Exhibit 99.2 INVIVYD Q2 2024 FINANCIAL RESULTS & BUSINESS HIGHLIGHTS August 14, 2024 © 2024 Invivyd, Inc. Invivyd , Pemgarda , and the Ribbon logos are trademarks of Invivyd, Inc. All trademarks in this presentation are the property of their respective owners.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Statements in this presentation that are not statements of historical fact are forward-looking statements. Words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “seek,” “could,” “intend,” “target,” “aim,” “project,” “designed to,” “estimate,” “believe,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, though not all forward-looking statements contain these identifying words. Forward-looking statements include statements concerning, among other things, PEMGARDA as a monoclonal antibody (mAb) for pre-exposure prophylaxis (PrEP) of COVID-19 in certain immunocompromised patients; our plans, strategies, goals and expectations related to the commercialization of PEMGARDA; potential evolution of PEMGARDA fact sheet; the future of the COVID-19 landscape, including the anticipated fall/winter respiratory virus season; our belief about the sufficiency of certain other COVID-19 therapies; our belief that mAbs may be critical for managing endemic virus over the long term; our expectations about the size of target patient populations and the potential market opportunity for our product candidates, as well as our market position; our research and clinical development efforts, including statements regarding initiation or completion of studies or trials, the time-frame during which results may become available, and the potential utility of generated data; our expectations regarding advancement of our pipeline and anticipated potential improved clinical and commercial profiles; our business strategies and objectives, and ability to execute on them; our future prospects; the company’s anticipated 2024 net product revenue and projected 2024 year-end cash position; and other statements that are not historical fact. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from the results described in or implied by the forward-looking statements, including, without limitation: how long the EUA granted by the FDA for PEMGARDA for COVID-19 PrEP in certain immunocompromised patients will remain in effect and whether such EUA is revoked or revised by the FDA; our ability to maintain and expand sales, marketing and distribution capabilities to successfully commercialize PEMGARDA; changes in expected or existing competition; whether we are able to successfully submit any future EUA request to the FDA, and the timing, scope and outcome of any such EUA request; uncertainties related to the regulatory authorization or approval process; changes in the regulatory environment; the timing, progress and results of our discovery, preclinical and clinical development activities; unexpected safety or efficacy data observed during preclinical studies or clinical trials; the ability to maintain a continued acceptable safety, tolerability and efficacy profile of PEMGARDA or any other product candidate following regulatory authorization or approval; the predictability of clinical success of our product candidates based on neutralizing activity in nonclinical studies; the risk that results of nonclinical studies or clinical trials may not be predictive of future results, and interim data are subject to further analysis; our reliance on third parties with respect to virus assay creation and product candidate testing and with respect to our clinical trials; potential variability in neutralizing activity of product candidates tested in different assays, such as pseudovirus assays and authentic assays; variability of results in models used to predict activity against SARS-CoV-2 variants; whether PEMGARDA or any other product candidate is able to demonstrate and sustain neutralizing activity against major SARS-CoV-2 variants, particularly in the face of viral evolution; the complexities of manufacturing mAb therapies; our dependence on third parties to manufacture, label, package, store and distribute clinical and commercial supplies of our product candidates; whether we can obtain and maintain third-party coverage and adequate reimbursement for PEMGARDA or any other product candidate; whether we are able to achieve improved clinical and commercial profiles with our product pipeline; any legal proceedings or investigations relating to the company; our ability to continue as a going concern; and whether we have adequate funding to meet future operating expenses and capital expenditure requirements. Other factors that may cause our actual results to differ materially from those expressed or implied in the forward-looking statements in this presentation are described under the heading “Risk Factors” in our most recent Annual Report on Form 10-K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (SEC), and in our other filings with the SEC, and in our future reports to be filed with the SEC and available at www.sec.gov. Forward-looking statements contained in this presentation are made as of this date, and we undertake no duty to update such information whether as a result of new information, future events or otherwise, except as required under applicable law. 2

u Executive Summary u Commercial Update Pipeline Virology Finance Q&A 3

A QUARTER OF BUSINESS PREPARATION, EVOLUTION & ACCELERATION • PEMGARDA uptake accelerating nicely after a slow start early in the quarter • Key respiratory disease season approaching; activation preparations underway • Pipeline offering improved clinical & commercial profile advancing • Ongoing evolution of in vitro virology, anticipated PEMGARDA Fact Sheet evolution, and future opportunities • CANOPY 180-day data anticipated to be released soon 4

IT’S 2024 AND YET… Approximately every 8 MINUTES, a person in the U.S. DIES with COVID-19* COVID-19=coronavirus disease 2019. *Calculation based on provisional CDC data (from Oct 1, 2023 start date of RESP-NET, through June 15, 2024, ~45,200 people in the U.S. died with COVID-19). Reference CDC. COVID Data Tracker. Accessed July 8, 2024. https://covid.cdc.gov/covid-data- tracker/#trends_weeklydeaths_select_00 5

THE VIRUS WILL NEVER GO AWAY 2021 2024 2022–2023 July 2, 2021 June 11, 2021 August 31, 2022 January 10, 2024 July 2, 2021 December 22, 2023 June 19, 2024 August 12, 2021 December 22, 2023 January 23, 2024 EVERY YEAR, THE SAME STORY: COVID-19 IS IN NONSTOP EVOLUTION COVID-19=coronavirus disease 2019. All trademarks and logos displayed are the property of their respective owners. Their use here is for identification purposes only and does not constitute endorsement or affiliation. Unauthorized use of these logos is strictly prohibited. 6

