EXHIBIT 3.1

CERTIFICATE OF

AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF

KEYSTAR CORP,

a Nevada corporation

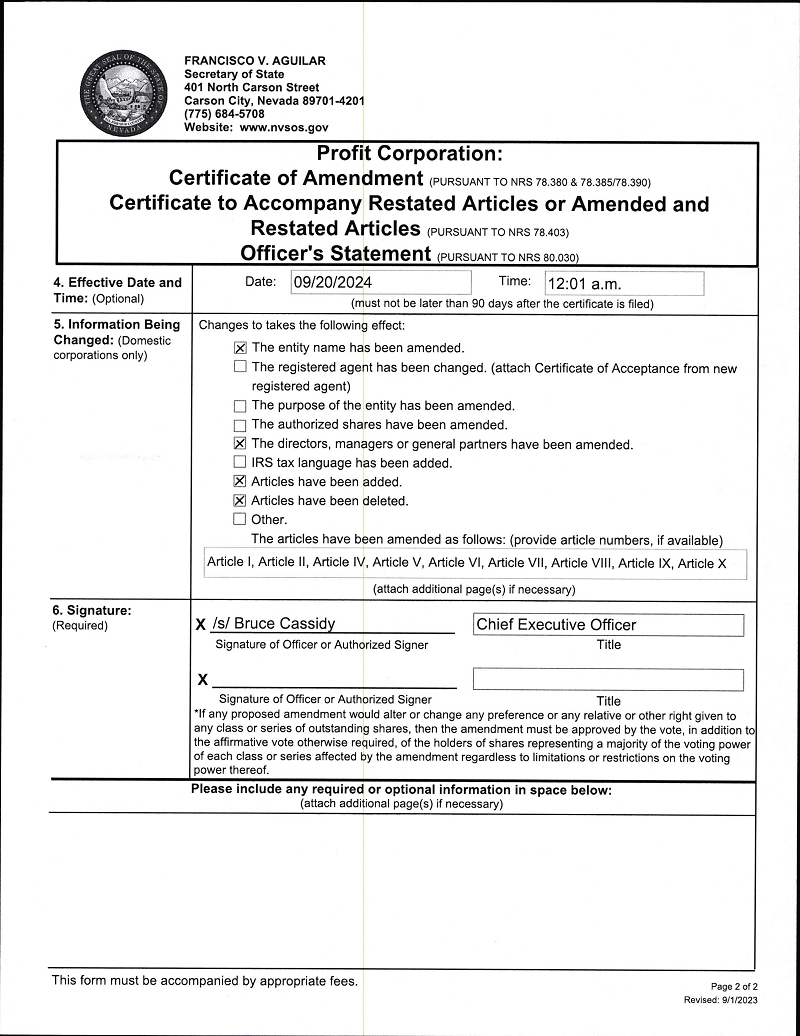

Pursuant to the provisions of Sections 78.385, 78.390 and 78.403 of the Nevada Revised Statutes (as amended from time to time, the “NRS”), the undersigned officer of KEYSTAR CORP, a corporation organized and existing under the laws of the State of Nevada, does hereby certify as follows:

1. The name of the corporation is KeyStar Corp (the “Corporation”). The Corporation’s Nevada Business Identification Number is NV20201760899.

2. The Corporation’s Articles of Incorporation was originally filed in the office of the Secretary of State of the State of Nevada on April 16, 2020 (“Original Articles”), and was subsequently amended by that certain Certificate of Amendment filed in the office of the Secretary of State of the State of Nevada on October 27, 2020 (“Certificate of Amendment”). The Corporation additionally filed two (2) Certificates of Designation on December 28, 2021, and June 10, 2022 (together, the “Certificates of Designation”). These Amended and Restated Articles of Incorporation (“Amended and Restated Articles” or the “Articles”), which restate and amend, in all respects, the provisions of the Original Articles and the Certificate of Amendment, were duly approved by the stockholders of the Corporation in accordance with the provisions of Section 78.390 of the NRS. These Amended and Restated Articles shall become effective on September 20, 2024 (the “Effective Date”).

3. Certain capitalized terms used in this Amended and Restated Articles are defined where appropriate herein.

4. The text of the Original Articles and the Certificate of Amendment are hereby restated and amended in their entirety to read as follows:

AMENDED AND RESTATED ARTICLES OF INCORPORATION

OF

VIP PLAY, INC.

Article I

NAME

The name of the corporation is VIP Play, Inc. (hereinafter, the “Corporation”).

Article II

REGISTERED OFFICE AND AGENT

The address of the Corporation’s registered office in the State of Nevada is 701 S. Carson Street, Suite 200, Carson City, Nevada 89701. The registered agent of the Corporation is C T Corporation System, 701 S. Carson Street, Suite 200, Carson City, Nevada 89701.

Article III

PURPOSE

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the NRS. The Corporation is to have a perpetual existence.

