholders”) and associated undertakings and their businesses. This presentation has been prepared to assist interested pa rti es in making their own evaluation with respect to a potential business combination between the Company and PAQC and the related transactions (the “Potential Business Combination”) and for no other purpose. This document is being made available on a confidential basis, and subject to the following provisions, to a limited number of persons who may be interested in thi s t ransaction. It is issued for the exclusive use of the persons to whom it is addressed, with a view to assisting the recipient in deciding whether it wishes to proceed with the further invest iga tion of the Company and PAQC. By reviewing or reading this presentation, you will be deemed to have agreed to the obligations and restrictions set out belo w. Without the express prior written consent of PAQC and the Company, this presentation and any information contained within it may not be (1) reproduced (in whole or in part), (2) copie d a t any time, (3) used for any purpose other than your evaluation of this transaction or (4) provided to or reviewed with any other person, except your employees and advisors with a need to k now and who are directed to keep this presentation confidential. The recipient of this presentation acknowledges that it (a) is aware that United States and Taiwan securities laws prohibit a ny person who has material, non - public information concerning a company from purchasing and selling securities of such company or from communicating such information to any other person und er circumstances in which it is reasonably foreseeable that such person may purchase or sell such securities and (b) will neither use, nor cause any third party to use this investor pre sen tation or any information contained herein in violation of the Securities Exchange Act of 1934, as amended, including, without limitation, Rule 10b - 5 thereunder or any other applicable securi ties law. Neither the Company, PAQC nor their respective shareholders nor any of their holding companies, subsidiaries, associated unde rta kings or controlling persons, nor any of their respective directors, officers, partners, employees, agents, representatives or advisers makes any representation or warranty, express o r i mplied, as to the accuracy or completeness of the information contained in this document or otherwise made available nor as to the reasonableness of any assumption contained herein or the rei n and any liability therefore (including in respect of direct, indirect or consequential loss or damage) is expressly disclaimed. Nothing contained herein or therein is, or shall be relied up on as, a promise or representation, whether as to the past or the future. This document does not purport to contain all of the information that may be required to evaluate the proposed transaction an d a ny recipient hereof should conduct its own independent analysis of the Company and PAQC and the data contained or referred to herein or in the information memorandum available. Nei the r the Company nor PAQC undertakes or expects to update or otherwise revise this document or the information memorandum or any other materials supplied. No information set out in this document will form the basis of any contract. Any prospective investor will be required to ack now ledge in the purchase contract that it has not relied on, or been induced to enter into such agreement by, any representation or warranty, save as expressly set out in such agreement.

3 Confidential Disclaimer (Continued) This document and any oral statements made in connection with this presentation do not constitute an offer or invitation for the sale or purchase of the securities or of any of the assets, business or undertaking described herein, or the solicitation of any vote, consent or approval in any jurisdiction in connect ion with the Potential Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This presentation does not constitute either advice or a recommendation regarding any securities. Any o ffe r to sell securities will be made only pursuant to a definitive fully - executed definitive agreement and will be made in reliance on an exemption from registration under the Securities Act of 1 933, as amended, for offers and sales of securities that do not involve a public offering. PAQC and the Company reserve the right to withdraw or amend for any reason any offering and to rej ect any definitive agreement for any reason. The communication of this presentation is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction whe re such distribution or use would be contrary to local law or regulation. The Shareholders reserve the right to negotiate with one or more prospective investors at any time and to enter into a defini tiv e agreement for the sale for the financing of this transaction without prior notice to the other prospective investors. The Shareholders, the Company and PAQC each also reserves the right, wi thout advance notice, to change the procedure; or to terminate negotiations at any time prior to the entry into of any binding contract for this transaction. Forward - Looking Statements Information in this presentation represents current expectations relating to transaction structure and is subject to further dis cussion and negotiation of definitive documentation in its entirety. All statements in this presentation other than statements of historical fact, including, but not limited to, statements regar din g the Company’s future operating results, financial position, business strategy, addressable market, anticipated benefits of its technologies, and plans and objectives for future operatio ns and offerings are “forward - looking statements” and can often be identified by the use of terminology such as “may,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect,” “anticipat e,” “should,” “could,” “potential,” “projection,” “forecast,” “plan,” “trend,” “assumption,” “opportunity,” “predict,” “seek,” “target,” or similar terminology, although not all forward - looking stat ements contain these identifying terms. These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics , p rojections of market opportunity and market share, expectations and timing related to commercial product launches, potential benefits of the transaction and the potential succe ss of the Company’s strategy, and expectations related to the terms and timing of the transaction. These forward - looking statements are based upon the Company management’s current expectations, assumptions and estimates as of t he date of this presentation, are subject to change and are not guarantees of future results or the timing thereof. While PAQC and the Company may elect to update these forward - looking statements in the future, each is not under any obligation, and expressly disclaims any duty, to update or otherwise revise the information after the date of this presentation, whether as a result of new information, new developments or otherwise.

4 Confidential Disclaimer (Continued) These forward - looking statements are provided for illustrative purposes only and are not intended to serve, and must not be relied on by any investor, as a guarantee, assurance, prediction or definitive statement of fact or probability . Actual results may differ materially from those contemplated in these statements due to a variety of risks and uncertainties, including, but not limited to, risks and uncertainties related to the inability of the parties to successfully or timely consummate the Potential Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Potential Business Combination, and the failure to realize the anticipated benefits of the Potential Business Combination ; the Company’s ability to execute on its business strategy, ability to attract and retain users, ability to develop new products and services and enhance existing products and services, ability to respond rapidly to emerging technology trends, ability to compete effectively and ability to manage growth ; the duration and global impact of COVID - 19 ; the number of redemption requests made by PAQC’s public stockholders and the ability of PAQC or the combined company to issue equity or equity - linked securities in connection with the proposed business combination or in the future ; and those factors discussed in documents of PAQC filed, or to be filed, with the U . S . Securities and Exchange Commission (“SEC”) . If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that neither PAQC nor the Company presently know of or that PAQC and the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward - looking statements reflect PAQC’s and the Company’s expectations, plans or forecasts of future events and views as of the date of this presentation . PAQC and the Company anticipate that subsequent events and developments will cause PAQC’s and the Company’s assessments to change . Use of Projections The projections, estimates and targets of the Company’s future performance and the future performance of the markets in which it competes in this presentation are forward - looking statements that are based on assumptions that are inherently uncertain and subject to a wide variety of significant business, economic, regulatory and competitive risks and uncertainties, many of which are beyond the Company and PAQC’s control, that could cause actual results to differ materially from those contained in such projections, estimates and targets . While all projections, estimates and targets are necessarily speculative, the Company and PAQC believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation . Such projections, estimates and targets are included for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The inclusion of projections, estimates and targets in this presentation should not be regarded as an indication that the Company and PAQC, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events . The independent auditors of PAQC and of the Company did not audit, review, compile or perform any procedures with respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation .

5 Confidential Disclaimer (Continued) Financial Information The financial information contained in this presentation has been taken from or prepared based on the historical financial statements of the Company for the periods presented . The Company’s historical financial information contained in this presentation is prepared in conformity with the Regulations Governing the Preparation of Financial Reports by Securities Issuers endorsed and issued into effect by the R . O . C . Financial Supervisory Commission ("Taiwan - IFRS") and has not been audited in accordance with Public Company Oversight Board (“PCAOB”) standards (“PCAOB Audit”) . The PCAOB Audit will be based on the financial information prepared in accordance with International Financing Reporting Standards (“IFRS”) issued by International Accounting Standards Board (the “IASB”) . There may be differences between the financial statements prepared and audited in accordance with Taiwan - IFRS and the financial statements prepared in accordance with IFRS as audited under the PCAOB standards (see appendix to this presentation) . The comparison of such financial statements is illustrative only and is not meant to be exhaustive . We cannot assure you that, had the financial statements been compliant with Regulation S - X under the Securities Act of 1933 , as amended, and the regulations of the SEC promulgated thereunder or audited in accordance with PCAOB standards, there would not be differences and such differences could be material . An audit of the Company’s financial statements in accordance with PCAOB standards is in process and will be included in the proxy statement, registration statement or prospectus relating to the Potential Business Combination . Accordingly, there may be material differences between the presentation of the financial information included in this presentation and in the proxy statement , registration statement or prospectus . By reviewing or reading this presentation, you will be deemed to have agreed that your are making investment decision on this transaction and the Potential Business Combination on the basis of the financial statements prepared in accordance with Taiwan - IFRS . You understand and agree that the Company’s financial statements prepared in accordance with IFRS issued by IASB and audited in accordance with PCAOB standards is in process and will not be available until the filing of proxy statement, registration statement or prospectus relating to the Potential Business Combination . NON - IFRS Measures This presentation includes certain financial measures not presented in accordance with IFRS including, but not limited to, Adjusted EBITDA and EBITDA Margin . These non - IFRS financial measures are not measures of financial performance in accordance with IFRS and may exclude items that are significant in understanding and assessing the Company’s financial results . Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under IFRS . You should be aware that the Company’s presentation of these measures may not be comparable to similarly - titled measures used by other companies . The Company believes these non - IFRS measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations . Please refer to footnotes where presented on each page of this presentation for a reconciliation of these measures to what the Company believes are the most directly comparable measure evaluated in accordance with IFRS .

