Investor Presentation November 15, 2021 Exhibit 99.2

Disclaimers and Forward-Looking Statements This investor presentation (this "presentation" and any oral statements made in connection with this presentation are for information purposes only and do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other securities of Aveanna Healthcare Holdings Inc. (including its consolidated subsidiaries, "Aveanna," the "Company," "we," "us" or "our"). The information contained herein does not purport to be all inclusive. The data contained herein as derived from various internal and external sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of such information. Any data on past performance contained herein is not an indication as to future performance. Except as required by applicable law, Aveanna assumes no obligation to update the information in this presentation. Nothing herein shall be deemed to constitute investment, legal, tax, financial, accounting or other advice. The communication of this presentation is restricted by law and it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. No representation or warranty (whether express or implied) has been made by Aveanna with respect to the matters set forth in this presentation. Cautionary Note Regarding Forward-Looking Statements Certain matters discussed in this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements (other than statements of historical facts) in this presentation regarding our prospects, plans, financial position, business strategy and expected financial and operational results may constitute forward-looking statements. Forward-looking statements generally can be identified by the use of terminology such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,” “may,” “should,” “predict,” “project,” “potential,” “continue” or the negatives of these terms or variations of them or similar expressions. These statements are based on certain assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate in these circumstances. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. Forward-looking statements involve a number of risks and uncertainties that may cause actual results to differ materially from those expressed or implied by such forward-looking statements, such as our ability to successfully execute our growth strategy, including through organic growth and the completion of acquisitions, effective integration of the companies we acquire, unexpected costs of acquisitions and dispositions, the possibility that expected cost synergies may not materialize as expected, the failure of Aveanna or the companies we acquire to perform as expected, estimation inaccuracies in revenue recognition, our ability to drive margin leverage through lower costs, unexpected increases in SG&A and other expenses, changes in reimbursement, changes in government regulations, changes in Aveanna’s relationships with referral sources, increased competition for Aveanna’s services or wage inflation, changes in the interpretation of government regulations or discretionary determinations made by government officials, uncertainties regarding the outcome of rate discussions with managed care organizations and our ability to effectively collect our cash from these organizations, our ability to effectively bill and collect under new Electronic Visit Verification regulations, changes in tax rates, the impact of adverse weather, the impact to our business operations, reimbursements and patient population were the COVID-19 environment to worsen, and other risks set forth under the heading “Risk Factors” in Aveanna‘s Registration Statement on Form S-1, as amended, filed with the Securities and Exchange Commission and which was declared effective on April 28, 2021, which is available at www.sec.gov. In addition, these forward-looking statements necessarily depend upon assumptions, estimates and dates that may prove to be incorrect or imprecise. Accordingly, forward-looking statements included in this presentation do not purport to be predictions of future events or circumstances, and actual results may differ materially from those expressed by forward-looking statements. All forward-looking statements speak only as of the date made, and Aveanna undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Industry and Market Data Unless otherwise indicated, information contained in this presentation concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable, but we have not independently verified the accuracy of this information. Any industry forecasts are based on data (including third-party data), models and experience of various professionals and are based on various assumptions, all of which are subject to change without notice. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in “Cautionary Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us. Non-GAAP Financial Measures This presentation includes various performance indicators and non-GAAP financial measures that we use to help us evaluate our business, identify trends affecting our business, formulate business plans, and make strategic decisions. EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Field contribution, Field contribution margin, Adjusted corporate expense and pro forma presentations of the foregoing are financial measures that are calculated and presented on the basis of methodologies other than in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Reconciliations of such non-GAAP measures to their nearest comparable GAAP measures can be found in the Appendix to this presentation or contained in Aveanna's filings with the SEC, which can be viewed on the SEC's website, www.sec.gov, and on Aveanna's website, www.aveanna.com. Any non-GAAP financial measures used in this presentation are in addition to, and not meant to be considered superior to, or a substitute for, the Company’s financial statements prepared in accordance with GAAP. Additional information with respect to Aveanna is contained in its filings with the SEC and is available at the SEC's website, www.sec.gov, and on Aveanna's website, www.aveanna.com

YEARS IN HOME HEALTH / HEALTHCARE Today’s Presenters Rod Windley Executive Chairman Tony Strange Chief Executive Officer David Afshar �Chief Financial Officer Jeff Shaner Chief Operating Officer 30+ 30+ 15+ 20+ Founded Healthfield in 1986, acquired by Gentiva Health Services in 2006 for $454 million Former Vice Chairman and later Executive Chairman of Gentiva Health Services, acquired by Kindred Healthcare in 2015 �for $1.8 billion Executive Chairman of �PSA Healthcare since 2015 Executive Chairman of �Aveanna Healthcare since 2017 Former President of Healthfield, acquired by Gentiva in 2006 �for $454 million Former CEO and Board Member �of Gentiva Health Services, �acquired by Kindred Healthcare �in 2015 for $1.8 billion Chief Executive Officer of �PSA Healthcare since 2015 Chief Executive Officer of �Aveanna Healthcare since 2017 Inspections Leader with the �Public Company Accounting Oversight Board Former CFO of ApolloMD Chief Financial Officer of �Aveanna Healthcare since 2018 Former VP of Operations of Healthfield, acquired by Gentiva Health Services in 2006 Former President of Gentiva �Health Services’ Hospice Division Former SVP, President of Operations of Gentiva Health Services Chief Operating Officer of �PSA Healthcare since 2015 Chief Operating Officer of �Aveanna Healthcare since 2017

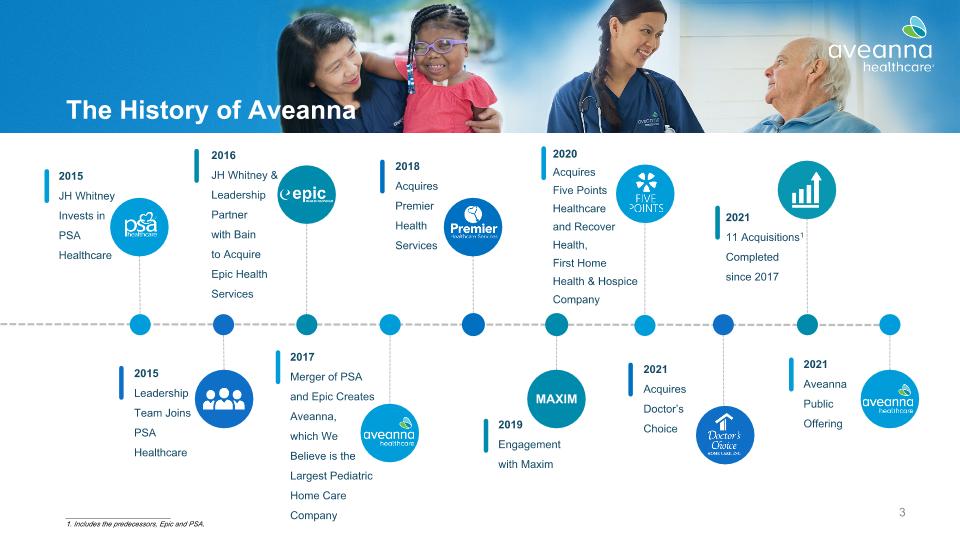

The History of Aveanna ___________________________ 1. Includes the predecessors, Epic and PSA. 2015 Leadership Team Joins PSA Healthcare 2018 Acquires Premier Health Services 2017 Merger of PSA �and Epic Creates Aveanna, �which We �Believe is the Largest Pediatric Home Care Company 2021 Acquires Doctor’s Choice 2015 JH Whitney Invests in �PSA Healthcare 2016 JH Whitney & Leadership Partner�with Bain �to Acquire�Epic Health Services 2020�Acquires Five Points Healthcare �and Recover Health, First Home Health & Hospice Company 2021 11 Acquisitions1 Completed �since 2017 2019 Engagement with Maxim MAXIM 2021 Aveanna Public Offering

