Sales and Marketing

Given our stage of development, we have not yet established a commercial organization. We intend to establish a targeted commercial infrastructure in key geographies at the appropriate time prior to regulatory approval of our single-agent drugs and fixed-dose combination therapies. We expect to manage sales, marketing and distribution through internal resources and third-party relationships.

In addition, we will opportunistically explore commercialization partnerships in territories outside the United States. As our drug candidates progress through our pipeline, our commercial plans may change. Clinical data, the size of the development programs, the size of our target markets, the size of a commercial infrastructure and manufacturing needs may all influence our commercialization strategies.

Competition

The biotechnology industry is intensely competitive and subject to rapid and significant technological change. We believe that our pipeline, development experience, and scientific knowledge provide us with competitive advantages. However, we face potential worldwide competition from many different sources, including large multinational pharmaceutical companies, established biotechnology companies, and smaller or earlier stage biotechnology companies. In addition, academic institutions, government agencies and other public and private organizations conducting research may seek patent protection with respect to potentially competitive products or technologies. Given the high incidence of NASH, it is likely that the number of companies seeking to develop products and therapies for the treatment of liver and cardio-metabolic diseases, including NASH, will increase. Most of our competitors are focused on single-agent product candidates; there are fewer competitors, of which we are aware, who are developing combination therapies for the treatment of NASH.

We are aware of both pharmaceutical and biotechnology companies with development programs in NASH. Large pharmaceutical companies participating in the development of NASH treatments include, but are not limited to, AbbVie, Inc., Amgen Inc., AstraZeneca PLC/MedImmune LLC, Bayer AG, Boehringer Ingelheim, Bristol-Myers Squibb Company, Eisai, Inc., Eli Lilly and Company, Gilead Sciences, Inc., GlaxoSmithKline plc, Johnson & Johnson, Merck & Co., Inc., Novartis Pharmaceuticals Corp., Novo Nordisk A/S, Pfizer Inc., Roche Holding AG, Sanofi, Sumitomo Dainippon Pharma Co., Ltd. and Takeda Pharmaceutical Co., Ltd.

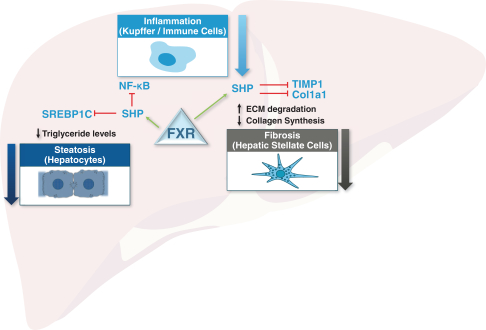

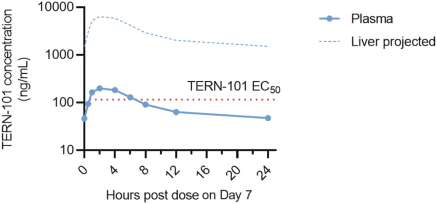

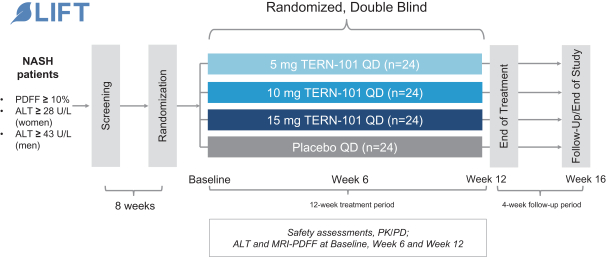

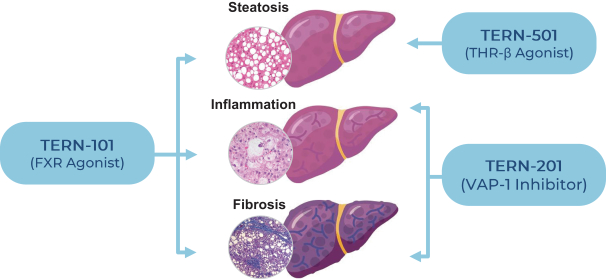

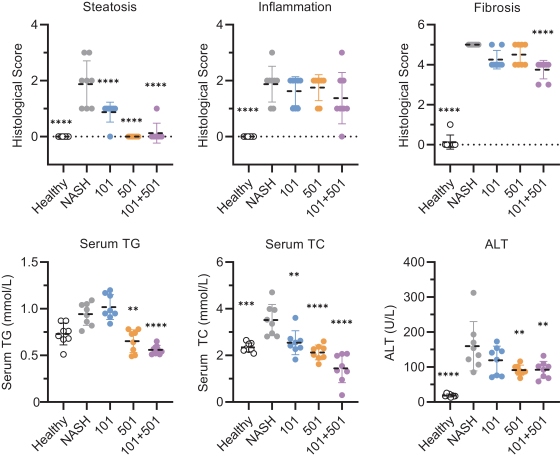

In relation to TERN-101, companies who are currently conducting clinical trials with FXR in the context of NASH include AbbVie, Inc., Enanta Pharmaceuticals, Inc., ENYO Pharma SA, Gilead Sciences, Inc., Intercept Pharmaceuticals, Inc., Metacrine, Inc. and Novartis Pharmaceuticals Corp.