Article IV

CAPITAL STOCK

1. Authorized Shares. The total number of shares of capital stock which the Corporation is authorized to issue is five hundred million (500,000,000) shares, of which (i) four hundred seventy-five million (475,000,000) shares shall be a class designated as common stock, par value $0.001 per share (the “Common Stock”), and (ii) twenty-five million (25,000,000) shall be a class designated as preferred stock, par value $0.001 per share (the “Preferred Stock”). The Preferred Stock may be issued in one or more of the following series, which series shall have the powers, designations, preferences, and relative participating, optional and other special rights, and the qualifications, limitations, and restrictions set forth below.

2. Common Stock.

(a) Dividend Rate. Subject to the rights of holders of any Preferred Stock having preference as to dividends and except as otherwise provided by these Articles as amended from time to time or the NRS, the holders of Common Stock shall be entitled to receive dividends when, as and if declared by the Board (as defined below) out of assets legally available therefor.

(b) Voting Rights. Except as otherwise provided by the NRS, the holders of the issued and outstanding shares of Common Stock shall be entitled to one (1) vote for each share of Common Stock. No holder of shares of Common Stock shall have the right to cumulate votes.

(c) Liquidation Rights. In the event of liquidation, dissolution, or winding up of the affairs of the Corporation, whether voluntary or involuntary (each, a “Liquidation”), subject to the prior rights of holders of Preferred Stock to share ratably in the Corporation’s assets, the Common Stock and any shares of Preferred Stock which are not entitled to any preference in Liquidation shall share equally and ratably in the Corporation’s assets available for distribution after giving effect to any Liquidation preference of any shares of Preferred Stock. A merger, conversion, exchange or consolidation of the Corporation with or into any other person or sale or transfer of all or any part of the assets of the Corporation (which shall not in fact result in the liquidation of the Corporation and the distribution of assets to stockholders) shall not be deemed to be a Liquidation.

(d) No Conversion, Redemption, or Preemptive Rights. The holders of Common Stock shall not have any conversion, redemption, or preemptive rights.

(e) Consideration for Shares. The Common Stock authorized by these Articles shall be issued for such consideration as shall be fixed, from time to time, by the Board.

3. Preferred Stock.

(a) Preferred Stock Generally. Preferred Stock may be issued in one or more series, each series to be appropriately designated by a distinguishing letter or title, prior to the issuance of any shares thereof. The voting powers, designations, preferences, limitations, restrictions, and relative, participating, optional and other rights, and the qualifications, limitations, or restrictions thereof, of the Preferred Stock shall hereinafter be prescribed by resolution of the Board pursuant to this 3 of this Article IV of these Articles, except for the Series A Convertible Preferred Stock, Series B Convertible Preferred Stock, and Series C Convertible Preferred Stock, which are set forth herein or in a certificate of designation concerning the specific series of Preferred Stock.

(i) Designation. The Board is hereby vested with the authority from time to time to provide by resolution for the issuance of shares of Preferred Stock in one or more series not exceeding the aggregate number of shares of Preferred Stock authorized by these Articles, and to prescribe with respect to each such series the voting powers, if any, designations, preferences, and relative, participating, optional, or other special rights, and the qualifications, limitations, or restrictions relating thereto, including, without limiting the generality of the foregoing: the voting rights relating to the shares of Preferred Stock of any series (which voting rights, if any, may be full or limited, may vary over time, and may be applicable generally or only upon any stated fact or event); the rate of dividends (which may be cumulative or noncumulative), the condition or time for payment of dividends and the preference or relation of such dividends to dividends payable on any other class or series of capital stock; the rights of holders of Preferred Stock of any series in the event of liquidation, dissolution, or winding up of the affairs of the Corporation; the rights, if any, of holders of Preferred Stock of any series to convert or exchange such shares of Preferred Stock of such series for shares of any other class or series of capital stock or for any other securities, property, or assets of the Corporation or any subsidiary (including the determination of the price or prices or the rate or rates applicable to such rights to convert or exchange and the adjustment thereof, the time or times during which the right to convert or exchange shall be applicable, and the time or times during which a particular price or rate shall be applicable); whether the shares of any series of Preferred Stock shall be subject to redemption by the Corporation and if subject to redemption, the times, prices, rates, adjustments and other terms and conditions of such redemption. The powers, designations, preferences, limitations, restrictions and relative rights may be made dependent upon any fact or event which may be ascertained outside the Articles or the resolution if the manner in which the fact or event may operate on such series is stated in the Articles or resolution. As used in this section “fact or event” includes, without limitation, the existence of a fact or occurrence of an event, including, without limitation, a determination or action by a person, government, governmental agency or political subdivision of a government. The Board is further authorized to increase or decrease (but not below the number of such shares of such series then outstanding) the number of shares of any series subsequent to the issuance of shares of that series. Unless the Board provides to the contrary in the resolution which fixes the characteristics of a series of Preferred Stock, neither the consent by series, or otherwise, of the holders of any outstanding Preferred Stock nor the consent of the holders of any outstanding Common Stock shall be required for the issuance of any new series of Preferred Stock regardless of whether the rights and preferences of the new series of Preferred Stock are senior or superior, in any way, to the outstanding series of Preferred Stock or the Common Stock.

