UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2022

Or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from__________to__________

Commission File No. 001-40293

DIVERSEY HOLDINGS, LTD.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | |

| Cayman Islands | | | 2842 | | | Not applicable | |

| (State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification No.) | |

| | | | | | | | |

| 1300 Altura Road, Suite 125 | | | | | | 29708 | |

| Fort Mill, South Carolina | | | | | | | |

| (Address of registrant's principal executive offices) | | | | | | (Zip Code) | |

(803) 746-2200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Title of each class | | | Trading Symbol(s) | | | Name of each exchange on which registered | |

| | Ordinary Shares, par value $0.0001 per share | | | DSEY | | | The Nasdaq Stock Market LLC | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☒ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Aggregate market value of voting and non-voting common equity held by non-affiliates of registrant on June 30, 2022, the last business day of the Registrant’s most recently completed second fiscal quarter: $437,383,267, based on a closing price of registrant’s Ordinary Shares of $6.60 per share.

As of January 31, 2023, there were 324,576,615 shares of the registrant's Ordinary Shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

EXPLANATORY NOTE

Diversey Holdings, Ltd. (the “Company,” “our,” “us” or “we”) and its subsidiaries, collectively, is filing this Amendment No. 1 on Form 10-K/A (this “Amendment No. 1”) to our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “Form 10-K”), which was filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 17, 2023, to provide the information required by Part III of Form 10-K. This information was previously omitted from the Form 10-K in reliance on General Instruction G(3) to Form 10-K, which permits the information in Part III to be incorporated in the Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after end of our fiscal year. We are filing this Amendment No. 1 to include Part III information in our Form 10-K because we will not file a definitive proxy statement containing this information within 120 days after the end of the fiscal year covered by the Form 10-K. This Amendment No. 1 amends and restates in their entirety Items 10, 11, 12, 13 and 14 of Part III of the Form 10-K.

In addition, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 12b-15 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, updated certifications of the Company’s principal executive officer and principal financial officer are included as Exhibits 31.1, 31.2, 32.1 and 32.2 hereto.

No other changes have been made to the Form 10-K other than those described above. This Amendment No. 1 does not reflect subsequent events occurring after the original filing date of the Form 10-K or modify or update in any way the financial statements, consents or any other items disclosures made in the Form 10-K in any way other than as required to reflect the amendments discussed above. Accordingly, this Amendment No. 1 should be read in conjunction with the Form 10-K and the Company’s other filings with the SEC subsequent to the filing of the Form 10-K.

TABLE OF CONTENTS

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Set forth below is certain information regarding each of the Company’s current directors as of December 31, 2022, including the qualifications, experience and selected other biographical information for each director. Directors are elected annually to serve until their successors have been duly elected and qualified, or until the earliest to occur of his or her death, disability, resignation, retirement or removal.

| | | | | | | | | | | |

Class III Director: Term expiring 2024 | Eric J. Foss Chair of the Board Former Chair, President and Chief Executive Officer of Aramark

Biography Mr. Foss served as President and Chief Executive Officer of Aramark Corporation, a provider of food services, facilities management and uniform services, from May 2012 until his retirement in August 2019 and additionally as Chairman of the Board of Aramark beginning February 2015 until his retirement in August 2019. He served as Chief Executive Officer of Pepsi Beverages Company, a beverage manufacturer, seller and distributor and a division of PepsiCo, Inc., from 2010 until December 2011. He was the Chair and Chief Executive Officer of Pepsi Bottling Group, Inc. from 2008 until 2010; President and Chief Executive Officer from 2006 until 2008; and Chief Operating Officer from 2005 until 2006. He has served on the board of directors of Cigna Corporation, a healthcare and insurance company, since 2011, as chairman of the board of directors of Selina Hospitality PLC since October 2022 and on the board of directors of Primo Water Corporation since March 2023.

Mr. Foss received his Bachelor of Science in Marketing from Ball State University.

Skills, Qualifications and Experience Mr. Foss brings to our Board extensive experience in managing the operations of a global business, with risk management, strategic planning and transactions, technology and financial oversight. Having served as an executive in the food, beverage and service industries, Mr. Foss’s knowledge and background provides relevant insight into, and guidance on, Diversey’s key customer segments and growth initiatives. |

Age 64 | Director Since 2021 | Board Committees Nominating and Corporate Governance (Chair) People Resources | Other Director Positions Cigna Corporation (NYSE: CI) (2011-Present) Selina Hospitality PLC (NASDAQ; SLNA) (October 2022-Present) Primo Water Corporation (NYSE; PRMW) (2023-Present) Aramark (NYSE: ARMK) (2012-2019) |

| | | | | | | | | | | |

Class I Director: Term expiring 2025 | Emily Ashworth Partner of Bain Capital Private Equity

Biography Ms. Ashworth is a Partner of Bain Capital Private Equity, where she has worked since March 2021. Prior to joining Bain Capital Private Equity, Ms. Ashworth spent many years as a C-level technology leader in various public and private companies, including serving at American Water Works Company from 2007 to 2012, World Fuel Services from 2012 to 2014, ABB Optical Group, a distributor of contact lenses, from 2014 to September 2018 and as Chief Technology Officer – Portfolio Operations at Platinum Equity, a private equity firm, from October 2018, to March 2021.

Ms. Ashworth received her Bachelor’s degree in Industrial Engineering and in Liberal Studies from the University of Central Florida and Master of Industrial Engineering from the University of Tennessee.

Skills, Qualifications and Experience Ms. Ashworth brings to our Board extensive management experience in information technology strategy, risk and security as a former chief information officer and chief technology officer. |

Age 48 | Director Since 2022 | Board Committees N/A | Other Director Positions N/A |

| | | | | | | | | | | |

Class III Director: Term expiring 2024 | Selim Bassoul Chief Executive Officer and President of Six Flags Entertainment Corporation

Biography Mr. Bassoul has served as the Chief Executive Officer and President of Six Flags Entertainment Corporation since December 2021. He served as a Chair of their board of directors from February 2020 until November 2021 and continues to serve as director. Mr. Bassoul was the Chief Executive Officer and Chairman of the board of directors at The Middleby Corporation, a commercial and residential cooking and industrial process equipment company, from January 2001 until February 2019 and, since February 2019, Mr. Bassoul has served as a consultant to the board of directors at The Middleby Corporation. From October 2021 to November 2021, Mr. Bassoul also held the role of Director of 1847 Goedeker, Inc., an appliance company.

Mr. Bassoul received his Bachelor of Business Administration from the American University in Beirut and his Master of Business Administration from the Kellogg School of Management at Northwestern University.

Skills, Qualifications and Experience Mr. Bassoul brings to our Board extensive experience as a public company director and operational leader. Having served as an executive in the food service, Mr. Bassoul’s knowledge and background provides relevant insight into, and guidance on, one of Diversey’s key customer segments and growth initiatives, as well as overall commercial strategy. |

Age 66 | Director Since 2021 | Board Committees Audit People Resources | Other Director Positions The Middleby Corporation (NASDAQ: MID) (2001-2019) Goedeker, Inc. (NYSE Arca: GOED) (2021) Six Flags Entertainment Corporation (NYSE: SIX) (2021-Present) |

| | | | | | | | | | | |

Class II Director: Term expiring 2023 | Robert Farkas Partner of Bain Capital Private Equity

Biography Mr. Farkas is a Partner of Bain Capital Private Equity, L.P. where he has worked since September 2012. Prior to joining Bain Capital Private Equity, Mr. Farkas served as an Associate Principal with McKinsey & Company, a global management consulting firm from September 2007 to July 2012. Prior to McKinsey, he was a Product Design Engineer for Ford Motor Company from August 1999 to June 2005.

Mr. Farkas received his Bachelor of Science in Mechanical Engineering from the University of Rochester, Master of Science in Mechanical Engineering from the University of Michigan – Dearborn and Master of Business Administration from Harvard Business School.

