- AGL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

agilon health (AGL) S-1IPO registration

Filed: 30 Aug 21, 4:03pm

Delaware | 8090 | 37-1915147 | ||

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Paul M. Rodel, Esq. Debevoise & Plimpton LLP 919 Third Avenue New York, New York 10022 (212) 909-6000 | William V. Fogg, Esq. Michael E. Mariani, Esq. Cravath, Swaine & Moore LLP 825 Eighth Avenue New York, New York 10019 (212) 474-1000 |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee | ||

Common Stock, par value $0.01 per share | $100,000,000 | $10,910 | ||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes shares of common stock subject to the underwriters’ option to purchase additional shares. |

Per Share | Total | |||||||

Public offering price | $ | $ | ||||||

Underwriting discounts and commissions (1) | $ | $ | ||||||

Proceeds, before expenses, to the selling stockholders | $ | $ | ||||||

| (1) | See “Underwriting” for a description of the compensation payable to the underwriters. |

J.P. Morgan | Goldman Sachs & Co. LLC |

| 1 | ||||

| 22 | ||||

| 66 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 72 | ||||

| 74 | ||||

| 106 | ||||

| 146 | ||||

| 153 | ||||

| 166 | ||||

| 168 | ||||

| 171 | ||||

| 177 | ||||

| 180 | ||||

| 183 | ||||

| 187 | ||||

| 197 | ||||

| 197 | ||||

| 197 | ||||

F-1 |

| i |

| • | “We,” “us,” “our,” “agilon” and the “Company” mean agilon health, inc., a Delaware corporation and its consolidated subsidiaries, unless the context refers only to agilon health, inc., as a corporate entity (which we refer to as “agilon health”). |

| • | ���Anchor geography” means the geographies in which our anchor physician groups operate. |

| • | “Anchor physician groups” means the physician groups with which we have long-term contractual arrangements, typically including joint governance, operations and leadership, and surplus sharing, and does not include physicians in our Hawaii geography. |

| • | “Capitation” means a payment arrangement in which a set amount for each enrolled beneficiary is paid to a provider or entity during an agreed upon period, regardless of whether or not such beneficiary seeks medical services or treatment. |

| • | “CMS” means the Centers for Medicare & Medicaid Services. |

| • | “CMS Innovation Center” means the Center for Medicare & Medicaid Innovation. |

| • | “DCE” means a Direct Contracting Entity participating in the CMS Innovation Center Direct Contracting Model. |

| • | “FFS” means fee-for-service. |

| • | “Independent physicians” means physicians not employed by health systems or insurance providers. |

| • | “Live,” when referring to a physician partner or a geography, means implementation of our platform with the physician partner or in the geography is complete, and we are generating revenue and assuming financial risk pursuant to agreements with payors. |

| • | “MA” means Medicare Advantage. |

| • | “Members” means the MA patients who are attributed to our PCPs (as defined below) by our payors (as defined below). |

| • | “Payors” means health insurance providers. |

| • | “Our PCPs” means PCPs contracted by our anchor physician groups and our network of contracted physicians. |

| • | “PCP” means primary care physician. |

| • | “Physician partners” means our anchor physician groups and all other physicians with whom we have contractual arrangements. |

| • | “PMPM” means per member per month. |

| • | “RBE” means a risk-bearing entity. |

| • | “STAR rating” means annual ratings awarded by CMS to health plans which measure the quality of health services received by beneficiaries enrolled in MA based on various calculated quality metrics. |

| • | “Total Care Model” means a PCP-led global capitation reimbursement model in which physicians receive a monthly payment from health plans to manage the total healthcare needs of their attributed patients. |

| ii |

| iii |

| • | Unsustainably high and rising costs characterized by waste, unnecessary variation in care and poor patient experience and health outcomes; |

| • | FFS reimbursement model focused on units of service rather than a coordinated approach to meet the unique needs of individual patients; |

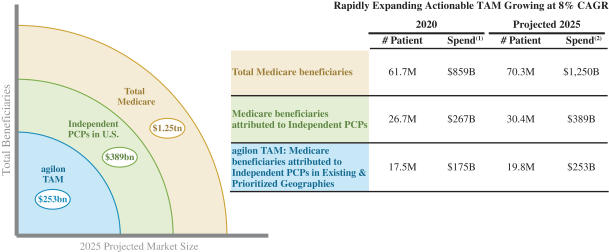

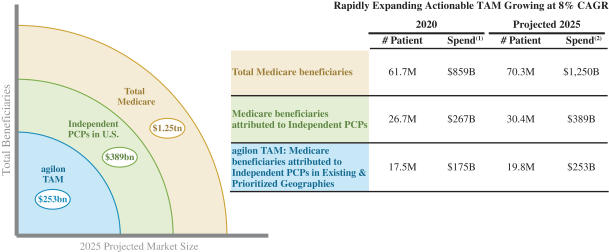

| • | The Medicare population is projected to grow from approximately 62 million in 2020 to more than 70 million individuals in 2025 with a total spend of approximately $1.25 trillion, and MA enrollment is projected to comprise 47% of total Medicare enrollment (which we refer to as the “MA penetration rate”); and |

| • | PCPs are positioned—but not currently empowered or incentivized—to act as the quarterback for healthcare delivery, with their decisions estimated to influence up to 90% of total healthcare spending according to a 2017 study. |

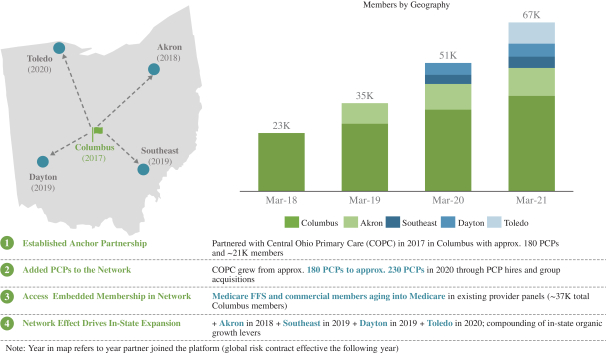

| • | Implemented the first MA multi-payor, globally capitated risk model with a community-based physician group in all of our diverse geographies in which our anchor physician groups operate (“anchor geographies”); |

| • | Exported the Total Care Model from one to 17 geographies ranging from communities as small as Zanesville, Ohio to large and rapidly growing communities such as Austin, Texas; |

| • | Grew from approximately 24,000 patients attributed to our PCPs by our payors (“members”) to approximately 230,700 MA members on our platform; |

| • | Expanded from two payors to 15 payors on our platform; and |

| • | Began participating in the Direct Contracting Model, with over 50,000 Medicare FFS beneficiaries served by our existing PCPs contracted through our five currently approved DCEs. |

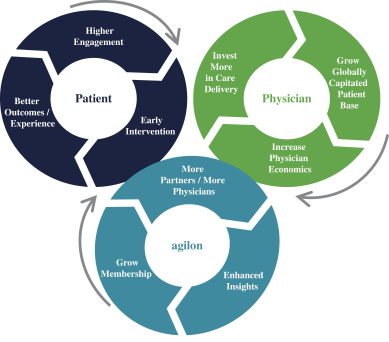

| • | agilon’s platform, which is holistic in enabling the rapid transformation to risk, is comprised of an integrated set of capabilities designed to continuously improve, and is delivered to our anchor physician groups through an aligned long-term partnership model; |

| • | agilon’s long-term physician partnership approach with community-based physician groups, which is designed to move healthcare closer to the physician, be outcome-centric and optimize the long-term sticky relationship between a patient and their existing physician; and |

| • | agilon’s network of leading community-based physician partners, functioning as a collaborative group which can share best practices, influence the development of the platform, compare notes on the transition to a Total Care Model and learn from one another. |

| (1) | 2020 Medicare spend for total Medicare beneficiaries is based on CMS spend per beneficiary. |

| (2) | 2025 Medicare spend for total Medicare beneficiaries, beneficiaries attributed to independent PCPs and agilon total addressable market is based on CMS projected Medicare enrollment and spending per beneficiary growth rates. |

| • | PCPs lack the incentive structure to reorganize the healthcare delivery system. |

| • | PCPs lack the infrastructure to participate in a multi-payor model. |

| • | PCPs lack the breadth of capabilities and resources necessary to transition to a Total Care Model. |

| • | PCP groups are highly fragmented and lack the benefits of scale. |

| • | Limited long-term, deep collaboration between payors and physicians. |

| • | Payor Engagement |

| • | Direct Contracting Model |

| • | Data Integration and Management |

| • | Clinical Programs and Product Development |

| • | Quality (Clinical and Experience) |

| • | Growth 60-64 year-old patients, to enable their patients to make educated healthcare choices. These patients represent an embedded growth opportunity. |

| • | Performance Management Analytics peer-to-peer |

| • | Financial Management |

| • | National Policy |

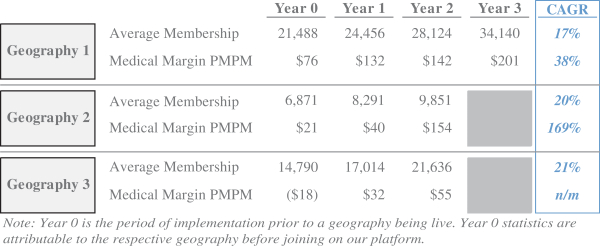

| • | Long-term partnership model that allows both agilon and physicians to take the long-term view and benefit from the maturity of a growing number of members on the platform; |

| • | Shared governance and co-location of staff to manage our local partnerships; |

| • | Local dyad leadership structure that includes a medical director from the local anchor physician group; |

| • | Local brand which reflects the local anchor physician group or geography; |

| • | Capital from agilon to support value-based care infrastructure supporting the delivery of high-quality healthcare, and 100% downside protection, which removes a major obstacle to physicians making the leap to a Total Care Model; |

| • | Operating leverage created by amortizing centralized investments in the platform infrastructure across a growing number of physician partners; and |

| • | Surplus dollars generated locally due to improvements in quality of care and healthcare costs are shared with the local anchor physician group. |