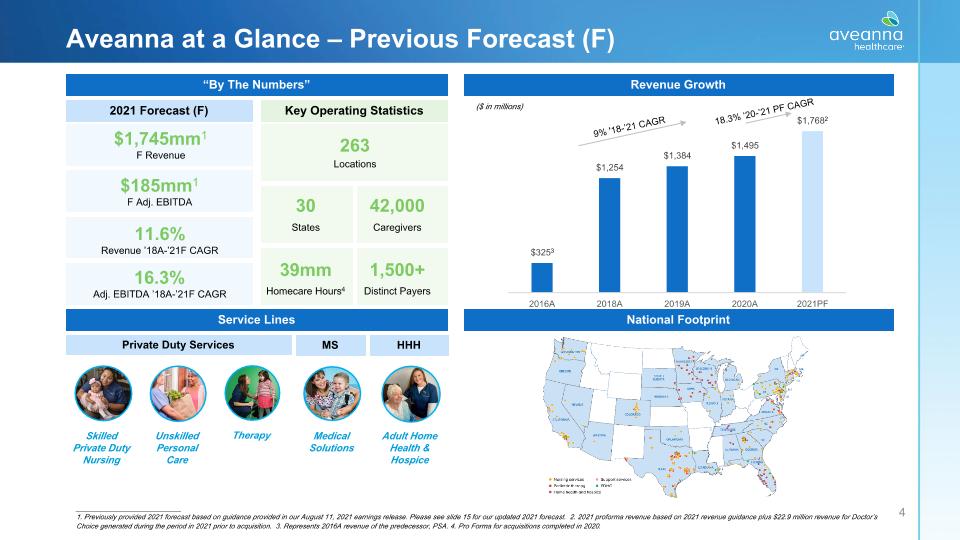

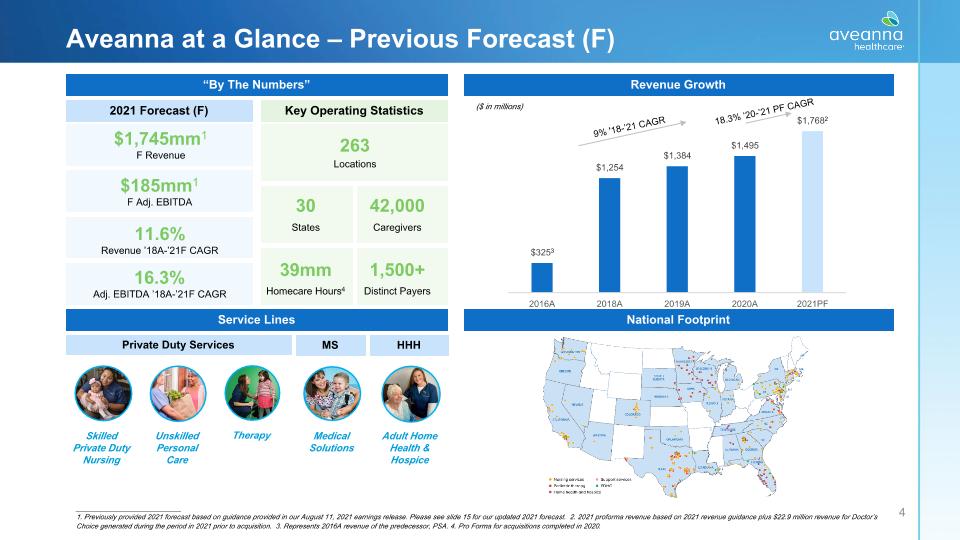

Aveanna at a Glance – Previous Forecast (F) “By The Numbers” Revenue Growth National Footprint Service Lines Skilled Private Duty Nursing Unskilled Personal Care Therapy Medical Solutions Adult Home Health & Hospice Private Duty Services 2021 Forecast (F) Key Operating Statistics $1,745mm1 F Revenue $185mm1 �F Adj. EBITDA 11.6%�Revenue ’18A-’21F CAGR 16.3%�Adj. EBITDA ’18A-’21F CAGR 263 Locations 30 States 42,000 Caregivers 39mm Homecare Hours4 1,500+ Distinct Payers MS HHH ($ in millions) 9% '18-’21 CAGR 18.3% ‘20-’21 PF CAGR ___________________________ 1. Previously provided 2021 forecast based on guidance provided in our August 11, 2021 earnings release. Please see slide 15 for our updated 2021 forecast. 2. 2021 proforma revenue based on 2021 revenue guidance plus $22.9 million revenue for Doctor’s Choice generated during the period in 2021 prior to acquisition. 3. Represents 2016A revenue of the predecessor, PSA. 4. Pro Forma for acquisitions completed in 2020.