(ii) Certificate. Before the Corporation shall issue any shares of Preferred Stock of any series, a certificate of designation setting forth a copy of the resolution or resolutions of the Board, and establishing the voting powers, designations, preferences, the relative, participating, optional, or other rights, if any, and the qualifications, limitations, and restrictions, if any, relating to the shares of Preferred Stock of such series, and the number of shares of Preferred Stock of such series authorized by the Board to be issued shall be made and signed by an officer of the Corporation and filed in the manner prescribed by the NRS.

(b) Series A Convertible Preferred Stock. The Corporation previously had a series of Preferred Stock known as “Series A Convertible Preferred Stock,” comprising two million (2,000,000) shares (“Series A Stock”), pursuant to the Corporation’s Articles of Incorporation dated April 16, 2020, and the Corporation’s Certificate of Amendment dated October 27, 2020. Prior to the Effective Date of these Articles, all shares of Series A Stock have been redeemed and cancelled. From and after the Effective Date of these Articles, none of the twenty-five million (25,000,000) shares of Preferred Stock are deemed or designated as Series A Stock.

(c) Series B Convertible Preferred Stock. The Corporation created a series of Preferred Stock known as “Series B Convertible Preferred Stock,” comprising twelve thousand (12,000) shares (“Series B Stock”), pursuant to a Certificate of Designation filed with the Secretary of State of Nevada on December 28, 2021 (the “Series B Certificate of Designation”). Each share of Series B Stock issued and outstanding immediately prior to the Effective Date of these Articles shall remain validly issued, fully paid and nonassessable upon the Effective Date of these Articles. The Series B Certificate of Designation shall remain valid and in effect upon the Effective Date of these Articles.

(d) Series C Convertible Preferred Stock. The Corporation previously created a series of Preferred Stock known as “Series C Convertible Preferred Stock,” comprising six million seven hundred thousand (6,700,000) shares (“Series C Stock”), pursuant to a Certificate of Designation filed with the Secretary of State of Nevada on June 10, 2022 (the “Series C Certificate of Designation”). The Corporation subsequently withdrew the Series C Certificate of Designation by filing a Certificate of Withdrawal of Certificate of Designation with the Secretary of State of Nevada, effective August 6, 2024.

4. Non-Assessment of Stock. The capital stock of the Corporation, after the amount of the subscription price has been fully paid, shall not be assessable for any purpose, and no stock issued as fully paid shall ever be assessable or assessed, and these Articles shall not be amended in this particular. No stockholder of the Corporation is individually liable for the debts or liabilities of the Corporation.

5. Distribution Restriction. To the fullest extent permitted by the NRS, the Corporation shall be expressly permitted, but not required, to redeem, repurchase, or make distributions on the shares of its capital stock in all circumstances other than where doing so would cause the Corporation to be unable to pay its debts as they become due in the usual course of business.

Article V

DIRECTORS

1. Powers. The business and affairs of the Corporation shall be managed by, or under the direction of, a governing board, the Board of Directors of the Corporation (the “Board”). The members of the Board are styled as directors. The Board shall be elected in such manner as shall be provided in the Bylaws.

2. Number of Directors. The Board shall consist of at least one (1) individual and not more than thirteen (13) individuals. The number of directors may be changed from time to time in such manner as shall be provide in the Bylaws.

3. Initial Directors. Omitted pursuant to NRS 78.403.

4. Qualifications. Each director of the Corporation shall not be an Unsuitable Person, as defined below. If a director is or becomes an Unsuitable Person, the director shall immediately resign effective immediately; if such director refuses or fails to so resign, either or both the Board or stockholders may remove the director from such office by Board or stockholder action, as the case may be, in such manner as shall be provide in the Bylaws for Board or stockholder action. Any removal by the Board or the stockholders of a director that is or becomes an Unsuitable Person will be deemed a removal for cause.

Article VI

LIMITATION OF LIABILITY

To the fullest extent permitted by the NRS, as the same exists or as may hereafter be amended, a director or officer of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director.

The Corporation shall indemnify to the fullest extent permitted by law any person made or threatened to be made a party to an action or proceeding, whether criminal, civil, administrative or investigative, by reason of the fact that he, his testator or intestate is or was a director or officer of the Corporation or any predecessor of the Corporation, or serves or served at any other enterprise as a director or officer at the request of the Corporation or any predecessor to the Corporation.

Neither any amendment nor repeal of this Article VI, nor the adoption of any provision of inconsistent with this Article VI, shall eliminate or reduce the effect of this Article VI in respect of any matter occurring, or any action or proceeding accruing or arising or that, but for this Article VI, would accrue or arise, prior to such amendment, repeal or adoption of an inconsistent provision.