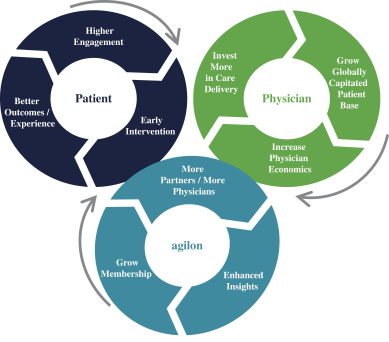

| • | empower PCPs to act as the quarterback for healthcare delivery; |

| • | enable PCPs to define a tailored patient experience across multiple payors; |

| • | create an operating partnership and economic model built around improved health outcomes instead of a transaction-based model; and |

| • | align the physician business model with the strength of their long-term patient relationships enabling the long-term growth of independent, community-based physician groups. |

| • | Rapid creation of a Medicare Total Care Model that enables our PCPs to take a long-term view of their relationships with their patients and allocate resources to meet individual member health needs. |

| • | Sustainable long-term business model alongside commercial and Medicare FFS. |

| • | Provides access to network of like-minded partners. |

| • | Improved economics. |

| • | Improving the physician experience. |

| • | Improving the patient experience. |

| • | Supporting superior health outcomes. |

| • | We believe we have the ability to generate significant, recurring and growing medical margin in concert with our physician partners over the course of our long-term partnerships and the inherently sticky physician-patient relationship. |

| • | Our physician partnerships are typically 20 years. |

| • | Average physician tenure within our anchor physician groups is 13 years. |

| • | Patients 65 years of age and older remain with their PCP for an average of 10 years, according to a 2004 study. |

| • | Embedded same-geography, long-term organic membership growth resulting from our physician partners’ existing patients who age into Medicare and elect to enroll in MA or who elect to convert from Medicare FFS to MA over the life of our long-term partnership. |

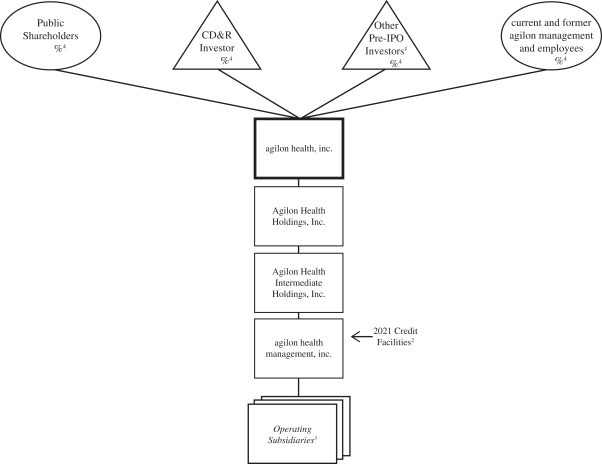

| 1 | Includes COPC, certain private investment funds and our physician partners with whom we have physician partner group equity agreements. |

| 2 | Includes indebtedness related to the 2021 Credit Facilities (as defined herein), including term loan indebtedness, revolver indebtedness and letters of credit. On February 18, 2021, we, through agilon health management, inc. (“agilon management”), entered in the 2021 Secured Credit Agreement (as defined herein) to refinance our outstanding indebtedness under the Credit Facilities (as defined herein). See “Description of Certain Indebtedness.” |

| 3 | Operating subsidiaries include wholly-owned RBEs, independent practice associations and other immaterial subsidiaries, which have been omitted from this chart for convenience. |

| 4 | Ownership percentages assume no exercise of the underwriters option to purchase up to additional shares of common stock in the offering, and are determined as described in “—The Offering.” |

| • | our history of net losses and the expectation that our expenses will increase in the future; |

| • | failure to identify and develop successful new geographies, physician partners and payors or execute upon our growth initiatives; |

| • | success in executing our operating strategies or achieving results consistent with our historical performance; |

| • | significant reductions in membership; |

| • | challenges for our physician partners in the transition to a Total Care Model; |

| • | inaccuracies in the estimates and assumptions we use to project the size, revenue or medical expense amounts of our target geographies, our members’ risk adjustment factors, medical services expense, incurred but not reported claims and earnings pursuant to payor contracts; |

| • | the spread of, and response to, the novel coronavirus, or COVID-19, and the inability to predict the ultimate impact on us; |

| • | dependence on a limited number of key payors, including for membership attribution and assignment, data and reporting accuracy and claims payment; |

| • | dependence on physician partners and other providers to effectively manage the quality and cost of care and perform obligations under payor contracts, which contracts generally provide that if the cost of care exceeds the corresponding capitation revenue we receive from payors in respect of attributed members we may realize operating deficits, which are typically not capped, and could lead to substantial losses; |

| • | dependence on physician partners to accurately, timely and sufficiently document their services and potential False Claims Act or other liability if any diagnosis information or encounter data are inaccurate or incorrect; |

| • | reductions in reimbursement rates or methodology applied to derive reimbursement from, or discontinuation of, federal government healthcare programs, from which we drive substantially all of our total revenue; |

| • | statutory or regulatory changes, administrative rulings, interpretations of policy and determinations by intermediaries and governmental funding restrictions, and any impact on government funding, program coverage and reimbursements; |

| • | the impact on our revenue of CMS modifying the methodology used to determine the revenue associated with MA members; |

| • | ability to comply with federal, state and local regulations and laws we are subject to, or to adapt to changes in or new regulations or laws, including as such regulations and laws that relate to our physician alignment strategies with our physician partners or the corporate practice of medicine; |

| • | our physician partners’ compliance with federal and state healthcare fraud and abuse laws and regulations; and |

| • | the influence of the CD&R Investor and our status as a “controlled company.” |

Common stock offered by the selling stockholders | shares. |

Common stock to be outstanding after this offering | 390,882,560 shares. |

Option to purchase additional shares | The underwriters also may purchase up to additional shares from the selling stockholders at the initial offering price less the underwriting discounts and commissions, within 30 days from the date of this prospectus. |

Use of proceeds | We will not receive any of the proceeds from the sale of our common stock by the selling stockholders in this offering, including any shares the selling stockholders may sell pursuant to the underwriters’ option to purchase additional shares of our common stock. |

Dividend policy | We do not currently anticipate paying dividends on our common stock for the foreseeable future. Any future determination to pay dividends on our common stock will be subject to the discretion of our board of directors and depend upon various factors. See “Dividend Policy.” |

Risk Factors | Our business is subject to a number of risks that you should consider before making a decision to invest in our common stock. See “Risk Factors.” |

NYSE symbol | “AGL”. |

| • | 41,197,388 shares of common stock issuable upon exercise of options outstanding as of June 30, 2021 at a weighted average exercise price of $4.40 per share; |

| • | 28,453,653 shares of common stock reserved for future issuance under our Omnibus Incentive Plan and ESPP; and |

| • | 1,112,131 shares of our common stock subject to outstanding unvested RSUs granted to directors and employees. |

Six Months Ended June 30, | Three Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

| ( dollars in thousands | 2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | |||||||||||||||||||||

Consolidated Statement of Operations Data: | ||||||||||||||||||||||||||||

Revenues: | ||||||||||||||||||||||||||||

Medical services revenue | $ | 910,090 | $ | 582,309 | $ | 497,678 | $ | 292,495 | $ | 1,214,270 | $ | 788,566 | $ | 466,612 | ||||||||||||||

Other operating revenue | 1,970 | 2,333 | 1,278 | 1,099 | 4,063 | 5,845 | 8,215 | |||||||||||||||||||||

Total revenues | 912,060 | 584,642 | 498,956 | 293,594 | 1,218,333 | 794,411 | 474,827 | |||||||||||||||||||||

Expenses: | ||||||||||||||||||||||||||||

Medical services expense | 802,837 | 468,016 | 442,483 | 220,363 | 1,021,877 | 725,374 | 412,669 | |||||||||||||||||||||

Other medical expenses | 57,355 | 53,187 | 33,694 | 34,761 | 102,306 | 40,526 | 34,092 | |||||||||||||||||||||

General and administrative | 79,318 | 60,832 | 43,013 | 34,248 | 137,292 | 122,832 | 88,745 | |||||||||||||||||||||

Stock-based compensation expense (1) | 276,020 | 3,176 | 274,548 | 2,155 | ||||||||||||||||||||||||

Depreciation and amortization | 7,008 | 6,517 | 3,581 | 3,319 | 13,531 | 12,253 | 11,385 | |||||||||||||||||||||

Total expenses | 1,222,538 | 591,728 | 797,319 | 294,846 | 1,275,006 | 900,985 | 546,891 | |||||||||||||||||||||