Skills, Qualifications and Experience Mr. Farkas brings to our Board extensive experience in the industrial and healthcare sectors, strategy development, commercial excellence, and operational transformation, as well as his valuable perspective as a representative of our largest shareholder. |

Age 45 | Director Since 2021 | Board Committees N/A | Other Director Positions N/A |

| | | | | | | | | | | |

Class III Director: Term expiring 2024 | Juan R. Figuereo Former Executive Vice President and Chief Financial Officer of Revlon, Inc.

Biography Mr. Figuereo has been a Venture Partner in Ocean Azul Partners, an early stage venture capital fund, since January 2018. Mr. Figuereo currently serves as a director and chair of the audit committee at Decker Brands, a footwear, apparel, and accessories company, and Western Alliance Bancorp, a company providing banking and related services. In addition, Mr. Figuereo was a director and chair of the audit committee at PVH Corp., from 2011 to 2020. Previously, Mr. Figuereo served as the Executive Vice President and Chief Financial Officer of Revlon, Inc., a manufacturer and marketer of beauty and personal care products from April 2016 to June 2017. Prior to that, Mr. Figuereo served as Vice President and Chief Financial Officer of NII Holdings, Inc., Vice President and Chief Financial Officer of Newell Brands, Vice President and Chief Financial Officer of Primo Water Company, VP in charge of Mergers & Acquisitions at Walmart and in numerous executive financial roles and senior management positions at PepsiCo.

Mr. Figuereo received his Bachelor of Business Administration from Florida International University.

Skills, Qualifications and Experience Mr. Figuereo brings to our Board extensive extensive experience in finance and general management across several industry sectors, as well as his service as a public company director. |

Age 67 | Director Since 2021 | Board Committees Audit (Chair) Nominating and Corporate Governance | Other Director Positions PVH Corp. (NYSE: PVH) (2011-2020) Decker Brands (NYSE: DECK) (2020- Present) Western Alliance Bancorp (NYSE: WAL) (2020- Present) |

| | | | | | | | | | | |

Class I Director: Term expiring 2025 | Kenneth Hanau Partner of Bain Capital Private Equity

Biography Mr. Hanau has served as a Partner of Bain Capital Private Equity since December 2015 and leads Bain Capital Private Equity’s North American Industrial Vertical. Prior to that, Mr. Hanau served as the Managing Partner of the private equity business of 3i, a private equity firm, in North America and held senior positions with Weiss, Peck & Greer, an investment management firm, and Halyard Capital, a private equity firm. He also has served as a Director and Audit Committee Member of Imperial Dade, a distributor of foodservice packaging supplies since June 2019. Mr. Hanau has also served as a Director and Compensation Committee Member of US LBM Holdings, Inc., a building products distributor, since December, 2020. Mr. Hanau has served on the board of directors of Triton International Limited, a container leasing company, since July 2016. Mr. Hanau also previously worked in investment banking at Morgan Stanley and at K&H Corrugated Case Corporation, a family-owned packaging business.

Mr. Hanau received his Bachelor of Business Administration from Amherst College and Master of Business Administration from Harvard Business School. Mr. Hanau is a certified public accountant.

Skills, Qualifications and Experience Mr. Hanau brings to our Board over 25 years of experience investing in the industrial sector and is a valuable member of our Board because of his extensive experience in global and industrial markets, as a director of the Company and in the private equity industry analyzing, investing in and serving on the boards of directors of companies, as well as his perspective as a representative of our largest shareholder. |

Age 57 | Director Since 2020 | Board Committees N/A | Other Director Positions Triton International Limited (NYSE: TRTN) (2016-Present) Imperial Dade (2019-Present) US LBM Holdings, Inc. (NYSE: LBM) (2020-Present) |

| | | | | | | | | | | |

Class I Director: Term expiring 2025 | Rodney Hochman, M.D. President and Chief Executive Officer of Providence St. Joseph Health

Biography Dr. Hochman has been the President and Chief Executive Officer of Providence St. Joseph Health, a not-for profit health system since 2013. Dr. Hochman was the 2021 chair for the American Hospital Association (AHA), and past chair of the board of trustees for the Catholic Health Association. Dr. Hochman was awarded the 2020 Lifetime Achievement Award by the Puget Sound Business Journal and in 2019, the National Center for Hochman served as a clinical fellow in internal medicine at Harvard Medical School and Dartmouth Medical School. He is a Fellow of the American College of Physicians and a Fellow of the American College of Rheumatology.

Dr. Hochman received his Bachelor and Medical degree from Boston University.

Skills, Qualifications and Experience Dr. Hochman brings to our Board extensive experience in healthcare, which is one of the key customer segments in our infections prevention growth strategy, as well as in executive and leadership roles. |

Age 67 | Director Since 2021 | Board Committees Audit Nominating and Corporate Governance | Other Director Positions GE Healthcare (NASDAQ: CHG) (2022-Present) |

| | | | | | | | | | | |

Class II Director: Term expiring 2023 | Susan Levine Managing Director of Bain Capital Private Equity

Biography Ms. Levine has served as a Managing Director of Bain Capital Private Equity since January 2018 and has been with Bain Capital Private Equity since June 2006. Previously, Ms. Levine was a consultant with Bain & Company for eight years serving clients in the industrials, financial services and consumer areas. Since December 2019, Ms. Levine has also served as a director of TI Fluid Systems, a manufacturing company. She has also served as a director of Rocket Software, a software development firm since December 2021.

Ms. Levine received her Bachelor of Science in International Affairs and Spanish from Georgetown University, Master of Arts in Communications from the Annenberg School at the University of Pennsylvania and Master of Business Administration from Harvard Business School.

Skills, Qualifications and Experience Ms. Levine brings to our Board extensive experience working with companies in the consumer products and industrial sectors, supporting companies on organizational and talent priorities as the Head of Talent at Bain Capital, her service on the board of directors for a global public industrial company, as well as her perspective as a representative of our largest shareholder. |

Age 55 | Director Since 2021 | Board Committees N/A | Other Director Positions TI Fluid Systems (LSE: TIFS) (2019-Present) Rocket Software (NASDAQ: RCKT) (2021-Present) |

| | | | | | | | | | | |

Class II Director: Term expiring 2023 | Michel Plantevin Former Managing Director of Bain Capital Private Equity

Biography Mr. Plantevin has served as an independent consultant since January 2021. Mr. Plantevin served as a Managing Director of Bain Capital Private Equity from April 2003 to December 2020. Previously, Mr. Plantevin served as a Managing Director of Goldman Sachs International in London, initially in the Investment Banking division, then in the Merchant Banking division (PIA). Prior to Goldman Sachs, he was a consultant with Bain & Company in London and later led the Bain & Company Paris Office as a Managing Director.

Mr. Plantevin received his Master of Science in Engineering from CentraleSupelec and Master of Business Administration from Harvard Business School.

Skills, Qualifications and Experience Mr. Plantevin brings to our Board extensive industrial products and services, as a director of the Company, in the private equity and investment banking industry analyzing, investing in and serving on the boards of directors of companies, as well as his perspective as a representative of our largest shareholder. |

Age 66 | Director Since 2020 | Board Committees N/A | Other Director Positions N/A |

| | | | | | | | | | | |

Class I Director: Term expiring 2025 | Philip Wieland Chief Executive Officer

Biography Mr. Wieland joined the Company as interim Chief Executive Officer in January 2020 and became Chief Executive Officer in July 2020. He was interim Chief Financial Officer from June 2019 to January 2020. Prior to joining the Company, Mr. Wieland served as an operating partner at Bain Capital Private Equity from January 2017 to June 2020, during which time he also served in leadership roles on secondment at Wittur International Holding GmBH, an elevator component manufacturer and Zellis Limited, a payroll software company. Previously, Mr. Wieland served as the United Kingdom Chief Executive Officer of Brakes Group from January 2015 to December 2016 and Group Chief Financial Officer at Brakes Group from October 2011 to April 2016. Prior to that, Mr. Wieland held numerous executive roles within the foodservice and healthcare industries since 1999, including Group Chief Financial Officer of General Healthcare Group and in senior finance positions at BSkyB. Mr. Wieland is a qualified chartered accountant.