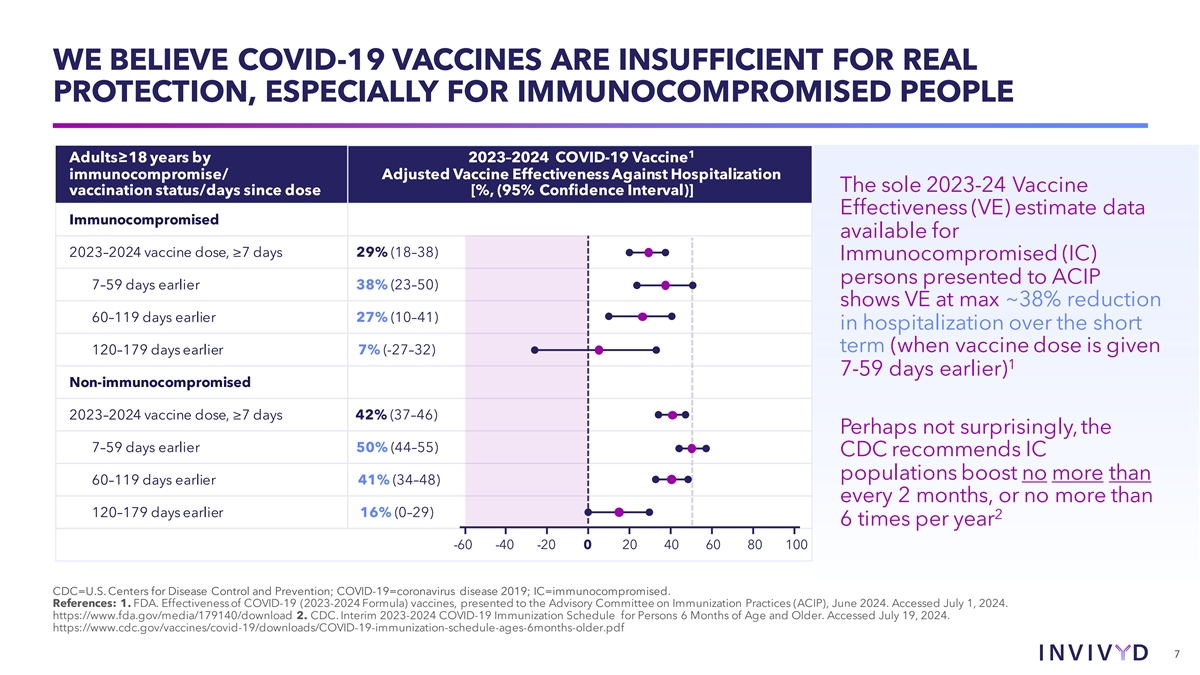

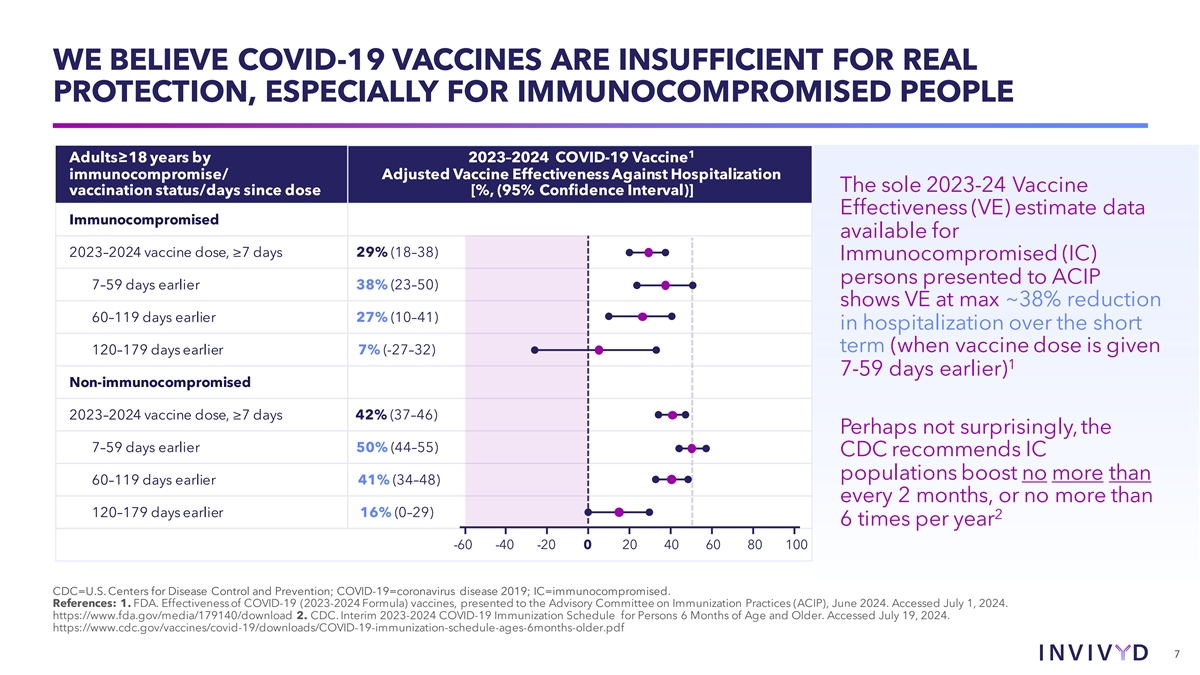

WE BELIEVE COVID-19 VACCINES ARE INSUFFICIENT FOR REAL PROTECTION, ESPECIALLY FOR IMMUNOCOMPROMISED PEOPLE 1 Adults≥18 years by 2023–2024 COVID-19 Vaccine immunocompromise/ Adjusted Vaccine Effectiveness Against Hospitalization The sole 2023-24 Vaccine vaccination status/days since dose [%, (95% Confidence Interval)] Effectiveness (VE) estimate data Immunocompromised available for 2023–2024 vaccine dose, ≥7 days 29% (18–38) Immunocompromised (IC) persons presented to ACIP 7–59 days earlier 38% (23–50) shows VE at max ~38% reduction 60–119 days earlier 27% (10–41) in hospitalization over the short term (when vaccine dose is given 120–179 days earlier 7% (-27–32) 1 7-59 days earlier) Non-immunocompromised 2023–2024 vaccine dose, ≥7 days 42% (37–46) Perhaps not surprisingly, the 7–59 days earlier 50% (44–55) CDC recommends IC populations boost no more than 60–119 days earlier 41% (34–48) every 2 months, or no more than 120–179 days earlier 16% (0–29) 2 6 times per year -60 -40 -20 0 20 40 60 80 100 CDC=U.S. Centers for Disease Control and Prevention; COVID-19=coronavirus disease 2019; IC=immunocompromised. References: 1. FDA. Effectiveness of COVID-19 (2023-2024 Formula) vaccines, presented to the Advisory Committee on Immunization Practices (ACIP), June 2024. Accessed July 1, 2024. https://www.fda.gov/media/179140/download 2. CDC. Interim 2023-2024 COVID-19 Immunization Schedule for Persons 6 Months of Age and Older. Accessed July 19, 2024. https://www.cdc.gov/vaccines/covid-19/downloads/COVID-19-immunization-schedule-ages-6months-older.pdf 7

WE BELIEVE MABS MAY BE CRITICAL FOR MANAGING ENDEMIC VIRUS OVER THE LONG TERM • COVID-19 disease remains a pervasive human health threat, with particular burden imposed on immunocompromised people. • Vaccinations, infections, and the associated immunologic imprinting have left humans with measurable baseline immune experience but continued risk and a potential benefit associated with increasing protective antibody titers • Upcoming CANOPY and Supernova (AZN) clinical trial results will yield important insights into the potential role of mAbs in immunologically experienced populations. We plan to leverage these insights, along with our work on VYD2311, to expand the scope of our business. References: FDA. Effectiveness of COVID-19 (2023-2024 Formula) vaccines, presented to the Advisory Committee on Immunization Practices (ACIP), June 2024. Accessed July 1, 2024., Invivyd data on file 8

u Executive Summary u Commercial Update Pipeline Virology Finance Q&A 9

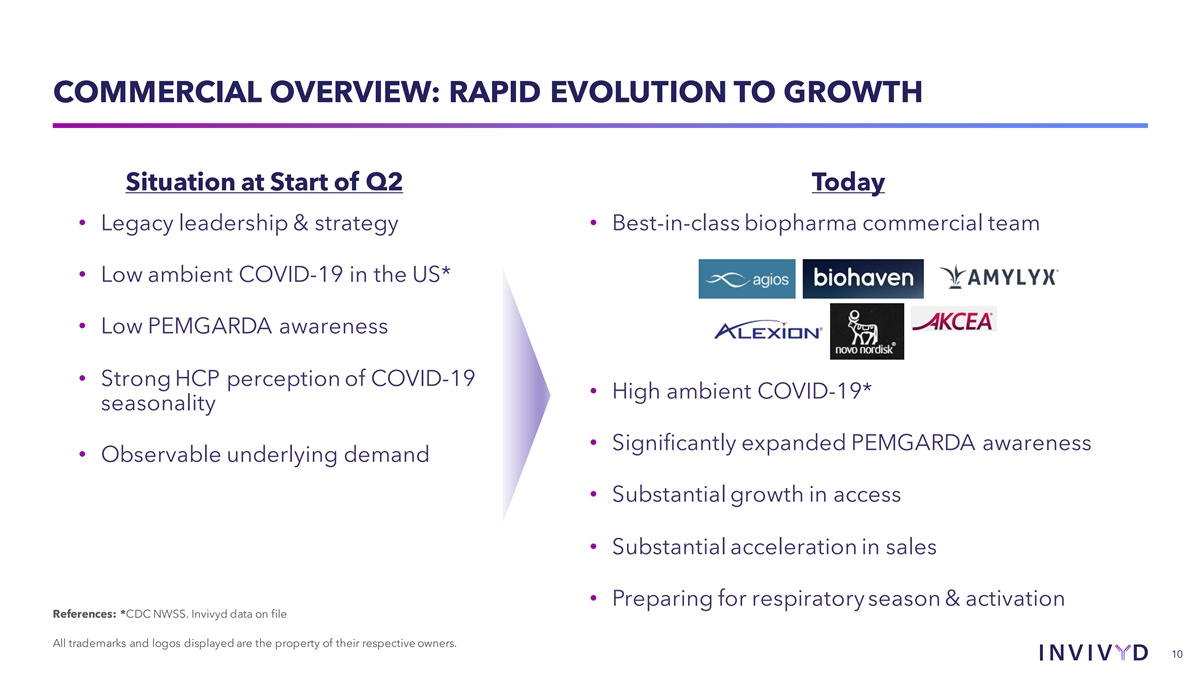

COMMERCIAL OVERVIEW: RAPID EVOLUTION TO GROWTH Situation at Start of Q2 Today • Legacy leadership & strategy • Best-in-class biopharma commercial team • Low ambient COVID-19 in the US* • Low PEMGARDA awareness • Strong HCP perception of COVID-19 • High ambient COVID-19* seasonality • Significantly expanded PEMGARDA awareness • Observable underlying demand • Substantial growth in access • Substantial acceleration in sales • Preparing for respiratory season & activation References: *CDC NWSS. Invivyd data on file All trademarks and logos displayed are the property of their respective owners. 10