Income (loss) from operations | (310,478 | ) | (7,086 | ) | (298,363 | ) | (1,252 | ) | (56,673 | ) | (106,574 | ) | (72,064 | ) | ||||||||||||||

Other income (expense): | ||||||||||||||||||||||||||||

Other income (expense), net | 4,303 | 48 | 2,967 | (74 | ) | 2,465 | 955 | 611 | ||||||||||||||||||||

Interest expense | (4,439 | ) | (4,229 | ) | (1,498 | ) | (2,080 | ) | (8,135 | ) | (9,068 | ) | (9,839 | ) | ||||||||||||||

Income (loss) before income taxes | (310,614 | ) | (11,267 | ) | (296,894 | ) | (3,406 | ) | (62,343 | ) | (114,687 | ) | (81,292 | ) | ||||||||||||||

Income tax benefit (expense) | (451 | ) | (39 | ) | (435 | ) | (39 | ) | (865 | ) | 232 | 113 | ||||||||||||||||

Income (loss) from continuing operations | (311,065 | ) | (11,306 | ) | (297,329 | ) | (3,445 | ) | (63,208 | ) | (114,455 | ) | (81,179 | ) | ||||||||||||||

Discontinued operations: | ||||||||||||||||||||||||||||

Income (loss) before impairments, gain (loss) on sales and income taxes | (2,898 | ) | (12,429 | ) | (1,547 | ) | (4,340 | ) | (20,049 | ) | (86,108 | ) | (32,132 | ) | ||||||||||||||

Impairments | — | — | — | — | — | (98,343 | ) | (40,794 | ) | |||||||||||||||||||

Gain (loss) on sales of assets, net | — | — | — | — | 20,401 | — | — | |||||||||||||||||||||

Income tax benefit (expense) | (129 | ) | (275 | ) | (65 | ) | (126 | ) | 2,804 | 16,166 | 7,588 | |||||||||||||||||

Total discontinued operations | (3,027 | ) | (12,704 | ) | (1,612 | ) | (4,466 | ) | 3,156 | (168,285 | ) | (65,338 | ) | |||||||||||||||

Net income (loss) | (314,092 | ) | (24,010 | ) | (298,941 | ) | (7,911 | ) | (60,052 | ) | (282,740 | ) | (146,517 | ) | ||||||||||||||

Noncontrolling interests’ share in (earnings) loss | 169 | — | 96 | — | — | 152 | (409 | ) | ||||||||||||||||||||

Net income (loss) attributable to common shares | $ | (313,923 | ) | $ | (24,010 | ) | $ | (298,845 | ) | $ | (7,911 | ) | $ | (60,052 | ) | $ | (282,588 | ) | $ | (146,926 | ) | |||||||

| (1) | For annual periods prior to 2021, stock-based compensation expense is included in general and administrative expenses. |

June 30, 2021 | December 31, 2020 | December 31, 2019 | ||||||||||

Consolidated Balance Sheet Data (at period end): | ||||||||||||

Cash and cash equivalents | $ | 1,109,372 | $ | 106,795 | $ | 123,633 | ||||||

Total assets | 1,701,734 | 446,361 | 402,794 | |||||||||

Total liabilities | 551,456 | 421,591 | 353,822 | |||||||||

Contingently redeemable common stock | — | 309,500 | 281,000 | |||||||||

Total stockholders’ equity (deficit) | 1,150,278 | (284,730 | ) | (232,028 | ) | |||||||

Six Months Ended June 30, | Year Ended December 31, | |||||||||||||||||||

| ( dollars in thousands | 2021 | 2020 | 2020 | 2019 | 2018 | |||||||||||||||

Consolidated Statement of Cash Flows Data: | ||||||||||||||||||||

Cash flows from: | ||||||||||||||||||||

Operating activities | $ | (80,119 | ) | $ | (35,498 | ) | $ | (53,204 | ) | $ | (103,861 | ) | $ | (67,531 | ) | |||||

Investing activities | (76,338 | ) | (2,351 | ) | $ | 22,066 | $ | (5,060 | ) | $ | (7,970 | ) | ||||||||

Financing activities | 1,143,077 | 31,522 | $ | 24,621 | $ | 176,298 | $ | 84,743 | ||||||||||||

Six Months Ended June 30, | Three Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

| ( dollars in thousands | 2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | |||||||||||||||||||||

Other Financial Data: | ||||||||||||||||||||||||||||

Medical margin (1) | $ | 107,253 | $ | 114,293 | $ | 55,195 | $ | 72,132 | $ | 192,393 | $ | 63,192 | $ | 53,943 | ||||||||||||||

Network contribution (2) | 54,436 | 63,250 | 24,294 | 38,510 | 99,016 | 25,598 | 22,083 | |||||||||||||||||||||

Adjusted EBITDA (3) | 2,088 | 16,888 | (1,674 | ) | 14,311 | 5,827 | (56,711 | ) | (32,240 | ) | ||||||||||||||||||

| (1) | Medical margin represents medical services revenue after deducting medical services expense. |

| (2) | Network contribution is a non-GAAP financial measure. Network contribution represents medical services revenue less the sum of: (i) medical services expense and (ii) other medical expenses excluding costs incurred in implementing geographies. Income (loss) from operations is the most directly comparable U.S. generally accepted accounting principles (“GAAP”) measure to network contribution. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” for more information regarding network contribution and a reconciliation to income (loss) from operations. |

| (3) | Adjusted EBITDA is a non-GAAP financial measure. We define Adjusted EBITDA as net income (loss) adjusted to exclude: (i) income (loss) from discontinued operations, net of income taxes, (ii) interest expense, (iii) income tax expense (benefit), (iv) depreciation and amortization expense, (v) geography entry costs, (vi) share-based compensation expense, (vii) severance and related costs and (viii) certain other items that are not considered by us in the evaluation of ongoing operating performance. Net income (loss) is the most directly comparable GAAP measure to Adjusted EBITDA. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures” for more information regarding Adjusted EBITDA and a reconciliation to net income (loss). |

| • | Changes to the Medicare fee schedule or other rate schedules which serve as the basis for payments issued to hospitals, specialty and ancillary physicians and other providers; |

| • | Contractual rates paid to hospitals, specialty and ancillary physicians and other providers; |

| • | The utilization rates of healthcare services, including inpatient hospitalization, by our members; |

| • | Changes to member benefit levels established annually by payors; and |

| • | The utilization rate and cost of pharmaceuticals or specialty drugs utilized by our members. |

| • | failure to obtain new physician partners or members or to retain existing physician partners or members; |

| • | decision by a payor to not renew the existing contractual agreement upon termination of such contract; |

| • | low quality of care by our physician partners, including as a result of our failure to provide tools and information to deliver high-quality care; |

| • | alternative care opportunities that are more attractive than those provided by our physician partners; |

| • | premium increases, benefit revisions or other similar changes, which cause our current payor relationships to be less attractive to members than other alternatives, including traditional Medicare or MA plans with which we do not maintain a relationship; |

| • | negative publicity, through social media, news coverage or otherwise, related to us, our physician partners, payors or MA; |

| • | failure of our payors to maintain their annual ratings awarded by CMS to health plans which measure the quality of health services received by beneficiaries enrolled in MA based on various calculated quality metrics (“STAR ratings”), which leads to members disenrolling from such payors; and |

| • | federal and state regulatory changes. |

| • | damage from fire, power loss, natural disasters and other events outside our control; |

| • | communications failures; |

| • | software and hardware errors, failures and crashes; |

| • | data security breaches, ransomware attacks, computer viruses, hacking, denial-of-service |

| • | other potential interruptions. |

| • | requiring us to change our platform and services; |

| • | increasing the regulatory, including compliance, burdens under which we operate, which, in turn, may negatively impact the manner in which we provide services and increase our costs; |

| • | adversely affecting our ability to market our services through the imposition of further regulatory restrictions regarding the manner in which plans market to MA enrollees; or |

| • | adversely affecting our ability to attract and retain physician partners and have patients attributed to those physician partners. |

| • | Federal and state laws, and related regulations, including the False Claims Act and the Civil Monetary Penalties Law (“CMPL”), which impose civil and criminal liability on individuals or entities that knowingly submit false or fraudulent claims for payment, or knowingly make, or cause to be made, a false statement in order to have a false claim paid, including qui tam |

| • | Federal and state anti-kickback laws, and related regulations, which generally prohibit transactions intended to induce or reward referrals for items or services reimbursable by a federal healthcare program; |

| • | Federal and state physician self-referral prohibition statutes, and related regulations, which generally prohibit physicians from referring a patient to an entity providing designated health services (“DHS”) if the physician (or his/her immediate family member) has a financial relationship with that entity; |

| • | Provisions of, and regulations enacted pursuant to, HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009 (the “HITECH Act”) and the American Recovery and Reinvestment Act of 2009, as well as similar or more stringent state laws, regarding the collection, use and disclosure of health information; |

| • | Provisions of, and regulations enacted pursuant to, the 21 st Century Cures Act, regarding interoperability and prohibitions against information blocking; |

| • | Federal laws and regulations that require providers to enroll in the Medicare program before submitting any claims for services, to promptly report certain changes in operations to the agencies that administer these programs, and to re-enroll in these programs when changes in direct or indirect ownership occur or in response to revalidation requests from Medicare; |