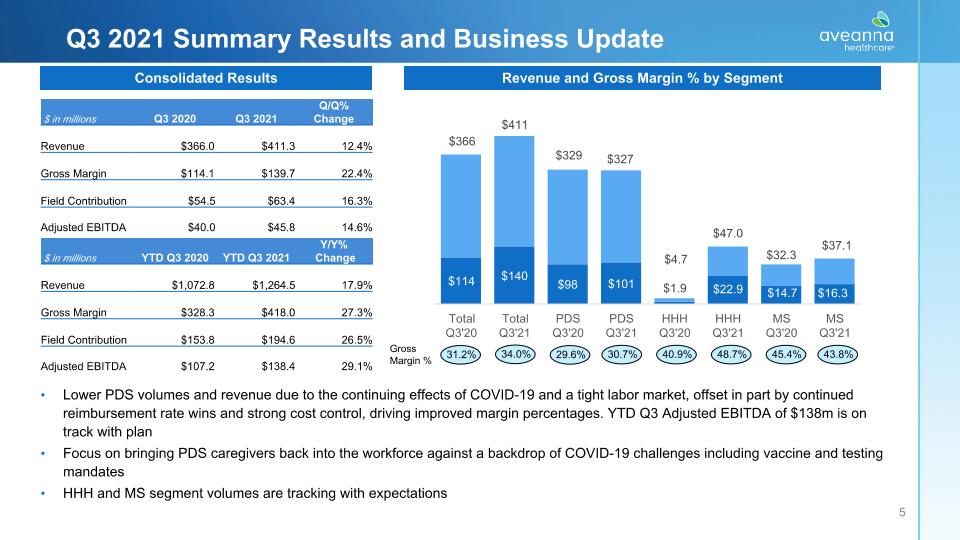

Summary of Q3 Results

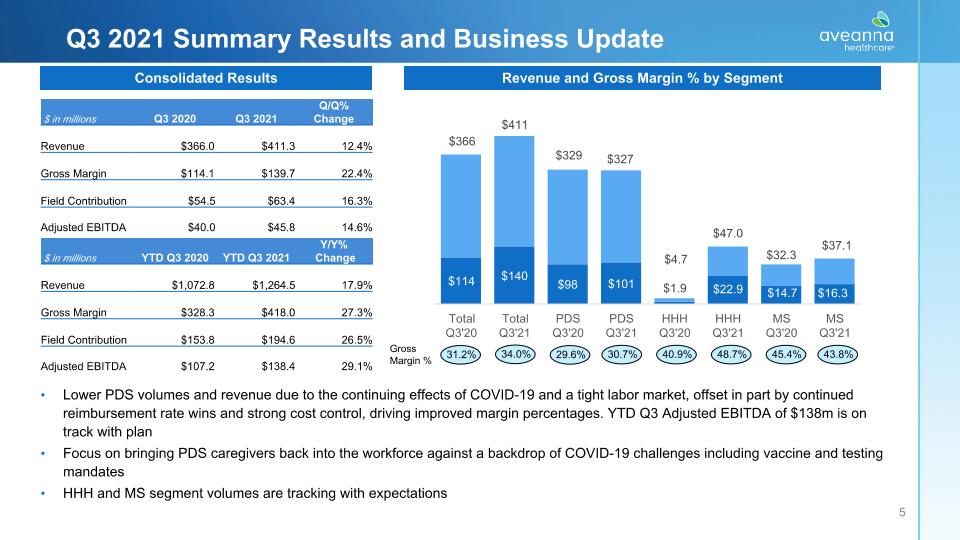

Q3 2021 Summary Results and Business Update Lower PDS volumes and revenue due to the continuing effects of COVID-19 and a tight labor market, offset in part by continued reimbursement rate wins and strong cost control, driving improved margin percentages. YTD Q3 Adjusted EBITDA of $138m is on track with plan Focus on bringing PDS caregivers back into the workforce against a backdrop of COVID-19 challenges including vaccine and testing mandates HHH and MS segment volumes are tracking with expectations $ in millions Q3 2020 Q3 2021 Q/Q% �Change Revenue $366.0 $411.3 12.4% Gross Margin $114.1 $139.7 22.4% Field Contribution $54.5 $63.4 16.3% Adjusted EBITDA $40.0 $45.8 14.6% Revenue and Gross Margin % by Segment $ in millions YTD Q3 2020 YTD Q3 2021 Y/Y%� Change Revenue $1,072.8 $1,264.5 17.9% Gross Margin $328.3 $418.0 27.3% Field Contribution $153.8 $194.6 26.5% Adjusted EBITDA $107.2 $138.4 29.1% Consolidated Results 31.2% 34.0% 29.6% 30.7% 40.9% 48.7% 45.4% 43.8% Gross Margin %

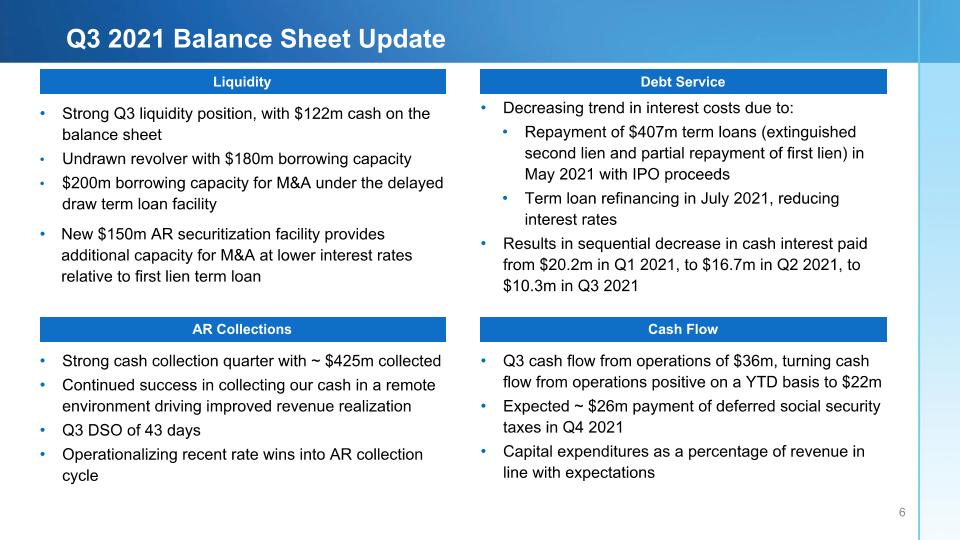

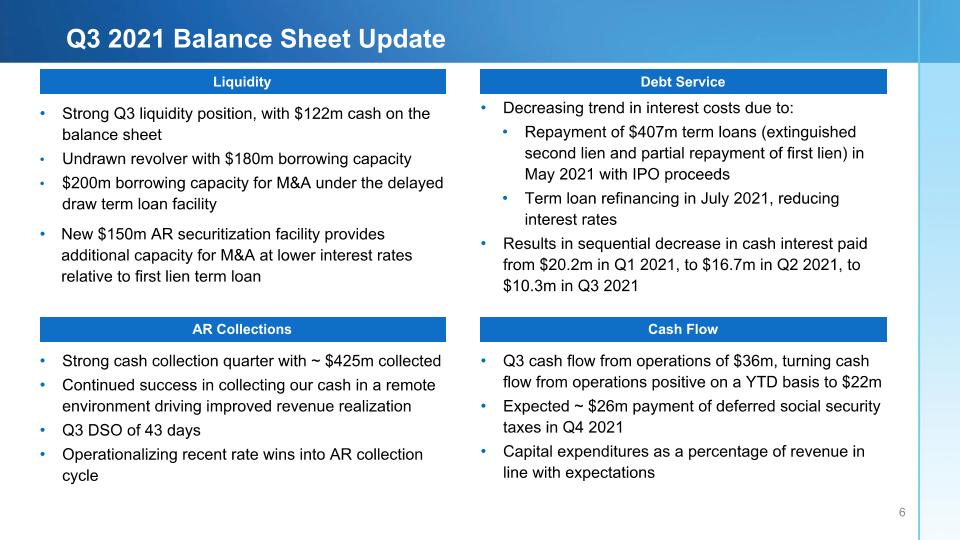

Q3 2021 Balance Sheet Update AR Collections Cash Flow Liquidity Debt Service Strong Q3 liquidity position, with $122m cash on the balance sheet Undrawn revolver with $180m borrowing capacity $200m borrowing capacity for M&A under the delayed draw term loan facility New $150m AR securitization facility provides additional capacity for M&A at lower interest rates relative to first lien term loan Strong cash collection quarter with ~ $425m collected Continued success in collecting our cash in a remote environment driving improved revenue realization Q3 DSO of 43 days Operationalizing recent rate wins into AR collection cycle Q3 cash flow from operations of $36m, turning cash flow from operations positive on a YTD basis to $22m Expected ~ $26m payment of deferred social security taxes in Q4 2021 Capital expenditures as a percentage of revenue in line with expectations Decreasing trend in interest costs due to: Repayment of $407m term loans (extinguished second lien and partial repayment of first lien) in May 2021 with IPO proceeds Term loan refinancing in July 2021, reducing interest rates Results in sequential decrease in cash interest paid from $20.2m in Q1 2021, to $16.7m in Q2 2021, to $10.3m in Q3 2021

