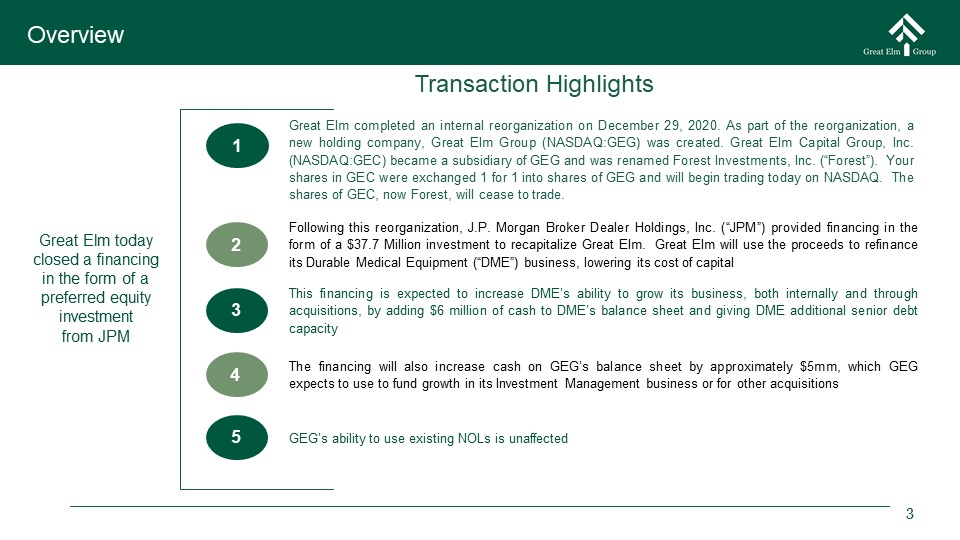

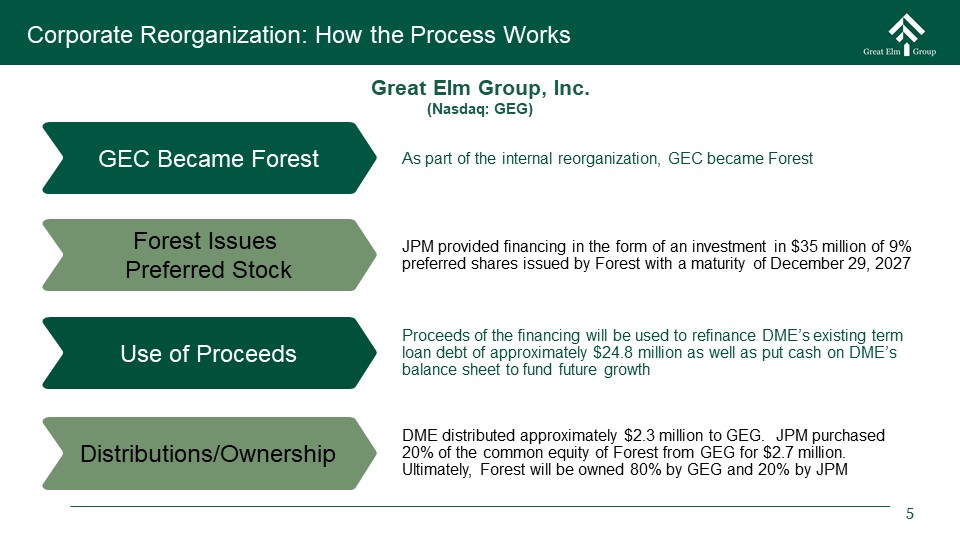

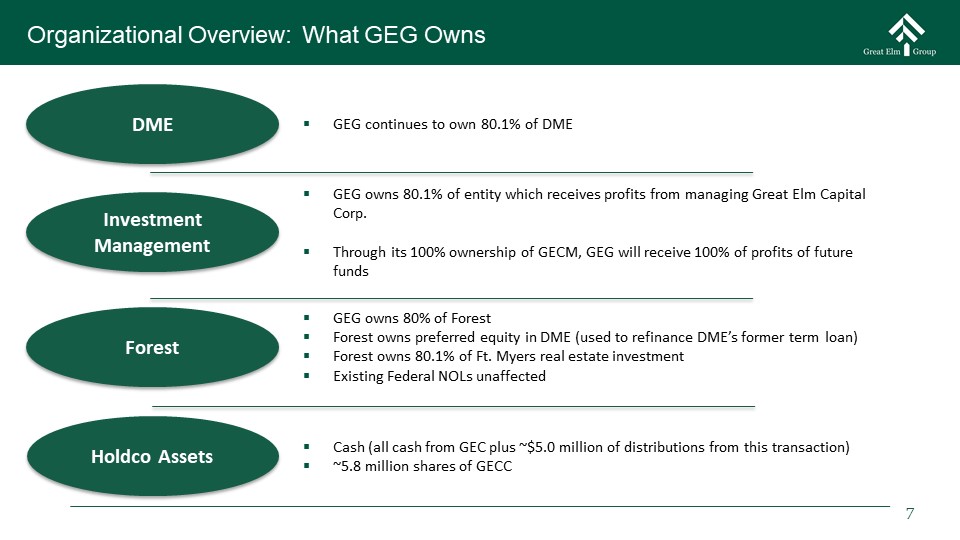

Overview Great Elm completed an internal reorganization on December 29, 2020. As part of the reorganization, a new holding company, Great Elm Group (NASDAQ:GEG) was created. Great Elm Capital Group, Inc. (NASDAQ:GEC) became a subsidiary of GEG and was renamed Forest Investments, Inc. (“Forest”). Your shares in GEC were exchanged 1 for 1 into shares of GEG and will begin trading today on NASDAQ. The shares of GEC, now Forest, will cease to trade. 1 Following this reorganization, J.P. Morgan Broker Dealer Holdings, Inc. (“JPM”) provided financing in the form of a $37.7 Million investment to recapitalize Great Elm. Great Elm will use the proceeds to refinance its Durable Medical Equipment (“DME”) business, lowering its cost of capital 2 This financing is expected to increase DME’s ability to grow its business, both internally and through acquisitions, by adding $6 million of cash to DME’s balance sheet and giving DME additional senior debt capacity 3 The financing will also increase cash on GEG’s balance sheet by approximately $5mm, which GEG expects to use to fund growth in its Investment Management business or for other acquisitions 4 Great Elm today closed a financing in the form of a preferred equity investment from JPM Transaction Highlights GEG’s ability to use existing NOLs is unaffected 5