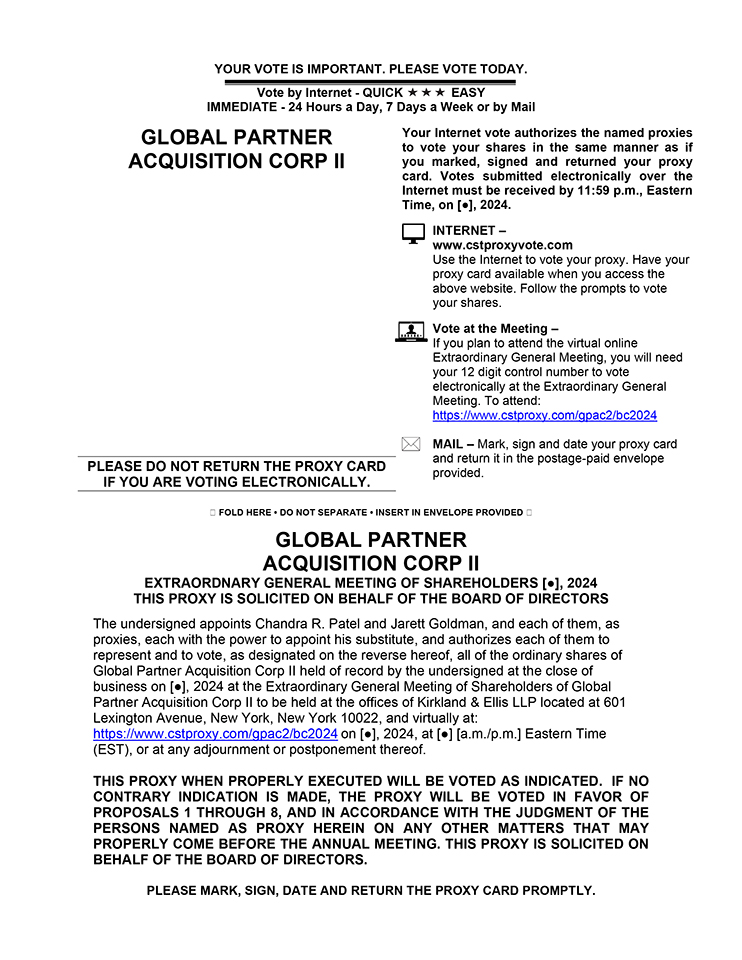

Important Notice Regarding the Internet Availability of Proxy Materials for the Extraordinary General Meeting of Shareholders The Proxy Statement and the Annual Report to Shareholders are available at: https://www.cstproxy.com/gpac2/bc2024 PROXY CARD THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE PROPOSALS. Please mark your votes like this 1. The Business Combination Proposal — To consider and vote upon a proposal, by ordinary resolution, to approve GPAC II’s entry into the Business Combination Agreement, dated as of November 21, 2023 (as amended, supplemented or otherwise modified from time to time, the “Business Combination Agreement”) by and among GPAC II, Strike Merger Sub I, Inc., a Delaware corporation and a direct wholly-owned subsidiary of GPAC II (“First Merger Sub”), Strike Merger Sub II, LLC, a Delaware limited liability company and a direct wholly-owned subsidiary of GPAC II (“Second Merger Sub” and together with First Merger Sub, the “Merger Subs”), and Stardust Power Inc., a Delaware corporation (“Stardust Power”), a copy of which is attached to the proxy statement/prospectus as Annex A, pursuant to which, among other things, following the de-registration of GPAC II as an exempted company in the Cayman Islands and the transfer by way of continuation to Delaware and domestication of GPAC II as a corporation in the State of Delaware (i) First Merger Sub will merge with and into Stardust Power (the “First Merger”), with Stardust Power being the surviving corporation of the First Merger; and (ii) immediately following the First Merger, Stardust Power will merge with and into Second Merger Sub (the “Second Merger” and, together with the First Merger, the “Mergers”), with Second Merger Sub being the Surviving Company of the Second Merger, and continuing as a direct, wholly owned subsidiary of GPAC II (together, the “Combined Company”), and the transactions contemplated thereby (collectively, the “Business Combination”). 2. The Domestication Proposal — To consider and vote upon a proposal, by special resolution, to approve that GPAC II be transferred by way of continuation to Delaware pursuant to Part XII of the Companies Act (As Revised) of the Cayman Islands and Section 388 of the General Corporation Law of the State of Delaware and, immediately upon being de-registered in the Cayman Islands, GPAC II be continued and domesticated as a corporation under the laws of the State of Delaware. 3. The Charter Proposal — To consider and vote upon a proposal, by special resolution, to approve that the amended and restated memorandum and articles of association of GPAC II currently in effect be amended and restated by the deletion in their entirety and the substitution in their place of the proposed new certificate of incorporation (the “Proposed Certificate of Incorporation”) (a copy of which is attached to the proxy statement/prospectus as Annex B), including, without limitation, the authorization of the change in authorized share capital as indicated therein. 4.The Advisory Governing Documents Proposals — To consider and vote upon on a non-binding advisory basis, the sub-proposals below, by ordinary resolutions, which are qualified by reference to the complete text of the Proposed Certificate of Incorporation and Proposed Bylaws, a copy of each of which is attached to this proxy statement/prospectus as Annex B and Annex C, respectively. All shareholders are encouraged to read the Proposed Certificate of Incorporation and Proposed Bylaws in their entirety for a more complete description of their terms: a. Changes to Authorized Share Capital — To consider and vote upon a proposal, by ordinary resolution, on an advisory nonbinding basis, to approve that the authorized share capital of GPAC II is increased from (i) 500,000,000 Class A ordinary shares, par value $0.0001 per share, 50,000,000 Class B ordinary shares, par value $0.0001 per share, and 5,000,000 preference shares, par value $0.0001 per share, to (ii) shares of common stock, par value $0.0001 per share, and shares of preferred stock, par