M&A Update

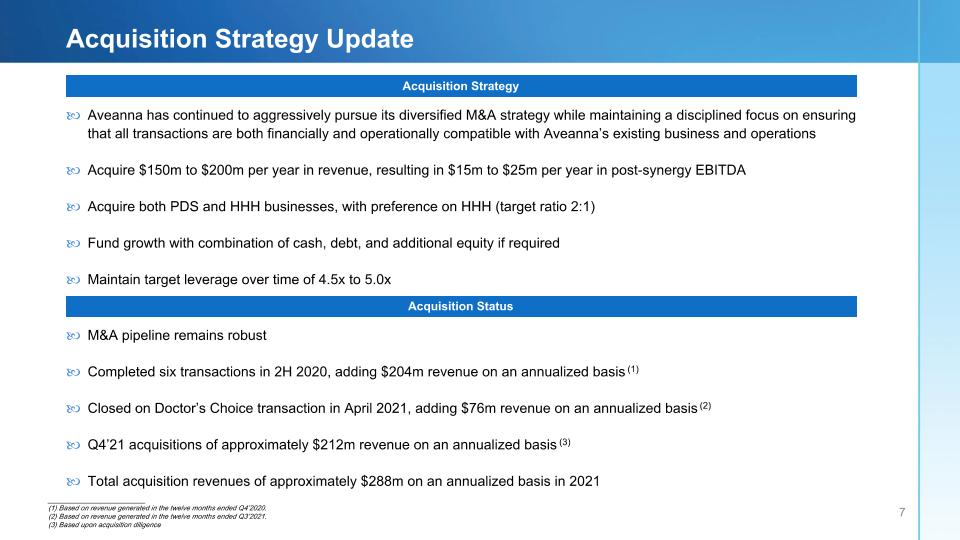

Acquisition Strategy Update Aveanna has continued to aggressively pursue its diversified M&A strategy while maintaining a disciplined focus on ensuring that all transactions are both financially and operationally compatible with Aveanna’s existing business and operations Acquire $150m to $200m per year in revenue, resulting in $15m to $25m per year in post-synergy EBITDA Acquire both PDS and HHH businesses, with preference on HHH (target ratio 2:1) Fund growth with combination of cash, debt, and additional equity if required Maintain target leverage over time of 4.5x to 5.0x Acquisition Strategy Acquisition Status M&A pipeline remains robust Completed six transactions in 2H 2020, adding $204m revenue on an annualized basis (1) Closed on Doctor’s Choice transaction in April 2021, adding $76m revenue on an annualized basis (2) Q4’21 acquisitions of approximately $212m revenue on an annualized basis (3) Total acquisition revenues of approximately $288m on an annualized basis in 2021 _________________________ (1) Based on revenue generated in the twelve months ended Q4’2020. (2) Based on revenue generated in the twelve months ended Q3’2021. (3) Based upon acquisition diligence

Q4 2021 M&A

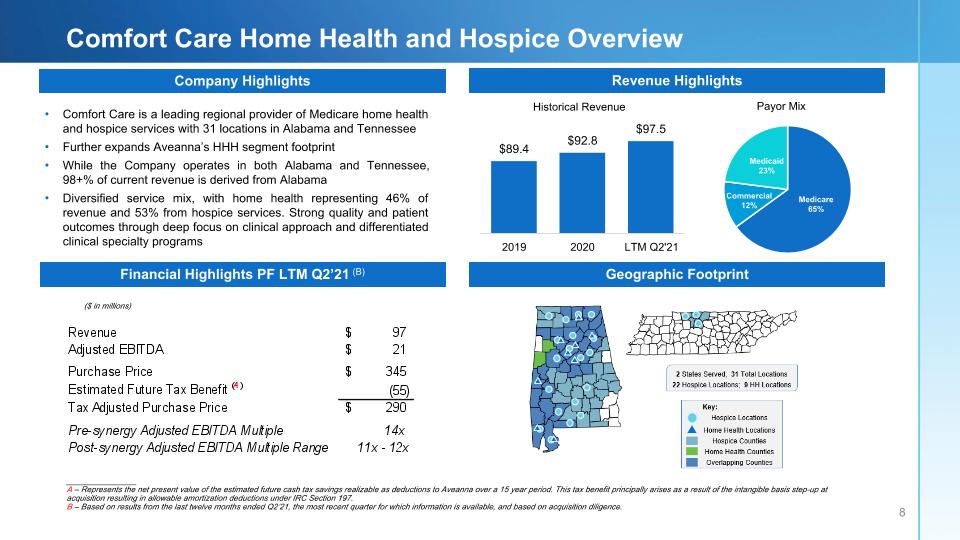

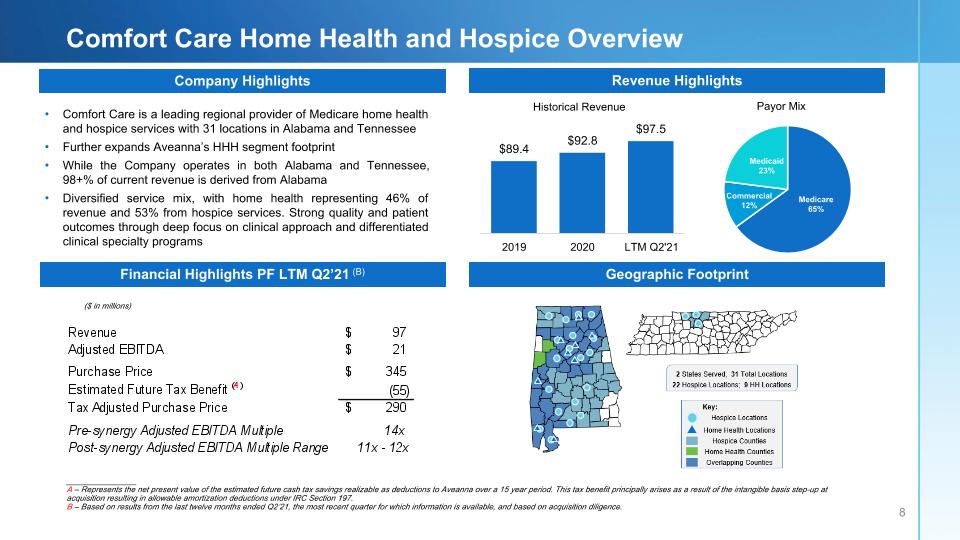

Company Highlights Revenue Highlights Comfort Care Home Health and Hospice Overview __________________ A – Represents the net present value of the estimated future cash tax savings realizable as deductions to Aveanna over a 15 year period. This tax benefit principally arises as a result of the intangible basis step-up at acquisition resulting in allowable amortization deductions under IRC Section 197. B – Based on results from the last twelve months ended Q2’21, the most recent quarter for which information is available, and based on acquisition diligence. ($ in millions) Financial Highlights PF LTM Q2’21 (B) Geographic Footprint Comfort Care is a leading regional provider of Medicare home health and hospice services with 31 locations in Alabama and Tennessee Further expands Aveanna’s HHH segment footprint While the Company operates in both Alabama and Tennessee, 98+% of current revenue is derived from Alabama Diversified service mix, with home health representing 46% of revenue and 53% from hospice services. Strong quality and patient outcomes through deep focus on clinical approach and differentiated clinical specialty programs