| • | Federal and state laws that govern managed care organizations, such as our payors, and downstream contracted entities, such as our RBEs, including laws governing timely payment of claims, quality assurance, utilization review, credentialing, financial solvency, downstream transfers of risk and payor-provider contractual relationships; |

| • | State laws that govern the activities of third-party administrators and utilization review agents; and |

| • | State laws that prohibit general business entities from practicing medicine, controlling physicians’ medical decisions or engaging in certain practices, such as splitting fees with physicians. |

| • | suspension or termination of our participation in federal healthcare programs; |

| • | criminal or civil liability, fines, damages or monetary penalties for violations of healthcare fraud and abuse laws, including the federal False Claims Act, CMPL, Anti-Kickback Statute and Stark Law; |

| • | enforcement actions by governmental agencies or claims for monetary damages by patients under federal or state patient privacy laws, including HIPAA; |

| • | enforcement actions by governmental agencies or monetary penalties for violations of the 21 st Century Cures Act; |

| • | repayment of amounts received in violation of law or applicable payment program requirements, and related monetary penalties; |

| • | mandated changes to our practices or procedures that materially increase operating expenses; |

| • | imposition of corporate integrity agreements that could subject us to ongoing audits and reporting requirements as well as increased scrutiny of our billing and business practices; |

| • | termination of various relationships or contracts related to our business; and |

| • | harm to our reputation which could negatively affect our business relationships, decrease our ability to attract or retain patients and physicians, decrease access to new business opportunities and impact our ability to obtain financing, among other things. |

| • | our ability to obtain additional financing for working capital, capital expenditures, acquisitions, debt service requirements, pay dividends and make other distributions or to purchase, redeem or retire capital stock or for general corporate purposes and our ability to satisfy our obligations with respect to our indebtedness may be impaired in the future; |

| • | a large portion of our cash flow from operations must be dedicated to the payment of principal and interest on our indebtedness, thereby reducing the funds available to us for other purposes; |

| • | we are exposed to the risk of increased interest rates because a significant portion of our borrowings are at variable rates of interest; |

| • | it may be more difficult for us to satisfy our obligations to our creditors, resulting in possible defaults on, and acceleration of, such indebtedness; |

| • | we may be more vulnerable to general adverse economic and industry conditions; |

| • | we may be at a competitive disadvantage compared to our competitors with proportionately less indebtedness or with comparable indebtedness on more favorable terms and, as a result, they may be better positioned to withstand economic downturns; |

| • | our ability to refinance indebtedness may be limited or the associated costs may increase; |

| • | our flexibility to adjust to changing market conditions and ability to withstand competitive pressures could be limited; |

| • | our ability to pay dividends and make other distributions or to purchase, redeem or retire capital stock may be limited; and |

| • | we may be prevented from carrying out capital spending and restructurings that are necessary or important to our growth strategy and efforts to improve our operating margins. |

| • | incur additional indebtedness and create liens; |

| • | pay dividends and make other distributions or to purchase, redeem or retire capital stock; |

| • | purchase, redeem or retire certain junior indebtedness; |

| • | make loans and investments; |

| • | enter into agreements that limit agilon management’s or its subsidiaries’ ability to pledge assets or to make distributions or loans to us or transfer assets to us; |

| • | sell assets; |

| • | enter into certain types of transactions with affiliates; |

| • | consolidate, merge or sell substantially all assets; |

| • | make voluntary payments or modifications of junior indebtedness; and |

| • | enter into lines of business. |

| • | industry, regulatory or general market conditions; |

| • | domestic and international economic factors unrelated to our performance; |

| • | changes in our physician partners’ or their patients’ preferences; |

| • | new regulatory pronouncements and changes in regulatory guidelines; |

| • | lawsuits, enforcement actions and other claims by third parties or governmental authorities; |

| • | actual or anticipated fluctuations in our quarterly operating results; |

| • | lack of research coverage and reports by industry analysts or changes in any securities analysts’ estimates of our financial performance; |

| • | action by institutional stockholders or other large stockholders, including future sales of our common stock; |

| • | failure to meet any guidance given by us or any change in any guidance given by us, or changes by us in our guidance practices; |

| • | announcements by us of significant impairment charges; |

| • | speculation in the press or investment community; |

| • | investor perception of us and our industry; |

| • | changes in market valuations or earnings of similar companies; |

| • | the impact of short selling or the impact of a potential “short squeeze” resulting from a sudden increase in demand for our common stock; |

| • | announcements by us or our competitors of significant contracts, acquisitions, dispositions or strategic partnerships; |

| • | war, terrorist acts and epidemic disease, including COVID-19; |

| • | any future sales of our common stock or other securities; |

| • | additions or departures of key personnel; and |

| • | misconduct or other improper actions of our employees. |

| • | authorize the issuance of “blank check” preferred stock that could be issued by our board of directors to thwart a takeover attempt; |

| • | provide for a classified board of directors, which divides our board of directors into three classes, with members of each class serving staggered three-year terms, which prevents stockholders from electing an entirely new board of directors at an annual meeting; |

| • | limit the ability of stockholders to remove directors if the CD&R Investor ceases to beneficially own at least 40% of the outstanding shares of our common stock; |

| • | provide that vacancies on our board of directors, including vacancies resulting from an enlargement of our board of directors, may be filled only by a majority vote of directors then in office; |

| • | prohibit stockholders from calling special meetings of stockholders if the CD&R Investor ceases to beneficially own at least 40% of the outstanding shares of our common stock; |

| • | prohibit stockholder action by written consent, thereby requiring all actions to be taken at a meeting of the stockholders, if the CD&R Investor ceases to beneficially own at least 40% of the outstanding shares of our common stock; |

| • | opt out of Section 203 of the DGCL, which prohibits a publicly-held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years following the time the person became an interested stockholder, until the CD&R Investor ceases to beneficially own at least 5% of the outstanding shares of our common stock; |

| • | establish advance notice requirements for nominations of candidates for election as directors or to bring other business before an annual meeting of our stockholders; and |

| • | require the approval of holders of at least 66 2/3% of the outstanding shares of our common stock to amend our By-laws and certain provisions of our Certificate of Incorporation if the CD&R Investor ceases to beneficially own at least 40% of the outstanding shares of our common stock. |

| • | the requirement that a majority of the board of directors consist of independent directors; |

| • | the requirement that our Nominating and Governance Committee be composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; |

| • | the requirement that we have a Compensation Committee that is composed entirely of independent directors with a written charter addressing the committee’s purpose and responsibilities; and |

| • | the requirement for an annual performance evaluation of the Nominating and Governance and Compensation Committees. |

| • | our history of net losses, and our ability to achieve or maintain profitability in an environment of increasing expenses; |

| • | our ability to identify and develop successful new geographies, physician partners and payors, or to execute upon our growth initiatives; |

| • | our ability to execute our operation strategies or to achieve results consistent with our historical performance; |

| • | our expectation that our expenses will increase in the future and the risk that medical expenses incurred on behalf of members may exceed the amount of medical revenues we receive; |

| • | our ability to secure contracts with MA payors or to secure MA at favorable financial terms; |

| • | our ability to recover startup costs incurred during the initial stages of development of our physician partner relationships and program initiatives; |

| • | our ability to obtain additional capital needed to support our business; |

| • | significant reductions in our membership; |

| • | challenges for our physician partners in the transition to a Total Care Model; |

| • | inaccuracies in the estimates and assumptions we use to project the size, revenue or medical expense amounts of our target market; |

| • | the spread of, and response to, the novel coronavirus, or COVID-19, and the inability to predict the ultimate impact on us; |

| • | inaccuracies in the estimates and assumptions we use to project our members’ risk adjustment factors, medical services expense, incurred but not reported claims and earnings pursuant to payor contracts; |

| • | the impact of restrictive or exclusivity clauses in some of our contracts with physician partners that may prohibit us from establishing new RBEs within certain geographies in the future; |

| • | the impact of restrictive or exclusivity clauses in some of our contracts with physician partners that may subject us to investigations or litigation; |

| • | our ability to retain our management team and key employees or attract qualified personnel in the future; |

| • | our ability to realize the full value of our intangible assets and any impairment charges we have or may record; |

| • | adverse determinations of tax matters; |

| • | security breaches, loss of data or other disruptions to our data platforms; |

| • | our reliance on third parties for internet infrastructure and bandwidth to operate our business and provide services to our members and physician partners; |

| • | our ability to protect the confidentiality of our know-how and other proprietary and internally developed information; |

| • | the impact of devoting significant attention and resources to the provision of certain transition services in connection with the disposition of our California operations; |

| • | our subsidiaries’ lack of performance or ability to fund their operations, which could require us to fund such losses; |

| • | our dependence on a limited number of key payors; |

| • | the limited terms of our contracts with payors and that they may not be renewed upon their expiration; |

| • | our reliance on our payors for membership attribution and assignment, data and reporting accuracy and claims payment; |

| • | our dependence on physician partners and other providers to effectively manage the quality and cost of care and perform obligations under payor contracts; |

| • | difficulties in obtaining accurate and complete diagnosis data; |

| • | our dependence on physician partners to accurately, timely and sufficiently document their services and potential False Claims Act or other liability if any diagnosis information or encounter data are inaccurate or incorrect; |

| • | our reliance on third-party software and data to operate our business and provide services to our members and physician partners; |

| • | the impact of consolidation in the healthcare industry; |

| • | reductions in reimbursement rates or methodology applied to derive reimbursement from, or discontinuation of, federal government healthcare programs, from which we derive substantially all of our total revenue; |

| • | uncertain or adverse economic conditions, including a downturn or decrease in government expenditures; |

| • | our ability to compete in our competitive industry; |

| • | the impact of government performance standards and benchmarks on our compensation and reputation; |

| • | statutory or regulatory changes, administrative rulings, interpretations of policy and determinations by intermediaries and governmental funding restrictions, and their impact on government funding, program coverage and reimbursements; |

| • | regulatory proposals directed at containing or lowering the cost of healthcare and our participation in such proposed models; |

| • | we, our physician partners or affiliates being subject to federal or state investigations, audits and enforcement actions; |

| • | regulatory inquiries and corrective action plans imposed by our payors; |

| • | repayment obligations arising out of payor audits; |

| • | the impact on our revenue of CMS modifying the methodology used to determine the revenue associated with MA members; |

| • | negative publicity regarding the managed healthcare industry; |

| • | the extensive regulation of the healthcare industry at the federal, state and local levels; |

| • | our substantial indebtedness and the potential that we may incur additional indebtedness; |

| • | our ability to sustain an active, liquid trading market for our common stock; |

| • | the significant influence the CD&R Investor has over us; and |

| • | risks related to other factors discussed under “Risk Factors” in this prospectus. |