Mr. Wieland received his Bachelor’s in Mathematics from the University of Leeds in the United Kingdom.

Skills, Qualifications and Experience Mr. Wieland’s experience as Chief Executive Officer and as a director of the Company and his previous executive roles make him a valuable member of our Board. |

Age 49 | Director Since 2021 | Board Committees N/A | Other Director Positions N/A |

| | | | | | | | | | | |

Class II Director: Term expiring 2023 | Katherine S. Zanotti Former Chief Executive Officer of Arbonne International

Biography Ms. Zanotti previously served as Chief Executive Officer of Arbonne International, a skin care company, from 2009 until her retirement in March 2018. Ms. Zanotti also served as Chair of Natural Products Group (the holding company of Arbonne) from 2010 until March 2018. From 2002 to 2006, she served as Senior Vice President of Marketing at McDonald’s Corporation. Prior to joining McDonald’s, Ms. Zanotti was a Vice President at the Procter & Gamble Company where she served in a variety of roles including Vice President and General Manager of the North American pharmaceutical business. Ms. Zanotti currently serves as a director of Exact Sciences Corp, a provider of cancer screening and diagnostic tests and on the Board of Trustees of Xavier University. She previously served as a director of Hill-Rom Holdings, Inc., Mentor Corporation, Alberto Culver Company, Cutera, Inc., and Third Wave Technologies, Inc.

Ms. Zanotti received her Bachelor’s in Economic and Studio Fine Arts from Georgetown University and Master of Business Administration with a concentration in Marketing and Finance from Xavier University.

Skills, Qualifications and Experience Ms. Zanotti brings to our Board extensive executive, managerial and leadership experience, including many years in the pharmaceutical industry, as well as her business acumen and experience on the boards of directors of numerous companies. |

Age 68 | Director Since 2022 | Board Committees People Resources (Chair) Audit | Other Director Positions Exact Sciences Corp. (2009-Present) Cutera, Inc. (NASDAQ: CUTR) (2019-2022) Hill-Rom Holdings, Inc. (NYSE: HRC) (2009-2013) Mentor Corporation (OTCM: MNTR) (2007-2009) Alberto Culver Company (NYSE: ACV) (2006-2009) Third Wave Technologies (NASDAQ: TWTI) (2006-2008) |

Shareholder Director Nominations

A shareholder who wishes to recommend a prospective nominee for the Board at an annual general meeting of shareholders should notify the Boards' Secretary in writing in accordance with the requirements set forth in the Articles.

Commitment to Board Diversity

The Company, its Board, and each committee of the Board values diversity as a core principle. Accordingly, diversity of personal and professional experiences, opinions, perspectives, and backgrounds, including with respect to race, ethnicity, gender, age, cultural backgrounds, geographic origin, sexual identity, and gender orientation, is a continuing goal for our directors. Our Board currently has 11 members, 4 of whom are diverse, including 3 directors who are women.

The Board is committed to working with recruiters who provide a diverse slate of candidates so as to produce the best candidates and the best Board. We have adopted the “Rooney Rule,” which requires that the Nominating and Corporate Governance Committee (NCGC) and any search firm it engages include women and racially and ethnically diverse candidates in the pool from which the NCGC selects director candidates.

The Board Diversity Matrix below presents the Board’s diversity statistics in the format prescribed by applicable Nasdaq listing rules. We also recognize the value of other diverse attributes that individuals can bring to our Board, including for example, those who are of an ethnic heritage other than the categories shown below.

| | | | | | | | | | | | | | |

Board Diversity Matrix(1) |

| Total Number of Directors | 11 |

| Part I: Gender Identity | Female | Male | Non- Binary | Did Not Disclose Gender |

| Directors | 3 (2) | 8 (9) | 0 | 0 |

| Part II: Demographic Background | | | | |

| African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 3 (2) | 7 (8) | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 1 | 0 | 0 |

| LGBTQ+ | 0 |

| Did Not Disclose Demographic Background | 0 |

(1) The numbers in parentheses represent the Company’s prior year diversity statistics.

Code of Conduct and Code of Ethics for Senior Financial Officers

We have adopted a Code of Conduct for all employees, directors and officers and a Code of Ethics for Senior Financial Officers, specifically focusing on our Chief Executive Office (CEO), Chief Financial Officer, Chief Accounting Officer, Vice President of Tax, Vice President of Treasury and Vice President of Internal Audit. Our Code of Conduct and Code of Ethics for Senior Financial Officers are available on our website at www.diversey.com, in the “Governance” tab under the “Investor Relations” section and are available in print to any shareholder by downloading from our website. These materials are also available in print to any shareholder upon request. The Board or a Committee of the Board shall consider any request by a person for a waiver or any amendment to the Code of Ethics for Senior Financial Officers or the Code of Conduct. All such waivers or amendments shall be disclosed promptly as required by law, rule or regulation. In 2022, the Company did not approve any waivers to the Code of Ethics for Senior Financial Officers or the Code of Conduct, and the Company made no public disclosure of any waivers of the Code of Conduct or Code of Ethics for Senior Financial Officers approved by the Company. If the Company amends or waives the Code of Conduct or Code of Ethics for Senior Financial Officers, it will post the amendment or waiver at the same location on its website.

Committees of the Board

During 2022, the Board had standing Audit, People Resources and Nominating and Corporate Governance Committees. The charter of each Committee is available on our website at www.diversey.com, in the “Governance” tab under the “Investor Relations” section of our website.

The table below shows the Board Committee membership of each director.

| | | | | | | | | | | |

| Board Member | Audit Committee | People Resources Committee | Nominating & Corporate Governance Committee |

Emily Ashworth Operating Partner of Bain Capital Private Equity, LP | | | |

| | | | | | | | | | | |

Selim Bassoul Chief Executive Officer and President of Six Flags Entertainment Corporation | ✓ | ✓ | |

Robert Farkas Operating Partner of Bain Capital Private Equity, LP | | | |

Juan Figuereo Former Executive Vice President and Chief Financial Officer of Revlon, Inc. | Chair | | ✓ |

Eric Foss Former Chairman, President and Chief Executive Officer of Aramark Corporation | | ✓ | Chair |

Kenneth Hanau Managing Director of Bain Capital Private Equity, LP | | | |

Rodney Hochman, M.D. President and Chief Executive Officer of Providence St. Joseph Health | ✓ | | ✓ |

Susan Levine Managing Director of Bain Capital Private Equity, LP | | | |

Michel Plantevin Former Managing Director of Bain Capital Private Equity, LP | | | |

Philip Wieland Chief Executive Officer of Diversey | | | |

Katherine S. Zanotti Former Chief Executive Officer of Arbonne International | ✓ | Chair | |

Audit Committee

Our Audit Committee is composed of Mr. Bassoul, Mr. Figuereo, Ms. Zanotti and Dr. Hochman, with Mr. Figuereo serving as chair of the Committee. We comply with the audit committee requirements of the SEC and Nasdaq on audit committee member independence. Our Board has determined that each of Mr. Bassoul, Mr. Figuereo, Ms. Zanotti and Dr. Hochman meet the independence requirements of Rule 10A-3 under the Exchange Act and the applicable listing standards of Nasdaq. The Board has also determined that Mr. Figuereo is an “audit committee financial expert” within the meaning of SEC regulations and applicable listing standards of Nasdaq. During 2022, the Audit Committee met seven times.