In addition to any other rights of indemnification permitted by the laws of the State of Nevada or as may be provided for by the Corporation in its Bylaws or by agreement, the expenses of officers and directors incurred in defending any threatened, pending, or completed action, suit or proceeding (including without limitation, an action, suit or proceeding by or in the right of the Corporation), whether civil, criminal, administrative or investigative, involving alleged acts or omissions of such officer or director in his or her capacity as an officer or director of the Corporation or member, manager, or managing member of a predecessor limited liability company or affiliate of such limited liability company or while serving in any capacity at the request of the Corporation as a director, officer, employee, agent, member, manager, managing member, partner, or fiduciary of, or in any other capacity for, another corporation or any partnership, joint venture, trust, or other enterprise, shall be paid by the Corporation or through insurance purchased and maintained by the Corporation or through other financial arrangements made by the Corporation, as they are incurred and in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of the officer or director to repay the amount if it is ultimately determined by a court of competent jurisdiction that he or she is not entitled to be indemnified by the Corporation. To the extent that an officer or director is successful on the merits in defense of any such action, suit or proceeding, or in the defense of any claim, issue or matter therein, the Corporation shall indemnify him or her against expenses, including attorneys’ fees, actually and reasonably incurred by him or her in connection with the defense. Notwithstanding anything to the contrary contained herein or in the Bylaws, no director or officer may be indemnified for expenses incurred in defending any threatened, pending, or completed action, suit or proceeding (including without limitation, an action, suit or proceeding by or in the right of the Corporation), whether civil, criminal, administrative or investigative, that such director or officer incurred in his or her capacity as a stockholder.

Any repeal or modification of this Article VI approved by the stockholders of the Corporation shall be prospective only, and shall not adversely affect any limitation on the liability of a director or officer of the Corporation existing as of the time of such repeal or modification. In the event of any conflict between this Article VI and any other provision of these Articles, the terms and provisions of this Article VI shall control.

Article VII

COMBINATIONS WITH INTERESTED STOCKHOLDERS

At such time, if any, as the Corporation becomes a “resident domestic corporation,” as that term is defined in NRS 78.427, the Corporation shall not be subject to, or governed by, any of the provisions in NRS 78.411 to 78.444, inclusive, as may be amended from time to time, or any successor statute.

Article VIII

BYLAWS

The Board is expressly granted exclusive power to make, alter or repeal the bylaws of the Corporation (the “Bylaws”) pursuant to NRS 78.120.

Article IX

UNSUITABLE PERSONS

1. Finding of Unsuitability.

(a) The capital stock of the Corporation owned or controlled by an Unsuitable Person (as defined below) or an affiliate of an Unsuitable Person (as applicable) shall be subject to mandatory sale and transfer on the terms and conditions set forth herein on the Transfer Date (as defined below) to either the Corporation or one or more Third Party Transferees (as defined below) and in such number and class(es)/series of capital stock as determined by the Board in good faith (following consultation with reputable outside gaming regulatory counsel) pursuant to a resolution adopted by the affirmative vote of a majority of the disinterested members of the Board; provided that any such sale or transfer shall occur subject to the following and shall not occur (and a Transfer Notice (as defined below) shall not be sent, and the Transfer Date shall be extended accordingly) until the later to occur of: (i) delivery to such stockholder of a copy of a resolution duly adopted by the affirmative vote of a majority of the disinterested members of the Board at a meeting thereof called and held for the purpose (after providing reasonable notice to such stockholder and a reasonable opportunity for such stockholder, together with the counsel of such stockholder, to be heard before the Board at such meeting and to provide documents and written arguments to the Board a reasonable length of time in advance of such meeting), finding that the Board has determined in good faith (following consultation with reputable outside gaming regulatory counsel) that (A) such stockholder is an Unsuitable Person, and (B) it is necessary for such stockholder or an affiliate of such stockholder (as applicable) to sell and transfer such number and class(es)/series of capital stock in order for the Corporation or any affiliated company to: (1) obtain, renew, maintain or prevent the loss, rejection, rescission, suspension, revocation or non-renewal of a material Gaming License (as defined below); (2) comply in any material respect with a material Gaming Law (as defined below); (3) ensure that any material Gaming