agreement were $1.2 million. The net amount paid to ICAM pursuant to the agreement in for the fiscal year ended June 30, 2022 after reimbursement by third parties was $0.9 million. Such net amount reflects third-party reimbursements made during one quarter of the fiscal year ended June 30, 2022.

On March 10, 2021, we issued $2.25 million of PIK Notes to MAST Capital Management, LLC (“MAST Capital”) in exchange for all outstanding obligations under the $3.1 million senior secured note issued by GECC GP Corp. (“GP Corp.”). to MAST Capital, all common stock in GP Corp. held by MAST Capital and its affiliates, and termination of MAST Capital’s board appointment rights. Separately, we repurchased the GP Corp. common stock held by certain of our employees for nominal consideration. MAST Capital owned 5% or more of our outstanding common stock at the time of the transactions.

On June 23, 2021, our majority-owned indirect subsidiary, Great Elm FM Acquisition, Inc. (“FM Acquisition”), entered into an agreement (the “Real Estate Purchase Agreement”) with Monomoy Properties Fort Myers FL, LLC (“Monomoy FM”) to sell our real estate business (“Real Estate Business”) to Monomoy FM for $4.6 million in cash. The Real Estate Business consists of majority-interests in two Class A office buildings totaling 257,000 square feet situated on 17 acres of land in Fort Myers, Florida. We acquired the Real Estate Business in March 2018 for $2.7 million. Pursuant to the terms of the Real Estate Purchase Agreement, the proceeds of the sale were reinvested in newly issued membership interests of Monomoy Properties, LLC (“Monomoy Fund”), a privately-held fund managed by ICAM and comprised of a portfolio of net leased industrial real estate assets. Jason W. Reese, the Executive Chairman of the Company’s board of directors, is the Co-Founder, Chairman and Chief Executive Officer of ICAM, and Mr. Reese and Long Ball Partners LLC, which is managed by ICAM, beneficially own, in aggregate, approximately 23.3% of our common stock.