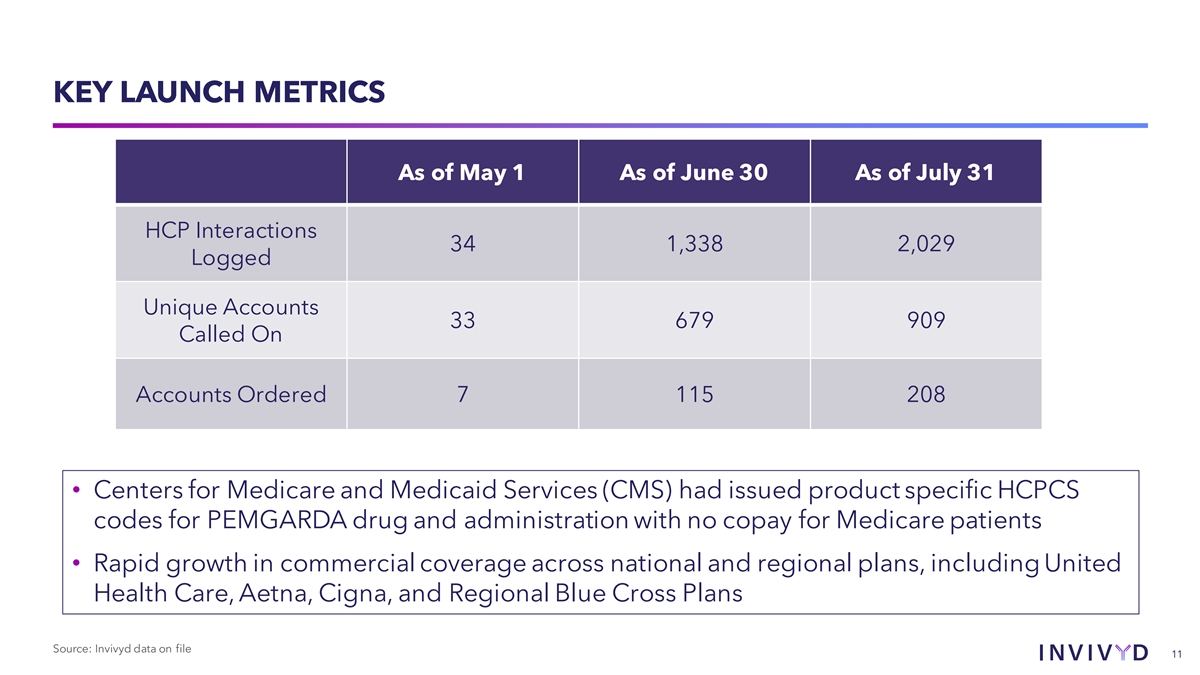

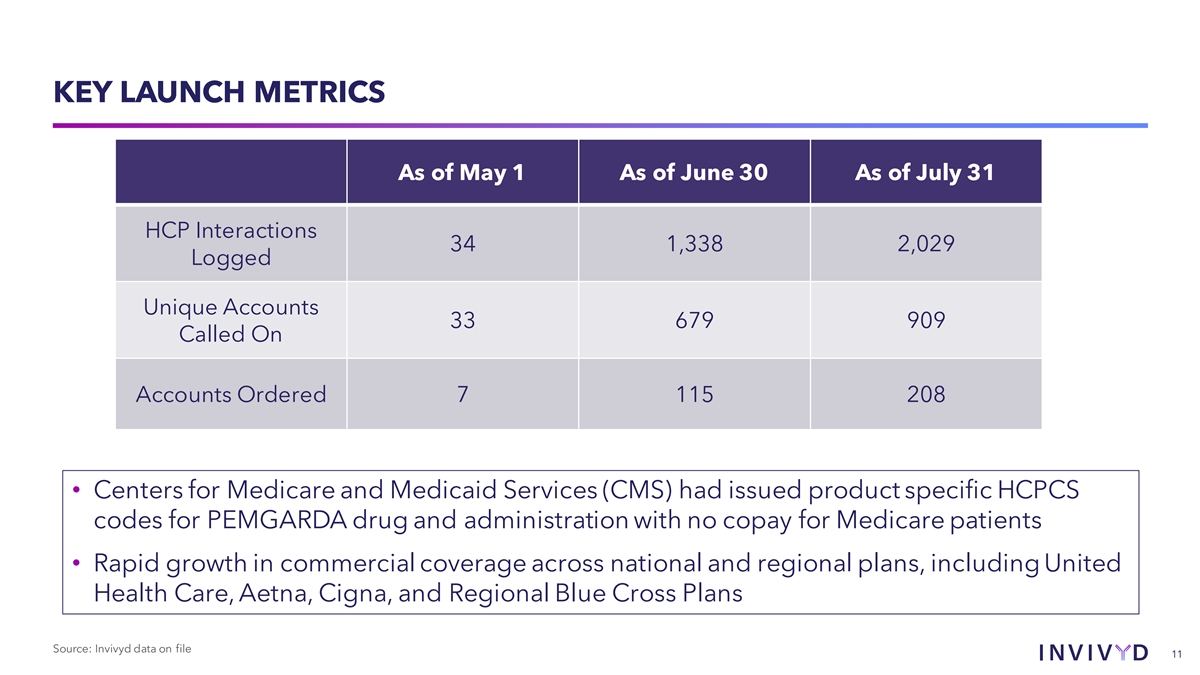

KEY LAUNCH METRICS As of May 1 As of June 30 As of July 31 HCP Interactions 34 1,338 2,029 Logged Unique Accounts 33 679 909 Called On Accounts Ordered 7 115 208 • Centers for Medicare and Medicaid Services (CMS) had issued product specific HCPCS codes for PEMGARDA drug and administration with no copay for Medicare patients • Rapid growth in commercial coverage across national and regional plans, including United Health Care, Aetna, Cigna, and Regional Blue Cross Plans Source: Invivyd data on file 11

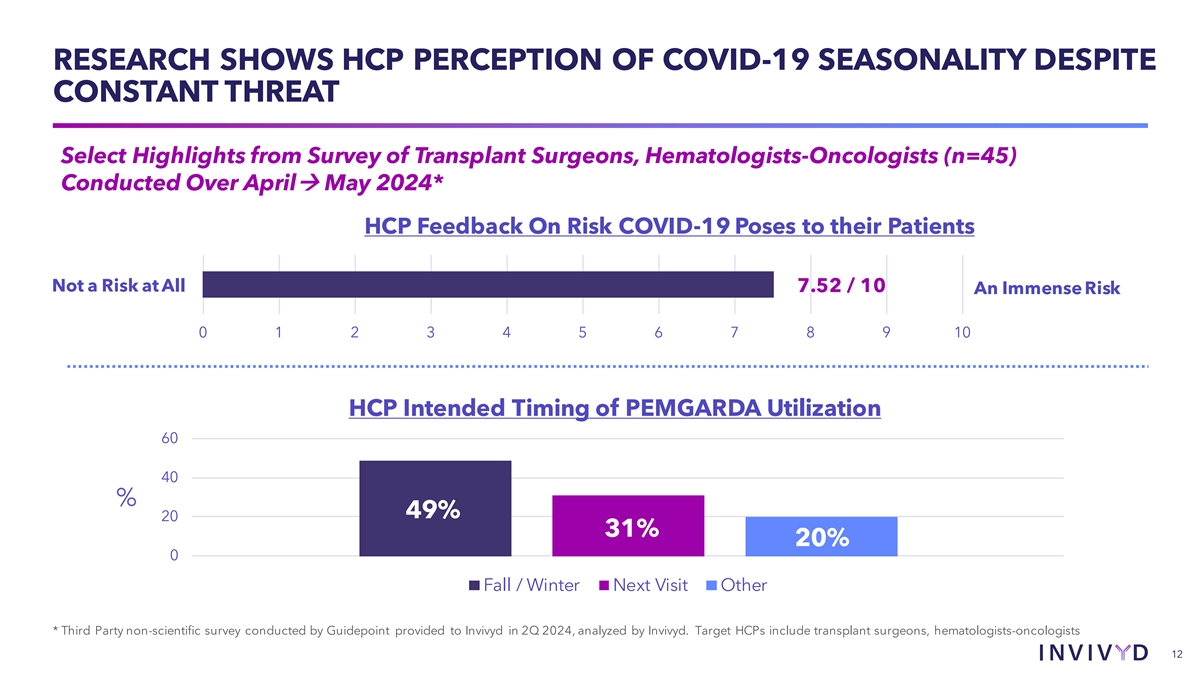

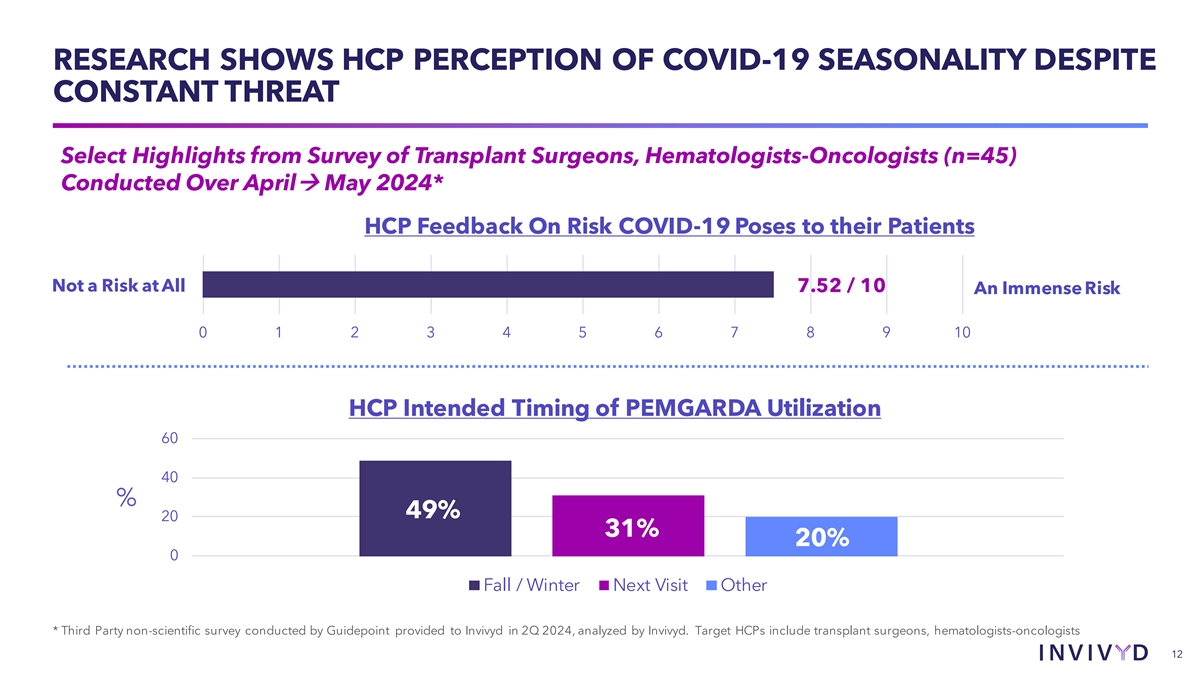

RESEARCH SHOWS HCP PERCEPTION OF COVID-19 SEASONALITY DESPITE CONSTANT THREAT Select Highlights from Survey of Transplant Surgeons, Hematologists-Oncologists (n=45) Conducted Over Aprilà May 2024* HCP Feedback On Risk COVID-19 Poses to their Patients Not a Risk at All 7.52 / 10 An Immense Risk 0 1 2 3 4 5 6 7 8 9 10 HCP Intended Timing of PEMGARDA Utilization 60 40 % 49% 20 31% 20% 0 Fall / Winter Next Visit Other * Third Party non-scientific survey conducted by Guidepoint provided to Invivyd in 2Q 2024, analyzed by Invivyd. Target HCPs include transplant surgeons, hematologists-oncologists 12