June 30, 2021 | ||||

(dollars in thousands, except share and per share amounts) | ||||

Cash and cash equivalents (1) | $ | 1,109,372 | ||

Long-term debt (1)(2) | 49,612 | |||

Mezzanine and Stockholders’ Equity: | ||||

Common stock, $0.01 par value (3) | 3,909 | |||

Additional paid-in capital (3) | 2,011,651 | |||

Accumulated deficit | (865,113 | ) | ||

Noncontrolling interests | (169 | ) | ||

Total stockholders’ equity (deficit) | 1,150,278 | |||

Total capitalization | $ | 1,199,890 | ||

| (1) | In connection with our IPO, on April 26, 2021 we made a mandatory prepayment of $50.0 million of the 2021 Secured Term Loan Facility as a result of the gross proceeds from the IPO exceeding $1.0 billion. |

| (2) | As of June 30, 2021, we had availability under the 2021 Secured Revolving Facility totaling $64.4 million and outstanding letters of credit totaling $35.6 million, of which $14.0 million was for the DCEs. See “Description of Certain Indebtedness” included elsewhere in this prospectus. |

| (3) | As of June 30, 2021, we had 390,882,560 shares of common stock issued and outstanding. The shares of common stock outstanding exclude: |

| • | 41,197,388 shares of common stock issuable upon exercise of options outstanding as of June 30, 2021 at a weighted average exercise price of $4.40 per share; |

| • | 28,453,653 shares of common stock reserved for future issuance under our Omnibus Incentive Plan and ESPP; and |

| • | 1,112,131 shares of our common stock subject to outstanding unvested RSUs granted to directors and employees. |

Per Share | ||||

Assumed public offering price per share (1) | $ | |||

Net tangible book value per share as of June 30, 2021 | ||||

Dilution of net tangible book value per share to new investors | $ | |||

| (1) | Based upon the last reported sale price of our common stock on , 2021 of $ per share on the NYSE. |

Shares Purchased | Total Consideration | Average Price Per Share | ||||||||||||||||||

Number | Percent | Amount | Percent | |||||||||||||||||

Existing stockholders | % | $ | % | $ | ||||||||||||||||

New investors | % | $ | % | $ | ||||||||||||||||

Total | % | $ | % | $ | ||||||||||||||||

| • | Adding new physician partnerships through the expansion into new geographies, |

| • | Growth in membership in existing geographies as a result of: |

| • | Patients who are attributed to our physician partners who (a) age into Medicare and elect to enroll in MA or (b) elect to convert from Medicare FFS to MA, and |

| • | Growth in the number of PCPs at existing physician partners, expanding our physician partners’ capacity to care for a greater membership population. |

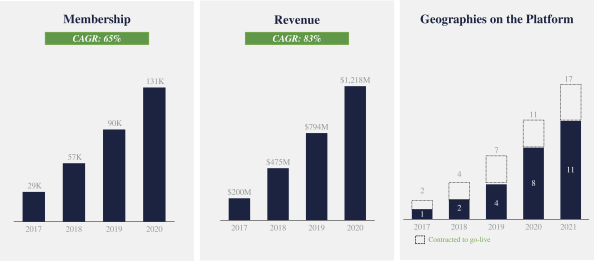

MA Membership | ||||||||||||||||||||

Geography Go-Live | December 31, 2017 | December 31, 2018 | December 31, 2019 | December 31 2020 | CAGR | |||||||||||||||

2017 & Prior | 28,900 | 31,400 | 33,700 | 36,700 | 8 | % | ||||||||||||||

2018 | — | 25,100 | 29,700 | 35,500 | 19 | % | ||||||||||||||

2019 | — | — | 26,800 | 33,000 | 23 | % | ||||||||||||||

2020 | — | — | — | 25,800 | ||||||||||||||||

| 28,900 | 56,500 | 90,200 | 131,000 | 65 | % | |||||||||||||||

| • | Patients who are attributed to our physician partners who age-in to Medicare and elect to enroll in MA or otherwise transition to MA. |

| • | Growth in the number of PCPs at existing physician partners, expanding our physician partners’ capacity to care for a greater membership population. |

| • | Affiliated physician groups recruiting new PCPs. |

| • | Affiliated physician groups acquiring other physician groups. |

| • | Contract with additional local physicians and physician groups by leveraging our local infrastructure and existing subscription-like PMPM agreements with payors. |

Year Ended | Three Months Ended June 30 | Six Months Ended June 30, | ||||||||||||||||||||||||||

2018 | 2019 | 2020 | 2020 | 2021 | 2020 | 2021 | ||||||||||||||||||||||

Platform support costs | $ | 62,739 | $ | 89,266 | $ | 99,943 | $ | 25,233 | $ | 30,667 | $ | 48,743 | $ | 59,075 | ||||||||||||||

% of Revenue | 13 | % | 11 | % | 8 | % | 9 | % | 6 | % | 8 | % | 6 | % | ||||||||||||||

Note: Represents costs to support our live geographies and enterprise functions, which are included in general and administrative expenses. | ||||||||||||||||||||||||||||

| • | Growth in New Membership—While new members are attributed to our platform throughout the year, our largest amount of growth typically occurs in January of each year. Operations in our new geographies generally begin on January 1, at which time our MA payors attribute members from our new physician partners to our platform as our agreements with those payors in those geographies become effective. This coincides with the beginning of the Medicare program year. Similarly, our same market growth within a given year is typically greatest in January, as a result of the outcome of the Medicare Open Enrollment Period (sometimes called Annual Election Period or AEP), which runs each year from October 15 to December 7. |

| • | Per Member Revenue—Our revenue is a function of the percent of premium we have negotiated with our payors as well as our ability to accurately and appropriately document the acuity of a member’s total health status. We experience an element of seasonality with respect to our average per member revenue as it generally declines over the course of a given year. This results from the monthly cycle of (i) attributed members aging into Medicare, who typically have lower acuity profiles (and, therefore, lower average per member revenue rates) and (ii) older members with more severe acuity profiles (and, therefore, higher per member revenue rates) expiring. Additionally, in January of each year, CMS resets county-level benchmark rates, the risk adjustment factor for each member based upon health conditions documented in the prior year, and other components of premium revenue. The collective impact of these revisions has historically led to an increase in our average per member revenue. |

| • | Medical Expense—Medical expense is driven by utilization of healthcare services by attributed membership. There are seasonal factors that can influence healthcare utilization, such as the flu season or the number of calendar or working days in a given period. |

As of and For the Three Months Ended June 30, | As of and For the Six Months Ended June 30, | As of and for the Year Ended December 31, | ||||||||||||||||||||||||||||||

2021 | 2020 | % Change | 2021 | 2020 | 2020 | 2019 | 2018 | |||||||||||||||||||||||||

MA members | 181,700 | 125,400 | 45 | % | 181,700 | 125,400 | 131,000 | 90,200 | 56,500 | |||||||||||||||||||||||

Medical services revenue | $ | 497,678 | $ | 292,495 | 70 | % | $ | 910,090 | $ | 582,309 | $ | 1,214,270 | $ | 788,566 | $ | 466,612 | ||||||||||||||||

Medical margin | $ | 55,195 | $ | 72,132 | (23 | )% | $ | 107,253 | $ | 114,293 | $ | 192,393 | $ | 63,192 | $ | 53,943 | ||||||||||||||||

Platform support costs | $ | 30,667 | $ | 25,223 | 22 | % | $ | 59,075 | $ | 48,743 | $ | 99,943 | $ | 89,266 | $ | 62,739 | | |||||||||||||||

Network contribution (1) | $ | 24,294 | $ | 38,510 | (37 | )% | $ | 54,436 | $ | 63,250 | $ | 99,016 | $ | 25,598 | $ | 22,083 | ||||||||||||||||

Adjusted EBITDA (1) | $ | (1,674 | ) | $ | 14,311 | (112 | )% | $ | 2,088 | $ | 16,888 | $ | 5,827 | $ | (56,711 | ) | $ | (32,240 | ) | |||||||||||||

| (1) | Network contribution and Adjusted EBITDA are non-GAAP financial measures. See“—Non-GAAP Financial Measures” for additional information, including reconciliations to the most directly comparable GAAP measures. |