| | | | | |

| Responsibilities of the Audit Committee |

| Appoint, approve the compensation of, and assess the qualifications, performance and independence of, our independent registered public accounting firm | Pre-approve audit and permissible non-audit services, and the terms of such services, to be provided by our independent registered public accounting firm, and review the conduct and results of the audit |

| Review and discuss with management the risks faced by the Company and the policies, guidelines and process by which management assesses and manages the Company’s risks, including the Company’s major financial risk exposures and cybersecurity risks and the steps management has taken to monitor and control such exposures | Review on a quarterly basis all ethics hotline submissions to determine the appropriate response and recommend policy and process changes |

| Review the adequacy and effectiveness of our internal controls over financial reporting and disclosures | Approve and review the functions of the Company’s internal audit department, and review the scope and performance of the department’s internal audit plan, including the results of any internal audits and any remedial actions |

| Establish policies and procedures for the receipt and retention of accounting-related complaints and concerns | Recommend, based upon the Audit Committee’s review and discussions with management and the independent registered public accounting firm, whether our audited financial statements shall be included in our annual report on Form 10-K |

| | | | | |

| Monitor our compliance with legal and regulatory requirements as they relate to our financial statements and accounting matters and overseeing the Company’s policies, procedures and programs designed to promote and monitor legal and regulatory compliance and sustainability | Prepare the Audit Committee report required by the rules of the SEC to be included in our annual proxy statement |

| Review all related party transactions for potential conflict of interest situations and approving all appropriate transactions | |

People Resources Committee

Our People Resources Committee is composed of Ms. Zanotti, Mr. Bassoul and Mr. Foss, with Ms. Zanotti serving as chair of the Committee. Each member of our People Resources Committee is independent under Nasdaq independence standards and independent of Bain Capital our majority shareholder. During 2022, the People Resources Committee met seven times.

| | | | | |

| Responsibilities of the People Resources Committee |

| Annually review and approve corporate and objectives relevant to the compensation of our CEO | Evaluate the performance of our CEO against our corporate goals and objectives and determine and approve the compensation of our CEO |

| Review and approve the compensation of our other executive officers | Appoint, compensate and oversee the work of any compensation consultant, legal counsel or other advisor retained by the People Resources Committee |

| Conduct the independence assessment outlined in Nasdaq rules with respect to any compensation consultant, legal counsel or other advisor retained by the People Resources Committee | Annually review and reassess the adequacy of the committee charter |

| Review and establish our overall management compensation, as well as compensation philosophy and policy | Oversee and administer our compensation and similar plans, including benefits programs |

| Review and make recommendations to our Board with respect to director compensation | Review significant human resources policies |

| Review and monitor corporate DE&I programs | Oversee any advisory votes on executive compensation and the frequency of such advisory votes and review the results of such advisory votes and whether to make any adjustments as a result of such votes |

| Review and discuss with management and preparing and recommending for approval the compensation discussion and analysis to be included in our annual proxy statement or annual report on Form 10-K | Prepare the People Resources Committee report to be included in our annual proxy statement |

In 2022, our People Resources Committee retained a compensation consultant, Mercer US LLC (Mercer), a wholly-owned subsidiary of Marsh & McLennan Companies, Inc. (MMC), to provide advice and recommendations on the Company’s executive compensation programs, including on the following topics:

•2022 year-end compensation decision support;

•Revalidation of peer group and competitive market evaluation for executive compensation;

•Review of annual and long-term incentive plans and pay-for-performance analysis; and

•Compensation discussion and analysis drafting assistance.

Until June 2022, the Company retained Marsh, a wholly-owned subsidiary of MMC, to provide insurance brokerage advice related to Marine and Cargo insurance and Property/All Risk insurance. The Company did not make any direct payments, as Marsh’s fees were compensated directly by the insurance companies through a commission arrangement.

The People Resources Committee has implemented policies and procedures to ensure that the advice it receives from the individual executive compensation consultant is objective and not influenced by Mercer’s or its affiliates’ relationships with the Company.

In advising the People Resources Committee, it is necessary for the consultant to interact with management to gather information, but the People Resources Committee may exercise its discretion in determining if and when the consultant’s advice and recommendations to the Committee can be shared with management.

Nominating and Corporate Governance Committee

Our NCGC is composed of Mr. Foss, Mr. Figuereo and Dr. Hochman, with Mr. Foss serving as chair of the committee. Each member of our NCGC is independent under Nasdaq independence standards and independent of Bain Capital our majority shareholder. During 2022, the NCGC met five times. The NCGC’s responsibilities include:

| | | | | |

| Responsibilities of the Nominating and Corporate Governance Committee |

| Develop the criteria for the requisite skills and characteristics of new Boards members as well as the composition of the Board as a whole | Recommend to the Board director nominees for election or reelection at each annual general meeting of shareholders |

| Recommend to the Board candidates to serve as members and chairpersons of each of the Board's committees | Review any director resignation letter tendered in accordance with the Articles and evaluate and recommend to the Board whether such resignation should be accepted |

| Monitor the Company's social responsibility and environmental sustainability policies and performance and review the Company's sustainability report | Oversee and make recommendations to the Board regarding the Company's political and charitable contributions |

| Propose to the Board director candidates to fill vacancies on the Board or Board committees in the event of a director's resignation, death or retirement, a change in Board or committee composition requirements, or the expansion of the Board of any committee thereof | Periodically review and, if desirable, recommend to the Board changes in the number, responsibilities and membership pf the Board committees |

| Review the appropriateness of a director's continued Board and committee membership in light of any change in the director's employment, relationship with the Company or any other changed circumstance that could affect the director's independence, qualifications or availability | Annually review and reassess the adequacy of the committee charter |

| Evaluate and make recommendations to the Board regarding shareholder proposals | Administer annual performance evaluations of the Board and its committees, including a review of this committee by its members and present the evaluation to the Board |

Executive Officers

The persons listed in the following table are our current executive officers. Officers are elected annually. There is no family relationship among any of the directors or executive officers and no executive officer has been involved during the past ten years in any legal proceedings described in applicable Securities and Exchange Commission regulations.

| | | | | | | | |

| Executive Officer | Age | Title |

| Philip Wieland | 49 | Chief Executive Officer and Director |

| Somer Gundogdu | 53 | President, Emerging Markets |

| Todd Herndon | 57 | Chief Financial Officer |

| Sinéad Kwant | 50 | President, Western Europe |

| Tracy Long | 44 | President, North America |

| | | | | | | | |

| Gaetano Redaelli | 61 | Chief Strategic Development Officer |

| Rudolf Verheul | 60 | Global President, Food & Beverage |

Mr. Wieland: For biographical information for Mr. Wieland, see the section headed “Our Board of Directors.”

Mr. Gundogdu has most recently served as Diversey’s President, Emerging Markets since September 2020. Prior to that, Mr. Gundogdu served as Diversey’s President of Global Accounts and the Taski® products line from June 2019 and September 2020 and President, Europe, Middle East and Africa from October 2018 and June 2019. Previously, Mr. Gundogdu served as President of Sealed Air Corporation’s and then Diversey’s Middle East and Africa region from April 2015 to September 2018. Mr. Gundogdu spent over 25 years with S.C. Johnson & Son, Inc., Unilever PLC, Sealed Air Corporation and Diversey in a variety of increasingly senior leadership roles in R&D, supply chain, marketing, corporate account management and general management. Mr. Gundogdu holds a Bachelor of Science degree in Chemical Engineering from Boĝazici University in Istanbul, Turkey and a Master of Business Administration from Virginia Tech.

Mr. Herndon joined Diversey as Chief Financial Officer in November 2019. Previously, Mr. Herndon served as Chief Financial Officer for Gardner Denver (now Ingersoll Rand Inc.), a manufacturing company, from November 2015 to February 2019. Prior to that, he served three years as Chief Financial Officer for Capital Safety (now a part of 3M Company) and before that spent 23 years with S.C. Johnson & Son, Inc., S.C. Johnson Commercial Markets, Inc. and Diversey in various financial and general management roles. He holds a bachelor’s degree from Indiana University and a Master of Business Administration from Marquette University.