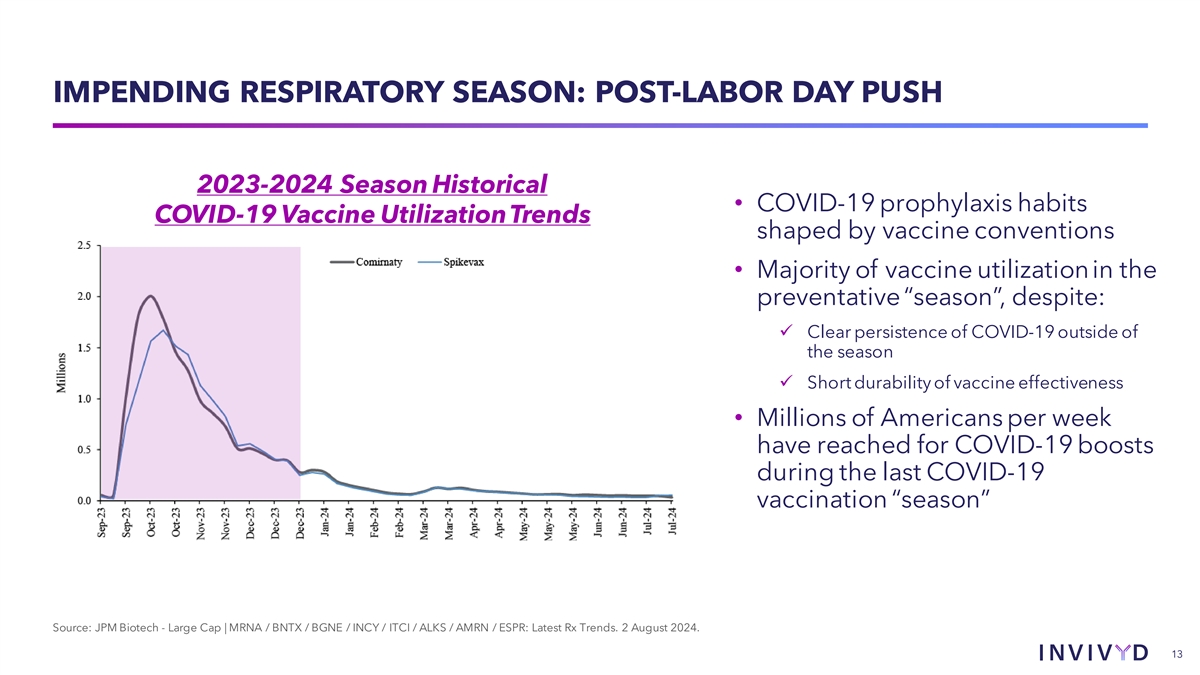

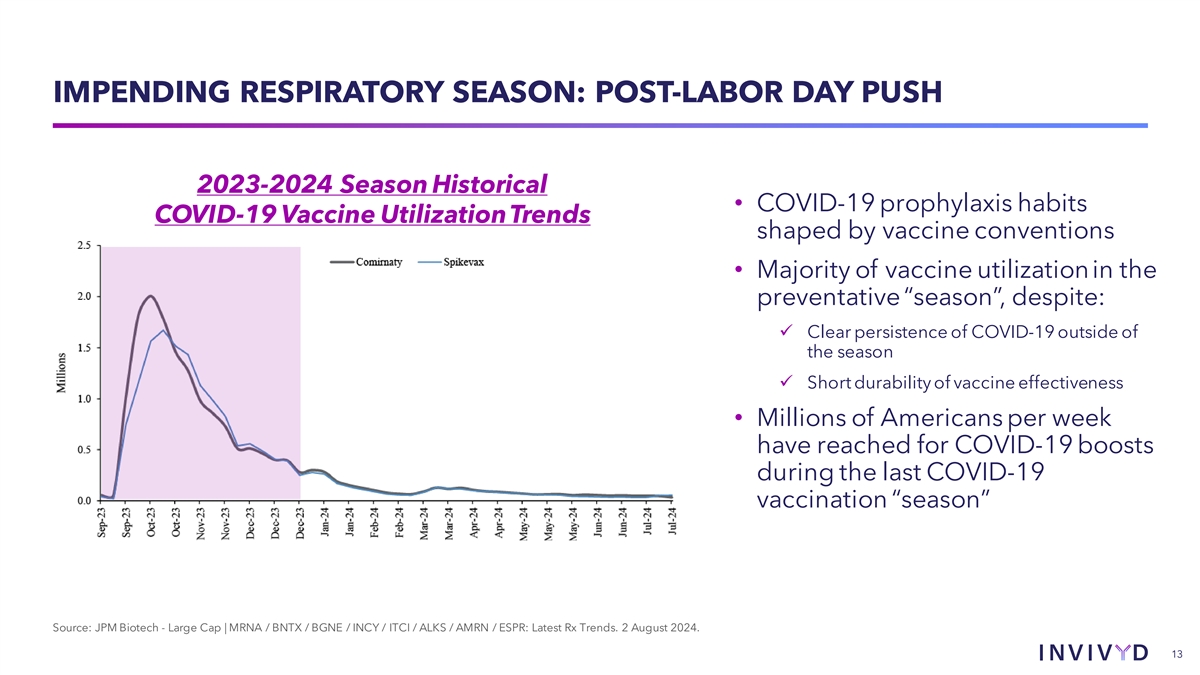

IMPENDING RESPIRATORY SEASON: POST-LABOR DAY PUSH 2023-2024 Season Historical • COVID-19 prophylaxis habits COVID-19 Vaccine Utilization Trends shaped by vaccine conventions • Majority of vaccine utilization in the preventative “season”, despite: ü Clear persistence of COVID-19 outside of the season ü Short durability of vaccine effectiveness • Millions of Americans per week have reached for COVID-19 boosts during the last COVID-19 vaccination “season” Source: JPM Biotech - Large Cap | MRNA / BNTX / BGNE / INCY / ITCI / ALKS / AMRN / ESPR: Latest Rx Trends. 2 August 2024. 13