Three Months Ended June 30, | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | ||||||||||||||||||||||

Medical services revenue | $ | 497,678 | $ | 292,495 | $ | 910,090 | $ | 582,309 | $ | 1,214,270 | $ | 788,566 | $ | 466,612 | ||||||||||||||

Medical services expense | (442,483 | ) | (220,363 | ) | (802,837 | ) | (468,016 | ) | (1,021,877 | ) | (725,374 | ) | (412,669 | ) | ||||||||||||||

Medical margin | $ | 55,195 | $ | 72,132 | $ | 107,253 | $ | 114,293 | $ | 192,393 | $ | 63,192 | $ | 53,943 | ||||||||||||||

Three Months Ended June 30, | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | ||||||||||||||||||||||

Medical services revenue | $ | 497,678 | $ | 292,495 | $ | 910,090 | $ | 582,309 | $ | 1,214,270 | $ | 788,566 | $ | 466,612 | ||||||||||||||

Medical services expense | (442,483 | ) | (220,363 | ) | (802,837 | ) | (468,016 | ) | (1,021,877 | ) | (725,374 | ) | (412,669 | ) | ||||||||||||||

Other medical expenses—live geographies (1) | (30,901 | ) | (33,622 | ) | (52,817 | ) | (51,043 | ) | (93,377 | ) | (37,594 | ) | (31,860 | ) | ||||||||||||||

Network contribution | $ | 24,294 | $ | 38,510 | $ | 54,436 | $ | 63,250 | $ | 99,016 | $ | 25,598 | $ | 22,083 | ||||||||||||||

| (1) | Represents physician incentive expense related to surplus sharing and other direct medical expenses incurred to improve care for our members in our live geographies. Excludes costs in geographies that are in implementation and are not yet generating revenue. For the three months ended June 30, 2021 and 2020, costs incurred in implementing geographies were $2.8 million and $1.1 million, respectively. For the years ended December 31, 2020, 2019, and 2018, costs incurred in implementing geographies were $8.9 million, $2.9 million and $2.2 million, respectively. |

| • | Interest income, which consists primarily of interest earned on our cash and cash equivalents and restricted cash and cash equivalents; and |

| • | Equity income (loss) from unconsolidated joint ventures. |

Three Months Ended June 30, | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | ||||||||||||||||||||||

(dollars in thousands) | ||||||||||||||||||||||||||||

Revenues: | ||||||||||||||||||||||||||||

Medical services revenue | $ | 497,678 | $ | 292,495 | $ | 910,090 | $ | 582,309 | $ | 1,214,270 | $ | 788,566 | $ | 466,612 | ||||||||||||||

Other operating revenue | 1,278 | 1,099 | 1,970 | 2,333 | 4,063 | 5,845 | 8,215 | |||||||||||||||||||||

Total revenues | 498,956 | 293,594 | 912,060 | 584,642 | 1,218,333 | 794,411 | 474,827 | |||||||||||||||||||||

Expenses: | ||||||||||||||||||||||||||||

Medical services expense | 442,483 | 220,363 | 802,837 | 468,016 | 1,021,877 | 725,374 | 412,669 | |||||||||||||||||||||

Other medical expenses | 33,694 | 34,761 | 57,355 | 53,187 | 102,306 | 40,526 | 34,092 | |||||||||||||||||||||

General and administrative | 43,013 | 34,248 | 79,318 | 60,832 | 137,292 | 122,832 | 88,745 | |||||||||||||||||||||

Stock-based compensation expense (1) | 274,548 | 2,155 | 276,020 | 3,176 | ||||||||||||||||||||||||

Depreciation and amortization | 3,581 | 3,319 | 7,008 | 6,517 | 13,531 | 12,253 | 11,385 | |||||||||||||||||||||

Total expenses | 797,319 | 294,846 | 1,222,538 | 591,728 | 1,275,006 | 900,985 | 546,891 | |||||||||||||||||||||

| (1) | For annual periods prior to 2021, stock-based compensation expense is included in general and administrative expenses. |

Three Months Ended June 30, | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | ||||||||||||||||||||||

(dollars in thousands) | ||||||||||||||||||||||||||||

Income (loss) from operations | (298,363 | ) | (1,252 | ) | (310,478 | ) | (7,086 | ) | (56,673 | ) | (106,574 | ) | (72,064 | ) | ||||||||||||||

Other income (expense): | ||||||||||||||||||||||||||||

Other income (expense), net | 2,967 | (74 | ) | 4,303 | 48 | 2,465 | 955 | 611 | ||||||||||||||||||||

Interest expense | (1,498 | ) | (2,080 | ) | (4,439 | ) | (4,229 | ) | (8,135 | ) | (9,068 | ) | (9,839 | ) | ||||||||||||||

Income (loss) before income taxes | (296,894 | ) | (3,406 | ) | (310,614 | ) | (11,267 | ) | (62,343 | ) | (114,687 | ) | (81,292 | ) | ||||||||||||||

Income tax benefit (expense) | (435 | ) | (39 | ) | (451 | ) | (39 | ) | (865 | ) | 232 | 113 | ||||||||||||||||

Income (loss) from continuing operations | (297,329 | ) | (3,445 | ) | (311,065 | ) | (11,306 | ) | (63,208 | ) | (114,455 | ) | (81,179 | ) | ||||||||||||||

Discontinued operations: | ||||||||||||||||||||||||||||

Income (loss) before impairments, gain (loss) on sales and income taxes | (1,547 | ) | (4,340 | ) | (2,898 | ) | (12,429 | ) | (20,049 | ) | (86,108 | ) | (32,132 | ) | ||||||||||||||

Impairments | — | (98,343 | ) | (40,794 | ) | |||||||||||||||||||||||

Gain (loss) on sales of assets, net | — | — | — | — | 20,401 | — | — | |||||||||||||||||||||

Income tax benefit (expense) | (65 | ) | (126 | ) | (129 | ) | (275 | ) | 2,804 | 16,166 | 7,588 | |||||||||||||||||

Total discontinued operations | (1,612 | ) | (4,466 | ) | (3,027 | ) | (12,704 | ) | 3,156 | (168,285 | ) | (65,338 | ) | |||||||||||||||

Net income (loss) | (298,941 | ) | (7,911 | ) | (314,092 | ) | (24,010 | ) | (60,052 | ) | (282,740 | ) | (146,517 | ) | ||||||||||||||

Noncontrolling interests’ share in (earnings) loss | 96 | — | 169 | — | — | 152 | (409 | ) | ||||||||||||||||||||

Net income (loss) attributable to common shares | $ | (298,845 | ) | $ | (7,911 | ) | $ | (313,923 | ) | $ | (24,010 | ) | $ | (60,052 | ) | $ | (282,588 | ) | $ | (146,926 | ) | |||||||

Three Months Ended June 30, | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | ||||||||||||||||||||||

Revenues: | ||||||||||||||||||||||||||||

Medical services revenue | 100 | % | 100 | % | 100 | % | 100 | % | 100 | % | 99 | % | 98 | % | ||||||||||||||

Other operating revenue | — | — | — | — | — | 1 | 2 | |||||||||||||||||||||

Total revenues | 100 | 100 | 100 | 100 | 100 | 100 | 100 | % | ||||||||||||||||||||

Expenses: | ||||||||||||||||||||||||||||

Medical services expense | 89 | 75 | 88 | 80 | 84 | 91 | 87 | |||||||||||||||||||||

Other medical expenses | 7 | 12 | 6 | 9 | 8 | 5 | 7 | |||||||||||||||||||||

General and administrative | 9 | 12 | 9 | 10 | 11 | 15 | 19 | |||||||||||||||||||||

Stock-based compensation expense (1) | 55 | 1 | 30 | 1 | ||||||||||||||||||||||||

Depreciation and amortization | 1 | 1 | 1 | 1 | 1 | 2 | 2 | |||||||||||||||||||||

Total expenses | 160 | 100 | 134 | 101 | 105 | 113 | 115 | |||||||||||||||||||||

| (1) | For annual periods prior to 2021, stock-based compensation expense is included in general and administrative expenses. |

Three Months Ended June 30, | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | ||||||||||||||||||||||

Income (loss) from operations | (60 | ) | — | (34 | ) | (1 | ) | (5 | ) | (13 | ) | (15 | ) | |||||||||||||||

Other income (expense): | ||||||||||||||||||||||||||||

Other income (expense), net | 1 | — | — | — | — | — | — | |||||||||||||||||||||

Interest expense | — | (1 | ) | — | (1 | ) | (1 | ) | (1 | ) | (2 | ) | ||||||||||||||||

Income (loss) before income taxes | (60 | ) | (1 | ) | (34 | ) | (2 | ) | (5 | ) | (14 | ) | (17 | ) | ||||||||||||||

Income tax benefit (expense) | — | — | — | — | — | — | — | |||||||||||||||||||||

Income (loss) from continuing operations | (60 | ) | (1 | ) | (34 | ) | (2 | ) | (5 | ) | (14 | ) | (17 | ) | ||||||||||||||

Discontinued operations: | ||||||||||||||||||||||||||||

Income (loss) before impairments, gain (loss) on sales and income taxes | — | (1 | ) | — | (2 | ) | (2 | ) | (11 | ) | (7 | ) | ||||||||||||||||