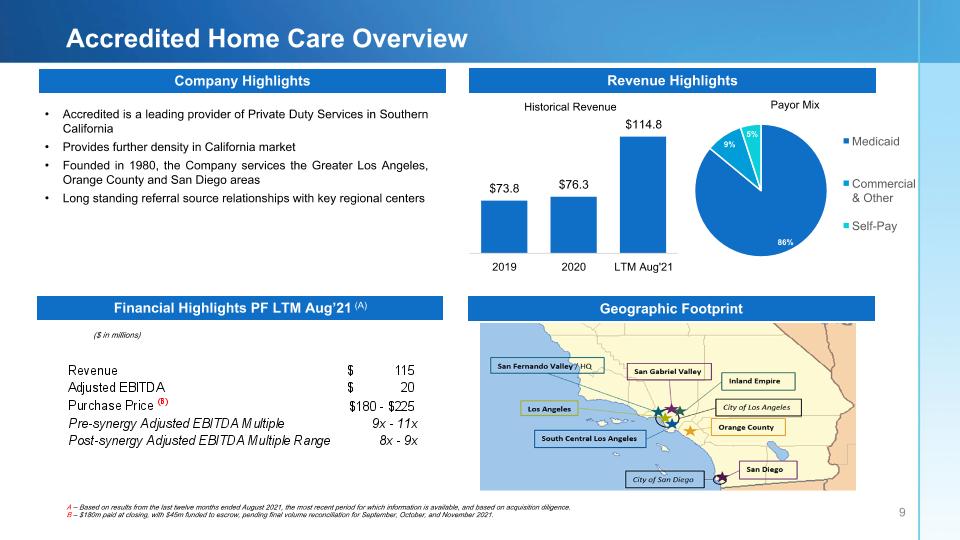

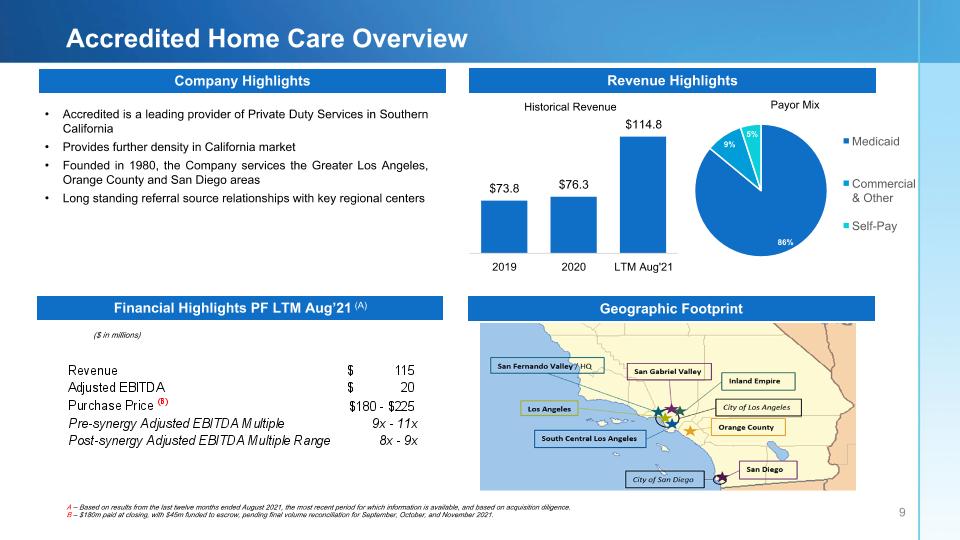

Financial Highlights PF LTM Aug’21 (A) Company Highlights Revenue Highlights Accredited Home Care Overview A – Based on results from the last twelve months ended August 2021, the most recent period for which information is available, and based on acquisition diligence. B – $180m paid at closing, with $45m funded to escrow, pending final volume reconciliation for September, October, and November 2021. ($ in millions) Geographic Footprint Accredited is a leading provider of Private Duty Services in Southern California Provides further density in California market Founded in 1980, the Company services the Greater Los Angeles, Orange County and San Diego areas Long standing referral source relationships with key regional centers

Capital Structure

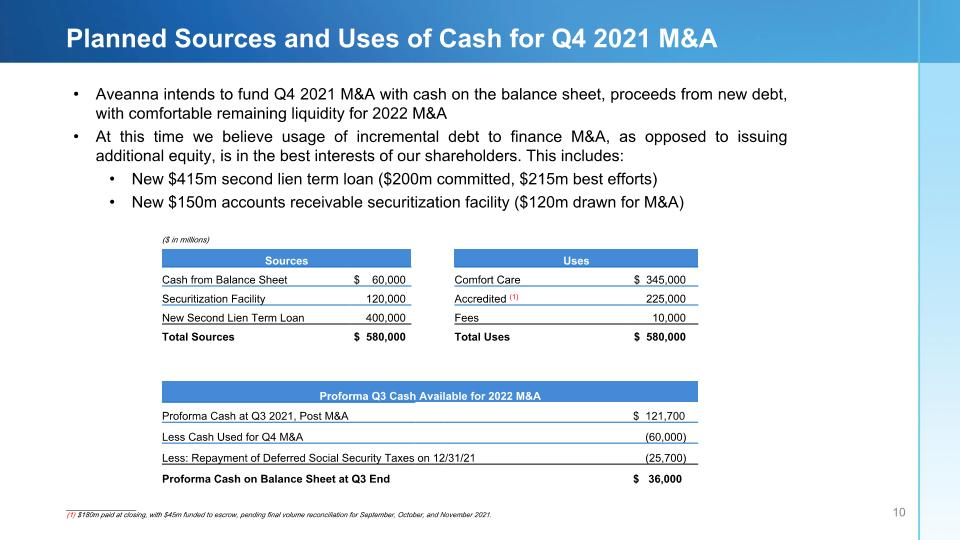

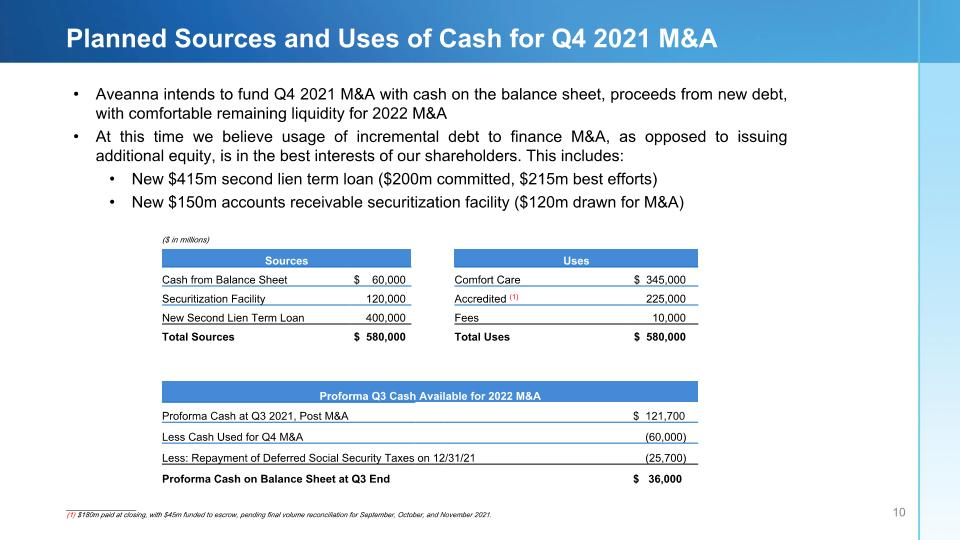

Planned Sources and Uses of Cash for Q4 2021 M&A __________________ (1) $180m paid at closing, with $45m funded to escrow, pending final volume reconciliation for September, October, and November 2021. ($ in millions) Aveanna intends to fund Q4 2021 M&A with cash on the balance sheet, proceeds from new debt, with comfortable remaining liquidity for 2022 M&A At this time we believe usage of incremental debt to finance M&A, as opposed to issuing additional equity, is in the best interests of our shareholders. This includes: New $415m second lien term loan ($200m committed, $215m best efforts) New $150m accounts receivable securitization facility ($120m drawn for M&A) Proforma Q3 Cash Available for 2022 M&A Proforma Cash at Q3 2021, Post M&A $ 121,700 Less Cash Used for Q4 M&A (60,000) Less: Repayment of Deferred Social Security Taxes on 12/31/21 (25,700) Proforma Cash on Balance Sheet at Q3 End $ 36,000 Sources Uses Cash from Balance Sheet $ 60,000 Comfort Care $ 345,000 Securitization Facility 120,000 Accredited (1) 225,000 New Second Lien Term Loan 400,000 Fees 10,000 Total Sources $ 580,000 Total Uses $ 580,000