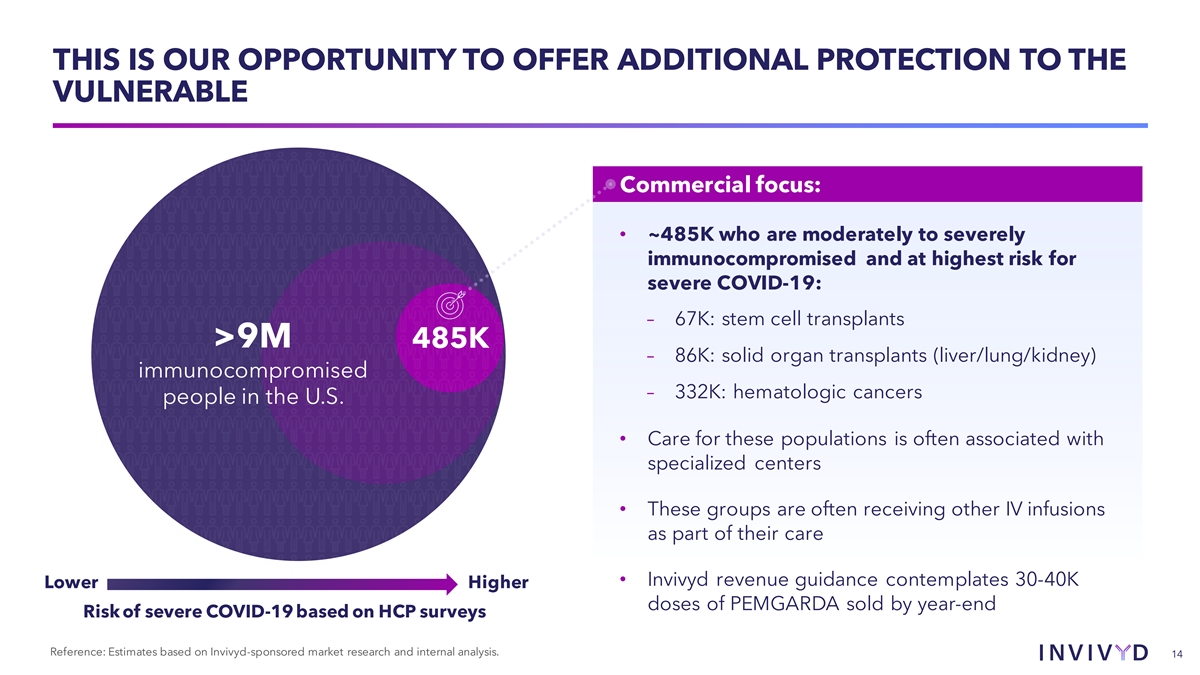

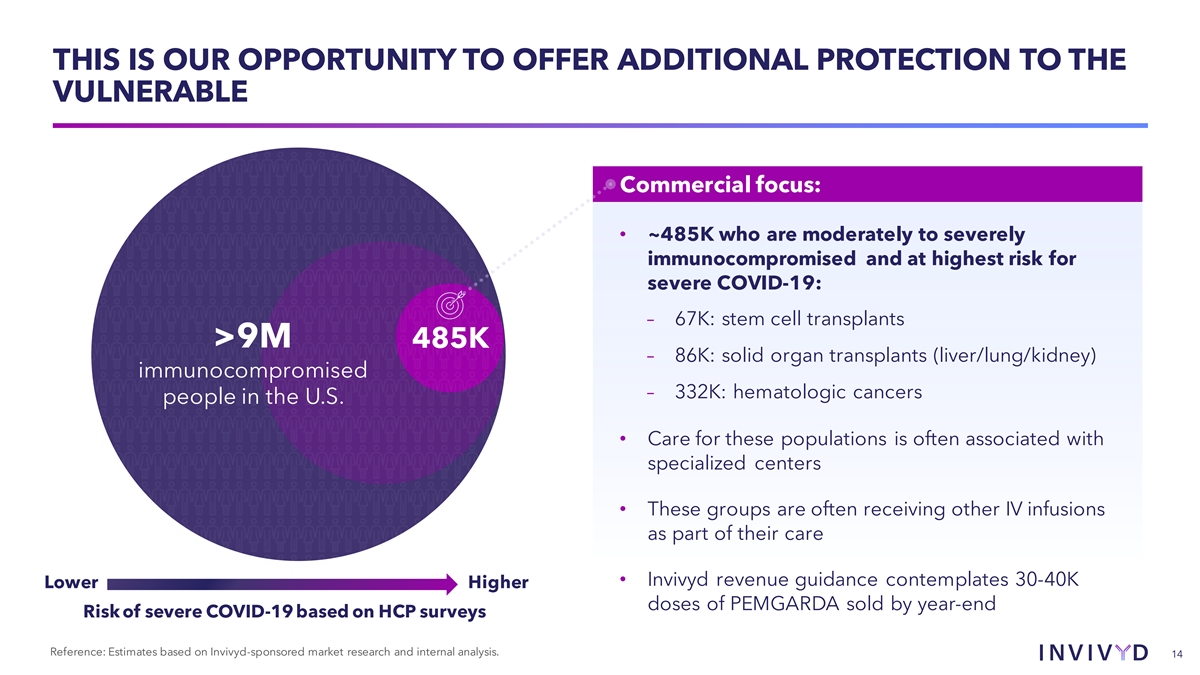

THIS IS OUR OPPORTUNITY TO OFFER ADDITIONAL PROTECTION TO THE VULNERABLE Commercial focus: • ~485K who are moderately to severely immunocompromised and at highest risk for severe COVID-19: – 67K: stem cell transplants >9M 485K – 86K: solid organ transplants (liver/lung/kidney) immunocompromised – 332K: hematologic cancers people in the U.S. • Care for these populations is often associated with specialized centers • These groups are often receiving other IV infusions as part of their care • Invivyd revenue guidance contemplates 30-40K Lower Higher doses of PEMGARDA sold by year-end Risk of severe COVID-19 based on HCP surveys Reference: Estimates based on Invivyd-sponsored market research and internal analysis. 14

INVIVYD FALL ACTIVATION PLAN • Digital campaign on disease awareness & antibody therapies • Hiring and deploying Regional Clinic Specialists • Developing updated corporate positioning and awareness • Developing a class of trade strategy to increase access to infusion sites • Educational HCP webinars and presence & educational events at National Congresses (ID Week, ACR, ASH, and ATC) • Inside sales team (high efficiency telephonic sales) 15

u Executive Summary u Commercial Update u Pipeline Virology Finance Q&A 16

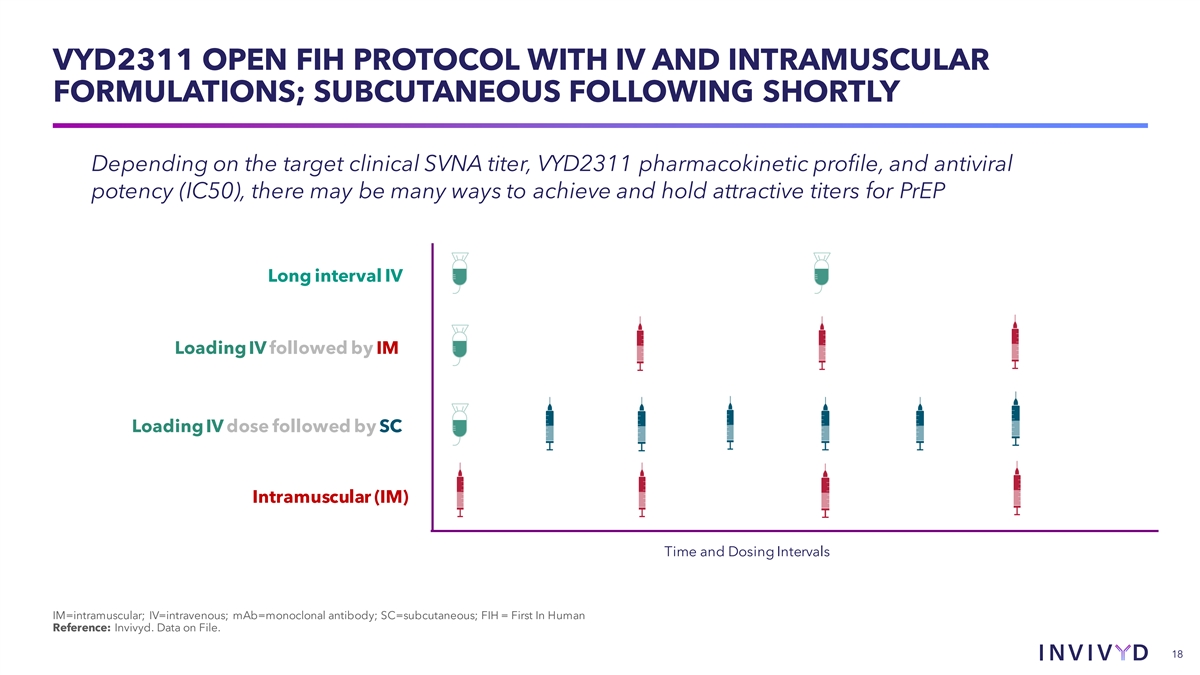

NEXT UP: VYD2311, A MAB WITH HIGH IN VITRO POTENCY SHOWN AGAINST POST-OMICRON COVID-19 VARIANTS TESTED TO DATE Our next-generation mAb, VYD2311, improves biophysical properties; shows continued in vitro neutralization activity in pseudovirus assays against KP1.1 FLiRT, KP.2 FLiRT, and KP.3 variants Development: • Next generation molecule VYD2311 first-in-human clinical trial dosing scheduled to begin late August • Development program for VYD2311 designed to evaluate diverse routes of administration (e.g., IV, IM, SC) for treatment and PrEP COVID-19= COVID-19=coronavirus disease 2019; IM=intramuscular; IV=intravenous; mAb=monoclonal antibody; PrEP=pre-exposure prophylaxis; SC=subcutaneous. Reference: Invivyd. Data on File. 17