6 Confidential Disclaimer (Continued) This presentation also includes certain projections of non - IFRS financial measures . Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, the Company is unable to quantify certain amounts that would be required to be included in the most directly comparable IFRS financial measures without unreasonable effort . Consequently, no disclosure of estimated comparable IFRS measures is included and no reconciliation of the forward - looking non - IFRS financial measures is included . A reconciliation of the non - IFRS financial measures to the corresponding IFRS measures is included in the supplemental materials at the end of the presentation. A reconciliation of forward - looking non - IFRS financial measures has not been provided because the various reconciling items are difficult to predict and sub ject to constant change. Use of Data This presentation also contains estimates and other statistical data made by independent parties and by the Company relating to market size and growth and other industry data . These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates . The Company and PAQC have not independently verified the statistical and other industry data generated by independent parties and contained in this presentation and, accordingly, cannot guarantee their accuracy or completeness . Important Information for Investors and Shareholders PAQC and the Company and their respective directors and executive officers and other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of PAQC stockholders in connection with the Potential Business Combination . Investors and security holders may obtain more detailed information regarding the names and interests of PAQC’s directors and officers in the Potential Business Combination in PAQC’s filings with the SEC, including PAQC’s registration statement on Form S - 1 , which was declared effective by the SEC on January 7 , 2021 . Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to PAQC’s stockholders in connection with the Potential Business Combination will be set forth in the proxy statement for the Potential Business Combination, which is expected to be filed by PAQC with the SEC . This presentation is not a substitute for the registration statement or for any other document that PAQC may file with the SEC in connection with the Potential Business Combination . INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION . Investors and security holders may obtain free copies of other documents filed with the SEC by PAQC at http : //www . sec . gov . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY REGULATORY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . THIS PRESENTATION DOES NOT CONSTITUTE AN OFFER OR SOLICITATION OF ANY SECURITIES . PAQC WILL MAKE ANY OFFER TO SELL SECURITIES ONLY PURSUANT TO A DEFINITIVE SUBSCRIPTION AGREEMENT, AND PAQC AND THE COMPANY RESERVE THE RIGHT TO WITHDRAW OR AMEND FOR ANY REASON ANY OFFERING AND TO REJECT ANY SUBSCRIPTION AGREEMENT IN WHOLE OR IN PART FOR ANY REASON .

7 Confidential Presenters Alice CHANG Founder & Chief Executive Officer Louis CHEN Senior Vice President & Chief Strategy Officer Winato KARTONO Executive Chairman Michael AW Chief Executive Officer & Chief Financial Officer

8 Confidential Overview Of Provident Acquisition Corp. (PAQC) Strategic Value - Add In Scaling Businesses And Delivering Superior Returns To Shareholders Proven Team Of Founders, Operators And Investors Well Positioned To Accelerate Perfect’s Growth x Deep experience in founding and building businesses to large scale x Established network in and know - how related to the global beauty industry x Track record of delivering superior returns to shareholders x Invested in 6 Southeast Asia’s Unicorns, including being a co - founder and active partner at JD . ID x Structural tailwinds in beauty industry due to rising digitization , increasing demand for AR & AI solutions x Strong capabilities to assist Perfect in opening up new markets in Southeast Asia x Unique access to global beauty brands and customers x Accelerate growth of Perfect by sharing knowledge and experience as founders and builders of businesses