value $0.0001 per share. b. Preferred Share Authorization — To consider and vote upon a proposal, by ordinary resolution, on an advisory nonbinding basis, to approve that the board of directors is authorized to issue any or all shares of preferred stock in one or more classes or series, with such terms and conditions as may be expressly determined by the board of directors and as may be permitted by the Delaware General Corporation Law. c. Exclusive Form — To consider and vote upon a proposal, by ordinary resolution, on an advisory nonbinding basis, to approve that the Court of Chancery of the State of Delaware will be the exclusive forum for certain shareholder litigation and the federal district courts of the United States of America will be the exclusive forum for resolving any complaint asserting a cause of action arising under the Securities Act of 1933, as amended, unless GPAC II consents in writing to the selection of an alternative forum. d. Annual and Extraordinary General Meeting Authorization — To consider and vote upon a proposal, by ordinary resolution, on an advisory nonbinding basis, to approve that any action required or permitted to be taken by the stockholders may be effected at a duly called annual or extraordinary general meeting of stockholders of GPAC II and, until such time that the Combined Company (as defined in the accompanying proxy statement/prospectus) is no longer a “Controlled Company” pursuant to Nasdaq Listing Rule 5615(c)(1), by any written consent by such stockholders. e.Director Removal—To consider and vote upon a proposal, by ordinary resolution, on an advisory nonbinding basis, to approve that, subject to the rights of holders of preferred stock and the terms of the Shareholder Agreement, any director or the entire board of directors may be removed from office at any time, but only for cause, and only by the affirmative vote of the holders of a two-thirds majority of the issued and outstanding capital stock of the Combined Company entitled to vote in the election of directors, voting together as a single class. f. Amendments to Proposed Certificate of Incorporation and Bylaws — To consider and vote upon a proposal, by ordinary resolution, on an advisory nonbinding basis, to approve that the proposed new certificate of incorporation may be amended by the stockholders in accordance with the voting standards set forth in [Article XI, Section 1] of the Proposed Certificate of Incorporation and the Proposed Bylaws may be amended by the stockholders in accordance with the voting standards set forth in [Article VII, Section 1] of the Proposed Certificate of Incorporation and [Article IX] of the Proposed Bylaws. g. Removal of Blank Check Company Provisions — To consider and vote upon a proposal, by ordinary resolution, on an advisory nonbinding basis, to approve the removal of provisions in GPAC II’s existing amended and restated memorandum and articles of association related to its status as a blank check company that will no longer apply upon the consummation of the Business Combination. 5. The Nasdaq Proposal — To consider and vote upon a proposal, by ordinary resolution, to approve, for the purposes of complying with the applicable provisions of 5635 of the Nasdaq Listing Rules, the issuance of shares of Combined Company Common Stock in connection with the Business Combination be approved. 6. The Equity Incentive Plan Proposal — To consider and vote upon a proposal, by ordinary resolution, to approve GPAC II’s adoption of the Stardust Power Inc. 2024 Equity Incentive Plan be approved, ratified and confirmed in all respects. A copy of the Stardust Power 2024 Plan is attached to the proxy statement/prospectus as Annex E. 7.The Director Election Proposal — To consider and vote upon a proposal, by ordinary resolution, to approve that effective as of the consummation of the Business Combination, each of , , , , , , and , be and hereby are elected as directors and serve on the Combined Company Board until the expiration of their respective terms and until their respective successors are duly elected and qualified.