Ms. Kwant joined Diversey as President, Western Europe in September 2020. Ms. Kwant joined Diversey from Royal Philips N.V., a health technology company, where, until her departure in August 2020, she worked for 13 years in increasingly senior executive roles culminating in her role as Executive Vice President, CEO of Philips’ Health & Wellness Business Group. She holds a Bachelor of Arts degree in International Marketing, German and French from Dublin City University in Ireland and a post graduate diploma in International Business from Tilburg University in The Netherlands.

Ms. Long joined Diversey as President, North America in May 2022. Ms. Long joined Diversey from Johnson Controls International Plc, a heating, ventilation and air conditioning company, where she worked for 12 years in increasingly senior executive roles, beginning in global product management and marketing to global business group management. Her final role at Johnson Controls was as vice president of Fire Installation & Service for Building Solutions, North America. Ms. Long holds a Bachelor of Arts degree in Social Studies from Harvard University and a Master of Business Administration from the Stanford Graduate School of Business.

Mr. Redaelli has served as Chief Strategic Development Officer since September 2020 (and also as Interim President of the Greater China region from September 2020 through December 2020). Since joining the Company in 1988, Mr. Redaelli has held a variety of roles in regional and global sales, marketing, corporate account management, strategic planning and performance management, primarily in the food and beverage market. Prior to his current role, Mr. Redaelli served as the President of the European division and as Global President of the Professional division. Earlier in his career, Mr. Redaelli led global marketing, strategic planning and business operations as the Global Vice President of Food & Beverage from January 2015 to August 2017, and served as managing director for our Italy and United Kingdom & Ireland businesses. Mr. Redaelli holds a Master’s degree in Marketing from Cranfield University in the United Kingdom and a Doctorate in Food Science from Università degli Studi di Milano in Italy.

Mr. Verheul has served as the global President of our Food & Beverage division since October 2018, where he leads the Company’s global food and beverage market sector. Since joining the Company in 1986, Mr. Verheul has held a variety of professional and food and beverage roles in research, development, innovation, portfolio management and marketing. Previously, Mr. Verheul served as our global Vice President of Food & Beverage and Vice President of Food and Beverage, Europe. Mr. Verheul holds a Master’s degree in Physical and Colloid Chemistry from the University of Utrecht in the Netherlands and Master’s degree in Chemical Technology from the University of Amsterdam in the Netherlands.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors and executive officers and persons who beneficially own more than 10% of our ordinary shares to file initial reports of ownership and changes in ownership with the SEC. The reporting directors, officers, and 10% shareholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) reports they file. To the Company’s knowledge, based solely on a review of copies of such reports furnished to Diversey and on written representations made by its directors and such covered officers, the Company believes that all of the Company’s directors and executive officers have complied with all Section 16(a) filing requirements with respect to 2022 except for one late Form 3 filed by Tracy Long reporting initial ownership information. The failure to timely file Ms. Long’s Form 3 resulted from delays in obtaining filing access codes for Ms. Long.

Hedging and Pledging and Other Prohibited Transactions

Our insider trading policy (Insider Trading Policy) governs trading by our insiders, including Board members, officers, employees, contractors and consultants who have access to material non-public information. The Insider Trading Policy requires pre-clearance of transactions involving Company securities by certain insiders and prohibits insiders from trading (or tipping others to trade) in Company securities on the basis of material, non-public information, in each case other than Bain Capital Private Equity and any of its affiliated investment funds.

Our Insider Trading Policy also prohibits all employees from engaging in hedging or short sale transactions involving Company securities and transactions in put or call options or other derivative securities on any exchange or other organized market, such as prepaid variable forwards, equity swaps, collars and exchange funds. Our employees are also prohibited from holding Company securities in margin accounts or pledging Company shares as collateral for a loan. In addition, our employees are discouraged from placing standing or limit orders of Company securities.

In December 2022, members of our Senior Leadership Team were able to enter into pre-arranged Rule 10b5-1 trading plans established when they were not aware of any material, nonpublic information. These plans allow them to engage in transactions in Company shares over a predefined period of time even if they are aware of material, nonpublic information during the transaction period.

ITEM 11. EXECUTIVE COMPENSATION.

People Resources Committee Report (Compensation Committee Report)

The People Resources Committee has reviewed and discussed the following CD&A of the Company with management. Based on their review and discussion, the People Resources Committee recommended to the Board, and the Board has approved, the inclusion of the CD&A in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022. This report is provided by the following independent directors, who comprise the People Resources Committee:

Katherine Zanotti (Chair)

Selim Bassoul

Eric Foss

Dated: April 25, 2023

Compensation Discussion and Analysis

Our NEOs

The table below shows each of our NEOs:

| | | | | | | | |

| Named Executive Officer | Title |

| Philip Wieland | Chief Executive Officer and Director |

| Todd Herndon | Chief Financial Officer |

| Sinéad Kwant | President, Western Europe |

| Gaetano Redaelli | Chief Strategic Development Officer |

| Rudolf Verheul | Global President, Food & Beverage |

Executive Summary

Our compensation philosophy is to align our executive compensation with the interests of our shareholders by ensuring our compensation decisions align with financial objectives that have a significant impact on shareholder value. The following various components of our executive compensation program are designed to achieve this:

| | | | | |

• “Pay-for-performance,” with a significant portion of total compensation tied to achieving our short- and long-term financial and strategic goals.

| • Foster entrepreneurship at all levels of the organization with a focus on employee value and retention by making long-term equity-based incentive opportunities a substantial component of our executive compensation.

|

• The appropriate level for each compensation component is based in part, but not exclusively, on internal equity and consistency, experience and responsibilities, as well as other relevant considerations, such as rewarding extraordinary performance and leadership qualities. | • Hire, engage and retain talented and experienced executives who are motivated to achieve or exceed our short- and long-term corporate goals and who feel true ownership for our success year over year. |

2022 Performance Highlights

Throughout 2022, we delivered strong results driven by high customer retention, new business wins and accelerating pricing. We executed well even while operating in an unprecedented environment with underlying results impacted by supply chain challenges, continued rising inflation, the war in Ukraine, and the effect of currency exchange rates associated with a strengthening U.S. dollar. We are pricing for inflation and once the current challenges recede, we expect to see revenue and margins improve and accelerate. Diversey continues to be encouraged by the resiliency of the core business and the ability to grow while implementing pricing actions reflective of the inflationary environment. The macro background is unpredictable and the volatility in global exchange rates continues to impact the Company's strong execution.

Financial Performance

Consolidated revenues improved by approximately 4% as compared to the prior year and over 15% on a constant currency basis, with:

◦Food & Beverage increasing 27% over prior year

◦Base Institutional increasing 11% over prior year

◦Revenue growing more than 11% from pricing

•We improved our Adjusted EBITDA margins from quarter-to-quarter in 2022 with our fourth quarter margins improved by 90 basis points as compared to the third quarter and 420 basis points above the first quarter of 2022, reflecting the continued maturity of pricing actions and significant efforts to manage costs in a challenging operating environment.

•In the face of significant increases in input costs, we implemented price increases across our various geographies and products. For the full year 2022, we realized more than 11% revenue growth from pricing.

•We improved our adjusted EBITDA margins from quarter-to-quarter with our fourth quarter margins of 13.3% improved by 420 basis points above the first quarter of 2022 reflecting the continued maturity of pricing actions and significant efforts to manage costs in a challenging operating environment.

•We continue to experience high customer win rates for new business, and our water treatment products are further expanding our organic growth. Our revenue of $211 million in the quarter is a 13.9% increase over the comparable prior year quarter and a 27% increase on a currency-adjusted basis.