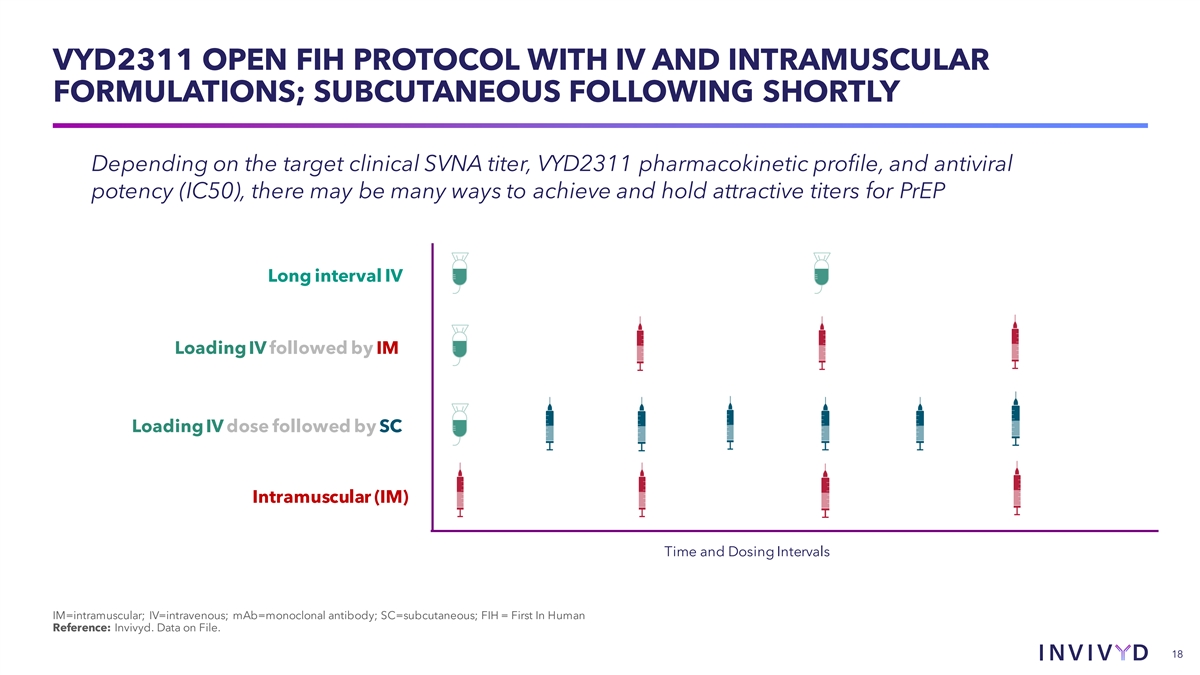

VYD2311 OPEN FIH PROTOCOL WITH IV AND INTRAMUSCULAR FORMULATIONS; SUBCUTANEOUS FOLLOWING SHORTLY Depending on the target clinical SVNA titer, VYD2311 pharmacokinetic profile, and antiviral potency (IC50), there may be many ways to achieve and hold attractive titers for PrEP Long interval IV Loading IV followed by IM Loading IV dose followed by SC Intramuscular (IM) Time and Dosing Intervals IM=intramuscular; IV=intravenous; mAb=monoclonal antibody; SC=subcutaneous; FIH = First In Human Reference: Invivyd. Data on File. 18

NEAR TERM VYD2311 GOALS • Determine first-in-human safety at escalating doses • Determine pharmacokinetic profile (PK), including in vivo half-life • Explore Safety and PK across posologies / routes of administration • Determine authorization pathways and titer thresholds with regulators going forward Reference: Invivyd. Data on File. 19

u Executive Summary u Commercial Update u Pipeline u Virology Finance Q&A 20

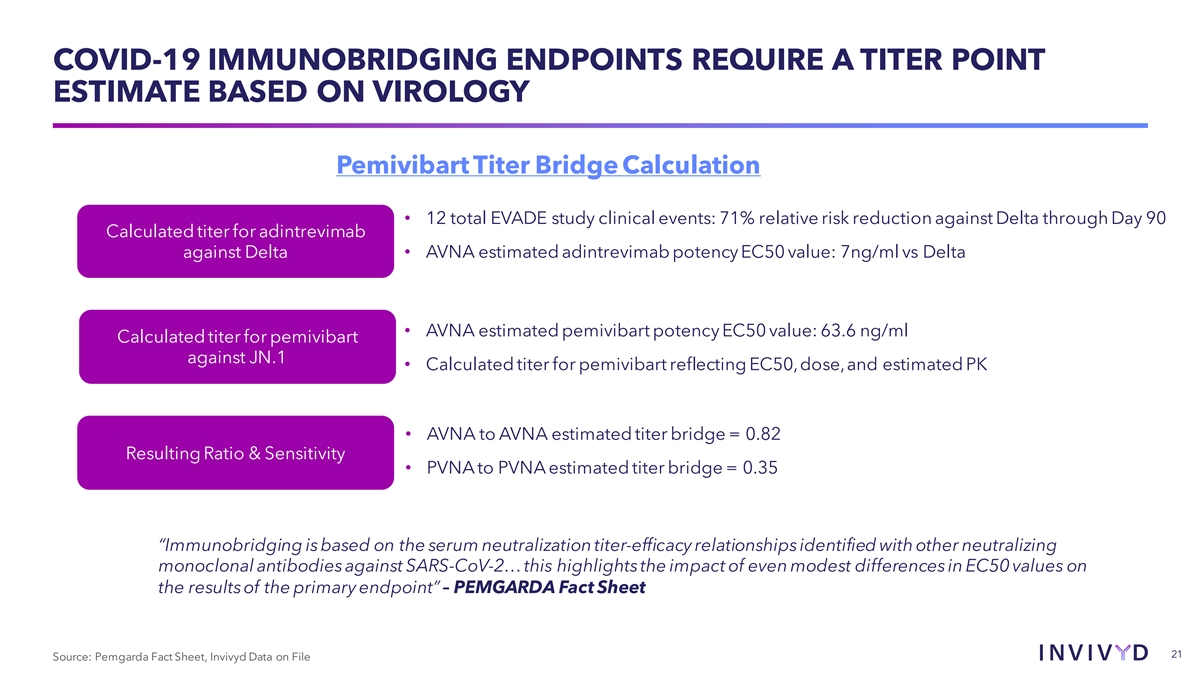

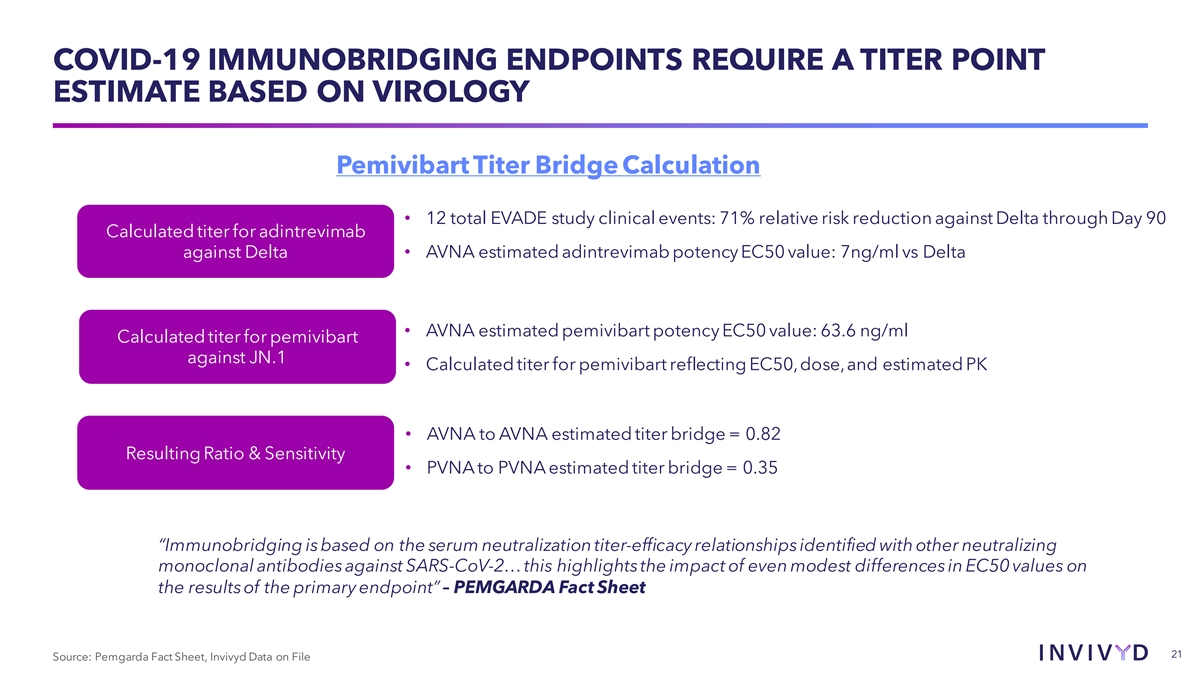

COVID-19 IMMUNOBRIDGING ENDPOINTS REQUIRE A TITER POINT ESTIMATE BASED ON VIROLOGY Pemivibart Titer Bridge Calculation • 12 total EVADE study clinical events: 71% relative risk reduction against Delta through Day 90 Calculated titer for adintrevimab against Delta • AVNA estimated adintrevimab potency EC50 value: 7ng/ml vs Delta • AVNA estimated pemivibart potency EC50 value: 63.6 ng/ml Calculated titer for pemivibart against JN.1 • Calculated titer for pemivibart reflecting EC50, dose, and estimated PK • AVNA to AVNA estimated titer bridge = 0.82 Resulting Ratio & Sensitivity • PVNA to PVNA estimated titer bridge = 0.35 “Immunobridging is based on the serum neutralization titer-efficacy relationships identified with other neutralizing monoclonal antibodies against SARS-CoV-2… this highlights the impact of even modest differences in EC50 values on the results of the primary endpoint” – PEMGARDA Fact Sheet 21 Source: Pemgarda Fact Sheet, Invivyd Data on File