License held or desired in good faith to be held by the Corporation or any affiliated company, or the Corporation’s or any affiliated company’s application for, right to the use of, entitlement to, or ability to obtain or retain, any material Gaming License held or desired in good faith to be held by the Corporation or any affiliated company, is not precluded, delayed, impeded, impaired, threatened or jeopardized in any material respect; or (4) prevent the imposition of any materially burdensome terms or conditions on any material Gaming License held or desired in good faith to be held by the Corporation or any affiliated company, and specifying the reasoning for such determinations in reasonable detail, and (ii) conclusion of the arbitration process described below (if applicable); provided, further, that in the event that such stockholder reasonably believes that any of the above-described determinations by the Board were not made in good faith and such disagreement cannot be settled amicably by such stockholder and the Corporation, such disagreement with respect to whether the Board’s determination(s) were made in good faith shall be finally, exclusively and conclusively settled by mandatory arbitration conducted expeditiously in accordance with the American Arbitration Association (“AAA”) rules, by a single independent arbitrator (to be chosen by mutual agreement of the applicable stockholder and the Corporation, and if the parties are unable to agree, to be chosen as provided in the AAA rules) in an arbitration process that shall take place in Las Vegas, Nevada, with each party bearing its own legal fees and expenses, unless otherwise determined by the arbitrator. For the avoidance of doubt, the only question before the arbitrator shall be whether such determinations were made by the Board in good faith. For the further avoidance of doubt, at the initial meeting described above with respect to whether a stockholder is an Unsuitable Person, the Board may defer making any such determination in order to conduct further investigation into the matter, but in connection with any future meeting of the Board regarding the matter, such stockholder shall be provided with reasonable notice and a reasonable opportunity for such stockholder, together with the counsel of such stockholder, to be heard before the Board at such meeting and to provide documents and written arguments to the Board a reasonable length of time in advance of such meeting. Following (x) the Board determining in good faith (following consultation with reputable outside gaming regulatory counsel) and in accordance with the foregoing (including such determination being made pursuant to a resolution of the Board adopted by an affirmative vote of a majority of the disinterested members of the Board), that such stockholder is an Unsuitable Person and it is necessary for such stockholder or an affiliate of such stockholder (as applicable) to sell and transfer a certain number and class(es)/series of capital stock for any of the reasons set forth above, and (y) if applicable, the arbitrator determining that such determinations were made in good faith by the Board, the Corporation shall deliver a Transfer Notice to the Unsuitable Person or its affiliate(s) (as applicable) and shall purchase and/or cause one or more Third Party Transferees to purchase such number and class(es)/series of capital stock determined in good faith by the Board in accordance with the foregoing and specified in the Transfer Notice on the Transfer Date and for the Purchase Price (as defined below) set forth in the Transfer Notice (which Purchase Price shall be determined in accordance with the definition of Purchase Price set forth below); provided that an Unsuitable Person or its affiliate(s) (as applicable) shall be permitted, during the forty five (45)-day period commencing on the date of the Transfer Notice (or before a Transfer Notice is formally delivered), to effect and close a disposition of the number and class(es)/series of capital stock specified in the Transfer Notice (or a portion of them) to a transferee that the Board determines in good faith (following consultation with reputable outside gaming regulatory counsel) is not an Unsuitable Person, on terms agreed between the Unsuitable Person and such person, entity or trust (an “Alternate Private Transaction”), it being agreed that in the event that the Board fails to make a determination in good faith that such transferee is not an Unsuitable Person within fifteen (15) days from the date on which the Corporation was presented in writing with the identity of such transferee and materials reasonably sufficient to make such determination, then the Unsuitable Person shall be entitled to consummate the Alternate Private Transaction with such transferee. In the case of a sale and transfer to the Corporation, from and after the Transfer Date and subject only to the right to receive the Purchase Price for such capital stock, such capital stock shall, be deemed no longer outstanding and such Unsuitable Person or any affiliate of such Unsuitable Person shall cease to be a stockholder with respect to such capital stock, and all rights of such Unsuitable Person or any affiliate of such Unsuitable Person therein, other than the right to receive the Purchase Price, shall cease.