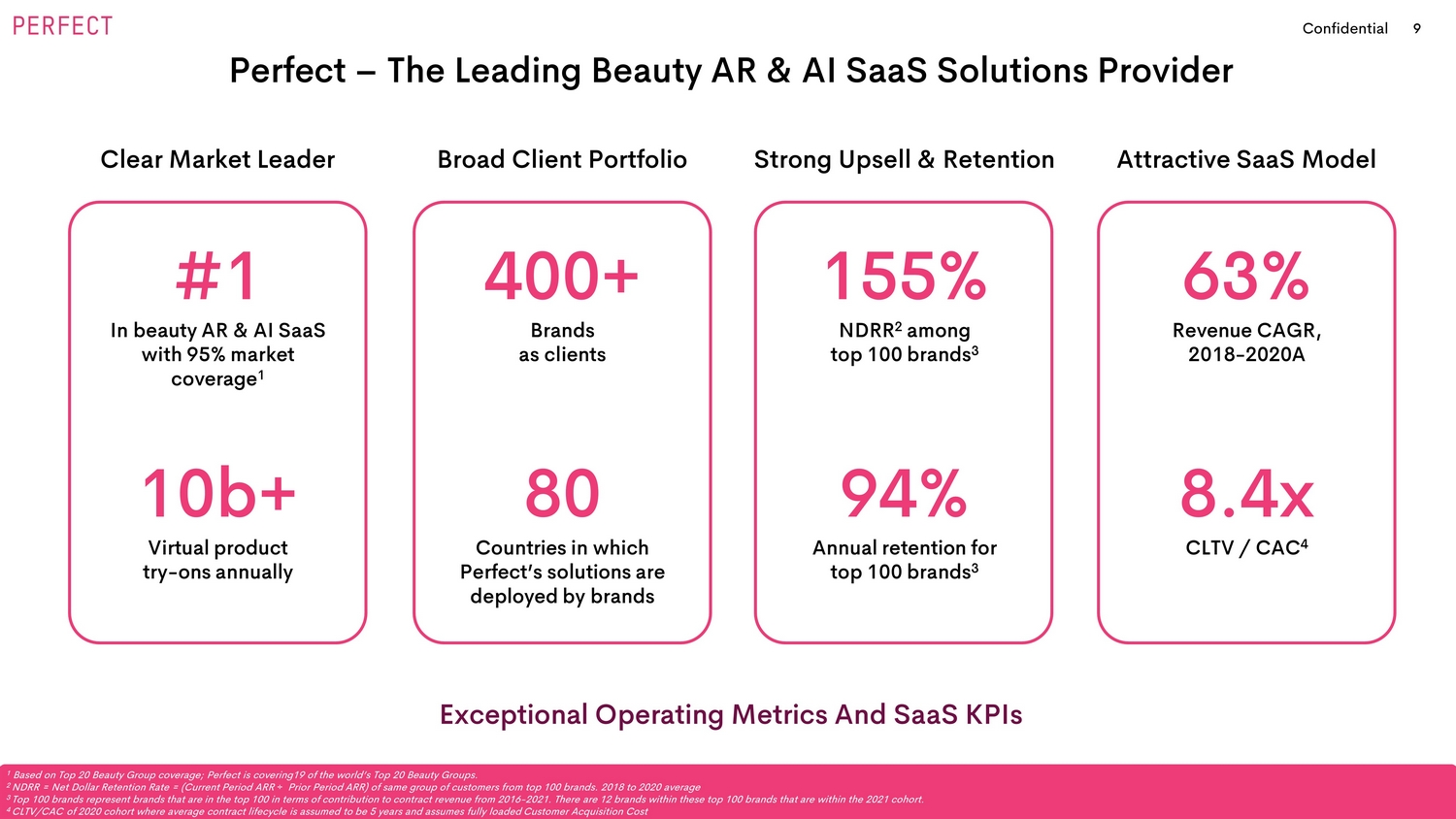

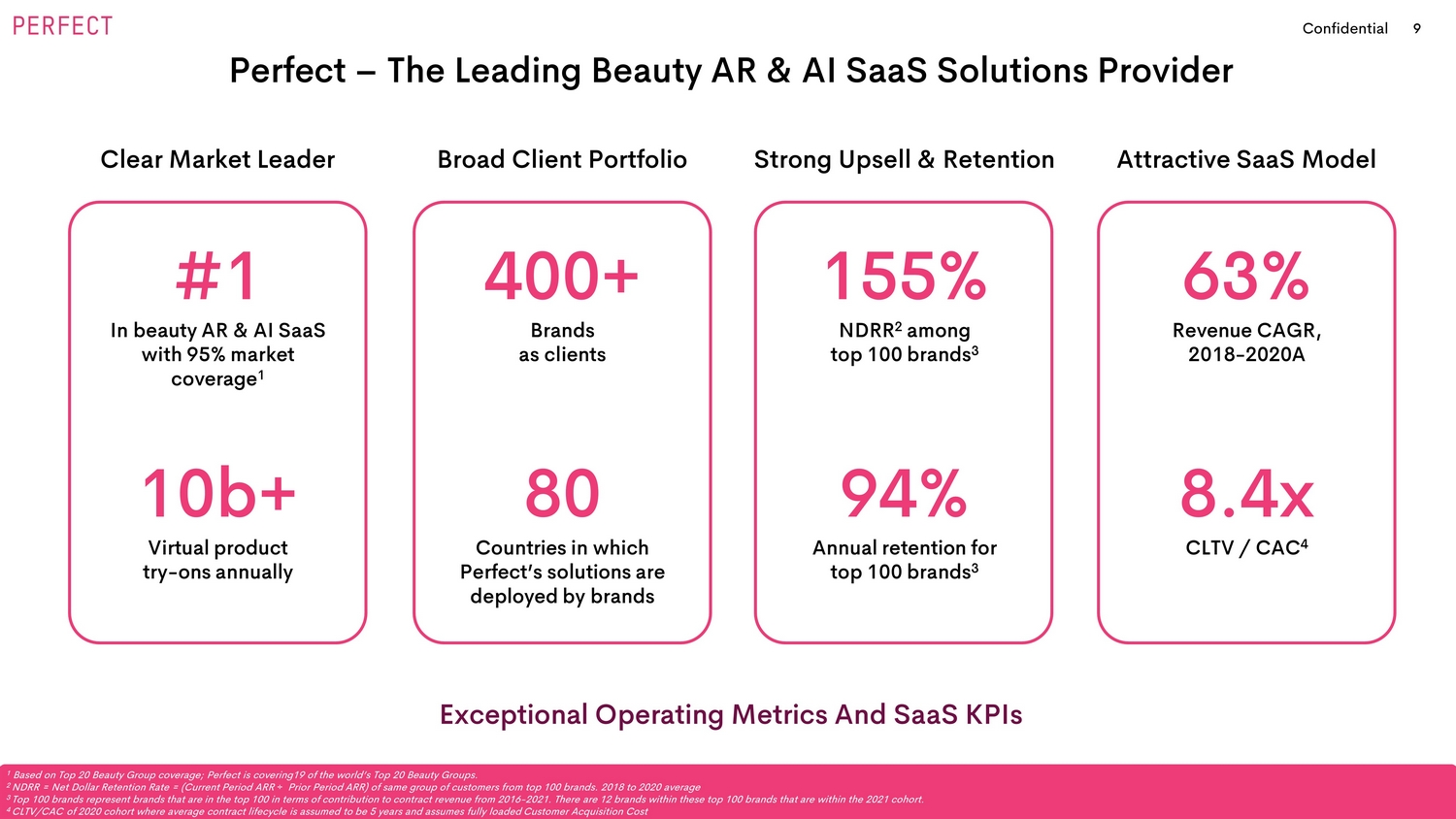

9 Confidential Clear Market Leader #1 In beauty AR & AI SaaS with 95% market coverage 1 10b+ Virtual product try - ons annually 400+ Brands as clients 80 Countries in which Perfect’s solutions are deployed by brands Broad Client Portfolio Strong Upsell & Retention 155% NDRR 2 among top 100 brands 3 94% Annual retention for top 100 brands 3 Attractive SaaS Model 63% Revenue CAGR, 2018 - 2020A 8.4x CLTV / CAC 4 Perfect – The Leading Beauty AR & AI SaaS Solutions Provider Exceptional Operating Metrics And SaaS KPIs 1 Based on Top 20 Beauty Group coverage; Perfect is covering19 of the world’s Top 20 Beauty Groups. 2 NDRR = Net Dollar Retention Rate = ( Current Period ARR · Prior Period ARR) of same group of customers from top 100 brands. 2018 to 2020 average 3 Top 100 brands represent brands that are in the top 100 in terms of contribution to contract revenue from 2016 - 2021. There are 12 brands within these top 100 brands that are within the 2021 cohort. 4 CLTV/CAC of 2020 cohort where average contract lifecycle is assumed to be 5 years and assumes fully loaded Customer Acquisiti on Cost

10 Confidential 2015 2016 2017 2018 2019 2020 2021 to Date Perfect’s Path To Becoming The Leader In Beauty AR & AI Market Leadership And Best - In - Class Tech Capabilities As Solid Foundation For Long - Term Growth Please refer to Perfect’s website for brands success stories: https://www.perfectcorp.com/business/successstory/list 1 As of 30 September 2021. Strong Investor Base Founded and spun - off from CyberLink Product Roadmap Makeup Virtual Try - On Nail VTO Skin Diagnostic Hair Color VTO Beauty Advisory 1:1 & Live Casting YouCam Video Eyewear/ Fashion More to Come Refined beauty AR tech Rolled out industry leading SaaS platform Partnered with global tech platforms Expanded to new verticals of fashion accessories Serving omnichannel and extending leadership in beauty AR & AI tech Number of Brands 400+ Brands as clients 1 370k+ Total SKUs Database 1 Introduced beauty tech AI

11 Confidential + 85 % Increase in sales 1 +200% Purchase conversion 2 + 30 0% Time spent on site 3 + 30% Add - to - carts 4 Perfect enables brands to achieve… Driving Brands’ Sales, Conversion & Customer Engagement “Perfect Corp. has also made it easy as we extended our Brow Try - On to websites of our retail partners, as well as to in - store brow bars.” - Benefit Cosmetics - “While we have always focused on innovating our products and services, with partners like Perfect Corp., we can now also innovate and elevate the consumer experience.” - Est é e Lauder - “Their AI algorithms work with their AR that gives it that very realistic appearance.” - AVEDA - Proven Track Record Of ROI With Endorsements From Global Brands 1 85% increase in sales for Decort é products through Virtual Try - On, please refer to: https://www.perfectcorp.com/business/successstory/detail/85 . 2 200% higher conversion rate for consumers experiencing e.l.f . Virtual Try - On, please refer to: https://www.perfectcorp.com/business/successstory/detail/21 for more details. 3 330% increase in Marianna Naturals website dwell time, please refer to: https://www.perfectcorp.com/business/successstory/detail/63 4 30% increase in Add - to - Cart for tarte cosmetics customers experiencing Virtual Try - On, please refer to: https://www.perfectcorp.com/business/successstory/detail/73

12 Confidential Massive, underpenetrated TAM of US$14.3b Market leader powering the digital transformation of the shopping experience Superior technology capabilities driving sales, conversion & customer engagement for brands Rapid growth and expanding margins Large portfolio of global clients, with strong customer loyalty and retention Proven leadership team with strong execution capabilities Investment Highlights

Business Overview 1

14 Confidential Massive, Underpenetrated TAM Digitization In The Beauty & Fashion Industry And Perfect’s Verticals Expansion Driving TAM Growth Source: Frost & Sullivan 1 Total AR & AI spend of fashion companies operating in apparel, eyewear, watches and jewelries verticals 2 Total AR & AI spend of beauty companies operating in skincare, haircare, makeup, and hygiene products verticals US$3.3b US$5.4b US$14.3b Beauty AR & AI (2021) Beauty AR & AI (2025E) Global Fashion Accessory AR & AI (2025E) 2 2 1

15 Confidential Amorepacific x Amway x Beiersdorf x Chanel x Clarins x Coty x Est é e Lauder x Henkel x J&J x Kao x K osé x L’Oreal LG H&H x LVMH x Mary Kay x Natura x P&G x Revlon x Shiseido x Unilever x Undisputed Market Leader In Beauty AR & AI SaaS Perfect Has Penetrated The Top 20 Beauty Groups And This Provides Tremendous Upselling Opportunity Source: EuroMonitor , company information 1 Coverage includes a group which has at least one brand served by Perfect. 2 Based on Euromonitor 2020 global beauty companies’ revenue in color cosmetics, skincare and haircare. 57% Top 20 Beauty Groups market share 2 US$158b Top 20 Beauty Groups combined revenues 2 Top 20 Groups combined [56]% Others [44]% Perfect’s Top 20 Beauty Groups Coverage 1 Top 20 Beauty Groups in the Global Beauty Market 3 Average online channel revenue contribution for listed companies in Top 20 Beauty Groups which have disclosed online channel rev enue contribution (Coty, Henkel, L'Oréal, Natura, P&G, Revlon, Shiseido, Unilever). 6.7% 9.6% 16.2% 2018 2019 2020 Average online channel contribution to total revenues 3 2.4x Upselling & cross - selling opportunities through more modules, territories, and SKUs 2018 2019 2020

16 Confidential Transforming The Shopping Experience With Beauty AR & AI SaaS Solutions Perfect Offers Modules Which Cover Multiple Beauty & Fashion Segments With Omnichannel Deployment AI 3D facial modeling & true - to - life virtual try - ons with authentic SKUs Identify various skin conditions and provide product recommendations Hair type detection and real - time hair color effects Real - time interaction with consumers with EC and virtual try - on capabilities Try a whole range of hyper realistic accessories in real time Scan users’ unique features for personalized recommendations AR & AI Makeup AI Skincare AR & AI Hair AR Video Consultation AR Fashion Accessories AI Face Attributes x Virtual Makeup x AI Smart Shade Finder x In - store Barcode Try - on x AI Skin Diagnostic x AI Skin Simulation x AI Skin Recommendation x Live Hair Color Try - on x AI Hair Care Diagnostics x AI Hair Style x AI Live Casting for Web and App x Beauty Advisor 1 - on - 1 x Live AR for Corporate Training x AR Eyewear x AR Jewelry x AR Watch x AI Face Attributes x AI Personality x AI Aging 360 ° Omnichannel AR & AI Strategy Physical Stores Social Media E - Commerce Shoppertainment