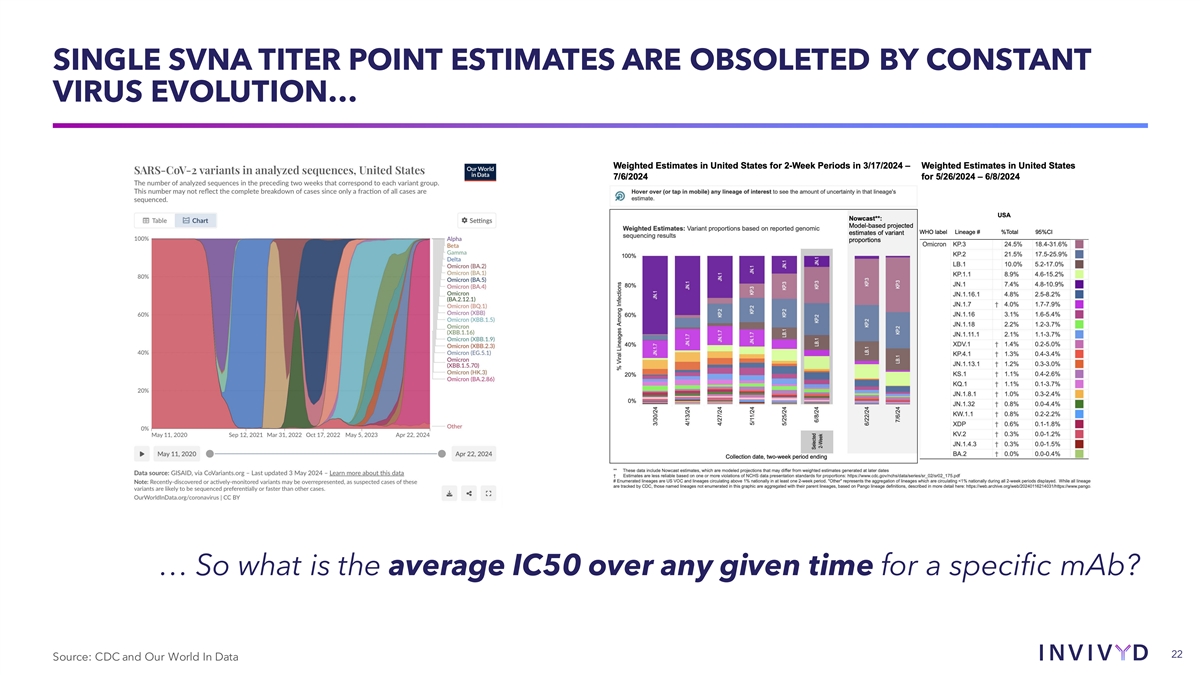

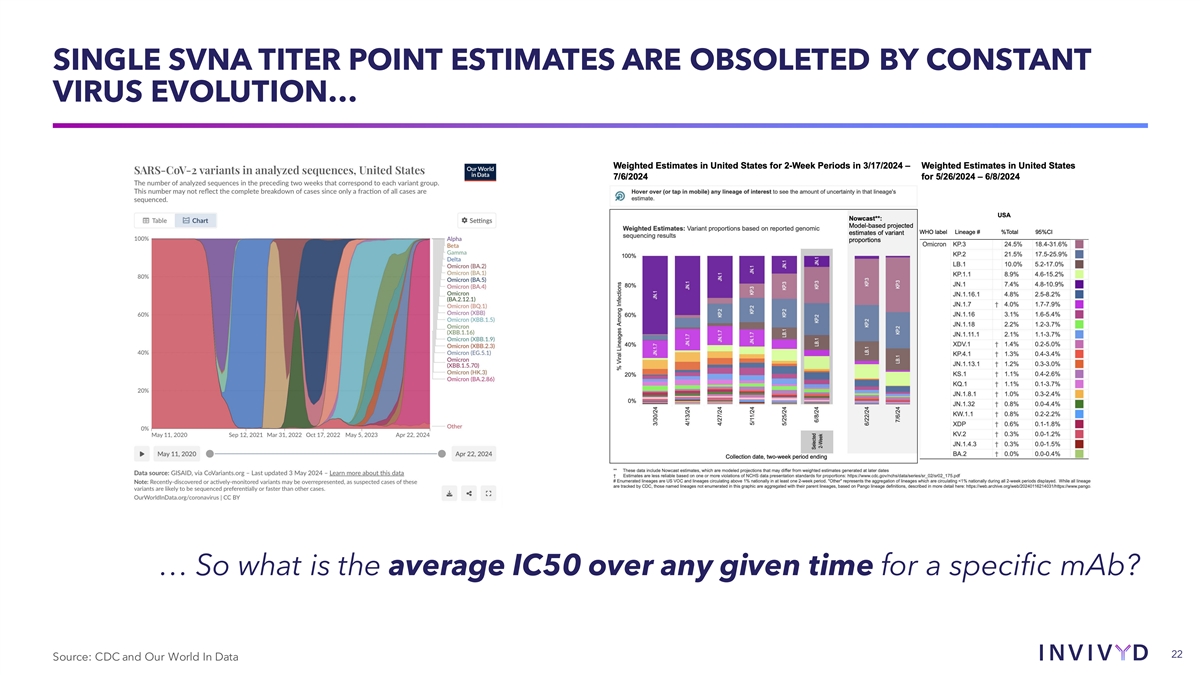

SINGLE SVNA TITER POINT ESTIMATES ARE OBSOLETED BY CONSTANT VIRUS EVOLUTION… … So what is the average IC50 over any given time for a specific mAb? 22 Source: CDC and Our World In Data