(b) In the case of an Alternate Private Transaction or a transfer to one or more Third Party Transferees otherwise determined by the Board above, from and after the earlier to occur of: (i) the Transfer Date, in the case of a transfer to one or more such Third Party Transferees, or (ii) consummation of an Alternate Private Transaction, subject only to the right to receive the Purchase Price for such Unsuitable Person’s capital stock, all rights and entitlements of the Unsuitable Person or any such affiliates of an Unsuitable Person as a stockholder of the Corporation shall be terminated, including, without limitation, any such Unsuitable Person shall from such date no longer be entitled to: (i) receive any dividend, payment, distribution or interest with regard to the applicable capital stock which has been declared following such date or of which the due payment date according to the applicable declaration is following such date, other than the right to receive the Purchase Price, or (ii) to exercise, directly or indirectly or through any proxy, trustee, or nominee, any voting or other right (including, without limitation, observer and information rights) conferred by the underlying capital stock.

(c) The closing of a sale and transfer contemplated by clauses (a) and (b) above in this Article IX, other than an Alternate Private Transaction (the “Closing”) shall take place at the principal executive offices of the Corporation or via electronic exchange of documents on the Transfer Date. At the Closing: (i) the Corporation or Third Party Transferee(s) (as applicable), shall deliver the aggregate applicable Purchase Price for the capital stock being purchased by each of the foregoing by wire transfer of immediately available funds to the account specified in writing by the Unsuitable Person or an affiliate of such Unsuitable Person (as applicable) in the case of Third Party Transferees, by unsecured promissory note in the case of the Corporation, or combination of both in the case of the Corporation in such proportion as the Corporation may determine in its sole and absolute discretion and (ii) the Unsuitable Person or affiliate of such Unsuitable Person (as applicable) shall deliver to the Corporation or each such Third Party Transferee (if applicable), such stock powers, assignment instruments and other agreement as are necessary or appropriate to fully convey all right, title and interest in and to the capital stock being purchased by each of the foregoing, free and clear of all liens and other encumbrances (other than restrictions on transfer under these Articles, the Bylaws, any applicable stockholders agreement(s), and applicable federal and state securities laws) and to evidence the subordination of any promissory note if and only to the extent required by any debt obligations of the Corporation (and to the minimum extent required pursuant to such subordination arrangement). Such stock powers, assignment instruments and other agreements shall be in a form reasonably acceptable to the Corporation and shall include no representations and warranties other than such representations and warranties as to title and ownership of the capital stock being sold, due authorization, execution and delivery of relevant documents by the Unsuitable Person or any such affiliates of such Unsuitable Person (as applicable), and the enforceability of relevant obligations of such party under the relevant documents). Under any promissory note, an amount equal to one-third of the principal amount and the interest accrued thereon shall be due and payable no later than three (3) months following the Transfer Date, and the remaining principal amount of any such promissory note together with any unpaid interest accrued thereon shall be due and payable no later than one (1) year following the Transfer Date; provided that in the event that the Corporation does not have funds available to make the first payment, the Corporation and the Unsuitable Party agree to negotiate an alternate payment structure (including, without limitation, whether or not the promissory note or payment obligation should be secured by assets of the Corporation) in good faith (except that in the event that the Corporation and the Unsuitable Person are unable to reach an amicable solution as to such alternate payment structure, the original payment schedule and terms set out in first part of this sentence shall remain in force, and the applicable amounts under the promissory note shall be due and payable in accordance with the payment schedule set out above). The unpaid principal of any such promissory note shall bear interest at the rate of five percent (5%) per annum, and such promissory note shall contain such other reasonable and customary terms and conditions as the Corporation reasonably determines necessary or advisable, provided that they do not include any unduly burdensome or unreasonably adverse terms to the Unsuitable Person or affiliate of such Unsuitable Person (as applicable), it being agreed that such terms may include, without limitation, prepayment at the maker’s option at any time without premium (other than the interest agreed herein) or penalty and subordination if and only to the extent required by any debt obligations of the Corporation (and to the minimum extent required pursuant to such subordination arrangement). The sale and transfer of the applicable capital stock shall be effected at the Closing upon delivery of the Purchase Price described in this Article IX1(c) without regard to the provision by the Unsuitable Person or affiliate of such Unsuitable Person (as applicable) of the stock powers, assignment instruments and other agreements described above (and subject to their terms described above) and the Corporation may in its sole and absolute discretion execute and deliver such instruments or other documents described above necessary to effect such transfer under such terms (including, without limitation, any stock powers, assignment instruments and other agreements) and deemed by the Corporation in its sole and absolute discretion (acting in good faith) to be necessary or advisable in its name or in the name and on behalf of the Unsuitable Person or any affiliate of such Unsuitable Person (as applicable) to effect the sale and transfer; provided, however, that the Unsuitable Person or affiliate of such Unsuitable Person (as applicable) shall continue to have the obligation to the Corporation and the Third Party Transferees, as applicable, to provide such stock powers, assignment instruments and other agreements.

(d) To the extent that a sale and transfer to one or more Third Party Transferees is determined to be invalid or unenforceable for any reason, the Corporation shall be permitted to redeem or repurchase the capital stock owned or controlled by an Unsuitable Person or an affiliate of an Unsuitable Person (as applicable) for the price and under the terms contemplated by this Article IX promptly following any such determination.

2. Indemnification. Any Unsuitable Person and any affiliate of an Unsuitable Person that owns or controls capital stock shall indemnify and hold harmless the Corporation and its affiliated companies for any and all losses, costs and expenses, including, without limitation, attorneys’ costs, fees and expenses reasonably incurred by the Corporation and its affiliated companies as a result of, or arising out of, such Unsuitable Person’s or Affiliate’s continuing ownership or control of capital stock following the Transfer Date in breach of this Article IX, the neglect, refusal or other failure to comply in any material respect with the provisions of this Article IX, or failure to divest itself of any capital stock when and in the specific manner required by the Gaming Laws or this Article IX and by acceptance of its capital stock any such Unsuitable Person or affiliate of an Unsuitable Person shall be deemed to have agreed to so indemnify the Corporation.

3. Non-Exclusivity of Rights. The right of the Corporation to purchase or cause to be purchased its capital stock pursuant to this Article IX shall not be exclusive of any other rights the Corporation may have or hereafter acquire under any agreement, provision of these Articles or the Bylaws or otherwise. Notwithstanding the provisions of this Article IX, the Corporation, the Unsuitable Person and any of its affiliates shall have the right to propose that the parties, immediately upon or following the delivery of the Transfer Notice, enter into an agreement or other arrangement (including, without limitation, based on any agreement that may be reached between the applicable Gaming Authority (as defined below) and an Unsuitable Person or its affiliates in this regard), including, without limitation, a divestiture trust or divestiture plan, which will reduce or terminate an Unsuitable Person’s or its affiliate’s ownership or control of all or a portion of its capital stock over time and, in the event such an agreement or arrangement is reached, the terms of such agreement or arrangement as agreed by the Corporation, such Unsuitable Person and any affiliates of such Unsuitable Person (including, without limitation, as to the purchase price at which the capital stock can be sold) shall apply and prevail over the terms of this Article IX.