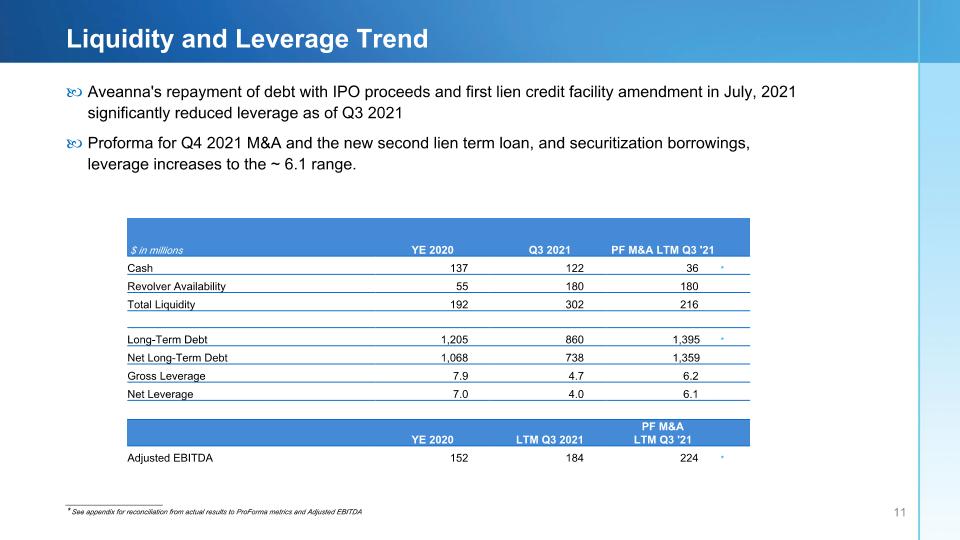

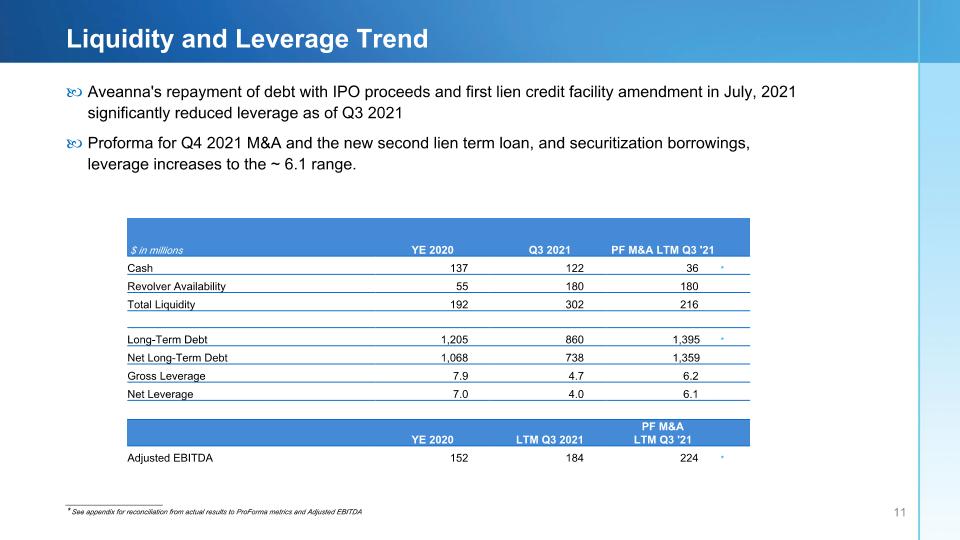

Liquidity and Leverage Trend Aveanna's repayment of debt with IPO proceeds and first lien credit facility amendment in July, 2021 significantly reduced leverage as of Q3 2021 Proforma for Q4 2021 M&A and the new second lien term loan, and securitization borrowings, leverage increases to the ~ 6.1 range. _________________________ * See appendix for reconciliation from actual results to ProForma metrics and Adjusted EBITDA $ in millions YE 2020 Q3 2021 PF M&A LTM Q3 '21 Cash 137 122 36 * Revolver Availability 55 180 180 Total Liquidity 192 302 216 Long-Term Debt 1,205 860 1,395 * Net Long-Term Debt 1,068 738 1,359 Gross Leverage 7.9 4.7 6.2 Net Leverage 7.0 4.0 6.1 YE 2020 LTM Q3 2021 PF M&A LTM Q3 '21 Adjusted EBITDA 152 184 224 *