We encourage you to review our 2022 Annual Report. Adjusted EBITDA is not determined in accordance with accounting principles generally accepted in the United States (GAAP) and should not be viewed as a substitute for the most directly comparable GAAP financial measure, net income (loss) before income tax provision (benefit). Net income (loss) before income tax provision (benefit) was $(149.5) million for the year ended December 31, 2022. Additional information regarding our use of non-GAAP financial measures and reconciliations to the most directly

comparable GAAP financial measure can be found in "APPENDIX A - Reconciliation of Non-GAAP Financial Measures" below.

2022 Pay and Performance

Given we did not meet our Adjusted EBITDA target under the 2022 AIP, our senior leadership team, including our NEOs, did not receive a payout. However, the People Resources Committee approved a discretionary award to Ms. Kwant in the form of RSUs to recognize the strong performance of the Western Europe Region during these unprecedented market challenges.

Further details are included in the “2022 AIP Performance Metrics” section below.

Compensation Philosophy

Our compensation philosophy is to align our executive compensation program with the interests of our shareholders by ensuring our compensation decisions align with financial objectives that have a significant impact on shareholder value. The various components of our executive compensation program are designed to emphasize “pay-for-performance,” with a significant portion of total compensation tied to achieving our short- and long-term financial and strategic goals. Our compensation philosophy is also designed to foster entrepreneurship at all levels of the organization and is focused on employee value and retention by making long-term equity-based incentive opportunities a substantial component of our executive compensation. The appropriate level for each compensation component is based in part, but not exclusively, on internal equity and consistency, experience and responsibilities, as well as other relevant considerations, such as rewarding extraordinary performance and leadership qualities.

Another important goal of our executive compensation program is to help us hire, engage and retain talented and experienced executives who are motivated to achieve or exceed our short- and long-term corporate goals and who feel true ownership for our success year over year. Our executive compensation program is designed to reinforce a strong pay-for-performance alignment and serve the following purposes:

•Reward our NEOs for sustained financial and operating performance and strong leadership;

•Align our NEOs’ interests with the interests of our shareholders; and

•Encourage our successful NEOs to remain with us for the long term.

We further seek to ensure that each NEO’s base salary and short-term target annual incentive opportunity are competitive with the market, while maintaining an emphasis on variable pay, in order to appropriately retain and reward our NEOs for their commitment to us and for their achievements on our behalf. We believe that both the design of our executive compensation program and our compensation practices support our compensation philosophy.

In 2022, our People Resources Committee retained Mercer to assist with compensation topics, such as policy design, executive compensation benchmarking, and assistance with the CD&A.

In addition to the overall compensation structure, the Company employs the following best pay practices which reflect our compensation philosophy:

| | | | | |

| What We Do | What We Don’t Do |

✓ Link executive pay to Company performance through our annual and long-term incentive plans | 🗴 Permit hedging or pledging by executives or directors of equity holdings |

✓ Balance among short- and long-term incentives, cash and equity and fixed and variable pay | 🗴 Re-price underwater share options |

✓ Compare executive compensation and Company performance to relevant peer group companies | 🗴 Adopt pay policies or practices that pose material adverse risk to the Company |

✓ Maintain a compensation Clawback Policy to recapture unearned incentive pay | 🗴 Use an aspirational peer group of significantly larger companies |

✓ Maintain minimum shareholding requirements for our directors and senior executives | 🗴 Grant in-the-money share options with an exercise price below the fair market value of an ordinary share on the grant date |

| | | | | |

✓ Use multiple types of equity awards to balance risk/reward | 🗴 Guarantee a minimum level of vesting for long-term incentives |

✓ Maintain overlapping performance periods for long-term incentives | 🗴 Provide excessive perquisites |

✓ Cap short-term incentives at 200% of target | |

✓ Retain an independent compensation consultant | |

Say on Pay and Shareholder Engagement

The People Resources Committee believes that our executive compensation program is consistent with our pay-for-performance philosophy and aligns the incentives for our executives with value creation for our shareholders. In 2022, the Company held a “say-on-pay” vote on the company’s executive compensation program as set forth in the proxy statement and 96.5% of shareholders voted “for” the proposal. When finalizing 2023 compensation, the People Resources Committee continued to apply the same principles and endorsed the 2022 "say-on-pay" vote in determining the amounts and types of executive compensation and did not implement substantial changes as a result of the shareholder advisory vote.

Our Compensation Process

Our executive compensation program includes base salaries, annual incentives and long-term equity-based incentives. Decisions with respect to increasing annual base salaries, setting target opportunities for annual incentives and determining long-term incentive award levels are made by our People Resources Committee and based on the individual’s role within the Company, duties and responsibilities, experience and performance and delivery of results.

The People Resources Committee is responsible for all determinations with respect to our executive compensation programs and the compensation of our NEOs. The People Resources Committee is composed entirely of independent directors as defined by our Corporate Governance Guidelines and Nasdaq listing standards. To set 2022 compensation, the People Resources Committee considered compensation provided by our peer group of companies in combination with general market compensation data, see the section headed “Compensation Benchmarking” below.

The People Resources Committee determines NEO compensation after consultation with the CEO and CHRO who provide insight and recommendations regarding compensation for all NEOs other than the CEO. Neither our CEO nor our CHRO participated in determining their own compensation.

Compensation Consultant

The People Resources Committee has the authority to retain, compensate and disengage an independent compensation consultant and any other advisors necessary to assist in its evaluation of executive compensation.

Mercer was engaged by the People Resources Committee in 2022 to provide recommendations for determining NEO compensation, including creating a peer group of companies, and to perform a competitive assessment of our executive compensation programs. In 2022, the People Resources Committee also retained Mercer to evaluate the compensation of our CEO, our other NEOs, and our other executives, and to develop and support the implementation of our compensation philosophy and programs as a public company and assist with compensation reporting requirements.

Compensation Benchmarking

In making compensation-related decisions, the People Resources Committee assesses whether compensation is competitive with the market. To set executive pay for 2022, the People Resources Committee established a peer group (Peer Group) to benchmark compensation, including base salaries, annual cash incentives and equity-based compensation. This benchmarking data was also used to assess total cash compensation (base salary and annual cash incentives) and total direct compensation (total cash compensation and total equity compensation). The selection criteria used to determine the composition of the Peer Group includes the following:

•Companies competing in the same talent market;

•Companies operating in similar industries, including specialty chemicals, environmental and facilities services, industrial machinery, specialized consumer services and diversified support services; and

•Companies of similar size, measured by revenue and market capitalization.

2021 and 2022 Peer Group

The 14 companies listed below form our 2021 and 2022 Peer Group and meet all or some of the above criteria. The Peer Group, supplemented by other sources of competitive pay information, was an important input in making post-IPO pay decisions for 2021 and establishing compensation levels and structure for 2022. The Peer Group companies shown below are US-based publicly-traded services or industrial companies ranging in size from $1.9 billion to $6.2 billion in annual revenue, and $1.3 billion to $21.6 billion in market capitalization as of December 31, 2021.

| | | | | |

| Peer Group Companies |

| ABM Industries Incorporated | Pentair plc |

| Clean Harbors, Inc. | Rollins, Inc. |

Covanta Holding Corporation (no longer public) | Stericycle, Inc. |

| Donaldson Company, Inc. | Terminix Global Holdings, Inc. |

| Harsco Corporation | Tetra Tech, Inc. |

| IDEX Corporation | UniFirst Corporation |

| Nordson Corporation | Xylem Inc. |

The table below shows the size of the Peer Group companies, measured by annual revenue and market capitalization, compared to the size of the Company as of December 31, 2021.

| | | | | | | | |

| Peer Group Comparison |

| Percentile Rank | Revenue ($ in millions) | Market Capitalization ($ in millions) |