4. Further Actions. Nothing contained in this Article IX shall limit the authority of the Corporation to take such other action, to the extent permitted by law, as it deems necessary or advisable (following consultation with reputable outside gaming regulatory counsel) to protect the Corporation or its affiliated companies from the denial or threatened denial, loss or threatened loss or material delayed issuance or threatened material delayed issuance of any material Gaming License of the Corporation or any of its affiliated companies, provided that any forced disposal of capital stock shall be effected only in accordance with the terms of this Article IX. In addition, the Corporation may, to the extent permitted by law, from time to time establish, modify, amend or rescind bylaws, regulations, and procedures of the Corporation to the extent they are not inconsistent with the express provisions of this Article IX for the purpose of determining whether any person, entity or trust is an Unsuitable Person and for the orderly application, administration and implementation of the provisions of this Article IX; provided that the provisions of any such bylaws, regulations and procedures shall not be more adverse in any material respect to the stockholders than the provisions of this Article IX. Such procedures and regulations shall be kept on file with the Secretary of the Corporation, the secretary of its affiliated companies and with the transfer agent, if any, of the Corporation and any affiliated companies, and shall be made available for inspection and, upon reasonable request, mailed to any record holder of capital stock. The Board shall have exclusive authority and power to administer this Article IX and to exercise all rights and powers specifically granted to the Board or the Corporation, or as may be necessary or advisable in the administration of this Article IX. Subject to the arbitration provisions set forth above, all such actions which are done or made by the Board in compliance with the provisions of this Article IX and applicable law shall be final, conclusive and binding on the Corporation and all other persons, entities and trust; provided, however, the Board may delegate all or any portion of its duties and powers under this Article IX to a committee of the Board as it deems necessary or advisable.

5. Legend. The restrictions set forth in this Article IX shall be noted conspicuously on any certificate or registration evidencing capital stock in accordance with applicable law in such manner as may be determined by the Corporation in its sole and absolute discretion.

6. Compliance with Gaming Laws. All persons, entities or trusts owning or controlling capital stock in the Corporation shall comply with all applicable Gaming Laws which apply to them in their capacity as owners or controllers of the capital stock, including, without limitation, any provisions of such Gaming Laws that require such stockholders to file applications for Gaming Licenses with, and provide information to, the applicable Gaming Authorities in respect of Gaming Licenses held or desired to be held by the Corporation or any affiliated companies, subject to any rights that such stockholders may have under such Gaming Laws to seek waivers or similar relief from the applicable Gaming Authorities with respect to such requirements to file applications and provide information. Any transfer of capital stock may be subject to the prior approval of the Gaming Authorities and/or the Corporation, and any purported transfer thereof in violation of such requirements shall be void ab initio.

7. Provisions of the Bylaws in Conflict with Law or Regulation. The provisions of these Articles are severable, and if the Board shall determine, with the advice of reputable outside gaming regulatory counsel, that any one or more of the provisions contained herein are in conflict with any laws or regulations, including without limitation, any Gaming Laws, then such conflicting provisions shall be deemed never to have constituted a part of these Articles, and the Board shall amend these Articles; provided, however, that this determination shall not affect or impact any of the remaining provisions of these Articles or render invalid or improper any action taken or omitted prior to such determination. If any provision of these Articles shall be held invalid or unenforceable, the invalidity or unenforceability shall attach only to that provision and shall not in any manner affect or render invalid or unenforceable any other provision, and these Articles shall be carried out as if the invalid or unenforceable provision was not present.

8. For purposes of this Article IX, certain capitalized terms shall have the meaning set forth below:

“Gaming Activities” means the conduct of gaming and gambling activities, race books and sports pools, or the use of gaming devices, equipment and supplies in the operation of a casino, gambling simulcasting facility, card club or other similar enterprise, including, without limitation, slot machines, gaming tables, cards, dice, gaming chips, player tracking systems, cashless wagering systems, mobile gaming systems, inter-casino linked systems and related and associated equipment, supplies and systems.

“Gaming Authorities” means all international, national, foreign, domestic, federal, state, provincial, regional, local, tribal, municipal and other regulatory and licensing bodies, instrumentalities, departments, commissions, authorities, boards, officials, tribunals and agencies with authority over or responsibility for the regulation of Gaming Activities within any Gaming Jurisdiction.

“Gaming Jurisdictions” means all jurisdictions, domestic and foreign, and their political subdivisions, in which Gaming Activities are or may be lawfully conducted, and in which or from which the Corporation or any of its affiliated companies conducts, or reasonably expects to conduct, Gaming Activities which are subject to Gaming Laws.

“Gaming Laws” means all laws, statutes and ordinances pursuant to which any Gaming Authority possesses regulatory, permit and licensing authority over the conduct of Gaming Activities in which the Corporation or any of its affiliated companies engages, or the ownership or control of an interest in any such entity that conducts Gaming Activities, in any Gaming Jurisdiction, all orders, decrees, rules and regulations promulgated thereunder, all written and unwritten policies of the Gaming Authorities with respect to the foregoing and all written and unwritten interpretations by the Gaming Authorities of such laws, statutes, ordinances, orders, decrees, rules, regulations and policies.

“Gaming Licenses” shall mean all licenses, permits, certifications, approvals, orders, authorizations, registrations, findings of suitability, franchises, exemptions, waivers, concessions and entitlements issued by any Gaming Authority necessary for or relating to the conduct of Gaming Activities by the Corporation or any affiliated company or the ownership or control by any person of an interest in any of the foregoing entities, to the extent that it conducts or reasonably expects in good faith to conduct Gaming Activities.

“Purchase Price” means the fair value of the applicable capital stock based on the per share value of such capital stock as determined by the Board in good faith (it being agreed that in the case shares of Common Stock or shares of Preferred Stock of the Corporation that are listed on a national securities exchange, such fair value per share shall be the average of the Volume Weighted Average Share Price of such shares for the twenty (20) consecutive trading days preceding the date on which the Transfer Notice in respect of such capital stock is delivered by the Corporation to the Unsuitable Person or affiliate of such Unsuitable Person (as applicable), if such information is available).