Impairments | — | (12 | ) | (9 | ) | |||||||||||||||||||||||

Gain (loss) on sales of assets, net | — | — | — | — | 2 | — | — | |||||||||||||||||||||

Income tax benefit (expense) | — | — | — | — | — | 2 | 2 | |||||||||||||||||||||

Total discontinued operations | — | (2 | ) | — | (2 | ) | — | (21 | ) | (14 | ) | |||||||||||||||||

Net income (loss) | (60 | ) | (3 | ) | (34 | ) | (4 | ) | (5 | ) | (36 | ) | (31 | ) | ||||||||||||||

Noncontrolling interests’ share in (earnings) loss | — | — | — | — | — | — | — | |||||||||||||||||||||

Net income (loss) attributable to common shares | (60 | )% | (3 | )% | (34 | )% | (4 | )% | (5 | )% | (36 | )% | (31 | )% | ||||||||||||||

Three Months Ended June 30, | Change | Six Months Ended June 30, | Change | |||||||||||||||||||||||||||||

(dollars in thousands) | 2021 | 2020 | $ | % | 2021 | 2020 | $ | % | ||||||||||||||||||||||||

Medical services revenue | $ | 497,678 | $ | 292,495 | $ | 205,183 | 70 | % | $ | 910,090 | $ | 582,309 | $ | 327,781 | 56 | % | ||||||||||||||||

% of total revenues | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||||||||||||||||||

Three Months Ended June 30, | Change | Six Months Ended June 30, | Change | |||||||||||||||||||||||||||||

(dollars in thousands) | 2021 | 2020 | $ | % | 2021 | 2020 | $ | % | ||||||||||||||||||||||||

Medical services expense | $ | 442,483 | $ | 220,363 | $ | 222,120 | 101 | % | $ | 802,837 | $ | 468,016 | $ | 334,821 | 72 | % | ||||||||||||||||

% of total revenues | 89 | % | 75 | % | 88 | % | 80 | % | ||||||||||||||||||||||||

Three Months Ended June 30, | Change | Six Months Ended June 30, | Change | |||||||||||||||||||||||||||||

(dollars in thousands) | 2021 | 2020 | $ | % | 2021 | 2020 | $ | % | ||||||||||||||||||||||||

Other medical expenses | $ | 33,694 | $ | 34,761 | $ | (1,067 | ) | (3 | )% | $ | 57,355 | $ | 53,187 | $ | 4,168 | 8 | % | |||||||||||||||

% of total revenues | 7 | % | 12 | % | 6 | % | 9 | % | ||||||||||||||||||||||||

Three Months Ended June 30, | Change | Six Months Ended June 30, | Change | |||||||||||||||||||||||||||||

(dollars in thousands) | 2021 | 2020 | $ | % | 2021 | 2020 | $ | % | ||||||||||||||||||||||||

General and administrative | $ | 43,013 | $ | 34,248 | $ | 8,765 | 26 | % | $ | 79,318 | $ | 60,832 | $ | 18,486 | 30 | % | ||||||||||||||||

% of total revenues | 9 | % | 12 | % | 9 | % | 10 | % | ||||||||||||||||||||||||

Three Months Ended June 30, | Change | Six Months Ended June 30, | Change | |||||||||||||||||||||||||||||

(dollars in thousands) | 2021 | 2020 | $ | % | 2021 | 2020 | $ | % | ||||||||||||||||||||||||

Stock-based compensation expense | $ | 274,548 | $ | 2,155 | $ | 272,393 | 12640 | % | $ | 276,020 | $ | 3,176 | $ | 272,844 | 8591 | % | ||||||||||||||||

% of total revenues | 55 | % | 1 | % | 30 | % | 1 | % | ||||||||||||||||||||||||

Three Months Ended June 30, | Change | Six Months Ended June 30, | Change | |||||||||||||||||||||||||||||

(dollars in thousands) | 2021 | 2020 | $ | % | 2021 | 2020 | $ | % | ||||||||||||||||||||||||

Total discontinued operations | $ | (1,612 | ) | $ | (4,466 | ) | $ | 2,854 | 64 | % | $ | (3,027 | ) | $ | (12,704 | ) | $ | 9,677 | 76 | % | ||||||||||||

% of total revenues | (0 | )% | (2 | )% | (0 | )% | (2 | )% | ||||||||||||||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Medical services revenue | $ | 1,214,270 | $ | 788,566 | $ | 425,704 | 54 | % | ||||||||

% of total revenues | 100 | % | 99 | % | ||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Medical services expense | $ | 1,021,877 | $ | 725,374 | $ | 296,503 | 41 | % | ||||||||

% of total revenues | 84 | % | 91 | % | ||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Other medical expenses | $ | 102,306 | $ | 40,526 | $ | 61,780 | 152 | % | ||||||||

% of total revenues | 8 | % | 5 | % | ||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

General and administrative | $ | 137,292 | $ | 122,832 | $ | 14,460 | 12 | % | ||||||||

% of total revenues | 11 | % | 15 | % | ||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Total discontinued operations | $ | 3,156 | $ | (168,285 | ) | $ | 171,441 | 102 | % | |||||||

% of total revenues | 0 | % | (21 | )% | ||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2019 | 2018 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Medical services revenue | $ | 788,566 | $ | 466,612 | $ | 321,954 | 69 | % | ||||||||

% of total revenues | 99 | % | 98 | % | ||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2019 | 2018 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Medical services expense | $ | 725,374 | $ | 412,669 | $ | 312,705 | 76 | % | ||||||||

% of total revenues | 91 | % | 87 | % | ||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2019 | 2018 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Other medical expenses | $ | 40,526 | $ | 34,092 | $ | 6,434 | 19 | % | ||||||||

% of total revenues | 5 | % | 7 | % | ||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2019 | 2018 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

General and administrative $ | 122,832 | $ | 88,745 | $ | 34,087 | 38 | % | |||||||||

% of total revenues | 15 | % | 19 | % | ||||||||||||

Year Ended December 31, | Change | |||||||||||||||

2019 | 2018 | $ | % | |||||||||||||

(dollars in thousands) | ||||||||||||||||

Total discontinued operations | $ | (168,285 | ) | $ | (65,338 | ) | $ | (102,947 | ) | 158 | % | |||||

% of total revenues | (21 | )% | (14 | )% | ||||||||||||

| • | Adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs; |

| • | Adjusted EBITDA does not reflect interest expense, or the requirements necessary to service interest or principal payments on debt; |

| • | Adjusted EBITDA does not reflect income tax expense (benefit) or the cash requirements to pay taxes; |

| • | Adjusted EBITDA does not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; |

| • | Although depreciation and amortization charges are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements; and |

| • | The expenses and other items that we exclude in our calculation of Adjusted EBITDA may differ from the expenses and other items, if any, that other companies may exclude from similarly titled non-GAAP financial measures. |

Three Months Ended June 30, | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | ||||||||||||||||||||||

Income (loss) from operations | $ | (298,363 | ) | $ | (1,252 | ) | $ | (310,478 | ) | $ | (7,086 | ) | $ | (56,673 | ) | $ | (106,574 | ) | $ | (72,064 | ) | |||||||

Other operating revenue | (1,278 | ) | (1,099 | ) | (1,970 | ) | (2,333 | ) | (4,063 | ) | (5,845 | ) | (8,215 | ) | ||||||||||||||

Other medical expenses | 33,694 | 34,761 | 57,355 | 53,187 | 102,306 | 40,526 | 34,092 | |||||||||||||||||||||

Other medical expenses (live geographies) (1) | (30,901 | ) | (33,622 | ) | (52,817 | ) | (51,043 | ) | (93,377 | ) | (37,594 | ) | (31,860 | ) | ||||||||||||||

General and administrative | 43,013 | 34,248 | 79,318 | 60,832 | 137,292 | 122,832 | 88,745 | |||||||||||||||||||||

Stock-based compensation expense (2) | 274,548 | 2,155 | 276,020 | 3,176 | ||||||||||||||||||||||||

Depreciation and amortization | 3,581 | 3,319 | 7,008 | 6,517 | 13,531 | 12,253 | 11,385 | |||||||||||||||||||||

Network contribution | $ | 24,294 | $ | 38,510 | $ | 54,436 | $ | 63,250 | $ | 99,016 | $ | 25,598 | $ | 22,083 | ||||||||||||||

| (1) | Represents physician incentive expense related to surplus sharing and other direct medical expenses incurred to improve care for our members in our live geographies. Excludes costs in geographies that are in implementation and are not yet generating revenue. For the three months ended June 30, 2021 and 2020, costs incurred in implementing geographies were $2.8 million and $1.1 million, respectively. For the six months ended June 30, 2021 and 2020, costs incurred in implementing geographies were $4.5 million and $2.1 million, respectively. For the years ended December 31, 2020, 2019, and 2018, costs incurred in implementing geographies were $8.9 million, $2.9 million and $2.2 million, respectively. |

| (2) | For annual periods prior to 2021, stock-based compensation expense is included in general and administrative expenses. |

Three Months Ended June 30, | Six Months Ended June 30, | Year Ended December 31, | ||||||||||||||||||||||||||