75th Percentile | $3,775 | $15,346 |

50th Percentile | $2,599 | $6,400 |

25th Percentile | $2,122 | $3,665 |

| Diversey | $2,614 | $4,225 |

| Percentile Rank | 51% | 28% |

2023 Peer Group

The 17 companies listed below form our 2023 Peer Group and are used to set pay for 2023. The Peer Group companies shown below are US-based publicly-traded specialty chemical, industrial machinery and environmental and facilities services companies ranging in size from $1.9 billion to $7.1 billion in annual revenue, and $500 million to $19.9 billion in market capitalization as of December 31, 2022. The 2021/2022 peer group was modified in 2023 to remove ABM Industries Incorporated due to its increased size and Covanta Holding Corporation because it is no longer a public company. Also, five companies were added to provide a more robust peer group and to increase the focus on companies that sell a diverse profile of products directly to customers, participate in hygiene and health industries similar to Diversey and sell to customers in the US and abroad.

| | | | | |

| 2023 Peer Group Companies |

| Ashland Inc.* | Rollins, Inc. |

| Cabot Corporation* | RPM International Inc.* |

| Clean Harbors, Inc. | Stepan Company* |

| Donaldson Company, Inc. | Stericycle, Inc. |

| Harsco Corporation | Terminix Global Holdings, Inc. |

| H.B. Fuller Company* | Tetra Tech, Inc. |

| | | | | |

| IDEX Corporation | UniFirst Corporation |

| Nordson Corporation | Xylem Inc. |

| Pentair plc | |

* Indicates new companies added for the 2023 Peer Group.

Our Compensation Program

Our NEO compensation program is made up of three primary elements: base salary, annual cash incentive awards and long-term equity compensation. Annual cash incentive awards and long-term equity compensation represent the performance-based elements of our compensation program. The performance metrics for our annual cash incentive awards are set each year to align with our short-term financial and operational business goals. The performance metrics for our long-term equity compensation are also set each year to align with our long-term financial and operational business goals.

Pay Elements

| | | | | | | | |

| Pay Element | Objectives | Features |

| Base Salary | Provide a fixed level of cash compensation for performing day-to-day responsibilities | Targeted the median of the peer group with adjustments for individual performance |

| Annual Incentive Plan (AIP) | Reward short-term financial, operational and individual performance | Cash payments based on meeting Global Adjusted EBITDA, Global Free Cash Flow, and Global or Regional/ Operational Revenue |

| Long-Term Incentive Plan (LTIP) | Align management interests with those of shareholders, encourage retention and reward long-term Company performance | Granted 50% performance share units, 25% restricted share units and 25% share options |

The amount of each NEO’s annual cash incentive award for a performance period is intended to reflect the NEO’s relative contribution to the Company in achieving or exceeding our short-term goals. The amount of an NEO’s long-term incentive compensation is intended to reflect the NEO’s expected contribution to the Company in achieving our long-term goals of driving an increase in our overall equity value for our shareholders.

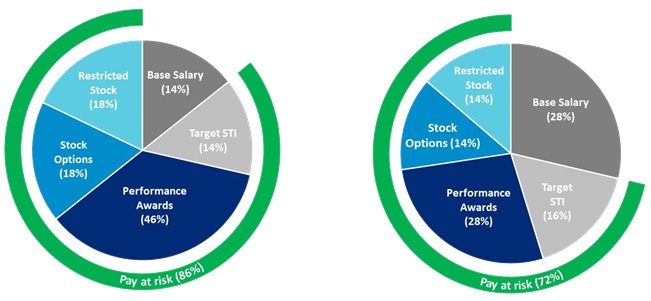

2022 Pay Mix

In 2022, the People Resources Committee considered the mix of pay for each NEO, including how much of target pay is cash versus non-cash, fixed versus variable and short- versus long-term and aligned with the interests of our shareholders. The following illustrations show the target mix of pay we delivered in 2022 to our CEO (86% at risk) and the average mix for each of our other NEOs (72% at risk).

CEO Average of Other NEOs

Base Salaries

We pay each of our NEOs a base salary based on the experience, skills, knowledge and responsibilities required of the individual and considering their working location. We believe base salaries are an important element in our overall compensation program as they provide a fixed element of compensation that reflects each NEO’s job responsibilities and value to us. The People Resources Committee has sole responsibility for determining a recommendation to the Board as to the base salary of our CEO. The People Resources Committee determines recommendations for the other NEOs’ base salaries after consultation with the CEO and the CHRO.

The People Resources Committee reviews our NEOs’ base salaries each year and, typically, base salary increases are determined based on the following factors: assumption of new responsibilities, relative importance of the position, individual performance and contributions and competitive marketplace. The base salary adjustments for Messrs. Redaelli and Verheul are based on the market analysis and are intended to more closely align their base salaries with the market. Base salaries are targeted at the median of our Peer Group based on data provided by our compensation consultant.

The table below shows each NEO’s annual base salary rates for 2021 and 2022 and the percentage change.

| | | | | | | | | | | |

| Named Executive Officer | 2021 Annual Base Salary Rate ($)(1) | 2022 Annual Base Salary Rate ($)(1) | % Change |

| Philip Wieland | 900,000 | 864,839(2) | (3.9) |

| Todd Herndon | 600,000 | 625,200 | 4.2 |

| Sinéad Kwant | 426,980 | 429,233(3) | 0.5 |

| Gaetano Redaelli | 391,571 | 402,143(4) | 2.7 |

| Rudolf Verheul | 360,921 | 362,837(5) | 0.5 |

(1) The 2021 and 2022 base salaries for each of Ms. Kwant and Messrs. Redaelli and Verheul were payable in Euros. The Euro denominated base salaries of each of Ms. Kwant and Messrs. Redaelli and Verheul were converted into U.S. dollars using the Bloomberg Euro to US$ FX rate of 0.9396 effective December 31, 2022.

(2) Mr. Wieland's annual base salary was unchanged between 2021 and 2022. Mr. Wieland’s 2022 base salary was paid in US$ for the period Jan 1 to May 31, 2022. Effective June 1, 2022, Mr. Wieland’s base salary of $900,000 was converted into GBP at the June 1, 2022 exchange rate of 0.799 GBP/US$. Following the conversion of Mr. Wieland’s base salary into GBP, his converted base salary of GBP 719,200 was paid in GBP through the remainder of 2022. The amounts of Mr. Wieland’s salary paid in GBP was converted into U.S. dollars using the Bloomberg GBP to US$ FX rate of 0.8316 effective December 31, 2022.

(3) Ms. Kwant received a 0.7% salary increase on April 1, 2022, increasing her base salary from €401,181 to €415,915.44.

(4) Mr. Redaelli received a 2.7% salary increase on April 1, 2022 from €367,920 to €377,853.

(5) Mr. Verheul received a 0.7% salary increase on April 1, 2022 from €339,120 to €352,819.

Annual Incentive Plan

We designed the Annual Incentive Plan for 2022 (2022 AIP) to incentivize our senior executives, including our NEOs, and other eligible employees to achieve our top business, financial and other goals. We re-evaluate the terms of our annual incentive plan each year, including target award opportunities, to ensure that we are adequately incentivizing our current objectives, which may change from year to year to reflect our primary areas of accountability and drive the right focus. Through our 2022 AIP, we provided short-term cash compensation that is at risk and subject to achievement of designated performance goals.