17 Confidential 145% 194% 126% 2018 2019 2020 115% 124% 9M2020 9M2021 Diversified Revenue With Strong Customer Loyalty Strong Upselling Ability Lays The Foundation For Long - Term Growth 1 2020 total accounting revenue was ~US$ 31 .3m. Brands within top 10 largest accounting revenue in 2020 generated ~US$10.0m in combined revenues (32% of total accounting revenue). Brands within top 100 largest contract value in 2020 generated ~US$21.9m (73% of 2020 total contract revenue). 2 Top 100 brands represent brands that are in the top 100 in terms of contribution to contract revenue from 2016 - 2021. Net Dollar Retention Rate (NDRR) Strong U psell 155% NDRR, 2018 - 2020 Average 2018 – 9M2021 Top 100 Brands 2 Revenue Concentration (%) Diversified Revenue 32% Top 10 brands 1 2020 Revenue Top100 73% Others 27% 1 Top 100 70% Others 30% 1 2018 2019 2020 9M2020 9M2021

18 Confidential Year 1 Year 2 Year 3 Year 4 1.0x 1.8x 3.8x 4.6x 1.0x 1.9x 2.4x 1.0x 1.3x 1.0x Average Monthly Recurring Revenue (MRR) by Cohort for Top 100 Brands 1 (Indexed to Year 1 2 ) 2017 Cohort 2018 Cohort 2019 Cohort 2020 Cohort 2020 & 2021: COVID - 19 impact Demonstrated Track Record Of MRR Expansion & Strong Retention Rate Consistent MRR Expansion & Strong Retention Despite COVID - 19 Impact 1 Top 100 brands represent brands that has top 100 contribution to contract revenue from 2016 - 2021. There are 12 brands within the se top 100 brands that are within the 2021 cohort. 2 As an example, for 2017, year 1 = 2017. Retention Rate by Cohort for Top 100 Brands 1 Top 100 Brands Cohort New Brands Remaining Brands in 9M2021 Retention Rate Implied Annual Retention Rate 2017 29 25 86% 96% 2018 18 14 78% 91% 2019 25 21 84% 91% 2020 16 16 100% 100% Average 94%

19 Confidential 840 2,205 7,937 9,916 26,169 2016 2017 2018 2019 2020 Growing With Brands: Key Brands Case Studies Deepening Relationship With Brands Is A Testimony To The Eminence of Perfect’s Solutions Please refer to Perfect’s website for more brands success stories: https://www.perfectcorp.com/business/successstory/list. Brand A Brand B 35 574 655 1,201 1,572 2016 2017 2018 2019 2020 ARR ( US$k ) No. of SKUs Covered No. of Subscribed Modules 45x 1 58 167 302 666 2016 2017 2018 2019 2020 ARR ( US$k ) 160 332 629 4,638 37,060 2016 2017 2018 2019 2020 No. of SKUs Covered No. of Subscribed Modules 489x 1 2 3 4 5 1 3 4 5 6 31x 232x No. of Countries No. of Countries 1 2 5 15 36 3 10 35 38 49

20 Confidential Virtual try - ons through brands' Instagram shops #1 Social Network Virtual Try - On Virtual try - ons through organic search results #1 Search Engine Virtual try - ons on Snapchat brand profile One of the Most Used Cameras Virtual try - ons through brand’s YouTube video campaigns #1 Video Platform Try it on 200+ brands using AR on Taobao and Tmall 6,000 SKUs available for users to try WeChat Mini Program covering AI shade finder & skincare, AR hair color & eye color, make - up virtual try on, and brow virtual try on Brands can subscribe to the service and expand their AR offering from Perfect Console with one click #1 Mobile E - commerce Platform #1 Social & Digital Payment Platform #1 Video Social Platform Asian tech giants Global tech giants Strategic Partnerships With World Class Tech Giants Enabling Global Coverage Of Brands’ End - Customers

21 Confidential Advanced AR & AI Technologies 1 Experts include Research and Development, Business Development, Marketing and Product Planning staff 3,900 - point Real - time facial 3D live meshes backed by visual computing 10m Training data sets across all ethnicities for AI deep learning for facial expressions analysis 200 - point Real - time facial landmarks to recognize user facial features 10+ Makeup textures ~90k Skin tones supported 44 Patents in beauty tech domain Unique Tech Capabilities And Extensive Collection Of Training Data Sets To Solidify Product Leadership

22 Confidential can detect lips very accurately and apply very natural makeup Peer A Peer B Peer C Lips Detection Skin Analysis Perfect Detected Not detected Not detected Not detected Spot can provide more precise skin analysis and indicate spots area Peer D Peer E Technology Capabilities Comparison Superior AR & AI Solutions Across Beauty And Skincare Segments Perfect

23 Confidential Portfolio Of Consumer Apps To Complement Core SaaS Business A Self - Sustaining Testbed And Data Collection Platform Consumer Platform Value - add 1 Testbed for new product innovations before offering solutions to brands 2 Gather valuable beauty trends data from 30 m+ Monthly Active Users 3 Continue to be a supporting platform to the core SaaS business Powerful selfie camera editor #1 makeup video app #1 AR makeover app Short video editor Selfie app with AR Face filters and effects Powerful nail design app

24 Confidential Help brands achieve and increase awareness of their ESG goals Achieving Environmental Sustainability With Beauty AR & AI Technology Consumers’ Awareness Towards Sustainability Would Further Accelerate Brands’ Adoption Of AR & AI Reduce beauty sampling / tester Prevent overconsumption Lower product returns Everyone can benefit from Beauty AR & AI Technology Environmental Sustainably for Beauty Support the industry in furthering sustainable beauty and eco - friendly practices Industry Brands Enable consumers to support environmental conscious brands and improve their beauty try - on experiences Consumers Perfect AR and AI - Powered VTO Technology was named 2021 Green Product of the Year 1 1 The Business Intelligence Group named Perfect’s AI and AR - Powered VTO Technology as the 2021 Green Product of the Year in the BI G Awards for Business. For more details: https://www.perfectcorp.com/business/news/detail/1891

Growth Opportunities 1

26 Confidential Multiple Avenues To Drive Growth Significant Growth Opportunities From Existing Brands, New Brands, New Verticals And Synergistic M&A Deepen Penetration Within Top 20 Beauty Groups x Cross - sell to sister brands in the Groups x Upsell more modules and functions to brands x Enable more SKUs in all categories x Upscale to more countries within a brand Expand To New Verticals Beyond Beauty x Expand product portfolio into other verticals – Fashion accessories – Clothing – Beyond fashion Expand Reach In Long Tail Of Indie Beauty Brands Brand Size No. of Brands x Significant growth runway as over 99% of indie beauty brands/merchants remain untapped x Differentiated value proposition to form potential platform partnerships Pursue Synergistic M&A Selectively x Speed up brand relationships, vertical and geographies expansion x Accelerate revenue growth and margins

27 Confidential Deepen Penetration Within Top 20 Beauty Groups Continue To Penetrate More Brands, Territories And Services Within Each Of The Top 20 Beauty Groups Source: Company data and estimates 1 Average number of countries covered per brand By SKUs By Countries By Brands 123 435 1.7m 80 6 ~3.5x ~6x ~13x Cross - sell to sister brands in the Groups Secure more Group level deals Enable more SKUs in all categories Offer new product effects Upscale to more countries within a brand Secure more global deals 1 266k

28 Confidential Expand Reach In Long Tail Of Indie Beauty Brands Differentiated Value Proposition To Form Potential Platform Partnerships To Target Indie Beauty Brands 1 Based on Euromonitor 2020 global beauty companies’ revenue in color cosmetics, skincare and haircare. 2 Management estimates as of September 2021. Indie Beauty Brands Is An Important Customer Segment, With Significant Growth Runway Perfect’s Differentiated Value Proposition Leveraging partnership with global platforms to rapidly penetrate Indie Beauty Brands Easy plug and play Convenient self - servicing solutions Competitive rates Shortened go - to - market times 43% Indie Beauty Brands combined market share 1 US$119b Indie Beauty Brands combined beauty revenue 1 200k+ Total number of Indie Beauty Brands and Merchants globally 2 <1% Indie Beauty Brands and Merchants AR & AI adoption rate 2

29 Confidential Target New Verticals Beyond Beauty Leverage Tech Capabilities And Partnerships To Expand Product Portfolio Into Other Verticals Fashion Accessories Clothing Beyond Fashion Eyewear Nail Design Watches Accessories Jewelry Men’s Grooming Clothes Hats Scarves Shoes Hair Salon Dental / Orthodontics Plastic Surgery Live Stream Video Conferencing

30 Confidential Selectively Pursue Synergistic M&A Focusing On Organic Growth Supplemented By Selected Synergistic M&A Target Criteria Target Value - Add To Perfect Perfect Accelerate Perfect’s expansion to new verticals, especially within fashion Tech capabilities integration and synergies Consolidate and extend market leadership Drive revenue growth and margin expansion Fit with Perfect’s company culture Reasonable valuation Relationships with brands that complement Perfect’s vertical and geographic presence Strong product & tech capabilities which can improve Perfect’s existing platform