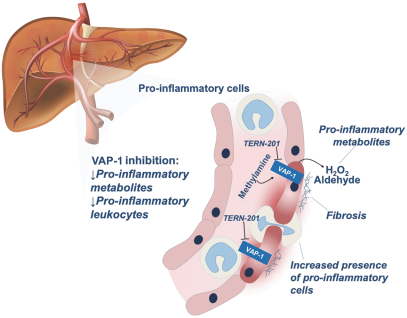

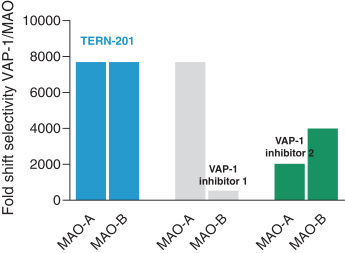

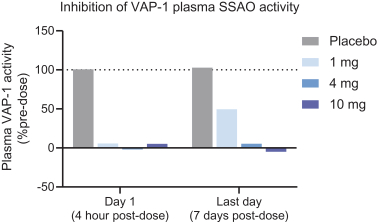

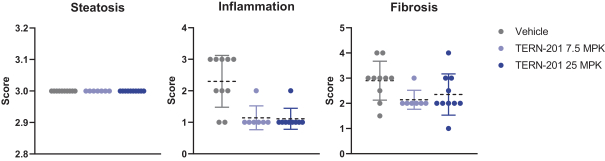

TERN-201, our VAP-1 inhibitor, is a relatively novel mechanism for the treatment of NASH, and thus has little competition we are aware of. The companies who are currently developing a SSAO/VAP-1 inhibitor with NASH as a lead indication are LG Chem Ltd. and Novo Nordisk A/S.

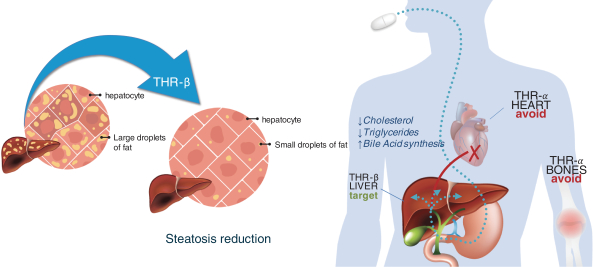

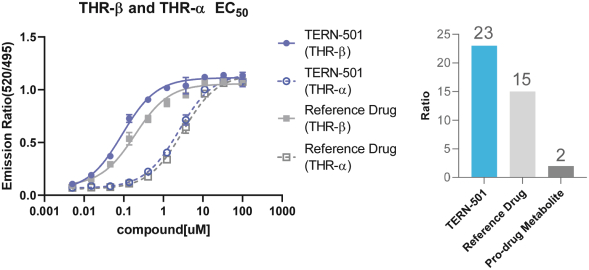

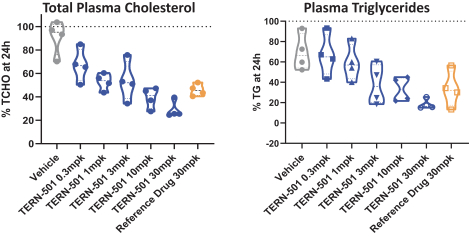

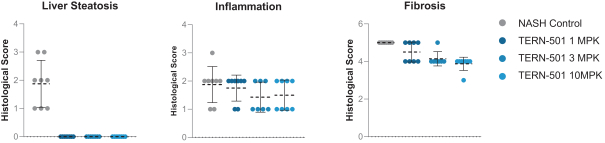

With regards to TERN-501, companies who are currently conducting clinical trials targeting THR-b in the context of NASH include Madrigal Pharmaceuticals, Inc. and Viking Therapeutics, Inc.

Furthermore, pharmaceutical and biotechnology companies who are developing clinical-stage drugs to treat NASH, using mechanisms not mentioned above, include 89Bio, Inc., Akero Therapeutics, Inc., Arrowhead Pharmaceuticals, Inc., Axcella Health, Inc., Carmot Therapeutics, Inc., Cirius Therapeutics, Inc., CohBar, Inc., Coherus Biosciences Inc., Corcept Therapeutics, Inc., CymaBay Therapeutics, Inc., Esperion Therapeutics, Inc., Galectin Therapeutics Inc., Galmed Pharmaceuticals Ltd., Hanmi Pharmaceutical Co., Ltd., Inventiva Pharma SA, Ionis Pharmaceuticals, Inc., MediciNova, Inc., NGM Biopharmaceuticals, Inc., NorthSea Therapeutics, Inc., Pliant Therapeutics, Inc., Poxel SA, Sagimet Biosciences, Inc. and T3D Therapeutics, Inc.

Many of our competitors have substantially greater financial, technical, human and other resources than we do and may be better equipped to develop, manufacture and market technologically superior products. In

128