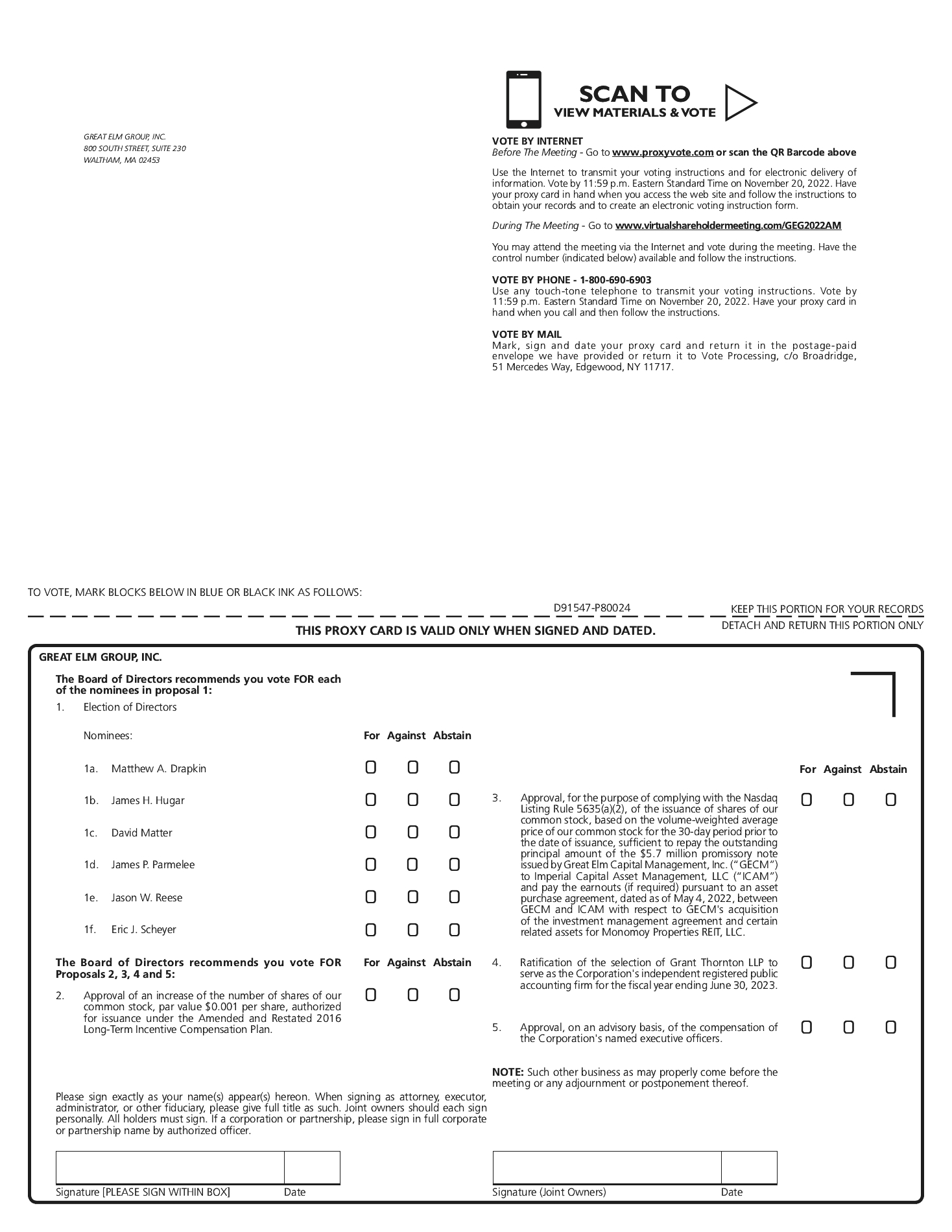

On May 4, 2022, GECM entered into the Monomoy Purchase Agreement with ICAM to acquire the investment management agreement and certain other assets related thereto for Monomoy REIT. Monomoy REIT focuses on acquiring, owning and managing primarily industrial properties to lease to single investment grade tenants in the United States. Formed in 2014, Monomoy REIT is a private real estate investment trust founded by ICAM, with a 114 property portfolio of diversified net leased industrial assets, including the Real Estate Business acquired by Monomoy Fund in June 2021, representing approximately $358 million of real estate at fair value as of June 30, 2022. The transaction closed contemporaneously with signing the Monomoy Purchase Agreement.

The upfront purchase price of $10.0 million was financed through (1) $2.5 million in newly issued shares of our common stock, which equals 1,369,984 shares issued at $1.81 per share, which is the 30-calendar day volume-weighted average of the closing sales price per share of our common stock ending on April 14, 2022, (2) $1.25 million of shares of GECC Common Stock, which were owned by us, valued at $12.50 per share, and (3) the ICAM Promissory Note issued by GECM in an aggregate principal amount of approximately $6.3 million, which bears interest at 6.5% per annum. The ICAM Promissory Note is due August 4, 2023, but may be extended by GECM for an additional nine months, subject to certain conditions. The ICAM Promissory Note may be prepaid at any time, in whole or in part, at GECM’s option with cash or newly issued shares of our common stock. GECM has repaid approximately $600,000 of the aggregate principal amount of the ICAM Promissory Note and approximately $5.7 million remains outstanding.

In addition to the consideration paid at closing, we agreed to pay up to $2.0 million if certain performance targets are met during the first two years following closing, payable at our option with either cash or newly issued shares of our common stock. Notwithstanding the ability to settle the ICAM Promissory Note and pay the Earnouts using shares of our common stock, no additional shares of our common stock may be issued without stockholder approval. Any shares of our common stock issued under the Monomoy Purchase Agreement will receive customary registration rights.

In connection with the transaction, we committed to investing $15.0 million into Monomoy REIT, and intend on investing an additional $15.0 million in Monomoy REIT over the next 12 months, although we are not contractually obligated to do so.

Jason Reese, the Executive Chairman of our Board of Directors, is the Co-Founder, Chairman and Chief Executive Officer of ICAM, and Mr. Reese and Long Ball Partners LLC, which is managed by ICAM, beneficially own, in aggregate, approximately 23.3% of our common stock. The transaction was approved under our related party transaction policy and unanimously approved by the disinterested members of our Board of Directors.