SHARES AVAILABLE FOR FUTURE SALE

Our common stock is listed on the NYSE under the symbol “AGL”. Sales of substantial amounts of our common stock in the public market could adversely affect prevailing market prices of our common stock. Some shares of our common stock will not be available for sale for a certain period of time after this offering because they are subject to contractual and legal restrictions on resale, some of which are described below. Sales of substantial amounts of common stock in the public market after these restrictions lapse, or the perception that these sales could occur, could adversely affect the prevailing market price and our ability to raise equity capital in the future.

Sales of Restricted Securities

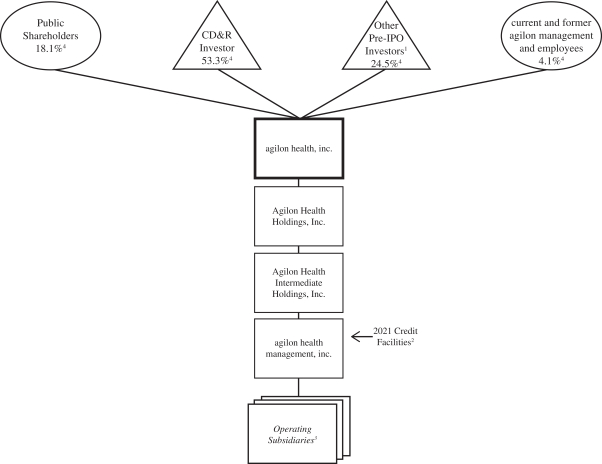

As of June 30, 2021, adjusted to give effect to this offering, we had 391,221,574 shares of common stock outstanding. Of these shares, all of the 53,590,000 shares sold in our IPO are, and the 17,000,000 shares to be sold in this offering will be, immediately tradable without restriction under the Securities Act except for any shares held by “affiliates,” as that term is defined in Rule 144. On April 14, 2021, we filed a registration statement on Form S-8 under the Securities Act to register the shares of common stock to be issued under our equity compensation plans and, as a result, all shares of common stock acquired upon exercise of stock options granted under our plans are also freely tradable under the Securities Act, subject to the terms of the lock-up agreements, unless purchased by our affiliates. As of June 30, 2021, there were stock options outstanding to purchase a total of 41,197,388 shares of our common stock, of which 30,634,736 options will be exercisable as of the consummation of this offering , including after taking into account the satisfaction of performance conditions applicable to certain options as a result of this offering. Additionally, 1,112,131 shares of our common stock are issuable pursuant to director and employee RSUs. As of June 30, 2021, 28,453,653 shares of our common stock were reserved for future issuance under our Omnibus Incentive Plan and ESPP.

320,631,574 shares of our common stock outstanding as of June 30, 2021, are “restricted securities” within the meaning of Rule 144. Restricted securities may be sold in the public market only if they are registered under the Securities Act or are sold pursuant to an exemption from registration under Rule 144 or Rule 701, which are summarized below. Subject to the lock-up agreements described below, shares held by our affiliates that are not restricted securities or that have been owned for more than one year may be sold subject to compliance with Rule 144 without regard to the prescribed one-year holding period under Rule 144.

Stock Options

On April 14, 2021, we filed a registration statement on Form S-8 under the Securities Act to register the shares of common stock to be issued under our stock option plans and, as a result, all shares of common stock acquired upon exercise of stock options and other equity-based awards granted under these plans will, subject to a 180-day lock-up period, also be freely tradable under the Securities Act unless purchased by our affiliates. A total of 41,197,388 shares of common stock are subject to outstanding stock options previously granted under our stock incentive plan as of June 30, 2021, of which 30,634,736 options will be exercisable as of the consummation of this offering, including after taking into account the satisfaction of performance conditions applicable to certain options as a result of this offering. An additional 28,453,653 shares of common stock are available for grants of additional equity awards under stock incentive plans adopted in connection with our IPO.

Lock-up Agreements

In connection with our IPO, the CD&R Investor, certain of our stockholders and our executive officers and directors entered into lock-up agreements for a period of 180 days after the date of the prospectus for our IPO. In connection with this offering, J.P. Morgan Securities LLC and Goldman Sachs & Co. LLC, as representatives of the several underwriters in our IPO, have agreed to waive the prior lock-up agreements with respect to up to 17,000,000 shares (or up to 19,550,000 shares including the underwriters’ option to purchase additional shares) of our common stock for the sale by the selling stockholders in this offering, which includes shares beneficially owned by certain of our officers and directors, provided that the waiver is limited to the shares actually sold in this offering. Additionally, in connection with this offering, we and our directors and executive officers and certain stockholders, including certain of the selling stockholders, have entered into lock-up agreements, under which we and they have agreed not to, among other things, offer, sell, contract to sell, pledge, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase,

178