Financial Highlights 1

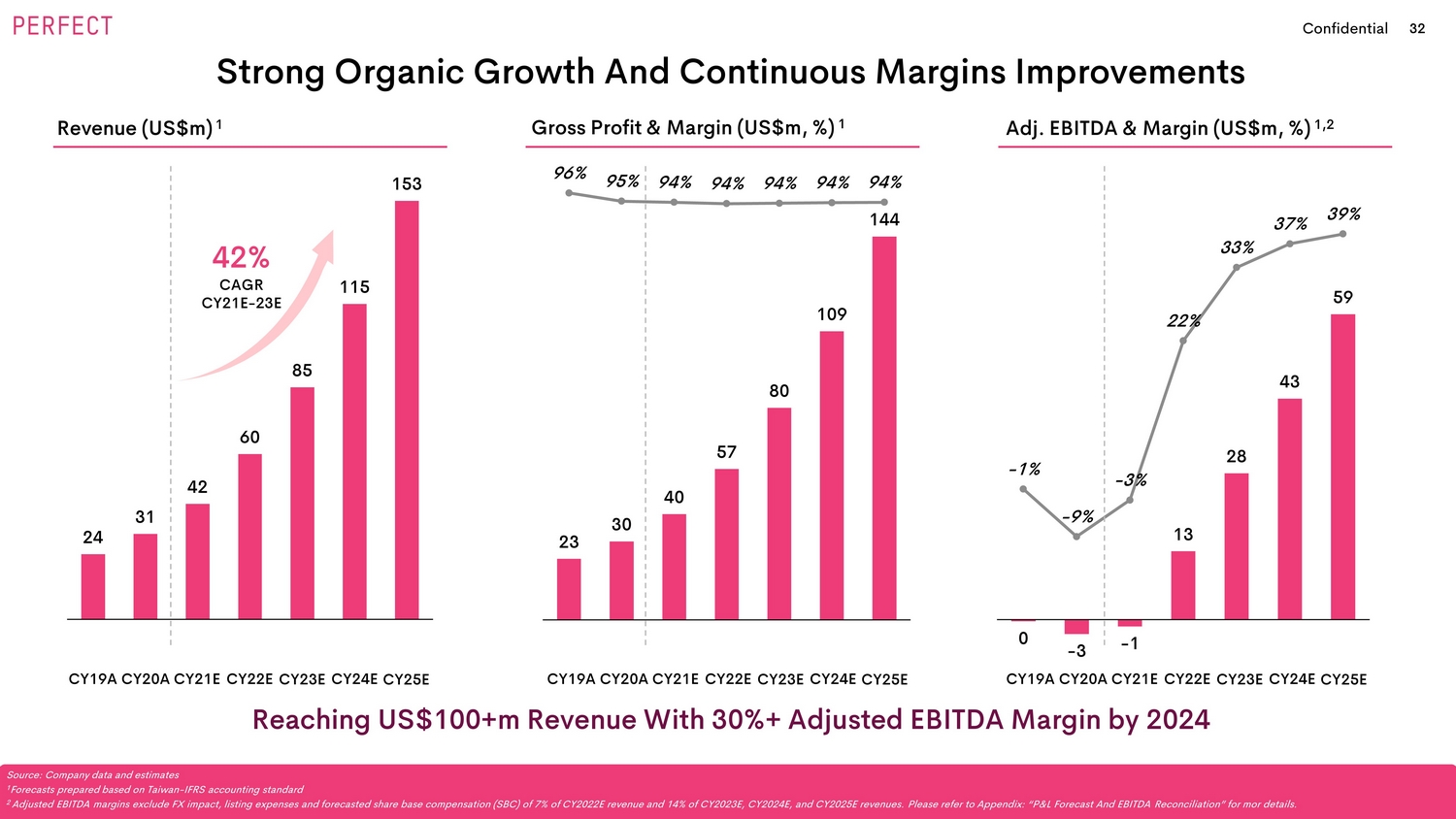

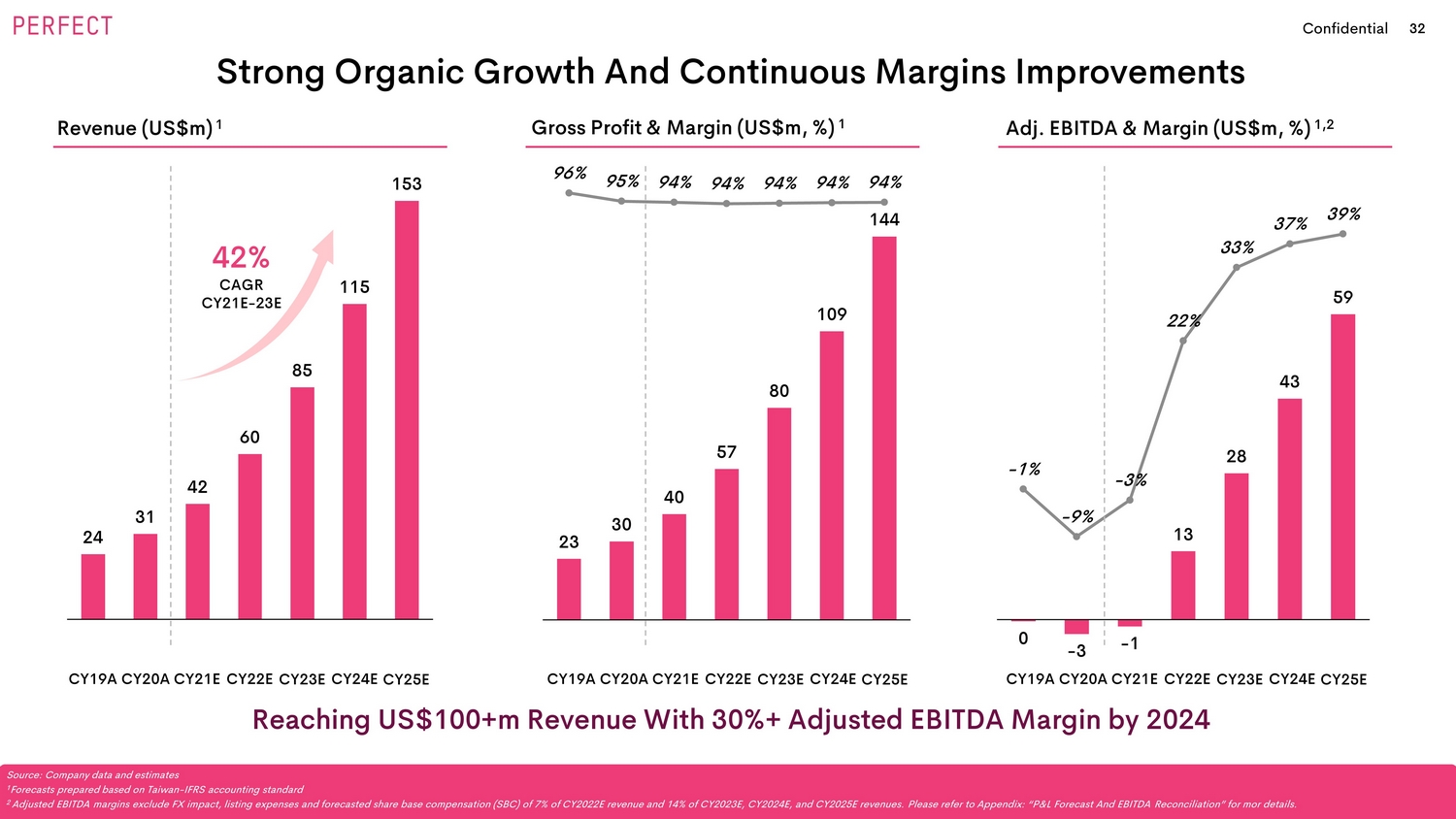

32 Confidential 0 - 3 - 1 13 28 43 59 - 1% - 9% - 3% 22% 33% 37% 39% -30% -20% -10% 0% 10% 20% 30% 40% -10 0 10 20 30 40 50 60 70 80 2019A 2020A 2021E 2022E 2023E 2024E 2025E 23 30 40 57 80 109 144 96% 95% 94% 94% 94% 94% 94% 0% 20% 40% 60% 80% 100% 0 20 40 60 80 100 120 140 160 2019A 2020A 2021E 2022E 2023E 2024E 2025E 24 31 42 60 85 115 153 2019A 2020A 2021E 2022E 2023E 2024E 2025E Strong Organic Growth And Continuous Margins Improvements Reaching US$100+m Revenue With 30%+ Adjusted EBITDA Margin by 2024 Source: Company data and estimates 1 Forecasts prepared based on Taiwan - IFRS accounting standard 2 Adjusted EBITDA margins exclude FX impact, l isting expenses and forecasted share base compensation (SBC) of 7% of CY2022E revenue and 14% of CY2023E, CY2024E, and CY2025 E r evenues. Please refer to Appendix: “P&L Forecast And EBITDA Reconciliation” for mor details. Revenue ( US$m ) 1 Adj. EBITDA & Margin ( US$m , %) 1,2 42% CAGR CY21E - 23E CY19A CY20A CY21E CY22E CY23E CY24E CY25E Gross Profit & Margin ( US$m , %) 1 CY19A CY20A CY21E CY22E CY23E CY24E CY25E CY19A CY20A CY21E CY22E CY23E CY24E CY25E