“Third Party Transferees” means one or more third parties determined in accordance with the procedures set forth in Article IX1(a) of these Articles to purchase some or all of the capital stock to be sold and transferred in accordance with a Transfer Notice and the terms of these Articles.

“Transfer Date” means the date specified in the Transfer Notice as the date on which the capital stock owned or controlled by an Unsuitable Person or an affiliate of an Unsuitable Person (as applicable) are to be sold and transferred to the Corporation or one or more Third Party Transferees in accordance with Article IX of these Articles, which date shall be no less forty-six (46) days and no later than seventy-five (75) days after the date of the Transfer Notice.

“Transfer Notice” means a notice of transfer delivered by the Corporation to an Unsuitable Person or an affiliate of an Unsuitable Person (as applicable) if the Board deems it necessary or advisable, to cause such Unsuitable Person’s or affiliate’s (as applicable) capital stock to be sold and transferred pursuant to Article IX of these Articles. Each Transfer Notice shall set forth (i) the Transfer Date, (ii) the number and class/series of capital stock to be sold and transferred, (iii) the Purchase Price with respect to each class/series of such capital stock which will be determined in accordance with the terms of Article IX of these Articles, (iv) the place where any certificates for such capital stock shall be surrendered, and (v) any other reasonable requirements of surrender of the capital stock imposed in good faith by the Corporation, including, without limitation, how certificates representing such capital stock are to be endorsed, if at all.

“Unsuitable Person” means a person, entity, or trust who (i) fails or refuses to file an application (or fails or refuses, as an alternative, to otherwise formally request from the relevant Gaming Authority a waiver or similar relief from filing such application) within thirty (30) days (or such shorter period imposed by any Gaming Authority, including any extensions of that period granted by the relevant Gaming Authority, but in no event more than such original thirty (30) days) after having been requested in writing and in good faith to file an application by the Corporation (based on consultation with reputable outside gaming regulatory counsel), or has withdrawn or requested the withdrawal of a pending application (other than for technical reasons with the intent to promptly file an amended application following such withdrawal), to be found suitable by any Gaming Authority or for any Gaming License, in each case, when such finding of suitability or Gaming License is required by Gaming Laws or Gaming Authorities for the purpose of obtaining a material Gaming License for, or compliance with material Gaming Laws by, the Corporation or any affiliated company, (ii) is denied or disqualified from eligibility for any material Gaming License by any Gaming Authority, (iii) is determined by a Gaming Authority in any material Gaming Jurisdiction to be unsuitable to own or control any capital stock, or be affiliated, associated or involved with a person engaged in Gaming Activities, (iv) is determined by a Gaming Authority to have caused in whole or in part any material Gaming License of the Corporation or any affiliated company to be lost, rejected, rescinded, suspended, revoked or not renewed by any Gaming Authority, or to have caused in whole or in part the Corporation or any affiliated company to be threatened in writing by any Gaming Authority with the loss, rejection, rescission, suspension, revocation or non-renewal of any material Gaming License (in each of (ii) through (iv) above, only if such denial, disqualification or determination by a Gaming Authority is final and non-appealable), or (v) is reasonably likely to, in the sole and absolute discretion of the Board, (A) preclude or materially delay, impede, impair, threaten or jeopardize (1) any material Gaming License held or desired in good faith to be held by the Corporation or any affiliated company or (2) the Corporation’s or any affiliated company’s application for, right to the use of, entitlement to, or ability to obtain or retain, any material Gaming License held or desired in good faith to be held by the Corporation or any affiliated company, or (B) cause or otherwise be reasonably likely to result in the imposition of any materially burdensome terms or conditions on any material Gaming License held or desired in good faith to be held by the Corporation or any affiliated company.

Article X

MISCELLANEOUS

1. Headings. The headings of the various sections and subsections of these Articles are for convenience of reference only and shall not affect the interpretation of any of the provisions of these Articles.

2. Interpretation. Whenever possible, each provision of these Articles shall be interpreted in a manner as to be effective and valid under applicable law and public policy. If any provision set forth herein is held to be invalid, unlawful, or incapable of being enforced by reason of any rule of law or public policy, such provision shall be ineffective only to the extent of such prohibition or invalidity, without invalidating or otherwise adversely affecting the remaining provisions these Articles. No provision herein set forth shall be deemed dependent upon any other provision unless so expressed herein. If a court of competent jurisdiction should determine that a provision of these Articles would be valid or enforceable if a period of time were extended or shortened, then such court may make such change as shall be necessary to render the provision in question effective and valid under applicable law.

[Signature Page Follows]

IN WITNESS WHEREOF, the Corporation has caused these Amended and Restated Articles of Incorporation to be signed by the undersigned, a duly authorized officer of the Corporation, on August 7, 2024.

| | KeyStar Corp, a Nevada corporation |

| | | |

| | By: | /s/ Bruce Cassidy |

| | | Bruce Cassidy, its Chief Executive Officer |