The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated October 26, 2021.

20,312,500 American Depositary Shares

| Representing 20,312,500 Ordinary Shares |

LianBio

We are offering 20,312,500 American depositary shares (“ADSs”). Each ADS represents one Ordinary Share, par value $0.000017100448 per share.

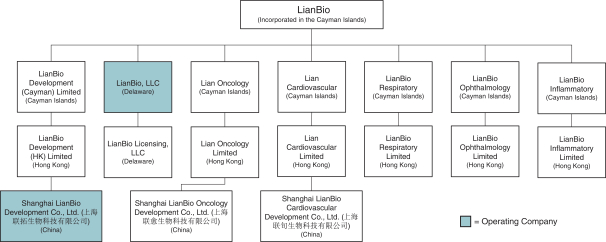

This is the initial public offering in the United States of LianBio, a Cayman Islands exempted holding company with headquarters and operations in both the United States and China. As a holding company, we may rely on dividends and other distributions on equity paid by our Chinese subsidiaries for our cash and financing requirements. If any of our Chinese subsidiaries incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to pay dividends to us. To date, there have not been any such dividends or other distributions from our Chinese subsidiaries to our subsidiaries located outside of China. In addition, as of the date of this prospectus, none of our subsidiaries have ever issued any dividends or distributions to us or their respective shareholders outside of China. As of the date of this prospectus, neither we nor any of our subsidiaries have ever paid dividends or made distributions to U.S. investors. Our Chinese operating subsidiary, Shanghai LianBio Development Co., Ltd., received $5,000,000, $2,500,095, $17,499,905 and $5,000,000 in equity financing via capital contributions from its shareholder outside of China in February 2020, September 2020, December 2020 and October 2021, respectively, to fund its business operations in China. In the future, cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to our Chinese subsidiaries via capital contribution or shareholder loans, as the case may be.

Throughout this prospectus, unless the context indicates otherwise, references to “LianBio” refer to LianBio, a holding company, together as a group with our subsidiaries, including our operating company subsidiaries. LianBio, LLC and Shanghai LianBio Development Co., Ltd., our U.S. and China-based operating subsidiaries, respectively, conduct our daily operations. Investors purchasing our ADSs in this initial public offering are purchasing equity securities of our Cayman Islands exempt holding company and are not purchasing equity securities of our subsidiaries that have business operations in the United States and China. No public market currently exists for our ADSs or Ordinary Shares.

We currently expect the initial public offering price to be between $15.00 and $17.00 per ADS. See “Underwriting” for a discussion of the factors to be considered in determining the initial offering price. We have applied to list the ADSs on the Nasdaq Global Market under the symbol “LIAN.”

We are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and a “smaller reporting company” as defined in the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and may elect to do so in future filings. See “Prospectus Summary—Implications of being an emerging growth company and a smaller reporting company.”

There are significant legal and operational risks associated with having the majority of our operations in China, including that changes in the legal, political and economic policies of the Chinese government, the relations between China and the United States, or Chinese or United States regulations may materially and adversely affect our business, financial condition, results of operations and the market price of our ADSs. Any such changes could significantly limit or completely hinder our ability to offer or continue to offer our ADSs to investors, and could cause the value of our ADSs to significantly decline or become worthless. Recent statements made and regulatory actions undertaken by China’s government, including the recent enactment of China’s new Data Security Law, as well as our obligations to comply with China’s Cybersecurity Review Measures (revised draft for public consultation), regulations and guidelines relating to the multi-level protection scheme, Personal Information Protection Law and any other future laws and regulations may require us to incur significant expenses and could materially affect our ability to conduct our business, accept foreign investments or list on a U.S. or foreign exchange. For more information on these risks and other risks you should consider before buying our ADSs, see “Risk Factors ” beginning on page 21.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per ADS | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discounts and commissions(1) | | $ | | | | $ | | |

Proceeds before expenses, to us | | $ | | | | $ | | |

| (1) | We have agreed to reimburse the underwriters for certain expenses. See “Underwriting.” |

To the extent that the underwriters sell more than 20,312,500 ADSs, the underwriters have the option to purchase up to an additional 3,046,875 ADSs from us at the initial public offering price less underwriting discounts and commissions.

The underwriters expect to deliver the ADSs against payment in New York, New York on or about , 2021.

Joint Book-Running Managers

| | | | |

| Goldman Sachs & Co. LLC | | Jefferies | | BofA Securities |

| | | | |

| | Lead Manager Raymond James | | |

Prospectus dated , 2021.