33 Confidential 33% 45% 34% 19% 17% 16% 14% 5% - 3% - 18% - 23% 6% - 10% 42% 56% 41% 38% 37% 35% 35% 34% 32% 31% NI 55% 33% CY2021E to CY2023E Revenue Growth CY2023E EBITDA Margin 1 Favorable Operating Metrics Relative To Peers Peer Median: 35% Strong Revenue Growth Leading To Rapid Margin Expansion Peer Median: 10% Source: Perfect Management projection, Capital IQ as of 04 February 2022 1 Peers EBITDA margins are calculated based on EBITDA consensus sourced from Capital IQ 2 Adjusted EBITDA margins exclude FX impact, l isting expenses and forecasted share base compensation (SBC) of 7% of CY2022E revenue and 14% of CY2023E, CY2024E, and CY2025 E r evenues. Please refer to Appendix: “P&L Forecast And EBITDA Reconciliation” for mor details. Market Leading, High - Growth SaaS Comps AR - related Software

34 Confidential 155% 133% 132% 130% 130% 119% 118% 118% 115% 112% 109% 106% NA 100% 93% 82% 75% 72% 61% 55% 50% 42% 40% 30% NA NA 53% 52% 37% 34% 27% 25% 25% 24% 23% 23% 21% 18% 10% 95% 87% 86% 84% 82% 78% 78% 77% 75% 74% 74% 56% 53% CY2018A to CY2020A CAGR FY2018A to FY2020A Source: Perfect Management projection, Capital IQ, Company Filings 1 Arithmetic average of NDRR disclosed in filings for FY2018, FY2019, and FY2020, unless stated otherwise ; 2 Revenue normalized to Calendar Year, unless stated otherwise. Best - in - Class Among SaaS Comparables Gross Profit Margin R&D Expenses (% Of Revenue) Net Dollar Retention Rate (NDRR) Subscription Revenue Growth Median: 78% Median: 25% 1 Median: 119% Median: 61% CY2020A CY2020A Notes for NDRR chart: 3 Average of FY2019 and FY2020 only; 4 Company 10 - K: 2019 and 2020 NDRR are above130%; 5 Quarter ended September 2020 only. Notes for Recurring Revenue Growth chart: 6 As subscription revenues portion were not disclosed, total revenues were used instead. 7 Used FY2019, 2020, and 2021 (FY ends in January) ; 8 Used FY2019, 2020, and 2021 (FY ends in March); 9 Total subscription and transaction revenue. 2 Superior Customer Retention, Growth, and Profitability Perfect High - Growth SaaS and AR - related Comps

35 Confidential 0.40x 0.40x 0.47x 0.50x 0.51x 0.54x 0.58x 0.70x 0.86x 0.88x NI 0.21x 0.64x Attractive Valuation Relative To Peers Offering Attractive Relative Valuation Despite Superior Operating Metrics EV/Revenue Growth Adj. 2 Source: Perfect Management projection, Capital IQ as of 04 February 2022 1 Perfect multiples based on the proposed transaction (US$1,019m pro forma Enterprise Value) 2 Adjusted for CY2021E to CY2023E Revenue Growth 16.9x 14.3x 16.6x 17.0x 17.5x 19.7x 19.8x 22.5x 30.5x 32.7x 32.8x 11.7x 21.3x EV/Revenue CY2022E 12.0x 11.0x 12.2x 12.6x 13.2x 14.8x 16.6x 17.2x 23.3x 24.3x 24.3x 7.1x 16.4x CY2023E Peer Median: 19.8x Peer Median: 0.54x 0.29x 0.29x 0.36x 0.37x 0.38x 0.41x 0.43x 0.54x 0.63x 0.67x NI 0.13x 0.49x Peer Median: 0.41x Perfect Market Leading, High - Growth SaaS AR - related Software Peer Median: 15.6x

36 Confidential Key Proposed Transaction Terms Pro Forma Valuation ( US$m ) Pro Forma Ownership @ US$10.00 per share Sources and Uses ( US$m ) 72% 20% 4% 4% Existing Shareholders SPAC Public Shareholders SPAC Promote PIPE Investors Sources ( US$m ) SPAC Cash in Trust 1 $ 230 Forward Purchase Agreement 55 PIPE Capital Raised 50 Stock to Existing Shareholders 1,010 Total Sources $ 1,345 • Pro Forma Enterprise Value of US $ 1 , 019 m, representing a transaction multiple of 16 . 9 x CY 2022 E revenue and 12 . 0 x CY 2023 E revenue • Current owners will retain ~ 72 % ownership in combined company • US $ 285 m total cash proceeds from SPAC and FPA and US $ 50 m PIPE raise 1 • US $ 300 m cash proceeds to balance sheet 1 Uses (US$m) Seller Rollover $ 1,010 Cash to Balance Sheet 300 Estimated Transaction Fees 35 Total Uses $ 1,345 Share Price at Merger $ 10.00 Pro Forma Total Shares Outstanding 2 139.9 Equity Value $ 1,399 Less: Net Cash 3 380 Enterprise Value $1,019 Implied EV / CY2022E Revenue 16.9x Implied EV / CY2023E Revenue 12.0x Transaction Summary 1 Assumes no SPAC shareholder has exercised its redemption rights to receive cash from the trust account. 2 Assumes undiluted share count of 101.0 million equity rollover shares, 28.5m SPAC public shares (including forward purchase s har es), 5.4m sponsor promote shares (held by SPAC directors, advisors, sponsors and Ward Ferry) vested at closing, and 5.0m PIPE sh ares. Excludes ( i ) out - of - the money warrants, (ii) unvested promote shares of 1.18m, (iii) seller earn - out shares and ESOP shares of 15.3m 3 Net Cash assumes US$80.0m existing cash and no debt as of December 2021 Existing Shareholders SPAC Public Shareholders SPAC Promote PIPE Investors

37 Confidential Alice CHANG Founder, CEO Louis CHEN SVP and CSO Johnny TSENG SVP and CTO Iris Chen VP of Finance Department Wayne LIU SVP and Head of Americas CEO of CyberLink from 1997 to 2015 before founding Perfect 18+ years with Perfect and CyberLink leading global strategic relationship alliances and corporate development 23+ years in Tech industry, received the Individual Achievement Award for technology advancement by Taiwan’s Ministry of Economics Affairs 12+ years with Perfect and CyberLink with extensive experience in engineering management positions with Intel, Broadcom and NVIDIA 20+ years experience as Head of Corporate Finance and Accounting of a public company at Cyberlink before joining Perfect Proven Leadership Team With Strong Execution Capabilities

38 Confidential Thank You

Appendix 1

40 Confidential Summary P&L (US$ in millions) 2019A 2020A 2021E 2022E 2023E 2024E 2025E Contract Revenue 30.0 35.6 48.2 71.9 101.3 137.4 179.5 YoY Growth (%) 19% 35% 49% 41% 36% 31% Accounting Revenue 23.9 31.3 42.2 60.5 84.9 115.3 153.0 YoY Growth (%) 31% 35% 43% 40% 36% 33% Gross Profit 23.0 29.6 39.8 56.8 79.8 108.6 144.3 % Margin 96% 95% 94% 94% 94% 94% 94% Adjusted EBITDA (0.3) (2.8) -1.3 13.2 28.3 42.8 59.1 % Margin -1% -9% -3% 22% 33% 37% 39% Adjusted EBITDA Reconciliation (US$ in millions) 2019A 2020A 2021E 2022E 2023E 2024E 2025E Net Income (1.1) (4.2) (4.5) (3.1) 11.8 19.4 27.7 Add back: Income Tax 0.2 0.4 0.4 (8.1) 3.9 6.4 9.2 Net Interest Expense (0.2) (0.2) (0.1) (0.1) (0.1) (0.1) (0.1) Depreciation & Amortization 0.4 0.5 0.5 0.6 0.7 0.8 0.9 Stock Based Compensation - - - 4.3 12.1 16.3 21.5 FX Impact 0.2 0.8 0.5 - - - - Listing Expenses - - 1.8 19.7 - - - Adjusted EBITDA (0.3) (2.8) (1.3) 13.2 28.3 42.8 59.1 Perfect Standalone Consolidated Forecast Perfect Standalone Consolidated Forecast P&L Forecast And EBITDA Reconciliation 1 Contract Revenue is defined as total signed contract value from all customers in the respective year 2 Please refer to Adjusted EBITDA Reconciliation table 1 2