2021 | 2020 | 2021 | 2020 | 2020 | 2019 | 2018 | ||||||||||||||||||||||

Net income (loss) | $ | (298,941 | ) | $ | (7,911 | ) | $ | (314,092 | ) | $ | (24,010 | ) | $ | (60,052 | ) | $ | (282,588 | ) | $ | (146,926 | ) | |||||||

(Income) loss from discontinued operations, net of income taxes | 1,612 | 4,466 | 3,027 | 12,704 | (3,156 | ) | 168,285 | 65,338 | ||||||||||||||||||||

Interest expense | 1,498 | 2,080 | 4,439 | 4,229 | 8,135 | 9,068 | 9,839 | |||||||||||||||||||||

Income tax expense (benefit) | 435 | 39 | 451 | 39 | 865 | (232 | ) | (113 | ) | |||||||||||||||||||

Depreciation and amortization | 3,581 | 3,319 | 7,008 | 6,517 | 13,531 | 12,253 | 11,385 | |||||||||||||||||||||

Geography entry costs (1) | 9,578 | 4,865 | 14,545 | 6,523 | 27,100 | 9,787 | 4,918 | |||||||||||||||||||||

Severance and related costs | 3,788 | 2,689 | 4,242 | 2,691 | 4,009 | 3,675 | 3.036 | |||||||||||||||||||||

Management fees (2) | 58 | 353 | 433 | 683 | 1,530 | 1,885 | 1,755 | |||||||||||||||||||||

Stock-based compensation expense | 274,548 | 2,155 | 276,020 | 3,176 | 6,472 | 4,399 | 2,950 | |||||||||||||||||||||

EBITDA adjustment related to equity method investments | 652 | — | 652 | — | — | — | ||||||||||||||||||||||

Other (3) | 1,517 | 2,256 | 5,363 | 4,336 | 7,393 | 16,757 | 15,578 | |||||||||||||||||||||

Adjusted EBITDA | $ | (1,674 | ) | $ | 14,311 | $ | 2,088 | $ | 16,888 | $ | 5,827 | $ | (56,711 | ) | $ | (32,240 | ) | |||||||||||

| (1) | Represents direct geography entry costs, including investments to develop and expand our platform, physician incentive expense, employee-related expenses and marketing. For the three months ended June 30, 2021 and 2020, (i) $2.8 million and $1.1 million, respectively, are included in other medical expenses and (ii) $6.8 million and $3.7 million, respectively, are included in general and administrative expenses. For the six months ended June 30, 2021 and 2020, (i) $4.5 million and $2.1 million, respectively, are included in other medical expenses and (ii) $10.0 million and $4.4 million, respectively, are included in general and administrative expenses. For the years ended December 31, 2020, 2019, and 2018, (i) $8.9 million, $2.9 million and $2.2 million, respectively, are included in other medical expenses and (ii) $17.9 million, $6.9 million, and $2.7 million, respectively, are included in general and administrative expenses. |

| (2) | Represents management fees and other expenses paid to CD&R. In connection with our IPO, we terminated our consulting agreement with CD&R, effective April 16, 2021. We were not charged a fee in connection with the termination of this agreement. |

| (3) | Includes changes in non-cash accruals for unasserted claims and contingent liabilities. |

Six Months Ended June 30, | Year Ended December 31, | |||||||||||||||||||||||

2021 | 2020 | Change | 2020 | 2019 | 2018 | |||||||||||||||||||

Net cash provided by (used in) operating activities | $ | (80,119 | ) | $ | (35,498 | ) | $ | (44,621 | ) | $ | (53,204 | ) | $ | (103,861 | ) | $ | (67,531 | ) | ||||||

Net cash provided by (used in) investing activities | (76,338 | ) | (2,351 | ) | (73,987 | ) | $ | 22,066 | $ | (5,060 | ) | (7,970 | ) | |||||||||||

Net cash provided by (used in) financing activities | 1,143,077 | 31,522 | 1,111,555 | $ | 24,621 | $ | 176,298 | 84,743 | ||||||||||||||||

| • | which activities most significantly impact the entity’s economic performance, and our ability to direct those activities; |

| • | our form of ownership interest; |

| • | our representation on the entity’s governing body; |

| • | the size and seniority of our investment; |

| • | our ability to manage our ownership interest relative to other interest holders; |

| • | our ability and the rights of other parties to participate in policy making decisions; and |

| • | our ability to liquidate the entity. |

| • | Expected Term |

| • | Expected Volatility |

| • | Risk-Free Interest Rate |

| • | Expected Dividend |

| • | valuations of our common stock completed on a regular basis; |

| • | our historical financial results and estimated trends and projections for our future operating and financial performance; |

| • | likelihood of achieving a liquidity event, such as an initial public offering or sale of our company, given prevailing market conditions; |

| • | the market performance of comparable, publicly-traded companies; and |

| • | the overall economic and industry conditions and outlook. |

| • | Unsustainably high and rising costs characterized by waste, unnecessary variation in care and poor patient experience and health outcomes; |

| • | FFS reimbursement model focused on units of service rather than a coordinated approach to meet the unique needs of individual patients; |

| • | High incidence of physician burnout driven by growing administrative burden and the FFS reimbursement model; |

| • | An aging U.S. population, with the over 65 population projected to grow from approximately 49 million in 2016 to approximately 77 million in 2034, driving Medicare growth and pressuring the healthcare system as average reimbursement fails to keep pace with the rise in average patient complexity; |

| • | Rapid patient adoption of MA plans, private health plans administering Medicare benefits, as seniors increasingly value supplemental benefits and low monthly premiums; |

| • | The Medicare population is projected to grow from approximately 62 million in 2020 to more than 70 million individuals in 2025 with a total spend of approximately $1.25 trillion, and MA enrollment comprised 37% of total Medicare enrollment in 2019 and is projected to comprise 47% of total Medicare enrollment in 2025; |

| • | PCPs are positioned—but not currently empowered or incentivized—to act as the quarterback for healthcare delivery, with their decisions estimated to influence up to 90% of total healthcare spending according to a 2017 study; and |

| • | The United States spends only 5% to 7% of its total healthcare dollars on primary care in contrast to 14% among OECD nations on average. |

| • | Implemented the first MA multi-payor, globally capitated risk model with a community-based physician group in all of our diverse anchor geographies; |

| • | Exported the Total Care Model from one to 17 geographies ranging from communities as small as Zanesville, Ohio to large and rapidly growing communities such as Austin, Texas; |

| • | Built strong local positions with established community-based physician group leaders who have intimate and trusted relationships with patients in their communities, such as Austin Regional Clinic in Austin, Texas, Buffalo Medical Group in Buffalo, New York, Central Ohio Primary Care in Columbus, Ohio, Preferred Primary Care Physicians in Pittsburgh, Pennsylvania and Wilmington Health in Wilmington, North Carolina; |

| • | Grew from approximately 24,000 MA members to approximately 230,700 MA members on our platform; |

| • | Expanded from two payors to 15 payors on our platform; and |

| • | Began participating in the Direct Contracting Model, with over 50,000 Medicare FFS beneficiaries served by our existing PCPs contracted through our five currently approved DCEs. |

| • | Payor Engagement |

| • | Direct Contracting Model |

| • | Data Integration and Management |

| • | Clinical Programs and Product Development |

| • | Quality (Clinical and Experience) |

| • | Growth 60-64 year old patients, to enable their patients to make educated healthcare choices. These existing patients represent a large, growing and durable source of potential attributed member growth. |

| • | Performance Management Analytics |

| • | Financial Management |

| • | National Policy |

| (1) | 2020 Medicare spend for total Medicare beneficiaries is based on CMS spend per beneficiary. |

| (2) | 2025 Medicare spend for total Medicare beneficiaries, beneficiaries attributed to independent PCPs and agilon total addressable market is based on CMS projected Medicare enrollment and spending per beneficiary growth rates. |

| • | Payor Engagement |

program management and financial management. Under our multi-year contracts with payors, agilon receives a percentage of total premiums and is responsible for managing the cost of the total healthcare needs of patients attributed to our PCPs. In 2021, we anticipate working with 15 payors, nine of which were live in 2020 and five of which went live in 2021, across a total of approximately 40 local contracts. Five of our payors are national, and our relationships with them across geographies support the portability of the agilon platform. |

| • | Direct Contracting Model |

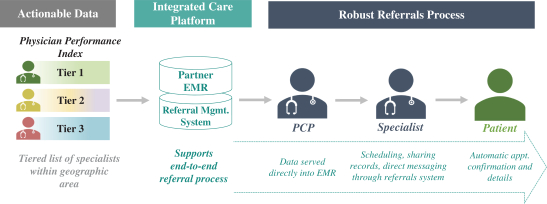

| • | Data Integration and Management |

| • | Clinical Programs and Product Development co-developed with our physicians and can be deployed and seamlessly integrated across our network to drive improved health outcomes. Combining insights from evidence-based medicine and patient-level data, our medical leadership and local physician leaders develop high-value actionable playbooks for partner physicians to deliver quality care, which include operational plans, analytics and tracking metrics. |

| • | Quality (Clinical and Experience) 4-STAR-rated or higher plans, compared to 77% of MA members nationally. More than 90% of our providers surveyed in our live anchor physician groups believed that the quality of care programs developed through the agilon network enabled our physician partners to provide better care to their patients. Based on data from most of our anchor partners, approximately 50% of total medical costs are driven by specialists, with the potential for wide variability in costs depending on the quality of the specialist providing care. |