Aveanna Outlook

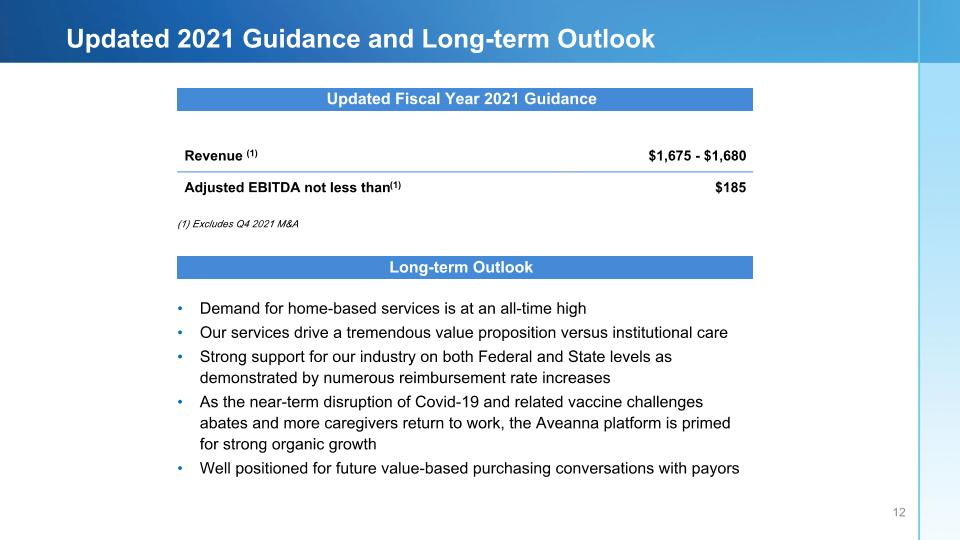

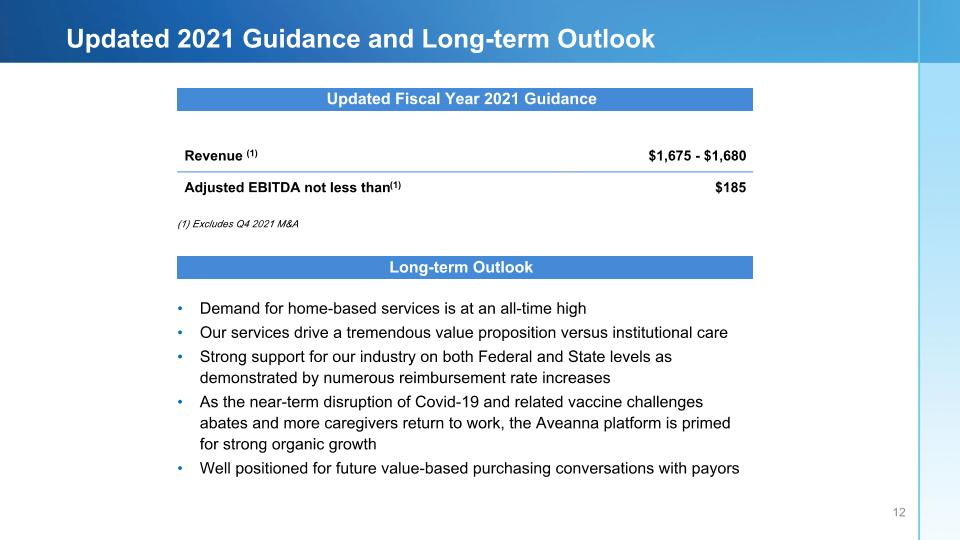

Updated 2021 Guidance and Long-term Outlook Updated Fiscal Year 2021 Guidance Revenue (1) $1,675 - $1,680 Adjusted EBITDA not less than(1) $185 Long-term Outlook (1) Excludes Q4 2021 M&A Demand for home-based services is at an all-time high Our services drive a tremendous value proposition versus institutional care Strong support for our industry on both Federal and State levels as demonstrated by numerous reimbursement rate increases As the near-term disruption of Covid-19 and related vaccine challenges abates and more caregivers return to work, the Aveanna platform is primed for strong organic growth Well positioned for future value-based purchasing conversations with payors

Appendix

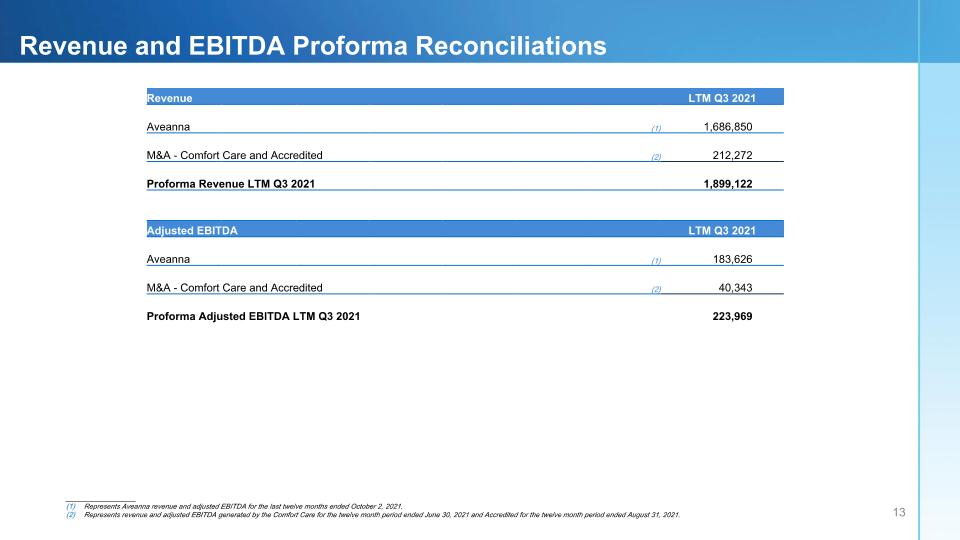

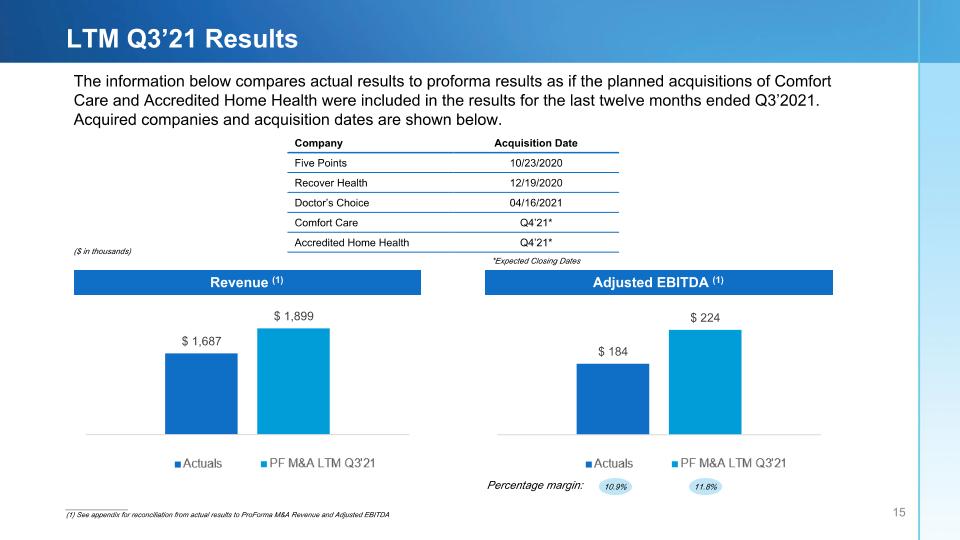

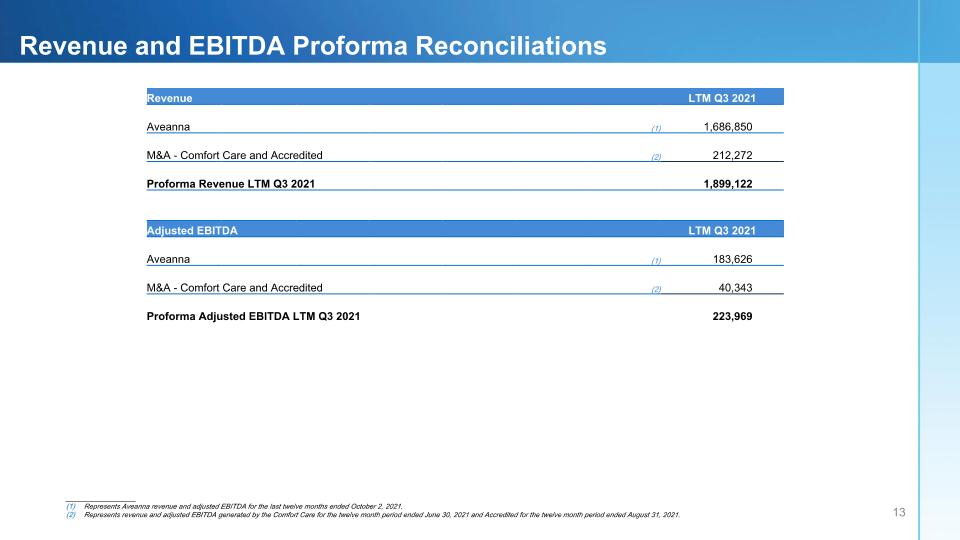

Revenue and EBITDA Proforma Reconciliations Revenue LTM Q3 2021 Aveanna (1) 1,686,850 M&A - Comfort Care and Accredited (2) 212,272 Proforma Revenue LTM Q3 2021 1,899,122 Adjusted EBITDA LTM Q3 2021 Aveanna (1) 183,626 M&A - Comfort Care and Accredited (2) 40,343 Proforma Adjusted EBITDA LTM Q3 2021 223,969 __________________ Represents Aveanna revenue and adjusted EBITDA for the last twelve months ended October 2, 2021. Represents revenue and adjusted EBITDA generated by the Comfort Care for the twelve month period ended June 30, 2021 and Accredited for the twelve month period ended August 31, 2021.