41 Confidential Risk Factors Risks Related to Perfect’s Business and Industry 1. We operate in relatively new and rapidly evolving markets. If the development of the markets stop or slow down, our business wil l be materially and adversely affected. 2. We have a new business model and a short operating history in developing and rapidly evolving markets for our products and se rvi ces, which makes it difficult to evaluate our future prospects. 3. If we fail to retain and expand sales to existing brand customers and 2C users or attract new brand customers and new 2C user s, or if users decrease their level of engagement with our brand customers or our 2C apps, our business and operating results may be materially and adversely affected. 4. We are in the early stages of monetization of our 2C apps and cannot guarantee that our current or future monetization strate gie s will be successfully implemented or will generate sustainable revenues. 5. Our success is dependent on the continued popularity and perceived precision of our technology solutions. 6. We may not be successful if we are not able to innovate, develop and provide new products and services or upgrade our existin g p roducts and services in a timely and cost - effective manner to address rapidly evolving user preferences, industry trends and technological changes, and any new products and services we develop and provid e, may expose us to new risks and may not achieve expected returns. 7. Our recent rapid growth may not be indicative of our future growth. Even if we continue to grow, we may not be able to succes sfu lly execute our growth strategies. 8. We may fail to compete effectively or maintain market leadership in the markets in which we currently operate or expand into. 9. Our current operations are international in scope, and we plan to further expand globally. If we fail to meet the challenges pre sented by our increasingly globalized operations, our business may be materially and adversely affected. 10. Our sales cycle for our brand customers can be long and unpredictable, and our sales efforts require considerable time and ex pen ses. 11. We make selective investments and acquisitions significant investment in new products and services and enhancement to our exi sti ng products and services which may not be successful and may not achieve expected returns. 12. Given that a small number of business partners contribute to a significant portion of our revenues, our business and results of operations could be materially and adversely affected if we were to lose a significant business partner or a significant portion of its business. 13. Google Play, for downloads of YouCam and our other apps, as well as for payment processing, and any interruption or deterioration in our relationship with such en ti ties may negatively impact our business. 14. We depend on the continuing efforts of our founders, senior management team and key personnel, and our business operations ma y b e negatively affected if we lose their services. 15. If we are not able to maintain and enhance our brands, our business and operating results may be materially and adversely aff ect ed. 16. User misconduct and misuse of our apps or any non - compliance of third parties that we conduct business with may adversely impact our brand image and reputation, and we may be held liable for information or content displayed on, retrieved from or linked to our products, which may materially and adversely affect our business and op era ting results. 17. Certain of our user metrics and other estimates are subject to inherent uncertainties in measurement, and real or perceived i nac curacies in such metrics may harm our reputation and negatively affect our business. 18. We may require additional capital to support our operations and the growth of our business, and we cannot be certain that fin anc ing will be available on reasonable terms when required, or at all. 19. CyberLink is estimated to hold at least 25.9% of our outstanding Class A Ordinary Shares and its interests may differ from those of our o ther shareholders. 20. We have limited business insurance coverage. Any interruption of our business may result in substantial costs and the diversi on of our resources, and cause an adverse impact on our financial condition and results of operations. 21. Our business depends on retaining and attracting high - quality personnel, and failure to retain, attract or maintain such personn el could adversely affect our business.

42 Confidential Risk Factors (Continued) Risks Related to Perfect’s Technology, Data Privacy and Intellectual Property 1. Security breaches, improper access to or disclosure of our data or user data, other hacking and phishing attacks on our syste ms, or other cyberattacks may make our products and solutions to be perceived as not being secure, which could harm our reputation and adversely affect our business. 2. Our business and operating results may be harmed by any significant service disruptions. If our products and services are sub jec t to attacks or misuse that disrupt or deny the ability of users to access our products and services, and we fail to develop enhancements to resolve any defect or other problems or adapt our existing tech nol ogy and infrastructure, our users and partners may curtail or stop using our products and services, which could significantly harm our business. 3. We rely on Google Cloud, AWS and Alicloud for the vast majority of our computing, storage, bandwidth, and other services. Any service interruption of their operating s ys tems, networks and hardware or other disruptions of or interference with our use of the cloud operation could impair the delivery of our platform and thus negativ ely affect our operations and harm our business. 4. We rely on third - party proprietary and open source software for our products and services. The inability to obtain third - party l icenses for such software, obtain them on favorable terms, or adhere to the license terms or any errors or failures caused by such software could harm our business. 5. Our business depends upon the interoperability of our platform across devices, operating systems, and third - party applications t hat we do not control. 6. We may incur substantial costs in protecting or defending our intellectual property and any failure to protect our intellectu al property could impair our competitive position and the value of our brands and other intangible assets may be diminished. 7. We may be subject to intellectual property infringement claims or other allegations by third parties, which may cause substan tia l costs and materially and adversely affect our business operations. Risks Related to Perfect’s Financial Results 1. We have incurred operating losses in the past, and our ability to achieve or maintain profitability in the future is uncertai n. 2. We recognize revenue from SaaS subscriptions to our products over the terms of these subscriptions. Increases or decreases in ne w sales may not be immediately reflected in our results of operations and may be difficult to discern. 3. Our financial results are likely to fluctuate from quarter to quarter due to seasonality and a variety of other factors, whic h m akes our period - to - period results volatile and difficult to predict. 4. Changes in subjective assumptions, estimates and judgments by our management related to complex accounting matters or changes in the IFRS could significantly affect our financial condition and results of operations. 5. Examinations by relevant tax authorities may result in material changes in reserves for tax positions taken in previously fil ed tax returns or may impact the valuation of certain deferred income tax assets. 6. Our costs are growing rapidly and may increase faster than our revenue, which could seriously harm our business or increase o ur losses.

43 Confidential Risk Factors (Continued) Risks Related to Laws and Regulations 1. Our business is subject to complex and evolving domestic and international laws and regulations regarding privacy and data pr ote ction. These laws and regulations are subject to change and uncertain interpretation, which could result in claims, changes to our data and other business practices, regulatory investigations, mo net ary penalties, increased cost of operations, or declines in user growth or engagement, or otherwise harm our business. 2. Any amendments to existing tax regulations or the implementation of any new tax laws in the R.O.C., the U.S. or other jurisdi cti ons in which we operate our business may have an adverse effect on business and profitability. 3. Given that we are incorporated in the Cayman Islands and our executive officers are located in Taiwan, your ability to protec t y our rights through U.S. courts may be limited. 4. Foreign government initiatives to restrict or ban access to our products in their countries could seriously harm our business . 5. Many of our customers deploy our products and solutions globally and we could be held liable in some jurisdictions in which w e o perate for contents posted by our users, which could expose us to damages or other legal liability. 6. We may be subject to governmental export and import controls that could impair our ability to compete in international market s a nd subject us to liability if we violates the controls. Risks Related to Doing Business in PRC 1. Uncertainties in the interpretation and enforcement of PRC laws and regulations could limit the legal protections available t o y ou and us. 2. Changes and developments in the political and economic policies of the PRC government may materially and adversely affect our bu siness, financial conditions and operating results. 3. If we fail to obtain and maintain the requisite licenses and approvals required under the complex regulatory environment appl ica ble to our businesses in the PRC, or if we are required to take actions that are time - consuming or costly, our business, financial condition and results of operations may be materially and adversely affected. 4. Cross - Straits relationship imposes macroeconomic risks which could negatively affect our business. Risks Related to the Perfect Class A Ordinary Shares and the Perfect Public Warrants 1. The price of our Class A Ordinary Shares may be volatile, and the value of our Class A Ordinary Shares may decline. 2. If we do not meet the expectations of equity research analysts, if they do not publish research or reports about our business or if they issue unfavorable commentary or downgrade our Class A Ordinary Shares, the price of our Class A Ordinary Shares could decline. 3. Our issuance of additional share capital in connection with financings, acquisitions, investments, our equity incentive plans or otherwise will dilute all other shareholders. 4. We do not intend to pay dividends for the foreseeable future and, as a result, your ability to achieve a return on your inves tme nt will depend on appreciation in the price of our ordinary shares. 5. We are an “emerging growth company,” and we cannot be certain if the reduced reporting and disclosure requirements applicable to emerging growth companies will make our Class A Ordinary Shares less attractive to investors. 6. We will be a foreign private issuer and, as a result, we will not be subject to U.S. proxy rules and will be subject to Excha nge Act reporting obligations that, to some extent, are more lenient and less frequent than those of a U.S. domestic public company. 7. We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses.

