for its U.S. and foreign structure and has not identified any opportunities to generate taxable income from such strategies as of December 31, 2020. As a result, the Company has concluded that the future realization of deferred tax assets is not more-likely-than-not to occur. The cumulative valuation allowance was ($43.1) million at December 31, 2020.

At December 31, 2020, the Company had net operating loss carryforwards for federal income tax purposes of approximately $22.7 million which do not expire. The Company had net operating loss carryforwards for state income tax purposes of approximately $1.2 million, which will expire if unused in years 2039 through 2040. The Company had foreign net operating loss carryforwards of $1.4 million which will expire if unused in 2025.

Foreign undistributed earnings were considered permanently invested, therefore no provision for U.S. income taxes was accrued as of December 31, 2019 and 2020. The Company has not identified nor recorded any reserves for uncertain tax positions as of December 31, 2019 and December 31, 2020. As of December 31, 2020, the Company was not aware of any anticipated audits by the IRS or any other state, local, or foreign taxing authorities for any other matters. The Company is not a U.S. shareholder and is therefore not expected to be subject to tax on Global Intangible Low-Taxed Income (GILTI).

On March 27, 2020 the Coronavirus Aid, Relief, and Economic Security (CARES) Act was enacted and implemented certain tax legislation, among which temporarily increases the interest expense limitation pursuant to Section 163(j), allows for acceleration of refunds of alternative minimum tax (AMT) credits, and retroactively clarified the immediate recovery of qualified improvement property costs under 100% expensing rather than 39-year recovery period for assets placed in service after November 27, 2017. The provisions of the CARES Act did not impact the Company.

12. Subsequent Events

Lyra License

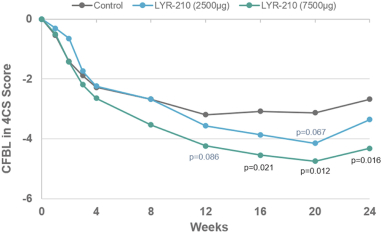

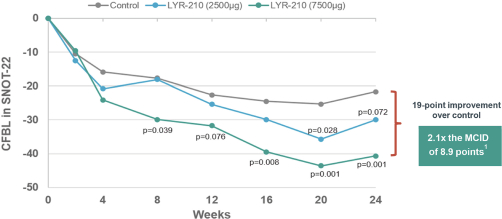

In May 2021, the Company entered into a license and collaboration agreement with Lyra Therapeutics, Inc. (“Lyra”). Pursuant to the license agreement, Lyra granted to the Company an exclusive license under certain patents and know-how of Lyra to develop and commercialize and otherwise use, offer for sale, sell, have sold and import Lyra’s proprietary product, LYR-210, in the licensed territory of Mainland China, Hong Kong, Macau, Taiwan, Singapore, South Korea and Thailand. Under the license agreement, Lyra received a nonrefundable upfront payment of $12.0 million. Additionally, Lyra is entitled to receive payments from the Company totaling an aggregate of up to $135.0 million upon the achievement of specified development and commercial milestones, up to $40.0 million and $95.0 million, respectively, plus tiered royalties from the low- to high-teens on the net sales.

Landos License

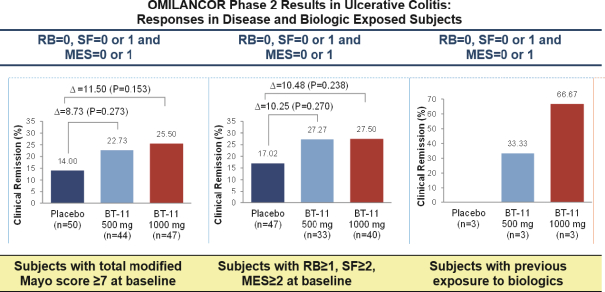

In May 2021, the Company entered into a license and collaboration agreement with Landos Biopharma, Inc. (“Landos”). Pursuant to the license agreement, Landos granted to the Company an exclusive license under certain patents and know-how of Landos to develop, manufacture, commercialize and otherwise, make and have made, use, offer for sale, sell, have sold, and import Landos’s proprietary compounds, BT-11 and NX-13, in the licensed territory of Mainland China, Hong Kong, Macau, Taiwan, Cambodia, Indonesia, Myanmar, Philippines, Singapore, South Korea, Thailand and Vietnam. Under the license agreement, Landos received a nonrefundable upfront payment of $18.0 million. Additionally, Landos is entitled to receive payments from the Company totaling an aggregate of up to $200.0 million upon the achievement of specified development and commercial

F-30