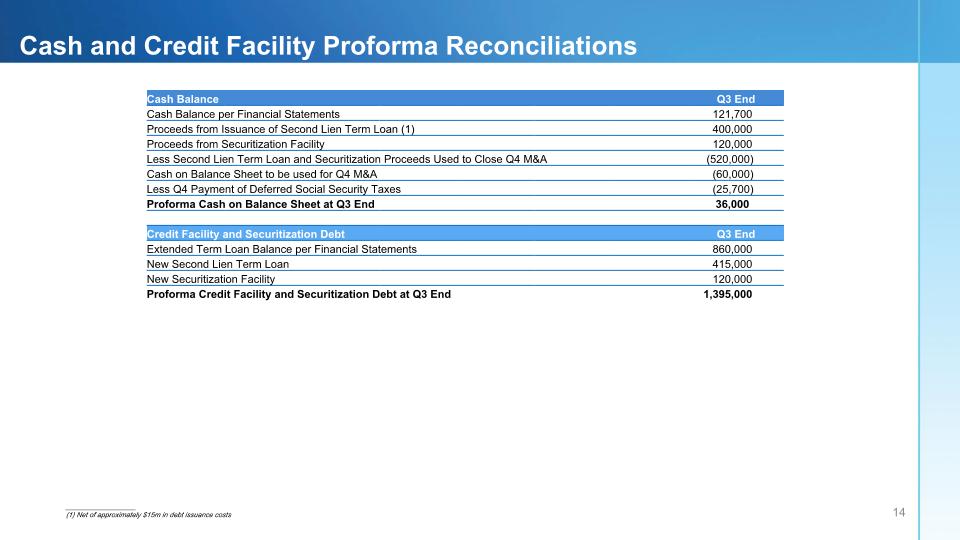

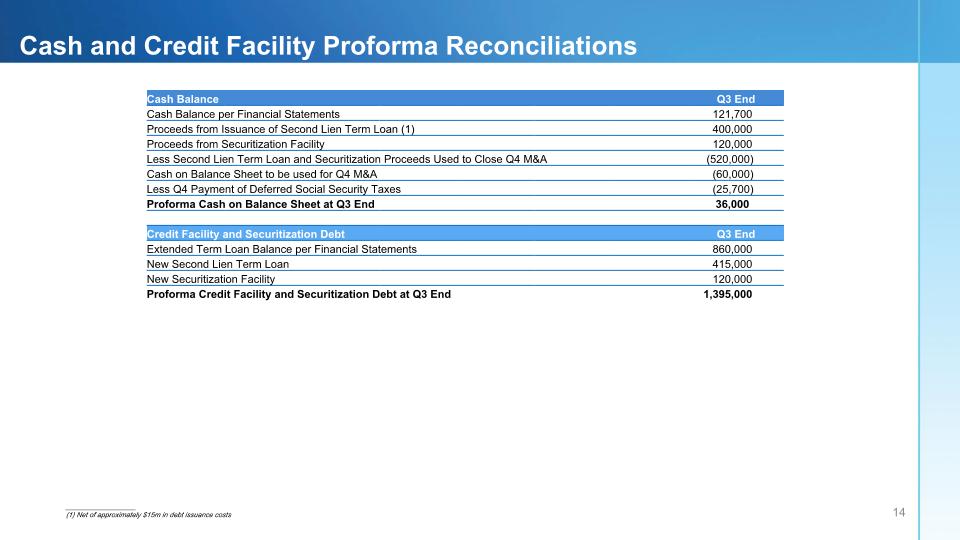

Cash and Credit Facility Proforma Reconciliations __________________ (1) Net of approximately $15m in debt issuance costs Cash Balance Q3 End Cash Balance per Financial Statements 121,700 Proceeds from Issuance of Second Lien Term Loan (1) 400,000 Proceeds from Securitization Facility 120,000 Less Second Lien Term Loan and Securitization Proceeds Used to Close Q4 M&A (520,000) Cash on Balance Sheet to be used for Q4 M&A (60,000) Less Q4 Payment of Deferred Social Security Taxes (25,700) Proforma Cash on Balance Sheet at Q3 End 36,000 Credit Facility and Securitization Debt Q3 End Extended Term Loan Balance per Financial Statements 860,000 New Second Lien Term Loan 415,000 New Securitization Facility 120,000 Proforma Credit Facility and Securitization Debt at Q3 End 1,395,000

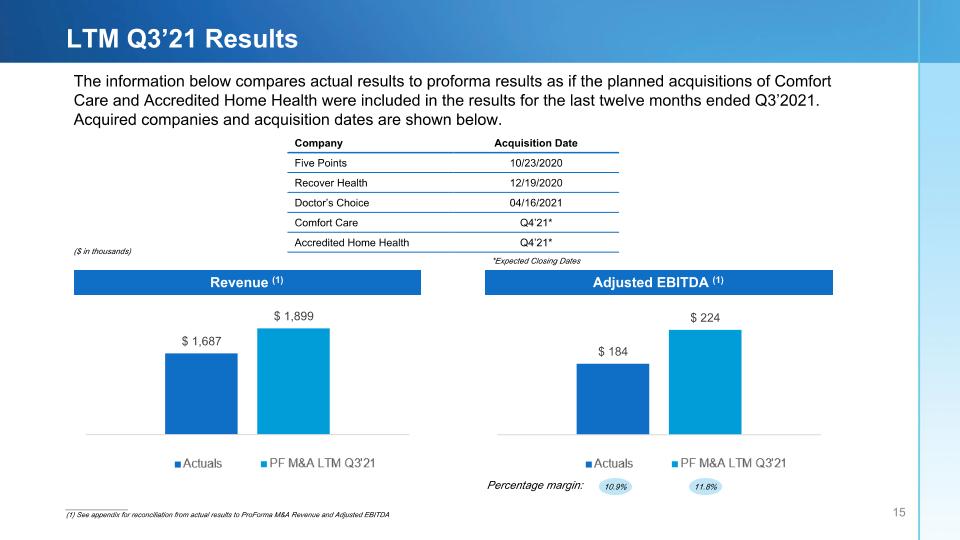

LTM Q3’21 Results ________________ (1) See appendix for reconciliation from actual results to ProForma M&A Revenue and Adjusted EBITDA Adjusted EBITDA (1) Revenue (1) ($ in thousands) 10.9% 11.8% Percentage margin: The information below compares actual results to proforma results as if the planned acquisitions of Comfort Care and Accredited Home Health were included in the results for the last twelve months ended Q3’2021. Acquired companies and acquisition dates are shown below. Company Acquisition Date Five Points 10/23/2020 Recover Health 12/19/2020 Doctor’s Choice 04/16/2021 Comfort Care Q4’21* Accredited Home Health Q4’21* *Expected Closing Dates