44 Confidential Risk Factors (Continued) 8. As we are a “foreign private issuer” and intend to follow certain home country corporate governance practices, our shareholde rs may not have the same protections afforded to shareholders of companies that are subject to all Nasdaq corporate governance requirements. 9. We will incur increased costs as a result of operating as a public company, and our management will be required to devote sub sta ntial time to compliance with our public company responsibilities and corporate governance practices. 10. We have identified material weaknesses in our internal control over financial reporting. If our remediation of these material w eaknesses is not effective, or if we experience additional material weaknesses or otherwise fail to maintain an effective system of internal controls in the future, we may not be able to report our financial re sults accurately, prevent fraud or file our periodic reports as a public company in a timely manner. 11. Perfect is a holding company with no operations of its own and, as such, it depends on its subsidiaries for cash to fund its ope rations and expenses, including future dividend payments, if any. 12. Perfect (or Provident, prior to the Merger) may be a PFIC for U.S. federal income tax purposes as a result of which U.S. Hold ers may suffer adverse U.S. federal income tax consequences. 13. Our CEO has control over key decision making as a result of her control of a majority of the voting right of our outstanding Ord inary Shares. 14. The grant and future exercise of registration rights may adversely affect the market price of our Class A Ordinary Shares upo n c onsummation of the Proposed Transactions. 15. After the Closing, we will be able to issue additional Ordinary Shares upon the exercise of outstanding Perfect Public Warran ts, which would increase the number of shares eligible for future resale in the public market and result in dilution to the Perfect’s shareholders. 16. The Perfect Warrant Agreement will designate the courts of the State of New York or the United States District Court for the Sou thern District of New York as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by holders of the Perfect Public Warrants, which could limit the ability of war ran t holders to obtain a favorable judicial forum for disputes with us. 17. If we do not maintain a current and effective prospectus relating to the Perfect Class A Ordinary Shares issuable upon exerci se of the Perfect Public Warrants issued in exchange for the Public Warrants, you will only be able to exercise such Perfect Public Warrants on a “cashless basis.” 18. An investor will be able to exercise a Perfect Public Warrant only if the issuance of Perfect Ordinary Shares upon such exerc ise has been registered or qualified or is deemed exempt under the securities laws of the state of residence of the holder of the Perfect Public Warrants . Risks Related to Provident and the Proposed Transactions 1. We may not be able to complete the Proposed Transactions or any other business combination within the prescribed time frame, in which case we would cease all operations except for the purpose of winding up and we would redeem our public shares and thereafter commence a voluntary liquidation, in which case our public shareholders may receive only $10.00 per share, or less than such amount in certain circumstances, and our warrants will expire worthless. 2. The Sponsor, directors, executive officers, advisors or any of their affiliates may elect to purchase shares from our public sha reholders, which may influence a vote on the Proposed Transactions and reduce the public “float” of our ordinary shares. 3. We will incur significant transaction and transition costs in connection with the Proposed Transactions. 4. Investors may not receive the same benefits as an investor in an underwritten public offering. 5. If third parties bring claims against us, the proceeds held in the Trust Account could be reduced and the per - share redemption a mount received by shareholders may be less than $10.00 per share. 6. Our directors may decide not to enforce the indemnification obligations of the Sponsor, resulting in a reduction in the amoun t o f funds in the Trust Account available for distribution to our Provident public shareholders.

45 Confidential Risk Factors (Continued) 7. If we are unable to consummate our initial business combination by January 12, 2023, or during an extension period, our publi c s hareholders may be forced to wait beyond the ten business day period thereafter before redemption from our Trust Account. 8. If deemed to be insolvent, distributions made to our public shareholders, or part of them, from our Trust Account may be subj ect to claw back in certain circumstances. 9. If, before distributing the proceeds in the Trust Account to our Public Shareholders, we file a bankruptcy petition or an inv olu ntary bankruptcy petition is filed against us that is not dismissed, the claims of creditors in such proceeding may have priority over the claims of our shareholders and the per - share amount that would otherwise be received by our shareholders in connection with our liquidation may be reduced. 10. Our Public Shareholders may be held liable for claims by third parties against us to the extent of distributions received by the m upon redemption of their public shares. 11. If, after we distribute the proceeds in the Trust Account to our Public Shareholders, we file a bankruptcy petition or an inv olu ntary bankruptcy petition is filed against us that is not dismissed, a bankruptcy court may seek to recover such proceeds, and the members of our board may be viewed as having breached their fiduciary duties to ou r c reditors, thereby exposing the members of our board and us to claims of punitive damages. 12. Because each of Provident and Perfect is incorporated under the laws of the Cayman Islands, you may face difficulties in prot ect ing your interests, and your ability to protect your rights through the U.S. federal courts may be limited. 13. The Initial Shareholders have agreed to vote in favor of the Proposed Transactions, regardless of how our public shareholders vo te. 14. The Sponsor and our executive officers and directors have potential conflicts of interest in recommending that shareholders v ote in favor of approval of the Business Combination Proposal and approval of the other proposals described in this registration statement on Form F - 4 and the proxy statement/prospectus included herein. 15. The shares beneficially owned by the Sponsor, our officers and directors will not participate in liquidation distributions an d, therefore, our officers and directors may have a conflict of interest in determining whether a particular target business is appropriate for our initial business combination. 16. Activities taken by our shareholders to increase the likelihood of approval of the Business Combination Proposal and other pr opo sals could have a depressive effect on our ordinary shares. 17. The exercise of discretion by Provident’s directors and officers in agreeing to changes to the terms of or waivers of closing conditions in the Business Combination Ag re ement may result in a conflict of interest when determining whether such changes to the terms of the Business Combination Agreement or waivers of conditions are appropr iat e and in the best interests of Provident securityholders. 18. Provident’s board of directors did not obtain a fairness opinion in determining whether or not to proceed with the Proposed Transactions an d, as a result, the terms may not be fair from a financial point of view to the Provident Public Shareholders. 19. Since the Sponsor and our executive officers and directors will not be eligible to be reimbursed for their out - of - pocket expense s if a business combination is not completed, a conflict of interest may arise in determining whether a particular business combination target is appropriate for a business combination. 20. Provident’s and Perfect’s ability to consummate the Proposed Transactions, and the operations of Perfect following the Proposed Transacti on s, may be materially adversely affected by the recent coronavirus (COVID - 19) pandemic. 21. Provident’s warrants are accounted for as liabilities and the changes in value of our warrants could have a material effect on our financ ia l results. 22. We have identified a material weakness in our internal control over financial reporting as of September 30, 2021. If we are u nab le to develop and maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results in a timely manner, which may adversely affect inves tor confidence in us and materially and adversely affect our business and operating results. 23. We, and following the Proposed Transactions, Perfect, may face litigation and other risks as a result of the material weaknes s i n our internal control over financial reporting.

46 Confidential Risk Factors (Continued) Risks Related to Redemptions of Provident Public Shares 1. If a shareholder fails to receive notice of Provident’s offer to redeem the Public Shares in connection with the Proposed Transactions, such shares may not be redeemed. 2. You will not have any rights or interests in funds from the Trust Account, except under certain limited circumstances. To liq uid ate your investment, therefore, you may be forced to sell your Public Shares and/or warrants, potentially at a loss. 3. There is no guarantee that a Public Shareholder’s decision whether to redeem their shares for a pro rata portion of the Trust Account will put such shareholder in a better future economic position. 4. Provident may be a PFIC which could result in adverse U.S. federal income tax consequences to U.S. investors who exercise the ir right to redeem our ordinary shares. General Risks 1. A severe or prolonged downturn of global economy or unfavorable conditions in our industry could materially and adversely aff ect our business and operating results. 2. Any catastrophe, including natural catastrophes, outbreaks of health pandemics such as the ongoing global COVID - 19 pandemic or o ther extraordinary events, could disrupt our business operations and have a materially adverse impact on our business and results of operations. 3. Fluctuations in exchange rates could have a material and adverse effect on our results of operations.

47 Confidential Summary Of Certain Material Differences Between Taiwan - IFRS and IFRS Perfect’s financial information in this presentation is prepared and presented in conformity with the Regulations Governing the Preparation of Financial Reports by Securities Issuers and IAS 34 “Interim Financial Reporting” endorsed and issued into effect by the R.O.C. Financial Supervisory Commission (“Taiwan - IFRS”). Taiwan - IFRS and IFRS differ in certain significant respects. A brief description of certain significant differences between Taiwan - IFRS and IFRS is set forth below. The regulatory organizations that promulgate Taiwan - IFRS and IFRS h ave initiated ongoing projects that may affect future comparisons such as the comparison below. This summary does not and is not intended to provide a comprehensive listing of all existing or future diff ere nces between Taiwan - IFRS and IFRS, including those specifically related to Perfect or to the industries in which it operates. No attempt has been made to identify future differences between Taiwan - IFRS and IFRS as a r esult of prescribed changes in accounting standards, or disclosure, presentation or classification differences that would affect the manner in which transactions and events are reflected in the financial state men ts of Perfect or the notes thereto. Further, had Perfect undertaken to identify the differences specifically affecting the financial statements presented in this proxy statement/prospectus, other potentially s ign ificant differences which are not in the following summary may have come to its attention. Accordingly, there can be no assurance that this summary provides a complete description or quantifies the effects of all dif fer ences which may have a significant impact on Perfect’s financial statements. Summary of Certain Material Differences Subject Taiwan - IFRS IFRS Tax on unappropriated earnings Companies in the R.O.C. are subject to 5% surtax on unappropriated earnings. The tax on unappropriated earnings is recorded in the year the shareholders approved the appropriation of earnings. Companies in the R.O.C. are subject to 5% surtax on unappropriated earnings. The tax on unappropriated earnings should be accrued during the period the earnings arise and adjusted to the extent of the appropriations approved by the shareholders in the following year.]