2022 AIP Target Opportunities

Each NEO’s 2022 AIP target opportunity was expressed as a percentage of the NEO’s base salary and varied based on the NEO’s position and level of responsibilities, as set forth in the table below. Based on performance achievement, the NEOs could earn between 0% and 200% of their 2022 AIP target opportunities.

| | | | | | | | | | | | | | | | | |

| Named Executive Officer | 2022 Base Salary Level ($)(1)(2) | 2022 AIP Target (% of Base Salary) | 2022 AIP Payout Range (% of 2021 AIP Target) | 2022 AIP Target Award ($)(3) | Actual 2022 AIP Award ($) |

| Philip Wieland | 864,839 | 100% | 0-200% | 864,839 | 0 |

| Todd Herndon | 625,200 | 80% | 0-200% | 500,160 | 0 |

| Sinéad Kwant | 442,652 | 60% | 0-200% | 265,591 | 0(4) |

| Gaetano Redaelli | 402,143 | 50% | 0-200% | 201,072 | 0 |

| Rudolf Verheul | 375,499 | 60% | 0-200% | 225,299 | 0 |

(1) Mr. Wieland's annual base salary is £719,200. The amount set forth in this table was converted from GBP to U.S. dollar using the using the Bloomberg GBP to US$ FX rate of 0.8316 effective December 31, 2022.

(2) The base salaries of Ms. Kwant and Messrs. Redaelli and Verheul are €415,915, €377,854 and €352,819, respectively. These amounts were converted into U.S. dollars using the Bloomberg Euro to US$ FX rate of 0.9396 effective December 31, 2022.

(3) Mr. Wieland’s AIP target award is payable in GBP. The amount set forth in this column was converted from GBP to U.S. dollar using the using the Bloomberg GBP to US$ FX rate of 0.8316 effective December 31, 2022. The AIP target awards of Ms. Kwant and Messrs. Redaelli and Verheul are payable in Euros. The amounts set forth in column for each of Ms. Kwant and Messrs. Redaelli and Verheul were converted into U.S. dollars using the Bloomberg Euro to US$ FX rate of 0.9396 effective December 31, 2022.

(4) The People Resources Committee approved a discretionary award to Ms. Kwant equal to 55% of her annual base salary values at $129,389 in the form of RSUs to recognize the strong performance of the Western Europe Region during these unprecedented market challenges. The RSUs will vest fully on January 1, 2024.

2022 AIP Performance Metrics

The People Resources Committee decided to continue to use Global Adjusted EBITDA and Global Free Cash Flow as metrics in the 2022 AIP and to add a revenue metric. The Global Revenue metric was added to reflect the importance of the Company’s growth ambition and pricing plans. The performance metrics that applied to the opportunities for our CEO, Chief Financial Officer and Chief Strategic Development Officer, Messrs. Wieland, Herndon and Redaelli, respectively, under the 2022 AIP are Global Adjusted EBITDA, Global Free Cash Flow, and Global Revenue. Mr. Redaelli participated in the same scheme as our CEO and Chief Financial Officer because of the global nature of his role. In addition, at the discretion of the Board, each NEO’s payout may be increased or decreased based on their individual performance on progressing our employee engagement, DE&I targets and ESG priorities.

The 2022 AIP for these three NEOs included the following three metrics:

•Adjusted EBITDA, which remains our primary metric to reflect our critical focus on increasing our margin and protecting the funding principle for the AIP pool.

•Global Free Cash Flow generation, which continues to be key in funding our growth investments.

•Global Revenue, which was introduced to reflect the importance of our growth ambition and pricing plans.

Our other NEOs, Ms. Kwant and Mr. Verheul, participated in a version of the 2022 AIP with greater regional/business unit focus. The AIP performance metrics for each of Ms. Kwant and Mr. Verheul had the same Global Adjusted EBITDA and Global Free Cash Flow targets as applied for the CEO, Chief Financial Officer and Chief Strategic Development Officer, but their revenue performance metrics were based on their specific responsibilities either regionally for Western Europe for Ms. Kwant or globally for Food & Beverage for Mr. Verheul.

Global EBITDA is the funding mechanism for the AIP pool, so if the EBITDA target is not met, the pool is reduced (and impacts the payout based on the other metrics) accordingly.

In 2022, the threshold performance levels were not achieved and the NEOs were not eligible to receive a payout under the AIP. However, the Board decided to award Ms. Kwant a discretionary award in the form of RSUs to recognize specific achievements in the Western Europe Region, as described in further detail on page 21 below.

| | | | | | | | |

| Why we use Global Free Cash Flow | Why we use Global Adjusted EBITDA* | Why we use Global and Regional/Operational Revenue |

| The Global Free Cash Flow metric is a useful indicator of the amount of cash the Company has to pursue opportunities that enhance shareholder value. It tracks our cash generation and is based on cash flow from operating activities less capital expenditures (including our dosing and dispensing equipment), and cash proceeds from the securitization program and sale of property and equipment and other assets, underscoring our progress on generating cash from operations, improving our balance sheet and the effective deployment of capital investments. | Global Adjusted EBITDA aligns with shareholder expectations and provides the best representation of our financial performance. Also, it is frequently used by analysts, investors and other interested parties in the evaluation of the financial performance of companies in our industry and as a useful means of measuring our ability to meet our debt service obligations. Adjusted EBITDA provides the best representation of how we are achieving results and managing our capital, with capital management supporting expansion in our operating margin. | The Global and Regional Revenue metrics reflects the importance our growth ambition and pricing plans. |

*Adjusted EBITDA consists of EBITDA adjusted to eliminate the following: (i) certain non-operating income or expense items, (ii) the impact of certain non-cash and other items that are included in net income and EBITDA that we do not consider indicative of our ongoing operating performance and (iii) certain unusual and non-recurring items impacting results in a particular period.

We encourage you to review our 2022 Annual Report. Adjusted EBITDA and Global Free Cash Flow are not determined in accordance with GAAP and should not be viewed as a substitute for the most directly comparable GAAP financial measures, net income (loss) before income tax provision (benefit) and cash provided by (used in) operating activities. Net income (loss) before income tax provision (benefit) and cash provided by (used in) operating activities were $(185.5) million and $33.7 million for the year ended December 31, 2022, respectively. Additional information regarding our use of non-GAAP financial measures and reconciliations to the most directly comparable GAAP financial measure can be found on Annex A below.

2022 AIP Performance Targets and Results

Threshold, target, maximum and actual performance, and performance as a percentage of target, for each performance goal (Global Adjusted EBITDA, Global Free Cash Flow and Global Revenue, for Messrs. Wieland, Herndon and Redaelli, and the Western Europe Region Revenue goal for Ms. Kwant and Food & Beverage Revenue goal for Mr. Verheul) are set forth in the table below:

| | | | | | | | | | | | | | | | | |

| ($ in millions) | Global Adjusted EBITDA (all NEOs | Global Free Cash Flow (all NEOs | Global Revenue (Wieland, Herndon and Redaelli) | Western Europe Region Revenue (Kwant) | Food & Beverage Revenue (Verheul) |

| Weighting | 50% | 25% | 25% | 25% | 25% |

| Threshold | $418 | $122 | $2,727 | $865 | $753 |

| Target | $440 | $135 | $2,871 | $911 | $793 |

| Maximum | $462 | $149 | $3,015 | $957 | $833 |

| Result | $330.1 | $(102.8) | $2,765.9 | $819.7 | $814.4 |

Weighted % of target | 0% | 0% | 7% | 0% | 38% |

2022 AIP Payouts

Based on 2022 performance, the calculated 2022 AIP award percentages for the NEOs are shown in the table below:

| | | | | | | | | | | | | | |

| Named Executive Officer | Target 2022 AIP Award (% of Base Salary) | Award Payout (as % of Target AIP Award) | Target Award ($) | Calculated Award ($) |

| Philip Wieland | 100% | 0.0% | 864,389 | 0 |

| Todd Herndon | 80% | 0.0% | 500,160 | 0 |

| Sinéad Kwant | 60% | 0.0% | 265,591 | 0 |

| Gaetano Redaelli | 50% | 0.0% | 201,072 | 0 |

| Rudolf Verheul | 60% | 0.0% | 225,299 | 0 |

Discretionary Award for Ms. Kwant: Western Europe Region