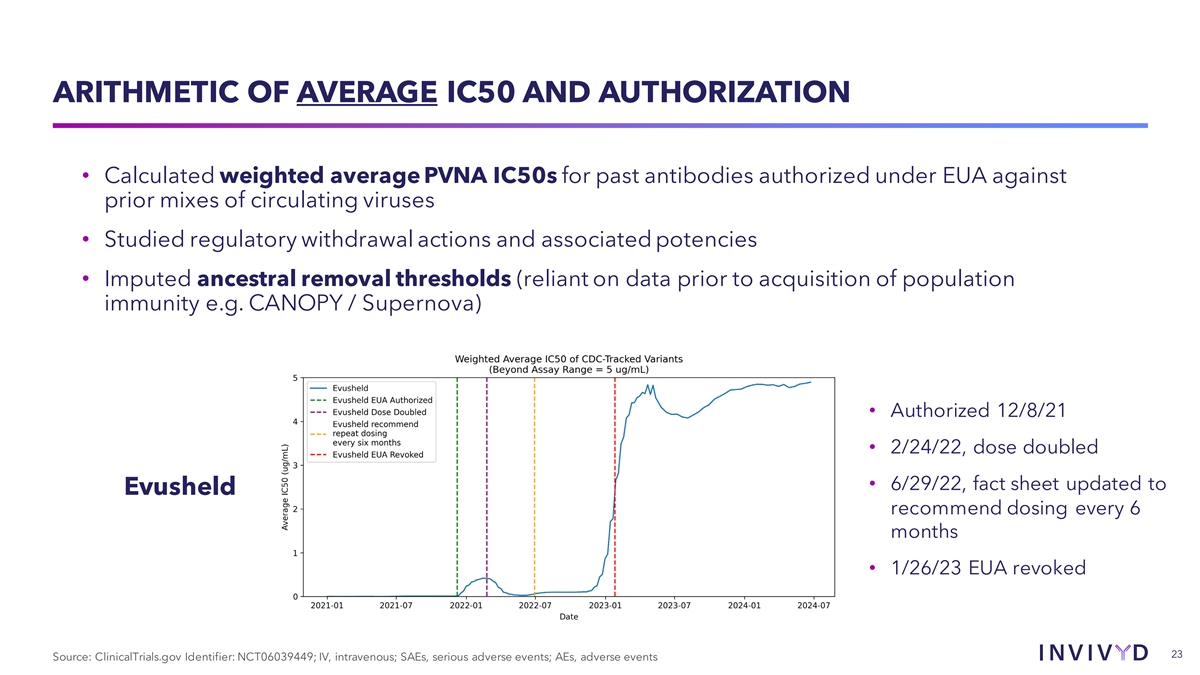

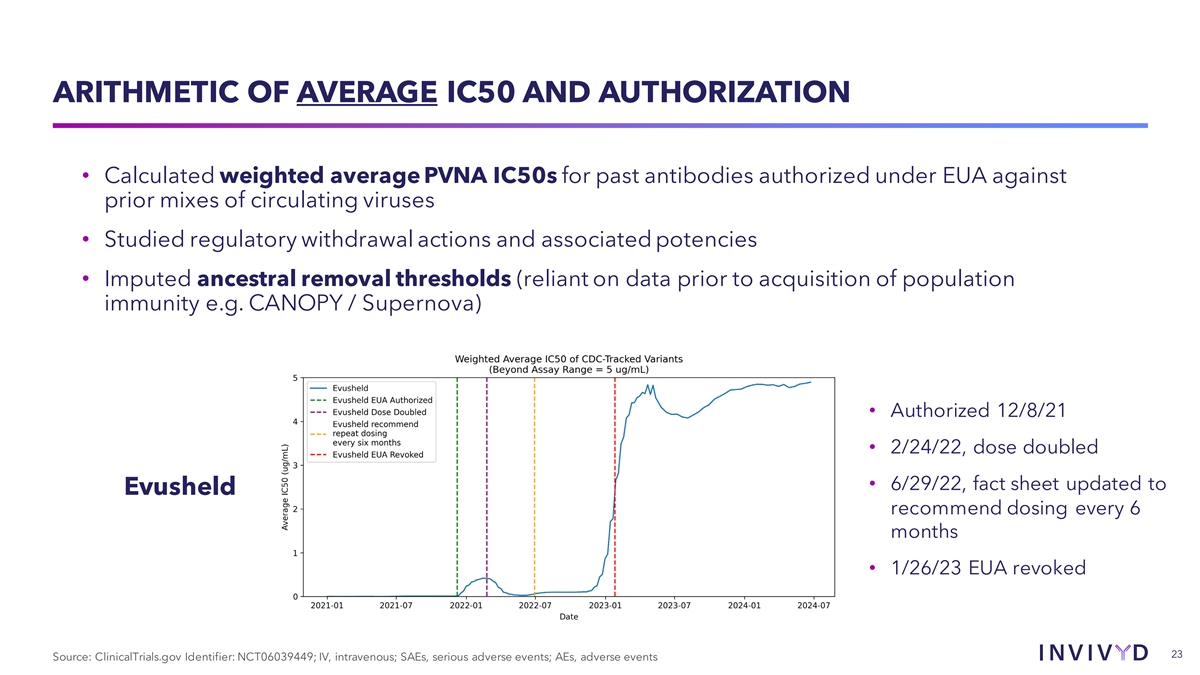

ARITHMETIC OF AVERAGE IC50 AND AUTHORIZATION • Calculated weighted average PVNA IC50s for past antibodies authorized under EUA against prior mixes of circulating viruses • Studied regulatory withdrawal actions and associated potencies • Imputed ancestral removal thresholds (reliant on data prior to acquisition of population immunity e.g. CANOPY / Supernova) • Authorized 12/8/21 • 2/24/22, dose doubled • 6/29/22, fact sheet updated to Evusheld recommend dosing every 6 months • 1/26/23 EUA revoked 23 Source: ClinicalTrials.gov Identifier: NCT06039449; IV, intravenous; SAEs, serious adverse events; AEs, adverse events

AVERAGE IC50 DEAUTHORIZATION THRESHOLD ~Average IC50 at deauthorization: 1.0 ug/mL sotrovimab (GSK/VIR) Recent treatment mAbs have lost EUA at an average of 1.2 ug/ml 1.3 ug/mL bebtelovimab (LLY) PrEP mAb combo Evusheld lost EUA at approximately 2 2.1 ug/mL Evusheld (AZN) ug/mL 24 Source: Published data and Invivyd analysis. 24

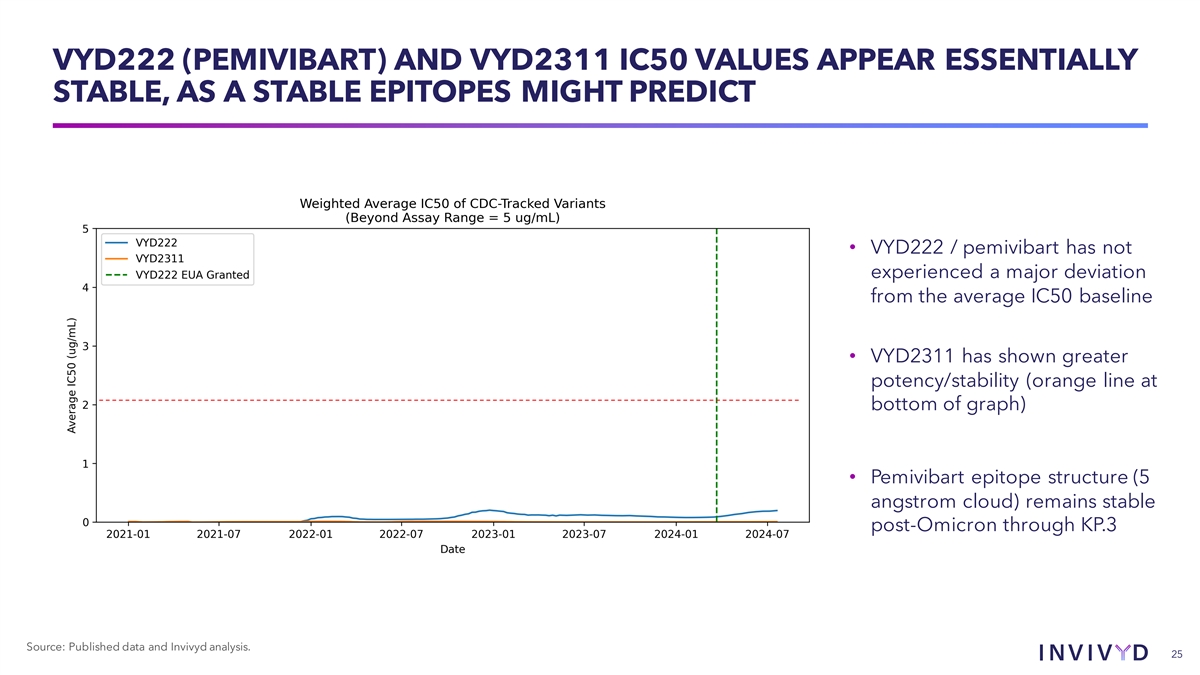

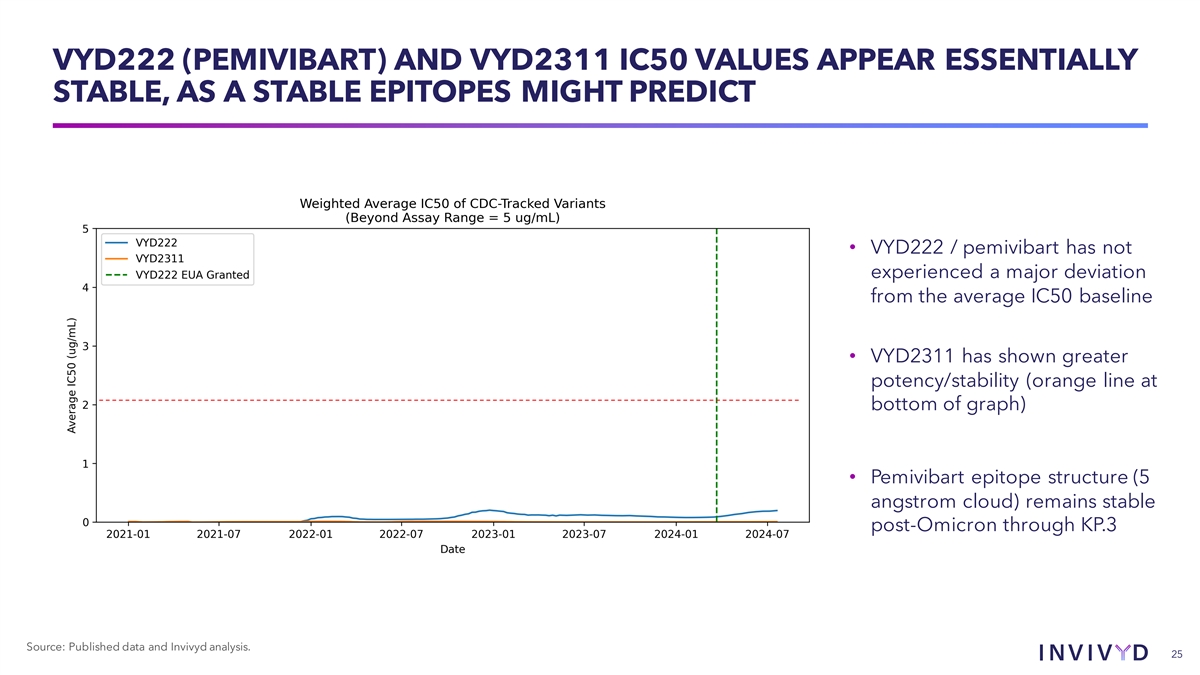

VYD222 (PEMIVIBART) AND VYD2311 IC50 VALUES APPEAR ESSENTIALLY STABLE, AS A STABLE EPITOPES MIGHT PREDICT • VYD222 / pemivibart has not experienced a major deviation from the average IC50 baseline • VYD2311 has shown greater potency/stability (orange line at bottom of graph) • Pemivibart epitope structure (5 angstrom cloud) remains stable post-Omicron through KP.3 Source: Published data and Invivyd analysis. 25

A POTENTIAL VENDOR CONTAMINATION EVENT REQUIRES REGENERATION OF ONE AVNA VALUE • In mid-July, Invivyd learned and promptly notified the FDA of a potential contamination event at a vendor that provides authentic viral neutralization assay (AVNA) testing services to the industry, including Invivyd • Invivyd is in the process of generating new JN.1 AVNA values at multiple labs, which may impact the estimated AVNA value for JN.1 • The JN.1 pseudovirus (PVNA) value is reassuringly similar to the AVNA value now in question (63.6 ng/ml AVNA vs. 74.6 ng/ml PVNA) • As required by the PEMGARDA EUA, Invivyd provides the FDA with continuous virology updates, including PVNA and AVNA values, which along with the aforementioned event, will likely result in revisions to the PEMGARDA fact sheet • FDA is also in receipt of preliminary CANOPY 180-day data, including exploratory efficacy endpoints 26 Source: Invivyd data on file.

u Executive Summary u Commercial Update u Pipeline u Virology u Finance Q&A 27

FINANCIALS • Ended Q2 2024 with cash and cash equivalents of $147.9 million • Revenue and cash guidance re-iterated ($150-$200m in revenue), $75m in year-end cash • Previously announced operating efficiencies began to take effect in Q2 • VYD2311 clinical and launch material production; meaningful quantities expensed to R&D already • Continuing to evaluate multiple sources of additional capital 28 Source: Invivyd Data on File

u Executive Summary u Commercial Update u Pipeline u Virology u Finance u Q&A 29